SEPTEMBER/OCTOBER 2025

SKY BLUE THINKING

Blue Bo le Coffee’s CEO on expansion in Asia and staying true to its artisan roots

Is the coffee industry heading for further consolidation?

The latest wellness trend infiltrating café menus across the US Dawn of the deal Regions on the rise Protein coffee

Increasing production and consumer demand sees China’s market surge

38 Colombia’s cool innovation

10 Blue sky thinking

Blue Bo le Coffee’s CEO on the brand’s unique blend of East meets West and staying true to its artisan roots. 14 24 36

“One day I had an epiphany that the world doesn’t need more stuff … it needs more connection between human beings, experiences, and places – and coffee plays a signature role in that.”

INDUSTRY INSIGHTS

14 Dawn of the deal

What’s driving the record-breaking acquisitions the coffee industry has witnessed over the past decade?

40 From vision to precision

Franke reflects on four decades in coffee and looks ahead to what’s next.

42 Creating smarter coffee

Can the application of AI and data science improve coffee quality for large scale roasters?

ORIGIN

18 Regions on the rise: China

Chinese coffee has long been a curiosity, but the sector has evolved beyond being a point of interest.

22 India’s next top producer

Vidya’s Founder on why India should be se ing its sights higher to become one of the world’s top four producers.

26 A Cuban coffee revolution

As the BioCubaCafé project continues to break new ground, Lavazza introduces a fermented Robusta.

Buencafé on tapping into the chilled coffee market and the further growth opportunities in the sector.

EQUIPMENT & TECH

24 Automation meets community

Eversys draws back the curtain on its product development process ahead of Host Milano.

29 Changing coffee cravings

SEB Professional reveals how automatic machines can help baristas create personalised coffee beverages.

36 The specialty shift

The trends shaping the coffee landscape and their influence on the new technologies Unic will release.

44 Great expectations

Amid shifting consumer expectations, Meli a Professional explores crafting customised beverages at scale.

46 Brewing the future with data

BibeCoffee is reimagining the way coffee professionals monitor, manage, and execute their operations.

48 Dedicated to the grind

The beverage market is changing, but can choosing the right grinder help craft the cup to win back consumers?

50 Performance-led innovation

Thermoplan shares a first look at the new equipment and technology it will launch at Host.

EVENTS

53 The ultimate Roasters Playground

Building on the success of the 2025

event, in 2026 MICE will welcome back its sell-out roasters feature.

57 How to maximise tradeshow a endance

How to tackle mega tradeshows and plan so your time counts.

CAPSULE SHOWCASE

30 A point of Difference

Pu ing some of the world’s rarest and highest-rated beans into capsules for a new generation of consumers.

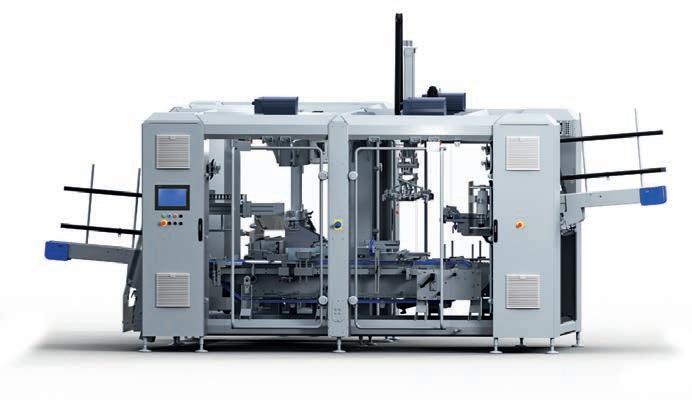

31 Packing the capsules of the future

How Cama Group engineered a bespoke secondary packaging line for a “game-changing” new product.

32 Improving the quality of convenience

With the demand for be er coffee pods higher than ever, Menshen shares its unique approach.

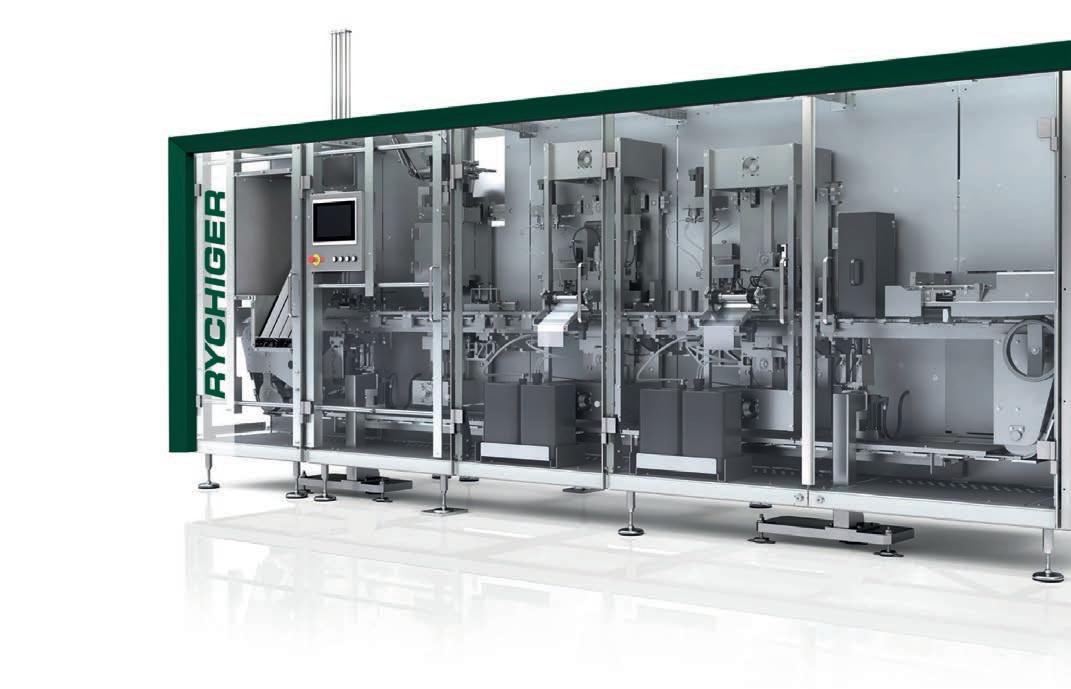

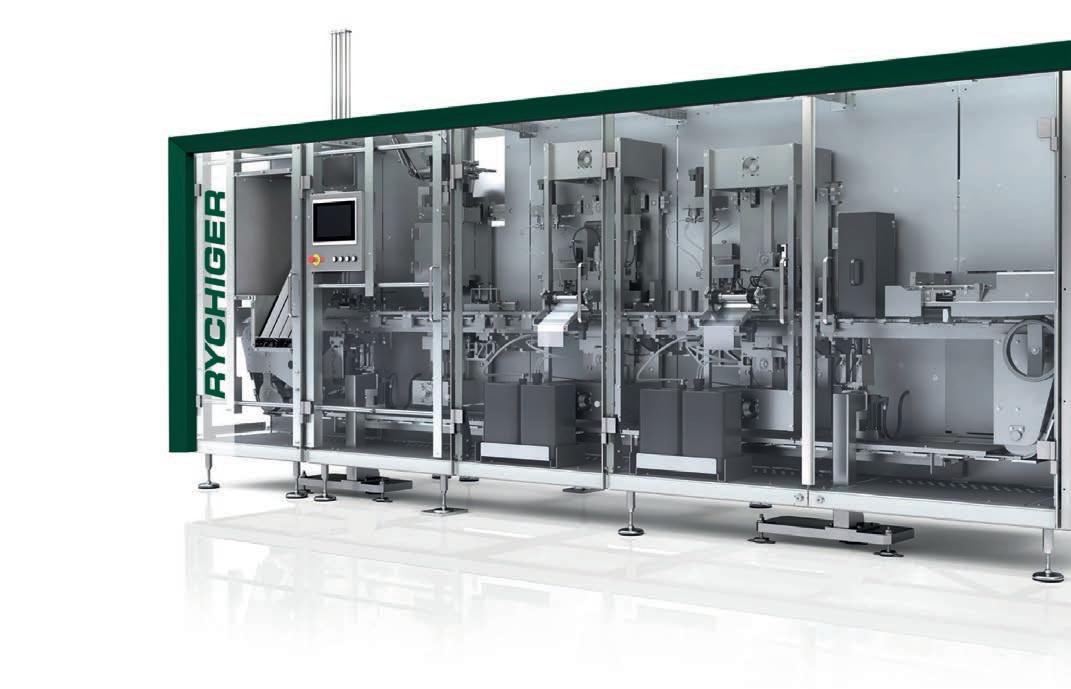

33 Giving capsules the EDGE

Rychiger provides solutions to the production challenges companies packing coffee capsules face.

34 Forecasting the future

IMA explores the evolution of coffee products and consumer trends.

LAST WORD

58 Is proffee coffee’s next big trend?

Protein coffee has become big business in the US, but will the latest ‘health’ trend go international?

Editor’s note

MMarket movement

ARKET CONSOLIDATION is a phenomenon that takes place in most major industries, o en waxing and waning over time. Sector boom and bust can in uence its activity, with companies riding the crest of the wave taking the opportunity to absorb others when funds are available, while in periods of uncertainty larger organisations take the chance to mop up smaller ones struggling to weather the storm.

Following what has been choppy few years for the co ee industry, some experts forecast more consolidation in the market. With high-green bean prices over the past 12 months, some co ee companies have run into nancial trouble, creating an opportunity for larger organisations to take action and gain a greater footprint.

In this issue of Global Co ee Report, we explore some of the biggest co ee deals struck over the past decade, ask experts for their market predictions, and speak to Chobani and Simonelli Group about the success of their recent acquisitions. As an industry intrinsically linked to communities, independent business, and creativity, could there be a day when it’s dominated by just a few major brands?

In this edition’s cover interview, we speak to someone with rst-hand experience of being part of one of the world’s largest brands. Blue Bottle Co ee CEO Karl Strovink – who took on the role two years a er the Californian roaster was majority acquired by Nestlé for about US$425 million – discusses the independent nature of the setup, how the

brand has remained true to its artisan roots, and the areas in which the food and drink conglomerate has been able to help Blue Bottle thrive.

With a growing footprint in Asia, Strovink shares the company’s insights into this ourishing market and the potential for new co ee varietals grown in the region. e CEO also reveals why, despite a recent series of at-home product launches, the brand’s focus will remain on the specialty café sector where he believes there’s still plenty of room for expansion. Ahead of Host Milano, which takes place from 17 to 21 October, some of the industry’s most innovative manufacturers share a sneak peek of the products they’ll be launching at the biennial hospitality tradeshow. Automation, a ordability, and specialty are the big trends this year, with some ground-breaking technology set to be released.

If you’re planning on visiting, don’t miss our guide to getting the most out of the event. Attending an international exhibition is a signi cant investment for any business, and is o en a juggling act of time, budget, and people. But, with the right strategies in place, it’s possible to turn the investment into real value.

Enjoy the issue. GCR

Kathryn Lewis Editor, Global Coffee Report

CHIEF EXECUTIVE OFFICER

Christine Clancy christine.clancy@primecreative.com.au

PUBLISHER

Sarah Baker sarah.baker@primecreative.com.au

MANAGING EDITOR

Myles Hume myles.hume@primecreative.com.au

EDITOR

Kathryn Lewis kathryn.lewis@primecreative.com.au

JOURNALISTS

Georgia Smith georgia.smith@primecreative.com.au

Daniel Woods daniel.woods@primecreative.com.au

ART DIRECTOR/DESIGN

Daz Woolley daz.woolley@primecreative.com.au

HEAD OF DESIGN

Blake Storey blake.storey@primecreative.com.au

BUSINESS DEVELOPMENT AND SALES MANAGER

Charlotte Murphy charlotte.murphy@primecreative.com.au

CLIENT SUCCESS

Cailtin Pillay caitlin.pillay@primecreative.com.au

HEAD OFFICE

Prime Creative Pty Ltd 379 Docklands Drive, Docklands, Victoria 3008 p: +61 3 9690 8766 enquiries@primecreative.com.au gcrmag.com

SUBSCRIPTIONS

+61 3 9690 8766 subscriptions@primecreative.com.au

Global Co ee Report Magazine is available by subscription from the publisher. e rights of refusal are reserved by the publisher.

ARTICLES

All articles submitted for publication become the property of the publisher. e Editor reserves the right to adjust any article to conform with the magazine format.

COPYRIGHT

Global Co ee Report is owned and published by Prime Creative Media. All material in Global Co ee Report Magazine is copyright and no part may be reproduced or copied in any form or by any means (graphic, electronic or mechanical including information and retrieval systems) without written permission of the publisher. e Editor welcomes contributions but reserves the right to accept or reject any material. While every e ort has been made to ensure the accuracy of information Prime Creative Media will not accept responsibility for errors or omissions or for any consequences arising from reliance on information published. e opinions expressed in Global Co ee Report are not necessarily the opinions of, or endorsed by the publisher unless otherwise stated.

NEWS in brief

AMERICAS

As of August 2025, Blue Bo le Coffee has 140 cafés in six countries and roasts about 1800 tonnes of specialty coffee each year. The company is in a significant period of growth, not just expanding its café presence in its home market of the United States and Asia but also its domestic product range, which now includes its Craft Instant Coffee lineup and collaborations with Nespresso.

“Blue Bo le is a growth brand. Since COVID, we’ve tripled the business through growth with distinction. We’re trying to do something no other coffee brand has ever done. Our quality is ge ing be er over time, which isn’t typically what happens in this category,” says CEO Karl Strovink.

See page 10.

In 1959, at the end of the revolution, Cuba’s rainforest cover was just 13 per cent due to years of monoculture farming. Fast-forward to the end of 2022, however, and that figure has more than tripled to 43 per cent.

Inspired by the success of these reforestation efforts and the potential for sustainable coffee production, in 2018 Lavazza started working in the Santiago and Granma regions. Seven years in, the project now works with more than 2500 farmers in the country.

See page 26.

In a world where interest in iced and ready-to-drink coffee options continues to climb, how are farmers adjusting to meet new demands?

Through innovations like the creation of freeze-dried, cold-soluble products, Buencafé and the Colombian Coffee Growers Confederation are helping local producers meet the demands of a changing global coffee market.

See page 38.

1.9 million 60-kilogram bags

China’s coffee production in 2024/25.

ASIA-PACIFIC

Chinese coffee has long been a curiosity, but the sector has evolved far beyond simply being a passing point of interest.

With 1.9 million 60-kilogram bags produced in the country in 2024/25 –compared to 105,000 bags in 1990/91 and 350,000 bags in 2003/04 – the industry is showing no signs of slowing down.

Yunnan in the southwest has become the Arabica engine-room of Chinese coffee, with Robusta crops grown in the country’s southernmost region of Hainan.

See page 18.

In June 2025, the Coffee Board of India published data revealing 25 per cent yearon-year growth of coffee exports for the first half of 2025/26. In the past 11 years, exports have shot up 125 per cent – with US$800 million recorded in 2014/15 compared to US$1.26 billion in 2023/24.

As part of the Board’s 10-year roadmap, it aims to double the country’s production by 2034 which, if output remains unchanged for other countries, would see India leapfrog Indonesia into fourth place in the world producer rankings.

See page 22.

After the launch of the Roasters Playground at MICE2025, the popular feature will

return for next year’s edition of AsiaPacific’s largest coffee tradeshow.

More than 30,000 visitors a ended the event this year, where the region’s movers and shakers rubbed shoulders with coffee roasters from around Australia and beyond to create new and exciting opportunities.

See page 53.

EUROPE

Coca-Cola’s 2018 acquisition of Costa Coffee for $5.1 billion and JAB Holdings’ $2 billion 2021 buyout of Pret A Manger have headlined a run of highly valuable mergers and acquisitions in the coffee landscape over the past decade.

With continuing rising costs, market saturation, and plateauing demand impacting the industry across the globe, company takeovers are happening every day – but what does this age of coffee market consolidation mean for the global industry, and will it continue?

See page 14.

Eversys has unveiled some of the new products in its research and development pipeline to key distribution partners ahead of its planned launch of new products at Host Milano 2025.

The team say this kind of collaboration is key in gaining deep insight and market-

specific feedback on its machines.

See page 24.

Quality and consistency have always been non-negotiables in creating a high standard of coffee experience. But there’s an added dimension to keeping customers satisfied in the modern era.

The rising demand for drink personalisation – whether through milk alternatives, the addition of syrups, or the inclusion of different ingredients in the signature drink space – is keeping baristas on their toes and customers expecting more from their morning cup.

See page 29.

While many of the world’s best coffees fetch a significant price at auction before being sold to consumers at a mark-up, capsule brand Difference Coffee prides itself on keeping its most expensive coffees within the price range of what a standard takeaway beverage would cost.

“My most expensive capsule is £5 (US$6.74), which is about the price of a large coffee with some whipped cream and toppings at a chain café,” says Founder Amir Gehl.

“If you can afford something like that, you can afford to have the best coffee in the world.”

See page 30.

With coffee capsules and pods estimated to account for between 15 to 25 per cent

BE THE STAR OF EVERY CUP

Let Mytico be your secret to wowing your customers. This user-friendly coffee machine crafts specialty beverages in no time, ensuring that a perfect barista moment can be fully enjoyed.

of the global coffee market, research and development in the space is a key driver for some of the world’s largest coffee companies.

In 2024, one of Europe’s most prominent coffee roasters approached Italian secondary-packaging machine manufacturer Cama Group with a challenge. With an innovative new capsule product in development, the client required a custom-made secondary-packaging line and carton that ticked the boxes for sustainability, efficiency, and design.

See page 31.

The coffee pod market continues to grow due to the increasing demand for convenience and quality among global coffee consumers. Currently, the capsule market is projected to be worth almost US$63 billion by 2032.

Through its multidisciplinary team of experts at its Centre of Excellence, manufacturer Menshen drills down into how to get the most out of the fresh roasted coffee or soluble ingredients that are packaged in its capsules. The team test everything from the capsule itself to ingredients and shares this knowledge with their customers.

See page 32.

It can be difficult for coffee capsule producers to gain an edge in the hypercompetitive capsule market, with freshness, design, and diversity being key drivers in a consumer’s decision-making process.

European machinery provider Rychiger details the three key ways capsule producers can get a step ahead of the competition.

See page 33.

In March 2025, some of the coffee industry’s most experienced thought leaders were asked to explore the future of coffee as part of Melbourne International Coffee Expo (MICE)’s comprehensive series

15 to 25 per cent

Capsule coffee’s estimated share of the global coffee market.

of educational panel discussions.

Ma eo Barbarossa, IMA Coffee Hub Area Manager, was one of the speakers to take part. He discussed the evolution of coffee products, consumer trends, and taste preferences. The million-dollar question of the panel series, according to Barbarossa, was the direction the industry would take over the next fi ve years.

See page 34.

Europe may have been the breeding ground for much of the coffee culture that has spread to all corners of the globe, but some coffee-loving nations in the region have been comparatively slow to join the specialty movement.

The tide is starting to turn, however, with countries including Italy, Greece, and Spain seeing marked shifts towards specialty coffee.

See page 36.

Franke has been active in coffee for more than four decades and has long been considered a pioneer of the fully automatic machine space.

In 1994 under the leadership of Michael Pieper, Franke released its first fully automatic coffee machine, the Swiss Mambo. The name came from a desire to combine Swiss precision with Latin flair.

See page 40.

details the moves the company is making in integrating new technologies in artificial intelligence, data science, and predictive maintenance to revolutionise coffee manufacturing and processing.

“A close collaboration between all professionals is needed, together with constant learning without fear of these disruptive technologies,” he says.

See page 42.

Wrangling the modern coffee consumer market in Asia is a vastly different proposition to doing so in Europe or North America.

According to Meli a Professional Chief Product and Solutions Officer Robin Franke, each region the company operates in has its own traditions, trends, and priorities that are unique to its customers.

See page 44.

From production to cup, “data is the new essential ingredient in coffee excellence”, according to BibeCoffee Co-Founder Panos Ve ros. Through a combination of Internet of Things (IoT) technology, realtime data insights, and strategic support, the software company is aiming to set new standards for excellence in the global coffee industry.

See page 46.

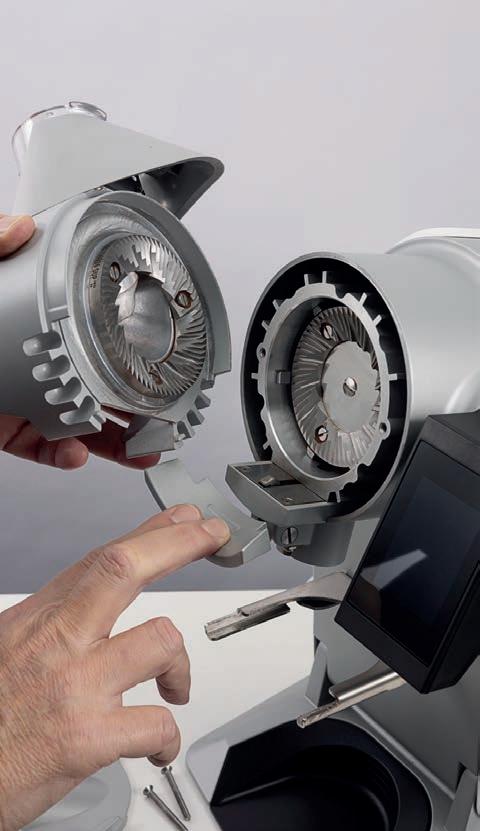

Plenty of thought is given to grind size and weight in the creation of a coffee, but Cimbali Group Manager for Grinders Marco Tesconi believes as coffee prices rise and customers become more discerning, further insight into grind shape and granulometry should be the next great focus in improving the cup.

“If you don’t want to risk losing clients in the future, you must present the best coffee product possible to consumers,” he says.

See page 48.

As an international brand, with 98 per cent of its production exported globally, Thermoplan’s innovations on display at Host Milano 2025 are not tailored to a single region but are designed to meet the universal needs of hospitality operators in Europe, North America, Asia, and beyond.

“The challenges are global, and our solutions are built to address those shared operational demands,” says Sanela Kujovic,

Thermoplan Communication and PR Manager.

See page 50.

With previous iterations of Host Milano hosting more than 2000 exhibitors, the 2025 edition of one of the world’s largest

IMA COFFEE

hospitality tradeshow is shaping up to be another titanic undertaking in the coffee industry. But how can opportunities, both personal and professional, be maximised in the sprawling Fiera Milano Exhibition Centre?

See page 57.

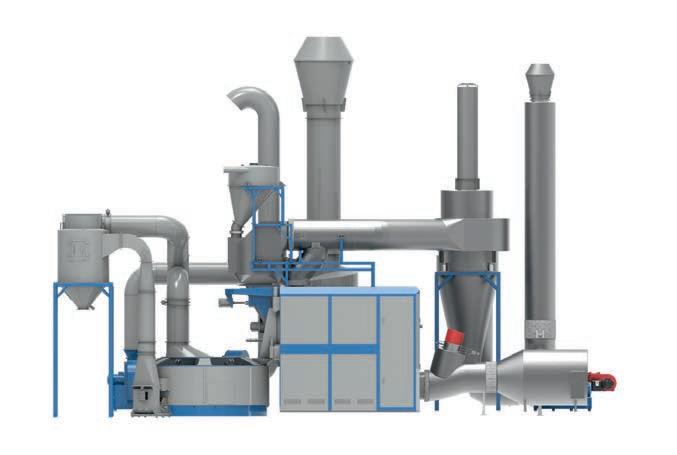

IMAGINE THIS

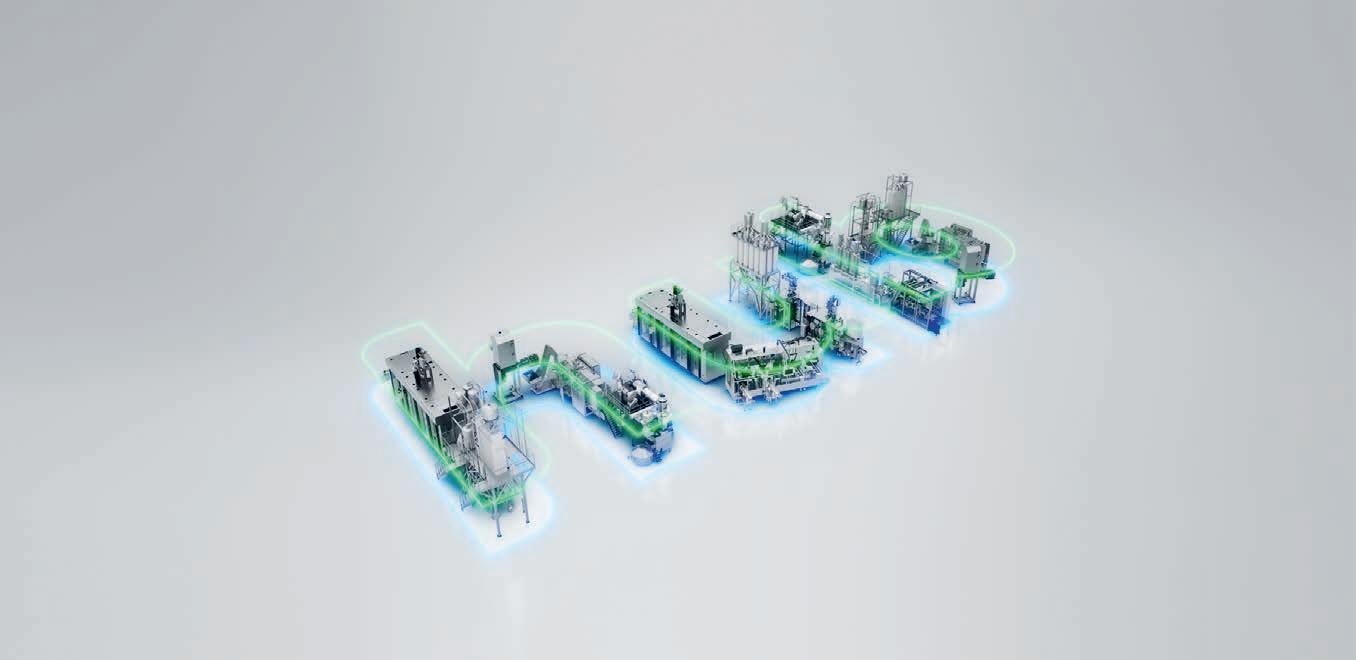

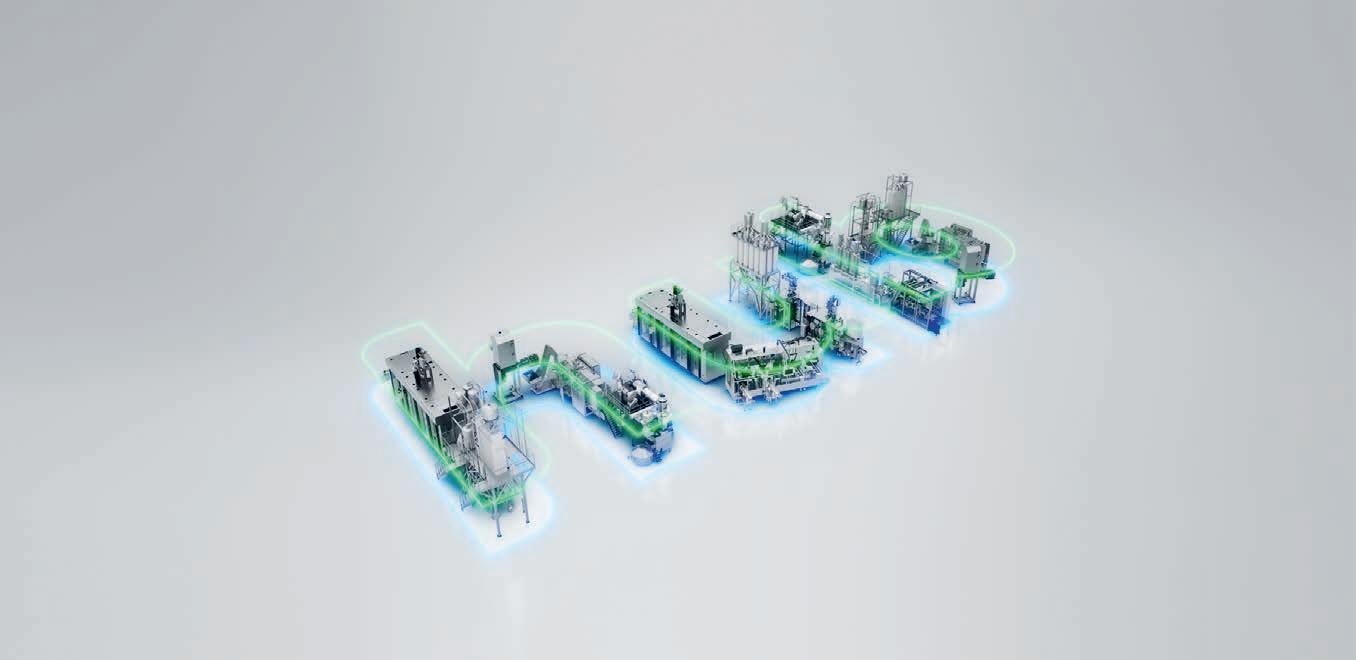

INTEGRATED TECHNOLOGIES, SUPERIOR SUSTAINABILITY

Imagine a complete turnkey processing and packaging line for your coffee. From beans reception to end-of-line solutions, each machine is interconnected in a digital ecosystem, maximising performance, production efficiency, and ensuring superior sustainability through monitored processing, reduced energy consumption, lower emissions, and with the ability to handle all compostable and recyclable packaging materials. Imagine being able to have all this from one single source. IMA Coffee Hub. Look no further.

GULFOOD MANUFACTURING 2025 Dubai, UAE • 4-6 November • Hall S3, Booth D36

SKY BLUE THINKING

Blue Bo le Coffee CEO Karl Strovink on staying true to the brand’s artisan roots while operating under one of the world’s largest companies.

ESTABLISHED IN California in 2002 by professional musician James Freeman, Blue Bottle Co ee is a modern-day example of the American dream. What started as a farmers’ market stall selling small-batch, home-roasted beans has evolved into an international co ee company with a signi cant and growing global footprint.

As of August 2025, the brand has 140 cafés in six countries and roasts about 1800 tonnes of specialty co ee each year. It’s in a signi cant period of growth, not just expanding its café presence in its home market of the United States (US) and Asia but also its domestic product range, which now includes its Cra Instant Co ee lineup and collaborations with Nespresso.

For the past ve years, CEO Karl Strovink has been guiding this evolution. With a background in consumer goods, when he made the move from footwear brand Converse to Blue Bottle he was green to the world of co ee beyond the knowledge of an average consumer.

“My parents were educators and co ee played a pretty prominent role in our household. I grew up in Berkeley, California, where there was a strong local café culture, and I remember inhaling that rich co ee aroma. However, like most young people, it took me a while to appreciate the taste,” Strovink tells Global Co ee Report

“From a young age, I’d always been interested in brands and had a fascination

in watching people shop and the emotions it elicited. rough my time working with Boston Consulting Group, I got the chance to see a wide plethora of brands in di erent categories, and then ended up in the footwear and sports apparel sector.

“But one day I looked in my closet, saw 150 pairs of shoes, and had an epiphany that the world doesn’t need more stu . What it needs is more connection between human beings, experiences, and places –and co ee plays a signature role in that. I started meeting with the Blue Bottle team and realised there was this glorious chance to move back to the west coast and join a hometown brand that had not only achieved global success but also remained true to its roots.”

Into the world of coffee

Strovink joined the company – rst as COO and President in 2019, then as CEO in 2020 – just two years a er multinational food and drink conglomerate Nestlé acquired a 68 per cent stake for a reported US$425 million. e deal came during a period of consolidation in the specialty co ee market and was part of a wider group of Nestlé acquisitions said to be driven by changing consumer attitudes towards big companies. As part of the acquisition, Blue Bottle Co ee would continue as an independent brand.

e incoming CEO stepped up in what was a uniquely challenging time for the co ee sector. While his ambitions were to help steward Blue Bottle into a new era of growth, the universe had other plans.

“Within a week of being handed the baton, COVID-19 hit and I had to switch my goal to stewarding survival, which was not an easy feat as a café-dominant brand,” he says.

“Nestlé as a backer was extremely supportive and we focused on supporting our teams, temporarily shutting our cafés, and protecting our people. I stepped into an absolute mess, but we managed to not only recover but also come out stronger.”

East meets West

It wasn’t just the US’ lockdown restrictions the team had to navigate. In 2015, Blue Bottle opened its rst international store in Tokyo, Japan, which was followed by stores in Seoul, South Korea, in 2019 and Hong Kong in 2020. Since then, it has also introduced venues in mainland China and Singapore.

is expansion into Asia was driven by Founder James Freeman who, since the early days of Blue Bottle, held a fascination with the ceremony-like tradition of Japanese co ee brewing. In the early 2000s, pourover co ee was almost unknown in the US.

“James’ interest in pourover –understanding the ritual of the process and its meditative qualities – began a love a air with Japan. rough this interest, Blue Bottle Co ee became one of the rst major importers of Oji drip brewing equipment into the US,” Strovink says.

“From early on, there was an east-west connection within the brand and that ultimately led to our rst international café in Tokyo. James had an emotional desire to bridge continents through co ee.”

As of August 2025, about a third of Blue Bottle’s venues are in Asia, with the region still a focus of its expansion plans. Over

the past few years, Asia’s appetite for co ee has continued to grow at pace, with a keen interest in specialty. Strovink says the brand is not only interested in the region’s consumer potential but also its emerging prominence as a producer of co ee.

“As part of our sustainability approach, we have a keen interest in new varietals, emerging origins, and regenerative farming. Many of these beans are coming out of regions that are also interested in enjoying the co ees they produce. In countries such as Vietnam and China, we already have a strong brand presence and that gives us an opportunity to build new relationships at producer level,” he says.

“Our intention is to champion what’s next at a varietal level and make sure diversity remains a concept of both species and taste pro le. We’re not just interested in protection, but also innovation.”

e brand is experimenting with these new varietals and origins through its Blue Bottle Studio residencies, which are held for limited periods in select markets around the world. e bespoke, sensory-based experience includes music and tasting rituals – a concept Strovink describes as “a megaphone for what’s next in co ee”.

As part of its origins as an independent specialty co ee roaster, Blue Bottle has

long prioritised direct-trade sourcing and paying premium prices to reward quality and sustainability. Yet, as a company based in the US, it’s not immune to recent uncertainty resulting from President Donald Trump’s tari s and the ongoing volatility of the co ee market.

“Everybody is facing the uncertainties that have been injected into the system. Because of our long-standing producer relationships, we have been able to continue to secure our supply and haven’t faced any major issues,” Strovink says.

“Over time, we are making adjustments to how we route our co ee to manoeuvre through any tari s. For example, we are avoiding shipping to the US before distributing to our Asia markets. We’re trying to be smart in how we respond.”

Despite the recent interest in the co ee market due to factors such as tari s and extreme weather events, Strovink says as a café-led brand co ee isn’t the most sensitive element of its economics.

“We’re continuing to invest in greater quality co ee with our partners, but more broadly costs are going up across the board. Our focus is on protecting the experience for our guests and ensuring our prices aren’t out of reach,” he says. “We serve great taste and we want to ensure everyone has access to it. At the heart of it, what sets Blue Bottle apart is not just the co ee itself but the care and hospitality behind it.”

Innovation meets accessibility

As part of Blue Bottle’s drive to make its co ee accessible to more consumers, over the past few years the brand has released a series of new products for the at-home market. First came its Cra Instant Espresso in 2022, the brand’s rst soluble espresso product made with specialty beans. e product received high praise from both the specialty industry and the wider food and drink space, with Bon Appétit describing it as “comparable to co ee-shop espresso … aromatic and malty”.

In mid-2024, in response to the rising popularity of chilled co ee, it introduced a soluble version of its customer-favourite New Orleans-style iced co ee, known as NOLA Cra Instant Co ee Blend.

“Make no mistake, our vision is to be the most distinctive and globally recognised café-led brand, so we’re not trying to splinter who we are. at said, we do want our guests to be able to extend their special co ee experiences beyond the café and so instant is a protagonist for that,” says Strovink.

“While we may be targeting the at-home market, there’s always a link back to the café. Take Cra Instant Espresso, for example: when we launched the product, we also launched a café that exclusively uses the instant co ee. If we’re going to sell it for you at home, we should put it to work in a café because that’s the ultimate endorsement of the quality.”

Most recently, the brand expanded its collaborations with Nespresso to launch a limited-edition capsule version of its NOLA blend.

“ e idea to collaborate with Nespresso didn’t come from Nestlé – we had to convince them there was a brother-sister relationship and an opportunity there. It’s a good example of how we operate as an independent company. ere is no pushing of brand, product, sourcing, or leadership from anybody within Nestlé – Blue Bottle is hermetically sealed top to bottom as a brand,” he says.

As part of its independence, Blue Bottle steers its projects in the innovation space, and Nestlé’s research and development (R&D) facilities and food-science experts have provided an additional resource to build on that work.

“It’s largely our most tenured Blue Bottlers who have been the most excited about linking with the Nestlé R&D team. For example, our Head of Innovation Benjamin Brewer has found himself among a passionate set of co ee peers with an ability to test hypotheses and explore new paths,” says Strovink.

“Nestlé has also been good at making sure Blue Bottle understands what depth of analysis actually looks like. ey’ve made us better in terms of how we work our processes, all the good things that

make us more secure in what we’re doing –sustainability is a great example.”

ese new innovations are being rolled out in store as well as part of the range of at-home products, which will continue to cater to market trends such as domestic consumption and chilled co ee. Strovink sees that the home market continues to gain momentum, but argues there’s still plenty of room for growth in the café sector.

“ e specialty co ee segment of the market is also growing signi cantly, so as a higher-end player we’re eating share from the middle market,” he says.

“I think part of the future is going to be breaking the tension between speed and quality, which very few, if any, co ee brands have been able to do. Ultimately, there are guests who want to savour in the café experience and then there are those who want their co ee at pace and don’t have time to wait in a long line.”

Strovink also believes the format of the traditional café will evolve in response to the rise of chilled co ee and customised beverages.

“Almost the whole setup of a café is tailored for the preparation of hot co ee. Chilled drinks are now much more dominant in the market compared to hot, yet the layout of the café hasn’t adapted to this. I think there’s going to be new innovation and we’ll see the café experience rotate around cold beverages,” he says.

So, where does Strovink see these cafés of the future for Blue Bottle Co ee? Asia will continue to be a key focus of the company’s growth plans, with possible breakouts in new regions also on the cards.

“We still have a tremendous runway in our existing markets. We recently launched in Singapore and in the whole Southeast Asia corridor there’s a lot of love for Blue Bottle. ere’s more potential in that region, but we need to focus on expanding while maintaining our quality standards,” he says.

“ e shi s we’re seeing in Europe and the Middle East are of interest and these are regions we haven’t traditionally pushed into, but for the moment our focus remains on our East meets West connection.

“ e broader narrative is Blue Bottle is a growth brand. Since COVID, we’ve nearly tripled the business through growth with distinction. We’re trying to do something no other co ee brand has done. Our quality is getting better over time, which isn’t typically what happens in this category. Going forward, the challenge for us is how to keep that warm, welcoming spirit Blue Bottle is known for.”

Over the past decade, the coffee industry has witnessed some of the largest acquisitions in history. Image: bnenin/stock.adobe.com.

Dawn of the deal

The coffee industry has witnessed record-breaking acquisitions over the past decade, with several deals exceeding the billion-dollar mark. What’s driving these mergers, and will continued market volatility see further consolidation in the coffee sector?

WHEN COCA-COLA purchased European café group Costa Co ee in 2018 for US$5.1 billion, the record-breaking acquisition was in the media for months. Journalists from New York to Norway, in places that had never hosted a Costa Co ee store, followed the story and made their predictions on the global beverage giant’s multi-billiondollar “bet”.

e deal was Coca-Cola’s biggest ever acquisition of a brand and was said to be in uenced by consumers’ shi away from sugary drinks, compounded by the continued growth of co ee consumption. At the time, Costa Co ee was the United Kingdom’s largest co ee chain, with more than 2400 domestic outlets and 1400 additional venues in other markets across Europe and Asia.

e announcement of the deal in August 2018 came less than a year a er Nestlé’s purchase of United States (US) specialty roaster Blue Bottle Co ee for about $425 million, which also got industry pundits talking.

Other signi cant acquisitions over the past decade include De’Longhi spending

$374 million to acquire a 41.2 per cent stake in Italian espresso machine brand La Marzocco in 2023, two years a er purchasing the remaining 60 per cent stake in Swiss co ee machine manufacturer Eversys for $164 million; and JAB Holdings’ buyout of the UK’s Pret A Manger for $2 billion in 2018.

Of course, not all these mergers are headline-making, billion-dollar deals. Every day around the world, mid-size co ee-aligned companies take over smaller companies.

It’s part of a broader trend of consolidation within the industry that’s being driven by a number of factors, such as saturation in mature markets. In places like Europe where demand is plateauing, bigger companies are growing market share by absorbing the competition rather than relying on organic growth. An interest in pursuing new trends and reaching younger demographics has also seen established brands venturing out of their lanes to explore fresh opportunities.

An unlikely partnership

An unlikely acquisition that made

headlines in 2023 was Chobani’s purchase of La Colombe Co ee Roasters for $900 million. While the US-established Greek yogurt brand had previously invested in the co ee category with the introduction of creamers, La Colombe’s experience in the ready-to-drink (RTD) market was a key driver in the investment.

“By bringing La Colombe into the Chobani family, the brands increased opportunities to bring delicious, highquality cold brew and ready-to-drink cra smanship to a next generation of consumers,” a Chobani spokesperson tells Global Co ee Report.

Before making the leap, Chobani’s research had identi ed opportunities for growth in the chilled co ee sector.

“Younger co ee drinkers are fuelling growth in the cold co ee market, resulting in RTD co ee consumption rising 43 per cent between 2019 and 2023. While La Colombe is known for its quality roasted beans and co eehouse experience, cold co ee is its cutting edge,” says the spokesperson.

“Consumers seek more convenient snacks and beverages, along with less sugar and

more functionality. By combining forces, we expect more brand innovation and accessibility that will transform the RTD co ee category.”

For now, La Colombe continues to operate as a separate brand while being part of the Chobani family. According to Chobani, the acquisition marked another step in its journey to become “a next generation food and beverage company”.

“ e acquisition provided us with a strong and di erentiated o ering in a category that is poised for disruption,” says the spokesperson.

“While celebrating its heritage, La Colombe is focused on pioneering the future of ready-to-drink co ee and the café experience. Chobani’s pursuit to provide co ee lovers with nutritious and natural creamers complements this focus on pioneering the co ee industry with healthier, more delicious products.”

Brewing the next generation of technology

Like Chobani, Simonelli Group saw acquisition as a route to tap into a sector of the industry it didn’t yet have the infrastructure to cater to. In December 2024, the espresso machine manufacturer purchased a stake in Swedish co ee lter machine company 3TEMP to expand its portfolio and strengthen its position in the growing specialty co ee market.

“As consumer demand grows for specialty and premium drip co ee, Simonelli Group saw in 3TEMP a partner with deep expertise in lter brewing and a proven track record of cutting-edge solutions. e brand’s unique tank-less brewing technology and sustainabilitydriven approach aligned perfectly with our strategic goals and innovation mindset,” says Marco Feliziani, CEO of Simonelli Group.

“ e co ee landscape is evolving rapidly, and lter brewing is experiencing big growth, especially in specialty co ee markets. By investing in 3TEMP, Simonelli Group is expanding its portfolio to meet a wider range of consumer preferences and better serve professionals and co ee enthusiasts globally. rough this partnership, we aim to explore the extractions of the future – hot, cold, and concentrate are just the beginning.” rough the acquisition, Simonelli aims to help 3TEMP scale its brewing technologies globally.

“ is collaboration is designed to accelerate growth, deepen market presence,

“Due to increasing green-bean prices over the past year, many coffee companies are running into trouble. Bigger companies are using this as an opportunity to buy struggling companies. ”

Gerd

Mueller-Pfeiffer COFFEE CONSULTANT

and raise the standard of batch brewing through sustainable, high-performance solutions,” he says. “We also want to enable the team to stay focused on what they do best: building advanced lter co ee machines.”

With Simonelli Group’s aspirations set on growth, Feliziani says when looking for new partners the company prioritises those that share its relentless drive for innovation, quality, and sustainability.

“In 3TEMP, we found a team deeply committed to technical excellence, creative brewing solutions, and a strong

understanding of co ee extraction and knowledge. e decision to invest was driven by the alignment in values and a mutual ambition to shape the future of co ee preparation,” he says.

“Simonelli Group is positioning itself to lead in a fast-evolving industry by building an integrated ecosystem that can swi ly respond to market trends and consumer needs. is strategic direction can suggest further growth via partnerships or investments remains a likely path.”

More consolidation on the menu?

Growth is the aim of the game for co ee businesses, yet recent challenges including volatile green-bean prices, supply issues due to con ict, and shi ing consumer preferences have made that goal increasingly di cult – especially for smaller setups with less purchasing power. As some co ee businesses struggle, some experts believe we’ll see increased market consolidation over the next few years.

“ ere are many consolidation deals every year, but the majority are on a small scale – it’s not always the big guys like Nestlé, JDE Peet’s, and Lavazza signing billiondollar agreements,” says international co ee consultant and former Nestlé Executive Gerd Mueller-Pfei er.

“Due to increasing green-bean prices over the past year, many co ee companies are running their P&L near to the zero line and running into nancial trouble.

“Bigger companies use this opportunity to buy struggling companies to gain a larger footprint in order to gain more scale and purchasing power. I do believe there will be more consolidation.”

While every business deal carries risk – especially billion-dollar takeovers – mergers and acquisitions can help businesses to reduce costs through shared logistics, procurement, and marketing. It also gives the brand more bargaining power with both suppliers and distributors.

Although Mueller-Pfei er forecasts more consolidation in the co ee industry’s near future, he doesn’t believe co ee will follow the path of some sectors in which only ve or six giants control the market.

“If you think about it, there are only a handful of companies that could have that much power: JDE Peet’s, Nestlé, Lavazza, Starbucks, and potentially Coca-Cola. Nestlé is focused on its core brands such as Nespresso and Nescafé, while Starbucks is concentrating on the home market and some geographical expansion such as China and the Middle East,” he says.

“JDE Peet’s has tried to do it, but the nancial results just aren’t there. ey have attempted to do too many things in a short period and not integrated enough, which causes complexity. I don’t believe we’ll end up in a situation in which several major players will dictate co ee.”

Although it’s o en the deals involving consumer-facing brands such as Costa Co ee and Blue Bottle Co ee that make the news, acquisitions have been taking place right across the supply chain. Green bean trading is one segment that Mueller-Pfei er believes will see continued consolidation.

“Due to the nancing model of merchants, some are experiencing nancial problems because they’re not running on a strong P&L. Due to the structure of the business model, even some of the larger organisations are struggling,” he says.

“We’ll see more direct models of co ee trading, with more producers skipping the middleman and distributing products directly into consumption countries.”

But what does more consolidation mean for the co ee industry – will less choice result in higher prices for consumers,

and what happens to creativity within the sector?

“Can consolidation be positive for the greater good of the co ee industry? Sometimes yes, but quite o en no,” says Mueller-Pfei er.

“As a consumer, you could be confronted with higher pricing from venues due to the fact they have less competition. e beauty of the co ee industry is having the local co ee shops, the local ideas, and the local tastes.”

For the team at Chobani, consolidation is a natural part of the sector and a vehicle for growth and new opportunities.

“Consolidation is nothing new in the co ee industry,” says the spokesperson.

“La Colombe operated independently for nearly 30 years, but by joining forces with Chobani, the brand now has the resources to scale ready-to-drink operations while simultaneously perfecting the café and hospitality experience the community has grown to know and love.”

Only time will tell whether this consolidation trend will continue or if independents will see a re-emergence. GCR

Regions on the rise China

How surging consumer demand and climbing production capabilities have accelerated China’s coffee market – with growth showing no signs of slowing.

CHINESE COFFEE has long been a curiosity, but the sector has evolved far beyond simply being a passing point of interest.

e country’s co ee industry – from both a production and a consumer standpoint – is booming. A burgeoning specialty market is gaining traction thanks to quality beans grown in the Yunnan and Hainan provinces, while domestic demand for cheap and accessible co ee is growing alongside a desire to experience new and high-quality products.

While still famed for its production of pu’erh tea, Yunnan in the southwest has become the Arabica engine-room of Chinese co ee, with Robusta crops grown in the country’s southernmost region of Hainan.

With 1.9 million 60-kilogram bags produced in China in 2024/25 – compared to 105,000 bags in 1990/91 and 350,000 bags in 2003/04 – the industry is showing no signs of slowing down.

From humble beginnings

French missionaries rst brought co ee to China, speci cally Yunnan, in the 1800s. Yet, it wasn’t until the country began to open its doors to international trade in the 1970s that co ee started gathering any real momentum in a region that is, historically, a major tea producer.

Starting with instant varieties from the likes of Nescafé and Mars Co ee in the 1980s, co ee became a link to western in uence and modernity – and was

primarily an imported product.

Today, Chinese-grown co ee is exported all over the world, and Yunnan Co ee Traders is key to introducing the international co ee community to this emerging region.

Head of Global Sales Maarten Hol says the industry only really started transitioning from instant and commodity co ee to specialty and higher-quality beans in the past decade or so.

“Co ee production did not become commercially viable until the late 1980s when Nestlé and the Chinese Government started a large agricultural program to develop rural communities in Yunnan,” says Hol.

“Because there was no local knowledge to speak of and the aim was not to produce high-quality co ee, Catimor was chosen as a varietal for its high yield and ease of maintenance, and all of it was washed.

“Until around 2010, co ee was still hardly available in China other than some of the three-in-one instant co ee packets. Lots has changed now, mainly because of the growth of large chain cafés such as Starbucks, and o the back of western culture.”

United States (US) expat David Henry was one of those who struggled to adapt his own tastes to China’s co ee industry when he arrived in Shanghai in the 1990s. At the ground oor of China’s co ee boom in 2009, the former teacher took things into his own hands with the launch of Jonas Emil Co ee Roasters.

e micro-roaster services the home

retail sector, with its products available to ship to mainland China, Macau, and Hong Kong, where it sells a range of locally and internationally grown co ee.

Henry says the approach to Chinese co ee, both domestically and globally, has changed dramatically since his arrival 30 years ago.

“I arrived here in 1995 as a teacher and I couldn’t nd a cup of co ee. I’m a co ee lover who really thrives on the stu and I had to stop drinking it for two years, which was really hard,” says Henry.

“When we started Jonas Emil, we were dependent on the foreign community. ere were around 300,000 foreigners in Shanghai at the time. Of course, they were spread out, but that’s still a big market for a small roaster.”

Forging an industry

e arrival of Starbucks in China was a major turning point for the growth of the nation’s co ee sector. e US brand launched its rst store in Beijing’s China World Trade Building in 1999, with its rst store in Shanghai opening a year later.

Now, there are more than 7700 Starbucks stores in China spread across more than 1000 county cities. In 2022, Shanghai became the rst city in the world to have 1000 Starbucks locations.

Along with being one of the largest co ee retailers in China, Starbucks is now also one of the largest buyers of Chinese beans in the world.

“We are proud to witness a dramatic

improvement in the quality of Yunnan co ee – the percentage of co ee that passes Starbucks’ stringent quality tests has increased from 20 to 80 per cent since 2012,” a Starbucks spokesperson tells Global Co ee Report.

“Today, Yunnan co ee contributes to every part of Starbucks’ bean portfolio in China. Used in the signature Espresso Blend, Yunnan co ee can be found in every cup of dark-roast espresso-based beverage served across our more than 7700 stores.

Yunnan Single Origin Bean, launched in 2017, is also sold in all our stores in China all year round.

“Since 2017, we have been proudly presenting Starbucks Reserve co ees from Yunnan every year. Twelve Yunnan Reserve co ees have been launched to date.”

Outside of growing its retail pro le in China, Starbucks has been involved in introducing new and more e cient agriculture methods to Chinese farmers to help them grow higher quality co ee.

To do this, it has been involved in improving farming practices in Yunnan through the Starbucks Yunnan Farmer Support Centre (FSC), which o ers farmers free agronomy expertise and resources.

“Since its opening in 2012, the FSC has trained more than 36,800 farmers on sustainable farming practices and 3411 farms have been veri ed through the Starbucks Co ee and Farmer Equity (C.A.F.E.) practices. As of September 2024, the cumulative certi ed area of these farms spans 352,465 miles,” the Starbucks spokesperson continues.

“We also purchase the co ee local farmers

produce and pay higher prices for better quality. is creates a virtuous cycle where farmers are rewarded and incentivised to constantly improve the quality of their co ee. We typically pay farmers 20 to 30 per cent more than what they could fetch in the local market.

“Beyond pro t, we foster farmers’ pride by honouring their e orts and connecting them to the cup of co ee in our customers’ hands. We organise the annual Yunnan Farmer Assembly, where we hand out quality awards to recognise successful farmers.”

Henry says the impact of Starbucks’ growth in China on the domestic market has laid the foundations for China’s modern co ee culture.

“When Starbucks came in, co ee became very fashionable. People in Shanghai like to be fashionable and they get really involved in trends, so co ee started to take o ,” he says. “It was inevitable that soon a er people were going to start looking at co ee as a more serious, long-term thing.”

Going global

While domestic interest in Chinese co ee is growing, so is international demand. Hol reports the United Kingdom, European Union, Middle East, and Australia as major buyers of Chinese specialty co ee, while Russia and Germany purchase large amounts of its commercial co ee.

With global exports increasing, some previously held perceptions of Chinese co ee as an inferior product are quickly changing.

“As all emerging regions have, there is a lot of curiosity around Chinese co ee,” says Hol. “However, China as a producing country for other products has long been associated with bad quality.

“ is, combined with some geopolitical in uence, does a ect the perceived status of Chinese co ee. We, as producers, deal with this is by emphasising the name Yunnan co ee rather than Chinese co ee.

“We have recently added ‘Product of China’ to our jute bags to slowly migrate to a narrative that pushes for a better perceived quality of Chinese co ee.”

He says while the dominance of Latin American countries in global Arabica production means China will likely never be one of the world’s top exporters of co ee, he still sees signi cant room for growth of its specialty industry.

“China is a very small player, so even though production will increase, the impact on the international commercial market will be negligible,” says Hol.

“But the impact on farmers wanting to evolve into specialty co ee producers has proven to be signi cant and will continue to evolve. Access to high quality equipment produced in country and the emergence of knowledge around specialty processing all contribute to the increase of local value in the value chain.”

is growing demand for new and di erent types of homegrown co ee has seen the emergence of new varietals grown in Yunnan.

“A new chapter has started that will again transform the Yunnan co ee scene. e introduction of alternative varietals such as

Yellow Bourbon, Yellow Caturra, Pacamara, and Geisha are now actively being set up to provide a new avour pro le,” says Hol.

According to Henry, the transformation in both quality of farming and consumer demand for better products has been felt through the entire Chinese co ee industry.

“When we started Jonas Emil, we advertised all our co ee as 100 per cent imported Arabica beans. e Chinese growers were not specialty growers and it was very low-grade co ee. We just couldn’t sell it,” he says.

“Now, we sell a fair amount of Chinese co ee alongside our imported beans. e co ee from Yunnan is good. It’s very distinctive and not like Latin American or African co ees, but it has become noteworthy and has some great complexities.”

Creativity unlocked

A quick glance through the menus of some of China’s largest co ee chains shows the creativity in the Chinese co ee scene.

Local companies Luckin Co ee and Cotti Co ee are part of a new generation of businesses taking the domestic consumer sector by storm. Starbucks is no longer the only major player looking to tap into the local market.

Luckin claims to have more than 26,000 stores across its market of China and Hong Kong, Singapore, and Malaysia, and recently opened its rst store in New York City, US. Cotti, on the other hand, says it operates more than 14,000 stores in 28 countries.

Outside the global standards like a cappuccino, espresso, or iced latte, consumers in China have options such as Luckin’s Apple Fizzy Americano, which

combines sparkling soda and apple juice with espresso and hot water, or Cotti’s Pampas Blue Coco Latte, which blends espresso with milk, coconut milk, and blue colouring.

Henry believes the comparatively recent emergence of the Chinese co ee market means it’s not shackled to any preconceived ideas about what co ee should be, giving creativity room to grow.

“I’m 73 years old and I’ve been drinking co ee for a long time,” he says. “My dad and I used to have co ee made in an old percolator when I was in high school, and that was our evening ritual. I have ideas about what co ee should taste like, but that doesn’t really exist in China.

“People here come up with these wild combinations I wouldn’t even dream of, but they’re free from any kind of traditional bias. I shake my head at some of the fruity

drinks that are concocted, but I have tried some and they taste pretty good. ey’re really interesting.”

Over the past 16 years, Jonas Emil’s competition has grown and interest in its products has boomed.

“ e co ee business has grown tremendously. When we launched there was one other foreign roaster that started about the same time. ere were some local roasters, but they were very old school and used cheap beans with a dark, dark roast,” he says.

“ e expansion has been phenomenal and the Chinese people have really taken to it. ey have grown their sophistication of knowledge about co ee and the di erence is incredible.

“In the space of a few years it has gone from ‘what’s co ee?’ to what it is now. It’s an industry that is open to trying anything new – there is so much experimentation going on. It’s been a wild ride.”

China’s domestic co ee industry is growing, but it’s still young and full of potential. According to the International Co ee Organization, the average co ee consumption per capita per year is just 0.15 kilograms.

If that reaches the global average of 1.36 kilograms, the domestic demand for co ee would grow to 31.7 million 60-kilogram bags, which would make China the single largest co ee market in the world, far surpassing the 25.9 million bags of the US.

Given that since 2010/11 consumption has grown at an average rate of 21 per cent, while the rest of the world’s average growth rate has been 1.8 per cent, it may only be a matter of time before that projection becomes reality. GCR There

India’s next top producer?

All eyes are on India as its annual coffee exports continue to increase. Vidya Coffee Founder Shyamprasad Kodimule details his ambitions to help make it one of the world’s top three producers and his brand the biggest exporter in the country.

INDIA IS HOT on the heels of the co ee industry’s major players. While in the 2024/25 harvest the country was ranked as the world’s seventh largest producer – growing just four per cent of global co ee that season compared with leaders Brazil (37 per cent), Vietnam (17 per cent), and Colombia (eight per cent) – over the past decade its exports have grown signi cantly.

In June 2025, the Co ee Board of India published data revealing 25 per cent yearon-year growth of co ee exports for the rst half of 2025/26. In the past 11 years, exports have shot up 125 per cent – with US$800 million recorded in 2014/15 compared to US$1.26 billion in 2023/24. As part of the Board’s 10-year roadmap, it aims to double the country’s production by 2034 which, if production remains unchanged for other countries, would see India leapfrog Indonesia into fourth place.

Shyamprasad Kodimule, Founder and President of full spectrum producer Vidya Co ee, believes the Indian co ee industry has the potential to exceed the Board’s ambitions and become one of the world’s top three producers.

“India should be reaching for the number two or three position. We are progressing

well and there are a lot of opportunities for expansion,” says Kodimule.

“Nearly all co ee in India is shade grown, which makes it quite unique. What’s more, the country is huge, so we have many di erent climatic conditions producing a vast range of beans with distinct avour pro les.”

Kodimule says the country’s recent

production success comes down to a number of factors, including the work of the Co ee Board and the knowledge of the farming communities.

“ e Co ee Board creates a very organised production system. It also provides a lot of bene ts for farmers, including sharing guidance on cultivation techniques, disease prevention, and reduction of pesticides,” he says.

“We’re also seeing a big rise in domestic consumption of co ee in India, which is a good thing for production here. We have a very educated population who are not just looking for commodity co ee but also organic, Rainforest Alliance, and specialty beans. Farmers are therefore showing more interest in producing these high-quality products to cater to both the domestic and international markets.”

The road to the top

Currently the fourth largest producer and exporter of green beans in India, Kodimule has his sights set on the top spot for Vidya Co ee.

“We are aiming to be the largest co ee producer in the country in the next two years. Alongside growth, quality and consistency are our top priorities to

provide our customers with a stable supply chain,” he says.

Vidya Co ee, a sub-brand of phytonutrients producer Vidya Group, has seen huge development since it was established in 2014. While the company started out as an exporter of green beans, it now o ers full-spectrum co ee production. It has its own estates in Chikmagalur and a team sourcing from the rest of the country and internationally, as well as facilities dedicated to postharvest processing, roasting, and instantco ee production.

e company recently introduced a new production facility in Belur, Karnataka, to boost its instant output – an arm of the business that has been a major focus over the past ve years. As well as expanding Vidya’s production capacity by 40,000 tonnes per year, the facility has introduced more than 500 new jobs for the local community.

“ e new facility is located in one of the region’s most rural areas. It is a strong farming community, so we hope to be able to contribute to the local economy and provide jobs for farming families,” says Kodimule.

“Within the facility, we focus on instant co ee production. At the moment, we use the spray drying method but will soon be using the freeze-dried method for about half of our production.

“We have a team of 50 scientists who are constantly monitoring the quality of our products through sensory evaluation, high-performance liquid chromatography, and microbiology labs.”

Functional focus

As part of Vidya Co ee’s expansion into

instant production and private-label services, the team have also introduced a new line of products that cater to the functional beverages market.

e range includes instant co ees blended with health-based ingredients including collagen, protein, cinnamon, liquorice root, turmeric, vanilla, and multivitamins.

“An increasing number of consumers are looking for beverages that can support their health. Instead of taking a pill, they can now get the bene ts of things such as multivitamins and protein in their co ee. Being a health brand with more than 20 years in the industry, we have the advantage of already having the experience and the technology,” says Kodimule.

“We’re seeing interest in these functional products in both the local and international markets. ere’s huge awareness in places such as Europe and the United States.”

Sustainability is another area in which Vidya has identi ed consumer interest. As such, the brand is focusing on clean energy use, recyclable packaging, and traceable sourcing.

“Sustainability is the backbone of our company. We work in a sector in which traceability is a crucial factor, and we want to create a positive environment for our co ee farmers and the wider population,” says Kodimule.

“We are partnering with farmers to nd ways they can make more money while also being more sustainable. For example, rerouting co ee pulp into bioethanol. For our own products, we’re exploring recyclable packaging and other ways to reduce waste.”

Roots in green coffee

While the company continues to explore new product innovation as part of its growth strategy to become India’s top producer, it hasn’t forgotten about its roots in green co ee processing and exporting. Vidya o ers a range of Robusta and Arabica beans, including specialtygrade co ees, directly from its estates to global buyers.

“We export 100 per cent of our green beans, mainly to Europe, the Middle East, and Korea,” says Kodimule.

“ ere is an increased interest among growers to produce specialty-grade beans for these markets. ere’s particular interest in the ‘monsoon’ co ees from the Mangaluru region, which are grown in the humid, coastal atmosphere.”

e business currently processes about 20,000 tonnes of green co ee each year in India, with an additional 5000 tonnes of African co ee processed at its facility in Uganda.

“Demand is continuing to increase for Indian co ee. More and more people want to get into co ee farming as they’ve seen how it can make some farmers rich. Unlike places such as Brazil and Vietnam, we are not so susceptible to extreme climate conditions – generally in India everything is a lot more stable,” Kodimule says.

“ e Co ee Board of India is encouraging farmers in northern regions such as Assam, Meghalaya, and Tripura to take up co ee and they’re taking it very seriously. I think the output will only increase over the next few years.” GCR

For more information, visit vidyacoffee.com

Eversys invited about 100 of its partners to a factory tour and lunch in

Automation meets community

With several new solutions set to be revealed at Host Milano in October, Eversys draws back the curtain on its product development process and the importance of input from its international distribution partners.

AT THE PEAK of European summer in a sun-soaked vineyard tavolata in Switzerland’s undulating Rhône Valley, the team at Eversys gathered about 100 of its key distribution partners for an alfresco meal. e event took place under glorious blue skies a stone’s throw from the super-automatic machine manufacturer’s headquarters and factory in Sierre – also known as the ‘city of the sun’.

“It was a beautiful day. ere were people from all around the world gathered around one long table enjoying fantastic food and wine,” says Guido Bernardinelli, CEO of De’ Longhi Professional Division.

“It was a moment of cohesion I wouldn’t have expected from a piece of equipment that is supposed to be human-less. Co ee brings people together and establishes a sense of community, and it was amazing to share that with our partners.”

e family-style supper was the climax of the manufacturer’s Partner Day, which

also featured a tour of its factory and the unveiling of several new products in its research and development (R&D) pipeline. Due to be introduced at international tradeshow Host Milano in October, these unreleased solutions were so top secret that partners were asked to sign NDAs and hand over their phones before being introduced to the technology.

While these measures may seem extreme, for the team at Eversys, sharing developments with their distribution partners before launch is an essential step in their R&D process. According to Eversys General Manager Stefano Barato, their deep industry knowledge and market-speci c feedback is invaluable.

“Sharing information about new products before they are released to market carries a bit of risk. Once distributors have seen the technology, they get excited about it, want to shout about it, and start selling it right away,” Barato says.

“However, sharing these solutions with distribution partners ahead of the launch is hugely important. We involve them from the early development phase so they can provide feedback and recommend additional improvements and ideas.”

Eversys’ super-automatic co ee machines are designed to be exible to the speci c needs of individual markets, with local distribution partners advising on the intricacies of their regions. Barato uses the preparation of chilled co ee as an example, with some areas requiring a tailored solution because water direct from the mains may not be safe to drink.

“From inception to the nal machines, there’s a very long process that involves many people. Before taking a new product to market, we do a lot of eld testing with our partners to see how the machines perform in the real world,” he says.

“For example, we’ll soon be delivering a new solution for Asia, which involved

two years of eld testing in di erent Asian locations before being approved by an important customer.”

e process starts with the careful study of market data and involvement in industry panels, which gives the Eversys team an indication of where the co ee machine market is heading. Distribution partners are also involved in this trend-identifying process, providing insights from their regions and customers.

“When we have permission from our customers to review the data from machines in the eld, we can analyse the di erent parameters of the machines to drive development – especially in terms of sustainability,” says Barato.

“Performance and reliability are our main goals. e way in which the machines are developed creates an ecosystem that can keep them in the eld for at least 10 years without compromising quality or consistency.”

rough research, the brand’s marketing team identi ed two main trends that are in uencing its next era of superautomatic solutions.

“Chilled co ee beverages are very popular and there’s a desire to be able to extract cold co ee direct from the machine. is trend is huge in Asia, with many favouring chilled or signature drinks in place of traditional hot beverages,” says Barato.

“Another area of interest for us is the

increasing issue of sta ng. One of the big challenges for co ee chains is training personnel only for them to leave the job a er a few months. Business owners are looking for automatic solutions that are e cient, deliver consistency, and reduce waste. ey also want a sustainable machine with a longer lifespan to minimise the investment.”

In October, the outcome of this industry research, knowledge sharing with partners, and extensive eld trials will be revealed at Host. Barato and team are tight-lipped about the speci cs of the new products, but are excited to share what they’ve been working on with the wider co ee world.

“We have been working on the next generation of the Eversys Legacy machine, which will integrate a new system that can also brew cold co ee and tea. e original Legacy machine was designed for convenience stores, but we’ll also be introducing a new version with a boiler and steam wand for co ee shops and hospitality venues,” he says.

“Furthermore, drawing on the strengths of sister company La Marzocco, we’ll be presenting a solution for high-end co ee shops that will remove the barrier between the barista and customer to encourage conversation and elevate the experience.”

Eversys’ partners who joined the celebrations in June were given early access to these innovations. Ben Fenton,

Chief Operating O cer of British café chain Black Sheep Co ee, highlights the importance of being part of the R&D process as a long-standing partner of the brand.

“Being involved early allows us to help shape the future direction of the equipment and ensures our voice is part of the innovation process. It also gives us a valuable competitive advantage as early insight means we can stay ahead of market trends and adapt faster than others,” he says.

“At the Partner Day, I really enjoyed meeting the senior leadership team and hearing directly from the people behind the product. eir passion for Eversys and their commitment to developing a world-class machine – from design aesthetics to co ee quality – was clear throughout.

“ e factory tour was a standout moment: it brought to life the scale of the operation and underscored how far the business has come in such a short time. When combined with their impressive growth trajectory and rich history, it really leaves you wondering ‘where will they be in another 10 years?’”

Eversys will be showcasing its new technologies at Booth D12-E11 in Hall 12 at Host Milano from 17 to 21 October. GCR

For more information, visit eversys.com

A Cuban coffee revolution

Deep

in the Cuban rainforest, agronomists and coffee experts are producing some of the world’s most unique beans. Lavazza reveals how its BioCubaCafé project continues to break new ground – including a first in fermented Robusta.

IN 1959, at the end of the revolution, Cuba’s rainforest cover was just 13 per cent due to years of monoculture farming. Fast-forward to the end of 2022, however, and that gure has more than tripled to 43 per cent.

is staggering improvement – one of the most successful reforestation projects in history – is largely thanks to a series of initiatives that have seen local communities, government projects, and global brands come together to form a connection between environment and development.

Among the vast swathes of forest that now cover the Caribbean country is some of the world’s most unique co ee. ere are no row-planted estates: instead, co ee is shadegrown in harmony with the forest. What’s more, these ‘farms’ are organic due to the island’s strict rules on chemical fertilisers.

Inspired by the success of these reforestation e orts and the potential for sustainable production, in 2018 the Lavazza Foundation started working in the Santiago and Granma regions with two main objectives: revitalise the country’s co ee farming industry by contributing to its reforestation e orts, and bring Cuban co ee back to the quality levels that had once made it popular around the world.

Seven years in, the project now

works with more than 2500 farmers in the country. Its core goals of forest protection, improvement of co ee quality, simpli cation of the supply chain, achievement of organic certi cation and training on good farming practices, and strengthening the role of women and young people have been hugely successful. So much so that, in 2023, the Lavazza Foundation teamed up with Hecho en Italia and Grupo Agroforestal to form economic association BioCubaCafé.

“BioCubaCafé is one of the very rst joint ventures operating in the agroforestry sector in Cuba and represents a major innovation: a systemic change in how the supply chain functions,” says Michele Curto, President of BioCubaCafé.

“ is joint venture can purchase co ee directly from producers, eliminating the need for numerous intermediaries. What were once purchase contracts have been replaced by stable, multi-year collaboration agreements with municipal enterprises.

“ is shi marks a paradigm change, as it allows BioCubaCafé to invest across the entire supply chain – from the producer to its own processing plant – providing essential production inputs that are o en scarce, such as fuel, which in turn enables the production of higher-quality co ee.”

As part of the project, the team have developed systems that blend blockchain technology with human processes to monitor traceability. What’s more, they’ve introduced a network of more than 30 sensors, geo-stations, and weather stations across the territory to record real-time data, which is made available to farmers to strengthen agroecological practices.

Alongside these practical innovations to aid Cuban co ee producers, the project has also established a series of open-air laboratories for processing and product research and development.

“We call them our ‘living laboratories’ as they are really in the eld – just next to the processing station and the forest in which the co ee is grown,” says Francesca Dangelico, Lavazza Group Food Development and Innovation Director.

“One of our key areas of research in these labs is fermentation.”

Fermentation is a key element of co ee processing and occurs either aerobically (when oxygen is available) or anaerobically (when oxygen isn’t available). Aerobic fermentation is standard in the co ee industry, but more recently people have started to explore anaerobic fermentation of co ee cherries stored in water tanks to produce di erent avour pro les.

“Cuba has world-class scientists and strong traditions in elds like biotechnology and fermentation. We’re connecting that existing knowledge with the co ee expertise,” says Dangelico.

“We’ve been collaborating with local producers and the scienti c community in Cuba to explore the use of naturally occurring bacteria and yeast strains to produce unique fermented co ees.”

Yeast or bacteria fermented co ees see speci c strains introduced to whole or depulped cherries to control the fermentation process.

“ is fermentation process can produce some beautiful fruity and wine-like notes. It’s o en used for Arabica beans, but it’s rare for Robusta. Over the past year, we’ve been experimenting with Robustas fermented in this way and have recently introduced it to a new professional blend in our La Reserva de ¡Tierra! Cuba range,” she says.

“To produce a round and balanced Italian espresso, we believe you need a good blend of Arabica and Robusta. Adding a fermented Robusta introduces those chocolate, fruit, and wine notes, creates a smooth texture, and yields a good crema.”

While Dangelico and team only recently

brought the new fermented Robusta La Reserva de ¡Tierra! Cuba product to market, they have been researching fermented co ees in Cuba for years. Over the course of their experimentation, they trialled about 200 variations before landing on their nal recipe.

“When people try the new co ee, they are quite surprised. Robusta is o en perceived as low-quality, but that’s not true – especially if it’s processed and selected in the right way,” she says.

“Using Robusta in place of Arabica may also be bene cial in terms of sustainability. Due to climate change, there is a possibility production rates of Arabica will fall while Robusta rise. In Cuba, we’re lucky regenerative farming is very much already embedded in the culture.”

e innovation in these eld labs doesn’t

stop at fermentation. Drawing on Cuba’s rich history of rum production, the team are trialling rum-barrel-aged co ees.

“We are aging the green beans in the barrels for about 90 days, which produces a sweeter tasting co ee with notes of caramel and vanilla. It really tastes like drinking co ee with a splash of rum in it, but with no alcohol,” says Dangelico. “It’s a unique product – very good as a hot brew but also amazing as cold brew.

“We love experimenting with research and development in this way. e

BioCubaCafé project has not only enabled us to support Cuba’s co ee industry but also tap into the local knowledge to create exciting and innovative new products.” GCR

Pioneers of Single-Serve Technology

From primary packaging to end-of-line. Our custom built machinery solutions cover the full spectrum of your production process.

Changing coffee cravings

SEB Professional reveals how fully automatic machines can help baristas and bar staff create an improved experience for customers craving coffee personalisation.

QUALITY AND CONSISTENCY are non-negotiables in creating a good co ee experience. Whether ordered in a bustling train station, a specialty café, or anywhere in between, the standard of the co ee must meet expectations – lest a customer be lost.

ere’s a new dimension to keeping customers satis ed in the modern era. e demand for personalisation – whether through milk alternatives and syrups or the inclusion of di erent ingredients – is keeping baristas on their toes and customers expecting more.

e rise of functional beverages – drinks enriched with ingredients such as vitamins, protein, or collagen – is also contributing to a new standard of wellness in co ee for the especially health-minded consumer.

SEB Professional – which includes brands Schaerer, WMF, Curtis, and La San Marco –believes automation has a vital role to play in meeting the demands being placed on the co ee industry, and the improvement of technology can only elevate the customer experience.

The influence of Gen Z

SEB Professional says Generation Z craves creativity and customisation in their drinks. Cold drink options and avoured fusions have become commonplace on café menus alongside classics like lattes and cappuccinos.

Gen Z is also the demographic that is driving the new age of health-conscious co ee habits, the manufacturer says.

Plant-based milks such as oat and almond are becoming a default choice rather than an alternative for many consumers. As a result, beverages like iced almond cappuccinos and iced matcha lattes have become an industry standard – alongside the expectation of delivering quality traditional hot espresso beverages.

SEB Professional says the younger generations also expect seamless ordering and app experiences, as well as social media-worthy drinks that turn their daily co ee into a shareable moment. Providers that can cater to these desires o en see strong customer loyalty and engagement.

Cold drink customisation

In this landscape of new drinks and expectations, SEB Professional says automatic machines can take pressure o venue sta and create an improved customer experience.