Strategic Precision

Driving Sustainable Transformation

Tahir Ali on Driving Supply Chain

Excellence at Al-Futtaim Marks & Spencer

Fabio Figueiredo on Kerry’s Evolving Supply Chain in Latin America

Growing Your Online Presence Through Innovative Methods

Innovation

Dear Readers,

Welcome to the December edition of The Supply Chain Ledger, where we close out 2025 with a powerful collection of stories that reflect the transformation, ambition, and resilience shaping supply chains around the world.

This edition, we feature organisations and leaders at the forefront of digital innovation, sustainability, strategic logistics, and operational excellence. We open with a special case study from EcoVadis, highlighting how global companies are embedding sustainability and responsible sourcing into the DNA of their supply chain strategies.

From there, we explore some of the most compelling leadership journeys of the year. Al-Futtaim Marks & Spencer’s Tahir Ali offers a deep dive into how retail supply chains are being strengthened through engineering-led thinking, supplier excellence, and a relentless focus on customer value. Whilst in Latin America, Kerry’s COO Fabio Figueiredo discusses how advanced planning, AI, and sustainability are transforming one of the region’s most complex supply chain networks.

We also spotlight global logistics transformation at Hirschmann Automotive GmbH, where Peter Spalt is leading a decade-long journey toward automation, resilience, and sustainable growth. And at StrongPoint, James Palmer shares his vision for the next era of grocery automation, robotics, and digitally enabled retail operations across Europe.

Rounding out the edition, we bring you a forward-looking Executive Insight from Lidia Pynoo, whose two decades of experience across logistics and procurement offer invaluable guidance on collaboration, sustainability, and building the next generation of high-performing European supply chains. Together, these features showcase a sector that is not only adapting to rapid global change but leading the charge, through innovation, strategic thinking, and a continued commitment to building smarter, more connected supply chains.

Thank you for joining us for another year of insights, leadership, and transformation.

EDITOR

Christopher O’Connor

CREATIVE DIRECTOR

Martyn Oakley

DESIGN SUPPORT

James Pate

SOCIAL MEDIA MANAGER

Summah Buisson

PROJECT DIRECTORS

Stuart Irving

Cisco Loevendie

PRODUCTION MANAGER

Ewa Piwoni

No.159, Field Maple Barns, Weston Green Road, Weston Longville, Norwich, Norfolk, NR9 5LA

ACCOUNTS

Emilio Vences

Joseph Heaton

MANAGING DIRECTOR

Denitra Price

CHIEF OPERATING OFFICER

Fabian Stasiak

CHIEF EXECUTIVE OFFICER

Alex Barron

If you would like more information about ways in which The Supply Chain Ledger can promote your business please email | info@thesupplychainledger.com

The Supply Chain Ledger does not accept responsibility for omissions or errors. The points of view expressed in articles by attributing writers and/or in advertisements included in this magazine do not necessarily represent those of the publisher. Any resemblance to real persons, living or dead is purely coincidental. Whilst every effort is made to ensure the accuracy of the information contained within this magazine, no legal responsibility will be accepted by the publishers for loss arising from use of information published. All rights reserved. No part of this publication may be reproduced or stored in a retrievable system or transmitted in any form or by any means without the prior written consent of the publisher.

© Ledger Series Media Group 2025

Transforming Procurement into a Strategic Advantage: How

EcoVadis is Powering Calix’s Sustainable Supply Chain

With a lean team and rising regulatory pressures, Calix needed a scalable way to accelerate supplier sustainability and manage risk across its supply chain.

About Calix

Industry: Technology | Headquarters: US | 2024 Revenue: $831M

Accelerating Calix’s ESG & Supply Chain Goals

Builds stakeholder trust with supply chain transparency

Boosts brand credibility through data-driven supplier assessments

Ensures due diligence for upcoming regulations

Drives sustainability improvements across Tier 1 and 2 suppliers

EcoVadis: More Than A Score

The EcoVadis platform helps you manage ESG risk and compliance, meet corporate sustainability goals, and drive impact at scale by guiding the sustainability performance improvement of your company and your value chain.

Lisa Boucher, Director of Supply Chain

Sustainability and Risk

Management

Get a Free Risk Mapping here

Take the first step in uncovering hidden supply chain risks.

Driving Sustainable Transformation: Fabio Figueiredo on Kerry’s

Shaping

STRATEGIC PRECISION

Tahir Ali on Driving Supply Chain Excellence at Al-Futtaim Marks & Spencer

With a foundation in engineering and a career built across some of the Middle East’s most complex logistics networks, Tahir Ali has carved out a reputation as a results-driven supply chain leader. Now serving as Head of Supply Chain for Al-Futtaim’s Marks & Spencer division, he oversees a multifaceted operation spanning perishables, fashion, and beauty products across seven regional markets. From implementing advanced digital tools and sustainable sourcing strategies to leading acquisition integrations and elevating supplier performance, Tahir is reshaping how retail supply chains deliver agility, compliance, and customer value in today’s fastmoving landscape. In this interview, he shares insights into his leadership journey, the transformation underway at M&S, and the future of supply chain talent in the UAE.

Career Journey

Can you share your career journey and what led you to the role of Head of Supply Chain for Al Futtaim’s Marks & Spencer division? What experiences have most shaped your leadership philosophy in supply chain management?

My journey to becoming Head of Supply Chain at Al-Futtaim Marks & Spencer has been one of deliberate progression across increasingly complex supply chain landscapes. I began my career as a Graduate Engineer in India, gaining early exposure to ERP systems and multi-site inventory management. This technical foundation shaped my systems-thinking approach.

The pivotal moment came after completing my Master’s in Supply Chain Management, when I joined Landmark Group in the UAE as a Management Trainee. Rapidly progressing to Warehouse Manager, I led operations in a 60,000 sqm facility with 8,000 FEUs in annual throughput and a workforce of over 300. This experience deepened my operational understanding and introduced me to the transformative potential of technology through Oracle WMS implementation and last-mile fleet optimisation.

Subsequently, at Easa Saleh Al Gurg Group, I managed logistics for luxury retail, where maintaining a 99.98% inventory accuracy rate reinforced the critical role of precision in building customer trust. At Al-Futtaim Marks & Spencer, I’ve expanded this knowledge regionally, navigating MENA operations during the pandemic and leading the KSA acquisition integration. My leadership philosophy centres on operational excellence, team empowerment through accountability, and strategic agility. Our recent improvements in e-commerce fulfilment and spoilage reduction stem directly from this team-driven, outcomes-focused culture.

Supply Chain’s Role in Retail Excellence

Supply chain is critical in retail for delivering product availability and customer satisfaction. How does your team ensure that Al Futtaim’s M&S stores consistently meet customer expectations in the UAE region?

Ensuring consistent product availability and customer satisfaction across M&S UAE stores requires precision, agility, and collaboration.

We take a holistic approach where every team member understands their role within the broader supply chain ecosystem. We emphasise ownership, cross-functional awareness, and a continuous learning mindset. This empowers our teams to proactively identify bottlenecks and maintain high service levels.

Our core focus areas include real-time inventory visibility, last-mile delivery excellence, and compliance with local standards. We also maintain strong supplier partnerships through regular performance reviews and joint demand planning, which enhances upstream reliability and reduces variability.

By continuously refining these processes, we consistently deliver the product quality, availability, and service standards that M&S customers in the UAE expect and trust.

Sustainable Procurement Practices

Al Futtaim has set ambitious net‑positive targets by 2040 and enforces sustainable procurement processes. How is your team embedding sustainability in sourcing and supplier selection for M&S products?

We work closely with M&S as part of their Plan A sustainability framework, embedding environmental responsibility into every aspect of our operations. Several key initiatives reflect our commitment to reducing waste, emissions, and resource consumption across the supply chain.

In terms of waste reduction and circularity, we’ve implemented recycling for all plastic hangers, introduced reusable totes, dollies, and pallet covers, and now use biodegradable shrink wrap for exports. These steps help reduce single-use plastics and promote more circular packaging systems. We’ve also made significant infrastructure upgrades. All our facilities underwent a full LED retrofit in 2019, and in 2022 we installed solar panels at our regional distribution centre. We continue to invest in energy-efficient systems across our network to reduce our operational footprint.

To reduce transport-related emissions, we’ve introduced smart product routing to minimise travel distances, prioritised local sourcing of food products, and are piloting the electrification of our lastmile delivery fleet.

Sustainability is also embedded into our supplier selection process. We apply ESG metrics, carbon scoring, and ethical compliance standards to every supplier review. All RFPs include sustainability scorecards alongside commercial KPIs, ensuring that every procurement decision aligns with our long-term environmental goals and supports Al Futtaim’s 2040 net-positive vision.

Supplier Engagement & Accountability

What strategies do you use to build transparent and cooperative relationships with your suppliers, ensuring they meet ethical, quality, and environmental standards, particularly in light of COP28 collaborative goals?

Our supplier engagement model is built on transparency, collaboration, and shared accountability, fully aligned with the climate commitments of COP28.

We conduct quarterly supplier performance reviews using integrated scorecards that cover ethical, quality, and environmental metrics alongside cost and service. This approach fosters continuous dialogue and improvement, moving us away from reactive correction and toward proactive, longterm development.

We prioritise long-term strategic agreements over short-term transactions. These contracts embed environmental requirements and create mutual incentives for innovation, such as fuel-efficient logistics planning with our airline partners for fresh food imports.

Understanding that suppliers vary in their capabilities, we provide support through best practice sharing, technical guidance, and collaborative planning. This shifts the dynamic from simple compliance monitoring to co-creating value, helping us build a more resilient, responsible, and future-ready supplier ecosystem.

Digitalisation in Supply Chain

Al Futtaim has embraced AI, analytics, and digital tools, led by their digital transformation agenda. How is your M&S supply chain leveraging digital technologies to boost efficiency, visibility, and responsiveness?

Our digital transformation has significantly enhanced supply chain responsiveness, visibility, and efficiency. One of our key milestones was the successful deployment of an advanced Warehouse Management System (WMS), implemented in collaboration with our Regional Distribution Centre partner. This upgrade tripled our operational capacity while providing vital scalability for future growth.

RFID integration has been especially transformative, offering real-time visibility and achieving 100% warehouse accuracy. It has effectively eliminated traditional blind spots and enabled the development of an intelligent, responsive supply chain.

We also utilise digital analytics tools that provide granular insights into cost drivers, service levels, and productivity, allowing for evidence-based decision-making. Our fleet tracking system monitors a large volume of shipments, including temperature-sensitive goods, ensuring SLA adherence and enabling proactive issue resolution.

Looking ahead, we are exploring AI to further optimise operations, from predictive demand planning and AI-driven warehouse layout design to automated invoice reconciliation. These technologies are set to redefine efficiency benchmarks across our supply chain in the years to come.

Inventory & Demand Forecasting

How does your team leverage demand forecasting tools and inventory optimisation techniques to balance stock availability and cost efficiency, especially given seasonal fluctuations and consumer trends in the UAE?

Balancing inventory levels and cost efficiency in the dynamic UAE retail environment requires a datainformed, locally tailored approach. We utilise advanced demand forecasting tools that integrate historical sales data, promotional calendars, and macroeconomic indicators.

Our models are specifically adapted to account for UAE-specific seasonality, including Ramadan, Eid, and major shopping festivals, enabling proactive and accurate inventory planning.

We also leverage real-time demand sensing and AI-enabled planning tools to mitigate risk and minimise obsolescence. Our cost model supports responsiveness without overstocking, giving us the agility to manage both peak demand periods and quieter trading cycles with efficiency.

Risk & Resilience Strategy

Global supply chains are prone to disruptions. How does Al Futtaim’s M&S supply chain identify and mitigate risks, such as logistical bottlenecks, geopolitical changes, or supplier instability, to ensure continuity?

Our risk mitigation strategy is built on redundancy, agility, and proactive intelligence. We maintain diversified sourcing and logistics networks to minimise dependency on any single geography. Our close partnership with Al-Futtaim Logistics (AFL) enables tailored freight solutions and proactive risk management. AFL’s deep understanding of our brand ensures continuity, even in the face of regional disruptions.

We also conduct early financial assessments of our suppliers to identify signs of instability before they impact operations. For perishables, we maintain multiple carrier contracts and backup capacity plans to safeguard cold chain integrity during transit shocks.

Geographic diversification, flexible contract clauses, and dual-sourcing strategies are all part of our broader approach, enabling us to respond quickly and decisively in times of crisis.

Advanced Finance Models

Al Futtaim Retail has introduced GCC’s first sustainable supply‑chain finance programme. Is Al Futtaim’s M&S division exploring similar financial mechanisms (e.g., sustainability ‑ linked finance) to incentivise supplier sustainability?

While Al-Futtaim Retail has pioneered the region’s first sustainable supply chain finance programme, our approach at M&S is currently rooted in a partnership-based model to support supplier sustainability. We prioritise capacity-building and collaboration over purely financial incentives. By sharing expertise, providing planning support, and aligning on environmental goals, we empower suppliers to adopt sustainable practices more effectively. Looking ahead, we are exploring ways to integrate sustainability-linked financing frameworks into our supplier scorecards, complementing our existing engagement model and further incentivising responsible sourcing.

Challenges in FMCG Retail Supply Chains

What unique challenges do you face in managing a complex FMCG ‑ style retail supply chain under M&S (e.g., handling perishables, fashion cycles), and how do you leverage Al Futtaim’s regional capabilities to address these?

Managing the M&S supply chain in the UAE involves balancing the complexity of perishables, fashion cycles, and regulatory diversity. Perishables require robust cold chain infrastructure, strict traceability, and rapid replenishment. We leverage Al-Futtaim’s advanced regional capabilities, including temperature-controlled logistics and strong compliance expertise to ensure product quality and minimise spoilage. Fashion retail brings seasonal volatility, rapid trend shifts, and forecasting complexity. Our adaptive warehousing and demand planning systems enable agility, reducing the risk of markdowns and missed cycles.

In beauty and personal care, we navigate diverse regulatory requirements across the region, from allergen labelling to ingredient approvals. Our regulatory affairs team, in coordination with regional labs, ensures compliance with GCC, Halal, and FDA standards. Operating across seven markets, we maintain 100% compliance by embedding regulatory planning early in our supply chain design process.

“Managing the M&S supply chain in the UAE involves balancing the complexity of perishables, fashion cycles, and regulatory diversity”

Future Trends & Advice for Talent

What supply chain trends (e.g., omnichannel fulfilment, sustainability, blockchain) do you see shaping the future of retail logistics? And what advice would you give to professionals looking to grow in supply chain leadership, especially in the UAE?

Key trends reshaping retail logistics include AI-powered forecasting, omnichannel fulfilment, microdistribution hubs, and ESG-driven sourcing models.

AI is enabling real-time decision-making, predictive maintenance, and optimised route planning. Omnichannel strategies now demand decentralised inventory and flexible delivery models to meet rising customer expectations.

My advice to future supply chain leaders is to master emerging technologies by building fluency in AI, analytics, and automation tools. It’s important to stay geopolitically informed, understanding trade policies and regional disruptions that impact sourcing and logistics. Leaders should think strategically, focusing not just on cost, but also on resilience, speed, and customer experience. Cross-functional skills are also essential, as successful leaders must be able to navigate seamlessly between operations, finance, and commercial teams.

In a market like the UAE — at the crossroads of East and West, those who combine global outlooks with local execution will lead the next generation of supply chain innovation.

Al-Futtaim Group is a leading diversified family-business based in Dubai, operating across more than 20 countries and employing over 40,000 people. Al-Futtaim +1 With a portfolio spanning automotive, retail, real-estate, health, finance, and education, the Group partners with globally admired brands to deliver exceptional customer experiences and drive innovation and sustainable growth.

Tahir Ali Head of Supply Chain - M&S Middle East, N Africa

DRIVING SUSTAINABLE TRANSFORMATION

Fabio Figueiredo on Kerry’s Evolving Supply Chain in Latin America

As Chief Operating Officer for Kerry Latin America, Fabio Figueiredo leads one of the region’s most dynamic supply chain transformations, anchored in digital innovation, sustainability, and customer-centric growth. Over three decades, Kerry has evolved from a regionally focused food and beverage solutions provider to a global leader in sustainable nutrition.

In this exclusive interview, Fabio discusses how Kerry is leveraging advanced technologies such as AI, predictive analytics, and integrated planning platforms to build a more agile, resilient, and environmentally responsible supply chain. He also highlights the company’s commitment to local sourcing, supplier collaboration, and operational excellence, ensuring that Kerry continues to deliver value, reliability, and sustainability across its Latin American network.

Transforming Supply Chains in Latin America

Kerry has marked 30 years of operations in Latin America. How has the supply chain evolved over this period, and what have been the key drivers of transformation in the region?

Over the past three decades, Kerry’s supply chain in Latin America has undergone a remarkable transformation, driven by digitalisation, operational resilience, and a deep commitment to sustainability. What began as a largely manual and localised network has evolved into a highly connected, data-driven ecosystem powered by technologies such as AI, machine learning, and advanced analytics. These tools have strengthened demand forecasting, optimised inventory management, and improved network design, making the supply chain more agile and responsive to market dynamics.

Key drivers of this transformation include the integration of digital tools for real-time visibility, robust risk management frameworks to navigate complex regulations, and a customer-centric approach that aligns supply chain decisions with business priorities. Kerry has also expanded its regional footprint through new warehouses and distribution centers, improving service levels and reducing lead times.

Sustainability remains at the heart of this transformation. Initiatives focused on responsible sourcing, waste reduction, and efficient resource use have created a more resilient and environmentally conscious supply chain. By combining technology, local expertise, and a sustainability-first mindset, Kerry continues to build a supply chain that is efficient, adaptive, and aligned with the evolving needs of the Latin American market.

Leveraging Technology for Supply Chain Efficiency

With the integration of AI and machine learning in logistics, how is Kerry utilising these technologies to enhance supply chain operations and meet the growing demands of the Latin American market?

Kerry is strategically leveraging Artificial Intelligence (AI) and machine learning to drive measurable improvements across its end-to-end supply chain operations in Latin America. These technologies are applied from sourcing and procurement through to internal processes and customer fulfillment, optimising key functions such as inventory management, demand forecasting, and network planning. By analysing vast amounts of structured and unstructured data, AI and machine learning models can detect emerging market trends, anticipate potential disruptions, and recommend proactive mitigation strategies. This data-driven approach strengthens agility and resilience, enabling Kerry to respond swiftly to market shifts and evolving customer expectations.

Beyond operational efficiency, AI-powered analytics also support Kerry’s sustainability goals by reducing waste, optimising resource use, and enhancing transport planning to cut emissions. These initiatives reflect Kerry’s wider strategy of embedding innovation and responsibility across its operations.

The result is a supply chain that is smarter, faster, and more adaptive, one that combines advanced technology with sustainability to meet the dynamic demands of the Latin American market and deliver lasting value to customers.

Expanding Infrastructure to Meet Market Demands

Kerry has been expanding its presence in Latin America, including new warehouses and distribution centers. How do these developments align with Kerry’s overall supply chain strategy in the region?

Kerry’s expansion across Latin America aligns directly with its commitment to better serve customers through a deeper understanding of local market needs. This strategic growth enhances Kerry’s ability to deliver innovative solutions efficiently, ensuring faster and more reliable service to meet increasing regional demand.

By optimising its physical footprint through new warehouses and distribution centers, Kerry can manage inventory more effectively, reduce lead times, and improve service levels, all while supporting local market growth. These facilities also allow Kerry to better respond to evolving consumer expectations around authentic taste, functionality, and nutrition.

Moreover, this expansion reinforces Kerry’s commitment to sustainability. Each development integrates environmentally conscious practices, enhancing operational efficiency while advancing the company’s broader goal of embedding sustainability throughout its supply chain and customer partnerships.

Sustainability in Supply Chain Practices

Sustainability is a core focus for Kerry. How are supply chain operations in Latin America contributing to Kerry’s global sustainability goals, particularly in terms of reducing environmental impact?

Kerry’s supply chain operations in Latin America are central to advancing the company’s global sustainability objectives, particularly around reducing environmental impact and driving long-term efficiency. The region has become a model for how technology, innovation, and local collaboration can create a more responsible and resilient supply chain.

Through the use of advanced technologies such as AI and machine learning, Kerry optimises resource utilisation, minimises food and packaging waste, and enhances route planning to cut fuel consumption and carbon emissions. These digital tools not only improve operational performance but also support Kerry’s mission to operate with minimal environmental impact.

Sustainability is embedded across every stage of the supply chain, from responsible sourcing of raw materials and water conservation to recycling initiatives and waste reduction. A standout example is Kerry’s Dairy Supply Pool initiative, which partners with local suppliers near key manufacturing sites to reduce transportation emissions while strengthening local economies.

All these efforts align with Kerry’s broader ambition to deliver sustainable nutrition to two billion people. By embedding sustainability into every link of the supply chain, Kerry is building an operation that is efficient, responsible, and future-ready, supporting both global goals and the communities it serves across Latin America.

Managing a Diverse Supplier Base

With a diverse supplier base across Latin America, how does Kerry ensure consistency, quality, and compliance in its supply chain operations?

Kerry ensures a robust, reliable, and compliant supplier network through a combination of rigorous standards, continuous monitoring, and strong collaborative partnerships. The company enforces strict quality protocols and certification requirements, complemented by regular audits to verify that every supplier meets Kerry’s global standards.

Each supplier undergoes comprehensive evaluation, covering end-to-end processes, quality management systems, regulatory compliance, and social responsibility practices, to ensure full alignment with Kerry’s values and operational expectations. Through its supplier collaboration programme, Kerry builds transparent, long-term relationships, offering guidance and training to help partners continuously improve their performance.

Sustainability is the foundation of Kerry’s approach. Suppliers are encouraged and supported to adopt responsible practices such as reducing waste, optimising resources, and cutting emissions. To maintain compliance, Kerry employs robust monitoring systems that track adherence to both local and international regulations, proactively managing market and regulatory risks.

By integrating these strategies, Kerry maintains consistency, quality, and compliance across its diverse supplier base, ensuring that every partnership contributes to the company’s vision of sustainable growth and operational excellence in Latin America.

Navigating Regulatory Compliance and Risk Management

Operating across multiple countries in Latin America presents regulatory challenges. How does Kerry manage compliance and mitigate risks associated with varying regulations in the region?

Kerry manages the region’s regulatory complexity through a comprehensive compliance management framework that integrates proactive monitoring, local expertise, and advanced digital tools. This approach ensures full alignment with both global and country-specific regulatory requirements across Latin America.

An integrated compliance system enables daily horizon scanning, continuous regulatory intelligence gathering, and automated documentation workflows. Country-specific requirements are centrally tracked and regularly updated, while local compliance specialists ensure operational alignment and rapid response to regulatory changes. Automated platforms manage certifications, audit trails, and reporting, reducing manual intervention and significantly lowering compliance risks. Recognising the growing importance of cybersecurity and ESG compliance, Kerry has invested in robust data protection systems to safeguard its digitalised supply chain, while complementing internal controls with SEDEX and SMETA audit frameworks in key geographies to uphold ethical, environmental, and human rights standards.

Regular internal and supplier audits, combined with dynamic risk assessments, help identify and mitigate non-compliance early. Through proactive engagement with regulatory authorities and continuous optimisation of processes, Kerry ensures both operational continuity and strong governance across its Latin American operations.

Enhancing Customer Service Through Supply Chain Excellence

Enhancing Customer Service Through Supply Chain Excellence: Customer satisfaction is closely tied to supply chain performance. What initiatives has Kerry implemented to ensure high service levels and responsiveness to customer needs in Latin America?

Kerry’s supply chain strategy in Latin America is built on three pillars, end-to-end operational excellence, technology enablement, and local market alignment, with customer satisfaction at its core. The company has established customer care centres of excellence, strategically located manufacturing facilities, and optimised distribution networks across the region. This integrated network, supported by a robust S&OP process, enables Kerry’s supply chain teams to work closely with commercial partners, fostering deep market understanding, improving order fulfilment, and ensuring rapid response to shifts in customer demand.

Advanced data analytics and predictive modelling further enhance performance by strengthening demand forecasting, capacity planning, and inventory optimisation. These tools allow Kerry to anticipate market fluctuations, minimise disruptions, and maintain exceptional service levels. Collaboration with local suppliers and logistics partners also reinforces agility and reliability throughout the value chain.

Customer-centric KPIs, focused on responsiveness and on-time, in-full delivery, are embedded within supply chain objectives to ensure service excellence remains a measurable priority. Continuous feedback loops with customers and commercial teams enable agile adaptation to evolving requirements, solidifying Kerry’s reputation for reliability, innovation, and customer focus across Latin America.

more supplierthan

MOMATT is a strategic ally that drives industrial growth across Mexico. With strategically located distribution centers and a highly trained technical team, it supports industries seeking greater efficiency and productivity. Through its Training Center, CECAM, it prepares certified professionals who strengthen the country’s operational capacity. MOMATT’s dedication to quality, innovation, and excellence reinforces its role as a company of great strength—one that moves materials, progress, and opportunity for every collaborator and partner.

MATERIAL HANDLING

MOMATT, Mexico’s leading company in

With over 50 years of experience and a forward-looking vision, MOMATT stands as Mexico’s benchmark in operational efficiency, reliability, and specialized service. Its philosophy is clear: deliver precise solutions backed by technology, expertise, and a strong commitment to each client’s logistical needs.

The essence of MOMATT

The company integrates every part of the process—from sales, rental, and maintenance of forklifts to technical training and spare-parts supply—ensuring continuity, safety, and high performance in demanding operations.

#1 IN MEXICO

Adapting to Market Volatility and Disruptions

The global supply chain landscape has faced significant disruptions in recent years. How has Kerry’s supply chain in Latin America adapted to these challenges to maintain resilience and continuity?

Kerry’s supply chain in Latin America has implemented a multi-layered risk mitigation strategy to safeguard resilience and ensure uninterrupted operations amid global disruptions. Diversifying the supplier base across multiple geographies has reduced single-source dependencies and mitigated both geopolitical and sanitary risks. Advanced inventory management practices, supported by Kerry’s extensive global manufacturing footprint, enable dynamic safety stock calculations and real-time visibility across facilities. This ensures optimal stock levels, balancing working capital efficiency with the ability to respond rapidly to demand fluctuations and supply interruptions.

On the logistics front, Kerry employs multimodal transport planning and flexible routing algorithms to navigate bottlenecks and maintain service continuity. Scenario-based contingency planning and integrated S&OP (Sales & Operations Planning) cycles further enable swift, data-driven decisions in response to capacity constraints or market shifts. Through strategic partnerships with local suppliers and third-party logistics providers, Kerry has strengthened regional agility and response capabilities. Continuous monitoring of market, logistics, and regulatory conditions, combined with digital control towers for end-to-end visibility, allows proactive exception management and rapid issue resolution. This comprehensive and digitally enabled approach ensures Kerry’s Latin American supply chain remains resilient, adaptive, and capable of sustaining high service levels, even in the face of global volatility.

Collaborating Across Functions for Supply Chain Success

Effective supply chain management often requires cross ‑ functional collaboration. How does Kerry foster collaboration between supply chain, procurement, and other departments to drive success in Latin America?

Kerry promotes cross-functional collaboration in Latin America through agile communication, integrated digital platforms, and a culture of transparency and shared accountability. These enablers connect functions such as supply chain, procurement, manufacturing, quality, RD&A, regulatory, and commercial teams, ensuring alignment across every stage of the value chain.

Real-time collaboration tools provide visibility across workflows, enabling fast information sharing, issue resolution, and decision-making. Cross-functional project teams are established for critical initiatives such as S&OP, innovation, and continuous improvement, ensuring synchronisation between demand planning, sourcing, and production scheduling.

Regular interdepartmental meetings, performance reviews, and workshops foster knowledge exchange and best-practice sharing, while shared KPIs and performance dashboards align all teams around common business objectives, customer priorities, and compliance standards.

Joint training programmes and capability-building sessions further embed a collaborative mindset, empowering teams to work seamlessly across functions. This integrated approach enhances agility, end-to-end visibility, and operational reliability, key elements in Kerry’s continued success and customer satisfaction across the Latin American region.

Future Outlook for Supply Chain in Latin America

Looking ahead, what are the key trends and opportunities you foresee for Kerry’s supply chain operations in Latin America, and how is the company preparing to capitalise on them?

Looking ahead, Kerry’s supply chain strategy in Latin America is guided by three key pillars: customer centricity, digital transformation, and network resilience. Each of these drivers reflects the company’s focus on creating a more agile, sustainable, and technology-enabled supply chain capable of meeting the region’s evolving market demands.

Customer centricity remains central to Kerry’s approach. Understanding the unique needs of diverse Latin American markets allows the company to design tailored solutions that deliver authenticity, reliability, and innovation, strengthening relationships and enhancing service excellence. Sustainability continues to shape decision-making across every function. Kerry’s initiatives focus on reducing food waste, lowering carbon emissions, transitioning to eco-friendly packaging, and prioritising responsible sourcing. These efforts not only support global sustainability goals but also align with the expectations of environmentally conscious customers and partners.

Digital transformation will be a major enabler of this strategy. The adoption of advanced technologies, including artificial intelligence, predictive analytics, and integrated planning platforms, will enhance demand forecasting, scenario planning, and responsiveness to market shifts. This ensures improved speed to market and service performance.

To bolster resilience, Kerry is expanding local manufacturing and sourcing capabilities while diversifying its supplier base. This reduces reliance on distant suppliers, shortens lead times, and lowers transportation-related emissions.

Through continuous investment in technology, sustainability, and local expertise, Kerry is positioning its Latin American supply chain to remain agile, compliant, and customer-focused, well-equipped to capitalise on emerging opportunities and drive long-term growth across the region.

Kerry Group is a global leader in taste and nutrition, offering innovative food-, beverage- and functional-ingredient solutions across Latin America. With a deep commitment to sustainable nutrition and local communities, Kerry helps brands deliver healthier, better-tasting products while making a positive impact on people and planet. Their LATAM operations span multiple countries from Mexico to Brazil, leveraging global expertise and local insight.

Fabio Figueiredo Chief Operating Officer

DRIVING SMART LOGISTICS

Peter Spalt on Automation, Resilience, and Sustainable Growth at Hirschmann Automotive

With operations spanning nine plants across seven countries, Hirschmann Automotive has built a reputation for precision, innovation, and reliability within the global automotive supply chain. Behind this success lies a forward-thinking logistics strategy led by Peter Spalt, Director of Logistics, whose decadelong leadership has steered the company through a transformative era of automation, digitalisation, and sustainable growth.

From introducing fully automated intralogistics and AI-enabled systems to strengthening global resilience and decarbonising transport, Spalt and his team are shaping a logistics network built for flexibility and the future. In this feature, he discusses Hirschmann Automotive’s journey toward a smarter, more connected, and sustainable supply chain, one where technology, people, and partnerships work in perfect sync.

Professional Journey

Peter, could you walk us through your career path and the key experiences that have shaped your journey to becoming Director of Logistics at Hirschmann Automotive?

After completing my studies in Business Project and Process Management at the University of Applied Sciences in Vorarlberg / Austria, I began my professional career at ThyssenKrupp Presta in Liechtenstein, working in the field of logistics. Over the following years, I gained deep insights into the business, further enriched by an MBA in Supply Chain Management from ETH Zürich and several months abroad at Presta’s plants in China.

As part of the core team responsible for introducing lean manufacturing, I developed a strong appreciation for continuous improvement principles, which later inspired me to join Hilti’s Austrian plant to establish a lean management and manufacturing organisation. My time there, combined with additional years in production and logistics, helped me build a solid operational foundation and a deep understanding of lean-driven processes.

My return to the automotive sector marked a new chapter, I joined Hirschmann Automotive as Head of Logistics and, just six months later, assumed the position of Director of Logistics. For over a decade now, I have been responsible for operational supply chain planning and execution across Hirschmann Automotive’s global network, driving efficiency, innovation, and excellence throughout our logistics operations.

Strategic Role of Logistics

How does the logistics function at Hirschmann Automotive support the company’s broader goals, such as innovation, sustainability, and global expansion, particularly considering its presence in plants across Austria, the Czech Republic, Morocco, China, Mexico, and beyond?

The function of logistics at Hirschmann Automotive is broad and strategically vital. It involves continuously adapting the external network, both inbound and outbound, to align with company and customer requirements in an environment of sustained growth, marked by multiple new plants and plant expansions.

In parallel, logistics plays a central role in driving operational innovation and sustainability. This includes the introduction of fully automated intralogistics systems in two plants, which enhance efficiency, reduce resource consumption, and support Hirschmann Automotive’s long-term commitment to technological advancement and environmentally responsible operations.

Since 1978, your family business has specialized in conveyor system closures and their control technology.

Conveyor system closures

We deliver fire protection closures as part of railway based conveyor systems for all conveyor systems as well as for pneumatic conveyor systems. Our product portfolio includes conveyor system closures for wall and ceiling installations of sliding and lifting gates, revolving doors and flaps up to swivel sliding gates.

We look forward to your inquiry! Fon +49 6131 5803 51 Sales@abs-brandschutz.de

Smart Factory Intralogistics

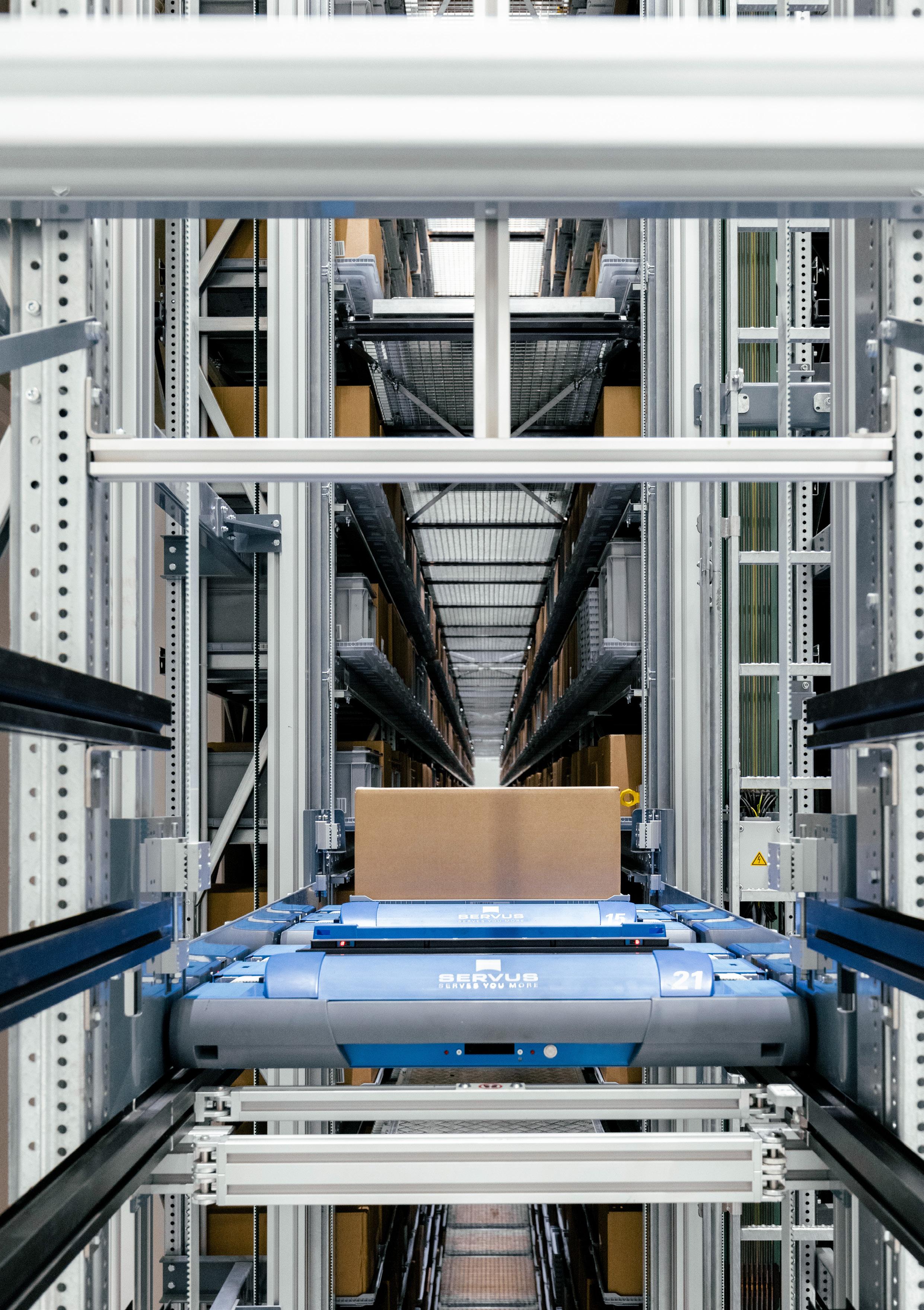

At your Rankweil site, you’ve implemented a fully automated intralogistics system, including transport robots integrated with ERP and the Servus ARC5 system. Could you explain how these technologies have enhanced flexibility, performance, and cost efficiency in your internal material flows?

At our Rankweil site, we have implemented a fully automated intralogistics system based on Servus ARC5 transport robots, fully integrated with our ERP environment. This setup has significantly enhanced flexibility, performance, and cost efficiency across all internal material flows.

Using a brownfield approach in a 24/7 operational environment, we established a highly scalable and fully automated intralogistics concept that ensures continuous and seamless material flow. Produced goods, process-based waste (such as sprues from injection moulding), and packaging supplies are transported automatically by the ARC5 robots without manual intervention. Our high-speed assembly area is supplied directly from the automated small-parts warehouse, complemented by automation solutions for carton building, box shaking, closing, and labelling.

This end-to-end flow minimises in-process stock, shortens lead times, and enhances transparency and efficiency, a major step toward lean, digitalised operations. The seamless connection between production and logistics enables agile adjustments to demand, reduces process costs, and marks a significant milestone on Hirschmann Automotive’s journey toward a fully digital and flexible Smart Factory.

Partnerships in Smart Intralogistics

Hirschmann Automotive partnered with Servus Intralogistics to implement a fully automated, modular intralogistics system, enhancing flexibility and efficiency at your plants. From your perspective as Logistics Director, what has been the impact of this collaboration on operational performance, and how do you see such partnerships shaping the future of smart logistics at Hirschmann Automotive?

The collaboration with Servus Intralogistics, a regional partner, has been a key success factor in implementing our Smart Intralogistics strategy. Working with a local company allowed for short communication channels, close alignment, and hands-on collaboration throughout the entire project lifecycle.

From day one, Servus was actively involved in the design and concept phase. Together, we conducted multiple joint workshops to shape the vision of a true Smart Factory, always focused on achieving the optimal state of our internal operational processes.

This partnership resulted in the establishment of a highly efficient, modular system perfectly tailored to our operational needs. It has significantly enhanced transparency, reliability, and responsiveness across all material flows. Moving forward, we view such strategic partnerships as essential enablers of innovation, allowing us to continuously refine and optimise our logistics and production performance at Hirschmann Automotive.

Sustainability Targets

Hirschmann Automotive aims to achieve net ‑ zero emissions (Scope 1 & 2) by 2030 and across all scopes by 2039, with all plants powered by green energy by the end of 2025. How is your logistics organisation aligning operations, such as transport management and supplier engagement, to support these sustainability objectives?

At Hirschmann Automotive, the logistics organisation plays a crucial role in delivering on the company’s ambitious sustainability goals: net-zero emissions (Scope 1 & 2) by 2030 and full valuechain neutrality by 2039. Both transport management and supplier engagement strategies are being aligned to actively support these objectives.

We are conducting a group-wide mapping project to ensure full compliance with the EU Packaging and Packaging Waste Regulation (PPWR). This initiative focuses on increasing the use of recycled materials and reducing waste across logistics processes.

“Moving forward, we view such strategic partnerships as essential enablers of innovation, allowing us to continuously refine and optimise our logistics and production performance at Hirschmann Automotive”

In transport operations, covering intercompany, inbound, and outbound flows, we optimise routes, consolidate shipments, and collaborate with long-term logistics partners who operate green fleets and invest in alternative-drive technologies. For outbound transport, where we maintain about 30 per cent direct responsibility, these partnerships are essential to lowering CO2 emissions and improving overall efficiency.

Close collaboration with our supply base is vital to strengthening transparency and resilience. Hirschmann Automotive is an active member of the Catena-X network, which enables continuous data exchange and harmonised sustainability reporting across the entire value chain.

We also use NQC/SAQ assessments to evaluate suppliers’ ESG performance and are implementing Green Purchasing Standards to further embed sustainability criteria in sourcing decisions. Our Business Partner Code of Conduct and CSRD Sustainability Assessment ensure that all partners align with our ethical, environmental, and social expectations, while continuous dialogue fosters improvement over time.

In short, our logistics strategy is built on compliance, collaboration, and innovation, ensuring that operational excellence directly contributes to Hirschmann Automotive’s progress toward a sustainable and resilient global supply chain.

Resilience & Risk Management

With global operations across multiple locations, how do you ensure resilience and agility in your logistics networks? How do you identify and mitigate emerging risks, such as supply ‑ chain disruptions or regulatory shifts?

Hirschmann Automotive operates nine plants across seven countries worldwide, each directly serving customers with highly specific, often customised products. Our customer portfolio spans the full supply chain spectrum, from OEMs to Tier 3 suppliers, and in many cases, identical products are produced in multiple plants, and even on different continents, to support localisation strategies.

For example, our core products, such as connectors, are manufactured in two highly automated facilities in Europe, as well as in our plants in China and Mexico. This multi-location approach provides significant flexibility: with minimal effort, we can shift production capacity between sites, as most customer approvals are already in place.

A similar philosophy applies to our supply chain. Core raw materials, such as resins, are sourced from multiple suppliers across several regions, ensuring low disruption risk. However, given the high level of product specification and the need for validation and approval, certain components and materials are necessarily single-sourced. These suppliers are selected through a strategic sourcing process that prioritises risk mitigation as a core criterion.

When disruptions occur, whether caused by global events such as the COVID-19 pandemic, floods, the Suez Canal blockage, or semiconductor shortages, our success lies in rapid, coordinated response. Cross-functional collaboration between development, purchasing, logistics, and external partners ensures we can act with agility and precision across our global network. This proactive and integrated approach enables Hirschmann Automotive to maintain operational continuity, protect customer deliveries, and strengthen overall supply chain resilience even in the face of unforeseen challenges.

Traceability & End‑to‑End Automation

The company emphasises full traceability and intelligent automation across product development, supply chain management, and quality control. How are digital tools integrated across these stages to enhance visibility, reduce errors, and optimise logistics workflows?

In our plants equipped with fully automated intralogistics, we achieve an exceptionally high level of tracking and tracing across all operational stages. The core systems interacting in this ecosystem include our ERP system with its integrated warehouse management module, an external material flow control system, and particularly at the interface with production, a self-developed Manufacturing Execution System (MES).

This integration enables seamless data flow between logistics and production, ensuring full visibility of materials, real-time inventory accuracy, and process reliability. Every product movement, from raw material intake to finished goods dispatch, is digitally tracked, supporting error reduction, quality assurance, and performance transparency.

Our strategic focus remains digitalisation on demand, implemented when it brings clear operational or quality advantages. Digital tools are deployed both in response to customer requirements and as part of our internal continuous improvement initiatives, such as quality and risk management. This pragmatic, purpose-driven approach ensures that technology supports our goals of efficiency, traceability, and reliability across the entire value chain.

Team Development & Skills Strategy

As logistics become increasingly digitised, with smart robotics, augmented reality, and ERP integrations, how do you ensure your logistics teams are prepared and upskilled to manage these sophisticated systems effectively? What initiatives support evolving capabilities within your workforce?

In today’s environment, where the competition for talent is intense and the boundaries between IT and logistics are increasingly blurred, our focus is on attracting young, motivated individuals with strong logistics foundations and a genuine interest in digitalisation.

The scope of potential applications is vast, from the upcoming SAP S/4HANA transition to the growing integration of automation in hardware and software across daily operations, and, in the ahead future, the deployment of AI-driven tools. To prepare our teams for this evolution, we apply several complementary approaches.

One key strategy is close cooperation with consultants and technology partners, embedding them directly within our logistics teams. This hands-on collaboration allows our employees to learn rapidly through real-world implementation, developing both technical competence and strategic understanding. Additionally, structured internal and external training programmes, covering digital tools, process optimisation, and leadership, play a central role in advancing capability.

We also place strong emphasis on dual education programmes, which combine theoretical knowledge with practical experience. This model ensures that young professionals gain a comprehensive understanding of both logistics processes and the digital systems that enable them.

Through these initiatives, we are building a workforce that is adaptable, digitally fluent, and ready to lead Hirschmann Automotive’s logistics operations into the next generation of smart, connected, and data-driven supply chain management.

Hirschmann Automotive is a global automotive-supplier specialising in connectors, cable-assemblies, sensor systems and customised connectivity solutions for all vehicle types and drive technologies. With over 60 years of experience, the company supports automotive OEMs and micromobility manufacturers by delivering robust, reliable components engineered for the most demanding environments.

Peter Spalt Director Logistics

SHAPING RETAIL AUTOMATION

James Palmer on Driving the Future of Grocery Innovation at StrongPoint

As Vice President of Automation, Robotics & Professional Services at StrongPoint, James Palmer FCILT brings over two decades of experience spanning Asda, PepsiCo, Ocado, GXO, and Fortna. A Fellow of the Chartered Institute of Logistics & Transport, he has been at the forefront of automation in retail and logistics, leading teams that have transformed how grocery operations are designed and delivered.

At StrongPoint, Palmer oversees automation and robotics strategy across Europe, helping retailers streamline fulfilment, improve efficiency, and enhance customer experience. Under his leadership, the company delivered the world’s first multi-temperature AutoStore, integrating ambient, chilled, and frozen zones, a milestone that earned two Retail Technology Innovation Hub Awards in 2024.

In this interview, Palmer shares his vision for the next decade of grocery automation, from modular robotics and AI-driven orchestration to in-store automation and dense hubs, revealing how StrongPoint is redefining the future of grocery retail.

Professional Journey

Can you tell us how your career developed, and what factors or experiences led you to your current role at StrongPoint, particularly overseeing automation, robotics, and professional services?

My career has been a journey through the worlds of retail, manufacturing, and automation, each stage shaping how I view efficiency, technology, and customer experience. After graduating from the University of Glasgow, I began at Asda as a Front Line Manager, where I learned the importance of logistics, teamwork, and operational precision in grocery retail.

I later joined PepsiCo as a Manufacturing Manager, gaining firsthand experience in process optimisation and automation within a high-volume production environment. That exposure sparked a long-term fascination with technology’s ability to enhance consistency and performance.

A defining chapter was my time at Ocado, where I eventually became Head of Automation Engineering Programme Management. Working at the forefront of warehouse robotics and automation gave me a deep understanding of how data, software, and machines can transform grocery fulfilment.

From there, I expanded into broader logistics and consulting, designing automation solutions at GXO Logistics, founding my own consultancy, and later serving as Operations, Planning & Delivery Director at Fortna, overseeing complex automation projects for major clients.

When I joined StrongPoint in 2021, it felt like a natural next step. Having worked across every level of the supply chain, from store floors to large-scale fulfilment, I now lead Automation, Robotics & Professional Services, helping retailers harness innovation to stay competitive in a rapidly evolving market.

Vision for Automation in Grocery Retail

StrongPoint has moved heavily into automation in grocery and e ‑ commerce. How do you see the role of robotics and automation evolving in grocery retail over the next 5–10 years, and where is StrongPoint aiming to make its biggest impact?

The next decade will see automation become as fundamental to grocery retail as barcodes or refrigeration. Robotics, AI, and automated fulfilment will no longer be optional, they’ll be essential to staying competitive. At StrongPoint, our goal is to democratise automation, making advanced solutions accessible not just to global chains but also to regional grocers and independent retailers.

We’re focused on creating modular, scalable systems that deliver real ROI. From the world’s first multi-temperature AutoStore to in-store robotics and smart lockers, we’re helping retailers achieve faster, more accurate, and more profitable fulfilment within compact, efficient spaces. Several factors are driving this shift: labour shortages, rising costs, and surging e-commerce demand. Customers now expect orders in hours, not days, and manual processes can’t keep pace. Automation enables rapid order processing, minimal errors, and near-zero shrinkage. One retailer we partnered with reduced fulfilment times from four hours to under 30 minutes, and in some cases, to just two.

The technology itself has matured. Robots are no longer futuristic experiments but proven, reliable tools. With the emergence of flexible commercial models such as Robots-as-a-Service, grocers can now deploy automation with far lower upfront investment and risk. Looking ahead, we see major growth in compact fulfilment and in-store automation. Compact, robotic systems that handle ambient, chilled, and frozen goods are becoming the new standard for urban grocery fulfilment, allowing retailers to serve customers faster and more sustainably. In stores, automation will increasingly handle shelf replenishment, stock checks, and backroom logistics, freeing employees to focus on service and experience.

At StrongPoint, we’re integrating robotics, AI, and software into a cohesive ecosystem that augments human work rather than replaces it. Our vision is clear: to make grocery automation practical, scalable, and accessible for retailers of every size, delivering efficiency for businesses, better jobs for staff, and faster, smarter service for shoppers.

Core Partner Strategy

StrongPoint has formed a number of key technology partnerships, AutoStore, Blue Yonder with ModernLogic, Coalescent Mobile Robotics, 1X Robotics, Nomagic, VersaTile Automation by Tharsus, AutoStore, and Breathe Technologies among others. How do you choose and manage these partnerships, and what are the biggest challenges and benefits of integrating technologies from multiple partners into coherent automation solutions?

Partnerships are at the heart of StrongPoint’s automation strategy. We don’t just collect vendors; we build ecosystems. Our goal is to partner for excellence and integrate for coherence, combining worldclass technologies into seamless, customer-ready solutions.

We carefully select partners based on five core criteria: proven performance in live grocery environments, scalability, openness to integration, operational relevance, and cultural fit. Each technology must solve real pain points, improving picking speed, reducing labour, or optimising energy and space efficiency. Equally, the technology must be modular and open, allowing us to tailor deployments for retailers of all sizes, from regional chains to large multinationals.

Integration is where the real challenge lies. Grocery is a tough environment with temperature zones, variable stock types, and high service demands. Our in-house orchestration and middleware teams ensure interoperability across robotics, automation, and software platforms. We run pilots, define joint KPIs, and work side by side with partners to fine-tune performance before full deployment. It’s a collaborative process built on transparency and shared accountability.

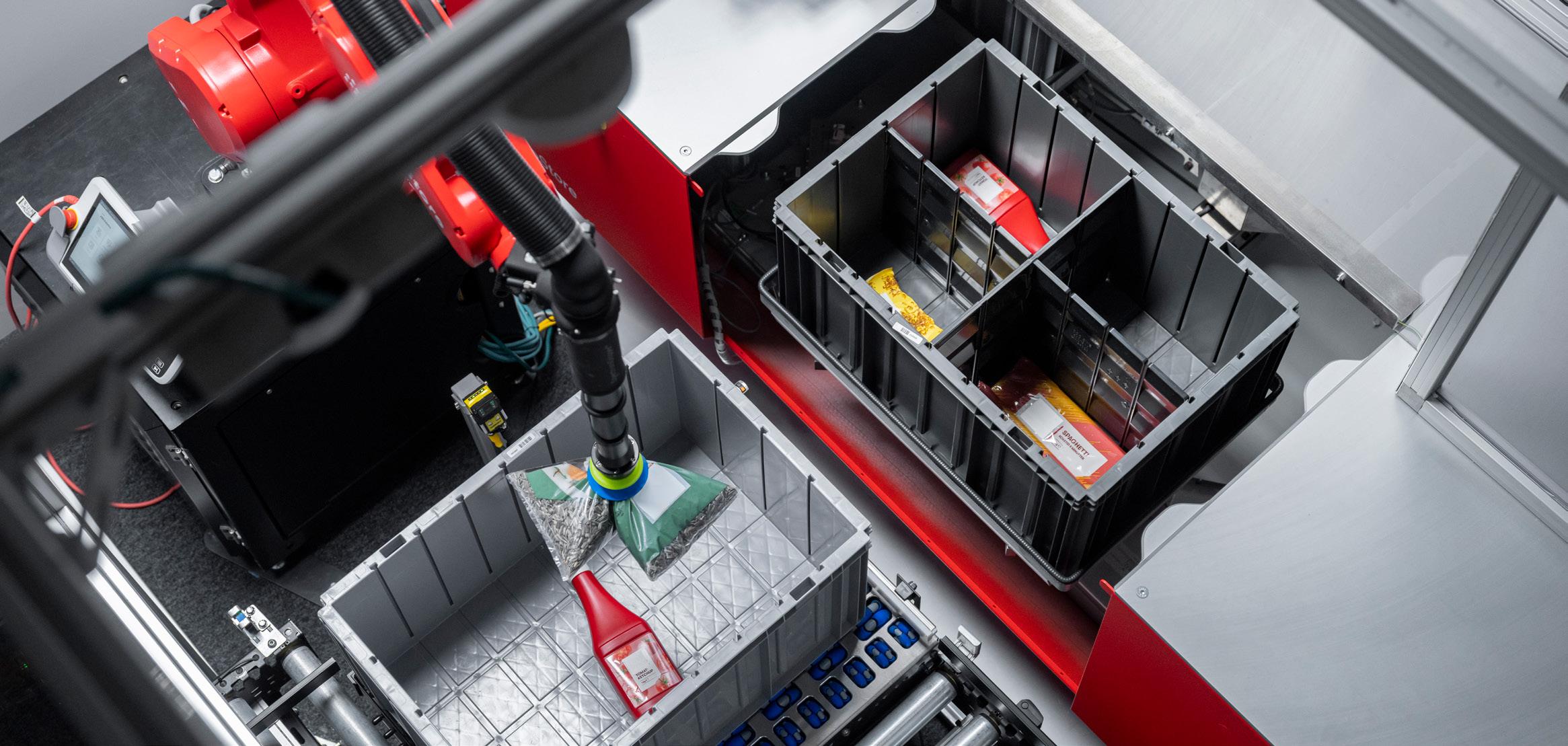

The payoff is enormous. By combining the best technologies, AutoStore for dense storage, Blue Yonder for orchestration, Coalescent for AMRs, Breathe for software optimisation, and Nomagic for AI robotics, we create flexible, best-of-breed systems that outperform monolithic, single-vendor solutions. This approach allows us to accelerate delivery, reduce risk, and continuously innovate without starting from scratch.

Our role at StrongPoint is to make these technologies work as one cohesive solution for retailers. We absorb the complexity, so our customers experience a seamless, high-performing system that delivers tangible ROI. That’s what defines our partner strategy: rigorous selection, deep collaboration, and an unwavering focus on integration excellence.

AutoStore & Pio Relationship

Given StrongPoint’s role as a distributor and integrator for AutoStore, and its extension to Pio, how do you balance offering full ‑ scale automation versus smaller, modular systems?

AutoStore is one of the most transformative technologies I’ve worked with. It allows retailers to unlock hidden capacity, delivering up to four times the storage density within the same footprint while maintaining exceptional uptime and throughput. I’ve seen grocers avoid multimillion-euro expansions simply by retrofitting AutoStore into existing buildings. It truly redefines the economics of grocery fulfilment.

At StrongPoint, our collaboration with AutoStore runs deep, from joint strategy at executive level to co-developing engineering proofs of concept. It’s a partnership built on shared innovation and continuous improvement.

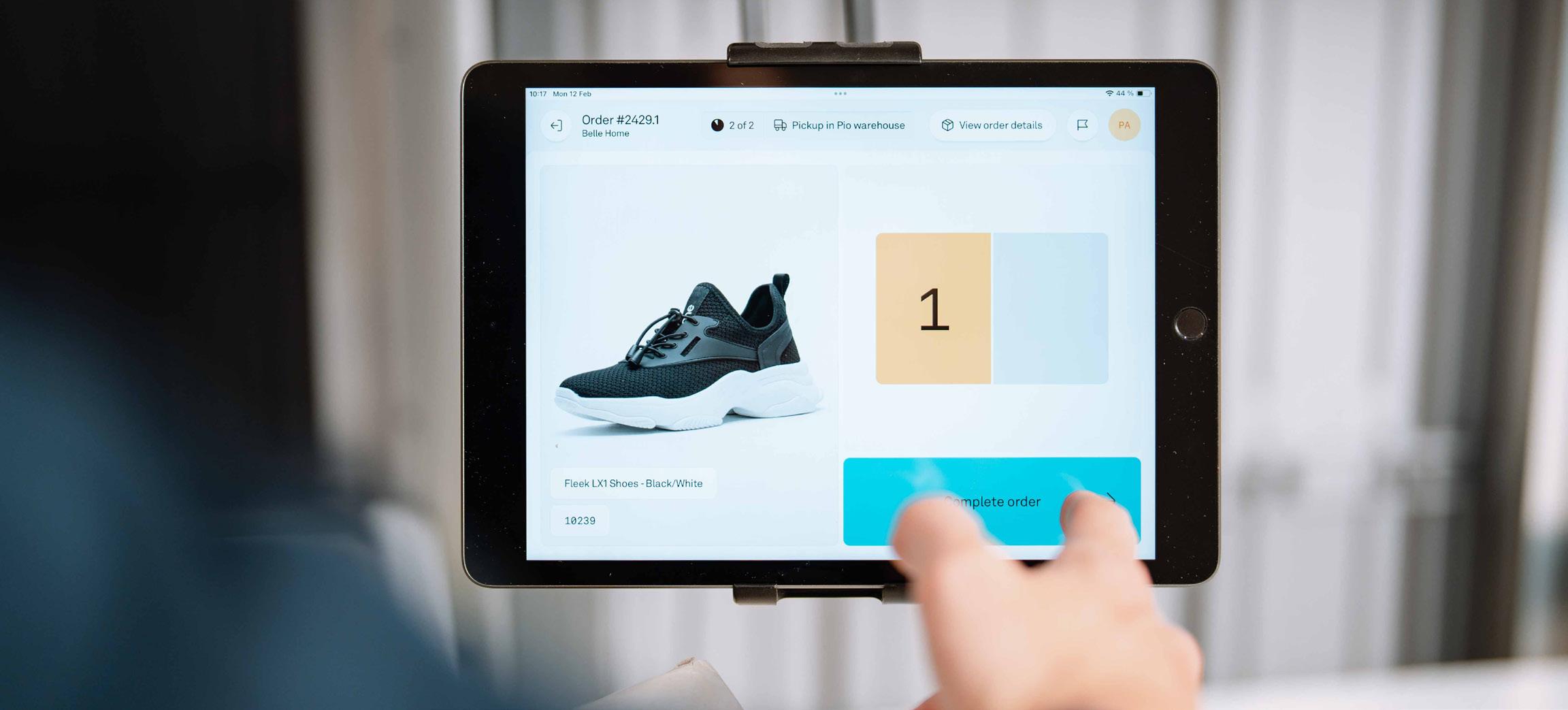

Pio extends that innovation to a broader audience. It takes the DNA of AutoStore, its efficiency, modularity, and compact design, and makes it accessible to smaller retailers or those starting their automation journey. Pio is about democratising automation, giving every retailer, regardless of scale, the ability to benefit from robotics and goods-to-person fulfilment.

The balance comes through right-sizing. Every project begins with a business case—analysing order volumes, SKU ranges, available space, and investment appetite. Sometimes the right solution is a small five-robot Pio grid in a store backroom handling 1,000 orders a day; other times, it’s a tritemperature AutoStore system processing tens of thousands across ambient, chilled, and frozen zones. By offering both ends of the spectrum, we can meet retailers where they are and grow with them as their needs evolve.

Both systems share key benefits: exceptional space efficiency, reliability, and scalability. AutoStore and Pio typically deliver up to four times greater storage capacity, throughput in the thousands of picks per hour, and uptime above 99.7%. They also reduce energy and labour costs, particularly in temperature-controlled environments, while increasing speed and accuracy in order fulfilment.

Ultimately, AutoStore and Pio embody flexibility. Retailers can start small and expand modularly, adding robots, ports, or grid capacity as demand grows, without disruption. That scalability is essential in grocery, where seasonal peaks, promotions, and market changes require operations that are both agile and resilient.

Blue Yonder WMS Partnership

What has been StrongPoint’s experience integrating Blue Yonder’s Warehouse Management System into your automation offerings, especially in terms of compatibility, scalability, and delivering value to customers?

Blue Yonder is the orchestration brain that makes automation truly effective. You can have the best robots in the world, but without intelligent direction and sequencing, you won’t achieve full ROI. That’s where a robust WMS and WES layer comes in, and Blue Yonder has been pivotal to StrongPoint’s integrated automation strategy.

We’ve invested heavily in middleware and integration expertise to ensure Blue Yonder communicates seamlessly with systems such as AutoStore, autonomous mobile robots, conveyors, and even instore robotics. In one project, a multi-temperature AutoStore deployment, Blue Yonder orchestrated goods across ambient, chilled, and frozen zones, optimising throughput, energy use, and temperature compliance. Without that orchestration layer, the solution would have required multiple disconnected systems, which simply doesn’t work in grocery operations.

What sets Blue Yonder apart is its scalability and adaptability. We’ve deployed it successfully in both compact urban fulfilment centres processing around 1,000 orders a day and regional hubs handling more than 50,000 order lines. Because grocery operations fluctuate with seasons, promotions, and demand spikes, having a WMS that can re-optimise in real time is invaluable.

From a customer perspective, the benefits are clear. Blue Yonder provides real-time visibility, giving retailers precise insight into stock levels and order status. It reduces errors by ensuring orders are fulfilled accurately and efficiently, and it optimises labour by dynamically balancing human and robotic workloads.

Software is the real force multiplier in automation. Adding more robots increases capacity incrementally, but orchestrating what you already have can multiply throughput dramatically. That’s the power of combining Blue Yonder’s WMS with StrongPoint’s integration expertise, creating intelligent, scalable systems that deliver measurable value to our customers.

Vertical Farming & Automation

Vertical farming is increasingly using robotics, AI, and climate control. Does StrongPoint currently see opportunities in vertical farming, and what is your view on how StrongPoint could collaborate with vertical farms?

Vertical farming is, in many ways, the agricultural twin of grocery automation. Both rely on precision, repeatability, and high reliability in demanding environments. What excites me most is that vertical farming compresses the agricultural supply chain into a tightly controlled, data-rich system, an ideal environment for automation.

The challenges in vertical farming, scaling up production, managing climate control, and coordinating robotic systems for seeding, harvesting, and packaging, mirror those we’ve already solved in grocery automation. The same principles behind our multi-temperature AutoStore deployments, Blue Yonder orchestration, and robotics integration apply directly here.

StrongPoint’s experience positions us to help vertical farms move from pilot-scale experiments to industrialised, commercially viable operations. Our expertise in multi-temperature logistics could support the management of varied environments; our robotics integration capabilities could coordinate mobile robots, robotic arms, and conveyors in compact spaces; and our experience in energy optimisation could help reduce the high power costs that come with vertical farming.

Perhaps the most exciting opportunity lies in orchestration, developing a “control tower” that unifies climate systems, robotics, and logistics into one intelligent platform. While grocery remains our core, vertical farming is a natural extension of what we do. I see real potential for collaboration, not only in technology but also in creating hybrid supply chain models where vertical farms and grocers share data and infrastructure to reduce food miles and deliver fresher produce to consumers.

StrongPoint and OnePointOne share many of the same long term visions: to help reduce food waste and provide sustainable food production globally. In the short term, it is not inconceivable that fresh fruit like strawberries can be grown in year round conditions in harsh winter climates like Norway, Finland and Sweden, that goal should be a shared goal amongst grocers to own their own production and reduce food miles.

OnePointOne / Agritech Collaboration

OnePointOne is pushing advanced vertical farming technology. Has StrongPoint explored, or would it consider, a strategic or technology partnership with companies like OnePointOne?

Companies like OnePointOne are pioneering the next frontier of vertical farming, combining robotics, AI, and climate science to create scalable agritech platforms. While StrongPoint hasn’t yet partnered directly with them, I see enormous potential in aligning their technological innovation with our strengths in integration and operational delivery.

Agritech specialists are brilliant at designing robotic systems for planting, tending, and harvesting, but many face challenges when moving from lab-scale pilots to large-scale, reliable operations. That’s precisely where StrongPoint can add value. Our experience in grocery automation, designing the world’s first tri-temperature AutoStore and orchestrating fleets of AMRs in live retail environments, has taught us how to engineer reliability, resilience, and interoperability into complex ecosystems.

A collaboration with OnePointOne or similar innovators could focus on three key areas. The first is systems integration, ensuring their robotics, AI, and climate systems connect seamlessly with supply chain and distribution platforms for end-to-end efficiency. The second is operational resilience, applying our expertise in demanding environments such as frozen automation zones to guarantee stability and uptime. And the third is commercial scaling, leveraging our retail experience to help agritech solutions align with grocers’ distribution models, food safety standards, and sustainability objectives.

Ultimately, agritech and grocery automation are converging. The same forces, labour shortages, sustainability pressures, and the demand for localised, efficient food production, are shaping both sectors. StrongPoint’s role could be to act as the bridge between these worlds, helping innovators like OnePointOne integrate seamlessly into the retail ecosystem so that vertical farms don’t just produce efficiently but also connect intelligently with how food is sold, delivered, and consumed.

Temperature Zones & Grocery Automation

StrongPoint has led the development of the world’s first AutoStore solution that handles ambient, chilled, and frozen temperature zones. What were the biggest technical, logistical, or design challenges in delivering a system with multiple temperature zones, and how do you address issues like energy use, safety, or reliability in freezing conditions?

Delivering the world’s first multi-temperature AutoStore was one of the most challenging yet rewarding projects of my career. Grocery automation is already complex, but introducing frozen and chilled zones into a robotic grid multiplies the engineering hurdles. The first major challenge was robot performance in extreme cold. Standard AutoStore robots are built for ambient use, but at -25°C, batteries drain faster, lubrication thickens, and sensors can fog or freeze. Working closely with AutoStore’s R&D, we ruggedised the robots, optimising batteries, sealing, and components to perform reliably through repeated freeze, thaw cycles.

Thermal transitions were another obstacle. It’s not as simple as adding a freezer to the grid, the points where bins and robots move between zones create condensation and frost risks. We engineered insulation barriers, airflow systems, and de-icing mechanisms to maintain smooth transfers between temperatures.

Energy efficiency was also critical. Frozen environments are power-hungry, so we implemented smart energy management to reduce door openings, balance robot charging, and minimise heat ingress, cutting energy use by around 30% compared to traditional frozen operations.

Safety and maintenance demanded careful planning. We introduced heated sensors, slip detection systems, and modular components for fast robot swaps, supported by remote diagnostics to limit human exposure to freezing conditions.

The result was a world-first system operating seamlessly across all temperature zones, capable of fulfilling thousands of multi-temperature grocery orders daily. More importantly, it proved that automation can now thrive in environments once considered impossible, setting a new benchmark for grocery fulfilment worldwide.

In‑Store Robotics & AMRs

Your partnerships include Coalescent Mobile Robotics and other robotics partners. How do you see these in-store robotics solutions integrating with backend automation in the broader omnichannel grocery retail model?

In-store robotics is the next major unlock for grocery retail. For years, automation has focused on warehouses and fulfilment centres, but the store is where most of the operational cost, complexity, and customer interaction happens. That’s why we’re collaborating with partners such as Coalescent Mobile Robotics and 1X to bring automation directly into the store environment.

Coalescent’s autonomous mobile robots (AMRs) are a great example. They can transport picking trolleys, move goods from the backroom to the sales floor, or carry waste to collection points. In live pilots, we’ve seen these AMRs reduce picker travel time by around 30%, directly improving fulfilment speed and labour efficiency. The key is integration, Coalescent AMRs connect to the same orchestration layer that manages AutoStore, allowing seamless coordination between warehouse and in-store robotics.

We’re also exploring humanoid reshelving robots in partnership with 1X and VusionGroup. Shelf replenishment accounts for roughly 30% of in-store labour hours and is both repetitive and physically demanding. By pairing humanoid robots with electronic shelf labels, replenishment can be automated and optimised. ESLs act as digital guides, directing robots to the correct shelf while simultaneously updating pricing and inventory data in real time.

The bigger picture is about true omnichannel integration. Imagine AutoStore fulfilling an online order in the back of the store, an AMR delivering the tote to the front, and a humanoid robot restocking shelves so that walk-in customers see the same availability reflected online, all orchestrated by Blue Yonder’s WMS in real time. That’s the future: one continuous, automated retail ecosystem where online, in-store, and fulfilment operations work in perfect sync.

For customers, it means faster pickups and fewer out-of-stocks. For retailers, it delivers lower cost-toserve, higher productivity, and greater resilience amid labour shortages. In-store robotics is still in its early phase, but its trajectory is unmistakable, they’re set to become as integral to store operations as self-checkouts are today.

Scaling & ROI Challenges

What are the biggest hurdles StrongPoint faces when scaling automation at both large and small retailers?

Scaling automation is not just a technical challenge, it’s also an economic and organisational one. For large retailers, the main hurdle is integration. Many have legacy systems, complex networks, and existing vendor contracts, which makes deploying automation without service disruption difficult. With the right orchestration layer and phased rollout strategy, however, it’s entirely achievable. My experience at Ocado taught me that integration is often the difference between pilots that stall and automation programmes that truly scale.

For smaller retailers, the challenge is affordability and ROI. Grocery margins are thin, and long payback periods are not viable. That’s why we focus on modular, scalable solutions. A regional grocer might start with a compact Pio grid or a single robotic packer, prove the value within 12–18 months, and then reinvest in further automation. This “start small, scale smart” model is reshaping adoption across the mid-market.

There are also universal hurdles to address. Change management is key, staff must adapt to new ways of working, supported by training and redeployment into higher-value roles. Demand variability means systems must handle both steady-state and seasonal peaks without overinvesting in capacity. Capital discipline is equally important, ensuring every euro invested delivers measurable payback in throughput, accuracy, or resilience.

To put it in perspective, a manual in-store picking operation across six sites might handle 3,000 orders per day. Introduce AutoStore to those same stores, and capacity doubles to 6,000 orders per day, without expanding labour or footprint. The ROI is transformative.

StrongPoint helps retailers overcome these challenges by building detailed business cases, modelling ROI under multiple demand scenarios, and structuring projects to scale modularly. Whether it’s a €50,000 pilot tackling a single bottleneck, a €3 million urban fulfilment centre, or a €30 million national hub, the principles remain the same: prove the ROI, minimise risk, and ensure resilience.

Ultimately, scaling automation isn’t about building the biggest or most complex systems, it’s about aligning technology with business strategy so that every retailer, large or small, can unlock the benefits of automation at a sustainable and scalable pace.

StrongPoint is a retail-technology company headquartered in Norway, providing innovative solutions designed to make stores smarter, shopping experiences smoother, and online grocery operations more efficient. With over 35 years of experience and a presence in more than 25 countries, StrongPoint offers a comprehensive portfolio including self-checkout & cashmanagement systems, electronic shelf labels, e-grocery fulfilment, warehouse automation, click-&-collect lockers, and last-mile delivery support.

Jmaes Palmer VP of Automation, Robotics & Professional Services

STRATEGIC COLLABORATION AND SUSTAINABLE PROGRESS