Executive

Executive

INDIVIDUAL RUNNING GEAR SOLUTIONS FOR SPECIAL TRANSPORT TASKS.

With our running gears and special axle solutions, there is nothing that can’t be transported. Your requirements motivate us to create new things. They inspire us to use our entire engineering expertise and decades of experience to develop innovative and reliable solutions together with you – customised for the type of vehicle and intended use.

The vehicle concepts for low-loaders are as varied as the transportation tasks. The use of air-sprung modules with rigid and steering axles is just one solution from our uniquely wide range of running gear systems for low-loaders. Challenge us!

For a company that has fully embraced the term ‘Enginuity’, an amalgamation of engineering and ingenuity, you come to expect some major developments in the elds of innovation, research and development.

Kässbohrer Deputy General Manager, Ahmet Yılmaz

At Global Trailer, we love discussing new technologies and the latest innovations that will enhance or improve our lives.

is applies to sharing new and exciting developments that will impact the transportation industry, such as e-trucks.

e growth in popularity of electric trucks, or low-emission commercial vehicles, is resulting in a steady march towards a nondiesel-truck powered world.

In its 2025 global outlook, the International Energy Agency found that sales of medium and heavy-duty electric trucks grew for the third consecutive year in 2024, exceeding 90,000 worldwide. It found that year-on-year growth was almost 80 per cent, a massive reversal of the dwindling sales from 2018-2021.

e IEA said the growth was primarily due to sales in China – accounting for more than 80 per cent of all electric trucks sold globally in 2024.

e Chinese e-truck market more than doubled from 2023 to 2024.

e report also found that, in 2024, Europe had more than 10,000 electric trucks sold for the second year in a row.

In the ckle US market, the IEA report said the number of electric trucks sold in 2024 (over 1,700) was more than the cumulative number of electric trucks sold throughout the US between 2015 and 2022.

In Brazil almost 500 e-trucks were sold in 2024, while Canada had almost 2,000 sales for the second consecutive year. Japan, South Africa and ailand saw

their collective sales jump from 130 to almost 900 between 2023 and 2024, the report found.

With lowering battery costs and government incentive schemes, lower total cost of ownership and increased safety, it is no wonder that electric truck sales and the range of heavy-duty e-vehicles on the market (450 models in China, 140 in the US) are rapidly growing.

Other reports have said North America’s e-truck market in 2023 was valued at $1.6 billion USD (€1.354 billion) and projected to grow at a staggering CAGR of 71.3 per cent from 2024-2032. Research also found that by 2030, ownership costs for battery e-trucks will be lower than for diesel trucks. Despite this, the US market still lags behind Europe’s electric truck market, which is estimated to be worth €1.493 billion in 2025 and grow by 57 per cent CAGR in 2030 (€14.3 billion).

Hindering US growth are reversals of California’s electric vehicle mandates and reports that transferring to e-trucks would increase transportation by up to 100 per cent, compared to using diesel trucks. Despite the contrary news, the growth of heavy-duty e-vehicles is not likely to decline any time soon, but could still prove problematic.

e future is electric, so have you got your ticket to ride?

CHAIRMAN

John Murphy john.murphy@primecreative.com.au

CEO Christine Clancy christine.clancy@primecreative.com.au

INTERNATIONAL SALES

Ashley Blachford ashley.blachford@primecreative.com.au

MANAGING EDITOR

Luke Applebee luke.applebee@primecreative.com.au

EDITOR

Paul Lancaster paul.lancaster@primecreative.com.au

HEAD OF DESIGN

Blake Storey

DESIGN

Laura Drinkwater

CLIENT SUCCESS MANAGER

Ben Sammartino ben.sammartino@primecreative.com.au

COVER Image: Kässbohrer.

HEAD OFFICE

Prime Creative Pty Ltd

379 Docklands Drive Docklands VIC 3008 Australia

+61 3 9690 8766 enquiries@primecreative.com.au www.globaltrailermag.com

SUBSCRIPTIONS

+61 3 9690 8766 subscriptions@primecreative.com.au

Global Trailer is available by subscription from the publisher. e rights of refusal are reserved by the publisher.

ARTICLES

All articles submitted for publication become the property of the publisher. e Editor reserves the right to adjust any article to conform with the magazine format.

COPYRIGHT

Global Trailer is owned by Prime Creative Media and published by John Murphy. All material in Global Trailer is copyright and no part may be reproduced or copied in any form or by any means (graphic, electronic or mechanical including information and retrieval systems) without written permission of the publisher. e Editor welcomes contributions but reserves the right to accept or reject any material. While every e ort has been made to ensure the accuracy of information, Prime Creative Media will not accept responsibility for errors or omissions or for any consequences arising from reliance on information published. e opinions expressed in Global Trailer are not necessarily the opinions of, or endorsed by the publisher unless otherwise stated.

FOLLOW US Global Trailer Magazine

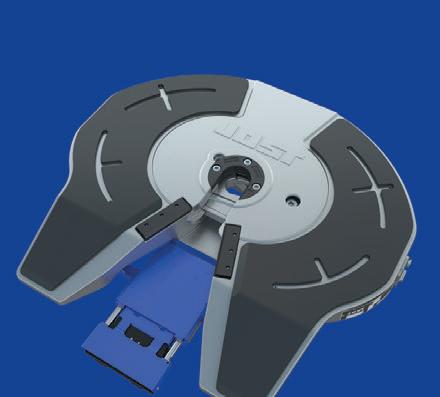

coupling –

Push-button trailer coupling

For anyone already using it, it’s a match made in heaven: The KKS allows you to automatically control and monitor the entire coupling and uncoupling process via remote control from the cab. And this includes the air, electrical and brake connections– with simple and intuitive operation. The future of logistics is now on the streets.

www.kks-successstories.com

DHL and the Malaysian Investment Development Authority (MIDA) extended their partnership to accelerate FDI in Malaysia, with the signing of an MOU. Under this agreement, the four DHL divisions operating in Malaysia – Express, Supply Chain, Global Forwarding and eCommerce – will work closely with MIDA to strengthen the logistics and supply chain ecosystem.

The parties’ collaboration started in 2023, where they worked on a range of priority sectors, including electrical and electronics, pharmaceutical, digital economy, aerospace and chemicals.

In 2024, the DHL Global Connectedness Index ranked Malaysia third in Asia Pacific and 26th globally.

The New Zealand Government will conduct a comprehensive reform of the country’s land transport rules.

Transport Minister Chris Bishop said the government was progressing with the extensive review and reform programme to increase productivity and efficiency.

“The rules system is overly cumbersome to update and creates a substantial

administrative burden for New Zealand businesses trying their best to operate safely, legally and efficiently,” he said.

The heavy transport reforms include reviews of:

• Heavy vehicle driver licencing, weight thresholds and freight permitting.

• Reforms permitting requirements for 50MAX trucks.

• Restrictions on overweight and overdimension vehicle movements.

• Weight thresholds for Class 1 and 2 licences.

• Heavy and special vehicle driver licencing.

Hellmann Worldwide Logistics has opened a new, state-of-the-art contract logistics centre on the outskirts of Melbourne, Australia.

The new site at Truganina, 22 kilometres west of the Melbourne CBD, doubles Hellmann’s warehouse capacity in the Melbourne metropolitan area and further expands its foothold in the Asia-Pacific market.

Hellmann offers comprehensive fullservice logistics solutions along the entire supply chain from a total of seven locations in Australia and New Zealand –

in Sydney, Melbourne, Brisbane, Adelaide, Perth, Darwin, Auckland and Christchurch.

DHL Global Forwarding, the freight specialist arm of DHL Group, has announced three strategic leadership appointments in the Asia Pacific region.

Christopher Lim, currently Managing Director of DHL Global Forwarding Singapore, Malaysia, and Brunei, will succeed Bruno Selmoni as Vice President and Head of Road Freight and Multimodal, DHL Global Forwarding Asia Pacific.

Praveen Gregory, currently Senior Vice President, Ocean Freight, DHL Global Forwarding Asia Pacific, will succeed Christopher Lim as Managing Director of DHL Global Forwarding Singapore, Malaysia, and Brunei.

Bjoern Schoon, currently Vice President, Global Business Development, Order Management Solutions (OMS) and Ocean Contract Management (OCM), DHL Global Forwarding, will succeed Praveen Gregory as Senior Vice President, Ocean Freight, DHL Global Forwarding Asia Pacific.

The three appointments were effective from 1 August 2025.

A state of the art, upgraded and fully integrated global manufacturing centre of trailer systems and On/Off highway systems. Expertly designed and engineered with worldwide accessibility, offering you private label and OEM manufacturing solutions.

Drawing upon decades ofexpertisespanning Asia, Australia US, and in Europe,Fuwastandsasa globalmanufacturing powerhouse, unrivalled astheforemostnetwork ofspecialists intruckand trailer componentsacross the globe.

Hamburg-based global logistics company, Fr. Meyer’s Sohn (FMS), has acquired South African freight forwarder GAC Laser International Logistics. The acquisition, which includes GAC Laser’s affiliated entities, marks a significant step in the company’s global expansion and particularly its strategic expansion into the African continent, which it sees as providing high-growth markets.

GAC Laser operates from key locations across South Africa, including Cape Town, Durban, Johannesburg, and Gqeberha (formerly Port Elizabeth), and will be known as Fr. Meyer’s Sohn South Africa.

CEVA Logistics has renewed its North Africa transport services with aircraft

equipment manufacturer Safran for three years.

The agreement covers the renewal of transport services on behalf of the world’s second-largest aircraft equipment manufacturer for three years between Morocco and France, and also between Tunisia and France.

As part of this agreement, CEVA will collect aerospace components from Safran’s sites in Morocco and Tunisia and manage their daily transport to France. The inbound loads leaving France feed the Safran sites in Morocco and Tunisia.

Asek Company for Mining (Ascom) will purchase 90 per cent of the shares in Ostool Transport, in exchange for €11 million.

Ostool Transport is one Egypt’s largest

logistics providers, and that nation’s largest importer and supplier of coal. It serves clients across a variety of industries, with a special focus on the transport of raw materials, such as coal, petroleum coke, grain, and cement.

Heil Trailer International has strengthened its relationship with leading Argentinian storage and transportation manufacturer, Bertotto Boglione SA.

Expanding its global reach, Heil Trailer has added Bertotto Boglione as its “new strategic partner in South America”, welcoming it to the EnTrans International family.

In June this year, the trailer manufacturer for liquid and dry bulk transport solutions, part of the EnTrans International group, announced it was entering into a franchise agreement with Bertotto Boglione.

Under that arrangement, Bertotto Boglione agreed manufacture and market Heil Trailer aluminium and stainless steel trailers for dry and liquid

materials in Argentina, Brazil, Chile, Paraguay, Peru, and Uruguay.

Brazilian OEM, Librelato, celebrated the seventh anniversary of its replacement parts brand, Libreparts, in July. Libreparts was founded with a focus on immediate parts availability and basic installation services, earning the trust of transporters and fleet owners across Brazil.

Over the course of seven years, Libreparts has established itself as a national leader in the trailer parts market, with a network of 30 stores and eight service centres located at strategic locations throughout Brazil.

Maersk has opened a new cold chain

logistics hub in Olmos, northwest Peru, to boost fruit exports and strengthen cold chain infrastructure in the Lambayeque agricultural region. The region is a top contributor to Peru’s fruit exports, and the new 17,500-square-metre centre is designed to deliver speed and freshness from farm to port.

It is expected to see more than 10,000 tonnes of produce to pass through the facility in its first year of full operation.

ZF has opened a state-of-the-art Remanufacturing (REMAN) and Service Operations Centre in Shanghai.

The facility, in Lingang New City, marks a major milestone for ZF Aftermarket in China, with the centre’s goal to ensure faster response times and optimised customer service, where staff will work hand-in-hand with dealers, workshops, and fleets.

Conserving up to 90 per cent of raw materials in its reman’ operations, ZF sees the APAC region as a market within which it can become an automotive reman industry leader.

CEVA Logistics has opened a new

4,300 square metre international road transport (TIR) centre in Alashankou, China, on the border with Kazakhstan.

It is CEVA’s first hub to consolidate inbound and outbound TIR road freight. An additional 1,000 square metres at the centre have been dedicated to dangerous goods handling.

Bordering Kazakhstan and served by highways that funnel into Central Asia, the Caucasus and Europe, Alashankou offers bonded-zone incentives, fast customs clearance and duty-free storage.

Kässbohrer

German trailer OEM, Kässbohrer, is celebrating a major milestone after delivering the 410th mega huckepack curtainsider semi-trailer to Dutch logistics provider, Ewals Cargo Care.

Family-owned Ewals Cargo Care, based in Tegelen, the Netherlands, is a key player in European intermodal logistics with 80 per cent of its daily 3,000-plus loads transferred intermodally by rail and short sea routes.

With more than 4,700 trailers and operations across Europe, Ewals specialises in intermodal and general cargo transport.

The huckepack trailer is ideally suited for the transportation of goods via road and rail transport.

Trailer manufacturer, KRONE, and Platform Science, formerly Trimble Transport & Logistics, have entered a partnership to launch a fully integrated trailer telematics solution.

The new platform will provide transport and logistics companies with a single, one-stop-shop application for tractors and trailers.

The new platform is intended to significantly reduce workload and promote cost and time savings, with truck and trailer operators not needing to switch between different portals, nor be concerned with duplicate invoices, or additional hardware.

Trailer builder, Fruehauf UK is embracing smart manufacturing with the introduction

of a new welding robot at its UK headquarters in Grantham.

The advanced Valk Welding robot is an upgrade in the company’s modernisation journey and underscores its commitment to innovation, efficiency and high-quality trailer production.

Fruehauf has introduced the robot welder to complement the skills of its workforce, rather than replace them, as it will undertake repetitive welding tasks, freeing up skilled operators to focus on more complex, craftsmanship-led areas of the trailer build.

The company’s management sees the combination of cutting-edge technology and engineering know-how as a perfect partnership for building more agile production processes that reinforce Fruehauf’s reputation for precision-built tipping trailers.

Finnish trailer manufacturer, Ekeri, is seeking to become majority owner of its competitor, Norwegian Bussbygg AS. Bussbygg is Norway’s largest manufacturer of cabinets for trucks and trailers and, since 1947, it has produced cabinets built in fibreglass, with fully moulded joints for the trucking industry, at its factory in Molde, on Norway’s western coast.

The investment by Ekeri is seen by both companies as a focus on growth, sustainability, and quality in the Scandinavian and European transport industries, particularly as both have maintained a path of expansion in their respective operations.

With Ekeri as majority owner, it would gain ownership in a company with strong roots in thermal products and a producer of a recognised quality product.

The acquisition is expected to be finalised in early September 2025.

Swedish steel manufacturer, SSAB, secured an additional €430 million green financing for the upgrading of its mini mill in Luleå, north-eastern Sweden.

The refurbished mini mill project is the centrepiece of SSAB Europe’s goal to position itself as a maker of premium products while significantly lowering costs and CO2 emissions.

SSAB’s €4.5 billion investment in the new Luleå mini mill was announced in 2024.

In June this year, it announced a postponement of the state-of-theart mini mill’s commissioning due to deliveries of grid reinforcements.

Wielton Defence Sp. z o.o, an arm of Wielton SA, signed a long-term agreement with Polish truck builder, Jelcz Sp. z o.o., to supply parts used for Polish military vehicles.

The framework cooperation agreement is valued at approximately €11.7 million (PLN 50 million) for 2025.

Wielton Defence specialises in the production of semi-trailers and specialised vehicles equipped with modern technologies.

Jelcz primarily operates in the design and production of trucks and the supply of specialised chassis for the Polish Armed Forces.

Under the open-ended agreement, Wielton Defence will manufacture, supply and assemble components to be used in the Jelcz trucks that are destined for use by the Polish military.

KRONE Trailer and the winkler Group will collaborate in the distribution of KRONE’s original spare parts.

The parties are seeking to make the distribution of original KRONE spare parts, including components such as underride protection systems, more customer-oriented and comprehensive. winkler is one of Europe’s leading wholesalers of commercial vehicle spare parts.

It has 1,700 employees at more than 40 locations and operates three of the largest central warehouses for commercial vehicle parts in Europe.

“The partnership with winkler is a logical step towards strategically expanding our spare parts distribution and significantly increasing the availability of our original parts on the market,” said KRONE Trailer Managing Director of Service, Ralf Faust.

Trucking industry representatives are urging Congress to find immediate solutions to skyrocketing cargo theft.

According to the American Trucking Associations, strategic theft, cargo theft involving deception, fraud, cyber theft, and other tactics have risen 1,500 per cent since the first quarter of 2021, with the average value per theft being over $200,000 USD (~€172,000).

The Senate Judiciary Committee convened a hearing to investigate the proliferation of cargo theft, which is costing the supply chain up to $35 billion USD (~€30.2 billion) annually.

It is considering the impact of the Combatting Organized Retail Crime Act, introduced as a bill in April 2025, which would establish a multi-agency taskforce

Strategic cargo theft in the US has skyrocketed over the past ve years. Image: Muratart/stock.adobe.com.

and equip law enforcement with new resources to tackle increased cargo theft across the US.

“Cargo theft will continue to metastasise unless Congress recognises the severity of the problem, law enforcement devotes sufficient time and resources, and the federal government takes a leading role in coordinating enforcement efforts,” said IMC Logistics’ Chief Strategy Officer, Donna Lemm.

The DHL Group appointed Mark Kunar, as CEO of DHL Supply Chain North America. Kunar was elevated from his previous role as that DHL division’s CFO and CSO. His appointed follwed the news that former CEO of that division, Patrick Kelleher, was appointed CEO of GXO Logistics.

Kunar joined DHL Supply Chain in 1996 as a Financial Analyst, advancing in senior roles. He played a pivotal role in the company’s recent acquisitions in the North American market, including Inmar Supply Chain Solutions, a leading returns solutions provider; CRYOPDP, a leading specialty pharma-courier; and IDS Fulfillment, an e-commerce provider.

Wisconsin-based Stoughton Trailers is the first trailer manufacturer to earn the Insurance Institute for Highway Safety’s (IIHS) TOUGHGUARD award for an intermodal container chassis.

The award applies to Stoughton’s 53-ft (16.15 metre) intermodal container chassis built after April 2025.

The TOUGHGUARD award is presented to trailers that meet the most rigorous safety standards for rear underride protection in the event of a rear-end collision.

The family-owned company is a top 10 international supplier of semi-trailers and is one of North America’s largest chassis manufacturers.

It previously won the TOUGHGUARD award in 2017 for its dry van and refrigerated trailer product lines.

Alberta-based Bowline Logistics Ltd. appointed industry expert, Delly McEwan, as its new CEO. He brings to the role more than 25 years’ experience in transportation, business development, and project execution across North America. His career includes founding NexGen Transportation, serving as its President for 13 years and also as an MD in the wind construction industry. His other senior roles include positions at Kuehne+Nagel, Bechtel, Bantrel and Air Liquide Global Energy Solutions

Tennessee-based B2B trailer logistics platform, REPOWR, has appointed a seasoned transport leader as its new CEO.

With more than 38 years’ experience in the transportation and technology sectors, and recognised as a trailblazer in the freight and transportation industry, Chris Hines brings to REPOWR a wealth of leadership and industry expertise, during a period of growth and innovation. Throughout his career, Hines has demonstrated strong ability to drive change, build successful businesses, and lead complex transformations.

His professional journey includes 17 years at GE Capital/TIP, the world’s largest trailer leasing business, where he honed his leadership skills as President and developed a deep understanding of transportation finance/leasing. He also spent five years as President/ COO of the Celadon Group.

GERMAN TRAILER OEM, KÄSSBOHRER, HAVING ALREADY PRODUCED 63 PATENTS IN THE PAST YEAR AND LAUNCHED 11 NEW VEHICLES THIS YEAR, AND WITH AN UNBROKEN INNOVATION AWARD RECORD SINCE 2017, PROVIDES EXCLUSIVE ACCESS TO ITS NEW R&D CENTRE AND EUROPE’S FIRST TRAILER OEM-OWNED OUTDOOR TEST TRACK.

For a company that has fully embraced the philosophy of ‘Enginuity’, an amalgamation of engineering and ingenuity, it is not surprising to see major developments in the eld of innovation, research and development.

Kässbohrer Deputy General Manager Ahmet Yılmaz explained how ‘Enginuity’ at Kässbohrer - the perfect balance of engineering excellence and customer-driven ingenuity - is fully supported by Europe’s top capacity R&D infrastructure.

“Kässbohrer currently meets 96 per cent of road transport trailer types for the European market, thereby being capable of o ering one of the most diverse and adaptive portfolios,” said Yılmaz.

“ rough our continuous stand alone and collaborative R&D work bene tting from Europe’s top infrastructure and capability, we are expanding Europe’s most diverse trailer portfolio – engineered to deliver unmatched durability, extended lifespan, superior safety, and intuitive ease of use across every application.

“Enginuity re ects our ability to combine advanced technical expertise with a deep understanding of real-world operational needs to deliver smart, e ective solutions to complex transport challenges.”

e company’s R&D philosophy is guided by three core principles of sustainability, e ciency and a customer-centred approach.

Embracing these principles, Yilmaz said Kässbohrer seeks to prioritise environmentally responsible products and reduce total cost of ownership (TCO) by optimising design, materials, and performance, while ensuring

The Kässbohrer test track is a crucial element of its R&D initiatives. Images: Kässbohrer.

its innovations deliver tangible bene ts to the customers.

“Our R&D strength goes far beyond technological development and patent generation,” he said.

Benefitting from €46 million spending over the past ve years into R&D operations, excluding infrastructure spending, Ahmet Yilmaz explained why R&D strength is so vital to Kässbohrer’s operations.

Innovative R&D focus

“ e pace of innovation has never been faster and technology adoption curve is steeper than ever,” said Yilmaz.

“Innovation cycles are shortening with technologies, while the transport sector is not immune to such transformative breakthroughs.”

Yilmaz referred to the World Economic Forum ndings that more than 70 per cent of new vehicles globally are expected to feature some level of autonomous driving by 2030.

“At Kässbohrer, we recognise that only companies with proactive, future-focused R&D strategies can lead in this evolving landscape,” he said.

“Our R&D processes are built to not only keep pace with technological disruption, but to de ne it.

“We pursue a multidimensional approach that includes long-standing customer partnerships, strategic OEM collaborations, and continuous investment in the expertise of our engineering teams.

“ is holistic model allows us to remain agile and responsive to evolving market needs, regulatory shi s, and future-oriented innovation agendas.”

With its laser-focused strategy to pioneer the future of trailer technology, Ahmet Yilmaz said Kässbohrer’s vision is to develop the highest quality solutions for sustainable and e cient transport.

is whole-hearted dedication to pursuing innovation through research and development is fully enabled by the multi-million Euro R&D Gebze centres and the Adapazarı Mega Campus. Coupled with these, there is Europe’s rst trailer OEMowned and operated outdoor trailer test track, inaugurated in collaboration with leading R&D company, IDIADA.

e R&D centres employ 194 highly quali ed engineers in the design, development, validation, analysis and testing functions, who lead end-to-end innovation for not only for Kässbohrer, but also for sister companies Talson and Van Eck.

Their work encompasses all aspects of design, from chassis and body engineering to material research and application, as well as process innovation and autonomous systems.

“Generating 63 patents in the past 12 months alone, the quali ed team has partnered with 23 universities and published 30 international peer-reviewed papers and whitepapers, spanning VECTO-based CO2 simulation, lightweight modular designs, and wireless remote-control applications, between 2021 and 2024,” said Ferhat Yiğit, Test and Prototype Manager, overseeing R&D activities across Kässbohrer, Talson, and Van Eck.

“We have invested a total of €14.2 million in our second R&D centre and Europe’s rst out-door test track, owned and operated by a trailer manufacturer,” he added. With the opening of the second R&D centre in Gebze, Turkey in 2023, the R&D

infrastructure serving Kässbohrer now operates across 22,000 square metres of advanced development space.

In an era when the transport industry and trailer manufacturers are seeking to reduce costs, while increasing e ciencies, Kässbohrer leverages Europe’s top capability and capacity test centres to ful l its vision and constantly deliver the most e cient and sustainable products to its customers.

“We are committed to constantly developing trailer technology in service of our customers and aligned with global technology trends,” said Ferhat Yiğit.

“We centralised our R&D activities in 2009 and have since continuously advanced product, component, material, and process innovation – while contributing to leading international projects.

“ e latest investments realised our goal to achieve the most advanced and diverse testing capabilities in Europe. In-house testing accelerates validation, reduces the product development cycle, and enables faster, more agile responses to evolving regulatory, technical and customer requirements.

“In early 2025, we inaugurated a state-of-the-art outdoor test track with 12 lanes, developed in collaboration with IDIADA – Europe’s leading testing and homologation partner.

“ e outdoor test track is the rst and only trailer OEM-owned and operated test track in Europe.

“ is facility enables complete in-house testing procedures that were previously conducted at various external European test centres, signi cantly accelerating our product development cycles and enhancing both e ciency and responsiveness.”

Yiğit highlighted that testing regimes conducted at the highest capability R&D centres prioritise durability and longevity, as well as providing ease of use and safety. e vehicle performance and longevity acceptance criteria are set at a minimum of one million kilometres of normal use, he said.

“Our vehicles undergo design, testing, and validation phases to operate at full performance in a wide variety of climatic and geographical conditions in more than 70 countries worldwide,” said Yiğit.

“ erefore, the vehicles, components and materials are tested and validated at temperatures between -70°C and +150°C, incorporating rain and water pressure, as well as real life road conditions.

“Our vehicles, materials, and components, veri ed through these simultaneous tests with the highest performance acceptance criteria, ensure our customers receive the highest return on their vehicle investments and maximise their long-term use, while optimising total cost of ownership.

“In corrosion resistance, our metallisation technology holds the European record – over 3,800 hours of salt spray testing with zero red rust.”

Advancing technology with stakeholders Ahmet Yılmaz highlights Kässbohrer’s continuing active role in EU Commission backed multinational and multi stakeholder consortiums.

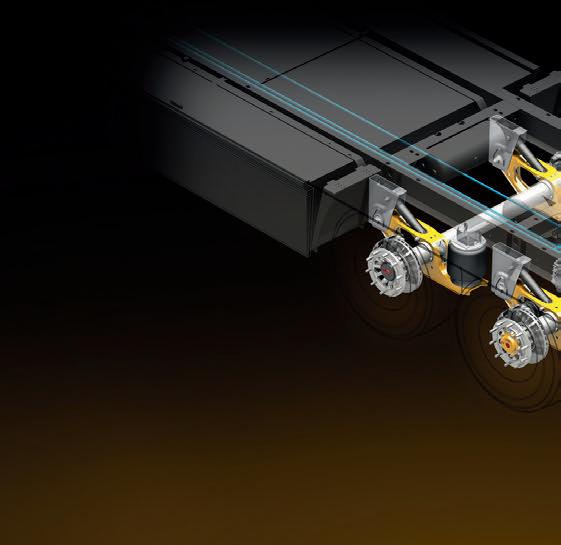

“Having already laid the groundwork with longer heavier vehicles (LHVs) and aerodynamic e ciency standards with the Aero ex project, today, as the trailer partner of the ZEFES project, we’re co-developing integrated electric axle systems and battery enclosures designed for seamless integration into modular trailer architectures, ensuring performance, durability, and extended lifecycle,” said Yilmaz.

As part of ZEFES (Zero Emissions long-haul Freight Eco System), Kässbohrer, in collaboration with ZF, has manufactured two electri ed vehicles for two separate real-life use cases. e rst is an intermodal e-curtainsider trailer operated by Scania between Sweden and the Netherlands via both road and sea. e second is an electri ed 45’ container chassis for Volvo and DPD, designed for EMS1 combinations along the Eindhoven–Munich.

ose prototypes are undergoing scenario-based evaluations under real infrastructure and current regulatory conditions until Q2 2026.

When developing its innovations through R&D, Kässbohrer measures its successes by the lasting impact on the industry, where it not only advances product innovation, but also safety, regulatory standards, and operational e ciency across the transport industry.

Ferhat Yiğit said one of the company’s landmark innovations, through its R&D centres, was the development of the world’s rst remotecontrolled autonomous bitumen tanker, created in collaboration with Hoyer.

“ is ground breaking project marked the rst major advancement in bitumen transportation in over 60 years,” he said.

Yiğit added that its research endeavours also lead to its award-winning octagonal central beam extendable container chassis successfully resolving a 30-year torsional issue, and setting a new engineering benchmark for structural integrity.

In addition to nding innovative solutions,

Kässbohrer has an equally strong commitment to shaping industry standards.

“During the development of our awardwinning 45’ coil swap body, the advanced testing methods were later incorporated into IRS 50592 as mandatory testing protocols. ese changes improved the safety standards for all swap bodies across Europe,” Yiğit said.

ere have also been broader e orts to build a smarter transport future through intelligent trailer systems.

“Our award-winning K-ADAS system, enhanced safety tipping silos, and developments in autonomous non-tipping silo discharge technologies exemplify our forward-looking strategy to support a fully automated logistics chain,” said Yiğit.

e result of these e orts has been its engineering team and the R&D centres delivering 10 trailer innovation awards since 2017 for Kässbohrer, Talson and Van Eck.

“Out of those 10, Kässbohrer has been recognised with seven international innovation awards spanning multiple categories, including body, chassis, components, safety, and smart systems,” said Yiğit.

“Four of these awarded solutions are already in use in our customers’ eets, proving both our foresight and execution capabilities.”

Its R&D e orts have also delivered improvements to existing products, such as its low-bed product series incorporating three patented technologies to improve load security and stability.

“In our next generation curtainsider vehicles, we present 12 patent-approved and seven utility model innovations that ease loading, reduce wear, and extend product lifespan,” said Yiğit.

Its full-hearted approach to innovation is not limited to headline technologies, but extends to lightweight engineering with its silo series including the lightest vehicles in Europe.

“Our 40-45’ xed container chassis is the lightest in its class, delivering fuel savings even when empty and our standard two-axle tipper model carries one additional tonne, thanks to re ned engineering,” said Yiğit.

Its next-generation reefer has also set a new benchmark in thermal performance with a K-value of just 0.31 – the lowest among standard trailers in the industry.

Since the beginning of 2025, Kässbohrer has launched 11 new vehicles across its widest product range, showcasing its R&D innovations and production capabilities that are meeting the evolving transport challenges across Europe.

“ e development of these vehicles begins with customer feedback. Upon these request our competent engineering team follow through our development cycle starting from digital design and test, real world data driven physical test and nished with one million km durability, longevity, safety and performance validation,” said Yiğit.

Across the European market, the SLS HS xed lowbed trailer introduces a hydraulic gooseneck ramp, enhancing loading e ciency for small forkli s and compact equipment. Its commercial vehicle carrier SOK LG, now VDI 2700-certi ed, ensures safe and compliant commercial vehicle transportation with standardised load securing.

In Spain, the SKA 24 aluminium tipper’s features optimise the transport of metal powders by improving durability, unloading speed, and cleanability.

Also serving Spain, as well as Scandinavia, the SSL 35 non-tipping silos operates in an A Double-type LHV con guration, increasing logistics exibility, minimising idle time, and o ering one of the most e ective CO2-reduction systems on the market.

Meanwhile, for Scandinavia, the STC 34 chemical tanker integrates four compartments and a 34,000-litre capacity, designed for optimal load distribution and high operational resilience in demanding transport environments.

In the Netherlands, the SSL 45 non-tipping silo, with three compartments and a

“WE ARE COMMITTED TO ADVANCING THE FUTURE OF TRAILER TECHNOLOGY THROUGH OUR MULTIDIMENSIONAL R&D APPROACH—COMBINING SUSTAINABILITY AND REAL-WORLD OPERABILITY. WE MEET THE DEMANDS OF TOMORROW’S LOGISTICS LANDSCAPE, WHILE DELIVERING MEASURABLE BUSINESS ADVANTAGES TO OUR CUSTOMERS.”

KÄSSBOHRER DEPUTY GENERAL MANAGER AHMET YILMAZ

45,000-litre capacity, incorporates axles rated for 10-tonne loads, aligning with national axle weight standards without compromising capacity.

In Germany, the STS 32 bitumen tanker sets a new benchmark in its segment with electric heating, remote-controlled discharge, integrated zero emission power generation, and outlet heating systems.

is all facilitates precise and e cient handling of bitumen and derivatives at temperatures up to 250°C, resulting in the STS 32 standing as the most technologically advanced vehicle in its class.

In the UK, the SKS 32 steel tipper and SSL 35 non-tipping silo are optimised with 8,000mm-plus wheelbases, ensuring stable axle load distribution and supporting 14/24-tonne payloads.

e STB 45 fuel tanker, a 45,000-litre, six-compartment unit with a cylindrical crosssection, o ers a lower centre of gravity and lighter weight than traditional elliptical models, rede ning safety and performance standards in fuel transport.

ese 11 product developments are not only tailored to regional logistics ecosystems, but also serve as scalable, technically robust products driven by the industry-leading R&D infrastructure.

Kässbohrer understands that sustainability can never be a stranger to innovation or R&D. e company pursues a two-fold environmental strategy - sustainability of manufacturing and sustainability of its products.

Kässbohrer operates a network of production and operational centres at Goch and Ulm in Germany, Blonie in Poland, as well as headquarters in the Netherlands, Spain, Italy, France and UK, delivering real-world value to customers across more than 70 countries.

e biggest production plant serving Kässbohrer - the appropriately named Mega Campus, with more than €60 million invested over the past ve years excluding R&D, is a strategic innovation hub where sustainable manufacturing and engineering and operational excellence converge.

e Mega Campus stands out as Europe’s most integrated trailer manufacturing facility - the only site in Europe where general cargo, liquid and solid hazardous material and heavy-duty and intermodal vehicles are produced under one roof.

Spanning a total of 400,000m², the campus features 81 advanced production technologies and embodies Kässbohrer’s commitment to lean manufacturing and Industry 4.0 principles.

Unique in the European trailer industry, it is the only facility where metallisation and cathodic dip coating (KTL) are integrated in a single continuous production ow, delivering unmatched corrosion protection and long-lasting durability for vehicles used in harsh operating environments.

e Adapazarı Mega Campus also houses Europe’s highest-capacity low-bed production facility, optimised through RFID-based traceability systems, automated crane logistics, and fully robotic surface treatment and painting lines.

General cargo vehicle assembly also bene ts from robotic welding and automated surface treatment and nishing at the Mega Campus, reducing variability and ensuring repeatable high-quality output.

Since 2021, Kässbohrer has actively tracked carbon emissions and its €9.6 million roo op solar power plant, commissioned in 2023, generates 92 per cent of its electricity from renewable sources.

is initiative alone contributes to a projected 42 per cent CO2 emissions reduction in scope 1 & 2 and, in 2024, a 30 per cent reduction was o cially recorded under ISO 14064 standards.

Certi ed as a zero-waste facility, the Mega Campus, in 2024, recycled 2,254 tonnes of nonhazardous and 993 tonnes of hazardous waste. In addition, more than 73,447m³ of process and grey water has already been treated and safely discharged.

Kässbohrer is maintaining a steady course through what it sees as a ‘complex landscape’, dogged by economic stagnation, global tari s, emission controls and weak capital expenditure.

Ahmet Yilmaz sees a “steady forward momentum through the end of the decade,” with issues, such as eet renewals, regulatory pressures and customer demand for more versatile and sustainable transport solutions, de ning industry priorities over the next ve to 10 years.

e company sees R&D initiatives as the only way to deliver on the solutions that will meet such challenges and, at the same time, deliver e ciency for customers.

“With our R&D and operational strategies we will continue to deliver the highest return and

future proof products and services in this shi ing market outlook,” said Yilmaz.

e hot-button issue of sustainability will continue as the primary driver of innovation, pushed by OEMs needing to implement decarbonisation innovations that align with EU carbon laws. ere is also the introduction of zero-emission zones across European cities and the evolution of the VECTO regulation pushing for cleaner trailer technologies.

“Kässbohrer is fully engaged in this transition. Our ongoing work on electri ed trailers through EU-supported projects, such as ZEFES, and our expanding range of intermodal and LHV solutions, directly contribute to lowering operational emissions while optimising payload and performance,” said Yilmaz.

Kässbohrer is also heavily engaged in intermodal solutions and modular LHVs to reduce carbon emission.

ese include the company’s award-winning 45’ coil swap body and octagonal central beam container chassis, part of Europe’s lightest swap body and xed container chassis range, as well as its LHV range that o ers increased operational e ciency, lower fuel consumption and reduced carbon footprints.

Although there are other industry challenges, including chronic driver shortages and high initial investments needed for electri ed and digitally equipped trailers, Kässbohrer still views this period as one of strategic reinvention.

“We are committed to advancing the future of trailer technology through our multi-dimensional R&D approach – combining sustainability and real-world operability,” said Yilmaz. is will be achieved by its product innovations in lightweight construction and fuel-saving trailer concepts.

“We are well-positioned to meet the demands of tomorrow’s logistics landscape while continuing to set new industry standards,” he said.

With such transformative changes faced by the transport industry, Kässbohrer’s priority is sustainably and e ectively addressing the needs of its customers.

“By fostering collaboration and maintaining agility across our expanding production and distribution network in Europe, we o er localised, practical solutions tailored to evolving needs,” said Yilmaz.

Kässbohrer also sees infrastructure as a critical future factor, such as the expansion of charging networks and availability of carbon-free electricity for widescale adoption of electri ed trailer systems.

“Looking ahead, collaboration among all stakeholders – industry, government, and customers – will be essential to ensure the zero-emission transition is not only ambitious but achievable,” Yilmaz said.

With a cautious eye to the future, the company looks to steady growth through R&D and meeting the needs of its customers in more than 70 countries.

“As the trailer industry continues to evolve, we remain focused on developing future-ready technologies and strengthening our presence across all segments of road transport,” said Yilmaz.

“Our highly skilled international teams enable us to maintain operational excellence and deliver value to our customers worldwide.”

Ahmet Yilmaz is also con dent that the company will deliver measurable business advantage to large eet operators and specialised small eets through its robust R&D processes.

“In the coming years, we will strengthen these partnerships by co-developing innovations that reduce carbon emissions, improve e ciency, and meet new regulatory standards,” he said.

He also sees it continuing its role in EU-funded projects and major consortia, while deepening ties with universities to advance the development of trailer technologies.

“From lightweight and intermodal designs to electri ed and smart trailer systems, we are helping shape a more sustainable and e cient transport future,” said Yilmaz.

“As the industry transforms under regulatory, technological, and environmental pressures, Kässbohrer remains focused on delivering value – through collaboration with all our stakeholders, starting with our customers, suppliers, EU and local level innovation projects, industry bodies and universities.”

As Europe continues to weather the economic and political winds of change, Kässbohrer’s vision is to meet all industry challenges head on and continue ‘together to the next 125 years.’

www.kaessbohrer.com

ALTHOUGH DISPARATE IN MANY CIRCUMSTANCES, SUCH AS LANGUAGE, CULTURE AND GEOGRAPHY, INDIA AND LATIN AMERICA APPEAR AS THE IDEAL PARTNERS IN TRADE. AFTER BEING NEGLECTED FOR DECADES, THE GOVERNMENTS AND MANUFACTURING SECTORS FROM THESE REGIONS ARE COMING TO APPRECIATE THE POTENTIAL OF THESE SLEEPING GIANTS.

India is regarded as a powerhouse economy, driven by its population and growing consumer and energy needs. Image: Ala/Stock.adobe.com.

Separated by thousands of kilometres, India and the Latin America (LATAM) region are coming closer together through trade associations, governmental diplomacy and an awareness that each region possesses vast resources to be tapped into –whether it be natural resources, human capital or burgeoning consumer power.

Trade potential between the regions is rapidly accelerating as India strengthens its role as a global manufacturing and export powerhouse, while Latin America continues to grow as a global provider of agriculture, energy and raw materials.

With a population of approximately 1.4 billion and a GDP of $4.27 trillion USD (~€4.054 trillion), India has rmly staked its place as a global economic powerhouse and the fastest growing major economy, supported by a growing middle class, huge consumer demands and a buoyant economy.

Expanding at an annual rate of up to eight per cent, India is regarded as the world’s fourth-largest economy, based on GDP, and the third largest by purchasing power parity.

India also boasts a Global Innovation Index of 39 with an available investor pool and funding of $560 billion USD (~€483 billion).

is rising global rating as has been due, in part, to the proactive work of various innovation agencies and incubators, such as the Department for Promotion of Industry and Internal Trade (DPIIT), Startup India, Atal Innovation Mission, Ministry of Electronics and Information Technology (MEITY) and the Department of Science and Technology (DST).

Consequently, it is home to more than 160,000 start-ups, primarily in the IT, healthcare and life sciences, education, agriculture and construction sectors.

e most populous nation in the world is also making great advances in space-related industries, due to its heavy investments in its nascent space program, primarily through its ISRO (Indian Space Research Organisation).

According to the World Economic Forum, by 2040 India is planning to expand its space economy to be worth $44 billion USD (~€38 billion), as well as commanding eight per cent of the global space market by 2033.

With its beguiling mix of population, voracious consumer demands and a ourishing economy comes in uence and power that is attracting the attention of governments and multinational corporations across the Atlantic Ocean.

India’s logistics sector has been forecast to reach $380 billion USD (~€ 328 billion) in 2025, growing at a CAGR of 10-12 per cent, according to a report by the India Brand Equity Foundation.

In addition, its domestic consumption market grew by 7.5 per cent in 2024, according to the Asian Development Bank.

Cognisant of this data, CEVA Logistics has opened a new strategic Logistics Corporate O ce in Mumbai, designed to foster innovation and collaboration.

“India is a vital part of CEVA Logistics’ global strategy,” said CEVA’s Deputy CEO, Olivier Storch.

“Our robust presence here supports both domestic consumption and the ‘Made in India’ initiative. Our teams across India are well-equipped to provide tailored solutions for clients and drive pro table growth.”

e robust state of India’s domestic markets has made warehousing and ground transportation top regional priorities for CEVA, with its new Mumbai o ce serving as a central hub for its operations on the Indian subcontinent.

CEVA’s Managing Director of the India Subcontinent, Paras Rawal, said the last ve years had proven to be a transformative period for the company.

“Our expanded presence enables us to better serve both international and domestic clients,” said Rawal.

“As India continues its economic transformation, CEVA is committed to providing innovative supply chain solutions that enhance e ciency and reliability for businesses operating in this dynamic market.”

Another global logistics provider has also seen the value of committing resources and investments to the Indian subcontinent.

Hellmann Worldwide Logistics has India rmly placed as part of its global growth strategy, driven by the nation’s dynamic and rapidly evolving logistics landscape. Hence, it is investing in creating strong local teams through its Hellmann Promise, which supports approximately 12,000 employees in their personal and professional development.

Accordingly, Hellmann India has embedded its global promise into everyday practice, strengthening a culture built on trust, purpose and performance.

“Our people are the driving force behind everything we do,” said Hellmann India Managing Director, Shubhendu Das.

Another sign of the importance of India in the global economics is Amazon’s announcement in June 2025 that it will invest more than $233 million USD (~€201 million) in 2025 to expand and upgrade its logistics infrastructure in India.

e S&P Global PMI, the manufacturing Purchasing Managers’ Index, a surveybased economic indicator designed to provide a timely insight into changing business conditions in the goods-producing sector, consistently rates India highly.

A PMI reading over 50 indicates growth or expansion of the manufacturing sector of the country as compared to the previous month.

India is the only country out of 14 surveyed to consistently maintain a PMI gure of over 55 (average 57.4) every month from May 2024 to May 2025, with March and April 2025 hitting highs of 58.1 and 58.2 ratings. e global average was 49.9 for that period.

One area of steady and sustained growth is India’s commercial trailer market, which in 2023 was valued at about $1 billion USD (~€864 million).

It is projected to grow at a CAGR of between eight and 10 per cent by 2028, reaching a market size of $1.5 billion USD (~€1.3 billion), with the growth in fast moving consumer goods, steel and cement being contributing factors.

A leading Indian trailer manufacturer, VST coreB Trailers, has stated it manufactures 350 to 400 trailers per month for the Indian market.

India was estimated to export approximately 5,000-6,000 trailers in 2023, with its main markets focused on the Middle East, Africa, and Southeast Asia. By 2028, exports are predicted to reach 10,000-12,000 units annually, equivalent to a 12-15 per cent growth rate.

Moreover, by 2030, India is expected to become one of the top three trailer exporters in the world, competing with China and Eastern European countries.

VST coreB has said that in 2025 it is planning to establish itself on the global market, with a monthly production capacity of 1,300-1,400 trailers and targeting those core sectors.

Complementing India as the growth market is that of the extended Asia Paci c (APAC) region, which is expected to contribute 52 per cent of growth of the global road freight transport market, itself forecast to increase by $204.4 billion USD (~€175.1 billion) between 2024-2029.

APAC’s road freight transport market is expected to continue experiencing rapid advances (2025-2029), with key players investing in inland transportation, logistics, and short-distance travel solutions that are a ordable, adaptable and cost-e ective.

To that e ect, the Rhenus Group expanded its investment in Southeast Asia in June 2025, with the launch of a new Air Freight Gateway in Singapore, enhancing its global network with multi-modal connectivity across air, ocean and cross-border trucking.

e global logistics provider said the new facility o ers a full range of cargo-handling services to support multi-modal shipments globally, including strong trans-Paci c linkages from Asia onward to US & LATAM markets.

While not experiencing the meteoric growth of India’s economy, Latin America is projected to experience a positive, albeit modest, economic growth rate in 2025, with some expecting a 2.5 per cent increase.

e giant of the LATAM countries, not just for its land size and its 212.6 million population, but economic gravitas is Brazil.

Mexico is a major exporter and trader, as well as having a strong automobile manufacturing base but, as the largest economy in LATAM, Brazil’s performance is crucial for the stability of South America.

As a major producer of oil and gas and exporter of agriculture and beef, Brazil has garnered a great deal of interest from India, both boasting growing consumer markets.

With a GDP of $3.967 trillion USD (~€3.4trillion) in 2023, Brazil is rightfully South America’s economic powerhouse and is seen as a mainstay of the BRICS multinational group.

While its Global Innovation Index is less than India’s – at 50 – it is home to an

impressive 16,000-plus start-ups, mainly found in the ntech, Edtech, AgriTech, e-commerce and new food sectors.

In 2024, Brazil improved ve positions to reach its 50th rank out of a total of 133 countries in the Global Innovation Index. is was the secondbest ranking achieved by the Portuguese-speaking country since 2012.

With an investor pool and funding of $119 billion USD (~€103 trillion), Brazil is the largest startup ecosystem in Latin America with the number of its startups in Brazil steadily growing in recent years. e Brazilian startup ecosystem is gaining global attention with startups attracting international investments and expanding their operations across Latin America and also to Europe and the US, particularly with the growth of near-shoring.

Brazilian cities, such as São Paulo, Florianópolis, Belo Horizonte, Recife and Campinas are gaining reputations as viable innovation and entrepreneurship hubs.

In May 2025 CEVA Logistics expanded its global deep-sea car carrier operations by o ering connections from Asia to Central and South America, via a regular trade lane and spot services.

As a result, three additional roll-on, roll-o (RORO) vessels, ranging from 5,500 to 7,000 car equivalent units (CEUs), have enabled CEVA to India

expand its nished vehicle logistics (FVL) solutions for the automotive market.

e new, regular trade route now runs between eastern Asia and the west coast of Central and South America, with multiple origin and destination calls available in China, South Korea, Japan, Mexico, Guatemala, El Salvador, Costa Rica, Panama, Argentina, Colombia, Ecuador, Peru, and Chile.

Another global logistics provider, DP World, continues to invest heavily in the LATAM region markets, seeing it as yielding as-yet unful lled potential for growth.

It has pumped signi cant investment into Peru’s Port of Callao and, one year since inaugurating its Bicentennial Pier in June 2024, DP World’s terminal has delivered a 19 per cent increase in container throughput and a surge in agricultural exports, boosting Peru’s economy.

e enhanced terminal has driven an 80 per cent increase in operational capacity, managing a record volume of 1.96 million TEUs during 2024.

e lengthened South Pier of the Port of Callao has an increased annual capacity of nearly 3 million TEUs and can handle three ultra-large container ships at once.

ese improvements play a vital role in boosting trade volumes, attracting larger vessels, and strengthening Callao’s reputation as the country’s leading port and logistics hub for South America’s West Coast.

DP World CEO for Peru, Ecuador and Colombia, Carlos Merino, said: “ is expansion transformed our ability to connect Peru to the world. It’s not just about moving more containers – it’s about building long-term resilience in our supply chains, attracting next-generation investments, and making Peruvian trade more agile and globally competitive.”

DP World has invested more than $3 billion USD (~€2.6 billion) in infrastructure at Callao since 2010, with the agricultural sector one of the biggest bene ciaries.

In 2024, the terminal facilitated $3.6 billion USD (~€3.11billion) in agricultural exports, including approximately 85 per cent of Peru’s blueberry shipments to Asia and nearly 40 per cent of all agricultural exports from the country.

e terminal was also Latin America’s rst electric charging station at a port terminal.

“ ese milestones not only reinforce our position as Peru’s leading container terminal, they re ect our long-term commitment to connecting

“THESE MILESTONES REFLECT OUR LONG-TERM COMMITTMENT TO CONNECTING PERU TO GLOBAL MARKETS, THROUGH INNOVATION, OPERATIONAL EXCELLENCE, AND RESPONSIBLE GROWTH.”

DP WORLD CEO FOR PERU, ECUADOR AND COLOMBIA, CARLOS MERINO

Peru to global markets through innovation, operational excellence, and responsible growth,” said Carlos Merino.

Peru has also drawn interest from shipping and logistics giant, Maersk which opened a new cold chain logistics hub in Olmos, northwest Peru, in July 2025, to boost fruit exports in the agricultural region.

e new facility strengthens cold chain infrastructure in the Lambayeque region, o ering packing, sorting and cold storage centre to support Peru’s agro-export sector.

e Lambayeque region is a top contributor to Peru’s fruit exports, according to Peru’s National Institute of Statistics and Informatics.

e new centre is expected to see more than 10,000 tonnes of produce pass through the facility in its rst year of full operation.

Both Brazil and India are now entrenched on the world economic and trade stage, as foundation members of the BRICS alliance.

e alliance’s growth has spawned an o shoot, comprised of 11 full member states - the ve original members of Brazil, Russia, India, China and South Africa - and new members Egypt, Ethiopia, Iran, Saudi Arabia, and the UAE admitted in 2024. Indonesia was admitted as a full member in 2025, while another 30 countries are waiting to join the ranks of the political, economic and diplomatic forum that rivals that of the G7 and other strategic alliances.

e BRICS’ objectives include strengthening economic, political, and social cooperation among its members, as well as increasing the in uence of those countries in the ‘Global South’ in international relations.

BRICS nations collectively represent approximately 3.3 billion people, accounting for over 40 per cent of the world’s population, with their combined economies contributing more than 37 per cent of global GDP.

e popularity of BRICS has grown so rapidly that there are now the BRICS Outreach - meetings between BRICS member countries and those from the geographic region of the host country.

BRICS Plus are meetings between BRICS member countries and invited countries that are not from the geographic region of the host country. BRICS Plus meetings account for 35 per cent of the world’s GDP compared to the G7 members’ 30 per cent.

As foundation members of BRICS, India and Brazil will continue to challenge some of the world’s more developed economies as they continue to reap the bene ts of trade relations and agreements that o en ignore geopolitical tensions around the world.

A clear example of this was the agreement struck in early August 2025, where India agreed to buy Russian oil despite threats of tari s being imposed by the Trump administration.

India and Brazil have bene tted from being foundation members of BRICS. Image: Hamzeh/ Stock.adobe.com.

Coinciding with the formation of BRICS in the early 2000s, India and Latin America have revitalised their trade and investment activities in the past 20 years, or so.

According to the Uruguay-based portal Dialogo Politico, trade between the regions in 2023 totalled $40 billion (~€38.8 billion), with Brazil, Mexico, Argentina, Colombia, and Peru standing out as India’s top traders.

Dialogo Politico reported that during the past decade, trade between the two regions mushroomed by 145 per cent, with India mainly exporting automobiles, auto parts, pharmaceuticals, and textiles to LATAM countries, and importing raw materials, such as hydrocarbons, metals, minerals, copper, oil and agricultural products.

In 2022, India exported goods to LATAM worth about $10 billion USD (~€8.65 billion), while its investments in the region were close to $20 billion USD (~€17.3 billion) in the energy, pharmaceuticals, and automotive sectors.

ose investments resulted in a record trade volume of $50 billion USD (~€43.25 billion) between the countries in 2022.

As a result of such buoyant markets, Indian companies have established a presence in the region, while reciprocal investments by LATAM companies have been relatively low. However, Latin America has emerged as a vital supplier of crude oil to meet India’s growing energy needs, with imports from Venezuela, Brazil and Mexico accounting for about 30 per cent of India’s imports from the Latin American and Caribbean (LAC) region.

Nonetheless, in March 2025, India’s union commerce minister Piyush Goyal, said the country was keen to broaden economic ties with the 43 countries in the LAC region.

In 2023 – 2024, India’s total trade with the LAC region was $35.73 billion USD (~€31billion), made up of exports worth $14.5 billion USD (~€12.5 billion) and imports worth $21.23 billion USD (~€18.5billion).

While raw materials, oil and agricultural products are the main commodities being traded by the LATAM countries, Latin America accounts for one-third of India’s global car and motorcycle exports.

In 2023-2024, motor vehicle exports from India to LATAM reached $1.793 billion USD (~€1.56 billion), making up 30 per cent of India’s global car exports of $5.92 billion USD (~€5 billion).

Mexico stands as India’s second-largest car market globally, with an average $941

million UDSD (~€813 million) in imports.

As a result, many Indian auto manufacturers, such as Mahindra, Hero Motors, Tata and Bajaj, have set up LATAM bases, including in Colombia, Mexico and Brazil.

German-headquartered logistics company, Rhenus Group has recognised the massive trade opportunities arising from the synergies between India as a global manufacturing and export hub and the LATAM region as a provider of energy, minerals and energy and raw materials and agriculture.

“ e ongoing collaboration through BRICS — with Brazil and India cooperating — and several free trade agreements between India and various Latin American countries are playing a pivotal role in strengthening this partnership,” said Rhenus India Joint Managing Director, Bhaswar Arya.

DHL Global Forwarding India Managing Director, Edwin Pinto said DHL saw strong bilateral growth between India and LATAM, it being one of the fastest-growing trade lanes.

INDIA:

• Population = 1.4 billion

• GDP = €4.054 trillion

• World’s 4th largest economy

• Global Innovation Index = 39

• Logistics sector = €328 billion (2025)

• Commercial trailer market = €1.3 billion (2028)

• Founding member of BRICS

BRAZIL:

• Population = 212.6 million

• GDP = €3.4 trillion (2023)

• Global Innovation Index = 50

• Founding member of BRICS

• Investor pool/funding = ~€103trillion

LATAM:

• Trade with India = €38.8 billion (2023)

• Indian auto imports = ~€1.56 billion (2023-2024)

• Trade with India = ~€43.25 billion (2022)

“Trade has grown over 12 per cent y-o-y, and in 2026, we expect the LATAM trade to grow by another six per cent, which is signi cantly higher than the projected growth with North America and Europe,” said Pinto.

He said sectors like pharmaceuticals, IT, and processed foods will join the traditional sectors of textiles, automotive, and chemicals as the drivers of trade, with Brazil and Mexico as DHL Forwarding’s primary markets.

Brazilian trailer manufacturer Librelato does not currently maintain commercial relations with the Indian market but does “recognise the strategic importance of the region and the potential for future international partnerships” a spokesperson said.

Exporting in excess of 6,000 trailers yearly, and Brazil’s second largest trailer exporter, Librelato’s current international markets are focused across Latin America, particularly Paraguay, Chile, Uruguay, and Bolivia, and also Europe and Africa, with a planned push into North American and Mexican markets.

With rising energy demands from its population and industries, and the uncertainty surrounding geopolitical and economic tensions across the globe, India, together with international companies, is shi ing its attention to Latin America as trade partners.

e world has already witnessed India ex its trade muscles, with Tata Motors’ proposed purchase of Italian trucking conglomerate, Iveco Group for a reputed €3.8 billion, announced in late July 2025.

As a result of that purchase, Iveco and Tata Motors’ commercial vehicle business will have combined revenues of about €22billion, split across Europe (50 per cent), India (35 per cent) and the Americas (15 per cent).

Will that be the trigger that unlocks a veritable Aladdin’s cave of riches between the two regions in the coming years?

While BRICS has great potential to multiply and add several new nations to its fold, rivalling the G7, the G20, ASEAN, APEC and other international associations, a separate, stand-alone trade alliance between India and the LATAM region will largely be dictated by the winds of politics and the prevailing economic vagaries. Perhaps the most crucial issue will be whether India’s juggernaut economy can be reined in to provide parity with its increasingly close LATAM neighbours, and whether the latter’s treasure trove of mineral and natural resources can meet India’s seemingly insatiable demands.

www.globaltrailermag.com

KRONE offers optimum solutions for all transport requirements with trailers that set standards in terms of innovation and quality. The simple and safe handling, the tested construction components, the first-class workmanship and the long-term protection provided by the KTL-plus powder coating make KRONE vehicles an investment that definitely pays off.

Find out more now!

GERMANY IS A WORLD LEADER IN INTERNATIONAL, COMMERCIAL TRANSPORT TRADE SHOWS – FROM BAUMA, IAA, TRANSPORT LOGISTIC AND MORE, IT HOSTS A PLETHORA OF TRANSPORT AND LOGISTICS EVENTS THAT ATTRACT RECORD ATTENDANCES AND CUTTING-EDGE TECHNOLOGY. NOW IT’S THE TURN OF KARLSRUHE AS IT PREPARES TO HOST NUFAM 2025.

The symbiotic worlds of commercial vehicles and technology are set to collide as the Karlsruhe Exhibition Centre will again become the nodal point for Europe’s commercial vehicle industry at NUFAM, held from 25-28 September 2025.

e full spectrum of the commercial vehicle industry, from transport, haulage and logistics to human resources, innovations, concepts and components will be showcased during the four-day trade fair.

Challenges and future opportunities facing the commercial vehicle industry, as well as practical solutions, will be deconstructed during several discussions, dialogues and networking occasions.

With the commercial vehicle industry constantly changing and evolving, innovations, such as telematics, digital services and charging infrastructure, will be examined in special exhibition sessions.

An exhibition on the advantages of hydrogen engine drives will be a feature,

• NUFAM started in 2009

• Held biennially

• 105,000m² space

• 24,000+ visitors

• 400+ exhibitors

• Features Peter-Gross-Bau outdoor space

• NUFAM Day held digitally

“(THE PETER GROSS BAU AREA) OFFERS OUR EXHIBITORS THE IDEAL OPPORTUNITY TO PRESENT THEMSELVES AND THEIR PRODUCTS IN THE BEST POSSIBLE WAY WITH AN OPTIMAL INFRASTRUCTURE.”

MESSE KARLSRUHE DIVISION MANAGER BEATE FRÈRES

as well as a session hosted by the Central Association for Bodywork and Vehicle Technology on training.

Topical issues relevant to truck drivers, from job security, health, and future of the industry will come under scrutiny at the Truck Driver Forum on 28 September.

Commercial vehicles of all classes, bodies, trailers and semi-trailers, accessories and items needed for the operation of those vehicles will be showcased at the trade fair.

Industry heavyweights will be at NUFAM in force. SAF-Holland, exhibiting at Hall 2/C 203, will be showcasing its innovative product range including includes axle and suspension systems, h wheels, coupling systems, kingpins, and landing legs.

JOST and Hyva will be found in Hall 2/A227 for the event, exhibiting versatile products, such as the JOST KKS automatic coupling system, the JOST King Pin Finder for h wheel coupling, and the Hyva hydraulic and tipping solutions.

e Krone range of trailers, including its Pro Liner, Cool Liner and Mega Liner series will be on display in Hall 1/C109.

At Hall 2/C215, global axle manufacturer, BPW will exhibit its range of innovations in commercial axle development, together with its growing reman and refurbishment division.

In addition, freight forwarders and logistics providers, trades and municipal companies will be present at the trade fair, while the variety of machinery to be featured will be aweinspiring, from trailers, tippers, low-loaders, curtainsiders, refrigerated, box and swap bodies to tank superstructures, bulk transporters, platform and delivery vehicles.

Topics of discussion throughout the four days will revolve around a plethora of elds, including, trucks, vans and vehicles, new mobility, automation and autonomous vehicles, alternative drive systems, hybrid vehicles, charging infrastructure, selfdriving vehicles, digital services, sensor technology and telematics, GPS tracking and geofencing, truck equipment, interior technics, smart city logistics, tyres, TPMS, wheels and axles, bodies, e-trailers and trailers.

is year’s NUFAM promises to be bigger than the 2023 event, which saw 24,000 visitors, more than 400 exhibitors from 23 countries and over 80,000 square metres of exhibition space. Organisers are again anticipating more than 400 exhibitors during NUFAM 2025, and are hoping to equal, or better, 2023’s visitor satisfaction rating of 95 per cent.

In 2025, for the rst time, an outdoor space, the Peter-Gross-Bau area totalling 105,000 square metres, will be used for truck and transport demonstrations during NUFAM, complementing the existing four spacious halls and atrium. e outdoor area is the third-largest outdoor exhibition space of this type of venue.

“I am delighted that we will be able to use the new outdoor area, the Peter Gross Bau Areal (PGBA), for our trade fairs starting this year,” said Messe Karlsruhe Division Manager, Beate Frères.

“It o ers our exhibitors the ideal opportunity to present themselves and their products in the best possible way with an optimal infrastructure. is creates a special outdoor experience – also for visitors, complemented by perfect transport connections.”

Beate Frères said a feature of the trade fair will again be its NUFAM Day, in its third edition this year. “NUFAM DAY is ideally suited to highlighting the challenges facing the industry,” said Frères.

“Where are the challenges? What needs to be done? Where are the shortcomings? At NUFAM, we will then showcase our exhibitors’ responses to these challenges.”

www.nufam.de

The host city for NUFAM 2025. Image: Fotograhe.de/stock.adobe.com..

The thinnest ame-retardant laminate on the market. Only 0.8 mm, high-performing, bio-based.

Strong in protection, light in application. FIRE REACTION CLASS

IN THE DYNAMIC, MODERN LOGISTICS INDUSTRY, RELIABILITY, FLEXIBILITY AND COST-EFFECTIVENESS ARE KEYS TO SUCCESS IN MEETING COMPLEX DEMANDS, AND FOR SECURING A LONG-TERM POSITION IN THE TRANSPORT INDUSTRY. KRONE MEETS THESE CHALLENGES WITH A COMPREHENSIVE PRODUCT AND SERVICE PORTFOLIO THAT GOES BEYOND THE DEVELOPMENT OF TRAILERS.

As a holistic system provider, KRONE o ers intelligent vehicles, digital tools and well-designed services.

Every product created by KRONE is derived from a single source, while everything is done with a clear goal - to make everyday life easier, more e cient and more economical for transport companies.

At the heart of KRONE’s vehicle portfolio are the proven models of its Liner series. e Liner series addresses all the requirements of modern freight transport – from temperature-controlled transport with the Cool Liner trailer, to the Dry Liner for dry freight and the versatile Pro Liner, which can be con gured in countless variations. Specialisations, such as the Paper Liner and the Coil Liner, o er tailor-made solutions for sensitive or heavy loads – each with sophisticated load securing and technical features that simplify everyday work.

“Our comprehensive transport solutions set new standards with innovative technology and outstanding quality,” said KRONE Sales and Marketing Managing Director, Dr Frank Albers.

“Whether in production, equipment or handling – for us, everyday practicality for our customers is the top priority.”

Of KRONE’s Liner series, the Pro Liner portfolio stands out as an all-round talent for solving versatile transport tasks in all industries, such as paper, food or steel rolls. rough a seamless symbiosis of technical innovations and practical applications, the Pro Liner stands out as a successful case study of a t for purpose product.

e Pro Liner is renowned as the all-rounder in the transport industry, setting new standards in logistics by taking exibility, reliability and e ciency to a new level, paving the way for a successful future in the transport industry.

It forms the basis of all KRONE’s curtainsider semitrailer models, including the Mega Liner, Coil Liner, Paper Liner and many other specialised variants.

Moreover, its innovative technology and versatility make it an indispensable investment for a wide range of industries.

With a welded chassis and featuring highquality, pre-galvanised series components, as well as a KTL powder coating from the KRONE Surface Centre, the Pro Liner guarantees exceptional durability and quality.

Today, the h generation Pro Liner can handle a gross vehicle weight of 39 tonnes with a comparatively low unladen weight of approximately six tonnes.

Cross-member reinforcements can be attached to the ladder frame construction at twelve positions as an option. is reinforces the 30mm thick, waterproof oor panel by one tonne, enabling it to bear a oor load of up to 8,000 kg forkli axle load.

Added to the mix is the KRONE Sliding Roof that makes uncomplicated loading possible, thanks to an integrated diagonal bracing in the tarpaulin roof and a very comfortable handling.

A highlight of the Pro Liner is its perfect adaptability for use in rail transport, thanks to its innovative piggyback version.

In this case, the crane can securely grip and load the trailer using the robust gripping edges, while any potential damage to the tarpaulin is prevented by the double tarpaulin fabric.

During the loading process, the spring bellows li o the carrier, avoiding them being pulled apart.

In addition, sturdy skids protect the underride guard when touching down, thus avoiding potential damage. Depending on the wagon, the side impact protection can also be folded up.

e Pro Liner’s e ective road or rail use is assured by its reinforced chassis, while an ILU code-compliant tarpaulin and rail-compatible tensioning fasteners are able to cope with the challenges of high rail speeds.

“In view of high tra c densities, tra c jams and delivery delays, this promotes the e cient deployment of drivers and reduces the burden on the roads,” said KRONE Trailer’s Head of Marketing, Simon Richenhagen.

e ingenious designers at KRONE have also taken into account the Pro Liner series’ use in international road transport.

e Pro Liner TIR has been specially optimised for international road freight transport within and outside Europe, so as to meet the requirements of hauliers operating within these sectors.

e custom rope is tensioned around the body using plank ramps, e ectively preventing

unauthorised opening of the cargo space, thanks to a sophisticated locking technology.

Creating state-of-the-art trailers is just one piece of the puzzle when KRONE looks to meet current and future market needs.

Another key component in meeting customer satisfaction is that of eet data management –particularly telematics.

Utilising KRONE Telematics, eet operators can obtain all relevant vehicle data in real time - from location and temperature to load compartment utilisation.

Rapid access to such data enables optimised route planning, as well as increased safety and reduced operating costs.

While classic transport apps o en fail in terms of acceptance and user-friendliness, KRONE relies on an intuitive and accessible solution with its ‘Smart Assistant’, that makes everyday life easier for dispatchers and enables smooth work ows.

e Smart Assistant works via a QR code on the trailer, which is scanned with a smartphone. is opens a messenger-based system via WhatsApp, Telegram or Viber.

In just a few seconds, drivers can report any damage, or faults, documented with photos, as well as provide digitally record handovers, report accidents in a structured manner or

access documents, such as operating instructions, insurance certi cates or the eCMR.

Now KRONE has gone a step further in the data management eld, with its new digital portal – mykrone.blue.

Mykrone.blue is a central platform where all information, services and vehicle data are intelligently bundled.