I am proud to present you with the third issue of this year’s Food from Poland magazine, which accompanies one of the world’s most important food industry event - the ANUGA trade fair in Cologne. This event has for years been a global platform for meetings between producers, distributors and experts from all over the world. Poland - with its strong, diverse and dynamically developing export offer - has an increasingly important place in this dialogue.

In this issue, we have placed a particularly strong emphasis on the voice of the industry. You will find here numerous interviews with representatives of Polish companies and institutions supporting exports - it is they who know best the realities of the market and share their experience and reflections on the upcoming challenges. We also analyze the condition of the Polish food sector on foreign markets in 2025 and show how tradition and quality are becoming pillars of strength for Polish products.

There is also a practical compendium - an extensive contact section for Polish producers, which our foreign readers value the most. It is here - in the export products section - that Polish companies present their flagship products, with which they confidently compete internationally.

You are cordially invited to read magazine and talk to us in person at our stand: Hall 5.2 |

market news

16 MLEKOVITA is constantly implementing the principals of the sustainable development

18 MLEKOVITA is collecting more and more milk A2A2

food sector

20 Polish food industry on foreign markets in 2025

80 The taste of tradition, the quality of the future

interview

10 Małgorzata Cebelińska, Vice President of the Management Board, MLEKPOL

13 Paweł Majchrzak, COO and Management Board Member, Gibar

36 Małgorzata Ryttel, President of the Management Board, and Wojciech Ryttel, Vice-president of the Management Board, PPH Maxpol

40 Iwona Kruszyńska, Export Key Account Manager, Eurowafel

42 Piotr Wieloch, Member of the Management Board, Director of Marketing and Exports, Partner Center

46 Fanex growing with taste tradition and innovation

50 Paulina Małachowska, Brand Manager, Adalbert’s Tea

54 Dariusz Goszczyński, President of the National Poultry Council – Chamber of Commerce

57 Marek Osuchowski, Director of Trade and Marketing, Wielkopolski Indyk

64 Joanna Szymczak, Vice-president, SEKO

commentary

60 Polish meat exports grow despite global challenges

86 Retail chains strengthen Polish food exports and local supply chains

Editor-In-Chief

Tomasz Pańczyk t.panczyk@foodfrompoland.pl

Managing Editor Monika Książek m.ksiazek@foodfrompoland.pl

Advertisement Office Phone: +48 22 847 93 67

Editorial Office Bagno Street 2/218 00-112 Warsaw, Poland Phone: +48 22 828 93 66 redakcja@foodfrompoland.pl www.foodfrompoland.pl

Fischer Trading Group Ltd.

CEO: Tomasz Pańczyk t.panczyk@ftgroup.pl

Mlekpol, one of the leading dairy cooperatives in Central and Eastern Europe, supplies its products to more than 100 countries. Vice President Małgorzata Cebelińska outlines how the company is addressing key challenges including sustainability requirements, digitalization, and changes in export markets.

Mlekpol has maintained a strong position in the dairy market for years, and your products reach consumers in many countries. What are the biggest challenges facing the company today?

One of the key challenges that Mlekpol currently has to face is the need to quickly adapt to the dynamically changing economic reality and increasingly restrictive standards of sustainable development and ESG. The growing expectations of consumers, business partners, and legislative institutions regarding transparency, energy efficiency, and environmental responsibility necessitate the implementation of ambitious technological goals. Therefore, we are consistently investing in renewable energy sources, process automation, and new circular economy solutions. These measures not only reduce our carbon footprint, but also increase the company’s global competitiveness.

In addition, changes in strategic export markets, such as China, are driving us towards even greater flexibility and a new approach to building trade relations. In response to the current situation, we are focusing, among other things, on diversifying our exports, concentrating on regions characterized by dynamic demographic growth and an absorbent market, such as Southeast Asia and Latin America.

Overcoming challenges always requires a lot of work, but it also determines the development and strengthening of Mlekpol’s position as a modern, responsible company. Our advanced production facilities, broad portfolio, and flexible approach to the needs of individual markets enable us to successfully sell our products to over 100 countries. This confirms that we are able to effectively respond to the diverse expectations of today’s consumers.

Which products from Mlekpol’s portfolio are most popular on foreign markets?

SM Mlekpol’s export structure is dominated by products with high added value and a long shelf life, primarily: UHT milk and cream, butter, ripening cheeses, cream cheeses, and a full range of powdered products.

For years, we have been intensively developing our export brands: Happy Barn and Milcasa, valued for their quality in European, Asian, African, and Middle Eastern countries. Both brands are effectively building Mlekpol’s recognition outside Poland, which facilitates the establishment of trade relations in other countries as well.

It is worth noting that our significant technological advantage in terms of potential milk sales to the most distant global markets is our modern production line of UHT milk, which, when stored at ambient temperature, retains its freshness and nutritional properties for up to 12 months. This solution is ideal for countries with a tropical climate, where refrigeration infrastructure is often limited and the demand for safe food with a long shelf life remains very high.

What distinguishes Mlekpol products from international competitors?

The Mlekpol Dairy Cooperative has been successfully building its position on the global market for years, thanks to a combination of high-quality raw materials, operational flexibility, and the ability to respond quickly to changing consumer expectations.

Mlekpol’s distinguishing feature is, above all, its individual approach to each trading partner. Our customers appreciate this flexibility, which allows us to cooperate with both large retail chains and smaller, local distributors.

Another advantage of the Cooperative is its modern production facilities, consisting of 12 plants throughout Poland, which are characterized by a high degree of specialization. Thanks to this structure, we are able to provide our customers not only with a broad portfolio and continuity of supply, but also consistent quality standards and rapid adaptation of production to the needs of individual markets, also in situations such as seasonal increase in demand.

The company’s transparency and responsibility are also important, both in terms of the origin of raw materials (sourced from Polish farmers who are members of the Cooperative) and compliance with international standards, including those relating to food safety and sustainable development.

In the long term, environmental transparency is also very important to us. That is why we are conducting advanced work on reducing our carbon footprint throughout the supply chain. We are therefore working with farmers – members of the Cooperative and contractors – to jointly reduce our impact on the climate, both through good agricultural practices and investments in innovation.

We carry out all these activities with the conviction that the future of the dairy sector depends on the ability to combine quality and scale of production with respect for the environment and corporate social responsibility.

Is the digitization of production processes and logistics the direction of Mlekpol’s development?

Due to data-driven decision-making, digitization has a very significant impact on changing the management style and organizational culture at Mlekpol. Working to provide reliable basic data, as well as determining its owners, is changing the way the company operates.

Our wide portfolio –from premium UHT milk and butter to top-quality cheeses – is built on trusted raw materials from Polish farms and tailored to meet the expectations of diverse global markets.

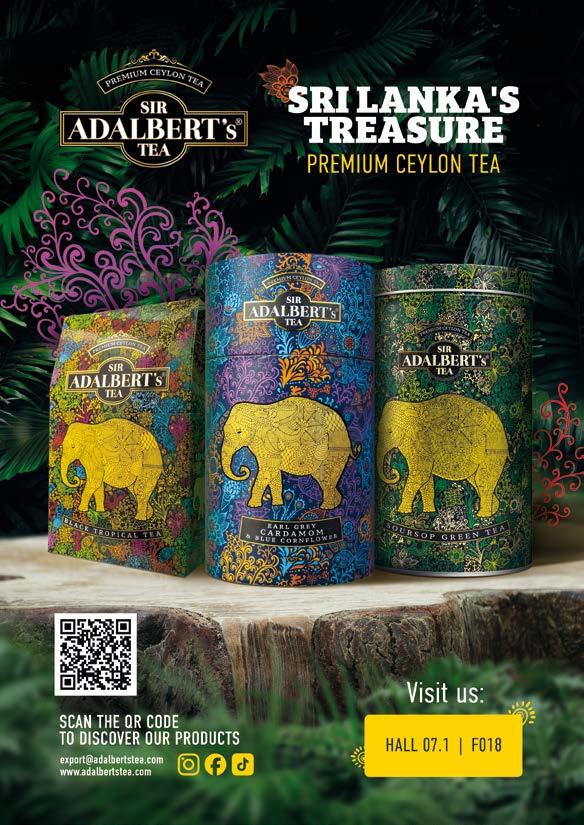

What sustainable development measures does Mlekpol take?

For Mlekpol, sustainable development is a conscious, long-term direction of action, embedded in the strategy of the entire organization.

One of the Cooperative’s most important achievements in this field is the complete elimination of hard coal from our production processes. We have replaced it with low-emission fuels such as natural gas and LNG. What is more, we already cover 20% of our electricity demand from our own sources, and our goal for 2030 is to reach 50% in this regard.

In terms of the circular economy, we can boast a unique investment – the launch of a modern biogas plant at the company’s wastewater treatment plant in Grajewo. It is the first facility of this type in our production structure. The plant uses all organic waste from the processing process and sludge from the treatment plant, converting it into green electricity and heat, as well as organic fertilizer used locally by farmers. For this investment, Mlekpol was awarded the title of “Eco-Investor in the Food Industry,” confirming that pro-environmental activities are an indispensable part of modern organizational management.

The digitization process has entered all areas of Mlekpol’s operations. In the areas of production and energy, for example, we are implementing advanced control systems based on digital data, continuously recorded thanks to precise measuring devices. This ensures a very high level of product standardization and the highest level of productivity in all processes.

The upgrade of the ERP system to version S4 is key for us. We have already successfully migrated the database to HANA. We have completed the implementation of a WMS-class management system in two distribution warehouses. Another major investment is the replacement of the currently used data warehouse with a new platform for managing data from various sources and a cloud-based solution for data reporting and analysis. And this is only part of the work in progress. What lies ahead of us, among other things, is a major upgrade of our transport management software and the adaptation of our current systems to the needs of KSEF, as well as the next stage of development of our raw material procurement support program.

The digital transformation also extends to our relationships with suppliers. We support farmers who are members of the Cooperative in developing smart farms that implement modern herd management, animal health monitoring, and sustainable feeding systems.

Thanks to these investments and initiatives, Mlekpol is consistently strengthening its position as a modern, responsible producer, well prepared for the challenges of the future.

Do you notice any differences between trends on the Polish and foreign markets?

On the Polish market, we are seeing a significant increase in the popularity of functional products, including high-protein products. Our Łaciate Protein+ line perfectly meets these expectations. Although high-protein products were initially associated mainly

with athletes, they are now popular among a wider group of consumers: people who care about a balanced diet, seniors, and parents looking for nutritious snacks for their children. In the functional products category, we have also launched a new line of lactose-free Łaciate drinking yogurts enriched with magnesium and biotin – ingredients known for their positive effect on the nervous system and the condition of the skin and hair.

Mlekpol

will continue to develop consistently based on three main directions: modern technologies, environmental responsibility, and further strengthening its position

In distant foreign markets, we observe slightly different preferences. In countries with a tropical climate, the shelf life of products at ambient temperature is crucial, hence the great popularity of our UHT milk of various brands. In many countries in Africa, Asia, and the Americas, there is also a noticeable growing demand for products with a high fat content, such as butter and cream, but also cheeses, including mozzarella.

on domestic and foreign markets.

How important is it for Mlekpol to participate in international trade fairs such as ANUGA?

Trade fairs of this rank bring together food industry leaders from around the world, so attending them gives us access to key decision-makers – distributors, importers, retail chains, and media representatives. It is an excellent opportunity to showcase product innovations, obtain feedback from partners and consumers, and monitor trends that shape the future of the dairy sector.

For Mlekpol, participation in events such as ANUGA brings concrete business results: getting new contracts, strengthening rela-

tionships with current partners, and developing sales in new markets.

The image aspect is also important. Mlekpol’s presence among exhibitors at such major events confirms our position as one of the largest and most modern dairy producers in Central and Eastern Europe. Trade fairs such as ANUGA are also a space for promoting Polish agriculture and processing, and Mlekpol, as a cooperative based on the strength of local suppliers, represents them in the best possible way.

What are Mlekpol’s plans for the coming years?

In the coming years, Mlekpol will continue to develop consistently based on three main directions: modern technologies, environmental responsibility, and further strengthening its position on domestic and foreign markets. We want to combine tradition and experience with innovation, adapting to the changing needs of consumers and the challenges of the modern world.

An integral part of our strategy remains cooperation with farmers – members of the Cooperative, who are at the heart of our business. Thanks to them we can not only develop high-quality dairy production, but also work together to ensure the future of Polish agriculture.

Further development will be based on responsible investment decisions, product portfolio development, and openness to new markets and partnerships. Our goal is to build a strong, sustainable organization that is ready to meet the demands of tomorrow and future generations.

We talk with Paweł Majchrzak, COO and Management Board Member at Gibar, about how the company is strengthening its position in Poland as a distributor and importer of niche confectionery, while steadily expanding into savory snacks and beverages.

How is Gibar currently positioned on the Polish and international markets?

Gibar positions itself as a distributor and importer specializing in niche confectionery, complemented by a growing offer of savory snacks and beverages. On the Polish market, the company is recognized for premium – quality products and innovate concepts. Internationally, Gibar seeks to bring unique, carefully selected treats to consumers, focusing on originality and memorable taste experiences.

What is Gibar’s greatest competitive advantage?

Gibar’s key advantage lies in its ability to combine tradition with innovation. The company offers products that stand out in flavor, form and packaging, while maintaining consistent quality. By focusing on niche categories often overlooked by larger players, Gibar brings consumers something distinctive and attractive.

In which foreign markets is Gibar already present, and which ones does it consider a priority for the coming years?

At this stage, Gibar does not directly export its products abroad. The company’s focus is on strengthening and expanding its distribution network in Poland, ensuring strong brand recognition and availability on the domestic market. Foreign markets are currently treated primarily as a source of inspiration and potential new products that could be added to the Gibar portfolio in the future.

Which products from Gibar’s range are currently the most popular with customers, both in Poland and abroad?

Among the most sought – after products are the iconic Luxury Plum in Chocolate, appreciated for its refined taste and premium character, and innovative items such as Snowball Pistachio or flavored donuts, which attract younger audiences. These products perfectly reflect current market trends – they are innovative, practical and designed to fit the dynamic lifestyles od today’s consumers.

What challenges is the company facing in its international expansion process?

The greatest challenges include adapting to diverse consumer preferences, regulatory requirements and strong competition in established markets. Building brand recognition abroad requires consistent investment in marketing and distribution partnerships. At the same time, Gibar treats these challenges as opportunities to refine its offer ang strengthen its international presence.

What are the company’s key objectives for the coming years?

The company’s main objectives are to expand its portfolio with unique products that combine innovative flavors, attractive formats and convenient packaging. Gibar aims to further strengthen its brand as a symbol of high – quality, distinctive confectionery while also broadening its presence in the category of savory snacks and beverages. The long – term vision is to anticipate consumer needs and deliver products that offer moments of indulgence.

The Mlekovita Group constantly follows the trends and expectations of modern consumers, placing great emphasis on innovation and environmental responsibility, which is reflected in intensive investments in packaging optimization, reduction of raw material consumption, and implementation of modern packaging technologies. These activities are aimed at making production more sustainable and environmentally friendly. Recently, a new investment in the blue cheese department was completed at the production plant in Baranowo.

The purchase of an advanced packaging machine has opened up completely new possibilities. The new production line automates the packaging process, significantly reducing the consumption of packaging materials and increasing production efficiency. A particularly important innovation is the change in the type of film used for packaging blue cheese. Unlike the films used previously, the new film is completely aluminum-free, yet retains excellent barrier properties, guaranteeing high product quality and shelf life. The elimination of aluminum not only facilitates the recycling process, but also reduces energy consumption throughout the entire life cycle of the packaging. Furthermore, it eliminates the need for paper wrappers, which previously served

an informational and aesthetic function.

The new technology has simplified the production, logistics, and recycling processes. This solution not only responds to growing consumer expectations in terms of sustainable development, but also allows for a significant improvement in production efficiency and a reduction in operating costs. “The introduction of the new machine and packaging technology is not only an expression of our concern for the environment, but also brings real economic benefits,” emphasizes Dariusz Sapiński, President of the Management Board of the Mlekovita Group. “Process automation and reduced packaging material consumption will allow us to reduce labor costs, streamline logistics, and reduce raw material consumption,

which in turn leads to a smaller carbon footprint. The new technology will also enable savings of approximately 15 million paper wrappers per year. This is another step by Mlekovita towards modern and responsible production solutions.

The company consistently invests in innovations that not only improve product quality but also promote the rational management of natural resources. Another example of this approach is the launch of a modern Dairy Products Factory at the company’s headquarters, based on automated lines and intelligent energy management. Mlekovita proves that modernity and responsibility can go hand in hand with economy and benefits for consumers and the natural environment.

Mlekovita was the first dairy company in Poland to launch a line of A2A2 milk products, which already includes UHT milk, natural yogurt, semi-fat cottage cheese and sliced cheese.

The largest dairy group in Poland and Central and Eastern Europe is constantly developing its product range, focusing primarily on product safety in terms of health and unique nutritional values. It was the first producer in Poland to introduce innovative A2A2 milk products to wide distribution – milk containing only A2 beta-casein, a unique type of protein that is more easily digestible by humans and comes from the milk of specially selected cows.

Beta-casein A2 is one of the forms of natural protein found in cow’s milk, i.e.,

casein, which accounts for as much as 80% of milk proteins. Commonly available milk contains a mixture of beta-caseins A1 and A2, while A2A2 milk contains only beta-casein A2. This small difference can be of great importance to health. The better absorption of beta-casein A2 by the human body makes A2A2 milk an alternative for people who suffer from allergic reactions after consuming cow’s milk or its products.

Therefore, after the successful debut of UHT milk, natural yogurt, and semi-fat cottage cheese made from A2A2 milk, Mlekovita has just expanded its range with a new product: sliced cheese made from A2A2 milk, which combines a delicate taste, creamy texture, and convenience of use. This product is

aimed at consumers who are looking for alternatives that are better for their health without giving up their favourite flavors. Sliced cheese made from A2A2 milk is perfect for everyday sandwiches, as well as an ingredient in snacks or casseroles. Thanks to a carefully selected production process, this cheese retains the natural nutritional values of A2A2 milk and is a valuable source of protein, calcium, phosphorus, zinc and vitamins A and B12.

By introducing another new product to its A2A2 milk product line, Mlekovita once again proves that innovation for the health and taste enjoyment of consumers is its priority. This offer is a response to the growing interest in conscious nutrition and products that have a beneficial effect on the body.

We want every consumer to be able to find products in our range that are not only tasty but also good for their health. We want those who have not been able to consume dairy products until now to be able to enjoy the familiar and beloved, but perhaps forgotten, flavors of milk, cheese, yogurt, and cottage cheese again. Because A2A2 milk and milk products are not only an innovation in the dairy market, but above all an alternative for many consumers, without in any way discrediting the main nutritional values of conventional milk.

Magdalena Szabłowska Director of Foreign Trade SM MLEKOVITA

The first half of 2025 showed that Polish food maintains a strong position on foreign markets, although the dynamics are no longer as spectacular as in previous years.

Magdalena Chajzler Editor

According to the Central Statistical Office (CSO), the value of all Polish exports amounted to PLN 661.8 billion, an increase of 2.7% year-on-year. Out of this total, as much as PLN 566.5 billion fell to the countries of the European Union, which are still the key recipients of Polish food products. Maintaining such a high share of the EU shows that despite the increasing diversification of destinations, Europe remains the natural and most important market.

At the same time, the structure of exports is changing qualitatively. Shipments to developing countries and Central and Eastern Europe declined as a result of

the economic slowdown and inflationary pressures in these regions. On the other hand, a clear increase was recorded in the exchange with highly developed countries outside the EU - primarily the UK and the US. The British market, after a period of decline due to Brexit and logistical problems, is returning to its role as one of the key recipients of Polish food, while the US is becoming an increasingly attractive destination due to the demand for dairy products and confectionery.

For Polish producers, this means the need to respond flexibly to differences in demand and consumer expectations. In the Eurozone, the most important challenge remains the struggle for margins in an environment of strong competition and high raw material costs, while in non-EU markets, innovation, certification and the ability to adapt the product portfolio are more important. This, in turn, requires companies to invest in R&D and marketing, not just production capacity.

It is worth noting that against the background of all Polish exports, food remains a category of exceptional stability. While the machinery or automotive industries react strongly to cyclical fluctuations, food sales maintain relatively stable volumes. Moreover, data for the beginning of 2025 show that exports to highly developed markets outside the EU have increased in value terms, demonstrating the ability of Polish companies to compete on quality and brand, not just price.

Forecasts for the next quarters are cautiously optimistic. Experts indicate that, barring major geopolitical turmoil or further escalation of logistics costs, Polish food exports should maintain positive dynamics in 2025, albeit at a rather single-digit level. This means that the main challenge for the industry will be not so much volume growth as maximising added value - through premiumisation, geographical diversification and consistent building of recognisable brands.

Polish dairy is one of the most internationalised segments of the food industry. Mlekovita, the largest dairy cooperative in the country, sells on 167 markets and exports over 30% of its production. In 2024, export revenues reached PLN 2.6 billion and 2025 brings further strengthening of this position, especially in Asia and the Middle East. The company emphasises the role of Halal and Kosher certification, which are a pass to markets with different legal regulations and religious requirements. Thanks to them, Mlekovita was able to enter, among others, the Persian Gulf countries, where Polish dairy products are becoming increasingly popular.

Another pillar of Polish dairy exports is Mlekpol, which reports sales in over 100 markets worldwide by 2025. Around 30% of the cooperative’s production goes abroad, which includes both mass products - such as powdered milk and maturing cheeses - and consumer brands, with Łaciaty at the forefront. Mlekpol’s strategy is to simultaneous-

ly build the position of a premium brand in Western Europe and to offer large volumes on Asian and African markets, where demand for powdered milk products is growing.

It is the diversification of the product portfolio that allows both cooperatives to reduce the risk of economic fluctuations. In a situation where the price of raw milk in Europe can be subject to large fluctuations, having outlets on several continents provides greater stability of revenues. Furthermore, both Mlekovita and Mlekpol invest in the segment of high added value products - from mozzarella-type cheeses to whey proteins used in sports supplements. This specialisation allows them to better compete with the global giants of the dairy industry, who increasingly see Poland as a serious export player.

Poland’s largest and best-known dairies include the Polmlek Group, Piątnica, Łowicz, Sierpc, Ryki, Spomlek, Krasnystaw, Sertop, or Koło, as well as international companies such as Danone, Zott, Hochland, and Lactalis.

The prospects for Polish dairy in 20252027 appear favourable, although challenging. Global demand for dairy products

will continue to grow, especially in Asian countries and the Middle East, but at the same time expectations for sustainable production and reducing carbon footprint are intensifying. Polish cooperatives pledge to invest in energy-efficient technologies and green logistics to help maintain competitiveness. However, flexibility will remain a key success factor - the ability to combine large volumes with niche product offerings that yield higher margins and open doors to the most demanding markets.

Poland has been one of the world’s leading exporters of chocolate products for years, with exports in this category currently exceeding €2.5 billion a year. There is a stable demand for Polish products in the EU countries, as well as in the UK, which has once again become a major customer after a period of Brexit-related decline. The strengths of Polish producers remain the combination of high quality with competitive pricing and the flexibility to adapt the offer to seasonality and consumer preferences.

Wedel remains the most recognisable brand abroad, with a presence in almost 50 countries around the world. From Germany and the UK, through the USA and the United Arab Emirates, to Japan and India - the sweets with the characteristic logo of the chocolate boy on a zebra are an example of a Polish brand with global reach. Wedel’s expansion is based both on cooperation with large chains and on building premium segments to compete in gifting or limited edition categories.

Wawel, on the other hand, relies on wide distribution and the consistent strengthening of its position as a family brand, recognisable in Europe, Asia and the Americas. The company today exports to 54 countries on six continents, and in its 2024 financial reports highlighted stable earnings growth despite increasing cost pressures. Wawel is building an advantage by combining everyday products (chocolates, bars, candies) with premium offerings, which allows it to remain competitive across price segments.

In addition to giants such as Wedel and Wawel, other confectionery manufacturers, such as Colian, which has a wide range of chocolate products in its portfolio, combining tradition with modern market trends, are also becoming increasingly important in exports. The most recognisable brands include Goplana, Solidarność, Jutrzenka, Grześki and Jeżyki - offering chocolate bars, pralines, bars and unique sweets with additives. Colian’s products are distinguished by their rich recipes, variety of flavours and high quality of ingredients, thanks to which they appeal to both customers looking for classic chocolate products and modern,

original compositions. The company is constantly developing its portfolio, responding to the expectations of consumers at home and in international markets.

Vobro, a confectionery manufacturer specialising in creating chocolate products of high quality and attractive design, is also a very active participant in the export market. The company offers pralines, boxes

been one of the world’s

of chocolates, filled chocolates, as well as seasonal collections prepared for holidays and special occasions. Particularly popular are product lines such as Choco Crispy or Frutti di Mare, which combine the intense taste of chocolate with a variety of fruit and cream fillings. Thanks to the wide assortment and attention to packaging aesthetics, Vobro products reach both individual

customers and export markets, building a brand recognisable in Poland and abroad.

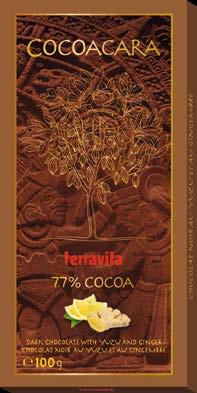

Terravita, a well-known Polish confectionery manufacturer whose speciality is chocolate products with a rich taste and a variety of forms, has a very strong position both at home and abroad. The company’s portfolio includes classic bars of milk, dark and white chocolate, chocolates with additives, as well as pralines and chocolate figurines. Terravita is also developing its seasonal offer, creating sweets dedicated to holidays and special occasions. Thanks to its wide range of products, high quality ingredients and recognisable brand, Terravita’s products are popular both in Poland and on foreign markets.

Attention should also be paid to companies such as Bogutti, Eurowafel or Gibar. These companies specialise in a flexible approach to their offerings - from impulse products to private labels - and have successfully penetrated the markets of Central and Western Europe and the Middle East. Thanks to them, Poland has become one of the largest confectionery production hubs in the region, and its broad brand portfolio allows it to compete with both global giants and local producers.

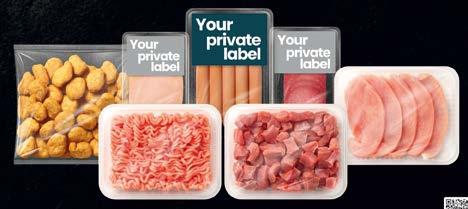

Meat and processing - building a position in the EU, looking for premium niches

Poland’s meat industry remains one of the pillars of the country’s food exports - both in terms of volume and value. In 2025, more than 70% of meat and meat processing exports go to EU markets, primarily to Germany, France, the Czech Re -

public and Italy. The CSO data confirms that these are the markets responsible for the largest volumes, although margins here are sometimes relatively low due to high competition and the high concentration of distributors.

The largest players are Sokołów S.A., CEDROB FOODS S.A. (Duda brand), Animex and Indykpol. Sokołów - which is part of the Danish Crown group - is developing its offer in the convenience and ready-to-eat products segment, targeting not only the Polish market, but also exports. CEDROB FOODS focuses on poultry, which for years has been the showcase of the Polish meat industry worldwide - Poland remains the largest producer of poultry in the EU, and a large part of this meat reaches foreign markets in fresh, frozen or processed form. Animex is one of the largest meat and cold meat producers in Poland, known for its extensive brand portfolio and wide range of products. The company offers traditional sausages, hams, tenderloins, wieners and pates, combining proven recipes with modern production technologies. Its portfolio includes such recognisable brands as Morliny, Krakus and Berlinki, which have been trusted by consumers for years. Indykpol, on the other hand, specialises in turkey meat, build -

ing a niche but increasingly desirable offer in Western Europe, where consumers are looking for alternatives to red meat.

Premium and speciality products are also growing in importance. Consumers in Western European countries and the UK increasingly expect meat with quality labels - such as ‘bio’, ‘eco’ or ‘origin specific’ - and products tailored to high-protein diets. Polish producers, recognising this trend, are introducing premium lines and investing in new packaging technologies (MAP, skinpack) that allow products to remain fresher for longer and look more attractive at retail.

However, regulatory and certification issues remain an important challenge. In 2025, stricter carbon footprint and animal welfare regulations take effect in the European Union, forcing Polish plants to invest in modernising infrastructure. Polish companies in the meat sector are effectively implementing ESG programmes to not only reduce emissions, but also to build an image as a responsible supplier in line with European consumer trends.

Forecasts for the meat industry indicate that while the volume of exports to the EU will remain stable, the greatest growth potential lies in premium markets - both within and outside the EU, such as the

the largest producer of poultry in the EU.

Middle East and Asia. Poland, thanks to its large production scale and processing flexibility, can develop niches related to high-protein products, convenience and premium meat in the coming years. However, it will be crucial to invest in parallel in refrigerated logistics and marketing, as these will determine the sustainability of the markets to be won.

The dynamic development of the functional beverages segment is one of the most visible trends in Polish food exports. Products in this category respond to the globally growing needs of consumers who are looking for beverages that not only quench their thirst, but also support health, regeneration and an active lifestyle. Poland stands out from the region thanks to companies that have boldly bet on innovation and global distribution partnerships.

The most recognisable example is OSHEE, whose products are already available in dozens of countries on six continents. The brand has consistently built an international position through collaborations with well-known athletes, sporting events and football clubs. This combination of marketing and product functionality makes

The dynamic development of the functional beverages segment is one of the most visible trends in Polish food exports.

For several decades, we have been one of the largest Polish manufacturers of chocolate and semi-finished confectionery products on the industrial and retail markets. We are a 100 % Polish company. Our headquarters is located in the heart of Greater Poland (Wielkopolska region) – in Poznań.

Our strengths

Terravita is characterised by its openness to new trends and flexibility towards customers needs, even the most original ones. Many years of experience have strengthened our position as a reliable supplier of chocolate products for the largest retail chains. Terravita also specializes in the production of confectionery and ice cream semi-finished products. We cooperate with both, large international corporations and local producers.

International reach

Our products are recognized and delighted by customers all over the world – from North America, through Europe, Africa, Asia to distant New Zealand. They are present in over 30 markets around the world and successfully conquer new markets.

OSHEE associated with isotonic, vitamin and energy drinks with a global reach. The transaction with the Innova Capital fund has further strengthened the expansion opportunities, paving the way for further distribution in Asia and North America.

The other major player in this category is Mokate, a producer of coffees, teas and milk frother, with a presence in over 70 markets. Although Mokate’s business profile is broader, it is the innovations in the instant drinks and ‘on-the-go’ products segment that are building the company’s international recognition. With a strategy combining private label and private brand development, Mokate is able to flexibly adapt to the needs of different markets, from Europe to the Middle East and Asia.

Also of growing importance in exports are products described as “better-for-you” - vitaminised water, drinks without added sugar or plant-based alternatives to milk. Polish producers are noticing that consumers in developed countries expect not only healthy ingredients, but also attractive marketing communications that emphasise health-oriented and ecological values. This is why companies are increasingly introducing vegan, gluten-free and low-calorie lines, which are becoming a standard in Western European or North American markets.

The functional and health-enhancing drinks category is also one of the most challenging export segments. There is a need for rapid innovation, investment in research and development, as well as compliance with labelling and formulation regulations, which vary significantly from country to country. However, companies such as Oshee and Mokate are demonstrat -

ing that Polish producers are able to compete with global giants with unique recipes, attractive packaging and aggressive marketing activities.

The development prospects for this category are extremely promising. Between 2025 and 2027, the global functional beverage market is expected to grow at a rate of 7-9% per year, and better-for-you products will account for an increasing share of Poland’s export basket. This means that companies that invest in innovation and certification today can soon achieve the scale to have a permanent presence in global markets, and Poland will strengthen its reputation as a source of modern, healthy and functional beverages.

Poland has for many years remained one of the most important producers and exporters of fruit in Europe. Apples play a special role, having become a permanent part of the export structure and being a recognisable commodity in EU countries and on

Asian and Middle Eastern markets. In 2024, Poland was the largest exporter of apples in the EU, with customers including Germany, Egypt, Kazakhstan and India. At the same time, exports of blueberries and raspberriesfruits considered premium products, sought after by consumers in highly developed markets - are growing dynamically.

Specialised distributor-exporters who build international sales networks play a key role in organising and maintaining this position. EWA BIS is one of the most important players in this sector - the company is present in more than 50 markets and acts not only as an exporter, but also as a trade intermediary, ensuring continuity of supply and adaptation of products to the quality requirements of the country in question. Thanks to its offices and partners abroad, EWA BIS effectively connects Polish producers with counterparties in Asia, the Middle East or Africa.

The importance of entities such as EWA BIS is also growing because foreign markets are increasingly tightening food safety and certification criteria. Distributor-exporters are taking on the burden of negotiation, logistics and quality control, allowing smaller farms and producer groups to stay ahead in competitive markets. Certifications such as GlobalG.A.P. or BRC are becoming the ticket to sales in Western European retail chains, and professional support from large distributors allows Polish products not only to compete on price but also to meet the highest quality standards.

In the coming years, the export of fresh fruit and vegetables will be challenged by climate change, cost pressures and growing competition from South America or Africa.

By 2027 it will not only become an export standard to have quality certifications, but also transparent carbon footprint reporting.

The Polish sector - based on distributors such as EWA BIS - will have to bet on further diversification of export destinations and building national brands promoting healthy food from Poland. Growth potential lies especially in South-East Asia and the Middle East, where demand for berries, apples or fruit preserves is growing rapidly and Polish exporters already have an established negotiating position.

Development directions up to 2027 - already visible in data and company strategies

Firstly, internationalisation of brands and currency diversification. The dispersion of sales between the EU, UK, North America and MENA markets reduces the risk of exchange rate and cyclical fluctuations. Mlekovita and Mlekpol show that a broad geography - 100-167 markets - provides resilience to local turbulence and allows faster monetisation of new trends (e.g. protein, A2A2, clean label).

Second, certification and compliance. Halal/Kosher requirements and quality standards are becoming the ticket to many countries, and companies that have invested in compliance systems and audits are increasing the ‘bankability’ of export contracts. The example of Mlekovita in MENA markets is representative here.

Thirdly, the premiumisation of confectionery and snacks. Stable increases in the value of chocolate exports with moderate changes in volumes indicate further room for growth in the ‘gifting’, ‘impulse’ and seasonal collections segments - something that Wedel and Wawel have consistently exploited.

Fourth, operational flexibility and nearshoring. CSO and KIG data suggest that non-EU highly developed destinations (UK, US) are growing faster than some EU markets in 2025 - facilitated by road and sea logistics and shortening supply chains to Western Europe. Polish food producers use this as an argument in tenders with regional chains and distributors.

Fifth, investment in green transformation and ESG reporting. Market analyses indicate that by 2027 it will not only become an export standard to have quality certifications, but also to have transparent carbon footprint reporting and implementation of environmental policies. Companies such as Oshee and Colian are already testing new models of environmentally friendly packaging, knowing that in Northern European countries this will be a condition for staying on the shelves.

Sixthly, the growth of the high-protein category and functional products. The increase in demand for protein drinks and

snacks in North America and Southeast Asia is opening up new opportunities for manufacturers who can combine nutritional value with an attractive form of serving. This trend is particularly supported by Oshee, as well as dairy manufacturers who are adapting their portfolios to meet the demands of physically active consumers.

Seventhly, building consumer brands with a Polish pedigree. Data from analyses of the German and UK markets show that consumers are keen on products from Central Europe if they are consistently positioned and supported in marketing. Vobro and Bogutti sweets, Eurowafel wafers or Mokate teas are increasingly competing not only on price, but also on the story of quality and tradition. By 2027, these strategies can be expected to translate into increased loyalty and a sustained presence on shelves in target countries.

How are the indicated companies positioning themselves?

Terravita, Wedel and Wawel are building exports on the recognition of chocolate brands and the ability to quickly introduce novelties to suit local tastes - from impulse formats to gift sets. These companies consistently invest in marketing and tailor their portfolios to local preferences, allowing them

to maintain their leadership positions in European markets and the Polish diaspora.

Colian combines the strength of its confectionery and beverage portfolio with broad international distribution, which naturally supports scaling in Central, Western Europe and beyond. Aksam (the ‘Beskidzkie’ brand), Eurowafel and Bogutti focus on price segmentation of wafers, biscuits and sticks, capturing shelves in various sales channels, both in classic supermarkets and smaller chains. SERTOP, with its melted cheeses and formats that are convenient to transport and display, is entering niches where product shelf life and quality consistency are important.

In meat and preserves, Sokołów S.A., Indykpol and Cedrob Foods S.A. (Duda) remain key suppliers in the EU market. Their competitive advantages stem from their competence in refrigerated logistics, their specialisation in species and their ability to maintain high volumes under price pressure. The ability to react quickly to changes in demand in individual countries allows these companies to grow exports steadily.

In the functional beverages and betterfor-you category, Oshee shows that Polish companies can scale globally based on product innovation, extensive marketing budgets and strategic distribution partnerships. Mokate in hot drinks - coffee, tea, chocolate instant drinks - proves that Pol -

ish brands can compete in the retail channel in foreign markets by offering products tailored to local consumption habits.

Mlekpol and Mlekovita, on the other hand, are consistently positioning themselves as leaders in dairy for export, building on a broad portfolio from butter and cheese to functional and organic products. Expansion into MENA and North American markets and Halal/Kosher certifications allow them to maintain stable growth while introducing product innovations in line with global healthy eating trends.

What does all this mean for the 2025/2026 decision?

‘Made in Poland’ food is already recognisable and competitively priced, but cost advantages alone are no longer enough. The companies that do best in foreign markets combine several key practices - treating certification as a sales advantage, working consistently on brand recognition, quickly adapting recipes and packaging to local requirements, and diversifying their portfolio geographically. In practice, this means that strategic decisions in 2025 and 2026 must take into account both investments in compliance and audits, as well as marketing and product development tailored to specific markets.

Sweets and dairy will remain the engines of Poland’s export value. In this segment, the role of premium brands and innovative

products tailored to local tastes will be key. Meat and processed meat will remain a volume pillar, where logistical and quality advantages determine the ability to maintain stable contracts with chains and distributors. Functional beverages and better-foryou snacks will become a testing ground for product innovations with global potentialtheir introduction allows Polish companies to test the scalability and effectiveness of new solutions in foreign markets.

Figures for 2025 indicate that shortterm growth levers lie in maintaining a strong position in Europe while increasing the share of highly developed markets outside the EU, such as the UK and the US. This is where Polish manufacturers are already competing effectively with speed of delivery, flexibility of logistics chains and the ability to tailor their offering to local consumer expectations.

Strategically, this means that in 2025/2026, companies should focus on several areas: developing a premium and innovative product portfolio, investing in certification and compliance with international standards, geographically diversifying sales and strengthening the strength of brands through marketing tailored to the specifics of each market. The combination of these elements will ensure a stable increase in export value while maintaining competitive advantages in a dynamically changing international environment.

Founded in 1990, PPH Maxpol has grown from its first trade fair in Lviv to organizing international exhibitions across multiple continents. On the occasion of the company’s 35th anniversary, we speak with Małgorzata Ryttel, President of the Management Board, and Wojciech Ryttel, Vice-president of the Management Board, about the company’s history, challenges, and plans for the future.

35 years of operation is a special anniversary. What were the company’s beginnings on the market like and what challenges did it face in the following years? How did its history unfold?

Małgorzata Ryttel: The company was founded in May 1990, so it is now 35 years old. It is a family business with a long tradition, founded by my father. The first trade fair we organized was the Leopold Fair in Lviv. A unique aspect of this venture was the fact that, as a Polish company, we were referring to the tradition of the pre-war Lviv fairs, which took place there before 1939. The idea to revive them after the war came from my father, and we managed to invite ten companies from various industries to the first edition. It was a multi-industry fair attended by representatives of the cosmetics, food, and processing industries, as well as producers of fruit, vegetables, textiles, and car parts. It was this event that marked the beginning of our activity in the field of fair organization.

And then everything happened very quickly – we organized trade fairs in Kiev, Dnipropetrovsk, and Moscow. Individual industries began to develop and, over time, focus on their own specializations. If it was

the food industry, then it was exclusively food; if it was the automotive industry, then it was mainly Moscow, Kiev, and Dnipropetrovsk.

In these cities, we even chartered planes because the number of exhibitors was really large. These were already industrial trade fairs, thanks to which we gradually expanded our activities throughout the East.

The natural next step was to enter Western markets. The first trade fair we organized there was Anuga, which is extremely prestigious and still enjoys a high reputation today. It is a food industry event covering a wide range of industries in this sector. Among other things, sweets, red meat, poultry, and dairy products were presented there – each segment had its own separate exhibition space. In this way, our business covered the entire range of the food industry.

And then new directions emerged: why not Paris? Why not Amsterdam? Why not go even further, for example to Barcelona? And so on and so forth.

In the current situation, I can say that we serve virtually the entire world – including distant Australia, Africa, and the entire Arabian Peninsula.

For over three decades, you have organized trade fairs on many continents, supporting Polish entrepreneurs in their international expansion. Which of these international projects were the most important for you and how did they influence the development of the company?

Małgorzata Ryttel: That’s a difficult question, because every trade fair is important – whether it’s in Paris, Cologne, or Amsterdam. But the key event, where the most companies participate and where we can talk about great success, is probably the trade fair in Amsterdam. There, we sell about 1,000 m² for each event.

I can refer to a certain story – we started with just 18 square meters in Amsterdam, and today we organize stands with a total area of nearly 1,000 meters. Last year, we were accompanied by 53 companies, which was a huge undertaking and a challenge at the same time, because we wondered if we would be able to serve such a large number of participants at the next edition.

The trade fair in Paris is also a very largescale event – around 40 companies regularly take part in it. Another important event is the trade fair in Cologne, which is of great significance for the industry.

But, it is not just about numbers, but above all about quality – about presenting Polish companies in the best possible light, finding new contractors, and presenting their offer in the most attractive way. Our role is to help them do this effectively.

Ryttel: First of all, we need to go back to the pre-pandemic times, when all trade fairs functioned in the traditional way. That is, customers came, exhibited, had stands prepared where they presented their products, advertised the best they had to offer and the best Poland had to offer in a given industry.

However, during the pandemic and immediately after it, voices began to emerge that our industry would change, that there would be greater digitalization, the internet, etc. But mainly, a group of people came up with the idea of organizing online trade fairs.

From what I remember, this information circulated on the internet for about a year. These online trade fairs were created quickly... and just as quickly they failed. Because people are used to meeting face to face, talking, and besides – trying, checking, touching. Tangible goods are completely different from those seen on the internet or through a webcam.

We have introduced our own facilities for stand construction: we have a well-equipped carpentry workshop, a paint shop, and designers who prepare stand concepts.

You have a slogan that beautifully describes both your company and supports manufacturers: “Trade fairs are the best direct marketing tool.” It emphasizes the enormous importance of face-toface meetings. Please tell us how the role of trade fairs is changing in the era of digitalization, social media, and e-commerce.

It’s not the same scale at all – not the same scale of experience, not the same scale of business. However, the best business was, is, and – I hope – will continue to be done face to face, i.e., at trade fairs, on site.

You already work with many companies, so you have an excellent insight into their needs. What are the dominant expectations among exhibitors at the moment?

Wojciech Ryttel: At the moment, exhibitors pay particular attention to the so-called exhibition, i.e., the construction of stands. This is our second domain – we have introduced our own facilities for stand construction: we have a well-equipped carpentry workshop, a paint shop, and designers who prepare stand concepts.

Today, exhibitors look at how their goods will be presented at the stand – whether they will be well arranged, nicely displayed, and whether the whole thing will make sense. It cannot just be a sample lying on a table – it must be nicely displayed, well exposed, and properly lit.

We prepare each stand design with the utmost care and present it to exhibitors for approval, asking whether the proposed concept meets their expectations or requires changes. It is becoming increasingly clear that this area is developing dynamically. Today, exhibitors pay attention not only to the product itself, but also to the way it is presented –both to customers visiting the stand and to potential contractors with whom they plan to sign contracts.

Product samples, which must be delivered to the venue, are of key importance – and we also support our partners in this regard. We organize transport, ensure the delivery of materials, and help with their placement at the stand.

Currently, the dominant trend is the expectation of increasingly individualized, customized booths. Standard solutions are being replaced by tailor-made concepts, using modern materials such as MDF, glass, and plexiglass. Large glazing, plexiglass elements, and multimedia screens are increasingly being used. TVs and monitors, on which companies present videos about their activities, are extremely popular today. A well-designed and well-lit stand makes a huge impression –and this is the direction in which the market is currently heading

You have received numerous awards for your excellent organization, for helping Polish companies, and for your contribution to promoting the Polish economy abroad. What makes Polish products and services attractive to foreign partners, especially in the food and industrial sectors?

We think that Polish products are simply wonderful. And we have to start with the fact that probably no one in the world can beat our confectionery industry.

It is such a well-known branch that our confectionery products are highly valued all over the world. It doesn’t matter whether we are in Dubai, Cologne, Paris, or anywhere else – even in the United States. Our brands – whether Wedel, Mieszko, or Jutrzenka – are recognizable and respected. The products are eagerly purchased.

We have been recognized not only by international trade fair organizers, who award us various diplomas and distinctions, but – what is particularly important to us – we have also been awarded the title of Ambassador of Polish Exports in the Food Industry. We received this distinction for our company, for which we are very grateful. It ennobles us and motivates us to become even more involved.

What are the current trends in the trade fair market?

New sectors are currently developing very dynamically, especially in the food industry – I am referring to the organic, eco, and healthy food segments. This is not a completely new topic, but in recent years its development has gained tremendous momentum. More and more companies, including our clients, are asking us at which events they can present their organic products and healthy food.

Trade fair organizers are recognizing this trend and adapting to it –they are expanding existing organic and eco zones, and if they do not have them yet, they are introducing them into their offer so as not to lose potential exhibitors. Companies with modern, attractive organic products quickly find customers because the market is extremely receptive and open to this type of offer. The best confirmation of this can be found at trade fairs such as Anuga or IFE in London, where organic and eco zones are already very well developed and enjoy great interest from both exhibitors and visitors.

The anniversary is a perfect moment for you to look to the future. We already know the history of the company – what are your plans? How do you see further development?

We are definitely looking to the future with optimism. We intend to continue what we are already doing, while adapting to changing technologies that also affect the way exhibitions are organized.

In the near future, we want to place even greater emphasis on environmentally friendly solutions. We plan to analyze whether the materials used to build stands are environmentally friendly, striving towards sustainable exhibition – this is our first priority.

The second area is further international expansion. Following the success of our expansion into the African, Middle Eastern, and Asian markets, we are now seriously considering South America. We are already receiving signals from companies interested in this direction and looking for new markets there. Our goal is to be present not only in Brazil, but also in other countries in the region.

In the coming years, we would like to offer Polish manufacturers the opportunity to participate in trade fairs in those markets – and this is one of the key points of our development strategy.

This is what we wish for you – every success, continued strong growth, and the same attention to every detail and every entrepreneur operating in the FMCG market.

An interview with Iwona Kruszyńska, responsible for coordinating exports and cooperation with international partners at

Eurowafel has been the leader in the baked wafer segment in Poland for years. What are the biggest challenges in maintaining this position, especially when you are simultaneously developing new product segments?

The most important thing is to grow in a thoughtful way and not cannibalize our bestsellers. Each new product must have a clearly defined role in the portfolio. Investment decisions are also key—whether to increase production capacity for best-selling products or to allocate CAPEX to new products, and most importantly, at what point. Another challenge is the appropriate allocation of human resources – so that the team can develop innovations without disrupting the core business. Added to this is the introduction of a new brand and the fact that we operate in a category where competition is extremely strong.

Which Eurowafel products are currently the most successful on foreign markets?

The core of our business is still the Polish market, where we are the undisputed leader in baked wafers. At the same time, starting this year, we are focusing even more on exports – which is also the reason why I joined the team. Expanded wafers, both in standard and mini formats, are performing best on international markets. We are also seeing a very good reception for our line of non-fried potato and lentil chips, which respond to the trend for healthier snacks.

Are there any differences between the expectations of Polish and foreign consumers?

They are significant, which is why we are consciously adapting our portfolio in both the wafer segment and the MOONSY line to suit the preferences of individual markets. Firstly, there is the flavor profile – in some countries, milder flavors are preferred, while in others, more distinctive flavors are preferred. We also modify recipes and adjust weights and packaging formats, e.g., single pack vs. multipack, to meet local expectations. Thanks to our experience and flexibility, we are able to quickly translate consumer insights into store shelf offerings.

Exporting is not only about sales, but also logistics and operational challenges. How do you deal with challenges in these areas?

For us, these are not so much difficulties as simply additional requirements that need to be addressed efficiently. We deal with fluctuations in transport costs, so we operate on the basis of a mix of contracts and proven logistics partners. We optimize palletization to market standards. On the product side, thanks to our own graphic designer and R&D department, we efficiently prepare layout and recipe variants for different markets, as well as customized packaging weights. We ensure that our packaging complies with regulations (required claims, recycling pictograms) for individual markets. A major challenge is the need to use multilingual labels on limited packaging space – we use late-stage customization, printing multilingual elements and variable data during production. Where necessary, we take into account additional certifications (kosher).

What are the strategic development plans for Eurowafel and the MOONSY brand in the coming years?

Our main goal is to strongly introduce the MOONSY line to export markets. It is an innovative line of non-fried chips, which has won the Perły Rynku (Pearls of the Market) award for the second time in a row. For us, this confirms that we are on the right track –customers want alternatives to traditional potato chips. At the same time, we are developing Eurowafel’s presence in new markets, showing that we are not only a leader, but also an innovative and efficient partner in implementation.

After the first trade fair presentations, we have seen a very good reception of our products, which is why we are expanding our portfolio with new flavors and adapting them to the expectations of consumers in a given country. Our R&D, marketing, and graphics departments give us a real advantage—we can quickly create recipes, prepare product mock-ups, and develop consistent promotional materials, which is a huge asset in international cooperation.

– says Piotr Wieloch, Member of the

Management Board, Director of Marketing and Exports at Partner Center. Today we take a closer look at Partner Center, one of Poland’s leading wine and spirits distributors.

Partner Center has been operating in the alcohol import and distribution market for many years, dealing in both wines and spirits. What were the key moments in the company’s development and what is its current position on the domestic and international markets?

Partner Center has been operating on the Polish market for nearly 35 years. The company’s beginnings, in the 1990s, were marked by the import of French wines and active sales development in the HoReCa segment. Over the years, the company has established a strong position in this market segment, becoming one of the leading importers of wines and spirits from around the world.

Ten years ago, another important moment came - our development strategy also took a new direction: off-trade. Today, Partner Center is a “comprehensive supplier” – we work with the biggest players in the ontrade and off-trade markets. We import and sell over 7,000,000 bottles annually and work with over 100 suppliers from around the world. 2025 is another milestone year for Partner Center. Our strategy is strongly focused on export activities. We are active in this field and are attracting an increasing number of foreign companies interested in our brands. Our craft vodka Czarna Olcha is number one when it comes

to exports. This is hardly surprising, as it is the most sought-after category of alcohol on foreign markets. And Polish vodka still enjoys a good reputation.

So, what conditions must vodka meet to attract the interest of demanding consumers on foreign markets?

– As a nation, we are famous for producing excellent quality vodka, and this opinion is still present on foreign markets. It is worth mentioning here that Poland is one of the leading exporters of spirits in the world. According to KOWR data, in 2024, products worth EUR 560.2 million were sold on foreign markets, almost 8% more than in the previous year.

The simplest criterion is the fact that it is produced and bottled in Poland. Another criterion is the quality of the vodka, and here we need to divide this “piece of the pie” into two categories: mass production and craft production. We focus on the latter – high-quality production.

This is in line with the premiumization trend observed on the market – it is not quantity but quality that matters. Our craft vodka, Czarna Olcha, is produced in Podlasie from the best raw materials

–

spirit made from Polish rye. It is aged for a minimum of two to three weeks, and no more than 2,500 bottles are bottled each day. This almost boutique production is what sets our product apart. The appearance of the bottle itself is also an important aspect. We attach great importance to this. All this means that our vodka is not a cheap product, but in return, the customer receives exceptional quality in an exceptional setting. I would also like to add that Czarna Olcha has won many prestigious industry awards.

Does the trend towards craftsmanship and artisanship still play an important role in the alcohol industry? How important are authenticity, locality, and product history in the process of building an alcohol brand today? How important is storytelling?

For customers, and there are more and more of them, who value quality products, authenticity, locality, and history are very important. Conscious consumers are also willing to pay more for such products.

Good storytelling is an increasingly appreciated currency. You can build a lot on it – relationships, trust, but, what is important in this case, also sales. This is, of course, a much smaller piece of the market, but one that gives much more “commercial” satisfaction.

It is worth mentioning that storytelling is particularly important for sales in the HoReCa channel. Guiding the customer using the history of wine during tasting or getting them interested in the product, and as a result selling not a glass of wine, but a whole bottle, are key areas of knowledge and activity in this segment.

Poles are traveling more and more often, returning from trips abroad with a solid knowledge of wine – we have simply become more aware consumers in this area.

The percentage of people visiting restaurants and knowing the basics of wine is much higher today than it was a few years ago. This translates into a search for specific grape varieties and wine regions, as well as curiosity about the history and storytelling of wine.

California, the Old World of Wine, Africa, the cradle of winemaking in Georgia and Armenia, to the corners of Australia and New Zealand.

From the point of view of our off-trade offer, our main activities focus on the development of the Italian brand Casa Pecunia, the Georgian Kazbek Peak, the craft vodka Czarna Olcha, and a new addition to our offer – the Dolcetino brand.

In recent months, we have seen a decline in sales of vodka and beer, but also wine. What do you think is the reason for these changes? Are they the result of changing consumer habits, economic factors, or perhaps legislative measures?

There are indeed declines, everyone can see that. In terms of volume, the market has been shrinking by several percent for years. That is why the export of strong alcohols is a great opportunity for Polish producers.

Personally, I ask an open question: is this already a trend, or is it still just a fad influenced by influencers?

Today, new generations are indeed entering the adult consumer market, shaping completely different purchasing expectations. This mix of older and younger consumers means that the offer must be very diverse.

We work with the biggest players in the on-trade and off-trade markets. We import and sell over 7,000,000 bottles annually and work with over 100 suppliers from around the world.

The off-trade market, on the other hand, represents a completely different consumer approach. Of course, conscious customers know exactly what brand, country, appellation, and grape variety they are looking for in the store. But the other group of customers, the less conscious ones, often make impulsive choices, focusing on the appearance of the bottle and label, narrowing their choice down to the categories of white/red/sparkling and sweet/dry.

If we conducted a survey on how many people read wine labels when choosing from the store shelf, I think it would be a small percentage of consumers.

What product categories is the company currently focusing on the most and what is the structure of its offer?

The priority is to develop the offer of well-known and reputable wineries from around the world for customers in the HoReCa segment. Our catalog is quite a journey – from South America, through

Over the last two years, we have seen a trend–including the NoLo trend – towards lighter alcoholic products, full of flavors and colors. Consumers who choose such products expect a much lighter flavor profile – I would call it “easy-drinking.” We must be ready for this. But let’s not kid ourselves – there are still consumers who prefer classic, strong spirits or wines.

What are your main export destinations and which foreign markets have the greatest potential today for the development of sales of wines, vodkas, and other alcoholic beverages from the Partner Center’s range?

We are open to all possible directions. We have been exploring this area for a long time and see great potential in typical export destinations for Polish vodka, such as Western European countries and the United States. However, we are surprised by the openness and interest in our offer from very exotic destinations, such as Bali.

What challenges does a company operating at the intersection of alcohol import, distribution, and export face today? Are these mainly logistical, cost, or legislative issues, or perhaps also cultural ones?

From the point of view of our offer, we operate in accordance with our brand development strategy. We focus on our main import destinations and actively develop our products. In terms of organization, like every other company in this sector, we emphasize the digitization and automation of our activities. We are committed to simplifying internal and external processes as much as possible and to using AI technology in our daily work. However, relationships, quality relationships, remain our greatest value.

With almost 40 years of family tradition, Fanex has become a trusted partner in the HoReCa sector in Poland and abroad. Known for its distinctive sauces, condiments, and openness to international cooperation, the company is focusing on innovation, sustainability, and exports to strengthen its position in Europe and expand into Asia and North America.

Advertising material commissioned by Fanex

You are a family business with almost 40 years of tradition, and your products have a strong position, especially in the HoReCa channel. What are the biggest challenges facing the brand in order to not only maintain this position, but also strengthen it?

Our priority is to respond quickly and effectively to the rapidly changing trends in the HoReCa industry. Customer expectations change from season to season, and we have to be ready for that. That is why we consistently focus on innovation, the highest quality, and partnership-based relationships with our customers. We see that this approach allows us to grow together with the market. Proactivity is also very important – we do not wait to see what the future will bring, but try to set the direction ourselves. This places high demands on our experienced team, but it also gives us great satisfaction when we see the results of these efforts.

You are a producer of savory and sweet sauces and various types of condiments. Which of these products are the most popular on foreign markets?

Our Premium ketchups, garlic sauce, mayonnaises, as well as distinctive BBQ and sweet and spicy sauces are the most popular on foreign markets. They meet the needs of demanding gastronomic customers who are looking for intense, distinctive flavors. Our Asian sauces, developed in cooperation with one of the largest catering companies in Japan, are also highly regarded. This is an example of how openness to international partnerships and the exchange of experiences can create a range of products that work well in different cuisines around the world.

Consumers are placing increasing importance on sustainable development and are also becoming more aware of the impact of nutrition on health. How is Fanex responding to changing consumer expectations regarding food products?

More and more of our products have a so-called clean label – no preservatives, less sugar and salt. We are also taking steps to optimize water consumption – we have our own pre-treatment plant, we use full osmosis and water recycling systems. When it comes to energy,

we purchase some of it from renewable energy packages from specialized suppliers.

Have you noticed any differences between the expectations of Polish and foreign consumers? Are the trends on the Polish and foreign markets similar or different?

Trends related to health consciousness, limiting artificial additives, and searching for new flavors are similar around the world, but differences emerge in the details—primarily in local taste preferences. In some countries, there is a demand for milder flavors, while in others, spicy and aromatic products are more popular. That is why we always adapt our recipes to the specific characteristics of the market. At the same time, in many cases, we are able to transfer interesting ideas from abroad to Poland, modifying them to suit local tastes.

Our Premium ketchups, garlic sauce, mayonnaises, and distinctive BBQ and sweet & spicy sauces meet the expectations of demanding gastronomic customers looking for bold, intense flavors.

In which countries are Fanex products most popular? Are you planning to take steps to increase exports to other countries?

When it comes to exports, we have so far focused mainly on European markets, and our products are available in Spain, Hungary, the Czech Republic, Romania, and Denmark, among others. These are markets where our brand is already well recognized and enjoys a high level of trust. In the coming years, we want to strengthen our position there, while developing sales in other European countries. We are also looking more and more boldly towards Asia and North America.

What makes Fanex products stand out and what is behind their great success?

The secret of our success lies in the combination of three elements: distinctive taste, consistent quality, and flexibility in adapting to customer needs. Every product that enters our range is the result of the consistent implementation of a strategy rooted in market re-

alities. We continuously invest in our team because we know that it is people—their knowledge, passion, and commitment—that are the foundation of our position. Equally important is our business culture, based on mutual respect and long-term cooperation.

You use modern technologies to produce your sauces and spices. Are you planning to invest even more in this area?