We are your strategic partner for packaging excellence.

Our people, products, and services ensure seamless processes, innovative technologies, and sustainable solutions. Based on your needs, challenges, and opportunities, we are committed to strengthening your market position and fueling your growth. At Syntegon, we co-create and co-succeed.

Discover how we can elevate your processing and packaging solutions in the food and pharmaceutical industries, and service.

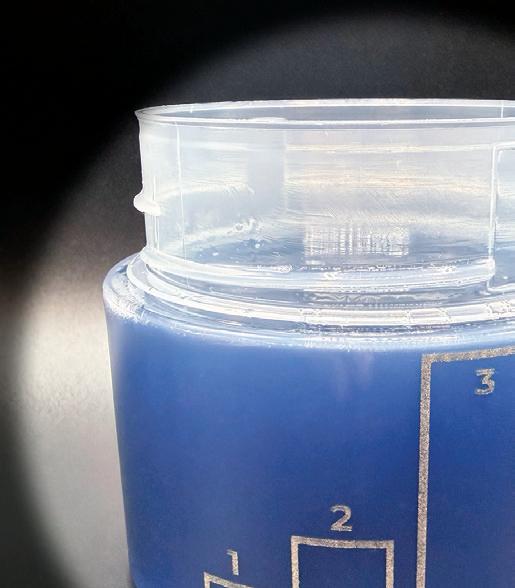

Laser marking on Tide’s polypropylene cap creates permanent, label-free branding and dosing cues. P&G uses this digital process to brand on-shelf and give consumers dosing guidelines while keeping the closure fully recyclable and produced at line speed.

24

Krusteaz Streamlines

Packaging Artwork Management for Speed, Accuracy

Moving from manual packaging artwork reviews to a digital workflow, baking mix company Krusteaz improves collaboration, speeds approvals, and ensures every label is accurate.

28 COVER STORY

P&G’s Tide Laser Marks Cap for Dosing, Branding, Recyclability

A new laser-marked closure eliminates labels and inks while giving consumers permanent, easy-to-read dosing guidance.

30

Great Earth Expands Use of Fiber-based Closures to Entire Line

A Swedish nutraceutical brand rolls out paper screw caps across all supplement jars, a first large-scale commercial use of Blue Ocean Closures’ molded fiber technology.

32

This specialty coffee roaster saw an opportunity when a customer asked for compostable packaging materials. “We’re heavily invested into doing this right,” says the firm’s president.

Jan Brücklmeier Technical Application Group Packaging Technology Expert, Nestlé

M. Shawn French Director – Innovation & Packaging Engineering (Beverage), Danone North America

Patrick Keenan R&D Packaging Engineer, General Mills/Annie’s Organic Snacks

Tim Lehman Sr. Engineering Manager, Supply Chain, GOJO Industries, makers of Purell

Mike Marcinkowski Director of R&D Material Science, Packaging & Sustainability – Nature’s Vault/Fresh Loop

Shannon Moore Director Global R&D Packaging Sustainability, Kellanova

Andrew Seys Senior Director, Global Operational Excellence, Spectrum Brands

David Smith, PhD Principal, David S. Smith & Associates

Brian Stepowany Packaging R&D, Senior Manager, B&G Foods, Inc.

Matt Reynolds Chief Editor

Anne Marie Mohan Senior Editor

Sean Riley Senior News Director

Casey Flanagan Associate Editor

Kim Overstreet Director of Content

Pat Reynolds, Sterling Anthony, Eric F. Greenberg Contributing Editors

David Bacho Creative Director

Reggie Lawrence Vice President, Sales rlawrence@pmmimediagroup.com

Courtney Nichols Director, Client Success & Development cnichols@pmmimediagroup.com

Lara Krieger Senior Manager, Print Operations lkrieger@pmmimediagroup.com

Janet Fabiano Financial Services Manager jfabiano@pmmimediagroup.com

David Newcorn President

Elizabeth Kachoris Vice President, Digital

Trey Smith Senior Director, Events

Jen Krepelka Senior Director, Digital Media

Amber Miller Director of Marketing

Joan Jacinto Director, Ad Tech and Search

Joseph Angel Founding Partner and Executive Vice President, Industry Outreach, PMMI

Questions about your subscription or wish to renew? circulation@pmmimediagroup.com.

PMMI Media Group

500 W. Madison, Suite 1000, Chicago, IL 60661 Web: www.pmmimediagroup.com

PMMI The Association for Packaging and Processing Technologies 12930 Worldgate Dr., Suite 200, Herndon VA, 20170

Phone: 571/612-3200 • Fax: 703/243-8556 • Web: www.pmmi.org

Flexible film recycling has hovered in “too difficult” territory for years, but conversations at The Flexible Packaging Association’s FlexForward conference last month showed the industry is now treating it as an economic problem first. Technology and infrastructure still matter, but economics will determine whether flexible packaging becomes recyclable at scale. California’s SB 54 deadlines sharpen that reality. Pat Keenan of General Mills didn’t sugarcoat it: “If it’s not recyclable, by 2032, you can’t ship it in California.” That forces brands to rethink substrates, redesign structures, and engage directly to accelerate the creation of recovery systems instead of waiting for them to appear.

General Mills and several peers launched the U.S. Flexible Film Initiative (USFFI) after concluding that films don’t move from material recovery facilities (MRFs) to end markets under current economics. “You need to subsidize the cost of a bale of film,” Keenan said. The point is simply to give MRFs a good reason to sort and sell flexible film into responsible end markets.

P&G is approaching the same gap in a complementary fashion through CalFFlex, a project under The Recycling Partnership (TRP). P&G’s Teo Medellin said, “We can pay the toll that is going to be fair for the processing of this material.” If brands want PCR, they have to help finance the systems that produce it.

But subsidies alone aren’t enough. Recovered material still needs a home. “Right now, there’s no demand for it,” Keenan said. USFFI research shows most shoppers “have no idea what [recycled content] means,” so brands can’t count on consumer pull. They have to put the very PCR they’re asking recyclers to supply to use in their own packaging applications.

These end markets are the central bottleneck. Jeff Fielkow of the Circular Action Alliance (CAA) said, “The biggest problem that needs to be unlocked is the end-market demand and pull, period.” Danielle Easdale of TRP agreed: “demand, demand, demand for the end markets.”

Neil Menezes, formerly of General Mills, now with CAA, warned that collecting film before demand exists could be “an absolute disaster,” even if it were only a temporary state. If skeptics were to follow material through costly, difficult-to-build systems only to see it landfilled, the result could be a public (and public relations) failure that undermines the system. Design, sortation, processing, and endmarket development have to advance together at a similar pace to avoid such outcomes.

Technology upgrades can help. P&G introduced Flexloop, a solvent-based mechanical extraction system developed with Lindner that removes “odors, adhesives, inks, and other impurities,” producing cleaner PCR suitable for higher-value uses. With fewer food-contact constraints, P&G can push purification technologies that expand mechanical recycling’s reach.

More constrained by food-contact requirements, GM is designing around mono-polyethylene because it aligns with the mechanical recycling pathways Keenan expects will still dominate by GM’s 2030 recyclability deadline. PE currently has the clearest near-term path to flow through those systems.

Design simplification remains critical. Menezes noted that consumers don’t distinguish PE from PP or PET—“to them, it’s just plastic”—but sortation equipment certainly does. Highly customized structures and heavy printing degrade bale quality, while monomaterial formats improve consistency and reduce processing costs.

Durable goods manufacturers are providing essential bridge markets. Decking, roofing membranes, and construction products can absorb significant volumes of recovered film while film-to-film markets mature. As Anne Johnson of Resource Recycling Systems (RRS) noted, roofing membranes “can pull material through the system continuously,” stabilizing the flow until packaging-grade demand grows.

Flexible packaging’s challenges weren’t created by any one stakeholder. The system wasn’t built for circularity, and the entire value chain—brands, converters, recyclers, and now PROs—is now trying to retrofit circularity onto infrastructure and economics never designed for it. Keenan and Medellin emphasized the role converter suppliers can play in developing recyclable monomaterial films with PCR content, and a huge plus would be for it to have food-grade “Letter of No Objection” validation.

It’s not easy work, but incentives might be aligning. If stakeholders follow through, the economics may at last support the circularity flexible packaging has been waiting for. PW

Test the SQUID INK CoPilot for high-resolution case coding or the LEIBINGER IQJET for small-character printing, both engineered for uptime and proven reliability.

The Sustainable Packaging Coalition (SPC) launched a new Retailer Forum project inviting packaging film suppliers to submit low-barrier flexible film concepts designed for improved recyclability and sustainability. Driven by major retailers such as Amazon, Walmart, CVS Health, and Target, the initiative focuses on private-label brands like Walmart’s Great Value brand, and specific products that do not require high-barrier materials to prevent spoilage, for extended shelf life, or for other forms of protection.

According to SPC, flexible packaging formats with low-barrier requirements, like polybags for durable goods, refill packs for household and personal care items, or secondary pouches for nonfood products, represent an opportunity to advance circularity without compromising product protection. High-barrier, multi-layer laminations films (for instance, those incorporating aluminum or multiple tie layers) are difficult to recycle, as are coextrusions. But single-material polyethylene (PE) films, including some newer ones with decent water vapor or oxygen transmission prevention properties, can often be collected through store drop-off systems.

flexible packaging films. The publicfacing Decision Matrix (see How2Recycle sidebar) was also announced at the co-located How2Recycle Summit.

Suppliers are asked to propose widely recyclable alternatives that can run on existing converting and packaging equipment with minimal changes. Submissions should include recyclability evidence aligned with How2Recycle and Association of Plastic Recyclers (APR) Design Guidelines for PE films, demonstrate operational readiness, and comply with regulatory frameworks such as California SB 343 and SB 54. Concepts meeting these requirements will be reviewed for presentation at SPC Impact 2026, with testable prototypes expected by the end of 2026.

“This project is a chance to see the power of SPC membership at work,” says Olga Kachook, director, SPC. “Retailers brought us a specific challenge, and we’re calling on suppliers to help solve this persistent sustainable packaging problem.”

Submissions are due soon, on December 19, 2025. More information and submission details are available in SPC’s Request for R&D Submission for Packaging Film Suppliers brief; visit pwgo.to/8927 to access it. —Matt Reynolds

The How2Recycle program, a project of GreenBlue, released a new public summary of its How2Recycle Decision Matrix (pwgo.to/8926), offering unprecedented transparency into how the program determines whether packaging qualifies as Widely Recyclable, Check Locally, Store Drop-Off, or Not Yet Recyclable.

The Decision Matrix consolidates criteria and data from across five core assessment categories— applicable law, collection, sortation, reprocessing, and viable end markets—as well as four additional considerations, including consumer experience, product application and residue, material health, and consistency and common sense.

For packaging engineers and sustainability leads, the matrix offers a clearer view of how recyclability determinations are made, and why some packaging formats, while technically recyclable, may not yet meet the infrastructure or market conditions required for a more favorable label. A companion guide details how design features such as closures, adhesives, and barrier layers can affect recyclability outcomes even within the same material type.

“As recycling infrastructure and policy evolve, we want brand owners and suppliers to see exactly how decisions are made,” How2Recycle said in announcing the tool. “Better decisions start with better information.”

The Decision Matrix and companion guide are designed as living resources, updated regularly as new collection data, end-market demand, and regulatory requirements like California’s SB 343 take effect. Both are available for public access through How2Recycle.

—Matt Reynolds

In 2020, Wild became a pioneer in sustainable personal care when it introduced a refillable, reusable stick deodorant system that replaced single-use plastic with a sleek metal case and compostable refills (see pwgo.to/8921). Now, the brand extends that same circular design philosophy to one of the most popular deodorant formats in the U.K. market: the roll-on.

Working once again with London-based industrial design and innovation agency Morrama, Wild has launched a refillable rollon deodorant that combines ease of use, style, and low waste. The design addresses the persistent problems found with other refillable roll-ons, which include messy pour-in refills and awkward mechanisms that discourage adoption.

Wild co-founder Freddy Ward says the decision to introduce a roll-on format came from consumer insight. “Data showed that a large segment of potential customers were not ready for stick application and preferred roll-on or spray,” he said. “We introduced the roll-on to satisfy this demand.”

He shares that the north star for the project was a product that was simple to refill with zero plastic in the refillable element. “The product also had to be aesthetically pleasing, effective, and easy to use,” he adds.

Adds Jo Barnard, founder and creative director at Morrama, “A

key insight from our previous product development in personal care showed that refillables only work when they’re a joy to use. Our focus was to not only design a product that looked and felt premium without compromising Wild’s sustainability values, but that also performed seamlessly.”

The refillable/reusable roll-on deodorant system was introduced in July and comprises a reusable case paired with a refill of aluminum-free, natural deodorant optimized for the new liquid format. As video instructions from Wild show, the roller-ball case is simple to refill. Customers simply pull off the top of the case, unscrew the lid of the refill, screw the refill into the top of the case, and push the refill into the body of the case. According to Barnard, the straightforward mechanism eliminates the need to decant product, reducing the risk of spill and mess and the barrier to reuse.

The 50-mL refill package is made in partnership with Shellworks from its plant-based Vivomer bioplastic resin and is topped with an aluminum screw cap. The bioplastic resin is made from waste biomass such as plants that is transformed into polyhydroxyalkanoate (PHA) through fermentation by microorganisms. The home-compostable material breaks down in the soil within a year and contains no toxic chemicals. “This makes it much more likely to be returned to the earth, avoiding landfill,”

explains Barnard. “This way we don’t have to rely on the many steps in the recycling process, which often result in the product not being properly recycled.”

The cylinder-shaped, reusable case is made from anodized aluminum with 50% post-consumer recycled plastic and is built for long-term use. Barnard says users refill Wild’s stick deodorant an average of four times, with some cases in use for more than three years with a bi-monthly refill rate. At end of life, the case can be

taken apart for recycling. Designed with ergonomics in mind, the case’s rounded, hand-fitting shape echoes Wild’s refillable stick deodorant and body wash packaging, offering a tactile, premium feel that maintains the brand’s commitment to sustainability.

To date, Wild has shipped more than 40 million refills for its stick deodorant, saving 720 metric tons of disposable alternatives. With this latest launch, it hopes to have the same impact in the roll-on market. Says Ward, “Each new launch means a new innovation in sustainable product design that moves us one step closer to our mission of eliminating single-use plastic from the bathroom.”

Wild roll-on deodorant is available in five scents; the reusable case is offered in two patterned finishes and two solid colors, with more designs planned. “The design of the product and scent is the best way for us to be creative and playful,” Ward says. The case retails for £9 (approximately $12), with refills priced at £4.80 (approximately $6.50). The product is available through the company’s website, as well as at retail. —Anne Marie Mohan

In a move that pairs convenience with sustainability, protein-forward pantry meal brand Born Simple is introducing a new line of shelf-stable “Better Bowls” in retortable cartons made by Tetra Pak. The singleserve meals—available in flavors like Thai Style Chicken, Ultimate Mac + Cheese, Chipotle Chicken, and Teriyaki Chicken—are filled and sealed in multilayer cartons before undergoing high-temperature retort sterilization. Each Born Simple Better Bowl is packaged in a six-layer Tetra Pak structure consisting of four polypropylene layers, an aluminum barrier layer, and a paperboard layer that makes up nearly 70% of the total package. According to Rob Johnson, CEO and founder of Born Simple, this composition allows the carton to withstand the hot water exposure of the retort process while maintaining food safety and quality.

“The structure provides a suitable environment for a wide variety of products—like Born Simple—while meeting demands for a long shelf life,” he says. Each carton begins as a flat-formed package, which is opened and filled with fresh or individually frozen ingredients before being sealed and cooked [retort process] in a hot water bath.

“The food is actually cooked after it’s already sealed in the carton, which is what allows us to avoid using any preservatives and still maintain shelf stability,” Johnson tells Packaging World. “It’s very similar to the process used in canning.” Born Simple worked with a U.S.-based contract manufacturer specializing in Tetra Pak formats to design and produce the new line. The company chose not to name the contract manufacturer and packager, but confirms that “they are experts in Tetra packaging and

have decades of expertise in all sorts of product areas,” Johnson says. “We worked together to design, source, and manufacture the products at their facility in the Midwest.” Johnson adds that Born Simple selected the Tetra Pak format not only for its functional and thermal properties but also for its recyclability.

“We’re dedicated to holistic sustainability, considering each product’s environmental impact from start to finish,” he said. “When you’re done enjoying Born Simple Better Bowls, you can easily recycle it where facilities exist—just visit [the Carton Council at] recyclecartons.com to learn more.” —Matt Reynolds

Trivium Packaging’s aluminum can for the Axe Fine Fragrance Collection reduces weight by 5% through a proprietary alloy while maintaining strength and visual precision. Produced in a renewable-energy facility, the can demonstrates how process and decoration advances continue to refine metal packaging performance—earning Trivium an IMDPA Best in Category award for Aerosols & Bottles.

Trivium Packaging has developed a technically refined aluminum aerosol can for the Axe Fine Fragrance Collection that achieves measurable weight savings while maintaining

performance and visual impact. The 50x121 can, produced for Unilever’s Axe brand, is formed from Trivium’s proprietary aluminum alloy designed to reduce material use by about 5% without affecting strength or pressure tolerance. According to the company, the result is a package that meets the functional demands of aerosol delivery while contributing to ongoing efforts to lower the environmental footprint of metal packaging. The can is manufactured in a facility powered by renewable energy and certified for both energy efficiency and environmental management, reflecting Trivium’s move toward circular production systems. While the technical work happens at the material and forming level, the can’s surface also showcases what can be achieved in decorative precision. Each of the five SKUs in the Axe Fine Fragrance Collection features motion-themed, scent-inspired artwork applied with tight registration and color control— attributes that depend on careful metal printing alignment across curved surfaces. The effect ties the engineering of the package to the sensory identity of each fragrance. The project was recently recognized by the International Metal Decorating& Packaging Association (IMDPA), which named the Axe Peach Infusion can Best in Category – Aerosols& Bottles in its annual Excellence in Quality Awards. —Matt Reynolds

When FrogTape decided to retire its recognizable plastic canister, it was more than a material swap. The rigid container had become synonymous with the brand, protecting tape edges and anchoring a bold green block on store shelves. Replacing that familiar form with recyclable paperboard meant balancing sustainability goals against functional and branding imperatives.

“We knew the structure change would be a large departure,” says Mary Kate Hearns, senior product manager for FrogTape Brand Painter’s Tapes. “Our goal was to retain the familiarity and strength of the current front label while optimizing for the new presentation.”

Another example of the paperization trend, the new primary pack is a folded paperboard carton designed to preserve the brand’s vertical presence and protect the roll edges. Constructed from 18-point coated-two-side (C2S) paperboard, it’s offset-printed in multiple colors and glueclosed rather than mechanically locked. The coating choices were limited to those compatible with curbside recycling, and the package remains fully FSC-certi ed.

providing a comparable barrier to dust and scuf ng. According to Hearns, the prior container wasn’t airtight either; the new material matches that protection level under typical humidity conditions.

Behind the scenes, parent company Shurtape Technologies made what Hearns calls “signi cant corporate investments” in new packaging equipment. The transition demanded close collaboration between packaging engineering and operations teams to integrate carton erecting, adhesive application, and case-packing functions around the new footprint. “It was a substantial effort to make the change as seamless as possible,” she says.

One of the subtler engineering wins was a resealable tabbed closure that allows consumers to store partially used rolls between projects—a behavior long supported by the plastic can. The curved front panel continues to echo the round roll inside, helping maintain continuity on the shelf.

“Large changes to established branded packaging can be intimidating,” Hearns says. “But we have an obligation to evaluate product impact and make improvements where we can.”

Moving from rigid plastic to paperboard required extensive testing to ensure the new structure could still shield the tape’s treated edges. The board now sits directly against the roll,

In distribution, the paperboard units are shipped in corrugated cases con gured for both standard replenishment and retail display. Case counts can ex by channel, and the new format’s dimensions required recalibration of pallet patterns and warehouse handling.

All graphic work was executed by FrogTape’s in-house team. Offset lithography ensured the saturation and precision of the brand’s characteristic greens and yellows, while a redesigned Signature Series badge helps unify premium SKUs—Advanced, Multi-Surface, and Delicate—under a single visual cue. “We wanted to maintain a premium look and presentation to match the product’s performance, while moving to a more sustainable format,” Hearns says.

Consumer testing con rmed that consumers quickly recognized the new pack and appreciated its recyclability, with few concerns about durability. Retailers, too, welcomed the change as consistent with their own sustainability goals. For Shurtape, the project ts within a broader materials strategy that includes solvent-free adhesives and PVC-free wraps. —Matt Reynolds

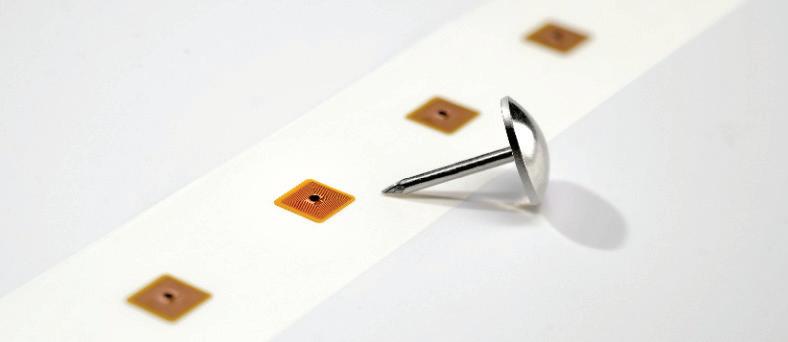

Reusable packaging systems provider Bold Reuse has teamed up with materials science company Avery Dennison to launch a pilot program that tracks the entire lifecycle of reusable cups using radio-frequency identification (RFID) technology. The two-month pilot brings digital traceability to Bold Reuse’s circular cup system at two of Portland’s busiest sports venues—the Moda Center, home of the Portland Trail Blazers, and Providence Park, home of the Portland Timbers and Thorns—as well as the company’s Portlandbased wash hub. Combined, the sports venues reach more than 2 million people annually.

“This pilot is about unlocking operational intelligence at scale,” says Jocelyn Quarrell, CEO of Bold Reuse. “With RFID, we can track every single cup throughout its journey, giving our partners transparency and performance metrics to make reuse as seamless and scalable as possible.”

Each of the cups in the pilot carries a unique RFID chip embedded during manufacturing. The chip is protected by layers of materials engineered to withstand high heat, industrial detergents, and repeated handling. Explains Mike Colarossi, head of sustainability enterprise at Avery Dennison, “The tags were purpose-built to remain readable and fully functional throughout. We ensure items can withstand repeated wash cycles without compromising RFID functionality, empowering consumers to reuse items again and again.”

According to Colarossi, this application demanded “a unique combination of durability, discretion, tamper resistance, reliable readability, and unobtrusiveness.” The tag uses Avery Dennison’s S8029 rubber hybridized acrylic adhesive, tested to withstand up to 1,000 industrial wash cycles, and a 1.2-mil PET over lamination for added strength and resistance to chemicals and heat.

This setup allows Bold Reuse to automatically collect data on return rates, dwell time, wash cycles, and the percentage of cups retired or damaged.

At the start of each event, cups are scanned and distributed to concessions. After use, they are returned by fans to collection bins throughout the venue. Venue staff then scan and consolidate cups before they are shipped to Bold Reuse’s wash hub, where they are washed, inspected, and tracked through sorting, sanitation, and packing. The process provides a clear record of every cup’s lifecycle, from first pour to final retirement.

The ultra-high-frequency (UHF) RFID tag and inlay used in the pilot, the AD-183 U9, integrates seamlessly with both fixed RFID readers installed at the wash hub and handheld scanners used by venue staff.

Each RFID tag stores a unique identifier that eliminates the need for line-of-sight scanning, allowing cups to be read in bulk. “This significantly improves efficiency at collection points and wash stations, automating processes and reducing the risk of human error,” says Colarossi.

The cups used in the pilot are Bold Reuse’s standard PP5 reusable polypropylene models, capable of withstanding more than 500 washes. About 15,000 of these cups have been RFID tagged for this initial phase, with Avery Dennison providing the tags, hardware, and software and Bold Reuse covering labor and operating costs.

Data from the pilot will help Bold Reuse to learn about back-of-house teams, including concessions and environmental services. Says Barry Kubasak, director of operations for Bold Reuse, “This pilot will allow us to gather very detailed information about where and how cups move throughout a venue, which we can then leverage to drive process improvements.”

If the pilot performs as expected, Bold Reuse plans to extend the technology across its growing network of venues and corporate campuses. “This is made possible through our unique combination of materials science expertise and RFID technology,” says Colarossi. “Together, we’re delivering a scalable, item-level traceability solution that enables realtime accountability and transparency in reuse.” —Anne Marie Mohan

Electronic position indicators with fieldbus connection for comparison of target / actual value and intuitive operation

Compact actuators for fully automated changeover - ideal for frequent positioning and high quality requirements

Easy upgrade options due to mechanical compatibility of all SIKO positioning systems

Nextloopp Americas, a recently launched initiative to advance food-grade recycled polypropylene through science, technology, and collaboration (see pwgo.to/8922), has received a Letter of No Objection (LNO) from the U.S. Food and Drug Administration confirming that its proprietary recycling process for recycled PP meets the requirements for direct food contact. The authorization, logged as Prenotification Consultation No. 3291, allows Nextloopp’s recycled PP to be used at levels up to 100% across all food types and under all Conditions of Use, from high-temperature sterilization to frozen storage.

“This marks a defining moment for food-grade recycled polypropylene,” says Professor Edward Kosior, founder and managing director of Nextek Ltd. and founder and president of Nextloopp Americas. “It validates the scientific rigor of our technology and provides brand owners and converters with complete confidence to use Nextloopp rPP in direct food-contact packaging.”

The review process took about a year, with several revisions required. Says Kosior, “Once we got the right data set in, it probably took six weeks to get their final assessment.”

The FDA decision represents an important step for Nextloopp’s efforts to expand circular systems for PP packaging across the Americas. With regulatory approval secured, the initiative is preparing to accredit recyclers that meet its technical and quality standards. “That will allow them to supply Nextloopp-accredited polypropylene to brand owners for direct food contact,” explains Kosior.

In the near future, Nextloopp members will have the opportunity to visit AI sorting at collection and sorting supplier Tomra’s new R&D facility in Charlotte, N.C. “We’ve taught the machinery to distinguish between food-grade and non-food grade materials,” Kosior says. “We can sort at approximately five tons per hour. Doing that manually would take 70 people. We do it with no people, just artificial intelligence.”

The system learns by viewing thousands of examples of food-grade and non-food grade packaging, building a database of color, shape, and surface characteristics. It then identifies and ejects food-grade materials from mixed post-consumer streams. “It’s like teaching a human,” Kosior explains. “The camera remembers shape, color, and even fine details like ribs and dimples that are typical of food-grade trays.”

Nextloopp is also working with waste management companies to expand PP collection and with converters to begin production trials. “Now that we’ve got the FDA approval, everyone will say, ‘We’ve got the green light,’” Kosior says. “It should trigger the whole supply chain.”

As the project scales in the Americas, it continues to add new partners. Alcamare International Group, a Mexico-based recycler with operations in the U.S., has become the first North American recycler to join the initiative, a move that Kosior says “is not just symbolic, it’s catalytic.”

Nextloopp Vice President Marcio Amazonas says the company’s participation demonstrates the initiative’s momentum. “Our aim is to give recyclers confidence— technical, regulatory, and commercial—to turn recycled PP back into food-contact packaging safely,” he says.

Ruben Valdez, industrial director of Alcamare, says the company expects significant opportunity from the partnership. “We look forward to a great collaboration with our new partners, with the expectation of expanding our capacity and reaching new markets for our products,” he says.

With FDA approval in place, AI sorting entering demonstration, and new regional partnerships underway, Nextloopp is positioning food-grade recycled PP for large-scale commercial adoption across the Americas, with Kosior anticipating the first commercial use of the material by early next year. —Anne Marie Mohan

“Designing something that is deeply accessible but doesn’t present itself as a special-use case or, worse, as performative, is one of the toughest inclusive design challenges in packaging. The goal is not to make packaging that looks ‘different’ for accessibility’s sake—it’s to make packaging that simply works better for everyone. When done deliberately and with curiosity, inclusive design gives you the best chance to create equitable access for users of all abilities. It’s a design practice grounded in empathy, not optics.”

–Kevin Marshall, Senior Director of Design, Packaging and Content at Microsoft, in a presentation at London Packaging Week, “Non-Negotiable Design: Why inclusive packaging must work for all”

“We know from consumer and sales research that if you can clearly communicate both product performance and sustainability credentials, you can achieve strong double-digit increases in purchase likelihood. But brands must connect the dots for the consumer. Packaging has rarely been a direct and unambiguous part of that story. Now it needs to be.”

–Amy Nelson-Bennett, CEO of Positive Luxury, in a press release from EasyFairs, “The new face of luxury: Smart, sustainable, and story-driven”

“Circularity for us is really about the ability to decouple our growth from our resource use. It’s all about reusing, not using up the finite resources that we have, and moving as far up the waste hierarchy as we can. We see it as a key mechanism to deliver business resilience—reducing exposure to raw material volatility and regulation, while strengthening our long-term growth ambitions.”

–Sophie Lees-Millais, circular partnership manager at Diageo, in a presentation at London Packaging Week, “Beyond the Bottle: Scaling Sustainable Packaging in the Beverage Industry”

“Our industry is reaching a tipping point. This year’s conference showed how molded fiber is no longer a niche alternative—it’s a mainstream, scalable solution that’s gaining traction across sectors and continents. From the students presenting bold design ideas to industry leaders developing global fiber strategies, the momentum in our field is undeniable. We’re solving real-world problems—plastic waste, carbon emissions, resource scarcity—and we’re doing it together. That kind of collaboration is what drives lasting change.”

–Gary Visser, executive chairman of the International Molded Fiber Assn. (IMFA), in a press release from the organization, “IMFA’s 27th Annual Conference Underscores Global Momentum for Molded Fiber”

By Eric F. Greenberg, Attorney-at-law

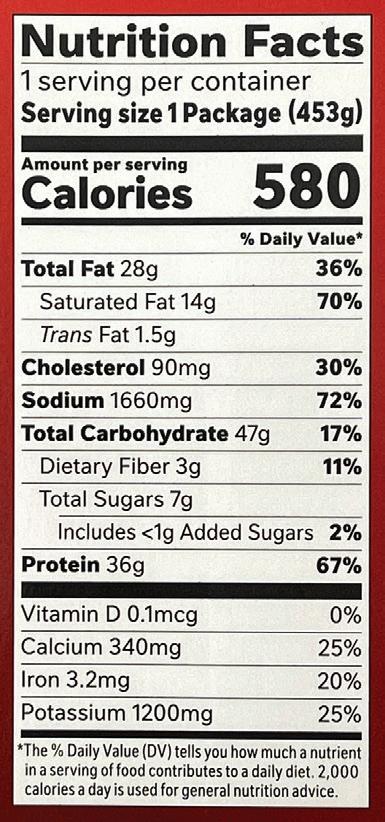

Most consumers have seen the nutritional claims on food package labels like “low fat” and “high fiber,” plus the distinctive Nutrition Facts box. But few know what’s behind that label content, both in terms of law and consumer demands. A big driver of what shows up on those labels is a less known but remarkably influential document called the Dietary Guidelines for Americans (DGA). This document gets updated every five years, and at press time the new edition for 2025-2030 was imminent.

Because they are both little-known and highly influential, I thought it would be interesting to study the new DGA both before, and after, the new edition emerges.

To help us with today’s “before” discussion, I enlisted an expert, my old friend Dr. Robert Post. He has been, as they say, in the room where it happened. Among his credentials is that he was a senior executive and appointed government official leading federal public health regulatory programs and nutrition policy agencies, which included the DGA development process for several editions of the policy. As a policy advisor to the White House, he also adapted the food pyramid to create MyPlate(.gov), which was the system to implement the DGA in 2011. Post is now the CEO of a food and nutrition regulatory and policy affairs consulting firm, FoodTrition Solutions, LLC.

Since its start in the 1980s, the DGA has been like a large stone causing ripples in the federal policy pool. Post says they influence the design of USDA’s national school meal programs and the other 15 food assistance programs, nutrition standards for military meals and rations, and the recommendations of health organizations and healthcare professionals, health and nutrition educators, and nutrition influencers. In turn, they also cause ripples in the food marketing and packaging pools, too.

“The DGA serve as a significant catalyst for innovation in the food sector to meet the demands of health professionals, customers, and consumers who want to follow the latest DGA recommendations,” Post says.

After past DGA editions have appeared, manufacturers have reformulated products to reduce sugar, sodium, and unhealthy fats. We also saw more whole grain food products, lower-sugar foods and beverages, and lowersodium foods. Post adds, “When the DGA pushed for clearer labeling, companies provided more detailed nutritional

and ingredient information on packaging. The Guidelines also promote stricter standards for health claims on packaging to ensure that products align with the guidelines, enhancing consumer trust.”

The process of generating the DGA is “one that is scientifically robust, authoritative, and transparent,” Post says. “The DGA policy is formed jointly by federal nutrition agencies at the USDA and HHS based on the recommendations in a scientific report of an external expert committee—the Dietary Guidelines Advisory Committee (DGAC)—that meets over a two-year period to assess the latest highquality research to address the prevailing dietary health concerns.”

If the upcoming DGA document is developed as in the past, he predicts it’ll reflect the DGAC committee’s conclusions. But Robert Kennedy, the Secretary of HHS, has hinted that the new guidelines will be much shorter than past editions. Since 2000, each edition of the DGA has been longer and more comprehensive. The 2020 DGA is 164 pages.

“Therefore,” Post observes, “if the federal agencies are planning a short brochure-type of policy document, it wouldn’t be a new thing.” But he still hopes it’s consistent with the DGAC scientific report and puts science first.

As for what the substance of the new DGA will contain, Post says it “should emphasize healthy dietary patterns relevant to life-stage that promote intakes of fruits, vegetables, whole grains, legumes, low-fat dairy foods, and lean protein foods; reduce the intake of added sugars, saturated fats, and sodium in daily diets; encourage the consumption of lean proteins, including seafood, poultry, and plant-based sources; advocate for limiting foods and beverages high in calories but low in nutrients, and not unfairly define all ‘processed’ foods in a pejorative way; support policies that promote food equity and access to healthy foods in underserved communities; and highlight the importance of physical activity as part of a holistic approach to health and nutrition.”

And what about the widely anticipated government definition of “ultraprocessed” foods? How would that fit into the DGA’s development? “My sense is that there are some differing views between the current HHS leadership and the 2025 DGAC on the conclusions drawn from the scientific review to base the 2025-2030 DGA recommendations” in several areas. “Some of the concerns stressed in the MAHA strategy need more research to make definitive relationships and recommendations.”

When we next address the DGA in this column, it will be after the new DGA recommendations appear, and we can compare the reality to these hopes and predictions. PW

BIODOLOMER IS A LIMESTONE BASED MATERIAL THAT CAN DO MOST THINGS THAT FOSSIL PLASTIC DOES.

But it is fully compostable (certified by TÜV and BPI), and when decomposed, it will actually leave extra calcium from the limestone in the soil. And it is without a number of things you rarely want close to your brand: Gaia BioMaterials AB,

No Microplastics

No PFAS No Phtalates

No Bisphenol-A

Biodolomer can be used for thermoforming, film blowing, extrusion coating, injection molding... you name it. It does all the good stuff that plastic does. But not the bad.

It uses less energy in production and results in up to 80 % less CO2 than traditional plastic. You can even put it in your home compost and watch it disappear.

Biodolomer might just be the easiest way to make your brand more sustainable. For real.

By Sterling Anthony, CPP, Contributing Editor

When troubleshooting continuous-thread (C-T) closures, focus on three topics: application, torque, and composition of closure and container.

Application refers to the capping machines that mate the closure with the container. Problems with capping not only can negate the good performance of upstream stations but also those of downstream stations. The reason is straightforward—poor application means that the closure fails some fundamental functions of packaging, i.e., containment and protection.

Whereas various makes of capping machines differ in design and complexity, they share certain operational components. All must have the capability to feed, meaning getting closures to the station, involving elevators, hoppers, and conveyors. All must have the capability to sort—that is, to arrange closures single-file for individual placement onto containers. All must have chucks, the component that grips the closure and supplies the application torque. Beyond such shared components, capping machines differ in their speeds and their inspection capabilities, detecting and rejecting closures incorrectly applied.

Of the aforementioned operational components, the one most likely to be a problem source is the chuck. They become worn, reducing their ability to grip. They slip around the closure, unable to adequately apply torque. Chucks should be periodically inspected and replaced when needed. A more fundamental problem is that of the wrong type of chuck. A child-resistant, a dispensing, and a tamper-evident C-T closure might have the same dimensions, yet each might require a different chuck. The realization sometimes plays out with contract packagers that overapply their equipment.

Torque is important not only in its application, as already explained, but also in its removal. It’s a rule of thumb that application torque, measured in inch-pounds, should be equivalent to one-half of the closure’s diameter, in millimeters. For example, a 24-millimeter closure should have an application torque of 12 inch-pounds and a removal torque of 6 inch-pounds.

Such rattling can further loosen already loose closures.

No rule of thumb can eliminate the possibility of overtightening nor of undertightening. Once torque settings are made, they don’t always stay calibrated that way, even without intervention. So, an operator must stay aware of the telltale signs and readjust the torque setting downward or upward, as required.

Material composition and design of closure and container affect the compatibility between the two and what is required for an effective pairing. Closures can be made of metal, or more commonly, of plastic. Regarding the latter, the composition can be a thermoset, such as a phenolic, or a thermoform, such as polyethylene or polypropylene. Container composition possibilities include metal, glass, and plastic. Different combinations of closure material and container material yield different levels of friction, which, in turn, affects torque retention.

Materials aren’t necessarily homogenous. Instead, they can contain additives—such as slip agents—that influence friction. Other influencers, residing on surfaces, include lubricants and release agents, both from the manufacturing process.

Environmental factors, particularly temperature and humidity, can influence compatibility between closure and container. A polymer closure, for example, can soften if exposed to high temperatures during storage or during transit. In that scenario, an application torque can decrease due to the reduced friction between closure and container.

Although container finishes and C-T closures are specified in standardized nomenclature, their fit can be defective in terms of thread engagement. An example is a mismatch where the uppermost thread in the finish engages with the corresponding thread track in the closure in a way that leaves a gap where the inner surface of the closure and the top of the finish should meet.

Over-tightening can cause threads to strip. Another result is closures that are cracked or otherwise damaged. One more possible result is damage to liners that are compressed beyond their recovery. Even in the absence of such compromising results, overtightening can cause the closure to be frustratingly difficult to open, which violates some fundamental functions of packaging, namely convenience and utility.

Under-tightening can cause loose closures, with leaks being the most foreseeable result. Loose closures tend to rattle under vibration imposed by conveyors and by vibration encountered during transit.

We’ll conclude with brief mentioning of some standardized testing of C-T closures, their aim being to address problems proactively. ASTM D2063 and ASTM D7860 measure torque retention by nonmechanical and mechanical means, respectively. Other methods can be classified as static or dynamic, depending on what conditions they purport to simulate. Manufacturers and testing laboratories are the usual performers. Some type of testing, however, should be part of each user’s quality-assurance. It can be as simple as setting aside samples directly off the capping station and testing removal torque immediately on some and later on the rest, at spaced intervals. PW

By Aaron Funke, Contributor

As consumer expectations evolve, the meaning of “premium” has expanded far beyond the traditional markers of high price and superior quality. Today, premium products are increasingly characterized by attributes such as sustainability, exclusivity, and health benefits. This transformation is significantly impacting industries such as pet food and beverages, where strategic branding and innovative packaging are redefining the premium experience.

Traditionally, premium products were synonymous with higher price points and exceptional quality. However, modern consumers now perceive premium through a broader lens. Insights from Mintel reveal that over 65% of U.S. consumers are willing to pay more for products that demonstrate environmental responsibility or ethical sourcing. This shift in consumer values has prompted brands to rethink what constitutes premium, incorporating elements like sustainability, transparency, and technological advancement into their offerings.

In the pet food sector, this change is particularly evident. Pet owners increasingly view their pets as family members, leading to a heightened demand for premium pet foods that align with values such as health and sustainability. Premium pet food is often characterized by high-quality ingredients that prioritize specific dietary requirements and innovative, environmentally friendly packaging solutions, such as resealable pouches and biodegradable packaging.

The beverage industry is experiencing a similar evolution. Recent discussions highlight that while the trend towards premiumization remains strong, it is evolving to emphasize authenticity and unique experiences. Consumers are increasingly seeking beverages that offer health benefits, such as low-alcohol or alcohol-free options that still deliver a sophisticated experience. Additionally, premium beverages often emphasize artisanal production methods and unique flavor profiles, underscoring their authenticity and craftsmanship.

To address varying levels of consumer indulgence and spending power, retailers are employing sophisticated tiering strategies:

• Accessible Premium: Offering enhanced quality at a moderate price, appealing to consumers who seek better value without substantial expense.

• Core Premium: Focusing on consistency and high quality, catering to those who prioritize reliable luxury.

• Ultra-Premium: Featuring exclusive, high-end products with superior craftsmanship, targeting the most discerning customers.

Label graphics for Co-op’s Irresistible Salice Salentino wine draw on classic Italian stonework, while modern typography and a red and gold color scheme evoke both the region’s history and the wine’s premium provenance. Photo courtesy of Equator Design

This segmentation allows brands to address diverse preferences and budgets, ensuring there is a premium option for every consumer.

Several emerging practices are shaping how brands approach premiumization.

Collaborations between brands, designers, or celebrities are creating exclusive, limited-edition products that boost visibility and appeal. These partnerships often result in products that are not just premium by quality, but also by their unique and limited nature.

Scarcity and collectability are also being leveraged to enhance perceived value. Limited editions and collectible packaging generate a sense of urgency and exclusivity, driving demand. According to a report on U.S. consumer trends and premiumization from Kantar, this approach is particularly effective in sectors like high-end spirits, where the fear of missing out (FOMO) can significantly impact consumer behavior.

Another crucial factor is the focus on origins and provenance. Consumers are increasingly interested in the stories behind their products. In pet food, this might involve highlighting locally sourced or organic ingredients, while in beverages, it could mean emphasizing traditional production methods or rare ingredient origins. According to Mintel, this focus on authenticity aligns with broader consumer values around sustainability and ethical consumption.

Health-conscious consumers are driving demand for premium products that offer health benefits. Kantar reports that, from organic pet foods to clean beauty products, this trend reflects a broader consumer focus on wellness and well-being.

Packaging is a key component in communicating the premium value of products. Modern packaging strategies go beyond mere functionality to become integral to the brand experience. In the pet food sector, for instance, high-end materials are used to convey luxury, while elegant design elements and sustainable options enhance the product’s premium positioning. For beverages, intricate designs and sophisticated materials such as high-quality glass bottles emphasize the product’s exclusivity and craftsmanship.

Walmart’s Pure Balance pet food bag uses highquality photography to convey freshness and natural ingredients.

Photo courtesy of Equator Design

In the U.K., supermarket chain Co-op used an exquisitely designed label to tell the story of its Irresistible Salice Salentino wine, a red blend of Negroamaro grapes from Puglia, Italy, which is renowned for its winemaking heritage. The design draws on classic Italian stonework, including the “pumi,” or pinecone, a symbol of prosperity, while modern typography and a red and gold color scheme evoke both the region’s history and the wine’s premium provenance within Co-op’s Irresistible range.

Photography can also be used to elevate the perception of premium products by capturing the fine details and artistry. Highquality imagery helps create a visual narrative that enhances the product’s appeal. For example, premium pet food might be photographed in stylish settings that emphasize its high-quality ingredients, while luxury beverages could be showcased in elegant, celebratory environments. Consistent, high-quality visual

representation across all platforms supports the brand’s premium positioning, helping to build a cohesive and compelling narrative.

The evolving definition of premiumization in the pet food and beverage industries reflects a broader shift towards sustainability, authenticity, and health. Embracing innovative packaging, leveraging strategic tiering, and utilizing high-quality photography are crucial for navigating these new frontiers. This comprehensive approach not only differentiates products in a competitive market, but also forges meaningful connections with a values-driven consumer base. As the landscape of premiumization continues to evolve, brands that adapt to these changes will be best positioned to thrive in this dynamic market.

One example of this is packaging for Walmart’s Pure Balance pet food line. The premium pet food bag effectively uses high-quality photography to convey freshness and natural ingredients, showcasing the product’s commitment to health and wellness for pets.

Premiumization goes far beyond just creating visually appealing packaging. For brands looking to launch or expand premium ranges, the key lies in research—developing a deep understanding of consumer preferences and the broader retail landscape. This ensures that every touchpoint, from packaging design to in-store presentation, reflects the product’s elevated status. By leveraging these insights, brands can craft a cohesive narrative that resonates with consumers and distinguishes them in an increasingly competitive market. PW

Aaron Funke is senior creative director at Equator Design

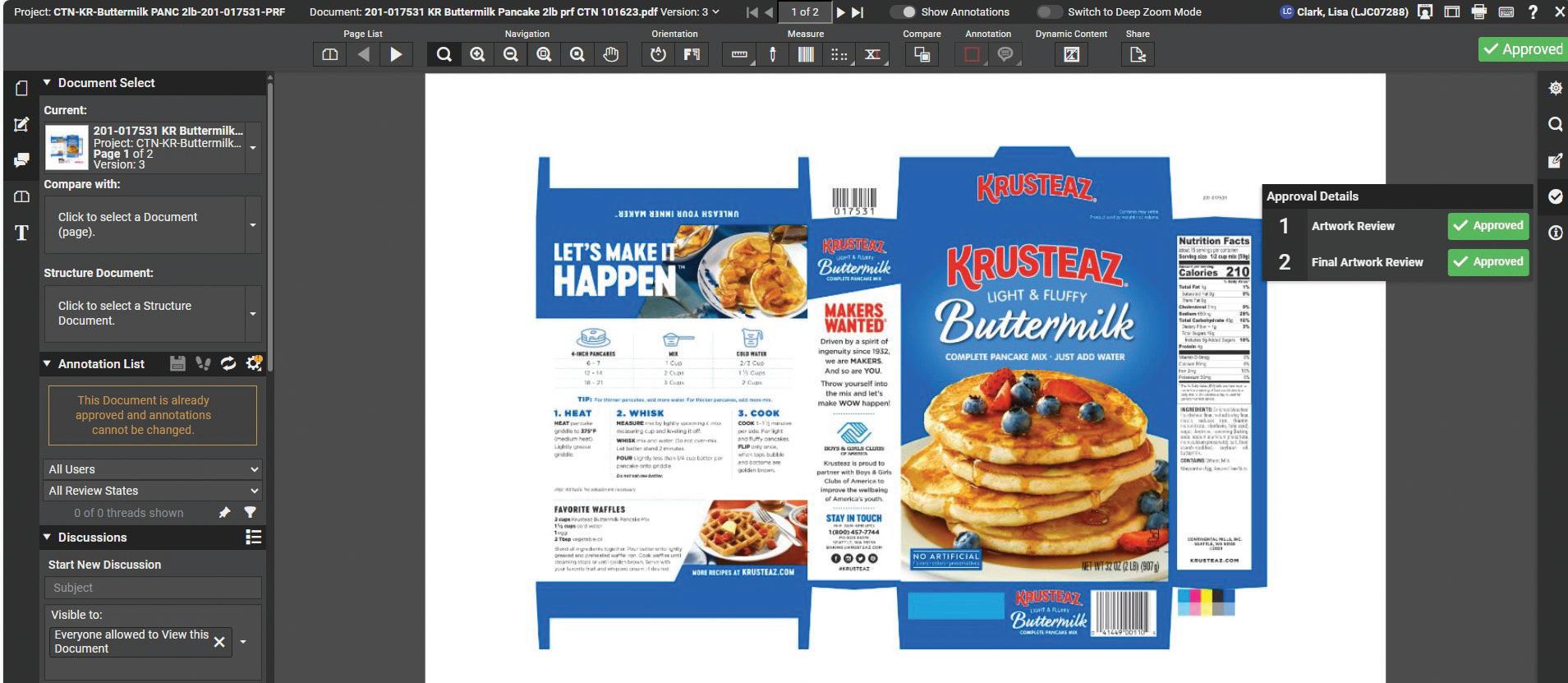

Moving from manual packaging artwork reviews to a digital workflow, baking mix company Krusteaz improves collaboration, speeds approvals, and ensures every label is accurate.

By Anne Marie Mohan, Senior Editor

Based in Tukwila, Wash., The Krusteaz Company produces an extensive line of easy-to-prepare baking mixes, including pancakes, waffles, muffins, cookies, cornbread, and brownies. Founded in 1932 by a Seattle bridge club that invented one of the first “just add water” instant pie crust mixes, or “Crust-Ease,” as it was named, the company has grown into a national brand found in grocery stores, club stores, and foodservice channels across the U.S.

As Krusteaz’s popularity grew, so did the scale of its operations. Expanding into new product lines and retail channels brought a steady increase in packaging variations, each one requiring its own artwork, content, and regulatory review. Managing that volume became increasingly complex, involving dozens of internal teams and external partners. Every design required input from marketing, legal, regulatory, and packaging engineering. Approvals moved by email, content lived in spreadsheets, and proofs were marked up manually. The process worked, but it couldn’t keep pace with the speed of today’s market.

“We needed a solution that could automate routing, reduce email volume, and let everyone know exactly where a project stood,” says Lisa Clark, senior manager of creative operations at The Krusteaz Company.

That search led the team to Esko’s WebCenter, a cloud-based platform for managing packaging artwork and content in one digital environment.

Clark says Krusteaz evaluated about eight different companies during its RFP process before selecting Esko. WebCenter stood out for its ability to meet nearly all of the company’s requirements—it could deliver on 190 of the 198 capabilities Krusteaz had outlined.

Implemented first as a proofing tool in 2018 and later expanded with content management in 2024, WebCenter has helped Krusteaz cut review time, improve accuracy, and strengthen collaboration among teams.

Before adopting WebCenter, Krusteaz’s proofing process relied heavily on email attachments. Each proof was sent to multiple approvers with no way to track status or version history. “We used Adobe to proof,” Clark recalls. “We would email the proof to each approver, but there was not a notification tool that would let us know when they approved or rejected it, and the annotation tool within that platform was not great.”

As packaging volumes grew, so did the challenge of keeping track of approvals. Marketing, regulatory, and design teams often worked

Krusteaz teams manage artwork approvals through WebCenter’s centralized platform, which tracks every task and ensures each packaging design meets brand and regulatory standards.

from different versions of the same file, creating confusion and delays. Krusteaz needed a system that could automate routing and make the approval process transparent.

That need was met with Esko’s Viewer tool, part of WebCenter’s Content Management for Packaging (CMP) module. Viewer is a cloud-based proofing tool that allows users to collaborate on packaging artwork within a structured workflow. “The tool sends an email to the approvers with a link to the proof. The annotation toolbar is fantastic—we can highlight, annotate, circle, measure—it’s really one of the best tools we have seen available,” Clark says. The team can also define stages so that, for example, marketing reviews artwork only after regulatory approval.

Each step is automatically tracked, and once a proof is approved or rejected, the initiator receives a notification to move it forward. The Viewer archives every proof, providing a searchable record of versions, comments, and decisions.

The move to Viewer saved hours of administrative work on each project. Designers can now see feedback directly on the artwork, reducing the risk of missed edits or miscommunication. What began as a proofing upgrade quickly became the backbone of Krusteaz’s packaging workflow.

With proofing under control, Krusteaz turned its attention to the management of packaging content, including ingredients, claims, and other information that appear across multiple SKUs. The company had been using a shared program that only allowed one person at a time to enter data. “We spent so much time going in to check to see if we could access the program for our inputs,” says Clark. “Also, anyone could change the data that was entered or accidentally erase it, copy data forward that didn’t apply, causing unnecessary swirl and increased time spent quadruple-checking information, and there was no tracking system to see who entered what information.”

In 2024, Krusteaz implemented Esko’s Content Sheet tool, also part of WebCenter’s CMP module. The tool enables simultaneous access for multiple users while maintaining strict role-based permissions. “Multiple users can be in the tool and in any given content sheet at the same time—no more waiting to complete a task,” Clark explains. Each team

Esko’s WebCenter digital artwork management interface allows users to collaborate on packaging designs in real time, reducing revisions and accelerating time to market.

member receives a task link and enters data in a controlled, staged sequence. The system automatically archives content sheets, creating a searchable library of packaging data for easy reference.

This single source of truth has eliminated version conflicts and made collaboration more fluid across marketing, regulatory, and packaging teams. “It is a much smoother process with fewer issues between cross-functional teams now that we have a content sheet that collects all usable content for packaging in one place, with the input staged in a way that team members can enter their data while also seeing the data required by others,” Clark says.

WebCenter’s automation has streamlined communication and given Krusteaz new visibility into its workflow. “The transparency has made it so much easier for everyone involved in projects to see what tasks are still open,” says Lisa Clark, senior manager of creative operations. “Participants don’t need to ask us. They can go directly into WebCenter and see for themselves.”

That visibility allows the team to monitor project progress in real time and identify bottlenecks before they slow down production. Dash-

boards within WebCenter show which tasks are active, which are complete, and where approvals may be waiting, giving users confidence that nothing slips through the cracks.

Krusteaz has also strengthened quality control through Esko’s Compare IT inspection tool. “We just started using the Compare IT tool this spring and have already found errors that have saved us time,” Clark says. “We look forward to lowering the risk for regulatory compliance soon, as well as achieving a goal of reducing rounds of review.”

Krusteaz approached WebCenter training with the same care it applies to product development, with thorough planning, clear communication, and hands-on support. According to Clark, the Viewer tool “is highly intuitive, and the teams adapted quickly.”

When the company implemented the more complex Content Sheet module in 2024, it took a layered approach to onboarding. Subject matter experts (SMEs) from each department participated early in the software’s configuration and testing, giving them a sense of ownership and helping identify potential process refinements before launch. Department-specific training sessions showcased real project examples, while one-page quick-start guides and short instructional videos offered easy reference for daily use.

To reinforce learning after rollout, the team distributed a weekly Tip of the Week email highlighting lesser-known capabilities or shortcuts that helped users work more efficiently. For the first few weeks, daily open hours gave employees an opportunity to stop by for on-the-spot guidance or troubleshooting. An exhaustive user manual and in-tool “tip bubbles” provided additional clarity for those entering data in the new system.

New hires received personalized onboarding that included department-specific cheat sheets and one-on-one training sessions. This ongoing support helped ensure that WebCenter became part of the company’s daily rhythm rather than a standalone system.

FBy investing in comprehensive training and user engagement, Krusteaz ensured a smooth transition and strong adoption across departments. The result was not only greater efficiency but also confidence among employees in using the tools that now drive the company’s packaging workflow.

With a solid digital foundation in place, Krusteaz plans to expand its use of Esko tools to further enhance speed to market and strengthen quality control. Future initiatives include exploring more automation within WebCenter and extending its data-driven workflows to additional packaging processes. The company is also looking at ways to integrate regulatory checks and content validation more tightly into the system to minimize manual review and shorten approval cycles.

WebCenter has already transformed how Krusteaz manages its packaging—from the way proofs are reviewed to how content is stored, shared, and tracked. The workflow is now faster, more collaborative, and more consistent across teams. What once relied on a patchwork of tools and manual steps now operates within a single digital ecosystem that connects people, standardizes processes, and preserves the integrity of every package that carries the Krusteaz name. PW

Cama Group is a leading supplier of advanced technology secondary packaging systems, from stand-alone machines to turn key systems continuously investing in innovative solutions.

Cama North ameriCa Buffalo Grove, il, uSa - 847-607-8797

/company/cama-north-america /user/cama1spa camagroup us

A new laser-marked closure eliminates labels and inks while giving consumers permanent, easy-to-read dosing guidance.

By Matt Reynolds, Chief Editor

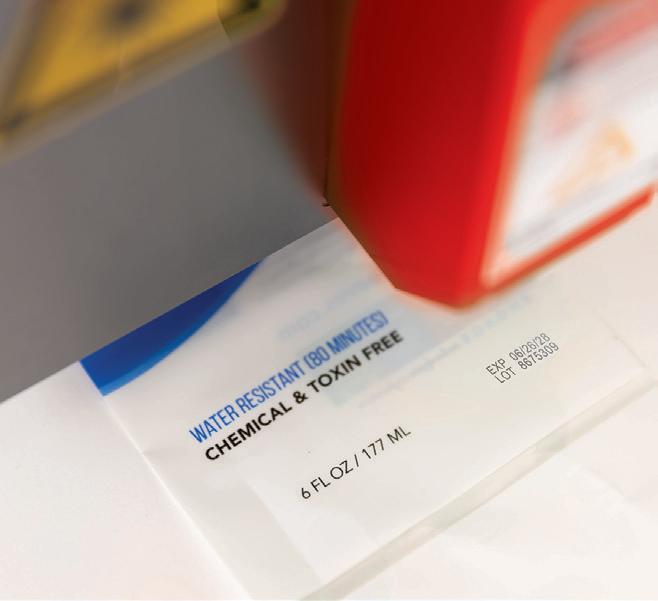

Procter & Gamble introduced laser-marked caps on its Tide Ultra OXI Boost liquid detergent, applying LasX’s LaserSharp Marking technology to enhance both consumer usability and packaging sustainability. The new application replaces molded-in dosing bars or printed indicators with precisely marked, permanent graphics that clearly show ll levels for small, medium, and large laundry loads.

“We were exploring laser marking as a way to improve sustainability of packaging—less waste with labels and other materials—as well as clear, more permanent on-pack communication,” says a P&G spokesperson. “The exploration on cap was a natural application, given the importance of clearly conveying dosing guidance for optimal results.”

Tide’s polypropylene caps undergo LaserSharp marking on two sides. On the left, we see an inverted bottle where Tide’s blue detergent is completely lling the dosing cap. Fill-level guidelines are visible both when detergent is in the cap as pictured, and when the cap is empty. On the upper right, we see the OXI logo on the other side of the cap. This branding/logo was also marked on the cap via the LaserSharp process.

The new caps mark the commercial culmination of a four-year collaboration between P&G and LasX, rst announced in a press release in November 2024. The partnership’s goal was to develop a high-speed, high-resolution alternative to traditional labeling or molding, enabling direct-to-package communication that could meet the needs of fastmoving consumer goods lines.

“We selected LasX as our partner for their laser marking expertise to bring to scale our vision of high-resolution, high-speed labeling to create packaging that delights consumers and is consistent with our sustainability goals,” said Lee Ellen Drechsler, SVP, R&D, sustainable technologies at Procter & Gamble in Nov. 2024. “We brought together our expertise in fast-moving consumer goods (FMCG) manufacturing with LasX’s laser marking capabilities to create LaserSharp Marking—and now we are excited for the possibilities this technology brings to our portfolio of trusted brands.”

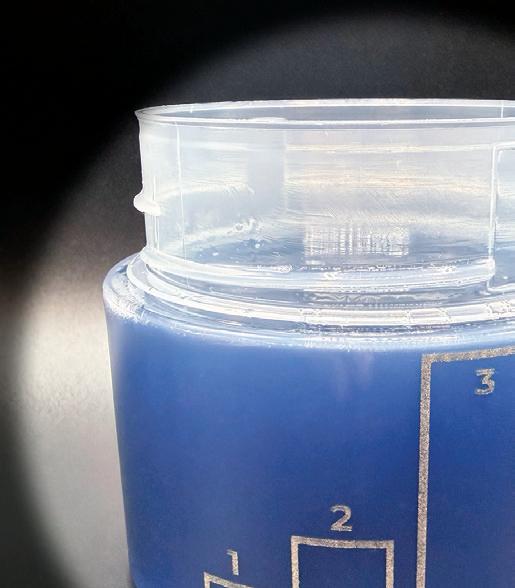

At the core of the system is LasX’s LaserSharp Marking technology, which uses high-frequency, digitally controlled lasers synchronized with

advanced motion controls to create ne-resolution markings at full production speeds.

“[It’s] marking at production speeds required pulsing and moving the lasers at speeds higher than any widely available marking technology,” a LasX spokesperson says. “The laser is pulsing millions of times per second to create the pixels in the image. This demands very highpower, high-frequency lasers.”

Because the process is digital, the system allows immediate artwork changes, lot coding, or product-speci c messaging without tooling adjustments. “Any artwork can be downloaded and instantly changed to the order quantity of one,” the LasX spokesperson added. “We can integrate lot coding, serialization, and security or anti-counterfeit features—all without tooling changes.”

Tom Weigman, VP of technology at LasX, calls the technology a “game-changing” advance in packaging exibility. “LaserSharp Marking uses LasX’s unique control technology to mark high-resolution graphics directly on bottles and other packaging materials at much faster rates than conventional laser marking,” he says. “It brings high-resolution, pro-

duction-speed marking to large areas, making it easy to create bold, customized graphics with minimal setup and effortless changeover.”

The system is designed to fit into existing packaging environments with minimal disruption. It can be installed inline within continuous-motion filling and capping lines or operated as a standalone module.

“As an engineer-to-order company, we offer both options,” says a LasX spokesperson. “Our primary goal is seamless integration, and ongoing developments are further reducing the system’s footprint.”

The technology’s versatility extends beyond polypropylene closures. LasX is exploring LaserSharp Marking for use on HDPE, LDPE, PET, and PP across both rigid and flexible formats, supporting a range of consumer and industrial packaging applications.

One of the key benefits of LaserSharp Marking is its alignment with P&G’s recyclability and sustainability goals. The laser-marked Tide cap is a mono-material component, eliminating inks, adhesives, and pressure-sensitive labels while maintaining brand aesthetics and legibility.

“LaserSharp Marking benefits include waste and cost reduction, flexibility of being digital, and supply chain simplification,” the LasX spokesperson says. “It also meets design-for-recyclability guidelines according to the Association of Plastics Recyclers (APR, U.S.) and RecyClass (E.U.).”

P&G adds that this compatibility supports its broader move toward mono-material packaging and easier end-of-life processing. LasX supports brand owners’ certification efforts by providing samples and data to demonstrate material compatibility.

“This initiative supports our efforts to ensure our packaging is recyclable,” adds the P&G spokesperson.

While the Tide cap marks the first commercial deployment of LaserSharp Marking on a consumer product, both companies see wider potential for the technology across multiple categories. The system’s digital agility enables variable or campaign-based graphics, multilingual labeling, and serialized tracking, all without adding consumable materials or changing tooling.

“LaserSharp technology has many applications,” the P&G spokesperson says. “Its versatility makes it a viable option for variable or campaign-based graphics.”

For LasX, the Tide collaboration demonstrates how direct-topackage laser marking can extend beyond labeling to a broader vision of digital manufacturing for packaging.

“LaserSharp Marking is the package labeling of the future,” Weigman says. “It delivers high-resolution text and graphics directly on packaging materials at rapid production rates.”

With the Tide project now scaling to 24/7 commercial production, the partnership exemplifies how precision laser technology can merge packaging functionality, operational efficiency, and material sustainability, all within the same process. While P&G is focused on optimizing the Tide application, LasX says additional brand owners of consumer goods are already exploring where similar laser marking could simplify their own designs and sustainability goals.

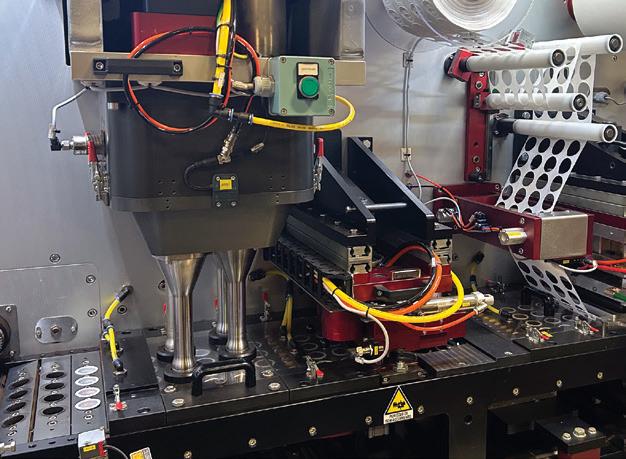

A Swedish nutraceutical brand rolls out paper screw caps across all supplement jars, a first large-scale commercial use of Blue Ocean Closures’ molded fiber technology.

By Matt Reynolds, Chief Editor

Following a successful pilot that began in 2024, Swedish nutraceutical company Great Earth converted its entire line of supplement jars to fiber-based screw caps developed by Blue Ocean Closures (BOC). This marks one of the first, if not the first, full commercial rollouts of molded fiber closures in the health and wellness sector. According to Blue Ocean CEO Lars Sandberg, the pilot launch on Great Earth’s topselling magnesium supplement was “very positively received by both the market and other actors in the value chain.”

He says the move aligns closely with both companies’ sustainability ambitions. “This introduction—being first to market with an innovation—has been recognized as a strong move, in line with our shared vision to improve sustainability,” says Sandberg.

Transitioning from pilot to full rollout, Great Earth and BOC worked to ensure the new closures could be adopted across the company’s entire range of more than 70 jarred products.

“Moving from pilot to scaling this solution to the full supplement range will take some time,” Sandberg notes, emphasizing the need for “continued close collaboration between us as well as with fillers and distributors.” Importantly, the switch to fiber did not slow down production. Sandberg confirms that “the capping line efficiency is not affected by the switch—it runs at the same speed,” though “some small adaptations may be necessary as we move to bigger volumes.” He adds that ongoing testing for storage stability has shown “good results.” BOC’s design aims for drop-in compatibility with existing filling and sealing systems.

“No exchange of machinery or equipment [was required],” Sandberg says. “Small adjustments to the settings on the lines are made as we increase volumes.”

Torque performance and seal integrity are reported to be equivalent to conventional plastic closures.

The fiber caps feature a mechanically assembled induction seal liner, the same liner Great Earth had used with its legacy plastic caps. Sandberg explains that it “does not affect recyclability as it is attached to the bottle, not the cap.”

Great Earth’s full supplement line now features molded fiber screw caps developed with Blue Ocean Closures, replacing plastic across more than 70 products.

The liner provides the necessary oxygen and moisture barrier, ensuring shelf life “is not affected.” The caps themselves are made from FSC-certified fiber, and each closure can be recycled in standard paper streams. Regarding the range of applications that incorporated the paper cap, BOC’s focus was on dry products rather than nutraceutical beverages.

“Blue Ocean Closures created a first design proposal, and final design discussions were held together with Great Earth,” says Sandberg. “Beverages are outside the scope of this project.”

Both companies also collaborated with fillers during validation and testing. Sandberg added that Blue Ocean is “pursuing a wide range of applications and custom solutions,” including work on “fiber caps for beverage cartons—a huge segment of its own representing around 135 billion screw caps per year.”

On the consumer side, Great Earth conducted a survey of 500 participants to evaluate usability and perception.

“The response on usability was unanimous—100% of participants found the fiber lid easy to open and user-friendly,” says Patrik Falk, Great Earth CEO.

Consumers rated the lid’s perceived strength at 4.3 out of 5, leading Falk to conclude that “a sustainable material can also be a robust, high-quality material.” Most strikingly, 95% said they would choose a product with the fiber lid again, which Falk describes as “the ultimate validation” of the sustainable shift. Retailers have also responded positively. Sandberg cites a statement from Apotek Hjärtat, Sweden’s leading pharmacy chain, which read, “We need to reduce the use of plastic where we can and help our customers make conscious choices. The closure is recyclable and made from renewable resources, which is in line with our packaging strategy.”

Great Earth also earned “Sustainable Supplier of the Year” from Apoteket AB, another major pharmacy chain, which praised the company for “combining sustainable innovation with a focus on health and well-being.”

For Great Earth, the shift is about long-term competitiveness as much as sustainability. Falk described the transition as “business-critical,” noting that sustainable packaging has become “a competitive advantage.” He says that the recognition from major retailers underscores how packaging innovation can drive both environmental and commercial success. “Today’s consumers want their wellness choices to reflect their values,” Falk says. “Sustainable solutions can’t carry a price premium, but when given the choice at the same price point, consumers consistently choose the sustainable option. Our fiber lids make that choice simple at the shelf.” Falk says the company’s goal is 100% circular packaging by 2030, and that the fiber lid is “just the first step.” He continues: “Each category requires its own tailored innovation, and we are already deep into that process. When we set our 100% circular goal for 2030, we didn’t have a perfect roadmap— we simply knew it was non-negotiable. That’s the power of setting a bold target without having all the answers: it forces innovation to happen.” On the cost side, Sandberg confirms that “there’s no difference in price at present” between the fiber and plastic caps, a fact bolstered by Blue Ocean’s recent breakthrough in manufacturing efficiency. According to an October 2025 company announcement, BOC’s proprietary deep-forming technology enables production cycles below two seconds and energy consumption roughly one-tenth that of conventional plastic molding. The company now reports that fiber-based closures “can match or even undercut fossil plastics in cost” while remaining recyclable and low-carbon.

“This is the moment when sustainability and profitability truly align,” Sandberg says.

As Blue Ocean scales up production for nutraceutical applications, Sandberg says brands across Europe are starting to adopt fiber cap solutions. “We are very fortunate to work with early adopters such as Great Earth and global brands such as The Absolut Company,” he says. “This is truly a game-changer for sustainability in packaging—and for the planet.” For Great Earth, the change represents both leadership and learning. “We’re not just meeting EU regulations,” Falk says, “we’re years ahead of them. That’s the difference between compliance and leadership.” PW

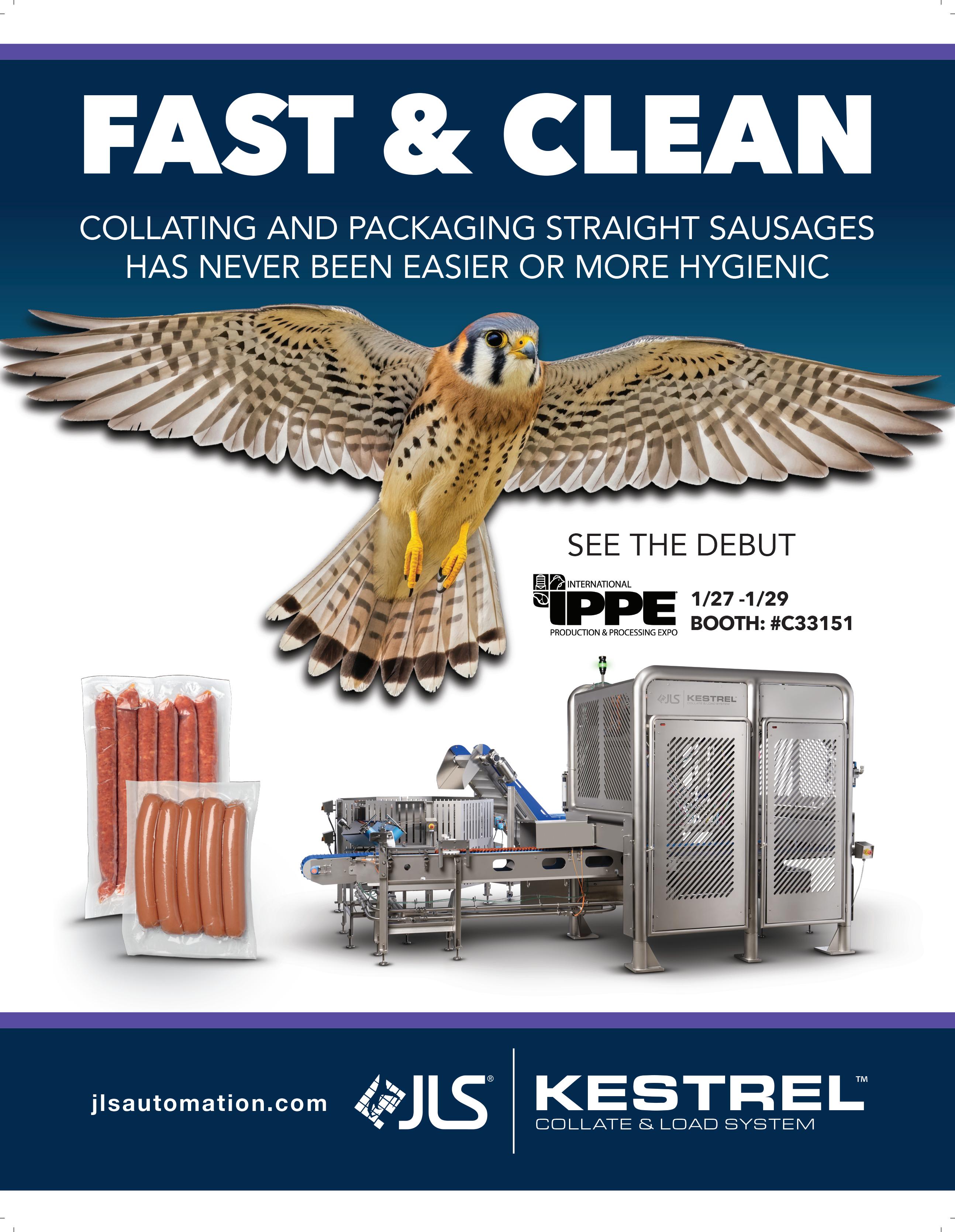

This specialty coffee roaster saw an opportunity when a customer asked for compostable packaging materials. “We’re heavily invested into doing this right,” says the firm’s president.

By Pat Reynolds, Contributing Editor

For nearly 25 years Chicago-based specialty coffee roaster Metropolis Coffee Co. and its private label arm Metropolis Workshop has been supplying whole bean and ground coffee to restaurants, hotels, and other institutions in 12-oz, 2-lb, and 5-lb premade bags. They also produce “fractional packs” weighing 2.5 to 9 oz that guests in a hotel room, for example, can use to conveniently brew a small pot of coffee with no need for measuring. But recently the firm began producing—under its own brand as well as for contract packaging customers—espresso capsules compatible with Nespresso Original Line machines. While not the first in the U.S. to begin offering this format, which is far more common and popular in Europe than in the U.S., Metropolis is believed to be one of the only, if not the only, firm in the U.S. to use fully compostable capsules and lidding.

The injection-molded capsules are supplied by Compostable Solutions and the equally compostable lidding material comes from JuraTech. Based in Bridgewater, N.J., Compostable Solutions is a subsidiary of Bio-Caps GmbH, which is based in Grabenstätt, Germany. Currently the capsules reaching North American customers from Compostable Solutions are made in Grabenstatt. But according to Frank Schuster, CEO of Compostable Solutions, plans for capsule manufacturing in North America are underway.

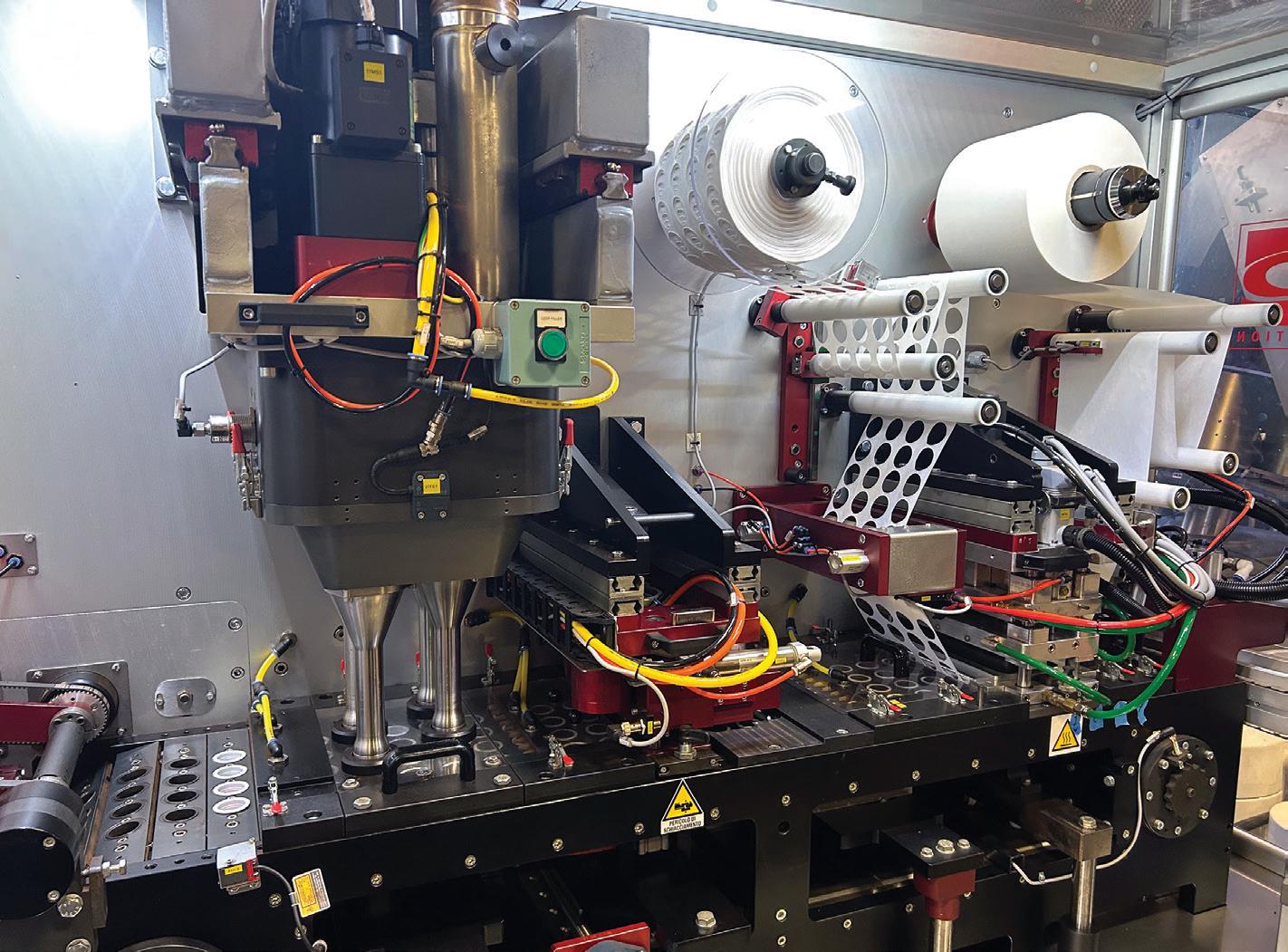

Visit pwgo.to/8924 or scan the QR code to watch a brief video of the compostable coffee pod equipment in action.