VOLUME 117/8 | SEPTEMBER 2025 AIMEX 2025

MOUNT ISA’S FUTURE

FLY-IN, FLY-OUT

VOLUME 117/8 | SEPTEMBER 2025 AIMEX 2025

MOUNT ISA’S FUTURE

FLY-IN, FLY-OUT

TOM PARKER

tom.parker@primecreative.com.au

THIS

The underground mining industry is a proven frontrunner when it comes to adopting safer, more efficient and sustainable ways of operating.

Its unique challenges – confined spaces, complex geology and evolving safety standards – demand constant innovation, making it a literal and figurative testing ground for technologies that often set benchmarks for the broader mining sector.

In this edition of Australian Mining, we dive deep into the technologies, strategies and partnerships shaping the future of underground operations.

The cover story sees Komatsu discuss its recent acquisition of GHH Group GmbH, which has seen the Tier 1 OEM add a suite of underground mining, tunnelling and civil engineering equipment to its product portfolio.

The underground theme continues with BME, which is redefining blasting standards through its integrated approach to products, technology and technical expertise.

BME’s commitment to sustainability and safety was discussed in a recent webinar, where the company highlighted new strategies to minimise vibration, air blast, and flyrock in confined spaces.

Flexco is raising the bar in underground mines with its Continuous Blade Secondary

(CBS) cleaner. Originally designed for surface applications, this innovation has been adapted for the stringent conditions of underground coal, offering superior cleaning in water-heavy, highcompliance environments.

Elsewhere, MASPRO’s redesigned bolting cradle and pipe assembly are helping underground operators boost efficiency and reduce downtime. With a design driven by client feedback, these solutions exemplify the company’s focus on practical innovation.

We also sat down with Glencore to discuss its goals for its Mount Isa operations and showcased Aureka – an exploration company setting a new standard for social stewardship in the Victorian gold industry.

Features on QME 2026, IMARC and the upcoming Prospect Awards round out our September edition.

Happy reading.

CHAIRMAN JOHN MURPHY

CHIEF EXECUTIVE OFFICER

CHRISTINE CLANCY

MANAGING EDITOR

TOM PARKER

Email: tom.parker@primecreative.com.au

JOURNALISTS

OLIVIA THOMSON

Email: olivia.thomson@primecreative.com.au

DYLAN BROWN

Email: dylan.brown@primecreative.com.au

PAUL HOWELL

Email: paul.howell@primecreative.com.au

Tom Parker Managing Editor

CLIENT SUCCESS MANAGER

JANINE CLEMENTS

Tel: (02) 9439 7227

Email: janine.clements@primecreative.com.au

SALES MANAGER

JONATHAN DUCKETT

Mob: 0498 091 027

Email: jonathan.duckett@primecreative.com.au

BUSINESS DEVELOPMENT MANAGERS

JAMES PHIPPS

Mob: 0466 005 715

Email: james.phipps@primecreative.com.au

ROB O’BRYAN Mob: 0411 067 795

Email: robert.obryan@primecreative.com.au

ART DIRECTOR MICHELLE WESTON michelle.weston@primecreative.com.au

SUBSCRIPTION RATES Australia (surface mail) $120.00 (incl GST) Overseas A$149.00 For subscriptions enquiries please contact (03) 9690 8766 subscriptions@primecreative.com.au

PRIME CREATIVE MEDIA 379 Docklands Drive, Docklands,

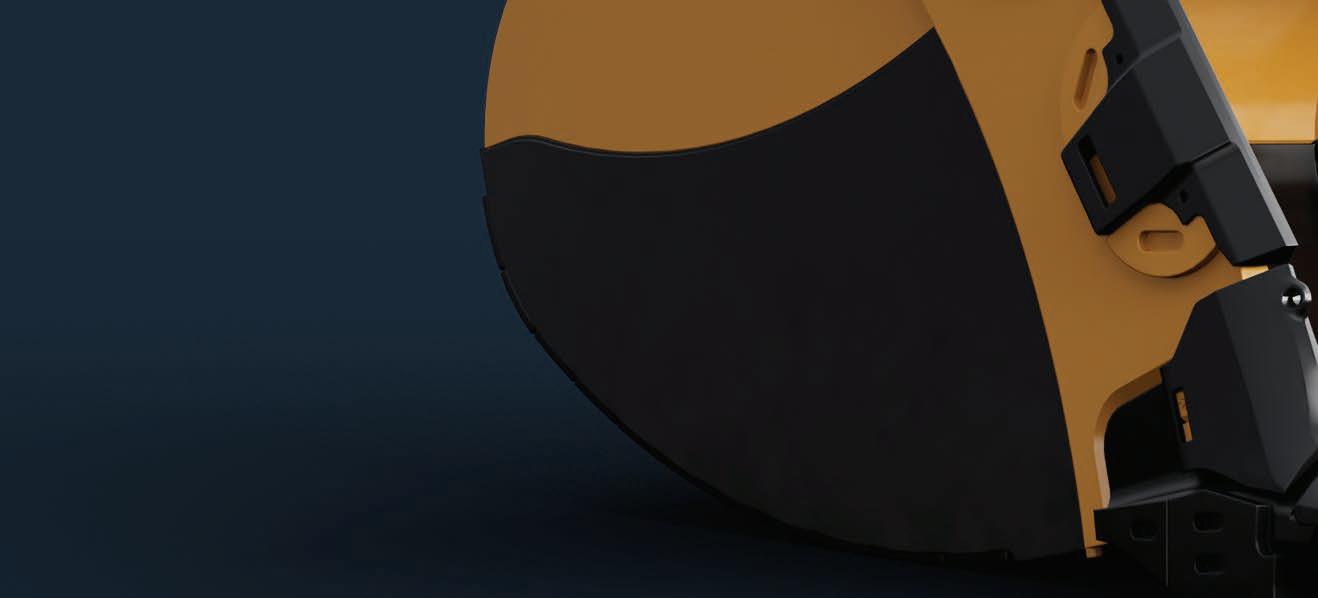

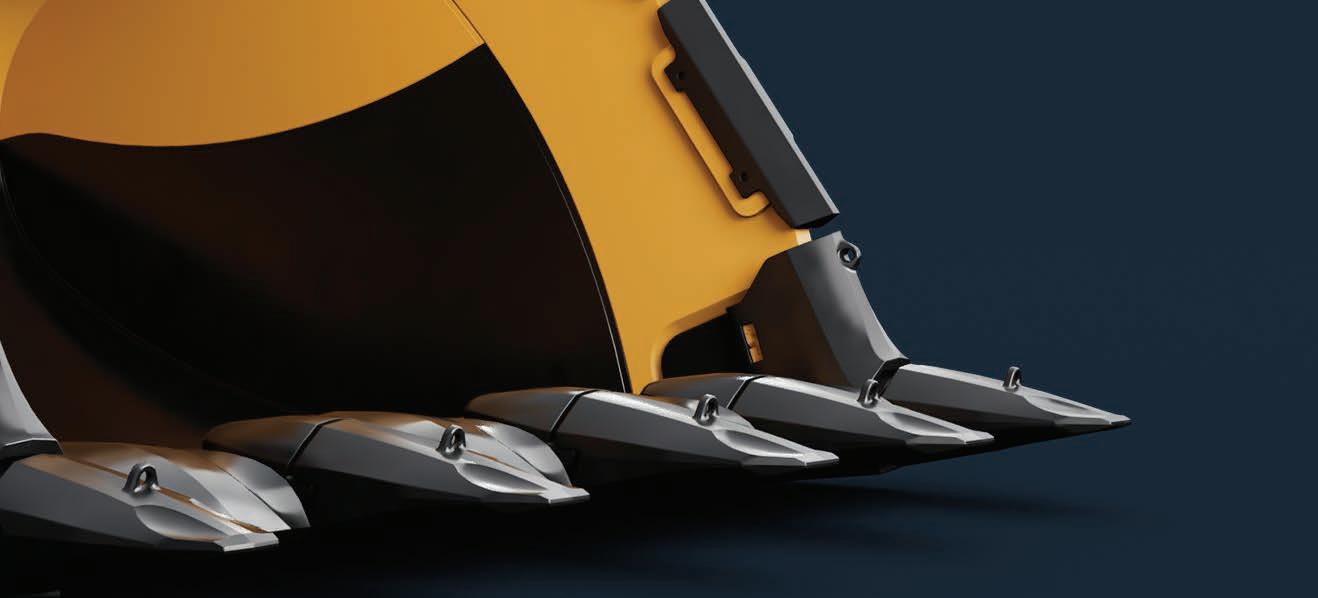

Front cover Komatsu has expanded its underground capabilities through the recent acquisition of GHH Group GmbH. Offering a range of machinery including diesel and batteryelectric loaders and trucks, Komatsu delivers solutions that enhance safety, efficiency, and productivity. Standouts include the WX range of LHDs (load haul dump), the HX range of trucks, and the innovative WX04B battery-electric loader with ground-level battery swap technology. With CE-certified, automation-ready equipment, advanced operator comfort, and OEM-agnostic charging solutions, Komatsu is meeting the evolving needs of global hard rock and industrial mineral miners – helping customers reduce costs, boost performance, and operate sustainably in the most challenging underground environments.

Cover image: Komatsu

With Vocus Satellite – Starlink, private mining networks can now be extended via Starlink without travelling over the internet. Remote mining sites can become part of a network with identical security protection as metro areas to support automation and advanced monitoring technologies. Visit vocus.com.au/starlink

10 INDUSTRY INSIGHT

Glencore digs in Glencore sees a long-term future for itself in Queensland – a state where nearly half of its employees are based.

17 INDUSTRY EVENTS

The mining show you can’t afford to miss AIMEX 2025 is shaping up as a show that will redefine mining events in Australia.

20 COVER STORY

A hard rock expansion

Komatsu’s recent acquisition has bolstered the original equipment manufacturer’s underground hard rock mining portfolio.

22 UNDERGROUND MINING

Smart blasting underground BME is reshaping underground mining with smart, sustainable blasting solutions that optimise costs and boost safety.

35 UNDERGROUND MINING

Premium performance at the face Discover how MASPRO’s redesigned cradle is doubling component life underground.

38 INDUSTRY EVENTS

A hub of mining innovation

Taking place in Perth, the WA Mining Conference will showcase the future of Australian resources solutions.

42 COMMODITY SPOTLIGHT

Unlocking rare-earths opportunities Australian Mining spotlights ASX-listed companies working to break China’s global rare earths dominance.

56 INDUSTRY INSIGHT

Unlocking Victoria’s untapped gold Aureka is setting a new standard in Victorian gold exploration by building strong community ties.

62 DECARBONISATION

Meet Viva Energy’s new hydrogen facility As mining companies work to decarbonise operations, hydrogen is being explored as a future energy source.

KEEP UP WITH THE LATEST EXECUTIVE MOVEMENTS ACROSS THE MINING SECTOR, FEATURING RIO TINTO, BOSS ENERGY AND BOOM LOGISTICS.

Rio Tinto iron ore chief executive officer (CEO)

Simon Trott has been chosen to succeed Jakob Stausholm as the company’s CEO.

Trott first joined Rio Tinto in 2012, serving as managing director of the company’s salt, uranium, borates and diamonds for five years.

Trott was then promoted to chief commercial officer (CCO) in 2018, where he established the company’s commercial operations and helped unlock efficiency and strengthen customer relationships.

Trott has been Rio Tinto’s iron ore CEO since 2021. In this role, he has bolstered the company’s iron ore business by improving operational performance, facilitating new mine developments, and refreshing partnerships with key stakeholders.

As the major’s CEO, Trott will utilise his 25-plus years of experience across various commodities and geographies to maintain partnerships with key stakeholders and a values-based performance culture.

“It is a privilege to have the opportunity to lead Rio Tinto, and I am excited about our future,” Trott said.

“The progress we have made over recent years gives us a foundation to build on with discipline and focus to deliver improved performance. With our outstanding assets and people around

the world, we are well positioned to grow value for shareholders and the communities who host us.”

Stausholm will step down from his role and the company’s board of directors as Trott assumes his new position.

“It has been an absolute privilege to lead Rio Tinto for nearly five years, during an important chapter in its history,” Stausholm said.

“Working together, our brilliant people across the group have built genuine momentum, setting out a pathway to a decade of profitable growth.

“As the chief executive (officer) of our largest business during this time, Simon has been an integral part of the journey. I am certain that under his leadership the group will continue to thrive and deliver value for its stakeholders.”

Boss Energy has also chosen a new managing director and CEO to succeed Duncan Craib.

Boss Energy COO Matt Dusci will step into the role on October 1, while Craib will stay at Boss Energy as a nonexecutive director from January 1 2026.

Dusci joined Boss Energy in September 2024, with more than 25 years’ experience in areas such as exploration, technical studies, operations, public markets, joint venture management, corporate governance, strategy, and executive leadership.

Since joining Boss Energy, Dusci has overseen the successful ramp-up of

operations at the restarted Honeymoon uranium mine.

Boss Energy chair Wyatt Buck thanked Craib for his eight-and-a-half years of service in the key leadership role.

“Under Duncan’s leadership, Boss has generated considerable growth for its shareholders and has transitioned from an exploration and development company to an ASX-200-listed company,” Buck said.

“(He) has led Boss from a microcap developer to being one of the few uranium producers in Australia. We look forward to continuing to work with him in his new capacity as a nonexecutive director.”

Buck also welcomed Dusci as Craib’s anointed successor.

“Matt has done an excellent job for the past year and we believe his significant operational, technical and industry experience will stand us in good stead,” Buck said.

At the time of writing, Boom Logistics is on the hunt for a new managing director and CEO after Ben Pieyre tendered his resignation on July 17, citing the opportunity to “pursue opportunities outside of the crane industry”.

Pieyre joined Boom Logistics in 2019 as general manager of Western Australia, South Australia.

He was then promoted to COO in 2021, and transitioned into the CEO position in February 2023.

Prior to his tenure at Boom Logistics, Pieyre served as company president of Sterling Crane in Canada and held multiple roles with Freo Group. He is also currently board president of the Crane Industry Council of Australia.

“On behalf of the board, I would like to thank Ben for his service to Boom over the past six years, including his two years as chief executive officer,” Boom chair Kieran Pryke said.

“Ben has contributed greatly to the performance and growth of Boom and we wish him every success in the future and recognise his commitment to a smooth leadership transition.”

Pieyre will remain with Boom Logistics as CEO until December 31, with the company searching for a replacement. Boom Logistics is expected to announce a permanent appointment later this year.

“I would like to thank the entire Boom team and the board for supporting me over the past six years, particularly in the role of CEO for the last two years,” Pieyre said.

“It has been a great step in my career and a privilege to work with incredible people at Boom Logistics.

“Moving away from our team and the industry was a big decision, but I believe the new path I have chosen is the right one for my family and I.” AM

Innovativedesignsfocusingonpower,efficiency,andoperatorcomfort. Eco-friendlyoperationswithsmartconnectivityforoptimalfleetmanagement.

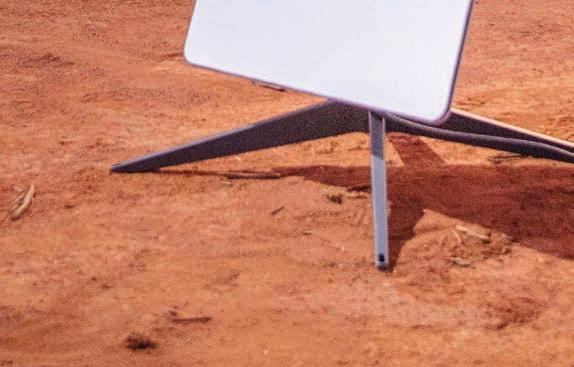

GLENCORE SPENT $436 MILLION ON SPECIALISED MACHINERY AND EQUIPMENT MANUFACTURING IN 2024.

From coal to critical minerals and base metals, Glencore is one of the world’s largest and most diverse natural resource companies.

Operating in more than 30 countries, the Swiss-based miner has an Australian footprint spanning 20 operating mines and seven processing facilities across Queensland, New South Wales, Western Australia and the Northern Territory.

These assets help to deliver billions of dollars annually for the Australian economy by supporting jobs, local communities and regional businesses, and through taxes and royalties paid to state and federal governments.

Glencore’s economic impact for 2024 has been detailed in the latest report, ‘Economic contribution of Glencore in Australia’, commissioned by PricewaterhouseCoopers (PwC).

“We felt it was important for us to articulate exactly what Glencore’s direct and indirect contribution is,” Glencore head of corporate affairs in Australia Cass McCarthy told Australian Mining.

“For every dollar we’re spending, how is that generating more economic activity in the region? And is it local or not?’. We’ve refined the project as we’ve gone along, to the point where

we can get down to specific local government areas (LGAs).

“This helps us paint a detailed and clear profile of economic contribution and suppliers, which becomes useful when talking with local stakeholders.”

Australian Mining takes a look at the key findings from the ‘Economic contribution of Glencore in Australia 2024’ report, and what it means for the future of the company.

The Mount Isa region has been a staple location for Glencore to uncover and mine copper for 100 years.

The company spent $2.3 billion throughout Mount Isa and Townsville in 2024, with 2470 direct employees and 1152 contractors working in the NorthWest Minerals Province.

“That really highlights that our operations are an economic anchor in that north-west region, going all the way up to Townsville,” McCarthy said.

“We understand those assets are incredibly strategic. And while it’s disappointing that the Mount Isa underground copper operation [closed] in late July, we are looking for a viable pathway forward for the smelter.

“Over the last five years, we’ve invested $1.8 billion in capital spending into our Queensland metals business.

“We’re looking to continue investing in the George Fisher zinc-lead-silver mine. That goes out until 2042, so we’ll look to extend that further. Then you’ve got the Black Star open-cut mine, which will be a copper and zinc redevelopment that’ll probably go for 10 to 20 years.

“We’ve continued to invest in the north Queensland region, and we will continue to do so and play a large role.”

A key example of this is Glencore spending $2.5 billion on copper concentrate from third parties in 2024.

“Glencore’s smelter is the only facility in Australia that processes third-party copper feed,” McCarthy said.

“As we’ve been preparing to close the Mount Isa underground copper mine,

GLENCORE HAS 2470 EMPLOYEES WORKING IN THE NORTH-WEST MINERALS PROVINCE.

we’ve been bringing in third-party feed from various companies. We might do a tolling agreement or, if you’re a junior miner, we might do an offtake arrangement for whatever they mine, which helps their economic case.

“We’re hugely supportive of the junior and mid-tier miners, and we’re certainly encouraging governments to approve more copper mines.”

Glencore spent a total of $19.59 billion over the course of 2024, with 59 per cent of this representing expenditure for 6814 third-party suppliers to the company’s Australian operations.

The $11.83 billion spent on suppliers included expenditure on mining contractors, equipment repair and maintenance, consumables, electricity, safety equipment, and goods and services for mine rehabilitation.

This approach means Glencore is directly supporting homegrown employment and boosting economic activity throughout the country.

“Sourcing locally and regionally wherever possible is really important to us as it underpins our regional license to operate,” McCarthy said.

“For example, if we purchase a mining truck or a longwall from an international heavy equipment manufacturer, we then try to use local providers to do the assembly and maintenance.

GLENCORE SPENT $11.83 BILLION ON THIRD-PARTY SUPPLIERS IN 2024, SUPPORTING LOCAL AUSTRALIAN EMPLOYMENT.

“That’s really where that value add for our business comes from.”

Glencore’s operations supported more than 68,000 jobs in Australia in 2024, with 12,763 direct employees and 50,693 indirect workers, and the balance comprising contractors.

“I hope people will read the report and understand that mining actually matters, and it matters to them,” McCarthy said.

“Readers may not directly work in the mining sector or know someone working in the mining sector, but the economic benefits that flow from Glencore and the mining sector inevitably will touch them, whether it’s through royalties, jobs or support for different suppliers.

“The sector is important for all Australians and is fundamental to the economy.”

The 6814 suppliers Glencore engaged in 2024 are spread across 361 LGAs, representing 67 per cent of all Australian LGAs.

Leading the pack is Brisbane, with $2.8 billion spent on suppliers in the region. This is followed by Mackay ($1 billion), Singleton in NSW ($927 million), and Mount Isa ($753 million).

Glencore’s contribution to Queensland’s gross value added (GVA) totalled $10.4 billion, with 49 per cent of the company’s total domestic supplier spend based in the state.

A total of $9.4 billion was spent across Glencore’s Queensland operations in 2024, with $1.7 billion paid in taxes and royalties.

“Brisbane is a massive standout throughout the report,” McCarthy said.

“Brisbane is a massive centre of economic activity for our business, whether it’s suppliers or the actual spend. It’s a big reflection of the taxes and royalties spent there.

“We have nearly half of our employee base in Queensland – 8380 in total – so it is a huge state for us.”

Since PwC began commissioning the ‘Economic contribution of Glencore in Australia’ reports in 2022, the mining company has contributed $19.2 billion in taxes and royalties, cementing the miner as a major economic player for the country.

McCarthy credited Glencore’s success to the dedication and skills of its workforce.

“One of our key strengths has always been understanding how to get the most value-add from our assets,” McCarthy said.

“Several are very mature, so you’ve got to work harder and deeper to uncover minerals as the ore grades are declining.

“I think this whole report is a testament to our workforce and how incredibly valuable (all 17,422 direct employees of Glencore’s mining and processing operations and corporate functions) are.

“We’re very proud of the fact that a lot of our people are subject-matter experts in their field.

“Whether it’s environmental monitoring or mine design, we’re incredibly blessed with the workforce. They work efficiently and they’re smart at what they do.

“And in the long run that helps us innovate and attract other people to work with us.” AM

MORE THAN 60,000 AUSTRALIANS ARE EMPLOYED IN FIFO WORK.

A YEAR OF OPERATION, MINRES AIR IS HELPING TO RESHAPE THE CONCEPT OF FLY-IN, FLY-OUT WORK IN AUSTRALIA.

When Mineral Resources (MinRes) launched its own airline in July 2024, it marked a shift in how mining companies manage the fly-in, fly-out (FIFO) workforce. One year on, MinRes Air has not only proven its value; it’s helping to reshape the very concept of FIFO work in Australia.

Operating a modern fleet of A319 and A320 aircraft, MinRes Air has now completed more than 1000 flights, connecting workers from Perth and Brisbane to key MinRes sites in the Pilbara like Ken’s Bore, which is part of the Onslow Iron project, and the Wodgina lithium mine.

But the innovation isn’t just about the logistics of moving people. The airline has become a strategic asset in keeping operations running smoothly and safely.

“Every aspect of MinRes Air – from roster planning to fleet optimisation – is developed to support the unique needs of MinRes and its workforce,” MinRes Air chief executive officer Graeme Taylor said.

That means fewer delays, faster transfers and, most importantly, more time at home for workers between swings. The latter is especially important in an industry where time away from family can take its toll.

The airline has also proved a boon for smoothing potential productivity issues.

Since February 2025, MinRes Air has delivered urgent freight, such as critical machine parts, directly to remote mine sites. Previously moved by road, these items often took days to arrive on-site, slowing productivity and increasing costs. MinRes Air means those delays have been minimised.

The airline has also proven its worth during emergencies.

Rapid evacuation is essential in cyclone-prone regions like the Pilbara, and MinRes Air has responded during adverse weather events, providing a safe, fast option.

“Whether it’s getting essential freight to site or swiftly evacuating staff, MinRes Air gives us capabilities that simply didn’t exist before,” Taylor said.

According to the Australian Bureau of Statistics (ABS), more than 60,000 Australians were employed in FIFO roles in early 2025, and that number has remained steady in recent years.

These workers are essential to the ongoing success of the mining, oil and gas, and infrastructure sectors, particularly in remote regions like the Pilbara and Far North Queensland.

The Australian Government’s parliamentary inquiry into FIFO work, which concluded in late 2024, reaffirmed concerns about the potential impact long-distance commuting can have on mental health, family life and community cohesion. Recommendations from the inquiry included improving facilities, investing in connectivity, and upgrading transport logistics to reduce the strain of travel.

MinRes Air appears to have taken that challenge seriously.

By controlling its own aviation services, MinRes is reducing dependency on third-party providers, improving punctuality and enhancing the overall travel experience, all while maintaining safety and productivity.

With its foundations now firmly in place, the airline has its sights set on growth. While current routes serve internal MinRes operations, there has been interest in expanding coverage to additional locations and exploring other industry needs.

“Our journey is just beginning,” Taylor said.

“We’ve laid a solid foundation, but there is still so much more ahead.”

This sentiment that echoes the broader shifts in FIFO management across the country.

Where once the focus was simply getting people to site, the conversation in 2025 is about wellbeing, efficiency and sustainability.

MinRes Air’s first year marks more than a business milestone; it’s a reflection of how Australian mining companies are rethinking their responsibilities to their workers.

In an industry so often defined by distance, giving back time, safety and comfort isn’t just good business – it’s the future of FIFO in Australia. AM

Built for harsh underground mining environments, MASPRO’s Bolting Series delivers the durability, reliability, and performance your operations count on. Compatible with TB60 and SB60 booms, it enhances traditional drilling functions and introduces new features for bolting applications. It’s one more way MASPRO helps you get more from your equipment, shift after shift.

BOSS ENERGY’S HONEYMOON MINE IS LEADING THE CHARGE IN WHAT COULD BE THE RE-EMERGENCE OF A KEY RESOURCE.

In the remote north-east corner of South Australia, a quiet but significant milestone is reshaping the narrative around the country’s uranium sector.

Boss Energy’s Honeymoon uranium mine has entered its second year of operations, and the site is proving to be something of a catalyst for the potential revival of uranium production nationwide.

The Honeymoon project exceeded its first-year guidance in the 2024–25 financial year (FY25) by producing in excess of 872,000 pounds of uranium oxide at a C1 cost of $35 per pound.

Boss Energy now expects to become cash-flow positive by FY26, with production forecast to nearly double to 1.6 million pounds of uranium oxide and a slightly higher C1 cost range of $41–45 per pound.

But Honeymoon’s ramp-up is more than just good news for a single miner; it could represent a symbol of uranium’s changing fortunes in Australia.

A re-emerging resource?

Australia possesses the world’s largest uranium resource base, according to

Geoscience Australia, yet the country remains a relatively small producer.

Uranium mining is confined to two jurisdictions in South Australia and the Northern Territory, with Western Australia maintaining a ban on new uranium developments.

However, the national uranium sector generated $1.19 billion in export earnings in FY24, with the Department of Industry, Science and Resources forecasting a rise to $1.7 billion by 2025–26.

Honeymoon is now one of only three operational uranium projects in Australia, alongside BHP’s Olympic Dam and the Four Mile mine, both also located in South Australia.

Boss Energy’s progress is injecting new energy into a sector that has long been viewed with strategic potential and regulatory hesitation.

Much of the near-term success at Honeymoon hinges on wellfield development. The mine uses insitu recovery (ISR), a low-impact extraction method whereby a solution is circulated through porous underground ore bodies, dissolving uranium for collection at the surface.

Nine wellfields are expected to be operational by June 2026. As the project transitions from its core Honeymoon domain to the lower-grade East Kalkaroo region, uranium grades are expected to decline, driving up production costs.

This shift is reflected in Boss Energy’s all-in sustaining cost forecast of $64–70 per pound for FY26.

To meet production targets, wellfield construction is moving swiftly. Wellfield 4 is already in flushing, with Wellfield 5 on track for commissioning this quarter. Meanwhile, materials for the East Kalkaroo trunkline are on-site, with construction having been scheduled to begin in August.

Despite the lower grades, Boss Energy remains focused on long-term growth, turning attention to exploration efforts in the broader Honeymoon region, particularly the Lake Constance area.

Originally drilled in the 1970s, Lake Constance has shown historic signs of mineralisation, with Boss completing 33 aircore drill holes covering 3770m in the most recent campaign.

While Honeymoon is leading the charge, the national conversation around

uranium remains complex. Uranium mining remains heavily regulated under the Environmental Protection and Biodiversity Conservation (EPBC) Act, requiring rigorous approvals that often span several years.

However, international demand, particularly in Asia and Europe, is shifting perceptions. As nuclear energy returns to the global decarbonisation agenda, Australia’s uranium assets are gaining new strategic relevance. Export markets remain strong, with uranium continuing to flow to approved nuclear countries under international safeguards. For now, the sector remains concentrated. Exploration expenditure on uranium reached $71.3 million in 2024, according to Geoscience Australia, a relatively modest investment compared to other minerals, but a meaningful one as miners eye long-term returns.

Boss Energy’s steady ramp-up at Honeymoon underlines the fact that commercial success is possible. As Australia continues to debate the role of nuclear energy and critical minerals in its future, projects like Honeymoon may pave the way for a broader uranium renaissance, one wellfield at a time. AM

THE AIMEX 2025 CONFERENCE IS VITAL FOR PEOPLE WHO WANT TO STAY AHEAD IN A FASTCHANGING INDUSTRY.

AIMEX 2025 IS SHAPING UP AS THE SHOW THAT WILL REDEFINE MINING EVENTS IN AUSTRALIA.

Taking place in Adelaide for the first time, Asia-Pacific’s International Mining Exhibition (AIMEX) is shaping up to be its most ambitious and impactful edition yet.

To be held at Adelaide Showground from September 23–25, the event is set to be a powerhouse gathering of industry leaders, cutting-edge technology, and opportunities to connect, learn and celebrate mining excellence.

With thousands of attendees expected from across Australia and around the globe, here are five reasons AIMEX 2025 cannot be missed.

The revamped Mining Pavilion

Sponsored by BHP, the redesigned Mining Pavilion gives key mining companies a dedicated space to showcase their initiatives and engage with the community and industry.

“These are some of the industry’s most prominent contributors and we are excited to welcome these organisations and provide them with a platform to highlight their contributions to the industry and communicate their

initiatives and advancements,” Prime Creative Media marketing manager –mining events Rebecca Todesco said. BHP will be joined by the likes of Boss Energy, Magnetite Mines and Andromeda Metals at the Mining Pavilion.

Celebrate excellence

The Australian Mining Prospect Awards will take place in South Australia for the first time in their history, coinciding with AIMEX’s second day.

Known as the most prestigious awards in the sector, the Prospect Awards have been celebrating innovation and achievement across Australia’s resources industry for more than two decades.

This year’s finalists reflect the breadth and brilliance of the sector:

• Discovery of the Year: True North Copper’s Vero Resource; Spartan Resources’ Dalgaranga Gold Project; Westgold Resources’ Beta Hunt Gold Mine – Fletcher Zone; Alligator Energy’s Big Lake Uranium Project

• Engineering Success of the Year: IPI Australia – Pulley Logistics System; Robson Civil Projects – Mt Arthur

Coal Rehabilitation; MASPRO – Reengineered Components for Tier-1 Client; Alpha HPA – HPA First Project; International Graphite –Collie Micronising Facility

• Excellence in Environmental Management and Sustainability: Bravus – Foodie Waste Reduction; Fortescue – Carabid Beetle Partnership; Hancock Iron Ore –Greater Bilby Offset; Bollé Safety –Go Green initiative

• Excellence in IIoT Application (sponsored by ifm): SAPHI Engineering – Shellshock AI; Madison Technologies – Mobotix App; Hancock Iron Ore –TrackDefectX; Emesent – Digital Stope Solution

• Excellence in Mine Safety, OH&S: SAPHI Engineering – Shellshock AI; Fortescue – Leading Safety Index; National Plastics and Rubber

– Stacko System; Hancock Iron Ore

– Brilliant at the Basics; Rio Tinto –R.O.R.I. firefighting robot

• First Nations Engagement Award (sponsored by Sandvik): Rio Tinto – ATAL Program; Bravus

– Indigenous Pathways; Blackrock Industries – Second Chance for

Change; Mallard Contracting –Aboriginal Engagement Strategy

• Innovative Mining Solution: Anglo American – The Armadillo; Fortescue – Collision Avoidance System; Mineral Resources –Marine Transhipping; Micromine – Micromine Advance; Dredge Robotics – Zero Entry Dredging; Rio Tinto – Corrosion Protection; McLanahan – QUICKCHANGE System; Sandvik – Agnew Stage 1

• Lifetime Achievement Award: Dino Otranto (Fortescue); Craig Pedley (MAX Plant and Striker); Leonard Rowe (Newmont)

• Outstanding Mine Performance (sponsored by Bonfiglioli): Fenix Resources – Beebyn-W11; Meeka Metals – Murchison Gold; Vertex Minerals – Reward Gold; Mineral Resources – Onslow Iron; Gold Fields – Agnew Gold Mine

• Safety Advocate of the Year (sponsored by Fortescue): Ed Tancred (Orisent); Dale Harris (Hancock Iron Ore); Soa Palelei (Strong Minds, Strong Mines); Aaron Giles (Yancoal); Dave Holland (Safety Training); Kathy Clarkson (Key Consultation Solutions)

The evening will also reveal the Australian Mine of the Year, sponsored by SEW-EURODRIVE. Held at the iconic Adelaide Oval, the awards night will be a highlight of the week, and tickets are already in hot demand.

A world-class conference program

AIMEX’s three-day conference is included with free event registration, but its value is priceless for those who want to stay ahead in a fastchanging industry.

Across two stages, delegates will hear from industry experts, government representatives, and researchers tackling the sector’s biggest challenges.

Topics will range from environmental, social and governance (ESG) and procurement strategies to workforce development, the energy transition and the latest in automation and digitalisation. Real-world case studies will showcase how companies are adapting to new regulations, improving safety, and integrating sustainability at the core of operations.

This is not just theory; it’s a platform for practical insights that attendees can apply immediately in their own organisations.

The Transformative Tech Showcase

Innovation is accelerating in the resources sector, and AIMEX’s Transformative Tech Showcase offers a

front-row seat to the future. Companies will display solutions that improve safety, boost efficiency and reduce environmental impact.

From drones that are able to inspect mine sites in minutes to data platforms that predict equipment failures before they happen, the showcase is a buzzing hub of ideas and partnerships.

Sustainability will be a strong theme, with technologies aimed at

reducing carbon emissions, improving water management, and enabling circular economy principles in mining operations.

Build connections that drive results

In mining, as in many industries, success can often come down to who you know. AIMEX is designed to foster meaningful connections, whether in the exhibition hall, at conference networking sessions, or during evening events at some of Adelaide’s top venues.

The event draws decision-makers from across the supply chain, offering opportunities to meet potential clients, suppliers, partners and collaborators from Australia and overseas.

AIMEX 2025 is more than just a trade show – it’s a convergence of ideas, innovation, and inspiration.

The event’s relocation to Adelaide has added a fresh new dimension, bringing new audiences and opportunities to engage with South Australia’s growing mining sector.

The combination of a hands-on exhibition, in-depth conference, technology showcase, and the Australian Mining Prospect Awards makes this an event where the entire mining community comes together to celebrate, learn and plan for the future.

With registration free but essential, and some ticketed events already selling fast, now is the time to secure your place at what promises to be the most important event in the Australian mining calendar. AM

AIMEX 2025 will be held at Adelaide Showground from 23–25 September. For more information, visit aimex.com.au and lock in your spot before it’s too late.

Scan the QR code or visit komatsu.com.au for more information.

KOMATSU’S RECENT ACQUISITION HAS BOLSTERED THE ORIGINAL EQUIPMENT MANUFACTURER’S UNDERGROUND HARD ROCK MINING PORTFOLIO.

Komatsu has been raising the bar in recent years in order to compete in the underground mining of hard rock and industrial minerals.

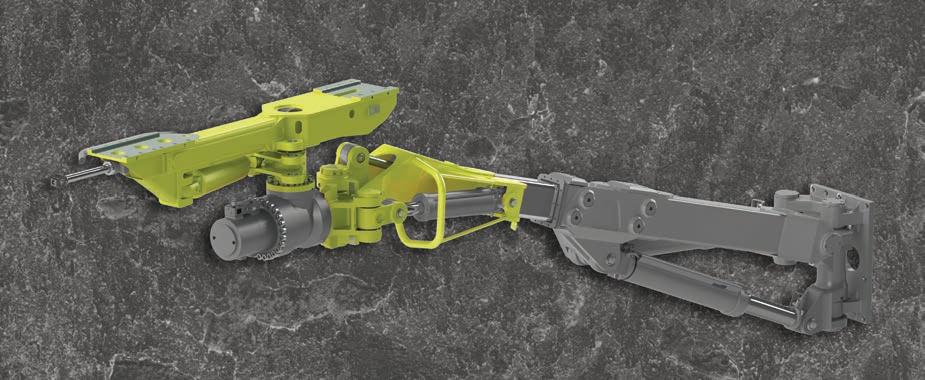

Following the 2024 acquisition of GHH Group GmbH (GHH), a German manufacturer of underground mining, tunnelling and civil engineering equipment, Komatsu has significantly increased its product portfolio and is accelerating its product development roadmap.

The acquisition helps to enhance Komatsu’s ability to provide products to a significantly larger customer base, as well as serve underground mining customers’ unique challenges, reduce their costs and help them achieve their production goals.

With a larger product portfolio covering the scope of low-profile, narrow-vein and mid-seamed mass mining equipment, with loaders from 3–15 tonnes (t) and trucks from 7–45t, Komatsu has a comprehensive range of load and haul equipment.

Komatsu also boasts diversity in its alternate technology drive train designs, having decades of experience in the

design, development and manufacturing of tethered electric loaders and more recent experience in battery products.

One of the latest releases is the WX11, a powerful 11t loader.

This workhorse offers what Komatsu describes as “best-in-class” breakout force and payload for optimal loading and haulage cycles.

“The WX11 is the first-tomarket LHD (load haul dump) with a full 11,000kg capacity while having the same general footprint and dimensions of LHDs in the 10t category,” Komatsu said.

The WX11 LHD has a unique bucket design engineered to penetrate the muck pile easily and completely fill the bucket when rolled back.

All bucket options include a durable, high-strength plate lip that helps to extend their lifespan.

“This and many other features, including high speed-on-grade and optimal operator visibility, make this an ideal LHD for mines aiming to boost productivity,” Komatsu said.

For the next size class in mid-seam mass mining, the Komatsu WX15 LHD is designed to deliver high performance and productivity.

This machine offers a first-rate power-to-weight ratio, a robust frame and system design, and a spacious, ergonomically designed operator cabin with a large footbox available in narrow and wide cabin configurations, making the product more fit-for-purpose for most operations.

With its versatile configuration, the WX15 is suited to create value for customer applications across underground mining operations.

This LHD also includes radio remote control and automation options, allowing the machine to complete an entire production cycle without manual supervision, further enhancing safety and productivity.

The matching mining truck to the WX15 is the Komatsu HX45, a robust and reliable machine delivering high power rating, excellent dumping angle and a leading turning radius.

The HX45 features an oscillating articulation with a front suspension system, enabling smooth manoeuvrability and reducing frame stress, helping to increase longevity of the frame and componentry.

Both machines are designed to work in tandem, offering productive

three-pass loading cycles for maximum efficiency in mining operations.

With a strong focus on safety, performance and maintainability, the WX15 and HX45 feature operatorfriendly cabs, CE certification, Tier 3 and Stage V engine packages, optional data loggers with Wi-Fi connectivity for digital analytics solutions, and proximity detection interfaces.

“These features allow the products to not only comply with local regulations but also provide for customised visibility into the machine performance, productivity and health, allowing customers to improve efficiencies across their operations continuously,” Komatsu said.

When it comes to operational flexibility of narrow vein equipment, Komatsu has the WX03, a small 3t LHD, and the WX04, a 4t LHD with a high lift boom.

For the 7t class narrow-vein loader, the WX07 is designed to improve versatility and operational flexibility, especially for truck loading. This loader is able to operate at altitudes of up to 4000m.

Komatsu has also taken the next step in globalising its narrow vein offering,

ensuring products like the WX07 and WX04 are also available with CE certification, Tier 4F and Stage V engine packages, and diesel particulate filters, allowing them to be sold into markets that are legislated accordingly.

The recently introduced HX30 underground mining truck boasts an ergonomic operator’s compartment with an additional emergency seat ideal for taking another person into or out of the mines or conducting training exercises, and an adjustable steering wheel for enhanced operator comfort.

The 30t truck comes with Tier 3 and Stage V engine packages with a 320kW engine. Also notable is the oscillating centre bearing, which allows for performance enhancing truck manoeuvrability and reduces stress on the frame while also maximising operator comfort.

The HX30 will complement the already proven 20t HX20 truck and the HX45, the largest truck in the offering at 45t, both of which come with an oscillating articulation.

For enhanced productivity underground, the HX30 truck is an ideal partner to the WX11 LHD and the HX20 truck can partner with the WX07 LHD for efficient threepass loading.

Rounding out the underground mining truck line-up are the 7t HX07 and 16t HX16 trucks, high-duty cycle loaders known for their long life and high productivity. These dependable workhorses combine power and efficiency with impressive breakout power.

Komatsu is also focused on sustainability.

The WX04B is its first batteryelectric LHD designed specifically for underground hard rock mining.

One of the standout features of the WX04B is its innovative battery swap system. Unlike systems that require extensive underground infrastructure, the WX04B’s battery swap can be performed at ground level without additional equipment or risks of rigging overhead loads, streamlining process reduces costs and complexity.

Komatsu pairs this innovative LHD with its new original equipment manufacturer (OEM)-agnostic 150kW battery charger, a robust solution built for the demands of hard rock mining.

From a technology standpoint, Komatsu’s underground loaders and trucks are available with proximity detection systems (PDS) Level 9 interface, as well as automation-ready and available with digital analytics and vehicle tracking solutions, which can be customised to support specific customer and application needs.

LHDs and haulage trucks are the backbone of any hard rock operation, with safety, efficiency, reliability and performance of highest importance for mine site operators.

From a comprehensive range of diesel and electric loaders and trucks – spanning from narrow-vein to mass mining applications – to innovative battery-electric LHDs with intuitive battery-swapping solutions, Komatsu demonstrates a commitment to productivity, operator comfort, and environmental stewardship. AM

RESHAPING

MINING WITH SMART, SUSTAINABLE BLASTING SOLUTIONS THAT OPTIMISE COSTS AND BOOST SAFETY.

BME is transforming the future of underground mining through a combination of advanced technology, safety leadership, and a deep commitment to sustainability.

This was the key message in BME’s recent webinar, ‘Advancing Underground Mining with BME’s Innovative Blasting Solutions’, where company experts detailed how their integrated offering is redefining blasting standards and operational excellence across the globe.

“For us at BME, we believe blasting is both an art and a science,” BME regional manager for underground operations Derek Menezes said.

“The science is backed by our in-house products, technology and equipment, which are designed to reduce ground vibration, air blast and flyrock, both on the surface and underground.

“The art comes from BME’s technical expertise and knowledge and linking that up with our products, technology and equipment.”

BME’s integrated approach is becoming increasingly relevant as mines face growing pressure to reduce environmental impact and maintain their licence to operate.

Menezes said BME’s innovations are enabling mining companies to improve cycle times while minimising noise, vibration and NOx gases, contributing to safer and more sustainable operations.

BME has built its underground offering around five core pillars: cost control, precision, equipment longevity, ground control and environmental stewardship.

Menezes said explosives typically represent 5–15 per cent of a mine’s operational cost. This makes blast optimisation an important lever in cost reduction.

By achieving better fragmentation, operators can reduce dig times, limit machinery wear and tear, and speed up load and haul processes.

At the heart of BME’s solution is its dual salt emulsion technology, which delivers consistent energy output while producing minimal toxic NOx gases after a blast.

This supports faster re-entry to the work area and reduces the need for excessive ventilation. Combined with

smart blast design and execution, it offers a more stable and predictable approach to underground operations.

BME operations manager Crevice Mala expanded on the company’s digital technology, focusing on the AXXIS Silver electronic detonator and centralised electronic blasting system (CEBS).

Developed in-house, these systems are designed to provide unparalleled control and accuracy in complex underground environments.

“Safety is paramount,” Mala said. “Our CEBS set-up includes secure access and programmable detonators, which means only authorised personnel can initiate blasts. The system also supports phased firing, reducing the risk of seismic triggers and fall-ofground incidents.”

The AXXIS Silver detonator delivers firing delay accuracy of 0.0025 per cent, enabling simultaneous blasting and improved fragmentation. Fewer misfires and reduced environmental impacts are just some of the benefits. The system can be adapted to suit various mining methods, including narrow-reef, sublevel caving, and long-hole operations.

Real-time diagnostics, self-monitoring and post-blast analysis further strengthen BME’s value proposition, enabling operators to improve decisionmaking and maintain production targets.

Smart blasting doesn’t stop at initiation systems, with BME’s pumpable emulsion technology and Smart Emulsion Charging Units (Smart ECUs) creating a seamless underground delivery system.

The Innovex dual salt emulsion, which is non-explosive until sensitised underground, has proven to be resilient under extreme handling conditions.

“We’ve dropped the emulsion over 1000m in a single pass with no change to its performance,” Mala said. “It can also be pumped multiple times without crystallisation or degradation.”

The emulsion is classified under UN 5.1 and suitable for all hole diameters, with a shelf life of up to six months. It’s sensitive at low and high densities, which is essential for underground blasting.

Smart ECUs are built for durability and flexibility, with dual-pump systems allowing charging to continue even if one pump fails.

These units are compatible with different carrier types and offer real-

time data collection to inform better on-site decisions.

BME explosives engineer Aviwe Dubula closed the webinar with a series of case studies showing how the company’s solutions are delivering realworld improvements.

A mine experiencing poor ground conditions and unstable tunnel walls implemented BME’s smooth-wall blasting technique using the Innovex emulsion. The result was a more stable hanging wall, better fragmentation and improved advance per blast. This was

all possible without additional costs or changes to the existing parameters.

“The team executed the project from drilling to post-blast analysis, demonstrating the benefits of a consistent and well-managed blast process,” Dubula said.

Another project saw a customer struggling with out-of-sequence detonator firings and low ore recovery.

BME’s global technical services team optimised the design parameters and remedied the problem areas with the implementation of the company’s Viperdet range of nonelectric initiation system, resulting in a 17 per cent increase in ore recovery and a significantly improved blast shape.

These results, combined with reduced nitrate leaching from BME’s emulsion, contributed to stronger environmental performance and safer underground conditions.

BME has reinforced its commitment to providing complete underground solutions that integrate people, technology and products.

“Good fragmentation isn’t just about breaking rock,” Menezes said. “It’s about controlling your entire value chain – from blast design to downstream processes – and achieving safe, sustainable, cost-effective outcomes.”

With growing demand for more efficient and responsible mining, BME is positioning itself as a leader in smart blasting.

Its tools, technologies and people are helping underground operations achieve higher productivity, lower emissions and better results. AM

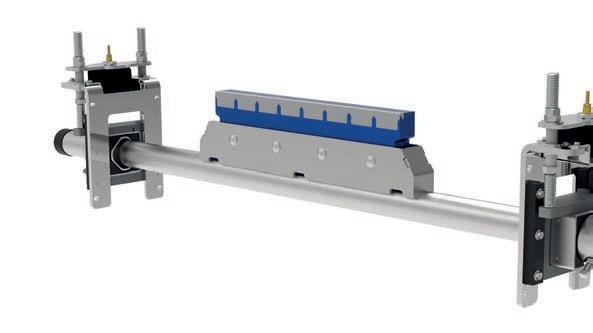

Flexco is setting a new benchmark in underground conveyor belt cleaning with its latest innovation, the continuous blade secondary (CBS) belt cleaner.

The popular CBS cleaner was originally designed as a heavy-duty, robust secondary cleaner for surface applications, but Flexco’s willingness to reimagine its use has led to strong results in underground mining.

This development, equipped with a fire-resistant and anti-static (FRAS) polyurethane blade, is proving to be a game-changer for mining operations, particularly in the water-heavy, high-compliance environment of underground coal.

“Through internal discussions between myself and the New South Wales territory manager, we identified potential for the CBS cleaner to be used in underground coal applications,” Flexco regional manager Sebastian Olguin told Australian Mining

The new venture began with a trial installation at a site in southern New South Wales. From there, the product’s value became immediately clear, addressing a long-standing issue: effective removal of carryback in wet, high-volume conditions.

“Underground coal tends to run a lot of water, not just for dust suppression but

also for maintenance and safety,” Olguin said. “The CBS cleaner has a unique squeegee-like effect that helps remove carryback material, which is otherwise hard to clean on underground belts.”

The CBS cleaner uses a 50mm-thick polyurethane block embedded with tungsten. This design provides the durability to tackle stubborn debris while maintaining enough flexibility to wipe the belt clean.

“The tungsten helps dislodge difficult material, while the polyurethane acts as a barrier to ensure nothing gets through,” Olguin said.

This single-piece blade is a departure from traditional segmented cleaners, achieving full-width coverage with no gaps, ensuring no streaking on the belt.

The cleaner is also easy to install.

“You’ve got one solid blade and an air tensioner to apply constant blade-tobelt contact,” Olguin said. “It’s simpler to install than many other systems that require manual tensioning.”

The CBS cleaner is also compatible with mechanical belt fasteners, which are commonly used in underground coal operations.

The cleaner integrates seamlessly with Flexco’s spring air tensioner (SAT), a system designed to handle mechanical fasteners with ease.

“The SAT allows for lateral movement of the cleaner,” Olguin said.

“When a mechanical fastener comes around, the cleaner reacts and twists slightly to provide an additional point of relief. Without that relief point, you risk damaging the fasteners or the blade.”

The SAT tensioner, which can also be run with nitrogen or water (though air is most common), offers continuous, adjustable pressure while preserving blade integrity.

A mine site in southern New South Wales recently saw two CBS cleaners installed over a sump. The outcome? A major improvement in water and material removal.

“They were running a primary cleaner and two secondary cleaners, yet excessive amounts of water were still getting past the existing cleaners,” Olguin said.

“Since installing our CBS cleaners, material hits the blade and drops straight into the sump, eliminating carryback running down the conveyor line.”

This reduction in carryback enhances not just belt efficiency but also safety and maintenance.

With reduced carryback travelling back along the conveyor, the risk of slips, trip hazards or equipment wear decreases significantly.

“No maintenance has been required since the cleaners have been installed, showcasing the reliability of the tensioning system, as well as the durability of the cleaner,” Olguin said.

The product’s success isn’t limited to coal. Flexco is also seeing strong performance in gold and iron ore environments.

Adding further value is Flexco’s commitment to local manufacturing. The FRAS polyurethane compound is poured in Australia, helping to ensure a high level of quality control and faster turnaround times for customers.

“By pouring the compound locally, we’re able to quickly deliver product to customers and support the Australian manufacturing industry,” Olguin said.

And while polyurethane blades often come with concerns about wear rates, Flexco has engineered the CBS cleaner to counter that issue.

“People assume polyurethane wears quickly,” Olguin said. “But the tungsten insert slows wear dramatically.”

As operations across Australia look to improve safety, reduce carryback and minimise maintenance, Flexco’s new FRAS blade-equipped CBS cleaner offers a practical, reliable and locally manufactured solution.

Serving the mining industry across Australia. Whether you’re in Western Australia’s iron ore heartland, the coal fields of Queensland, or the mineral-rich regions of New South Wales and South Australia, our regional service centres are ready to support you with expertise, repair and machining services.

FLS’s state-of-the-art Service Centres in Australia are strategically located near major mining regions.

You can be sure our team is ready to meet your needs by

■ Reduce downtime - mining experts on your doorstep, for planned maintenance or an unplanned outage

■ Local machining facilities - reduce lead time for spare and wear parts, repairs, rebuilds, exchanges

■ One-stop-shop supports performance improvement –training, engineering or onsite support

GEOVIA’S UNDERGROUND DESIGNER IS BRINGING AEROSPACE-GRADE AUTOMATION AND PARAMETRIC PRECISION TO UNDERGROUND MINE PLANNING.

In underground mining, where time is money and precision is paramount, even minor design errors or delays can have costly consequences.

But what if redesigns could take minutes instead of months?

That’s the promise of Dassault Systèmes’ new GEOVIA Underground Designer role.

At the core of this innovation is parametric modelling – a powerful design methodology long trusted by industries like aerospace and automotive. Now, Dassault Systèmes is applying the same precision and flexibility to the mining sector.

Dassault Systèmes GEOVIA industry process expert Christina Ludwicki has been deeply involved in developing and adapting this technology for underground mine planning.

“I come from underground mining and have spent months on a single design, only for it to be changed and thrown away,” Ludwicki told Australian Mining

“That’s why I fell in love with this technology – it’s fast, flexible and completely parametric. You change one element, and everything updates automatically. That’s a game-changer.”

Traditional mine design is notoriously time-consuming, involving manual updates and often disconnected workflows.

GEOVIA Underground Designer leverages CATIA, an engineering and design program behind Boeing’s 777 and 787 aircraft, to offer a dynamic, parametric design environment.

“Everything is connected,” Ludwicki said. “If I change the length of a heading or the position of a point, all the related infrastructure – stopes, drives, raises –update in real time. That ability alone cuts weeks off design timelines.”

This isn’t just about speed, it’s about enabling mining engineers to explore multiple strategic options quickly.

“You can now test 10, 20, even 30 design scenarios in the time it used to take for one,” she said. “That flexibility enables better decisions based on real constraints like changing cut-off grades or unexpected geological structures.”

While the role’s capabilities are advanced, Ludwicki said ease-of-use remains front of mind.

“It does require a mindset shift from traditional workflows,” she said. “But once users grasp the parametric logic –that everything’s an input or output – it becomes intuitive.”

The visual scripting engine adds further customisability for power users, allowing teams to build automated workflows tailored to their specific methods, whether it’s longhole, block caving or cut-and-fill.

“You don’t need to go deep into scripting if you don’t want to,” Ludwicki said. “There are simple tools for everyday use. It just depends on what problems you want to solve.”

GEOVIA Underground Designer doesn’t just build static plans, it creates fully parametric models, so any updates – whether due to a new fault, changed production targets, or updated geotechnical data – can be incorporated instantly.

“This is the foundation of a virtual twin,” Ludwicki said. “A design that evolves with your mine, and that reflects real-time decisions and inputs.

“And because it’s cloud-based, everyone – from engineers to analysts – can collaborate on the same up-todate model.”

The cloud-based 3DEXPERIENCE platform allows teams to work together globally. Permissions can be set, changes tracked, and visualisations shared instantly across the value chain.

While the Underground Designer role was only officially released in July, its technology has been stress-tested through years of development and internal use.

“This is aerospace-grade technology being tailored for mining,” Ludwicki said. “If you can model a jet engine, you can model a stope.”

She points to a recent block cave model built entirely using the new tools.

“It took under two weeks, and everything – every ring, every access point – was parametric and simulationready. In the past, that could’ve taken months.”

As the industry embraces automation, virtual twins, and ESG-driven efficiencies, Ludwicki sees Underground Designer as the logical next step.

“We’re helping clients get from strategy to operation faster and more accurately,” she said. “We can simulate, evaluate, and adapt before committing millions of dollars underground.”

While still in early deployment, Dassault Systèmes is actively seeking strategic partners to adopt and refine the technology in realworld environments.

“We don’t expect everyone to jump in blindly,” Ludwicki said. “This is new tech for mining, and we want to work hand-in-hand with clients to build the right models for their challenges. Once the framework is there, it’s yours to tweak, update and evolve as needed.”

For mines navigating tighter margins, ESG requirements, and shifting production targets, GEOVIA Underground Designer offers a rare combination of speed, accuracy and adaptability.

“This is just the beginning,” Ludwicki said. “We’ve built the foundation. Now, it’s about seeing how the mining industry takes it forward.”

With GEOVIA Underground Designer, the age of reactive mine planning may soon be behind us.

For those ready to embrace parametric tools and digital collaboration, the future is already here.

JSG INDUSTRIAL SYSTEMS IS ENHANCING UNDERGROUND MINING EFFICIENCY THROUGH ITS RANGE OF LUBRICATION SYSTEMS AND PUMPS, FUEL NOZZLES AND RECEIVERS.

For almost 60 years, JSG Industrial Systems has been a leading provider of quality lubrication and flow management solutions for the mining industry.

Building off its decades-long legacy, John Sample Group sold JSG to SKF Group in late 2024.

JSG has since been integrated into SKF’s existing lubrication management business, strengthening the latter’s mining capabilities across Australia and New Zealand.

“It combined JSG’s deep industry knowledge, local support and customer relationships with SKF’s global brand recognition and market leadership,” JSG said.

“JSG offers a well-established and capable dealer and distributor network.

“This synergy enables faster service, engineered lubrication solutions,broader product access, and streamlined supply chains for underground mining operations.”

As mining operations continuously look to enrich performance and expand machine longevity, JSG joining the SKF family comes at the perfect time for the industry.

According to SKF, while lubricants account for just 2–3 per cent of a machine’s running costs, poor lubrication contributes to 40–60 per cent of maintenance expenses.

This demonstrates the importance of reliable lubrication practices, especially in underground mining applications.

SKF’s automatic lubrication systems deliver precise amounts of lubricant to critical components such as joints and bearings at predetermined intervals, minimising human intervention and ensuring consistent lubrication. Each system comprises a central reservoir, metering valves, distribution lines, and electronic controllers.

Utilising a single supply line to automatically deliver lubricant to injectors, each serving a specific lubrication point, single-line lubrication systems can be customised to cater to single machines, zones or multiple machines. Progressive lubrication systems, on the other hand, are designed to automatically distribute the correct amount of lubricant to multiple points in a sequence.

“Automatic lubrication systems offer a proven solution, reducing downtime,

extending equipment life, lowering operational costs and minimising environmental impact by preventing over-lubrication,” JSG said. “These systems also improve safety by reducing manual handling and freeing technicians

for other tasks. In a landscape where a single missed lubrication point can affect productivity, effective lubrication management – enabled by smart, connected systems – is essential to keep operations running efficiently.”

Automating and monitoring lubrication helps to inform preventive maintenance and planning at a swifter pace compared to proper manual lubrication.

“Proper manual lubrication usually takes about 15 to 20 minutes per machine and maintenance cycle,” JSG said. “Failure to properly lubricate each lubrication point on every machine can have a negative impact on schedules, maintenance costs and running time performance.”

Ideally suited to continuous miners and underground dump trucks, SKF’s lubrication systems are built to withstand coal dust, water spray, high temperatures or heavy shock loads. They are designed to ensure consistent and thorough lubrication of all critical points and components, boosting productivity and minimising downtime.

“If dust, dirt, sand and water are allowed to work their way into critical machine components, they form a ‘grinding compound’ that reduces components life substantially,” JSG said.

“Maintaining a proper lubricant film is key to reducing wear and downtime. Frequent lubrication reduces friction and keeps bushing and bearings free of penetrating contaminants.”

SKF’s lubrication systems have seen great success in the mining industry, with a SKF Lincoln P653 pump being used with injectors on agitators and haul trucks from a Caterpillar customer.

Easy to mount and compatible with one of seven different reservoir sizes, the P653S pump has reservoir capacities ranging from 4–100L and

provides flexible options for different operational scales.

“These single-line systems were chosen for their adaptability, compact design and consistent performance,” JSG said.

Proven in the toughest mining conditions, SKF’s lubrication systems and pumps are built to deliver reliability underground and on the surface.

JSG has built strong relationships with premium suppliers over the years. This includes a partnership with FloMAX International, a US-based fluid management solutions provider.

FloMAX manufactures industrial fluid transfer system components such as fuel nozzles and fuel receivers, both of which play a critical role in proficiently delivering and transferring fuel to machinery.

Fuel nozzles control the flow, atomisation and mixture of fuel with air, whereas fuel receivers facilitate a secure connection and flow between fuel lines.

FloMAX’s fuel nozzles provide users with a leak-free process to transfer large fuel volumes at high flow rates. Available in multiple designs and configurations, FloMAX’s nozzles accommodate different types of fuelling systems and equipment.

The FNBL nozzle offers durability and reliability in harsh mining conditions due to its all-metal construction and stainless-steel nose.

Known as one of the smallest and lightest diesel units at just 2.7kg, the FNBL nozzle holds a minimum flow

rate of 151L per minute and maximum flow rate of 682L per minute.

Able to latch with 10 stainless steel balls, FNBL’s pullback assembly is removable without tools, making it easy to clean, maintain and repair on-site.

While the FloMAX FN600 nozzle holds the same flow rate and weight as the FNBL, it works best in maintenance facilities and less demanding environments.

“The FN600 nozzle has latching dogs and the FNBL nozzle uses a ball lock design,” JSG said. “Both nozzles come with an optional ball-bearing 1.5-inch NPT swivel.

“An available plug is specially designed to seal out dirt and contaminants and is attached with a S/B 1/8-inch coated wire lanyard. A patented removable piston assembly allows the cylinder to be easily removed for rebuilding.”

FloMAX’s fuel nozzles can connect to all standard fuel receivers and be adapted to specific customer needs.

In addition, all FloMAX fuel receivers are designed with a patented enclosed poppet stem spring that provides a smooth fuel flow path, extending the life of the receiver and nozzle.

“This greatly enhances the life of both the receiver and fuel nozzle due to the decrease in fuel restriction and vibration,” JSG said.

“Our FR-RS fuel receivers also have a patented removable stainless steel wear sleeve. This innovative patented concept allows the fuel receiver wear surface to be replaced quickly and easily without removing the fuel receiver from the tank or incurring any fuel loss.”

COBRA HOSE REELS ARE ENGINEERED TO WITHSTAND TOUGH WORKING ENVIRONMENTS AND EXTREME CONDITIONS.

To further strengthen a mine’s fuelmanagement system, JSG offers the Cobra range of heavy-duty hose reels – designed with quality, durability and serviceability at the forefront.

Suitable for underground coal mining, the Cobra spring-rewind reel and hydraulic-rewind reel are built with a compact frame for spacelimiting installations.

The Cobra spring-rewind reel features a drive spring constructed from high carbon steel for strong hose retraction, while the Cobra hydraulic rewind reel boasts a high strength and rigid frame and drum. This reduces operator risks as less effort is required in extending or retracting large or long hoses.

The Cobra pneumatic-rewind reel has an epoxy powder coat finish and a right-angled gearbox for compact design and durability. A direct mount drive also helps avoid pinch points.

“The Cobra heavy-duty hose reel range is engineered to withstand harsh, hazardous and difficult working environments simultaneously,” JSG said.

“These conditions require the best quality hose reels, which must be designed to accommodate critical factors relevant to each application, such as dimensions, drive type or materials used.”

Efficient lubrication and fuel management is critical to underground mining operations maximising resource recovery.

Luckily, JSG has the product range to withstand challenging working conditions and ensure miners stay on top of productivity. AM

CORTEX SMARTDRILL’S MACHINE DATA PROVIDER IS BRINGING CRITICAL REAL-TIME INSIGHTS FROM BELOW THE SURFACE.

CORTEX SMARTDRILL’S MACHINE DATA PROVIDER COMBINES REAL-TIME REMOTE MONITORING, TELEMETRY AND ANALYTICS, AND LOCAL EDGE COMPUTING.

As underground mining continues to push deeper, the need for smarter and cost-effective solutions is ever more vital.

This is where Cortex Smartdrill, a leading telemetry data analytics provider, can help.

Western Australia-based with distributors nationwide and internationally, Cortex Smartdrill believes the key to efficient mining operations is harnessing real-time data in a seamless, reliable and affordable manner. Its Machine Data Provider (MDP) is a rugged, original equipment manufacturer (OEM)-agnostic telemetry and data acquisition system designed to capture, process and deliver high-value operational information from mobile mining equipment in real-time.

“It works by interfacing with OEMs’ machine control systems and sensors to collect data on performance, usage, health and operator inputs,” Cortex Smartdrill executive general manager Mike Lane told Australian Mining

“This data is then processed locally on the edge device and securely transmitted to cloud or site-based, user-configurable dashboards for use by production teams,

maintenance planners, data analysts and management, enabling faster, evidencebased decisions.”

Built with a modular design and plugand-play retrofit capability, the MDP was originally developed for surface drill rigs; however, the system can now be installed on any piece of underground equipment, including load haul dump trucks (LHDs), drill rigs, loaders, and service and utility vehicles – all without disrupting existing control systems or costly customisations.

“Retrofitting the MDP to underground equipment is remarkably straightforward,” Lane said.

“Installation typically takes less than a shift and does not require OEM intervention nor affect their warranty, making it ideal for operations looking to digitise their fleet without replacing equipment.”

When adapting the MDP for underground use, Cortex Smartdrill considered challenges such as limited and inconsistent connectivity, space constraints, and equipment vibration.

“The MDP addresses these challenges with compact industrial-grade hardware, compressed data files, intelligent storeand-forward logic for offline operation,

and a low-impact footprint for confined cabins,” Lane said. “It’s designed to withstand harsh underground conditions while maintaining full data logging and transmission capability, even in disconnected or meshnetwork environments.”

Using a store-and-forward mechanism to cache data locally until a wireless network connection is available, the MDP logs all machine activity, operator inputs and system alerts. It also includes optional machine video streaming.

“Once in a network node range, the system synchronises data automatically without human intervention, ensuring no data is lost and insights remain timely and actionable, even in highly segmented or intermittently connected underground zones,” Lane said.

The gathered data is accessible via secure dashboards tailored to maintenance crews, shift supervisors, operations managers, and head office analysts. The information can then be used to prepare and streamline

shift reports, service logs and safety reviews,and to schedule maintenance interventions before equipment failures take place.

This not only saves time and operating costs but increases productivity, reduces unplanned downtime, and enhances safety compliance and equipment life and scheduling.

“In a recent deployment, a client operating both surface and underground rigs used MDP data to identify excessive non-productive time, providing databacked evidence to trial and implement effective changes,” Lane said.

“If you can measure it, you can control it.

“By adjusting operator practices and rescheduling maintenance based on real machine hours rather than assumed usage, the site increased equipment availability by 11 per cent and reduced fuel costs by over $150,000 annually.

“The same dashboards also highlighted a training gap in one shift, leading to targeted coaching that improved performance within two weeks.

“Adjustments to processes and targeted operator training led to a five per cent throughput increase and over $150,000 in annual fuel savings.

“Maintenance intervals were also optimised, extending component life and reducing unplanned repairs.”

With several underground operations still relying on manual reporting, Lane

believes there’s a gap in scalable, retrofit user-friendly telemetry solutions that provide real operational insights across mixed OEM fleets.

“Many mines lack visibility into what their equipment is actually doing –especially in underground operations – and relying instead on assumptions or

delayed manual reporting,” Lane said.

“The MDP closes this gap by delivering real-time, machine-level visibility without requiring a full systems overhaul for all makes and models of plant on a single platform.

“As mining increasingly seeks low-cost digital transformation and automation-

readiness, the ability to deploy MDP across legacy and new equipment alike is a significant strategic advantage.”

Looking to the future, CORTEX Smartdrill is focused on expanding the MDP by including advanced modules for machine-learning-based predictive maintenance, precision tramming analytics, operator behaviour scoring, and dynamic shift benchmarking.

Also on the agenda is integration with ventilation-on-demand systems and energy optimisation tools, which is expected to help MDP users reduce their carbon footprint while maintaining productivity levels.

“We’re also developing plug-in capability for environmental and geotechnical sensors, enabling a unified view of machine health and ground conditions on a single platform,” Lane said.

“As the industry moves toward autonomous operations, CORTEX Smartdrill is ensuring the MDP becomes a foundational enabler by collecting, contextualising and acting on data at the source.

“Our vision is to provide underground mines with the same level of visibility, control and continuous improvement that our surface clients enjoy today – without the need to overhaul their fleets or infrastructure.” AM

• Up to 5,278m2 Light Coverage

• 420Wp solar panel

• Compact design

• Robust HardHat® canopy

•Mask down feature as standard

secure your stock today with our exclusive introductory offer!

The best performing underground operations have confidence that they can push their equipment to the limits without unintended movement.

Recognising that unscheduled breakdowns are an operator’s worst nightmare, Timken’s PT Tech is making waves in the Australian market with its innovative enclosed wet brakes and torque-limiting clutches.

Since acquiring PT Tech in 2017, Timken has been broadening its reach beyond its heritage in bearings, delving deeper into underground mining technology. Timken national mining manager Mark Davies said the move has given the company exposure to critical underground equipment segments previously outside of its product range.

“PT Tech has been designing and developing brakes and clutches for the mining industry for over 25 years,” Davies told Australian Mining. “PT’s enclosed wet brake is considered one of the most reliable and high-performing braking solutions for underground mobile equipment globally.”

Central to the PT Tech portfolio is the A+ enclosed hydraulic brake, a product renowned in the industry as “the brake that lasts”.

Designed for continuous miners, shuttle cars, longwall shearers and more, the A+ brake offers a spring-set parking brake and a dynamic service brake in one compact unit.

“It’s not just about stopping power,” Davies said. “These brakes are engineered to meet the highest safety standards, especially in high-risk environments like coal mines.

“Being fully enclosed, they eliminate fire risks caused by heat and dust ingress – critical for explosive atmospheres underground.”

PT Tech’s through-shaft cooling technology increases brake survivability and durability and, according to the company, outperformed competitors in rigorous in-house testing.

With lower drag and less heat generation, the A+ brake is designed to enable greater productivity without compromising safety.

“We keep these brakes in stock and offer local servicing through our

authorised distributor network,” Davies said.

“We also have servicing capabilities in Sydney, which gives our customers nationwide support.”

What makes the A+ even more attractive for Australian mining operators is its interchangeability with competitor systems, allowing for straightforward integration into existing fleets.

Spare parts kits, including replacement discs, compression plates and wear indicators, are readily available.

Underground mining is no place for guesswork, especially when it comes to brakes. That’s why the A+ brake is designed to be tamper-proof, a feature Davies said is a critical differentiator.

“These brakes can’t be adjusted on-site,” he said. “They’re factory-set to meet OEM (original equipment manufacturer) specifications and once they wear out, they’re replaced or rebuilt entirely.

“That removes the risk of incorrect adjustment by maintenance crews, which can be a serious safety hazard.”

Fitted with the dynamic service brake, used when the vehicle is in motion, and the spring-loaded parking brake, the system ensures multiple layers of fail-safe stopping power.

For mine sites where narrow margins can separate routine operations from disaster, this assurance is worth its weight in gold.

PT Tech doesn’t just stop at brakes. The company also manufactures torque-limiting clutches (TLCs) such as its UJT-500 series, built for longwall machinery and continuous miners.

These clutches act like a mechanical fuse, disconnecting drive systems

during overloads to help prevent damage and downtime.

“Imagine a continuous miner cutting through coal,” Davies said. “If it hits a rock seam, the torque spikes and the cutter head could stall or get damaged.

“The torque limiter absorbs that shock, disengaging the drive momentarily, then reconnecting once the load normalises.”

Unlike traditional shear pins or pressure-slip devices, the UJT-500 is continuously engaged, with no need for lubrication or adjustment throughout its lifecycle.

Its tamper-resistant torque settings are calibrated at the factory using colourcoded spring cup bolts, which eliminate the potential for on-site misconfiguration.

“You don’t need special equipment to check torque settings. Just count the bolts and match the colours,” Davies said. “It’s designed to simplify maintenance and eliminate human error.”

The UJT also features a graphited bronze bearing for permanent lubrication, a wear indicator for quick visual inspections and optional output configurations to match common driveshaft set-ups used in mining vehicles.

THE UJT FEATURES A GRAPHITED BRONZE BEARING FOR PERMANENT LUBRICATION.

While PT Tech’s technologies are widely embedded in North American mining operations, Timken is working

the full landscape of Australian underground mobile fleets, but the foundation is solid.

“We’re focused on promoting these products through our distributor network, backed by strong local support,” he said.

“Our goal is to provide both OEM and after-market customers with a comprehensive solution –not just a product but a reliable, supported system that improves both safety and efficiency.”