St. Paul Saints Game Outing Highlights

PRESIDENT Randy Notto

IMMEDIATE PAST PRESIDENT

Aaron Swanson

SECRETARY-TREASURER

Brandon Wistrom

COLLISION DIVISION DIRECTOR

Shannon Christian

MECHANICAL DIVISION DIRECTOR

Ashlan Kaplan

ASSOCIATE DIVISION DIRECTOR

Andrea Ossowski

COLLISION SEAT

Scott Miller

MECHANICAL SEATS

Dan Gleason

Greg Kasel

STAFF

EXECUTIVE DIRECTOR

Linden Wicklund

OFFICE MANAGER

Jodi Pillsbury

1970 Oakcrest Ave., Suite 102

Roseville, MN 55113

PHONE: 612-623-1110

FAX: 612-623-1122

aasp@aaspmn.org | aaspmn.org

AASP of Minnesota is an association of independently-owned automotive service businesses and industry suppliers dedicated to improving the state’s automotive service industry and the success of its members.

PUBLISHED BY:

Thomas Greco Publishing, Inc.

244 Chestnut St., Suite 202 Nutley, NJ 07110

PHONE: 973-667-6922

FAX: 973-235-1963 grecopublishing.com

PUBLISHER

Thomas Greco thomas@grecopublishing.com

SALES DIRECTOR

Alicia Figurelli alicia@grecopublishing.com

EDITORIAL DIRECTOR

Alana Quartuccio alana@grecopublishing.com

SENIOR CONTRIBUTING EDITOR

Chasidy Rae Sisk chasidy@grecopublishing.com

OFFICE MANAGER

Donna Greco donna@grecopublishing.com

PRODUCTION COORDINATOR

Joe Greco joe@grecopublishing.com

A MESSAGE FROM AASPMN

4 Collision Repair in Minnesota: What Should You Be Doing?

Collision repair in Minnesota is not just about restoring vehicles, it’s about restoring trust, safety and fairness.

LEGISLATIVE UPDATE

5 Record Year for Special Elections

A busy year at the polls for Minnesota voters.

ASSOCIATION UPDATES

6 Career Fair Season is Here! MNCARS resources available for members’ use.

NATIONAL NEWS

10 16 Million New Vehicles

Not Sold in the U.S., But the Aftermarket Rolls Up Growth New vehicle annual sales expected to fall.

INDUSTRY ROUNDTABLE

14 Fighting the Good Fight: Industry Leaders Consider Changes and Challenges

Association leaders from around the country weigh-in on pressing issues!

HEALTH, SAFETY & ENVIRONMENTAL UPDATES

18 It Can’t Happen Here Serious considerations for protecting employees from serious harm.

22 D.E.G. ESTIMATING TIPS

Updates from Solera Qapter, Mitchell and CCC.

23 AASPMN MEMBER BENEFITS

Learn about AASPMN member benefits, services and programs.

AASPMN hosted a night out for members and their employees and families.

AASPMN

by Shannon Christian, AASPMN Collision Division Director

goes beyond fixing vehicles – you’re also a key advocate for your customers’ rights. Understanding the landscape around appraisal rights, arbitration, OEM procedures, customer decision-making and the cost of doing business is essential for protecting your shop’s integrity and ensuring vehicles are repaired safely and correctly.

We all understand that we need work in the door to be profitable. With that said, the days of undercutting, lowballing and rate dropping need to disappear. Our big red insurance company just lowered rates in many areas of the state and across the country, but guess what…you let them. All the estimate matching, rate concessions, adjustments... well, that all works in their favor. We need to write fair, honest, accurate repair assessments and stick with them. We are the repair professionals and should retain professional judgement of how the vehicle needs to be repaired and what that cost is - that is, if you have the customer’s support and have explained everything to them. The current technology of new vehicles is vastly outpacing what insurance companies can keep up with. If you are not educated and prepared, then how do you help your customer?

When insurers undervalue repairs or push for total loss declarations, the Right to Appraisal (RTA) can be a powerful

tool for your customer. Minnesota-written insurance policies

independent appraisers when there’s a dispute over repair costs. You can support your customer in invoking appraisal to challenge incomplete insurance estimates. The customer must be the one to exercise this policy right if it is part of their policy. You, as the shop, can support them with accurate estimates, referrals to quality independent appraisers and by being transparent about the process. Ensure your estimates are well-documented and based on OEM procedures to strengthen your position. Collaborate with qualified appraisers who understand structural and safety-critical repairs. I invite you to actually read through several auto insurance policies to see what the fine print states. This, by no means, makes you an expert in policy interpretation, but knowing what is in most policies can be helpful when talking with your customers.

Minnesota’s arbitration system, managed by the American Arbitration Association (AAA), offers a streamlined way to resolve disputes with insurers. If you have read many insurance policies issued in Minnesota, you would probably find this in most of them. This is especially useful when insurers refuse to pay for necessary procedures or

Record Year for Special Elections

Minnesota voters have already gone to the polls for three separate special elections this year to fill vacancies in the Minnesota Senate and the Minnesota House of Representatives and they are just getting warmed up. Following the tragic assassination of Speaker Emerita Melissa Hortman, the resignation of Senator Nicole Mitchell following a guilty verdict in her felony burglary case and the surprising passing of Senator Bruce Anderson, Minnesota voters will be busy this summer and fall filling vacancies at the Legislature.

Sen.

Mitchell Resigns

State Senator Nicole Mitchell (DFL – Woodbury) resigned her Senate seat in early August, one week after being convicted of felony burglary following an April 22, 2024 arrest at her stepmother’s home in Becker County. Sen. Mitchell’s resignation came slightly earlier than expected after her attorney previously announced that she would resign sometime prior to August 4, 2025, citing the need to wrap up some constituent projects and support her staff in transitioning to new employment. Michell currently awaits sentencing and faces between six months and 20 years in jail. Her resignation had been called for by her DFL colleagues after her guilty verdict was returned.

Sen. Anderson Passes Away Unexpectedly

A second vacancy occurred in the Minnesota Senate after the unexpected passing of Sen. Bruce Anderson (R-Buffalo) at the age of 75. Sen. Anderson served in the Minnesota Senate since 2012, having previously served in the Minnesota House of Representatives from 1995-2012. A military veteran, Sen. Anderson’s legislative service focused on issues impacting veterans and rural communities.

With the passing of Sen. Anderson and Sen. Mitchell’s resignation, the Senate Democrats currently hold a 33-32 majority in the chamber. Gov. Tim Walz has called special elections to fill these vacant seats in November. Two sitting DFL House members have expressed interest in running to fill Sen. Mitchell’s seat, if either is successful there would need to be yet another special election to fill their vacant House seat.

Security Is an Issue

The discussion surrounding lawmaker security and the security of those at the Capitol has long been a debate in Minnesota. However, the assassination of Speaker Emerita Hortman and her husband Mark have turbo charged up this conversation. There will be further discussions going into the 2026 legislative session as to how the Capitol will be further protected.

In light of the security breach that occurred in late July when Capitol security found a man in the Senate chamber and arrested him, while later determining he required a mental health evaluation, a more in-depth look into security issues has been requested. The man returned to the Capitol grounds twice more over the weekend before he was arrested and is now being detained at the Ramsey County jail.

by Sam Richie, AASPMN Lobbyist

Legislative leaders stated that they are disappointed in the security breach, as Capitol security is unsure as to how he got into the Senate chamber. Everything from security check points at the Capitol to an investigation by the Office of the Legislative auditor to review security and rapid response protocols have been suggested.

It was announced last week that current Minnesota lawmakers will have access to each chamber’s operation fund to access up to $4,500 per member to cover the cost of home security systems, deadbolt locks, and other safety enhancements to their homes.

Minneapolis Mayoral Race

While the legislative races have the potential to be incredibly impactful, the race for mayor of Minneapolis is likely the most high-profile contest heading into the fall. Earlier this summer the Minneapolis Democratic FarmerLabor Party (DFL) endorsed Sen. Omar Fateh (DFLMinneapolis) over two-term incumbent Mayor Jacob Frey. This was the first time in 16 years that the Minneapolis DFL had reached the 60 percent thresholder needed to endorse a candidate for mayor. Sen. Fateh’s success was seen as a major victory for the more progressive wing of the Minneapolis DFL, including those who identify as Democratic Socialists. However, because Minneapolis uses ranked choice voting for municipal elections, all candidates will face off on the same ballot regardless of party, and the winning candidate must receive more than 50 percent of the initial votes.

Another interesting twist in the race occurred recently when Democratic Gov. Tim Walz endorsed Mayor Frey for re-election, stating that he is a national leader on issues like housing and that he believes he is the right choice for the future of the city. Mayor Frey has also announced that he will challenge the DFL endorsement of Fateh over alleged issues with the electronic voting system used at the DFL convention.

St. Paul Mayoral Race

Saint Paul’s Mayor Melvin Carter officially filed to run for his third term as St. Paul Mayor. To the surprise of many, Mayor Carter faces a challenge from within his own party ranks as state Representative Kaohly Vang Her (DFLSt. Paul), announced her candidacy in late July. Rep. Her (District 64A), which encompasses the Mac-Groveland, Cathedral Hill, Lexington-Hamilton and Merriam Park neighborhood, has served in the legislature since 2019. Rep. Her previously worked for Mayor Carter at the City of St. Paul and is currently the co-chair of the House Commerce Committee.

Like Minneapolis, St. Paul also uses ranked choice voting to determine the winner. One other interesting note about this year’s St. Paul mayoral election is that the mayor typically serves a four-year term, without term limits, but the person elected in 2025 will only serve a three-year term. This is because last year, St. Paul voters approved a ballot measure to move the city’s mayoral and city council elections to presidential years starting in 2028.

AASPMN’s St. Paul Saints Game Outing Highlights

AASPMN hosted “A Night Out with the St. Paul Saints,” Thursday, August 21 at CHS Field in St. Paul. Nearly 60 AASPMN members, their employees and families attended the event, which kicked off with a tailgate party at Lancer Service – just a few blocks from the field.

Along with the free parking provided by Lancer Service, attendees enjoyed a BBQ, along with a few cold beverages and great conversation before heading to the 7pm game. The game featured the St. Paul Saints v. Round Rock Express.

Unfortunately for Saints fans, the Round Rock Express took the win in a 0-6 victory.

Northern MN Collision Shop Meeting

THANK YOU AASPMN 2025 SPONSORS!

PLATINUM

LKQ Minnesota Lube-Tech

Optimize Digital Marketing GOLD 3M

Auto Value/Benco Equipment BASF

NCS/Single Source

PPG Automotive Finishes

SILVER

Axalta Coating Systems

Colonial Life Enterprise Mobility

O’Reilly Auto Parts

Sherwin Williams

Suburban GM Parts

Vestis

BRONZE

aaa Auto Parts

Apple Ford White Bear Lake

C.H.E.S.S.

Dentsmart PDR Gallagher

Heartman Insurance

Langer Construction Precision Diagnostics

AASPMN UPCOMING EVENTS

1st Tuesday Each Month, 6 - 8pm TBA Northern MN

Southern Metro Collision Shop Meeting

1st Wednesday Each Month, 8 – 9:30am MN ADAS, Bloomington

Central MN Area Collision Shop Meeting

2nd Wednesday Each Month, 7:30 – 9:30am APH Headquarters, St. Cloud Mechanical Zoom Meetup 3rd Tuesday Each Month 9 - 10am Collision Zoom Meetup 3rd Thursday Each Month, 9 - 10am

The crew from Norm's Tire arrived in the "Cool Bus."

Why Join WIN?

WIN offers education, mentoring and leadership development opportunities to build critical skills for success in the collision repair market.

• Local/Regional Networking Events

• Annual Education Conference

• Educational Webinars

• Mentoring Opportunities womensindustrynetwork.com

• Scholarship Program

• School Outreach Program

• Most Influential Women (MIW) Award

Career Fair Season is Here!

MNCARS is committed to helping shops connect with new employees. This includes providing resources for internships and career fairs! Even if you are not hiring right now, reminding young people about the opportunities the automotive industry has to offer is key for a steady flow of future employees.

MNCARS partners with the Transportation Center of Excellence to keep shops updated on local events. For a calendar of career events, visit: minntran.org/events/.

Not sure what you would bring to a career event?

MNCARS can help you with that! You can request a tabletop display be mailed to you, stop by our office to pick up materials, and visit the MNCARS website for digital resources. The Motor Mouth Toolbox is full of tools for shops to use to connect with prospective employees, particularly students or those considering a career in the automotive industry.

For career fair materials, visit: mncarcareers.org/ motormouth#CareerFairsandEvents

BUERKLE HYUNDAI

Vadnais Heights, MN

parts. Educate your team on how to assist customers in filing arbitration claims. There is training available from industry professionals all over the country, and we have local public adjusters who are familiar with this process. You can attend training virtually or in-person, or have an industry professional come on site and present directly to your team. Maintain detailed records of repair procedures, communications and insurer responses. Consider working with legal counsel, industry advocates or public adjusters familiar with Minnesota’s arbitration process.

Minnesota supports the use of OEM repair procedures and parts, especially when safety is at stake. Insurers may attempt to substitute aftermarket parts or shortcut repairs, but you are not obligated to comply if it compromises vehicle integrity. Be sure you are serving the right customer.

It seems like every day I am reviewing an estimate from a customer that went to a preferred shop but now chose to come to my shop. No one asked the customer what parts they preferred, but all aftermarket and LKQ were selected. No one asked the customer if they preferred mandatory safety inspections, but they were omitted in the estimate. No one asked the customer if they preferred OEM procedures be followed and they were not, based on the estimate written. Preferred shops will eventually mean nothing if you don’t have preferred customers.

A few key points to consider: speak with the customer and find out how they want the vehicle repaired; parts, procedures, calibrations, paint, etc. Follow OEM guidelines and document the repairs. Use estimating systems as a guide; that is all they are. Estimating systems were designed

as a guide for labor studied times on new vehicles, with new undamaged panels. When was the last time you worked on a brand-new vehicle with all new undamaged panels during a collision repair? This process will involve manual line entries to accurately assess the scope of damage. Push back against insurer “caps” or refusals to pay for OEM-required steps. Your customer’s safety is non-negotiable. As repairers, it is our responsibility to know what is right, do what is right and involve the customer in their repair.

We all need to do better at understanding the cost of doing business. How many price increases have been released in the last five years on refinish products, allied supplies and body supplies? Did you recalculate your cost of doing business at the time? Did you just eat the difference? Are you charging for what you use? Are you accepting what you are told? If the latter is true, you are the problem. Is a car cover really $3? Has your cost of labor risen in the last few years? Do you have a door rate that doesn’t match what you bill insurance companies? Does your rate and what you charge for vary based on which insurance company it is? Does your final bill match what was completed? These are all questions that you need to ask yourself. Why should the repair cost vary on my vehicle just because of my insurance company? The repair cost should be based on the procedures required to properly repair the car, regardless of who the bill payer is. Why, as a shop, would you be willing to charge your customers full rate, but give the billion-dollar insurance companies a break?

A conversation that occurred this morning has me wondering…The following statements were made: “You

over-repair cars,” “You make it harder for the rest of us to get paid for what is needed,” and “Not every car needs a scan or calibration.” When I reflect on the conversation, I can see that person’s point of view, at least for a moment. A few questions come to mind: Where were they educated on collision repair? How up-to-date is their training on modern repair methods and technology? When have they reviewed OEM procedures? What training have they attended for negotiation and/or customer communications? Is this person aware that most vehicle manufacturers have at least a position statement on pre- and post- scanning? After a bit of reflection, my response is quite simple.

You are under-repairing cars by not following manufacturers’ procedures. If you billed for what was required, it would help the industry and your customers versus your insurance partner. Your views of scanning and calibration requirements are dead wrong. Perhaps you should find a new line of work before someone gets hurt.

Minnesota law prohibits insurers from steering customers to specific shops or adjusting estimates without proper inspection. How many shops have had their customers file a complaint with the Department of Commerce when this occurs? Honest answer: Very few, because it involves time, work and customer involvement. Did you ever think that if nothing is reported, then in the eyes of the Commerce Department, there is no problem?

As a shop owner, you must ensure customers are fully informed and empowered to make decisions. Clearly explain

Any P.A.R.T. Any Time.

Paint | Aftermarket | Recycled | Transmissions & Engines

At LKQ, the “R” in P.A.R.T. stands for Recycled OEM parts LKQ first began 25 years ago through the acquisition of several auto salvage yards, and through the years, LKQ has grown to become the largest recycler of vehicles in the industry. LKQ now operates more than 125 auto recycling yards across North America. Through its stateof-the-art processes, LKQ recycles or re-sells more than 90% of the materials from end-of-life vehicles that would otherwise end up in landfills.

repair options, costs and implications to customers. Avoid any practices that could be seen as coercive or misleading; leave that to the claims folks. Encourage customers to retain control over their claim and repair decisions. There are too many times that I have been told, “They just had me drop it off and called me when it was done. I have no idea what they did.” Nor did they even receive a final bill on what was completed.

Insurers attempt to direct repairs, limit costs or override your professional judgment every day. Your responsibility is to advocate for proper repairs and ensure customers are not misled or pressured. You and your staff need to be trained to handle insurer pushback both professionally and assertively. This will not happen when the big picture goal of most shops is “insurance partner.” Our industry needs to do better by building relationships with customer advocates and legal experts. It is paramount that customers are educated about their rights and the importance of safe and proper repairs.

Collision repair in Minnesota is not just about restoring vehicles; it’s about restoring trust, safety and fairness. By understanding and leveraging consumer rights around appraisal, arbitration, OEM procedures, customer advocacy and your cost of doing business, you can protect your shop’s reputation and ensure every vehicle is repaired to the highest standards. That is, manufacturer’s standards; not insurance company standards.

16 Million New Vehicles Not Sold in the U.S., But the Aftermarket Rolls Up Growth

New vehicle annual sales in the U.S. will fall by nearly 15 percent from 2020 to 2026, compared to the record-high yearly volume recorded between 2015 and 2019, according to the latest projections by Lang Marketing. This new vehicle market dilemma is sending repercussions through the light vehicle aftermarket, which traditionally has relied on new auto sales to expand the nation’s vehicle population and stimulate aftermarket growth.

Through 2030 and beyond, this significant downturn of the new vehicle market will have a variety of consequences for the light vehicle aftermarket, some good and some not-so-good, but auto parts volume will continue to grow strongly, especially for Internal Combustion Engine (ICE) cars and light trucks.

16 Million Fewer New Vehicles Sold

New car and light truck annual sales in the U.S. averaged 17.3 million vehicles between 2015 and 2019, a record-high level.

The onslaught of COVID-19 undercut the new vehicle market in the U.S., causing it to fall abruptly in 2020 to 14.7 million, down almost 20 percent from the previous year. Annual sales continued at low levels, with 14.9 million in 2021 and a slide to 13.8 million cars and light trucks in 2022. Annual sales averaged 15.5 in 2023 and 2024.

2025 New Vehicle Sales and Beyond

Lang Marketing projects that in 2025 and 2026, the new light vehicle market in the U.S. will be hit by tariffs and other factors, causing it to slip to an average yearly sales level of about 15.2 million.

New car and light truck volume will total over 16 million fewer cars and light trucks during 2020 through 2026 compared to sales at the 17.3 million annual average of the previous five years (2015 through 2019).

VIO Impact

The new vehicle shortfall between 2020 and 2026 will be a powerful downward force on the growth of vehicles in operation (VIO).

Nevertheless, the negative impact of lower new vehicle sales on the nation’s VIO will be largely offset by the reduction in the country’s automotive scrappage rate (starting in 2022) as the transportation needs of consumers and businesses are saving millions of cars and light trucks from the junk yard.

ICE Vehicle Population and Aftermarket Volume

While ICE vehicles will represent over 90 percent of the 16 million or so vehicles not sold from 2020 to 2026, they will constitute virtually all of the million cars and light trucks that will dodge the scrap heap over these seven years.

Since older vehicles require more repair parts per mile than newer models, the ICE vehicles that remain on the road due to lower scrappage represent much greater aftermarket product volume (through the end of this decade) than the ICE vehicles that have not entered service due to struggling new vehicle sales since 2020--more analysis of this in future issues of the weekly Lang iReport.

Aftermarket Impact

The average age of vehicles will climb, and the number of older cars and light trucks will reach historic high levels. Accordingly, older cars and light trucks will travel more miles, and their odometers will reach record levels.

This will provide a strong tailwind for aftermarket product sales through 2030.

Foreign Nameplate Aftermarket

The foreign nameplate aftermarket will be boosted in future years by the growing foreign nameplate share of new car and light truck sales.

However, the moderate auto scrappage rates resulting from the struggling new vehicle market will keep millions of older domestic light vehicles on the road, which will slow the pace of the inevitable growth of the foreign nameplate aftermarket.

Repair-Age Sweet-Spot

The ongoing reduction in new vehicle volume is working its way through the VIO age mix to the repair-age sweetspot (vehicles six to 10 years of age).

At mid-year 2030, the repair-age sweet-spot population will be down by nearly 15 percent, compared to the number of cars and light trucks in the six-to-10-year age bracket seven years earlier.

Aftermarket Consequences

The falling population of the six-to-10-year repair-age sweet-spot will not reduce aftermarket volume because miles on U.S. roads, which will continue to increase, will be shifted to older vehicles that generate more aftermarket product volume per mile than newer models.

Overall Impact

Low new car and light truck annual sales between 2020 and 2026 (and, perhaps, beyond) will be positive for the aftermarket (especially ICE vehicle product volume) through this decade. The only products negatively affected will be those with relatively high rates of use among newer vehicles, such as tires and selected accessories.

Six Major Takeaways

• Lang Marketing projects that new vehicle sales in the U.S. will fall by about 15 percent between 2020 and 2026, compared to the average annual volume of the new light vehicle market from 2015 to 2019.

• An estimated 16 million fewer cars and light trucks will be sold in the U.S. from 2020 through 2026, compared to the record-high 17.3 million annual average volume of the new light vehicle market from 2015 to 2019.

• The new vehicle sales shortfall from 2020 to 2026 will be a powerful downward force on the growth of vehicles in operation (VIO) across the U.S. Nevertheless, the negative impact of the faltering new vehicle market on the nation’s VIO will be largely offset by the drop in the country’s annual automotive scrappage rate. Lang Marketing projects yearly increases in the light vehicle population to the end of the decade.

• Lower new vehicle sales and moderate scrappage rates

will lead to an increase in the average age of vehicles and a rise in the population of older cars and light trucks. Consequently, older vehicles will be driven more miles, which will create growth in the aftermarket.

• ICE vehicles will represent over 90 percent of the 16 million vehicles not sold from 2020 to 2026, but they will constitute virtually all of the millions of cars and light trucks that will dodge the scrap heap during those seven years. The older ICE vehicles that remain on the road due to lower scrappage represent much greater aftermarket product volume (through the end of this decade) than the ICE vehicles that fail to enter service due to the struggling new vehicle market.

• The 16 million light vehicles not sold in the U.S. from 2020 to 2026 (compared to annual new vehicle sales during the previous five years) will have a variety of consequences for the aftermarket. Still, auto parts volume will continue to grow strongly, especially for ICE cars and light trucks. For a 10-year perspective of the ICE aftermarket (2016 to 2026), see the 2026 Lang Aftermarket Annual. Please visit bit.ly/4luH7CN for the Table of Contents and bit.ly/4nUbnZk for the Order Form.

ATTENTION MINNESOTA REPAIRERS:

Help us create stronger laws to better protect your customers

Are you unhappy with how your insurance company is handling your claim?

Over 200 people in 74 cities have utilized the information below this year to file a complaint with the MN Department of Commerce. The more customers that complain, the stronger the laws that get passed! Cut out the graphic below, give it to your customers, and urge them to speak up!

● Refusing safety repairs?

● Underpaying your claim?

CUT THIS OUT & GIVE IT TO YOUR CUSTOMERS!

Are you unhappy with how your insurance company is handling your claim?

● Lack of responsiveness?

ARE YOU UNHAPPY WITH HOW YOUR INSURANCE COMPANY IS HANDLING YOUR CLAIM?

● Refusing safety repairs?

● Underpaying your claim?

● Lack of responsiveness?

• Refusing safety repairs?

• Underpaying your claim?

• Lack of responsiveness?

Scan to share your experience!

SCAN TO

SHARE

YOUR EXPERIENCE!

The Minnesota Department of Commerce wants to hear from you! Auto insurance is expensive and the people inside your vehicle are not replaceable.

The Minnesota Department of Commerce wants to hear from you! Auto insurance is expensive and the people inside your vehicle are not replaceable.

Scan to share your experience!

651-539-1600

Mn.gov/commerce

The Minnesota Department of Commerce wants to hear from you! Auto insurance is expensive and the people inside your vehicle are not replaceable.

651-539-1600

Mn gov/commerce

651-539-1600

Mn gov/commerce

Fighting the Good Fight: Industry Leaders Consider Changes and Challenges

Every day, the collision repair industry changes. Shops face a heavy load of challenges that come in many forms –from consolidation and workforce shortages to technological advances and contention with third-party payers. Yet, the need for vehicle repairs remains consistent, demanding shops keep up with the constant evolution of the industry to remain competitive and profitable. Those unwilling to put in the work to strengthen their businesses just might see their doors shuttered before long.

But what are the biggest changes and challenges facing the industry? And how can shops make sure they’re strong enough to carry the burden? AASPMN News sat down with AASPMN Executive Director Linden Wicklund, Alliance of Automotive Service Providers of Massachusetts (AASP/MA) Executive Director Lucky Papageorg, Alliance of Automotive Service Providers of New Jersey (AASP/NJ) Executive Director Charles Bryant, Society of Collision Repair Specialists (SCRS) Executive Director Aaron Schulenburg and Auto Body Association of Texas (ABAT) Executive Director Jill Tuggle who weighed in on some of the biggest challenges they’re seeing in their regions and offered suggestions on how shops can build the business muscle needed to survive the onslaught.

Wicklund offered a very valid reminder that is worth sharing before we dive into the responses given by the industry leaders above: “In answering these questions, it is easy to make generalizations that cast criticism or give the sense that the issues facing the industry are straightforward. They are the right questions, but these are tricky topics. Trying to distill down the enormity of what shops are facing into a few sentences does not capture the reality of what shops are grappling with. I know that is obvious, but I don’t think it is said enough. It needs to be said loudly and repetitively, so shops that are struggling don’t feel alienated by other shops or lose hope because they see the struggle around them. Independent shops have lasted for good reason, and they will continue to do so.”

AASPMN News: Although the collision repair industry continues to be in high demand, it faces a number of challenges which forces constant evolution. What do you see as the biggest changes impacting shops today?

Linden Wicklund: The biggest disrupter for shops – both mechanical and collision – seems to be a few different things coming together to make a perfect storm: baby boomers who own a large percentage of independent shops are retiring, investment companies are buying up businesses and consumer spending habits are changing. Boomers selling at the same time that investment companies are looking to buy is an obvious threat to the share of shops remaining independent. Consumer preferences might seem a bit removed from that, but as shops are given a facelift that looks like professionalism when they are bought out, customers may increasingly see this as an improvement in quality regardless of what actually goes on in the shop.

Lucky Papageorg: The challenges in keeping up with the advances in technology because of the very low ROI when investing in training, equipment and keeping and attracting new talent to the industry.

Charles Bryant: The biggest change is the car itself and how vehicles have evolved. Today’s cars are computerized and contain tons of electronic components which need to be recalibrated after an accident, and shops need the right tools, equipment and training to do that.

Aaron Schulenburg: The obligation to perform safe and proper repairs has never been more critical – especially when it comes to structural components and safety systems designed to protect occupants. There are many external, commercial entities trying to influence what processes, parts and tools shops use, but the repair facility ultimately holds full responsibility for the decisions made during the repair. That accountability hasn’t changed, but the external pressure is increasing significantly.

Those decisions must be rooted in OEM procedures and factory information, yet we’re seeing growing resistance to proper safety inspections, adherence to repair procedures and even third-party service providers entering agreements with insurers that dictate pricing. Often, these agreements include end-user license terms that subtly shift liability back to the shop – it’s essential to read those closely.

At the same time, vehicle technology continues to advance rapidly, adding to repair complexity. Combine that with rising costs for materials, labor and outsourced services, and you have a perfect storm driving up the total cost of repair while putting more pressure on shops to do more with less.

Jill Tuggle: Economic changes are being felt really heavily right now. Many of us saw this coming in some regard because there were warnings, but none of us expected the way it actually showed up. Part of the problem for shops lies in insurers’ insistence on decreasing labor rates by $5 to $8 per hour which presents additional pressures in a time when claims are down and the cost of living has increased.

AASP: Many independent shops may view consolidation as a huge problem they’re forced to contend with. Why does consolidation create challenges, and how can independent operators overcome those concerns?

LW: In addition to customer perceptions, the speed of buyouts is increasing the pressure as some shops are feeling the need to ‘get out while they can.’ The other big factor is buying power; those with national contracts can get better pricing than individual shops can. Independents need to differentiate themselves and have a clear understanding of how they can serve their customers better than the competition. The challenge is knowing what this looks like from the customer’s perspective. Badmouthing the quality of repairs coming from consolidators is not an effective strategy.

It is worth noting that consolidation is a big topic on the collision side, but it is also happening on the mechanical side. The market squeeze from national quick-service operations popping up is a clear indicator of what customers are looking for.

LP: Part of the issue regarding consolidation stems from some shop owners not knowing the true value of their business by either selling themselves short and leaving too much on the table or having truly unrealistic expectations of what they are worth. The other challenge is thinking that they have to jump on the consolidation train as their only way of surviving rather than expending the energy to make themselves unique and appealing to potential customers who do not want the big box store type of service.

CB: The biggest problem is consolidators controlling industry rates by lowballing and working on volume; it’s difficult for independent shops to compete with that. If the consolidators were smart, they would lay down the law and tell insurers ‘this is how much it takes to fix the car, period’ because they hold a large enough market share that they could make a positive impact. Until they do that, I’d urge independent shops to focus on performing quality repairs and refusing to accept the nonsense that insurance companies try to demand. After all, the insurer isn’t liable for the repairs; the shop is. Too many shops buckle to the insurer and make concessions on how they repair a car just to get the work, but the potential ramifications aren’t worth it.

AS: Anytime you have larger entities that are focused primarily on volume and growth, there’s often pressure to make agreements and concessions on how the repair process and claims process intersect. This can create confusion for customers who are told by some shops that certain steps aren’t needed or that others will do the job for less.

The concern around consolidation often comes from the presence of well-funded businesses that prioritize acquiring market share above all else. That can tilt the playing field. Businesses who have invested in their culture, their people, their capabilities, their communities and their commitment to the vehicle owner still have a clear path to stand out. There’s an opportunity to differentiate through commitment to process, transparency and relationships. Customers recognize and value that.

JT: Shops should recognize that consolidators rely on a completely different business model. Instead of trying to compete, they should lean into their

identity as an independent shop by pushing consumer education and engaging with their local community – because they are part of that community, and MSOs cannot compete with that. Find new ways to differentiate your shop by focusing on providing a higher customer service experience and possibly seeking out those certifications that you’ve been putting off.

AASP: Rising costs present another obstacle for shops to overcome, especially as they continue to face pecuniary pressures from third-party payers. What are the best ways for shops to clear that hurdle?

LW: Shops need to know their numbers: what their profit margins are on every element of a repair, how many repairs they need to be doing to cover general overhead and when to turn away certain jobs. Third party payers are a major challenge, but mechanical shops are also faced with repairs being turned down. Maybe there is more to learn from one another with that.

LP: BE MORE PROFESSIONAL IN THEIR APPROACH and overcome the fear... put the time in to explain what insurers are doing and why. Just as in the medical field, the vehicle owner may have to pay upfront and seek reimbursement from the insurer to be fully indemnified as per the policy they purchased. Shops have to take a stand and STOP subsidizing an industry which announces from the mountaintops how much profit they are making – profit at the expense of the vehicle owner and the collision repairer.

CB: Educate yourself. Every shop should belong to their local and national associations and take advantage of the training opportunities! Beyond that, they can simply lay the law down. It’s a joke (though it’s not funny) how insurers use the 15 percent of shops that are DRPs to control the other 85 percent, but those shops get concessions to compensate for their restrictions, which non-DRP shops don’t get, such as being able to act as the appraiser. That gives DRP shops the opportunity to adjust their hours to ensure they’re remaining profitable.

AS: The biggest issue with rising costs is when businesses fail to track them closely or adjust quickly. If you’re not actively monitoring your costs – and updating your pricing to reflect them – you’re likely already behind. Everyone involved in the repair planning and billing process needs to understand and communicate real-time continued on pg. 16

by Chasidy Rae Sisk

Jill Tuggle

Lucky Papageorg

Charles Bryant

Aaron Schulenburg

Linden Wicklund

costs accurately. For example, if your part-code tables or pricing systems aren’t updated to reflect your charges, inflation will outpace your revenue. More responsive estimating and invoicing tools can help ensure your pricing aligns with actual costs and profit expectations. Ultimately, staying agile and informed is key.

JT: It’s more important than ever to ask good questions, present the right documentation and be willing to challenge insurers when they refuse to pay for certain operations. Shops can also make their voices heard with their local Department of Insurance and by keeping labor rate surveys, like the National AutoBody Research’s (NABR) LaborRate Hero and insurer surveys, updated with their actual door rates. This will help lay the groundwork for future fights on their behalf. In the meantime, it’s worth considering a customer co-pay model.

AASP: Even as the number of shops dwindle due to the aforementioned issues, workforce shortages continue to plague the industry as experienced technicians near retirement and fewer young people are entering the trade. Some estimates suggest as many as 100,000 positions could be unfilled by 2026! Where can shop owners/ managers find qualified talent? Are there ways for them to proactively cultivate an incoming workforce?

LW: This is an interesting question because in the past 18 months, I have had so many shops say this is no longer an issue, yet the numbers clearly suggest a major shift is coming. The conversation has gone from not being able to find anyone to there being enough entry level people, but too few people with advanced skills. Replacing a top-level performer with a top-level performer is not easily done unless the shop is promoting someone internally. Shops need to pay close attention to retention. Sending a B-tech to host a table at a career fair might be just the thing to give them a sense of pride in the work they are doing and pay off even more than picking up some student names. MNCARS has resources shops can use when visiting a tech school. Being on a school advisory board builds direct relationships with faculty, which is a great way to get leads on new graduates. Techs need clear growth pathways at every level of their careers.

LP: Offering apprenticeship opportunities in their shop and getting involved with their local technical schools is a good place to start, but they also need to look outside the box and always be seeking new sources of employees, whether it is at the local fast food venue or at a store selling gaming equipment. Think outside the box!

CB: Not to keep harping on the same topic, but the labor rate is the biggest deterrent to attracting more talent to our industry. When body shops are working for $50-$55 an hour, they cannot pay someone a decent salary. Why would a young man or woman come to work in such a physically and mentally demanding job when they can make the same amount – or more! – working at Amazon? Or they can go to work at a mechanical shop and make nearly double what they could make in a body shop. Until our labor rate realistically addresses the cost of doing business and allows shops to fairly compensate workers, this problem is going to persist; we aren’t going to attract new talent into our industry.

AS: Attracting and retaining talent starts with building the right culture. Shops that only focus on hiring the next ‘A-tech’ on-demand are likely to continue struggling. The most successful businesses I’ve seen invest in developing their own people. They foster mentorship, support interdisciplinary training and create collaborative environments where employees have a voice in shaping both process and culture. Even in tough labor markets, these shops grow and retain experienced staff.

Culture isn’t just about what happens at work – it’s also about how a business supports its people outside of work. Do they offer strong benefits? Are they helping create better financial planning? Do they provide flexible scheduling that respects work-life balance? These things matter. As an association, SCRS has been working to provide tools and resources – such as our 401(k) resource (scrs.com/401k or healthcare insurance (scrsbenefitscenter.decisely.com which help our members become better employers in this regard.

JT: It starts with keeping a good culture for the employees that shops already have, which includes creating incentives that encourage employees to help with efforts to grow their own talent. Because consolidators have different resources that often allow them an edge, smaller shops need to lean into their identity by engaging in their local community, getting to know people and seeking out opportunities to attract more young people to the industry – whether that be by partnering with local schools or simply developing relationships with neighbors and friends which might give them an opportunity to learn that someone they know is seeking a new position.

Shops can also embrace some of the more technologically advanced methods for finding talent, such as bodyshopjobs.com, which was created specifically to help independent shops find employees.

AASP: They say that ‘only the strong survive’ – do you think that’s true when it comes to collision shops in the current environment? With so many changes coming at lightning speed, how can shops strengthen their positions to ensure they are among those that survive the evolution of the industry?

LW: Nimble can beat brute strength. In Japan, fabric buildings are often used instead of metal buildings in areas susceptible to storms, particularly tsunamis. The buildings’ fabric shell washes away, but the foundation and frame are unharmed and ready to quickly be recovered with a new fabric shell. I don’t know what the version of this is for shops, but I’m very certain there are independent shops who know how to think like this. They know what is not important and can be sacrificed versus what is critical for thriving even after the worst the world can throw at them.

LP: Strength has to come from within, but know that you cannot do it alone. There are resources out there, and the ‘strong’ have set great examples of how to survive and get better, so you do not have to reinvent the wheel...find out how others have succeeded and do what they did!

CB: The strong survive, but strength doesn’t have to be individual. Join together. Create a strong network. Our industry needs more unity; we need to create a community

on pg.

It Can’t Happen Here

Some people read the Sunday Times. Some read blogs. I read OSHA serious accident reports. They’re useful – but scary – guides to what can go wrong.

OSHA requires prompt reporting of any injuries that caused amputation of any body part, loss of an eye or overnight hospitalization. Those reports might trigger an inspection; at the least, they’re likely to trigger an inquiry from OSHA to find out what happened. And the reports get added to OSHA’s database (if you want to look them up, go to osha.gov/severeinjury-reports).

What did I find when I looked for the serious injuries reported for body and mechanical shops? The most common serious injuries for both types of shops were fractures, followed by amputations. Vehicles accounted for the most mechanical shop injuries, followed by tires and floors. For body shops, it was the floor (slips and falls), followed by vehicle and mobile equipment parts, metal chips, jacks and fuel. But that’s all abstract. What were some of the more notable incidents?

Belts and tires – especially tires, seem to cause a lot of finger amputations. An employee mounting a tire caught a finger between the rim and caliper. One person’s thumb was caught in the tire machine as it lowered to break the bead from the rim. Another lost a fingertip when he tried to determine if the tire was coming off the rim while it was spinning. A mechanic was hunting down a wheel bearing noise by spinning the tire and listening with a stethoscope. As he did so, his right hand slipped into the rim, catching his fingertip. The lesson: getting fingers between tires and rim is a good way to lose a fingertip.

Getting fingers around moving belts will do that, too. An Illinois technician lost three fingers when his hand was on the motor belt as a co-worker started the vehicle. Another had cuts and bruises, bad enough to require hospitalization and surgery, when his hand was caught in the moving serpentine belt for a car’s air conditioning unit. Belts

by Janet L. Keyes, CIH

on machines are usually diligently guarded, with the machine turned off and locked out if the guard has to be removed. That may not always be feasible during car repair. But mechanics need to remember that those moving belts can remove fingers.

We harp on the need to wear safety glasses in nearly every walkthrough we do. There’s a reason for that. When an employee removed a panel from a vehicle using a clip removal tool, the tool bounced off the vehicle door and punctured the employee’s eye. An employee pulled a metal object out of a tire; it flew out and struck him in the eye. He was hospitalized because of that. Another employee used a box cutter to remove some plastic wrap. The blade snapped, flying into his eye and cutting it.

I don’t consider box cutters to be all that dangerous. But this injury was severe enough to require reporting to OSHA.

Anyone who attends the training I do has heard me holler, repeatedly, about labeling containers and about not using food containers for chemicals. This case illustrates why: An employee used Gatorade bottles to store floor cleaning products. The employee mistakenly drank the floor cleaner, became very ill and was hospitalized. I can hear you saying, “I would never be that stupid.” But we see food containers reused for chemicals much too often. And we’ve heard from people who have made that type of mistake. Usually, it’s been taking a swig of paint thinner. That’s not good for you, but it isn’t likely to cause the type of chemical burns floor cleaners can cause. The take-home rules: never ever use food containers for anything you won’t drink. And always label containers.

Another take-home rule: do not siphon by mouth. An employee was doing that to remove water from a tank. He ingested chemicals in the siphon hose, making him sick enough to require hospitalization.

Air blow guns should never be pointed at anyone, including yourself. Why? A Caliber Collision employee

found out the hard way. When he used compressed air to blow off a car, he blew the air across his hand, causing an embolism. I knew that was theoretically possible, but have never before seen a documented case of it.

Air is one thing that can be injected under the skin. Grease is another. An employee was using a pressurized pneumatic grease gun when a leak in the line injected the grease into his middle finger. Injection injuries like that don’t seem like much at first. But if all of that foreign material isn’t removed, the body tissues will die. The recommended treatment: extensive surgery.

Both body and mechanical shops work a lot with flammable liquids – gasoline, thinner, brake cleaner. Because we use those so much, we often forget about the fire danger. An employee installing a fuel pump on a car was sprayed with fuel as he tried to bleed the air out of the fuel lines. As he jumped to get away from the spraying fuel, the wrench he was using touched the positive terminal on the battery and sparked. That ignited the fuel, burning the mechanic’s hand. In a different shop, an employee used thinner to clean car parts, getting the

What’s wrong with this Photo?

solvent on his gloves. He went outside for a smoke. As he lit up, the thinner on his gloves ignited.

The body shop employee’s burns were completely preventable. Use less flammable solvents for cleaning – they may not evaporate as quickly, but they’re a lot safer. Don’t wear gloves that can absorb cleaning solvents. And don’t smoke. The fuel pump incident may have been harder to prevent. Maybe the technician just needed to be more careful around gasoline, which is much more flammable than thinner.

The full list of serious incidents is over 250 entries long (and doesn’t include states, such as Minnesota, that have their own OSHA programs). I’ll leave you with one more category: injuries caused by moving cars. An employee drove a pick-up truck onto an alignment rack, got out and started to set wheel chocks when the truck began rolling backwards. When he tried to jump into the truck to stop it, he fell. The truck ran over him, fracturing both legs. Another mechanic was repairing brakes underneath a vehicle when it moved, rolling over his right side. The result: a fractured femur and ankle and a dislocated hip. And in a case that sounded too familiar, because we nearly had it happen at one of our shops: an employee was guiding a co-worker as he drove a car onto a four post lift. The co-worker

continued on pg. 22

continued from pg. 16

among the shops that are willing to fight for our industry. We need to come together as a team that will stand together to do what’s right not just for our businesses but also for the customers who are counting on us to make sure their vehicles are safe to drive when they leave our shops. We are always going to be stronger collectively than any one of us can be alone.

AS: If it’s true that ‘only the strong survive,’ it’s worth considering how strength is formed. True strength isn’t something we simply have; it’s something we build, often slowly, from the repeated act of showing up and pushing through resistance. But I think it’s fair to say that the process is accelerated — and made more sustainable — when you are surrounded by others. A strong and supportive community can help challenge your blind spots, celebrate your growth and share resources, perspectives and wisdom you couldn’t access on your own. I like to think the associations in our industry offer these types of communities and opportunities for growth, accountability and vision.

I’d encourage shops to do more than just seek survival in your business; seek belonging, and be a part of something bigger than the four walls of your business!

JT: The strong certainly survive, but consider how you define strength. Does ‘strong’ encompass having a good business acumen, a marketing mind or something more? I believe being well-rounded is the most important component to strengthening your shop, and that begins with educating yourself to understand all the opportunities that exist within this industry and embracing what makes the most sense for your individual business.

HELPING TO IMPROVE COLLISION REPAIR

ESTIMATE INFO THROUGH REPAIRER FEEDBACK

If you’re performing automotive repairs of ANY kind, you need to utilize the DEG! Check out some recent Database Inquiries - and their resolutions - below!

Solera Qapter (Audatex) – Fender Edge Refinish

In situations where the fender edge needs to be refinished, reference Solera Qapter DBRM Section 4-4 Refinish Guidelines. Page 144 states: “To receive the labor for edges, jambs or undersides, the panel must be replaced and refinish must be selected for that panel. When a repair is being performed, labor for edges, jambs or undersides needs to be a separate consideration”

Mitchell – Two-Stage / Three-Stage Paint Formula

Recent DEG Inquiry 39526 provides feedback from Mitchell regarding two-stage / three-stage color selection.

“Our two-stage/three-stage paint code identifications are based on the consensus methods outlined by the major refinish suppliers. Some paint lines may offer a three-stage solution for a widely accepted two stage color in order to achieve better results. Users may encounter situations where the paint line being used identifies a color as threestage but we do not. We recommend deferring to the requirements and guidelines of the specific refinish line utilized for the repair.”

Mitchell – Color Matching & Mixing Toners

DEG Inquiry 39422 provides feedback from Mitchell stating that mixing toners from an in-shop mixing system is not included in their published refinish time considerations. Specifically, Mitchell clarifies:

• Mixing individual toners from a mixing bank per a formula to create a quantity of paint for a specific color or code is not included in any published Mitchell labor time.

• Determining the correct variant of a specific paint code (whether by using variant card decks or automated color-matching tools to arrive at a correct formulation) to mix toners and create a quantity of paint of a specific color is not included in any Mitchell refinish time.

Mitchell advises referencing “Color match or tinting” from the Not Included Operations of the Refinish Procedure in the Mitchell P-pages for further details.

CCC – Prepping Vehicle for Sensor & Camera Aiming

Before aiming cameras and sensors for an ADAS system, OEM’s may require specific preparation steps. The following are not included in published labor times:

• Adjusting tire pressure

• Filling fluids (fuel, oil, washer fluid, etc.)

• Adding or removing cargo weight from the vehicle’s interior

• Verifying ground levelness

Information regarding included and not included operations can be found in the CCC Guide to Estimating.

Keeping

Spotless: The Importance

a Clean Room for Aluminum Repairs

When performing aluminum repairs, preventing crosscontamination is crucial. Aluminum is highly sensitive to contamination, especially from steel. If you don’t prevent steel dust from settling on aluminum-intensive vehicle surfaces, galvanic corrosion will occur and weaken aluminum components. When aluminum exterior surfaces like the hood, roof or door panel are exposed to steel dust, galvanic corrosion can damage a paint job. Aluminum dust also is explosive when exposed to a spark.

A clean room minimizes the risk of cross-contamination by providing a controlled environment free from airborne dust, metal shavings, and other contaminants. This ensures that the aluminum repair process is conducted in optimal conditions, prevents surface damage and helps maintain the integrity of the repair as required by OEMs.

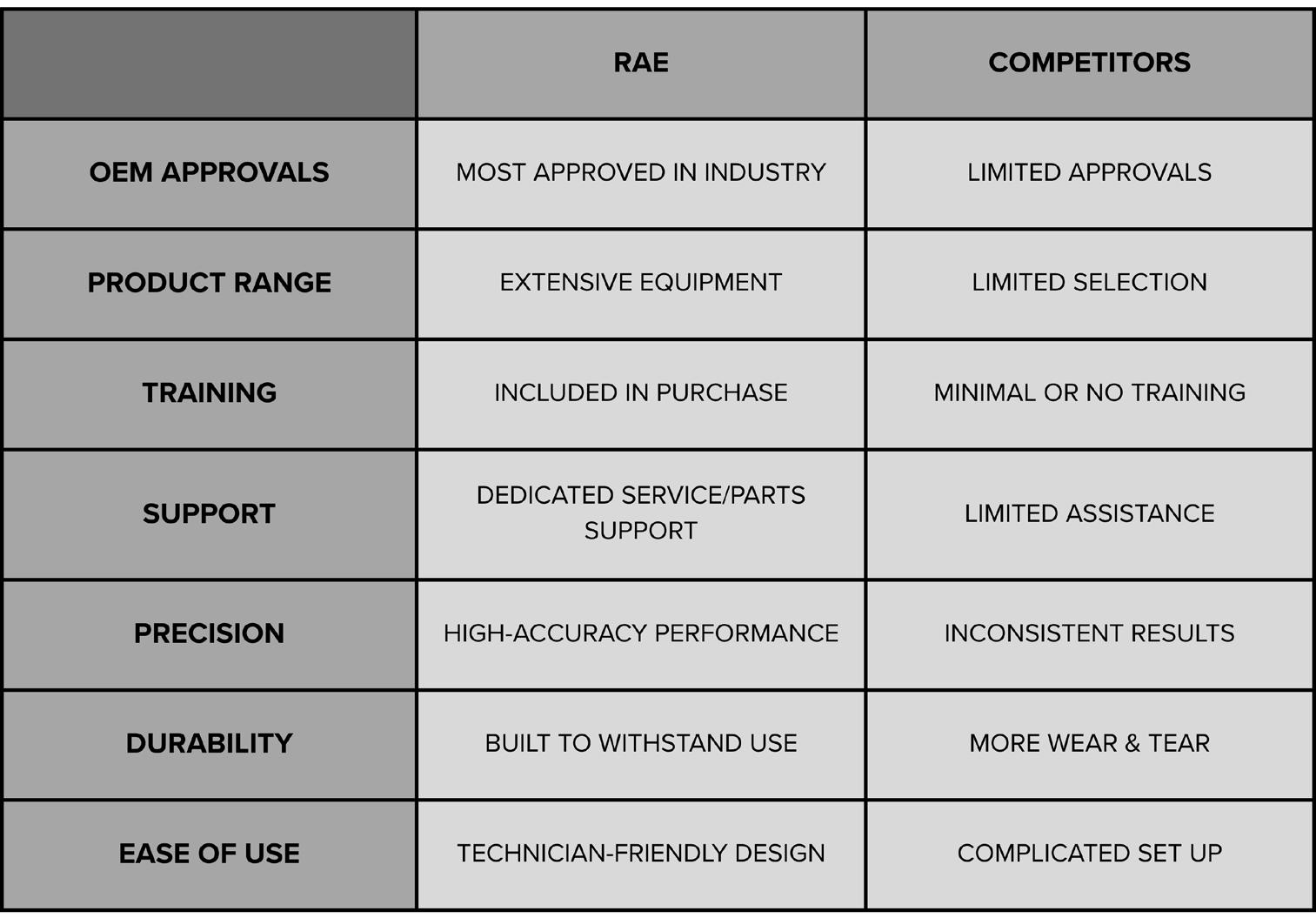

The RAE Body Repair Station features a curtain that has special light reflection as well as fire approved properties. This will isolate your aluminum work area from nearby bays. Accepted by leading OEM certified collision repair facility programs, the body repair station features an e-glass curtain that meets fire retardation standard EN-13501-1 (required by OEM certification programs across the globe). A built-in viewing window meets standards for eye protection of workers outside the aluminum bay. LED lighting helps provide ideal lighting conditions when performing intricate repairs, while a specially-coated welding curtain separates and protects the

The RAE Body Repair Station isolates your aluminum work area from nearby bays

surrounding area from the aluminum bay. Please contact Reliable Automotive Equipment to learn more about how we can help you perform aluminum repairs safely, efficiently and cleanly. Visit Booth #32135 in the South Upper Hall at SEMA for more information on our full line of collision repair equipment, products, training, service and more.

continued from pg. 19

accidentally hit the gas pedal instead of the brake. The car jumped forward, pinning the employee against a tool box. The employee suffered a spinal fracture, cracked ribs, a lacerated spleen and a hematoma.

When that type of incident happened at our shop, the shop instituted some basic precautions. Don’t stand directly between the vehicle and a fixed object; stand to the side. Make sure technicians know how to operate the vehicle. This car had a manual transmission, which the technician had never driven.

We learn from things that went wrong. It’s much less painful to learn from others’ mistakes. What have you learned from these? Can you share that knowledge with your employees? Are there changes you can make in your shop, to protect employees from serious harm?

For more information, contact Carol Keyes at 651-487-9787 or carkey@chess-safety.com

AASPMN MEMBER

INSURANCES

Gallagher Contact: William Knopick

612-412-30413 / william_knopick@ajg.com

Gallagher is your one stop shop for all types of insurance. From garage liability and workers’ compensation to health and dental, Gallagher will develop an insurance program that delivers better product and pricing for AASPMN members.

REPAIR SHOP PRODUCTS/SERVICES DISCOUNTS

CARS Cooperative

Contact: Stephenie Sheppard 405-547-4077

membersupport@cars.coop

Members receive discounts on a variety of products and services they use every day! From discounts on paint and rental cars to office supplies and phone services. Over 50 programs available!

EMPLOYEE VOLUNTARY BENEFITS

Colonial Life

Contact: Deb Ferrao

612-600-4135 / deb.ferrao@coloniallifesales.com or Tracy Bailey

612-801-0139 / tracy.coloniallife@gmail.com

Dedicated representatives can help members transform their benefit package with competitive rates, value added services at no cost and complimentary legal document preparation service. Colonial Life has the tools and flexibility to create a plan to fit everyone’s needs.

UNIFORM & LINEN SUPPLIES

Vestis

Contact: Ryan Vick

612-269-2303 /ryan.vick@vestis.com

Discounted pricing to members on rental of uniforms, entrance mats, shop rags, etc. Purchases are also discounted. Members receive annual rebate equal to 10% of their business with Vestis each year.

LEGAL CONSULTATION

Larkin Hoffman

Contact: Sam Richie srichie@larkinhoffman.com

Members receive free, over-the-phone legal assessment and consultation (some restrictions apply) with an attorney who specializes in the area of law that is the subject of the call.

PROVIDER PROGRAMS

WEBSITE AND INTERNET MARKETING SOLUTIONS

Optimize Digital Marketing

Contact: Max Gamm

651-217-8152 / mgamm@whyoptimize.com

All-in-one Digital Marketing Solutions: Expert social media, digital advertising, website and software solutions that keep you present online so you can be present offline!

CREDIT CARD PROCESSING

Association BankCard Services

Contact: Robert Rewood

715-254-9600

robertrewood@newtekone.com

Competitive rates for AASPMN members. Terminals and printers sold at cost.

INFORMATION PROVIDERS

Mitchell 1

Contact: Mitchell 1 Representative 888-724-6742 ext. 6669

Mitchell 1 offers AASP members a $10 per month discount on any eligible Mitchell 1 subscription.

Mitchell International

Contact: Mitchell International Representative 800-238-9111

AASP members receive $350 off Mitchell's MD-500 all-in-one solution for scanning, calibration, estimating, and blueprinting.

TECHNICAL INFORMATION HOTLINE IDENTIFIX

800-745-9649

Members enjoy a 20% annual savings on Direct-Hit and Direct-Help subscriptions, the industry's most reliable source for experience-based repair information.

SAFETY COMPLIANCE

Complete, Health, Environmental & Safety Services (C.H.E.S.S.)

Contact: Carol Keyes 651-481-9787 / carkey@chess-safety.com

AASPMN members receive a 20% discount on Safety Data Sheet Management (SDSLinks), Right to Know(RTK)/Hazard Communication program customized for your facility and monthly safety reminders, and other safety, OSHA or environmental assistance.

CHECK GUARANTEE SERVICES

Certegy Check Services

877-520-2987

Discount rate of .75% to AASPMN members. Use existing credit card terminal. Fast claim payments.

AUTO EMPLOYEE ASSESSMENT

Assessment Associates International

Contact: Nate Page 952-854-6551 / nate@aai-assessment.com

Designed to help facilitate and enhance hiring decisions. AASPMN members receive 50% off retail price, starting as low as $15 per assessment.

LIVE-ONLINE & ON-DEMAND TECHNICAL TRAINING

Automotive Seminars

Contact: Tim Houghtaling 920-866-9813 / tim@automotiveseminars.com

Discounted pricing to AASPMN members on all live-online events, as well as ondemand training videos. Automotive Seminars specializes in diagnostic training that provides automotive technicians with knowledge, testing techniques and data interpretation skills needed to diagnose today’s vehicles. The live-online events and on-demand training videos focus on automotive electronics and engine management systems and are written and created by some of the industry’s leading diagnostic technicians.

BUSINESS COACHING 180BIZ

540-833-2014 / info@180biz.com

Members receive a 25% discount on Rick White's Pocket Business Genius subscription, offering independent auto shop owners fast access to actionable business advice from a leading industry expert.

BUILDING CONSTRUCTION & MAINTENANCE

Langer Construction

Contact: Josh Schultz 651- 256-3312 / josh@langerconstruction.com

AASPMN members receive free in-depth project consultation with general project concepting and guidance to help members with both small- and large-scale projects and maintenance.