Nalie May

Natalie May

Astheclimatechangecrisisloomsasoneofthegreatestchallenges

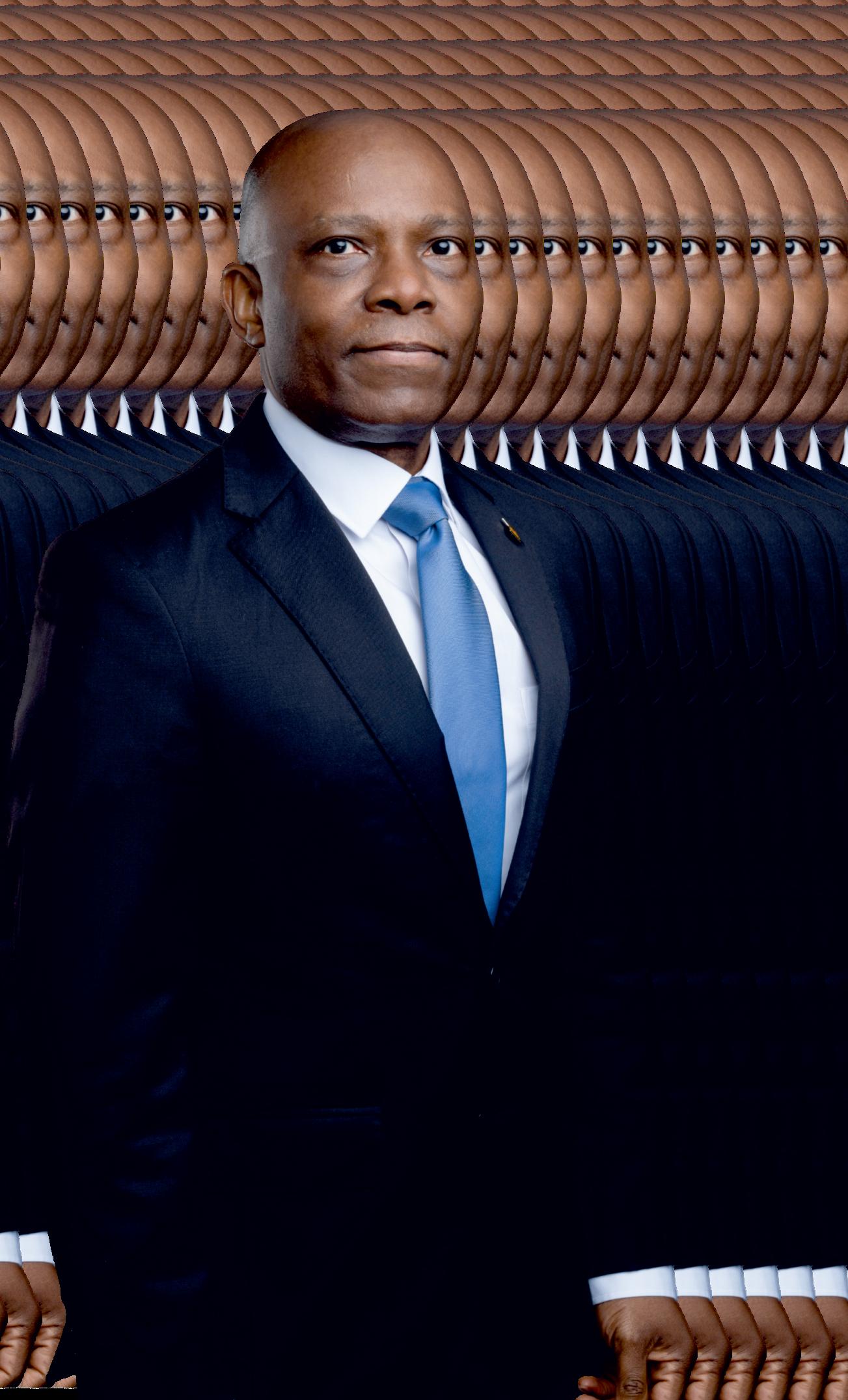

ofourtime,thecallforsustainabilityresonatesacrossallsectors.It isnolongerconfinedtoenvironmentalistsornicheindustriesbut demands collective action from every domain, including finance and healthcare. One critical hurdle in advancing sustainable initiatives is funding, yet innovative solutions like green bonds are empowering organizationstodriveimpactfulprojects.InthiseditionofInsightsCare,we featureapioneeringleaderwhoseeffortsaredefiningthefutureofclimate riskmanagement:Dr.GregoryJobome.

Dr Gregory,whoservesasExecutiveDirectorandChiefRiskOfficerat Access Bank Plc, has revolutionized the way financial institutions lead sustainability With more than two decades of experience in banking, risk management, and academics, his vision has placed Access Bank at the forefrontinembeddingclimate-responsiblestrategiesinitsoperations.His impact reaches beyond Nigeria as he takes part in the Institute of International Finance and the Climate Governance Initiative Nigeria, shapingglobaldebates.

Through the use of instruments such as green bonds, Dr Jobome is channeling funds into sustainable projects so that environmental stewardshipkeepspacewitheconomicdevelopment.Thispublication, Dr. Gregory Jobome: Pioneering Excellence in Climate Risk Management2025,isatestamenttohisinnovativeinfluence.

Turn the page for a thought-provoking read, as we follow Dr Gregory’life andtherippleeffectofhisworktowardscreatingasustainabletomorrow

The Risk Expert Driving Sustainable Banking Forward T H E S I G N A T U R E S T O R Y

Dr. Gregory Jobome Executive

Director, Risk Management

Access Bank Plc.

What if banks didn’t just lend money but also

played a pivotal role in building a cleaner, greener future? That’spreciselywhat’s happeningwithgreenbonds—servingasfinancial instrumentsthatprovidefundingforsustainable initiativesrangingfromrenewableenergy developmenttosustainabletransportationandclimateadaptedagriculturalprograms.Theseinvestments havedualimpactsbecausetheydeliverfinancialgains yetalsofacilitateenduringenvironmentalprotection andsocialresponsibility.

Behindthesetransformativeinitiativesarevisionary leaderswhounderstandthatfinancehasvastpotential tocreatepositiveimpact.OnesuchleaderisDr. GregoryJobome,whoseworkgoesbeyond traditional.Inadditiontohandlingfinancialrisks,he dedicateshiseffortstocreatingbankingsystemsthat combinesustainablepracticeswithresponsible financialoperations.Throughstrategicleadership,Dr. Gregoryhashelped embed AccessBankPLC environmentalandsocialgovernance(ESG)intoits coreoperations,provingthatfinancialsuccessand sustainabilityarenotmutuallyexclusive.Today,as ExecutiveDirectorandChiefRiskOfficer,heleads ateamof400expertswhilecollaboratingwithnearly 30,000employeestoembedriskawarenessacrossthe organization.

FromdrivingthelaunchingofAfrica’sfirstcorporate greenbondtopioneeringsustainablefinance programs,hiscareerdemonstratesprogressive commitmenttodevelopbankingbeyonditsfinancial foundationintoaninstrumentthatsupportspositive evolution.Thejourneyshowshowbanksare increasinglybecomingimportantentitiesinglobal challengesasethicalleadershipthroughsmartpolicies andinnovationdriveslastingeffectsonfinanceand socialsystems.

Let’s explore the future of banking with Dr. Gregory—where financial success meets sustainability and innovation for a greener tomorrow!

Canyousharewithusyourjourneyintothefield ofriskmanagementandhowithasshapedyour approachtoleadershipatAccessBankPLC?

Uponcompletingallthenecessaryeducational qualifications,IlandedmyfirstjobatGTBankwhere Igainedexperienceinfinancialcontrolandtreasury activities.AfterGTBank,Isubsequentlybroadened outintoresearchandanalyticalworkonissuesaround operationalrisk,fraudissues,andfinancialcrimes.On thatbasis,Ipickedaninterestinriskmanagement, riskcontrols,understandingthedriversoffraudand themosteffectivewaystomitigatefraudinthe financialsystem.Fromthatearlyperiod,myinterest grew,andIkeptexploringthetopic.Ihadthe opportunitytoreturntoGTBankasaconsultant,and atthetime,BaselIIwasbecomingakeytopicinthe bankingindustry,makingittheperfectmomentto exploreriskmanagementfurtherandunderstandwhat BaselIIwasallabout.

Iimmersedmyselfinalltherelevantmaterialsand,as aconsultant,playedaroleinclarifyingwhatBaselII meant,howitworked,anditsimplicationsforbanks.I examinedwhatfinancialinstitutionsneededtoinvest intocomplywithBaselII,whatwillitmeanforthe industryanditsstakeholders.Throughthisprocess, mypassionforriskmanagementgrew,andIinvested indevelopingmyexpertise,tobuildthatinterestintoa tangibleprofessionalendeavor.

BythetimeIjoinedAccessBank,Ihadalreadybuilta strongfoundationinriskmanagement,particularlyin thecontextoflargefinancialinstitutions.AccessBank hadanexistingRiskManagementFramework

When you recognize the needs of your community, leadership becomes clearer. It’s not about power, it’s about service. It’s about working with people, not just for them.

establishedbytheMD/CEOatthetime,including enterprise-wideriskpoliciesandframeworksaswell aswhatwasrequiredtodriveexecutionand implementation,andIwasfortunatetobeoneofthe peopleresponsiblefordrivingthatforward.Thatwas howmyjourneyinriskmanagementgatheredsteam.

Overtheyears,Ihavehadtheopportunityto contributesignificantlytothefield.AsChiefRisk Officer,myrolegoesbeyondtechnicalexpertise–it involvesleadershipaswell.LeadingaRisk Managementgroupofaround400peoplerequiresa deepunderstandingofpeople,teamwork,and communication.

Enterprise-wideRiskManagementcoverstheentire bank,touchingmanagerialandoperationalaspects acrossvariousdepartments.Beyondmyimmediate team,Iworkwithnearly30,000staffmembersacross thebank,ensuringastrongsecondlineofdefense.My responsibilitiesincludeshapingpolicies,guiding compliance,strengtheningriskcontrols,andensuring regulatoryadherence.Alloftheseelementsarecritical tokeepingthebankoperatingoptimallyandinthe bestinterestofourwiderangeofstakeholders.

Myleadershiprolewaswell-groundedandembedded inmyearlierexperiences,andIwasabletobuildon that.Thisinvolveseffectivelycommunicatingrisk frameworks,policies,controls,andriskarchetypes whileensuringthatthebank’sriskethosremain ingrainedacrossalllevels.Leadershipand communicationarecrucialinmakingthishappen.

Additionally,Ileveragemyextensiverisk managementexperiencetoguideteamsanddrive culturaltransformation.Myroleextendsbeyondbeing theExecutiveDirectorofRiskManagement–Ialso serveastheExecutiveComplianceOfficer,overseeing complianceandchampioningsustainabilityinitiatives withintheinstitution.Wearingmultiplehatshas allowedmetocontributetovariousfacetsofthe organization.

Whatinspiredyoutospecialiseincorporaterisk management,compliance,greenfinance,and corporategovernance?

Ofcourse,Icanspeaktowhatpiquedmyinterestto specialiseingreenfinance,sustainablefinanceandso on.Thisdatesbacktoaround2015or2016;atthat

point,thebankhadinteractedsignificantlywiththe likesofIFC,FMO,DEG,andmore.Havingworked withtheseDFIsforagoodnumberofyearspriorto thatpoint,wehadprogressedonprovidingbanking productsaroundgender,sustainabilityandsoon, beingtypicallythecovenantsthatwerepartofthedeal structuresatthetime.Thatinspiredmetostartlooking athowwecanmakethoseDFIrequirementspartof thebusinessmodelasopposedtocompliancechecks thatyoumustsurmountbecauseyouarealready fundedfromthoseDFIs.So,atthattime,weworked withthesustainabilityunit,andwecameupwitha businesscaseforsustainablefinanceandforthebank tohaveasustainability-drivenmodelattheheartofits businessbeyondcomplyingwithDFIrequirements.

Fromthatpoint,thingssnowballed.Webroughtin consultantstohelpformalizethebusinesscase,which wethenpresentedtomanagement.Aroundthesame time,wealsostartedtrackingouroperationalfootprint moresystematically.Forthefirsttime–around2015 –wewereabletomonitorkeyenvironmentalmetrics acrossallourbranches,whichatthetimenumbered around400.Thisincludedtrackingdieselandpetrol consumption,publicelectricityusage,andbusiness travel.Weimplementedanelectronicplatformthat allowedustogatherandanalyzedataacrosstheentire country Thisexperiencereinforcedwhatcouldbe achievedwiththerightmixofinspiration, determination,andcollaborationwithstrategic partners.

By2018,wedecidedtotakethingsastepfurtherby launchingagreenbond.Givenoursignificantlending inthegreenspace,issuingagreenbondfeltlikea naturalprogression.

Itrequiredalotofeffort,butwithstrongsupportfrom partnerslikeIFCandFMO,whosharedtheir expertise,wewereabletomakeitareality.This collaborationledtotheissuanceofAfrica’sfirst corporategreenbond,certifiedbytheClimateBonds Initiative(CBI).Amajormilestone.

MyearlyinteractionswithIFCandFMOhada profoundinfluenceonmypassionforgreenfinance andsustainability.Fromthatinitialgreenbond issuancein2019,wewentontoissueanothergreen notein2022.In2024,welaunchedtheSustainable FinanceAcceleratorProgramandexpandedour initiativesaroundgenderandtheSustainable DevelopmentGoals(SDGs).

Wealsoinstitutionalizedoursustainabilityeffortsby establishinganESGcommittee,chairedbytheCEO andco-chairedbyme.Thisstepensuredthat environmentalandsocialconsiderationsbecame centraltoourbusinessoperations,ratherthanbeing treatedassideprojects.Ultimately,whatstartedasan interestgrewintoamission–tointegrate sustainability,corporategovernance,greenand sustainablefinanceintothemainstreamofbanking.

CouldyouelaborateonAccessBankPLC’s missionandvisionregardingsustainablebusiness practices,andhowthesealignwithyourpersonal valuesandprofessionalgoals?

WhatIdescribedpreviously,thatwasmyown personaljourney,myencounterwiththeworldof sustainabilitythroughourearlyinteractions withtheDFIs,aswellaswithotherpeople. Fromthere,Iworkedcloselywithmy colleaguesatthebanktotransitionfroma compliance-basedapproachtofullyintegrating sustainabilityandenvironmentalconsiderations intoourbusinessmodel.Today,sustainabilityis embeddedinhowthebankoperates.

Forexample,whenaloanrequestismade,it typicallyoriginatesfromthebusinessteamand thengoesthroughthebank’smanagementfor approval.However,since2015or2016,we haveincorporatedenvironmentalandsocial riskassessmentsaspartofthecreditapproval process.Everysinglecreditrequestundergoes athoroughreviewbasedonthehighest performancestandards,ensuringthat environmentalandsocialrisksareproperly evaluated.Additionally,eachcreditrequestis flaggedbasedonitsgreenpotential.

Thisentireprocessalignswithmythought processandpersonaljourneyin sustainability.Inparticular,theGreenBond issuanceprocessdemonstratedthepowerof initiative,conviction,andpassionindriving meaningfulchange.Whenwelaunchedthe firstGreenBondinNigeria–andin Africa–itwasn’timmediatelyclearto manybanksandcorporateswhywe weredoingit.Eventoday,somestill ask,“WhatisaGreenBond?”and “Whydidweissueone?”So,thevibe isstrong,andwehaveprovenitas well.

Lookatwherewearetoday,Nigeria’slargestbank,a majorforceonthecontinent,andaleaderin sustainability.We’vebecomeoneofthebiggest magnetsforforeigncurrencyfundingfromDFIsand otherinternationalpartnersandatopplayeringenderbasedlending.Andit’sallbuiltonamodeldrivenby sustainability.Clearly,it’sworking.

Onapersonallevel,thisjourneyhasbeenjustas transformative.Italignswithmyvalues,mywayof thinking,andhowIseetheroleofbusinessinthe world.Beyondjustbanking,it’saboutbeinghuman, howweinteract,howweimpactourcommunities, howwebringmorepeopleintothefinancialsystem. AccessBankhasgivenmetheplatformtomakethis kindofdifference,tomovetheneedleinwaysthat matter.Whatstartedasaninitiativehasnowbecome partofoureverydaywayofdoingbusiness.That,to me,isrealprogress.

Whatuniqueleadershipqualitiesorapproachesdo youbelieveareessentialfornavigatingthe complexitiesofsustainabilitywithinafinancial institution?

Sustainability,atitscore,isjustlikeanyotheraspect oflifeorbusiness–it’saboutpeople.It’sabout workingtogether,sharingideas,andbuildingstrong communitiesandinstitutionsthatcreatelastingvalue.

Totrulyleadinthisspace,teamworkandempathyare non-negotiable.Wecan’ttalkaboutsustainability withoutconsideringitsimpactonpeople,howit shapeslives,createsopportunities,andfosters inclusion.ThisisespeciallyimportantinAfrica,

hometooneoftheyoungestpopulationsintheworld. Youngpeopleneedmotivation,guidance,andsupport tobuildtheirbusinesses,chasetheirdreams,and contributemeaningfullytosociety.Helpingthem succeedisn’tjustanactofgoodwill;it’san investmentinthefuture.

Butbeyondyouthempowerment,there’sanother pressingreality–—genderinclusion.Womenplaya massiveroleinoureconomies,yettheyremain underrepresentedinfinancialstructuresand opportunities.It’snotenoughtorecognizetheir potential;wemustcreatepathwaysforthemtothrive, ensuringtheyhavethetools,resources,andaccess theyneed.

Whenyourecognizetheneedsofyourcommunity, leadershipbecomesclearer.It’snotaboutpower,it’s aboutservice.It’saboutworkingwithpeople,notjust forthem.Becauseattheendoftheday,sustainability goesbeyondpoliciesandprograms–it’saboutthe reallivesweimpact.Thatstartswithpeople,asyou mustworkwiththemtodelivertheimpact.It’sabout yourteam,yourorganization,yourpartners.Noone drivesimpactalone.Ittakescollaboration,shared goals,andtherightpartnershipstocreaterealchange. That’swhyoneoftheSDGs(No.17)highlightsthe importanceofpartnershipsandcollaboration, —becauseprogresshappenswhenweworktogether

Butbeyondpartnerships,thingsaroundsustainability andclimatechangerequiresomethingdeeper, determination.Weknowthathumanactivityhas contributedtocertaindegreesofglobalwarming,and theevidenceisclear.Yet,somepeoplestillbelieveit’s adistantproblem,somethingforfuturegenerationsto worryabout.Thatkindofthinkingisnothelpful.

Sustainability isn’t about the future, it’s about the choices we make today. And as leaders, we must have the conviction to make those choices count.

Wedidn’tjustinheritthisplanet;weareresponsible forwhatweleavebehind.Leadershipinthisspace meanshavingthecouragetoactnow,evenwhen othersdelay.Itmeanspushingforwardwhenpeople say,“We’lldealwithitin20years.Or2100or2070 asthecasemaybe.”Therealityis,sustainabilityisn’t aboutthefuture,it’saboutthechoiceswemaketoday Andasleaders,wemusthavetheconvictiontomake thosechoicescount.

Asleadersinthisspace,wemustremaincommittedto pushingforward,toadvocating,andtodemonstrating therealimpactofsustainability,climaterisk management,andsustainabledevelopment.Wecannot affordtoslowdownorlosefocusbecausethereare stillmanywhohaveyettorecognizetheurgencyof thiswork.Everyplatform,everyopportunitywehave mustbeusedtoshiftmindsetsanddrivepoliciesthat turnsustainabilityfromaconversationintoareality.

Take,forexample,ourfirstgreenbondin2019, followedbythesecondin2022.Nootherbankhas takensimilaractioninNigeria.Thattellsus something,thatthelevelofcommitmentto sustainabilityisnotevenlyspread.Butthatisexactly whywemustkeepgoing.Wemustleadbyexample, keepinvesting,andcontinueprovingthat sustainabilityisnotjustgoodethics,it’sgood business,goodgovernance,andgoodleadership.

Eventually,otherswillhavetocometothetable becausesustainabilityisnotaone-manjob.Nosingle organizationcantransformanation.Nosingle institutioncanmanageanentirecountry’s environmentalfootprint.AchievingtheSustainable DevelopmentGoals,whetherit’sreducingpoverty, improvingeducation,oradvancinggenderequality requirescollectiveaction.Ittakesbusinesses, governments,andindividualsworkingtogetherat local,national,andgloballevels.

That’swhyrealleadershipinsustainabilityrequires resilience,courage,andunwaveringdetermination. Thoseofuswhoarepioneersinthisspacemustkeep pressingforward,notjustfortodaybutforthefuture wearebuilding.Andalongtheway,wemustinspire otherstostepupandtakeownershipbecausetrue changeonlyhappenswhenweallmovetogether.

WhatstepshasAccessBankPLCtakentoensure thatitsgrowthstrategyremainssustainable, profitable,andsociallyrelevant?

Well,IthinkI’vetouchedonthatalreadyinsome ways.Thebusinessmodelhasbeensustainability drivenforalongtime.Iguessmyexampleearlieron waswithrespecttoourlendingapproach.Everyloan weapprovegoesthroughasustainabilityfilter, ensuringthatprojectsalignwithenvironmental, social,andgovernance(ESG)principles.Wecarefully monitorourcarbonfootprint,trackthefuelused acrossourbranchnetwork,andsetinternaltargetsto minimizeemissions.Withover600branches,thisis nosmallfeat,butit’sacommitmentwetakeseriously

Thisfocusonsustainabilityisaboutimpact,it’salso aboutgrowth.We’vebuiltoneofthelargestandmost diversifiedfundingportfoliosinNigeriaandacrossthe continent,attractingglobalpartnerswhorecognizeour commitmenttoresponsiblebusiness.Theresult?A steadyinflowofforeigncurrencyfundingon favorableterms,atestamenttothetrustwe’veearned. It’snotjustaboutfunding,though.We’reactively creatingsustainableassets–loansandprojectsthat directlysupporttheenvironment,businessesand communities.WearethelargestlenderinNigeriaand aroundTop10lenderinAfrica.Thismeanswe’re makingpositivechangeonbothsidesofthebalance sheetwhilealsomaintainingstrongprofitability.In fact,we’reoneofthemostprofitablebanksinthe country,provingthatsustainabilityandfinancial successgohandinhand.

Therecognitionspeaksforitself.We’vebeenrated amongthebestinESGperformanceandare commendedbyleadingagencies.Simplyput, sustainabilityisn’tanadd-on,it’sacorepartofour businessmodel,andtheresultsshowthatit’sworking.

WhatroledofinancialinstitutionslikeAccessBank PLCplayinaddressingglobalchallengessuchas climatechangeandsustainability?

Financialinstitutionslikeoursplayamajorrolein addressingglobalchallengessuchasclimatechange andsustainability.Well,globalfinancialinstitutions haveabigroletoplay.Ourroleistwofold:we influenceboththroughouroperationsandthroughthe waywesupportourclients.

No single organization can transform a nation. No single institution can manage an entire country’s environmental footprint.

Ononehand,wedirectlyimpacttheenvironment throughourphysicalpresence,ourbranchnetwork, offices,buildings,vehicles,andtheeveryday operationsthatcomewithrunningabusiness.These operationscontributetoemissions,which,ifleft unmanaged,canworsentheplanet’scondition.That’s whywetakegreatcaretominimizeouroperational footprintandkeepemissionsaslowaspossible.

Ontheotherhand,ourbiggestimpactisthroughour lendingactivities.Whileourownoperationsaccount forasmallportionofouremissions,thebulkofour environmentalfootprintcomesfromthebusinesseswe lendto,whichfallunderwhatwecallScope3 emissions.Thesearetheindirectemissionstiedtoour clients’activities.Asabank,wehaveavitalrolein helpingmanagetheseemissions.

Todothis,weneedtotrulyunderstandourclientsand theiroperations.Everyindustryhasitsown environmentalimpact,dependingonfactorslikethe technologiestheyuse,theageoftheirplants,their transportationmethods,andthematerialsinvolvedin theirprocesses.It’snotjustaboutlendingmoney;it’s alsoaboutpartneringwithourclientstohelpthem reducetheiremissionsandtransitiontomore sustainablepractices.

Bankshavetounderstandwhateachofthetopclients arealsodoingwithrespecttotheirowntransition towardsthenetzeroposition.Byunderstandingand supportingourclients’efforts,we’renotjusthelping them,we’realsomanagingourownemissions.After all,theemissionsfromthebusinesseswesupport becomepartofourownenvironmentalfootprint.So, thebetterwecanhelpthemmanagetheiremissions, thebetterwemanageourstoo.

That’sakeyrequirement.Andalotoftheclimaterisk modellingthat’sgoingonwithinthebankinvolves significantclientinteractionsothatwebetter understandhoweachofoursignificantemitting customerswillimpacttheinstitutionindifferent scenarios.

AsaleaderatAccessBankPLC,howdoyou inspireandmotivateyourteamtoactivelyengage withclimateriskmanagementinitiativesand integratesustainabilityintotheirdailypractices?

Alotofwhatwedoisnowintegratedintoourday-todaypractices,whetherit’sintermsoflending, whetherit’sintermsofourbranchnetwork,interms ofmanagingouremissionsandgoingacrosswherever weoperateandbeingabletosettargetstomanage them.Wehavedevelopedapipelineofactivitiesand initiativesovertheyearsandarenowlookingtogo forward.Buttogetthere,ofcourse,wehaveto inspire,wehavetoeducate,wehavetoengageboth internallyandwithourclients,andexternallywith otherplayersandpartners,toensurethatwetakethe actionsthatwecanmoveinthatdirection.

Amajordrivingforcebehindoursuccessisthe commitmentfromthetop.OurBoardhasfully embracedasustainability-ledmodel,whichiscrucial forembeddinganynewwayofthinkingintoan organization.Whenleadershipisfullyaligned,it becomeseasiertodeveloppolicies,frameworks,and riskmanagementstrategiesthatprioritize sustainability.Thisstrongbackinghasallowedusto weavesustainabilityintoeverythingwedo,makingit anaturalpartofourdecision-makingratherthanjusta boxtocheck.

Aswe’vedeepenedourcommitment,we’vehadto updateourpoliciesandframeworkstoreflectour sustainabilitygoals.Wherecertainpracticesdidn’t existbefore,weintroducedthem,ensuringthatESG (Environmental,Social,andGovernance)and sustainabilityprinciplesareembeddedacrossall aspectsoftheinstitution.Today,nearlyeverypolicyin ourorganizationtouchesonsustainabilityinsome way,whetherit’sfinancialcontrol,procurement, businessservices,orproductdevelopment.

Inspirationalsocomesfromshowcasingpowerfully impactfulinitiativeslikeW,WomenBanking,aswe callit,it’sawholeteamdevotedtodeveloping creativeproductsandservicesaimedattackling challengesthatarelargelyuniquetowomen; fromsupportingwomenSMEstoenabling fertilitytreatmenttocompletefamilies,among others.Alloftheseinitiativestookseveralyears tomakethepointthatitworksasabusiness case.

Forexample,ourEnterpriseBusinessServices (EBS)teamensuresthatadministrativeand procurementprocessesalignwith sustainabilitygoals,whileourproductteams focusondevelopingfinancialsolutionsthat supportagreenerandmoresustainable economy.Ourcommitmenttowomen's banking,asmentionedearlier,isanother keyarea,withadedicatedteamfocusedon creatingfinancialproductstailoredto women,ensuringtheyhavetheresources theyneedtothrive.

Allofthishastakenyearsofeffort,but it’sworkingbecausethetoneatthetopis verystronganditiscascadedthrough thedifferentfunctionsoftheinstitution, thedifferentproducts,thedifferent processes.

AnotherexampleistheBank’s launchingofaSustainableFinance Acceleratorprogram-whichenables ustofast-trackthedevelopmentof apipelineofclientsandoperatorsthat wouldotherwisehavelimitedaccess tothemainstreamfinancialservices

Sustainability isn’t an add-on, it’s a core part of our business model, and the results show that it’s working.

likeloans-wehavethousandenrolledonthisviaa capacityuilding,lending,seedfundingandpartnership program.

Thispurelyshowsthatourleadershipisfully committed,sustainabilityisnowembeddedacrossall levelsoftheinstitution,influencingourproducts, processes,andpartnerships.Bystayingfocused,we’re notjustsettinggoals,we’reachievingthem.

Canyoushareanyspecificchallengesyou’ve encounteredwhilemainstreamingsustainable businesspracticesintoAccessBankPLC’s operations,particularlyinrelationtoclimaterisk management?

Oneofthebiggestchallengeswefacedintheearly dayswasn’tresistance–itwasthefactthatsomuch ofwhatweweredoingwascompletelynew Wehad totaketimetounderstandit,internalizeit,andfigure outhowtomakeitworkwithinourinstitution.It wasn’tjustaboutadoptingsustainabilityprinciples,it wasaboutgettingtheentireorganizationonboard, helpingpeopleseewhythismattered,andintegrating itintoourwayofworking.

Knowledgewaskey.Oncepeoplewereengagedand understoodthevision,thingsstartedtopickup.Butin thebeginning,wewerenavigatingunchartedterritory. Whenweissuedthefirstgreenbond,forexample,we werethefirstbankonthecontinenttodoit.Therewas noblueprint,noexampletofollow Theonlyreference pointsweregreenbondsissuedinotherpartsofthe world–placeswithdifferentregulatorysystems, differentmarketconditions,anddifferentinvestor expectations.

Tociteanexample,whenyou’redoingthingslikea greenbond,you’rethefirstbankonthecontinentto doagreenbond.Youdon’thaveanycompass;you don’thaveanyoneelsewhohasgoneonthatjourney before.Theclosestthatyouhaveareothergreen bondsfromotherpartsoftheworld,thathavea differentregulatorysystem,differentmarketsystem, differentinvestorsystem.

Therefore,youhavetoinventthewheelforyourself tobeabletorunsuccessfullythroughthatprocess. Andofcourse,Therewasno“greenbondteam”inthe bankatthetime,sowehadtopulltogetherabout15 differentdepartmentstocreatethenecessary frameworks,processes,useofproceeds,and verificationmechanisms,tocreateawayofdelivering resultsthatthey’veneverdonebefore.

Thatmeantwehadtobuildeverythingfromscratch. Wehadtoalignpolicies,holdworkshops,andensure everystakeholderunderstoodtheroletheyhadtoplay. Becausethiswasafirstforthecontinent,weweren’t justlearningforourselves,weweresettinga precedent.

So,thatwasaheavyliftingatthetime.Andofcourse, asIsaid,duringthefirsttime,therewerechallenges ofgettingpeopletounderstandalltheconcepts,to understandwhysomethingmustgoinsuchaway.But wewerequitefortunatethatwehadstrongpartnersin thelikesofIFCandFMO,thatwereabletoleverage theirownexperiencestotryandcarveoutanapproach thatworkedforouruniqueenvironment.

Today,we’vesuccessfullycompletedtwomajorgreen bonds,andwe’renowworkingonasustainability bond.Theprocesshasbecomemuchsmoother becausewe’vebuilttherightframeworks,policies, andteamstosupportit.

Whatoncefeltlikeanuphillbattleisnowsecond nature,andthat’sthebeautyofprogress.

AsanExecutiveDirectoratAccessBankPLC, whatdoyouconsideryourgreatestachievementin termsofadvancingriskmanagementandfinancial systemstability?

Therearemanythings.Themainthingisthatwhen youworkforaninstitutionlikeAccessBank,itoffers youaplatformtomakearealimpact–onpeople,on theindustry,andonsocietyatlarge.Thebankisn’t justafinancialinstitution;it’saplatformthatallows peopletodrivemeaningfulchange,bothwithinand beyonditswalls.Throughpartnershipsacrossthe continentandbeyond,we’vebeenabletoexpandour influence,pushingforbestpracticesandglobal standardsinseveralmarketsacrossthecontinent ratherthanlimitingourselvestolocalbenchmarks.

YoufindusintheUK,HongKong,inUAE,inParis, youfindusinMalta,it’spartoftheEU.So,that’sthe beginning,thatonceyou’reinaplacelikeAccess Bank,itgivesyouwingstofly,itgivesyouaplatform toimpactsociety Andinthisperiod,I’vebeenwith thebank,definitelyI’vebeenaffordedtheopportunity tocontributeinwaysthattrulymatter.

WhenIfirstjoinedthebank,wehadwhatwecalled HeadofCredit,HeadofMarketRisk,andHeadof OperationalRisk.IwasthefirstformalChiefRisk Officer,whichmeantthatIhadaresponsibilityto supporttheCEOandtheBoardinbuildingarisk culture,amoderateriskenvironment,anenvironment whererisk-basedperformance,risk-based measurement,risk-basedeverythingwasatplay, whereriskwasalignedwithstrategyandperformance. Thatrequiredconsiderableinvestmentoftimeand effort.

Overtheyears,wewereabletogettoaplacewhere weenjoyedtopratingsfromratingagencies,inour markets,weenjoyedtopratingsfromourinvestors, topratings,wewereallhappywithit.So,Iwouldsay

thatisintermsofwithintheriskethos,inan enterprise-widesense,thatmeansthatwe’reableto takeittoanymarketandanycountryweoperatein, andit’sstrongandrobustenoughtobetakento Botswana.ThatEnterprise-wideRiskManagement FrameworkcanbetakentoRwanda,theUK,Hong Kong,andalmostanymarket.Thiswassupportedby several"firsts"thatwerenotchedupinthisperiodfirst ICAAP,ILAAP,risk-basedperformancesystem, lowestnon-performingloans,etc.

It’sstrongenoughtowithstandthestressoftime.

TheCentralBankofNigeriausedtoawardbanksfor sustainabilityefforts,andyearafteryear,AccessBank wouldsweeptheawards–whetherforESG,the GreenBond,orbroadersustainabilityinitiatives. Internationally,we’vealsobeenrecognized, consistentlywinningmultipleawardsannuallyforour workinsustainability,genderinclusion, environmentalandsocialriskmanagement,and SDGs.AndthosearethingsthatI’mveryproudof becauseI’vebeenluckytobepartofthisplatformthat AccessBankprovidesandbeenabletoplayarolein achievingthosemilestonesfortheinstitution.

Beyondthebank,I’vealsohadtheprivilegeof shapingtheindustry AsaformerPresidentoftheRisk ManagementAssociationofNigeria,Iledeffortsto professionalizethefield,spearheadingthecountry’s first-everRiskManagementProfessionalCertification exam.Beforethis,Nigerianswhowantedtopursuea careerinriskmanagementhadtorelyonforeign certifications.Wechangedthatbydevelopinga rigorousthree-stagecertificationprocess,in partnershipwiththeCharteredInstituteofBankersof Nigeria,thatnotonlymetglobalstandardsbutalso incorporatedlocalandregionalcontexts.Today,many certifiedriskmanagersandfellowshaveemerged fromthisprogram,strengtheningtheprofessionin Nigeriaandbeyond.

ThesearejustsomeofthemilestonesI’vebeen fortunatetobepartof.Lookingback,I’mgratefulfor theopportunitiesAccessBankhasprovidedtodrive impact,toshapeindustries,andtocontributetoa legacyofexcellence.

Couldyoushareanypersonalphilosophiesor principlesthatguideyouinyourroleasExecutive Directorandinyourcommitmenttoadvancing sustainablebusinesspracticeswithinAccessBank PLCandbeyond?

Well,leadingbyexampleisoneofthemostpowerful waystoinspirechange.Peoplearemorelikelyto embraceanideawhentheycanseeitinaction–when theyseetheimpact,thetransformation,andthe tangiblebenefitsitbrings.It’sbeyondtalking,butalso aboutshowing.Whenpeoplewitnessrealresults, whentheyseehowaparticularapproachcanimprove lives,theyaremorewillingtofollowthatpath.

Forme,certainvalueshaveguidedmyworkand shapedmyapproach.Fairnessisoneofthem.Life maynotalwaysbefair,butweshouldstrivetocreate environmentswhereequityandjusticematter–whetherintheworkplace,indecision-making,orin thewayweinteractwithothers.It’saboutensuring thatopportunitiesareopentoeveryone,andthat peoplearetreatedwithdignityandrespect.

Accountabilityisanothercorevalue.Ifyouworkin riskmanagementorsustainability,accountabilityis non-negotiable.It’saboutrecognizingyourimpact, owningyourdecisions,andtakingresponsibilityfor theresourcesyouuse.Insustainability,forexample, wedon’tjustacknowledgeourcarbonfootprint—we takeactivestepstoreduceit.Andthebeautyof accountabilityisthatitoftenleadstobetteroutcomes. Whenbusinessesoperateresponsibly,theydon’tjust protecttheplanet,theyalsogaintrust,attract investment,andbuildstrongercommunities.

Beingcommunity-mindedandimpact-drivenisalso key.It’snotjustaboutexecutingprojects—it’sabout

asking, what difference are we making? Whatdoes thisinitiativemeanforthepeopleonthestreet,forthe underserved,forthecommunitiesweaimtosupport? orwhateverthecasemaybe.Sothosearesomeofthe valuesthatItreasureandwhichIhopehavebeen helpingmeinwhatIdo.

Therearethingsaroundthatwe’vedonewithrespect togenderthathavebeentransformational.One initiativeI’mparticularlyproudofisourMaternal HealthSupportScheme,partofAccessBank’sW Initiative.Irefertothatbecausethisisahealth magazine,apartfromhavingawidersustainability agenda,healthisacriticalpartofsustainability–it’s evenoneoftheUN’sSustainableDevelopmentGoals (SDGs).Thisschemewasdesignedtohelpwomen theyhavefertilitychallengesthatthey’retryingto overcomemedically,throughmedicalprocedures,or theyhavefertility-relatedorgynecologicallyrelated conditionstheywanttoovercome.Thebankisableto stepinwithfinancetosupportthemthroughthat journey Throughthisprogram,AccessBankhas helpedover100familieswelcomehealthybabiesinto theworld.That’smorethanjustafinancialservice, it’salife-changingintervention.

Thisspeakstoalargertruth:womenarethe cornerstoneofprogressanddevelopment,especially inAfrica.Womenplayapivotalroleinraising families,supportingcommunities,anddriving economicgrowth.Thedatasupportsthis–when womenhaveaccesstofinancialresources,theynot onlyinvestintheirbusinessesbutalsoupliftthose aroundthem.Eveninlending,womenloansarethe safestwithalowernon-performingloan(NPL)ratios comparedtomen,provingthattheyarereliable borrowerswhodriveeconomicstability

Our role is twofold: we influence both through our operations and through the way we support our clients.

When you recognize the needs of your community, leadership becomes clearer. It’s not about power, it’s about service. It’s about working with people, not just for them.

ThisiswhyIbelieveincontinuouslychampioning women’sempowerment.Whenwomenthrive,society thrives.Whentheyaregiventherightsupport,they don’tjustimprovetheirownlives—theycreatea rippleeffectthatbenefitsentirecommunities.That’sa valueIdeeplysharewithAccessBank,andit’sa missionwewillcontinuetodriveforward.

WhatareyouraspirationsforAccessBankPLCin termsofitsleadershiproleinclimaterisk managementandsustainablefinance,bothwithin Africaandontheglobalstage?

So,what’snext?What’sthenextlevel?

Rightnow,we’reinthemiddleofamajor transformation,movingourbranchestoward renewableenergysources.We’realreadyabout halfwaythere,andthegoalistoensurethateveryone ofourbranchesispoweredbysolarenergy, significantlyreducingourcarbonfootprint.Thisisa majorstep,butwewon’tstopuntileverybranchruns oncleanenergy

Beyondourownoperations,we’realsoworkinghard toreduceemissionsthroughourloanbook.Ournetzeroaspirationsarenotjustplansonpaper,we’ve donetheclimateriskmodeling,engagedwithour clients,andmappedoutthenecessarystepstoget there.Now,it’sallaboutexecution–translatingthose modelsintoreal-worldimpact.

Anotherkeyfocusisbringingmoreplayersintothe conversation.Rightnow,therearen’tmanyfinancial institutionsinNigeriaorevenacrossAfrica,fully embracingsustainabilityatthescalethatweare.

Butrealprogressrequirescollectiveaction.Onebank alonecannotachievethenationalorcontinental sustainabilitygoalsweaspireto.That’swhyI’vebeen activelyparticipatinginconferences,panels,andother speakingengagementstoencouragemorebanksand financialinstitutionstostepup.Themoreofusthat cometothetable,thegreatertheimpact.

Globalcollaborationisalsoabigpartofthejourney. We’restrengtheningpartnershipswithbothlocaland internationalorganizationstosupportajust transition,ensuringthatourshifttosustainable practicesisfairandinclusive.Whetherit’sworking withinstitutionsintheU.S.orotherglobalfinance leaders,we’releveragingeveryopportunitytobringin expertise,technology,andinnovativesolutions.

Thisisn’tjustaboutAccessBank;it’saboutthe peopleweserve.Wehavehundredsofthousands, evenmillions,ofclients–scientists,engineers, developers,entrepreneurs,whoarelookingfor solutionsinrenewableenergy,artificialintelligence, andmachinelearning.Throughsustainablefinance, wearecreatingopportunitiesforthemtoaccessthe technologyandpartnershipstheyneedtothrive.

Theworkdoesn’tstophere.Overthenextmonthsand years,we’llcontinuescalingup,pushingboundaries, andensuringthatsustainabilityisn’tjustanagenda item,it’sthefoundationofhowweoperate.

www.insightscaremagazine.com

iththepaceatwhichtheworldischangingtoday, climateissuesarethecalltoactionforsmalland largebusiness.Fromsupplychainbreakdownin the case of extreme weather to the implementation of new legislation to contain carbon emissions, the business landscape is evolving hand-in-hand with the climate. The needforresilienceisnolongeradreamofsustainability—it’s a business imperative. Those companies that act early to addressthechallengeofglobalwarmingcanprotectbusiness, avoideconomicloss,andachievecompetitiveedgeinaworld wherecompaniesaregoinggreen.

Climate risks are either physical or of a transition nature. Climate change’s direct effects, like hurricanes, floods, droughts,andwildfires,areexamplesofphysicalthreats.The incidents have the potential to impair supply chains, harm infrastructure,anddecreaselaboravailability.Transitionrisks include low-carbon economy transition and involve policy change, market forces, disruption through technology, and reputationaldamage.

For example, a manufacturer will suffer supply chain disruptionsfromdroughtthatdestroysrawmaterialcropsor will face added expense under carbon pricing. Industryspecificriskisthedanger,butallsectorsareexposed.

The path to climate resilience is quantifying your vulnerabilitiesbyundertakingastrategicriskassessment.By that,whatismeantisidentifyingwhatpartofyourbusinessis exposed to physical and transition risks Some of the questionsyouneedtoaskyourselfare:

1. Are our major suppliers situated in areas with a high likelihoodofextremeclimaticoccurrences?

2. How much do we rely on fossil fuels or non-renewable resources?

3. Whatregulatoryshiftswillaffectourbusinessmodel?

Byusingscenarioplanningandclimatemodels,notonlyisit possible but also achievable to foresee the future and make long-term decisions. Guidance from outside environmental consultants or sustainability officers is what most organizationsalsodependontoadvisethem.

Globalsupplychainsareespeciallyvulnerabletotheimpacts of climate destabilization. A hurricane in one region of the country can create a ripple effect through a series of industries. Businesses can reduce vulnerability by diversifyingsuppliers,buyinglocallywhentheyareable,and notbecomingtoodependentononesupplierorarea.

Building backup suppliers and investing in more durable logistics infrastructure can also counter such risks. Other digital technologies like supply mapping and real-time analyticscanyieldincreasedvisibilityandresponsiveness.

InvestmentinGreenInfrastructure

Going green is good for both the environment and business. Whencompaniesinvestinthingslikewater-savingsystems, clean energy, or energy-efficient buildings, they can reduce theirrisksfromclimatechange.energies,andenergy-efficient structures, corporations can minimize their vulnerability to climatechange.

For example, replacing new air conditioning units or providingsolarpanelsreducesthepriceofenergyandriskof fossilfuelprice.Theinvestmentsaretax-preferredandreturn brandvaluetogreenconsumers.

Aclimateactionplanformalizesafirm’semissionsreduction strategy as well as mitigation of environmental problems. Someofthemostcriticalcomponentscouldbe:

• Measurementandemissionsreductiontargets

• Sustainableprocurementpractices

• Wastereductionandrecyclingprograms

• Environmentalpracticestafftraining

Aplansuchasthisnotonlyshowsregulatorsandstakeholders that the firm is dedicated to sustainability, but it is a map duringacrisis.Plannedchangeismorelikelytorespondand recoverwhenthingsgowrong.

Resilience is built in collaboration. Businesses can enhance their climate action through collaborative efforts with industry colleagues, municipal government, and NGOs Collective intelligence and collective action also generate moreinnovativeandcheapersolutions.

People at every level of a company should understand the environmentalgoalsandknowhowtheyfitin.Beinghonest abouttheseeffortshelpsbuildtrustwithfolksontheoutside whocareaboutwhatbusinessesaredoingfortheplanet.

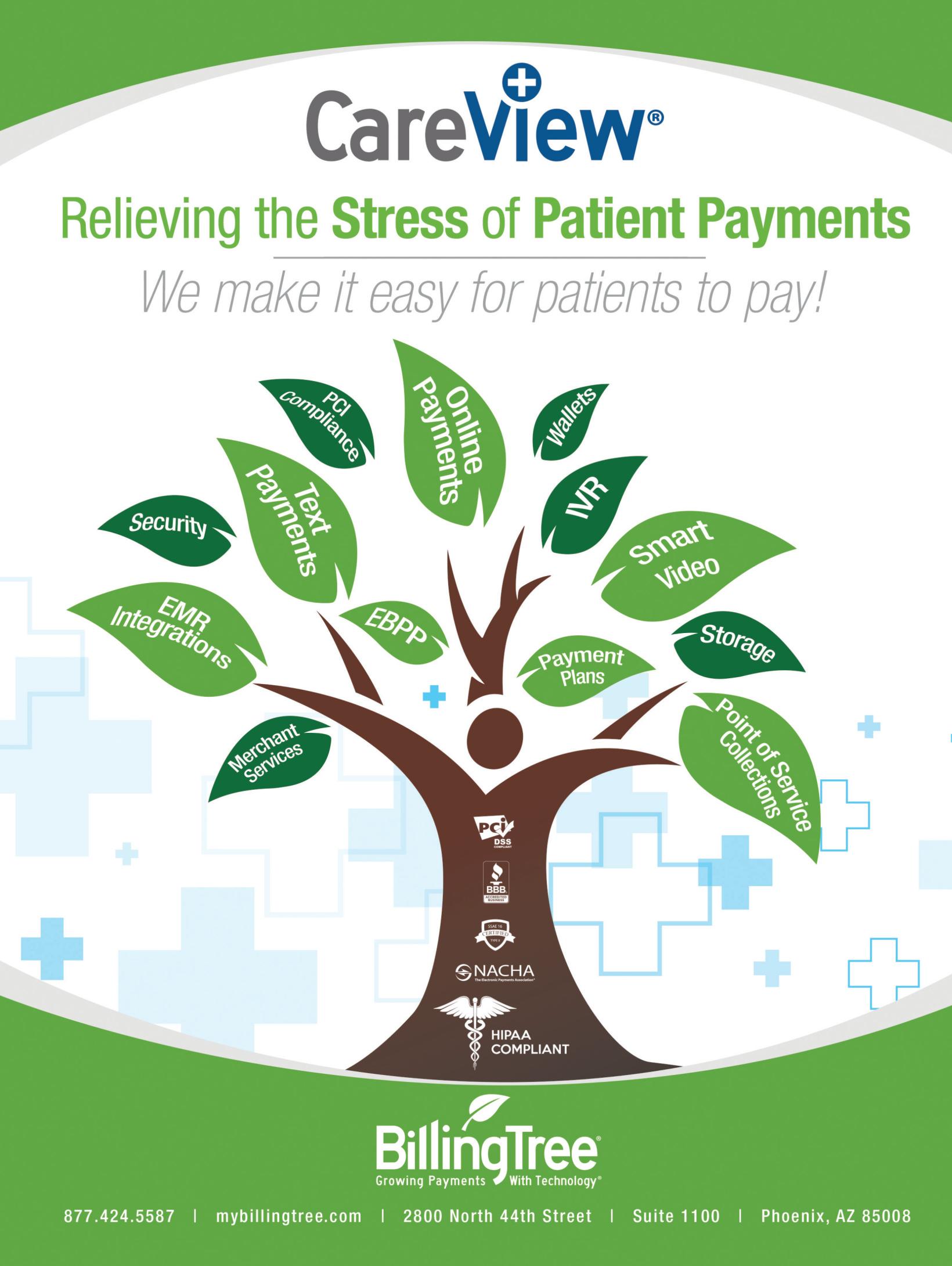

Insurance is a traditional yet crucial climate risk hedging product. Corporates will periodically have to review their insurance covers to obtain coverage for new and emerging risks. Other products like green bonds or ESG-linked loans mayalsobeemployedforfundingsustainabilityprojectswith theadditionalcueofenvironmentalpurposetoinvestors.

Climatechangeeffectscontinuetoincrease;sodoesglobalIQ and global consciousness. Companies that adopt resilience todaypositionthemselvestosucceedtomorrow.Fromgreen investingtomoreintelligentsupplychainsandsmartpolicy, therearenumerouspathstoremainaheadoftheclimaterisk curve.

Adaptingtoclimatechangehelpsbusinessesstaystrongand moveforwardinagreenerfuture.

-Pearl Shaw

stherealitiesofclimatechangecontinuetomanifest and disruption becomes inevitable, mainstreaming climate risk into decision-making is no longer a choice—it is a necessity. In community planning, business planning, and government planning, this consciousness and preparednessforthenewclimaterealityareneededinorderto be able to assure resilience, long-term sustainability, and soundleadership.

Climate risk takes the form of two forms: physical and transition risks. Physical risks consist of the actual impact, directeffects,ofachangingclimateintheformofrisingsea levels, more intense and frequent storms, droughts, and heatwaves.Transitionrisksemergeassocietyistransforming intoalow-carboneconomy-policy,technological,consumer, andmarkettransformations.

Decision-makers wasted decades dithering over basing assumptions on historical climate trends. But the past is no longerpredictable.Withdecisionstodaynowliabletofailif climateriskisnotconsidered,whetherthat’sspendingonatriskinfrastructure,launchingaproductintomarketinahighrisk region, or growing agriculture without accounting for changing weather patterns, the business case for action is compelling.

Climateriskisanenvironmentalriskandafinancialrisk.The climate risks have become the global highest risks for potential impact as well as probability, based on the World EconomicForumdefinition.Companiesarenowseeingthat deniability of the risks will lead to reputational damage, regulatorypenalty,anddirectfinancialimpact.

Investors are also investing. Climate disclosure regulations liketheTaskForceonClimate-relatedFinancialDisclosures (TCFD)encouragescompaniestoquantifyandreportonthe impactthatclimate-relatedriskshaveontheiroperationsand strategy The clearer it is, the more the investors are able to makeadecisionandthemorethecompanieswillneedtotake intoconsiderationclimatechangeadaptation.

Policy is at the core of climate-informed decision-making. Governments are starting to integrate climate risk into national and local plans. Urban development plans or large infrastructureprojectsinothernationsarenowlegallybeing requiredtobeassessed.

Localgovernmentsaretakingthelead.Citiesareconstructing seawalls,modernizingzoningcodes,andinvestingingreen infrastructure to protect against future loss. These are not green choices-they’re good business choices A dollar invested today in preventing climate risk can save several dollarsoflossinthefuture.

One of the hindrances in making climate risk a part of decisions is the availability of good-quality, local, forwardlooking data. Happily, the character of climate models and risk estimation has arrived for the better Now, from construction codes to insurances coverage, decision-makers areabletoobtaindatathatinformsthemofhowclimatetrends are poised to change in affected areas and make decisions accordingly

Private sector products, scholarly research and global climatological monitoring all yield data that can be engineered to meet industrial application. Agriculture, for instance, applies climate prediction to alter crop choice or planting time. The energy sector employs climate risk analysistodecidewheretositerenewablefacilitiesordefend againstintenseevents.

Notonlyareforward-thinkingcompaniesaddressingclimate risk, but they are also using it as an opportunity to innovate. Instead of threatening possibilities presented by climate issuesasarisk,companiesareviewingthemasnewmarkets, green product innovation, and efficiencies that lower emissionsandcostsofoperations.

Climate risks are similarly something which needs to be coalescedinsupplychainresilience.Firmschartriskswithin their supply chains, particularly water, agricultural, and exposedsiterisks,andre-designtobeaheadofdisruption.

And this advance planning also generates work and technological innovation due to it like climate-resilient agriculture, energy-efficient building materials, and predictivedisasterresponseanalytics.

While institutions have to make choices, communities and citizens are also involved, e g , in resident-involvement communityplanningthatengagedresidentsinactivitiessuch as flood-proofing one’s home, emergency networks, or developing urban forests to mitigate climate effects and promotesocialsolidarity

Knowledge and education are also crucial. Once the people are informed about the risks they are undergoing and what their other option is, it also seems to make them endorse measuresandpoliciesthataremeanttoenhancelonger-term flourishingatthecostofshort-termbenefit.

Preparationfortomorrowtakestheformofdoingsomething today Mainstreaming climate risk into day-to-day decisionmakingisatypeofforesight—arecognitionthattheworldis transformingandsuccessandsurvivalhingeonourcapacity to adjust. It requires cooperation across sectors, openness to questioningtraditionalpractices,andshort-termimagination thinkingcapacity

Growing uncertainty in the world, nutty weather, clever, climaticchoicesaren’tjustsoundpolicyorstrategy;theyare plaingoodsense.Thesoonerweact,thebetterequippedwe’ll befortomorrow.

-Natalie May

www.insightscaremagazine.com