Executives from COL Group, Kedoo Entertainment, VIP 2000 TV, SDO Entertainment, TelevisaUnivision, and Udea Media explain why

they entered the industry's latest trend while discussing the rapid expansion of microdramas and the promising future of short-form content.

Rodolphe Buet, Chief Distribution Officer at STUDIO TF1, describes the strengths and business strategy of the newly revamped distribution unit.

Tom Miyauchi, VP and Head of Nippon TV LA Business Office, details the strategy behind the launch of Gyokuro Studio, scaled for global opportunities.

50 Julie Dansker, Co-Head of Sales, Distribution & Strategy and Executive VP of Global Licensing, shares the company's vision after the merger of FilmRise and Shout! Studios.

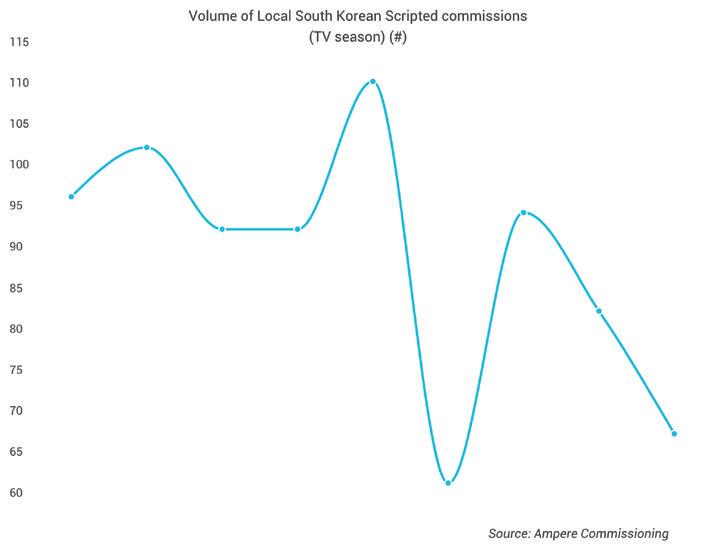

Source: Ampere Commissioning

-43%

AMPERE’S DATA REVEALED THAT WHILE GLOBAL AUDIENCES ARE WATCHING MORE SOUTH KOREAN CONTENT THAN EVER, COMMISSIONING HAS SLOWED SHARPLY.

-20%

BETWEEN H1 2023 AND H1 2025, LOCAL KOREAN PRODUCTIONS FELL BY 20%.

-39%

SCRIPTED CONTENT WAS PARTICULARLY AFFECTED BY THE PRODUCTION SLOWDOWN.

As other global SVOD have cut Korean commissions, Netflix has maintained commissioning volume. The streaming giant accounts for 88% of South Korea’s H1 2025 global SVOD launches, but has reduced its proportion of scripted content as it shifts its focus to unscripted.

Since October, Valerio Fiorespino and Alessandro Saba are the newly-appointed Co-CEOs of Fremantle Italy Group. The CEOs of the Italian companies within the group (Fremantle Italia, Lux Vide, The Apartment, Wildside, Picomedia, and Stand By Me) will have dual reporting lines to both, while group functions will be divided by area of expertise. Fiorespino and Saba will both report to Andrea Scrosati, Group COO and CEO Continental Europe. •

Alter Ego Media launched a new international distribution division as part of a broader push to expand its global footprint. The initiative is aimed at promoting Greek-produced drama content abroad, with a focus on high-quality titles from MEGA TV’s growing slate. Cagla Menderes has been appointed Head of International Content Sales to lead the newly created unit. •

World Storytelling Media Group (WSMG) was launched last month by Insight TV’s CEO, Viktoriia Tkachenko, as a vehicle to consolidate the growing group following the recent acquisition of Off The Fence’s distribution assets. The two companies will now sit under the new WSMG banner, with the content investment and exploitation teams at Insight TV and Off The Fence to be consolidated into a single unit to position the group for accelerated growth. •

All3Media International promoted Jennifer Askin to Executive Vice President, Americas, as Sally Habbershaw departs to relocate to the UK. As EVP, Americas, Askin

will be responsible for managing the New Yorkbased Americas team of All3Media International, maximising exploitation of the UK distributor’s multi-genre portfolio across the region. All3Media International also announced that Cristina Smith is being promoted to Manager, Sales and Commercial Strategy, North America, having joined the Americas team in 2022. •

Plan B, the production company co-led by Brad Pitt, Dede Gardner, and Jeremy Kleiner, part of the Mediawan group since 2022, announced the creation of its subsidiary Plan B Europe, based in London. This new European base will foster ongoing growth for Plan B, particularly increased production of premium series in the UK and across Europe. To lead Plan B Europe, the Plan B partners have appointed acclaimed British producer and executive Ed Macdonald. Under the supervision of Plan B’s leadership and Mediawan, Ed Macdonald will focus on developing television content in the UK and Europe and building further bridges and synergies across markets. •

BBC tapped Nick Lee as Head of Acquisitions, where he will lead the team responsible for acquiring TV series and feature films for publication on BBC iPlayer and for transmission on the BBC TV channel portfolio. Lee will start in his new role in November. Lee will be the strategic lead for programme acquisition at the BBC, ensuring that BBC iPlayer and channels have something for everyone and the greatest possible range of quality programming that will deliver value to audiences of all ages. •

ITV Studios is set to launch a new entertainment label in January 2026, focused on scalable and competitive formats, as Tim Carter, Managing Director of Unscripted, UK at ITV Studios, appoints Lily Wilson as Managing Director and Tom Williams as Creative Director. The name of the new label will be revealed at its formal launch in January, when both executives take up their roles. The label will specialize in ambitious, primetime formats designed to be brand-defining and returning. It will aim to deliver highimpact, scalable IP for both domestic and international markets. •

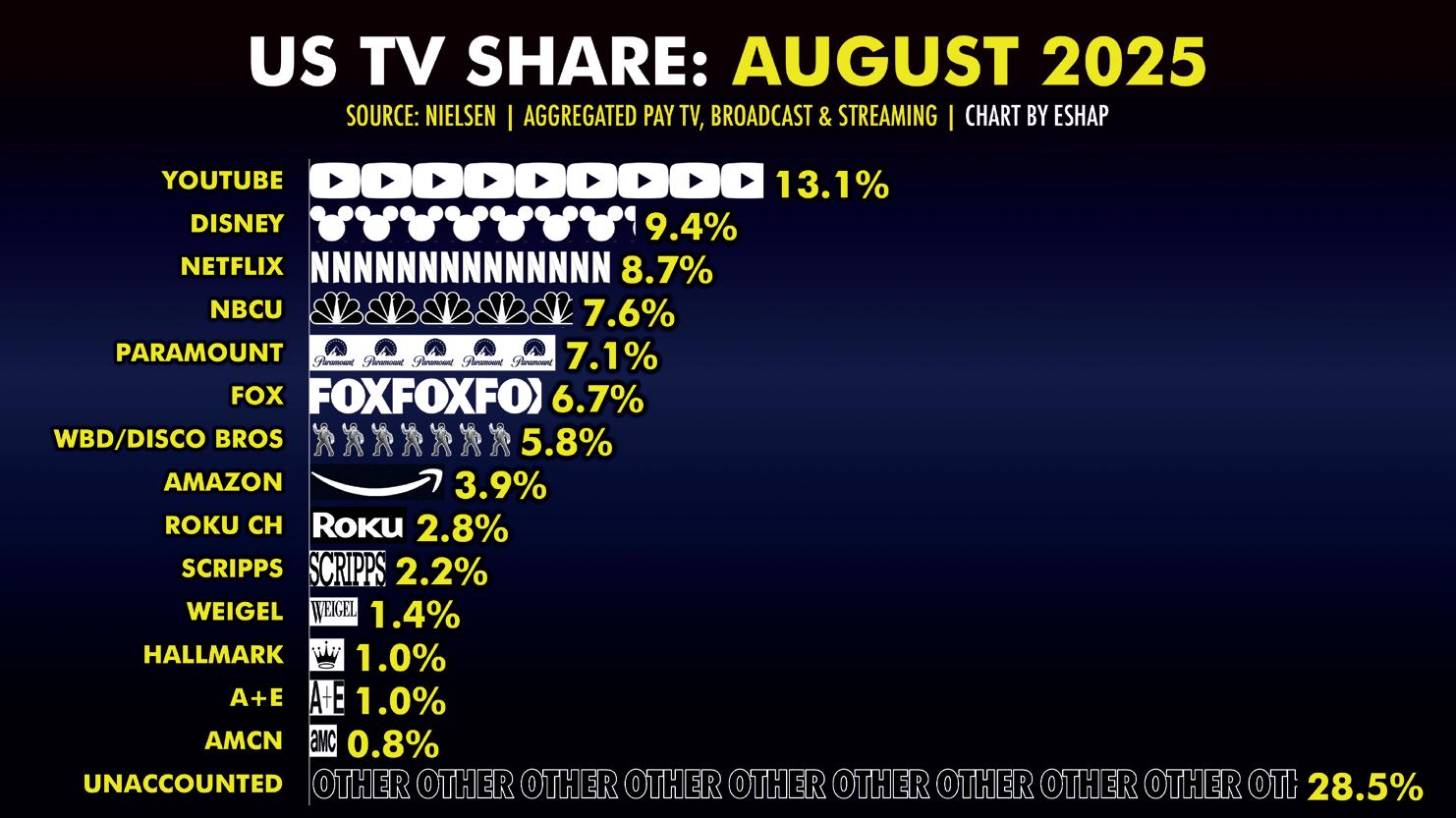

Television used to be a device. Now it's a question. Ask ten people in the media today, and you'll get at least four different answers and dozens of hot takes. Is it a linear broadcast? Netflix on a tablet? Can TikTok be on a smart TV? For many, the answer is simple: TV is whatever is on the TV. If it holds attention on the biggest screen in the room, it counts. Viewers aren't debating formats, they're just watching. However, our industry continues to argue about the definition, rather than the consequences. What if we've been asking the wrong question?

The honest debate isn't whether YouTube is television; it's whether television can survive on YouTube's economic model. Because if we define "TV" only by what shows up on the screen, whether broadcast, on Netflix, or in a MrBeast video, then, sure, YouTube is today's most-watched "TV channel." However, if we genuinely care about sustainability, cultural investment, and creative ambition, that comparison falls apart. You can win the screen, but not the equation. YouTube loves calling itself the "new TV." They highlight creators, empowerment, and accessibility, but the platform is built to serve one thing: Google's ad machine. Yes, some creators make millions. But most don't.

Consider the case of Jimmy Kimmel. When censorship, network deals, or editorial restrictions

limit him in the traditional system, moving to YouTube might seem appealing. In fact, many argue that he should go full-time on YouTube. How many resources would YouTube offer to a "light" version of Kimmel? No band, no big production, just a monologue? A Kimmel podcast? Sure. There would be some dollars there, but nothing close to a multimilliondollar network contract. That kind of migration may sound liberating on the surface, but the limits of the digital economic model still constrain it.

TV is not just about format; it's about viability. Scripted dramas, sports leagues, investigative journalism, or even late-night comedy —they are all not algorithm-native. They rely on structured financing, long development cycles, and returns beyond the next click. We can say it clearly: CPM ≠ Impact. YouTube monetizes at approximately $2–$6 CPM. FAST channels promise $10–$25, depending on fill rate and demand. Cable or prime-time TV? Still capable of $20–$50+ CPM in premium slots. Yet, most new projects are chasing volume instead of value. They measure attention in seconds, not substance.

The industry still argues about what qualifies as "TV." Linear vs. streaming. Short-form vs. longform. UGC vs. professional. The audience? They don't care. They watch what they want, when they

want, where they want. So yes, TV is whatever is on TV, but let's not pretend that's the end of the discussion.

Behind this apparent freedom lies a troubling trend: algorithms now determine what is seen, promoted, and paid for. Editorial curation, once a strength of networks and broadcasters, has been outsourced to opaque systems optimized for retention rather than depth. YouTube presents itself as a friendly platform, claiming to "empower creators," "democratize access," and "be TV for everyone." We must be honest here; for too many, it appears more like a Trojan Horse, a global ad-tech engine masquerading as a public square, absorbing cultural attention while centralizing monetization and control. It is not just about content distribution. It's about data dominance, editorial power, and value extraction. So the question is no longer "What is TV?" The real question is "Who controls it?".

Some players are trying. FAST channels, niche streamers, public broadcasters, and independent producers are all seeking hybrid models that balance audience reach with creative freedom and financial viability. There's hope in ad-funded storytelling that respects both art and cost.

The future isn't linear vs. digital. It's about making television that justifies its cost, respects its craftwork, and reaches its audience, without losing its soul. The format survived, but if we want the economics to survive too, we need to stop chasing views and start building value.

Recently, I have gotten into and/or started a raging debate in the comments sections of several social media platforms on the topic of whether, or not, YouTube, is in fact, television.

My position is clear: those who work in television don’t get a vote on this issue. The only opinions that truly matter are those of our audiences. If a viewer sits down and watches something that they believe is TV, then whatever they are watching is TV.

The arguments against this position range from “if a consumer is watching a video loop of a choo-choo train, then that is not television,” to “the industrial standards of television demand certain level of quality and production value that YouTube channels do not offer,” to “the CPMs and/or revenues from YouTube cannot sustain the operational needs of a true television publisher, therefore YOU’RE WRONG!” to “We can’t really tell if anyone is actually watching something, or if the video is just playing as background noise, so how can we even tell if it’s television?”

What’s missing from most, if not all, of these arguments? Data. Specifically, what these very strong opinions omit and ignore, is the usage data, from across the globe, which represents the behaviors, opinions, and voices of the audience itself.

For most of this year, YouTube has been the most watched channel in the United States – ON TV. However, it’s not just the most consumed television channel in America; YouTube, by itself (without YouTube TV) is 40% bigger than all of Disney (Disney+, Hulu, ABC, ESPN) combined. YouTube’s television audience is bigger than all of FOX (FOX TV and Fox News) PLUS all of Warner Bros. Discovery (HBO, TNT, TBS, CNN) – combined. This is without YouTube viewing on phones, laptops, or tablets.

Those who counter with “but what are they watching, cat videos?” are not just using outdated references, they ignore (often willfully) the available data of what is being watched. More than 70% of all YouTube consumption (hours of viewing) is for content thirty minutes or longer. One billion people on earth now watch Podcasts on television (mostly on YouTube). If someone watches three hours of Joe Rogan or ninety minutes of Alex Cooper, on TV, then that, my friends, is called a talk show - perhaps the oldest of television formats.

Beyond emerging Creator formats, however, regular old-school TV shows are also being consumed in huge numbers, often by many more viewers on YouTube than on the original TV channel where they aired. Perhaps

the best, and most important example I can offer is PBS’ historic series Frontline. This Oscar-winning series streams all their original, feature documentaries on YouTube on the same day their air on Broadcast TV via PBS. Based on data I have seen, Frontline films (usually 90 minutes or more) are viewed by three times more people on YouTube (predominantly on TV) than on PBS. The YouTube audience is typically one-to-two generations younger than the

TV or PBS app viewership and the average view-time (30 minutes plus) is identical on both platforms.

When someone chooses to watch the entire Academy Award Winning Documentary 20 Days in Mariupol on their TV set, on YouTube (which nearly four million people have done to date), are they NOT watching television? If not, what are they watching?

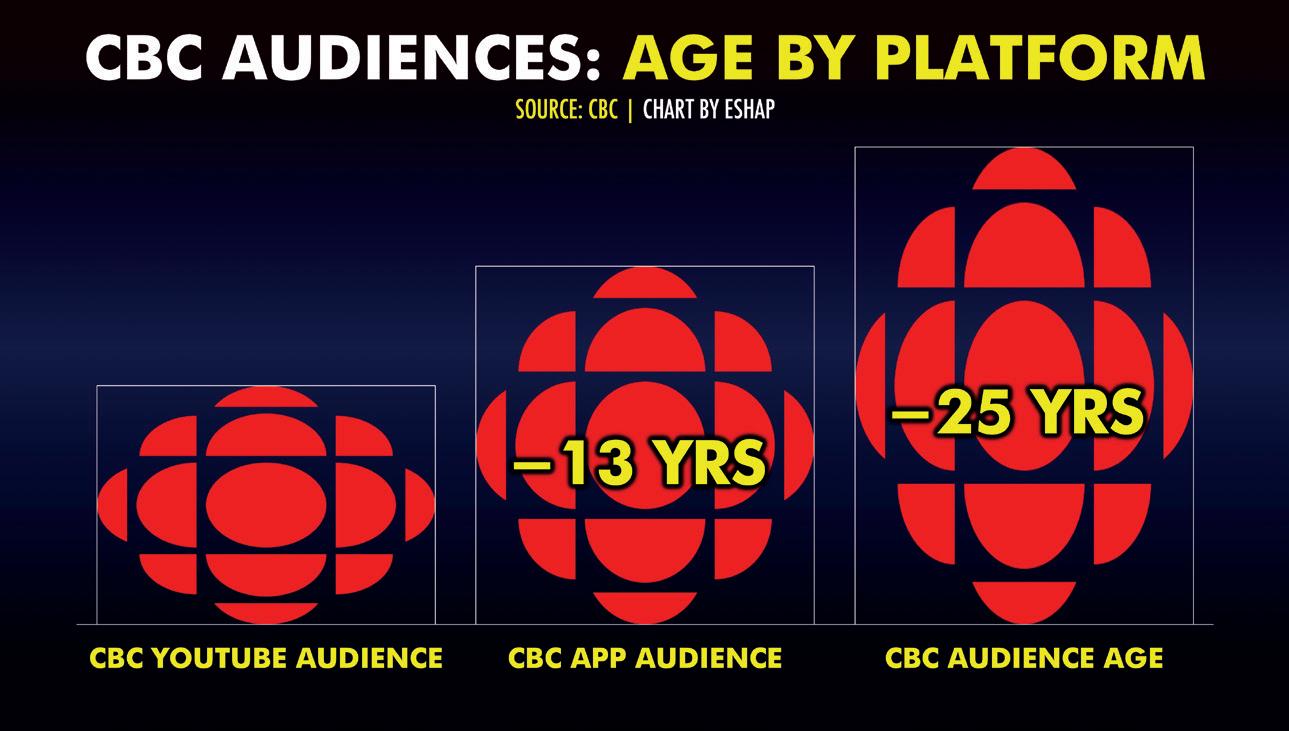

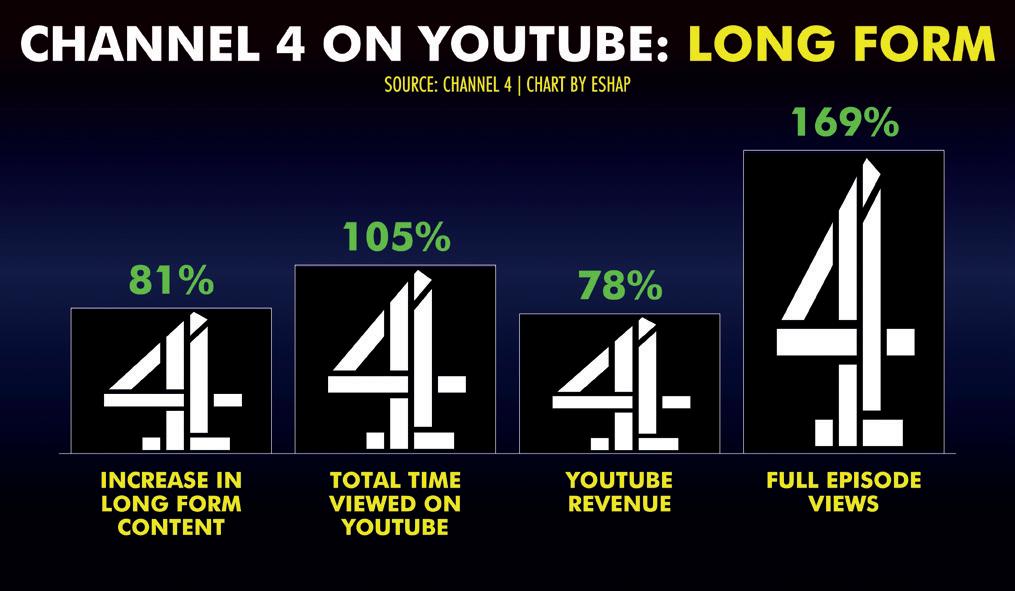

I can offer numerous other examples: Saturday Night Live is watched by far more people on YouTube than on NBC. When CBC posted hundreds of their premium long-form TV episodes on their YouTube channels, they more than doubled viewing on those channels, increased their YouTube revenues by 70%, and found entirely new audiences, two generations younger than their Broadcast viewership and a generation younger than the CBC streaming app. Channel 4 executed a very similar strategy, with very similar results.

These case studies all demonstrate something very crucial to survival in this new User-Centric era: There are two distinctly different ecosystems of Media consumption on the planet – one for Gen X and older, the other for Millennials and younger. 70% of the world’s population are now Millennials, Gen Z, or Gen Alpha. The only way to serve both populations (the olds AND the youngs) is to distribute – to Broadcast – your content to both of them, on the platforms where they choose to watch TV.

But, why does this even matter? Why do I take the time to engage in these debates? Why should we even care? Well, firstly, social media algorithms LOVE arguments in the comments section, so the debates are very helpful for my traffic and follower count!

More urgently, the more that the professional television elite ignore and dismiss YouTube as “not television,” the less they will use it to broadcast their signals. The longer they do that, the further they will lose the three youngest generations on earth, who now control the majority of our workforces, our

consumerism, and our voting populations.

Just as importantly: YouTube is just the first social video platform to come to television sets, it most certainly will NOT be the last. TikTok is likely months, not years, away from going horizontal and marching toward our TVs. The looming deal to give the US operation to Larry Ellison, who also now owns Paramount and CBS, makes this all-but inevitable. Watching all the ad money stampeding towards big screen YouTube, Zuckerberg or some other Big Tech genius won’t be far behind. If you reject YouTube today, then you fail to build the necessary infrastructure to succeed on the next YouTube. For anyone and everyone in the television business, that is a fatal mistake.

For commercial entities, this risks their business models, and therefore their employees. For public broadcasters such willful ignorance jeopardizes democracy itself. Most people on the planet now get their news from social media. By refusing to fully embrace the only social media platform (so far) to come to the television, the news organizations of the world’s public broadcasters, exacerbate our global misinformation epidemic by ignoring the television and news preferences of 70% of the world’s population.

Someone engaged with me in this ongoing debate recently commented that “no one who watches YouTube on TV calls it television.” That’s absolutely correct. And no one ever says “let’s TV and chill” either. But whether a viewer turns on their TV for their kids to watch Ms. Rachel on Netflix or on YouTube – either way, for that family, that is TV.

The broadcasters, publishers, advertisers, media executives, producers, performers, and public service media who ignore these facts are ignoring their audiences. History and data repeatedly prove that when you disregard your audience, you do so at your own peril. For the sake of our television business, our professional community, and our democracy, I hope those who read this start to listen.

By Evan Shapiro

ACCORDING TO OMDIA'S STATS, JAPANESE, SPANISH, AND KOREAN ARE THE LANGUAGES MOST WIDELY REPRESENTED IN ON-DEMAND CATALOGS. HOWEVER, THERE ARE SOME VARIATIONS FROM COUNTRY TO COUNTRY.

Omdia's "On-Demand TV & Movie Catalog Tracker" provides an overview of the catalogs of major streaming services. In May 2025, Amazon Prime Video in the UK and US had the most extensive catalog in terms of titles and runtime, although Netflix offered the largest catalog in some markets, and Tubi had the most comprehensive offering in Mexico. In addition to English, Japanese, Spanish, and Korean are the languages most widely represented in on-demand catalogs. However, there are some variations from country to country. Korean was the most common nonlocal language in Japan and the UK, and it was equal to Japanese in Germany. Netflix remains the world market leader in terms of subscriber numbers, and the platform offers a fairly consistent catalog size across the 11 countries, ranging from 9,179 titles in Spain to 7,637 titles in Mexico. Unlike Amazon, the US offering

is relatively small, comprising 7,457 titles and 62,000 hours of content available. South Korea is a significant source of content for Netflix, which announced it would invest $2.5 billion in Korean content from 2023 to 2026. The Netflix catalog of 7,900 is significantly larger than the 1,800 hours offered by Amazon.

Netflix's catalog size has increased slightly. In the US, for example, the runtime went from 57,000 in June 2024 to 62,000 in May this year. "There is a heavy emphasis on series, with 87% of runtime in May in the US," stated Tim Westcott, Digital Content & Channels at Omdia.

Amazon Prime Video has a significantly larger catalog in the UK and the US than its main competitors, with more than 25,000 titles. Its offering is heavily weighted toward movies, which made up 84% of titles in the US. However, there are significant differences in the size of the offer in other countries, ranging from fewer than 2,000 titles in South Korea to just under 14,000 in Canada and 12,000 in Japan, where all content was available on an AVOD basis, unlike in other countries.

Disney+'s catalog is less than half the size of Netflix in terms of titles. As with Netflix, the US was the smallest of these markets, with 2,113 titles and 15,000 hours of content available. The UK and Australia were the largest markets, although Disney's offering of 25,000 hours in the UK is compared to Netflix's 63,000 hours.

Apple TV+ has the smallest catalog among AVOD and SVOD services, with a consistent total of around 300 titles across the 11 countries. That is primarily driven by the heavy emphasis on original production in the on-demand offering. The availability of some local sports-related content skews the US and Canada offering to 1,800 hours. "Apple has generally focused on quality rather than quantity," said Westcott. "The catalog could be boosted by more acquisitions of movie rights, though so far this has been a question of rumor rather than actual strategy," he added.

Finally, Paramount was among the first US studios to adopt a two-pronged approach to on-demand services, operating AVOD service Pluto TV, as well as

SVOD service Paramount+. Paramount+'s offer in the US had, by a significant distance, the largest offer of content, with 1,400 titles and 49,000 hours available. Englishspeaking Australia and the UK had the most extensive catalogs. Across all countries, the Paramount+ catalog skews toward movies in terms of runtime, with films accounting for 60% in the UK and US, and as much as 72% in France.

By Omdia

EXECUTIVES FROM COL GROUP, KEDOO ENTERTAINMENT, VIP 2000 TV, SDO ENTERTAINMENT, TELEVISAUNIVISION, AND UDEA MEDIA EXPLAIN WHY THEY ENTERED THE INDUSTRY'S LATEST TREND WHILE DISCUSSING THE RAPID EXPANSION OF MICRODRAMAS AND THE PROMISING FUTURE OF SHORT-FORM CONTENT.

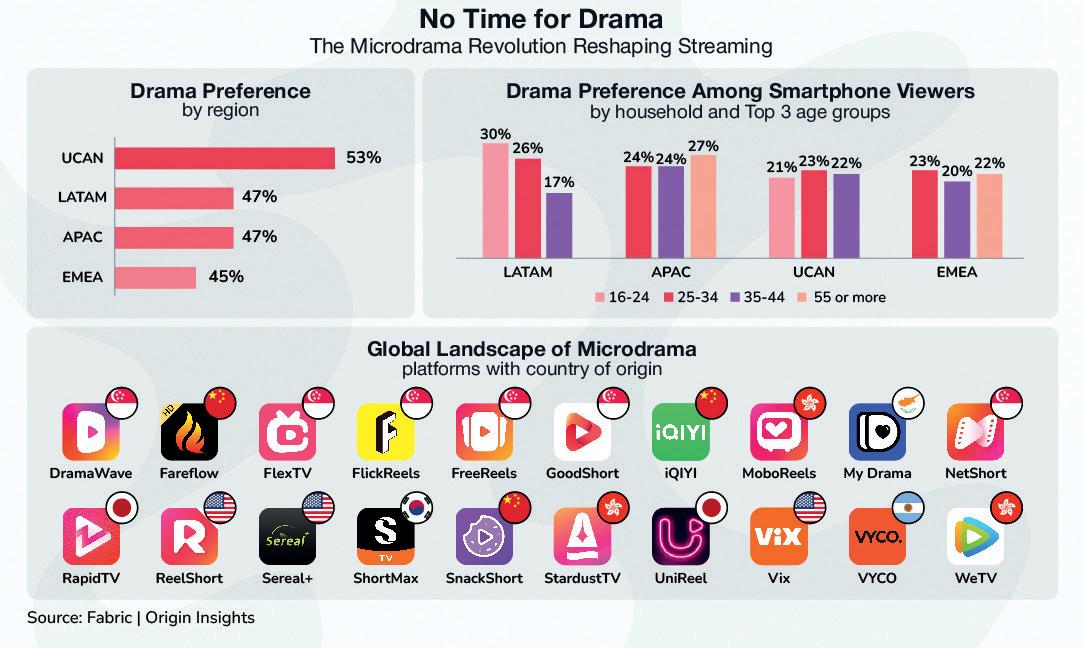

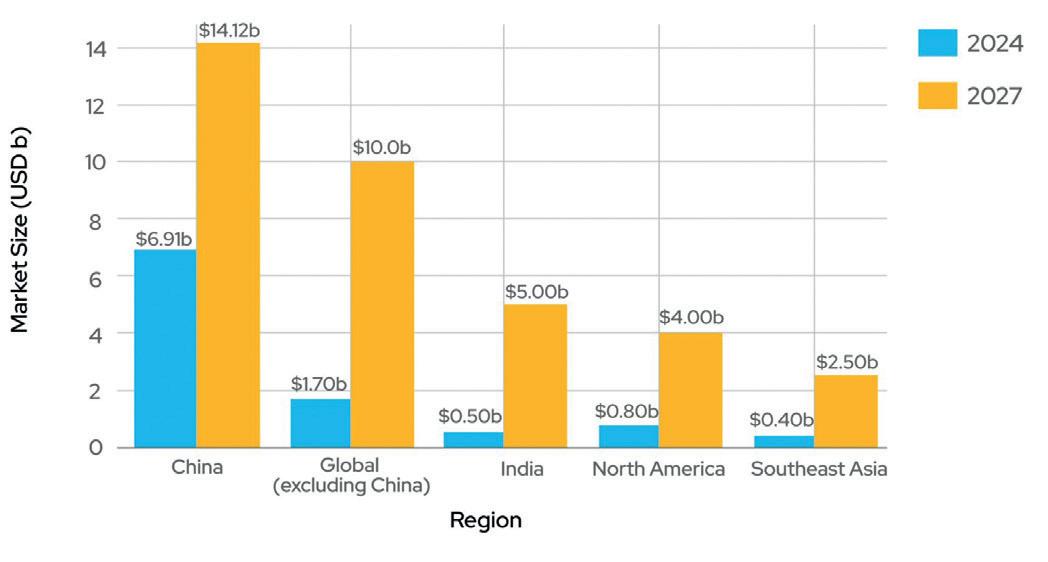

Younger generations have led a shift in TV consumption habits, placing the smartphone at the center of how content is watched. Social media platforms have consolidated this trend, creating the perfect environment for the current boom in microdramas, microfictions, and vertical content. This short-form, vertical content phenomenon originated in China but has now become highly popular in the United States, Southeast Asia, India, and Latin America.

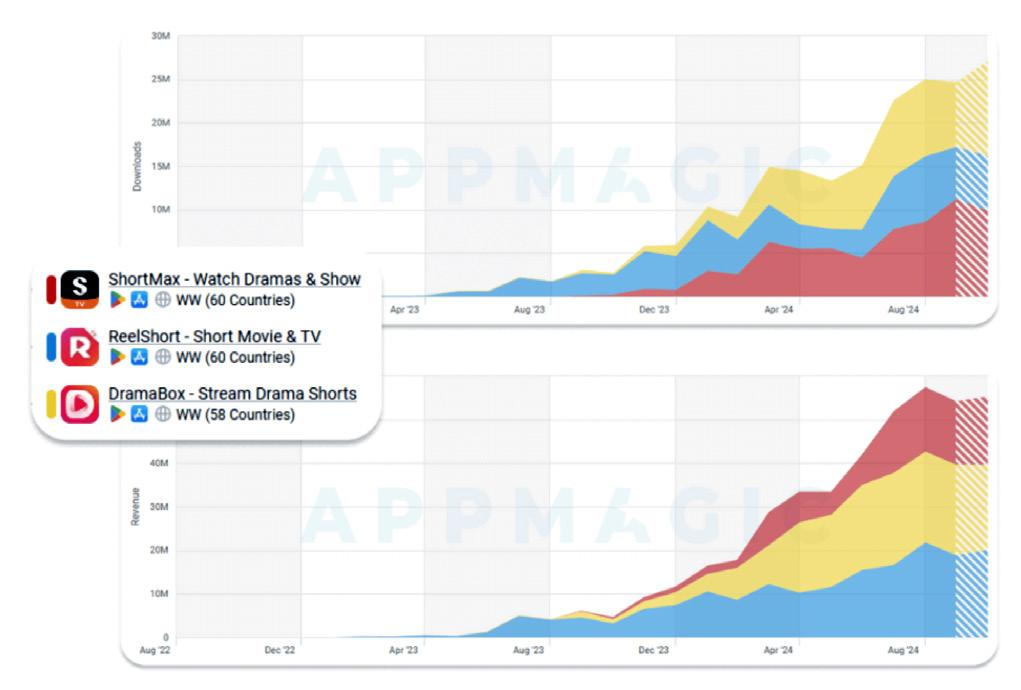

According to the China Netcasting Services Association, microdramas generated approximately CNY 50.5 billion (~US$6.95 billion) in 2024, surpassing domestic box office sales for the first time. Data from Sensor Tower shows that since the start of 2024, inapp revenue from short drama apps has grown rapidly, increasing from USD $178 million in Q1 2024 to nearly USD $700 million in Q1 2025, almost quadrupling the market. As of March 2025, global cumulative in-app revenue from short drama apps reached approximately USD $2.3 billion.

In Q1 2025, short drama app downloads in Latin America increased by 69% quarter-over-quarter, reaching nearly 100 million downloads, with DramaWave experiencing a 27-fold increase. This market is also driving strong growth for other emerging apps such as RapidTV, MeloShort, FlickReels, and Swift Drama. Southeast Asia experienced similar momentum, with short drama app downloads rising 61% quarter-onquarter to nearly 87 million. Apps like DramaWave, FreeReels, and Melolo experienced explosive growth, while ReelShort and DramaBox recorded in-app revenue increases of 31% and 29%, respectively, reaching USD $130 million and USD $120 million. As of March 2025, ReelShort and DramaBox have generated

cumulative global in-app revenue of USD $490 million and USD $450 million, respectively.

In China, COL Group has launched its newest microdrama platform, FlareFlow, which has quickly emerged as a global contender in the digital entertainment space. "We launched in late April 2025, entered the United States Top 5 Entertainment apps on Google Play and Top 8 on Apple's iOS Entertainment chart within weeks, crossed 10 million downloads in three months across 177 countries and regions, and saw monthly user spend grow more than 500%. When you see that level of adoption, you build the distribution rails to match it," said Timothy Oh, General Manager at COL Group.

Furthermore, Kedoo Entertainment unveiled Love Drama, its brand-new streaming app dedicated to short-form romantic content, built for the next generation of mobile-first viewers. Nick Okorokov, CEO & Co-Founder of Kedoo Entertainment, explained that

NICK OKOROKOV CEO & Co-Founder of Kedoo Entertainment

one of the most exciting shifts they have observed is the rapid growth of short-form, serialized vertical dramas, fueled by TikTok, Instagram Reels, and YouTube Shorts, as mobile becomes the primary screen for audiences of all ages. "While this style of storytelling is thriving in Asia, it is still underrepresented in the Americas and other regions. The gap inspired us to launch Love Drama, a go-to destination for bitesized, emotionally charged, and easily bingeable romantic series for today's mobile-first viewers," he added. Turkey, a global leader in content production, now faces the challenge of adapting its expertise to emerging formats, delivering measurable results, and showcasing them to the world. "Telling a story with cliffhangers in episodes of up to 90 seconds is the new challenge we are working on," said Umay Ayaz, CEO of Udea Media. "Unlike traditional formats, vertical drama directly engages technology companies: they provide infrastructure, while storytelling gives the format its soul. For decades, Turkish dramas and formats have captivated global audiences, proving that emotional narratives transcend borders. The current challenge is applying that expertise to new screen dimensions and rhythms," she anticipated.

UMAY AYAZ CEO of Udea Media

Following the success of the microdramas, VIP 2000 has launched a slate of vertical-format digital series. "The rise of short-form vertical content opened a new creative and business opportunity for us. It's not just a trend, but a new language of storytelling," said Roxana Rotundo and Rosalind Rotundo from VIP 2000 TV. "Our motivation came from seeing how younger audiences engage with fast-paced, visually dynamic narratives

VIP 2000 TV

on their phones, and realizing we could bring our expertise in scripted series to that space. We were pleasantly surprised to discover that viewers of all ages were also enjoying the content," they explained. Another company that entered into this trend is SDO Entertainment, which recently announced its first vertical microfiction, "Bon Vivant." "I got really excited to realize there were other opportunities to make fiction, just by changing the format and the business model. That was really encouraging, so I kicked off the research process that eventually led to the production of 'Bon Vivant'. Now we're working on new projects, getting more experienced with the vertical format," stated Loli Miraglia, SDO Entertainment Founder.

SDO

Entertainment Founder

TelevisaUnivision's streaming platform ViX has produced more than 20 microdramas and is on track to launch 40 original titles by the end of the year. "The launch of our microcontent marks an exciting evolution in Spanish-language storytelling. We saw

an opportunity to connect with a young, mobile-first audience that craves fast, bold, and emotionally resonant content," stated Rafael Urbina, President of Streaming and Digital at TelevisaUnivision, who agrees with Rotundo and Miraglia that this new format and approach allows companies to meet audiences where they are: on their phones and social media feeds. "We are building a bridge between social-first storytelling and long-form entertainment," Urbina added.

TIMOTHY OH

General Manager at COL Group

COL Group's Timothy Oh has described microdramas as the storytelling language of the mobile generation. "It starts with attention on a phone. We write to hook first. Episodes live in the 60 to 150-second window, emotions are immediate, stakes are crystal clear, and every chapter ends on a cliffhanger that earns the next tap," he described. "The rhythm is simple and powerful. Empathy, conflict, release, and then repeat. It borrows the rhythm of social video but applies series discipline across dozens of episodes. That is why binge curves for microdramas look closer to mobile games than to traditional television," he added.

For Kedoo's Nick Okorokov, short-form romantic dramas, also known as micro-dramas, are the evolution of traditional series, reimagined for mobile-first audiences in today's attention economy. "The stories are fast-paced, emotionally charged, and built for impact. Told in vertical format and under two minutes, each episode ends with a dramatic hook, echoing the classic cliffhanger, perfectly adapted to the scrolland-binge rhythms of on-the-go viewing. This form of storytelling makes micro-dramas irresistible. They

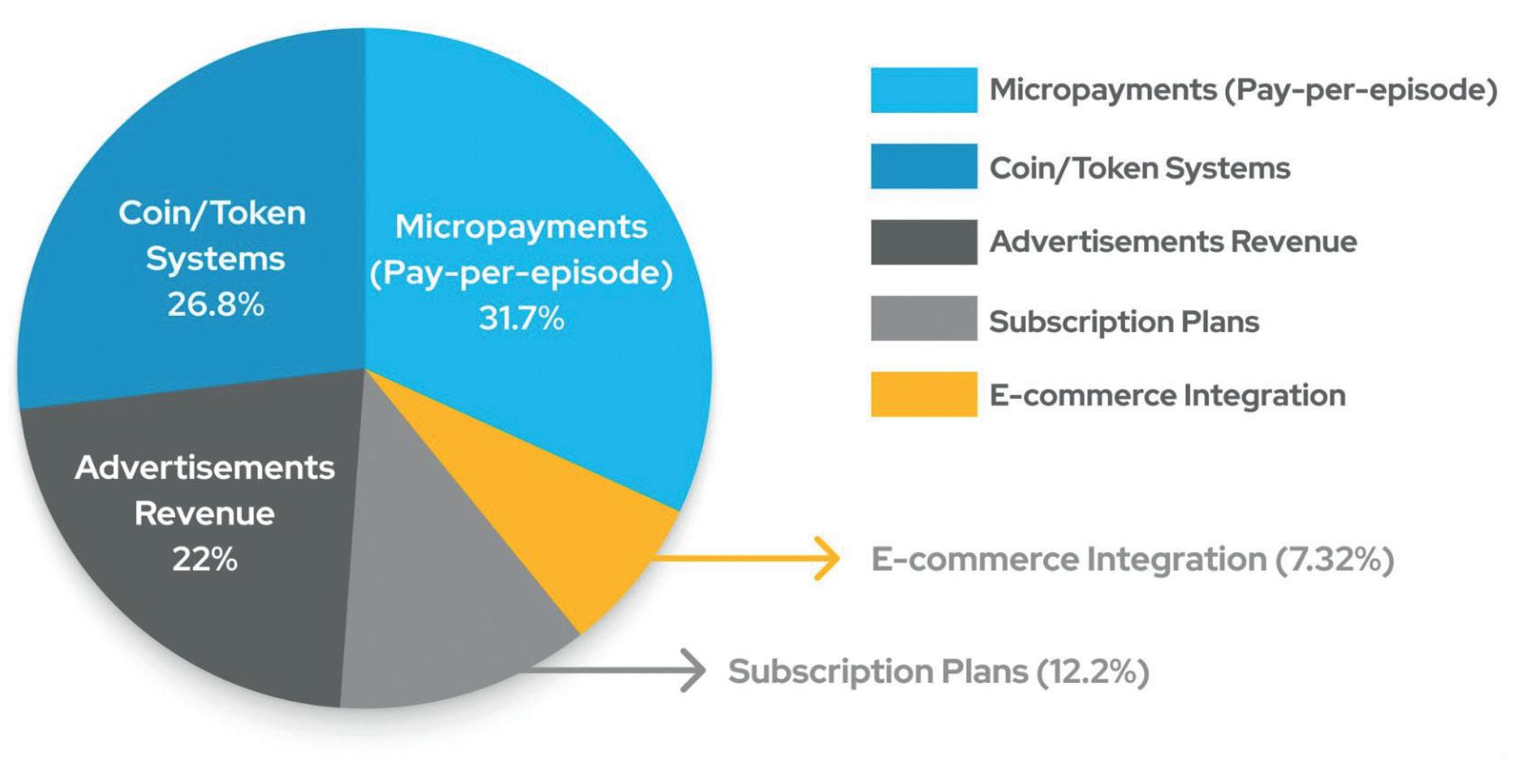

USER PREFERENCE BY MONETIZATION MODEL

capture attention instantly, keep audiences coming back for more, and provide a quick escape from their everyday lives," he said.

For producers like VIP 2000 and SDO Entertainment, the biggest challenge of producing vertical short-form content is the storytelling economy. "We have to hook the audience within the first few seconds and deliver a satisfying beat in under two minutes," said Rosalind and Roxana Rotundo, who also explained that there's no room for stuffing: every frame and line of dialogue must drive the plot or deepen the character. "The vertical frame demands a different approach to blocking, composition, and editing, so we adapt our production style to keep it visually engaging," they said. "We also have to work with a solid script with more dynamic and aggressive cliffhangers. People often underestimate how a story is told, thinking that just because it's on mobile, it must be simpler, but it's actually the opposite," Miraglia added. "The narrative has to be built in a completely different way, with shorter arcs not only for the season, but also within the story itself and for the characters. On the directing side, it was also a big challenge to think about everything in 9:16. Scouting locations forced us to explore spaces with different heights and dimensions than when you're thinking in 16:9. The cast rehearsals were also a huge learning experience, because it meant working with them in a process where everything happens very quickly. Every gesture matters, and movements must fit naturally within the shot," she described.

"Vertical storytelling, with shorter attention spans, faster pacing, and unique visual priorities, introduces new rules for production and consumption, demanding

a recalibration without changing the fundamental essence of narrative," added Udea Media's Ayaz.

TelevisaUnivision's Urbina added that telling a compelling story in under two minutes, in vertical video, requires an entirely new approach. "It's about grabbing attention instantly, structuring stories for engagement, and adapting for mobile screens. Every element, from script to camera framing, is designed with this audience and format in mind. We've built a nimble, in-house model to support this, with full production coming out of our Televisa San Ángel studios in Mexico," he explained.

While any new format presents challenges, microcontent has opened the door to innovative storytelling. "The global industry is increasingly shifting toward shorter, digital-first, and vertical formats, yet the essence of storytelling remains unchanged. Turkey, already recognized for its proven success in scripted and unscripted content, is now demonstrating its adaptability to new consumption models," Ayaz argued.

Kedoo's Love Drama offers several monetization models, including subscriptions and token-based access for batches of episodes. "We design the monetization model to be flexible, giving audiences multiple ways to enjoy Love Drama: free, level up with tokens, or paid subscription," Okorokov commented. Users can access content for free via a freemium model, unlocking episodes after sampling the series by watching ads and completing daily missions. For those who prefer quicker access, users can obtain token bundles via optional in-app purchases to unlock content instantly, starting at around US$1.99 for 20 episodes. "Additionally, we offer subscription plans providing premium features, including full ad-free viewing, early access to exclusive content, and offline downloads, which will be available soon. Rather than tailoring the models for specific markets or user segments, our goal is to provide options that meet individual preferences. As our audience grows, we can gain deeper insights into which model resonates best in different regions and user groups," he said.

For VIP 2000 executives, vertical short-form content represents a new way to monetize their brand. "We have developed a new business model around this format, one that we're not quite ready to share publicly yet, but that we believe will redefine how we approach content production and distribution," Rotundo said.

TelevisaUnivision's Urbina mentioned that microcontent has allowed them to unlock a new level of creative opportunity for brand integration. "Because the format is short-form, native, and highly engaging, brands can show up in ways that feel organic, from custom-branded storylines to in-content placements. The content is sponsorship-ready," he described. "It's an ideal environment for brands looking to connect with digitally native, Spanish-speaking audiences in a meaningful way. Additionally, a micro-transaction

Source: AppMagic

President of Streaming and Digital at TelevisaUnivision

model is emerging where consumers pay for access to content, which we are also exploring," they added. Reflecting on the future of mobile-first storytelling, Col Group's Oh stated that AI is increasing both speed and specificity. "Creatively, we can prototype multiple openings, alternate twists, and poster lines, then publish the version that wins in testing. Operationally, AI assists with scripting, editing, and multilingual localization, which enhances quality without increasing the cost curve. That is how we sustain hundreds of experiments a month while keeping a consistent creative voice," he described. Looking ahead, expect more dynamic personalization: market-specific cuts, viewer-selectable branches, and release schedules measured in days rather than months. As the ecosystem formalizes and licensing becomes clearer in major markets, we will see higher quality pipelines, more cross-border co-production, and a premium layer that still respects the grammar of mobile storytelling," he anticipated.

Looking ahead, Kedoo aims to explore potential expansion beyond romance into a broader range of genres, such as anime and reality, to demonstrate that microdramas are just testing grounds for innovation and that other content types can also be created and optimized for mobile viewing.

By Romina Rodriguez

RODOLPHE BUET, CHIEF DISTRIBUTION OFFICER AT STUDIO TF1, DESCRIBES THE STRENGTHS AND BUSINESS STRATEGY OF THE NEWLY REVAMPED DISTRIBUTION UNIT, WHICH WILL FOCUS ON RAPID GLOBAL GROWTH.

Earlier this year, STUDIO

TF1, formerly Newen Studios, unveiled its new brand, aiming to leverage the strength of the TF1 brand to gain greater visibility in Europe and around the world through its core areas of expertise: production and distribution. Señal News spoke with Rodolphe Buet, Chief Distribution Officer, who outlined the company's distribution strategy, market positioning, and expansion plans.

STUDIO TF1 was created with a focus on expanding into intellectual property. What is the business distribution strategy behind the new identity of this unit?

"The IP business is strategic to support the distribution growth. Some of our key successes in 2024 and 2025 relied on existing IPs such as 'Cat's Eyes,' 'Erica,' 'Mlle Holmes,' or 'La Comtesse de Montecristo.' In the meantime, Studio TF1 has been extremely active in securing format rights, partnering with ABC in the US for the remake of 'Call My

Agent,' which has multiple formats in Europe (Amazon UK, Disney+ Germany). Our format business has doubled in 2025, illustrating the quality of the projects developed in France. STUDIO TF1 DNA relies on passion, agility, and a winning mindset."

What are the company's international positioning and expansion goals?

“STUDIO TF1 is one of the Top 10 distribution companies. On nonEnglish speaking projects, we are the leading distributor, and we are extremely pleased to partner with producers such as UGC, Quad, Banijay, Big Bang, or Gaumont, in addition to the Studio TF1 series. We've been developing solid skills in international coproduction and financing engineering for ambitious projects, such as 'We Come in Peace' ($2+ million per episode) and 'La Comtesse de Montecristo' ($3 million), which were co-financed with TF1, Netflix, and Mediaset. Our next chapter is to bring this know-how to Englishspeaking shows, supporting fantastic producers such as Claperboard or Riff Raff."

How do you identify and approach the current global market demands?

"The market has been drastically shifting from an abundance approach to a curation one. Our partners are looking for fewer shows but with higher production value, featuring recognized names (writers, directors, cast). In the ocean of content available, the only way for linear channels or streamers to make a difference

and attract audiences is to support event shows such as 'Montmartre' (TF1 & Disney+), 'Surface,' (France TV), or 'Etty'".

What is the strategy to expand the company's distribution expertise?

"At STUDIO TF1, we rely first on our connection with our partners to better anticipate the market evolutions. Our shareholder, TF1, is one of the most innovative broadcasters in the world, with recent developments including a Netflix distribution agreement, micro-payments, and more integrated cross-platform offers for advertisers. We have a significant advantage in understanding what's going on.

The other challenge is to develop the best talents internally who will bring about a 10% uplift and make a difference in supporting and financing their shows. We've been nurturing those talents, not only in sales, but also in marketing and business foundation and growth teams, which are always looking for excellence in skills, integrated tools to support the business.

At Mipcom, we will ensure that every single show matches with a broadcaster and entertains audiences around the world."

By Alan Levy

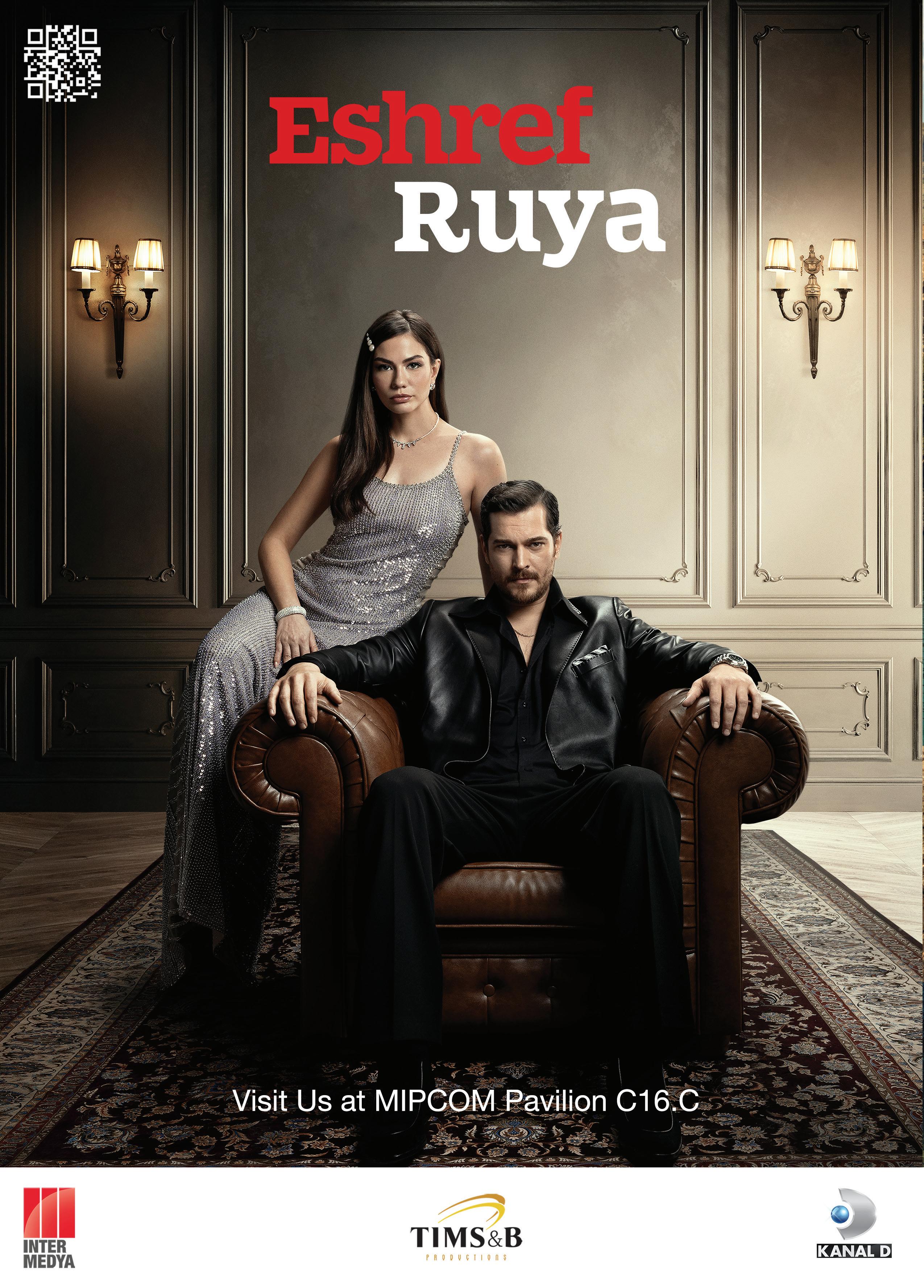

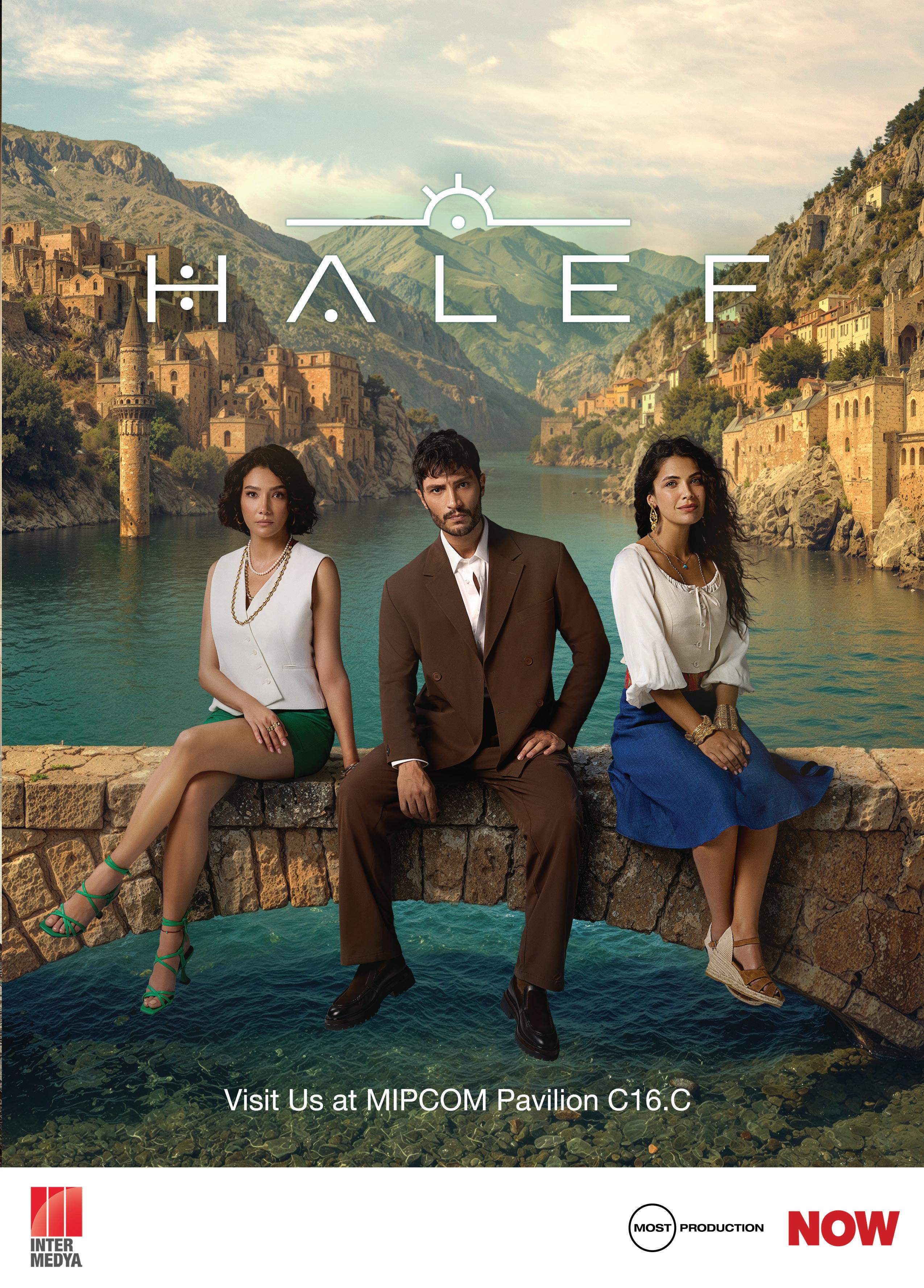

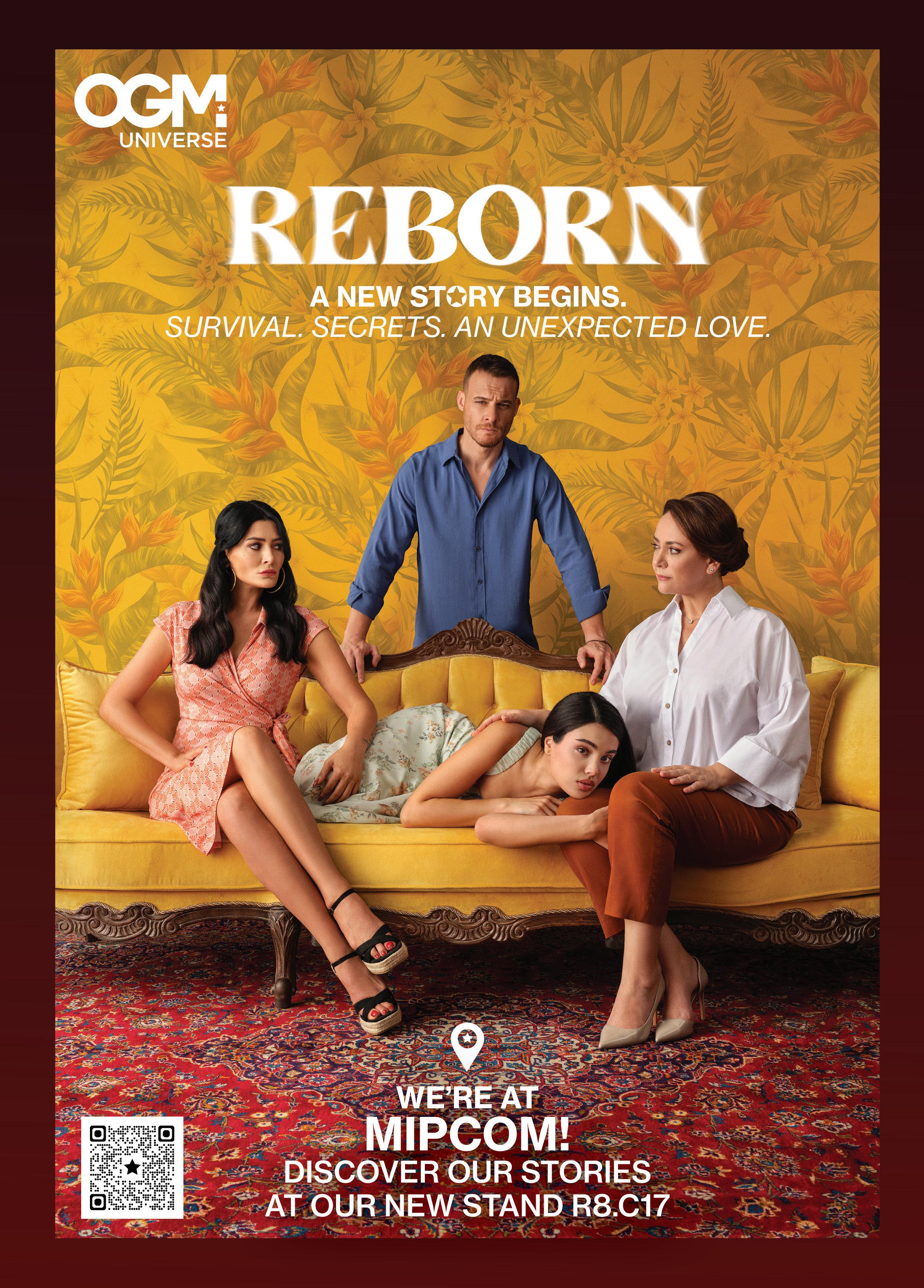

TURKISH DRAMA REMAINS ONE OF THE MOST POPULAR CONTENT CATEGORIES GLOBALLY. AFTER ESTABLISHING MATURE MARKET POSITIONS IN OTHER TERRITORIES, IT HAS NOW ADDED A NEW LOYAL CLIENT BASE AND FANDOM IN WESTERN EUROPE. EXECUTIVES FROM TOP TURKISH DISTRIBUTORS EXPLAIN THIS NEW TREND.

Besides new competition from other countries and emerging content genres, Turkish drama remains one of the most popular content categories in the world. With mature markets established in the Middle East, Latin America, US Hispanic, and Central and Eastern Europe, Turkish drama has conquered a new territory in recent years: Western Europe.

“The growing demand in Western Europe highlights both the maturity of Turkish drama and the evolving preferences of audiences in this region. Viewers are increasingly drawn to high-quality productions that not only deliver strong emotional storytelling but also reflect universal themes. Turkish dramas stand out because they combine cinematic production quality with long-form narratives that allow characters and relationships to develop in depth, something that Western European audiences have embraced enthusiastically,” described Muge Akar, ATV’s Head of Sales. “At the same time, the boom demonstrates how Turkish series have moved beyond being a niche. They are now part of the mainstream entertainment landscape, competing directly with global productions and gaining prime slots on television and streaming platforms. This shift also signals a wider openness in Western Europe toward diverse content from outside

the region, and Turkish dramas have positioned themselves at the center of this trend by consistently delivering engaging, high-volume, and relatable stories,” she added.

“Western Europe has recently become a vibrant hub for Turkish drama. What started with strong demand in Spain quickly spread to many other countries. Today, Turkish series rank among the most-watched content in the region. The variety of audience preferences across different territories, combined with their appetite for diverse genres, creates significant opportunities to license a wide range of our titles. The habits formed by audiences through free TV, coupled with the rapid growth of both local and

genuine affection for Turkish storytelling here. We’ve made tremendous progress, but we’re also aware that there’s still a long, promising road ahead,” Can Okan, Founder and CEO of Inter Medya, stated.

Elif Tatoğlu, Distribution Strategy and Sales Director at Kanal D International, agrees that the appetite for Turkish drama in Western Europe is global streaming platforms, have enabled our content to reach even broader audiences. We believe there are still many untapped opportunities to explore in this market. There is a deep trust, strong interest, and

genuine. “Audiences there have become more open to international storytelling, and Turkish series offer high production values, relatable family and relationship themes, and a fresh alternative to local content. Streaming platforms have also accelerated exposure, making it easier for viewers to discover and bingewatch our titles,” she said.

“Turkish drama has built a unique position in Western Europe by offering high-quality storytelling that blends universal themes with strong emotional appeal. Viewers in countries like Italy, Spain, and Portugal are drawn to the richness of the narratives, the production values, and the cultural proximity that still feels fresh and different from local content,” added

Goryana Vasileva, Sales Manager for Europe, Latam, Nordic at Calinos Entertainment.

The growing success of Turkish dramas in Western Europe stems from their ability to combine universal themes with authentic cultural storytelling.

“The emotional depth and high production quality appeal strongly to European audiences, while digital platforms accelerate their accessibility and visibility. This boom highlights the growing global significance of Turkish content,” Aysegul Tuzun, Managing Director at Mistco, said.

Ekin Koyuncu, Director of Distribution and Alliances

"Western Europe has recently become a vibrant hub for Turkish drama. What started with strong demand in Spain quickly spread to many other countries. Today, Turkish series rank among the most-watched content in the region"

Ekin Koyuncu

at OGM Universe, agrees that the rise of global platforms has been a game-changer, allowing these stories to reach new audiences seamlessly and in parallel with local content. “Over the past few years, Turkish drama has gained remarkable traction in Western Europe. We see a convergence of factors: the high production value of Turkish series, the richness of storytelling, and the universal themes of family, resilience, and love. These elements resonate with European audiences who are increasingly seeking fresh, emotionally charged narratives beyond Hollywood or local productions,” she said.

What were the key factors to open and conquer this competitive market? What content types and distribution strategies do clients in Western Europe need? There are several answers to those questions, but certainly, the success of Turkish drama in Western Europe comes from a combination of high production values, powerful storytelling, and strong talent. Turkish distributors’ catalogs consistently deliver series that meet international standards while preserving the emotional depth that makes Turkish drama unique.

“ATV’s long-running story arcs and emotionally layered

narratives give broadcasters a unique advantage: the ability to build loyal and sustained viewership. While many international shows are designed for shorter runs, ATV delivers extended storylines that keep audiences engaged week after week. That balance, premium quality, star-driven productions, and enduring storytelling have been essential in opening doors and conquering highly competitive Western European markets,” ATV’s Muge Akar stated.

“A key part of our strategy was adopting a data-driven approach to windowing, carefully analyzing where long-running dramas perform best versus limited series and strategically sequencing our distribution across free-to-air, AVOD/FAST, and SVOD platforms to maximize business potential. Building strong, lasting relationships in the market helped us better understand the market and connect with the right partners. Above all, trust and reliability have been crucial: delivering quickly, responding to partner needs efficiently, and maintaining high operational standards are just as important as the content itself,” said Inter Medya’s Can Okan. “We implemented a hybrid distribution strategy, offering content tailored to both free-to-air channels and digital platforms to meet diverse demands. While viewing habits vary from country to country, classic Turkish dramas consistently remain at the center of audience interest, which significantly supports our marketing and sales efforts. Additionally, we’re seeing growing demand for format sales and remake rights,” Okan added.

Kanal D’s Elif Tatoğlu remarked that consistency and quality were essential in the Western Europe expansion. “We’ve invested in premium, character-driven stories

with universal themes while maintaining high production standards. At the same time, we built long-term relationships with key broadcasters and platforms, offering flexible licensing models and marketing support.

This combination of strong content and strategic partnerships allowed us to stand out,” she indicated. “Clients are increasingly looking for adaptable contentstories they can localize or reimagine for their own markets-alongside ready-to-air dramas with a proven track record. They also want multi-platform rights, fast delivery, and strong promotional assets to maximize reach. We’ve responded by expanding our format sales,

creating marketing toolkits, and offering packages that suit linear, digital, and on-demand platforms. At the same time, viewing preferences vary widely across Western Europe. Some buyers are looking for more traditional, long-form storytelling, while others prefer shorter, episodic series that cater to different scheduling needs. Localization is another key factor: certain countries are willing to invest in dubbing themselves, while others require pre-dubbed content, which can make reach and entry more challenging. By balancing these different expectations and offering flexibility, we can serve a broad range of clients across the region,” she added.

Calino’s Goryana Vasileva also noted that several factors contributed to the outcome. First, the consistency of Turkish dramas in delivering longrunning, high-performing series provided broadcasters with reliable content that yielded a strong return

Goryana

on investment. Second, dubbing and localization efforts have been critical, making the series feel native to each market while preserving its unique identity. “Of course, momentum matters. Early successes in key markets, such as Italy, help create awareness and open doors in other countries. Clients are seeking content that can be effective across multiple platforms. Strong daily or primetime dramas remain essential, but flexibility in distribution is increasingly important,” he said.

“Entering such a competitive market required a mix of cultural connection and strategic positioning. At the same time, close collaboration with European

broadcasters, careful localization, and strong promotional strategies ensured that our series reached the right audiences and built lasting engagement,” Mistco’s Aysegul Tuzun added.

OGM Universe’s Ekin Koyuncu also noted the central role that content authenticity and consistency, strategic partnerships, and localization played in the path to growth in Western Europe. “We work closely with leading broadcasters and streamers to ensure optimal placement and promotion. By delivering a slate of premium series, we built trust with buyers who now recognize us as a reliable partner,” she said. “Clients in Western Europe are seeking strategies that make content accessible and visible, whether through thoughtful release planning or targeted launch initiatives. For us, it is always about finding the right approach for each partner and each market. We focus on being flexible and collaborative,” she added.

All major Turkish distributors had struck deals in Western Europe, which opened a new major market for drama distribution. “Recent deals in Spain and Italy highlight the strong demand for ATV’s dramas in Western Europe. These achievements represent an important step in the company’s long-term international growth strategy. Looking ahead, it is clear that our content will

continue to expand rapidly across Western Europe.

Strengthening existing partnerships while introducing new titles to the market will remain a key priority as ATV builds on this momentum,” Akar estimated.

“Turkish dramas are breaking viewership records in Spain and Italy. We’ve licensed many titles to these countries, and they consistently outperform even local competitors, often becoming the most-watched shows in their time slots. They’ve also generated major buzz on social media, and local press shows great interest in the stars of these series. Many Turkish actors have even become the faces of Italian and Spanish brands, highlighting just how strong the cultural impact has been,” Okan explained. “Beyond selling ready-made content, we are actively developing co-productions and remake deals with partners in the region. Spain and Italy have

become indispensable destinations for Turkish content, and we’re confident that Western Europe will continue to be one of the major growth engines for Inter Medya in the coming years,” he added.

Kanal D also looks forward to building on its momentum in France, Spain, and Italy to further expand across Western Europe, particularly in Germany and the Benelux countries. “We’re also committed to strengthening our format partnerships and coproductions to blend Turkish storytelling with local creative input. Our titles are already proving their appeal in the region: ‘Fatmagül’ is currently airing in Switzerland, ‘Hekimoglu’ in Italy, and we’ve also sold ‘Kuzey Güney,’ ‘Price of Passion,’ ‘Matter of Respect’ and ‘Fatmagül’ into other Western European markets,” Tatoğlu stated.

“France and Belgium are next on our radar. At the same time, we are looking at opportunities to reach younger audiences through streaming platforms. Our Turkish series are delivering strong results in the region: ‘Forbidden Fruit,’ ‘Woman,’ and ‘Cherry Season’ are performing exceptionally well in Italy; while in Portugal, ‘Woman,’ ‘Our Story,’ and ‘In Spite of Love’ are achieving impressive ratings,” Calinos Vasileva remarked.

Since Latin America is one of the largest markets for Turkish dramas, Spain has naturally become a significant milestone in Western Europe. “The market has a strong tradition of embracing high-quality drama, and the fact that our titles are finding a place there demonstrates both the appetite for Turkish storytelling and the confidence in our brand,” OGM’s Koyuncu said.

“We have been working in Spain for a long time and have sealed many deals, including ‘Bahar.’

In recent years, interest in Turkish content has been increasing in Portugal. As a result, titles like ‘Secrets of an Angel,’ ‘The Town Dr,’ ‘Melek,’ and ‘Hold My Hand’ were licensed there. We are glad to see that the same trend is growing in Italy,” Mistco’s Tuzun affirmed.

By Diego Alfagemez

Linette Zaulich

LINETTE ZAULICH, HEAD OF B2C AND DIRECTOR OF UNSCRIPTED AT ZDF STUDIOS, DISCUSSES THE CHALLENGES AND OPPORTUNITIES IN THE B2C ARENA AND

HOW THE COMPANY ADAPTS ITS STRATEGY TO A CONSTANTLY EVOLVING CONTEXT.

Linette Zaulich took on the role of Head of B2C, in addition to her role as Director Unscripted at ZDF Studios. She oversees the development and management of direct offers to end consumers through licensing to platforms such as streaming services, FAST channels, or digital marketplaces. Señal News spoke with Zaulich to detail the challenges of her new position.

How would you define ZDF Studios’ B2C strategy?

"Historically, our B2C activities played a secondary role to our core B2B operations. However, this has significantly evolved. We now define B2C as any activity where we determine both the brand and the content, whether it's distributed via FAST, SVOD, or AVOD platforms. Through direct licensing partnerships with third-party platforms and trusted collaborators, we gain valuable consumer feedback. In today's dynamic media landscape, this kind of insight is crucial, as it enables us to continuously adapt, ensure relevance, and develop

sustainable, high-performing channel offerings. Our B2C efforts have matured considerably and are now being approached in a more strategic and centralized way across the organization. Globally, our primary goal is to strengthen and expand our brands among diverse audiences. We recognize that each market has its own digital maturity and local players, which must be factored into our strategies. That requires a deep understanding of regional trends, something we're fortunate to possess within our dedicated team and genre-specific expertise."

What are the challenges and opportunities in the B2C arena? "We need to focus equally on both B2B and B2C strategies. Building new brands in unfamiliar markets requires patience, investment in localization, and marketing resources. One of the biggest challenges, and also a key opportunity, is the shift from creating content for known programming slots to producing for discoverability on algorithmdriven platforms. That demands a new mindset, where success is often defined by how content performs in an unpredictable, user-led environment. That said, our longstanding relationships with global and local platforms allow us to spot emerging trends early and adjust our content strategy accordingly. We see a clear advantage in combining the expertise and storytelling tradition of linear TV with innovative approaches for digital-first audiences, especially the younger half of the population. It all starts with being open to learning and adapting."

How do you work with your catalogue to reach the right B2C platform with the right content?

"It starts with understanding the platforms. I spend time on both streaming and social platforms to experience how content is surfaced and consumed. Each platform has its own algorithmic language and logic for discovery. Once we understand the context, we return to our catalog to identify IPs and brands that meet specific needs. That could mean revisiting longstanding titles or finding hidden gems that align with current trends or audience preferences. We also implement tailored windowing strategies within our own distribution ecosystem, ensuring content is launched in the right place at the right time. That helps us maintain the value of our premium programming while adapting flexibly to platform-specific requirements."

How do you adapt your strategy to a constantly evolving context?

"Learn, adapt, apply. We monitor new platforms and emerging trends, and when appropriate, we integrate those insights into our broader windowing and content strategies. We often have content that can be distributed non-exclusively, which makes us a supportive and flexible partner, especially for newer platforms. I don't see B2C distribution as a zero-sum game. There's only so much time and attention a viewer can give, and no one's watching two services at the same time. As long as the content is strong and strategically placed, there's space for multiple players to coexist."

By Diego Alfagemez

TOM MIYAUCHI, VP AND HEAD OF NIPPON TV LA BUSINESS OFFICE,

DETAILS THE STRATEGY BEHIND THE LAUNCH OF GYOKURO STUDIO AND HOW THE COMPANY AIMS TO ENSURE JAPANESE CREATIVITY IS DEVELOPED AND SCALED IN STEP WITH GLOBAL OPPORTUNITIES.

Earlier this year, Japan's Nippon TV launched Gyokuro Studio, a production studio dedicated to developing content for the global market, and introduced the Nippon TV LA Business Office, a new business hub in Los Angeles. To understand the strategy behind that move, Señal News spoke with Tom Miyauchi, VP and Head of Nippon TV LA Business Office.

What are the motivations and strategies behind the creation of the new office in the United States?

"Nippon TV LA Business Office was founded with a clear mission: creating global entertainment. Establishing a base in California allows us to deliver on that promise from the epicenter of the entertainment industry. The strategy is straightforward: be closer to key partners, move at the speed of the market, and ensure Japanese creativity is developed and scaled in step with global opportunities. Strategically, the LA office serves as a hub to accelerate the international rollout of Nippon TV and Gyokuro Studio formats in North America and Latin America, spearhead format development to meet market demands, and expand into emerging

“JAPANESE CONTENT IS EXPERIENCING UNPRECEDENTED GLOBAL MOMENTUM”

areas of the entertainment business through collaborations."

How will the LA office work alongside the rest of the business areas of Nippon TV?

"Nippon TV LA Business Office connects Nippon TV's global strategy with the global market through creativity. Positioned between the global strategy headquarters and Gyokuro Studio in Tokyo, it ensures that international ambitions are channeled directly into the development of new content, and that the originality of Japanese ideas is brought to market in step with global demand. In doing so, the office acts as both a pipeline and a catalyst, turning strategy and creativity into entertainment with global appeal. We all work closely as one team to gear up and go global."

Why will the LA office focus on unscripted content? What business potential do you observe for this genre?

"Unscripted content has universal appeal and is one of Nippon TV's strongest areas of expertise, with formats like 'Dragons' Den/ Shark Tank,' 'Silent Library' and 'Old Enough!' demonstrating a proven track record of international success. In today's fragmented media landscape, unscripted shows offer scalability, adaptability, and

immediate engagement across territories. Nippon TV LA focuses on this genre because the U.S. remains the biggest market for unscripted formats, and success here generates global momentum for Japanese formats worldwide."

Gyokuro Studio aims to develop 10 unscripted titles each year. What types of shows are you looking for?

"We aim to develop unscripted titles that combine originality with international adaptability, reflecting Nippon TV's long track record of successful global formats. That includes studiobased game shows, competition series, bold social experiments, touching lifestyle and relationship shows, and family-friendly entertainment. Each title must carry a distinct Japanese creative spark while being built to travel globally, embodying our mission of creating global entertainment and ensuring Japanese ideas reach the broadest possible audience."

How would you describe the current positioning of Japanese content in the international industry?

"Japanese content is experiencing unprecedented global momentum. From the mainstreaming of anime to the enduring popularity of unscripted and scripted content, there is a strong appetite for Japanese originality and creativity. The industry now recognizes Japan as a source of innovative storytelling, and this momentum aligns perfectly with our mission: to harness Japan's creativity and amplify it on the global stage."

By Diego Alfagemez

WHILE THE NUMBER OF SCRIPTED SHOWS ORDERED FOR PRODUCTION IN 2025 FELL DRASTICALLY, IT IS UNCLEAR WHETHER THIS REPRESENTS AN OPPORTUNITY FOR UNSCRIPTED, LEGACY SHOWS, OR ANY OTHER CONTENT STRATEGY. EXECUTIVES FROM DIFFERENT PARTS OF THE WORLD ANALYZED THIS TREND.

Has the demand for scripted declined? Is there a new boom for unscripted titles? Is that a new opportunity to enhance legacy titles and licensing? How to balance the scripted and unscripted pipeline? All those questions might have different answers, and executives from various parts of the world analyzed one of the most discussed issues in the global content industry this year: the balance between scripted and unscripted content, and the future of each business.

LISA PERRIN , MANAGING DIRECTOR, INTERNATIONAL PRODUCTION, ITV STUDIOS

"It's clear that some linear broadcasters are making less scripted projects due to the rising costs of making drama. However, streamers are still demanding highquality drama, and we're pleased to have producers all over the world who can create those types of shows. Viewers still love watching unscripted shows, so I'm not sure I would call it a boom but a continued love. Broadcasters know that unscripted shows are still very popular, but they are looking at titles that can work on lots of their platforms - not just one."

"We are still seeing broadcasters wanting our longrunning, bankable brand titles. However, there is also a genuine desire for new content, and we're pleased to be launching a substantial slate of original new formats at Mipcom this year. We are already getting lots of interest from them."

"By having producers all over the world who have excellent relationships with their local broadcasters and streamers, we have an intimate knowledge of what our clients need. We rely on those producers of unscripted and scripted shows to have their finger on the pulse of the trends in their markets. It's definitely not one size fits all. In unscripted, we are always

looking for a good idea from any of our producers and creators through our Creative Network, and Mike Beale's team does a brilliant job of identifying undiscovered jewels and getting them traveling around the ITV Studios group."

VANDA RAPTI, EVP VIAPLAY SELECT & CONTENT DISTRIBUTION

"Internationally, the content that travels best across borders is scripted drama. The demand for such content by international content buyers has not declined, but what has declined is the commissioning of scripted content. We continuously monitor audience behavior and market dynamics across our footprint. Scripted commissioning has notably slowed down, primarily due to limited returns vs significant (and rising) production costs. In contrast, unscripted and reality formats have gained momentum, both for local and global streamers,

as such shows provide a more certain return on investment and are of lower cost to produce. Therefore, our streaming platform and free TV channels in the Nordics have continued to commission strong reality and non-scripted shows, and reduced our scripted output. Internationally, however, we continue to expand our inventory with the best of Nordic and other European storytelling, to fulfil the acquisition needs of our clients globally, as well as our specialized SVOD and Viaplay Select offering that focuses on the genre."

"We approach the scripted and unscripted balance with a dual lens. On the commissioning side, we prioritize unscripted formats that resonate with local audiences and deliver a good return on investment. These titles enable us to remain agile and relevant in a rapidly evolving landscape. Internationally, we represent the region's best scripted content, including distinctive and premium dramas and crime series that buyers continue to seek out. This balance allows us to deliver what works best in each context: relevant, costeffective unscripted for local markets, and high-quality scripted for international buyers."

SEBASTIAN KIM, VP OF INTERNATIONAL CONTENT BUSINESS DEPARTMENT, CJ ENM

"For ready-made content, the demand for Korean scripted shows has remained consistently strong rather than declining. Buyers continue to prioritize highconcept dramas with clear export potential: characterdriven thrillers, elevated rom-coms, and IP-based titles that leverage built-in awareness. The bar for story architecture keeps rising, so what's changed is not the appetite but the selectivity. In parallel, unscripted is enjoying a renewed tailwind, especially formats that

can localize cleanly while preserving a signature game mechanic or reveal. Titles like 'I Can See Your Voice' and 'The Genius Game' demonstrate two durable vectors of demand: first, co-viewing entertainment built on simple, repeatable rules and secondly, premium mindgame competition that feels fresh in every market."

"Our internal read suggests that the total number of titles on-air in 2025 is down approximately 30% versus 2023, reflecting domestic ad-market softness and a broader recalibration of commissioning risk. That contraction pressures both scripted and unscripted."

KELLY WRGHT, MD OF DISTRIBUTION, KESHET INTERNATIONAL

"From our experience, there's still a major appetite for scripted and unscripted formats and tape. In terms of our Keshet dramas, we recently sold three dramas to Netflix and licensed comedy formats in France for TFI and Germany for ProSieben.Sat1's JOYN, respectively. On the unscripted side, we are seeing renewed interest in format adaptations, particularly game shows. It's actually an opportunity for formats. Proven IP and legacy titles aren't going to stop being in vogue."

"We are lucky to have a continuous stream of scripted IP coming to us from our commercial broadcaster, Keshet 12. While these are local stories developed for local viewers, the themes are always universal. Simultaneously, we've always been known for our creativity in unscripted. We're now collaborating with various players to develop new IP from Latin America, and it's a fascinating venture for us. We love the creativity and the boldness of the TV leadership in this market; it's been an enjoyable and productive place to begin rebooting our unscripted creativity."

BRAD HORVATH , VP, CONTENT SALES & DISTRIBUTION, BOAT ROCKER STUDIOS

"The industry is in a moment of recalibration. While scripted premieres in the U.S. have come down from the peak in 2022, they are generally in line with other recent years, and 2025 is on pace with 2024. We're seeing that buyers are more cautious with spend and risk, and that could create room for more unscripted, but it doesn't mean scripted has lost its value."

"When scripted commission volume softens, it is an opportunity to lean into unscripted, but scripted remains essential, especially on projects with strong creative voices that resonate internationally. Yes, it's also a moment to maximize the value of legacy titles and licensing."

"For Boat Rocker Studios, adaptation is built into our DNA. We've always been a multi-genre, multi-platform studio, so we're set up to adapt with shifts in demand. We don't see scripted and unscripted as competing. Our goal is to have a diversified slate with the flexibility to lean into whichever side the market rewards at any given moment. That's how we build resilience through cycles, by being able to move where the audience and the buyers are headed."

BRYAN GABOURIE, SVP, INTERNATIONAL SALES & PARTNERSHIPS, BLUE ANT STUDIOS

"We do have strong scripted programming at Blue Ant, primarily in the Kids & Family, Y/A, and animated spaces, for which we have established strong broadcast partnerships in key territories around the world. Our scale and position in the market enable us to continue producing premium content across all genres through a range of flexible deal models, leveraging co-production partnerships, strategic windowing, and various production finance models and incentives. We are also uniquely positioned to include participation from our O&O Channels and Services as part of these collaborative models, bringing fresh content to market, a key component of the advantages the broader Blue Ant Media brings to the table. Our slate is an example of very strong creative that we are putting the full weight of Blue Ant Media behind, to commence production and deliver premium content in proven genres ahead of securing platform partners. Our clients have had a tremendous response to this model thus far, and it's a key component of our international content strategy going forward."

PAULA TERUKO, DIRECTOR, CONTENT SALES, LATIN AMERICA & U.S. HISPANIC, BBC STUDIOS

"In Latin America, scripted remains a cornerstone, particularly local drama and telenovelas, which continue to drive audiences and subscriptions. Even with budgets under pressure, buyers in the region continue to seek high-quality scripted content with broad appeal consistently. Alongside this, we're seeing sustained and growing interest in BBC Studios' Natural History Unit and factual programming. Natural history resonates strongly, offering both global prestige and family-friendly appeal. My role is to help clients identify the right mix, whether that's premium scripted titles with international potential or standout factual programming that delivers scale and distinction."

"It's not about scripted being replaced but rather complemented in smarter ways. Local drama and telenovelas remain the backbone of viewing, but with fewer originals being commissioned globally, catalog titles and factual content are playing a bigger role. Buyers are turning to natural history and other factual genres to refresh their offerings, appeal to family audiences, and stand out in an increasingly competitive landscape."

"Because we offer both premium scripted and world-class factual programming, we can adapt quickly depending on what partners are prioritizing. That agility is key, sometimes the immediate demand is for a scripted title with international recognition, and other times it's for standout factual content, such as natural history, that delivers global prestige and broad family appeal."

"In Latin America, clients have become more selective when approving projects, as the region grapples with significant global shifts, such as M&A activity with the merger of Warner Bros. Discovery and the sale of Paramount, among other corporate restructurings. That said, BBC Studios' portfolio of scripted IP remains strong, high-quality, and well-known, and we are confident in its long-term potential in the market. On the unscripted front, I wouldn't describe the current moment as a "boom." What we are seeing is a stable and consistent flow of unscripted production and renewals, which has remained relatively unchanged. In contrast with the slowdown in scripted, that steady activity can

look like a surge, but in reality, it is more a continuation of the usual cycle for unscripted formats."

"In most cases, it's an opportunity to enhance legacy titles and licensing. When there is a decrease in the commissioning of scripted originals, the natural tendency is not necessarily to replace that demand with unscripted, but rather with other forms of scripted content, such as licensed formats or well-established legacy titles. Commissioners still prioritize content that aligns with the same consumption habits and audience expectations and scripted remains a core viewing choice. We are also seeing an increased willingness for our partners to invest in strong scripted IP at the start of a scripted format's international journey."

"While the market has become more cautious, scripted content remains central to global programming strategies. What we're seeing is a shift toward selectivity and strategic investment: buyers are looking for strong IPs, distinctive editorial voices, and stories that resonate across cultures. At Federation, scripted is our core strength. We continue to see solid demand for premium drama. Rather than a decline, we see a refocusing of scripted commissioning, toward projects that are editorially sharp, internationally scalable, and creatively ambitious."

"It's

clear that some linear broadcasters are making less scripted projects due to the rising costs of making drama. However, streamers are still demanding high-quality drama. Viewers still love watching unscripted shows, so I'm not sure I would call it a boom but a continued love."

"The slowdown in scripted commissioning is a chance to reinvest in existing IPs and formats. At Federation, we've created IP360, a dedicated entity focused on identifying, acquiring, and adapting scripted formats with strong international potential. We also see continued interest in licensing and reboots of legacy titles. In a more cautious market, scripted formats that are already tested and editorially distinctive offer a compelling path forward."

"We've built our model around editorial ambition and international reach. Scripted is at the heart of our identity, and we continue to invest in premium drama series that combine strong storytelling with global resonance. While we do explore unscripted opportunities, our focus remains on developing scripted series with strong IP, international coproduction potential, and long-term value. We adapt by staying close to our partners, listening to market signals, and building a pipeline that balances creative ambition with strategic pragmatism."

By Diego Alfagemez

"RADIAL

JULIE DANSKER , CO-HEAD OF SALES, DISTRIBUTION & STRATEGY AND EXECUTIVE VICE PRESIDENT OF GLOBAL LICENSING, TVOD, AND

INTERNATIONAL DISTRIBUTION, SHARES THE COMPANY’S VISION FOLLOWING THE MERGER OF FILMRISE AND SHOUT! STUDIOS.

Earlier this year, FilmRise and Shout! Studios merged to form Radial Entertainment, bringing together two companies with overlapping businesses and complementary strengths, Julie Dansker, Co-Head of Sales, Distribution & Strategy and Executive Vice President of Global Licensing, TVOD, and International Distribution explains Radial’s unique market positioning, the synergies driving its growth, and how the company is preparing to meet audience demand across streaming, FAST, and traditional broadcast markets.

What was the strategic vision behind the merger of FilmRise and Shout! Studios to create Radial Entertainment?

"The goal was to combine two really great companies with overlapping businesses and complementary content. By leveraging the strengths and capabilities of each company, we can offer an end-to-end solution for production, distribution, and streaming. Shout! is one of the longest-standing independent distributors in the business, with deep expertise across streaming, transactional, theatrical, and physical channels, and has a diverse library of premier titles across cultclassic, animation, action, award-winning, western, and horror. FilmRise brings one of the largest independent catalogs of television and non-scripted content, with particular strength in true crime, reality, classics, medical, food, and UK genres. By combining libraries, capabilities, and best-in-class leadership teams from Shout! and FilmRise, we believe Radial Entertainment is primed to become the independent distributor of choice, better serving content owners and platforms."

How does Radial differentiate from its competitors in the global content distribution landscape?

"Radial Entertainment is the largest independent distribution studio with over 70,000 movies and episodes, making it the largest independent distributor and biggest FAST channel provider. It became a leading player in a multi-platform entertainment industry, and

we offer best-in-class capability in all the distribution channels across streaming and FAST channels, broadcast sales, paid rentals, and downloads."

What benchmarks guide your content acquisition and curation strategy?

"Radial's strategy is rooted in identifying titles with outsized audience demand, across a wide spectrum of genres, formats, and vintages. Rather than focusing narrowly on a single category or era, we take a wideangle, data-informed approach to building a culturally and commercially resonant library. Our strategy prioritizes content that audiences consistently love and return to, whether scripted or unscripted, classic or contemporary. With a catalog of 70,000 titles and a robust pipeline of ongoing acquisitions, we're able to continually package, refresh, and distribute content in ways that align with evolving viewer behaviors across all media types. This dual emphasis on scale and relevance enables us to serve both niche and mass audiences across all major content verticals."

How will Radial leverage the distinct genres from both companies?

"Radial's strategy is to double down on what is already working while expanding into new sources of content to stay ahead of audience demand. We will continue to leverage the distinct strengths of each library, scripted from Shout and unscripted from FilmRise, while also exploring creator-driven content, short-form formats, and selective original productions, particularly in true crime, where audience engagement remains consistently strong. By combining reliable genre depth with fresh storytelling approaches, Radial will position itself as both a trusted provider of proven content and an innovator driving growth across emerging platforms."

How would you define Radial Entertainment's mission in the global distribution ecosystem?

"International expansion is a huge priority for us as the merger gives us the scale to beef up our rights. We see the FAST/AVOD business growing significantly, and we'll be there when it happens. We've already got a strong foothold in major territories. Our international content has rapidly grown in the last few years. We're trying to source and acquire local content from major markets."

By Romina Rodriguez

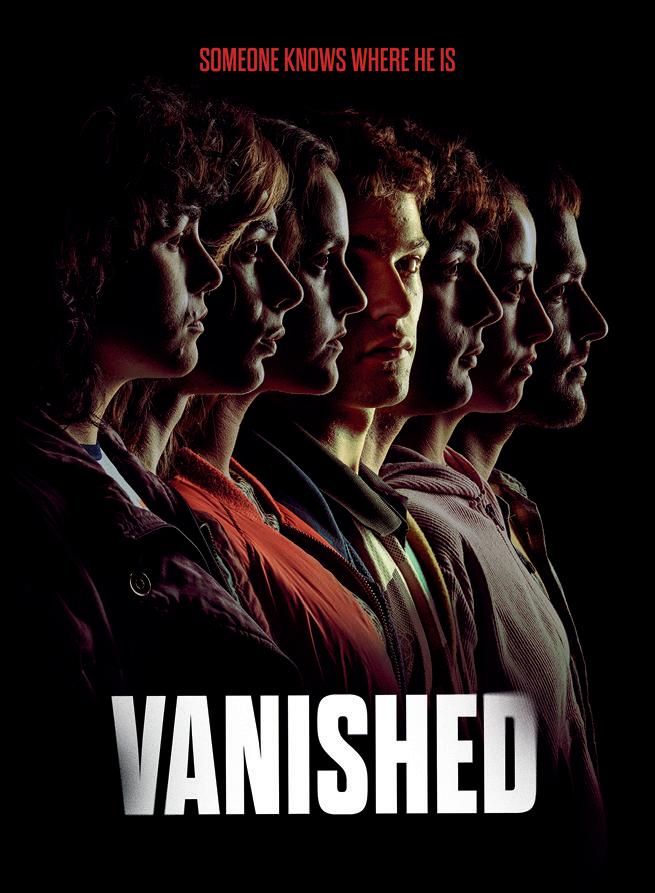

SILVIA COTINO, DEPUTY DIRECTOR OF SALES AND BUSINESS DEVELOPMENT AT MEDITERRÁNEO, DETAILS

WHY MEDIASET SPAIN'S SALES AND PRODUCTION DIVISION BEGAN DISTRIBUTING THIRD-PARTY CATALOG TITLES, WITH MAJOR LAUNCHES SET TO DEBUT AT MIPCOM.

After launching the international distribution of Prime Video and RTP series "Punto Nemo" last April, Mediterráneo, the content sales and production division of Mediaset Spain, expands its third-party catalog by adding new titles for global expansion. The first titles will be "Desaparecido", a Zebra Producciones (Grupo iZen) and Pausoka Entertainment production for Netflix and Primeran (EITB), and "Olivia", a Studio60 and Womack production. To understand the whole expansion strategy, Señal

and

Why did you decide to start distributing titles from third-party production companies?

"Our catalogue has always been rooted in the strength of Mediaset España's productions, with high-quality and diverse titles. Partnering with third-party producers enables us to expand our offerings, respond to market trends, and build a more diverse portfolio that resonates with different audiences worldwide. The opportunity lies in complementing our strong in-house slate with premium projects that carry distinctive voices and fresh narratives. In many cases, these projects come from very powerful first windows with platforms of the caliber of Netflix or Prime Video, which have already invested in the local territory with outstanding success in Spain. That gives us enormous solidity when we try to distribute them beyond our borders. At the same time, our role is to maximize their visibility internationally, ensuring that stories that captivated Spanish audiences can also have a successful path globally."

How would you blend that strategy with the traditional Mediaset and Mediterráneo catalog?

"We see it as a natural integration. Our in-house catalog gives us

brand recognition, while thirdparty acquisitions bring variety. The goal is not to dilute but to enhance: combining flagship Mediaset titles, which already have a proven track record with audiences, with innovative productions from external partners creates a more compelling catalogue. The aim is to revamp our catalog and make it even more attractive to international buyers. The titles we distribute share common qualities: warmth, powerful production values, and the ability to connect with audiences. That coherence enables us to position Mediterráneo as a distributor, thereby strengthening our value proposition in global markets like Mipcom."

How would you describe the global appeal of Prime and RTP's "Punto Nemo"?

"'Punto Nemo' has all the ingredients of a premium drama