MIG/MAG PULSE SYNERGIC

Instant precision or total control Switch modes and master any job.

Weld from 10A to 220A with full pulse control.

The P3 accommodates input voltages from 185V to 265.

3 MIG/MAG welding modes: Standard Dynamic, Pulse & Manual

4-roller wire feeder with digital encoder for precise wire feed.

IP23S rated for use in the harshest shop environments. Support for two gas cylinders.

Digital arc control with instant ignition. Excellent arc stability to minimize spatter.

Auto torch detection and built-in programs get you welding fasterno wasted time dialing it in.

New 3.5” intuitive multilingual interface.

Stores up to 200 welding programs for recurring job applications.

Technician jobs and machine configurations can be loaded/ saved/transported using a USB drive.

Kemperle represents hundreds of the industry’s top manufacturers and stocks thousands of their superior products. With more than 50,000 products available to our customers, Kemperle’s locations are uniquely equipped to find the products you need.

KEMPERLE PERFORMANCE DRIVEN PRODUCTS

Abrasives | Adhesives | Body Fillers & Polyester Putty | Clearcoats Detailing Products | Hardware | Masking Products | Prep Solvents/Cleaners Primers/Sealers | Reducers | Spray Suits | ...and more

PINNACLE EQUIPMENT

U.S. Importer for Car Bench International

NJ TRAINING CENTER

• Hands-on technical training

• Classroom seminars

ON-SITE MOBILE DEMONSTRATIONS & TRAINING

626 E. Elizabeth Ave Linden, NJ 07036

P: (908) 925-6133

F: (908) 925-4344

414-416 Madison Ave Paterson, NJ 07524

P: (973) 279-8300

F: (973) 279-9030

100 Melrich Rd Cranbury, NJ 08512

P: (609) 860-2800

F: (609) 860-2801

Linkedin.com/company/albertkemperleinc

631 Clifton Ave Toms River, NJ 08753

P: (732) 797-3942

F: (732) 797-0774 4 Emery Ave

NJ 07869

P: (862) 244-4818

F: (862) 244-4822

Our flagship dealerships are pleased to offer a wide selection of authentic genuine parts so you can repair your customer’s luxury car to the highest quality.

We not only sell WHOLESALE GENUINE PARTS across the tri-state area, but we also offer a knowledgeable team of parts specialists who will find the component you need for a seamless vehicle repair.

AUDI QUEENS

30-35 College Point Blvd. Flushing, NY 11354

Wholesale Direct: 929.297.0788

parts@audiqueens.com audiqueens.com

MERCEDES-BENZ OF BROOKLYN 1800 Shore Pkwy. Brooklyn, NY 11214

Wholesale Direct: 718.258.7055

parts@mbofbrooklyn.com mbofbrooklyn.com

MERCEDES-BENZ OF CALDWELL

1220 Bloomfield Ave. Caldwell, NJ 07006

Wholesale Direct: 973.808.0204

Parts@mbofcaldwell.com mbofcaldwell.com

JAGUAR BROOKLYN 809 Neptune Ave. Brooklyn, NY 11224

Wholesale Direct: 929.583.6492

parts@jlrbrooklyn.com jaguarbrooklyn.com

LAND ROVER BROOKLYN 809 Neptune Ave. Brooklyn, NY 11224

Wholesale Direct: 929.583.6492

parts@jlrbrooklyn.com landroverbrooklyn.com

LEXUS OF BRIDGEWATER 1550 US-22 Bridgewater, NJ 08807

Wholesale Direct: 866.679.7054

parts@lexusbridgewater.com lexusofbridgewater.com

LEXUS OF EDISON 711 US Highway 1 Edison, NJ 08817

Wholesale Direct: 732.593.6860

parts@lexusedison.com lexusofedison.com

P.O. Box 734

Neptune, NJ 07753

EXECUTIVE DIRECTOR

Charles Bryant 732-922-8909 / setlit4u@msn.com

2023-2025 OFFICERS

PRESIDENT

Ken Miller, 821 Collision, LLC (973) 949-3733 / kmiller@821collision.com

COLLISION CHAIRMAN/

PAST PRESIDENT ATTENDING

Jerry McNee, Ultimate Collision Repair, Inc. 732-494-1900 / ultimatecollision@att.net

MECHANICAL CHAIRMAN

Keith Krehel, Krehel Automotive Repair, Inc. 973-546-2828 / krehelauto@aol.com

TREASURER

Tom Elder, Compact Kars, Inc. 609-259-6373 / compactkars@aol.com

SECRETARY

Thomas Greco, Thomas Greco Publishing, Inc. 973-667-6922 / thomas@grecopublishing.com

BOARD

Nick Barbera, Union Collision 908-964-1212 / nick@unioncollision.com

Dennis Cataldo, Jr., D&M Auto Body 732-251-4313 / jr@dnmautobody.com

Brad Crawford, Livingston Collision, Inc. 973-992-5274 / livingston.collision@gmail.com

Todd Fontana, Proline Body & Chassis 201-398-1512 / todd@prolinebody.com

Gary Gardella, Jr., County Line Auto Body 732-363-5904 / countylineautobody@gmail.com

Dean Massimini, Autotech Collision Service, Inc. 856-232-1822 / autotechnj@comcast.net

Jeff McDowell, Leslie’s Auto Body 732-738-1948 / chacki@aol.com

Danielle Molina, 821 Collision (973) 949-3733 / dmolina@821collision.com

Ted Rainer, Ocean Bay Auto Body 732-899-7900 / ted@oceanbayautobody.com

Anthony Trama 973-818-9739 / anthonytrama@aol.com

BOARD ALLIED

Joe Amato, The Amato Agency 732-530-6740 / joesr@amatoagency.com

Mike Kaufmann, Mike Kaufmann Dealer Group 973-332-7014 / mkaufmann@adps.com

PRESIDENT/PUBLISHER

Thomas Greco / thomas@grecopublishing.com

VICE PRESIDENT/SALES DIRECTOR

Alicia Figurelli / alicia@grecopublishing.com

EDITORIAL DIRECTOR

Alana Quartuccio / alana@grecopublishing.com

SENIOR CONTRIBUTING EDITOR

Chasidy Rae Sisk / chasidy@grecopublishing.com

OFFICE MANAGER

Donna Greco / donna@grecopublishing.com

PRODUCTION COORDINATOR

Joe Greco / joe@grecopublishing.com

CONTRIBUTING

Charles

Rich

Mike

Nick

Keith

Michael

Tom

Bob

Russ Robson

Jerry Russomano

George Threlfall

Anthony Trama

Cynthia Tursi

Lee Vetland

Paul Vigilant

Rich Weber

Brian Vesley

Glenn Villacari

I’m old enough to remember the 60s. I remember the Vietnam War, the protests, the division in our country. Sure, I was a kid, but seeing those things play out on TV left an impression on me that lingers to this day. I always hoped I’d never live to see us return to those days. But sadly we have.

Never has that been more apparent than by what has taken place over the last few weeks. I was driving to a trade show when an alert came up on my phone that Charlie Kirk had been shot. As someone who is pretty active on social media, I was familiar with who Charlie Kirk was. I wasn’t a follower, but when he came up on my feed, I stopped and watched. He seemed like a genuinely good guy who was challenging people to debate. I found him entertaining, and he didn’t seem like your typical political con man. I liked him.

Once I walked into the trade show, I kept refreshing my feed to find out if there was any more information on how badly he was hurt. I will forever remember exactly

WIN offers education, mentoring and leadership development opportunities to build critical skills for success in the collision repair market.

• Local/Regional Networking Events

• Annual Education Conference

• Educational Webinars

• Mentoring Opportunities

womensindustrynetwork.com

• Scholarship Program

• School Outreach Program

• Most Influential Women (MIW) Award

by THOMAS GRECO, PUBLISHER

where I was when that horrible video came up on my screen. I felt like someone had punched me in the stomach.

There have been so many words written about that day, most of them from a political viewpoint. But to me, it wasn’t about politics. It was about the cold blooded murder of another human being. A murder that was being seen by hundreds of millions of people simultaneously. And it made me want to throw up.

As you well know, the outpouring for Charlie Kirk came from many places. I was surprised how many people I knew, who had never heard of him, were upset over the assassination. People I knew who have no interest in politics at all. It made me wonder why Charlie Kirk had this effect on so many people.

I came to the conclusion that even people as old as I am had never witnessed something like this happen to a national figure. By that, I mean we never saw it happen almost instantaneously, replaying over and over. There was no footage of Martin Luther King, Jr. or Robert Kennedy or John Lennon. Even if there were, TV back then would never show something so graphic. People tend to forget that no one saw the JFK assassination footage until years after it happened.

Today? Today, we live in a world where this horrific moment in time is right in our pockets on our frigging phones.

Take the f#$king politics out of it. I don’t want to hear your “what abouts?” A young man was murdered in cold blood for all the world to see. That alone should have brought us together. But did it?

Go ask a Jimmy Kimmel fan.

We maintain a comprehensive inventory of high-quality, genuine OEM parts. Email or call today to speak with our highly knowledgeable parts staff!

LAND ROVER PRINCETON 1125 US-206 • Princeton, NJ 08540 609-921-7788 Visit us at www.landroverprinceton.com! GENUINE LAND ROVER PARTS

Every week, I hear about another claim that starts – and too often ends – with a handful of cell phone pictures. A customer takes a few shots of the damage, uploads them to an insurer’s app and receives a quick estimate that seems to settle the matter. On the surface, it feels convenient. But convenience should never replace a real inspection when a vehicle’s safety is at stake.

Modern vehicles are engineering marvels filled with advanced driver assistance systems (ADAS), high-strength structural components, hidden sensors and intricate electronics. A single collision can compromise these systems in ways no camera can capture. Frame misalignment, microscopic fractures in high-strength steel or a shifted radar sensor simply do not show up in a photo. Yet, insurers increasingly rely on photos alone to write an estimate and tell a customer the car is safe to drive.

The problem is that most vehicle owners do not realize how much technology is hidden behind the paint. After their insurer’s “inspection,” they often assume the vehicle is roadready. They may continue to drive a car with disabled safety systems or unseen structural damage, placing themselves and everyone on the road in danger.

by KEN MILLER

The financial side of photo estimating is just as troubling. Quick-hit estimates almost always understate the true cost of a proper repair. When a shop performs a thorough teardown and documents the full scope of damage, the real cost can be thousands of dollars higher than the photo estimate. This is not a harmless mistake. It is a deliberate tactic, known as “anchoring,” in which the first number presented becomes the psychological baseline. By planting a low figure early in the process, insurers set an expectation in the customer’s mind that anything higher is excessive.

When the repairer provides a complete and accurate repair plan, that anchored number lingers. Customers who trust their insurer may begin to doubt the shop, wondering if the higher cost is padded or unnecessary. This tactic creates tension, undermines the repairer’s credibility and turns a routine claim into a stressful confrontation. The insurer can then position itself as the consumer’s defender, questioning legitimate repair costs that were never captured by the initial photo estimate.

A photo estimate is not a repair plan. It is a strategic starting point that favors the insurer by minimizing the

There was a time when insurers partnered with highly qualified shops – those that invested in training, equipment and proper procedures to ensure safe, professional repairs with the client’s best interests at hand. That era is long gone. Today, bean counters dominate. Everything is reduced to numbers. The result? Necessary procedures are skipped, safety is compromised, and NJ consumers pay the price.

Modern repair isn’t just about fixing dents. Advanced driver assistance systems, OEM requirements and calibrations demand training, specialized tooling and constant education. Yet insurers behave as if nothing has changed in 30 years, treating repairs as routine line items. Cutting corners today isn’t just unprofessional – it’s dangerous.

The system is collapsing under delays, supplements and poor oversight.

Doing a few Post-Repair Inspections (PRI), I reviewed an estimate that had seven supplements totaling $45,000; yet not a single calibration was included. How could the shop and appraisers “miss” something so critical? I’ve viewed photos of this vehicle repaired on a 30-year-old frame machine that had no business in a facility today.

Here’s another case: A vehicle recently repaired is now worth 50 percent less due to the repair shop unprofessional, industry standard repair. Another vehicle inspected three times by the insurance company was declared “repaired” yet left structurally unsafe. These aren’t exceptions; they’re routine. And who suffers? The unsuspecting owner, whose second-largest investment becomes a liability.

It’s not only insurers. Too many shops chase volume, skip training or rely on outdated tools. A 30-year-old frame machine or a 10-year-old welder or little to no training doesn’t make you a professional; it makes you a liability. Producing “cheap and fast” work to satisfy insurers only deepens the crisis.

Insurers mislead customers with half-truths, smokescreens and outright lies. Appraisers follow orders they know are wrong. All the while, insurers claim to protect policyholders while underpaying, undercutting and dictating repairs – hiding behind phrases like “prevailing competitive pricing.”

This isn’t consumer protection. It’s a monopoly.

True professionals accept responsibility for restoring

by JERRY MCNEE

vehicles to safe, pre-loss condition. That requires investment, education and integrity. Insurers carry no liability for the quality of repairs, yet they control the process –dictating safety outcomes while bearing none of the risk.

There is hope. New Jersey Senate Bill No. 4534 would protect consumers from abusive insurer practices. The bill seeks to require all automotive insurance policies issued in the Garden State to include the Appraisal Clause. (Read the bill in its entirety at bit.ly/SB4534.)

Predictably, insurers will scramble to oppose it – not to protect policyholders, but to protect their control.

Other states are already ahead.

• Oregon has required appraisal clauses since 2010.

• Rhode Island strengthened policyholder rights in 2023.

• Massachusetts mandates appraisal in all personal auto policies.

• Texas (effective Sept. 2025) and Washington (effective Jan. 2026) now require mandatory appraisal clauses.

• North Carolina provides appraisal rights through statute.

New Jersey must be next!

As a professional, I’ve seen firsthand what these PRI outcomes produce:

• Missing welds

• Unperformed calibrations

• Misaligned radar sensors

• Aftermarket structural parts

• Totaled vehicles returned to the road, to name a few.

Every unsafe repair is a ticking time bomb. Not if, but when tragedy strikes. Insurers hide behind NDAs, burying the outcomes of PRI. Legislation like SB 4534 isn’t optional; it’s urgent.

On another PRI following two DRP shops’ corrections, our inspection uncovered 38 missing welds, no corrosion protection and zero calibrations or factory scans. The customer’s only complaint? Color match. Insurers had already inspected the vehicle three times and declared it industry standard repair.

The vehicle was ultimately totaled, then sold at auction, placed back on the road to endanger another unsuspecting family. That’s not an oversight. It’s negligence.

While performing a PRI, one of our Board members discovered that a shop had wired resistors into a seatbelt harness to trick the computer into thinking seal belts don’t require replacement. Talented? Clever? Stupid? Dangerous? Absolutely! Kudos to the shop and the level of professional training and experience to uncover and disclose the hidden sin.

Repair professionals must do more than fix vehicles. We must educate lawmakers, consumers and each other, along with our clients. Third-party appraisals are not luxuries; they’re consumer rights.

I’m not anti-insurance. But coexistence cannot come at the cost of safety, professionalism or integrity just to satisfy insurance company egos or KPIs.

• N.J. Stat. § 17B:30-13.1: Unfair claim settlement practices.

• N.J. Stat. § 17B:30-13.1: Bans misrepresentation, delays and unfair settlements.

• N.J.A.C. 11:2-17: Details on the rules insurers must follow.

• N.J. Admin. Code Title 11, Chapter 2, Subchapter 17: Regulations defining unfair claim settlement practices and rules insurers must follow.

Under § 17B:30-13.1, the law says no person (insurance company, etc.) shall engage in unfair claim settlement practices. Certain specific behaviors, when done with such frequency as to indicate a general business practice, are unfair.

I’ve pulled a few requirements. It’s open to debate: would or can you say that the insurers are following this statute?

Here are requirements that I see violated daily:

• Misrepresenting facts or policy provisions.

• Failing to act reasonably or promptly upon communications regarding claims.

• Not attempting in good faith to settle when liability is reasonably clear.

• Compelling insureds to litigate by offering substantially less than the amount they would get in court.

• Delaying by requiring duplicative documentation (prelim report plus proof of loss with same info).

• Failing to explain denials or compromise offers in writing, in relation to policy and law.

• Lying or misleading about what the policy covers.

• Not responding to claimants.

• Denying payment before looking at all relevant information.

• Waiting too long to say yes or no when documentation is complete.

• Even when it’s obvious an insurer is responsible, they drag out or make unreasonable offers.

• Making an offer so low that the insured has no option but to sue.

• If ad materials promised something, insurer can’t use that to mislead or underpay.

The New Jersey Department of Banking and Insurance (DOBI) has yet to find an insurer in violation even when citing their own statute! It’s completely shocking and a disservice to NJ consumers. Who are they really protecting?

Insurers violate these daily, yet regulators look the other way – even as rates have climbed 50 to 80 percent in just five years.

Actuaries determine policy amounts based on loss ratios. For every 10,000 policies, there are approximately 600 claims. Despite this, insurance companies are reporting a negative loss ratio – but mathematically, the numbers don’t add up.

Let’s view this example.

Full coverage for a standard policy is $2,800-$3,500.

Minimum liability $1,200-$1,400.

Let’s keep it simple.

• 10,000 policies times $1,000 each = $10M collected

• Average NJ claim: $6,200 × 600 claims = $3.7M paid. That’s 37 cents on the dollar. The rest goes to lawyers, lobbyists, bonus and profits – while DOBI and consumers are told costs are “out of control.”

Insurers hide behind Section 64 of the Auto Insurance Cost Reduction Act, but it only applies if four conditions are met. If even one is missing, the defense is invalid. Yet, insurers invoke it anyway to deny fair payments and accountability.

To invoke Section 64 properly, the following must be satisfied:

1. Existence of a “financial arrangement.” The insurer must have some financial arrangement with one or more auto body repair shops (or a network of such shops) for repairing vehicles under collision, comprehensive or physical damage coverages.

2. Insured’s right to choose repair shop The insured must be allowed to select a repair facility of their choice, rather than being forced into the insurer’s network. That is a central protection of Section 64.

3. Acceptance by chosen shop of same terms and conditions. The repair shop chosen by the insured must accept from the insurer the same terms and conditions, including but not limited to price, that the insurer offers to the shop or network of shops with which it has the most generous arrangement.

4. Written notification to the insured. Before any repair is undertaken, the chosen repair shop (if not a network shop/non-DRP shop) must provide the insured with a notice (in a form to be established by the Commissioner of Banking and Insurance) warning that by accepting the same terms and conditions as the insurer’s most generous shop, the insured may jeopardize any manufacturer or dealer warranty or lease agreement. This notice must be signed by the insured before repairs begin.

Section 64 itself is valid law. However, if any of the four required conditions are missing, the insurer cannot properly invoke Section 64 as a defense or shield in that instance. In such a context, it would not be enforceable.

Key questions to consider:

1. Were you offered their DRP agreement upfront?

2. Have they attempted to steer their policyholder away from your facility?

World has been specializing in complete insurance coverage for the automotive services industry for more than 30 years. We partner with carriers to design coverage enhancements, dividend programs, and new products specific to the automotive services industry.

An exclusive program administered by trade professionals who are ASE Master Certified and I-CAR Certified technicians.

ALL-IN-ONE, NON-AUDITABLE POLICY

• Commercial auto

• Commercial property

• General liability and umbrella

• Garagekeepers

• Cyber liability

• Employment practices liability

PLUS, SPECIAL INCREASED LIMITS

• Pollutant clean up

• False pretense

• Employee tools

• Extended Garagekeepers

• Autonomous car coverage

• Customer complaint defense

• And many more

An exclusive workers compensation safety group program, only available for auto service businesses.

•Great pricing for qualified shops

•Optional managed care premium discounts

• Potential dividend plans available

GROUP HEALTH PLANS

Health Plans with Fortune 500 benefits for small and mid-sized auto service employers.

• Competitive Rates

• Two participant minimum

•Multiple plan design options

• Multiple provider networks in all 50 states

• Dental and vision plans available

• Supplemental benefits available

continued from pg. 13

3. Were you offered the same terms and conditions as other providers?

4. Did the client sign the written notice that could potentially void their warranty or lease agreement? Insurers often rely on the argument: “We only have to pay for what we can get it done for.”

Consumers pay their premiums with the expectation that their insurer will be there in their time of need. But too often, they’re left shortchanged, alone and confused – fighting against a system built to minimize payouts, not maximize safety.

Stay tuned for next month’s issue, where I’ll break things down even further as we take a look at whether or not the New Jersey Automobile Insurance Cost Reduction Act really does equate or impact the auto body repair business.

• Audi Parts Professionals are your subject matter experts on collision parts, replacement components and mechanical items.

• Many Audi dealers offer technical service support hotline access that can reduce your repair times and help you meet an on-time promised delivery.

• Installing Audi Genuine Parts contributes towards improved cycle time that makes both your customer and their insurance company happier.

Helping you do business is our business. Order Audi Genuine Parts from these select dealers.

Paul Miller Audi

179 Route 46 East

Parsippany, NJ 07054

Toll Free: 800.35.MILLER

Parts Direct: 973.575.7793

Fax: 973.575.5911 www.paulmiller.com

Bell Audi

782 Route 1

Edison, NJ 08817

732.396.9360

Fax: 732.396.9090 www.bellaudi.com

Jack Daniels Audi of Upper Saddle River

243 Route 17

Upper Saddle River, NJ 07458

201.252.1500

Fax: 201.254.1552

tbabcock@jackdanielsmotors.com www.jackdanielsmotors.com

Audi Bridgewater

701 Route 202-206 N Bridgewater, NJ 08807

929.600.9156

Fax: 908.595.0237

parts@audibridgewater.com www.audibridgewater.com

Collision and mechanical repair shop owners have so much to contend with they may not easily find the time to think about the fundamentals of their business beyond the everyday. But the fact of the matter is that business finances can be quite complex. Everything from payroll to exit planning and everything in between should be given regular consideration in order to maintain good financial health.

Last month, AASP/NJ welcomed Rachel James of Torque Financial Group to lead a comprehensive discussion geared toward business owners and their principal team members at INDASA USA Training Academy (Fairfield) that left them with a deeper understanding of how to maximize their company finances.

James – a former technician and former major paint manufacturer employee turned financial advisor –stressed just how many components play a role in a healthy financial picture. It’s not something that shines by slapping on a layer of clearcoat.

It may have started with how they got into the industry; many may have grown into the family business or started as technicians and estimators before opening their own shop.

“For most of us who get into the business, we learn the hard way,” she acknowledged. “You sort of build this quilt of things around you in your business. For example, your employees may be asking for a 401(k) plan, so when a random 401(k) plan representative knocks on your door, you decide to go with them. Perhaps the bookkeeper you work with is someone your uncle referred to and is the person you just always used. It can be so difficult to run a business that it can often be hard to really reevaluate all these different people in your business because there’s all these other fires that you’re putting out at any given time.”

James illustrated the process of starting out and the appropriate steps that should be taken along the way toward growth and eventual exit planning.

“The more you observe your finances, you’ll start to get better performance, and that is true of everything in our life, right? The more you monitor and track things, the better you’ll see.”

She encouraged establishing relationships with one’s bank or an accountant to regularly review finances because it really “takes a village” to make finances work well for one’s business.

Once a business is established and is sustaining a profit, “we get to the place where you want to maintain, and that’s usually after the 10-year mark. That’s the right time to start looking at whether you have the right benefits in place or who is your CPA. Who are your board of directors? Who are the people that help you make decisions and who will help you build this out like a real official sparkling business? Next comes exit planning. Whether it’s a family member or to a third party, one should at a minimum start [thinking about it] five years out. That may sound shocking, but five years out, you really should identify the successor, figure out the logistics of that arrangement and start working on the estate team and tax team and people to get there.”

Doing the research and understanding what options may be available to businesses is another key toward healthy finances. James pointed to various tax write-offs related to owning property and purchasing new equipment that are available to shops

as per the passage of the federal Big Beautiful Bill many may not be aware of.

James got attendees to think about offering incentives to key employees to keep them on board long-term and about “perfect world” SOPs to consider. “Make sure that you have a personal emergency fund and one for your business and that each has three months of expenses in cash.”

She pointed out how some business owners may find comfort in numbers when, for example, they have a million dollars in their checking account, but “that’s inefficient. You’re not making any money on that. High yield savings accounts are a great opportunity.”

Building investments outside of the business is key to one’s personal financial growth.

“A business is not necessarily a wealth-generating asset, but it is an income-generating asset,” she reminded all. “The value of your business is really determined upon who’s willing to buy it. You could have the most beautiful shop with a floor you could eat off of and all the best equipment, but if you’re geographically in a place where no one wants to buy your shop or you can’t find a buyer, there is no value in the business. So, as a business owner, make sure you’re taking money out of your business and putting it into things for yourself, for your family, so that if you get to the point where you want to leave, and you can’t find the right buyer, you will have other things to lean on.”

Managing finances should be an ongoing process. “Maybe it’s just increasing what you put into an IRA from $100 to $150. Financial planning should not be painful; it should be manageable, and one should have the discipline to do a little more every year.

“Be consistent. It doesn’t matter who you are. Whether you’re a multimillionaire or someone just starting out, keep layering on top.”

Equip Yourself Against Repair Nightmares.

Old, uncertified tools lurking around? Don’t let them haunt your shop. RAE provides top-of-the-line OEM-approved equipment designed to handle even the most monstrous jobs.

BMW of Springfield

391-399 Route 22 E. Springfield, NJ 07081

Toll Free: 800-648-0053

Fax: 973-467-2185

bmwofspringfieldnj.com

BMW of Bridgewater

655 Route 202/206

Bridgewater, NJ 08807

PH: 908-287-1800

FAX:908-722-1729

bridgewaterbmw.com

©️2025

Circle BMW

500 Route 36

Eatontown, NJ 07724

Parts Direct: 732-440-1235

Fax: 732-440-1239

wholesale@circlebmw.com circlebmw.com

Park Ave BMW

530 Huyler Street

South Hackensack, NJ 07606

PH: 201-843-8112

FAX:201-291-2376

parkavebmw.com

Paul Miller BMW 1515 Route 23 South Wayne, NJ 07470

PH: 973-696-6060

Fax: 973-696-8274 paulmillerbmw.com

BMW of Bloomfield

425 Bloomfield Avenue Bloomfield, NJ 07003

Parts Direct: 973-748-8373

psantos@dchusa.com

Please contact an Authorized Hyundai Dealer for all your parts needs: MAXON HYUNDAI

2329 ROUTE 22 WEST UNION, NJ 07083

TOLL FREE: 800-964-7281

FAX: 908-851-5631

371 ROUTE 17 NORTH MAHWAH, NJ 07430

201-529-3600

FAX: 201-529-3051

When it comes to running a successful automotive repair business, Jacki Skillender recognizes that it’s about more than just the cars; it’s also about instilling customers with the confidence to make the right decisions about their car care needs and creating a community that makes them feel welcome.

Located on South Route 9 in Howell Township, Skillender’s Automotive Center utilizes the latest diagnostic tools and technology to offer everything from routine maintenance to more extensive repairs, but the most important service they provide to customers is education that empowers them. “Most people don’t really understand how their cars work, so we make it easy,” Skillender says. “I explain what is needed in simple terms and take it a step further by teaching them why certain repairs are necessary. We share photos and videos to help them see the problems we find because building confidence is really what this business is all about. We never forget that our customers are entrusting us with their lives and their children’s lives, and we strive daily to deserve that trust they’re placing in us. I sleep well with the knowledge that we’re doing our best to help people.”

Skillender and her team take that desire to help people beyond the shop as well through their philanthropic efforts, participating in multiple food and toy drives throughout the year as well as giving their time to deliver food to the underprivileged. “It’s just how I was built.” She credits her father, Terry, for teaching her to have a humble heart.

Terry also taught her the business, raising her around his automotive businesses since she was just a child. In 1994, he purchased an old gas station and opened the doors to Skillender’s Automotive Service. “One day, he called me and asked me to come in and answer the phone because it ‘doesn’t stop ringing,’ and once I started answering it, I never stopped,” Skillender recalls. “My father did all the business work, but I was the face of the business, working directly with the customers every day to make sure we met their needs.”

When Terry passed away in 2008, Skillender was faced with the choice to sell or run the business, but that was barely a choice at all! “I love what I do,” she shares, and despite

being a “woman in a man’s world,” she finds it “gratifying and rewarding” to share her knowledge, attention to detail and caring nature with the local community. “Our customers know there’s no nonsense; they’re going to get the repairs they need without any nonsense or extra unnecessary expense. It costs nothing to be nice to someone, to be compassionate with what they’re going through.”

That belief was reinforced in 2011 after a mechanic in her shop – Skillender’s husband – fell and hit his head, suffering a traumatic brain injury that stranded him in the hospital for the next year as he learned to live again. “You never know what’s going to happen in life, and that experience helped me truly realize what is important in life. I spent a lot of time in the hospital that year, and that left us shorthanded at the shop. Despite being so busy that we often had to schedule appointments further out than usual, our customers stuck by us. Their devotion truly felt like evidence that we’ve always done right by them.

“Our customers know that we’re always there for them,” Skillender adds, noting another example of a former customer who moved to Florida but still called for advice on his car repairs. “That speaks volumes and shows that we’ve built the necessary trust and truly helped people.”

Skillender praises her team for going above and beyond to create the reputation the shop enjoys. She’s joined in the front office by Lori, her assistant who “keeps me on task” and listens to customers compassionately. “Her attention to detail extends beyond the customers to myself and the other employees.” Four mechanics work at the shop, ranging from a 24-year-old to the two most tenured who have 80 years of experience between them. “It’s a good mix. Our newest technician is more technologically inclined, so he’s teaching us about different training opportunities even as he learns himself. We also have a gifted diesel and gas mechanic who isn’t afraid to jump into anything. Our head mechanic is a master diagnostics technician, skilled in all things electrical; he’s an absolute wealth of knowledge, and nothing leaves the shop that he doesn’t touch. He generously shares his knowledge with our other technicians, helping to train the next generation.”

by CHASIDY RAE

Skillender worries about what the future holds in store for the automotive repair industry. With fewer training opportunities available since the pandemic, she believes that there needs to be a push for more education in several ways. “We need seasoned mechanics to teach new mechanics, or we’re in for a lot of trouble,” she predicts. She also promotes the need for access to data and repair manuals that will help independent shops succeed. “We shouldn’t have to send customers back to the dealership, where they’ll pay more for repairs, simply because we can’t get the repair manual.” She stresses the need for the Right to Repair Act to go through as she laments, “People are struggling –insurance costs have gone up by 30 percent, and costs are getting out of control.”

But some costs are necessary. “As individual shops and as a collective industry, we need to be investing in training the next generation,” Skillender insists. “This is key to the future of all shops, but it’s especially vital for small mom-andpop shops like ours. Without training and specialized knowledge, we’re not going to be around anymore. Small businesses don’t just support our customers with their repair needs; we support local fire departments, sports teams and even kids’ lemonade stands. If we’re overtaken by big corporations, it’s going to negatively impact our communities. We have to accept that this is a different time. Jobs and demographics are changing, and we need to adapt.”

The need to keep abreast of all these changes led to Skillender’s recent decision to join AASP/NJ, inspired by the association’s new executive director of the mechanical division, Joe Ocello. “When Joe came out of retirement to encourage me to join the association that he was going to be part of, it was an easy ‘yes.’ He’s a go-getter who listens and is results-oriented. I know that he’s going to make sure we’re able to get the training that we need to ensure the success of our business long into the future. Without that knowledge, we have no future.”

In today’s business climate, auto service and auto body shops can’t afford to leave any money on the table. Every dollar saved can significantly impact a business’s bottom line.

One area where many automotive businesses unknowingly lose substantial revenue is through credit card processing fees. These seemingly small percentages can add up, especially on high-ticket items. For years, automotive businesses have been absorbing these fees as this “cost of doing business” cut into profit margins, preventing them from investing back into their business.

my bank records and found that I had spent $4,800 in credit card fees in just one month.

“This is an industry with small margins; giving up nearly $5,000 a month is no small thing,” adds McNee, who is now only spending between $600 to $1,000 in small fees over the course of a year – a big difference!

Titanium Payments, an AASP/NJ allied member, offers a smart solution to pass these fees onto the customer which results in considerable savings for shops. AASP/NJ has been hard at work with adding more alliances to its member benefit program to help bring resources and cost savings to its members, and Titanium’s credit card program is gaining in popularity as more and more shops are signing up and are singing its praises.

Not only are they saving thousands in fees, but the program is also easy to use.

“It was a no-brainer,” Jerry McNee (Ultimate Collision Repair; Edison) explains why he made the switch. “The deciding factor was when I checked

“The tipping point for me was seeing how much revenue I was leaving by taking on the processing fees,” says Dennis Cataldo, Jr. (D&M Auto Body; Old Bridge) who started with Titanium Payments about a year ago. “I probably spent about $8,900 in credit fees the year prior. That’s a lot of lost revenue.”

According to Lou Puglisi of Titanium Payments, shops don’t even see the 3.5 percent fee by using the program as it’s diverted directly to Visa. And there’s a fast turnaround on payments. Via Titanium Boost, businesses can have their processing funds available the same day to speed up cash flow.

Set up is easy as Puglisi will come to the shop, install it and train on-site.

Other features of the program include text and email payment links that can go directly from the credit card terminal or online portal. Participants can also set up a monthly payment program with customers via Titanium.

“It’s easy to use.

The equipment is shipped to you, and Lou comes in and sets it up,” explains McNee. He stresses what an easy decision it was to make as he noticed how many services these days are charging customers for credit card processing fees. Big retail businesses may be able to absorb the cost in their pricing, but that is not an option in the automotive world. When necessary, businesses do have the option to waive the credit card fee for a customer if they wish.

Cataldo reports zero problems with the program. “They have kept their word, and there are no external fees outside of the cost to run the program.”

One thing he recommends is making sure to have the proper signage posted within the shop to alert customers to the credit card charge. He also has the fee noted in his repair authorization agreement.

“Our industry has micro margins, so it’s good to keep whatever you can get in the profit column and not see that money go elsewhere.”

When customers use their credit cards, they achieve points and benefits if they have those programs. “We don’t get the benefits of their reward program,” Cataldo points out.

When it comes down to what credit card processing program to use, McNee asks, “Why wouldn’t you want to switch?”

If not already on board with AASP/NJ’s benefits program, members should take a look at page 27 to learn more about all the available benefits and various cost saving options they can take advantage of. Not a member of AASP/NJ yet? Visit aaspnj.org to join today!

Being an AASP/NJ member has its privileges. Between savings and revenue generated by AASP/NJ member benefits, discounted education and training opportunities, access to the AASP/NJ Labor Pool and Hotline, advocacy in Trenton and exclusive members-only access to documentation, forms and regulations on aaspnj.org, you simply can’t afford NOT to be an AASP/NJ member!

AASP/NJ Health Benefits ProgramSave on Insurance!

You’ve got the right tools, staff, technology and procedures to give your customers the best repair possible. The missing piece of the puzzle? Genuine Volkswagen Collision Parts. Contact an authorized dealer today and find your perfect fit.

Paul Miller Volkswagen 118 Morristown Road

Bernardsville, NJ 07924

TOLL FREE: 877-318-6557

LOCAL: 908-766-1600

FAX: 908-766-6171

Email: aaitchison@paulmiller.com www.paulmillervw.com

Douglas Motors

491 MORRIS AVE.

SUMMIT, NJ 07901

PHONE: 908-277-1100

FAX: 908-273-6196

TOLL FREE: 800-672-1172

Email: douglasparts@douglasautonet.com www.douglasvw.com

Trend Motors 221 Route 46 West Rockaway, NJ 07866

TOLL FREE: 888-267-2821

FAX: 973-625-4985

Email: dreinacher@trendmotors.com www.trendmotors.com

Crestmont Volkswagen 730 ROUTE 23 NORTH

POMPTON PLAINS, NJ 07444

TOLL FREE: 800-839-6444

FAX: 973-839-8146

Email: vwparts@crestmont23.com www.crestmontvw.com

Join Reliable Automotive Equipment’s Dave Gruskos for conversations with industry leaders sharing their insights and the latest from the world of certified collision repair. This month, Dave talks with Vartan H. Jerian, Jr., CEO and co-founder of Vive Collision.

Dave Gruskos: VIVE Collision locations are known for operating with advanced technology and a strong commitment to safe repairs. Why is this philosophy so important to the way your locations do business?

Vartan Jerian: When you leave your vehicle with us, you’re trusting us with something that carries your family every single day. That’s a responsibility we don’t take lightly. By combining advanced technology with the skill of our technicians, we make sure your car is repaired to the best of human ability. A big part of this comes from our Ambassador Program, which is designed to grow our technicians, build apprenticeships, and strengthen our culture from the shop floor up. It’s how we make sure quality repairs are not only consistent but part of our DNA and our values of People, Process and Passion for the collision industry.

D.G.: How does VIVE define “quality” in terms of collision repair, and what steps do you take across all locations to consistently deliver on those standards?

V.J.: For us, quality means doing it right the first time and giving you complete confidence in your vehicle when you leave our shop. We achieve that by investing in technician training, apprenticeships, and programs like our Ambassador Program that help teammates take ownership of both the repair and the culture in the shop. Quality is more than the end result — it’s the process, the teamwork, and the pride our technicians put into every repair.

D.G.: The investment in tools, equipment, and technology is significant. How much weight do you place on the importance of a good vendor relationship in comparison to price or capabilities?

V.J.: Price matters, but trust matters more. That’s why we partner with companies like Reliable Auto Equipment, who not only provide the right tools but also support us in technician training and development. These vendor relationships ensure

Current number of locations: 64 States Represented: CT, DE, MA, ME, NH, NJ, NY, PA, RI, VT

OEMs Represented: 26 PRESENTS

our people always have the right resources to deliver safe, consistent repairs. The cheapest option may save a dollar today, but the right partnership pays off in the long run — for our technicians and for our customers.

D.G.: How do you feel repairers can best prepare to create a shop culture where every repair is done right?

V.J.: Culture comes from the ground up and the top down. At VIVE, we invest heavily in our technicians — because they are the ones repairing vehicles and shaping the customer experience. Through our Ambassador Program, we give technicians the tools, training, and mentorship opportunities to grow their careers, while also reinforcing the pride and accountability needed for every repair. When teammates feel supported, respected, and part of a bigger mission, the culture naturally becomes one of excellence.

D.G.: What message would you share with shops about the role of training in maintaining a successful collision repair facility?

V.J.: Training is the most important investment a shop can make. Cars evolve every year, and without ongoing training, even the most skilled technician can fall behind. That’s why we’ve made training a pillar of our culture — with structured apprenticeships, advanced development programs, and the Ambassador Program helping teammates grow into leaders. Training ensures every repair meets the highest standards, but it also strengthens careers, builds loyalty, and creates the culture that customers can feel the moment they walk in.

The Automotive Recyclers Association of New Jersey David Yeager - EL & M Auto (800) 624-2266 / elandmauto@aol.com

Ed Silipena - American II Autos (609) 965-0987 / esilipena@yahoo.com

Norm Vachon - Port Murray Auto (908) 689-3152 / portmurrayauto@yahoo.com

Dillon Rinkens - East Brunswick Auto (732) 254-6501 / ebautonj@comcast.net

President - Rodney Krawczyk Ace Auto Wreckers (732) 254-9816 / aceautonj@comcast.net

1st Vice President - Daryl Carman Lentini Auto Salvage (908) 782-4440 / darryl@las-parts.coms

2nd Vice President - Mike Ronayne Tilghmans Auto Parts (609) 723-7469 / tilghmans@snip.net

Past President - Bob Dirkes Dirkes Used Auto Parts (609) 625-1718 / dirkesauto@gmail.com

With hurricane season in full swing, it’s important to have a program or be prepared for a windstorm. Here are a few basic steps to follow:

Pre-Storm Precautions – Evaluate all building structures as to the damage they could sustain. Inspect the grounds for the condition of trees, as dead or dying trees could cause damage or injury during high winds. Develop a list of emergency phone numbers of contractors.

Building Precautions – Close unnecessary openings, and make windows and doors weather-tight. Check for broken window panes, and nail down loose window framing. Close windows on the windward side of a hurricane, and open windows on the side of the building away from the storm’s approach to reduce dangerous pressure differential. Inspect roof coverings and roof perimeter flashing. Secure or remove work in progress, temporary structures, trailers and scaffolding.

Post-Storm Actions – Immediately initiate salvage activities. Develop plans to secure the facility against looters and trespassers.

Always review and update your action plan annually. As always, please call us if you have any questions regarding your insurance coverages.

Mario DeFilippis AAI Vice President Wharton Insurance Group

(732) 686-7020 (direct line) (908) 513-8588 (cell) mdefilippis@whartoninsurance.com

3.

5.

6.

7.

8.

1st Place Team:

Joe Amato Jr., Jason Bataille, George Notte, Matt Matey (World Insurance Team)

2nd Place Team:

Dondi Pollera, Evan Pollera, Lucas Kean, Jack Coffey (Compact Kars Team)

“Most Honest” Team:

Roy Griep, Louie Mastropasqua, Al Fanelli, Paul Pereira (Albert Kemperle Team 3)

Longest Drive

Matt Matey & Paul Pereira

50/50 RAFFLE: John Kaufmann

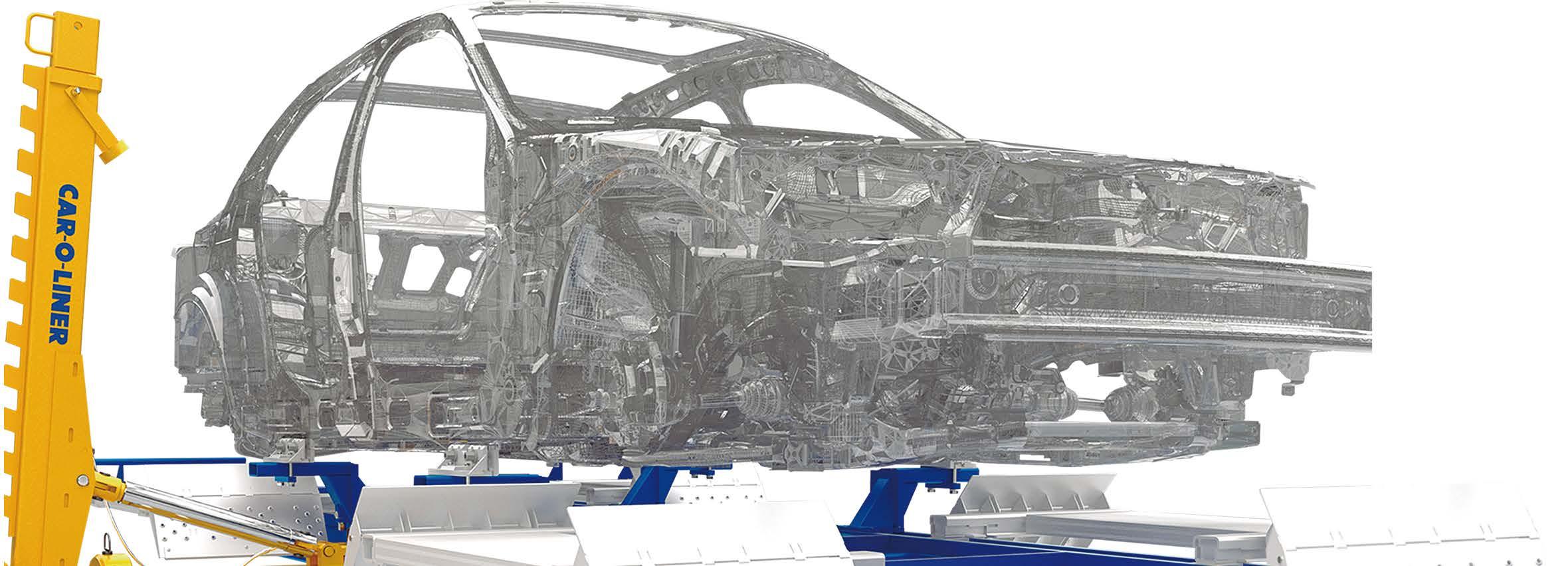

PLATINUM SPONSOR: Metropolitan Car-o-liner

GOLD SPONSORS: Matthew’s Auto Supplies

SILVER SPONSOR: Albert Kemperle

BRONZE SPONSOR: Central Paint & Dashlight Solutions

LUNCH SPONSOR: Auto Body Distributing Co.

DINNER SPONSOR: Fenix Parts

HOLE IN ONE CONTEST SPONSORS:

K&L Auto Body & Cash or Vacation Hole in One

LONGEST DRIVE CONTEST SPONSOR: Indasa USA & CCC Intelligent Solutions

CLOSEST TO THE PIN CONTEST SPONSOR: Bill Flannery Automotive

HOLE & PRIZE SPONSORS: 821 Collision, AkzoNobel, Alloy Wheel Repair Specialists, Bricon Collision, Conicelli Toyota, D&M Auto Body, DJ’s Restoration Collision Repair, Douglas Infiniti Volkswagen, Fred Beans, Hertz, Livingston Collision, Luxury Vehicle Inspections, Mike Kaufmann Dealer Group, New Jersey Automotive / Greco Publishing, NUCAR, Prestige Lexus of Ramsey, SMG / Meadowlands Expo Center, and World Insurance Associates

EFFICIENCY AT ITS BEST

OEM APPROVED PRODUCTS

Introducing the Bench Rack™ Versa, the latest in-ground innovation in collision repair technology from Car-0-Liner® . Engineered for excellence, the BenchRack™ Versa is designed to revolutionize your workshop by providing unm atched lifting capabilities, enhanced ergonomics and compliance with OEM requirements.

Contact us now to experience the future of collision repair efficiency!

Low-Clearance Ready: Seamlessly loads sports cars and EVs without extended ramps.

Optimize Shop Workflow: Drive-over design enhances shop layout and accessibility.

Boost Productivity & ROI: Reduce setup times-complete jobs faster, increase throughput, and maximize profits.

Precision-Crafted in Sweden: Built with quality and durability to outperform the competition.

perceived value of the claim. As professionals, we must make this clear to every customer. Document unsafe conditions, outline the likely hidden repairs and emphasize that only a full, in-person assessment can produce an estimate that reflects the real cost of restoring the vehicle to pre-loss condition. Explain how a low ball photo estimate is designed to influence expectations and why a proper repair plan protects both their safety and their wallet.

It is time for regulators and policymakers to recognize the danger of photo-only estimates. A quick photo may speed a claim, but it should never be the final word on whether a vehicle is safe to drive or what it will cost to repair it properly. Until standards catch up, our industry must continue to champion complete inspections, expose anchoring tactics and communicate the risks to every customer who walks through our doors. The safety of New Jersey motorists – and the integrity of the repair process – depend on it.