November 2025

November 2025

43 Pioneering innovation for a lower-carbon future

Siva Veerasakthi, Rebecca O’Donnell, Chris Jewell, and Jason Knudson, Baker Hughes, explore the various roles severe service control valves and pressure relief valves play in LNG plants and highlights the importance of choosing appropriate valves for each application.

Kyle Haberberger, Black & Veatch, outlines why floating LNG is redefining what is possible in energy security.

20

Morten Christophersen, CEO, ECOnnect, Norway, illustrates the importance of energy flexibility within the current geopolitical climate, and explains how strengthening regional energy security with LNG will be crucial moving forward.

Maria Carolina Chang and Jonathan Raes, EXMAR, Belgium, detail why nearshore and floating LNG are gaining traction, and consider what the next decade could hold for this segment of the LNG value chain.

LNG Industry speaks to several companies about key factors, challenges, and developments associated with insulation for LNG projects.

With US LNG playing a pivotal role in global energy security, Colin M. Frazier, API, discusses how emerging management programmes can provide operators with a proven framework for continuous improvement in process safety.

In a Q&A with LNG Industry, Abang Yusuf Abang Puteh, Senior Vice President of LNG Assets at PETRONAS, shares how the company’s pursuit of innovation has been fundamental in advancing the industry’s decarbonisation journey.

46 Harnessing digital innovations to optimise LNG transportation efficiency

Nick Fryer, Vice President of Marketing, Sheer Logistics, addresses the challenges facing modern LNG transportation and explores the digital innovations that can be implemented to combat them.

51 S-100 and the importance of safety in LNG shipping

Tom Mellor, Head of Technical Partnerships, UK Hydrographic Office, examines how a new data standard will help to transform LNG shipping, creating a safer future for the sector.

55 Bringing order to LNG operations

Willem-Wouter Rutgers, Senior Business Consultant, Quorum Software, highlights the importance of unifying LNG operations in an era of complexity.

58 Unlocking Africa's LNG potential

Keren Hall, Principal Process Consultant, LNG, Midstream & Terminal Services Lead, Consulting International, KBR, reviews Africa’s current relationship with LNG, highlighting the opportunities and challenges it presents as an energy source, and evaluates LNG’s role in the continent’s future.

61

I-Tech evaluates the impact barnacle fouling has on the LNG transport industry and examines how effective antifouling techniques can make huge improvements.

LNG plants are expanding rapidly, emphasising timely delivery and reliable operations. Selecting the right components – especially severe service control valves and critical pressure relief valves – is vital for safety and efficiency. These valves face extreme conditions and must perform without failure. Early engagement with experts and local commissioning support ensures optimal product selection and long-term reliability. Baker Hughes' article highlights key valve applications and the importance of digital diagnostics and collaboration with EPCs to prevent downtime and accelerate project success.

JESSICA CASEY EDITOR

Managing Editor

James Little james.little@palladianpublications.com

Senior Editor

Elizabeth Corner elizabeth.corner@palladianpublications.com

Editor Jessica Casey jessica.casey@palladianpublications.com

Editorial Assistant

Abby Butler abby.butler@palladianpublications.com

Sales Director Rod Hardy rod.hardy@palladianpublications.com

Sales Manager Will Powell will.powell@palladianpublications.com

Production Designer Siroun Dokmejian siroun.dokmejian@palladianpublications.com

Head of Events

Louise Cameron louise.cameron@palladianpublications.com

Event Coordinator

Chloe Lelliott chloe.lelliott@palladianpublications.com

Digital Events Coordinator

Merili Jurivete merili.jurivete@palladianpublications.com

Digital Content Assistant

Kristian Ilasko kristian.ilasko@palladianpublications.com

Junior Video Assistant

Amélie Meury-Cashman amelie.meury-cashman@palladianpublications.com

Digital Administrator

Nicole Harman-Smith nicole.harman-smith@palladianpublications.com

Administration Manager

Laura White laura.white@palladianpublications.com

Senior Web Developer

Ahmed Syed Jafri ahmed.jafri@palladianpublications.com

While we’re experiencing colder and darker weather in the UK, many world leaders and government officials will soon be gathering in a warmer part of the world for the United Nations Framework Convention on Climate Change, otherwise known as COP30.

This year, the meeting will be held in Belém, Brazil, one of the gateways to the Amazon River. It is here the President of Brazil, Luiz Inácio Lula da Silva, hopes to make good on his statement of ensuring the 30th conference on climate change is the “turnaround COP”.1 All eyes will be on the meetings in South America to see what is decided upon in the hopes that we can move closer to achieving the goals set in the Paris Agreement in 2015, and perhaps take it even further.2

Elsewhere, the International Maritime Organization (IMO) has adjourned the sessions of the Marine Environment Protection Committee (MEPC), which had convened to consider the adoption of draft amendments to MARPOL Annex VI, including the IMO Net-Zero Framework. At the meeting, the IMO made the decision to adjourn discussions on the adoption of the Net-Zero Framework for one year, with talks to resume in 2026.3

Responses to this news have been mixed, but some see this decision as offering more time for companies and other organisations (such as SEA-LNG4) to work with members and continue the development of scientific studies to support the IMO’s work in helping the maritime industry reduce its emissions.

Of course, the industry has long been trying to find ways of counteracting the environmental concerns associated with it. As well as the IMO regulations, there are multiple other ways the entire value chain can target its emissions, both in the marine and onshore LNG industries. The articles in this issue of LNG Industry go on to showcase some of these options. For example, our annual Insulation Q&A provides insight into how insulation can be an underrated and sometimes underutilised method for improving efficiency and reducing emissions.

In addition, I-Tech talks about how barnacle biofouling can decrease a vessel’s Carbon Intensity Index rating and increase greenhouse gas emissions. With many LNG carriers carrying a lifespan of 25 – 30 years, they will be active during the enforcement of many regulations that will clamp down on emissions. As a result, hull coatings are just one method of reducing emissions and fuel costs, as well as minimising the impact of potential carbon taxation systems, as the article explains.

As we start winding down towards the end of the year, the LNG industry shows no signs of slowing down. As always, the team at LNG Industry will be with you for every news update, project and technological development, event, and more. You can pick up a copy of the November issue at the World LNG Summit & Awards, taking place in Istanbul, Türkiye, from 2 – 5 December 2025.

1. ‘“COP30 will be our last chance to avoid an irreversible rupture in the climate system,” calls Lula at the final thematic session of the G20 Brasil Leaders’ Summit’, G20 Brasil 2024, (19 November 2024), www.gov.br/g20/en/news/cop30-will-be-our-last-chance-to-avoid-anirreversible-rupture-in-the-climate-system-calls-lula-at-the-final-thematic-session-of-the-g20brasil-leaders-summit

2. ‘The Paris Agreement’, United Nations Climate Change, https://unfccc.int/process-and-meetings/ the-paris-agreement

3. ‘IMO net-zero shipping talks to resume in 2026’, International Maritime Organization, (17 October 2025), www.imo.org/en/mediacentre/pressbriefings/pages/imo-net-zero-shippingtalks-to-resume-in-2026.aspx

4. ‘SEA-LNG MEPC Statement’, SEA-LNG, (20 October 2025), https://sea-lng.org/2025/10/sea-lngmepc-statement

The British Columbia Utilities Commission (BCUC) has approved FortisBC Energy Inc.’s application for the Tilbury LNG storage expansion project.

The project includes constructing a new, larger LNG storage tank at FortisBC’s Tilbury facility in Delta, British Columbia. The new tank will replace an existing 56-year old storage tank that has reached the end of its service life.

Following a transparent and public review process, the BCUC determined the project is in the public interest. In its decision, the BCUC agreed that replacing the existing LNG storage tank is necessary for FortisBC to continue to reliably meet customers’ increasing energy demands on peak days.

The BCUC also found that building a larger capacity tank will address the resiliency risk of FortisBC’s natural gas delivery system. The expanded LNG storage will help mitigate the risk of supply disruption by providing back-up storage of natural gas. Two-thirds of the new storage tank will be set aside as a reserve in the event of unexpected supply interruptions, while the remaining volume will be used to meet customers’ energy needs on high demand days.

The new storage tank will be used exclusively to store and supply natural gas to customers and will not be used to provide LNG for marine fuelling or for LNG export.

Excelerate Energy, Inc. has executed a definitive commercial agreement with a subsidiary of Iraq’s Ministry of Electricity for the development of the country’s first LNG import terminal at the Port of Khor Al Zubair.

The agreement was signed at the office of the Prime Minister in a ceremony attended by Excelerate’s President and CEO, Steven Kobos, U.S. Deputy Secretary of Energy, James Danly, Chargé d’Affaires of the U.S. Embassy in Baghdad, Joshua Harris, Iraq’s Prime Minister, Mohammed Shia' al-Sudani, and Minister of Electricity, Ziyad Ali Fadhil.

The integrated project includes a five-year agreement for regasification services and LNG supply with extension options, and a minimum contracted offtake of 250 million ft3/d. Under the agreement, Excelerate will construct the floating LNG import terminal, which is designed to accommodate a guaranteed 500 million ft3/d of regasification capacity. The company will deploy Hull 3407, its newest FSRU, and will be responsible for delivering the topside equipment and berth modifications to enable FSRU operations at the jetty. The total project investment is expected to be approximately US$450 million, inclusive of the cost of the FSRU.

As part of the integrated arrangement, Excelerate will serve as the LNG supplier to the terminal. Commercial operations are expected to commence in 2026, subject to final permitting and construction timelines.

Tokyo Gas Co., Ltd has signed a new letter of interest (LOI) with Glenfarne Group, a subsidiary of the US-based Glenfarne Group, regarding the Alaska LNG project, which Glenfarne is promoting. While this LOI is not legally binding, it aims to enable Tokyo Gas, as a strategic partner of Glenfarne, to gather information on the project's development trends and consider the economics of the project, with an eye towards future LNG procurement possibilities.

The project involves Glenfarne refining natural gas produced from the North Slope gas fields in Alaska, the US, and transporting it to the Nikiski LNG terminal

for liquefaction. The project will produce approximately 20 million tpy of LNG. Given the region's abundant natural gas reserves and proximity to Asia, the project has the potential to contribute to improving the stability of LNG supplies in the region.

Tokyo Gas has set a goal of ‘Transforming the LNG Value Chain’ in its Group Management Vision, ‘Compass 2030’. With an eye on procuring LNG from this project, the company will contribute to a stable supply of energy by diversifying its raw material procurement sources, taking into account the balance of supply stability, price, and flexibility.

I

n the current marketing round on 23 October 2025, Deutsche Energy Terminal GmbH (DET) allocated all offered regasification products for the period from 2 January – 26 May 2026 for the Brunsbüttel terminal (BBU). With this, DET once again makes an important contribution to security of supply in Germany and Europe.

A total of 58 million Btu – equivalent to 16 slots, each with a standard size of 3.6 million Btu – were allocated. The auction, conducted via the digital PRISMA platform, achieved an average price of €0.66/Btu.

The remaining capacities for the year 2026 for the Brunsbüttel terminal are expected to be offered to the market in 1Q26.

Delfin Midstream Inc. has entered into a letter of award (LOA) with Samsung Heavy Industries (SHI) whereby SHI has been selected and awarded as the exclusive EPCI contractor for the first floating LNG (FLNG) vessel of the Delfin LNG project. Delfin is also entitled to the exclusive rights to SHI’s dock for construction of the first FLNG vessel.

As part of the LOA, the parties have agreed to commence an early engagement scope of work, mobilise project teams, de-risk the overall project schedule, and prepare for imminent execution.

The announcement further secures the path towards FID in November 2025 for Delfin’s leading US energy infrastructure project offshore Louisiana.

Given the progress towards an FID for the first FLNG vessel and excellent collaboration among all the project stakeholders, the parties have agreed to strengthen their partnership in advance of the second and third FLNG vessels for the Delfin project. Under the LOA, the parties have agreed a dock reservation scheme for the second FLNG vessel for the Delfin project following FID of the first FLNG vessel, which will enable Delfin to take an FID in early 2026 for the second FLNG vessel. For the third FLNG vessel, Delfin and SHI plan to jointly develop strategic business and trade opportunities, including shipbuilding co-operation.

PATRIZIA, an investment manager in global real assets, through its portfolio company Renergia S.p.A., has secured over €70 million in new senior debt financing from UniCredit to accelerate the next phase of growth in Italy’s biomethane and bio-LNG sector.

The transaction establishes a flexible, long-term capital structure to support both the conversion of existing biogas plants to biomethane production and select acquisitions to expand Renergia’s integrated renewable fuels network. Once complete, the programme will enable Renergia to produce around 130 GWh of biomethane annually from approximately 230 000 t of biowaste and agricultural feedstock, thus strengthening its position as one of Italy’s leading circular-economy energy platforms.

The project financing was arranged and structured by UniCredit, acting as global co-ordinator, mandated lead arranger, bookrunner, and sustainability co-ordinator, and supports PATRIZIA’s broader strategy to scale mid-market infrastructure platforms that advance the energy transition and resource efficiency across Europe.

X Anew Climate and Seaspan Energy complete first bio-LNG loading for maritime sector

X QatarEnergy signs 17-year LNG SPA with Gujarat State Petroleum Corp. X Rolande opens new bio-LNG station in Germany

- Mission-critical equipment manufactured in-house

- Nitrogen cycle & proprietary IPSMR® process technology

- Liquefaction capacities from 10,000 to >20MM tonnes per annum

- Modular design & construction minimize project cost, schedule & risk

LNG is crucial to meeting the world’s increasing energy demands and improving energy access, independence and security. By choosing Chart, you gain a reliable and trustworthy project partner with a proven, solution-driven track record who will accompany you through the entire project lifecycle.

02 – 05 December 2025

World LNG Summit & Awards

Istanbul, Türkiye www.worldlngsummit.com

02 – 05 February 2026

21st International Conference & Exhibition on Liquefied Natural Gas (LNG2026) Ar-Rayyan, Qatar

https://lng2026.com

09 – 10 March 2026

LNGCON 2026

Barcelona, Spain

https://lngcongress.com

10 – 11 March 2026

StocExpo Rotterdam, the Netherlands

www.stocexpo.com

18 March 2026

World Pipelines CCS Forum 2026

London, UK

www.worldpipelines.com/events/ world-pipelines-ccs-forum--london-2026

18 – 21 May 2026

Asia Turbomachinery and Pump Symposia (ATPS) 2026

Kuala Lumpur, Malaysia

https://atps.tamu.edu

01 – 05 June 2026

Posidonia 2026

Athens, Greece

https://posidonia-events.com

09 – 11 June 2026

Global Energy Show Canada 2026

Calgary, Canada

www.globalenergyshow.com

Titan has completed the first delivery of bio-LNG to Brittany Ferries’ Saint-Malo during one of its recent regular bunker calls in Portsmouth International Port with the company’s Optimus bunkering vessel.

This Saint-Malo is a hybrid ferry that operates on LNG, battery power, or a combination to reduce greenhouse gas emissions.

Burckhardt Compression, a global leader in reciprocating compressor systems, has delivered a turnkey compression solution for a leading manufacturer of engineered cryogenic gas processing equipment and small scale LNG and industrial gas plants at LNG terminals in Nicaragua and the Bahamas.

The customer faced a time-sensitive project requiring a compression solution that could be rapidly deployed, fit within constrained terminal layouts, and deliver high reliability and performance under cryogenic conditions. Key requirements included a turnkey, skid-mounted configuration, compact footprint, high reliability and performance under cryogenic conditions, fast delivery and installation, and extensive testing to validate operational integrity.

Rather than promoting a specific product from its own portfolio, Burckhardt Compression conducted a thorough evaluation of available technologies, including its own Laby® compressors, and determined that an other brand compressor (OBC) package would best meet the customer’s needs. This decision was based on a holistic assessment of budget constraints, delivery timelines, installation complexity, performance expectations, and long-term serviceability.

Woodside has simultaneously signed and closed a transaction with Williams for an integrated investment in Louisiana LNG. The strategic partnership involves the sale by Woodside of a 10% interest in Louisiana LNG LLC (HoldCo) and an 80% interest and operatorship of Driftwood Pipeline LLC (PipelineCo) to Williams for a purchase price of US$250 million at the effective date of 1 January 2025. The total proceeds received are US$378 million including proportionate capital reimbursement since the effective date.

Williams will contribute its share of the CAPEX for the LNG facility and pipeline, of approximately US$1.9 billion. As part of the investment in Louisiana LNG, Williams assumes LNG offtake obligations for 10% of produced volumes.

Leveraging the established Sequent platform and capabilities, a gas supply team will operationalise and optimise daily gas sourcing and balancing in accordance with Louisiana LNG’s gas procurement strategy.

We build: Cryogenic Storage Tanks, Intermodal ISO Tank-Containers, Marine Cargo Tanks, Peak-Shaving Plants, LNG Terminals, and LNG-Cooled AI Data Centers.

Siva Veerasakthi, Rebecca O’Donnell, Chris Jewell, and Jason Knudson, Baker Hughes, explore the various roles severe service control valves and pressure relief valves play in LNG plants and highlights the importance of choosing appropriate valves for each application.

LNG plants are being developed at a record pace across the globe, with intense focus on project execution and timely delivery to market. The importance of time-to-market is paramount for LNG developers and operators as it directly impacts competitiveness and profitability.

Once LNG trains become operational, uninterrupted plant performance becomes critically important. Key equipment is expected to run reliably for extended periods before scheduled turnarounds. This makes the selection of the right components, such as severe service control valves and critical relief valves, essential for maintaining safe and efficient operations.

The goal of this article is to highlight the importance of severe service control valve and critical pressure relief valve product knowledge, choosing the right solution for the right application, and the value of partnering with companies that have the correct expertise. It also underscores the need for suppliers to offer local commissioning and start-up support to ensure smooth project execution and long-term reliability.

Severe service control valves play a vital role in the reliable operation of LNG plants. While there is no universally accepted industry definition for these valves, Baker Hughes TM – drawing on extensive experience with LNG operators and EPC firms – considers valves exposed to high pressure drops (greater than 750 psid), erosive or corrosive fluids, large flow variations, cryogenic temperatures (such as those caused by the Joule-Thomson [JT] effect), and suspended solids to fall under the severe service category.

Companies have seen first-hand that poor performance of these critical valves can result in serious consequences: plant trips, equipment damage, safety hazards, and costly unplanned downtime. Compounding the risk, these valves have typically long-lead items, and any trim replacement can take days or even weeks.

Given these challenges, this article emphasises the importance of early engagement with EPCs to bring special application engineers (SAEs) into the project lifecycle from the outset. Early discussions around start-up and commissioning support are equally essential. At Baker Hughes, SAEs bring deep expertise in LNG plant operations, product selection, material compatibility, and commissioning strategies, ensuring that the right solutions are in place to support long-term reliability and performance.

Below are the applications to be considered as severe service valves as minimum in an LNG plant. The valve locations are shown in Figure 1, which is a generic representation of the valve applications:

1. Feed gas control valve.

2. Lean amine pump recirculation.

3. Rich amine let down.

4. Vent to flare valve.

5. Compressor anti-surge.

6. Joule-Thomson valve.

Feed gas to the LNG plant is critical and controls the inlet feedstock to the plant. This is the start of LNG production; the LNG plant requires steady feed gas flow and pressure to meet the nameplate capacity and performance guarantee expectations. The feed gas control valve accurately controls the flow and pressure of the feed gas entering the LNG plant.

The feed gas control valve faces high pressure drop that leads to high acoustic noise. Addressing the acoustic noise level at the source based on IEC 60534-8 is important. The path treatment of noise may not be suitable for this application as feed gas valves will have multiple operating cases and require addressing the noise for all cases. The operating cases vary from low flow to high flow. A single valve with special characterised trim may be required to address the wide operating cases. When the operating cases are too wide to handle for a single valve, a small valve in parallel with noise attenuation should be considered during start-up operation. If the feed gas has moisture, a self-flushing trim design is recommended to avoid hydrate formation or the need for heat tracing of valve and pipe. Ball or globe design is a suitable valve design for this application. For example, Becker T-Ball with Quiet Trim (T2 or T4) or MasoneilanTM 41000 Series with Lo-dBTM would be a suitable solution for the feed gas application.

The feed gas will go through pre-treatment, acid gas removal (gas sweetening), and dehydration. The pretreatment unit helps to remove the liquids and heavy impurities.

The acid gas removal unit (gas sweetening) unit will help to remove the acid gas (for example, sulfur). The lean amine is amine before it has cleaned the feed gas. The lean amine pump is designed to pump the lean solvent to the acid gas-removed column. The minimum flow recirculation valve controls the flow to protect the centrifugal pump during start-up, shut-down, and upsets cases. The valve faces high pressure drop. Due to high pressure drop, cavitation damage can occur in the valves. The valve should be designed with anti-cavitation trim with ANSI Class V shutoff. Masoneilan 1 or 2 stage anti-cavitation trim or the 18400/78400 Series LincolnLog TM is a proven solution in this application.

The rich amine letdown valve regulates the liquid level in the acid gas removal column. Rich amine, containing entrained and dissolved gases (primarily hydrogen sulfide and carbon dioxide), accumulates at the bottom of the column. Reliable and well-designed level control is critical for efficient sour gas removal.

During operation, the valve is exposed to severe vibration, gas expansion from off-gassing, and potential solids carryover. Therefore, the design must

withstand vibration, accommodate gas volume expansion, and ensure stable operation. A cage-guided, axial-flow, anti-cavitation trim combined with a reinforced stem design provides an effective solution for this service.

Special sizing methodology is required to account for off-gassing conditions. To mitigate stem twisting and related damage, the stem may be tack-welded or fitted with an additional stem pin. The Masoneilan 18400/78400 Series LincolnLog valve is a proven solution for such applications, with a long track record of reliable performance.

Proper control valve sizing must therefore account for trim noise, outlet noise, and total noise. Outlet fluid velocity should be maintained within the recommended Mach limits. Globe or angle control valves equipped with aerodynamic noise-abatement trims are preferred to address these challenges.

Acoustic-induced vibration (AIV) and flow-induced vibration (FIV) calculations should be performed to ensure there are adequate pipe supports and bracing. In many cases, the wide open flow rate of pressure valves can influence the sizing of relief valves. Accordingly, co-ordination between pressure-vacuum (PV) and pressure relief valve (PRV) sizing is essential to optimise valve C v and ensure appropriate PRV capacity. An engineered, characterised trim is often the most effective choice for balancing PV and PRV requirements.

In addition, fixed pressure-drop noise-abatement devices, such as diffusers or stack plates, can create downstream back pressure that enables the use of relatively smaller, fit-for-purpose valve sizes.

The Masoneilan 77003 Series Lo-dB valve and Lo-DB Cartridge are suitable designs in this application.

Compressors are among the most critical equipment in an LNG plant and represent a significant portion of the capital investment. Protecting these compressors from surge conditions is essential for ensuring continuous and reliable plant operation. An optimally-designed control valve plays a key role in maintaining stable flow and preventing compressor surge.

Given the compressible fluid volumes and pressures involved, the anti-surge valve (ASV) is subject to aerodynamic noise and vibration. The valve must respond rapidly (within 1 – 2 sec.) while still delivering precise control. When out of service, it is required to provide metal-to-metal shutoff in accordance with ANSI Class V standards.

To achieve the necessary performance, the valve trim should incorporate a characterised cage, enabling both accurate control under normal conditions and the ability to accommodate large flow rates during trip scenarios. Special design considerations are required for acoustic noise prediction as well as acoustic and flow-induced vibration analysis. For continuous operation, noise levels must not exceed 85 dBA, while higher noise levels (up to 105 dBA) are permissible under intermittent conditions such as trip or hot-gas bypass.

The ASV must be supplied with an engineered actuation package capable of meeting the stringent dynamic performance requirements specified by compressor original equipment manufacturers (OEMs). In cases where hot-gas bypass flow rates exceed the capacity of a single control valve, the use of an automated on-off butterfly or ball valve in parallel should be considered to optimise overall process control and valve sizing. The Masoneilan 72005 Series high-capacity valve with engineered characterised trim and actuator package is a proven solution in anti-surge applications.

The main JT valve functions as a critical bypass element, diverting flow around the turboexpander when the expander is offline or unable to meet process flow requirements. Depending on the plant design, the fluid entering the valve can be in liquid, gas, two-phase, or liquid with dissolved gas. The valve is designed for cryogenic service and incorporates a characterised cage to address flashing, off-gassing, and potential cavitation effects.

During normal operation, the JT valve remains closed; therefore, reliable shutoff performance is essential. To ensure compliance with cryogenic leakage requirements under all operating conditions, dedicated cryogenic seat leakage testing must be conducted. Proper trim and seat design, along with actuator sizing and seat load verification, are required to achieve consistent and repeatable shutoff performance.

In LNG operations, PRVs are critical components that provide last-resort protection against overpressure events. Due to the high-risk nature of these systems, PRVs must meet stringent design and material standards. For cryogenic applications specific to LNG, BS-EN 13648 and ISO 21013 offer product testing guidance to ensure compliance and operational safety.

Unlike control valves, PRVs operate in a normally closed position, with the primary leak path at the

disc-to-nozzle interface. Due to elastomer incompatibility at low temperatures, metal-to-metal seating is standard.

To address leakage concerns commonly encountered in cryogenic service applications, Baker Hughes engineered and patented the cryodisc design. This specialised solution significantly enhances seat tightness, ensuring reliable sealing both before and after a pressure relief event.

Central to the cryodisc’s performance is its proprietary thermolip technology, engineered to actively adapt to fluctuating thermal loads by mitigating stress concentrations and preserving structural integrity. During extreme temperature fluctuations, the thermolip deflects downward, generating uniform contact pressure across the nozzle seat. This adaptive behaviour helps maintain a tight seal even under the demanding conditions typical of cryogenic applications, where conventional seat designs may struggle to perform consistently.

Full nozzle pilot-operated PRVs are preferred in LNG liquefaction due to their superior sealing, stability, and reliability in cryogenic service. Their metal-to-metal seating eliminates the need for elastomers, which are incompatible at cryogenic temperatures, while the full nozzle and seat isolates the main valve from direct process exposure during normal operations. These valves also tolerate operation closer to their set pressure, allowing for increased system throughput without compromising safety. This capability is especially valuable in low temperature LNG processes, where maximising flow efficiency is critical. Additionally, pilot-operated PRVs along with the metal-to-metal cryodisc can help improve re-seat integrity and reduce the risk of leakage, product loss, and fugitive emissions.

LNG plants are designed by EPC contractors in close alignment with licensor requirements. These facilities are expected to operate safely and reliably, with minimal downtime, to meet long-term contractual obligations. Severe-service control valves and PRVs are therefore critical to ensuring dependable LNG plant performance.

This article outlines the key factors to consider in the selection of severe service control valves and critical PRVs. Beyond these factors, the integration of digital diagnostics in valve positioners enables non-intrusive preventive maintenance, helping to avoid plant trips and equipment failures.

Furthermore, early engagement of SAEs during the project development phase allows EPCs to identify the most suitable valve for each application, while also accelerating sizing and procurement activities.

Kyle

The world’s appetite for reliable power sources deepens, and abundant natural gas continues to feed the intense demand. In an unfolding race for energy security, getting more of it to market – and positioning the processing assets in the right places – will be crucial.

Floating LNG (FLNG) assets – a transformative force in the global energy landscape – may hold the key, helping explain why global FLNG capacity is expected to more than triple by 2030.

These floating factories, of sorts, that create LNG to ship around the globe (from often-remote locations to

far-flung markets) are redefining how the fuel is monetised. Unlike traditional onshore LNG plants requiring extensive infrastructure and long development timeframes, self-contained FLNG units offer a flexible alternative. In remote offshore settings, they minimise the need for pipelines and coastal terminals, reducing CAPEX and environmental footprint. Nearshore deployments, meanwhile, can leverage existing infrastructure, including pipelines, while incorporating electric-driven motors powered by renewable energy sources to enable lower-carbon operations. Whether positioned far offshore

or closer to land, FLNG’s adaptability across geographies and configurations reinforces its role as a strategic asset in the evolving energy landscape.

And of special significance, FLNG units can be redeployed elsewhere, embodying flexibility and cementing their status as a globe-trotting game-changer in an evolving global energy ecosystem.

FLNG’s influence begins with its adaptable scalable nature – notably when using technologies such as the PRICO ® liquefaction system by industry leader, Black & Veatch – that enables rapid deployment and adaptation to an array of gas compositions and site conditions. That makes it a highly flexible solution for today’s dynamic energy landscape.

Designed for versatility, FLNG units can also be configured with or without on-board storage, powered by gas turbines or external electric sources, and accommodate various liquefaction technologies. PRICO’s single-mixed refrigerant (SMR) loop for liquefaction, for instance, simplifies operations while reducing equipment needs and lowering costs.

FLNG can be tailored to specific project needs, whether it is a compact barge for nearshore deployment or a full scale offshore production unit with integrated storage capabilities, ensuring that FLNG can meet demands of diverse markets and environmental conditions.

Beyond technical and economic benefits, FLNG plays a vital role in enhancing global energy security. By unlocking stranded offshore gas reserves and enabling rapid response to shifting demand, FLNG supports a more resilient, diversified energy supply chain. In regions where infrastructure is limited or geopolitical risks are high, FLNG is a nimble and less invasive alternative to fixed onshore installations.

Technology such as PRICO does much of the heavy lifting, offering a simplified refrigeration system requiring minimal equipment, low CAPEX and OPEX, and simplified control and maintenance, making it ideal for FLNG use. The simplicity of PRICO liquefaction design fosters flexibility and the ability to adjust to a myriad of potential gas compositions.

As the gas sector constantly changes and geopolitical uncertainty grabs more headlines, developers clamour for solutions that help them nimbly adapt to the evolving energy landscape. The mobility of FLNG answers that call, providing flexibility for rapid deployment to monetise gas assets and uproot a project to a new location.

That compelling ability to relocate a world scale energy asset on the fly is not merely a technical feat, but a strategic asset. Unsurprisingly, such flexibility is increasingly cited in permitting applications as a key advantage for future-proofing investments.

Call it a powerful hedge and a fountain of options for project developers against uncertainty in a world rife with geopolitical shifts, changing economies and regulations, tariffs, dynamic energy policies and depleting resources, among other things.

Over time, FLNG interests have showcased the ability to operate in multiple geographies, from South America to Africa to southeast Asia, redeploying when conditions (some unforeseen) merit.

More than three football fields in length and about half a US city block wide, Golar LNG’s Hilli Episeyo has defined mobility. Built in Singapore without a final destination chosen, the FLNG vessel planned to use PRICO technology in a generic configuration to allow the Hilli to be deployed to any of a number of locations globally. Having the flexibility to change locations has allowed Golar to pursue projects around the globe that more traditional facilities might avoid.

In 2015, Golar entered into agreements to ultimately send the Hilli off the coast of Cameroon in central Africa, where it has been operating offshore for oil and gas company Perenco. With its contract ending in 2026, Golar looks to quickly relocate the FLNG asset to Argentina for LNG production for Southern Energy S. A. (SESA).

In the meantime, Golar is again betting on FLNG flexibility by taking a final investment decision on its MKII FLNG design in September 2024, enlisting Black & Veatch for a third time to provide its robust PRICO technology. Though that asset began construction without a home, it is now scheduled to deploy to Argentina – again for SESA –when it is completed in 2027.

Elsewhere, other FLNG projects such as Tango FLNG and Petronas Satu FLNG have utilised this mobility strategy. Tango FLNG, for example, is now operating off the coast of Congo and has produced LNG on three different continents.

FLNG is proving itself as a cornerstone of tomorrow’s energy strategy. Its ability to unlock stranded resources, adapt to shifting market and geopolitical realities, and redeploy across continents makes it a powerful hedge against uncertainty. As developers and operators seek resilience and agility in a rapidly changing world, FLNG’s mobility and versatility stand out – redefining what is possible for energy security and global supply.

Morten Christophersen, CEO, ECOnnect, Norway, illustrates the importance of energy flexibility within the current geopolitical climate, and explains how strengthening regional energy security with LNG will be crucial moving forward.

The 2022 sabotage of the Nord Stream pipelines exposed the vulnerability of Europe’s energy network, cutting a major artery of Europe’s gas supply and sending a clear signal: critical energy infrastructure is vulnerable, and energy flexibility is no longer optional.

With geopolitical tensions high and climate-related disruptions increasing, Europe’s energy security now hinges on solutions that can be deployed quickly and adapted to changing needs. ECOnnect Energy’s work at the Wilhelmshaven II terminal in Germany demonstrates how jettyless LNG technology can provide this resilience in practice.

Europe’s energy infrastructure is in a new era, shaped not only by supply and demand, but by sabotage and vulnerability. In many ways, the 2022 sabotage of the Nord Stream pipelines in the Baltic Sea has served as a wake-up call, demonstrating how critical energy assets can be deliberately targeted to destabilise entire regions. In Norway, the Police Security Service now considers sabotage against energy infrastructure a likely threat, urging both public and private actors to strengthen their resilience.

Furthermore, NATO urges a new approach that places energy at the core of defence planning, calling for a ‘wartime mindset’. At the 2025 Hague summit, leaders reinforced this by committing 5% of GDP annually to defence capabilities, infrastructure modernisation, and innovation by 2035. This marks a clear shift where energy security is now perceived as a central strategic issue not only for the energy sector itself, but for society’s overall defence capability.

In addition to geopolitical threats, Europe’s energy systems also face growing climate-related risks. Storms, floods, and other extreme weather events can disable centralised infrastructure, leaving regions vulnerable. Flexible, modular LNG solutions offer a way to maintain supply when established networks are disrupted.

Historically, Europe’s energy infrastructure has been built on fixed installations such as pipelines, land-based terminals, and centralised networks. Additionally, a significant amount of Europe’s gas infrastructure, such as the pipelines from the North Sea, lies exposed on the seabed. Today’s rigid energy infrastructure represents a significant weakness, and the lack of flexibility further amplifies the issue.

Following the 2022 Nord Stream explosions, at least 11 undersea cables and pipelines in both the Baltic and North Sea have suffered suspected sabotage. This has shown how an attack or failure in just one part of the energy network can cause ripple effects throughout the entire supply chain. For instance, Norway supplies one-third of the EU’s gas through exposed undersea pipelines, underscoring the need for rapid, flexible backup solutions.

In response, policymakers are developing strategies to ensure reliable energy supply during unexpected events. In this process, LNG import terminals are quickly becoming a game changer. Offering an alternative to gas supply, LNG can provide energy if one supply line is disrupted.

With declining pipeline gas imports from Russia, experts expect the reliance on LNG to intensify, forecasting record-breaking import levels in the coming years.

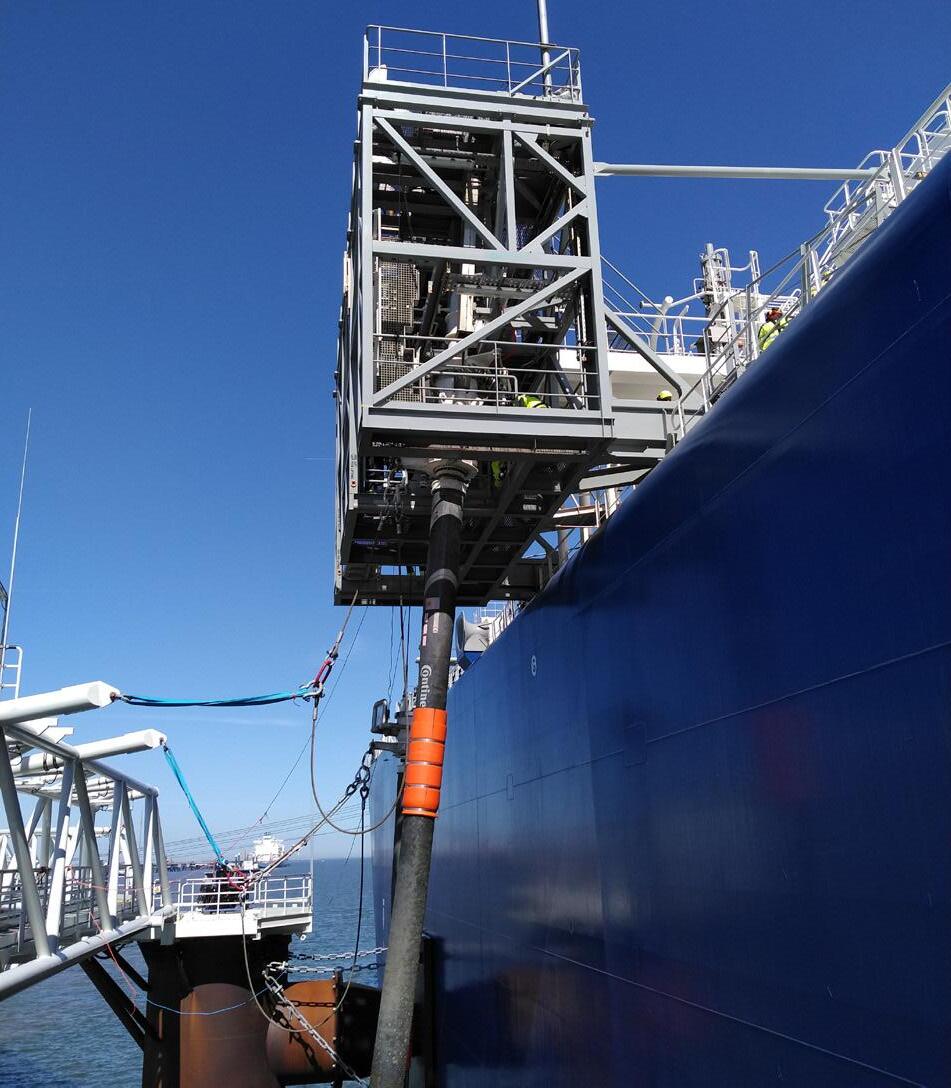

The Wilhelmshaven II LNG terminal, owned and operated by Deutsche Energy Terminal GmbH (DET), serves as a leading example of proactive energy security, with ECOnnect Energy’s

IQuay F-Class system as a key component. With the innovative natural gas transfer solution, this project advances regional resilience through the rapid expansion and modernisation of LNG infrastructure.

ECOnnect Energy specialises in jettyless marine transfer systems. Its proprietary IQuay technology enables the transfer of LNG and other fuels efficiently and flexibly between ships and shore without the need for permanent infrastructure. These adaptable systems are drawing increased interest as energy demand and security concerns continue to evolve.

The Wilhelmshaven terminal, designed to supply up to 8.5% of Germany’s national gas demand, is critical to diversifying the country’s energy imports and reducing dependence on traditional pipeline gas. Recognised as a priority site, Wilhelmshaven underwent rapid expansion with the addition of a second FSRU. To accelerate deployment, ECOnnect’s IQuay transfer system was implemented, making the connection between FSRU Excelsior, delivered by Excelerate Energy, and onshore infrastructure. This approach enabled swift commencement of LNG imports, avoiding the typically lengthy development associated with constructing permanent infrastructure. The transfer system was fast tracked, with less than 12 months from contract award to installation, demonstrating how this approach can bypass traditional permitting and construction bottlenecks.

Looking to the future, the terminal is designed to be adaptable. The project not only addresses immediate supply challenges, but is also closely aligned with Germany’s long-term decarbonisation goals, which started in 2025. The terminal infrastructure is constructed with flexibility in mind, capable of handling not only LNG but also future energy carriers such as ammonia and carbon dioxide. Its modular design meets both civil and defence needs, strengthening broader European and transatlantic ambitions for secure and adaptable energy solutions.

In addition to rapid installation and compatibility with various vessel types, the IQuay system offers another key benefit. Since the technology was first introduced in 2017, minimal environmental impact has always been a critical focal point. Compared to alternative and traditional solutions, the disturbances to the marine ecosystem are significantly reduced, helping preserve local biodiversity and seabed integrity.

The project was made possible through close co-ordination between ECOnnect Energy, DET, German federal agencies, TES, ENGIE, and other key partners. This collaborative approach ensured that the Wilhelmshaven II terminal could be delivered on an accelerated timeline while meeting stringent technical and environmental standards.

As geopolitical threats continue to affect the energy sector, ensuring the security of supply chains is more important than ever. The transition to flexible LNG infrastructure represents a significant strategic move rather than just a technical improvement. The developments in Wilhelmshaven demonstrate the adoption of flexible and adaptable energy solutions, providing a model that can drive initiative worldwide.

Maria Carolina Chang and Jonathan Raes, EXMAR, Belgium, detail why nearshore and floating LNG are gaining traction, and consider what the next decade could hold for this segment of the LNG value chain.

When the first LNG carriers set sail in the mid-20th Century, few imagined a future where entire LNG plants could float at sea or sit just offshore, quietly transforming global energy flows.

Since then, the global LNG landscape has undergone a structural transition. Demand diversification, supply flexibility, and the drive for rapid decarbonisation are creating simultaneous opportunities for nearshore and floating LNG (FLNG/FSRU) solutions which are no longer novelties. They have become more mainstream tools in the

global quest for cleaner energy, rapid deployment, and flexible supply chains.

More and more, countries without the land, time, or capital for onshore terminals are turning to floating solutions – either moored near the coastline or stationed over offshore fields. At the same time, LNG producers are unlocking previously stranded gas reserves through floating liquefaction. The results: faster projects, smaller environmental footprints, and, in many cases, lower risk and higher flexibility.

For decades, the LNG market was dominated by large scale, long-term, point-to-point supply contracts – often between major producing countries and industrialised buyers. Terminals were expensive, with fixed assets and extended project timelines that stretched well into decades. But, in the last 15 years, several seismic shifts have reshaped the industry:

1. Global demand migration: For rapid access to natural gas to power industry, reducing coal dependence and stabilising grids.

2. Decarbonisation pressures: LNG/natural gas is a transitional fuel that can displace higher-emission coal or oil and be compatible with the renewable power generation.

3. Geopolitical volatility: Events such as the Russia–Ukraine conflict exposed vulnerabilities in gas supply chains, prompting urgent moves to diversify sources, primarily via LNG.

4. Capital discipline: Investors are increasingly wary of megaproject risk; they prefer modular, phased developments with faster payback.

5. Flexibility: If demand changes, the asset can be relocated – a critical hedge against stranded investment.

Within this context, EXMAR has been a pioneer in the industry, providing innovative nearshore and floating solutions to meet the global energy needs. From the development of the ship-to-ship transfer systems to enabling the fast-track

implementation of import and export terminals in close relationship with its partners, EXMAR has helped contribute to the rapid evolution of the LNG industry.

Nearshore LNG refers to LNG facilities positioned close to shore – on breakwaters, artificial islands, next to quayside, or shallow water platforms – and tied into existing shoreline networks. They are particularly attractive where: shallow bathymetry prevents deep-draft vessels from berthing at shore, there are close connections to shore distribution facilities, or where coastal constraints limit land availability. Floating LNG technology covers a broad spectrum which fills a distinct market need:

z FSUs: LNG vessels with specific adjustments to remain permanently moored for the receipt, storage, and delivery of LNG. An example of this unit is the Excalibur FSU, owned by EXMAR, and located in Congo as a permanent FSU to receive the LNG produced at the terminal for export.

z FSRUs: These are newly-built units or converted LNG carriers equipped to store and regasify LNG on board and send natural gas directly into a shore pipeline. EXMAR’s Eemshaven LNG is an FSRU barge, which was installed in the Netherlands in a very short time due to the geopolitical volatility and was designed specifically for small draft foreseeing nearshore niche markets.

z FLNG: The reverse process: offshore facilities that take raw natural gas, process it, and liquefy it into LNG for export. EXMAR received delivery of a 0.5 million tpy barge-based FLNG in 2017 which operated initially Argentina and is currently in Congo.

FSUs provide seasonal or strategic storage flexibility enabling import or export terminals with hybrid solutions while FLNG facilities enable producers to monetise gas fields, reducing expensive investment on lengthy pipelines.

While nearshore and floating LNG hold clear advantages, they also present unique engineering and operational challenges:

z Mooring and metocean constraints: Units must withstand storms, swells, and – in some regions – ice conditions.

z Integration with shore systems: In nearshore configurations, pipeline tie-ins, compression, and grid interconnects must be meticulously planned.

z Maintenance access: Floating units have limited space and maintainability needs to be carefully planned to minimise off-field works, which could disrupt supply.

z Safety: Emergency shutdown systems, marine exclusion zones, and crew training are paramount.

EXMAR has in-house expertise to ensure these challenges can be overcome with innovative cost-efficient solutions implemented from the design of the units and

mooring systems. Early involvement of its specialist maritime LNG operators, with decades of LNG experience, are well placed to ensure lessons learned are considered during the early phases.

In 2022, EXMAR developed a project where its 138 000 m3 LNG carrier Excalibur (delivered by Daewoo in 2002) was converted into an FSU to remain in place for a minimum of 10 years as extra storage capacity for an export terminal 3 km from shore.

As a ship, it would normally require regular dry docking, meaning that in order to stay permanently on site, a lot of life extension work has been done on top of project-specific modifications.

Examples of such life extension works are the full refurbishment of one of the 60 bar steam boilers and the installation of a few thousand anodes in the ballast tanks.

After six months of works at the shipyard, the Excalibur FSU was able to use its own steam-powered propulsion system and sailed under its own power from Dubai to its final location 3 km offshore Pointe Noire in Congo, following the route around the Cape of Good Hope.

The company, with its in-house expertise across the whole LNG value chain, served as the EPC contractor for the implementation of the export terminal. EXMAR developed the design of the mooring system, performed the conversion and life extension in a challenging timeline, commissioned the FSU, and performed the operations and maintenance of the unit for the term of the contract.

The company’s integrated approach makes it a one-stop shop for nearshore and FLNG solutions, offering governments, investors, and operators energy security and swift development of market opportunities.

In 2025, EXMAR signed an agreement for an FSU that will be deployed in Buenaventura, Colombia, for a term of five years with possible extensions up to 10 years. An LNG carrier will be converted as a permanent storage unit that will be deployed at the inner bay of Buenaventura as part of the fast-track LNG import solution that RDP is developing. The FSU will be part of the supply chain for the delivery of 60 million ft3/d of gas to the national grid.

The global LNG market is currently experiencing high liquidity, with an abundance of trading activity and flexibility in supply arrangements. This dynamism is supported by a large number of LNG vessels available in the market providing opportunities to convert them into FLNG units. Together with a sufficient number of experienced yards with both the technical expertise and available capacity to carry out these conversions, an integrated solution provider such as EXMAR can integrate customised solutions from engineering to start of operations in fast track manner.

With the continued growth of LNG, its role will evolve – and so will the platforms that deliver it. Nearshore and floating solutions will not replace every onshore terminal, but they will increasingly anchor the next chapter of LNG growth: one defined by mobility, modularity, and market responsiveness.

LNG Industry speaks to several companies about key factors, challenges, and developments associated with insulation for LNG projects.

Jonathan Bush stands at the forefront of revolutionary insulation technology as Director of Commercial & Engineering for AlkeGel at Alkegen, where he has spearheaded commercialisation of breakthrough aerogel insulation materials that are transforming industrial environments worldwide. Jon brings real-world insights into how innovative materials can solve complex industrial challenges while improving worker safety and project efficiency.

With over two decades of experience at Aspen Aerogels, Mark has been instrumental in advancing the use of aerogel-based insulation technologies across the LNG industry – from Aspen’s first LNG applications in the Northeastern US in 2007 to leading the efforts that resulted in the first insulation system qualified to protect LNG assets from sequential cold spill and jet fire hazards in 2019. Throughout his tenure, Mark has worked with owners, engineers, and contractors to help them unlock the performance and value of these next-generation insulation materials.

He holds a BS in Chemical Engineering from Northeastern University (1988) and an MBA from Babson College (2003).

Scott Sinclair has worked in industrial insulation for over 20 years, and has been the National Specification Manager for Johns Manville’s (JM) Industrial Insulation team since joining JM in June 2019. Prior to joining the insulation industry, he had 20+ years of experience in various technical, operations and sales/product management positions within the semiconductor and telecommunications industries. He has a BSEE in Electrical Engineering from Virginia Tech.

Scott represents JM and the mechanical insulation industry on various Association for Materials Performance & Protection (AMPP), American Petroleum Institute (API), National Insulation Association (NIA), and American Society for Testing and Materials (ASTM International) committees. He is a NIA Certified Thermal Insulation Inspector and Insulation Energy Appraiser, and an instructor for both of these NIA certification classes.

Nathan Longwell is associated with ROCKWOOL Technical Insulation as the Specifications Sales Manager for the Southeastern region of the US.

He brings in eight years of industrial experience; while most of it is in the after-market pump sector, he has an understanding for the needs and sustainable solutions for industrial plants.

Based in Houston, he is strategically situated near the majority of LNG owner offices, facilitating timely and effective in-person engagement and issue resolution.

Kamal Gupta is associated with ROCKWOOL Technical Insulation as Global Key Account Manager for Asia, Middle East, and Africa region.

He brings in 16 years of industrial experience, having worked in research and development, application, testing and technical services of insulation products, polymeric compounds, and specialised high-performance coatings used in process industry, protective maintenances, and marine applications.

Based next to ROCKWOOL’s manufacturing unit in India, he is responsible for support on all technical aspects relating to Process, Marine, and Offshore insulation requirements.

Q1. What factors need to be considered when selecting insulation for an LNG project?

Choosing the right insulation is pivotal to the successful delivery and completion of LNG projects, where pipe storing and transportation temperatures differ significantly from the ambient temperatures at which project managers and installers operate. Exposure to the elements, as well as hazardous chemicals, exacerbates the effects of these extreme temperature amplitudes. Effective pipe insulation can mitigate the safety and environmental risks associated with the petroleum industry by blocking heat ingress from the environment and controlling condensation, preventing ice buildup and providing critical passive fire protection. The decision-making factors at play should therefore be based first and foremost on safety and compliance. Then there is the obvious cost consideration, but several technical factors should also influence insulation selection. To ensure operational continuity, returns on investment, and operational efficiency, project managers should choose insulation that is quick and easy to install, certified for the required thermal performance, and of the optimal thickness and weight for the project. In addition, dimensional stability, ease of application, overall footprint, and the expected frequency of maintenance impact the build schedule and long-term performance. However, we should also be mindful of the fact that insulation, like most products, does not operate in a vacuum. Thermal performance, for example, can be improved depending on the interaction between all moving parts on site. Real-life conditions collectively determine whether certain type of insulation can deliver both operational performance and long-term reliability, so my advice is to seek consultation from the technical experts on the products under consideration.

Insulation selection can have an outsized influence on the overall success of an LNG project. While making up only 1% of the total cost, it can account for 5 – 10% of the craft labour hours and span 30 – 40% of the project timetable. The insulation selected can have a major influence on whether a project is on time and budget.

From a technical standpoint, the specifying engineer must assess what the primary drivers of the insulation requirements are: is it controlling condensation on the jacketing surface or is reducing heat gain into the LNG the primary driver? There are other considerations too – compressors and high velocity gases are notoriously loud, so does the insulation also need to reduce noise? Does the facility have passive fire protection requirements for process piping and equipment? Some LNG facilities now require jet fire, pool fire, and cold splash protection. On the hot side of the LNG process, a major consideration is to select materials that do not promote corrosion under insulation (CUI). The trend in facility construction is to go modular whenever it makes sense; selecting the proper insulation can allow you to move the physical insulation installation and vapour sealing from the

field to a controlled fabrication shop setting. This moves insulation hours out of the projects critical path, reducing on-site man hours, and congestion. The act of selecting the ‘right’ insulation has impacts far greater than just providing thermal protection to the asset.

Selecting insulation for an LNG project involves balancing multiple priorities across different stakeholders, including the owner/operator, design engineer, and insulation contractor. From the owner/operator’s perspective, the most critical factors are long-term performance and low total installed cost. For example, a thinner material that requires 4 – 8 times more layers may significantly increase labour costs, offsetting any savings from reduced material thickness.

For the design engineer, materials with a proven track record on LNG facilities are essential. They also prioritise availability and ease of installation, which help ensure the project stays on schedule and is executed correctly. Additionally, thermal performance affects insulation thickness, which in turn influences the design of pipe racks and supports. Material density is another key consideration – a denser product may require less thickness but could add substantial weight, necessitating more robust structural design.

The insulation contractor will focus on materials that are easy to handle and install, which can improve installation speed and reduce the risk of errors.

Ultimately, the ideal insulation system for an LNG project must strike a balance between performance, cost, constructability, and reliability, tailored to the needs of all parties involved.

Insulation materials serve several crucial purposes in an LNG facility, including heat conservation, cold insulation, acoustic protection, corrosion mitigation, passive fire protection, or any combination thereof.

For effective heat conservation, an insulation material must possess a low thermal conductivity and be able to effectively mitigate CUI. To conserve extremely cold temperatures and keep natural gas in a liquefied state, insulation must provide low thermal conductivity at low temperatures and have a closed-cell structure that is not porous to water vapour. Because cyclic plant operations can run between temperature extremes of -4˚F – 608˚F (-20˚C – 320˚C), insulation materials must be designed to withstand thermal stresses.

Because some plant operations generate high-frequency or high-decibel sound, insulation that delivers superior acoustics-dampening performance is required to protect plant personnel and neighbouring communities.

Passive fire protection requires a material with low thermal conductivity that maintains its integrity even after prolonged exposure to high temperatures.

In many plant operations, the optimal insulation material protects against multiple threats (e.g. insulation with both heat conservation and acoustic suppression properties).

Insulation plays a vital role not only in LNG production, where it can help plants meet their quality and output requirements, but it is also important for the energy efficiency of facilities where LNG is handled, from sea-borne or land transportation to on or offshore pipe installation. One of the main benefits from insulation is that it optimises energy consumption, thereby reducing operational expenses. It also minimises evaporation losses from heat transfer between cryogenic tanks and pipelines. It protects equipment by preventing ice formation and condensation, which typically lead to corrosion. Insulation also contributes to improved safety on site by maintaining pressure stability and quieter work environments. This not only helps protect infrastructure investments, but also the people who work with LNG systems.

The benefits of operating an LNG facility with a robust, properly designed and installed insulation system cannot be overstated. With this system, the plant is efficient, has the lowest possible carbon footprint, and is safe for plant personnel and the surrounding environment. The facility will not experience weather-related variations in process conditions, and the insulated surfaces will stay dry and algae free. The facility will also be protected from the unplanned downtime that CUI can bring and, if the unthinkable happens, robust passive fire protection will give plant personnel the time needed to purge the effected processes and fall back to a safe position.

Insulation plays a vital role in the LNG process by delivering performance across three critical areas: preventing condensation (internal and external), limiting heat gain, and reducing noise.

On cryogenic piping and equipment, insulation must be thick enough to keep the outer surface temperature above the dew point. If it’s too thin, external condensation can occur, leading to mould/mildew growth, safety hazards from dripping water, and corrosion risks. Additionally, insufficient insulation allows excessive heat gain, which increases boil-off gas generation. This can cause operational instability, elevated pressures, and reduced process efficiency.

Internal condensation, which degrades thermal performance, is more dependent on the system design and installation quality – particularly the integrity of the vapour barrier that prevents moisture migration from the external environment.

Noise control is another key function. Effective acoustic insulation typically involves a combination of insulation material, mass-loaded vinyl layers, and metal jacketing. Together, these components help meet design targets for noise reduction across octave bands, ensuring safe and comfortable operating conditions within the facility.

In summary, insulation is not just a passive layer – it’s a critical system component that supports process stability,

safety, efficiency, and compliance with acoustic standards in LNG operations.

One of the main operational challenges facing an export or import LNG terminal is how to minimise the boil-off rate, or the rate at which LNG will turn into gaseous natural gas if its temperature rises above -260˚F (-162˚C). Reliquefying natural gas requires expensive and energy-intensive refrigeration systems, which lower efficiency and increase the facility’s operating costs.

A properly designed insulation system, which includes the proper selection of insulation material type, thickness, and cladding, can reduce boil-off risks and avoid the need for an extensive refrigeration step, improving plant efficiency and lowering costs.

Effective insulation directly reduces methane emissions, one of the key environmental challenges in LNG operations. Since LNG is a resource with high energy demands during its production, transportation, and installation, using the right insulation can reduce power consumption at every step of the process. Mitigating thermal stress in turn prolongs the service life of LNG equipment, necessitating fewer repairs and cutting down on transportation emissions. This not only supports global decarbonisation goals in the long term, but also helps upstream and downstream players meet their Scope 3 environmental, social, and governance (ESG) targets.

While some advanced insulation materials, such as aerogels, may carry higher upfront costs, they offer long-term benefits associated with ultra-fast installation that does not require special personal protection equipment (PPE). One of the lessons we learned from the global COVID pandemic was that the disposal of PPE is a major environmental hazard. Aerogels deliver additional environmental benefits by lowering lifetime emissions due to reduced product losses and improved vapour containment, so they are a prime example of how technological advancements can help safeguard the environment.

LNG is viewed as having the lowest carbon footprint of any of the major conventional energy sources. Facility designers are digging deep into their toolkits to further reduce the carbon intensity of the LNG that facilities produce. One often overlooked way to improve both the construction and operational carbon footprint of an LNG process facility is to choose a stringent thermal design and select an insulation that meets that strict criteria in the smallest possible footprint. This allows designers to literally reduce the footprint of the plant. Equally important is to use a system that is durable and fault tolerant so in the future the plant is just as efficient as the day it is commissioned.

Yes – insulation plays a key role in reducing emissions throughout LNG operations by improving energy efficiency in both high-temperature and cryogenic areas of the process.

In high-temperature zones, a well-designed insulation system minimises heat loss, which reduces the amount of energy required to maintain operating temperatures. This translates to lower fuel consumption, whether from on-site hydrocarbon combustion or external power generation, ultimately leading to reduced greenhouse gas emissions.

In cryogenic areas, insulation helps limit heat gain from the surrounding environment. When properly designed, installed, and maintained, the insulation system reduces the energy needed to keep process fluids at extremely low temperatures. This also results in lower emissions, both directly at the facility and indirectly through reduced demand on external energy sources.

In short, effective insulation contributes to lower energy use, greater process efficiency, and reduced emissions, making it a critical component in the environmental performance of LNG facilities.

Insulation plays a critical role in reducing emissions across LNG operations by improving energy efficiency and minimising product losses. High-performance insulation helps maintain cryogenic conditions, keeping natural gas in its liquid form with minimal energy input. By reducing heat transfer, insulation reduces the amount of energy required for refrigeration and compression, thereby cutting both fuel consumption and the associated greenhouse gas emissions.

In addition, effective insulation limits boil-off gas – the vaporised LNG that forms when heat enters storage tanks or transfer lines. Containing and reusing this gas instead of flaring or venting it helps operators curb direct methane emissions. Overall, advanced insulation materials and systems are crucial for enhancing LNG process efficiency, reducing operational emissions, and facilitating the energy industry’s transition towards more sustainable operations.

With standards and regulations frequently revised and updated, how does this impact insulation design and quality?

Unfortunately, regulations typically evolve as the result of incidents, the Grenfell Tower fire being a prime example in the UK construction industry. Insulation solutions therefore must meet ever more stringent performance requirements, depending on the application use and location. Materials that were once widely used, such as perlite or polyurethane foam, have been phased out due to performance limitations and, in some cases, serious safety incidents. Polyisocyanurate (PIR) foam, in both its multilayer, rigid form and its preformed, injectable variant, have shown different disadvantages, containing either environmentally-hazardous halogens or chemical substitutes that compromise insulation performance. Therefore, it is

paramount to test and certify any innovations in insulation materials according to the latest local regulations. ASTM C795 is the standard that defines requirements for thermal insulations used in contact with austenitic steel. ASTM C871 is contained within ASTM C795 and is the Standard Test Method for Chemical Analysis of Thermal Insulation Materials for Leachable Chloride, Fluoride, Silicate, and Sodium Ions, which covers test methods for lab processing. ASTM C795 contains the pass/fail criteria for ASTM C781. Additionally, ASTM C795 contains a requirement for corrosion testing ASTM C692, which is a 28-day corrosion test that aerogel materials must meet. Our AlkeGel Ember products are designed for higher temperature applications. The material contains high-temperature insulating wools and are 80% less dusty vs traditional aerogels.

In summary, today’s insulation must meet stricter requirements for thermal efficiency, dimensional stability, safety, and environmental health, whilst also offering best-in-class CUI mitigation.

While the core insulation materials used in cryogenic LNG applications – such as PIR and cellular glass – have remained largely unchanged for decades, evolving standards and regulations continue to influence how insulation systems are designed, specified, installed, and maintained.

Key impacts include:

z System design adjustments: Updates to codes and standards (e.g. ASTM, ISO, API) may introduce new requirements for thermal performance, fire safety, acoustic control, or mechanical integrity. Even if the base materials remain the same, insulation systems may need to be redesigned to meet revised criteria – such as increased insulation thickness, enhanced vapour barriers, or multi-layer configurations.

z Documentation and compliance: Regulatory changes often require more rigorous documentation, including material certifications, installation procedures, and inspection protocols. This ensures traceability and compliance with increasingly stringent environmental, safety, and performance standards.

z Installation practices: Updated standards may influence how insulation is installed, especially regarding vapour barrier integrity, joint sealing, and layering techniques. These changes can affect labour requirements, training needs, and quality control procedures.

z Quality assurance and testing: New or revised standards may call for enhanced testing protocols – such as thermal conductivity verification, fire resistance testing, or acoustic performance validation – to ensure consistent quality across projects and geographies.

z Sustainability and emissions: As global regulations increasingly focus on carbon reduction and sustainability, insulation systems may be evaluated not just for performance, but also for their environmental impact, including embodied carbon, recyclability, and contribution to energy efficiency.

In summary, while the fundamental insulation materials may remain stable, the design and execution of insulation systems

With 30–40 + years of demonstrated service life, TRYMER ® PIR is the insulation solution relied on for long-term performance in cryogenic environments.

Learn more about how Trymer compares in LNG applications.

*Inquire with JM for project references.

must continuously adapt to meet evolving regulatory expectations – ensuring safety, efficiency, and compliance in LNG operations.

Evolving design standards and regulations have a significant impact on insulation design and quality for LNG operations. As global and regional authorities tighten requirements around safety, energy usage, and environmental performance, insulation systems must meet higher expectations for thermal efficiency, mechanical durability, and fire resistance. For example, updated standards often demand lower allowable heat leakage rates and improved resistance to mechanical stress or cryogenic cycling. These shifts drive innovation in insulation materials and installation methods – pushing suppliers and engineers to develop solutions that not only meet compliance thresholds, but also enhance long-term performance and reliability. At the same time, sustainability considerations are increasingly shaping regulatory frameworks. New guidelines are emphasising reduced lifecycle emissions, recyclability, and safer handling of insulation materials. This encourages the adoption of advanced, high-quality insulation systems that combine efficiency and environmental responsibility. As a result, compliance is no longer just about meeting minimum requirements – it is a catalyst for better design, improved operational integrity, and reduced environmental impact across the LNG value chain.

Q5. How might insulation develop for use in the LNG industry in the future?

With our AlkeGel products, the future of LNG insulation is in safe hands. AlkeGel Glacier meets the top three safety requirements of LNG applications: thermal insulation, acoustic mitigation, and best-in-class fire protection. In addition, its use translates to 20 – 30% total cost savings from installation, as AlkeGel requires minimal PPE, no special tools to cut, and is quick to install due to its malleable roll product form. AlkeGel Glacier and AlkeGel Ember protect assets

from fire, ice, mechanical damage, and CUI, whilst also helping improve energy efficiency and lower greenhouse gas emissions, ensuring that handling and transporting LNG for industry is future proof.

The trend in insulation systems is one of increased thermal resistance coupled with multiple protection requirements such as passive fire protection or noise reduction, all the while protecting metallic surfaces from corrosion. It would seem that future material developments would encompass those increased performance demands into a material that is easy to install, fault tolerant, and highly durable. Such materials exist today in the form of flexible aerogel fibre composite blanket insulation – Pyrogel and Cryogel bring those benefits and have proven their performance in the field for over 20 years. As these materials improve with future developments, all these attributes will be enhanced to bring even greater value to owners, operators, and EPCs.

As the LNG industry continues to grow and adapt to global energy demands, insulation technologies are likely to evolve in several key areas to support improved efficiency, sustainability, and performance.

1. Advanced materials

Future insulation systems may incorporate nanotechnology or hybrid composites that offer superior thermal performance with reduced thickness and weight. These materials could help optimise space, reduce structural loads, and improve energy efficiency – especially in compact or offshore LNG facilities.

2. Enhanced sustainability

With increasing pressure to reduce carbon footprints, insulation products may be developed using low-emission manufacturing processes, recyclable components, or bio-based materials. Lifecycle assessments and embodied carbon metrics could become standard in material selection.

3. Smart insulation systems

The integration of sensor technology into insulation systems could allow for real-time monitoring of temperature, moisture intrusion, and system integrity. This would enable predictive maintenance, reduce downtime, and improve safety by detecting issues before they escalate.