A Black firefighter began his career in a City’s fire department in the 1990s, was promoted to Captain in the early 2000s, and was later promoted to Battalion Chief (BC) in 2012.

In early 2021, the BC attempted to skip a rank by applying for promotion to Deputy Chief (DC). The rank between BC and DC is Assistant Chief (AC). The 2021 promotion process used a structured oral interview with standardized questions that a panel of senior officials, from both within and outside the City, scored independently. The panel used a forced ranking process, and the applicants were ranked based on their interview performance. The BC ranked second overall. The topranked candidate, who was White and held an AC position, was promoted.

The BC filed internal complaints beginning in 2021 related to workplace investigations, discipline, and alleged mistreatment. He was disciplined with a 48-hour suspension, which was unrelated to his prior complaints and based on separate conduct. He took an extended medical leave and, upon return, was required to complete a physical readiness test. In 2022, the BC filed an internal EEO complaint regarding how his discipline was delivered.

In 2022, two DC vacancies arose. As in 2021, the 2022 promotion process used a structured oral interview panel with independent scoring. The panel members included senior officials from within and outside the City who used forced rankings. The BC again applied. The panel members independently scored the candidates, ranking the BC near the bottom of the candidate pool. The two highest-ranked candidates, who were White and held AC positions, were promoted. The decision-makers for the 2022 DC promotion relied solely on panel rankings and did not discuss the BC’s race or prior complaints.

The BC did not challenge the 2021 and 2022 promotion decisions until he filed a lawsuit in 2023. The BC alleged that he was denied promotion in 2021 and 2022 because of his race, in violation of California’s Fair Employment and Housing Act (FEHA). The BC also alleged that the City retaliated against him for his protected activity – such as internal complaints, participation in investigations, or opposition to perceived misconduct – by denying him a promotion and subjecting him to adverse employment actions.

LCW Partner Jesse Maddox, Partner Nathan Jackson, and Associate Attorney Charles Hellstrom aggressively represented the City during a five-week jury trial. The trial team successfully bifurcated the trial into liability and damages phases; used motions in limine to control the scope of the claims and evidence; was required to address multiple “me too” witnesses; and located key rebuttal evidence in the middle of the trial.

The jury returned a complete defense verdict for the City, finding that the BC’s race was not a substantial motivating reason the City selected others for the DC positions. The jury also concluded that the BC’s race was not a substantial motivating reason for his 48hour suspension. The BC also lost his FEHA race and retaliation claims.

A county uses a standard process to enroll new employees in health insurance. That process requires a third-party administrator to enroll the new employee after the employee is entered into the county’s HR system. The county has no control over the administrator’s scheduling of new employee enrollment meetings.

In this case, the county hired an employee at a salary level that required the county CEO’s approval. The time needed for that approval delayed the employee’s entry into the county’s HR system until November 30th. The third-party administrator contacted the employee that day and held an enrollment meeting on December 2nd.

The employee became a plan participant effective January 1st, with medical coverage beginning February 1st, after the required 30-day waiting period. To maintain continuous coverage, the employee paid one month of COBRA premiums for the insurance he had from his prior employer. The employee then filed a grievance against the county seeking reimbursement for the COBRA premiums.

The arbitrator rejected the employee’s claim that coverage should have begun on January 1st. The arbitrator found that the county made no promise or guarantee regarding when health insurance coverage would begin. The arbitrator noted that the employee met with the benefits administrator within 30 days of eligibility, as required by the health plan enrollment guidelines.

The arbitrator found no MOU violation and determined that the county timely and properly enrolled the employee in health insurance coverage.

The union for a healthcare district filed a grievance. The grievance alleged that the employer violated the collective bargaining agreement (CBA) by failing to apply base salary increases to the most senior nurses who had exceeded the highest step on the salary grid.

The CBA provided for annual across-the-board wage increases tied to a salary grid that capped at a specified maximum year of service. Nurses who served beyond that maximum were not eligible for step increases but instead received a separate, long-term service adjustment. These nurses who were already paid above the top grid rate were “red-circled,” meaning their base salary was frozen until the grid caught up, although they continued to receive the separate, long-term service adjustment.

In the grievance arbitration, the union argued that it understood that all the nurses would receive the increase in base salary plus the long-term service adjustment. The employer countered that it followed the explicit terms of the CBA.

The arbitrator acknowledged that the employer’s approach could negatively affect the retention of the most experienced nurses. But the arbitrator concluded that the CBA’s unambiguous language controlled. Because the salary grid did not extend beyond the maximum step, and the CBA specifically addressed compensation for

employees above the maximum step through a long-term service adjustment, there was no contractual basis for any additional base salary increases.

The arbitrator further determined that the employer’s decision to red-circle senior nurses did not reduce their pay, nor violate the CBA. The arbitrator denied the grievance in its entirety.

In 2019, a fire department suspended a firefighter for 30 days based on 11 instances of misconduct, including discourteous and offensive conduct toward the public and failures of supervisory responsibility. The firefighter appealed.

An administrative law judge (ALJ) found just cause for the suspension based on 10 of the 11 alleged incidents. The ALJ concluded that the firefighter’s conduct harmed the public service by: undermining patient trust, exposing the department to potential liability, and creating tension within the crew. The ALJ further found that no emergencies had occurred to justify any deviations from policy. The firefighter’s repeated confrontations with patients and colleagues showed he had poor judgment in his supervisory role.

The ALJ determined that there was a risk of recurrence because the firefighter had only accepted limited responsibility and minimized or denied the misconduct. The ALJ concluded that a 30-day suspension was an appropriate and proportionate penalty that both addressed the misconduct and allowed for the possibility of rehabilitation.

The MOU defined the ALJ’s decision as advisory to the city manager, who concurred with the ALJ’s decision.

A group of employees of the City and County of San Francisco (the City) filed a class action alleging that the City’s disability retirement system benefits formula discriminated against older workers in violation of California’s Fair Employment and Housing Act (FEHA).

The employees challenged the San Francisco Employee’s Retirement System (SFERS) which calculated disability retirement benefits using two formulas and paid retirees the higher amount of either: Formula 1 (Regular Formula): based primarily on years of service and salary; or Formula 2 (Backup Formula): based on estimate of what the employee might have earned if they had continued working until age 60, subject to limitations.

The employees argued that Formula 2 disproportionately benefited younger workers and could result in lower disability retirement benefits for employees hired at age 40 or older. They claimed this was unlawful age discrimination. After a bench trial, the court ruled in part that pension status motivated the City’s disability retirement system and that age was not a substantial motivating factor. The employees appealed.

The California Court of Appeal ruled in favor of the City, holding that the disability retirement system formulas did not violate FEHA. The Court found no evidence that the City designed the system to target or disadvantage older workers because the formulas are based on years of service and earnings, not age. The employees failed to prove any discriminatory intent or to state a disparate impact on older workers.

Carroll v. City & County of San Francisco, 115 Cal. App. 5th 1192 (2025).

Deputy’s Refusal To Undergo Treatment Doomed His Service-Connected Disability Retirement Application.

Alberto Mendoza worked as a Deputy Sheriff for Ventura County. He injured his back at work in late 2014 and mid-2015. In 2015, three different doctors recommended the surgery, and the County authorized it. One doctor predicted Mendoza had a 90% chance of good to excellent results. Mendoza declined the surgery. A doctor reported that Mendoza was “simply scared” to complete the procedure based on “bad information” from his friends and the internet. Mendoza applied for a service-connected disability retirement in 2016. The County advised Mendoza that it was challenging his application.

Doctors continued to examine Mendoza’s back from 2016 to 2019. In 2018, Mendoza reported constant pain, but he was still not interested in surgery. He did not continue a doctor-recommended home exercise program because he said the exercises hurt his back. In 2019, a doctor recommended that Mendoza undergo a work-hardening program to help him increase his ability to lift and potentially return to work.

The administrative hearing on Mendoza’s service-connected disability retirement petition took place in December 2019. Mendoza called no witnesses and testified that he declined the surgery because his incontinence symptoms had decreased, and he felt he was getting better. He testified that he did not see any medical benefit to the work-hardening program because the exercises increased his pain.

In October 2020, the hearing officer issued a recommended decision to deny Mendoza’s application. The hearing officer determined that Mendoza refused to undergo reasonable and appropriate medical treatment that had a high probability of success and would have allowed him to return to work; may have made his condition worse by refusing surgery; unilaterally decided to stop home exercise; and did not participate in the work hardening program the County had authorized. The County’s retirement board adopted the hearing officer’s recommended decision.

Next, Mendoza petitioned for a writ of administrative mandate in the superior court. The superior court denied Mendoza’s petition based on the common law doctrine of avoidable consequences/ mitigation of damages. Under that doctrine, an application for service-connected disability retirement benefits is properly denied if the applicant’s disability is caused, continued, or aggravated by their unreasonable refusal to undergo medical treatment for their injuries. Mendoza appealed.

In the California Court of Appeal, Mendoza argued that the doctrine could not be applied to him because: the initial surgery he refused to undergo would no longer be effective; and the subsequently recommended surgeries would not enable him to perform all of his job duties.

The Court disagreed. It found that the doctrine of avoidable consequences/ mitigation of damages applies not only if it is likely that the employee could still return to work with recommended medical treatment, but also if it is likely the employee could have returned to work but for their unreasonable refusal to timely submit to treatment that may no longer be effective due to the passage of time. A retirement board can find that the employee’s inability to return to work is not a result of their work-related injury, but rather a result of their unreasonable refusal to submit to medical treatment.

The Court of Appeal also noted that the trial court was right to presume that the findings underlying the County board’s decision were correct. Although the trial court focused on Mendoza’s refusal to undergo the approved surgery, the County board also found Mendoza had: unreasonably refused to participate in the work hardening program; unreasonably stopped the home exercise program; and required further medical care and treatment. The Court decided that Mendoza failed to establish that his writ petition was erroneously denied.

Mendoza v. Board of Retirement of the Ventura County Employees’ Retirement Association, 2025 Cal. App. LEXIS 865.

The County of Los Angeles sought a workplace violence restraining order (WVRO) against Senior Mechanic Neill Francis Niblett after a series of escalating incidents when he angrily confronted management officials and an Assistant Fire Chief over employment decisions. In October 2022, Niblett yelled profanities at the Assistant Fire Chief, advanced to within inches of the Assistant Fire Chief’s face, and spit on him while shouting.

Several days later, Niblett told a secretary that if management did not “change things,” they would have “another situation as they had with Tatone.” That was a reference to a June 2021 incident in which one firefighter fatally shot another at a fire station. The County argued this statement constituted an implied credible threat of violence, particularly in light of: Niblett’s angry demeanor; his history of confrontational conduct toward management; and evidence that he owned firearms.

Multiple witnesses testified during the hearing in the trial court. The trial court found by clear and convincing evidence that Niblett’s reference to the prior shooting constituted a credible threat of violence under California Code of Civil Procedure section 527.8, and that there was a reasonable probability of future harm. The trial court issued a WVRO prohibiting Niblett from harassing or contacting the Assistant Fire Chief or entering the Assistant Fire Chief’s workplace. The WVRO also required Niblett to relinquish firearms and ammunition.

Niblett appealed. He argued that there was no evidence of an immediate threat or that he had any intent to harm. He claimed that his statement was protected speech related to union activity and workplace grievances. He said the WVRO violated his First and Second Amendment rights.

The California Court of Appeal rejected Niblett’s arguments. The Court held that a “credible threat of violence” under section 527.8 need not be explicit or immediate or supported by an intent to harm, but may be implied when the context shows a reasonable person would fear for their safety. The statute defines “credible threat of violence” as a knowing and willful statement or course of conduct that would place a reasonable person in fear for their safety, or the safety of their immediate family, and that serves no legitimate purpose. The Court concluded that speech that meets this definition is not protected by the First Amendment. The Court further held that the firearm prohibition was lawful and consistent with historical restrictions on those who were found to pose a credible threat to others.

County of Los Angeles v. Niblett, 116 Cal. App. 5th 454 (2025).

Andrew Black sued both the Los Angeles County Metropolitan Transportation Authority (MTA) and Public Transportation Services Corporation (PTSC) for wrongful termination, Labor Code violations, and breach of contract. The PTSC is a nonprofit public benefit corporation that MTA created. Black, however, did not file a prelitigation government claim before filing his lawsuit.

The trial court sustained demurrers without leave to amend. The court concluded that both MTA and PTSC were public entities entitled to Government Claims Act (GCA) protections and that PTSC was not required to register separately because it functioned as an organizational unit of MTA.

On appeal, Black conceded MTA was a public entity but challenged PTSC’s public entity status. The California Court of Appeal held that PTSC is a public entity for purposes of the GCA because MTA used its statutory authority to create it; and that PTSC exists to further MTA’s public transportation mission, operates subject to MTA’s control, and functions as MTA’s instrumentality in managing and supplying employees. The Court rejected the argument that nonprofit public benefit corporations can never be public entities and explained that public entity status depends on the entity’s creation, governmental purpose, and relationship to government. Public entity status is not based only on traditional sovereign powers like taxation or eminent domain.

The Court agreed, however, that Black should be allowed to amend his complaint to allege an excuse from the claims presentation requirement based on PTSC’s alleged failure to comply with statutory registration requirements. A public agency must register both with the Secretary of State (SOS) and the county clerk of each county in which it maintains an office, and failure to do so excuses a plaintiff from filing a government claim. (Gov. Code sections 946.4 and 53051.)

Although MTA submitted evidence that it registered PTSC with the SOS, it failed to demonstrate registration with the relevant county clerks. The Court rejected the trial court’s conclusion that PTSC’s relationship with MTA excused it from independent registration, holding that each public agency must comply with the statute on its own. The Court affirmed the judgment in favor of MTA, reversed the judgment in favor of PTSC, and remanded to allow Black to amend his complaint.

Black v. Los Angeles County Metropolitan Transportation Authority, 116 Cal. App. 5th 677 (2025).

Members of Liebert Cassidy Whitmore’s employment relations consortiums may speak directly to an LCW attorney free of charge regarding questions that are not related to ongoing legal matters that LCW is handling for the agency, or that do not require in-depth research, document review, or written opinions. Consortium call questions run the gamut of topics, from leaves of absence to employment applications, disciplinary concerns and more. This feature describes an interesting consortium call and how the question was answered. We will protect the confidentiality of client communications with LCW attorneys by changing or omitting details.

We use volunteers from the community to assist with a variety of our agency’s events. Can we pay a volunteer, under the Fair Labor Standards Act (FLSA), for their services?

No. The U.S. Department of Labor (DOL) regulations say “individuals are considered volunteers and not employees of … public agencies if their hours of service are provided with no promise of expectation, or receipt of compensation for the services rendered, except for reimbursement for expenses, reasonable benefits, and nominal fees, or a combination thereof.” (29 USC section 553.104.) The FLSA regulations contain some parameters as to what constitutes a reasonable benefit or a nominal fee. (See 29 USC section 553.106.) Examples of the types of expenses, reasonable benefits, or nominal fees an agency may provide volunteers could include: uniform allowance; reimbursement for outof-pocket expenses; tuition reimbursement; membership in group insurance plans; or stipends that are not a substitute for compensation. In no event can a volunteer receive an hourly wage.

Brittany Roberts joins us as an Associate with experience as a federal law clerk and a strong background in employment law, making her a fantastic addition to our team and well-equipped to help clients navigate compliance and workplace challenges with practical, proactive solutions.

Whether you are looking to impress your colleagues or just want to learn more about the law, LCW has your back! Use and share these fun legal facts about various topics in labor and employment law.

An employer cannot state in a job description that driving is required for a job unless the employer: 1) reasonably expects driving to be one of the job functions for the position; and 2) reasonably believes that satisfying the job function using an alternative form of transportation (such as ride hailing, taxi, carpooling, bicycling, or walking) would not be comparable in travel time or cost. (Gov. Code section 12940(q)(1).)

Beginning January 1, 2026, the Secure 2.0 Act adds a new mandatory Roth requirement for catch-up contributions to employer-sponsored retirement plans that permit salary-deferral catch-up contributions. This includes governmental 457(b), 401(a), and 403(b) plans. Catch-up contributions are an option for allowing participants to contribute more than the typical annual limit in the years leading up to normal retirement age.

If an agency’s plan allows catch-up contributions, employees age 50 or older who earned more than $145,000 in Social Security wages in the prior year (referred to as high earners) must make any catch-up contributions on a Roth (after-tax) basis, and not as pretax contributions. The FICA wage threshold will be indexed annually. Payroll systems will need to be able to identify which employees are high earners and route

their catch-up contributions to Roth. Agencies should communicate with employees to explain why their catchup contributions are now treated as Roth.

This new requirement only applies to public agency high earners who participate in Social Security. For agencies that do not participate in Social Security, their highearner employees’ catch-up contributions will not be subject to this new mandatory Roth rule for catch-up contributions.

For agencies that participate in Social Security, high earners can elect a regular deferred amount that remains pretax, and then their catch-up contributions will be treated as Roth. For 401(a) and 403(b) plans, the IRS regulations provide an option allowing employers to use “deemed elections.” Deemed elections automatically treat the catch-up contributions as Roth once the high earner reaches the annual elective deferral limit. This provision in the IRS regulations, however, does not extend to 457(b) plans.

Please note that the requirement does not force employer-sponsored retirement plans to offer Roth contributions for regular deferrals. It only requires Roth treatment for catch-up contributions for employees who are high earners.

The new year brings many significant updates to the benefits commonly offered by public agencies to employees. Below is a summary of the key changes your agency should be aware of as you prepare for benefits administration in 2026.

• DCAP Contribution Increase: The maximum dependent care flexible spending account (also known as dependent care assistance plans or DCAPs) amount will increase to $7,500 ($3,750 for married filing separately) in 2026. This is up from $5,000 ($2,500 for married filing separately) in prior years.

• Health FSA Contribution Increase: The employee salary reduction contribution limit for health flexible spending accounts (health FSAs) will increase to $3,400 for 2026 (up from $3,300 from 2025).

• Health FSA Carryover Increase: For health FSAs that allow carryovers, employees can carry over up to $660 of unused health FSA funds at the end of a 2025 plan year and will be allowed to carry over up to $680 of unused health FSA funds at the end of a 2026 plan year.

• Educational Assistance Plan (Section 127 Plan) Cap Increase: Starting in 2026, the $5,250 cap for Section 127 educational assistance plans will be indexed for inflation. The IRS will announce what the new amount will be.

• Student Loan Repayments: Employer-provided student loan repayments are now a permanent benefit available through a Section 127 educational assistance plan. Section 127 plans can be updated to permanently include this benefit.

• Continued Telehealth Coverage under HSAs: High-deductible health plans (HDHP) can cover remote telehealth services before the deductible is met without affecting a participant’s HSA eligibility.

• HSA Reimbursements for Direct Primary Care: Beginning in 2026, HSA participants may spend up to $150 per month per individual ($300 per month per family) to pay for direct primary care (DPC) arrangements. DPC arrangements are contracts between patients and doctors where patients pay a recurring fee for a set of primary care services. Under existing HSA rules, HSA/HDHP participants cannot participate in other health plans. Under the One Big Beautiful Bill Act, DPC arrangements are not considered to be “another health plan,” so HSA participants can subscribe to them.

What steps can our public agency take to prepare a procedure for handling the final paycheck and accrued leave cash-out for a deceased employee?

In the unfortunate event that an employee passes away, public agencies should already have a plan in place for issuing the final paycheck and any accrued leave cash out. The best way to prepare is to have new hires and active employees fill out a written designation to direct the agency to issue the final paycheck and accrued leave cash out to a designated beneficiary. Government Code section 53245 allows public agency employees to designate a person, corporation, trust, or estate that shall be entitled to all checks that would have been payable to the employee had they survived. The employee is allowed to change the designation at any time. Such a designation should be retained in the employee’s personnel file. Without such designation, the final paycheck and leave cash out become an asset of the deceased employee’s estate. In that situation, an agency generally must wait until a court-appointed representative of the estate contacts the agency or until a surviving spouse or registered domestic partner files a valid affidavit to claim the asset.

For more information on some of our upcoming events and trainings, click on the icons:

Each month, LCW presents a monthly benefits timeline of best practices.

• Prepare for the Monday, March 2, 2026, deadline to furnish Form 1095-C to employees. Retain a record of your agency furnishing the forms to employees.

• Prepare for the Tuesday, March 31, 2025, deadline to e-file Forms 1094-C and 1095-C. Retain a record of the forms and proof of the e-filing. To the extent a vendor performs these filings on behalf of the agency, the agency should secure copies of the filings from the vendor. In the event of a potential future assessment, the agency will need to see the details of exactly what was filed.

• If the agency would like an automatic 30-day extension to file Forms 1094-C and 1095-C, the agency must submit Form 8809 on or before the due date of the returns.

Labor Relations

Certification Program

Developing Positive Partnerships and Leadership Excellence for Labor Relations Professionals

The use of this official seal confirms that this Activity has met HR Certification Institute’s® (HRCI®) criteria for recertification credit pre-approval.

All seven workshops include both traditional training and interactive simulations to develop skills helpful to labor relations professionals.

LCW 2026 Pre-Conference 21 January COSTING LABOR CONTRACTS

*In-Person event: San Francisco

12 & 19 February NUTS & BOLTS OF NEGOTIATIONS

12 & 19 March RULES OF ENGAGEMENT

16 & 23 April BARGAINING OVER BENEFITS

07 & 14 May PERB ACADEMY

04 & 11 June TRENDS & TOPICS AT THE TABLE

Interested?

Start Earning Your Certificate at: https://cvent.me/qWm1W9

16 & 23 July COMMUNICATION COUNTS!

13 & 20 August RULES OF ENGAGEMENT

17 & 24 September NUTS & BOLTS OF NEGOTIATIONS

15 & 22 October PERB ACADEMY

03 & 10 December BARGAINING OVER BENEFITS

*Each class consists of two dates/parts. Participation in both dates/parts is required for certification.

*Participants in the LRCP program have a three-year timeframe to complete all seven classes.

LCW Train the Trainer sessions will provide you with the necessary training tools to conduct the mandatory AB 1825, SB 1343, AB 2053, and AB 1661 training at your organization.

California Law requires employers to provide harassment prevention training to all employees. Every two years, supervisors must participate in a 2-hour course, and non-supervisors must participate in a 1-hour course.

Trainers will become certified to train both supervisors and non-supervisors at/for their organization.

Attendees receive updated training materials for 2 years.

Pricing: $2,000 per person. ($1,800 for ERC members).

Via

February 25, 2026 9:00 AM - 4:00 PM

To learn more about our program, please visit our website below or contact Anna Sanzone-Ortiz 310.981.2051 or asanzone-ortiz@lcwlegal.com.

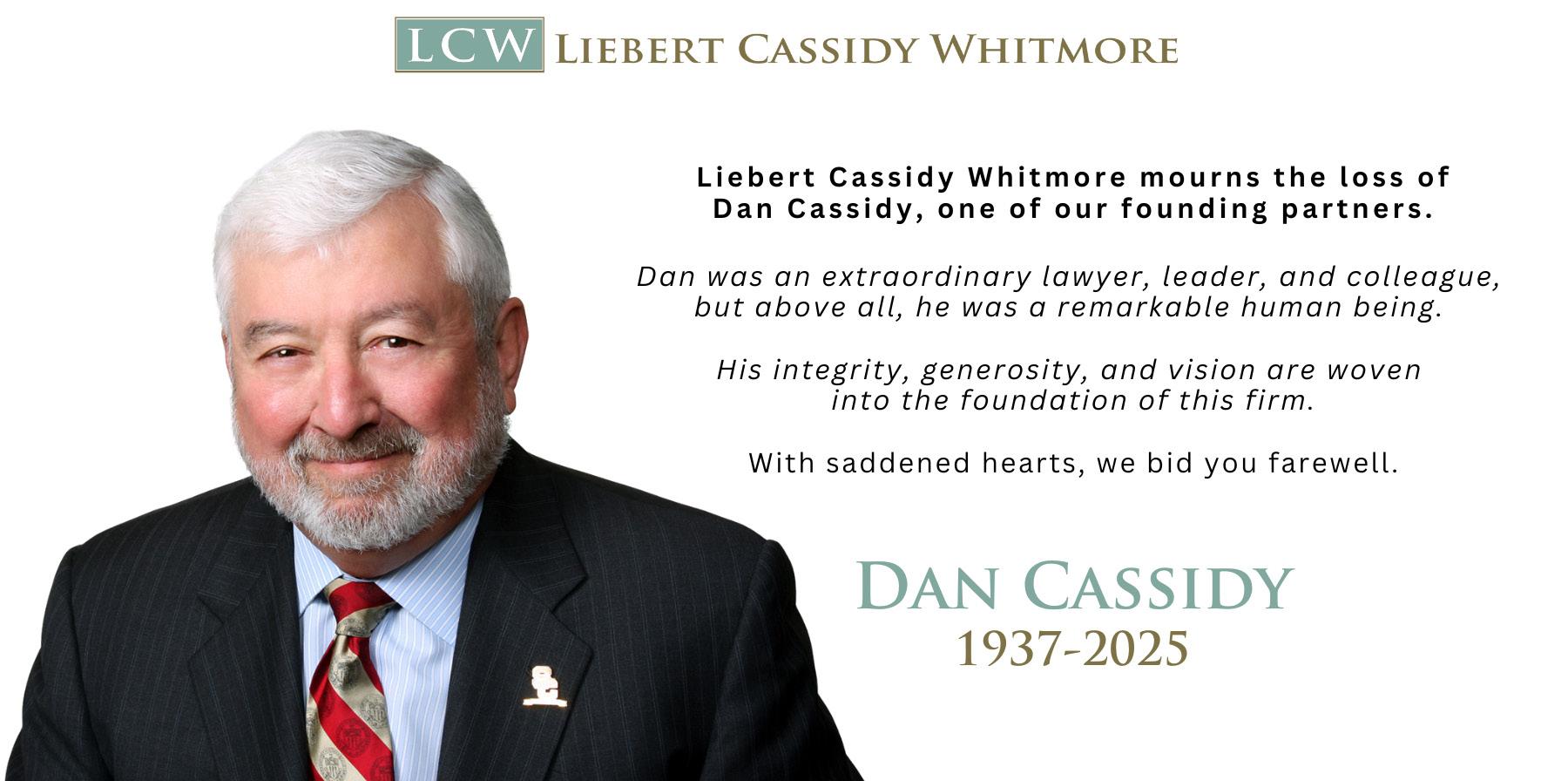

Dan Cassidy, pre-eminent public sector labor relations attorney and founding member of Liebert Cassidy Whitmore passed away on December 19, 2025. He was 88 years old.

Dan Cassidy was among the most experienced and accomplished practitioners in the fields of public sector labor relations and employment law. Over the course of his career, Dan effectively advocated on behalf of counties, cities, special districts, community colleges and school districts in negotiations, arbitrations and civil service commission and other administrative hearings. Dan negotiated hundreds of labor agreements for public agency clients, including various public safety, general, professional, and supervisory units. He also represented public agencies as a presenter and panel member in numerous interest arbitrations and fact-finding proceedings.

During his career, Dan became a well-established and widely respected authority on labor relations. He lectured and trained on labor relations – at the National College of District Attorneys at the University of Houston School of Law, University of Southern California School of Public Administration, California State University at Long Beach and before numerous other professional and educational organizations.

Dan began his legal career at Los Angeles County, eventually serving as Chief of the Labor Relations Division of the Los Angeles County Counsel’s office. He left the County to join Patterson & Taggert, where he met John Liebert. Together the pair, along with 4 other attorneys, formed our firm in 1980 and grew the firm’s practice to become California’s leading public sector, education and nonprofit management law firm which now has more than 120 attorneys in five offices.

Dan was a USC Trojan through and through. He was a longtime university volunteer and served on the Half Century Trojans Board of Directors (including as President) and was honored with the Alumni Service Award in 2017.

Dan also remained active in the firm, providing mentoring to our attorneys as well as serving as a faculty member of our Leadership Academy.

Dan is survived by his beloved wife Terri, sons Tim (Chris), Stephen (Janelle) and Danny (Denise); daughters Kathy (Mike) and Jeanine (Joe), along with 14 grandchildren and 14 great grandchildren (with number 15 on the way).

He is also survived by hundreds of colleagues, friends and mentees whose lives have been changed due to his vision, leadership and presence. Regardless of school affiliation, in his memory we collectively strive to honor his legacy and FIGHT ON.