15 October 2025

1. INTRODUCTION

1.1. This paper is the Railway Industry Association (RIA) submission to HM Treasury, as part of the Autumn Budget 2025 representations.

2. ABOUT RIA

2.1. The Railway Industry Association (RIA) champions a dynamic UK rail supply sector. We help to grow a sustainable, and high-performing railway as well as promoting UK rail expertise and products to international markets. RIA has over 450 companies in membership, active across the whole of the rail supply sector and covering a diverse range of products and services, including both multi-national companies and SMEs (60% by number).

3. SUMMARY

3.1. RIA welcomed the spending commitments made at the Spending Review 2025. Commitments to fund multiple projects, notably the TransPennine Route Upgrade and East-West Rail, over the Spending Review period are extremely important to economic growth as well as housing and jobs. Further, the Transport for City Regions funding offers great opportunities for increased connectivity and productivity across the UK.

3.2. As central Government spending has been outlined for the coming years, this submission does not ask for additional public spending but identifies three main areas where clear and swift Government decisions could secure significant additional value from the Government’s financial investment in the railway.

3.3. The proposals can all generate benefits within the lifecycle of this Parliament, but this now requires urgency and strong cross-government coordination.

1. URGENTLY PUBLISH A LONG-TERM RAIL STRATEGY TO SECURE INVESTMENT AND LOWER COSTS

To give industry confidence to keep investing, the Government now needs to publish a clear long-term rail strategy, including clear targets for passenger and freight growth, decarbonisation, and new strategic connections, aligned with wider national priorities, such as housing and productivity. Long-term strategic clarity will help put an end to inefficient investment spending cycles, reduce the cost of railway improvements, and sustain jobs, while demonstrating how rail underpins housing, regeneration, and national economic objectives.

Strategic clarity has been lacking for many years across Governments of all political colours. Fifteen months into the new Government, if we are to get the benefits of cost reduction and increased investment confidence within the lifecycle of this Parliament, we believe a clear strategy needs to be published with urgency. We provide further details on the core content we expect to see in a strategy in this submission.

2. USE THE BUDGET TO ANNOUNCE A CLEAR FRAMEWORK FOR ATTRACTING PRIVATE INVESTMENT INTO RAIL

The railway industry welcomes the Government’s commitment to attracting private capital in the Infrastructure Strategy but now needs clarity on where and how private investment can be facilitated into rail, and what “appropriate risk transfer” means in practice. There are particular opportunities through:

• Extending the well-established rolling stock leasing model to secure investment in other assets such as depots and battery traction.

• A new model for investment in and around stations. RIA is proposing Station Investment Zones, which would integrate housing, commercial and transport development and bring together multiple funding streams for maximum impact.

We provide further details below.

3. PRODUCE A JOINT-GOVERNMENT AND INDUSTRY ACTION PLAN TO SECURE ESSENTIAL DIGITAL AND ENGINEERING SKILLS THAT ARE NEEDED TO DELIVER A RESILIENT AND EFFICIENT TRANSPORT NETWORK

The railway industry faces significant skills challenge, with an ageing workforce and low investment confidence to recruit from the supply chain, which delivers the majority of the work on the railway.

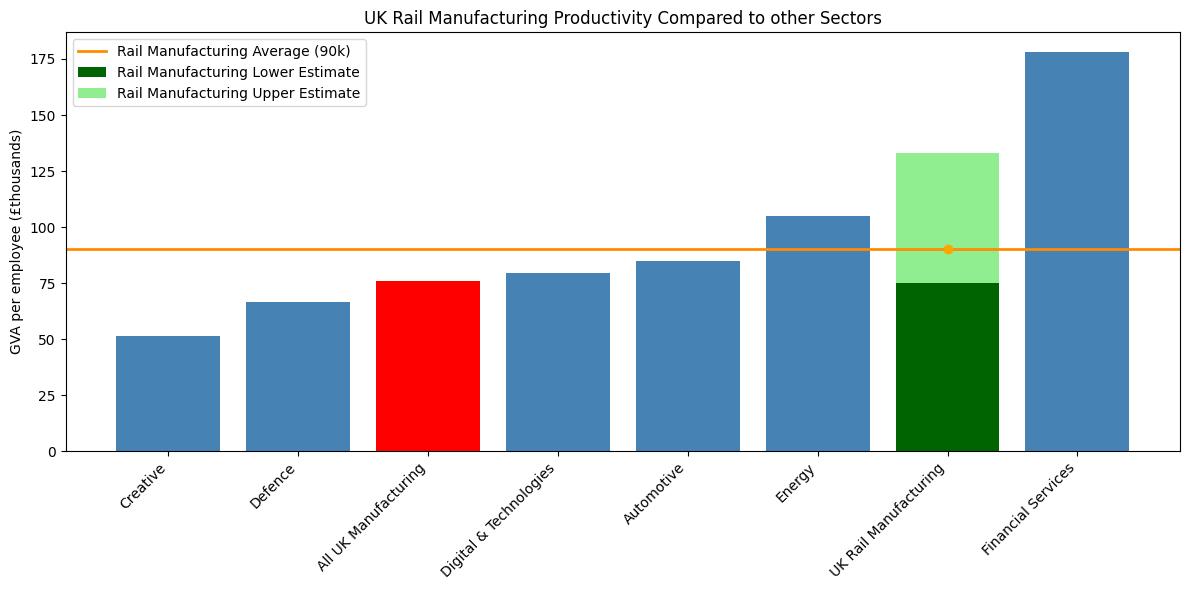

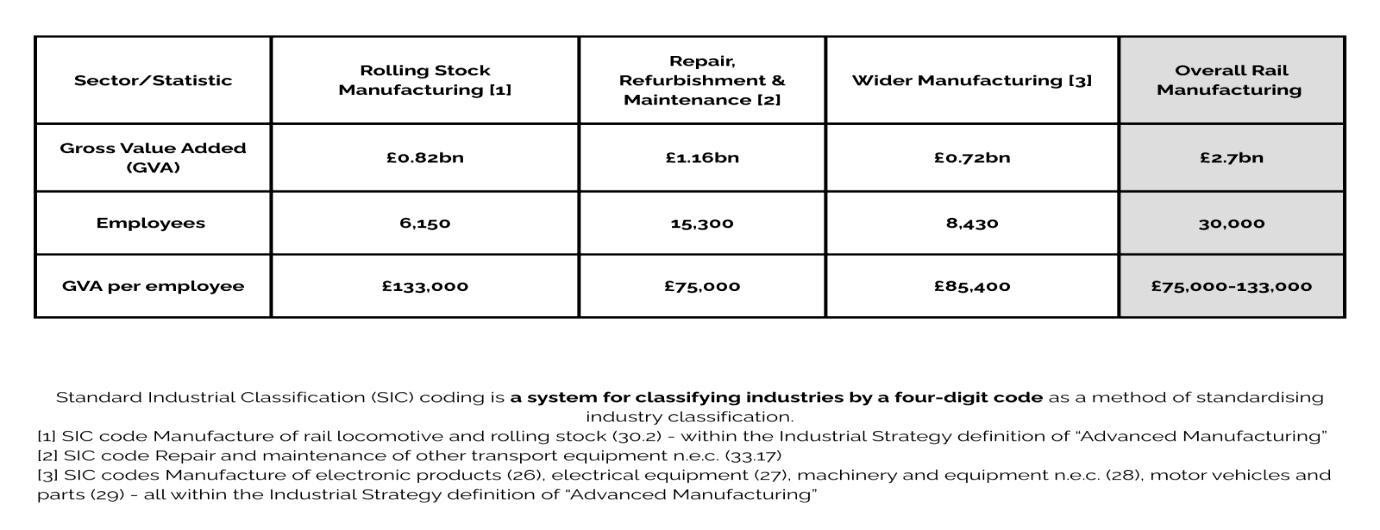

A sustained cross-government and industry approach is needed to address the risks this creates. There is a huge opportunity for high quality jobs creation right across the UK, for instance with rail manufacturing jobs yielding higher GVA than many other sectors (Annex D).

Improved pipeline visibility, and a clear long-term strategy underpins skills investment, and so action is needed from across both the public and private sectors. Uncertainty discourages firms from hiring apprentices or upskilling existing workers –a stable, transparent work pipeline will unlock investment.

Finally, as a member of the High Speed Rail Group (HSRG), RIA endorses HSRG’s budget submission proposals to support the reset of HS2 and secure the maximum benefits from the investment to date. Please refer to that submission for specific proposals.

4. ABOUT UK RAIL

a. The rail network remains one of the UK’s most valuable assets, with huge potential to support both economic growth and skilled jobs for communities right across the UK. A 2024 report produced by Oxford Economics,1 for the Department for Business and Trade and RIA, shows that in 2023 the railway industry supported:

• £41 billion GVA in economic growth;

• 640,000 jobs across the UK (both directly and indirectly - for every 1,000 people employed in the rail network, a further 4,300 jobs were supported across the economy);

• £14 billion in tax revenues; and

• Higher labour productivity, with productivity in the rail supply sector 29% higher than the national average (at £74,100 GVA per job).

b. Rail has a unique role in supporting the productivity of city regions, by enabling fast connectivity for large numbers of people to and between densely-used urban centres. The National Infrastructure Commission (before being merged into the National Infrastructure & Service Transformation Authority, or NISTA) found that the productivity of city regions is dependent on the quality of their transport connections. Rail connections also facilitate significant new housing development, and the decarbonisation and decongestion of the UK transport system, with a freight train removing up to 129 heavy goods vehicles from the roads.2

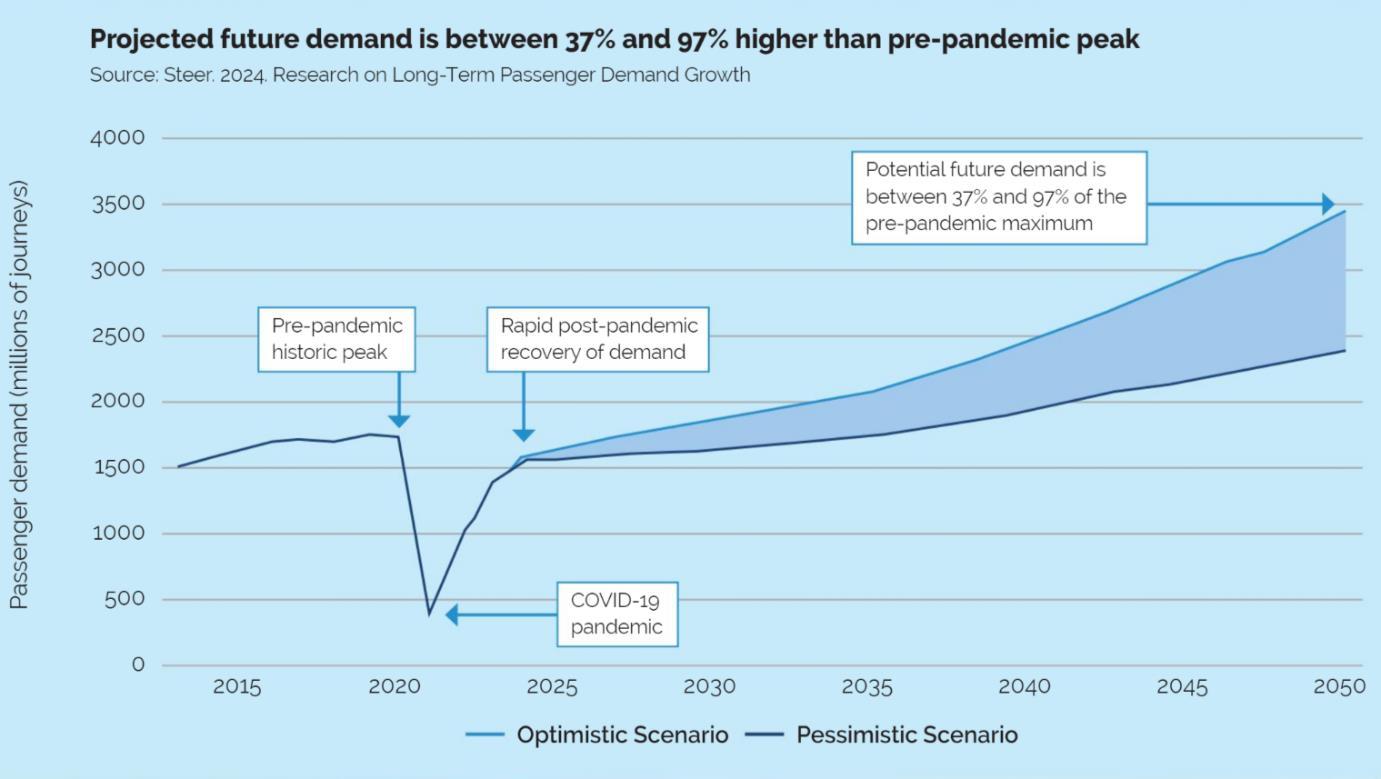

c. Demand for passenger rail is set to grow between 37-97% by 2050 (compared with the pre-pandemic peak),3 and Government has a target to grow freight volumes by 75% by 2050.4 In this context, a rail investment plan is an essential ingredient as part of a coherent suite of Government strategies for growth, infrastructure, industrial development, trade and transport. (See Annex B)

d. Polling of 250 rail business leaders by Savanta published in November 2024 (Annex A) found that over 80% of businesses expect a hiatus in work over the year ahead. 5 Many companies are already undertaking redundancies. A rail workforce survey by the National Skills Academy for Rail (NSAR) published in autumn 2024 found that 9.4% of the workforce (the majority of them working in the supply chain) had left the industry in the previous 12 months.6 The UK is at risk of losing critical capability, such as specialist engineering skills, which we know is necessary to maintain, renew and develop the railway efficiently in the future.

e. Rail businesses in our sector now look to Government for clear, long-term commitments, to set out a coherent rail strategy, provide visibility of future work, and create a stable environment for investment. This will give companies confidence to retain skilled staff, plan efficiently, and invest in innovation that lowers costs and drives growth.

5. URGENTLY PUBLISH A LONG-TERM RAIL STRATEGY TO SECURE INVESTMENT AND LOWER COSTS

a. To help them plan efficiently our members would like to see the Government publish a long-term, comprehensive, rail strategy setting out clear priorities for the rail network over a 25-30 year horizon This strategy needs to:

• Define explicit goals for passenger and freight growth, decarbonisation, digitalisation, and capacity enhancement, setting measurable targets for each area. This would provide a clear statement of purpose for the railway – as an enabler of national productivity, connectivity, and growth – rather than treating it as a cost centre.

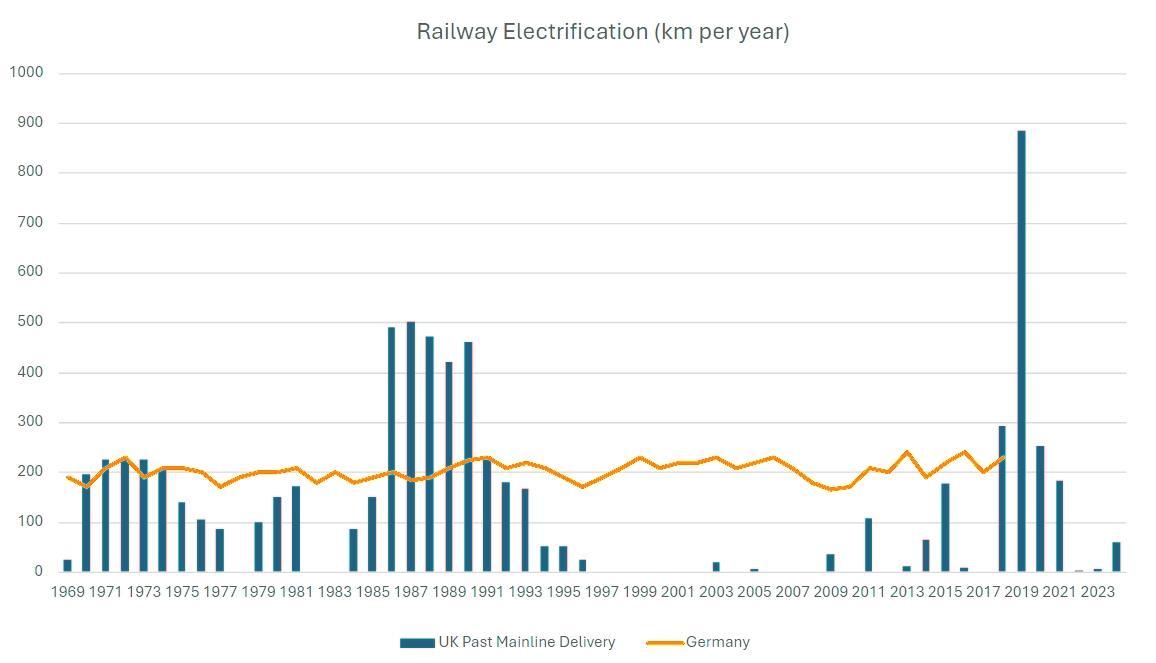

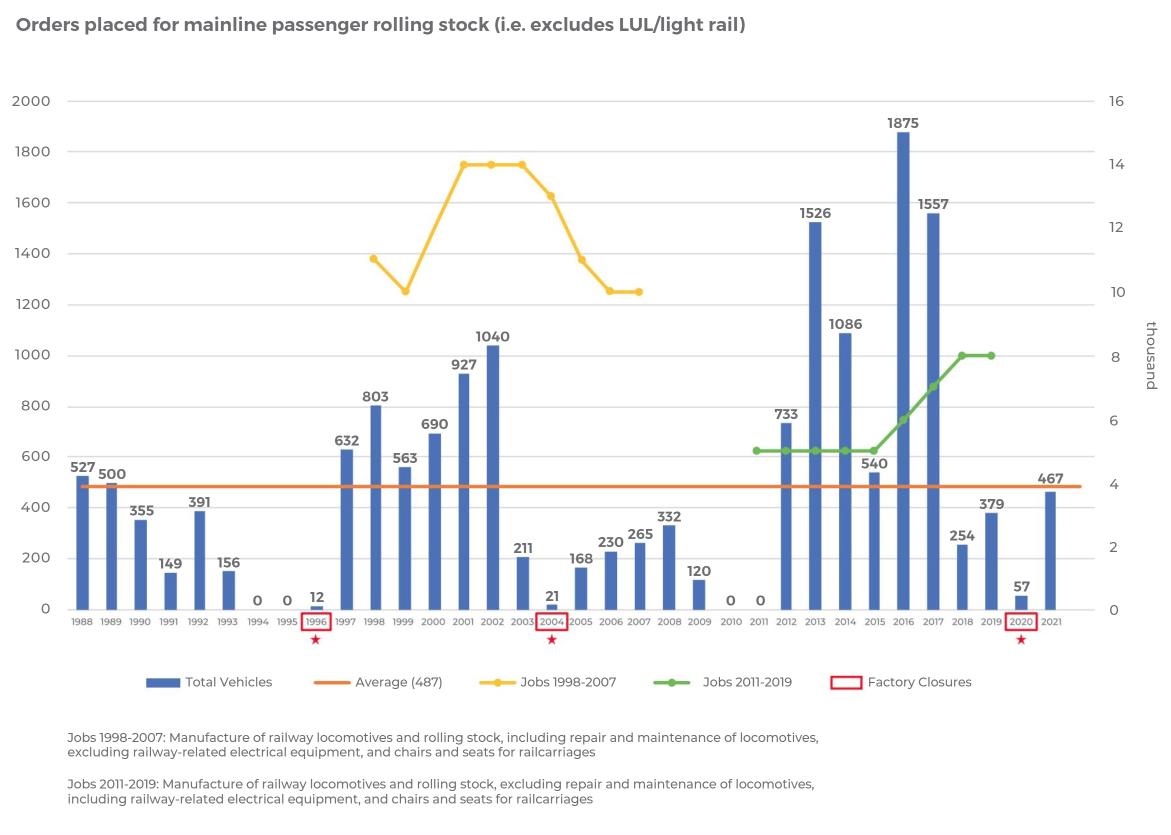

• Include a rolling, cost-efficient investment programme, particularly in electrification, digital signalling, renewals and rolling stock. RIA analysis and international comparisons show stop-start investment patterns have repeatedly increased costs and undermined delivery capability (Annex C).

• Include a clear and stable funding framework for the railway, outlining the long-term public investment profile, opportunities for private investment, and mechanisms to maintain certainty for suppliers – encompassing enhancements, renewals, maintenance, and digital upgrades across both passenger and freight networks.

i. Integrate goals with wider policy frameworks – including the Infrastructure Strategy, Industrial Strategy, New Homes Strategy and regional development plans – ensuring rail is recognised as central to delivering these goals.

ii. Define clear institutional responsibilities. The creation of Great British Railways (GBR) presents an opportunity to simplify decision-making, reduce micromanagement, and give the industry confidence through transparent planning and procurement.

b. A long-term rail strategy would deliver economic, environmental, and fiscal benefits by improving visibility of work which helps companies plan their investments in capital and skills Stable, multi-year, planning would also help to end the cyclical “boom and bust” investment pattern that inflates costs and disrupts supply chains. Steady investment programmes can cut costs by 20–30% by helping industry retain skills, boost productivity, and provide incentives to invest in innovation.7 A rolling, sequenced, programme of electrification and traction decarbonisation around 8,600 single track kilometres by 2050 would also enable cost-effective progress toward Net Zero. Consistent policy attracts inward investment, sustains exports, and strengthens the UK’s global competitiveness.

6. USE THE BUDGET TO ANNOUNCE A CLEAR FRAMEWORK FOR ATTRACTING PRIVATE INVESTMENT INTO RAIL

a. The Government’s Infrastructure Strategy rightly recognises the potential positive role private capital can have to help deliver the UK’s ambitious infrastructure programme, a goal welcomed by RIA and its members. While the Strategy references Public-Private Partnerships (PPPs) where there are clear revenue streams, appropriate risk transfer, and value for money, investors require more detail on how these principles will be applied in practice – for example, they need to know what “appropriate risk transfer” means in the current policy context.

b. Clear, consistent guidance will be essential to building investor confidence and unlocking private funding at scale. Greater transparency would give institutional investors and suppliers confidence to participate earlier in project development. However, the railway industry currently lacks a clear mechanism for such participation. Only 10% of rail programmes listed in the national infrastructure pipeline are identified as having potential for private investment. Inconsistent balance-sheet treatment and unclear governance have deterred investors from engaging

c. The Government should endorse innovative investment models. For example, there are opportunities to extend the rolling stock model to finance other assets such as depots and battery power for traction.

d. RIA, alongside a cross-industry working group, has developed a proposal for ‘Station Investment Zones’. These zones would support integrated housing, commercial, and transport improvements. The delivery model would entail a partnership between local authorities, private developers, and the railway. Such models do not require new public spending but instead use existing revenue streams – including commercial revenues, land value capture, farebox income – to deliver growth. Grouping stations into regional portfolios could further attract private investment by achieving scale and reducing risk.

e. Innovative co-investment approaches, such as Station Investment Zones, could deliver major gains across a number of Government objectives. Around 1.2 million new homes could be built within a ten-minute walk of rural stations, whilst property values near stations are between 5% and 9% higher in major cities. For example, Station-led regeneration in the King’s Cross/St Pancras area tripled employment and quadrupled local economic output (GVA)

f. By setting out which projects are open to private capital and how investment models such as PPPs will operate, the Government can build investor confidence and encourage early participation in project development. Transparent guidance on risk transfer, accounting treatment, and governance would give investors certainty, helping attract long-term capital to rail schemes such as stations, rolling stock, and freight, while reducing the need for direct public funding.

g. Private participation brings commercial discipline, improved cost control, and better lifecycle management, reducing whole-life asset costs and ensuring better value for money. Innovative models – such as Station Investment Zones integrating housing, transport, and commercial development – could drive local regeneration and productivity without requiring new public spending. In short, clear, consistent policy on private investment would help accelerate infrastructure delivery while protecting the public purse.

7. PRODUCE A JOINT-GOVERNMENT AND INDUSTRY ACTION PLAN TO SECURE

ESSENTIAL DIGITAL AND ENGINEERING SKILLS THAT ARE NEEDED TO DELIVER A RESILIENT AND EFFICIENT TRANSPORT NETWORK

a. To manage the risk of critical skills loss the rail industry now requires a dedicated rail skills action plan as well supporting the transformation of the rail industry, ensuring the sector can deliver where it needs to on key national priorities, including Net Zero, economic growth, and social value. Building on the work of NSAR, the action plan should:

i. Define critical capabilities needed for future rail (mechanical, electrical, digital, and green skills).

ii. Map existing gaps and monitor workforce trends across the UK.

iii. Link skills planning directly to investment and pipeline certainty.

iv. Support apprenticeships and degree-level training to meet demand.

v. Ensure better quality and more complete input data supports development of more refined outputs and conclusions, and provides a stronger basis for making predictions about future workforce gaps and skills needs

b. The 2016-2020 Transport Infrastructure Skills Strategy showed that long-term workforce planning is vital for the transport sector, but also highlighted key lessons that RIA believe the current Government should learn and act upon:

i. Apprenticeship targets were overly ambitious – revised down from 30,000 to 15,200 but still unmet – partly due to problems with the Apprenticeship Levy and SME barriers not being fully addressed, leading to deficiencies in companies’ ability to take on apprentices.

ii. The four-year timeframe was too short to tackle deep-rooted skills challenges in areas like signalling and rolling stock, underlining the need for a longer-term strategy with realistic milestones and a focus on retention and diversity.

iii. Procurement proved an effective tool for driving apprenticeships, generating up to 2,000 roles through contract requirements.

iv. Smaller firms continued to face financial and operational barriers, and the skills forecasting tool – though useful – suffered from data and integration issues.

A future strategy must therefore take a longer view, address systemic barriers, and embed workforce planning in procurement and investment decisions.

c. Apprenticeships are key to addressing the rail workforces’ challenges, yet only 1% of the workforce are new apprentices – far short of the 2.5% needed to meet future demand. Strategic plans to increase apprenticeships in the rail industry will be essential to this strategy. The Government’s shift from a university-focused target to encouraging two-thirds of young people into university or “gold-standard” apprenticeships is welcome and could boost uptake. However, clearer Government support is needed to incentivise employers, through consistent pipelines of work and clear policy guidance.

d. The railway industry is a highly productive sector, contributing £74,100 GVA per job, and £41bn GVA in the UK economy. However, research by the NSAR has shown that the rail workforce is falling. NSAR’s 2024 Workforce Survey reports a 9.4% fall in the workforce in just one year, with ageing demographics compounding the challenge.

i. Only 6.3% of workers are under 25 – up slightly since 2023 but still below the 2016 level of 10.3%.

ii. Meanwhile, around one-third of the workforce is over 50, with up to 47,000 expected to retire within five years.

iii. This imbalance between retiring staff and limited new entrants points to significant skills shortages ahead unless workforce renewal accelerates.

e. A dedicated rail skills strategy would directly benefit the public sector by ensuring delivery certainty and value for money on publicly funded projects. A stable, skilled workforce prevents project delays, budget overruns, and loss of expertise that undermine delivery and confidence. By maintaining essential skills within the UK, Government can avoid costly reliance on short-term contractors or overseas specialists, strengthening national capability and resilience.

f. This strategy would also align with wider Government priorities on apprenticeships, Net Zero, and industrial policy, demonstrating how rail investment supports national growth and sustainability goals. Smoothing labour demand would reduce cyclical redundancies and shortages, protecting communities and ensuring the long-term health of a strategic national industry.

For more information, please contact RIA Policy Director Robert Cook at robert.cook@riagb.org.uk and 020 7201 0777.

ANNEX A: ANNUAL BUSINESS CONFIDENCE SURVEY

In September and October 2024, Savanta conducted a survey of 250 rail business leaders on behalf of the Railway Industry Association (RIA). Results from the survey are below. The 2025 survey is currently being conducted, and we are happy to share the results on request.

The key findings of the survey are:

• Only 26% of respondents believe that the rail supply industry will grow in the next year, with 48% saying it will contract. This is a slight improvement from last year’s score of 54%.

• 46% think their business will grow and 29% say they will contract in the coming year. This is largely consistent with 2023 but is the lowest score of the last five years.

• As last year, 83% think it likely that there will be a hiatus in rail work over the next year, for example due to the time taken to deliver GBR-related rail reform, or uncertainty over enhancement or major projects budgets.

• The three main measures rail businesses will take in response to a hiatus in the coming year are freezing/slowing recruitment (51%, up from 44% in 2023), prioritising work outside the UK (51%, up from 42% in 2023), and pausing or slowing plans to expand in the UK (35%).

Q1. How likely, if at all, do you think it is that the rail supply industry will grow or contract in the coming year? Base: All respondents 2024 (n=250) 2023 (n=200) 2022 (n=163) 2021 (n=265), 2020 (n=257), 2019 (n=174).

Q2. How likely, if at all, do you think it is that your business will grow or contract in the coming year? Base: All respondents 2024 (n=250) 2023 (n=200) 2022 (n=163) 2021 (n=265), 2020 (n=257), 2019 (n=174).

Don’t know

Q4A. How likely or unlikely do you think a hiatus in rail work over the next year is, for example due to the time taken to deliver GBR-related rail reform, or uncertainty over enhancement or major projects budgets?

(2023 wording: How likely or unlikely do you think a hiatus in rail work over the next year is, for example due to a delay in GBR-related rail reform, or uncertainty over the completion of major projects?) (2022 wording: or uncertainty over future rail funding?) Base: All respondents 2024 (n=250) 2023 (n=200) 2022 (n=163)

Quite likely 46% 48% 39%

Quite unlikely 12% 9% 9%

Very unlikely 2% 5% 2%

Don’t know 9% 5% 6%

Net: Likely 77% 83% 83%

Net: Unlikely 14% 13% 12%

Q4B. Which of the following measures, if any, is your business likely to take in response to a hiatus in the coming year? Base: All respondents who think a hiatus in rail work is likely 2024 (n=207) 2023 (n=165) 2022 (n=125)