15 September 2025

1. INTRODUCTION

1.1. This paper provides the Railway Industry Association’s (RIA) response to the questions raised in the Transport Select Committee’s call for evidence for their inquiry into skills for transport manufacturing. This response draws on engagement with RIA members, research from Oxford Economics commissioned by RIA, engagement with other trade associations, and wider research conducted in-house by RIA.

2. ABOUT RIA

2.1. The Railway Industry Association (RIA) champions a dynamic UK rail supply sector. We help to grow a sustainable, and high-performing railway as well as promoting UK rail expertise and products to international markets. RIA has over 450 companies in membership, which is active across the whole of railway supply, covering a diverse range of products and services and including both multi-national companies and SMEs (60% by number).

2.2. The rail industry is a foundation sector for the UK’s economy which supports sustainable investment and jobs in towns and communities across the UK. The sector contributes more than £41 billion in economic growth and £14 billion in tax revenue each year, as well as employing 640,000 people. It is also a vital industry for the UK’s economic recovery, supporting green investment and hubs in towns and communities across the UK; for every £1 spent in rail, £2.50 is generated in the wider economy.

3. CLARIFICATIONS

3.1. In the case of this inquiry, we believe that manufacturing, assembly, maintenance, refurbishment, repair and upkeep all fall within the scope, as part of the broader notion of producing vehicles, buses, aeroplanes, ships, and trains and rolling stock.

3.2. It is important to consider the difference between rolling stock manufacturing and assembly. Given the role of global just-in-time supply chains, components are manufactured in different countries and often assembled in others. In the case of rail locomotive and rolling stock manufacturing, both UK-based assembly and manufacturing should be considered in scope.

4. ABOUT THE UK RAIL MANUFACTURING INDUSTRY

4.1. The UK rail manufacturing industry covers a breadth of skills and jobs and is a highly productive sector.

4.2. Using the Department for Business and Trade’s (DBT) Industrial Strategy sector definitions, multiple areas of rail manufacturing that fall into “Advanced Manufacturing”, based on Standard Industrial Classification (SIC) codes, as outlined by Eurostat as being medium-high-technology or high-technology:1 2

• Manufacture of computer, electronic and optical products (SIC code 26)

• Manufacture of electrical equipment (27)

• Manufacture of machinery and equipment not elsewhere classified (28)

• Manufacture of other transport equipment (30), specifically, manufacture of rail locomotives and rolling stock (30.2)

4.3. RIA also believes that Modern Methods of Construction constitutes advanced manufacturing.

4.4. Beyond advanced manufacturing the rail industry also contributes greatly to “general manufacturing”, using the official definitions. Most notably: Repair and maintenance of other transport equipment (SIC code 33.17). Whilst advanced manufacturing is one of the Industrial Strategy’s “growth-driving sectors” the importance of “general manufacturing” in supporting advanced manufacturing must not be lost. For example, in the rolling stock sector, a strong after-market capability in maintenance and refurbishment (“general manufacturing”) supports confidence to invest in new trains, sustaining demand in the primary manufacturing market (“advanced manufacturing”)

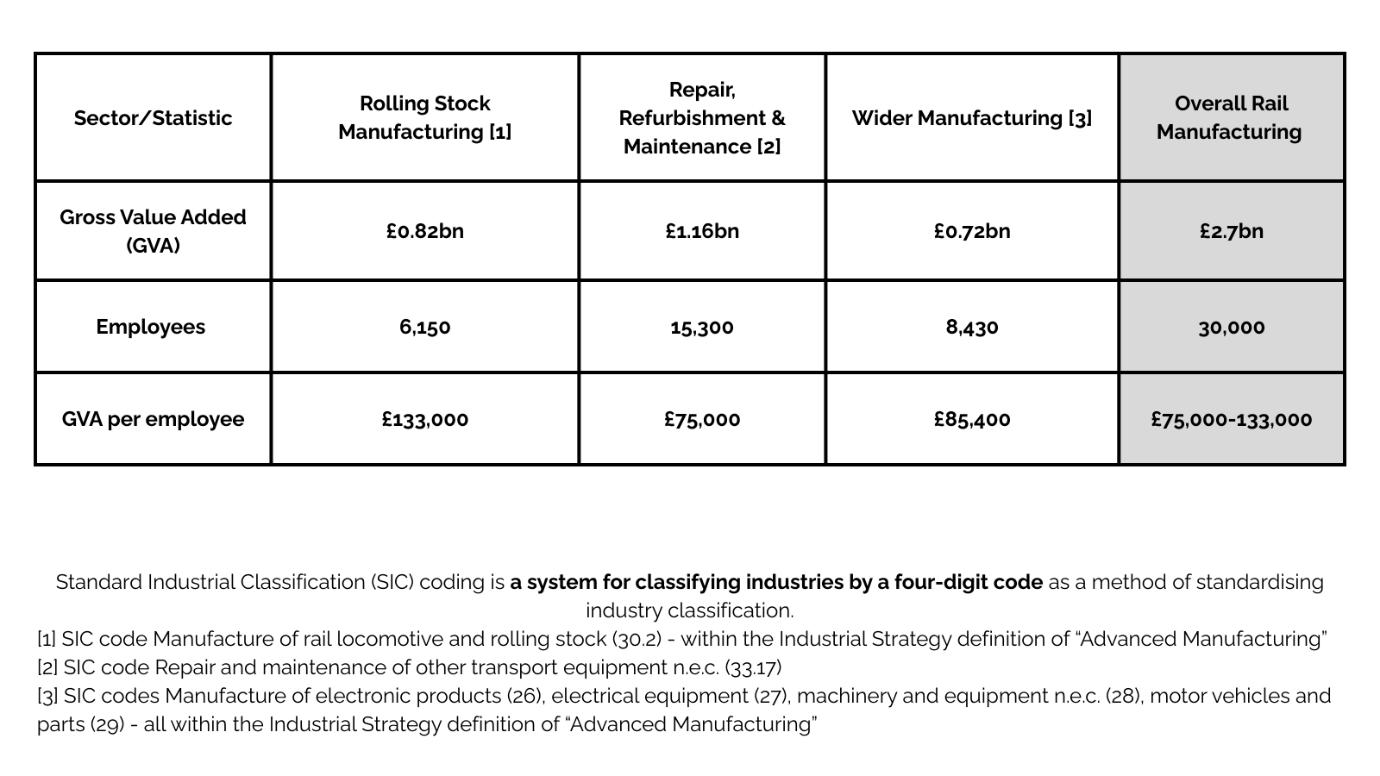

4.5. Research by Oxford Economics has shown that the rail manufacturing industry is an extremely productive sector.3 The sector employees roughly 30,000 people in the UK. Across rolling stock manufacturing, repair, maintenance, refurbishment and wider manufacturing needs (for example, signalling) the Gross Value Added (GVA) per employee across the industry is between £75,000 and £133,000.

5. KEY MESSAGES

5.1. Rail manufacturing is included in the defined scope of the Industrial Strategy but now needs to be recognised in the debate:

• The Industrial Strategy sector definitions show that “advanced manufacturing” includes manufacture of railway locomotives and rolling stock (as well other activity such as signalling, electrification and presumably Modern Methods of Construction).

• However, despite this, rail manufacturing is not discussed as a priority in the document, and there is a risk that Government overlooks a highly productive and strategically important industry that underpins wider economic growth, 30,000 manufacturing jobs, and the shift to a high-skill, high-productivity, low-carbon economy.

5.2. UK rail manufacturing productivity is world-class:

• Rail manufacturing delivers some of the highest productivity in the UK economy, with GVA per employee ranging from £75,000 to £133,000, compared with the UK manufacturing average of £76,000.

• This places the rail manufacturing industry, and particularly advanced manufacturing – sitting at the top end – ahead of several of the Industrial Strategy’s “growth-driving” sectors, demonstrating that rail is already a high-value contributor to the UK economy.

5.3. There is a risk of critical skills loss in UK rail:

• The sector faces an ageing workforce, with one-third of employees over 50 and a 9.4% fall in the workforce reported by the National Skills Academy for Rail in 2024. Key manufacturing skills at risk include welding, fabrication, rolling stock assembly, signalling design and testing and overhead line equipment engineering.

• Many companies have told us they have been reallocating staff to projects in other countries or sectors. The risk is that the UK loses critical capabilities permanently, with lower expertise resulting in lower productivity.

5.4. A steadier and more visible pipeline of manufacturing work will boost investment and lower costs:

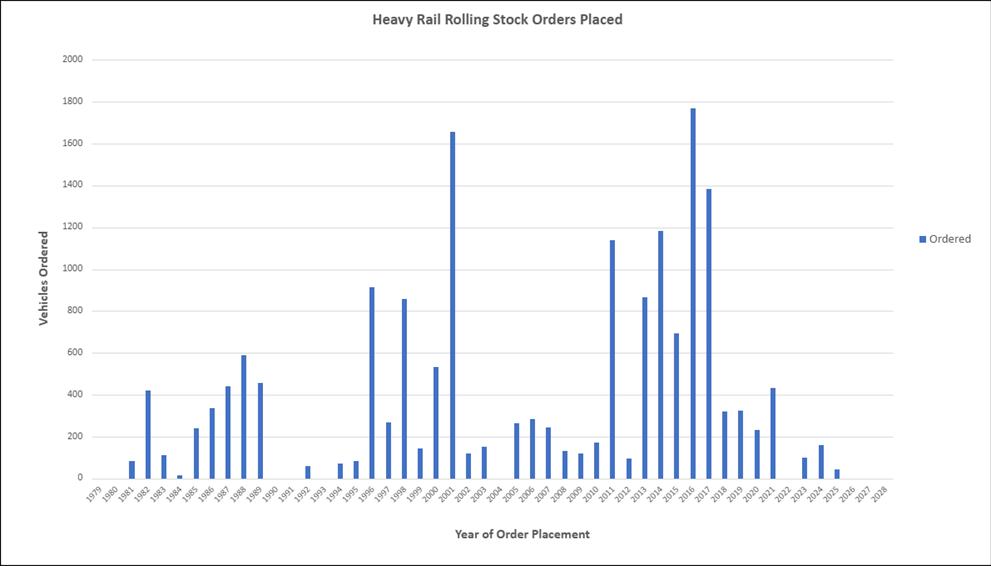

• The substantial volatility in rail manufacturing volumes from year to year (which are commissioned by the public sector) is in stark contrast to the much more stable work volumes in seen in other manufacturing industries. A steady long-term pipeline of work is the single most important factor for skills investment.

• Suppliers from Tier 1 manufacturers to SMEs make judgements about the certainty of future workload when deciding whether to invest in apprenticeships, retraining, and advanced technical capabilities. In rolling stock manufacturing, volumes in peak periods are more than five times higher than during downturns.

5.5. Joint Government and industry leadership is needed. Rail manufacturing is vital to both the infrastructure and industrial strategies. Transport connections connect city regions and industrial hubs. To manage the risk of critical skills loss the industry requires a dedicated rail skills action plan. This should:

• Define critical capabilities needed for future rail (mechanical, electrical, digital, and green skills).

• Map existing gaps and monitor workforce trends.

• Link skills planning directly to investment and pipeline certainty.

• Support apprenticeships and degree-level training to meet demand.

• Currently, the National Infrastructure and Service Transformation Authority (NISTA) Infrastructure Pipeline lacks rail-specific detail, leaving businesses without the clarity needed to invest in workforce development

5.6. The following sections of the paper address each of the specific questions posed by the Transport Select Committee inquiry.

6. WHAT ARE THE MAIN SKILLS NEEDS FACING TRANSPORT MANUFACTURERS?

6.1. Across the rail sector in general there are significant skills and workforce shortages. The National Skills Academy for Rail (NSAR) 2024 Workforce Survey shows a 9.4% reduction in the rail workforce compared to 2023, with this coming predominantly in the supply chain.4

• Whilst the proportion of workers under the age of 25 increased to 6.3%, this is far outweighed by the number of workers expected to retire in the next five years (potentially 47,000). One-third of the work force is aged 50 or older, meaning high levels or departures are expected in the coming years.

• This combination of high levels of workers over 50, high predicted levels of people leaving the industry and low numbers of new, younger entrants indicates a likelihood of significant skills shortages in the coming years.

6.2. Further, NSAR’s report demonstrates the change in skill level requirements for the rail sector. NSAR allocate each job role a Skill Level – these are equivalent to the academic level required to undertake each role.

• The largest increase can be seen in Skill Level 3 roles (equivalent to A-Levels) and a notable decrease in Skill Level 2 roles (equivalent to GCSEs)

• This would indicate that the increasing levels of technology of the modern rail system demands higher levels of expertise.

6.3. In rolling stock assembly and manufacturing the significant roles within the process are Skill Level 3 or higher:

• Technicians and Fitters - Skill Level 3

• Project Managers - Skill Level 5

• Engineers - Skill Level 6

6.4. Department for Education (DfE) data from 2022 reinforces this challenge. 10.5% of employees working for businesses classified under SIC code 30 ‘Manufacture of other transport equipment’ are considered to not be “fully proficient”. This highlights a skills gap in the industry 5 Without certainty of future orders, businesses are reluctant to invest and find it harder to justify spending money on training and upskilling their workforce, despite rail manufacturing being one of the UK’s most productive industries (see Annex A) A visible pipeline of work is essential to underpin workforce development.

6.5. Rolling stock assembly and manufacturing is a high-skill, highly technical industry. As the sector progresses and becomes increasingly digital, electrical and green, a combination of mechanical, electrical and digital competencies will be required to solve challenges the future system may bring.

6.6. While urgent clarity is needed on the medium-long term (5-10 years) new-build order pipeline, a significant - and increasingly overlooked - opportunity lies in sustaining this critical workforce through the planned upgrade and modernisation of existing operational fleets.

6.7. The Government’s Net Zero goals will further reshape skills needs. With Net Zero goals set in law, the rail sector has been embracing advanced and greener technologies, leading to a growing demand for niche expertise, particularly with a focus on digital technologies, sustainability, and environmental roles. Yet, the path to Net Zero could lead to skills uncertainty, until the precise technologies for the transition are chosen. For example, if hydrogen is the selected means with which to approach Net Zero in rail there will need to be a targeted development of chemical engineering expertise. However, if electrification and battery technology are the favoured approach a different set of skills would be required.

6.8. It must also be considered that there is intense inter-sector competition for skills As the transport manufacturing industry continues to adapt it is becoming increasingly more important to have the right skills. However, this creates competition, not just between rail companies but other attractive and technically advanced industries such as defence, energy and technology, which target individuals with similar skillsets.

7. HOW FAR IS THERE OVERLAP BETWEEN THE SKILLS NEEDS OF MANUFACTURERS

IN DIFFERENT TRANSPORT SECTORS?

7.1. The manufacturing industry is currently experiencing skills shortages and vacancy gaps:

• At the time of writing, there are an estimated 46,000 vacancies in the sector, and with a 42% Skills-Shortage Vacancies (SSVs) density, the third highest for a single sector, there are clearly issues to be resolved across the sector.

• A report from EngineeringUK in 2023 has shown that the demand for engineers and technicians is on the rise with engineering occupations projected to grow by 2.8%, adding 173,000 net new jobs, by 2030.6

7.2. The overlap between skills in the manufacturing industry suggests that greater crosssector employment mobility could help alleviate skills gaps However, employment mobility is not a ‘silver bullet’ :

• Across rail, automotive, aerospace, and maritime manufacturing there are highly specialised sector-specific expertise that is required for the greatest efficiency.

• As such, when people move from one sector to another, they will not necessarily be able to immediately begin working at full efficiency. Time and money will need to be spent on upskilling them, and should they return to a sector they previously worked in the need to upskill and reskill will still be the case.

• Further, it should not be expected that the potential for mobility means that people will move between sectors. Should they find that one sector is more lucrative or that work is more consistent with clear pipelines of work published, it is unlikely that they would leave this new sector.

• RIA recognises that some mobility and diversification between sectors can support beneficial lesson learning and innovation, but the movement of skills needs to be in both directions for this to happen, with rail manufacturing also benefiting from new skills entering the industry. The employment data collected by NSAR suggest this is not happening at any significant scale.

7.3. Consultations by Skills England demonstrated three key trends that manufacturers believe will drive future skills demand:

• Automation: 59% of manufacturers cite automation as a trend that is changing jobs and skills needs for their business, with 46% of manufacturers highlighting a lack of technical skills as creating challenges for adopting automation technologies

• Digitalisation: 50% of manufacturers cite digitalisation as a trend that is changing jobs and skills needs for their business

• Environmental sustainability: 37% of manufacturers cite environmental sustainability as a factor in changing skills needs, about recourse efficiency as well as design and innovation.7

7.4. The need for digital expertise is becoming an ever more important area of overlap Skills in digital design, data analysis, cybersecurity, electrical and systems engineering, and AI are now essential across all transport manufacturing sectors. Likewise, project planning and management capabilities are in strong demand and highly transferable, with the ability to oversee complex projects, allocate resources effectively, and manage risks proving vital across every mode of transport.

8. HOW EFFECTIVE ARE THE PIPELINES FOR NEW WORKERS INTO TRANSPORT MANUFACTURING, INCLUDING FROM SCHOOLS AND COLLEGES, FROM UNIVERSITIES AND APPRENTICESHIPS, AND RECRUITING OLDER WORKERS RETURNING TO OR CHANGING JOBS?

8.1. Despite the significant effort and focus being invested in encouraging young people to pursue STEM (Science, Technology, Engineering and Mathematics) subjects the rail industry continues to face perceptions of being outdated, even though cutting edge technologies are deployed. Combined with strong competition from other sectors, this

means that, despite ongoing initiatives, many young people still do not view the industry as a potential career path.

8.2. NSAR’s Workforce Survey data would suggest that the pipelines for new workers into the rail sector, as a whole, are ineffective. Young people are still under-represented:

• 16–20-year-olds make up 1% of the workforce

• 21–25-year-olds make up a further 5.3% (a combined 6.3% of the workforce under 25)

• Although this represents a small recovery from the post-pandemic low point, it remains below the 10.3% figure recorded in 2016. Encouragingly, the actual number of under-25s has grown by 2,300 since 2023, even at total recorded employment fell by 23,000.

8.3. Office for National Statistics (ONS) data paints a mixed picture in rail manufacturing specifically:

• Between 2021 and 2022, the number of “rail and rolling stock builders and repairers” (Standard Occupational Classification code 5237) fell from 14,016 to 12,836.

• By contrast SIC code data shows significant fluctuation in employment in the “Manufacture of railway locomotives and rolling stock” (30.2). 18,622 in 2020, falling to 11,450 in 2021, before recovering to 18,197 in 2022.

• This may suggest both cyclical patterns of work and the movement of workers between projects. While flexibility and transferable skills are strengths, excessive movement risks eroding highly specialised capabilities in rolling stock production.

8.4. The benefits of hiring apprentices are well known. A recent poll showed that:

• 50% of employers found that apprentices stay in their business longer than any other recruits.

• 75% say they actively promote their apprenticeship credentials when pitching for new business.8

8.5. However, the rail industry faces major barriers in expanding apprenticeship numbers:

• Only 1% of the current workforce are new apprentices, far below the 2.5% per year needed to meet future workforce demand.9

• Employers are often unwilling to take apprentices without long-term certainty of workload, as training and upskilling requires sustained investment in both time and money.

• Furthermore, the administration of schemes can be complex, though organisations like the National Training Academy for Rail (NTAR) are working to simplify these processes. NTAR will be discussed later in this response.

8.6. Whilst the benefits of hiring apprentices are well known, railway industry suppliers are not incentivised or supported to take them on due to the lack of a clear and visible pipeline of work. Without a clear pipeline businesses are unable to invest in skills, whether that be training up the next generation or re-training the existing workforce, as it is unclear as to whether they will be able to afford it:

• The Government’s recent apprenticeship reforms are a welcome change to the system. Significantly, the reduction in the mandatory duration requirement from 12-months to 8-months could deliver greater flexibility in the sector.

• However, the success of these changes will depend heavily on the operational implementation – most importantly whether rules and frameworks will be changed and also how funding will be adjusted.

• There are discussions to be had as to on whose shoulders the task of increasing apprenticeship uptake, especially in the rail sector, falls on: the Government or industry. Ideally, this should be a joint venture. Government must create a viable environment for businesses to hire apprentices.

8.7. Further, there needs to be greater support for expanding degree apprenticeships. As noted above the skill sets at both technician and manager level are too narrow. The workforce needs to have a broader skill set to cope with new technologies and the integration of track and train operational thinking. Not only would this provide further skills for the workforce, it could also save the industry between £100m and £240m per annum.

8.8. The potential rewards of strengthening pipelines into the rail workforce are substantial:

• Closing skills gaps in rail could generate £344m for the UK economy by 2029.

• The largest social value is created in roles at Skill Level 3, which implies the sector should be targeting school leavers, through Level 3 apprenticeships.10

8.9. Further, social mobility can be enabled through apprenticeships. For example, East Midlands Railway (EMR) uses apprenticeships to drive diversity within their workforce, enabling social mobility and supporting career development. EMR’s plans align with their diversity and inclusion strategy, with a key focus on increasing the percentage of female applicants and applicants from ethnic minority backgrounds with targeted recruitment campaigns.

9. HOW HAVE TECHNOLOGY AND NET ZERO CHANGED THE SKILLS MIX THAT IS NEEDED, AND HOW PREPARED ARE TRANSPORT MANUFACTURING INDUSTRIES FOR FUTURE CHANGES?

9.1. The rail industry is committed to achieving Net Zero greenhouse gas emissions by 2050. Government’s ambition is to remove all diesel-only trains (passenger and freight) from the network by 2040. RIA’s RailDecarb23 campaign outlined a four-point plan of commitments to achieve this target:

• Immediately implement a rolling programme of cost-effective electrification on intensively used lines.

• Ramp-up fleet orders of low carbon rolling stock using new traction methods on less intensively used parts of the network, including hydrogen and battery.

• Government, Network Rail and other rail clients to work with suppliers so they never lose out for offering lower carbon solutions but are incentivised to reduce emissions.

• Planning for cost efficient delivery. There should be a cross-industry dialogue to establish a plan that maximises carbon reduction and rail service benefits within the available funding.11

9.2. To fulfil these aims the rolling stock manufacturing industry now requires increasing levels of expertise in:

• Digitalisation: the integration of digital technologies into rolling stock, such as A.I.powered systems for optimised train movements and predictive maintenance, requires expertise in data analytics, software engineering, and cyber security.

• Battery Technology: as battery-powered trains become more prevalent, skills in battery management systems, charging infrastructure, and battery maintenance are crucial.

• Alternative Fuels: the transition to hydrogen or other alternative fuels necessitates expertise in fuel cell technology, hydrogen storage, and the associated infrastructure.

• Sustainable Materials: designing and manufacturing rolling stock with sustainable and lightweight

• Green Skills: beyond the technical aspects, there is a growing need for skills related to sustainability, such as life cycle assessment, waste management, and carbon footprint reduction.

9.3. The “feast and famine” nature of rolling stock procurement and rail electrification in the UK has increased costs and made it difficult to maintain skills, expertise, and a sustainable supply chain. The transition to Net Zero demands specialist expertise in the design and manufacture of zero-emission vehicles, including electric, battery-electric, and hydrogen-powered trains. At the same time, retrofitting existing diesel fleets to enhance energy efficiency and cut environmental impacts represents a major opportunity to sustain vital UK skills during gaps between new fleet orders.

10. WHAT ARE THE MAIN CHALLENGES IN UPSKILLING EXISTING WORKFORCES?

10.1. The central barrier to upskilling the existing workforce is the uncertainty caused due by the lack of a visible, consistent, and clear pipeline forecast and rolling stock strategy. The prevailing stop-start approach to procurement creates production gaps, undermines domestic manufacturing capability, and discourages long-term investment in training and workforce development. This challenge applies not only to new-build fleets but also to the upgrade and modernisation of existing rolling stock.

10.2. The pipeline issue extends into the electrification priorities of the system. The Government urgently need to confirm the electrification priorities for the rail network. Confirming which areas will be fully electrified, partially electrified, or served by alternative propulsion technologies would give the industry the certainty it needs to plan and invest in skills and capabilities for the medium to long term across all rail asset classes.

10.3. The challenges caused by the lack of a clear pipeline are felt through the whole supply chain. If Tier 1 suppliers do not have detailed forward looking work banks available, they cannot provide the necessary confidence to their supply chain, many of whom are SMEs:

• The lack of a clear pipeline has been seen over recent years. There has been significant movement in the market with changing information on four tenders between January 2024 and January 2025. These delays and scope changes erode trust and stability.

• Delays or cancellations in procurement compel businesses to make difficult choices, often resulting in workforce reductions and cuts to training investment. Consequently, highly skilled professionals are drawn to sectors offering greater stability, leading to the erosion of critical capability within the UK rail industry.

• In 2024, the detrimental impact of not having a clear pipeline of work was seen at Alstom’s Derby Litchurch Lane site. It was reported that Alstom lost nearly 1,000 years’ worth of welding experience due to delays with new fleet opportunities entering the market, combined with a lack of pipeline visibility

10.4. A clearer, more visible and longer-term strategy will also allow businesses:

• To identify the critical skills needed moving forward.

• To design and deliver training and assessment programmes in good time.

• To ensure workers gain the necessary practical experience before new technologies and projects come around.

10.5. The urgency of this is exacerbated by the fact that over the next 15 years around 7,500 train carriages will need to be replaced, based upon an assumed 35-year design life. To meet these needs 500 train carriages will need to be manufactured and assembled on average every year.

10.6. Current levels of investment in training are insufficient, due to the lack of clarity in the sector. According to data gathered by the DfE, for 2022:

• Fewer than half (47%) of sites in the UK that fall under SIC code 30 ‘Manufacture of other transport equipment’ funded or arranged any training for staff in the previous year

• Further, only 46% of these sites providing training provided new technology training.

• Businesses need to have confidence to invest in training, especially for providing training on new technology. Without a clear pipeline to allow businesses to craft detailed business plans they are unwilling and unable to spend money on skills development within their current workforce.

10.7. The cost and time demand associated with training constitute a significant barrier to workforce development. Developing and delivering comprehensive programmes particularly in specialised areas such as digital and green skills requires substantial investment. In addition, releasing employees from operational duties for training can reduce productivity and disrupt project delivery, a considerable challenge for businesses already operating under tight deadlines, limited resources, and contractual penalties.

10.8. The demographic profile of the rail workforce, characterised by a large proportion of older employees, offers opportunities for valuable knowledge transfer but also poses challenges in ensuring widespread adoption of new digital skill sets. Ensuring widespread adoption of new digital skills among this group requires tailored training approaches and sustained support.

11. ARE THERE PARTICULAR SKILLS SHORTAGES, OR EXAMPLES OF SUCCESS IN DEVELOPING SKILLS, AT DIFFERENT POINTS IN THE SUPPLY CHAIN?

11.1. Technical skills, such as welding, fabrication and machine assembly, remain the bedrock of train manufacturing in the UK. Without a stable, visible and fully funded order pipeline for new trains, investment in the recruitment, training and retention of the technical workforce for the long term will continue to be undermined.

11.2. Highly specialised roles, including signalling design and testing staff and linesmen for Overhead Line Equipment (OLE) work, are particularly vulnerable to the "boom and bust" cycle of investment, as these skills take years to develop and are easily lost during downturns.

11.3. In addition to technical expertise, there are wider shortages in digital skills (such as data analysis and cybersecurity) and green technology capabilities across the supply chain, with smaller firms often lacking the resources to keep pace with fast-changing demands. Market uncertainty also leads some contractors to bring work in-house rather than subcontracting to SMEs, which further limits skills development and retention across the wider supply chain.

11.4. NSAR has highlighted a substantial shortage of skilled workers in capital projects, particularly within electrification and plant; civils and structures; and signalling and telecoms. This shortfall extends across the supply chain rather than being limited to prime manufacturers:

• For example, one major supplier informed RIA that it was forced to make 660 redundancies including 172 highly skilled and experienced permanent signalling staff owing to delays and cancellations at the outset of Control Period 7 (CP7).

• Specialised roles such as signalling design and testing engineers, as well as overhead line equipment (OLE) linesmen, are acutely exposed to the cyclical nature of rail investment. These capabilities require many years to develop yet can be lost rapidly during downturns, undermining the industry’s long-term resilience.

11.5. NTAR demonstrates how targeted public-private partnerships can build resilience in critical skill areas:

• A collaboration between NSAR, DBT, DfT and Siemens Mobility, to create a training academy that would ‘mind the gap’ and create a highly skilled workforce for the future.

• Since opening its doors in 2015, over 21,000 delegates have attended the training facility in Northampton to up-skill and retrain on a multitude of practical skills development and educational programmes.

11.6. Modern Methods of Construction involves innovative techniques, processes, and materials designed to improve efficiency, quality, and sustainability of projects. Not only should Modern Methods of Construction be considered under “Advanced Manufacturing,” but it also offers a case study of success for developing skills and the workforce:

• For example, Laing O’Rourke’s Worksop construction centre has been able to attract people from “traditional trades” jobs, where they have built up some transferable skills, and bring them into full-time employment in their Worksop construction centre.

• The guarantee of full-time employment, as well as better working conditions makes the move an attractive prospect for the individuals. This has also had a large social value impact on the local and surrounding communities – driving uplift in the economy through the increase in the workforce in the local area.

• This model illustrates that the sector can draw in new talent by offering secure, high-quality careers.

12. HOW EFFECTIVELY ARE DIFFERENT GOVERNMENT DEPARTMENTS WORKING TOGETHER, AND WORKING WITH LOCAL COMBINED AUTHORITIES, TO ENSURE TRANSPORT MANUFACTURERS HAVE THE RIGHT INCENTIVES AND SUPPORT FOR MAINTAINING A SKILLED WORKFORCE?

12.1. Successful cross-Government working is fundamental for delivering better outcomes for passengers and ensuring better value for money for the taxpayer. RIA is not aware of any cross-Government activity to define and monitor the strategic manufacturing capabilities required to support the rail industry

12.2. The Institution for Engineering and Technology’s (IET) 2021 Skills Survey outlined that businesses believe the best thing the Government can do both nationally and in their local area to improve skills is to provide funding for apprenticeships:12

• With 51% of businesses surveyed stating that the Government should be providing more support to train or reskill.

• The third most popular Government action among businesses surveyed is better careers advice and guidance in schools and colleges, highlighting the importance of early engagement in shaping future skills pipelines.

12.3. The DfE has encouraged closer collaboration between schools and large local employers, particularly in local areas where new schools are established:

• One approach under consideration is the development of an “enhanced curriculum offer” or supplementary modules that align classroom learning with local industry needs.

• For example, schools could integrate practical workshops, employer-designed projects, or industry guest lectures as an add-on to the standard curriculum, helping students build awareness of career pathways in advanced manufacturing. For transport manufacturing, such partnerships would ensure a stronger pipeline of young people equipped with the right technical foundations, while also raising the profile of the sector as an attractive long-term career choice.

12.4. The Government’s rail procurement policies could be used to generate greater tax income for HM Treasury to spend on the Government’s goals across different departments. For example, enforcing a procurement policy that encourages suppliers to procure more UK-based products would in turn generate more tax receipts from the business.

13. HOW EFFECTIVELY WILL THE GOVERNMENT’S MODERN INDUSTRIAL STRATEGY AND SECTOR PLANS SUPPORT SKILLS IN TRANSPORT MANUFACTURING? WHAT IS MISSING?

13.1. The rail industry was concerned to see that the Industrial Strategy does not explicitly discuss transport and rail as a significant enabler of growth, either for the eight specific sectors mentioned or for the UK industry and the economy more widely. However, we were pleased to see the definitions of scope do include rail. The Standard Industrial Classification (SIC) Codes, outlined as being relevant to Advanced Manufacturing as defined in the Industrial Strategy Sector Definitions List, included SIC code 30 “Manufacture of other transport equipment”, within which sits SIC code 30.2 “Manufacture of railway locomotives and rolling stock”, as well as other codes that are clearly relevant to the rail industry.

13.2. However, this leaves the industry in an uncertain position within the Strategy without formal recognition as a priority sector despite many of its core functions supporting the Strategy’s objectives.

13.3. Initial announcements in the Industrial Strategy around delivering training were initially seen as positive opportunities Notably, the expansion of Technical Excellence Colleges beyond construction. Across the rail industry this could serve as a positive opportunity to develop key skills needs in young people, allowing them to flourish when they enter the industry. The engineering community was hopeful that these expansions would reach the engineering sector.

13.4. However, subsequent announcements from the DfE have confirmed that the expansions will be focused on the skills needed for housebuilding to reach the Government’s goal of building 1.5m houses during this Parliament. Whilst some of these skills will be transferable and those enrolled at these colleges may be able to move over to the rail sector, the skills required for manufacturing of rolling stock and railway locomotives are highly specialised and it is much harder to gain the skills required without direct training and experience

13.5. The expansion of the Growth and Skills Levy is a positive step for transport manufacturing. With foundation apprenticeships funding for Engineering and Manufacturing going live in August 2025 there will be greater opportunities for businesses to invest in young people to join and develop the workforce ahead of potential skills gaps in the future.

13.6. Nonetheless, the Industrial Strategy and its Sector Plans have so far failed to engage meaningfully and directly with the rail manufacturing workforce. The rail manufacturing sector is a highly productive industry, even when compared to the Industrial Strategy’s eight “growth-driving” sectors. While other sectors have benefited from targeted attention, existing skills initiatives have delivered neither significant improvements nor a dedicated focus on rail manufacturing. This highlights the gap between the Industrial Strategy’s high-level ambitions and its practical impact on the ground.

13.7. In the Industrial Strategy’s white paper from November 2024 a commitment was made to publish a visible and viable Rolling Stock Strategy. However, no such commitment was outlined in the final Industrial Strategy nor the Advanced Manufacturing sector plan. As RIA awaits confirmation of this strategy, we must stress that the true value of the strategy will depend on the ability to translate commitments into a clear and actionable delivery plan.

13.8. Commitments to support the growth of the rail manufacturing industry and workforce need to be made, and in turn must be seen to fruition to support this highly productive industry.

14. HOW CAN THE UK GROW EMPLOYMENT IN TRANSPORT MANUFACTRUING?

14.1. The industry needs clear, visible and long-term pipelines and strategies to generate confidence within the industry:

• As referenced throughout, and in written and oral evidence to the Committee’s inquiry into ‘boom and bust’, a robust, visible and long-term rail pipeline and strategy is essential for the industry.13

• This pipeline would provide businesses with the clarity and certainty they need to invest in skills development of the existing workforce as well as allowing them the confidence to invest in expanding their workforce. This point goes beyond just manufacturing but into the rail industry as a whole.

• The prevailing “boom and bust” investment cycle presents significant barriers to effective long-term skills planning and sustained investment in transformative areas across the rolling stock supply chain. This cyclical pattern undermines stability throughout all tiers of the supply chain and constrains the sector’s overall capacity to build resilience and prepare for future requirements.

14.2. Rail Reform and Great British Railways (GBR) must deliver a long-term rolling stock strategy that sustains the supply chain, supports Net Zero, and fosters investment and growth:

• The rail reform process should provide a role for GBR to consider the long-term rolling stock needs of the network and the sustainability of the supply chain, creating strategy - including framework orders - to smooth the pipeline of work and sustain the supply chain.

• Key priorities include system-wide lifecycle cost evaluations, balancing interim solutions (e.g., alternative fuels and rolling stock cascades) with full fleet upgrades, all supporting Net Zero targets and supply chain sustainability.

• GBR should operate transparently, partner with suppliers, and avoid disrupting ongoing rolling stock projects. Collaboration and clarity will invigorate investment in the UK, allowing for growth in employment.

14.3. Promoting rail and transport careers is essential to attract young talent, strengthen skills, and secure a sustainable future for the UK’s manufacturing and transport industries:

• The manufacturing industry has a broad publicity problem, especially amongst the younger generation.

• In RIA’s manifesto prior to the 2024 General Election, we outlined our key asks for the incoming Government. One of our key asks was to support a sustainable supply chain – one of the ways in which this should be carried out is by promoting skills in rail and transport by celebrating the career opportunities the sector provides. The Government should promote a positive image of transport as a sector which offers local, national, and global career opportunities to work on some of the most exciting agendas of our time, helping to attract and retain talent in the sector.14

• Apprenticeships are central in tackling the employment issues in the UK rail industry. The Government has announced measures to reform the apprenticeships system; however, we have not seen any specific commitments to rail. For greater effectiveness the Government must engage meaningfully with industry.

• Further, with regard to A-Levels and T-Levels results, engineering and technology courses have seen the largest increase in placed applicants. However, Universities UK research has shown that allocation for ‘high cost’ courses such as engineering has decreased.15 With engineering skills at the heart of the UK’s Industrial Strategy and the transport manufacturing sector, this is a challenge that cannot be ignored.

• Targeted work experience placements designed to build confidence, develop basic competencies, and prepare individuals for formal training will enable a smoother transition into apprenticeships and help address barriers including limited qualifications and lack of a prior work experience. Formal experience at a

young age will encourage young people to consider a career in transport manufacturing. Support for work experience placements will enable.

14.4. Barriers to apprenticeships must be addressed succinctly:

• A key barrier to apprenticeships within the rail manufacturing sector is, broadly, locations. Apprentices traditionally have had to travel to multiple different sites, and live in new places at a young age, for short periods of time. This inconsistency can be very unattractive for school leavers. This constant moving around of individuals can be driven by clients insisting that suppliers have at least one apprentice on site.

• RIA members have suggested the creation of a Government sponsored pool of apprentices, that instead of being employed by one company, work in a geographical area and move between different companies when the companies have a project within their region. This would enable apprentices to set up their lives in a region as well as engage with a wide range of people from the industry –developing not only necessary technical skills but also people and life skills.

14.5. The UK transport manufacturing industry must be made an attractive industry compared to international counterparts:

• Those who study for many years are extremely proud of their qualifications. However, in the UK the term engineer has no legal protection when it comes to job titles. As such anyone could call themselves an engineer whether they are a bricklayer, fix washing machines or run large infrastructure projects. This can lead to a sense of deterioration of the prestige of the title, especially among young people yet to decide the career path they want to pursue.

• However, in other countries including Germany, Italy, Canada and Australia the title is restricted by laws and regulations to those with specific academic and professional qualifications. This can lead to graduates in the UK moving to these other nations where their qualifications are more vilified and their job title is protected.

14.6. Creating a stable, investment-friendly environment is essential for attracting global investment and developing a skilled UK transport manufacturing workforce:

• The UK faces intense global competition for investment, and some listing requirements have made the UK market less attractive compared to other global centres.

• The Confederation of British Industry (CBI) stresses the need for the Government to create a genuinely supportive environment for businesses, moving beyond “warm words” and towards practical policies that boost productivity and dynamic growth. A stable, investment-friendly environment is critical for building up a skilled workforce.

14.7. The UK must learn from international counterparts:

• In France the Comité d’Orientation des Infrastructures (COI) serves as a permanent infrastructure advisory body for the French Government, with a mission to deliver investment scenarios for transport infrastructure covering long-term horizons. The COI’s reports form the foundation for national rail investment roadmaps. These roadmaps cover and consider planning for the whole rail system including track, traction, rolling stock and signalling. These coordinated capital investment plans

support pipeline certainty for manufacturers and allows for long-term workforce planning. Further, embedding their industrial strategy into procurement ensures domestic firms benefit from sustained demand.

14.8. Boosting UK-based procurement in rail manufacturing can create jobs, strengthen the supply chain, and unlock significant economic value while supporting local skills and workforce development:

• New public procurement objectives include supporting local workforces and economies, as well as creating local jobs. Research carried out by Oxera Consulting in 2021 has shown that only 25% of parts for assembly of rolling stock came from UK companies, with 75% being imported from abroad. It is evident that although the UK rail sector sources just over half of rolling stock from suppliers with assembly plants based in the UK, the components used in new-build rolling stock are usually sourced from other geographies. The UK sourced proportion rises to 50% in the refurbishment market.16

• Oxera’s analysis shows that an approach to procurement that increases UK content in manufacturing from the current low of 25% to 50% could create an additional £133m GVA per annum and 2,000 new jobs. This would also provide far greater resilience in the supply chain and increase the scope for UK suppliers to expand their export potential.

• To reap these potential benefits, the Government should provide greater clarity and emphasis on how local source requirements are scored/assessed in procurements. Companies that Oxera interacted with contrasted the UK with the USA where the position is much clearer and firms can decide whether they wish to participate in the procurement or not. Greater emphasis on procuring from within the UK will allow for greater employment due to spend being carried out locally rather than through exports. In doing so UK employment can grow, as well as new public procurement objectives to be realised.

• It would also be extremely important to ensure that suppliers based outside of the UK are also having these same targets enforced.

• This increased mandatory UK-sourced content should also be coupled with greater transparency around workforce outcomes through employment and skills reporting from suppliers.

14.9. Manufacturers require greater clarity on exports expectations in order to make informed business planning decisions:

• Exporting of manufactured goods can be a very lucrative venture for businesses, and UK rail businesses are looking for more opportunities to do so. Greater exporting potential will also allow for growth in the UK rail manufacturing workforce due to the increased capacity that comes from increased production of goods.

• However, greater clarity is needed from the Government with regard to whether there is going to be greater earning potential for businesses by focusing on UKbased sales or exporting outside of the UK. By doing so the Government will allow businesses to plan more efficiently for the coming years.

For further information please contact RIA Policy Director Robert Cook at robert.cook@riagb.org.uk or 020 7201 0777 / 07951 776 874.

Figure 1 - Heavy Rail Rolling Stock Orders, 1979-2028

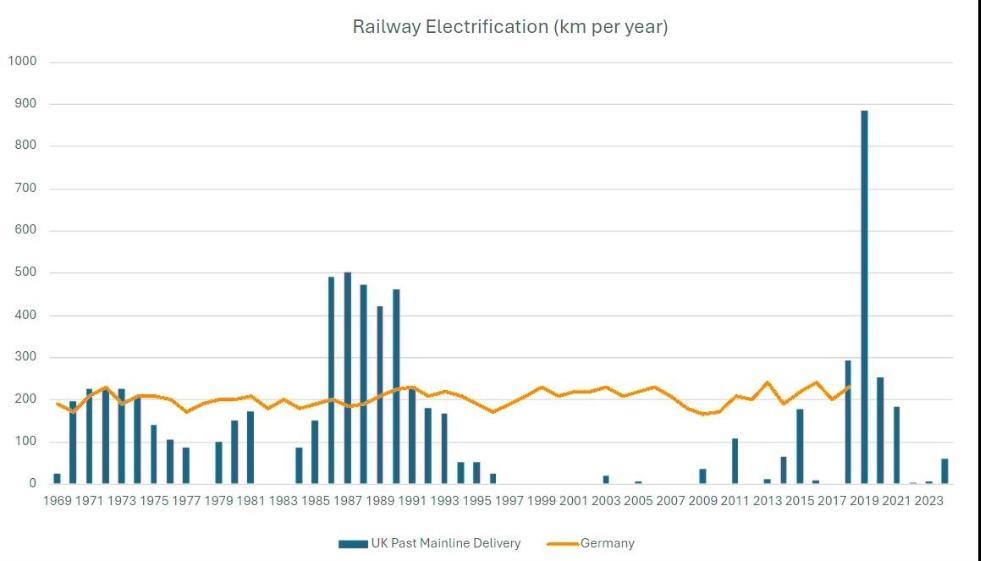

Figure 2 – Railway Electrification (km per year) in the UK and Germany, 1969-2023.

The UK has historically delivered electrification of rail lines at an irregular pace, a trend that has worsened since 1990, when investment in electrification began to significantly decline. There were then no major projects for two decades, until the CP5 programme including Great Western Electrification Project (GWEP) in 2009, which faced considerable challenges. This boom-bust cycle has resulted in higher costs, inefficient delivery, and poor skills retention, as outlined in RIA’s 2019 Electrification Cost Challenge report. In contrast, Germany has maintained a steady and consistent electrification programme, leading to lower costs and greater efficiency.

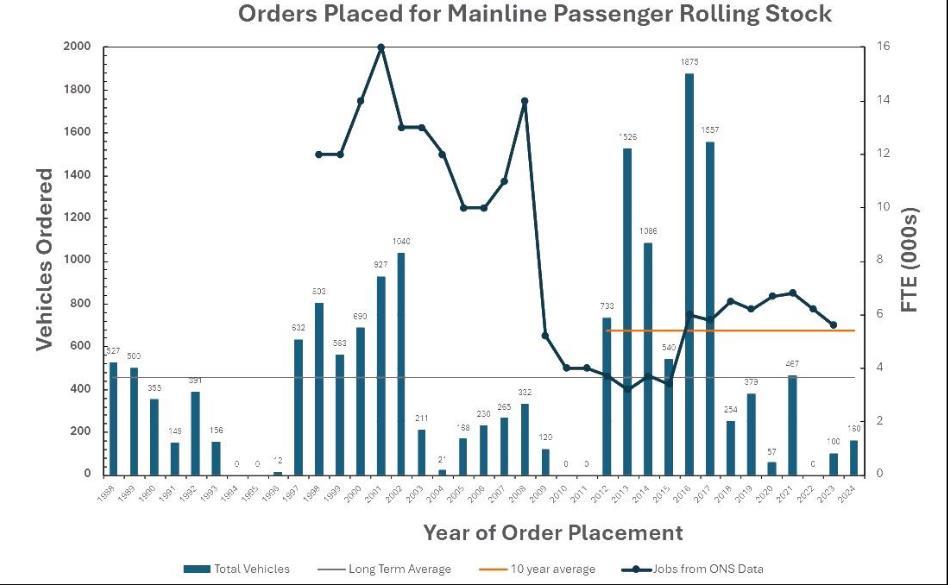

Figure 3 – Orders placed for mainline passenger rolling stock, including overlaid data on jobs, 1988-2024.

An inconsistent rolling stock order profile has led to inefficiency and higher costs. This is especially problematic for maintaining a skilled workforce, because of the unpredictability in levels of work. The decline in the workforce is concerning, particularly since passenger demand is expected to rise, so workforce retention and recruitment is vital. RIA’s Rolling Stock Strategy outlines how to smooth this ‘boom and bust’ cycle and thus reduce costs and support employment.

References for Sector Productivity Comparisons Table.

a Oxford Economics. UK: The everyday economy matters to local economic performance. 2024. https://www.oxfordeconomics.com/resource/uk-the-everyday-economy-matters-to-local-economicperformance/#:~:text=Apr%2023%2C%202024,UK%20%3A%20The%20everyday%20economy%20matters%20to%20local%20economic%20perfor mance,services%20and%20has%20low%20productivity

b CBI & Energy and Climate Intelligence Unit. The future is green: the economic opportunities brought by the UK’s Net Zero economy. 2025. https://eciu.net/analysis/reports/2025/Net Zero-economyacross-the-uk

c House of Lords Library. Creative industries: growth, jobs and productivity. 2025. https://lordslibrary.parliament.uk/creative-industries-growth-jobs-and-productivity/

d ADS Group. Defence industry adds £9.8bn to UK economy. 2023. https://www.adsadvance.co.uk/defence-industry-adds-9-8bn-to-uk-economy.html

e Department of Business and Trade. Industrial Strategy: Digital and Technologies sector plan. 2025. https://www.gov.uk/Government/publications/digital-and-technologies-sector-plan

f House of Commons Library. Financial services in the UK research briefing. 2024. https://researchbriefings.files.parliament.uk/documents/SN06193/SN06193.pdf

g CBI. The charge towards change: the UK auto industry’s path to electrification. 2024. https://www.cbi.org.uk/articles/the-uk-auto-industry-path-to-electrification/

Endnotes – References from the main body of this response.

1 Industrial Strategy Sector Definitions List. https://www.gov.uk/Government/publications/industrialstrategy/industrial-strategy-sector-definitions-list

2 Eurostat. Glossary: High-tech classification of manufacturing industries. https://ec.europa.eu/eurostat/statistics-explained/index.php?title=Glossary:Hightech_classification_of_manufacturing_industries

3 Oxford Economics, The Economic Impact of UK Rail 2023. 2024. https://www.riagb.org.uk/RIA/RIA/Newsroom/Publications%20Folder/The_Economic_Impact_of_UK_ Rail_in_2023_Infographic.aspx

4 National Skills Academy for Rail (NSAR). Navigating the skills shortage. Annual rail workforce survey 2024. 2024. https://www.nsar.co.uk/wp-content/uploads/2024/11/ONLINE-Annual-WorkforceSurvey-2024-compressed.pdf

5 Employer Skills Survey. https://explore-education-statistics.service.gov.uk/find-statistics/employerskills-survey/2024

6 Engineering UK. Engineering skills needs – now and into the future. 2023. https://www.engineeringuk.com/media/uqqdal5b/engineering-skills-needs-discussion-paperengineeringuk-may-23.pdf

7 Skills England. Sector skills needs assessment: Advanced manufacturing. 2025. https://assets.publishing.service.gov.uk/media/683d692be2008d4b92c80e29/Sector_skills_needs_as sessments_Advanced_Manufacturing.pdf

8 https://www.ntar.co.uk/apprentices

9 NSAR. Annual rail workforce survey 2024.

10 NSAR. Annual rail workforce survey 2024

11 https://www.riagb.org.uk/RIA/RIA/ArchiveNotVisibleOnSearch/Stories/Rail_Decarb_23.aspx

12 The Institution of Engineering and Technology. IET skills and demand in industry 2021 survey. 2021. https://www.theiet.org/media/9234/2021-skills-survey.pdf

13https://www.riagb.org.uk/common/Uploaded%20files/Publications/RIA%20Response%20to%20Rail %20Investment%20Pipelines%20-%20Ending%20Boom%20and%20Bust%202025.pdf

14 https://riagb.org.uk/RIA/Rail-Insights/RIA-Manifesto-2024/Support-a-sustainable-supply-chain.aspx

15 Universities UK. Supply and demand for high-cost subjects and graduate progression to growth sectors. 2025. https://www.universitiesuk.ac.uk/sites/default/files/field/downloads/2025-05/uukanalysis-pack-changes-in-supply-and-demand-of-high-cost-subjects.pdf

16 Oxera Consulting. How can the rolling stock supply chain create greater value for the UK? 2021. https://www.oxera.com/wp-content/uploads/2022/01/UK-rolling-stock-market-v1.2.pdf