GOVERNMENT

FINANCE OFFICERS ASSOCIATION

FINANCE OFFICERS ASSOCIATION

PRESENTED TO

For the Fiscal Year Beginning January 01, 2025

Executive Director

The Government Finance Officers Association of the United States and Canada (G.F.O.A.) presented an award of Distinguished Budget Presentation Award to the City of Merriam, Kansas for its annual budget for the fiscal year beginning January 1, 2025.

In order to receive this award, a governmental unit must publish a budget document that meets program criteria as a policy document, as an operations guide, as a financial plan and as a communication device.

The award is valid for a period of one year only. We believe our current budget continues to conform to program requirements, and we are submitting it to G.F.O.A. to determine its eligibility for another award.

Merriam was incorporated on October 23, 1950. The city operates under a Mayor-Council form of government with the appointment of a City Administrator. The Mayor is elected on an at-large, nonpartisan basis and serves a four-year term. The eight City Council members are elected (nonpartisan) by ward and serve four-year terms of office. An election for Council members is held every odd-numbered year, with one representative from each of the four wards being chosen at each election.

The City Administrator is appointed by the Mayor and City Council as the chief administrative officer of the city and is charged with the efficient and effective administration of the city.

Mission

To serve the public with transparent government focused on progress.

Values

▶ Teamwork

▶ Service

▶ Leadership ▶ Accountability ▶ Excellence ▶ Dedication

JACOB LAHA

WARD 1

913–608–7636

JASON SILVERS

WARD 1

913–370–9910

WHITNEY YADRICH

WARD 2

913–303–1017

AMY RIDER

WARD 2

913–735–0828

CHRIS EVANS HANDS

WARD 3

913–384–5340

BRUCE KALDAHL

WARD 3

913–708–3043

REUBEN COZMYER WARD 4

913-297-9339

STACI CHIVETTA WARD 4

913–303–0594

WARD 2

WARD 4 WARD 1

3

Chris Engel

City Administrator

Caitlin Gard

Assistant City Administrator

Meagan Borth

Finance Director / City Treasurer

Darren McLaughlin

Police Chief

Celia Kumke

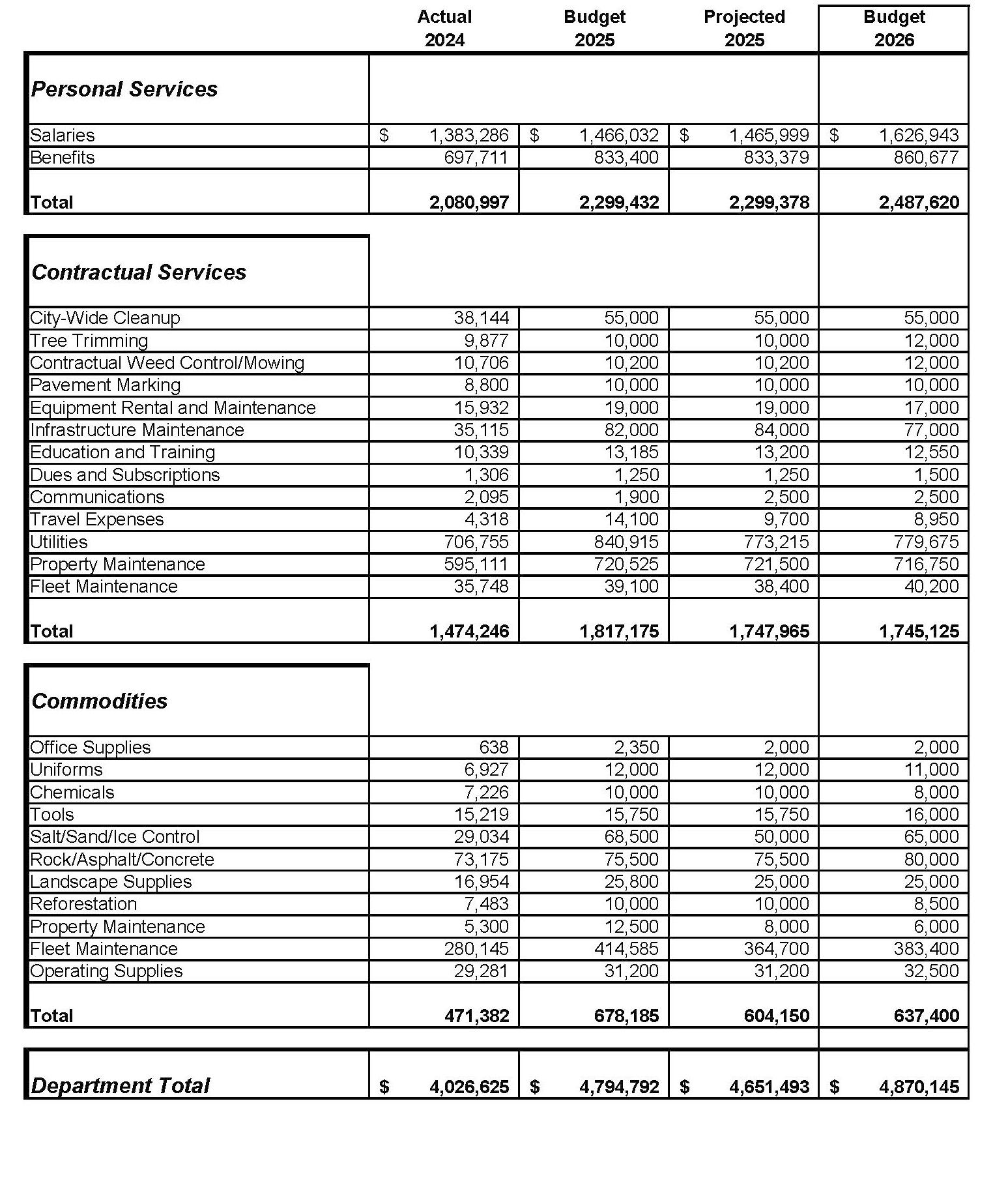

Public Works Director

Bryan Dyer

Community Development Director

Anna Slocum

Parks & Recreation Director

Total Adopted Budget: $50,117,771

Total General Fund Budget: $26,495,780

Major Source of Revenue: 1% Regular City Sales Tax - $10,649,113

Total Budget Reserves in the General Fund: $9,477,126

Assessed Valuation in 2025: $299,603,290

Mill Levy Rate: 26.412

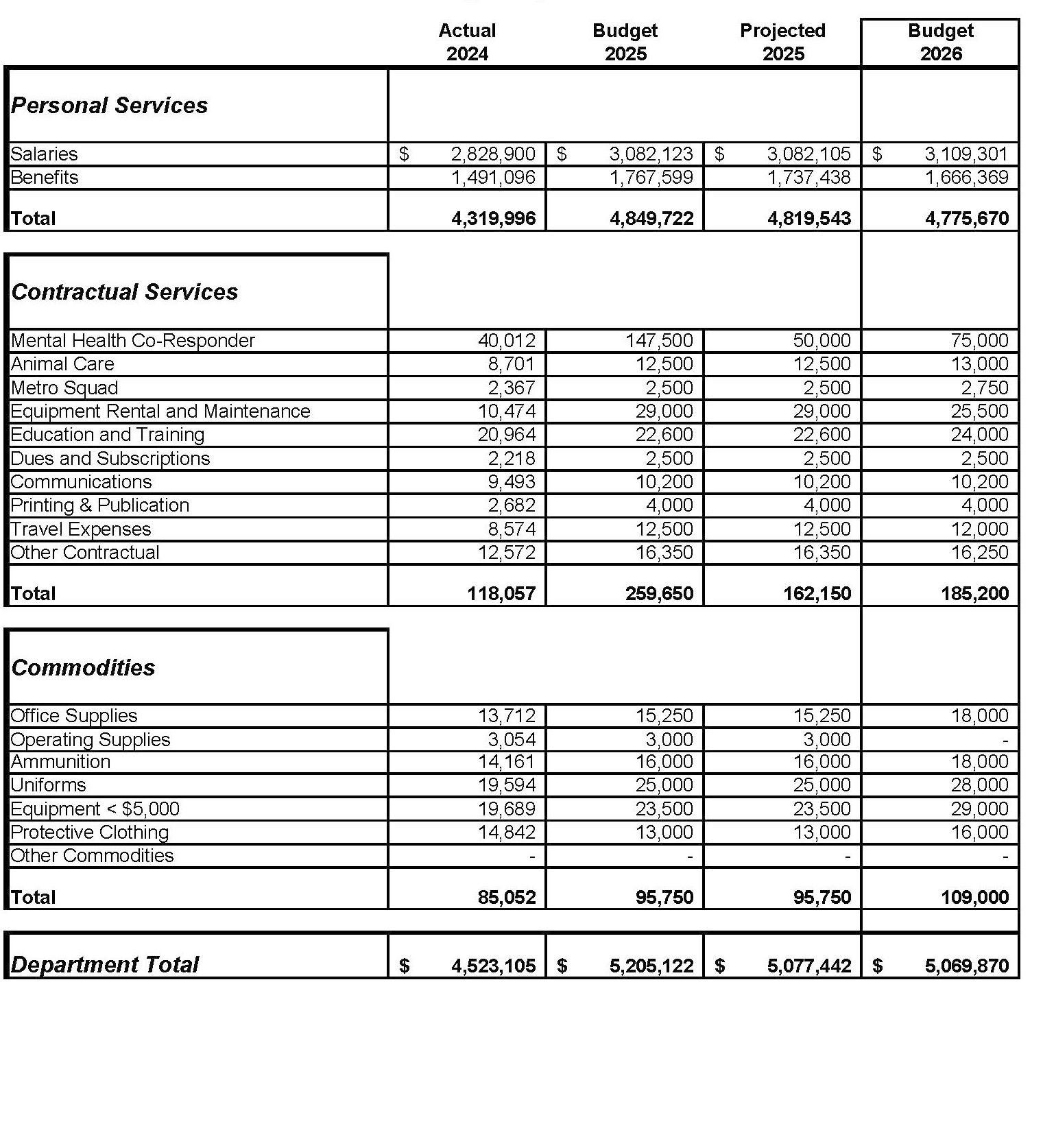

Largest General Fund Department Budget: Police – $5,352,370

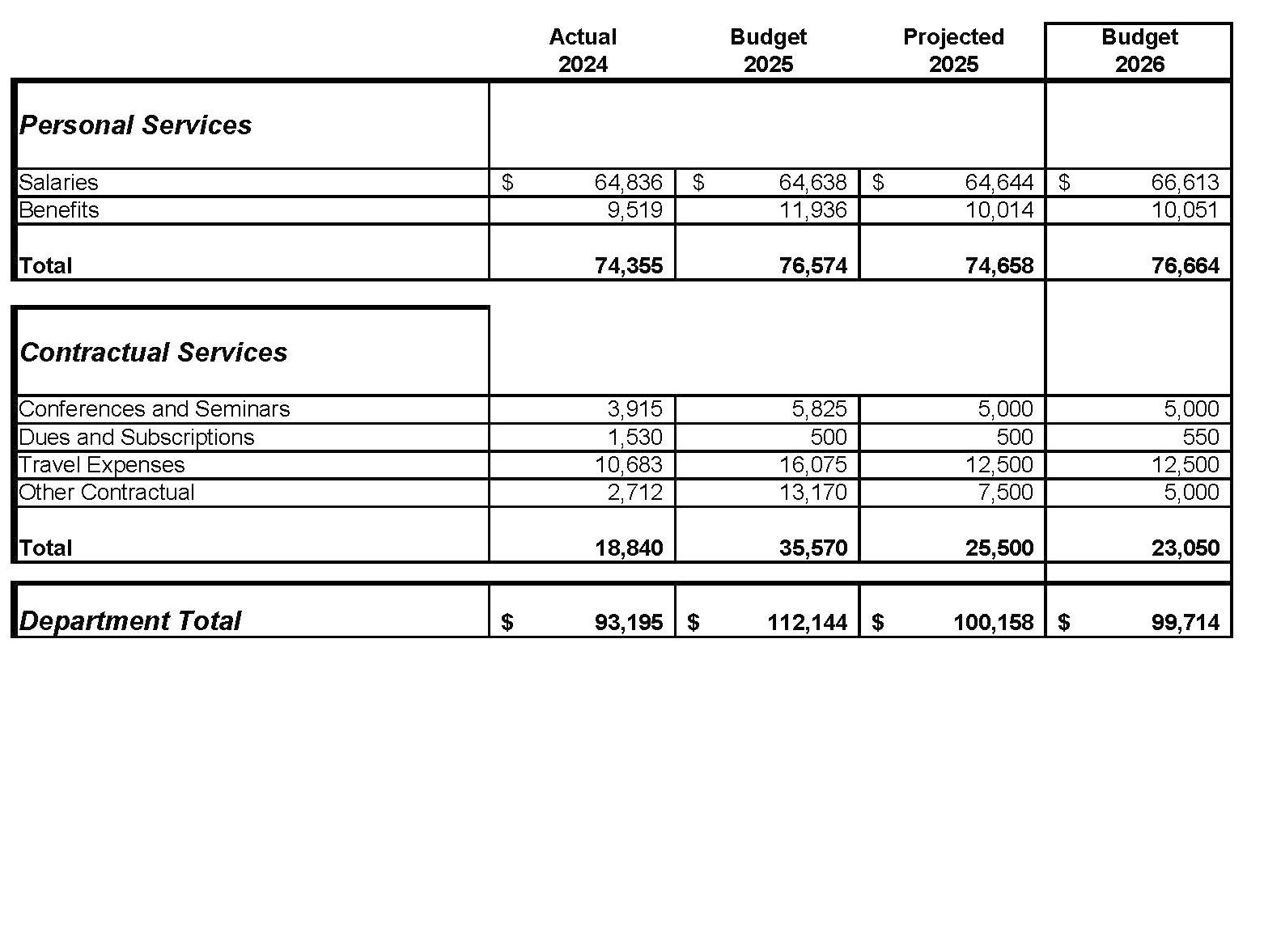

Smallest General Fund Department Budget: City Council – $99,714

Juli Pinnick

City Clerk

Alan Long

Overland Park Fire Chief

Ryan Denk

MVP Law, City Attorney

This document was prepared by a team of City staff members who worked enthusiastically, with pride and dedication, to provide a meaningful, useful document for the benefit of the residents, the business community and the City of Merriam organization.

We recognize the Department Heads and their staff for assisting with the preparation of this document and their contributions to the budget process. The members of the Finance Department and Administration Department are recognized for their significant contributions in the preparation of this document.

RESIDENTS OF MERRIAM

MAYOR

Bob Pape

CITY COUNCIL

Jacob Laha

Jason Silvers

CITY ATTORNEY

Ryan Denk

CITY PROSECUTOR

Thomas Penland

MUNICIPAL JUDGE

John Harvell

PUBLIC WORKS / CIP

Celia Kumke Director

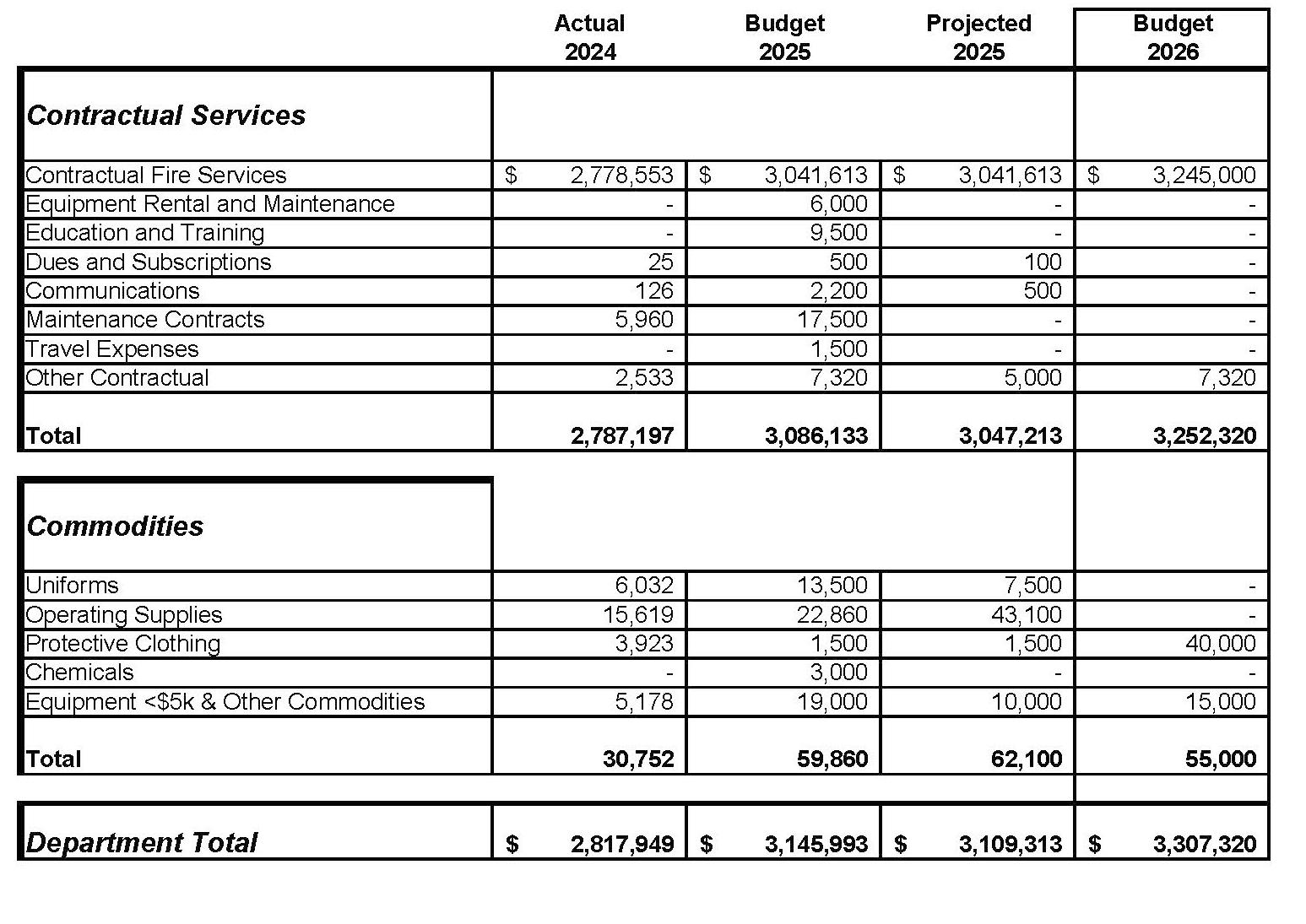

FIRE DEPARTMENT

Service Contract with Overland Park

Amy Rider

Whitney Yadrich

Christine Evans Hands

Bruce Kaldahl

Staci Chivetta

Reuben Cozmyer

ADMINISTRATION

Chris Engel City Administrator

ADMINISTRATION

Caitlin Gard

Assistant City Administrator

POLICE

Darren Mclaughlin Police Chief

CITY ENGINEER

Randy Gorton (BHC Rhodes)

COMMUNITY DEVELOPMENT

Bryan Dyer Director

BOARDS & COMMISSIONS

Planning Commission

Parks & Recreation Advisory Board

Board of Zoning Appeals

Board of Structure Appeals

Visitors Bureau Advisory Council

CITY CLERK

Juliana Pinnick

FINANCE

Meagan Borth Director / Treasurer

PARKS & RECREATION

Anna Slocum Director

DATE: NOV. 1, 2025

To: The Honorable Mayor and City Council of the City of Merriam, Kansas

From: Chris Engel, City Administrator

The City of Merriam is pleased to present the 2026 Budget. The budget process began on February 24, 2025, when City Council adopted the goals and objectives representing current priorities. These goals continued to guide staff through departmental budget preparation, financial forecasting, and capital project planning. After extensive public discussion and a Revenue Neutral Rate (RNR) hearing on August 25, 2025, the City Council voted to exceed the RNR and adopt the final 2026 mill rate of 26.412. This represents a 0.282-mill decrease from 2025 (26.694) and continues Merriam’s commitment to maintaining stable, predictable property tax rates for residents and businesses.

▶ Enhance Community Identity and Connections

▶ Provide Exceptional Service Delivery

▶ Improve Physical Conditions and Property Values

▶ Maintain Economic Vitality

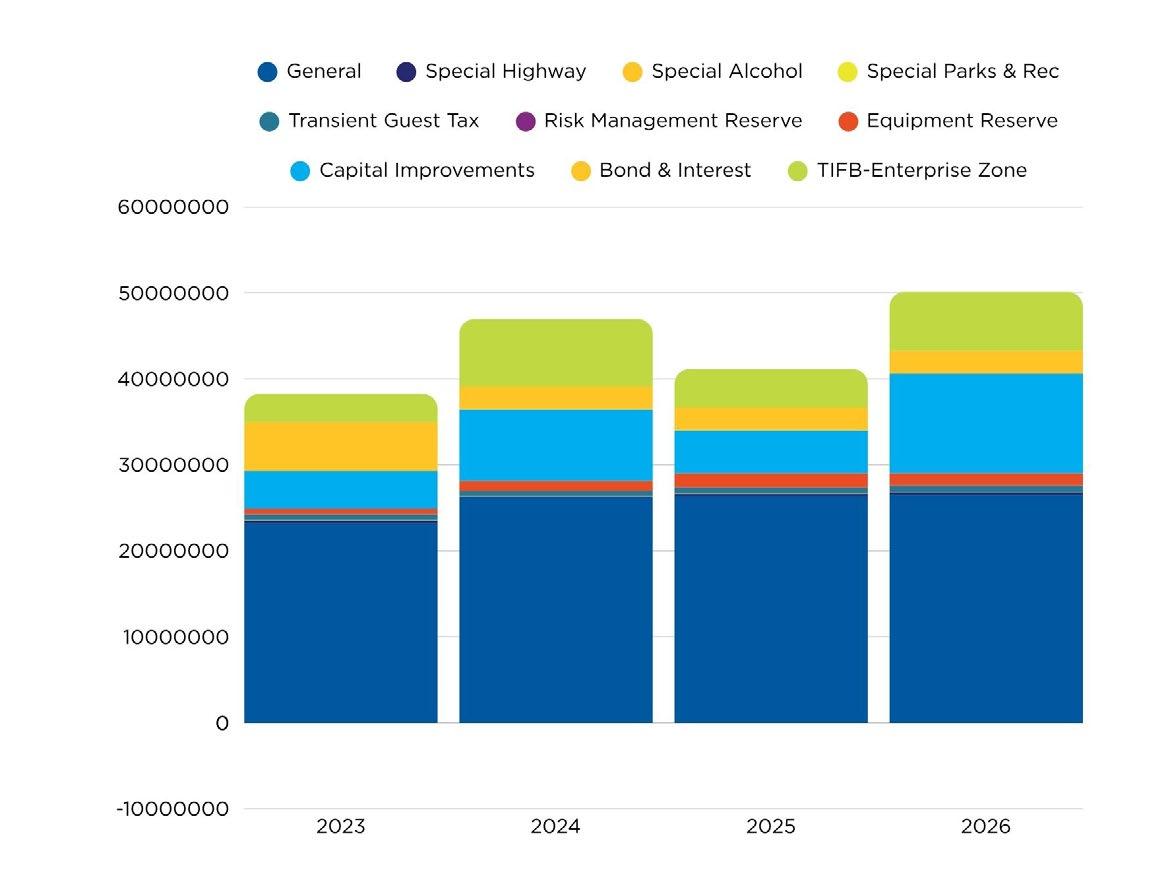

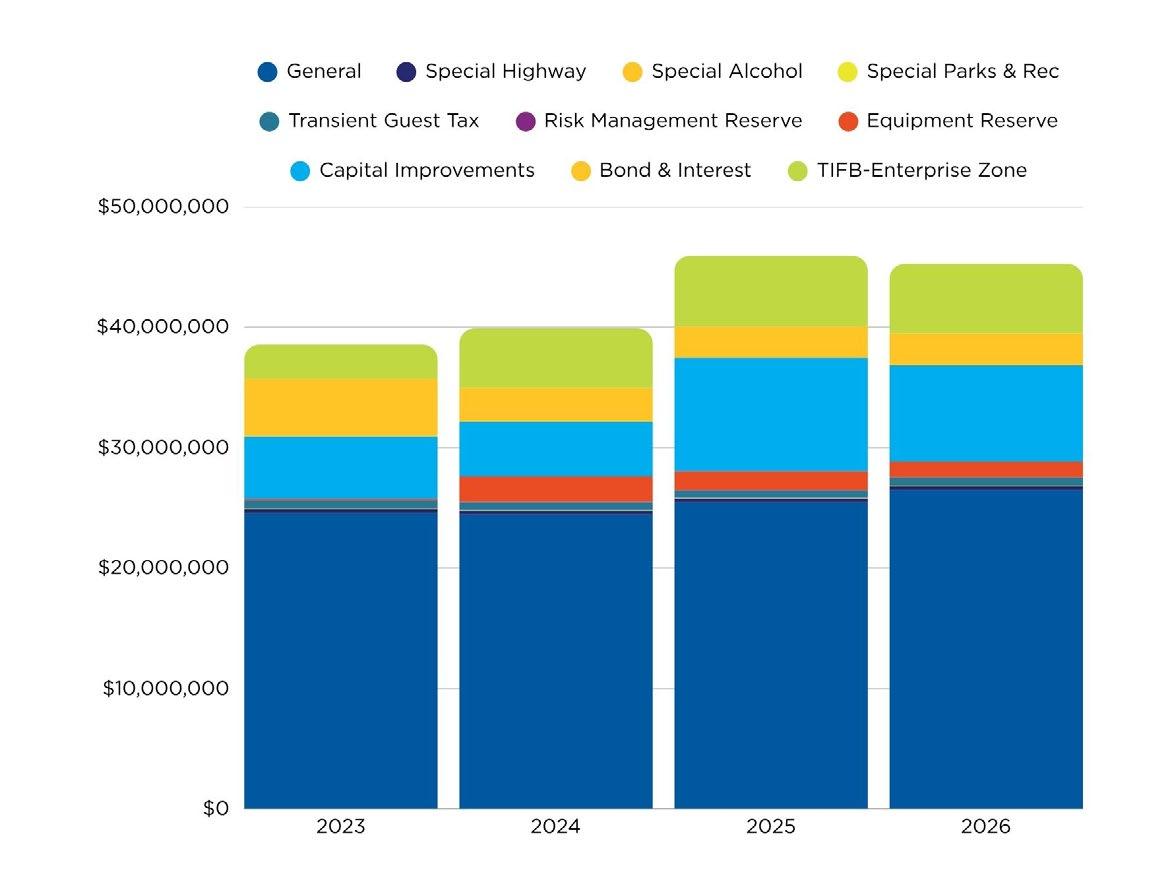

The 2026 Budget authorizes $50.1 million in total expenditures across all funds, supported by $40.1 million in revenue. Sales and use taxes ($19.8 million) and ad valorem property taxes ($7.91 million on a $299.6 million assessed valuation) remain the City’s largest funding sources. The City’s mill rate decreased from 26.694 in 2025 to 26.412 for 2026, providing tax relief while maintaining high-quality services and continued capital reinvestment.

Budgeted Revenues – All Funds

▶ Total revenues: $40.1 million (excluding transfers)

▶ Sales & Use Taxes: $19.8 million (49% of total revenues)

▶ Ad Valorem Property Taxes: $7.91 million, reflecting valuation growth and a lower mill rate

▶ Total expenditures: $44.97 million (excluding transfers)

▶ Capital Improvements: $11.6 million

▶ Capital Equipment: $1.4 million

▶ Debt Service: $2.7 million

▶ TIF Expenditures: $6.1 million

▶ Expenditures reflect continued cost pressures from inflation, salaries, and insurance premiums

Fund Balances – All Funds

▶ Ending fund balances projected at $57.7 million by year-end 2026

▶ General and Risk Management Funds combined reserves equal 39.3% of operating revenues, exceeding the City Council’s 30% policy minimum

Property Tax: The 26.412 mill levy generates $7,913,059 in ad valorem revenue for 2026. The City continues to maintain one of the lower mill levies among Johnson County cities while sustaining strong service delivery.

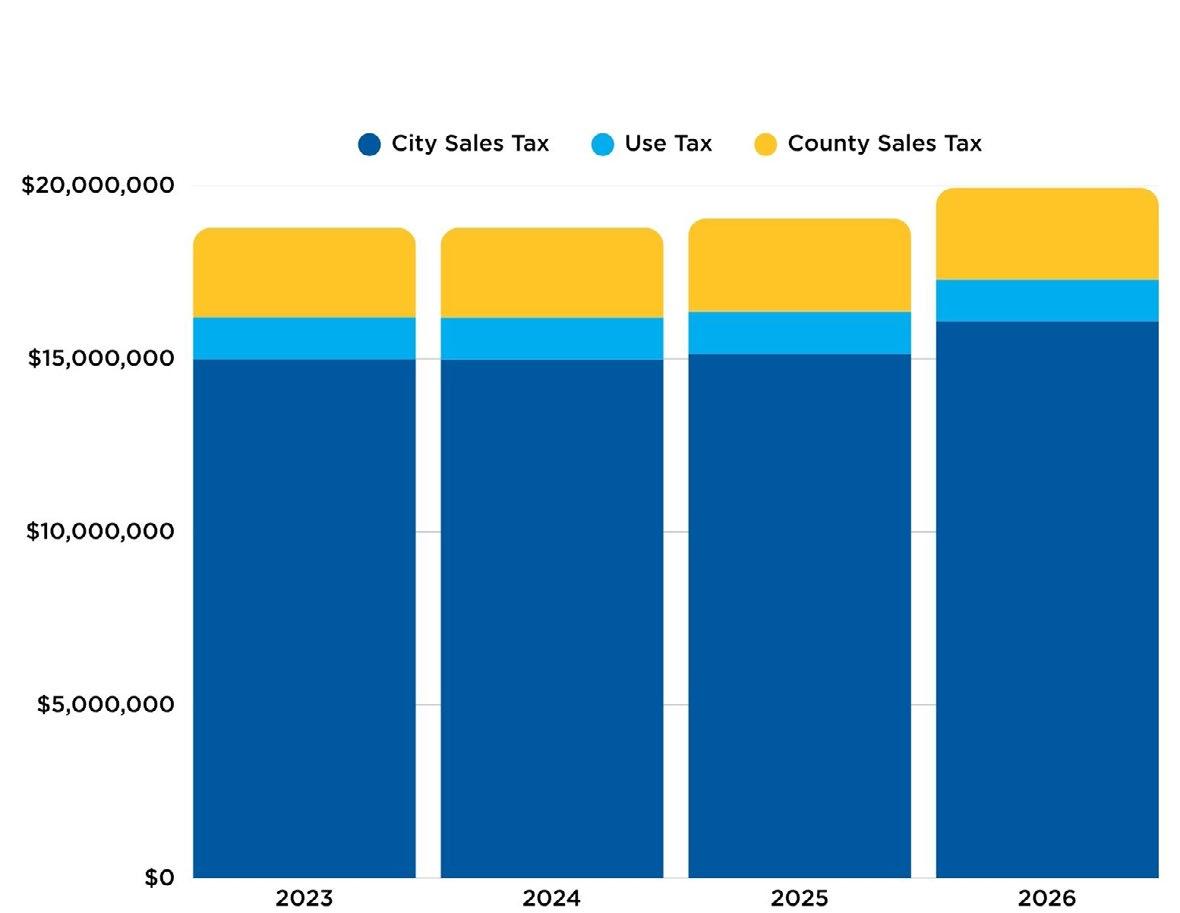

Sales and Use Tax: Total sales and use tax revenue for the General Fund is estimated at $14.5 million. The City’s 1% local sales tax is projected to grow modestly by 4% over the 2025 Budget, or about 2% above 2024 audited actuals. Because Merriam’s sales tax revenue relies heavily on automobile sales, collections can fluctuate as prices and consumer demand change. The 2026 Budget assumes stable sales activity but plans conservatively.

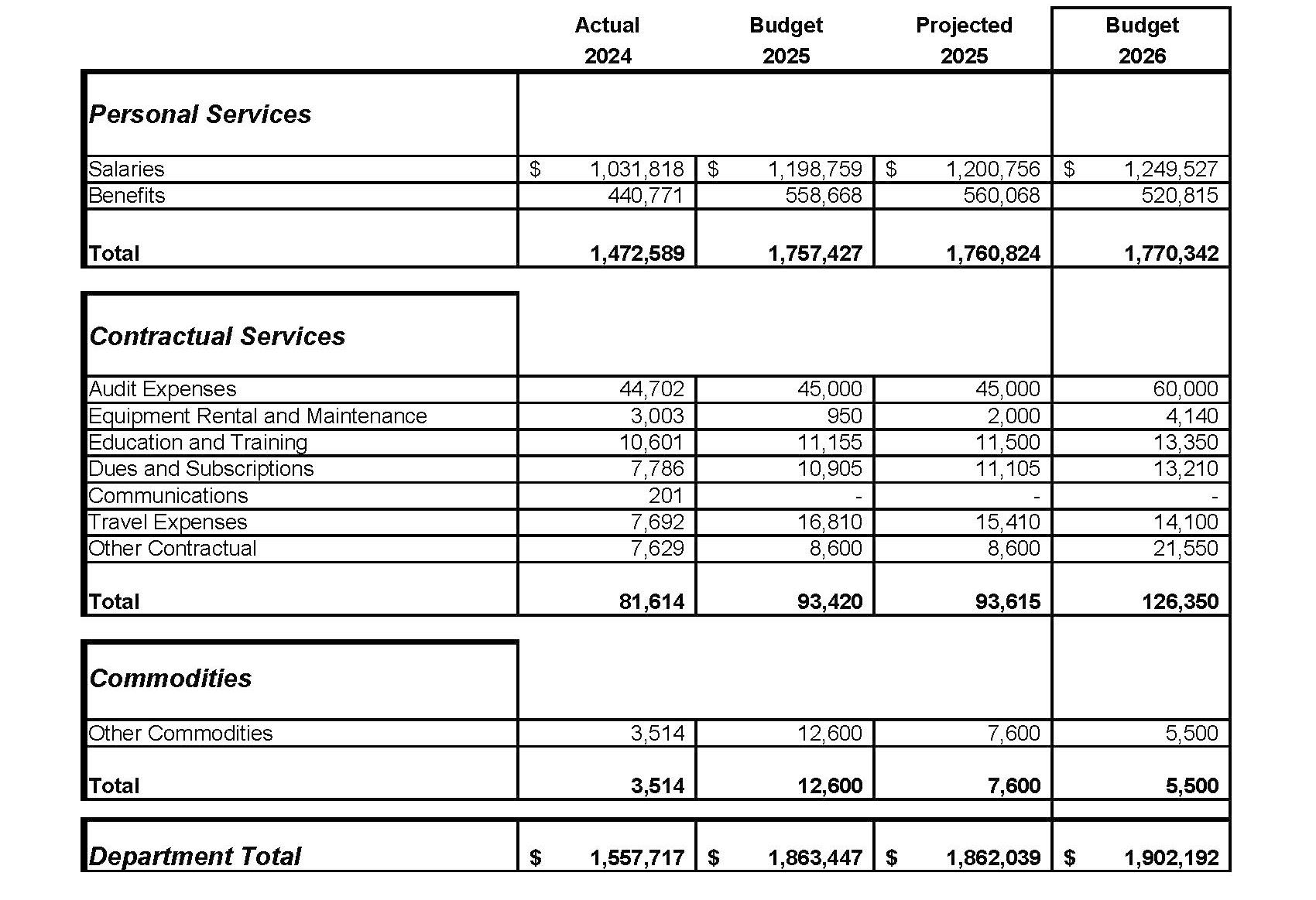

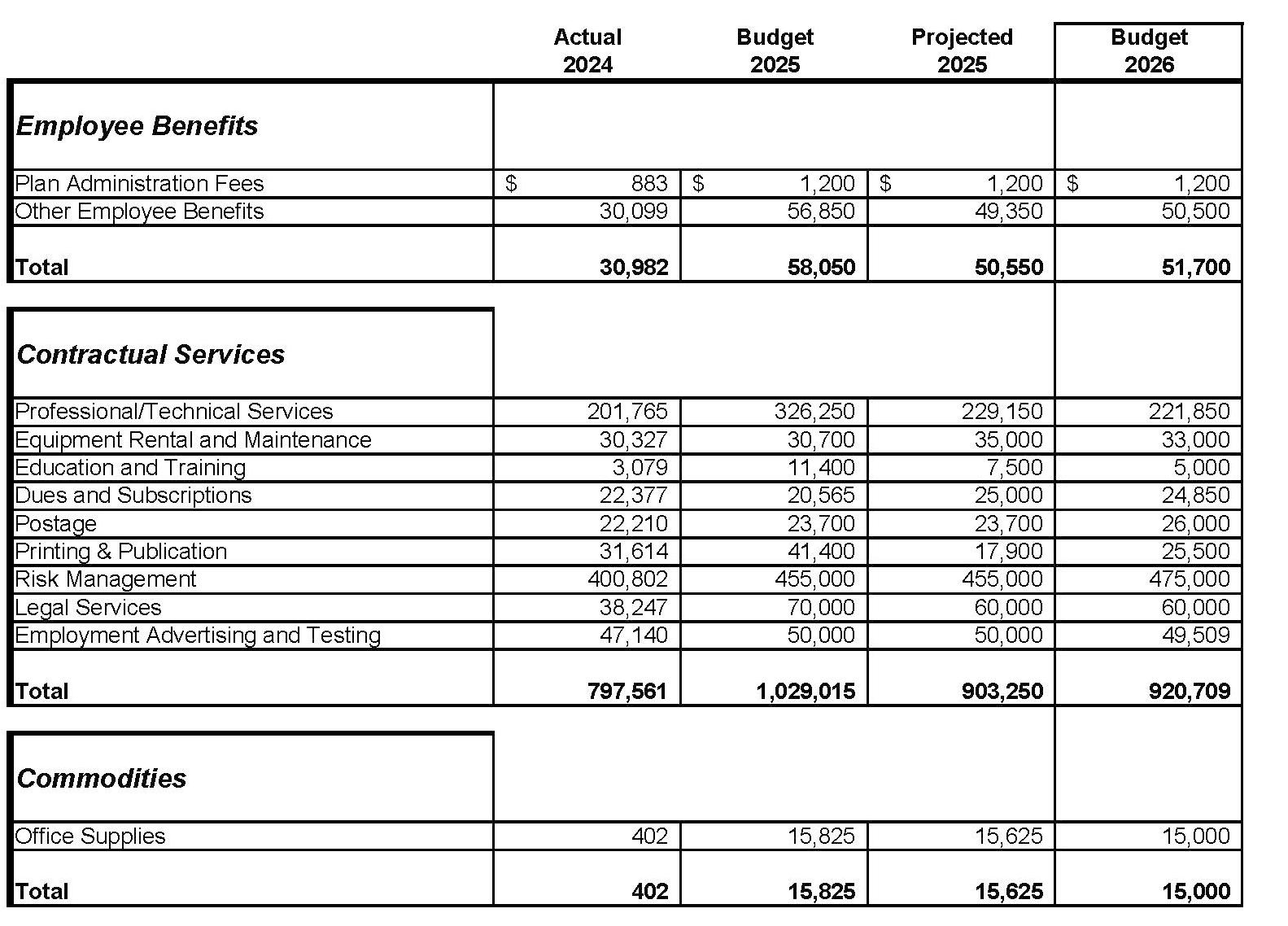

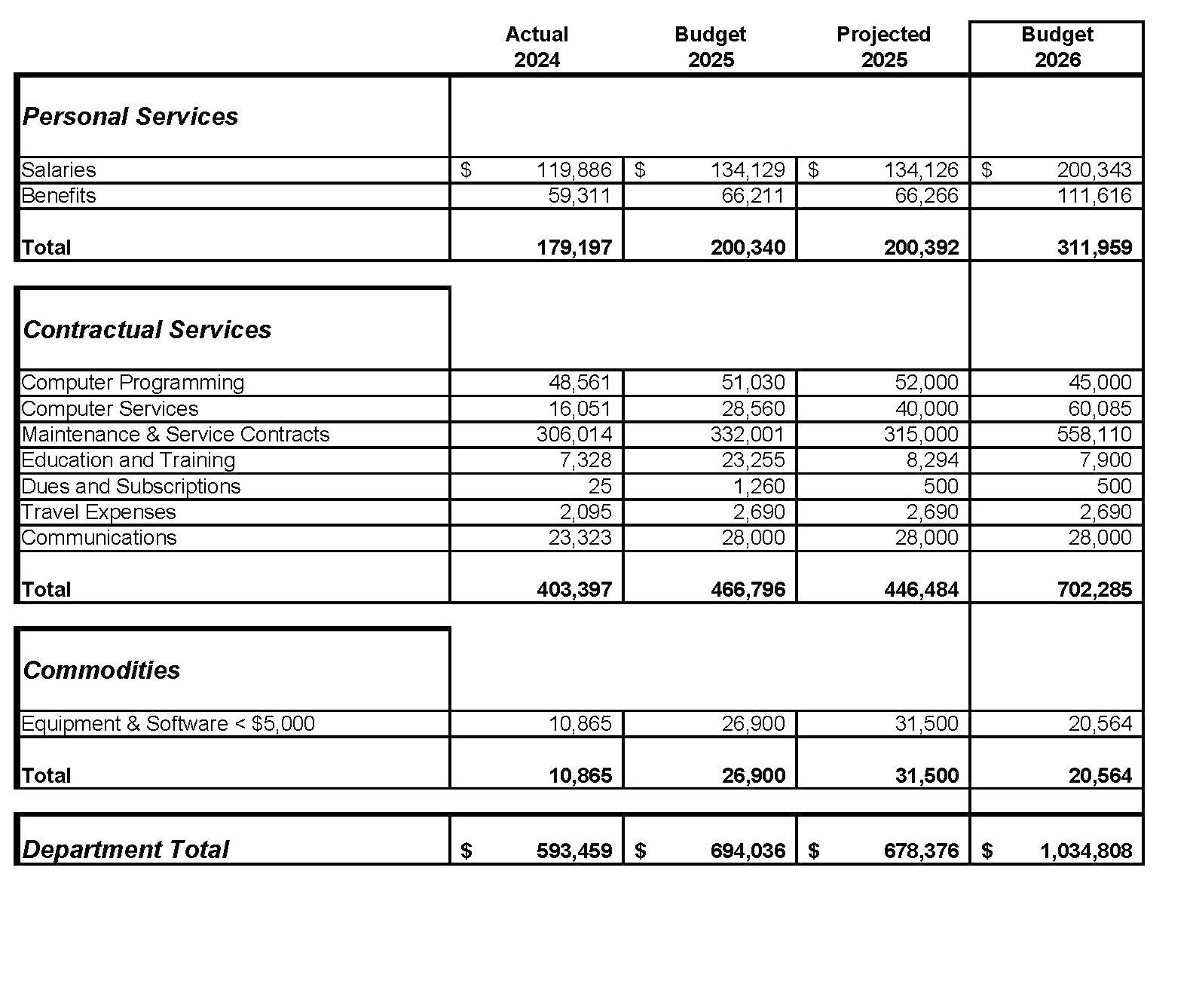

The City continues to invest in its workforce as the foundation of service delivery. For 2026, the budget includes one new full-time position, Technology Specialist, to support the City’s growing IT infrastructure, cybersecurity needs, and internal help-desk support.

▶ Total FTEs: 127 (up from 125 in 2025)

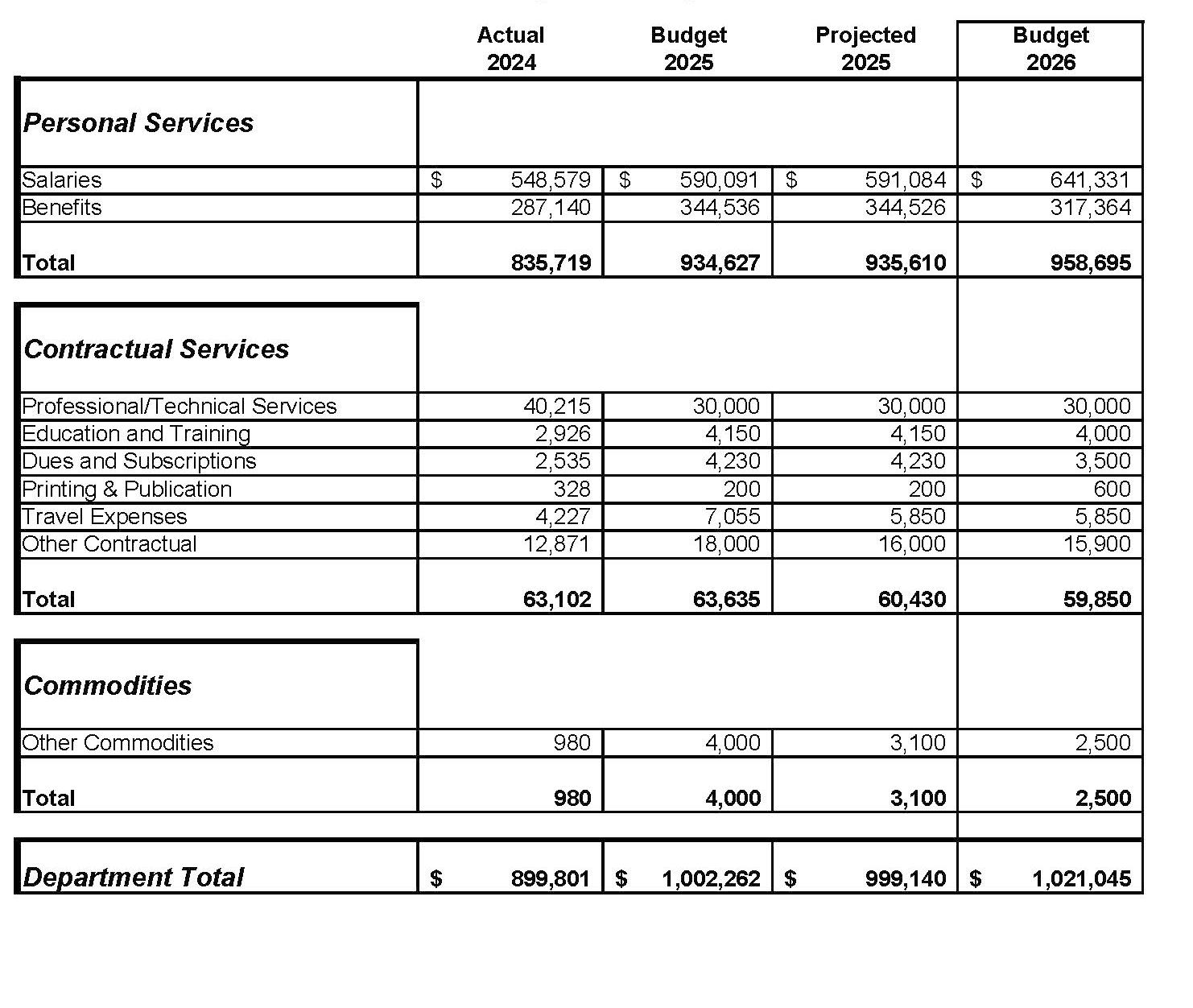

▶ Personnel Costs: $13.5 million (includes salaries and benefits)

▶ Compensation Plan: 3.0% cost-of-living adjustment plus 2.0% merit pool

▶ Required KPERS/KP&F Rates: 24.67% Police/Fire; 10.71% General

▶ Supplemental Retirement: 10% contribution for non-police employees

▶ Health Insurance: premiums projected to rise up to 15%

These adjustments maintain Merriam’s competitiveness in attracting and retaining qualified employees and ensure continuity of services.

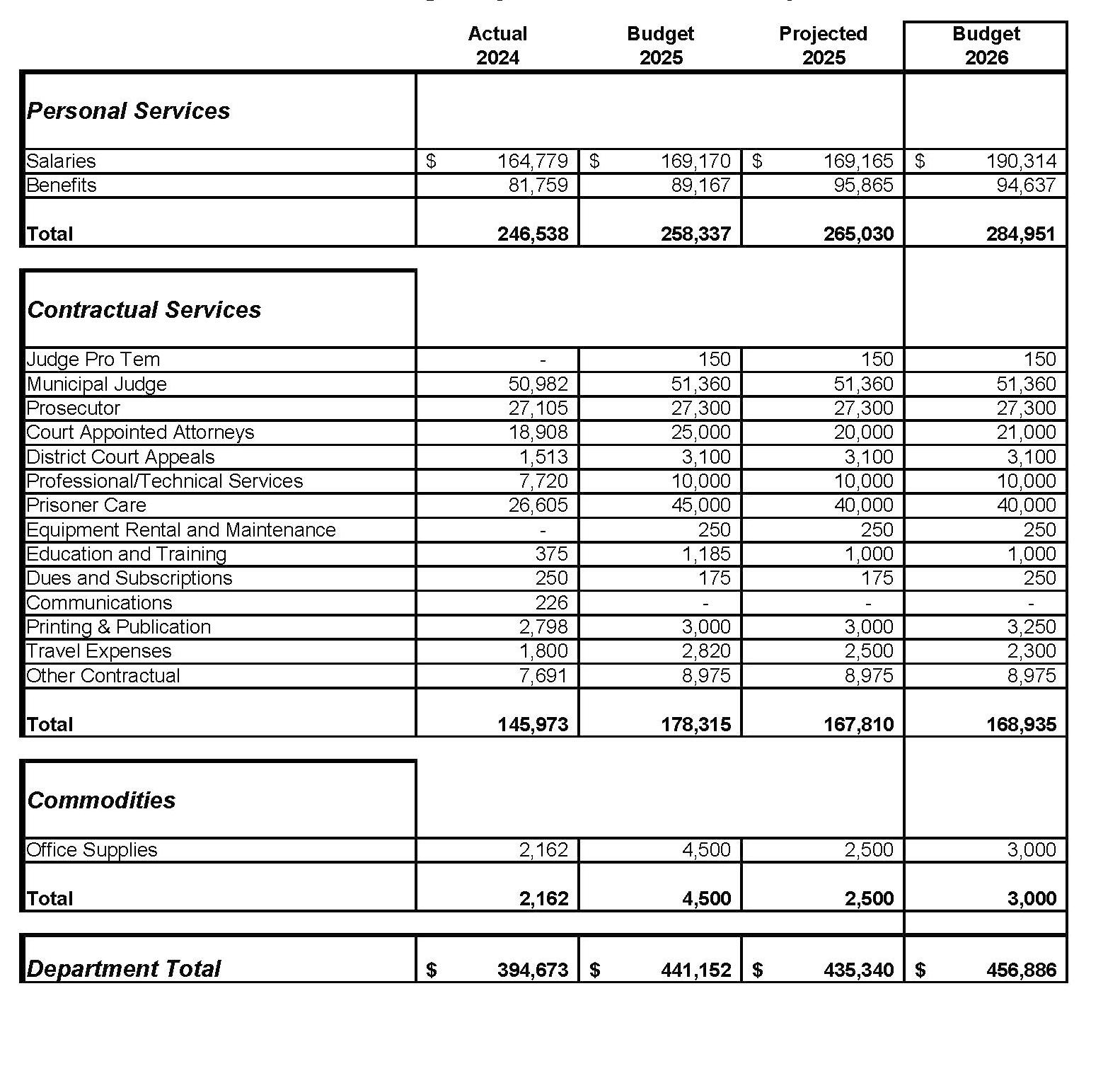

The City will continue its contracted fire services partnership with the City of Overland Park, budgeting $3.31 million for the Merriam station in 2026. This cost-effective partnership ensures professional service delivery and coordinated emergency response coverage.

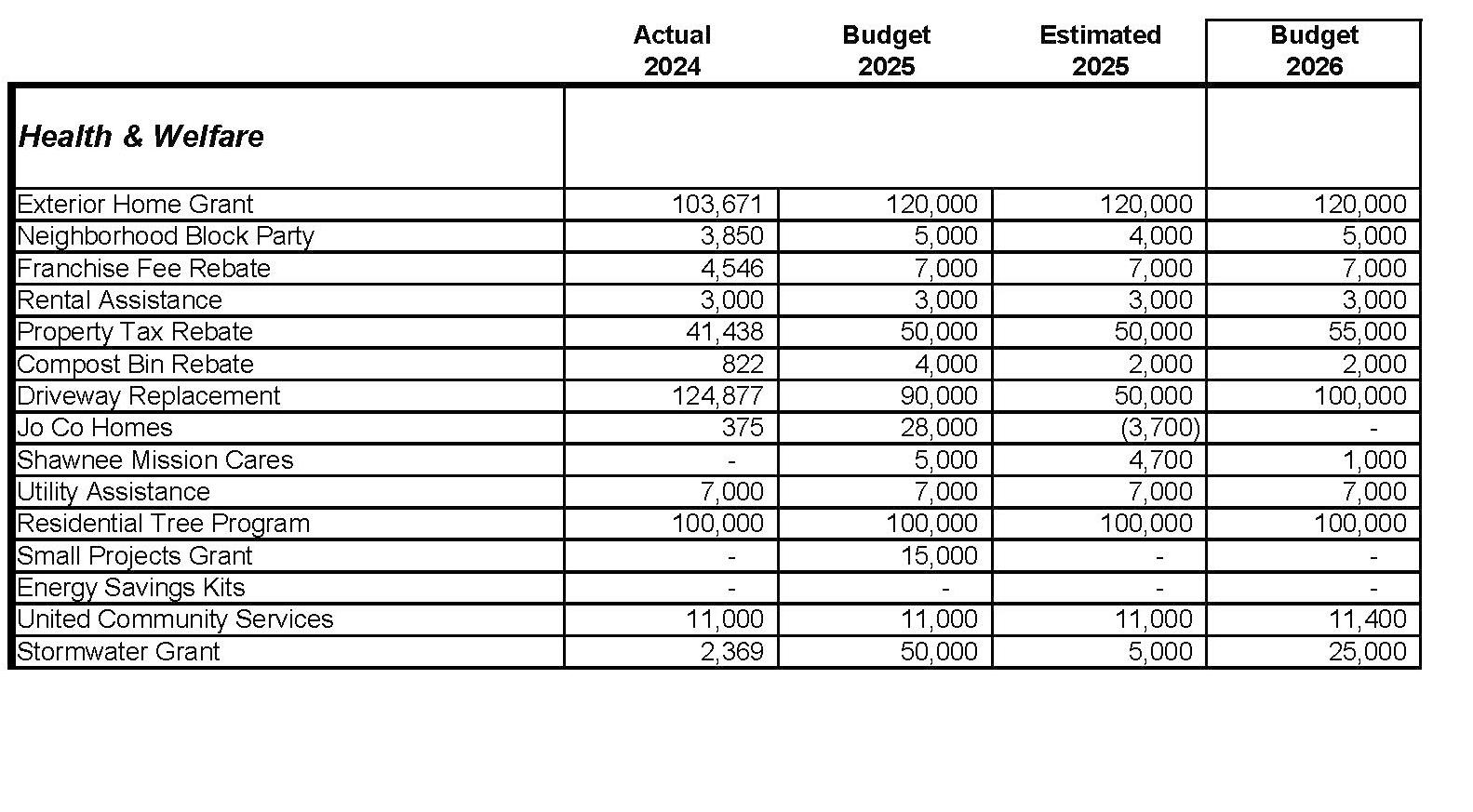

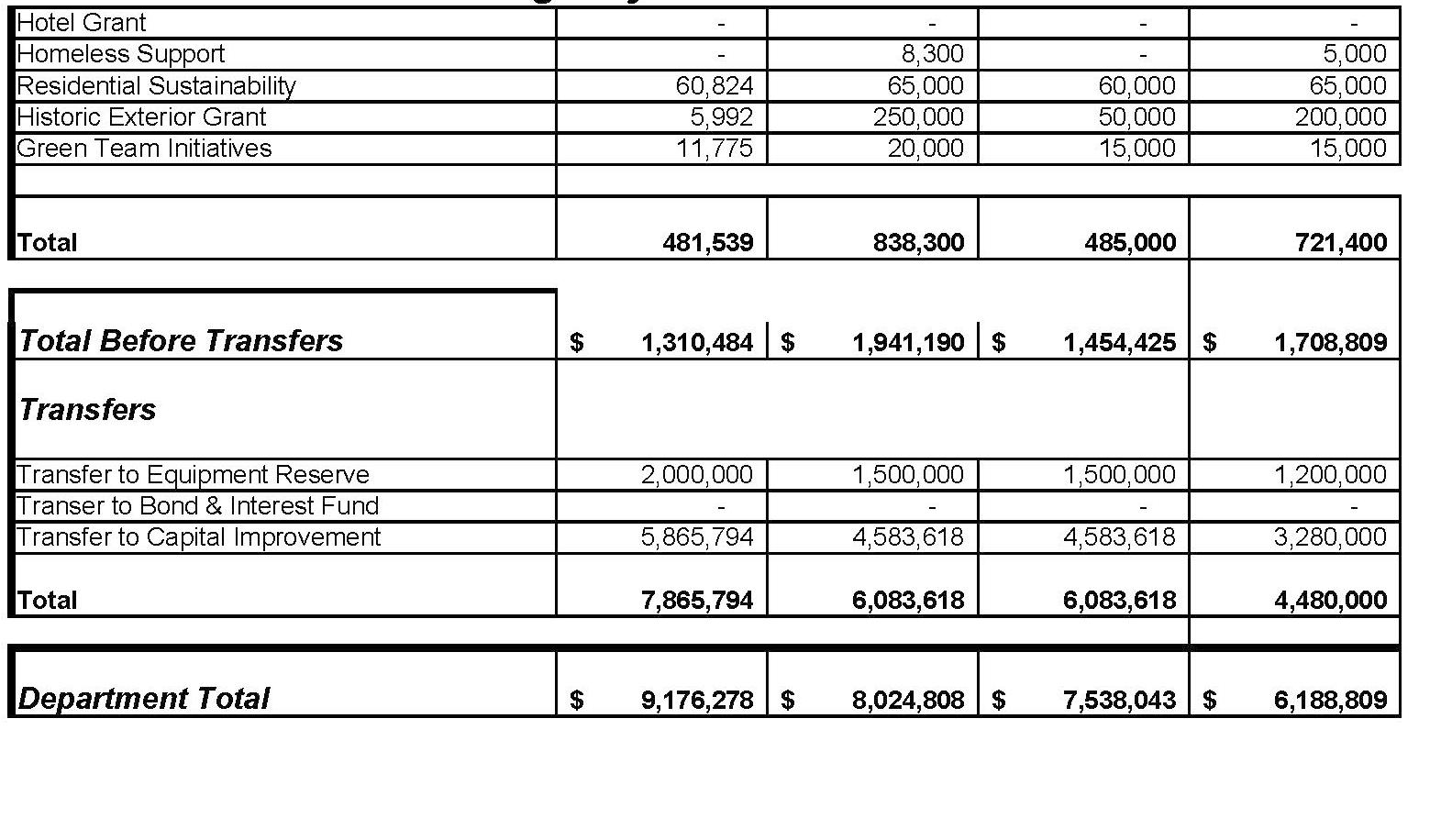

The 2026 Budget allocates $721,400 to community programs that enhance quality of life, support property reinvestment, and strengthen neighborhood stability, including:

• $120,000 – Exterior Home Improvement Grants

• $55,000 – Property Tax Rebate Program

• $100,000 – Driveway Repair/Replacement

• $65,000 – Residential Sustainability Initiatives

• $100,000 – Residential Tree Grant Program

• $25,000 – Stormwater Grant Program

• $200,000 – Historic Exterior Grant Program

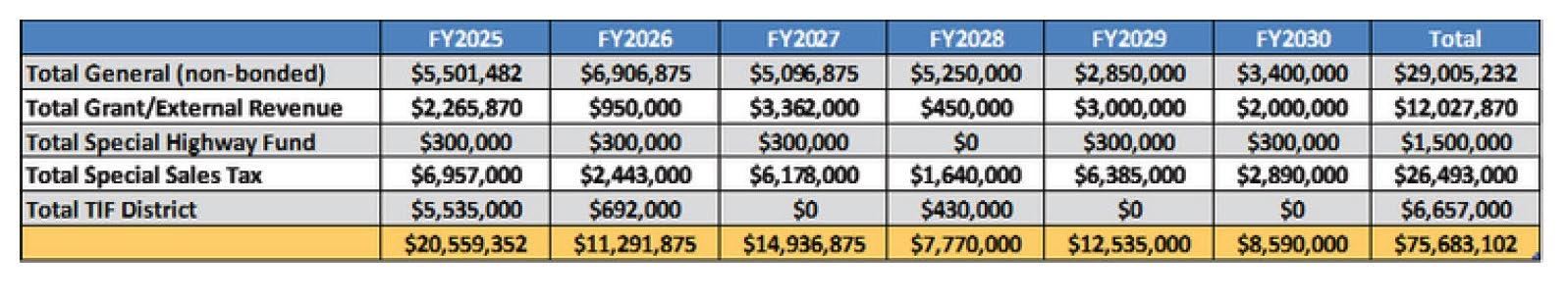

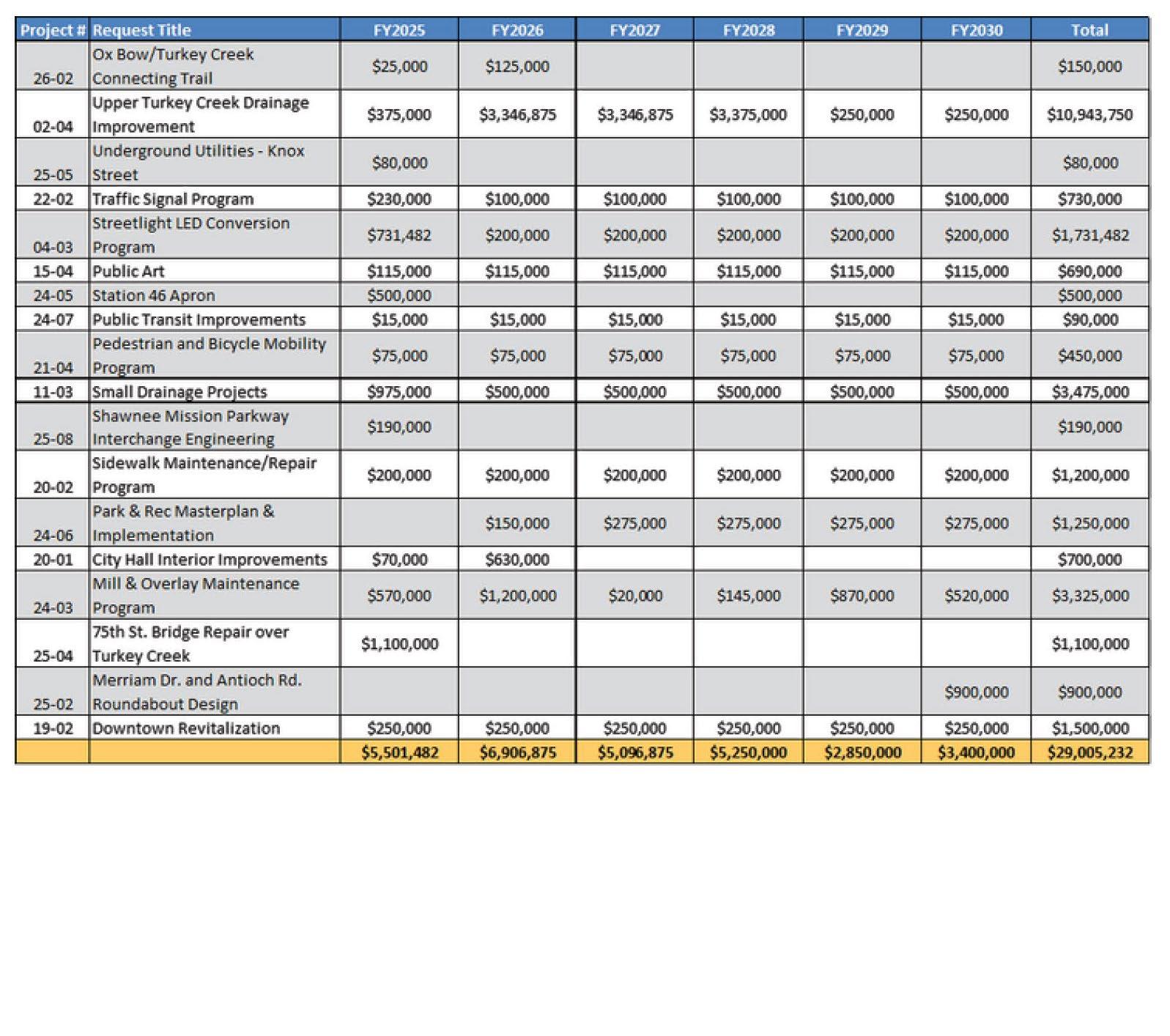

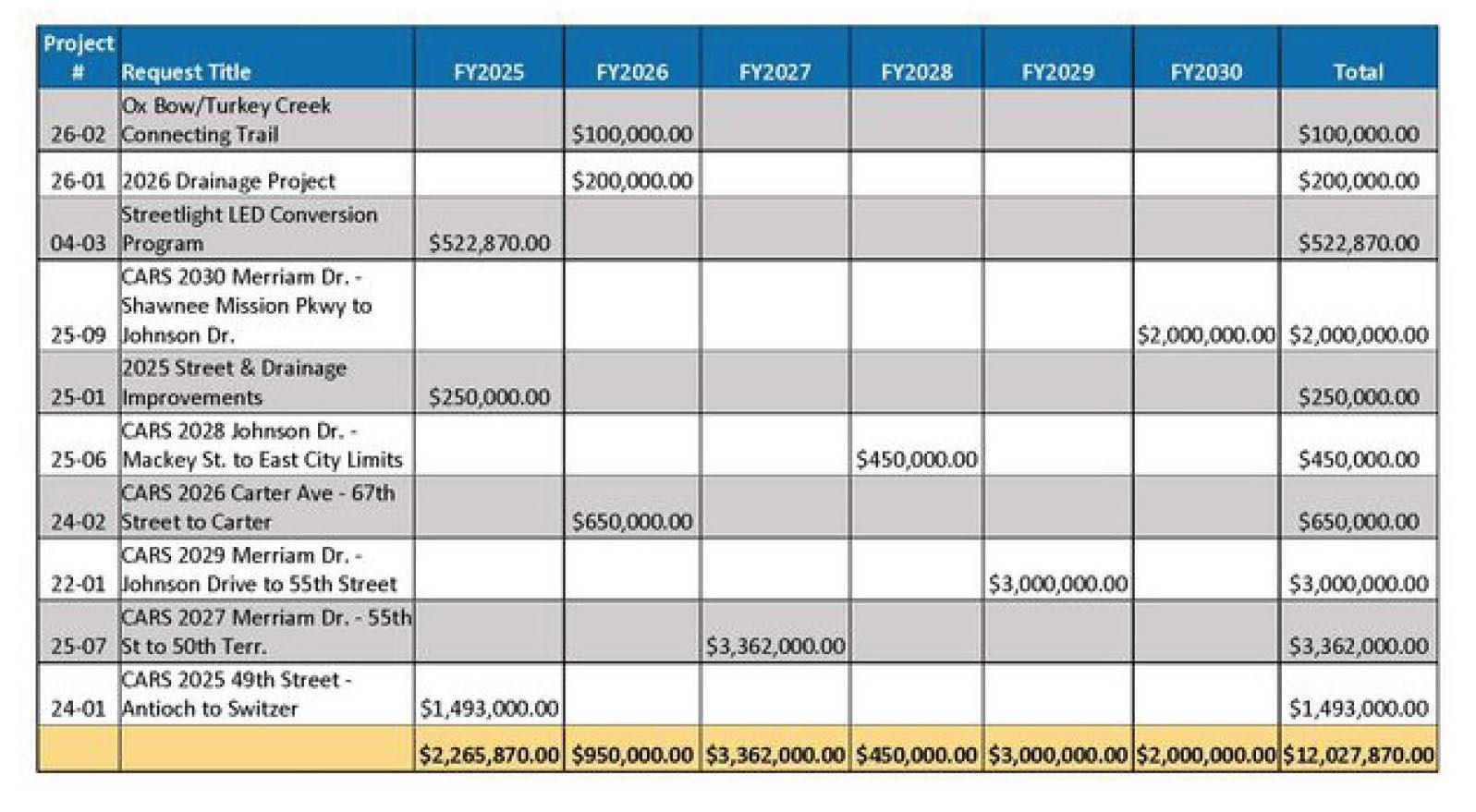

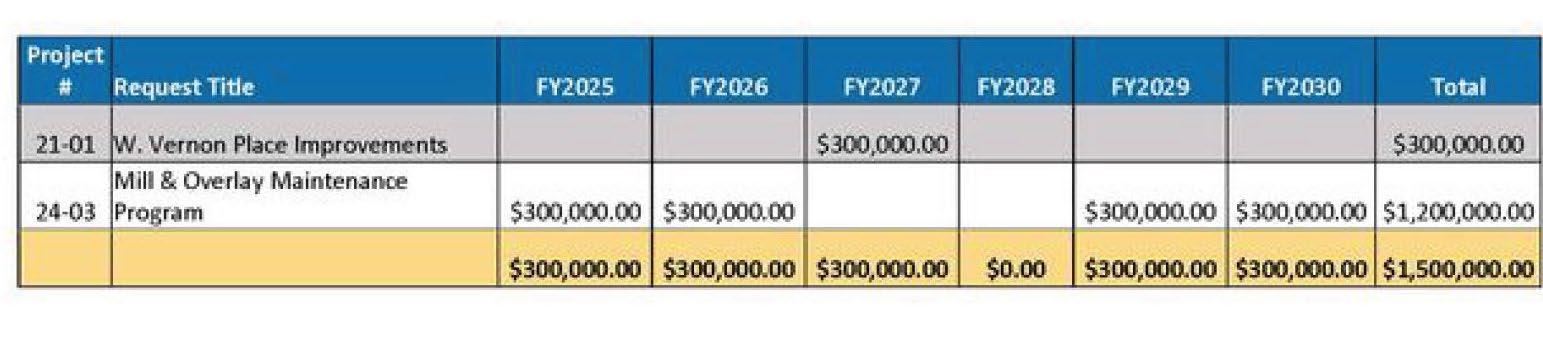

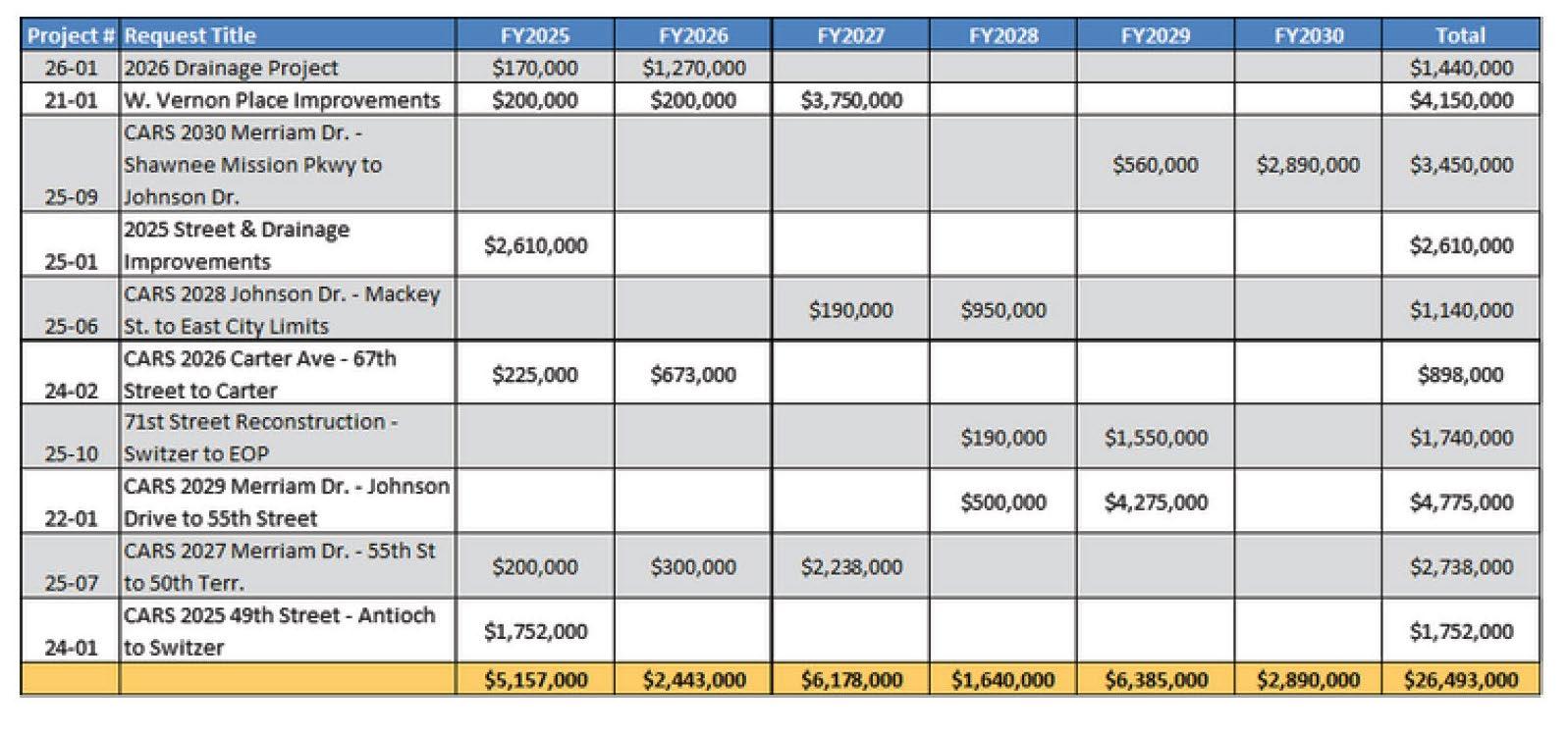

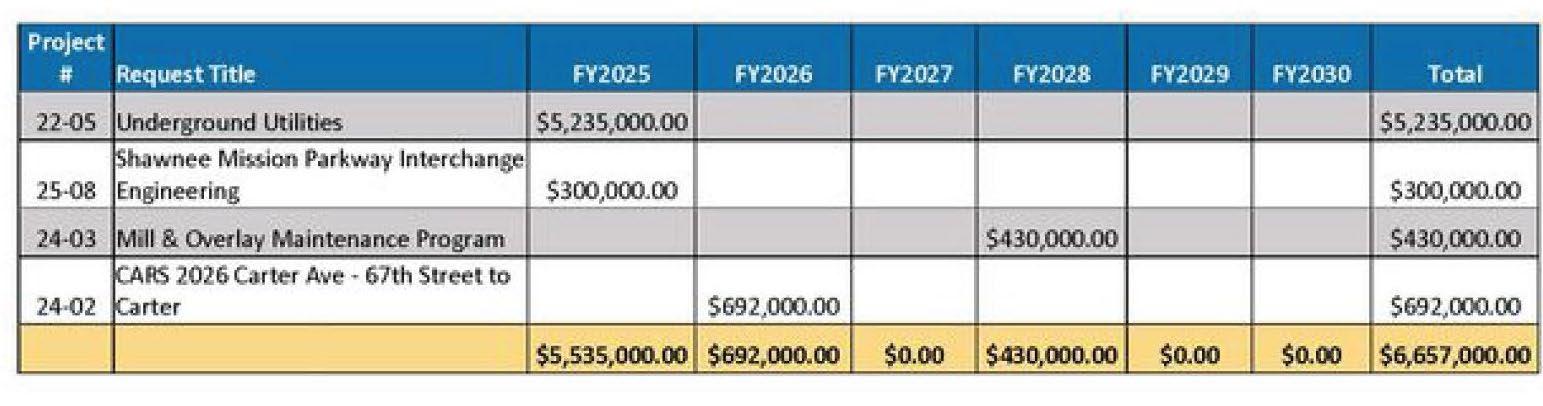

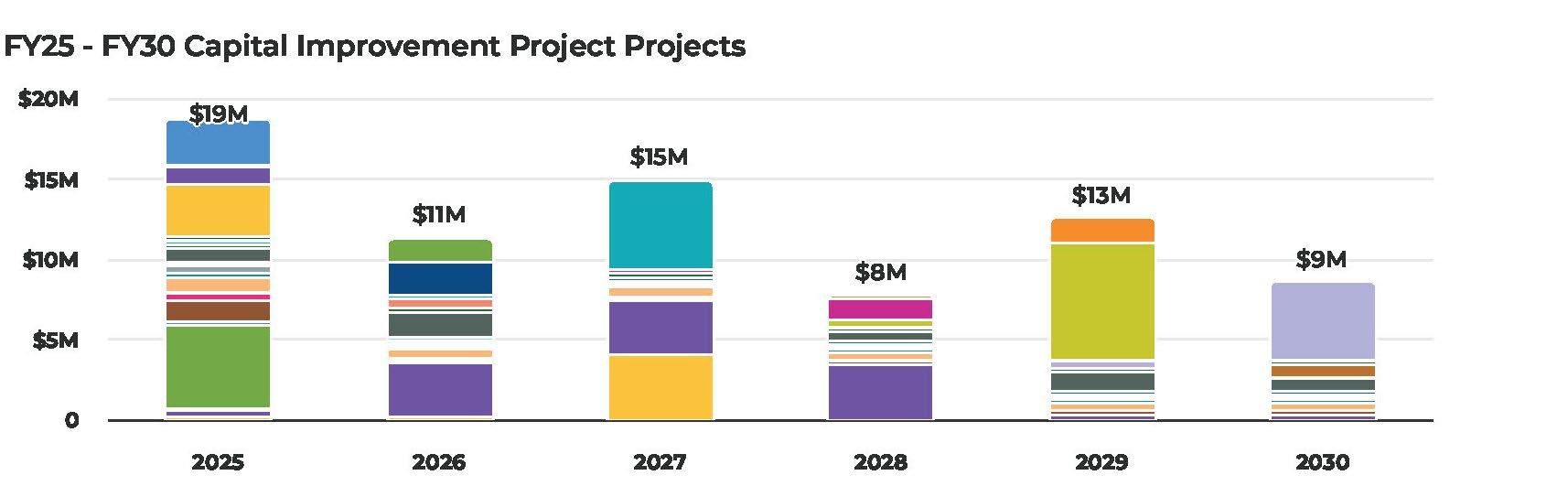

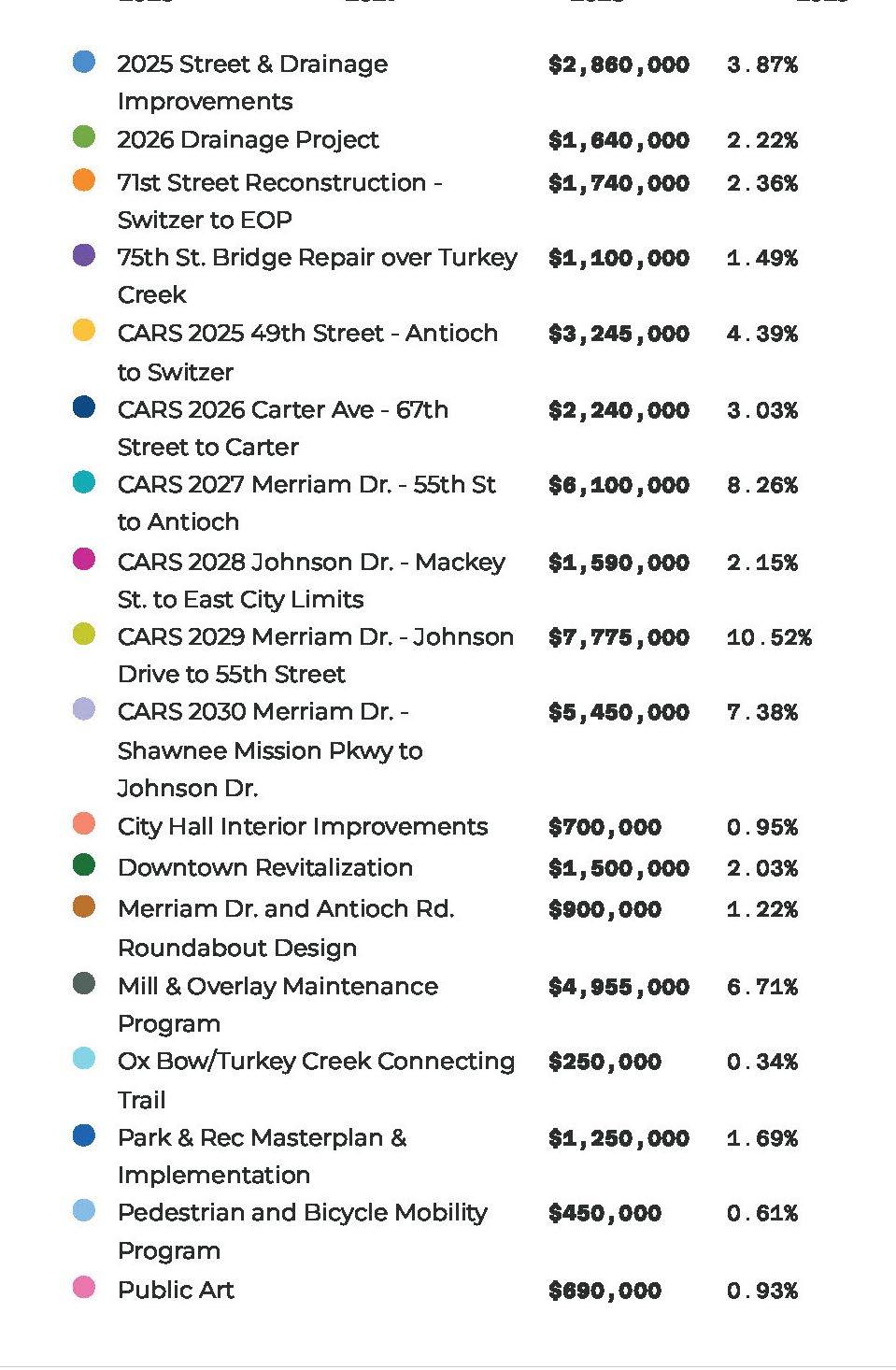

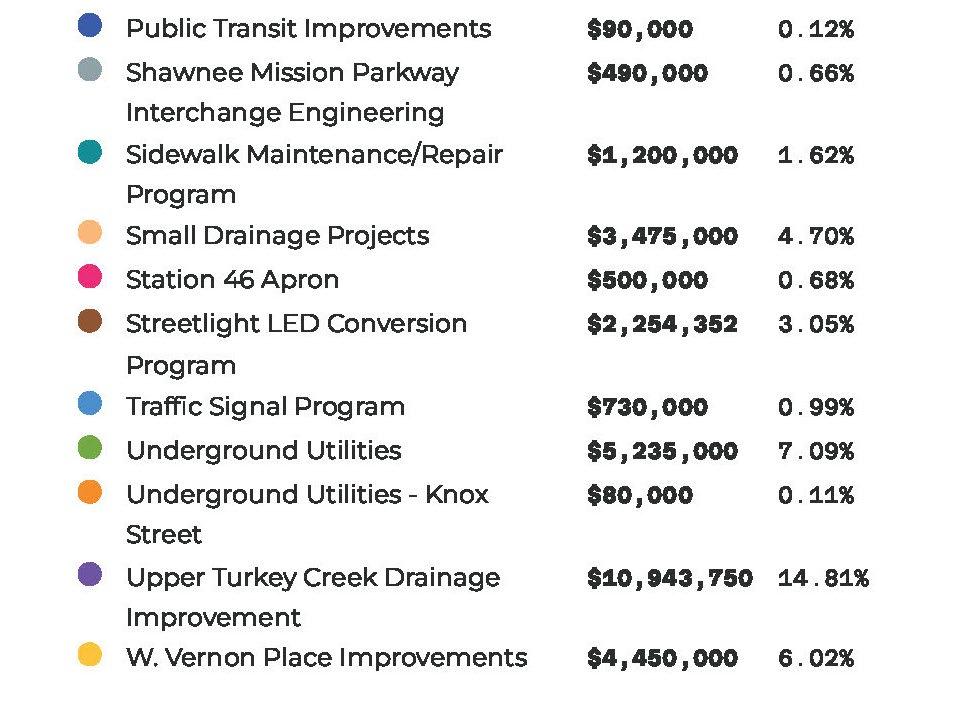

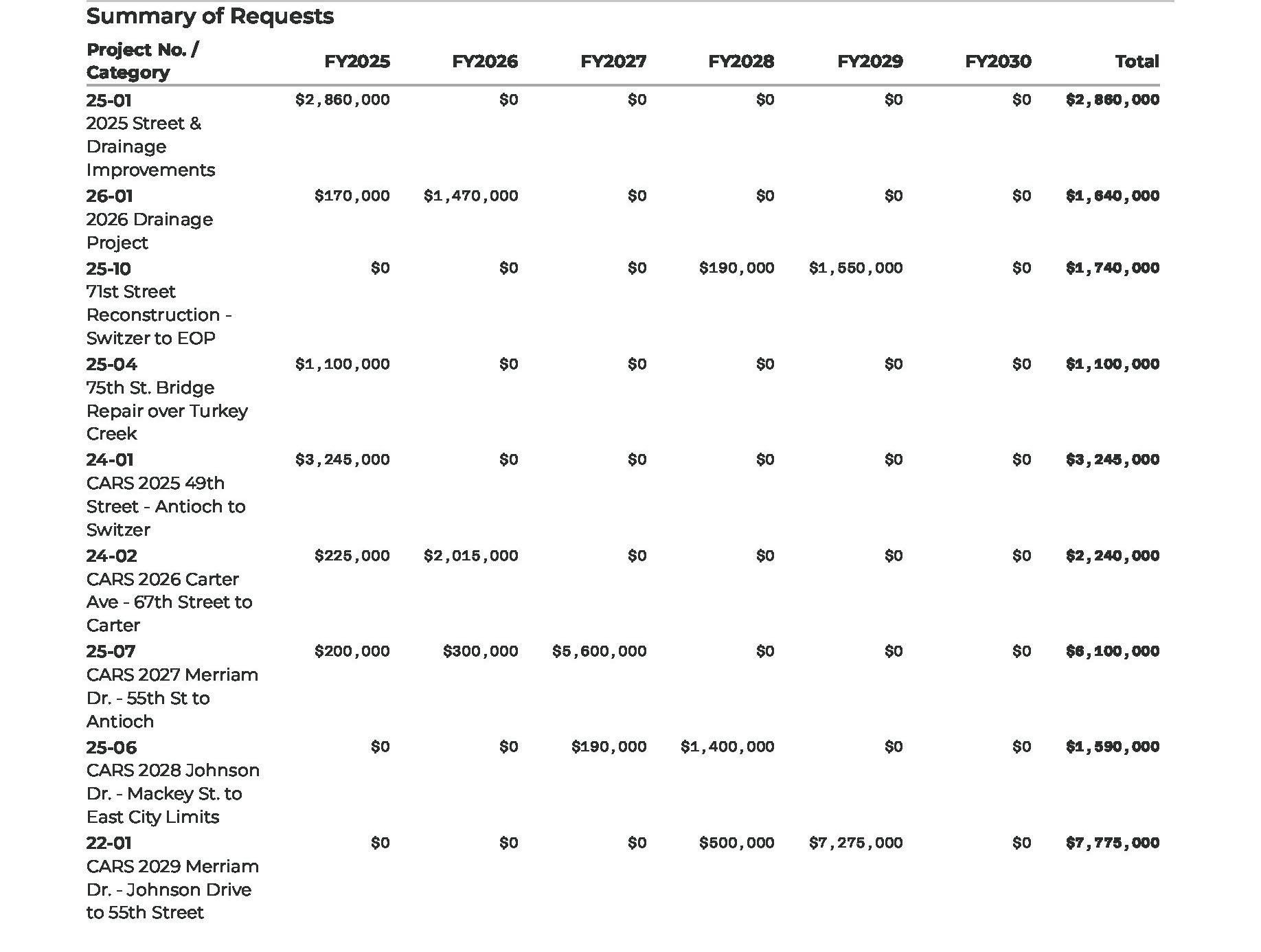

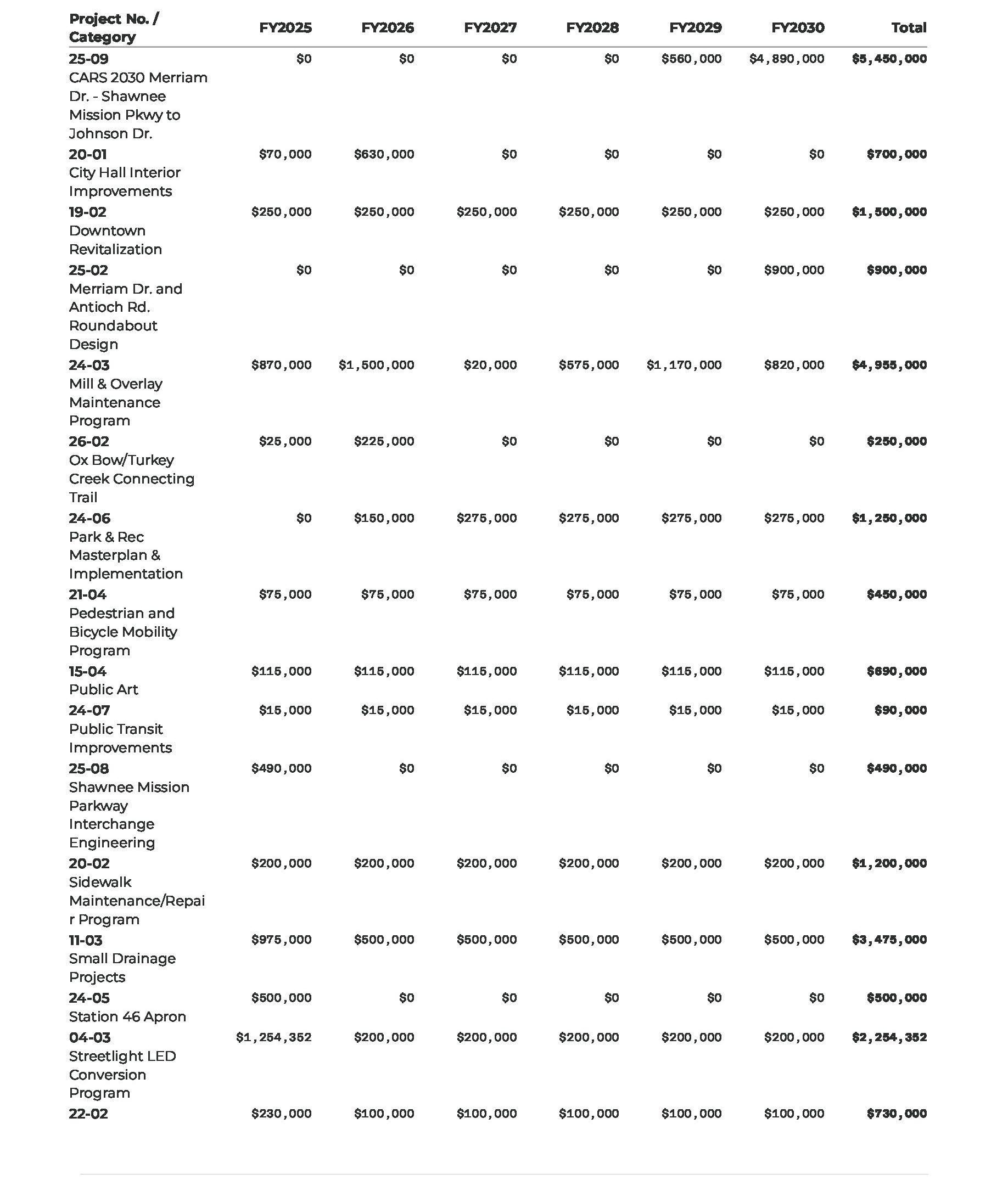

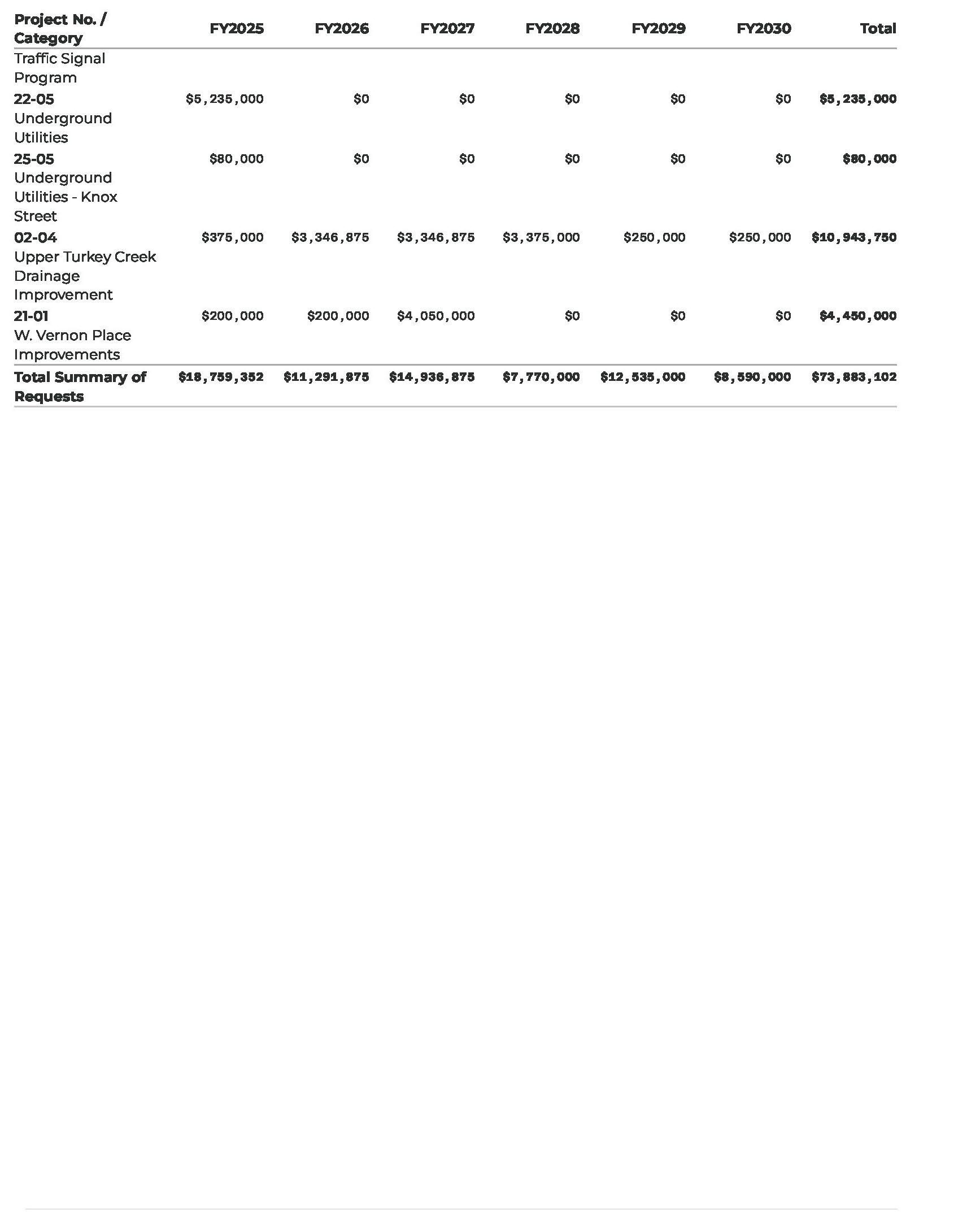

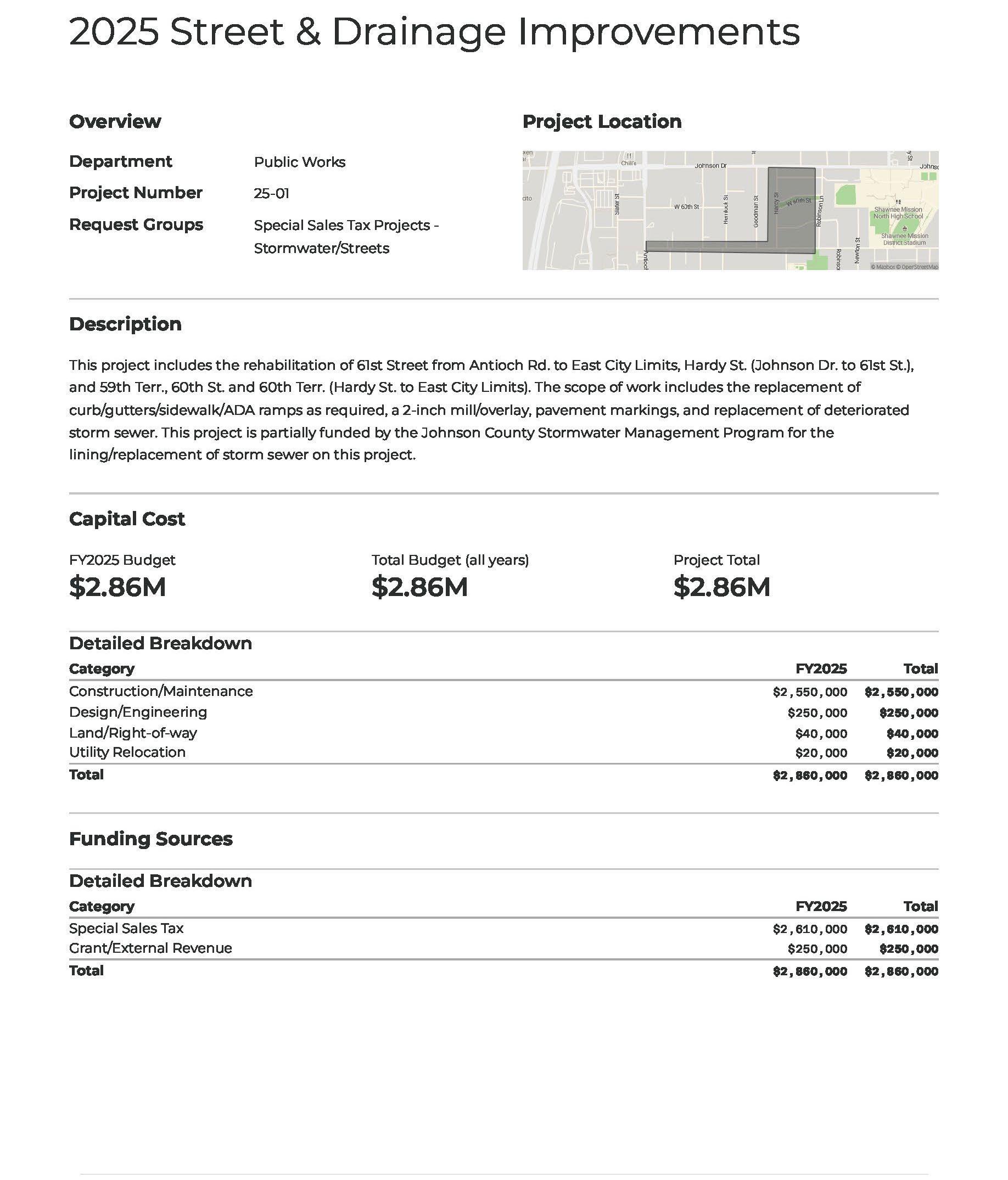

The 2026–2030 Capital Improvement Program totals $11.5 million for 2026, supporting City infrastructure priorities and community enhancements. Major projects include:

▶ Streetlight LED Conversion Program

▶ Ongoing Facility and Stormwater Improvements

Funding sources include sales tax transfers ($3.28 million), grants, and General Fund contributions.

Debt Service: Principal and interest payments total $2.65 million in 2026 ($2.41M principal, $247K interest). These payments are funded by the dedicated 0.25% recreation sales tax, ensuring no additional property tax burden for bond repayment. Due to recent issuance, outstanding G.O. Bonds total $43.35 million as of January 1, 2026.

Interfund Transfers: Total $4.48 million, including $1.2 million to the Equipment Reserve Fund and $3.28 million to the Capital Improvement Fund.

Maintaining strong reserves remains a cornerstone of Merriam’s fiscal strategy. Combined General Fund and Risk Management Fund reserves total 39.3% of expenditures, exceeding the City Council’s adopted policy target of 30–35%. This healthy financial position provides the City with the flexibility to manage short-term economic fluctuations, sustain consistent service delivery, and uphold Merriam’s AAA bond rating.

The City will continue to monitor valuation trends, state tax law changes, and automobile sales activity to ensure sustainable growth in revenue streams. If sales or property tax revenues slow, the City stands prepared to adjust project timing or defer lower-priority initiatives to protect reserves and core services.

The 2026 Budget embodies Merriam’s long-standing commitment to fiscal responsibility, high-quality service delivery, and reinvestment in community infrastructure. With the mill levy decrease, a strengthened reserve position, and continued focus on innovation through the new Technology Specialist position, Merriam is well-positioned for continued financial stability and operational excellence.

We extend our appreciation to Mayor Bob Pape and the City Council for their leadership and guidance in developing this budget. Special thanks to all department directors and Graphic Designer Brenna Dwyer for their dedication and contributions to this process.

Respectfully Submitted,

Chris Engel

Christopher Engel

City Administrator

AVERAGE MERRIAM HOME VALUE

To determine assessed valuation, multiply market value by 11.5%. 310,000 x .115 = 35,650

To calculate the annual tax bill, multiply the assessed valuation by the mill rate and divide the result by 1,000. 35,650 x 26.412 / 1,000 = 941.59

Monthly Expenses for City Services: $76.47

To determine the tax expenses for city services, divide the tax liability by 12 months. 941.59 / 12 = 78.47

The following list is a representative of the City Services provided for $78.47 per month.

▶ Police Protection

▶ Municipal Court

▶ Snow Removal

▶ Community Center and Indoor/Outdoor Pools

▶ Fire Protection

Animal Control

Code Enforcement

Parks, Playgrounds

Capital Improvements

FOR COMPARATIVE PURPOSES, THE FOLLOWING ARE COMMON MONTHLY EXPENSES FOR A MERRIAM FAMILY:

A family of four could eat one large pizza four times a month at $16.00 each for about $64.00.

A homeowner could receive weekly lawn mowing service at $40.00 per visit or $160.00 per month.

Merriam is located along I-35 in northeast Johnson County, Kansas. Just eight miles south of downtown Kansas City, Merriam is a welcoming, peaceful, tight-knit community that is small in size, but big at heart.

Our residents enjoy a wide variety of amenities and services including beautiful tree-lined streets, walking trails, plentiful parks, public art and abundant events. With affordable housing in safe neighborhoods, an award-winning school district, and our convenient location, Merriam is the ideal community to call home.

Wherever you’re from, whatever you do, Merriam is just right…for all the best reasons.

Just right for your family.

Just right for making friends.

Just right for starting your life together.

Just right for building a business.

Just right for your first home.

Just right for your forever home.

The City of Merriam, Kansas is the thirty-fourth largest city in Kansas and is a suburb located in the west portion of the Kansas City metropolitan area. The City encompasses 4.32 square miles of land in Johnson County and is approximately eight miles south of downtown Kansas City, Missouri.

Merriam occupies a strategic location within the metropolitan area. Its position at the intersection of several major transportation routes has been a major factor in Merriam’s growth and development.

Merriam is located within 260 miles of the geographic center of the continental United States.

Interstate 35 bisects the city north south and U.S. Highway 56, or Shawnee Mission Parkway, bisects the city east west.

Airports: Kansas City International (MCI) is 26 miles north of Merriam. Johnson County Executive Airport is 16 miles southwest of Merriam.

Major Railways: Burlington Northern Santa Fe Railway (BSNF)

Executive, Communications, Community Development, Finance, Information Technology, Human Resources, and Municipal Court

Police admininistrative offices, briefing room, holding cells, and property management.

Public Works admininistrative offices, including the Capital Improvement Program. Services: Large-item pickup, tree limb collection, snow removal, and city maintenance.

Parks & Recrecation administrative offices. Amenities: Indoor pool, outdoor pool, fitness center, classes, personal trainers, gymnasium, walking track, and birthday party spaces.

Farmers’ Market, event space, access point to the Turkey Creek Streamway Trail, and home of the public art piece Planting the Seeds.

Administrative offices for tourism and economic development. Amenities: Meeting space, Merriam visitor information, historic walking trail, and pollinator garden.

124

21 LANE MILES OF ROADS MILES OF ENCLOSED STORMWATER PIPES TRAFFIC SIGNALS

28

5.25 PARKS

MILES OF TRAILS

TOTAL ACRES

AMENITIES:

SHELTERS

SPORT COURTS & COURSES

ATHLETIC FIELDS

UPLIFT

Merriam’s public art collection includes 2- and 3-dimensional art pieces located throughout the city on public property. In 2025, murals were added to the Merriam Community Center campus by the Milagros Collective. Other works include Bask by Blessing Hancock, Hmmm... by Joshua Weiner, Still Time by Dan Maginn, DRAW Architecture + Urban Design, Planting the Seeds by Christopher Weed, and Motherhood by Kwan Wu. The Tim Murphy Art Gallery, located in the Merriam Community Center, features monthly exhibits open for all to enjoy.

Budgeted full-time equivalent positions (FTEs) are 127 for fiscal year 2026 – an increase of 1 FTE from 2025 for the addition of a full-time Technology Specialist to support the City’s growing IT infrastructure and cybersecurity needs.

PLAYGROUNDS

In 2024, a part time Intern position replaced the previously unpaid position, and the part time program assistant position was changed to a full time Recreation Assistant - Programs. In 2025, an Administrative Coordinator position will will be added. In 2026, a Technology Specialist position will be added.

POPULATION BY RACE

$71,665

SomeCollegeor Associate’sDegree

AVERAGE FAMILY SIZE

2.1

Bachelor’sDegree

ProfessionalGraduateorDegree

HighSchoolor EquivalentDegree NoHighSchoolDiploma

TOTAL NUMBER OF HOUSING UNITS

5,370 AVERAGE HOME VALUE

$310K

A variety of industrial, office, and retail firms are located in Merriam, including small and medium sized businesses and the only Fortune 500 company in the Kansas City metropolitan region.

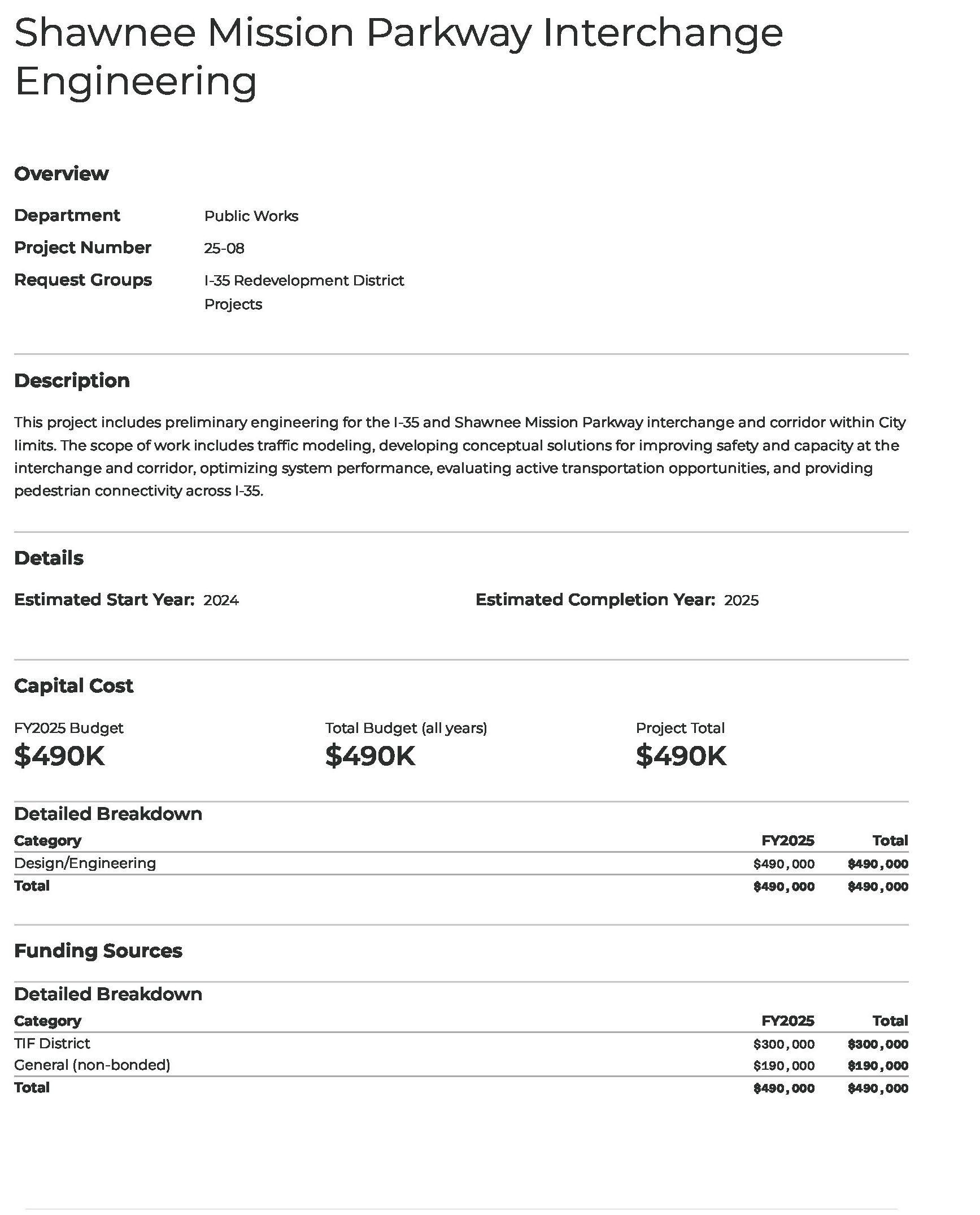

The Tax Increment Financing (TIF) Act allows cities to support private investments in redeveloping blighted areas by using special city bonds or “pay as you go” reimbursements, funded through increased property or sales taxes from the improved property. TIF establishes a partnership between the city and private investors to promote economic development in conservation areas. The I-35 Redevelopment District, including projects like Merriam Pointe and Merriam Village, has benefited from TIF agreements. Major projects include a 359,000 sq. ft. IKEA and a Hobby Lobby at Merriam Village, backed by a $19.9 million TIF agreement with IKEA. Recent agreements in 2022, like Merriam Grand Station, provide incentives for commercial, civic, and residential spaces, enhancing Shawnee Mission Parkway with retail and Class A apartments.

In 2025, an agreement was made for the Merriam Grand Marketplace development which is a transformative, mixed-use development located just north of Shawnee Mission Parkway, on the site of the former Johnson County Library. This redevelopment project supports City priorities for housing diversity, economic growth, and revitalization.

▶ Shawnee Mission School District No. 512

▶ Johnson County Community College

▶ University of Kansas Edwards Campus

▶ University of Kansas Schools of Medicine, Nursing and Health

▶ University of Saint Mary

▶ Kansas State University Johnson County Extension Office

▶ Advent Health-Shawnee Mission

▶ Trinity Lutheran Manor

▶ Electrical power // Evergy

▶ Local gas // Kansas Gas Service

▶ Local phone, cable/fiber, and internet service // AT&T, Everfast, Spectrum, and Google

▶ Water // Water One

▶ Sanitary Sewer // Johnson County Unified Wastewater District

▶ Trash, Recycling, Yard Waste // Earth First Waste Solutions, Gardner Disposal, GFL, KC Disposal, Republic Services, Waste Management (Deffenbaugh)

▶ Interstate 35, Kansas City International Airport, Amtrak, Greyhound, Johnson County Transit (RideKC), KC Streetcar

▶ Operated by Johnson County, Merriam Plaza Library is located on the Merriam Community Center Campus.

Mission Statement and Values

“To serve the public with transparent government focused on progress”

The Governing Body conducted work sessions to update their mission statement and identify what they value most highly about the City. Resident input was obtained via an online survey and was incorporated into their discussions. Values identified were: quality service, convenient location, public safety, and diversity.

Planning and Goal Setting by the Governing Body

Citywide goals and objectives are reviewed and updated annually by the Governing Body. The four goals below reflect the long-range goals of the Governing Body. Additions and updates to specific initiatives were made as

part of the review process. Goals are followed by specific objectives that will gauge progress toward the goal.

City Council and staff use several processes and documents to develop long-term goals, including:

Resident surveys – These are conducted every three years to help set goals and measure the City’s progress. The most recent survey in spring 2024 revealed:

▶ 93% said they were “very satisfied” or “satisfied” with the overall quality of city services

▶ 92% were satisfied with the overall quality of life in the City

▶ 80% were satisfied with the overall value received for tax dollars and fees

Preliminary Budget Work Sessions – The Council and staff meet from February through July each year to discuss the budget and the Five-year Capital Improvement Plan (CIP). These sessions review financial priorities for the upcoming budget.

Five-year Capital Improvement Plan – The Council sets capital improvement priorities based on citizen input and conducts site visits. Revenue from a 0.25% special tax supports the CIP, funding infrastructure and other city improvements.

Twenty-year Comprehensive Plan – Adopted in 2021, this plan is a long-range policy for city development and includes objectives like:

▶ Promoting diverse housing options and sustainable growth

▶ Enhancing transportation mobility and public services

▶ Supporting mixed-use and commercial centers

Economic Development – The City identifies redevelopment opportunities in limited spaces, partnering with developers to maximize economic potential.

Parkland Development – Limited by available space, the City plans strategically to purchase and develop parkland as opportunities arise.

Downtown Enhancements – The City revitalized downtown with Merriam Marketplace for events like the farmer’s market, and made upgrades to Merriam Drive with expanded sidewalks and decorative elements. Upcoming projects include further downtown improvements and drainage upgrades.

Infrastructure Maintenance – The City maintains a nine-year schedule for street overlays, funded by state fuel taxes and the Capital Improvement Fund.

Ten Year Major Equipment Replacement Schedule – The City maintains a ten-year equipment replacement schedule for items over $5,000 per department, forecasting needed General Fund transfers to the Equipment Reserve Fund for annual budgeting.

Five Year General Fund Balance Projections – The City projects General Fund balances, factoring in revenue and expense trends, with regular updates to prioritize spending.

ENHANCE COMMUNITY IDENTITY & CONNECTIONS

PROVIDE EXCEPTIONAL SERVICE DELIVERY

IMPROVE PHYSICAL CONDITIONS & PROPERTY VALUES

MAINTAIN ECONOMIC VITATLITY

Facilitate better communication between the city and its citizens

▶ Continue to review, revise and enhance the city's communications to ensure relevancy, accessibility transparency and a superior user exprience.

▶ Provide opportunities for residents to engage in city affairs utilizing the Community of All Ages playbook.

▶ Conduct a resident and business satisfaction survey every three years to gauge public perception of service delivery.

▶ Complete a community-wide strategic planning process.

Encourage participation in sustainability initiatives including economic, environmental, and social sustainability.

▶ Coordinate the annual recycling event with other NEJC cities.

▶ Identify a preferred vendor and negotiate a discounted rate for an optional curbside composting service and curbside glass recycling.

▶ Participate in the metro-wide Climate Action KC discussion and explore opportunities to implement relevant programs in the community.

▶ Consider sustainability and use high design standards for construction and repairs of City buildings.

▶ Provide funding in the 5-yr CIP Budget for the selection, creation and installation of public art.

▶ Investigate a policy providing for private funding of art throughout the City, similar to a "% for the Arts" policy.

Department Goal: Enhance citizen engagement and transparency

Objectives:

▶ Continue expanding reach through digital platforms and multimedia content.

▶ Improve accessibility and user experience on merriam.org.

▶ Streamline information-sharing processes between departments.

*The City stopped using Twitter in April 2024.

Department Goal: Enhance citizen engagement with the City

Objectives:

▶ Utilize Community Development tracking software to provide information to citizens regarding code enforcement activities.

▶ Utilize Community Development tracking software to allow for the business and landlord licenses and residential permit submission to be done on-line.

▶ Continue supporting the City’s website as a tool for citizens to submit code concerns.

▶ Utilize the Neighborhood Service Manager to engage neighborhood groups and associations and be a liaison between those groups and the City.

Department Goal: Provide and promote multi-dimensional inclusion and access for facilities and programming.

Citywide Goal Supported: Enhance Community Identity and Connections

Objective: Anticipate the needs of the changing community. Structure programs, marketing materials and forms to be more inclusive.

Department Goal: Increase community awareness of park improvement and amenities.

Citywide Goal Supported: Enhance Community Identity and Connections. Objective: Promote availability of open space amenities available for private rental.

*2020 / 2021 Coronavirus Pandemic with gathering restrictions / limitations. 2020 Field rental increased as organizations looked for open space to hold programs outside.

Department Goal: Enhance citizen engagement in Parks and Recreation activities and programs by creating and promoting programs that enhance the quality of life for residents.

Citywide Goal Supported: Enhance Community Identity and Connections

Objective: Use information obtained from the completion of the Facilities Master Plan process to design a variety of programs to meet needs of citizens in the new community center.

Department Goal: Utilizing the community response, implement the vision desired for recreation facilities.

Citywide Goal Supported: Enhance Community Identity and Connections

Objectives:

▶ Evaluate facility operations and implementation plans to remain relevant with the needs of the community.

▶ Develop and evaluate recreation program operation plan to identify staffing needs, program schedule and fee structures to be competitive within the market.

▶ Evaluate operating procedures.

Department Goal: Offer events and activities with a community focus to provide opportunities to enrich citizens’ lives through social, educational and cultural events.

Citywide Goal Supported: Enhance Community Identity and Connections

Objectives:

▶ Events experiencing a decline of 30% or greater in attendance in one year will require a SWOT evaluation to determine cause and if a change is needed.

▶ Evaluate existing event locations with the plan to enhance or expand current events.

▶ Host a minimum of four special events with varying audience appeal at the Merriam Marketplace through the year.

Department Goal: Provide and promote multi-dimensional inclusion and access for facilities and programming.

Citywide Goal Supported: Enhance Community Identity and Connections

Objective: Anticipate the needs of the changing community. Identify events, programs and activities to be more inclusive.

Department Goal: Operate and utilize the Merriam Marketplace in an efficient manner

Citywide Goal Supported: Enhance Community Identity and Connections

Objectives:

▶ Increase Farmers’ Market visitor attendance.

▶ Increase public awareness of Farmers’ Market through use of various marketing strategies to include but not limited to social media marketing, various print and electronic media advertising.

Department Goal: Community education

Objectives:

▶ Provide community education programs like Citizen’s Police Academy, National Night Out Against Crime, and school events.

▶ Continue the Coffee with a Cop program to allow citizens time to interact with patrol officers.

▶ Continue training community members for “active shooter” events.

Department Goal: Beautify the City

Objective: Share information with citizens on how to build and maintain a hanging flower basket.

Department Goal: Enhance engagement with affected property owners on all projects

Objectives:

▶ Provide clear expectations to affected property owners regarding capital improvement projects.

▶ Negotiate all required easements and private property impacts in a uniform and equitable manner, without the use of eminent domain.

▶ Provide timely project updates to residents that enhance communication and understanding.

Improve the utilization of technology to increase efficiency.

Explore opportunities to better connect existing technologies to provide a more robust and seamless user experience.

Recruit and retain the best talent within NE Johnson County that best reflects the diversity of our community.

Appropriately fund competitive compensation packages and train employees to be the best asset they can.

Investigate and develop pilot programs to explore new ways to deliver services.

Reguarly monitor the results of new initiatives and adjust accordingly to maximize efficiency and ease of access.

Continue the mental health co-responder program and regularly monitor usage to anticipate future needs.

Investigate a single hauler trash, recycling and leaf removal program.

Department Goal: Efficient and effective operations

Objectives:

▶ Hold worker’s compensation claims below 5% of eligible payroll through proactive safety and training programs.

▶ Maintain active investment of unrestricted cash at or above 75% of available funds.

▶ Reduce property and liability claims through enhanced risk management practices.

Department Goal: Department Goal: Support employee wellness and professional growth.

Department Goal: Efficient and effective operations

Objectives:

▶ Allow attorneys to file documents online.

▶ Continue to work on scanning and e-filing in an effort to become paperless.

▶ Remodel clerk’s office to make the office a more efficient work space.

Department Goal: Efficient and effective technology services

Objectives:

▶ Enhance the network infrastructure to accommodate more cloud-based applications.

▶ Continue to decrease the physical number of Windows servers with virtualization.

▶ Assist departments with applying appropriate technologies to serve the community better.

▶ Research and develop more centralized services (wireless, access control, digital signage).

▶ Explore system redundancy and its cost-effectiveness.

* A Mission-Critical Server refers to a server essential for City operations and connections with other outside services that significantly impact City services.

Department Goal: Data driven policing

Objectives:

▶ Monitor Part One violent crime (Murder, Rape, Robbery, Aggravated Assault/Battery) reports for patterns, increases, and effective clearance percentage.

▶ Monitor Part One property crime (Burglary, Theft, Vehicle Theft, Arson) reports for patterns, increases, and effective clearance percentage.

Department Goal: Efficient and effective operations

Objectives:

▶ Maintain

▶ Maintain average response time for non-emergency calls for service to 9 minutes or less.

Objective: Provide safe streets with traffic enforcement as a means to reduce traffic accidents.

Department Goal: Cross train department employees to enhance productivity

Objectives:

▶ Continue to develop employees through IMSA certifications. (Work Zone, Signs & Marking, Traffic Signal Maintenance & Roadway Lighting, Certified Playground Inspectors & KDOT Inspector’s Certifications)

▶ Continue to develop supervisors in the Public Works Institute through the APWA.

Department Goal: Deliver quality projects in an efficient manner

Objectives:

▶ Continue taking programmed projects through a public process, design, and construction to meet the Five-year Capital Improvement Plan schedule.

▶ Ensure high quality projects through a detailed and comprehensive construction inspection process.

▶ Effectively manage all projects to achieve substantial completion

▶ Provide monthly updates regarding actual versus budgeted expenditures of capital improvement projects.

▶ Effectively administer contracts for design and construction services for all projects.

Reduce

▶ Utilize the Neighborhood Services Manager to connect residents with the available resources to maintain their properties.

▶ Ensure repeat code offenders are fairly and appropriately adjudicated in Municipal Court.

Sustain capital improvement efforts.

▶ Continue to submit for federal and county grants to leverage the use of City funds.

▶ Coordinate multi-year CIP efforts to minimize disruptions within neighborhoods.

▶ Continue to explore city-funded grant opportunities to target specific areas of need within neighborhoods.

▶ Continue to increase our urban forest throughout the City.

▶ Create and maintain a well-connected transportation network that includes efforts related to walkability, bikeability, and providing safe access to both sides of I-35.

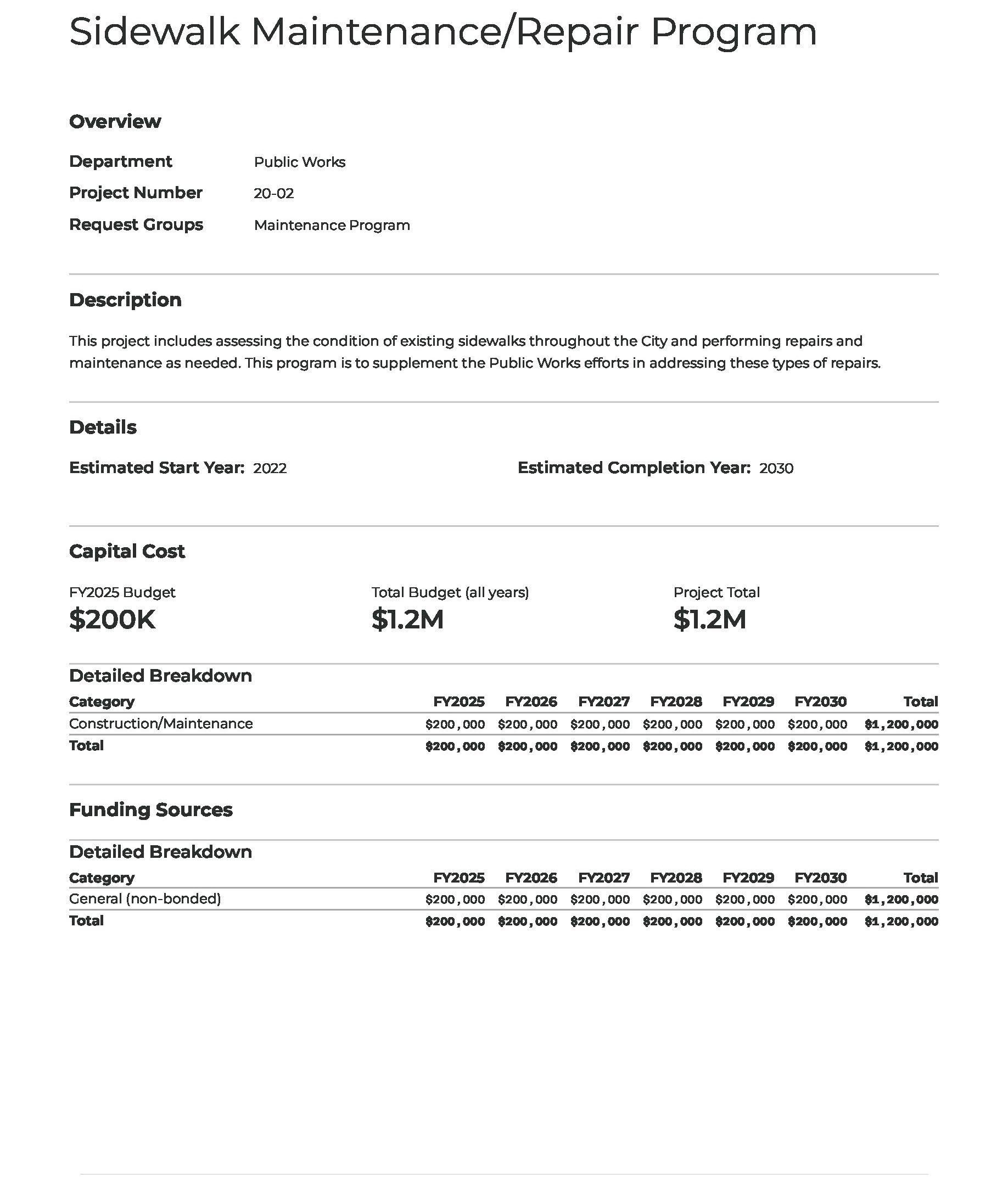

▶ Continue to maintain streets, trails, and pedestrian pathways.

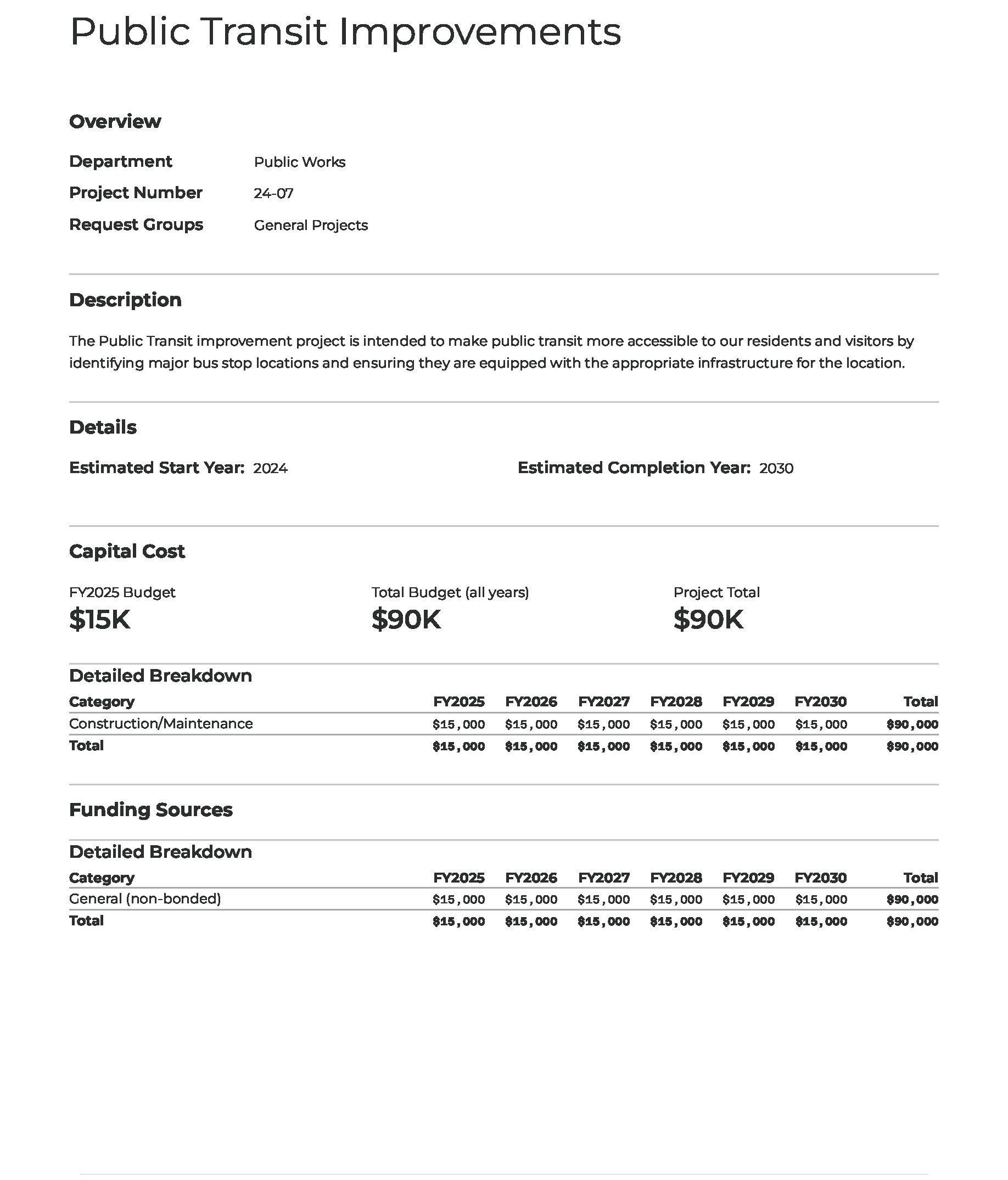

▶ Make public transit more accessible by identifying major bus stops and ensuring they are equipped with the appropriate infrastructure for the location.

Department Goal: Utilize data to efficiently and effectively enforce City property maintenance codes

Objective: Assist code enforcement officers in the enforcement of property maintenance.

Department Goal: Enforce City codes fairly to improve physical conditions in the community

Objective: Enforce City codes uniformly and fairly. Achieve closure of 80% of code cases within 30 days.

Department Goal: Improve our neighborhoods through investment in our parks

Objectives:

▶ Continue to support Adopt-A-Park program to assist with keeping parks clean and noting potential maintenance issues.

▶ Develop a park evaluation program to identify future improvements for neighborhood parks to improve experiences of users and assist in maintaining property value of neighborhoods.

▶ Continue to implement portions of park master plan for Waterfall Park.

Department Goal: Maintain and upgrade existing streetlight infrastructure

Objectives:

▶ Conduct quarterly streetlight inspections.

▶ Repair known streetlight outages within 48 hours. Department Goal: Provide a safe and enjoyable environment for users of City parks and trails.

Department Goal: Provide a safe and enjoyable environment for users of City parks and trails.

▶ Continue to repair substandard areas on Streamway Trail along with controlling vegetation overgrowth.

▶ Conduct and document monthly playground inspections. Repair or replace unsafe items found during inspections within 24 hours of inspection.

Department Goal: Identify infrastructure needing replacement such as asphalt, curb, and sidewalk

Objectives:

▶ Maintain at least 85% of City streets with a condition rating of fair or better.

▶ Conduct annual Overlay Program for streets and coordinate with Capital Improvement Program department.

▶ Map and identify curbs and sidewalks needing repair and coordinate with Capital Improvement Program department.

Department Goal: Program CIP based on a logical priority system that considers needs and available funding.

Objectives:

▶ Continue program development of projects.

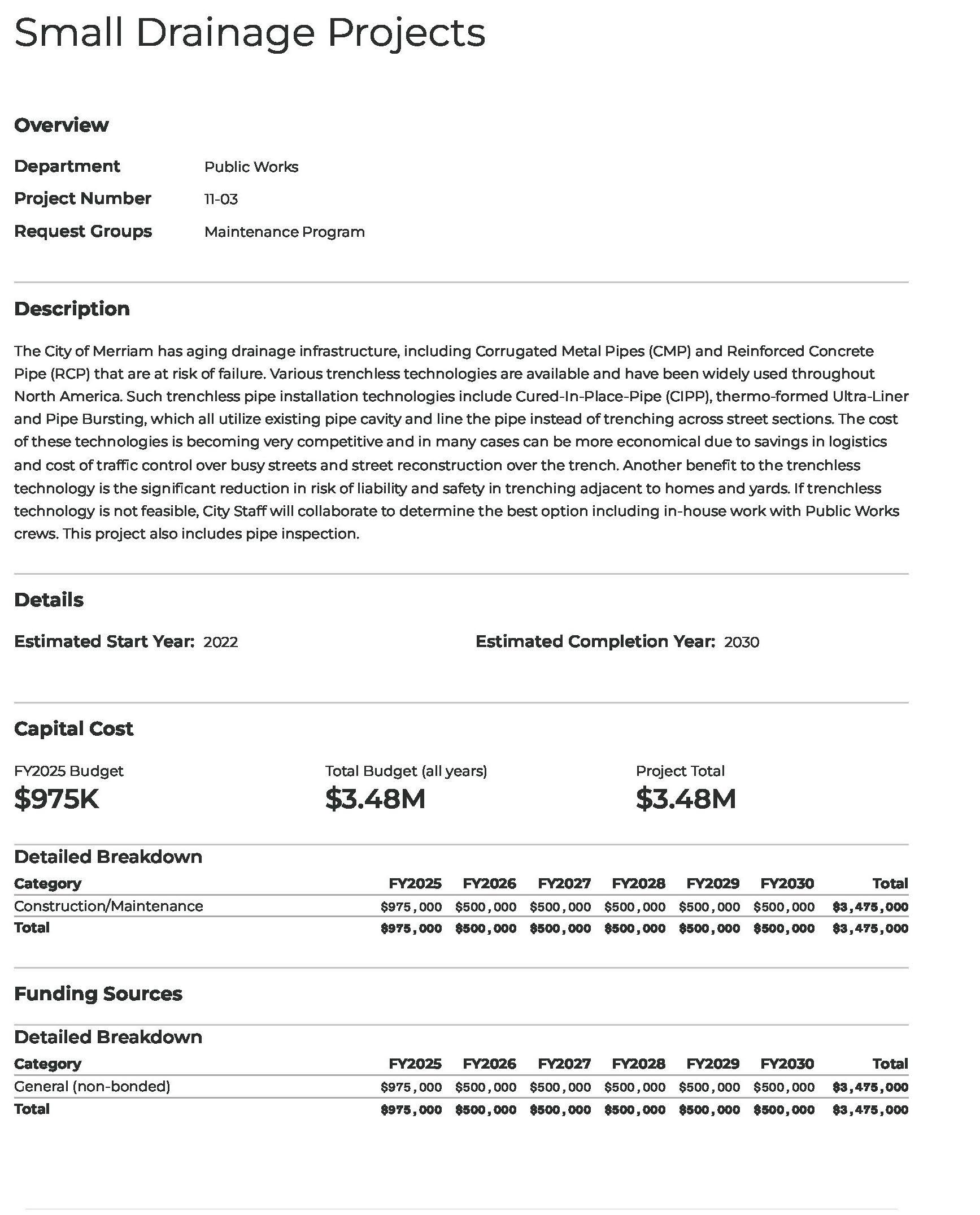

▶ Continue support for USACE Upper Turkey Creek Project.

Provide support to existing businesses.

▶ Focus on capital improvements that enhance economic opportunity and minimize business disruption.

▶ Develop relationships with local owners and business associations.

Expand the commercial tax base.

▶ Promote Merriam as being an attractive and viable option for redevelopment opportunities.

▶ Update the Tax Increment Financing Policy (TIF) and adopt a new Community Improvement District (CID) Policy that includes the city’s preference that development include sustainability best practices.

Facilitate a public discussion about future development possibilities in downtown Merriam.

▶ Continue to promote the Upper Turkey Creek mitigation project as a viable option to enhance downtown.

Promote a diverse revenue structure and maintain adequate reserves.

▶ While maintaining adequate reserves and funding City services, reduce the City’s mill levy when possible..

Department Goal: Facilitate economic and community development

Objectives:

▶ Adopt a new Community Improvement District policy.

▶ Update Tax Increment Financing policy.

▶ Identify appropriate tools for use by parties interested in establishing businesses in Merriam.

Department Goal: Serve as a connector between local tourism partners and visitors through marketing, sales, and service to drive visitation in Merriam.

Objectives:

▶ Distribute translated rack cards and provide Merriam promotional giveaways to international guests through hotels and events during World Cup.

▶ Coordinate a micro campaign aimed to promote Merriam during shoulder seasons (winter/ spring break).

▶ Conduct tourism partner visits to exchange ideas, solve challenges, and maintain continual communication.

▶ Increase destination awareness by securing paid and earned media placements such as travel blogs, regional lifestyle magazines, and influencer partnerships that highlight Merriam’s attractions, events, and visitor amenities.

▶ Track the progress and outcomes of the proposed Kansas Sports Tourism Bill to assess potential impacts on Merriam’s visitor economy.

Department Goal: Strengthen Merriam’s business community by supporting business expansion and retention, fostering connections among local businesses, and serving as a central resource for guidance, networking, and growth opportunities.

Objectives:

▶ Enhance the business section at merriam.org/business to better position Merriam as an ideal place to start or conduct business.

▶ Host networking events and workshops, to foster collaboration among local businesses. Explore hosting a trades fair for local high school students through the NEJoCo Chamber.

▶ Provide support to existing Merriam businesses by connecting them with city programs, incentives, and resources that streamline operations, encourage growth, and strengthen longterm business success.

▶ Conduct quarterly business retention visits and distribute a regular e-newsletter for subscribing businesses.

▶ Continue offering the Shop Merriam program to new and renewing Merriam businesses to encourage visitation to local shops and service businesses.

▶ Continue the process to further the Certified Economic Developer accreditation.

Department Goal: Promote and stimulate quality development to enhance our economic base

Objective: Facilitate the appropriate development of Advent Health Medical Center, downtown Merriam, and the K-Mart site.

Department Goal: Enhance City’s economic base by offering activities and programs that promote the use of Merriam Marketplace

Citywide Goal Supported: Maintain economic vitality

Objective: Provide some form of bi-monthly entertainment or activity during the Farmers’ Market.

Department Goal: Promote and stimulate quality development to enhance the City’s economic base.

Objective: Promote redevelopment and new development within Merriam by improving and enhancing public infrastructure.

The accounts of the City are organized on the basis of funds and groups of accounts, each of which is considered to be a separate accounting entity. The operations of each fund are accounted for by providing a separate set of self-balancing accounts, which is comprised of its assets, liabilities, fund balance, revenues and expenditures or expenses, as appropriate. The types of funds maintained by the City are as follows:

General Fund: The principal fund of the City and accounts for all financial transactions not accounted for in other funds. The general operating expenditures, fixed charges and capital improvement costs that are not paid through other funds are financed through revenues received by the General Fund. The General Fund is used to pay for the expenditures of various departments throughout the City, with a few exceptions as noted below under Special Revenue Funds. The Risk Management Reserve Fund accounts for transfers from the General Fund and is used for the payment of risk management related expenses. For financial reporting purposes, the City's Risk Management Reserve Fund, which has its own legally adopted budget, is reported with the General Fund. Revenue sources include property and sales taxes.

Special Revenue Funds: Used to account for revenues derived from specific taxes, governmental grants or other revenue sources which are designated to finance particular functions or activities of the City as identified below.

▶ Special Highway Fund: accounts for Motor Fuel tax receipts and is used for construction, maintenance and repairs of City roads.

▶ Special Parks and Recreation Fund: accounts for one third of the Special Alcohol tax receipts and is used to purchase and maintain City parks and recreational services and facilities.

▶ Special Alcohol Fund: accounts for one third of the Special Alcohol tax receipts and is used to support the Johnson County Alcohol Tax Fund programs and the City’s own programs to prevent and manage substance abuse.

▶ Transient Guest Tax Fund: accounts for Transient Guest tax receipts and is used to enhance the community in ways that attract visitors and economic development.

▶ I-35 TIF Fund: accounts for receipts from the property and sales tax increments in the redevelopment district.

Bond and Interest Fund: Used to account for the accumulation of resources for and the payment of principal, interest and other related costs of the City’s general obligation bonds. Resources include a dedicated mill levy and transfers from the Capital Improvement Fund.

Capital Projects Funds: Used to account for and report financial resources that are restricted, committed, or assigned to expenditures for capital outlays including acquisition or construction of capital facilities and other capital assets.

▶ Capital Improvement Fund is used to account for monies derived from General Fund transfers, special sales taxes for streets, grants and contributions of outside agencies used to finance infrastructure improvements in the City. This fund also accounts for monies tax incremental financing (TIF) revenues not committed to developers.

▶ Equipment Reserve Fund accounts for transfers from the General Fund and is used to finance the acquisition of major equipment purchases.

The City has additional funds that are audited, but not included in the budget. The special law enforcement fund accounts for monies derived from property seizures related to illegal drug arrests and prosecution as well as the disbursement of monies for drug enforcement purposes. The Grant Fund is used to account for major federal grants.

The Expenditure account numbers used in the City of Merriam’s budgeting and accounting process are broken down by fund, function, department, division, and object.

A function is a group of related activities aimed at accomplishing a major service. A department is a major administrative section of the City of Merriam, which indicates overall management responsibility for an operation, or group of related operations within a functional area. A division is a segment of the department, which is assigned a specific operation. The expenditure object number designates a specific expense account and is consistently applied throughout all departments, divisions, and organizations.

The Revenue account numbers used in the City of Merriam’s budgeting and accounting process are broken down by fund, section, and object.

Sections are categories of revenues such as property taxes, non-property taxes, licenses and permits, intergovernmental, charges for service, fines and forfeitures, use of money, miscellaneous, and non- revenue receipts. The revenue object number designates a specific revenue account and is consistently applied in funds.

The Special Highway Fund covers street expenses, the Special Alcohol Fund supports Police education programs, the Special Parks & Recreation Fund aids park purchases, the Transient Guest Tax Fund funds community events, the Risk Management Fund covers risk consulting fees, and the Equipment Reserve Fund supports large equipment purchases across departments.

Many General Fund programs generate insufficient revenues to cover operational costs, relying on sales, property taxes, and other general revenues for support. For instance, building permits fund less than one-fifth of the Community Development department’s expenses. City Council policy decisions will guide resource allocation during funding pressures.

All governmental and agency fund types use the modified accrual basis of accounting, where revenues are recorded when collected, unless they are measurable and available for City operations. Significant revenues susceptible to accrual include delinquent property taxes, sales and utility taxes, interest, and certain grants. Expenditures are recorded when the liability is incurred, excluding long-term debt interest. Intergovernmental revenues follow specific legal and contractual guidelines, with virtually unrestricted funds recognized upon receipt or earlier if criteria are met. Licenses, permits, service charges, fines, and miscellaneous revenues are recorded when cash is received. Proprietary fund types use the accrual basis, recognizing revenues when earned and expenses when liabilities are incurred, but the City does not have proprietary fund types.

The City Council must adopt a balanced budget, aligning total resources with obligations, as mandated by State Budget Law, which prohibits excessive spending and unappropriated balances in tax-supported funds. The budget is prepared on a modified accrual basis, utilizing prior year’s ending cash balances to balance the budget. Although the fund balance is not an annual revenue source, year-end carryovers support future operating and capital budgets, with reserves critical for unexpected demands and revenue shortfalls. Kansas statutes require budgeted ending fund balances to be zero, but the City does not expect to expend these reserves. The City meets its reserve goal of 30-35% of General Fund operating revenue through 2026. The Bond and Interest Fund pays debt service costs through property taxes and a 1/4 cent sales tax for the community center, while the non-major Equipment Reserve Fund varies based on projected needs, and the Risk Management Fund acts as a contingency for uninsured expenditures. Encumbrances are treated as budgetary expenditures in the year incurred.

To ensure fiscal responsibility, the Kansas Legislature enacted a cash-basis law in 1933 (K.S.A. 10-1101 to 10-1122) prohibiting municipalities from incurring debt beyond the funds available in their treasury. This law prevents municipalities from spending more than their annual operating revenues and issuing short-term debt for operating expenses. Kansas Statutes require municipal record-keeping that complies with cash-basis and budget laws, maintaining separate funds for specific purposes and projects per state law, bond covenants, tax levies, and City Council resolutions. An annual report details revenues, encumbrances, and expenditures against budgeted amounts.

The City of Merriam financial policies and provisions, compiled below, set forth the basic framework for the overall fiscal management of the City. These policies assist the decision making process of the City Council and the Administration. These policies provide guidelines for evaluating both current activities and proposals for future programs and budgets. Some policies are covered by formally adopted City Council policies; others are covered by administrative policy only.

Financial policies aid the City by improving financial management, improving financial position, and improving the creditworthiness of the City. They also serve to ensure that all financial transactions conducted by or on behalf of the City, its agencies, departments, officials, and authorized agents, shall be made in a manner and method which provides for the most proficient and effective management of the financial resources and funds of the City. These policies provide for the maximum protection of the City taxpayer, in accordance with and utilizing established financial management practices, accounting standards, and auditing requirements.

Included in these are specific policies related to operations, accounting and auditing, reserves, capital projects, cash management, debt, and budget.

The City Council is responsible for establishing and authorizing policies and procedures for the management of all financial resources and transactions of the City. The City Administrator, Finance Director, and other City officials are responsible for adopting administrative procedures necessary to implement the financial policies.

It is the policy of the City to maintain sound financial practices and policies which are viable and current according to generally accepted accounting principles, auditing standards and best financial management practices, and which are consistent and comply with all applicable state and federal laws. The City shall regularly review its policies and procedures and reserves its right to change and supplement them as necessary.

The City will attempt to maintain a diversified and stable revenue system to shelter it from short term fluctuations in any one revenue source.

The City will attempt to obtain additional revenue sources as a way of ensuring a stable balanced budget.

The City will establish user charges and fees at a level relative to the cost of providing the service.

The City will annually review its user charges and fees. The City will consider market rates and charges levied by other public and private organizations for similar services.

The City acknowledges the fact that property values have historically increased in this area of the country. Increasing property values will consequently increase the taxes that citizens pay unless the mill levy is reduced by a comparable level. The City will annually review the effect of increasing property values and will take that into consideration when establishing the mill levy rate. The City of Merriam’s property tax rate has trended down over the past few years. A clerical error in the 2024 budget artificially decreased the rate significantly, however the 2025 budget corrected the error and increased the rate back to an appropriate level. City Council’s priority is to lower the mill levy rate as feasible each year, which was accomplished with over a 0.25 decrease for 2026.

The Council has adopted a policy that dictates the use of sales tax revenues. The City’s local sales tax is initially deposited into the General Fund. After ensuring the General Fund reserve policy is followed, up to 50% of sales tax receipts is transferred to the Capital Improvement Fund. The 0.25% special streets and stormwater sales tax, which was renewed in January 2020, and will be collected through 2030, is utilized for applicable capital improvement projects. The 0.25% special sales tax for Parks and Recreation, which will be collected through 2027, partially funds the debt service on the new community center.

The City will manage expenditures to assure that service will be efficient and cost effective in carrying out the public policy directives established by the Council.

The City will actively participate in risk management pools with other local area governments as long as the pools continue to outperform the market rates for these same services.

The City will continue to support a scheduled level of maintenance and replacement of its infrastructure, fleet, and other equipment and facilities.

The City maintains a reserve and fund balance policy which sets a target of 30% to 35% of General Fund revenue for the combined General Fund and Risk Management Fund balances. If projected fund balances fall below the target range, the policy requires the City Administrator to submit a plan to restore the balances within range of the next five-year General Fund balance projection. The Risk Management Reserve Fund provides security from uninsured losses including emergency events or lawsuits, and conditions resulting in unanticipated expenditure requirements or revenue fluctuations.

The 2026 Budget satisfies the policy regarding General Fund reserves.

The City will annually develop a five-year plan for capital improvements in accordance with City policies.

The City will adopt an annual capital budget based on the five-year capital improvement plan.

The City will deposit all funds the day following the reciept. Cash and checks will be secured overnight in a lockbox. The City will collect revenues aggressively, including past due bills of any type.

The Council has adopted a formal investment policy to guide the investment of idle funds. The policy emphasizes the preservation of principal, while seeking to obtain the best available rate of return. The policy fully complies with statutes concerning the investment of funds by municipalities in Kansas.

The City maintains a debt financing policy to ensure that debt is managed in a fiscally prudent manner and complies with state/federal laws, minimizes taxpayer costs, does not adversely impact future generations, and will not harm the City’s credit rating.

When general obligation debt is issued, the City will seek to obtain interest costs that are the lowest attainable in the market, preferably through competitive sale. The City will seek to maintain good financial policies and financial reporting to aid in the acquisition of the best market rates. The City will comply with the legal debt margin established by the statutes. The State of Kansas limits bonded debt to 30% of assessed valuation (excluding: revenue bonds, storm drainage or sanitary sewer improvement bonds and refunding bonds).

The City will follow the Generally Accepted Accounting Principles (GAAP) as promulgated by the Governmental Accounting Standards Board (GASB) for budget preparation and financial reporting. The City will submit to an annual audit by an independent certified public accountant with the goal of attaining an unqualified opinion. The City will prepare an Annual Comprehensive Financial Report (ACFR) and submit it for consideration to the Government Finance Officers Association for their Certificate of Achievement for Excellence in Financial Reporting. The City will prepare a Popular Annual Financial Report (PAFR) and submit it for consideration to the Government Finance Officers Association for their Award of Outstanding Achievement in Popular Annual Financial Reporting. The City will follow the standards of full disclosure in all financial reporting and bond offering statements.

The City Council must adopt a balanced budget, where total resources equal total obligations in accordance with K.S.A. 79-2927. Total resources include beginning fund balances and total obligations include contingency and ending fund balances. The budget adoption and amendment process is described further on the following pages. This budget complies with all relevant state laws and City financial policies.

It is the policy of the City Council to plan for the orderly operation of the City by the adoption of an annual budget of all anticipated revenues and expenditures according to K.S.A. 79-2927 et. seq. Total resources include beginning fund balances and total obligations include contingency and ending fund balances.

Citizens are encouraged to share ideas and provide input concerning City operations as well as budgetary issues. Citizens may provide input at council meetings, public hearings, and through surveys and other forms of communication.

The City Council is responsible for reviewing and adopting an annual budget for all funds for which the City is responsible. Council must also approve large purchases, change orders to existing contractual agreements, and budget transfers between funds.

The City Administrator is responsible for recommending a balanced budget to the Council for adoption. In addition, the City Administrator provides general guidelines for budget preparation as well as overseeing budget implementation during the fiscal year.

The Finance Director is responsible for establishing the budget schedule; evaluating department requests; estimating revenues, expenses, and financial impacts of budget proposals; ensuring compliance with applicable state budget laws; providing the Council with the information necessary to make responsible decisions; and administering the policy and procedures.

During the first quarter of each year, the Finance Director and the City Administrator establish the calendar for adoption of the annual operating budget for the following year. The calendar is designed to allow sufficient time for preparation of budget requests, public comment, staff and City Administrator review, Council consideration, and publication and submission deadlines established by statute. All dates are to be considered mandatory deadlines unless otherwise modified by the City Administrator.

The Finance Director issues budget forms and instructions to departments in March. All departments shall submit their budget requests according to the schedule and instructions. The Finance Director reviews and evaluates the budget requests, and assists the City Administrator in formulating the budget to be recommended to the Council. Departments are prepared to fully explain and justify their requests to the City Administrator.

The City Administrator formulates a recommended budget and submits it to the Council for consideration in July. The Council will meet in work sessions to consider and discuss the budget. The Council may invite officials, departments, and agencies to present additional information or justifications concerning their requests. Copies of the proposed budget summary are available to the public at City Hall and on the website by mid-July.

By June 15, the County Clerk will calculate and provide to the City the Revenue Neutral Rate (RNR) along with the most current assess valuation. The RNR is the rate for the current tax year that would generate the same property tax revenue as levied the previous tax year using the current tax year’s total assessed valuation. The city is required to notify the County Clerk by July 20 of its intent to levy above the RNR.

The Finance Director publishes the proposed budget, intent to exceed the RNR and notice of a public hearing in the local newspaper. The public hearing shall be scheduled at least 10 days later than the date of the publication and between August 20 and September 20. In addition to city required notifications regarding the RNR Hearing, for tax years commencing after 2021, the County Clerk will notify all taxpayers of intent to levy above RNR.

The Council will then hold a public hearing on the date and time specified in the publication for the purposes of hearing taxpayer questions and comments concerning the intent to exceed the RNR and the proposed budget. Copies of the Budget in Brief are available at this meeting. The Council adopts an annual budget and the Finance Director files it with the County Clerk. Copies of the expanded budget document are available to the public at City Hall and on the website in late fall.

The process of amending the City’s budget is outlined and authorized by K.S.A. 79-2929a. Amendments to the City’s budget are allowed only in the event of an increase in the original budget for previously unbudgeted increases in revenues other than ad valorem property taxes. To amend the budget the City is required to publish a “Notice of Hearing” 10 days prior to the hearing. The City then must hold a public hearing and forward amended budget forms to the County Clerk for certification.

13 14 15 16 17 18

20 21 22 23 24 25 26 27 28 29 30 31

10 Solicit Goals & Objectives Update from Council Admin and Fin

24 Accept New Goals & Objectives Admin & CC

25 Review New Goals and Budget Request Instructions with Dept. Heads Admin

3/31-4/4 Audit Fieldwork FD

4 Dept. Budget Requests Due Dept. Heads 7-18 Review of Dept. Budget Requests Admin and Fin 25 CIP Tour CC, Ad,in, PW, and Fin

28 5-Year Capital CIP Presentation and Discussion CC, Admin, PW, and Fin

4/21-6/6 Develop Recommended Budgets Admin and Fin

4/21-6/6 Develop Recommended Budgets Admin and Fin

25 Discussion of 5-Year CIP Updates Admin, PW, and Fin

3/31-4/4 Audit Fieldwork Fin

4/22-6/6 Develop Recommended Budgets Admin and Fin

9 Preliminary Operating Budget Discussion Review 2025/2026 Review Projections CC, Admin, and Fin

13 Revenue Neutral Rate and Tax Valuations Available Johnson County Clerk

24 Review Detailed Budget Drafts and Determine Mill Rate CC, Admin, and Fin

The City of Merriam has developed a diverse base of revenues to fund its operational and capital needs. The purpose of this section is to describe the major revenue sources and trends and how these affect the City. Special emphasis is placed on five major revenue sources. This set of revenues is significant in that they collectively represent 75% of the City’s projected current revenues in 2026.

Current revenues are those funds that the City has budgeted to collect in 2026. Current revenue does not include beginning fund balance, interfund transfers, or bond proceeds. Each major source of revenue is described on the following pages. These five major revenue sources and their contribution to overall revenues are summarized in the charts below.

In 1994, the City established the I-35 Redevelopment District (the District) pursuant to Kansas Statute Annotated 12-117. Real property taxes produced from that portion of the current assessed valuation of real property within the District in excess of the base year assessed valuation (the tax increment) are captured by the District. In addition, 50% of certain sales taxes in excess of base year collections are also captured. These revenues can be used to pay for redevelopment project costs within the District.

The City currently has four tax increment financing agreements with developers:

▶ IKEA Merriam: The 360,000 square foot IKEA home furnishing store at I-35 and Johnson Drive opened in September 2014. The City committed future sales and property tax increments to IKEA Property, Inc., a “destination-retailer”, who attracts shoppers from throughout the region.

▶ Merriam Village: This 17-acre site located near Johnson Drive and I-35 includes a 55,000 square foot Hobby Lobby (craft and home décor), Quik Trip convenience store, and four fast food restaurants. The City has committed to provide future property tax increments to Developer’s Diversified Realty, Inc.

▶ Merriam Grand Station: Provides reimbursement in eligible project costs for the construction of approximately 10,000 square feet of restaurant and retail space, approximately 10,000 square feet of civic activity space and outparcels totaling approximately 11,000 square feet.

▶ Merriam Grand Marketplace: This development is located just north of Shawnee Mission Parkway, on the site of the former Johnson County Library. This redevelopment project includes over 200 modern apartment units, with 18 designated for affordability, one to two sit-down restaurants, a grocery store, and green spaces and pedestrian pathways.

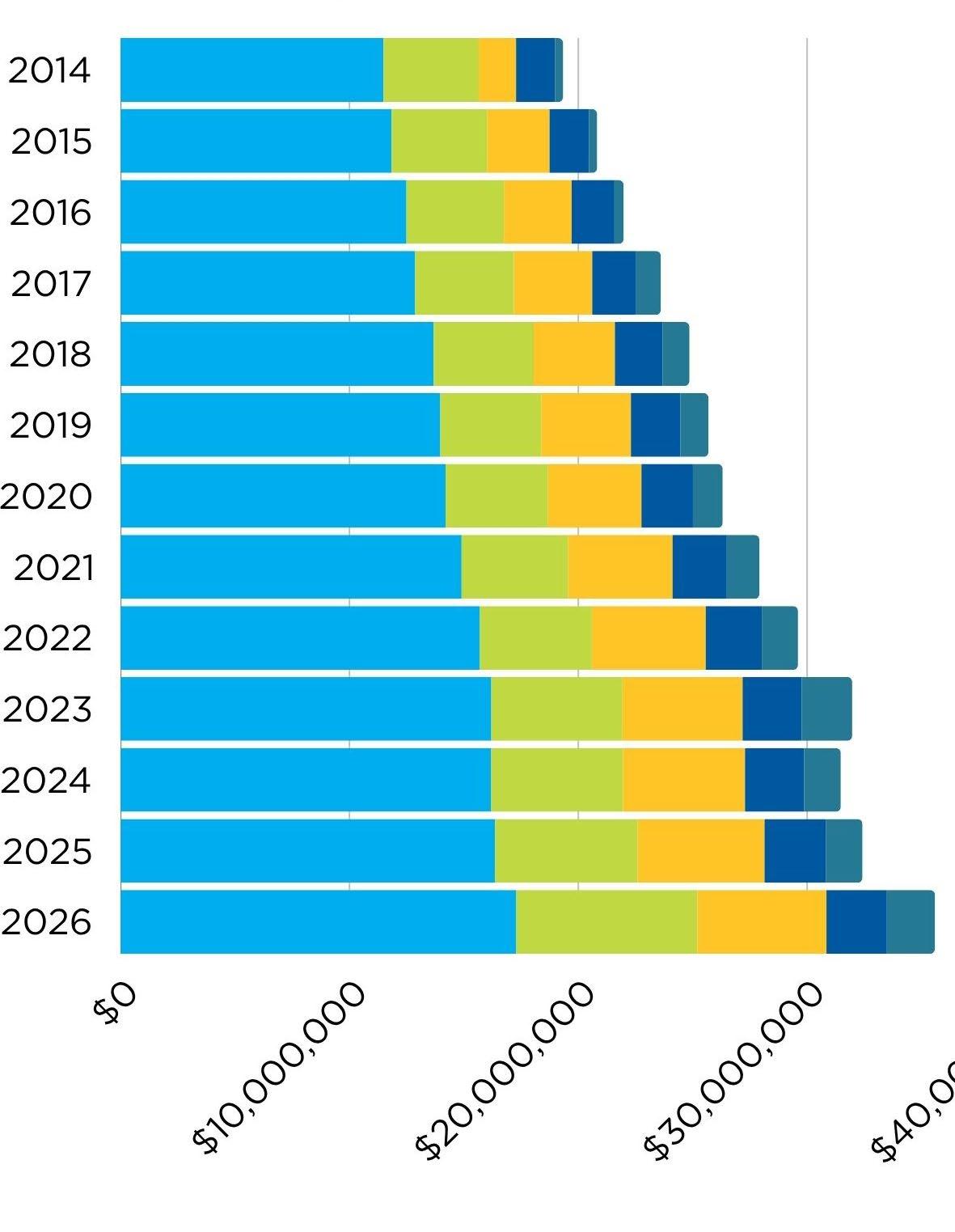

Property taxes are one of Merriam’s most stable and significant revenue sources, providing a dependable foundation for funding essential city services and long-term capital investment. Property taxes are levied on the assessed valuation of real and tangible personal property, as certified by the Johnson County Clerk each year.

The assessed valuation established and mill levy set in 2025 fund the 2026 Budget. The City’s total budgeted ad valorem property tax revenue for 2026 is $7,913,059, which accounts for approximately 17.5% of all current revenues. Within the General Fund, property taxes comprise about 28.4% of total current revenues (excluding transfers).

The 2026 mill levy is set at 26.412 mills, representing a decrease of 0.282 mills from the 2025 rate of 26.694. This marks the second consecutive year the City has reduced its property tax rate, reflecting Merriam’s ongoing commitment to fiscal stewardship and taxpayer value.

Despite the rate reduction, stable growth in assessed valuation, driven by continued commercial investment and sustained residential property strength, ensures sufficient funding for operations and capital priorities. The City’s ability to lower its rate while maintaining service levels underscores a balanced financial strategy that leverages diversified revenues and disciplined expenditure management.

The City’s assessed valuation represents the total taxable value of real and personal property within Merriam and serves as the foundation for calculating ad valorem property taxes. Each year, the Johnson County Appraiser certifies the City’s valuation, which is then used by the County Clerk to determine the mill levy necessary to fund the adopted budget.

For the 2025 tax year, Merriam’s total assessed valuation increased from $261 million in 2024 to $299.6 million, an increase of $38.6 million, or 14.8%. This growth was primarily driven by continued commercial reinvestment, new residential construction, and steady appreciation in existing property values.

The sustained expansion of Merriam’s tax base allows the City to maintain high service levels while reducing the mill levy to 26.412 mills for 2026. A broad and stable valuation base continues to be one of Merriam’s strongest financial indicators, supporting long-term fiscal health and flexibility.

The City’s 2026 mill levy is set at 26.412 mills, following a 2025 rate of 26.694 mills and continuing Merriam’s trend of gradual, deliberate rate reductions. The 2025 levy represented a decrease of 0.971 mills from the 2023 rate, reflecting the City’s ongoing commitment to maintaining a stable and responsible tax rate.

It is important to note that the 2024 mill levy contained a clerical adjustment that temporarily reduced the rate below the expected level. To ensure consistency in historical reporting, future mill levy comparisons are measured against the 2023 rate, which accurately represents Merriam’s long-term fiscal trend.

The steady decline from 26.694 mills in 2025 to 26.412 mills in 2026 demonstrates the City’s continued emphasis on fiscal stewardship, operational efficiency, and sustainable tax policy, balancing service delivery with prudent financial management.

The City’s largest source of income is a 1.50% local sales tax on items purchased within Merriam. The 1.00% general City sales tax is allocated to the General Fund; a 0.25% special City sales tax supports the Capital Improvement Fund for street and stormwater projects; and another 0.25% special City sales tax supports the Bond & Interest Fund for Parks and Recreation capital improvements.

For 2026, total City sales and use tax revenues across all funds are budgeted at $17,291,644, comprising approximately 43% of total Citywide revenues. Of this total, City sales taxes are projected at $16,088,644, reflecting a 6.3% increase from the 2025 budget, while use taxes are projected at $1,203,000, maintaining stable growth consistent with consumer spending trends.

Sales and use tax projections assume continued modest economic expansion and ongoing reinvestment within Merriam’s commercial corridors, including the IKEA and Merriam Town Center districts.

The City’s share of the countywide sales tax includes four components: 1) the City’s distribution of the 0.6% countywide sales tax, 2) the original 0.25% Public Safety sales tax (effective 2011), 3) the 0.25% Public Safety sales tax (effective 2009), and 4) the 0.25% Public Safety sales tax (effective April 1, 2017). Proceeds are distributed monthly by the Kansas Department of Revenue, based on formulas reflecting both population and taxing effort across Johnson County municipalities.

For 2026, Merriam’s county sales tax revenues are budgeted at $2,640,000, representing approximately 6.6% of total City revenues. This estimate assumes collections consistent with 2025 levels, supported by steady countywide retail activity and a balanced distribution formula.

The 2026 Capital Improvement Fund budget includes $2,102,500 in Intergovernmental Grants from a variety of external sources. These revenues provide critical support for the City’s longterm capital investment strategy and are restricted to specific projects rather than ongoing operations.

For 2026, grant funding includes allocations from the Johnson County Assistance Road System (CARS) program and remaining American Rescue Plan Act (ARPA) funds, primarily supporting street and stormwater reconstruction along Merriam Drive (Johnson Drive to 55th Street). Additional reimbursements are anticipated from state and federal transportation and infrastructure programs as projects progress.

All intergovernmental revenues are tied to identified capital projects and will not be used for regular City operations. These strategic partnerships allow Merriam to leverage outside funding to complete major infrastructure improvements while preserving local resources for essential services.

Description

Local Ad Valorem Property Tax

Received from Johnson County, KS five times during the year

Levy is based on the amount needed to fund the Ad Valorem Property tax requirement for this fund based on the assessed valuation in 2025.

The basis of this tax is the assessed valuation of taxable real & tangible personal property in each county & special taxing district. State law requires that all real & tangible personal property shall be assessed at fair market value. Property is classified into various classes & assessed at different percentages based on classification. Each individual government controls the tax levy set for its jurisdiction.

Delinquent Property Tax

Received from Johnson County, KS five times during the year

Motor Vehicle Tax

Received from Johnson County, KS five times during the year.

City Sales Tax

Received from State of KS monthly

Countywide Sales Tax

Received from State of KS monthly

Based on historical receipts.

Countywide Sales Tax-Public Safety (eff. 1/1/1995)

Received from State of KS monthly

Based on information received from the County.

The County Clerk is responsible for placing on the tax rolls any land or improvements that have previously escaped taxation in the amount equal to that amount that would have been paid had the property been on the tax rolls, plus delinquent taxes paid after the due date.

The basis of this tax is the levy of a county average mill rate applied against the assessed valuation of registered motor vehicles within the City. The tax is payable in full annually at the time of vehicle registration. Distribution is made as the revenue is collected.

Based on 101% of estimated 2025. The City reviews collection trends of individual businesses in detail.

This is the City’s share of the countywide 0.5% sales tax. Based on 100% of estimated 2025 collections.

The City levies a 1% tax on all nonexempt sales within the City.

This is the City’s share of the countywide 0.25% Public Safety sales tax. Based on 100% of estimated 2025 collections. This tax does not sunset.

The proceeds of the Countywide sales tax are distributed by the State Department of Revenue based on the following formula: One half of all revenue collected within the County shall be apportioned among the County & cities in the proportion of each entity’s total taxing effort in that preceding year relative to the total taxing effort of all cities & the County in the preceding year. The remaining one half of the revenue shall be apportioned to the County & cities in the proportion each entity’s population has relative to the total population in the County. The County share shall be calculated by the percentage of people residing in unincorporated areas.

The portion of the Countywide Sales Tax due to the passage of the 1995 Public Safety Sales Tax is based on the following formula: One half of all revenue collected from the additional 0.25% sales tax shall be apportioned to the County. The remaining half shall be apportioned based on the formula used to distribute Countywide Sales Tax as previously stated.

Countywide Sales Tax-Public Safety (eff. 1/1/1995)

Received from State of KS monthly

Countywide Sales Tax-Public Safety (eff. 1/1/2009)

Received from State of KS monthly

This is the City’s share of the countywide 0.25% Public Safety sales tax. Based on 100% of estimated 2025 collections. This tax does not sunset.

The portion of the Countywide Sales Tax due to the passage of the 1995 Public Safety Sales Tax is based on the following formula: One half of all revenue collected from the additional 0.25% sales tax shall be apportioned to the County. The remaining half shall be apportioned based on the formula used to distribute Countywide Sales Tax as previously stated.

Countywide Sales Tax-Public Safety (eff. 4/1/2017)

Received from State of KS monthly

Same as Countywide Sales Tax-Public Safety (eff. 1/1/2009). This tax does not sunset.

Alcohol Tax

Received from State of KS quarterly

Same as Countywide Sales Tax-Public Safety (eff. 4/1/2017). This tax sunsets 3/31/2027.

The portion of the Countywide Sales Tax due to the passage of the 2009 Public Safety Sales Tax is based on the following formula: One half of all revenue collected from the additional 0.25% sales tax shall be apportioned to the County. The remaining half shall be apportioned based on the formula used to distribute Countywide Sales Tax as previously stated.

The portion of the Countywide Sales Tax due to the passage of the 2017 Public Safety Sales Tax is based on the following formula: One half of all revenue collected from the additional 0.25% sales tax shall be apportioned to the County. The remaining half shall be apportioned based on the formula used to distribute Countywide Sales Tax as previously stated.

Electric Franchise Fees

Received from franchisees monthly

Gas Franchise Fees

Received from Kansas Gas monthly

Phone Franchise Fees

Received from SW Bell monthly

Cable Franchise Fees

Received from franchisees monthly and quarterly

Disposal Franchise Fees

Received from franchisee monthly

Based on estimates received from the League of Kansas Municipalities.

The State levies a 10% surtax on the sale of all alcoholic beverages sold by any club, caterer, or drinking establishment. 70% of the taxes paid within City limits are returned to the respective cities & must be allocated 1/3 to each of the following funds: General, Special Parks & Recreation, and Special Alcohol.

Based on recent actual. The City levies a franchise tax of 5% of gross receipts from the electric utilities operating within the City limits.

Based on recent actual. The City levies a franchise tax of 5% of gross receipts from the gas utilities operating within the City limits.

Based on recent actual, with adjustment for gradual loss of land lines in favor of cell phones.

Based on recent actual, with adjustment for reduction in cable usage in favor of internet streaming.

The City levies a franchise tax of 5% of gross receipts from the local exchange telephone companies operating within the City limits.

The City levies a franchise tax of 5% of gross receipts from the cable companies operating within the City limits.

Based on recent actual. The City levies a franchise tax of 7% of gross receipts from the waste disposal companies operating within the City limits.

Description Key Projection Factors Applicable Laws

Occupational Licenses

Received from businesses annually

Other Licenses

Received from applicants annually

Construction Permits

Received prior to permit issuance

Community Center Fees

Received from patrons per use/ monthly/quarterly/ annual

Other Fees

Received from payer per charge

Fines

Received from defendant as paid

Interest Income

Received from financial institution monthly

Based on projections of business occupation and applicable fees.

Based on projected number of businesses requiring these licenses.

Based on historical receipts and trends, as well as known upcoming construction.

Based on department estimates and historical receipts and trends.

The governing body sets fees. Fees are analyzed annually.

See Occupational Licenses. (Liquor licenses, cereal malt beverage licenses, etc.)

The governing body sets fees. Fees are analyzed annually. Fees are linked to the value of the new construction.

Program services, aquatics and admission fees are set by the governing body. Concession fees are set by the department.

Miscellaneous Revenue

Received from payer per charge

Based on historical receipts and trends.

Primarily court fines. Based on departmental estimates.

Based on the percentage return on investments and available cash balances. Due to the variable nature of this revenue source, projections are conservative.

Based on historical receipts and trends. Based on the nature of these revenues, it is difficult to make accurate estimates.

Description

Fuel Tax

Received from State of KS quarterly

Based on estimates provided by the League of Kansas Municipalities.

Fees are set by the governing body. Fees are analyzed annually.