SMSF PROPERTY GUIDE

Navigating the intersection of SMSFs and property

Your in-depth guide on how to navigate the regulation and compliance issues in borrowing and buying property through an SMSF

SELF-MANAGED SUPERANNUATION funds have become increasingly popular among Australians who want more control over their retirement savings. One of the investment options available within an SMSF is investing in property, which allows individuals to leverage their superannuation to acquire real estate assets.

It also offers an opportunity to diversify a fund’s investment portfolio beyond traditional assets like stocks and bonds, and the range of properties available covers everything from commercial and residential to specialist housing options under the National Disability Insurance Scheme and industrial properties.

In recent years, changes to superannuation legislation have meant it’s now possible for SMSFs to use borrowed funds to acquire property, providing a greatly enhanced opportunity to diversify investment portfolios.

With this change has come a plethora of strategies and lending options that can be challenging to navigate for trustees and advisers.

Buying a property in an SMSF can be a great investment strategy to generate long-term retirement wealth, but it is certainly not a onesize-fits-all solution. To successfully invest in property through an SMSF requires a significant level of knowledge – not just about how property works as an investment, but also the rules that apply to property as an SMSF asset.

The SMSF Property Guide: Navigating the intersection of SMSFs and property offers an insight into how different strategies can be used to acquire property and ensure any investment meets the stringent compliance and regulation issues that must be met.

This guide leverages the knowledge and expertise of leading property development companies, SMSF lenders and specialist advisers who have worked within the SMSF space and understand the stringent compliance conditions that apply to this specialist investment area.

Specifically, this guide offers information on lending options and requirements, investment options across the property sector and the best ways an SMSF can strategically grow their wealth and provide optimal results for their members.

This guide includes details on:

Meeting compliance obligations for property valuations.

Obtaining finance for property investment.

Options for investment.

Diversification strategies.

Sustainable and social investment.

On behalf of SMSF Adviser and our partners, we hope this guide is instructional and educational in helping SMSF trustees and advisers understand the complex and exciting opportunities growing in the property investment sphere.

Keeli Cambourne SMSF Adviser reporter

IN PURSUIT OF STABLE INCOME RETURNS

Commercial real estate may not be the most common property investment for an SMSF, but where a property is well leased and well managed, it has the potential to generate stable income and give investors a clear understanding of the asset held

STUART WILTON , co-head of unlisted funds at Centuria, an Australasian real estate fund manager, says SMSF investors can potentially generate a far higher yield in commercial real estate compared to residential, with returns ranging between 5 to 8 per cent per annum.

Wilton adds that commercial real estate provides a more accessible entry point, starting as low as $10,000, compared to residential property investment which typically requires a much larger initial deposit.

“Additionally, the other benefit of investment in commercial real estate is there are plenty of opportunities to value-add through active management compared to residential real estate where you might only look to do a renovation in upgrading a bathroom or kitchen,” Wilton says.

“There are many more angles to value-add with commercial property, whether it’s converting into higher and better use, developing, and releasing within a market where you think rents are going to be stronger and achieving rental growth that way.”

Centuria boasts around $20 billion of real estate assets under management, with a significant

portion in the unlisted sector across office, retail, large format retail, agriculture, healthcare, industrial and more.

Over the past 25 years, Centuria has expanded beyond traditional real estate sectors to diversify into various alternative sectors of the commercial real estate market including healthcare and agriculture. This expansion has elevated Centuria’s expertise as an Australasian real estate fund manager and has contributed to its growth and success.

A simple asset class

Wilton says the attraction of commercial property investment in the SMSF space is growing with its potential to generate healthy and stable income returns – particularly for high-quality assets that are well-leased in good locations.

Commercial real estate presents a straightforward asset class when compared to investment in companies, which often involve a multitude of administrative and financial documentation. This simplicity can be particularly beneficial for SMSFs as it reduces the potential for overwhelming administrative burdens.

“To put it simply, in commercial real estate investment you have tenants within the asset paying their rent, you service your debt, you might have some other costs involved there, and then depending on any other future financial commitments, the rest of that can be distributed to investors,” Wilton says.

“It keeps it simple, and people can understand it relatively easily. Plus, it’s also quite tangible, so you can go and touch and feel it, drive past that asset, which I think people quite like, because it just gives that transparency and comfort as well.”

Diversified and tax-effective

The inclusion of commercial property in an SMSF portfolio not only adds diversification but also comes with tax effectiveness, with certain funds offering deferred income distributions. This can result in tax advantages over the investment term, allowing for the reinvestment of the untaxed income.

Wilton points out that investors are frequently unaware that certain funds may offer income distributions that are partially or completely deferred over the investment’s duration. This deferral is based on depreciable allowances and the income generated by the fund, potentially

resulting in an SMSF paying no tax throughout the investment’s lifespan.

Despite the benefits, Wilton says there are barriers to entry in commercial real estate, such as requirements for investors to meet sophisticated wholesale investor criteria, and the illiquid nature of some unlisted funds. There is also the potential impact of regulatory changes on investor eligibility, noting the government’s consideration to adjust the thresholds for sophisticated investor status. However, he says there are a number of vehicles, including retail registered schemes, in which anybody can invest with a product disclosure statement.

“Centuria primarily does that, even though there is also a wholesale arm to the company. Anybody can invest in our retail products. They tend to be a little bit less total return focus and lower risk, but are ideal if an investor is looking for something a bit up the risk curve and for some capital growth,” he says.

“The one other thing to consider is liquidity and generally, these unlisted funds are considered illiquid. They’re either fixed-term closed-end funds or what they call open-ended funds, but these have limited liquidity facilities as well.”

A sustainable investment choice

Investment in commercial real estate can also play a crucial role in helping a fund achieve its sustainability goals. Given that buildings account for a significant portion of electricity usage and emissions in the country, investing in commercial properties with robust ESG (environmental, social and governance) frameworks can make a positive contribution to sustainability objectives.

As the government looks to introduce mandatory climate-related reporting for listed companies, Wilton says it is critical to have some ESG targets in any investment portfolio, and if a commercial property is managed well and includes sustainability targets and measures, it can help attract and retain tenants.

Meeting those sustainability targets within a commercial property portfolio is also relatively straightforward, simple and cost-effective, Wilton says, and can include things such as installing renewable energy measures such as solar panels.

“Centuria is now rolling out a big solar program across a number of our office buildings and industrial sheds, which not only helps the emissions from both a landlord and tenant perspective, but

INVESTORS HAVE TO REMEMBER THEY SHOULDN’T JUST FOCUS ON OFFICE SPACE. THEY NEED TO BE CONVINCED THAT A COMMERCIAL OPPORTUNITY IS THE RIGHT ONE FOR THEM AND TAKE A LITTLE BIT OF RISK

Stuart Wilton

Co-head of unlisted funds, Centuria

any new developments we put forward will clearly need to be highly rated – whether that be a five star or green star design – in order to meet the credentials that investors need,” he says.

Sustainability and environmental factors are also an important part of lease arrangements with government tenants and departments. Ensuring commercial properties have green credentials is not just about social responsibility but also attracts healthy returns and retains tenants looking for those credentials.

Buying and investing pathways

The primary methods for SMSF investors to engage with commercial property include direct ownership, unlisted funds, and Australian real estate investment trusts (A-REITs) on the ASX. But, as with any investment journey, it is important to consider diversification within the commercial property stream to mitigate risks and enhance portfolio stability.

Regarding unlisted funds, Wilton explains that this approach provides investors with the opportunity to purchase units within a trust that is managed by an experienced property fund manager. These funds can either be closed-end, fixed-term trusts or open-ended with limited liquidity facilities,

offering investors different options based on their investment preferences and liquidity needs.

Alternatively, funds can invest in a REIT on the ASX and buy shares in a bigger portfolio, such as a specific office portfolio or mixed REIT which is diversified across several sectors.

Despite prevailing pessimism regarding the feasibility of investing in office spaces amid rising interest rates, Wilton points out that robust fundamentals are supporting the market with factors such as population growth and low unemployment anticipated to fuel demand. Additionally, sectors like industrial real estate continue to perform strongly, offering attractive opportunities for investors adopting a medium- to long-term investment outlook.

Growth potential

Wilton notes that as Australia’s population grows, there will be increased demand for commercial property – especially office space. He highlights a forecasted need for 4 million more square metres of office space in the next decade1. Ultimately, SMSFs, with their long-term investment approach, are poised to benefit from this trend.

Currently, Wilton says the opportunities in the commercial property space are expanding,

especially in Centuria’s industrial sector which in its December results reported a 51 per cent leasing spread – meaning that when an existing lease expired it was quickly renewed with an increased rent of around 50 per cent across that portfolio.

“Investors have to remember they shouldn’t just focus on office space,” Wilton says. “They need to be convinced that a commercial opportunity is the right one for them and take a little bit of risk.”

For SMSF investors, unlisted commercial property funds can play a valuable role in a portfolio by providing diversification, income generation, capital growth potential and tax efficiency.

1 Source: Centuria, CBRE ‘Australian and New Zealand International Migration Trends’ Report.

To learn more about how Centuria can assist you, click here.

MOVING PAST THE BUY-AND-HOLD STRATEGY

In the ever-changing landscape of the Australian real estate market, SMSFs are finding innovative ways to navigate the complexities of property investment

ANDREW M cVEIGH, managing partner at Remara says that, for SMSFs, real estate has traditionally been a buy-and-hold investment aimed at capital growth and yield. However, the current market conditions demand a nuanced approach, especially considering the limitations on borrowing and development.

McVeigh says: “The Reserve Bank of Australia has researched what drives the real estate market and essentially it comes down to interest rates. If you think about the market, interest rates go down, people’s borrowing capacity goes up, so then they’re willing to pay more for a property, and that drives the increase in value of properties.”

With the rapid interest rate rises of the past few years, borrowing power has been limited and McVeigh says many potential investors are not willing to extend themselves as they once did. However, supply has been limited, which is now acting to stabilise the market.

“In our view, we’re probably in a sideways trend for the next 18 months. We may have a plus/minus 3 per cent move but until there is a major supply addition or interest rate decline to most markets, we’re probably not going to see tremendous amounts of property growth.”

Buy and hold is not the only strategy

McVeigh says that for those with property in an SMSF, it’s primarily a buy-and-hold strategy focused on capital growth. However, he cautioned trustees to assess whether the market is aligning with this strategy effectively.

Most returns on property within an SMSF are derived from rental returns and capital growth which are generally between 2 and 5 per cent, but if there is leverage on the asset, trustees may be paying more in interest than what they are receiving as income. With limited capital growth, the asset is expected to be defensive only and offer limited returns for an investor’s portfolio.

“Essentially you’re almost going backwards by having leverage on those assets and you should be looking for capital growth to be able to prop up your portfolio,” he says.

He explains that SMSFs frequently acquire industrial or commercial properties, leveraging their ownership of a business to rent out the property to their own business.

This method allows them to utilise their business earnings to acquire a long-term asset for their SMSF. Although that process works well because the fund is essentially accruing wealth, it has to be done to comply with NALE requirements.

BY ENGAGING IN EQUITY PARTNERSHIPS AND DIVERSIFYING THE CAPITAL STACK ... SMSFS CAN ACHIEVE A BALANCED INVESTMENT APPROACH THAT CATERS TO LONG-TERM

STABILITY

Andrew McVeigh Managing partner, Remara

In this domain, McVeigh says Remara has witnessed substantial growth in real estate acquisition within SMSFs over the past few years. However, he mentions there are a couple of other strategies that have not been available to the SMSF market. The two components that are not typically utilised or actively employed within an SMSF for property investment are asset repositioning and redevelopment, largely due to restrictions imposed by rules and regulations.

“There are limits on how much an SMSF can borrow and what it can borrow for, which in turn limits the ability to do developments. What the government doesn’t want to see are people doing more speculative developments and more speculative activity in their super and potentially losing that or suffering a large loss which wipes out a big portion of their savings profile,” he says.

To address these challenges, Remara has developed a fund product designed to allow SMSF investors to partake in development opportunities, diversifying their investment portfolio while mitigating risks associated with direct property development. This strategy involves partnering with developers on a range of projects, ensuring diversification across geographic locations, price points, and project types. The fund aims to provide a balanced mix

with a repositioning of existing assets and higherrisk, higher-return development projects, offering a comprehensive solution for SMSFs looking to navigate the current real estate market. The strategy has been largely built similarly to Remara’s credit-based strategy, where the company looks for a large number of smaller loans to diversify its risk across a large number of projects.

“You don’t have one single project that has risk around development, sales, postcode, product, market type, but have a very diversified pool that allows a continuous maturity of those projects, to provide cash flow and diversify risk,” McVeigh says.

“It limits the exposure to individual projects, so the risk of loss across the entire portfolio diminishes but the return profile from that development activity still maintains at the headline levels of what are traditionally anywhere between 20-30 per cent.”

Partnerships promote prosperity

McVeigh says Remara can offer this product by partnering through its credit business to fund smaller developers that develop these exact types of products. Developers also invest equity into the project and then run the project day in, day out, and deliver the final asset. This approach gives Remara

diversity in terms of local market, geographic spread, product spread, and also price points.

The Remara model allows for a greater level of diversification, not just in terms of project types and locations, but also in spreading risk across different developers and investment structures. By engaging in equity partnerships with developers and diversifying the capital stack through senior debt, mezzanine debt, preferred equity, and equity, SMSFs can achieve a balanced investment approach that caters to long-term stability and the potential for higher returns through active property development.

Don’t forget diversification

McVeigh says Remara keeps diversification at the centre of everything it does, which is a unique approach compared to similar offerings where opportunities for SMSFs are single assets and single asset exposures to a manager or a developer who is just running that project.

“Any time you have a single asset exposure, whether it’s credit or whether it’s equity through a development, there is an increased amount of risk that if something goes wrong, you might not lose money, but you might have a delay in receiving your funds, or you might have a reduced

return profile or suffer some form of loss, so that diversification is critical,” he says.

He elaborates that Remara’s approach to acquiring property into an SMSF complements the buy-andhold strategy rather than replacing it. Instead of allocating the entire real estate investment to an SMSF, the model is designed to be a smaller core component offering investors an enhanced return profile and a higher risk profile. However, the fund is structured, delivered and managed to mitigate the traditional challenges and risks associated with a development framework.

Consider fluctuations and limitations

As the real estate market continues to evolve, SMSFs must remain adaptable, considering both the long-term upward trend of property values and the immediate challenges posed by interest rate fluctuations and regulatory limitations. By leveraging diversified investment strategies and partnering with experienced asset managers like Remara, SMSFs can navigate the complexities of the current market, optimising their investment portfolios for both security and growth.

“Our view is that property does go up over time and it’s a question of what your time frames are.

We would always say there should be a fairly large proportion of buy and hold within your portfolio, where we’re in periods such as this, there could be sideways movement,” McVeigh says. “Where you’ve got the opportunity in a sideways trending market, or even a potentially declining market or small declining market, is through that development activity and the reason we say that is through developing a property, you’re actively changing it.

“If we use the analogy of active versus passive investment, active investment is the repositioning or redevelopment of an asset. It’s buying an asset, adding to the asset and actively changing the value, or it’s redeveloping the asset and actively changing the worth of that entire asset.”

To learn more about how Remara can assist you, click here.

GRANITE OFFERS ROCK-SOLID SMSF LENDING

Convenient, compliant and consideredLBRA lending customised to meet evolving SMSF property investment demands

YIANNI SOCRATOUS, general manager of Granite Home Loans, a company that has been providing lending opportunities in niche markets since its inception in 2018, says the advent of COVID-19 changed the landscape of its funding. This causing it to pivot to SMSF borrowing, especially among self-employed business owners wanting to invest in commercial property.

To cater for this changing demographic of SMSF borrowers, Granite Home Loans pivoted its model so its commercial SMSF product now enables self-employed owners to buy the property that they’re currently renting, or buy or transfer the property out of the business and own it through their SMSF.

Three years ago, Granite reviewed the market offering for SMSF property lending to understand what was required to better service the market. It built dedicated SMSF lending products and processes from the ground up to be compliant with the Superannuation (Industry) Supervision Act 1993 (SIS Act), while also offering all the benefits and features available on standard residential home loans - including offset accounts and digital application processes.

Convenience and compatibility

Socratous says after the major banks exited from offering LRBA loans to SMSF several years ago because of the stricter regulations that apply, many borrowers with SMSFs have loans that now are attracting interest of more than 8 per cent.

“They often don’t know there are other options out there, but non-bank lenders like Granite can offer them a cheaper rate,” he says.

Additionally, Granite Home Loans offers convenience and is a pioneer in digital applications. It incorporates DocuSign execution and provides third-party access for advisers and accountants, making it easier than ever for SMSFs, advisers and accountants to work with Granite and perform annual tax reviews.

Examples of the flexible benefits and features available on Granite SMSF loan products include the money-saving offset account, no annual reviews, and up to 80 per cent LVR for commercial property and up to 90 per cent LVR for residential property.

Socratous says he understands that setting up an SMSF is a time-consuming process. One of the additional benefits provided by Granite Home Loans to SMSF borrowers is the issuance of an indicative offer contingent upon the establishment and

WE BELIEVE THAT THE FUTURE OF WEALTH MANAGEMENT REQUIRES MORE CUSTOMISED SERVICES AND INNOVATIVE PRODUCTS TO BE MADE AVAILABLE TO MORE PEOPLE

Yianni Socratous General manager, Granite Home Loans

completion of the fund. These offer letters can be issued within 48 hours and will outline fee charges and a list of documents required to finalise the application submission.

Benefits for business owners

This model of buying commercial property for an SMSF means the business is not dipping into its current cash flow, and other transactions or saving plans can still be accomplished outside of super.

“The way that we’ve been able to accomplish this is if the business owner has already got that property in the business is essentially selling it to the SMSF, and talking to their adviser or accountant about making an in-specie transfer that allows them to get some of the money out of the fund, put it back into the business for cash flow and then obviously enable that asset to then sit there and grow,” Socratous says.

“The business then pays their rent, which then looks after their retirement.”

It also does not impact the take-home pay of members who can still get their super guarantee contributions through their employer, as well as allowing the business to own the property in its SMSF.

Socratous warns this is not a strategy that applies readily to residential property ownership as it is not in line with the non-arm’s length legislation.

Residential investment achievable within the regulations

Socratous emphasises that maintaining compliance when borrowing to purchase either residential or commercial property through an SMSF requires strict adherence to a limited recourse borrowing arrangement (LRBA) –something Granite Loans prioritises.

“As a business owner, obviously when you’re dealing with commercial property and a business that you own, there’s a lot of LRBA considerations people have to think about as well,” he says.

“Whenever something comes across our desk through a broker, it’s normally always supported by a statement of advice or something from an accountant, a financial planner, an SMSF adviser to say they’ve done all the numbers, this option makes sense for the business and the business owner.”

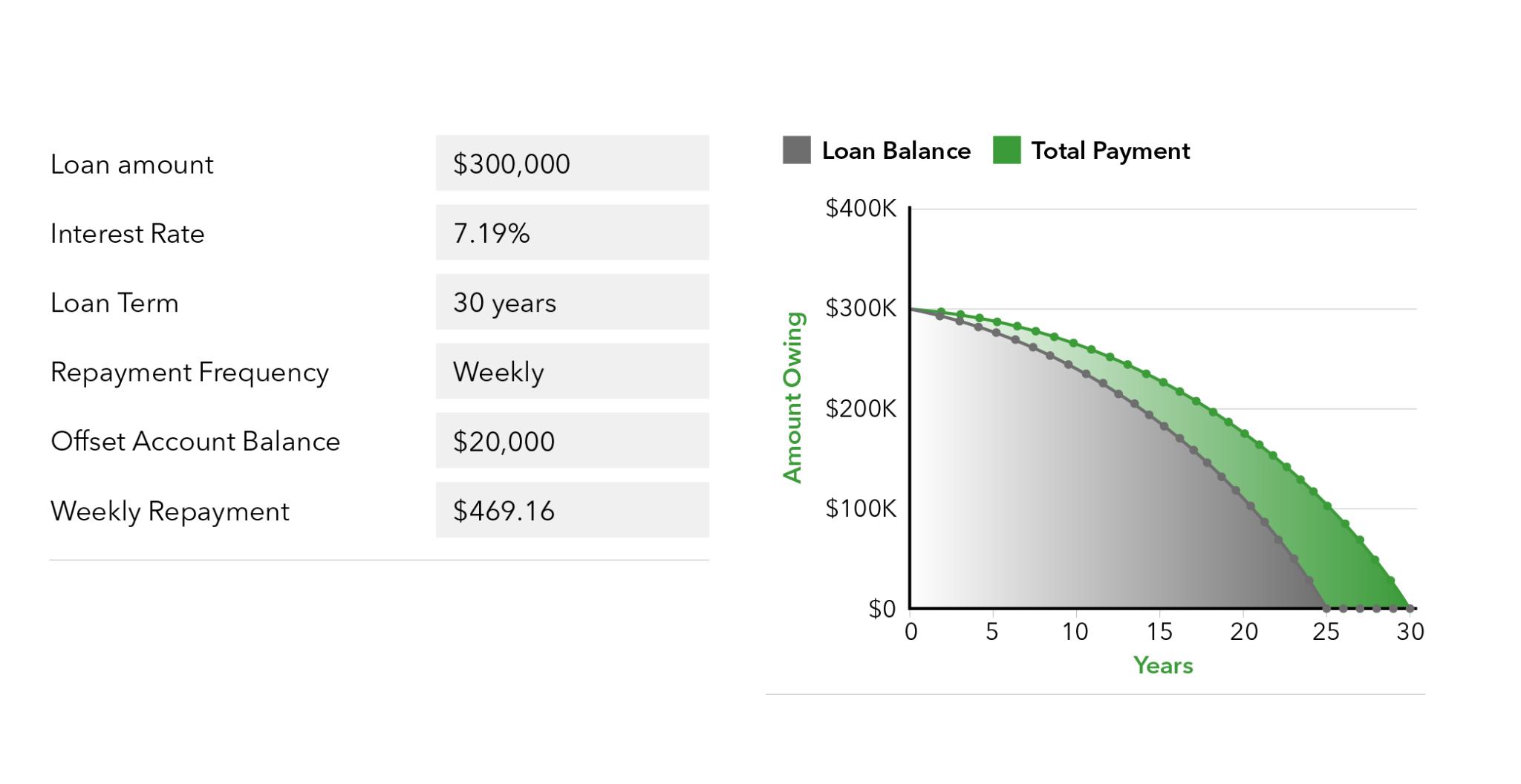

Socratous says offset accounts are another strategy available for SMSFs, although they do have their limitations, especially around LRBAs. Granite’s offset account allows an SMSF to be able to put money

against the loan, reap the benefits of having a normal offset account, and use those funds to pay back to a cash management account when needs arise.

Generally, advice around using offset accounts is not positive, but Socratous says Granite Home Loans offers this option.

“We’ve got more than 10,000 SMSF customers and we offer offset accounts for free with all of them. They can opt-in whether the adviser wants them to take one or not, and we’ve never had a customer come back and say there’s been an issue,” he says.

“They’ve all gone through their audits over the past five or six years and we’re completely confident that the way the offset account works in our system is compliant with the SIS Act. It’s just like having a normal mortgage outside of your super account. Having an offset account will mean that you’re paying down the loan quicker, which means that you’re building up your asset portfolio faster and spending less on interest.”

SMSF lending – where to from here?

“We believe that the future of wealth management requires more customised services and innovative products to be made available to more people,” Socratous says.

Thousands in savings: Linking an offset account linked to an LRBA SMSF loan

Interest saved $119,662.58

Time saved: 4 years and 48 weeks

Revised time: 25 years and 4 weeks

Based on a loan balance of $300,000 at 7.19% interest rate over 30 years and starting offset balance of $20,000. These figures are indicative only and will vary based on offset payments made and offset balance.

Moreover, over the past two years, Granite Home Loans has extended its SMSF product offering to provide Sharia-compliant SMSF finance, allowing more communities the opportunity to invest in residential and commercial real estate using their superannuation.

It also offers dedicated NDIS or co-living SMSF lending products for those looking to invest for ESG and investment purposes.

Socratous adds that any SMSF that is considering refinancing should talk to their lender first to ask for a rate review, but if that is not possible, then investigate options such as Granite Home Loans.

To learn more about how Granite Home Loans can assist you, click here.

Loan balance chart

DISABILITY HOUSING INVESTMENT

MEETS SOCIAL NEEDS AND GROWTH TARGETS

Investing in disability housing presents a unique opportunity for SMSFs

CURRENTLY, THE NATIONAL DISABILITY INSURANCE

SCHEME (NDIS) supports 550,000 Australians with that number estimated to grow to 741,000 by 2026. With that growth, an additional 2,460 dwellings will be required to house participants needing a property that has been categorised as a Specialist Disability Accommodation (SDA) dwelling.

Arthur Naoumidis, CEO of Aligned Disability Property Fund (ADP), says investing in properties for the NDIS in metropolitan centres has emerged as an attractive option for investors, with substantial and reliable subsidies involved.

The primary objective of ADP is to deliver SDA where it’s needed in metropolitan areas across Australia, and its strategy combines social responsibility with attractive yields for investors, ensuring compliance with the sole purpose test mandatory for SMSFs.

“You’ve got to look at a commercial return [in any investment] and that’s been the lens through which we’ve looked. This strategy lets us create a return that will interest investors, including SMSFs, and they can also achieve their socially responsible investment outcome, which is to

deliver accommodation for people who need it,” Naoumidis says.

He says there are challenges faced by large industry funds in creating affordable housing due to legal constraints on returns and underscored the importance of a commercial return in investment decisions, a principle ADP adheres to by focusing on creating value for investors while achieving significant social impact.

“The position the government is in is that people with a disability need somewhere to live and without the private enterprise coming in and creating accommodation, it is a challenge,” he says.

Nicholas Ali, head of technical services at Neo Super, says disability property investing in an SMSF structure benefits from a maximum tax rate of 15 per cent on the fund’s earnings during accumulation mode.

Capital gains tax (CGT) is also concessionally taxed – the realised capital gain is discounted by one-third, which means the effective tax rate of CGT is 10 per cent for an accumulation fund. When a fund is wholly in the pension phase it is a taxexempt entity, which results in no tax on a fund’s earnings or capital gains.

Government incentives

From an investor perspective, one of the risks of investing in NDIS properties is that it’s a specialised form of accommodation, and it can cost up to $100,000 more in building costs to meet regulations.

However, the government is offering incentives to investors for these types of construction by subsidising rent from between $60,000 and $90,000 per year per tenant and creating a potentially attractive yield for investment.

Moreover, the government’s publication of areas with a demand for such developments assists potential investors in targeting specialist accommodation for people with disabilities, offering a high potential yield of around 12 per cent.

Unique design offers more opportunities Naoumidis adds that while specialist disability accommodation differs from residential properties in terms of its profile and may not experience the same level of capital growth, the higher income yield is appealing to investors, leading to increased interest in the market.

THIS STRATEGY LETS US CREATE A RETURN THAT WILL INTEREST INVESTORS, INCLUDING SMSFS, AND THEY CAN ALSO ACHIEVE THEIR SOCIALLY RESPONSIBLE INVESTMENT OUTCOME, WHICH IS TO DELIVER ACCOMMODATION FOR PEOPLE WHO NEED IT

Arthur Naoumidis CEO, Aligned Disability Property Fund

The majority of NDIS property investments have historically focused on regional or greenfield locations as the low cost of the land allows for attractive rental yields of around 12 per cent to be delivered. Unfortunately, most disabled people live in metropolitan areas where the price of land is substantially higher.

The fund’s hybrid development approach involves constructing multi-storey buildings with a mix of NDIS and residential apartments, effectively reducing the cost per unit and making investments in metro areas feasible.

The residential apartments will be offered for sale on an ‘off-the-plan basis’ with the fund retaining the SDA apartments being retained by the fund to be leased to disabled Australians.

ADP’s model promotes the safety and wellbeing of disabled tenants by providing self-contained one-bedroom apartments, avoiding the issues associated with shared living spaces.

This design also enhances the investment’s appeal by ensuring that the apartments can easily be repurposed for the residential market if necessary.

“The motto for our business is delivering disability accommodation where it’s needed, which is metropolitan Australia,” Naoumidis says.

“We have figured out a way to target metropolitan areas and still deliver 12 per cent, assuming the national average occupancy of 92.5 per cent our modelling is based on.”

ADP’s approach means that for every three SDA apartments built in a complex, there’s a separate one-bedroom carer apartment and from an investor perspective, this can be sold separately as a one-bedroom residential apartment.

Pricing model

ADP also seeks to benefit from asymmetrical pricing where institutional investors pay a premium for large-scale income-producing assets.

Naoumidis explains that when an industry fund buys an asset such as a Bunnings building, it buys what’s called a cap rate, which is the income divided into the purchase price. For an asset like Bunnings, this may be around 5 per cent.

NDIS properties, on the other hand, have been historically sold for a cap rate of between 7 and 8 per cent.

“Our strategy is if we are building a portfolio of 50 NDIS properties, for example, we’ll go to an institution and sell them that line of properties in one go at a cap rate of 8 per cent,” he says.

“So, if you’re spinning 12 per cent and you’re selling at 8, it’s nearly 50 per cent capital gain that you’re making over a 2-3 year period. As a fund, we’re targeting a moderate yield and this cap rate sale is an attractive boost to the investment return.”

He adds the key is that investors get the potential of an asset sale, which will sell the NDIS properties in one go at a significant capital uplift, distribute the profits, recycle and do it again.

Investors also have the option to withdraw their funds, redeem them, or reinvest the principal, potentially compounding their returns. This flexibility can lead to significantly higher investment outcomes in terms of returns.

Following the sale of the disability accommodation portfolio, any net profits will be distributed to investors, and the capital reinvested in building another SDA property portfolio, which will then also be sold. This will increase the number of much-needed SDA properties that can be delivered with each investment.

Naoumidis says ADP’s model aims to target a 10 to 14 per cent income return to investors, net of fees, for completed and leased properties and the fund will utilise a responsible level of debt that is no more than 60 per cent of the property value but will generally be set to around 50 per cent.

Diversification is key

As with any investment strategy, Naoumidis says diversification is a key consideration to ensure there are different return profiles.

“Most people have fixed income, they have equities, they have international bonds and this is an investment that’s a bit of a hybrid because it’s a bit like an income investment, and it’s got a little bit of capital growth as well.”

“There’s an average of about a 3 per cent increase in rent to allow for CPI which effectively increases the capital value of the investments, so from an asset allocation diversification perspective, a percentage of 5 or 10 per cent probably should be allocated to this. It’s a fairly robust long-term investment, and SMSFs are perfect because the investment horizon is long-term.”

To learn more about how Aligned Disability Property Fund can assist you, click here.

ENSURING COMPLIANCE AND ACCURACY

THE ESSENTIAL ROLE OF SMSF PROPERTY VALUATIONS

As the regulatory landscape evolves and property markets fluctuate, the importance of specialised support in securing the best outcomes for clients and maintaining compliance for SMSFs has become increasingly crucial

SMSF PROPERTY VALUATIONS specialises in assisting clients across Australia to accurately value their property assets – a necessity for annual financial reporting and compliance.

The firm collaborates closely with advisers, auditors, and trustees to ensure properties are evaluated correctly, considering the unique circumstances of each case. This process is vital, especially given the complexities in valuing unique properties or those with limited comparable market sales.

Mike Wilczynski, owner of SMSF Property Valuations, emphasised the challenges encountered when properties lack clear comparables in the market. He explains that SMSF Property Valuations employs various methodologies to justify valuations, ensuring they meet the stringent requirements set by regulatory bodies.

“One of the most challenging aspects SMSFs face in meeting compliance when they have property assets is when there aren’t many comparable sales to compare against,” he says.

NALI compliance essential

Some problems have arisen from the changes to non-arm’s length income (NALI) legislation,

and Wilczynski says independent valuations are especially important where self-rental or unique property types, such as family farms or commercial real estate, are involved. This is because such situations often require a nuanced understanding of the market and regulatory requirements, underscoring the value of professional valuation services.

The firm’s approach to complex valuations involves direct engagement with clients to understand their specific needs and circumstances. This client-centric approach helps it craft tailored solutions that align with regulatory expectations and market realities. For properties that present unusual challenges, the firm offers a money-back guarantee, reflecting its commitment to delivering accurate and compliant valuations.

“We like to work with clients and advisers on those scenarios where it gets a little too tricky for auditors who know they are going to have to get some assistance because they don’t want their clients to fall foul of the new regulations,” he says.

“We’re seeing a bit more activity from auditors requesting reports more regularly rather than the three-year standard. Some auditors are asking for

INDEPENDENT VALUATIONS

ARE ESPECIALLY IMPORTANT WHERE SELF-RENTAL OR UNIQUE PROPERTY TYPES, SUCH AS FAMILY FARMS OR COMMERCIAL REAL ESTATE, ARE INVOLVED

Mike Wilczynski Owner, SMSF Property Valuations

reports every year and as property prices in Australia have been rising post-COVID, it’s understandable why they are asking for yearly reports.”

Getting the details right

Attention to detail is particularly crucial in navigating NALI rules, which can significantly impact an SMSF’s tax position if not managed correctly.

Wilczynski adds SMSF Property Valuations prefers to work closely with clients to understand the basis for their income calculations. They then collaborate to incorporate these details into a final report that complies with all regulatory requirements.

Wilczynski says the services of SMSF Property Valuations are not only pivotal for compliance but also play a crucial role in the broader SMSF ecosystem, which is now being heavily scrutinised by the ATO.

With the Tax Office now requiring more information rather than the ‘kerbside’ valuations that were common in previous years, SMSFs and their financial advisers need to research more comparable sales to substantiate their valuations. Moreover, the regulator now requires more than just a letter from a real estate agent stating the price and the amount of rent that will be generated from a property.

“With the compliance burden that we have with SMSFs, auditors are having to clean up some of those old reports on behalf of the trustees, where the trustees might not always be fulfilling their duties and getting an up-to-date valuation,” he says.

Wilczynski says the nature of the SMSF sector means collaboration between accountants, advisers and auditors is extremely important in the management of a fund, and it is often accountants initiating valuation requests to bridge the gap between trustees and auditors.

“This collaboration is essential in navigating the complexities of SMSF property investments, ensuring that all stakeholders are aligned and informed,” he says.

“Accountants are often the ones caught in the middle, and that is originally how SMSF Property Valuations kicked off as I have a background in accounting and I wanted to create a cost-effective service that fits in the slot of doing the valuations for SMSF.”

SMSF Property Valuations works closely with auditors to develop a set of reports that are not only ATO compliant but also that clients are happy with concerning the level of information contained in them.

TRUSTEES NEED TO ENSURE THAT THE ASSETS OF A FUND ARE VALUED PERIODICALLY TO STAY COMPLIANT IN A FAST-MOVING MARKET

Mike Wilczynski Owner, SMSF Property Valuations

Wilczynski says there are market valuation rules and trustees need to ensure that the assets of a fund are valued periodically to stay compliant in a fast-moving market.

“One of the biggest challenges for us is ensuring we’ve got enough data to substantiate the valuations and having enough of a spread, whether it’s similar rentals, similar sales, which are within the ballpark of what we’re trying to achieve for the client.”

It’s also imperative that data around titles is correct, especially when property such as farmland is split into allotments.

Keeping it simple

SMSF Property Valuations strives to make the process as simple as possible for clients with an online form that asks clients to input the expected values for the property and the expected rental returns to provide a starting point for the firm to begin its preliminary searches.

After establishing a clear understanding of the income calculations, client-centred conversations commence at SMSF Property Valuations. During these discussions, the team gathers information about the client’s specific requirements regarding

the valuation and, if applicable, the rental return. They also assess if any additional information is needed to ensure the report complies with regulatory standards.

Wilczynski says when clients are renting a property there is often a disconnect between how much they believe the property may be worth to justify the rental income, and SMSF Property Valuations will do a comparison analysis as well as determine any unique aspects of the property to ensure it meets the regulations.

“This not only ensures compliance but also supports the strategic objectives of SMSFs, ultimately benefiting trustees and their beneficiaries,” he says.

To learn more about how SMSF Property Valuations can assist you, click here.

WITH THANKS TO OUR PARTNERS

Aligned Disability Property Fund

Centuria Granite Home Loans

Remara SMSF Property Valuations