The budget bISME

ISME reacts to Budget 2026

Credit where it’s due.

Having difficulty getting a new business loan or restructuring your existing debt with your bank? Established by the Minister for Finance, Credit Review is here to help.

Talk to the credit experts today on 0818 211 789 or visit creditreview.ie

CONTENTS

17 Kildare Street, Dublin 2, Ireland.

Phone : (01) 662 2755

E-mail: info@isme.ie

Web: isme.ie

Published by iSME

Editorial: gopika@isme.ie

Design: whooleyciara@gmail.com

Advertising: marketing@isme.ie

4. A Message from the Chief Executive: ISME CEO Neil McDonnell discusses Defamation Bill, Budget, and Benefits

6. ISME at work for you: ISME Reacts to Budget 2026

8. The b News: News and updates for business

14. HR Focus: Gender Pay Gap Reporting 2025

18. Future Focus: Pension AutoEnrolment Arrives January 2026

20. Heath & Safety Focus: Safe Driving For Work

22: Marketing Focus: How Marketing Data, Strategy and Focus Drive Results

24.The b Insight How SEAI Business Supports Are Powering Irish Businesses Toward a Greener Future

27. Finance Focus: The Hidden Costs Undermining Irish SMEs

28. The b Event The ISME Annual Business Lunch is BACK

30: Learning Focus Empowering Businesses Through Applied Research

32. Member Feature Gilligan Black Recruitment

Update on Defamation Bill, Budget, and Benefits

Colleagues,

As we go to press with this update, we have no idea if the Seanad will accept amendments we have made to the Defamation Amendment Bill at Committee Stage on 1st October. The legal lobby have played a blinder in confining the debate to whether we have juries in defamation trials, despite the fact that jury trials make up less than 1% of the 300 defamation cases each year. The vast majority of cases are taken in a retail setting. We have made it clear to both the Department of Justice and to Commissioner Michael McGrath who oversees the Justice portfolio in Brussels that we will not rest until we see this defective legislation properly amended.

Tuesday 7th October was budget day. Our prebudget submission covered five essential themes for small businesses:

1. The need to control business Costs

2. The need to reform Indigenous Enterprise Policy

3. The need for Skills and Training among our enterprise base

4. The need to control public finances

5. The need for adequate levels of affordable housing

We saw very little indication of what any movement on the main areas that require action in this budget. The 9% VAT reintroduction next year is welcome, but many SMEs may have gone under by the time it arrives.

The expansion of the R&D tax credit is also welcome, but to date, this credit has been grossly overconcentrated in the FDI sector. Moves to reduce the cost of apartment building cannot come fast enough.

We remain determined to ensure that government does not proceed with the plan to raid the NTF

Neil McDonnell, Chief Executive, ISME

surplus. We’ve never has such demand for training courses, and this money was never intended to put solar panels on the roofs of universities.

We attended a Department of Social Protection information launch on Auto-Enrolment on 24th September. You can view the recoding of the briefing HERE. The good news for employers is that admin will be very simple: AE requires only that employers (and/or their payroll provider) registers for AE, and sets up a variable direct debit. What happens then is that anyone who is eligible for the AE deduction, Revenue will process that deduction automatically. It will be similar to but separate from the automatic deduction of PAYE/PRSI/USC.

A key point that emerged from the AE briefing is that the qualification hurdle, which is €20,000 in income per annum, is analysed QUARTERLY. Therefore, if you have any workers who exceed €5,000 in income between the second week of October and the end of the year, they will qualify for an AE deduction in January. There are many workers in retail and hospitality for whom this will be the case. You should talk to your payroll provider and your accountant NOW.

Lastly, remember you’re in Q4, and if you’re considering granting staff a tax-free benefit under the Revenue Small Benefit Exemption scheme, you need to plan for it now and order your Me2You gift cards from ISME. Remember- you can now gift up to €1,500 annually, which is the equivalent of €3,480.68 in total remuneration cost to you the employer. Don’t forget to let employees know in good time ahead of Christmas what they qualify for- they can budget a voucher into their Christmas shopping.

Neil McDonnell ISME CEO

Centre of Excellence for the Education & Development of Finance Professionals

At LIA, we empower our members with the knowledge and skills to deliver the best financial advice - guiding clients toward true financial wellbeing.

We’re proud to continue to elevate the standard of financial advice in Ireland through our evolving education programmes , expert thought leadership , and a membership experience built on exceptional service and support.

Contact us today to find out how we can support you!

Email - education@lia.ie Phone - 01 456 3890.

“ Steady but Unambitious ”

ISME Reacts to Budget 2026

ISME has described Budget 2026 as “steady but unambitious,” welcoming its stability and fiscal responsibility while criticising its lack of vision for Ireland’s indigenous enterprise sector.

The association broadly welcomes the Budget as a stable and responsible package that maintains fiscal discipline in uncertain times. Employment remains at record highs, reflecting the resilience of Irish enterprises and workers. However, persistent cost pressures, skills shortages, and housing challenges continue to impact businesses, families, and communities across the country.

While inflation is projected to ease to around 2% in 2026, the cost of doing business remains unsustainably high. SMEs continue to face rising costs in energy, insurance, wages, and compliance, with little in this Budget to deliver the structural reform needed to support competitiveness or protect local employment.

Although there are some reliefs for businesses in the form of VAT reductions, these will not commence until the second half of 2026, while cost increases associated with the minimum wage rise and autoenrolment will take effect immediately in January. “Not all SMEs will make it through the next six months,” ISME warns.

With the US economy under strain and bond markets signalling fiscal stress in both France and the UK, ISME had hoped for a step-change. Unfortunately, Budget 2026 has delivered only incremental change.

SME Competitiveness and Structural Reform

ISME highlights that while Ireland spends heavily on enterprise supports, much of this is captured by large foreign companies. R&D tax credits, for example, remain concentrated in multinationals with limited impact on SMEs. The association notes that €1.5 billion currently sits idle in bank deposits that could be channelled into SME capitalisation via an Irish version of the UK’s ISA.

Meanwhile, SME credit continues to fall in sectors such as retail, hospitality, and construction due to cost pressures and excessive risk.

“If we want to scale our indigenous enterprise base, we need ambitions and goals in the spirit of Ardnacrusha or Whitaker’s Programme for Economic Expansion,” said ISME CEO Neil McDonnell.

Key Recommendations

In its Pre-Budget submission released in May, ISME outlined several recommendations to address the imbalance favouring large multinationals over Irish SMEs. These included:

1. Business Costs

ISME called for a reset on the national minimum wage calculation, legal reforms to deter vexatious lawsuits, and the reintroduction of the insurance ‘Blue Book’ to improve transparency.

It noted that countries with the highest wages in Europe — Denmark, Switzerland, Norway, and Iceland — do not have a statutory minimum wage. While the UK has a higher minimum wage than Ireland, its median wage is lower, showing that workforce productivity, not minimum wage rates, drives higher earnings.

ISME also warned that as long as the legal lobby continues to push for higher awards, insurance costs will keep rising. It further stressed that Ireland’s increasingly complex tax code needs comprehensive simplification to reduce compliance costs and restore transparency.

2. Indigenous Enterprise Policy

ISME proposed targeted tax reliefs for Irish entrepreneurs, a reduction in VAT thresholds for exporters, and formal SME representation on the Labour Employer Economic Forum (LEEF).

The group highlighted the omission of its proposed change to Revenue rule Section 56 on VAT treatment

for exporters — a measure that would have cost the Exchequer nothing. ISME also criticised the lack of reform to the EII, KEEP, and SURE schemes and maintained that the 33% Capital Gains Tax (CGT) rate is costing the Exchequer at least €500 million annually.

The increase in lifetime entrepreneurial relief from €1 million to €1.5 million is welcome but, according to ISME, “too small to encourage serial angel investors.” While the simplification of the R&D tax credit is positive, the association cautions that the credit must not be strangled by excessive regulation and red tape.

3. Skills and Training

ISME has raised concerns about the failure to increase the Skillnet budget. Employers currently contribute €1 billion per annum into the National Training Fund, but can only access €60 million — just 6% — of training funding, which they must also match by at least two to one. The Fund, ISME argues, should be used as intended: to support lifelong and in-work learning, particularly as Ireland’s workforce faces an urgent need for upskilling.

4. Public Finances

The association cautioned against funding permanent current spending with volatile corporation tax receipts. It proposed a standing Public Pay Commission, greater use of the Rainy Day Fund, and reforms to the PRSI system to ensure fairness.

ISME expressed concern over the 8% increase in the Social Protection budget when inflation is running at 2%. It reiterated its call to adjust PRSI rates — applying a 2% rate to all earnings and a 6% rate to marginal earnings above €424 per week — which it estimates would increase social fund contributions by over €850 million annually.

ISME also noted the absence of a voice for young people at Cabinet level, warning that “constant increases in current spending funded by itinerant corporation taxes will ultimately impoverish young people.” The organisation urged Government to take a longer-term, sustainable approach to public spending and pensions policy.

5. Housing

With housing now acting as a de facto business cost, ISME called for tax incentives to unlock rental supply. It welcomed the VAT cut for apartment construction, calling it a “most welcome stimulus” that will cost the Exchequer nothing since this accommodation is currently not being built.

ISME also welcomed the increase in derelict property reliefs, the new rental profit cost-rental scheme exempt from corporation tax, enhanced deductions for apartment conversions, and improvements to the Living City Initiative. However, it cautioned that these measures remain “far below what is required” to attract builders and landlords back into an over-regulated, over-taxed sector.

To address housing supply immediately, ISME recommends a temporary CGT reduction to 20% for a 12-month period for “accidental landlords” selling to first-time buyers — a measure it believes would free up housing stock, improve mobility, and boost home ownership.

Conclusion

In summary, ISME sees Budget 2026 as steady but unambitious — a fiscally responsible package that lacks the structural reform and entrepreneurial drive required to strengthen Ireland’s indigenous SME base.

ISME’s full Pre-Budget Submission can be accessed here .

UPCOMING ISME TRAINING & USEFUL EVENTS FOR SMES

Customer Service & Complaints Handling

Thursday, 6th

November 2025

Online Book Here

Microsoft Excel Creating & Working with Pivots

Wednesday, 19th

November 2025

Online Book Here

ESG Autumn 2025 Summit

Thursday 20th

November 2025

Croke Park, Dublin Book Here

Gifted – The Contemporary Craft & Design Fair

Wednesday 3rdSunday 7th December

RDS, Dublin Book Here

The Irish Startup Conference 2026

Thursday, 22 January 2026

Ed Burke Theatre, Trinity College Dublin Book here

ISME Finance Finder

The ISME Finance Finder, developed in partnership with Swoop Funding, is an online platform designed to streamline access to finance for Irish SMEs. It offers a centralized solution for businesses seeking funding options to start, expand, improve cash flow, refinance debt, acquire assets, or invest in new markets.

Key features include:

• Comprehensive Funding Options: Access to loans, equity, grants, and asset finance tailored to various business needs.

• Expert Guidance: Support from a team of funding specialists to assist with queries and application processes.

• Application Tools: Provision of templates and resources to facilitate funding applications.

• Dedicated Support: Availability of a hotline and email support five days a week for funding-related inquiries.

• Regular Updates: Finance updates and alerts to keep businesses informed of new opportunities

Additionally, businesses can avail of a complimentary 30-minute one-on-one consultation with Swoop’s funding experts, offering confidential and obligation-free advice.

For more information or to begin your funding journey, visit the ISME Finance Finder here.

Save Now with ISME’s Affinity Programmes

As business costs continue to rise and income for so many at the moment has been challenged, we want you to take ADVANTAGE of your ISME Membership to reduce your costs and add value to your business through the buying power of ISME.

We have negotiated preferential rates, added services and access to selected companies across a range of industries for our members. Browse the listing here to make savings of up to 50%.

To access these offers, Members need to log into isme.ie via the Members Area.

boost skills - boost business

Future-proof your skills with Skills to Advance Micro-Qualifications - short, targeted courses, at little or no cost, in key areas like sustainability, digital business skills, market development, and more.

Stay ahead by contacting your local Education and Training Board or visit skillstoadvance.ie.

Supported by the SOLAS Skills to Advance initiative and the Government of Ireland.

ISME HR Hub – your HR support

To support Members to deal with the everchanging world of HR and employment law, we have created a portal to give you access to guides, templates, contracts, policies and more to support you in managing HR in your business. We have curated the information based on the HR Life Cycle: Attraction, Recruitment, Onboarding, Policies & Training, Performance Management and Exit.

You can also find information from government agencies and other third parties in our General Information & Resources page, links to the top downloads and view our selection of blogs including Statutory Sick Pay FAQs and EU Directive on Transparent and Predictable Working Conditions.

To find out how it works and looks, click on the video about the portal here. To use the ISME HR Hub log into the Members Area, click on the top left button.

ISME’s Employee Assistance Programme

Menopause in the Workplace

October was Menopause Awareness Month, an initiative by the International Menopause Society (IMS) and the World Health Organisation (WHO) to raise awareness about menopause and improve support for women.

ISME offer an Employee Assistance Programme (EAP) to support our members and their employees. We are committed to delivering the best and most appropriate, and accessible solutions along with our partners, Laya healthcare and their health and wellbeing provider, Spectrum Life. All of their services continue to be delivered to the highest clinical standards by fully accredited, experienced professionals.

This programme offers unlimited access for your employees & their families to a 365 freephone EAP service also accessible via website, app, or live chat.

What is the cost?

• Members up to 30 employees €950 (fixed cost per year)

• Each subsequent employee €8 per employee per year

This is a discounted rate for ISME Members

For further information visit www.isme.ie/isme-wellness-programme/

50% of the population will experience menopause (with 80% of those experiencing symptoms). And the other 50% may be impacted, directly or indirectly. Menopause affects women personally and professionally, with 45 being the average age of perimenopause (the lead up to menopause) and 51 being the average age of menopause (when menstruation stops). According to the most recent Census in 2022 there are 652,000 menopausal women in Ireland and 420, 000 of these are in paid employment. This is a very large part of the workforce in Ireland.

As an employer you can avail of a number of training modules available free from the HSE on www.hseland.ie. These sessions are just 20 minutes long. In order to access these you’ll need to set up a HSEland account at https://www.hseland.ie/dash/Account/Login

From Paperwork to Progress: Government Cuts Red Tape for SMEs

On 15th October 2025, the Department of Enterprise, Trade and Employment unveiled a major initiative aimed at reducing administrative burdens and simplifying compliance for small and medium-sized enterprises across Ireland.

Under the plan, the Government will extend the “SME Test” across all departments to ensure that new regulations are assessed for their impact on smaller businesses before implementation. This is part of a wider drive to make Ireland’s business environment more agile and competitive.

The reforms will also see updates to the Companies Act, improvements to the Small Company Administrative Rescue Process (SCARP) to make it more accessible, and the introduction of a streamlined reporting system designed to cut down on duplicated paperwork and compliance costs.

These measures reflect the Government’s commitment to supporting enterprise growth, freeing up business owners to focus more on innovation, productivity, and job creation rather than red tape.

To find out more click here.

ISME Surveys

Q3 2025 Trends Survey

How did your business find the third quarter of 2025? In an ever-changing business environment, we want to hear from you on how your organisation has been impacted by completing our Trends Survey for Q2 2025 here.

Please share this survey with your network.

Watch Back: ISME Webinar with SEAI

On Thursday 23rd November ISME held this essential webinar on Steps & Supports to Becoming a Low Carbon Business featuring keynote speaker Kathleen Moore, Executive on SME Business Decarbonisation Supports team at SEAI. This outlined how your business can mitigate the risk of transport and energy costs for your business, through SEAI SME-focused tools and grants to decarbonise.

During this webinar, Kathleen talked about the SEAI supports which enable businesses to:

• Understand their energy use

• Identify significant energy users (equipment and processes)

• Suitability for deployment of renewable heat solutions

• Identify opportunities for reducing energy use and carbon emissions at their site

• Become aware of SEAI grants and supports that will help businesses to implement energy saving opportunities

If you missed the webinar— or would like to revisit key takeaways—you can now watch the full recording at your convenience here.

You can also download the presentation slides here.

Watch Back:Your 2025 Employment Law Update

There have been several important employment law changes arising from the courts and new legislation in the past year. In response to that, ISME held this webinar with Katherine McVeigh, Barristerat-Law to provide important updates to Irish SMEs.

Some of the areas we covered in the webinar are:

• A review of the WRC Annual Report – what are the most common types of cases for an employer to be aware of?

• New law relating to settlement agreements under the Employment Equality Act 1998

• How to effectively manage long term absences of an employee and what are the risks?

• Key Principles for Investigations prior to a Disciplinary Procedure

• Probationary employees: What are the risks if there is a failure to manage employees on probationary period properly and how to effectively manage them?

• Recent important employment law case law and key legal principles arising from the case law that every employer should know

Please note all information is accurate as of the date of recording in October 2025

Click here to view the watchback video

VAT Reduction for Hospitality and Hairdressing Sectors

In a move aimed at alleviating financial pressures on businesses, the Irish government has announced a reduction in the Value-Added Tax (VAT) rate for the food, catering, and hairdressing sectors. Effective from 1 July 2026, the VAT rate will decrease from 13.5% to 9%, marking a return to the rate previously applied during the COVID-19 pandemic.

This decision, confirmed in the 2026 Budget presented on 7 October 2025, is expected to cost the Exchequer €232 million in 2026, with the annual cost rising to €681 million in 2027. The government has indicated that this reduced rate will be a permanent feature of the tax code, with no “sunset clause” attached.

The VAT reduction applies to businesses in the food and catering industry, including restaurants, cafés, and takeaways, as well as hairdressing services. However, it does not extend to hotel accommodation services or admissions to certain attractions, such as cinemas and theatres, which will continue to be subject to the standard 13.5% VAT rate.

While the VAT cut has been welcomed by industry representatives as a much-needed relief, some have expressed concerns about the delayed implementation. The decision to postpone the reduction until July 2026 was attributed to the significant cost to the Exchequer and the overall budget framework.

Businesses in the affected sectors are advised to prepare for the upcoming change by reviewing their pricing structures and updating their accounting systems to reflect the new VAT rate. Further details and guidance will be provided by the Revenue Commissioners in due course.

Gender Pay Gap Reporting 2025: What Employers Need to Know

The Gender Pay Gap Information Act, signed into Irish law in 2021, marked a crucial step towards greater workplace equality and transparency. As its reach expanded to include more businesses in 2025, employers must understand its implications and take the necessary steps to ensure compliance.

This article explores the core aspects of the Act, who it applies to, and how businesses can prepare effectively.

Understanding the Gender Pay Gap

The gender pay gap refers to the difference in average earnings between men and women within an organisation. Expressed as a percentage of men’s earnings, this measure sheds light on systemic disparities in pay structures, career progression opportunities, and representation in leadership roles. While it does not necessarily indicate direct pay discrimination, it serves as a crucial metric for assessing broader gender-based inequities in the workplace.

Overview of the Gender Pay Gap Information Act

The Gender Pay Gap Information Act was introduced to address these inequities by mandating transparency in pay-related data. Under this legislation, employers in Ireland must publicly disclose detailed information about their gender pay gap, including:

• Mean and Median Hourly Remuneration – The difference in average (mean) and middle-point (median) hourly earnings of male and female employees.

• Mean and Median Bonus Payments – The average and median differences in bonus payments between genders.

• Percentage Receiving Bonuses or Benefits in Kind – The proportion of male and female employees receiving bonuses or non-monetary benefits, such as company cars or health insurance.

• Explanatory Notes – A narrative that explains the factors contributing to the pay gap and the measures being implemented to address them.

By promoting accountability, the Act encourages employers to take meaningful steps to close the gender pay gap.

Who Needs to Comply?

The implementation of the Act has been phased in gradually to allow businesses time to prepare. As of 2025, the reporting requirement now extends to all organisations with more than 50 employees, making it essential for employers of this size to be fully prepared.

7 Key Steps for Employers to Achieve Compliance

Ensuring compliance with the Gender Pay Gap Information Act requires a structured and proactive approach. Below are the essential steps businesses should take:

1. Understand the Legislative Requirements

• Employers must familiarise themselves with the Act’s requirements by:

• Identifying the reporting metrics mandated by legislation.

• Staying informed about deadlines and updates

from the government.

• Understanding the penalties for non-compliance, which could include reputational damage and potential legal consequences.

2. Determine Applicability

Businesses must confirm whether they meet the employee threshold for compliance. As mentioned previously, as of this year, the Act applies to organisations with over 50 employees.

3. Conduct a Pay Audit

A comprehensive pay audit is the foundation of compliance. Employers should:

• Collect and analyse payroll data for all employees, based on a snap shot date of their choosing in June.

• Calculate the mean and median hourly pay for male and female employees.

• Assess bonus payments and benefits in kind. Employers must also ensure that data collection methods align with GDPR and data protection regulations.

4. Identify Contributing Factors

Once the data is compiled, it’s important to analyse it for root causes of any gender pay gaps. Contributing factors may include:

• Underrepresentation of women in senior leadership roles.

• Unequal access to training and development opportunities.

• A higher prevalence of part-time work among female employees.

5. Develop an Action Plan

• A key aspect of compliance is the narrative accompanying the data. Employers must:

• Provide a clear explanation of the identified pay gap.

• Outline specific measures to address these disparities, such as mentorship programs, flexible working arrangements, and diversity initiatives.

• Set measurable goals and timelines to track progress.

6. Publish the Report

Employers must ensure their reports are publicly accessible on their website or another easily reachable platform by November each year. Reports should:

• Be clearly visible and easy to understand.

• Present data transparently, avoiding misleading interpretations.

A government-operated central portal for report submissions is also expected to increase accessibility.

7. Communicate with Stakeholders

Transparent communication is essential for demonstrating a commitment to gender equality. Employers should consider:

• Informing employees about findings and planned actions.

• Showcasing gender equity efforts in external communications to enhance employer branding.

Addressing the gender pay gap is an ongoing effort that requires continuous assessment and adaptation. As employers, you should regularly review pay data to evaluate the effectiveness of implemented measures and identify areas for improvement. Action plans should be adjusted based on insights gained from data analysis and employee feedback. Additionally, staying updated on legislative changes and best practices in gender pay equity ensures organisations remain compliant and proactive in fostering workplace equality.

But while the Act goes a long way to promote workplace fairness, some challenges may arise during implementation. Ensuring precise and comprehensive data collection can be complex, making data accuracy a significant concern. Smaller businesses may also face resource constraints, struggling to allocate sufficient time and expertise for compliance efforts. Additionally, overcoming ingrained biases and systemic barriers requires long-term cultural change, which can be difficult to implement effectively. Addressing these challenges proactively will be key to achieving meaningful progress in closing the gender pay gap.

Despite these challenges however, compliance with the Gender Pay Gap Information Act offers numerous advantages. Transparent pay practices will enhance your organisation’s reputation, improve public perception and strengthen your brand image. Demonstrating a commitment to workplace equity can also be a powerful tool for talent attraction, drawing jobseekers who prioritise fairness and inclusivity. Internally, addressing pay disparities fosters trust and loyalty among employees, leading to improved retention rates. Furthermore, research indicates that diverse and equitable workplaces achieve stronger financial performance and drive greater innovation, making gender pay gap compliance a strategic advantage for businesses.

Conclusion

The Gender Pay Gap Information Act represents a pivotal moment in advancing workplace equality. By understanding the legislation and taking proactive measures, employers can not only meet their legal obligations but also contribute to a more equitable society.

Rather than treating compliance as a mere legal requirement, you should see this as an opportunity to assess internal practices, cultivate inclusivity, and foster an environment where all employees can thrive.

At MSS, The HR People, we have the expertise to guide you through this legislation and reporting requirement with confidence. We can even assist you with completing it.

Contact us today to ensure your organisation remains fully compliant and prepared for the future of workplace equality. Info@mssthehrpeople.ie www.mssthehrpeople.ie

John Barry Director, MSS, The HR People

Ireland’s My Future Fund: Pension Auto-Enrolment Arrives January 2026

On 1 January 2026, Ireland will launch My Future Fund, its long-planned auto-enrolment pension scheme. The rollout, delayed from 2025, aligns with the tax year and allows employers and payroll providers extra preparation time.

The scheme targets Ireland’s pension coverage gap—two-thirds of private-sector workers lack private pensions. With contributions from employees, employers, and the State, it aims to boost retirement savings and ease future public-pension pressures.

Who’s Included

Employees are automatically enrolled if they:

• Are 23–60 years old

• Earn €20,000+ annually

• Are not already in a payroll pension scheme

Those outside these criteria, but aged 18 to State pension age, can opt in. Those who are self-employed are excluded.

Once enrolled, workers stay in for six months before a two-month opt-out window.

Opt-outs are automatically re-enrolled after two years; with the option to opt out again during month 7 & 8. When an employee elects to opt out, any employee contributions will be refunded to the employee however any employer & government contributions will be retained in the employees future fund. During the opt out period, the employer and the government do not make any contributions to the fund on the employees behalf.

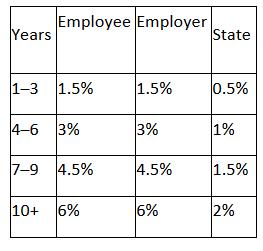

Contributions

Based on gross pay up to €80,000, contributions rise gradually over 10 years:

By Year 10, combined contributions reach 14%. In Year 1, a €40,000 salary yields €1,400 annually—€600 each from employee and employer, plus €200 from the State.

Employer Impact

1. Legal obligation – Every employer with PAYE staff must comply. Non-compliance is a criminal offence with fines up to €50,000 and possible jail terms. The National Automatic Enrolment Retirement Savings Authority (NAERSA) will assess eligibility, notify employers, and calculate contributions; employers deduct and remit via payroll.

2. Payroll updates – The delay allows changes to be built into year-end payroll software updates, avoiding mid-year disruption. Testing should start early.

3. Budgeting – Employer costs will rise from 1.5% in Year 1 to 6% by 2035. Planning for the long-term increase is key.

4. Staff communication – Clear guidance on eligibility, contribution rates, opt-out rules, and investment options will help avoid confusion and boost employee engagement.

Employee Impact

1. Compulsory savings – Workers gain a pension without having to actively sign up, supported by employer and State contributions.

2. Opt-in flexibility – Those under €20,000 earnings or outside the auto-enrolment age can still join.

3. Opt-out choice – Possible after six months during month 7 & 8, but forfeits employer and State matches; re-enrolment happens after two years.

4. Investment options – Default “lifecycle” investment gradually reduces risk, with alternative funds available.

The Bigger Picture

My Future Fund could enrol over 800,000 workers, with Tata Consultancy Services operating the central platform. It represents Ireland’s most significant pension reform in decades—simplifying savings and sharing responsibility between employees, employers, and the State.

For employers, the focus now is on payroll readiness, budgeting, and communicating with employees.

For employees, the scheme offers an easy route to build substantial retirement savings over time— potentially hundreds of thousands of euro over a career—strengthened by employer matching and State top-ups.

Safe Driving For Work

Deirdre Sinnott, Maria Staunton Murray & Joan Cahill (Health and Safety Authority).

Driving for work activities contribute to road crash risk for workers in all work sectors in Ireland. These risks affect not only employees but also other road users, including pedestrians, cyclists, e-scooter users, and powered two-wheeler riders— groups considered particularly vulnerable on the roads. According to the Road Safety Authority (RSA), road traffic collisions are a leading cause of work-related deaths in Ireland (2024). Accident data from 2018 to 2022 shows that approximately 8% of road user fatalities were work-related (RSA, 2024). To address this risk, all organisations should foster a culture of responsible and safe driving. This involves both management and employees consistently adhering to safe driving practices.

What is Driving for Work?

Driving for work refers to any situation where an individual operates a vehicle on public roads as part of their job. This includes:

• Driving a company-provided vehicle, or

• Driving a privately owned vehicle where the employee receives an allowance or reimbursement from the employer.

Law

The laws and regulations that apply to driving for work in Ireland include health and safety laws, road traffic law and EU rules on training, driver time and commercial vehicle roadworthiness. Other legislation and legal Codes of Practice

may also apply, relating to the transport of dangerous goods by road, agriculture, construction and quarry operations.

Under the Safety, Health and Welfare at Work Act 2005, vehicles used for work—whether owned by the employer or the employee—are legally considered a place of work. This means road safety is subject to the same health and safety obligations as any other workplace.

Employer Responsibilities:

• Ensure the safety and health of workers who drive as part of their job.

• Implement a safe systems approach to managing driving for work.

• Develop a driving for work policy.

• Carry out a risk assessment on all driving for work activities and include in the company Safety Statement.

• Engage and consult with employees about any aspect of the work that may affect their safety, including driving.

Employee Responsibilities:

• Comply with the employer’s driving for work policies, procedures, and safety rules.

• Hold a valid driving licence and appropriate insurance for work-related driving.

• Be fit to drive and plan journeys with safety in mind.

• Follow all road traffic laws and regulations.

As highlighted in the HSA’s guidance, the (1) driver, (2) vehicle and (3) journey should be considered.

Risk Assessment Process

A risk assessment for any workrelated driving requires the Employer to undertake the five steps as outlined in the figure below.

Road Safety is A Shared Responsibility

Creating and maintaining a safe driving culture is essential to protecting workers and the wider public. Road safety is a shared responsibility—employers and employees must work together to reduce risks and prevent fatalities on our roads.

Further Information & Resources

• Driving for Work: Risk Management Guidance for Employers

• Driving for Work (HSA Resources)

• Vehicles at Work (HSA Transport Safety Guidance)

• eLearning - Health and Safety Authority

• https://drivingforwork.ie/

Accelerating Sales to Year-End: How Marketing Data, Strategy and Focus Drive Results

As the year draws to a close, many businesses find themselves under pressure to hit ambitious sales targets. But while the final quarter can often feel like a sprint to the finish line, panic-driven marketing activity rarely delivers sustainable results. Instead, the businesses that finish strong are those that take a strategic approach – one guided by data, focused on their target buyers, and pragmatic about what really works.

If you want to accelerate sales between now and December, here are five proven steps to sharpen your efforts and create momentum that carries into the new year.

1. Let the Data Do the Talking

The first step is to take a step back. Before investing more time, energy, or budget, dig into your numbers. Which channels are delivering qualified leads? Which campaigns have converted to revenue? Are there patterns in customer behaviour you can double down on?

Too often, businesses only look at top-line figures like website visits or social engagement, and while useful, these metrics don’t tell you what’s truly moving the needle. Instead, track your funnel: from awareness to lead generation through to conversion. Focus on the activities that consistently drive revenue and pause or adjust those that don’t. The goal is to be ruthless about ROI (Return on Investment) - every activity between now and year-end must serve a clear commercial purpose.

2. Reassess Your Targets

The goals you set in January may not reflect today’s reality. Market conditions shift, buyer behaviour evolves, and external pressures can alter demand. Ask yourself: are your current targets achievable?

Reassessing isn’t lowering ambition; it’s about alignment. A target that feels out of reach risks demoralising teams and creating scattergun behaviour. A stretch-but-realistic goal, on the other hand, sharpens focus and ignites performance.

3. Stay Close to Your Buyers

Your buyers’ needs are not static. Their priorities and decision-making processes shift, especially as budgets tighten at year-end. Now is the time to listen closely and adapt quickly. Ensure your messaging reflects current challenges, highlight what makes you different from the competition, and frame your offering in terms of outcomes that support their year-end objectives.

Understanding what matters to your buyers today allows you to adjust your pitch and value proposition to match the moment.

4. Unlock Opportunities With Existing Clients

The quickest path to revenue is often through the customers you already serve. Retention typically cost less and delivers faster results than chasing new business.

Review your client base: where can you cross-sell, upsell, or repackage services to solve a broader problem? Even a simple check-in conversation can reveal opportunities to extend contracts, introduce premium options, or deepen partnerships. Strengthening existing relationships can boost shortterm sales while also laying the groundwork for longterm growth.

5. Stay Focused on What Works

When pressure mounts, it’s very tempting to experiment with the latest “silver bullet” - a new social media platform, a trendy automation tool, or simply pushing out more ads. But while these may feel appealing now, they’re unlikely to generate immediate returns.

Instead, focus on what’s already working. If email campaigns deliver results, refine segmentation. If referrals are strong, incentivise them. If events bring leads, prioritise them. Concentration brings results; distraction dilutes them.

Turning Q4 Focus into Long-Term Growth

Increasing sales to year-end isn’t about frantic activity. It’s about having clarity, strategy, and focus – about knowing which priorities deserve attention and which can wait. By letting data guide your decisions, reassessing your targets, staying close to your buyers, maximising your existing clients, and resisting shiny distractions, you give your business the best chance not only to finish the year strong but to enter 2026 with confidence and momentum.

About the Author

Lissa McPhillips is a Strategic Marketing Adviser and Fractional CMO who works with business leaders to achieve their revenue targets through structured, strategic marketing. With extensive national and international experience across high-growth startups and Fortune 500 Corporations, Lissa specialises in aligning marketing activity with commercial goals, ensuring businesses invest in what truly drives results. Lissa partners with companies to create clarity, focus, and momentum - turning ambitious targets into measurable growth.

STRUGGLING WITH HEALTH AND SAFETY?

Safety Sorted is your go-to guide for small Irish businesses. Written by Mary Darlington, a health and safety expert with over 30 years of experience, the book is a practical, no nonsense road map to get your business compliant. Get your copy for just €20 (+

It contains: - 33 crucial topics - 18 real-life cases - 8 practical appendices

Unlocking Easy Wins:

How SEAI Business Supports Are Powering Irish Businesses Toward a Greener Future

In today’s fast-paced business environment, energy efficiency isn’t just a sustainability goal—it’s a competitive advantage. Across Ireland, thousands of businesses are discovering that cutting energy costs and reducing carbon emissions doesn’t have to be complicated or expensive. Thanks to the Sustainable Energy Authority of Ireland (SEAI), there are easy wins available for every business, no matter the size or sector.

At SEAI, we have broken down your business’ sustainable energy journey into 3 simple steps: Understand, Assess and Invest.

Understand

For all small and medium enterprises (SMEs), the journey to energy efficiency begins with understanding their current energy use. SEAI’s Energy Academy is empowering businesses with free, self-paced online training. Whether you’re new to energy or looking to refresh your knowledge, the Energy Academy offers practical modules on everything from understanding your energy bills to implementing clean energy systems. It’s a no-cost way to upskill your team, engaging them in the shared challenge, while fostering a culture of sustainability within your organisation.

Another free training support for SMEs, which will help you to permanently lower your energy bills and protect your profits, is SEAI’s Introduction to Energy Management training. In a 2-hour online workshop, facilitated by an energy consultant, learners will be guided through the steps needed to build an Energy Action Plan for their business. Learn more and register here.

Assess

The next step is for a business is to assess their unique energy use through completing an energy audit. SEAI offers a €2,000 voucher to cover the cost of a professional energy audit. This audit provides you with a list of tailored recommendations that identify immediate and long-term opportunities to save energy,

emissions and money. It’s a simple second step that can unlock significant savings—just ask the team at Poppies Café in Enniskerry, who saved over €5,000 after implementing audit recommendations.

Invest

Now you’ve got your list of recommended energy upgrade actions from your energy audit, the next step is determining which measures to adopt first. SEAI offers financial supports for most energy upgrade measures.

Whether you’re looking to install a heat pump, upgrade insulation, or install solar thermal to heat your water, SEAI’s streamlined rapid approval business supports allows businesses to apply in just minutes and receive near-instant approval. The grant payment structure is transparent, with businesses receiving either the amount offered at application or 30% of the invoice amount, whichever is lower. This approach ensures fair distribution of funds while maintaining programme sustainability.

For larger or more complex projects, SEAI offers tailored business supports that fund a percentage of your investment. These grants are designed to accommodate a wide range of upgrade measures, from comprehensive retrofits to innovative renewable energy solutions.

Electric vehicles offer many benefits to businesses including lower costs, positive brand image, and emission reductions. There are several financial supports available to help make the move to electric vehicles, including a new EV fleet assessment grant. Through this, a business can get up to €8000 to have an experienced assessor examine your current fleet and assist in identifying a pathway to fleet electrification. Find out more here.

Real Stories, Real Impact

The success stories speak for themselves. With support from SEAI, Shannon Springs Hotel undertook a comprehensive energy upgrade that included replacing oil boilers with air-to-water heat pumps, installing solar PV panels, and improving insulation. These changes not only reduced the hotel’s carbon footprint but also significantly cut energy costs—demonstrating that sustainability and profitability can go hand in hand.

By embracing renewable technologies and energyefficient systems, Shannon Springs in Co. Clare has embedded annual savings of €35,296, 128 tCO2 and 510,100 kWh, positioning itself as a leader in sustainable hospitality, appealing to eco-conscious guests and setting a powerful example for the industry.

Why Now?

With rising energy costs and increasing pressure to meet environmental standards, there’s never been a better time to act, to bolster your competitiveness, resilience and become a leaner operation.

Take the First Step

Whether you’re a café owner, hotel manager, or manufacturing leader, SEAI has a support pathway tailored to your needs. Visit https://www.seai.ie/grants/ business-grants to explore your options.

International Payments: The Hidden Costs Undermining Irish SMEs

ISME members know better than most the pressures of running a small or medium-sized business. You juggle cash flow, manage staff, and push for growth in a competitive market. When dealing with overseas suppliers or clients, another challenge often slips under the radar—the true cost of international payments.

Why SMEs can’t ignore this

Expanding into foreign markets brings opportunity, but it also exposes firms to fees, weak exchange rates, and delays. More than a third of Irish SMEs report difficulties with cross-border transfers. For businesses already operating on fine margins, this can be a serious drain.

Breaking down the hidden charges

• International transfers are rarely as simple as they appear. Beyond the visible transaction fee, Irish SMEs often face:

• Transfer charges of €15–€50 per payment

• FX markups of 2–3% over the mid-market rate

• Receiving bank deductions of €10–€40

• Undisclosed intermediary fees

These add up quickly. Send €100,000 abroad and a poor exchange rate alone could cost €2,000, dwarfing the upfront fee.

The danger of exchange rate swings

Without a hedging strategy, SMEs leave themselves exposed. A sudden market shift can turn a profitable order into a loss. For some, one badly timed payment has meant strained supplier ties or cash shortages at home.

Operational headaches

According to LexisNexis, almost half of businesses report serious costs from failed payments. Simple mistakes, like mistyping an IBAN, can stall transfers, tie up funds, and add costly repair charges.

The growing risk of fraud

Invoice redirection scams are rising fast. FraudSMART figures reveal Irish SMEs lost more than €17 million through such schemes in just two years. Criminals know smaller firms often lack specialist defences, making vigilance vital.

Invoice redirection and CEO impersonation scams remain as top threats to businesses, which have seen average losses of €11,500.

Practical

steps for ISME members

• Explore alternatives: Specialist FX payments companies often deliver much more competitive rates and lower costs than traditional banks.

• Lock in rates: Forward contracts provide certainty in planning and safeguard profits.

• Insist on clarity: Don’t accept vague fee structures— demand upfront transparency.

• Build awareness: Train your team to recognise fraudulent payment attempts. Never reply by email to requests to change bank account details. Fraudsters may be impersonating your supplier. Always verify change of bank detail requests by phone using the supplier number which you have on record.

Turning risk into control

Cross-border payments need not be a drain on resources. With the right systems, SMEs can take charge of costs, protect their bottom line, and trade with greater confidence.

Fexco International Payments, an Irish company headquartered in Kerry, partners with ISME to support members with smarter, safer payment solutions. We combine ZERO TRANSACTION FEES, competitive rates, and advanced safeguards designed for SMEs.

For ISME members, every euro saved strengthens competitiveness. Take the next step—review your payment processes and see what you could save with Fexco International Payments today. Scan the QR code at the top of the page for more information.

The ISME Annual Business Lunch is BACK

We are delighted to welcome you once again to the ISME Annual Lunch, taking place this year at Fitzpatrick Castle Hotel, Dublin on Friday 28th November. The event will bring together owners and leaders of small and medium enterprises from across Ireland for an afternoon of networking, insight and celebration of the SME community.

Guests will enjoy a four-course lunch and a soon to be announced, entertainer.

The lunch will also feature an insightful talk from Michelle Carney, a leading Irish business speaker who will offer perspectives and ideas to inspire and inform your business journey.

Whether you are coming to network, enjoy great food, or simply be part of Ireland’s vibrant SME community, the ISME Annual Lunch is the perfect occasion to reconnect, reflect, and celebrate. We look forward to welcoming you!

Visit our website for more information on ISME Annual Business Lunch.

For sponsorship enquiries please contact Damien Heffernan, ISME – damien@isme.ie

Book your tickets today!

Single Ticket: https://isme.ie/product/isme-annualbusiness-lunch-2025-single-ticket

Table of 10: https://isme.ie/product/isme-annualbusiness-lunch2025-table-of-10

The How of Innovation: Empowering Businesses Through Applied Research

There have been many phrases that capture the importance of innovation for businesses. “Innovate or emigrate.” “Ideas won’t keep – something must be done about them.” “It’s easy to come up with new ideas, the hard part is letting go of what worked for you two years ago but will soon be out of date.” All point to the same truth: innovation is essential.

Words can convey urgency, and customers, suppliers, and competitors can provide inspiration. But inspiration alone does not show a business how to develop and implement new products, services, or processes. That is where universities increasingly step in. In the US, Berkeley helped shape Silicon Valley. In the UK, Oxford and Cambridge are engines of economic growth. Others have followed like Leuven in Belgium, Delft in the Netherlands. Dublin has its strengths too, with five universities. Yet, which of the five has the largest concentration of applied academics in Ireland? The hint is in the name: Technological University Dublin / TU Dublin.

For enterprises, particularly SMEs in the Eastern and Midlands regions, accessing this expertise has been made easier through the ARISE initiative. ARISE connects businesses with TU Dublin academics to turn ideas into real-world solutions.

The programme provides sector-specific expertise across:

• Advanced Manufacturing and Engineering

• Audio-Visual, Creative, and Cultural Industries

• Biopharma, Life Sciences, and Med-Tech

• Food, Agri-Tech, Bioeconomy, and Sustainability

• ICT and Financial Services

Using TU Dublin’s campuses in Aungier Street, Blanchardstown, Bolton Street, Grangegorman, and Tallaght to provide access to state-of-the-art facilities and equipment, it makes collaboration practical and hands-on.

In summary, ARISE is about the how of innovation. It allows businesses to:

• Connect with the right academic expertise

• Access specialised facilities and resources

• Explore collaborative research projects tailored to their needs

• Benefit from mentoring, training, and practical problem-solving

By doing so, ARISE turns ideas into action, reduces the risks of experimentation, and accelerates the development of new products, services, and processes.

Supported with €13.6m of funding from the Government of Ireland and the EU’s ERDF, ARISE equips SMEs to compete confidently in national and international markets. It is not just about helping individual companies grow; it strengthens Ireland’s broader innovation ecosystem.

Innovation cannot be left to chance. Inspiration is important, but execution is critical. Through ARISE, TU Dublin provides the guidance, expertise, and infrastructure for businesses to navigate the complexities of innovation successfully. For enterprises in the Eastern and Midlands regions, this initiative on www.tudublin/arise is a pathway to stay competitive, relevant, and future-ready.

Gilligan Black Recruitment

Gilligan Black Recruitment was established in 2004, born from a passion for recruitment and a drive to provide a service with an entrepreneurial approach. Initially, the business focused on Financial Services and the Public Sector, leveraging strong contacts and in-depth industry knowledge. Like many in the market, the company faced challenges during the 2007/2008 downturn when these sectors contracted sharply. However, Gilligan Black quickly adapted, diversifying into new areas and building a broad client base to ensure long-term stability.

Over time, the company has expanded its offerings beyond core recruitment. In addition to Temporary, Permanent, and Contract placements, Gilligan Black provides Outplacement Services, Executive Search, and Shortlisting Services. These cover a wide range of industries, including Office Support, Accounting, Financial Services, HR, Sales, Marketing, Engineering, and Legal.

The company’s success over 21 years is rooted in strong client relationships, continuous improvement, and deep knowledge of the markets it serves. Clients return repeatedly, confident in Gilligan Black’s ability to not only deliver but also provide expert advice tailored to their business needs.

In recent years, the recruitment landscape has shifted significantly. Where once the talent pool was primarily Ireland-based, today at least 30% of roles managed by Gilligan Black require a Europe-wide search. This international reach reflects the company’s commitment to evolving with client demands and staying ahead of market trends.

Gilligan Black Recruitment is proud to support the SME community, recognizing that talent is the backbone of the Irish economy. The company is open to offering favourable rates for fellow ISME members, understanding that the right hire can make a critical difference to any business.

For recruitment enquiries, contact: Theresa@gilliganblack.ie or call 01 7999100.

Managed Print Services

With over 30 years of experience in Managed Print Services, alongside an impressive 99% customer retention rate, a footprint across 44 countries, and the distinguished title of Lexmark’s top service provider in Europe With our all inclusive print management solutions, we handle everything from supply replenishment to device monitoring, so you can focus on what matters most.

EMEA Cloud Dealer of the year 2023

Best New Business Partner EMEA 2023

EMEA Cloud Dealer of the year in 2020/2021

BSD Dealer of the Year 2020

Lexmark Diamond Plus Partner

Member of the Office of Government Procurement

Optimise printing, lower costs, and improve security through efficient management and monitoring

IPS take immense pride in positioning ourselves as pioneers of accessibility and inclusion within MPS services Save IT time and resources with complete control of your print environment with data analytics

As part of our initiative to ensure all our devices are Net Zero, IPS will plant 10 trees for every device installed

We specialise in delivering tailored print management solutions to meet the unique needs of your business