P.18

ALIGNING AMAZON’S ARAB AMBITIONS

RONALDO MOUCHAWAR ON REDEFINING THE FUTURE OF E-COMMERCE IN THE REGION

P.29 THE INDIAN EQUATION

A SHOWCASE OF THE TOP 100 POWER PLAYERS

P.18

ALIGNING AMAZON’S ARAB AMBITIONS

RONALDO MOUCHAWAR ON REDEFINING THE FUTURE OF E-COMMERCE IN THE REGION

P.29 THE INDIAN EQUATION

A SHOWCASE OF THE TOP 100 POWER PLAYERS

AZIZ KOLEILAT ON GE AEROSPACE’S FIRST-YEAR MOMENTUM AND NEXTGEN AVIATION IN THE REGION

At EFG Hermes, An EFG Holding Company, we realize more for clients looking to us as a gateway to compelling MENA Markets’ equities; and for investors who want to deploy impact capital into renewables, healthcare, and education.

An insight into the news and trends shaping the region with perceptive commentary and analysis

GE Aerospace is moving quickly to become a cornerstone of the region’s next aviation chapter. Aziz Koleilat, president and CEO of METCIS at the company, shares details

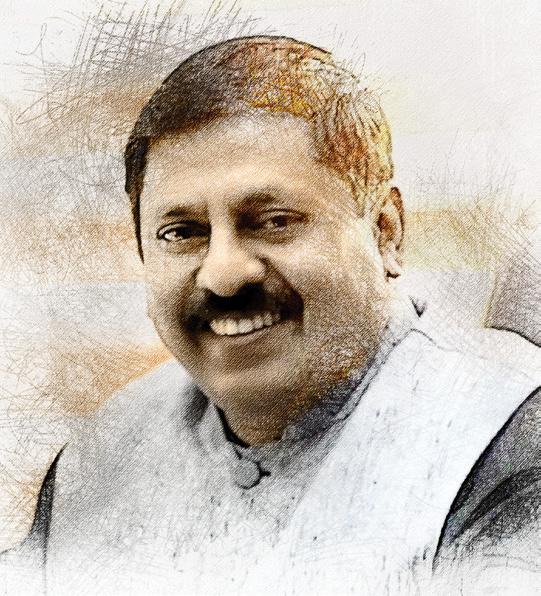

Editor-in-chief Obaid Humaid Al Tayer | Managing partner and group editor Ian Fairservice 22

Chief commercial officer Anthony Milne anthony@motivate.ae

Publisher Manish Chopra manish.chopra@motivate.ae

Group editor Gareth van Zyl Gareth.Vanzyl@motivate.ae

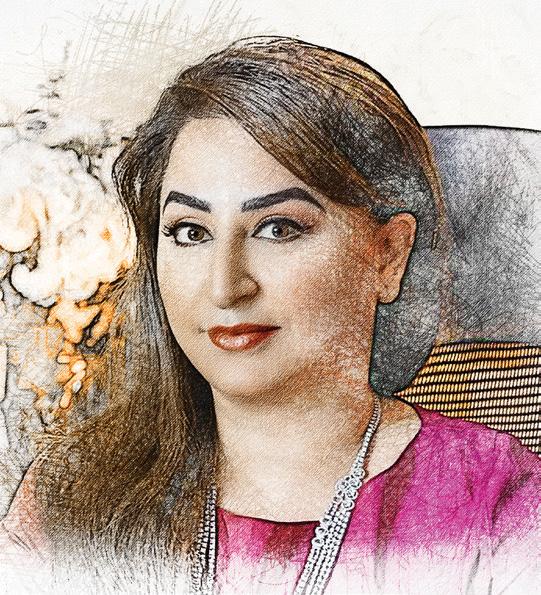

Editor Neesha Salian neesha.salian@motivate.ae

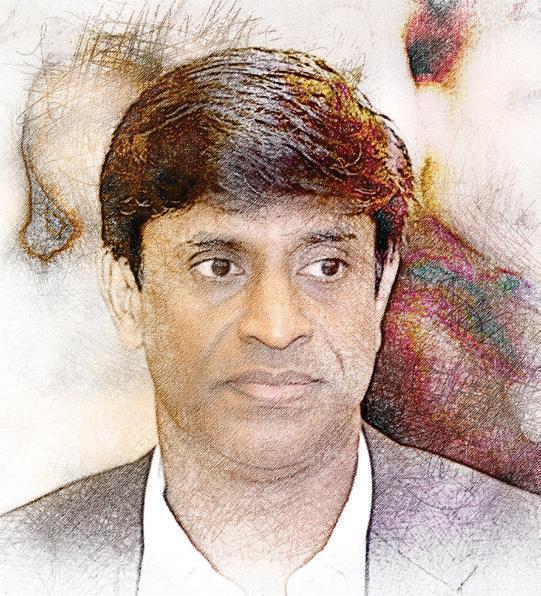

Deputy editor Rajiv Pillai Rajiv.Pillai@motivate.ae

Reporter Nida Sohail Nida.Sohail@motivate.ae

Senior art director Freddie N Colinares freddie@motivate.ae

motivate@motivate.ae

Offices

455 - 456,

motivate@motivate.ae

General manager – production S Sunil Kumar

Production manager Binu Purandaran

Assistant Production Manager Venita Pinto

Digital sales director Mario Saaiby mario.saaiby@motivate.ae

Sales manager Hitesh Kumar Hitesh.Kumar@motivate.ae

The UAE’s digital transformation is redefining how money moves and businesses operate, with embedded finance emerging as the next big catalyst

The UAE is rapidly becoming a world leader in digital development, fuelling transformation and powering innovation across industries. Under its Digital Economy Strategy from 2022, the Emirates aims to raise the digital economy’s share of GDP from 9.7 to 19.4 per cent in 10 years.

The UAE’s banking sector sits at the intersection of a national digital agenda and a thriving, diversified economy, using technology as both a growth engine and a resilience strategy.

Forward-thinking regulation amplifies this shift: the Central Bank of the UAE, alongside innovationfriendly financial centres such as Abu Dhabi Global Market and Dubai International Financial Centre, has fostered test-and-learn sandboxes, pragmatic

guidelines for digital onboarding and e-KYC, and clear rulebooks for emerging models such as open banking, digital assets and embedded finance.

Guided by an ambition to deliver world-class digital services and seamless experiences, banks are rearchitecting core systems around cloud, APIs and data platforms to enable real-time, mobile-first finance.

At the core of this transformation lies embedded finance, which allows for the seamless integration of financial services into non-financial platforms, allowing any business to perform financial operations, such as digital payments, without leaving its platform.

The UAE’s embedded finance sector is expanding rapidly, with revenues expected to rise from $1.56bn in

2024 to $5.5bn by 2029, representing a compound annual growth rate (CAGR) of 28.6 per cent. This substantial market growth has translated into transformative impacts on a number of industry subverticals including business-to-business (B2B) payments. For example, financial institutions such as Emirates NBD in the UAE are developing invoice management solutions that integrate directly with businesses’ ERP systems. This solution offers digital invoice submission and processing capabilities with real-time status updates, previously available only through standalone service providers.

Traditional B2B invoice payment processes have long been characterised by inefficiency and lack of transparency. Invoices are often submitted via e-mail and followed up with phone calls requesting status updates, leaving suppliers without visibility into the invoice approval process.

ULTIMATELY, THIS TRANSFORMATION IN INVOICE MANAGEMENT IS A MAJOR STEP FORWARD FOR B2B TRANSACTIONS.

THE EMBEDDED APPROACH BENEFITS BUYERS BY STREAMLINING THEIR PROCUREMENT-TO-PAYMENT PROCESSES. AUTOMATED INVOICE MATCHING AGAINST PO ENSURES THAT ONLY LEGITIMATE INVOICES ENTER THE APPROVAL WORKFLOW,

REDUCING PROCESSING ERRORS AND IMPROVING EFFICIENCY.

Advanced invoice management solutions offer a streamlined, digitised channel for B2B buyers to efficiently manage invoices directly from their own systems. Now suppliers can upload invoices and supporting documents for the goods supplied to a buyer through a dedicated portal. The solution has built-in configurable logic to perform purchase order (PO) to invoice matching services. Upon successfully meeting the configured criteria, eligible invoice data is sent to the buyer’s ERP systems for further booking and approval.

The solution brings efficiency and transparency to the entire invoice submission and approval process with minimal disruption to the existing approval setup. This efficiency extends beyond individual transactions, significantly impacting the broader supply chain. A strong supply chain boosts business growth by streamlining operations, cutting costs and enabling swift market adaptation. Supply chain finance brings in the element of cash flow optimisation, improving the financial health of the entire value chain.

Embedded invoice management solutions are delivering direct advantages for suppliers by offering greater visibility into their receivables. When

THE UAE’S EMBEDDED FINANCE SECTOR IS EXPANDING RAPIDLY, WITH REVENUES EXPECTED TO RISE FROM $1.56BN IN 2024 TO $5.5BN BY 2029

delivered through banks’ platforms, these solutions create additional value, enabling suppliers to track and manage payments more efficiently.

Given banks are highly regulated entities, these institutions are uniquely equipped to manage critical financial processes, particularly when integrated with advanced technologies while ensuring data security and confidentiality.

Furthermore, the market is seeing the rise of flexible implementation options, including white-label capabilities. This allows businesses to present supplier portals as their own branded interfaces, maintaining brand consistency while leveraging sophisticated banking technology and compliance infrastructure.

In the UAE, SMEs play a critical role in driving economic diversification, innovation and job creation, contributing significantly to the country’s non-oil GDP. By automating invoice processing and enabling early payment through embedded supply chain finance, the solution strengthens SMEs’ cash flows, directly supporting their working capital needs and business growth.

Ultimately, this transformation in invoice management is a major step forward for B2B transactions. The embedded approach benefits buyers by streamlining their procurement-to-payment processes. Automated invoice matching against PO ensures that only legitimate invoices enter the approval workflow, reducing processing errors and improving efficiency.

Looking ahead, as more businesses recognise the operational and financial benefits of unified, embedded solutions, B2B invoice payments are set to become the standard rather than the exception, fundamentally reshaping how B2B commerce operates in the UAE and beyond.

This transformation represents more than technological advancement, it embodies a fundamental shift toward customer-centric, efficiency-driven financial services that support business growth and economic development –key attributes in an increasingly competitive global marketplace.

We look at why

utility-scale batteries

are central to the GCC’s energy future

Battery storage is rapidly becoming central to the Middle East’s energy transition, bridging the gap between abundant but intermittent solar and wind generation and rising demand. The GCC countries are hosting some of the world’s largest battery tenders, led by Saudi Arabia and the UAE . In our view the GCC has become one of the most dynamic

battery storage markets globally, with Saudi Arabia targeting 48 gigawatt hours (GWh) of capacity by 2030. The kingdom is moving quickly, commissioning or contracting several projects in the past year alone. Simultaneously, the UAE is advancing one of the world’s largest solar-plusstorage projects. The unprecedented scale and speed of these projects underscore how the GCC has shifted from pilot schemes to large-scale deployment in just a few years. We believe that battery storage is fast becoming a central pillar of GCC energy-transition strategies in line with their long-term goals. While fossil fuels continue to dominate the regional energy mix, expanding renewable pipelines, stronger regulations, and rising investment and rising investment signal an increasingly firm commitment to clean energy. Emerging demand from AI and data centres infrastructure is also accelerating this transition, as this requires large-scale, rapid, and highly reliable power. This shift toward low-carbon, flexible power systems is quickly becoming a defining feature of national energy strategies across the region.

Saudi Arabia’s Vision 2030 illustrates this shift. The government aims to generate 50 per cent of its electricity from renewable sources by 2030, with the rest to come from highly efficient gas-fired plants. Similarly, the UAE has committed to netzero emissions by 2050, supported by large-scale solar projects, competitive tenders, and a robust clean-energy roadmap. It also plans to triple its installed clean-energy capacity by 2030. Oman, Qatar, and Bahrain are also scaling up renewable energy, advancing decarbonisation agendas through utility-scale procurement and public-private partnerships.

Abundant solar resources, significant land availability, and complementary wind conditions give the region a natural advantage in developing clean energy. In our view, GCC governments’ ability to launch several gigawatt-scale projects each year reflects increasing confidence among local and foreign investors, backed by sophisticated procurement frameworks.

However, the growing share of intermittent renewables in the generation mix raises system-level challenges. Peak electricity demand in GCC typically occurs in the evening, just as solar output drops. This mismatch between the timing of generation and demand means that without flexible resources, renewables can’t fully deliver reliable power. We believe that addressing this challenge is now a priority for both policy and investment. In this context, we are seeing a strong push for battery energy storage systems

Sofia Bensaid is the director, Infrastructure and Project Finance Ratings MEA at S&P Global Ratings

(BESS), not just as optional add-ons, but as enablers of energy security and grid flexibility in a low-carbon system.

Momentum is building fast across the region, projects are scaling up, and procurement pipelines are expanding. In our view, battery storage is becoming critical to delivering reliable, roundthe-clock, clean power. As renewables gain ground across the GCC, storage is increasingly defining the way that power systems are designed, financed, and operated. As governments scale up renewable energy deployment, cost-competitive storage is becoming essential to ensure grid flexibility and the steady supply of dispatchable clean energy. In our view, continued price declines remain a key enabler of large-scale adoption.

Over the past decade, lithium-ion battery prices have declined by more than 80 per cent, driven by global electric-vehicle demand, scaled manufacturing, and steady advances in battery design, performance, and durability.

This steep cost decline is especially critical for the GCC, where the cost of solar photovoltaic (PV) power is already among the lowest in the world — often below $0.02 per kilowatt hour (kWh). Pairing ultra-low-cost solar power with increasingly affordable storage enables the region to deliver clean power at highly competitive prices, enhancing both grid reliability and long-term cost efficiency. These dynamics make BESS an

economically viable investment for developers and governments alike.

The GCC’s growing pipeline of renewable energy projects is transforming the region’s electricity mix. The primary driver of this is solar PV, with wind also beginning to play a role in markets like Saudi Arabia. Record-low solar tariffs together with battery storage are redefining the economics of renewables. The ability to manage the timing and flexibility of supply is bringing clean energy closer to having baseload characteristics - a major step in stabilising grids and scaling renewables more aggressively.

In countries like Saudi Arabia, where energy exports remain vital to the economy, storage also allows for greater optimisation of domestic resources, freeing up gas or oil for export while renewables cover local demand more effectively. Battery storage is also increasingly displacing oilfired generation during peak demand hours. This helps reduce domestic oil consumption and allows for more efficient allocation of energy resources. Saudi Arabia’s peak electricity load was 60 gigawatts (GW) in 2018, and we expect it to increase to 100 GW by 2030. Oil-based generation has traditionally met most of this demand. We expect BESS to play a growing role as a scalable alternative to oil peaker plants, supporting fuel optimisation and contributing to long-term decarbonisation objectives.

In our view, the case for battery storage is particularly strong in the Middle East due to the region’s unique combination of high levels of sunshine and sharply defined load curves.

Reinforcing these advantages are ultra-competitive solar power prices that reflect the large scale of the projects and the high quality of the natural resources.

The region also benefits from abundant available land, a strong policy push, ample capital, fast-track permitting frameworks, and a proven track record of efficient project execution. In this context, solar PV-plus-storage is emerging as a compelling proposition: it allows developers and utilities to deliver clean energy with dispatchable characteristics, reinforcing both reliability and investor appeal.

THE SAUDI GOVERNMENT AIMS TO GENERATE 50% OF ITS ELECTRICITY FROM RENEWABLE SOURCES BY 2030, WITH THE REST TO COME FROM HIGHLY EFFICIENT GAS-FIRED PLANTS

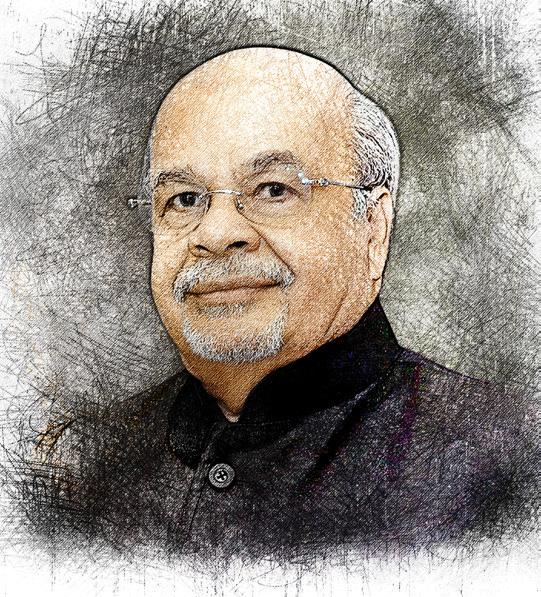

Emilio Pera is CEO of KPMG Lower Gulf and deputy CEO of KPMG Middle East

governance

As part of a strong governance framework, an organisation’s board has a critical role to play to ensure the health and stability of each individual business, improving investor confidence to the benefit of the economy as a whole. And for this to be effective, it is vital that every board member fully understands their role and takes this responsibility seriously.

A board director’s obligations move beyond handling operational, day-to-day issues in a management role, to overseeing the activities of the executive and representing the interests of all stakeholders, ensuring alignment to the organisation’s strategy.

Each board member has a critical role to play, contributing diverse skills and perspective to the general benefit of the organisation in the first instance. They should not be influenced by decisions relating to external stakeholders, for example on paying out a dividend or not, to the detriment of the organisations’ best interest.

Here, the governance framework is critical. Where do you draw the line between providing oversight versus getting involved in running the business and second guessing the decisions management is taking? The issue is that the CEO can be perceived as being some kind of lieutenant to the chair, which is generally not healthy for the organisation.

This can be a particular challenge for family businesses – and occasionally semi-government organisations – but the roles must be made clear, formally and informally, to avoid confusion. Board members must ask themselves, what is in the best interests of the organisation?

Since I arrived in the UAE almost a decade ago, there has been noteworthy enhancements in legislation relating to boards. Although significant progress has been made, we are currently still a bit less mature than several developed markets, but the country is meeting global standards while maintaining local relevance.

Indeed, there has been significant improvement in governance over the last couple of decades, for example with the adoption of the UK’s Corporate Governance Code (or Combined Code). And in the banking sector, the Basel regulatory framework, with its governance guidelines for risk function within an organisation, means the country meets internationally common business standards. Banking is a more regulated environment, so governance issues are more pronounced than in other sectors, though the rest of the economy is moving in the same direction.

Having more women on boards is another positive development. Since January 1, both private and public joint-stock companies in the UAE must have at least one woman on their board. Although there is still some way to go, we expect better business outcomes with (gender) diversity at corporate leadership, across all sectors.

In terms of earning stakeholder trust, governance frameworks have a critical role to play in a country’s capital markets. A well governed board of directors gives reassurance to investors and other stakeholders alike.

It is therefore significant that in the UAE we are increasingly seeing a requirement for independent validation and evaluation of the board. The country is now playing host to a wellspring of initial public offerings (IPOs), accompanied by the need to consolidate capital markets and engender market liquidity. These activities can only be enabled through strong governance frameworks, in which the board – working in harness with the C-suite – has a critical role to play.

Additionally, the UAE, being one of the Gulf’s leading financial hubs, will most likely see its financial frameworks further converging with international bodies such as the OECD. This is already the case with the adoption of minimum tax status, which will also create greater harmonisation and transparency.

So, the structure is there. Everything goes to building the credibility of the region and of the UAE, to attract investment. That’s why the transparency, stability and strength of the market has been a key focus, and why board directors of UAE companies have such a crucial role to play.

THE COUNTRY IS NOW PLAYING HOST TO A WELLSPRING OF INITIAL PUBLIC OFFERINGS (IPOS), ACCOMPANIED BY THE NEED TO CONSOLIDATE CAPITAL MARKETS AND ENGENDER MARKET LIQUIDITY.

Alexander

Even without a driver behind the wheel, human ingenuity, collaboration, and judgment remain at the core of autonomous racing

When people see a driverless car, whether it be a racing car or a taxi, they often assume the technology is doing all the work. The machine is in control and humans are out of the picture.

The problem is not just one of perception. As autonomous vehicles become more common, the story we tell about them matters. If we view autonomy as something automatic or inevitable, we risk underestimating the human effort it still requires. That effort is not only technical. It is strategic, emotional and deeply collaborative.

I come to this space from a traditional motorsport background, with over 16 years working across some of the most competitive racing environments in the world. That perspective has shaped how I view this shift. In conventional racing, teams protect their data. Knowledge is rarely shared, competitive advantage is everything and the culture rewards secrecy, speed and control.

Autonomous development challenges that mindset. It depends on shared progress. Teams often help one another, even when they are direct competitors. I have seen top developers sit with newer teams to troubleshoot software or recalibrate systems. They do it not out of charity, but because they understand that autonomy only succeeds when the whole field can perform. If only one car completes a race, that is not a victory. It is a failed experiment.

The

same tools that allow a driverless car to manage grip or react to changing track conditions can help human teams prepare better strategies, monitor tyre degradation or model risk with greater accuracy.”

Every lap completed by a driverless car is the result of months of human effort. Engineers, coders and technicians work late into the night solving problems that have no manual. These systems are still prototypes, held together by relentless testing and collaboration. Nothing about this work is automatic. That collaborative spirit does not make the work easier. If anything, it introduces new pressures. These teams are made up of specialists with different ideas about how to solve the same problem. Some want to push harder, while others argue for a safer approach. Reaching consensus under tight deadlines demands more than technical skill, it requires leadership, communication and trust. Still, the progress is remarkable. I have seen autonomous cars complete sub-one-minute laps around the north track at Yas Marina Circuit on tyres that had already clocked more than 800 kilometres. In traditional racing, a set of tyres used aggressively might last 60 to 80 kilometres before falling off in performance. These autonomous systems adjust continuously, learning with every turn. They are not held back by instinct, fatigue or hesitation. But this is not about replacing drivers. Motorsport remains a sport, and human performance will always be central to its appeal. Autonomy offers something different. The same tools that allow a driverless car to manage grip or react to changing track conditions can help human teams prepare better strategies, monitor tyre degradation or model risk with greater accuracy. Engineers working in autonomy today are building systems that could quietly make racing more efficient, more sustainable and more competitive. Events like the Abu Dhabi Autonomous Racing League (A2RL) are helping to test these possibilities in real-world conditions, under pressure and at speed. None of this happens without people. Every decision an autonomous vehicle makes is shaped by human judgement, testing and design. These systems are not independent of us. They are built through human insight, creativity and care. Removing the driver does not remove the human. It simply shifts their role, from operating the vehicle to developing the systems that guide it.

Plastics are at a crossroads. Once valued for their durability, versatility, and low cost, they are now under scrutiny as governments, businesses, and consumers rethink how materials can be produced, used, and reused sustainably. This global shift has opened the door for alternative materials including plantbased and compostable plastics that balance performance with environmental responsibility.

in sustainable plastics, fostering innovation and eco nomic growth while advancing environmental goals.

One of the most promising alternatives is polylactic acid (PLA), a bio-based polymer derived from renewable feedstocks such as corn starch or sugarcane. PLA offers a circular end-of-life pathway through industrial composting, breaking down into

ACROSS THE UAE AND MIDDLE EAST, AWARENESS OF PLASTIC POLLUTION IS GROWING, WITH CONSUMERS INCREASINGLY SEEKING REUSABLE, COMPOSTABLE, OR BIO-BASED PRODUCTS AND MAKING CHOICES BASED ON ENVIRONMENTAL IMPACT.

natural components without leaving microplastics. It is highly suitable for packaging, disposable products, and other applications where conventional plastics contribute to pollution. By integrating PLA into production and supply chains, companies can deliver functional products while significantly reducing their carbon footprint. PLA represents both a material innovation and a catalyst for systemic change in product design, manufacturing, and sustainability practices.

Consumer behaviour is a key driver of this transition. Across the UAE and Middle East, awareness of plastic pollution is growing, with consumers increasingly seeking reusable, compostable, or bio-based products and making choices based on environmental impact. Public awareness encourages companies to innovate and develop products that meet sustainability standards, creating a positive feedback loop that strengthens circular economy practices and accelerates adoption of sustainable alternatives.

Government initiatives further reinforce this shift. The UAE is taking bold steps to phase out single-use plastics, starting with a nationwide ban on plastic shopping bags in 2024 and a federal ban on products like cups, cutlery, and food containers by 2026. Dubai and Abu Dhabi have also rolled out phased bans on bags, Styrofoam, and other disposable items.

International climate agreements and frameworks, including COP28, are also expected to accelerate adoption of sustainable materials. Commitments to reduce carbon emissions and promote circular economy principles will likely increase demand for plant-based, compostable plastics and encourage the adoption of innovative production technologies. Aligning domestic strategies with global sustainability goals strengthens the UAE’s leadership in sustainable plastics and demonstrates how industrial-scale eco-friendly initiatives can be implemented effectively.

Global innovations in bio-based plastics provide additional insights. Polymers such as PLA, PHA, and other compostable materials have been successfully applied worldwide in packaging, disposable products, and single-use items. Design strategies like monomaterial packaging simplify end-of-life management and enhance circularity. Organisations such as the United Nations Environment, trade associations like European Bioplastics and the Gulf Petrochemical Association facilitate knowledge sharing, accelerate adoption, and set standards that can be adapted to the UAE context. By integrating these innovations locally, the UAE can create a robust ecosystem for sustainable materials and position itself as a model for the region.

Collaboration across multiple stakeholders is essential for success. Governments provide policies and incentives, businesses drive innovation and market adoption, and research institutions develop new materials and technologies. Together, these stakeholders ensure that product design, supply chains, and industrial processes are aligned with circular economic principles. For initiatives like the Falcon PLA Project, collaboration ensures scalable production, high-quality materials, and integration into regional and international markets. Multi-stakeholder partnerships are vital to overcoming challenges and accelerating adoption of sustainable plastics.

Economically, investing in sustainable plastics presents significant opportunities. Large-scale production of bio-based polymers generates new green industries, fosters high-skilled jobs, and strengthens the UAE’s position as a hub for innovative materials.

The plastics industry is at a pivotal moment. Petrochemical-based plastics are no longer compatible with environmental and economic priorities. Plantbased and compostable alternatives, particularly PLA, offer practical solutions that reduce impact without sacrificing functionality. With its forwardlooking policies and strategic location, the UAE is uniquely positioned to lead the Middle East and set new global benchmarks in sustainable plastics.

How MENA is proving itself a force in the global crypto future

Crypto’s roots are in the West, but the Gulf is now leading innovation with regulation and global collaboration

Like so much of the major tech-based movements around the world, crypto’s start can be traced back to the West. Equally, like so much acceleration in capability and regulation of technology, the exciting next chapter is unfurling here in the Middle East.

Over the years, the Gulf has consistently shown its ability to act responsibly with innovation, blending government regulation, real-world integration, with speed and scale.

While other markets wrestle with uncertainty, MENA’s approach is pragmatic: create the frameworks first, then invite innovation to flourish inside them. And what’s more, they remain openarmed, which bodes well for disruptive entrepreneurs and outliers driving and scaling technologies at the forefront of culture, society, and economies.

Bahrain was among the earliest movers, with the Central Bank of Bahrain establishing one of the world’s most comprehensive digital-asset frameworks. Binance became the first exchange to secure a Category 4 license there, a pin-worthy compliance milestone for the rest of the world.

The UAE, meanwhile, has evolved into one of the world’s most dynamic Web3 ecosystems. Through the Virtual Assets Regulatory Authority (VARA) in Dubai and ADGM in Abu Dhabi, the Emirates are not only attracting exchanges and fintechs, but also incubating the next generation of blockchain start-ups, tokenised-asset platforms, and AI-driven financial solutions.

For Binance, the UAE serves as both a regional base and a hub for education, institutional collaboration, and product innovation, from self-custody solutions like Trust Wallet – now serving over 280 million users – to Binance Institutional, which provides compliant trading and custody for global investors. It also serves as the home of this year’s Binance Blockchain Week for the second

consecutive year - the brand’s flagship gathering taking place in December at the Coca-Cola Arena.

Saudi is now signaling its own intent to join the digital-asset future. Under Vision 2030, the kingdom is investing in fintech sandboxes and pilot blockchain projects aimed at financial inclusion and efficiency.

For the initiated, the opportunity is obvious, for the curious, it’s vast and exciting. The tokenisation of real-world assets (RWA) — from real estate to corporate debt — already exceeds $20bn globally, with a projection of another $10tn to follow in the coming years. There is no doubt that MENA’s strong regulatory infrastructure will make it a key gateway for this new capital market.

By pairing this ambition with accountability, MENA is building a bridge between traditional finance and the decentralised future. It’s unrivaled in terms of readiness, eagerness, governmental support, and global talent. You need only do a 360 turn almost anywhere in the Emirates to see it.

The Gulf is no longer a follower in the crypto story. It is a co-author, helping to define a more transparent, inclusive, and hybrid financial system for the world.

The tokenisation of real-world assets (RWA) — from real estate to corporate debt — already exceeds $20bn globally, with a projection of another $10tn to follow in the coming years.”

Attractions

Activities

Dining

Health

Education

Entertainment

Real

Hotels

Shopping

The

In an era of heightened market uncertainty, Bank of Singapore's Mehvish Ayub shares how its strategic asset allocation approach helps investors build resilient, well-diversified portfolios while capitalising on opportunities across regions and alternatives

In today’s environment of heightened market volatility and policy uncertainty, what role does asset allocation play in building resilience for investors?

Amid the current landscape of increased market volatility and policy uncertainty, asset allocation plays a crucial role in building resilience for investors. It serves as a strategic framework for investing that balances exposure across various asset classes while aligning with an investor’s risk tolerance and return objectives. By, determining asset weightings and implementing rebalancing methodologies, asset allocation enhances portfolio robustness, enabling investors to better navigate the unpredictable shifts in global markets and policies we are likely to continue experiencing.

How can alternatives complement traditional asset classes, and what diversification benefits do they bring to a client’s portfolio right now?

Alternatives are often viewed primarily through the lens of their performance potential, the illiquidity premium and the ability to potentially provide an enhanced return over public markets. However, their value extends far beyond just return profiles. They are a great complement and diversifier to traditional assets as they provide exposure to different areas of the markets and can potentially tap onto secular trends before they become more mainstream.

Current macro factors such as the stock-bond correlation shifting from negative to positive, heightened policy uncertainty and ongoing geopolitical risks make a strong case for adding alternatives into investor’s portfolios. Alternatives offer unique characteristics such as stable income generation, inflation hedging, regional diversification and tactical opportunities. These features enhance portfolio diversification and resilience, helping investors better navigate market volatility and uncertainty.

Bank of Singapore has introduced its Strategic Asset Allocation (SAA) approach – could you explain how this framework supports clients in constructing long-term, resilient investment portfolios?

Bank of Singapore’s new strategic asset allocation (SAA) approach is designed to help clients build long-term, resilient investment portfolios by delivering more stable returns across varying market cycles. Central to this framework is the integration of uncertainty directly into the portfolio design process. By rigorously stress-testing portfolios against a wide range of historical and forward-looking scenarios, we evaluate asset classes and investments within a comprehensive “portfolio context.” Our approach encourages “portfolio thinking” –evaluating each investment by its contribution to overall portfolio’s risk and return profile, rather than in isolation. This holistic risk management approach enables us to construct well-diversified portfolios that are better equipped to withstand market volatility and evolving economic conditions, ultimately supporting clients’ long-term financial goals with greater confidence.

Where do you currently see the most compelling opportunities across asset classes, and conversely, what risks should investors be mindful of?

Currently, some of the most compelling opportunities lie in regions and sectors that may be underappreciated or overlooked due to market momentum elsewhere. Investors should be wary of overconcentrating in areas driven primarily by short-term enthusiasm as this could drift away from their strategic asset allocations and increase risk.

Our CIO team has been advocating for regional diversification in equities, maintaining overweight positions in European and Asia ex Japan equities throughout the year to capture attractive valuation and growth opportunities. Within

the alternatives space, we see strong potential in real assets, particularly infrastructure, which has compelling secular tailwinds, offers a stable cash flow profile and provides valuable inflation hedging properties.

With your experience across global markets and asset management, how do client expectations in the UAE and wider GCC differ from other regions when it comes to portfolio construction?

While clients in the UAE and wider GCC share many investment goals with investors globally, their expectations around portfolio construction often reflect regional factors such as a greater preference for capital preservation, a strong interest in wealth preservation across generations. Over the last three years, investors globally have been used to achieving stellar returns in equities. It is important to manage expectations in the context of longer-term return expectations, stress test portfolios under a variety of possible scenarios (not just extrapolate recent trends) and build well-balanced portfolios.

Looking ahead, how do you see the role of alternatives evolving in client portfolios over the next five years, particularly given structural shifts in the global economy?

Our goal is to help clients think and allocate capital with the same discipline and sophistication as institutions. We believe that growing awareness of the diversification benefits alternatives provide, combined with the emergence of evergreen solutions tailored for the wealth market, will be key drivers behind increased allocations to alternatives in client portfolios over time.

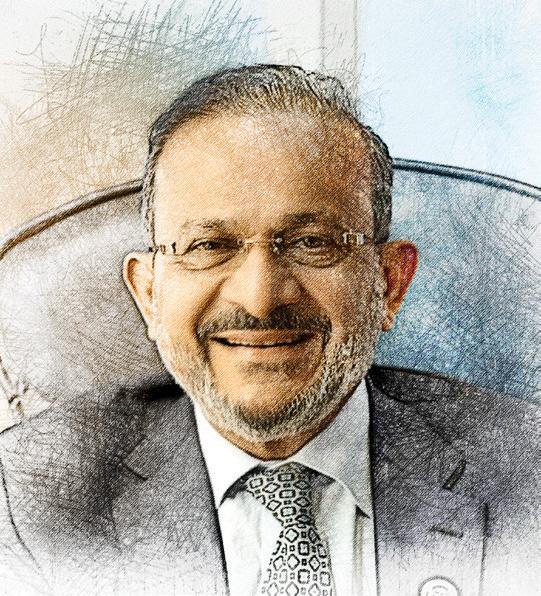

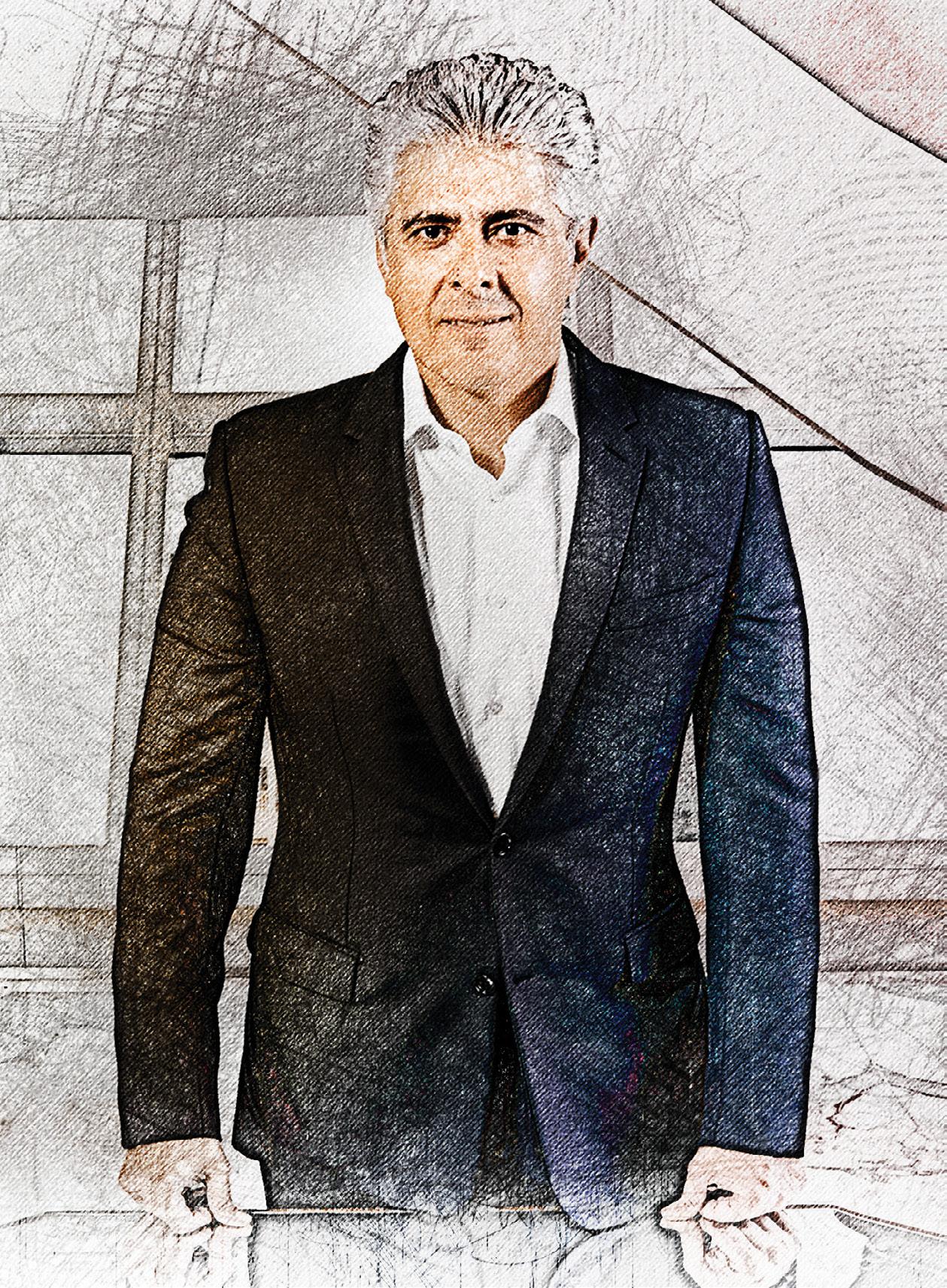

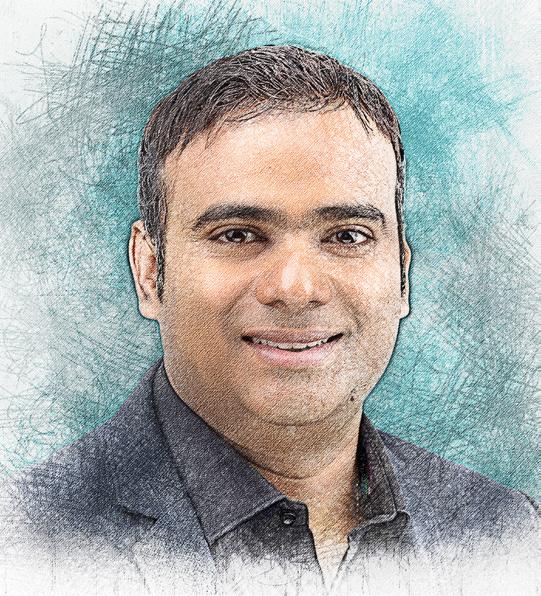

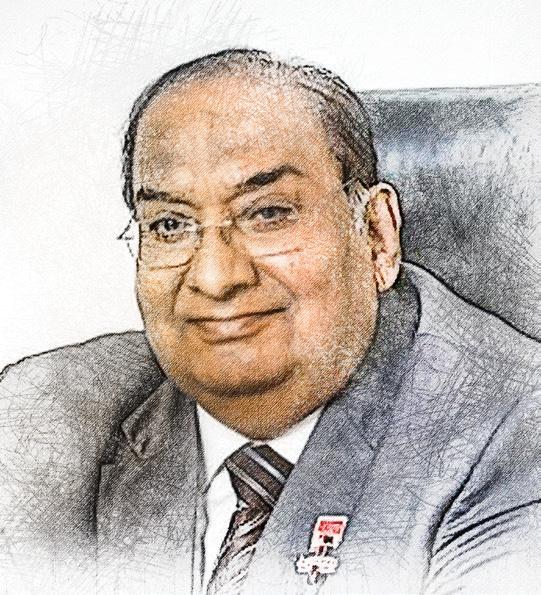

RONALDO MOUCHAWAR, AMAZON’S VP FOR MIDDLE EAST, AFRICA AND TURKEY, SHARES INSIGHTS

BY NEESHA SALIAN

What leadership lessons and strategies have you carried from souq.com into your role at Amazon?

If you think of one principle that has stayed with me throughout the journey, it’s being very close to the customers, making sure that we hear them and understand their needs. We stay in touch with customers, sellers, and vendors, and sometimes we even do ride-alongs with our drivers and visit our warehouses. I think that’s super critical. The second is really relying on technology to solve problems at scale. If

you really want the business to scale and deliver consistency to customers time and time again, we rely on technology and innovation to solve customer needs at scale.

How do you balance Amazon’s global values with localisation and regional innovation, and what are some key peculiarities of the market?

The whole premise is bringing the global experience of how to operate at scale with the local nuance of each of these markets. The main principles — large selection of products, good prices, convenience, and

seamless customer service — are almost the same everywhere. However, every country has its specificity and a different level of maturity in e-commerce penetration. It varies a lot between the Gulf, Africa, and Turkey.

The key peculiarities are payments, delivery, and addresses. Many countries in the region didn’t have a strong postal system, so we had to develop our own last-mile capabilities. Addresses often rely on landmarks, which we address using maps and technology. On payments, we must cater to unbanked consumers who use cash heavily. For example, in Egypt, our percentage of delivered orders with cash on delivery is higher than in the Gulf. Over time, as we improved the online experience, we’ve seen a big shift to digital payments.

Amazon Now was launched globally from this region. Why was the Middle East chosen as the destination to launch it?

In this part of the region, speed really matters. We see consumers really wanting and demanding us to deliver faster.

In the last two to three years, we’ve seen a big push toward consumers buying

THE KEY RIGHT NOW IS TO MAKE SURE MOST OF THE CUSTOMERS THAT WE HAVE IN THE GCC ARE SERVED WITHIN 10 MINUTES, AND THEN WE’LL EXPAND BEYOND THE REGION.”

their everyday essentials on our website, products like milk or eggs that they want immediately. The region has the demand. It is a continuation of our ability to deliver to customers now in minutes. Sometimes our fastest delivery was like six minutes, which is insane.

What have been the key learnings driving this growth, and how important are partnerships?

We pride ourselves on operational excellence and take reliability very seriously. The key learning has been ensuring we can deliver the whole cycle — from payment to doorstep — within the promised timeframe. This requires understanding the local topology, having our micro warehouses located near customer demand, and putting the right assortments in place.

In this region, we don’t need to build everything from scratch. We partner with established players. For fresh and grocery, we partnered with Lulu in Dubai and Al Othaim in Saudi. We also work with entities that have a local presence, including petrol stations, postal services and grocery chains, because proximity to the customer is the number one element for delivering within minutes.

What have been some of the challenges as you’ve expanded across different markets?

We have a motto at Amazon: “fail fast”. When we launched, making sure our Arabic service and local search understood customers took time. We had to focus on adapting our global technology to local habits and the different words customers use to search. Localising the service but not compromising on Amazon’s high standards for customer reliability is our purpose here.

How has AI transformed everything from logistics to the retail experience?

Today, AI is in everything we think about. It’s a big shift, and I’m very excited to be part of it. We have teams working on initiatives across the business: from how we place products for 10-minute delivery to how we compute the promise time that comes down to seconds and minutes. We are investing heavily to make sure that customers, sellers, and vendors are benefiting from the revolution we’re going through in terms of generative AI and its capability. This feels like another major shift in adoption, following the personal computer and the mobile phone.

You recently launched a credit card in the UAE. Tell us about it.

Our customers, especially those buying daily essentials, come back every day. The credit card we’re launching will enable these customers to save more as they shop with us, with a 6 per cent cashback for Prime members. It’s one more service we localize, working with a local bank to provide value and savings.

What can we expect from Amazon in the coming months, and what lessons can businesses learn from Amazon’s success?

Our big focus right now is on convenience, ensuring we are delivering to most of our customers within minutes and always having the relevant products available to meet their daily needs.

The lesson is simple: always focus on the customer. We use technology to solve customer pain points, innovate on their behalf, and we don’t shy away from trying things that may or may not work. We fail fast at experiments that happen daily. Embracing that culture will drive innovation.

For me personally, solving these problems, looking at how you deliver in minutes, how AI plays a factor—is the most fun and exciting thing I do at work.

As global wealth shifts generations, Habib Bank AG Zurich’s leadership explains how trust, technology, and cultural insight are reshaping client expectations

With over three decades in global banking, what fundamental shifts have you observed in how ultra-high-networth (UNHW) individuals define ‘value’ in a private banking relationship, and what hasn’t changed?

The basic definition of value amongst the UHNW segment remains unchanged, seeking banking relationships offering trust and quality service. However, as families become global they need wealth advisors that understand challenges of estate and tax planning, succession and wealth preservation. Industry is also seeing transfer of wealth to the next generation, for whom efficiency in advice and execution is a key value. Hence the need for digitisation and automation in workflows.

Digital transformation is often spoken of in retail and corporate banking, but how is digitalisation redefining the private banking experience for UHNW clients, and what innovations are on your radar in the Swiss context?

Digital transformation is inevitable for wealth industry if we have to keep up with the new generation of wealthy. With the breakneck pace of AI and internet of things, clients want paperless, efficient and seamless solutions to banking services. This could range from account opening, portfolio analysis, investment advice, funds transfers etc. Hence it’s imperative that the wealth industry invest capital and resources towards digitalisation in order to keep up with client expectations. We, at HBZ,

have made a conscious effort to automate and modernise our systems and make necessary upgrades to improve client experience.

You’ve worked across global financial powerhouses, JP Morgan, Deutsche Bank, Citi. How has that international exposure shaped your leadership style today at Habib Bank AG Zurich, especially as you lead its expansion in Switzerland?

I have been blessed to have worked not just across these well reputed global firms but also in different countries and jurisdictions. These firms taught me the importance of ownership and accountability. I also learnt the value in client engagement, knowing how they

think and what matters to them. This applies across their investment needs, business strategy, family constitution and conflict resolution. This has been my guiding principle and something I try to instill amongst my team members.

The jurisdictional exposure allowed me to work with various regulators and learn from their rule books. The common recurring theme is about knowing your clients and always doing what’s appropriate and suitable for them. This has been a central theme for us at HBZ.

One of the biggest intergenerational wealth transfers in history is underway. How is your team advising next-gen clients who often have very different values, expectations, and risk appetites than the previous generation?

We are fully cognisant of the importance of this massive wave of wealth transfer. In most cases, the patriarch/matriarch has been the creator of this wealth, and the next generation has been born into affluence. For us, convincing the seniors to get children involved early on in key discussions such as trust and estate planning is important. Also, through

client events like our flagship G3 (next generation) summit, we attempt to educate and introduce key topics such as succession, family constitution and conflict resolution.

Given your deep relationships across culturally and economically diverse regions, what do you think global private banks often

I also learnt the value in client engagement, knowing how they think and what matters to them. This applies across their investment needs, business strategy, family constitution and conflict resolution.”

misunderstand about serving clients from emerging markets?

International private banks often misunderstand the entrepreneurial nature and risk tolerance of emerging market clients. Relationship continuity and the need to understand cultural nuances is paramount to this segment. Habib Bank AG Zurich has the unique advantage of its deep-rooted, multidecade presence in South Asia, Africa, and the Middle East. We have managed to understand and capture product needs such as offering Shariahcompliant solutions, wealth advisory services and borrowing requirements. Our commercial banking presence helps bridge their personal and business needs through our local branches, representative offices and subsidiaries.

Swiss banking is evolving under new regulatory, reputational, and market dynamics. As country head, how are you positioning your institution to uphold the legacy of Swiss banking while meeting the transparency and innovation demands of tomorrow?

It is crucial that we stay close to the regulator, to be on top of any changes in regulatory framework, prepare well for audits and very importantly invest in quality personnel in crucial areas such as compliance and internal audit. An open communication with regulators enables us to understand the standards they hold banks to, thus allowing us to align our internal policies and practices to these expectations.

HABIB BANK AG ZURICH HAS THE UNIQUE ADVANTAGE OF ITS DEEP-ROOTED, MULTIDECADE PRESENCE IN SOUTH ASIA, AFRICA, AND THE MIDDLE EAST

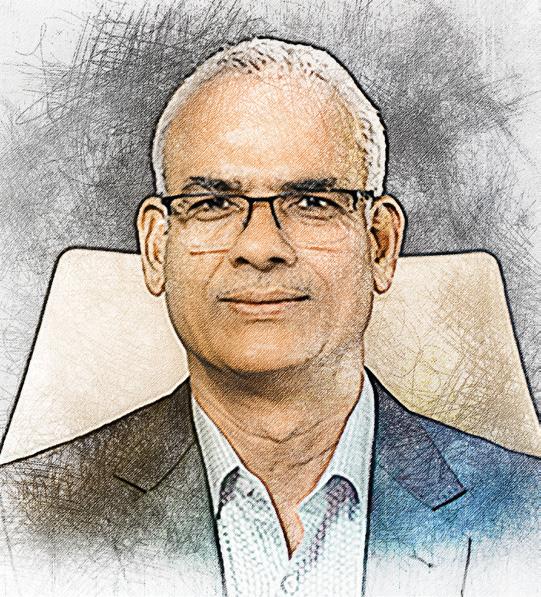

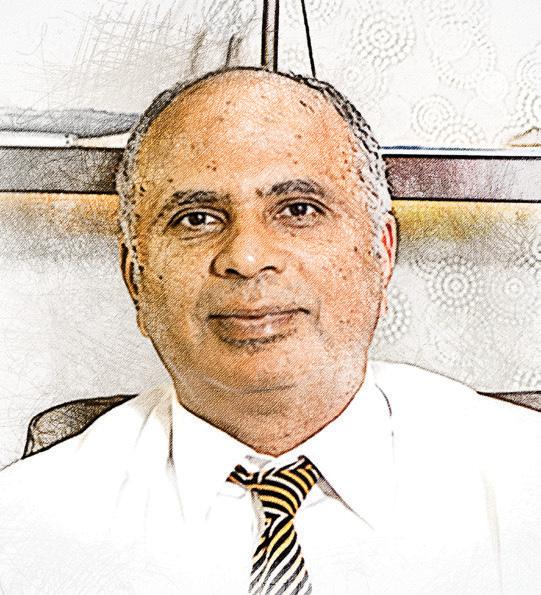

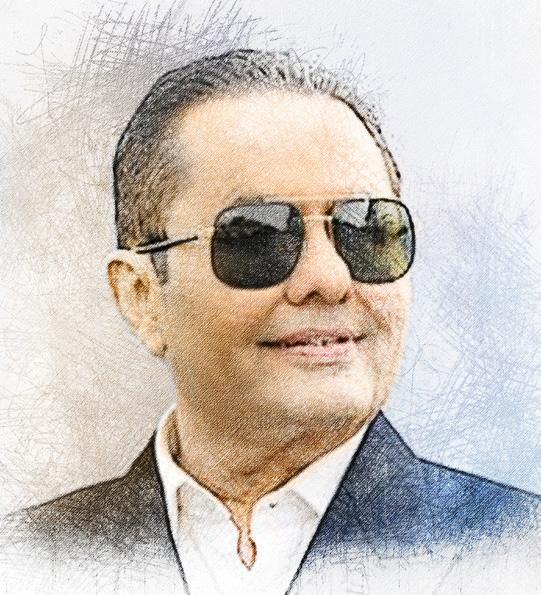

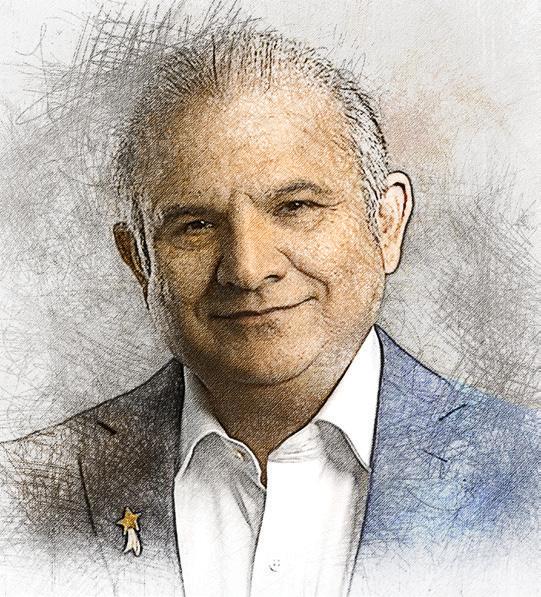

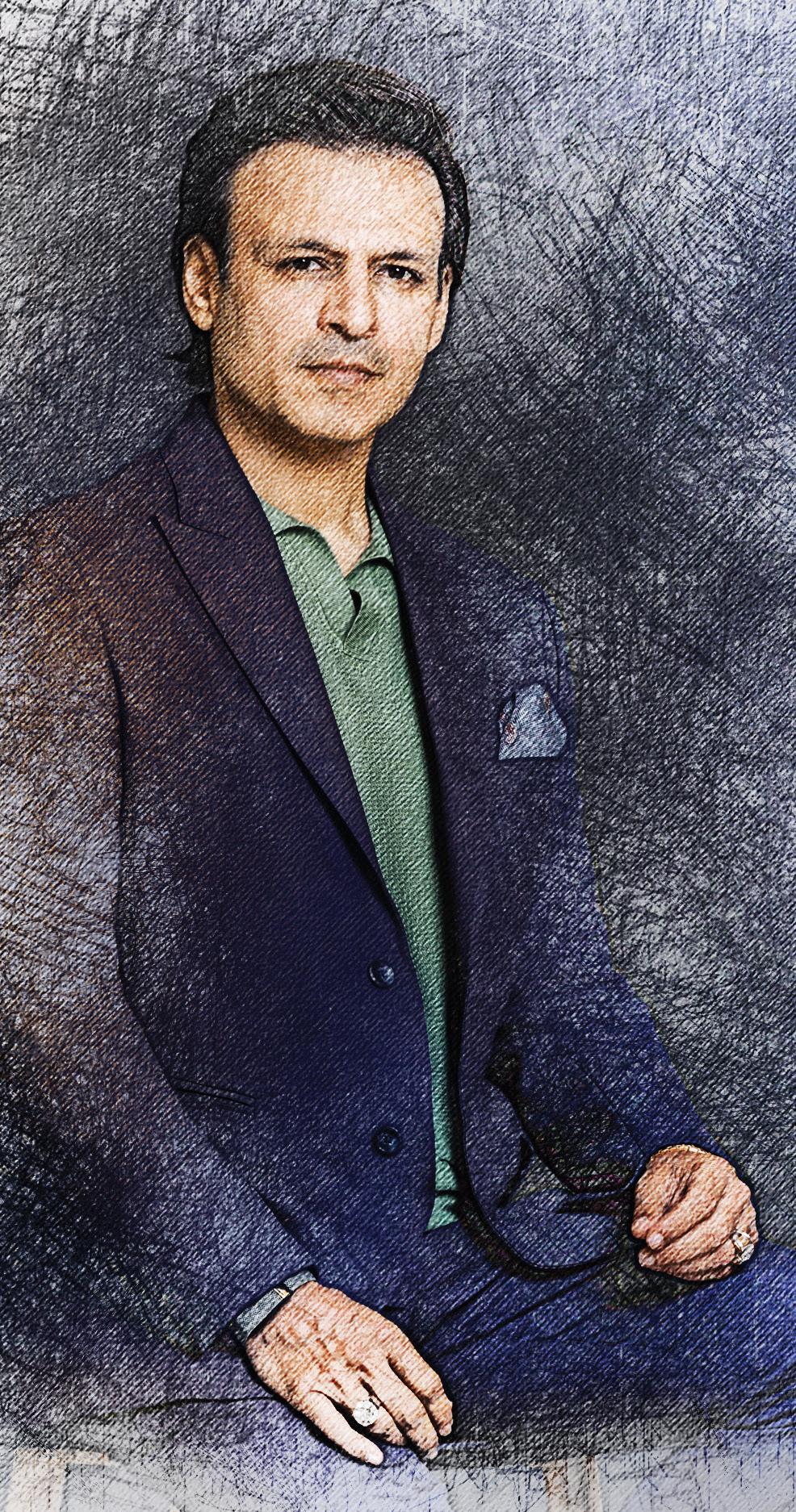

As Gulf carriers ramp up fleet orders and airports race to expand capacity, GE Aerospace is moving quickly to become a cornerstone of the region’s next aviation chapter.

Eighteen months on from its spin-off as an independent company, the aerospace giant is charting a new course: one defined by significant growth, digital innovation, sustainability, and deeper partnerships across one of the world’s most dynamic aviation markets.

In an exclusive interview with Gulf Business , Aziz Koleilat , President and CEO of GE Aerospace for the Middle East, Pakistan, Türkiye and CIS, reveals how the company is reshaping its strategy, why the Middle East is emerging as a global “centre of gravity” for aviation, and what the next decade of flight could look like.

GE Aerospace’s aviation journey began in 1917, when General Electric first started developing aircraft turbochargers during World War I.

In 1941, it built the first US jet engine, the I-A, which powered the Bell XP-59A, America’s first jet aircraft.

From the 1950s through the 1990s, GE became a global leader in commercial and military jet engines, powering aircraft such as the Boeing 747 and F-16 fighter jets.

In the 2000s, it expanded into digital aviation and services, becoming the world’s leading provider of commercial jet engines, powering aircraft such as the Boeing 777 and 787 Dreamliner.

Today, the company’s scale is vast.

“In 2024, 3.4 billion people flew with our engines under wing. Three out of four commercial flights globally are powered by GE Aerospace and our partners: that’s the scale of our immersion with the industry,” says Koleilat.

The company’s separation from General Electric in 2024 marked a turning point.

Many in the industry were watching closely to see how the new, standalone GE Aerospace would perform: and the shift has been particularly significant in the Middle East, a region experiencing some of the fastest aviation growth in the world.

According to IATA’s June 2025 Global Outlook, total Revenue Passenger Kilometres (RPKs) — the standard measure of airline passenger traffic — in the Middle East is expected to grow by 6.4 per cent year-on-year, outpacing the global average of 5.4 per cent and placing the region among the world’s top two fastest-growing aviation markets, just behind Asia-Pacific.

For Koleilat, the separation has brought clarity and focus amid this backdrop.

“By launching as an independent entity, we became very focused on our own mission,” he told Gulf Business.

“Our purpose is simple: we invent the future of flight, lift people up, and bring them home safely. Now all our efforts and power as an organisation are focused on that mission.”

That clarity is driving a more targeted regional strategy. Over the past 18 months, GE Aerospace has expanded its footprint, strengthened customer engagement, and begun building the infrastructure to support future growth.

“The past year has really been about growing our presence and focusing on the customer,” Koleilat explained.

A core part of that strategy is GE Aerospace’s $10m investment in expanding its MRO (maintenance, repair and overhaul) facilities in Dubai and Doha.

But the company’s commitment to the region began long before this, with the launch of the Middle East Technology Centre (MTC) in 2014. This facility was created to study the Gulf’s extreme

operating conditions. “The Middle East has the largest wide-body fleet in the world and a unique hub-and-spoke model around cities like Dubai, Doha and Istanbul,” said Koleilat.

“We created MTC to study the hot and harsh environment — the sand, dust, and temperature — and build the capabilities to support airlines here.”

That early work has paid off.

GE Aerospace now operates on-wing support facilities in Qatar and the UAE and continues to scale its capacity and training to support next-generation fleets, including the GE9X. Airlines in Middle East hold the company’s largest orders for this new engine.

“We’re aligning our resources and capabilities to support fleet expansion ahead of time,” Koleilat said.

“It’s about new capacity, new training, and delivering support when and where customers need it.”

Designing engines that will operate efficiently in the Middle East is unlike anywhere else. GE Aerospace has spent years analysing

Our purpose is simple: we invent the future of flight, lift people up, and bring them home safely.”

the chemical composition of dust from across the region, revealing significant differences between, for example, Dubai, Doha and Riyadh. This research directly influences engine design and maintenance strategies.

“We’ve built models to understand how these conditions affect engine performance,” said Koleilat.

“That led to innovations like our proprietary engine foam wash: essentially bespoke cleaning solutions that remove dust more effectively and extend engine time on wing.”

Those insights shape new products too.

“When we designed the GE9X, all of that information influenced the materials and the design,” he explained. “We combine global technology with local knowledge to create the most effective solutions.”

“Adapting to the local market means adapting to customer needs,” he added.

“If you built a car without air conditioning here, you’d have a problem. It’s the same with engines: you have to design something that can operate in this environment.”

Cutting-edge engineering is only part of the story.

Advanced data tools sit at the heart of GE Aerospace’s support model.

Its Analytics-Based Maintenance (ABM) platform uses digital twins — virtual replicas of individual engines — to predict maintenance needs and extend their operational life.

“Each engine has a digital model,” Koleilat explained. “We forecast performance, project how long it will fly, and work with airlines to predict when maintenance is truly needed. It’s like a car: you might be told to service it after 10,000 kilometres, but depending on how you drive, that could be 5,000 or 15,000.”

Emirates was the first airline to use ABM, and today every airline operating the GE90 on Boeing 777s in the region relies on the technology.

AI takes this predictive approach even further. “We’ve used AI to simulate field performance, predict part needs, and more accurately forecast work scopes,” he said. “It also guides technicians

The journey begins General Electric enters aviation, developing aircraft turbochargers during World War I.

America’s first jet engine

GE builds the I-A jet engine, powering the Bell XP-59A — the first US jet aircraft.

Powering aviation’s golden age

GE becomes a global leader in commercial and military jet engines, powering iconic aircraft such as the Boeing 747 (CF6 engine) and F-16 fighter jets (F110 engine).

Expanding into digital aviation

The company pioneers data-driven services and next-generation engines, powering flagship aircraft including the Boeing 777 (GE90), Airbus A380 (GP7200) and the Boeing 787 Dreamliner (GEnx).

Middle East Technology Centre opens GE launches the MTC in Dubai, dedicated to understanding and engineering for the region’s unique operating conditions.

GE Aerospace officially becomes an independent, publicly traded company, sharpening its focus on growth, sustainability, and innovation in the aviation industry.

Shaping the future of flight

With next-generation propulsion systems like the RISE open-fan program and expanding regional partnerships, GE Aerospace is preparing for aviation’s next era: one defined by greater connectivity and transformative technologies.

to the right areas based on the engine’s history.” But Koleilat stressed that technology is always combined with physical testing to ensure safety and compliance.

“AI is like steroids,” he says. “It gives us speed and more options, but everything still needs to be validated.”

With Middle Eastern airlines entering a period of rapid fleet expansion, GE Aerospace is scaling its workforce and capabilities to match.

The company plans to increase its headcount in its regional on-wing support centres by 30 per cent.

“We also start planning with customers up to two years before a new fleet enters service,” Koleilat said.

“With Riyadh Air, for example, we’ve been preparing for their entry into service well ahead of time.”

Partnerships with airlines and maintenance organisations are central to this approach. GE Aerospace works closely with Emirates Engineering Maintenance Centre and Saudia Technic to expand their maintenance capabilities and develop local expertise. The company has also trained 4,000 students from 50 airlines over the past decade through training programmes, apprenticeships and internships.

“We see this as a partnership — we’re in it together,” Koleilat said. “If you reduce engine removal time by 50 per cent, that means aircraft spend less time on the ground. These are the kinds of efficiency gains we deliver with our customers.”

Scale and efficiency are crucial to GE Aerospace’s future, but so is sustainability.

This region is becoming a real centre of gravity for the global aviation industry: people are coming here, business is growing, and aviation sits at the heart of that momentum.”

IF YOU REDUCE ENGINE REMOVAL TIME BY 50 PER CENT, THAT MEANS AIRCRAFT SPEND LESS TIME ON THE GROUND

In 2021, IATA adopted a global commitment to reach net-zero CO₂ emissions by 2050.

Achieving that is one of the industry’s defining challenges. GE Aerospace is tackling it with a three-phase strategy: now, near and next.

Now: GE Aerospace’s newest commercial engines are 10–15 per cent more fuel-efficient than their predecessors. Digital solutions such as Fuel Insight also help airlines measure and optimise fuel consumption, improving efficiency across fleets. With 3.4 billion passengers flying on GE Aerospace and partner-powered engines in 2024 — about three out of every four flights worldwide — even a 1 per cent fuel saving has a massive impact.

Near: GE Aerospace is actively involved in assessing and qualifying Sustainable Aviation Fuel (SAF). All of the company’s engines can operate on approved SAF blends today and the team also supports industry initiatives for the approval and adoption of 100 per cent unblended SAF.

Next: GE Aerospace is advancing a suite of technologies for the future of flight. This includes the CFM International RISE demonstration production that is developing Open Fan, compact core, hybrid electric and other technologies for at least 20 per cent better fuel burn than current commercial engines. These technologies are also being designed to meet customer expectations for durability. “We’ve completed more than 350 tests so far,” Koleilat says. “These technologies could be available by the second half of the 2030s.”

GE Aerospace’s future in the Middle East is inextricably tied to the region’s ambitions. With massive investments in infrastructure, workforce development, and next-generation technology, the company is ready to help shape the next chapter of aviation in the GCC.

“Aviation has a higher economic impact here than almost anywhere else,” Koleilat says. “It’s the backbone of connectivity, tourism, business, and mega-projects. This region is becoming a real centre of gravity for the global aviation industry: people are coming here, business is growing, and aviation sits at the heart of that momentum.”

In a recent interview with Gulf Business, the PIF’s head of aviation, Muhammad Ovais Yousuf, said the aviation sector is critical to Saudi Arabia’s economic growth as it is highly accretive and delivers a GDP multiplier effect of up to fourfold.

From Vision 2030 in Saudi Arabia to global events like F1, Expos, and World Cups, aviation underpins every pillar of growth. Airlines plan to grow their fleets by more than 5 per cent annually, while governments aim to develop their own MRO capabilities and in-house technical expertise.

“Our role is to be the partner that helps them achieve that,” Koleilat says. “We want to grow with them: closer partnerships, more capability, and deeper collaboration.”

“The potential here is mind-blowing,” he adds. “The partnerships we’re building, the technology we’re bringing, the talent we’re developing: it’s all coming together. And this is just the beginning.”

Aziz Koleilat’s advice to future leaders in the aviation sector is straightforward: walk the talk.

“If you ask someone to do something, make sure you’ve done it yourself,” he says. “Support your team, understand their challenges, and celebrate their successes. I take great pride in seeing people grow. Many of our team who started in the Middle East are now in global roles, and more global roles are being positioned in the Middle East.”

Humility, Koleilat believes, is key to long-term success. “Be humble, empower your people, and always stay focused on delivering value for the customer,” he says. “That’s the formula.”

Koleilat attributes GE Aerospace’s success to a strong internal culture built on three principles: respect for people, continuous improvement, and customer focus.

“Respect is the foundation of any team,” he explains. “Empower people to find solutions and they will deliver. Continuous improvement keeps us evolving, and customer focus ensures what we do matters.”

This people-first approach becomes even more critical as the company grows. “We all win together; or we don’t win at all,” he says. “I’m incredibly proud of the team we’ve built and the relationships we’ve forged with our customers.”

Over the past 15 years, Shurooq has redefined Sharjah’s economic landscape. With an almost Dhs8bn investment portfolio spanning over 50 projects, the authority has transformed the emirate from a manufacturing- and trade-driven economy into a diverse hub for sustainable growth. Ahmed Obaid Al Qaseer, CEO of Shurooq, outlines how the authority’s strategy is positioning Sharjah as a benchmark for balanced development.”Shurooq’s investments are designed to generate long-term value across sectors that contribute to Sharjah’s social and economic resilience.”

Shurooq’s model blends the strategic vision of government with the agility of private enterprise. Through public–private partnerships and alliances with global firms such as Eagle Hills, Diamond Developers, GHM, and The Lux Collective, it has accelerated the development of largescale real estate, eco-luxury hospitality, and sustainable urban projects. Its investment promotion arm, Invest in Sharjah, attracts high-value capital in growth sectors including green manufacturing, logistics, and cultural tourism. Cultural heritage remains a cornerstone of Shurooq’s development vision. Projects such as the Heart of Sharjah have converted historic neighbourhoods into active commercial and cultural hubs. “We see heritage as a growth asset,” Al Qaseer explains. “It adds depth to our destinations and value to our economy.”

For Shurooq, sustainability is an operational

framework. All developments undergo environmental and social impact assessments from planning through delivery. The 7.2-million-sq ft Sharjah Sustainable City exemplifies this approach through solar-powered homes, smart mobility systems, and wastewater reuse. Across the Sharjah Collection of eco-retreats — Al Faya, Kingfisher, Moon Retreat, and the soon-to-launch Nomad — Shurooq integrates renewable energy, minimal-impact designs, and eco-materials. Partnerships with Beeah Group and other green technology leaders embed waste management, energy efficiency, and circular-economy practices across operations.

More than 600 small and medium enterprises operate within Shurooq’s destinations, benefitting from access to new markets and visibility. From retail and food services to logistics and tourism, SMEs form a vital part of the authority’s value chain. “Every development we create is designed to generate opportunity,” says Al Qaseer. “We want local entrepreneurs to grow

alongside our destinations.” Since establishing Invest in Sharjah in 2016, the emirate has attracted over Dhs96.7bn in foreign direct investment, resulting in 617 projects and more than 46,000 jobs. The focus now lies on sectors shaping the global economy — renewable energy, advanced logistics, agri-tech, and cultural tourism .

Under the vision and guidance of Sheikh Dr Sultan Bin Mohammed Al Qasimi, Supreme Council Member and Ruler of Sharjah, and the leadership of Sheikha Bodour bint Sultan Al Qasimi, Shurooq has built a development philosophy around “place-making”— creating destinations that bring people, culture, and nature together. From Al Noor Island and Al Montazah Parks to the House of Wisdom, each project demonstrates how integrated design can drive civic engagement and cultural vitality. In the eastern region, projects such as Nomad in Kalba and Najd Al Meqsar in Khorfakkan are redefining eco-tourism and coastal hospitality. Meanwhile, Mleiha National Park, within the UNESCOinscribed Faya Palaeolandscape, connects archaeology, ecology, and adventure, showing how heritage and progress coexist.

“Our role is to ensure that progress and preservation move in tandem,” concludes Al Qaseer. “That is how we build economies that endure.”

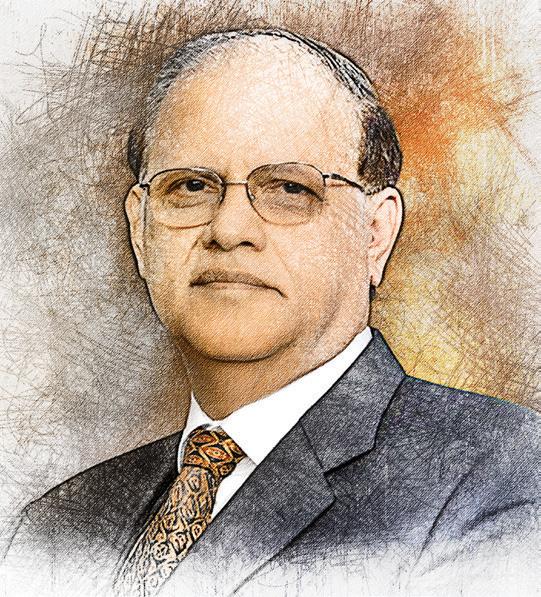

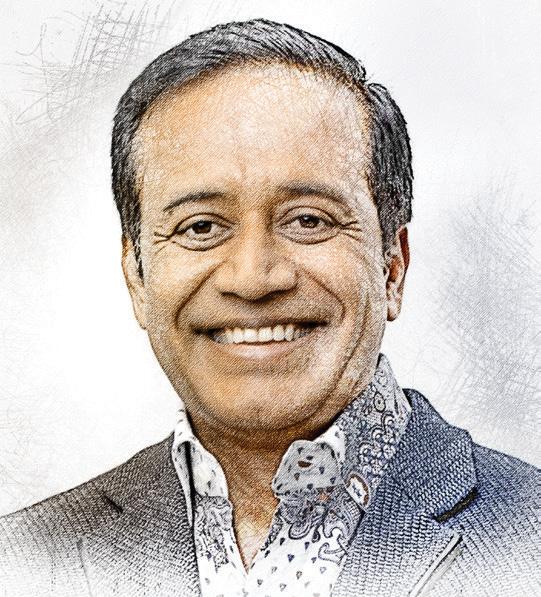

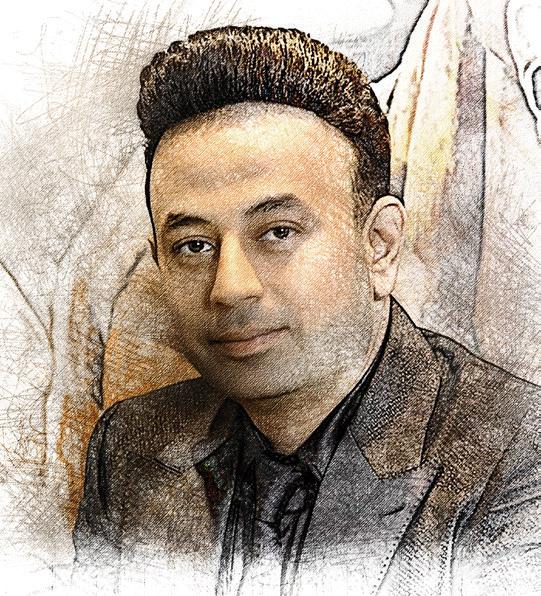

Indian influence runs through every major sector — from healthcare and education to construction, retail, finance, and technology. Indian-founded and led enterprises have become powerhouses, shaping industries and creating thousands of jobs.

In this special feature, Gulf Business presents 100 of the most recognised Indian business leaders in the UAE and beyond: an alphabetical showcase of visionaries whose innovation and leadership continue to define the business landscape. The list celebrates achievements across economic contribution, influence, expansion, and community impact.

Sajan represents the second generation of leadership driving one of the UAE’s most diversified conglomerates in the region. Having joined the family business around the age of 14, he learned its operations from the ground up before leading major expansions across retail, home solutions and real estate.

Under his direction, Danube launched ventures such as Danube Home and Danube Sports World, which have become household names across the region. Armed with a marketing degree from the American University of Sharjah and executive education from Harvard, Sajan is now steering Danube towards a data-driven, AI-enabled future focused on smarter real estate and customer experience.

Chilwan leads the UAE’s largest Islamic bank by assets. With nearly three decades of experience across conventional and Islamic banking, he has played a pivotal role in elevating Islamic finance on the global stage.

Under his leadership, DIB has expanded its footprint internationally, emerging as a driving force in Islamic finance while reshaping the regional financial landscape. He oversees assets exceeding $95bn, a market capitalisation of over $14bn, and a workforce of more than 10,000 employees, reflecting his focus on sustainable growth and operational excellence. A strong advocate for integrating Islamic banking into the broader global financial system, Chilwan has spearheaded innovations that bridge traditional finance with Sharia-compliant practices.

Moopen oversees one of the region’s biggest healthcare companies. Just this year, Aster DM Healthcare has been ranked as the second largest healthcare provider in the UAE and 15th largest in the EMEA (Europe, Middle East and Africa) region by revenue, according to Healthcare Business International (HBI).

Moopen joined the company in 2013 as a director, and since then has been instrumental in charting its direction. Aster operates across all five countries in the GCC and Jordan, delivering a full-spectrum of care through hospitals, clinics and pharmacies. A chartered accountant by training (via the Institute of Chartered Accountants of Scotland or ICSA), she is also an alumni from the University of Michigan.

Member of corporate office, Emaar

As a former management consultant from India, Jain has a wealth of experience across real estate and banking industries. Following a four-year stint as head of finance for Dubai Bank, Jain began his career at Emaar as the company’s chief financial officer in 2006, shifting from his previous role as head of finance at Dubai Bank. Over the years his leadership in finance and operations has been pivotal in driving Emaar's growth and expansion, and, in 2017, he was appointed group COO and CEO of Emaar’s Dubai operations. In 2023, he took on the role of group CEO of Emaar Properties, overseeing the company's diverse portfolio of residential, commercial, and hospitality projects. Jain is a chartered accountant from the Institute of Chartered Accountants of India and holds a CFA Charter from the CFA Institute.

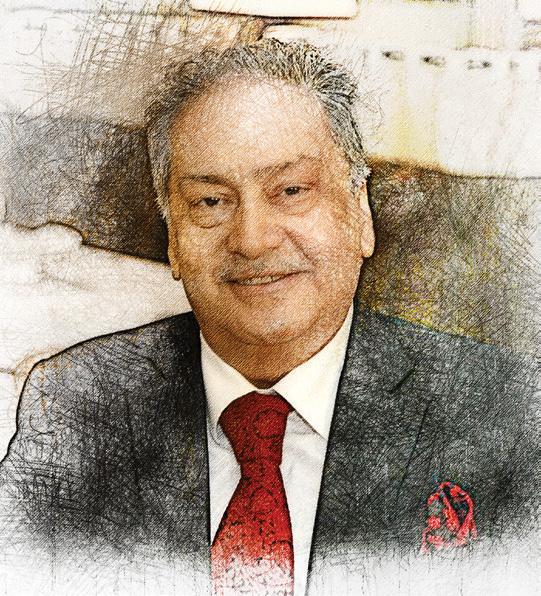

As chairman of the Sterling Group and a key figure behind Fakhruddin Holdings, Dr Fakhruddin has carried forward a generational legacy and expanded it into a globally recognised conglomerate that fuses tradition with innovation.

Starting in the family business at 17, he is behind the success of subsidiaries such as Sterling Perfumes, Premier Cosmetics, and Premier Plastics, serving consumers across the Middle East, Africa, Europe and Asia.

Under his leadership, Sterling has evolved from a regional enterprise into a global contender, with advanced R&D laboratories, automated production facilities, and certifications including GMP, ISO, Halal, and FDA. Dr Fakhruddin led the Group’s digital transformation, scaling production from 250 pieces a day to hundreds of millions annually, exporting to more than 130 countries.

STERLING HAS EVOLVED FROM A REGIONAL ENTERPRISE INTO A GLOBAL CONTENDER, WITH ADVANCED R&D LABORATORIES, AUTOMATED PRODUCTION FACILITIES, AND SEVERAL KEY CERTIFICATIONS.

During the COVID-19 pandemic, he swiftly pivoted Sterling’s resources toward sanitiser manufacturing, ensuring affordable, safe products when they were needed most.

His achievements have earned him multiple honours, including the Lifetime Achievement Award at Beautyworld Middle East 2023, the Divya Chakra Award from the Consulate General of India in the UAE, Global Indian of the Year 2023–24, and the FTI EA International Excellence & Global Leadership Award 2024. He also holds a professional doctorate in international business from the European International University – Paris.

What defines Dr Fakhruddin’s vision is his drive to make “Made in UAE” a mark of pride worldwide. With Sterling’s products reaching more than 130 countries and serving more than a billion customers, his goal remains clear: to make quality, innovation, and excellence accessible from Dubai to the world.

Founder and managing partner, Macwise Capital

Nair is a Dubai-based entrepreneur, global investor and venture strategist. As the founder and managing partner of Macwise Capital, he drives investments across high-potential sectors, including healthtech, wellness, fintech, AI, sports, and emerging technologies — helping startups scale from the UAE to global markets with capital, advisory, and go-to-market (GTM) support. He is also the chief operating officer at Verve Wellness, where he is advancing personalised health optimisation through advanced diagnostics, regenerative therapies, and tailored longevity programmes. He further leads The Experience Store as CEO, transforming how consumers experience wellbeing through premium and meaningful journeys. Nair’s entrepreneurial footprint extends into sports and community development as founder of Macwise Titans, a UAE cricket team.

CEO, Andersen UAE

With over 20 years of experience, Chaturvedi has built a career serving large and complex global clients, specialising in areas such as VAT, GST, FATCA, SOX and direct tax matters. His expertise spans both public and private sectors across the Middle East and Asia. Chaturvedi is also the chairman of the Institute of Chartered Accountants of India (ICAI) Dubai Chapter, where he has held various leadership roles, including vice chairman and secretary. He is a chartered accountant, an associate member of CPA Australia, and a Fellow of the International Accountant (UK). He is also a Prince2-certified professional. Andersen UAE has expanded its presence, offering a range of services including direct and indirect tax advisory, international tax structuring, and compliance. Chaturvedi is also a recognised thought leader, regularly contributing to local industry discussions on tax and economic development.

CEO,

Koshy has risen from chief operating officer to chief executive officer of Inception, an Abu Dhabibased AI company within the G42 ecosystem. The firm develops domain-specific AI products designed to transform sectors such as healthcare, finance, and government.

Before joining Inception, Koshy was group chief operating officer at M42, where he played a key role in the merger of G42 Healthcare and Mubadala Health, forming the M42 group. Earlier, as CEO of G42 Healthcare, he led initiatives in genomics, diagnostics and digital health, helping establish the UAE’s largest national biorepository and advance the Emirati Genome Program.

Koshy is also listed on the leadership of Malaffi, the Abu Dhabi Health Information Exchange, contributing to efforts that enhance healthcare delivery and data interoperability in the region.

Founder and managing partner, Ashish Mehta & Associates

Mehta's multi-jurisdictional law firm serves multinationals, regional businesses and highnet-worth clients in the UAE, India and UK.

He is credited as being one of the first licensed independent Indian lawyers in Dubai and holds qualifications to practice in India, the UK and the UAE (including before the DIFC Courts).

Mehta's expertise spans corporate and commercial law, banking and finance, real estate, restructuring, arbitration, mediation, intellectual property and wealth-management.

He is a fellow of the Indian Council of Arbitrators and his firm provides pro-bono legal aid to distressed Indian nationals in the UAE.

ggarwal, a visionary entrepreneur, is the founder and chairman of one of the UAE’s fastest growing real estate firms, BNW Developments. With a decade-long career as a chartered accountant, Aggarwal’s expertise in financial management laid the groundwork for his transition into real estate.

Driven by a commitment to ethical guidance, Aggarwal established BNW, swiftly transforming it into a reputable 360-degree real-estate consulting and development organisation boasting a group of multitalented consultants, CPAs and legal advisors. His business philosophy blends deep industry insight with a forward-looking mindset, driving BNW Developments’ assets under development to Dhs22bn.

Known for his strategic foresight, Aggarwal is driven by a passion for creating future-ready communities. He aims to create world-class developments that generate long-term value for investors and stakeholders. With a keen eye for opportunity and a commitment to excellence, his business philosophy blends deep industry insight with a forward-looking mindset, positioning the company at the forefront of luxury real estate innovation.

Group CEO, BPG Group

Chairman and founder of the House of Ashish Vijay

Vijay is the driving force behind House of Ashish Vijay, a Dubai-based group spanning Meraki Gems & Jewellery, Tiara Gems, and AV Globale. The latter, AV Globale, is known for having organised gemstone auctions and tenders at the likes of the Dubai Diamond Exchange. With deep roots in his family’s gemstone legacy, he has built a global reputation for sourcing, cutting and auctioning some of the world’s finest precious stones.

A director of the International Colored Gemstone Association (ICA) Dubai Chapter, he also founded Seiko Financial Services in 2016 to mentor and fund emerging ventures, particularly women-led startups. Combining entrepreneurship with philanthropy, Vijay continues to champion transparency and innovation across the jewellery and investment sectors.

Bhojani leads BPG Group, one of the Middle East’s leading integrated marketing and communications networks. With over 40 years of experience spanning marketing services, media, private equity and real estate, he has led BPG since 1991, consolidating its operations across advertising, public relations, design, activations, media asset management and digital verticals, in the Middle East and North Africa region. Bhojani played a central role in integrated communications campaigns for high-profile initiatives such as the Dubai Shopping Festival and Dubai Summer Surprises, as well as the knowledge economy hubs of Internet City and Media City. Holding positions on the founding board of Endeavor UAE and the International Institute of Tolerance, he is widely regarded as one of the region’s most influential business leaders.

Founder

and CEO, InsuranceMarket.ae

Babur is the founder and CEO of InsuranceMarket.ae, the UAE’s leading digital insurance platform. Building on his family’s brokerage legacy, he launched the company in 2010 with a mission to simplify how consumers access and manage insurance.

Under his leadership, the brand has become synonymous with innovation and trust, driven by its iconic mascot, Alfred.

Babur also spearheaded the creation of myAlfred, a digital rewards platform that enhances customer engagement and loyalty. Combining technology, data and personalisation, he continues to shape the UAE’s evolving insurance ecosystem through a customer-first, digital-driven approach.

Dubai and India share an exceptional relationship built on mutual trust and a commitment to economic integration. India holds an important position as a key trading partner for Dubai. The value of non-oil trade between our markets exceeded Dhs142bn during the first nine months of 2024, achieving year-over-year growth of 19 per cent."

Ahmad bin Byat, vice chairman of Dubai Chambers

Rahman is the founder and chairman of ORO24 Developments, a Dubai-based real estate company focused on sustainable, affordable, and lifestyle-driven communities. With over 23 years of experience across residential, commercial, retail, and serviced apartment projects, Rahman has successfully navigated three market cycles, earning recognition for his disciplined governance and riskmanagement approach.

Since launching ORO24 in 2021, Rahman has overseen eight new developments, adding to a wider portfolio of 32 projects and more than 11,750 units

RAHMAN HAS OVERSEEN EIGHT NEW DEVELOPMENTS, ADDING TO A WIDER PORTFOLIO OF 32 PROJECTS AND MORE THAN 11,750 UNITS WORTH OVER DHS11.5BN IN TOTAL SALES.