Members’ Newsletter

February 2026

February 2026

Dear member,

January was the month we almost had another trade war with the US over a threatened invasion of Greenland. It is extremely difficult to deal with trade issues in an environment where the position of the current US administration changes on a near hourly basis.

This lack of certainty is having real-world effect, and unemployment to December stayed at 5%, and Christmas retail sales were lower than 2024 figures There is no doubt that business confidence has taken a knock.

ISME was disappointed to see the result of the Mercosur vote in the EU Parliament, to refer that deal to the ECJ This will delay Mercosur by up to two years, at a time when free trade around the globe is threatened. This deal would have been particularly beneficial to small dairy and agrifood producers, and to our craft distillers. Unfortunately, the downsides of this deal have been oversold, and the upsides have not been sold at all

This is particularly concerning given the sharp appreciation of the euro against the dollar, with the exchange rate now over $1.20 to the euro. Our exports to the US have already become more expensive on a purely exchange-rate basis.

The deadline has now passed for the Revenue’s PAYE Settlement Arrangement for misclassified contractors, following the Karshan judgment. It is important, if you use the services of contractors in your business, that you always remain up to date on classification If in doubt about the tests to be applied in deciding employment status, talk to your accountant now.

Storm Chandra has caused a significant amount of damage to domestic and commercial premises, particularly in the East and South East If you have been affected, aside from insurance coverage, you should check if you can access support under the Emergency Humanitarian Flooding Scheme.

With rents reaching record highs, it is interesting that some developers are considering legal action against government over the proposed rent “reforms. ” We will watch developments with interest, but our constant message to government has been that increasing regulation and taxation in the rental sector has reduced supply to the pint where employers have had to step in and provide accommodation for workers This situation is not acceptable

Lastly, we are keen to know from you what your policy priorities are for 2026. FLASH SURVEY HERE

From all the team in 17 Kildare Street, we hope you have a busy Q1!

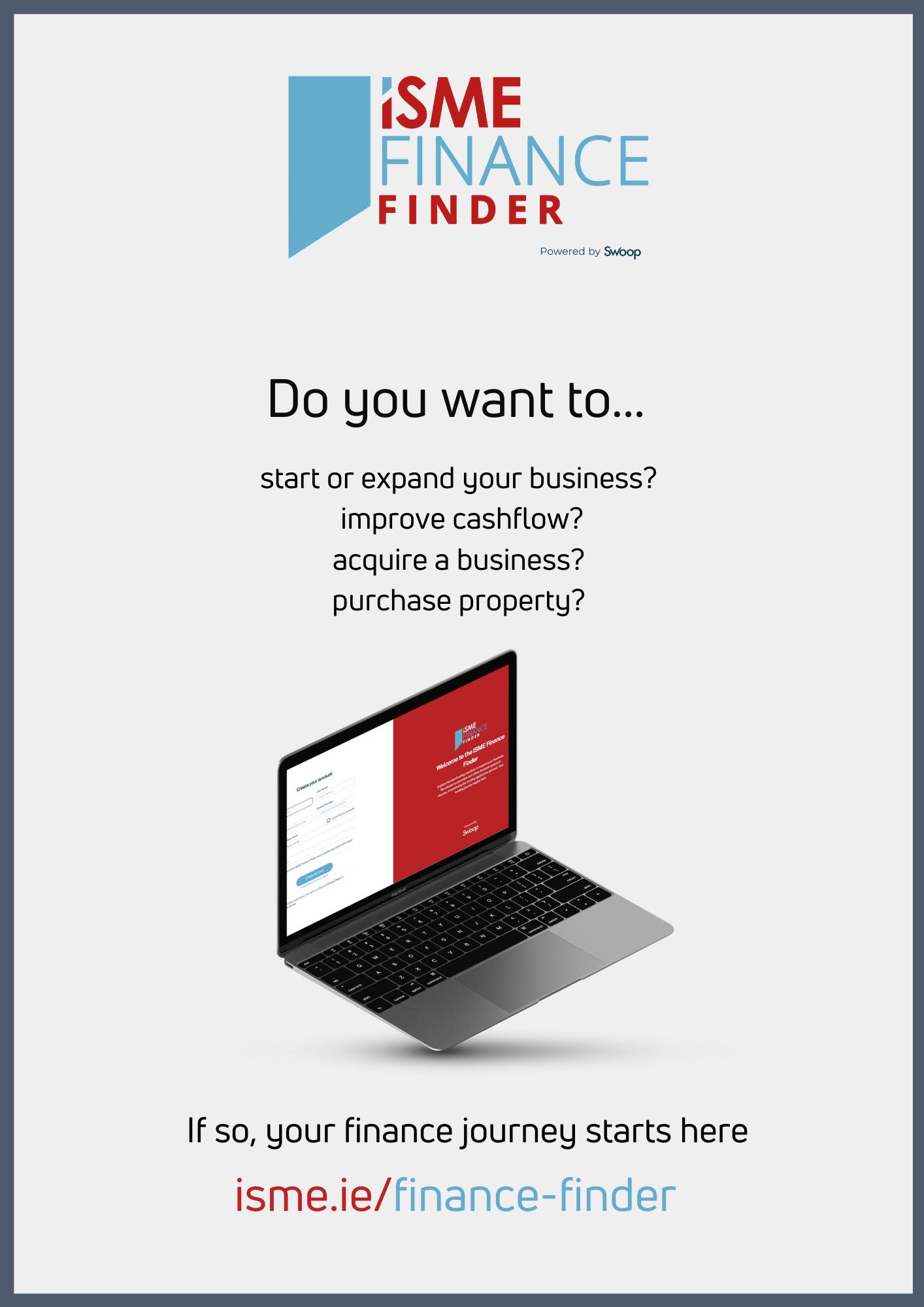

The ISME Finance Finder, developed in partnership with Swoop Funding, is an online platform designed to streamline access to finance for Irish SMEs. It offers a centralized solution for businesses seeking funding options to start, expand, improve cash flow, refinance debt, acquire assets, or invest in new markets. Key features include:

• Comprehensive Funding Options: Access to loans, equity, grants, and asset finance tailored to various business needs.

• Expert Guidance: Support from a team of funding specialists to assist with queries and application processes.

• Application Tools: Provision of templates and resources to facilitate funding applications.

• Dedicated Support: Availability of a hotline and email support five days a week for funding-related inquiries.

• Regular Updates: Finance updates and alerts to keep businesses informed of new opportunities

Please take our Bank Watch Survey for Q4 2025 based on your experiences of accessing finance and engaging with lenders here.

Additionally, businesses can avail of a complimentary 30-minute oneon-one consultation with Swoop's funding experts, offering confidential and obligation-free advice.

For more information or to begin your funding journey, visit the ISME Finance Finder.

The Bank Watch Survey provides us with the latest up to date information on SME's access to finance. The findings of these surveys will be circulated to media and will feed into relevant groups and committees ISME sit on. Reports will also be uploaded to the ISME website, view previous reports here.

Please share this survey with your network.

ISME HR Hub – your HR support

To support Members to deal with the everchanging world of HR and employment law, we have created a portal to give you access to guides, templates, contracts, policies and more to support you in managing HR in your business. We have curated the information based on the HR Life Cycle: Attraction, Recruitment, Onboarding, Policies & Training, Performance Management and Exit.

You can also find information from government agencies and other third parties in our General Information & Resources page, links to the top downloads and view our selection of blogs including Statutory Sick Pay FAQs and EU Directive on Transparent and Predictable Working Conditions.

To find out how it works and looks, click on the video about the portal here To use the ISME HR Hub log into the Members Area, click on the top left button.

Cork-based Remedy Credit Control Solutions, founded by Denise O’Gorman, is making waves in the Irish and UK business community with the expansion of its credit control and debt management services.

Having already supported over 100 businesses across multiple sectors, Remedy Credit Control Solutions is now offering tailored outsourced credit control packages and bespoke debt recovery strategies for SMEs. These new services are designed to help businesses improve cash flow, reduce operational costs, and recover outstanding debts efficiently—particularly critical in today’s fastchanging economic environment.

Denise O’Gorman, founder, commented: “With the pressures businesses face today, managing cash flow effectively is no longer optional—it’s essential. Our goal is to provide expert support that allows business owners to focus on growth, while we handle the complexities of credit control.”

This expansion marks a significant milestone for the company and reinforces its commitment to delivering measurable results, personalized service, and practical solutions for businesses navigating financial challenges

Reach Ireland’s SME Decision Makers in 2026!

Put your brand in front of over 15,000 Irish SMEs and key business leaders through The bISME the official business magazine of ISME, Ireland’s leading independent association for small and medium enterprises. The bISME combines high-value editorial with trusted insights across sectors like retail, manufacturing, services, construction, transport and more and every issue is emailed directly to business owners and promoted online.

Download the spec here or email marketing@isme.ie for more information

The bISME- Winter Issue Out Now!

The Winter issue of bISME is here – a jam-packed edition bringing timely insight, expert commentary, and practical guidance for Ireland’s SME community as we navigate rising costs, new obligations, and ongoing uncertainty.

Read and download the Winter issue here

Exclusive Cyber Security Event for ISME Members | 12th March

Infinity IT, alongside SonicWALL and ISME, is bringing Irish business leaders together this March for a focused, in-person cybersecurity session. The event will be focused on how Irish businesses can unlock stronger, more resilient digital defence, without unnecessary complexity or cost.

This invitation-only session is designed for Irish business leaders who want practical guidance on how to build effective, layered cyber defences aligned with modern risks.

The event will focus on:

▪ The current cyber threat landscape

▪ How attacks are evolving beyond basic malware

▪ Practical approaches to strengthening cyber resilience

▪ Peer discussion and real-world insight

The Ivy, Dublin 12th March

Limited spaces (intentionally)

Agenda and speaker lineup will be announced shortly.

❑ Workplace Occupational Safety and Health Training (HSA Resources): Employees require Occupational Safety and Health (OSH) training at different points in time. Providing comprehensive occupational health and safety training for staff is essential to fostering a safe and healthy workplace environment. The provision of training helps reduce the risk of work-related injuries and ill health. This page provides links to information including the employee OSH learner journey, workplace OSH training requirements and approach, tips for procuring training, training providers, hsalearning.ie and more.

❑ Code of Practice: Safe Use of Industrial Trucks: This Code of Practice provides practical guidance on compliance with legislation related to the use of rider operated industrial trucks in all workplaces.

❑ Driving for Work: Risk Management Guidance for Employers: This guidance document has been jointly developed by An Garda Síochána, the Health and Safety Authority and the Road Safety Authority to help employers understand and manage the main risks that working drivers face and create when driving for work.

❑ Annual Review of Workplace Injuries, Illnesses and Fatalities 2022–2023 report presents the Annual Review of Workplace Injuries, Illnesses, and Fatalities for 2022- 2023. In preparing this report, we recognise the importance of providing reliable and up-to-date statistical information as an evidence base for decision-making.

❑ A Short Guide to Health Surveillance in the Workplace aims to assist employers and health professionals working on their behalf in understanding their legal requirements regarding health surveillance in the workplace. It also highlights the key elements to consider when implementing a health surveillance programme.

❑ Employing Apprentices: Safety On the Job information sheet is written for people who employ apprentices. It provides a summary overview of how employers should fulfil their duties as an employer and protect apprentices, who may be more at risk of injury and ill health.

❑ Safety On the Job for Apprentices- This information sheet is written for Apprentices. It provides some essential tips to help Apprentices stay safe and healthy as they start their career.

Key events that influenced foreign exchange markets in January

• The US Federal Reserve voted for no change in interest rates with its chair, Jerome Powell, defending the importance of central bank independence. He noted that US economic activity has been expanding at a solid pace.

• U.S. employment growth slowed more than expected in December amid job losses in the construction, retail and manufacturing sectors, but a decline in the unemployment rate to 4.4% suggest the labour market is not rapidly deteriorating.

• U.S. President Donald Trump backed down from a threat to impose additional tariffs on eight European countries opposing his plans to seize Greenland

• The Irish Consumer Price Index (CPI) fell to 2.8% in the 12 months to December 2025, down from 3.2% in November, which had been the highest level in almost 2 years

• Inflation slowed more than expected in some of the euro zone's biggest economies while economic growth held up - inflation slowed sharply in Germany, while also easing in France and Spain

What data and factors could impact the major currencies in February?

• Thursday February 5th – ECB interest rate decision

• Thursday February 5th – Bank of England interest rate decision

• Friday February 6th - US Nonfarm Payrolls employment data

• Friday February 13th – EU GDP and Employment data

• Tuesday February 17th – US Retail sales

• Wednesday February 25th – EU inflation rate year on year

As an ISME member, you have exclusive access to Fexco’s dedicated account manager John Barry, who will help you with all your foreign exchange requirements.

• Reduce your cross-border payments costs

• Protect your business from currency volatility

Discover the benefits to your business without an obligation to trade!

Since 1st January 2023, Irish legislation introduced a mandatory statutory sick pay scheme in the form of the Sick Leave Act 2022.

Under the Act, paid sick leave was gradually introduced and is currently at 5 days paid leave per year. Originally, the legislation envisaged further increases to 7 days in 2025 and 10 days in 2026. However, a review in 2025 resulted in the decision to keep the entitlement at five days in 2025 rather than increasing it.

These days are calculated over the calendar year (January to December) and may be taken consecutively or broken up throughout the year.

When an employee takes statutory sick leave, the employer must pay 70% of the employee’s normal daily earnings, subject to a maximum of €110 per day. This rate is designed to balance financial support for workers while helping control costs for employers.

The payment is subject to normal tax and social insurance deductions, similar to regular wages.

Not all employees qualify automatically. To be eligible for statutory sick pay, a person must:

• Be an employee including full-time, part-time, apprentices, agency workers, and interns.

• Have completed at least 13 weeks of continuous employment with the same employer.

• Provide a medical certificate from a registered medical practitioner confirming they are unfit for work on the relevant days.

There is no pro-rating the 5 days entitlement in line with employees working hours, all employees hold the same 5 days leave entitlement.

The sick leave entitlement applies to days on which the employee would normally work but is incapable of working due to illness or injury.

Once an employee exhausts their statutory sick pay entitlement, they may be able to claim Illness Benefit from the State, provided they meet the required PRSI contributions. Illness Benefit is administered by the Department of Social Protection and typically pays a weekly amount.

Importantly, while statutory sick pay and Illness Benefit cannot be paid for the same days simultaneously, once SSP runs out, eligible workers can transition to the state benefit.

What if the business has a sick pay scheme in place?

Where an employer already operates a sick pay scheme, that scheme may be used to satisfy statutory sick pay obligations, provided it is at least as favourable as the statutory entitlement. This means it must offer sick leave for the same minimum number of days and at a rate of pay equal to or greater than statutory sick pay. If the employer’s scheme is less favourable, statutory sick pay must be provided in addition.

The case of “Lee Peate v Musgrave Marketplace” highlighted the importance of ensuring the company sick pay scheme is more favourable to all employees.

If the company scheme has a waiting period before an employee is eligible to receive sick pay then once the employee has 13 weeks continuous service and the time they are eligible for sick pay, statutory sick pay must be afforded to an employee when on certified sick leave.

Days taken as statutory sick pay can be referenced in an absence record, but they should not be treated as misconduct or grounds for disciplinary action simply because statutory sick leave was used. As outlined in the findings of “Worker V Service Provider to Financial Services”, an employer shall not.

penalise or threaten penalisation of an employee for proposing to exercise or having exercised his or her entitlement to statutory sick leave.

In summary, statutory sick pay in Ireland marks a significant advancement in workers’ rights, providing a guaranteed minimum level of financial support when employees fall ill. While still modest compared with schemes in some other European countries, it represents a critical safety net that did not previously exist.

Employers must maintain accurate records of statutory sick leave taken and sick pay paid. Failure to comply with the Sick Leave Act can result in enforcement action by the Workplace Relations Commission (WRC), including fines and compensation orders.

There are limited circumstances where an employer can apply for an exemption (for example, where financial hardship can be demonstrated), but these are judged on a case-by-case basis

The ISME Skillnet service is here to help both the business owner and their employees.

ISME Members can receive up to 40% discount on ISME Skillnet training, view courses below.