COMPETITION IN AI INFRASTRUCTURE

Competition Committee 4 December 2025

Greg Jackson

Competition Expert

Competition Division

• Introduction

• Overview of the AI infrastructure supply chain

• Common market features

• Potential tools and responses

• Conclusion

• AI now viewed as next general-purpose technology

• Over 1bn people now regularly use standalone AI Platforms

• All this is built on complex supply chain of markets which is receiving enormous amounts of investments (trillions of $s)

• AI infrastructure

• Cloud

• Datacentres

• Chips Introduction

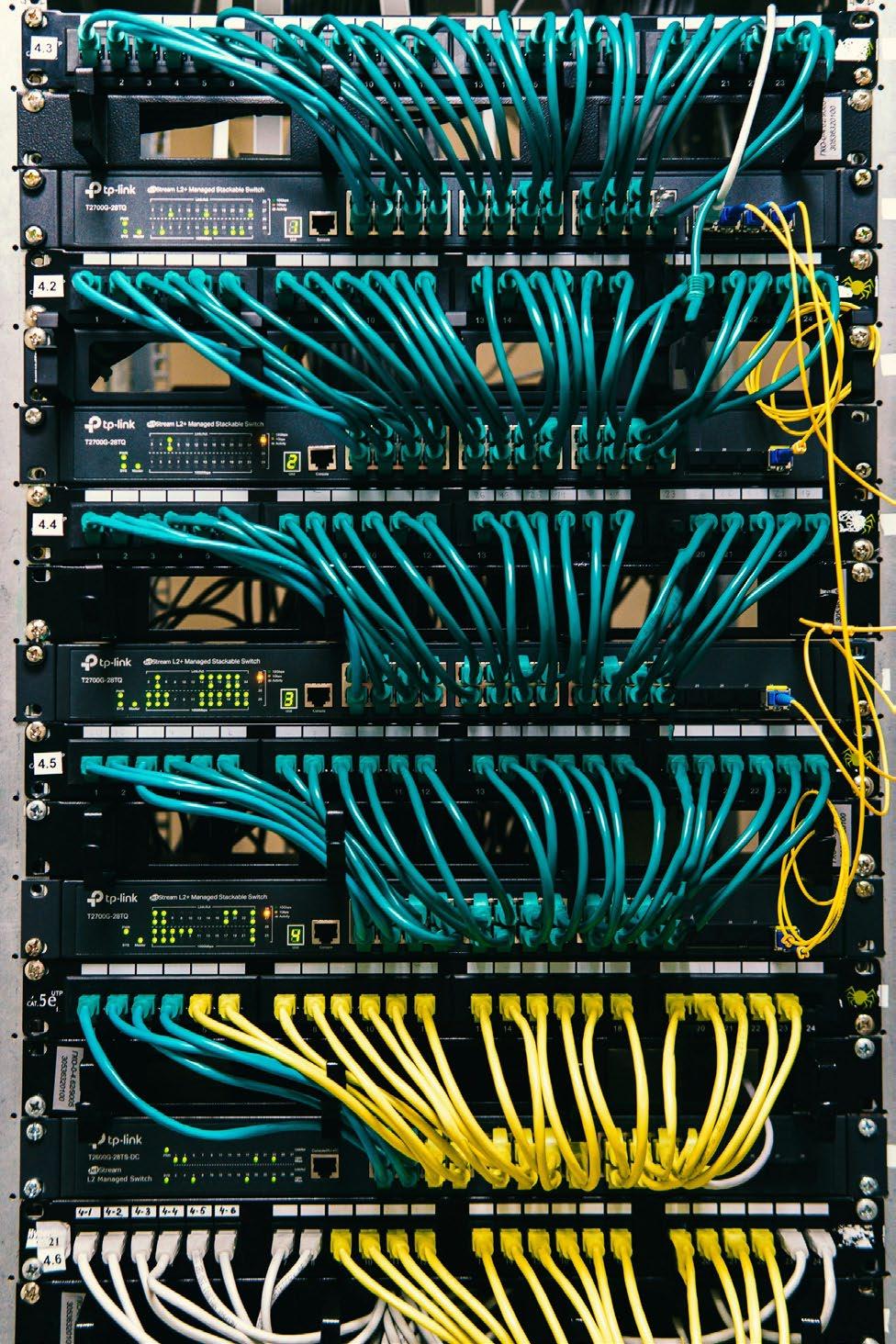

• Energy/Networking

Common market features in AI infrastructure

Excess demand

High levels of innovation

Implications for competition?

Increasing levels of state intervention

Increasing integration and agreements

High Concentration and barriers to entry

High innovation and dynamic markets

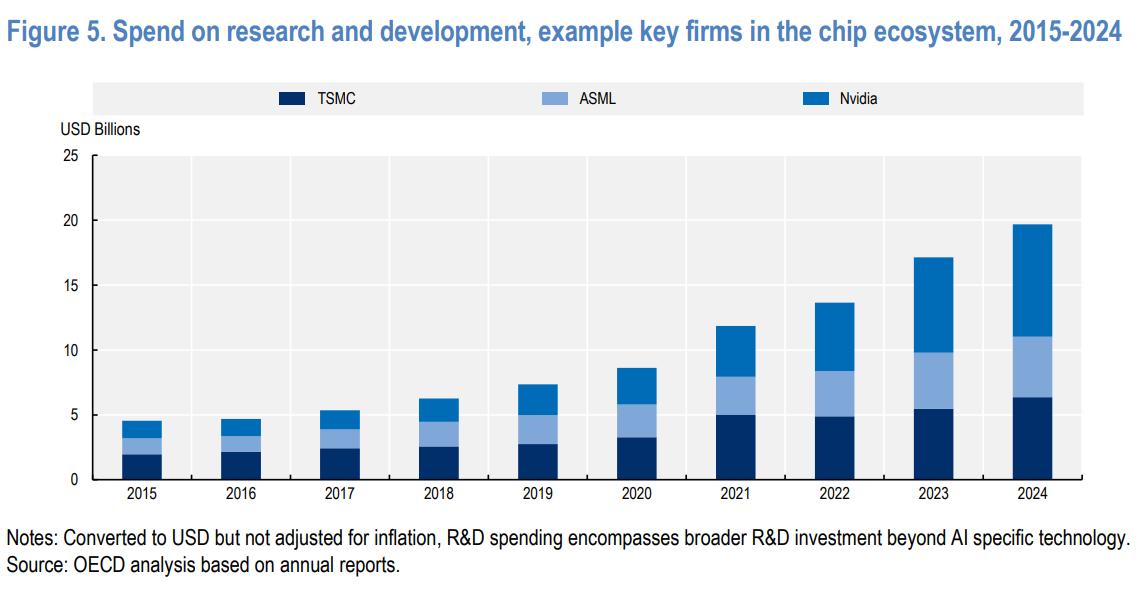

• Vast R&D Spending

• Short lifecycles and exponential improvements

• High levels of intellectual property

“mechanics and sensors so exact… they could be used to aim a laser to hit a golf ball as far away as the moon”

Chip War, Chris Millar

High concentration & barriers to entry

Many layers of supply chain highly concentrated

Often very high entry barriers

High capital demands

Economies of scale

Long lead times

Global share for largest provider reported as over 80% of market Global share of largest 3 players reported as over 60% of market

Sources: Authority market studies and news reports

Note: The OECD has not done a market definition exercise, and these shares may not therefore relate to economic markets but are commonly understood to be key parts of the AI supply chain.

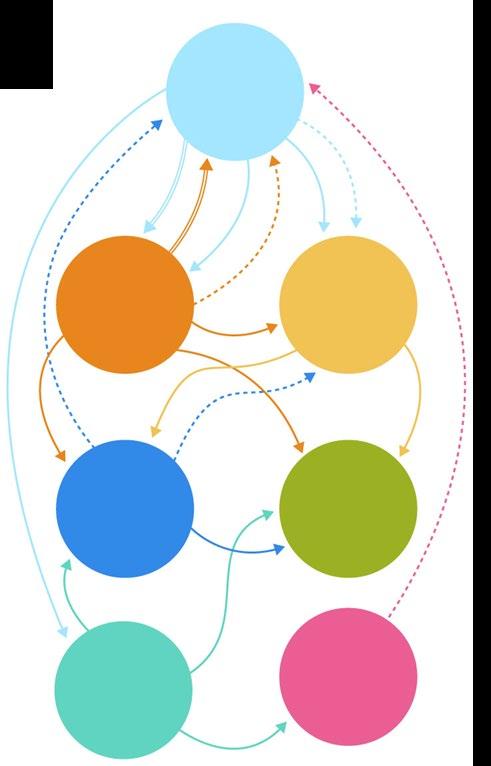

Increasing agreements and integration

• Key players expanding into other related markets both organically and via mergers

• Long term partnership agreements

• Minority shareholdings

Source: Anonymised circular AI deal visualisation, Barron’s October 2025

Excess demand

• Huge anticipated demand

• Constrained supply

• Possible bottlenecks of key components

• How will competition dynamics change if market moves to oversupply?

Recent example of price surges over 100% in DRAM markets due to shortages

Increasing state intervention

• Long history of state intervention in semiconductor industry

• Level of interventions have increased significantly as AI infrastructure has become a key geopolitical issue

Traditional competition responses

Merger Control

Conglomerate

Vertical

Killer acquisitions

Antitrust Enforcement

Abuse of dominance / Monopolisation

Collusion

Other policy tools

• Market studies and research

– Upskill and monitor

– Find potential issues

• Cooperation

– Global markets create opportunity for increased cooperation

• Advocacy

– Potential pro-competitive interventions

– Guidance and early warning letters

Conclusion

• Hugely important sector

• Complicated and varied markets but with some common features with implications for competition

• Challenge of policy response in such dynamic markets

Thank you