INDIA

Alpha Foam Manufactures Spunbond and Spunlace Nonwovens on Large Scale

RECYCLING

T2T Alliance Unites Leading Net-Gen Fiber Companies to Scale Global Efforts

COMPOSITES

Industry Works to Prevent False Claims Surrounding Advanced Carbons Use

INDIA

Alpha Foam Manufactures Spunbond and Spunlace Nonwovens on Large Scale

RECYCLING

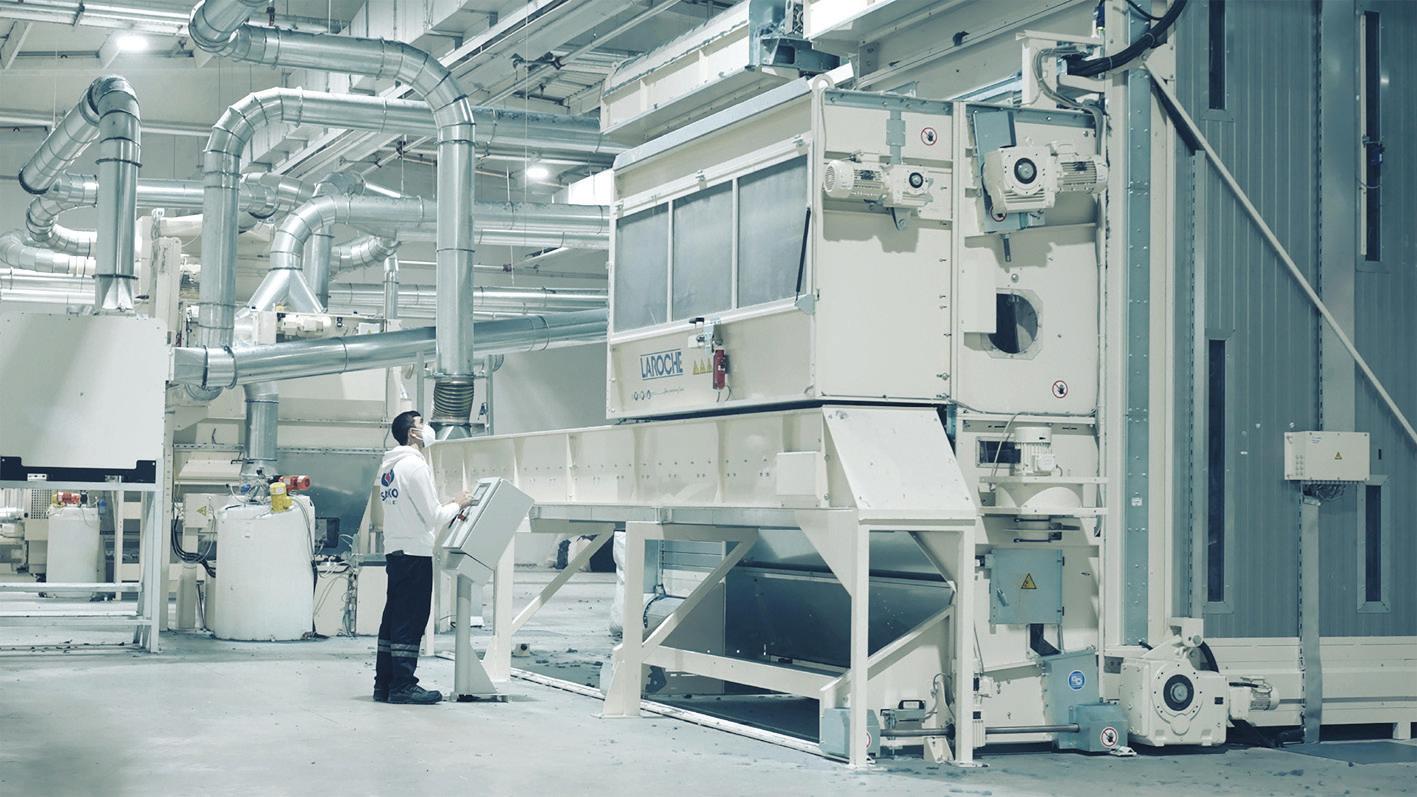

T2T Alliance Unites Leading Net-Gen Fiber Companies to Scale Global Efforts

COMPOSITES

Industry Works to Prevent False Claims Surrounding Advanced Carbons Use

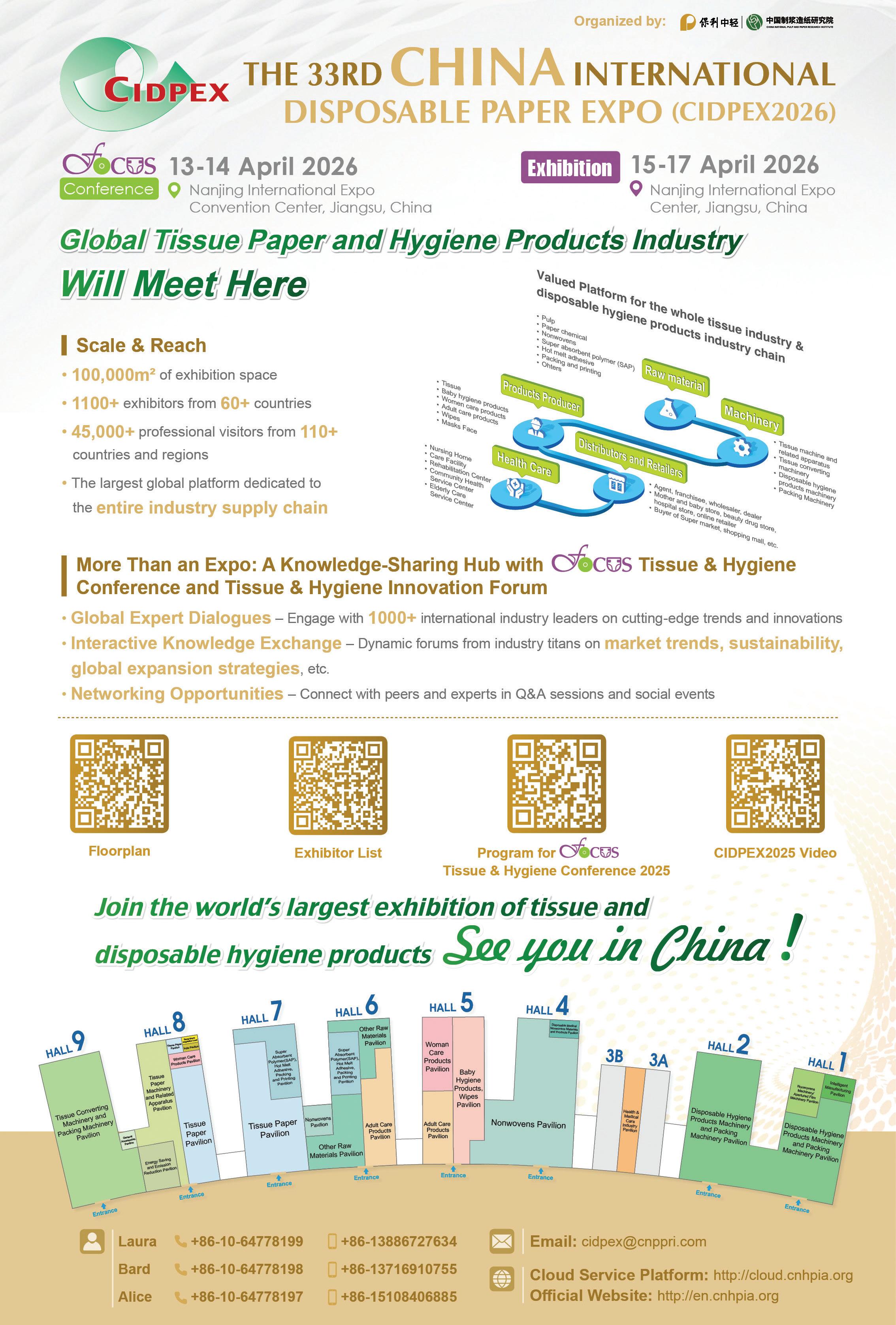

Cohosted with

Mar 23–24, 2026 | Washington, DC

When policy is uncertain, presence matters.

Join INDA and industry leaders at the 2026

INDA Advocacy & Fly-In Summit, cohosted with ISSA, for two powerful days of advocacy training, policy insight, and direct engagement with lawmakers—just steps from the U.S. Capitol.

• Advocacy training and policy briefings

• Nonwovens-focused breakout discussions

• A “Hike the Hill” with in-person meetings on Capitol Hill

March 23–24, 2026

Royal Sonesta Washington, D.C. Capitol Hill

Attendance is limited to just 35 participants. (Translation: influence favors the early registrant.)

Early bird pricing ends January 15, 2026.

This exclusive event brings together leaders from INDA, ISSA, IICRC, and WSA to ensure the nonwovens industry is heard on the issues shaping its future—from PFAS and EPR to tariffs and the WIPPES Act. Register now: events.issa.com/events/cleanadvocacy-summit-2026

CEO Q&A: Alpha Foam— Leveraging Strengths to Meet Growing Nonwovens Demands By Arun Rao, International Correspondent, India

Thinking Out Loud

From Across the Supply Chain, Thought Leaders Provide Their Perspective on 2026 and Beyond

Compiled by Caryn Smith, Publisher and Chief Content Officer, IFJ

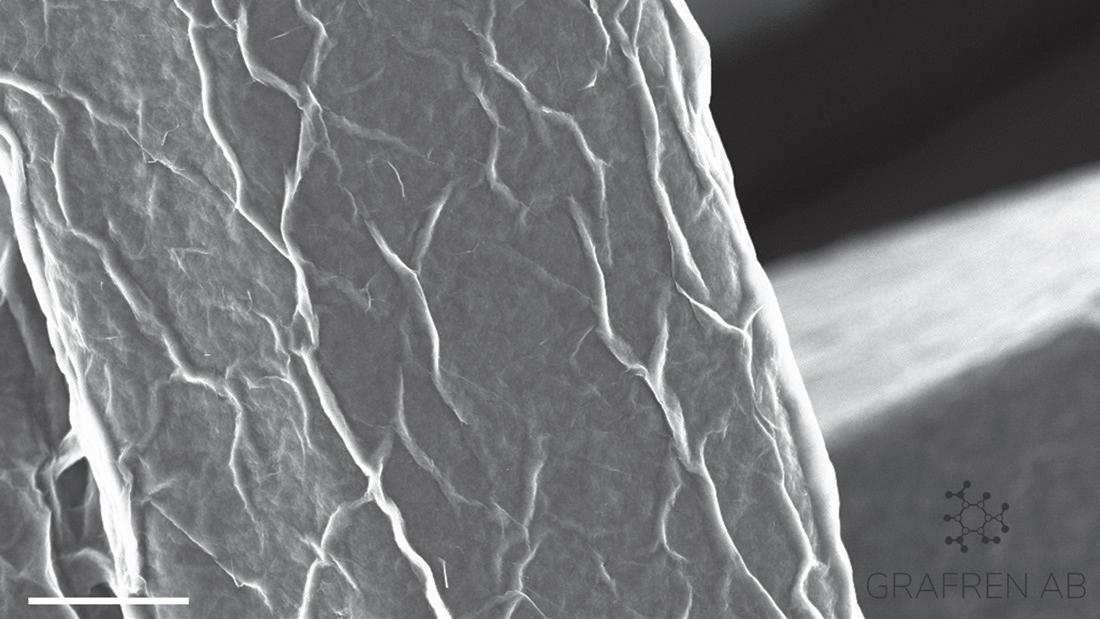

PREVENTING FRAUD: Detecting Fake Graphene in Textiles

By Geoff Fisher, European Editor, IFJ

Investments Cue Optimism for Circular Textiles That Can Scale By Adrian Wilson, International Correspondent, IFJ

HYGIENIX 2025: Leaders in Hygiene Move the Needle

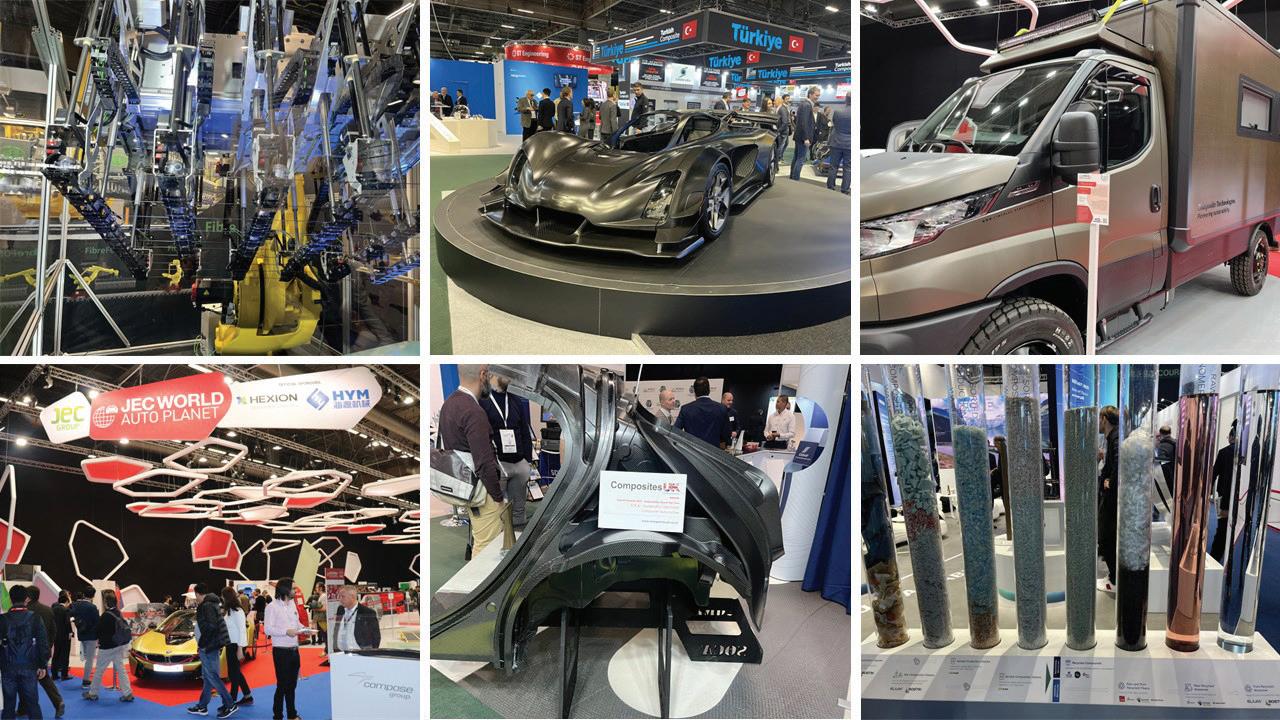

Automotive—Lighten Up By Geoff Fisher, European Editor, IFJ

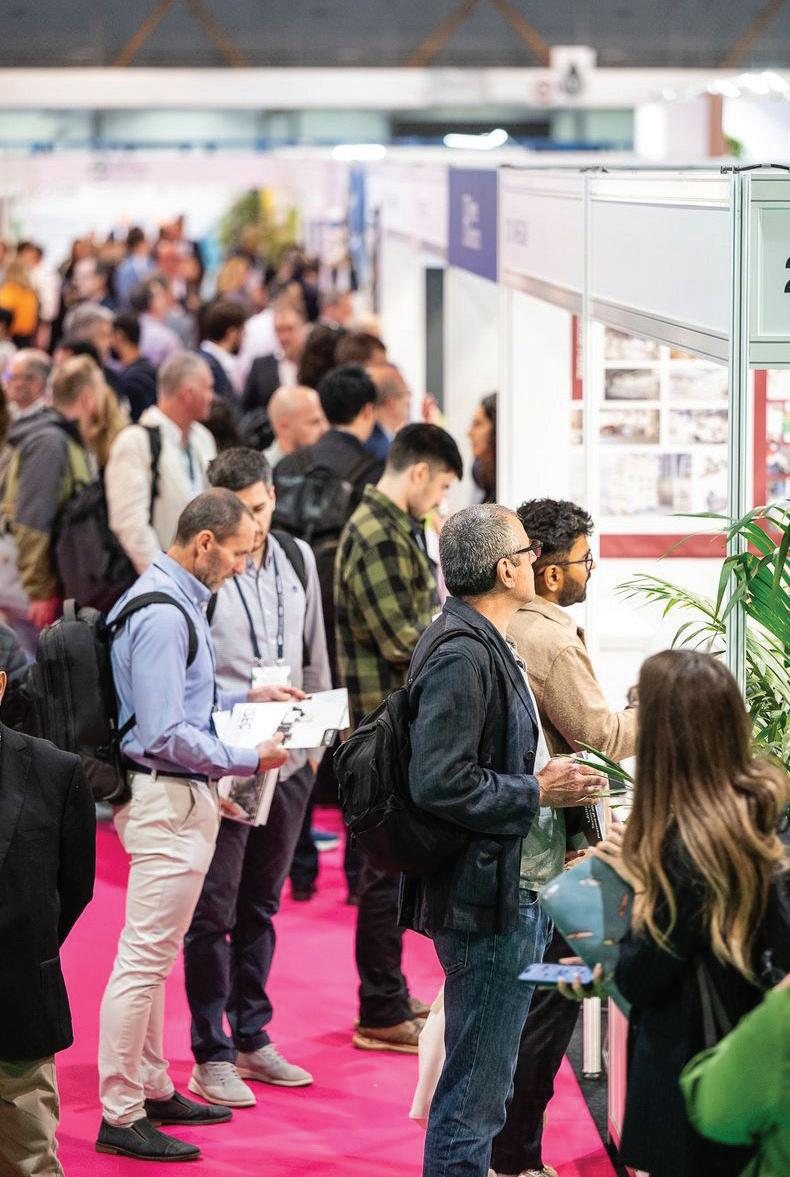

EVENTS 2026: Showcasing the Clear Path from Fibers to End-Use Solutions By Adrian Wilson, International Correspondent, IFJ

Viewpoint IYKYK ... Then What?

By Caryn Smith, Chief Content Officer & Publisher, IFJ

Tech Spotlight

How Recyclable Carpets Could Transform the Flooring Industry

Tech Notes

Latest Technology Briefs

Emergent Textiles

Trending University & Institutional Research

Compiled By Ken Norberg, Editorial & Production Manager, IFJ

In the Business: Nonwovens

Beyond Compliance and What Comes Next for Nonwovens, EDANA’s Sustainability and Policy Forum in Brussels By Philippe Wijns, Principal at CleverSustainability

Movers & Shakers

Industry News and Notes

CONTENT | EDITORIAL

CHIEF CONTENT OFFICER & PUBLISHER

Caryn Smith

Driven By Design LLC

csmith@inda.org

+1 239.225.6137

EDITORIAL & PRODUCTION MANAGER

Ken Norberg ken@ifj.com

+1 202.681.2022

ART DIRECTOR

Caryn Smith

GRAPHIC DESIGNER

Julie Flynn

EUROPEAN EDITOR

Geoff Fisher

INTERNATIONAL CORRESPONDENT, EUROPE

Adrian Wilson

SMART & ADVANCED TEXTILES CORRESPONDENT

Marie O’Mahony

INTERNATIONAL CORRESPONDENT, CHINA

Jason Chen

INTERNATIONAL CORRESPONDENT, INDIA

Arun Rao

ADVERTISING | SALES

See Sales Representative Contact Details in Movers & Shakers Section

For Inquiries to Your Sales Representative, e-mail advertising@inda.media

Download the IFJ Media Kit at www.fiberjournal.com/advertise

AUDIENCE | CIRCULATION CIRCULATION MANAGER

inda@darwin.cx

+1 319.861.5017

International Fiber Journal is published by INDA Media, the b2b publishing arm of INDA, Association of the Nonwoven Fabrics Industry.

+1.919.459.3700

info@fiberjournal.com | www.fiberjournal.com News & Press Releases to IFJNews@inda.media

2026 BUYER’S GUIDE www.fiberjournal.com/buyers-guide

SUBSCRIBE: www.fiberjournal.com/subscription

MISSION

“Tomorrow belongs to those who can hear it coming.”— David Bowie

n the 1980s, Let’s Dance was one of my go-to songs. David Bowie was a Rock & Roll Hall of Fame musical icon, and his quote rings truer now more than ever. Tomorrow comes quicker than you can imagine. If you are a parent, you experience this every day. One day your kid is in a car seat chewing on a plastic set of musical toy car keys; the next day you are handing them the keys to your car. We knew it was coming, but it still seems too soon.

Bowie is famous for hearing the sounds of tomorrow, and making music from it today. That is a good lesson for us, too.

We have personal beliefs about tomorrow, and reinforce them in our thoughts and words. We hear what society is saying about today’s textile industry, such as the conservationists’ impractical ideas about reducing waste. Or, consumers who attend rally in support of sustainable options ... yet reveal their true lack of support in spending their habits. Some day, these efforts will align. Will you hear it coming?

The industry is at a crossroads. We know what the issues are; we can hear the future calling for change. The billion dollar question is, will we?

I ask a question that I cannot answer. Most of us hope that we are innovating towards a fully sustainable textile industry. At present, sustainability is in the car seat. Someday, it will be asking for your keys. Between now and then, how will we help it grow into maturity?

On that note, we invited industry thought leaders to share their top-of-mind wisdom to launch us into 2026. On page 22, “Thinking Out Loud” offers perspectives from fifteen leaders from across the textile supply chain who responded. They covered production, materials sourcing, natural fibers, economic insights, marketplace conditions, emerging materials, and more. This is worth a good read.

On page 39, Geoff Fisher provides an update on the trend of light weighting in the automotive industry, which is only going to evolve as more electric vehicles with their heavy batteries hit our roads across the globe. Fisher also provides us with a look at “fake” claims of grapheneenriched fabrics that is muddying the waters for the wonder-carbon super material. This trend is leading to ways to verify claims, discussed on page 46.

Adrian Wilson gives us two articles, as well, in this issue. On page 42, he discusses the new T2T Alliance, formed to advocate for policy changes in relation to fiber recycling. T2T has attracted the key players in fiber recycling who are leading the way with technology, processes, and materials. They promote closedloop recycling, and held their first Textile Recycling Expo in Belgium, June 2025. Then, on page 48, Wilson gives an overview of the important textile shows not to miss in the first portion of the year.

Lastly, this issue of IFJ is my last as your Publisher & Chief Content Officer. I have learned so much from all of you, and I hope that over the past several years, the articles herein have inspired you to think outside the box, just a bit more than usual. I want to sincerely thank all the writers, experts, and companies who contributed their ideas and content to the IFJ

The very capable Rachael Davis, previously Executive Editor of Textile World, and their collection of titles, will take the mantle for the next issue.

I sign off with high esteem for all of you, the readers, and gratitude for all of your amazing contributions that make this industry great!

Caryn Smith Chief Content Officer &

Publisher, INDA Media, IFJ

Caryn Smith Chief Content Officer & Publisher, INDA Media csmith@inda.org +1 239.225.6137

Geoff Fisher European Editor gfisher@textilemedia.com +44 1603.308158

Adrian Wilson International Correspondent adawilson@gmail.com +44 7897.913134

Arun Rao International Correspondent, India Owner, Taurus Communications arun@tauruscomm.net

Philippe Wijns Principal, CleverSustainability, Filtration Expert and Sustainable Business Development Advisor philippe.wijns@ cleversustainability.com

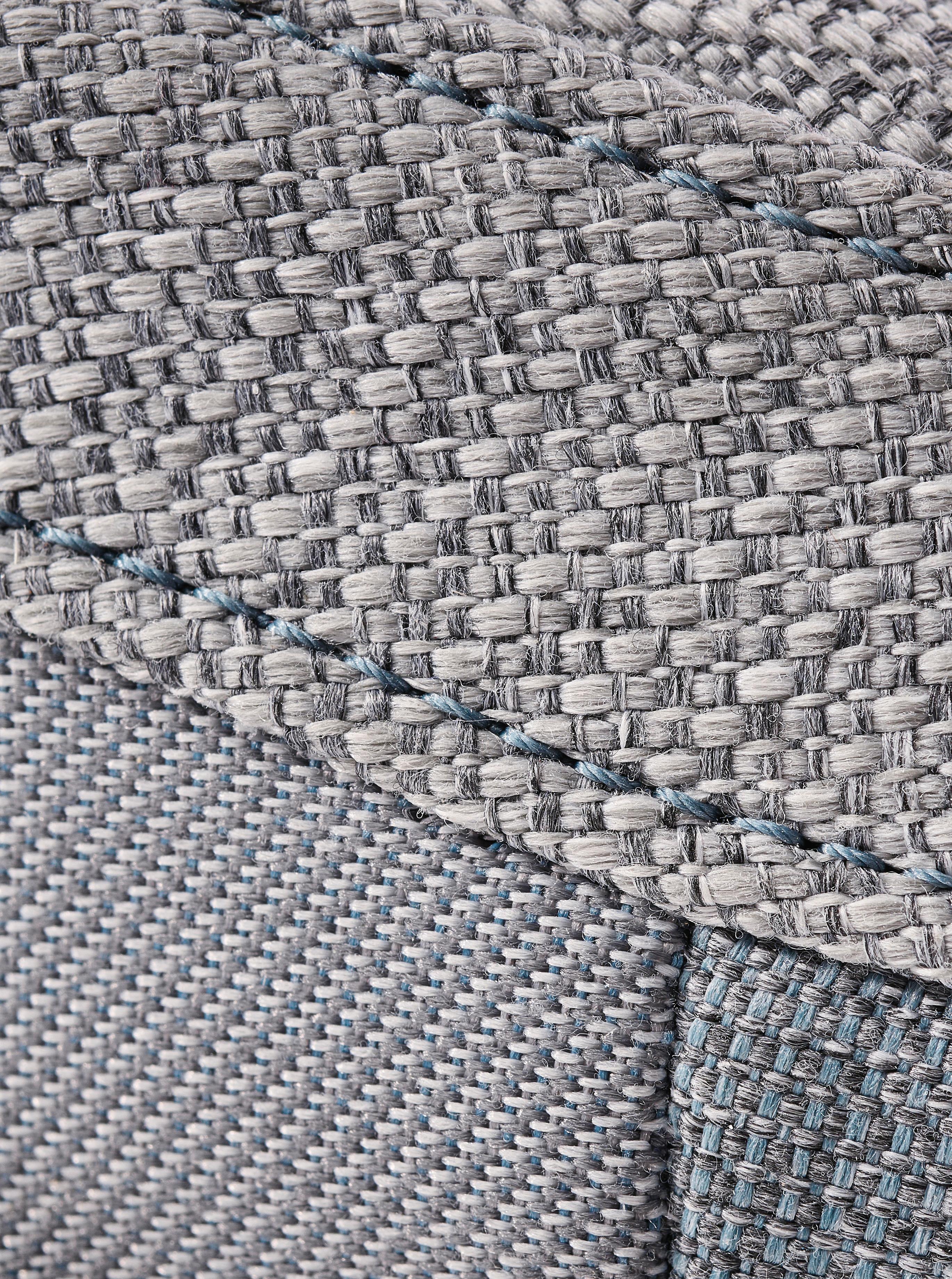

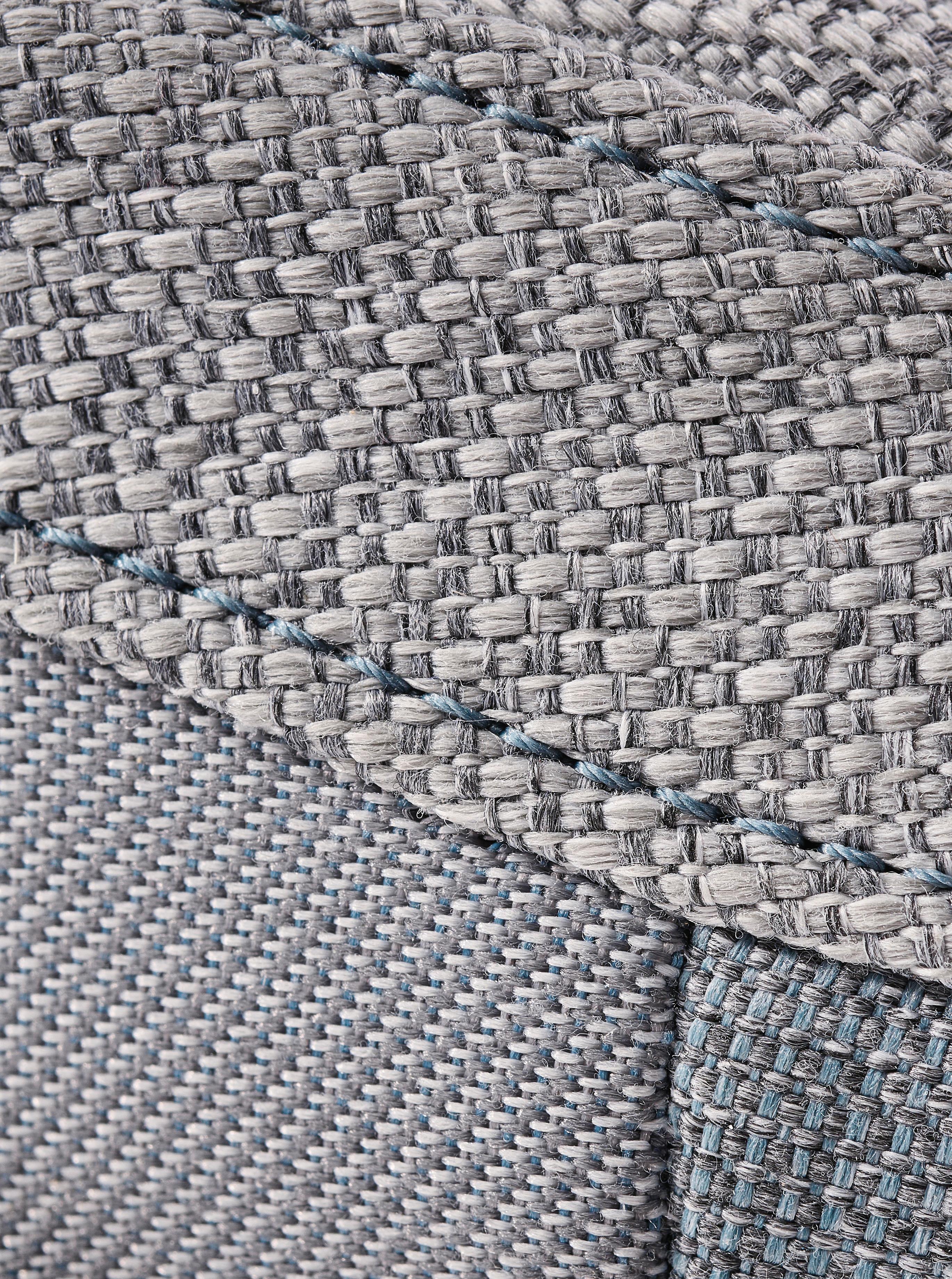

ost carpets end up in landfills or incineration, locked out of the circular economy. In Europe, an estimated 1.6 million tonnes of carpet waste are sent to landfills each year. According to data from Deutsche Umwelthilfe from 2017, nearly 98% is either incinerated or sent to landfill. While the use of polyester has improved recycling rates, these improvements remain in the low single digits. In the United States, approximately 1.8 million tons of carpet waste are generated annually. Of this enormous amount, only 5% is recycled, and 6% is incinerated for energy recovery. The remaining 89% end up in landfills. These figures highlight a significant environmental problem, as most carpet materials are not biodegradable and therefore remain in landfills long-term. The low recycling rate indicates considerable potential for improving circular economy practices in the carpet industry1

Although most carpet face fibers are technically recyclable, the way carpets are constructed has historically kept them out of the circular economy.

For decades, latex-based backings have been the standard in carpet production. While effective at binding fibers, latex creates a complex, inseparable composite. Once combined with pile fibers, the materials are permanently bound, resulting in carpets that perform well in use but are destined to become waste at the end of their life.

Luxury Vinyl Tile (LVT) dominates design trends, but carpets remain essential in homes, offices, and commercial spaces. Over

the past two decades, carpets have steadily lost market share to hard surface alternatives, most notably LVT.

Yet carpets are far from obsolete. In residential markets, consumers continue to prefer carpets for their warmth, comfort, and acoustic properties. In commercial spaces, carpet tiles have become the dominant modular flooring option, accounting for about 44% of modular flooring revenue. Carpet’s resilience lies in its versatility and its ability to adapt to design trends. What has held the category back is its environmental baggage, and this is where innovation is beginning to change the story.

Compared to traditional latex coating, hotmelt technology offers significant benefits. The manufacturing process with hot-melt coatings consumes up to 80% less energy2 and generates no wastewater. This efficiency gain results from the fundamentally different coating process itself. Hot-melt coatings are applied in a molten state and harden through cooling, while latex systems require energy-intensive drying and curing processes with high water consumption. This shift to hot-melt technology represents a significant step toward reducing the ecological footprint of carpet production, regardless of the end product’s material composition.

The potential for recyclable carpets is not confined to residential or office interiors. Mono-material design, specifically for PP and PET carpets, enables their downcycling into

less performance-demanding items such as flowerpots or waste bins. This becomes more challenging when different raw materials are used in carpet construction. A particular advantage of PET-based carpets lies in the possibility to depolymerize and subsequently repolymerizing the material through chemical processes, achieving a closed material loop with virgin-quality material.

Carpet tiles, the workhorse of the commercial sector, are now being designed for cradle-to-cradle loops. For carpets with multiple components, such as those made with Polyamide 6 yarn or natural fibers like wool, the recycling process developed by Fraunhofer IVV and patented by Clariant for floor coverings ensures the pure recovery of the raw materials used, regardless of their composition.

In sports infrastructure, artificial turf is another major application. Modern turf systems typically combine polyethylene fibers with a primary backing based on either PP or PET. While latex and polyurethane are traditionally used as backing materials, polyolefin (PO) backing offers an alternative for better recyclability. Polypropylene-based solutions not only provide the necessary stability and tear resistance but are also fully recyclable.

Carpet may never reclaim the dominance it once had, but it doesn’t have to. By aligning with circular economy principles, the industry can carve out a future where carpet is not just

For details on how to submit your company’s technology for consideration as a “Technology Spotlight” in IFJ, contact Ken Norberg at ken@ifj.com or +1 202.682.2022.

Once combined with pile fibers, the materials are permanently bound, resulting in carpets that perform well in use but are destined to become waste at the end of their life.

a flooring option of comfort and style, but also one of responsibility and resource efficiency.

New materials are leading the way. Licocene™ polymers, for example, are already enabling recyclable carpet systems by turning backings into polyolefin-based layers that can be reprocessed. And with the Licocene Terra line, which uses mass-balance certified renewable feedstocks, the industry now has an option that is both recyclable and renewable.

The image of carpets as bulky, unrecyclable waste could soon give way to something entirely different: a flooring solution designed to be used, recovered, and used again.

The carpet industry is rapidly moving toward circularity, and Clariant’s Licocene polymers have played a crucial role in enabling recyclable carpet systems. Now, Licocene Terra builds on this innovation, combining reliable performance with renewable feedstocks to reduce its environmental footprint.

Licocene Terra is produced using mass-balance-certified renewable feedstocks, has a lower CO2 footprint, and performs just like fossil-based versions with drop-in solutions. The result is the same bonding strength and process efficiency with a reduced carbon footprint. www.clariant.com

1 Source: SleepBloom.com - Carpet Waste in the USA

2 Source: Lacom – Laminating and Coating Machines; Aumann AG Licocene® IS A TRADEMARK OF CLARIANT.

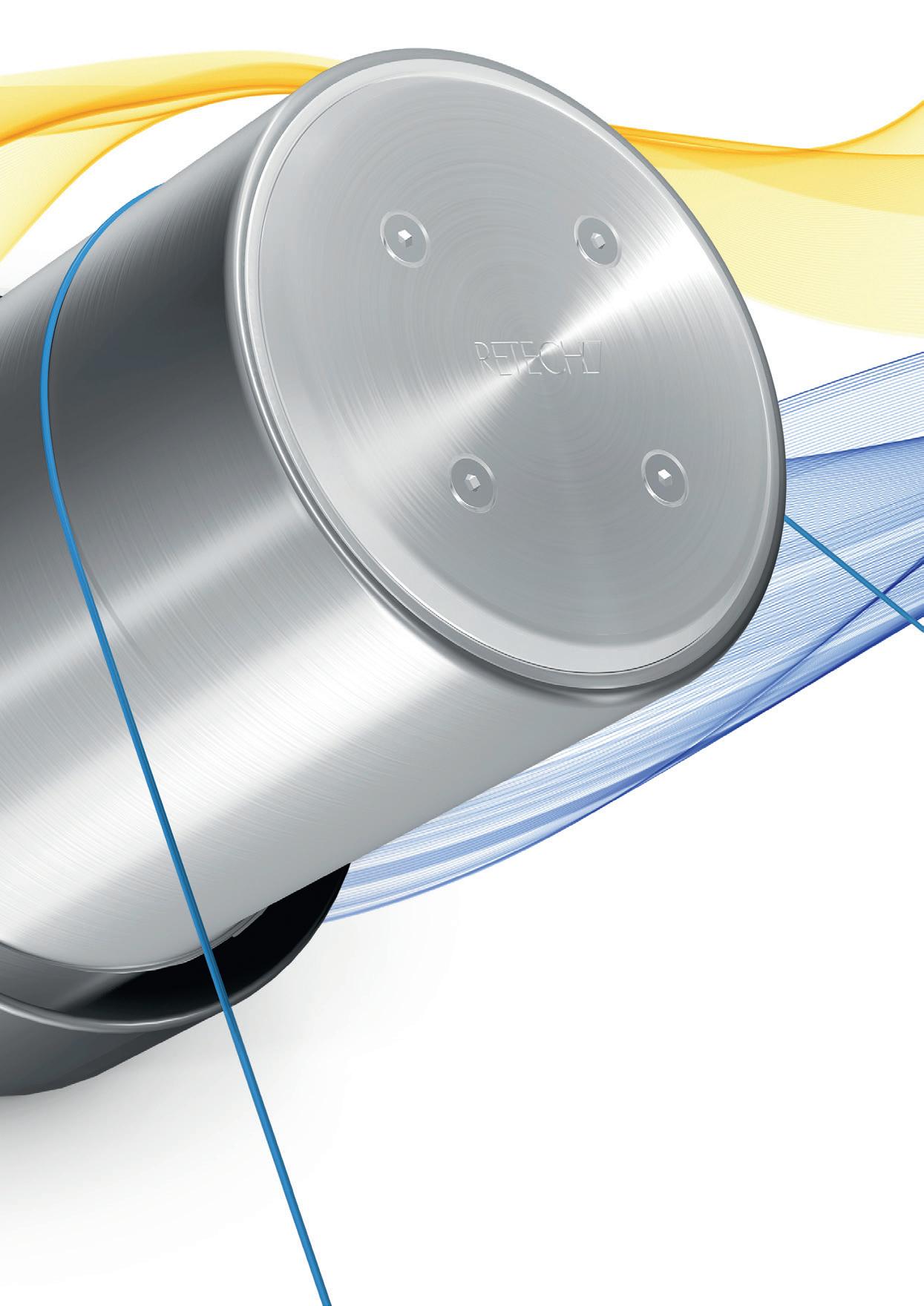

Rolls, godets, heating elements and custom built machines for heat treatment and drawing of synthetic filaments. Win – OLT ® yarn tension on-line monitoring systems.

Engineered and produced in Switzerland

Retech Aktiengesellschaft CH-5616 Meisterschwanden

Kontoor Brands Inc., the parent of Lee and Wrangler brands, recently launched their latest innovation based on the thermal regulation properties of Kyorene® graphene fiber.

Graphene is carbon-based nanomaterial, and its unique chemistry and versatility brings innovations to vastly different fields including electronics and batteries, plastics, lubricants, concrete and now clothing. In most cases, the graphene is used as an additive in a very small percentage, to bring about improvements in strength, stiffness, durability, or electrical conductivity.

reversible

Xenia, global player in engineering and manufacturing reinforced thermoplastic composites for injection molding and additive manufacturing, recently announced the launch of XECARB ® PA12-CF-ST, a new carbon fiber reinforced filament for FFF/FDM 3D printing.

Developed on a PA12 (Nylon 12) matrix, XECARB® PA12-CF-ST delivers high strength, excellent abrasion resistance and low moisture absorption, while the 15% carbon fiber reinforcement allows it to achieve high mechanical performances, lightness and dimensional stability.

Xenia’s proprietary Super Tough (ST) Upgrade significantly enhances impact resistance and elongation at break, allowing the material to withstand shocks and mechanical stress without compromising its lightweight nature. With a Heat Deflection Temperature (HDT) of 150°C, the filament also ensures reliable performance and precision for functional components, making it ideal for demanding structural 3D printing applications.

Thanks to this combination of mechanical performance, lightness and processability, XECARB® PA12-CF-ST is suited for automotive, aerospace, industrial and consumer goods applications requiring structural capability, fatigue resistance and long-term durability in demanding environments. www.xeniamaterials.com

The Wrangler ATG men’s reversible vest and jacket utilize a highly efficient, lightweight insulation material made of a blend of Sorona® and Kyorene® graphene fibers that offers improved flexibility, reliable performance, and the lasting warmth without the bulk of traditional polyester fiberfill materials.

The Kyorene® graphene fiber produced by Graphene One LLC, is a hollow polyester staple fiber that contains their patented graphene oxide nanomaterial. The graphene can absorb far infrared radiation given off by the body and that heat energy is captured in the Sorona®/Kyorene® fiber blend. In developmental testing the Kyorene® graphene provided a 20% improvement in thermal insulation, allowing for a lighter, thinner layer to be used in the vest and jacket design.

In addition to thermal insulation, Kyorene® graphene fibers have antibacterial and anti-odor performance that has been key in their commercial use in sportwear, socks, underwear, sleep wear and more. This development builds upon the success of Kontoor’s 2023 product launches, which showcased the integration of advanced graphene technology in apparel. The Kontoor Denim jeans introduced that year featured Kyorene ® graphene fibers blended with cotton, delivering a unique balance of increased warmth, breathability, and lightweight comfort. The inclusion of graphene enhanced not only thermal regulation—helping to retain body heat in cooler conditions—but also contributed to improved durability, odor control, and moisture management for all-day wearability. www.kontoorbrands.com

Bioworks Corporation in Japan announced the first commercial launch of its plant-based synthetic fiber “PlaX,” modified from PLA using Bioworks’ proprietary technology, across two Goldwin Inc. brands: The North Face and NEUTRALWORKS. Since 2022, Bioworks and Goldwin have been collaborating on the product development of PlaX and starting with Goldwin’s 2025 Fall/Winter collections for The North Face and NEUTRALWORKS, outerwear made from PlaX-based pile fleece is now available.

In preparation for commercialization, both companies carried out an extended period of prototyping and testing. To meet Goldwin’s highquality standards—particularly regarding dyeability and durability, they collaborated to review yarn processing conditions and design, working closely with textile manufacturers and dyeing facilities to conduct repeated tests and continuously refine the material. Through these sustained efforts to enhance quality, preparations for practical use were conducted over approximately three years, ultimately leading to the material’s adoption. Moving forward, both companies will continue to deepen collaboration in material development and product design, aiming to accelerate sustainable manufacturing. Through the expanded adoption of PlaX, Bioworks aims to contribute to reducing the environmental impact of the fashion industry and promoting a circular economy. bioworks.co.jp/en/

Nonwovenn, one of the world’s leading nonwoven fabric-tech companies, has made significant advancements in its activated carbon (AC) fabric technology, improving AC accessibility, performance and manufacturing robustness across its certified face mask ranges.

The latest developments focus on enhancing processing systems that enable greater AC accessibility, resulting in improved filtration performance, manufacturing consistency and product value.

Through the refined processing systems, Nonwovenn has optimized how activated carbon is integrated and exposed within the mask fabric structure, ensuring high adsorption efficiency and longer service life. The business has also made advancements in bonding and lamination techniques, AC and fiber distribution control and layer architecture. The innovations help make the manufacturing process more stable and scalable, reduce waste and improve quality consistency.

Dr. Ross Ward, CarbonTech Business Director at Nonwovenn, said, “We are continually developing new ways to make our activated carbon systems more accessible and effective. By refining how AC is incorporated and exposed within our fabric structures, we are seeing measurable improvements in both performance and process stability, which translates into stronger customer value and product competitiveness.”

Nonwovenn’s certified mask fabrics are designed to meet recognized standards such as EN 149 for particle-filtering half masks under the European PPE Regulation, and relevant medical device standards where applicable. The products provide consistent protection and traceability for both occupational and clinical use. Alongside these certified face mask fabric options, Nonwovenn continues to offer mask fabrics that deliver comfort, odor control and protection from volatile organic compounds found in everyday environments. The business has also introduced selective additive and catalyst enhancements that broaden adsorption profiles for volatile organic compounds. www.nonwovenn.com

Archroma, a global leader in specialty chemicals focused on sustainable solutions, has supported the Institute of Chemical Technology (ICT), Mumbai, India in the renovation and development of a sustainable laboratory facility as part of its Corporate Social Responsibility (CSR) program.

The upgraded facility will strengthen the department’s capacity to conduct fundamental research and develop future-oriented technologies in textile processing, manufacturing, and effluent treatment. It is designed to help address current industrial challenges while encouraging innovation in sustainable and

Eton Systems—a member of TMAS, the Swedish Textile Machinery Association—is taking part in the current Microfactories System Innovation project which is working on the development of a fully automated workflow for secondhand garments. Eton is contributing its well-proven transport system for material handling to the project, which also involves specialists at the Swedish School of Textiles in Borås, the Automation Region innovation cluster at Mälardalen University and the national collaboration platform iHubs Sweden.

According to ThredUp’s 2025 Resale Report, the value of the global second-hand apparel market is already worth an annual $256 billion this year and growing at 10% annually to reach a value of $367 billion by 2029.

A test facility is being established at Science Park Borås involving garments being placed on custom product carriers within an Eton Systems conveyor system and transported through a series of stations.

The garments are inspected using a vision system, after which AI is employed to categorize them based on parameters such as manufacturer, model and size. Any damage is analyzed and the system also provides recommendations for possible repairs.

“The collected information is fed into a calculation model that, based on market data, makes suggestions for a sales price,” explained Jan Molin, CEO of Eton Systems. “Finally, the garment is photographed for marketing and then transported to a warehouse awaiting sale.” www.etonsystems.com

resource-efficient textile technologies.

Through its CSR support, Archroma is also enhancing the learning environment for students by providing modern infrastructure for practical training and scientific exploration.

the upgraded facility in Mumbai, India.

The initiative also strengthens the department’s technological capabilities, helping it to keep pace with evolving educational and industrial requirements, particularly at a time when only a few institutes continue to offer specialized academic expertise to the textile sector. Beyond academic development, the

new laboratory is expected to serve as a platform for community outreach. The department aims to organize training programs for small business entrepreneurs, artisans, and local stakeholders to promote knowledge sharing, eco-friendly processing practices, and value-added techniques that support broader sustainable development goals.

www.archroma.com

IFJ highlights research from universities and institutions around the world. To highlight your research, email rdavis@inda.org. Please write “IFJ Emerging Research” in the subject line. Send a press release and/or summary of the research as you would want it to be printed, a link to the university online story (if applicable), and all high resolution art and short researcher bio(s). All selections could be edited for length.

By Louis DiPetro

Could a flat piece of fabric hold a 3D shape, the way paper does in origami?

Aiming to find out, researchers from the Cornell Ann S. Bowers College of Computing and Information Science developed OriStitch, a new software and fabrication system that takes simple 3D objects—a toy or a teapot, say—and spins them into a textile design using carefully placed stitches.

This approach is more efficient and accessible than existing machine embroidery—and could be a creative boon for areas such as fashion, architecture, and smart textiles, according to researchers.

“Folding fabric into 3D geometries is time-consuming,” said Thijs Roumen, assistant professor of information science at Cornell Tech and senior author of “OriStitch: A Machine Embroidery Workflow to Turn Existing Fabrics into Self-Folding 3D Textiles,” which was presented at the ACM Symposium on Computational Fabrication on Nov. 21, 2025, in Cambridge, Massachusetts. “Current approaches either rely on manual processes—like in hand-pleating—which is labor-intensive, or advanced machinebased processes.”

But designs made with OriStitch fold themselves when exposed to heat, he said.

“OriStitch can be used with a wide range of materials, like leather, felt, woven fabric, and composite fabrics,” said Zekun Chang, doctoral student in the field of information science at Cornell Tech and

Compiled by Ken Norberg, IFJ Editorial & Production Manager

Xinyue Hu, a master's student at Cornell Tech, models a hat created with OriStitch, a new software and fabrication system developed by Cornell Tech researchers.

the paper’s lead author. “By making textile folding easier, we hope to unlock its broader potential—enabling personalized 3D forms shaped from flat patterns and making it possible to embed smart functions like sensing before the fabric transforms into 3D.”

OriStitch’s core innovation lies in its design of fully closed hinges, each formed by a pair of triangles that are pulled closed when the heat-shrinking polyester thread, called chizimi, contracts. First, OriStitch converts a user input 3D triangle-mesh model into a 2D configuration, producing a network of hinges. Then the tool computes the functional patterns for each hinge’s geometries, generating a fabrication-ready plan for both laser cutting and embroidery.

Users can then fabricate the design: The laser cutter scores the mountain and valley folds to create sharp creases and trims away the excess fabric. An embroidery machine stitches all functional threads—including the heat-shrink thread—according to the generated layout. After embroidery, the piece is soaked in water to dissolve the water-soluble support stitches, and finally heat-treated, causing the chizimi threads to contract and pull all hinges closed, forming the target 3D shape.

In tests, the software successfully converted 26 out of 28 test models used in related papers in the field of computational

fabrication. Researchers also successfully fabricated a cap, a vase cover and a handbag using OriStitch.

“What is really interesting about OriStitch is that it is compatible with existing hardware and fabrics, rather than weaving or knitting new fabrics from scratch,” said Roumen, who directs the Matter of Tech lab at Cornell Tech. “That practicality and utility should sync nicely with existing workflows in the industry.”

OriStitch is still far from being a fully automated process, since embroidery machines require manual adjustments, researchers said. Looking ahead, Chang hopes to extend the approach beyond uniform textiles and develop machine workflows for a much broader range of materials—especially those with diverse structural variations, such as seams that are difficult for other fabrication methods to handle.

Along with Chang and Roumen, the paper’s authors are: Yixuan Gao, doctoral student in the field of computer science at Cornell Tech; Yuta Noma from the University of Toronto, Canada; Shuo Feng, doctoral student in the field of information science at Cornell Tech; Xinyi Yang of Georgia Institute of Technology; Kazuhiro Shinoda, Tung Ta, Koji Yatani, Tomoyuki Yokota, Takao Someya, Tomohiro Tachi, Yoshihiro Kawahara, and Koya Narumi, all of the University of Tokyo; and François Guimbretière, professor of information science.

This work was partially supported by JST Adopting Sustainable Partnerships for Innovative Research Ecosystem (ASPIRE). Louis DiPietro is a writer for the Cornell Ann S. Bowers College of Computing and Information Science. news.cornell.edu

Researchers Gain International Recognition for Textile Innovation esearchers at De Montfort University, Leicester (DMU), Great Britain, have been named among the best in the world for textile innovation. The Textile Engineering and Materials (TEAM) research group was named a finalist in last month’s Innovate Textiles Awards 2025.

RTEAM, led by Professor Jinsong Shen, earned a place on the international shortlist for groundbreaking work in developing innovative technologies for textile coloration and enzyme-based recycling of textile waste. Their work could help shift the industry towards a more circular economy.

The awards are organized by World Textile Information Network (WTiN), one of the world’s leading authorities on textile innovation and technology. The awards celebrate breakthroughs that are reshaping the global industry.

TEAM was praised for its work in tackling one of the textile industry’s most long-running issues—how to recycle blended fabrics. Mixed materials, such as wool blended with synthetic fibers, typically end up in landfills because it is hard to separate the component materials.

Professor Shen’s team uses targeted enzyme-based biotechnology to gently break down fibers, enabling their separation, recovery, and reuse.

The same process can even reclaim dye molecules from discarded textiles, enabling the reuse of colorants in new wool, silk, and nylon products.

The research drew international attention when it was showcased at the Future Fabrics Expo 2024, where sustainabilityfocused designers and manufacturers described it as a potential “game-changer” for circular fashion.

Professor Shen now leads a BBSRCfunded collaboration with several major industry partners, including Camira Fabrics, The Woolmark Company, Fox Brothers, Matter, Wilson Knowles, DyeRecycle, and

Roberts Recycling, to scale up the process and explore its industrial applications.

Professor Shen said, “I am very proud of our research and the contribution we are making to textile sustainability and circularity. It is an honor to have our innovations recognized by the WTiN Innovate Textile Awards.”

Professor Mike Kagioglou, Deputy Vice-Chancellor, Planning, Research and Innovation, said, “Being shortlisted for such a prestigious global award is a powerful signal of the impact our researchers are making.” www.dmu.ac.uk

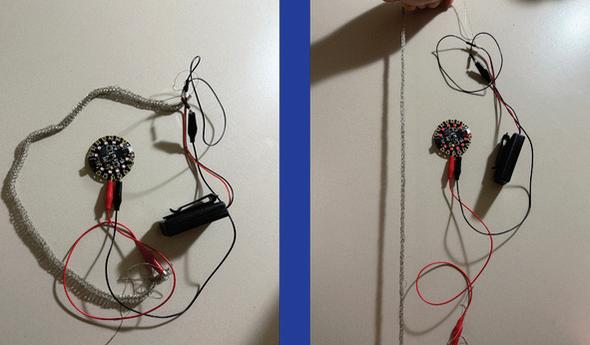

By Hannah Piedad

Drawing inspiration from all around her, University of Ken tucky College of Design graduate student Faezah Panahandeh is working to bridge the accessibility gap through design.

Panahandeh, who already holds a master’s degree in Iranian architectural studies, is pursuing a second master’s in interior design. She applied for a College of Design Graduate Research Fellowship to develop sensory-adaptive e-textiles that respond to their surroundings.

Panahandeh said she felt compelled to pursue a project centered on meeting the sensory needs of those with disabilities after watching a documentary in class.

Neuroarchitecture research shows how touch, temperature, and sound af fect how people feel and perceive spaces. Panahandeh found that traditional interior materials are often static and rigid, especially if they are electronic, like LED screens and panels.

Our Fi-Tech Team connects you to the most technologically advanced suppliers serving the Polymer, Synthetic Fiber, Nonwoven and Textile Industries.

Our customers trust us to provide the best quality and service. They rely on our commitment to their needs day to day and when exploring new opportunities to grow and to improve their manufacturing operations.

Instead, she explored a more dynamic material. Her end product: A handheld sensory material that responds to stretching, lighting up as the user extends it.

Panahandeh tested 20 different types of conductive yarn to determine which would be the best fit for her final prototype, including fishing wire and materials from Shield X. She worked closely with her faculty mentor, Jennifer Meakins, an assistant professor in the School of Interiors, who also works in the SoftLab—a soft goods-focused research lab exploring new materials. Meakins has previously worked on developing e-textiles and making them on a larger scale with a digital knitting machine in the SoftLab. The two have worked on previous e-textile research projects together.

Knitting the yarn into an i-cord—basically a knitted tube—Panahandeh wanted to hide the electrical wiring the product requires, creating a much more approachable sensory tool.

“Our aim is that it could be just used easily through stretching,” Panahandeh said. “Just hiding the complex process of conductivity and working with electricity behind or inside the material.”

To do this, Panahandeh had to learn how to knit by hand, as well as learn how to use the digital knitting machine to design a pocket for light batteries and other wires.

“Knitting is using stitches, and through those stitches, you can knit different kinds of material as threads and bring new qualities to your final piece,” Panahandeh said.

Panahandeh’s experience with lighting from an acrylics class aided her research journey. “In that course, I worked with acrylics and creating light,” Panahandeh said. Her interest in lighting stood out after researching autism and sensory needs, learning that visual and tactile stimulation can be helpful to autistic people.

For her prototype, Panahandeh planned to use something as stretchable as a Slinky. While the toy would be a small-scale application of her design, it could be expanded.

“In a larger scale, this design could be applied as lighting as well—hung from the ceiling or even something that is attached to the wall.”

Despite this research fellowship only lasting he summer, Panahandeh wants to pursue the project, not only to advance her product but also to conduct the most meaningful and useful research possible. uknow.uky.edu

Source: University of Kentucky News

By Anne J. Manning, Harvard News

magine a road cyclist or downhill skier whose clothing adapts to their speed, allowing them to shave time by simply pulling or stretching the fabric.

Such cutting-edge textiles are within reach, thanks to researchers at the Harvard John A. Paulson School of Engineering and Applied Sciences (SEAS). Led by SEAS mechanical engineering graduate student David Farrell, a study published in Advanced Materials describes a new textile that uses dimpling to adjust its aerodynamic properties when worn on the body. The research has the potential to change not only high-speed sports but also industries like aerospace, maritime, and civil engineering.

The research is a collaboration between the labs of Katia Bertoldi, the William and Ami Kuan Danoff Professor of Applied Mechanics, and Conor J. Walsh, the Paul A. Maeder Professor of Engineering and Applied Sciences.

Farrell, whose research interests lie at the intersection of fluid dynamics and artificially engineered materials, or metamaterials, led the creation of a unique textile that forms dimples on its surface when stretched, even when tightly fitted around

a person’s body. The fabrics use the same aerodynamic principles as a golf ball, whose dimpled surface causes it to fly farther by generating turbulence that reduces drag. Because the fabric is soft and elastic, it can move and stretch to change the size and shape of the dimples on demand.

Adjusting dimple sizes can improve the fabric’s performance at certain wind speeds by reducing drag by up to 20%.

“By performing 3,000 simulations, we were able to explore thousands of dimpling patterns,” Farrell said. “When we put these patterns back in the wind tunnel, we find that certain patterns and dimples are optimized for specific windspeed regions.”

Farrell and team used a laser cutter and heat press to create a dual-toned fabric made of a stiffer black woven material, similar to a backpack strap, and a gray, softer knit that’s flexible and comfortable. Using a two-step manufacturing process, they cut patterns into the woven fabric and sealed it together with the knit layer to form a textile composite. Experimenting with multiple flat samples patterned in lattices like squares and hexagons, they systematically explored how different tessellations affect the mechanical response of each textile material.

“We’re using this unique property that [Bertoldi] and others have explored for the last 10 years in metamaterials, and we’re putting it into wearables in a way that no one’s really seen before,” Farrell said.

The paper was co-authored by Connor M. McCann and Antonio Elia Forte. The research was supported by the National Science Foundation under award No. DMR-2011754. The Harvard Office of Technology Development has safeguarded the innovations associated with this research and is exploring commercial opportunities. seas.harvard.edu

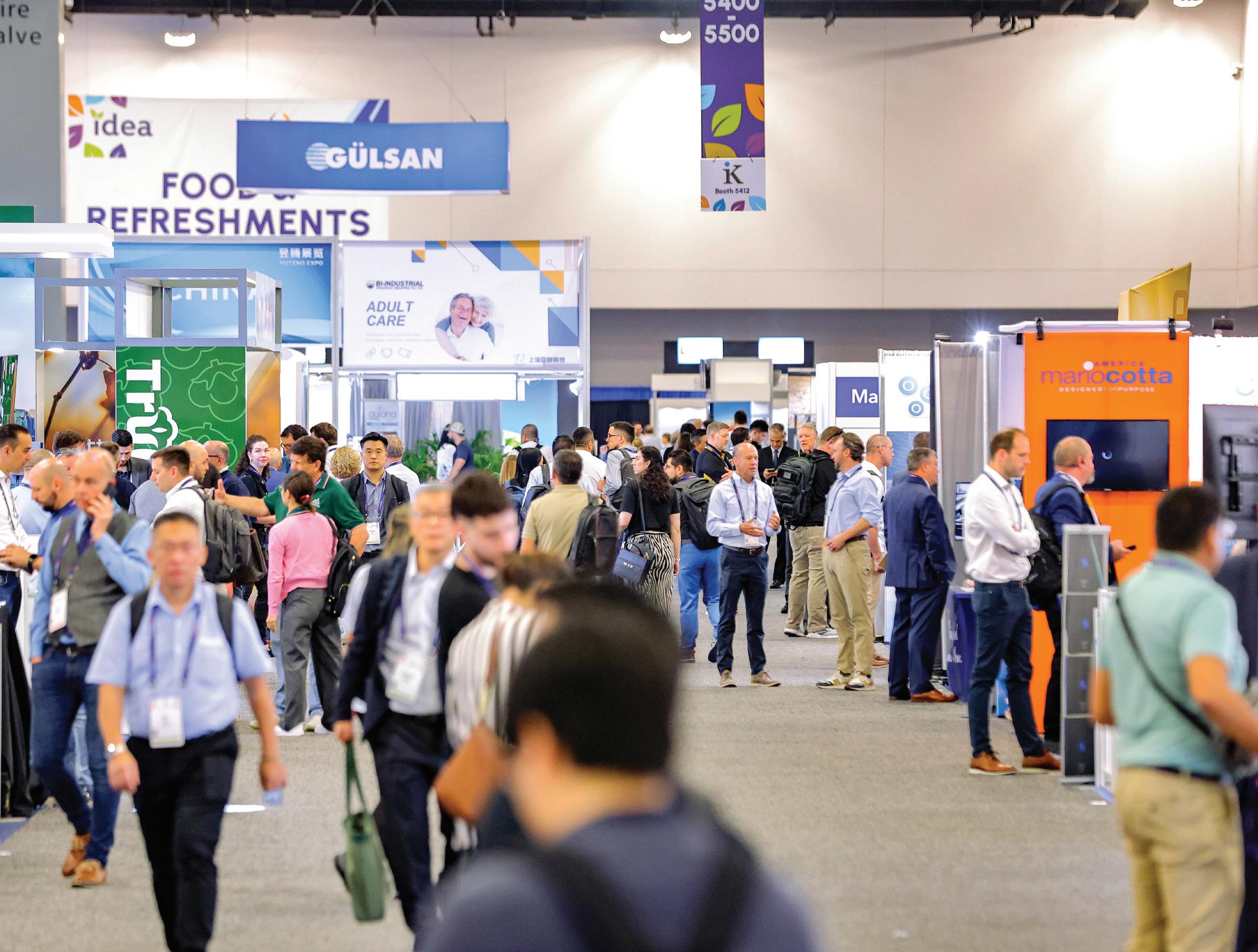

Kansas City Convention Center

At IDEA®27, your booth is more than just space—it’s your launchpad for new business. Over three powerful days, you’ll engage directly with decision makers from major nonwoven manufacturers, showcase your latest products and technologies, and build partnerships that drive results.

IDEA®27 is the world’s preeminent event for nonwovens and engineered fabrics— where innovation meets opportunity.

Kansas City, Missouri Don’t let

Join thousands of professionals from over 60 countries who come to IDEA® to source solutions, form collaborations, and shape the future of nonwovens. Exhibiting at IDEA®27 positions your company at the center of it all.

• Connect with brand owners, converters, roll goods producers, material and equipment suppliers, and service providers.

• Achieve in three days what would take months of calls, emails, and travel.

• Meet current customers and new prospects ready to do business.

• Collaborate on solutions that improve product performance and sustainability.

• Expand into new markets and grow your business globally.

Reserve your exhibit space today and position your company at the center of the nonwovens world. ideashow.org

ndia-based Alpha Foam Ltd, which operates five production lines, has dedicated nonwoven lines for the production of performance fabrics for hygiene and medical applications. The company believes its fabrics perform better because it has lines designed specifically for certain applications. Its medical line focuses more on better hydrostatic head, air permeability and microbial penetration. The hygiene line is designed for larger volumes, fine denier, less elongation and lower GSM.

It also has an SMS line that produces performance fabrics in niche colors and high-performance meltblown fabrics. It produces spunlace for niche industrial markets and also for health and hygiene. It is probably India’s most diversified nonwoven company. Additionally, in meltblown technology, the holes per inch in a die are very crucial and are standardized by the production line supplier. With nearly 20 years of experience, Alpha Foam has developed its own dies and optimized the number of holes per inch in each die.

International Fiber Journal: Kindly provide a history of your company, like when it was started, who started it, etc. Please share details about the manufacturing infrastructure and annual capacity.

Apurva Ranka: Alpha Foam began its journey as a manufacturer of automotive foam for seats, and then we ventured into producing seats and other automobile components, and we continue to be in this business. In 2005, we forayed into the production of nonwoven fabrics and were among the first in India to start a spunbond nonwoven fabric manufacturing line. In 2007, we installed a spunlace line and in 2009, we put up an SMS produc-

By Arun Rao, International Correspondent, India

tion line, and in 2011, we began laminating our nonwoven fabrics.

In 2014, we installed an SMMS line designed specifically for producing medical fabrics. In 2022, we installed an SSMMS line, and in 2024, we installed another spunlace line dedicated to producing high-quality cotton fabrics. Currently, we have three spunmelt lines and two spunlace lines and two lamination lines. During this period, we have also diversified further into coated, anti-static, and alcohol-repellent fabrics.

Now we are probably the only company in India that manufactures both spunlace and spunbond fabrics on a large-scale production base and has dedicated production lines for specific products. Our production capacity is 2,200 metric tons per month for spunmelt fabrics and 500 metric tons per month for spunlace fabrics, for a total of 2,700 metric tons per month. Our key raw

materials include polypropylene, polyester, viscose and cotton. We also have a very active R&D lab focused on developing new nonwoven fabrics.

IFJ: Which are the core company products and solutions you offer to the market?

Ranka: The GSM range for our spunbond nonwoven fabric is 6 to 120, and for spunlace fabrics, it is 30 to 250. On our SMS line, we offer customized fabrics for orders as small as five tons. In spunbond fabrics, we can supply all the needs of the hygiene or medical fabrics market, from laminates to AAMI LEVEL 4 fabric. Within spunlace, we offer proprietary, customer-specific fabrics for industrial applications, including laminates.

We also manufacture filtration fabrics in spunlace and higher-GSM, higherstrength materials, used for rexine backing and automotive scrim. We have been able to provide an alternative to woven fabrics in industrial applications. We also offer printed fabrics. The newly set-up cotton spunlace crosslapped line applications include covers for tampons, wipes, gauzes, and bandages.

Since we have so many lines in different configurations and speeds, we can supply to tight or short delivery deadlines. Our customer base extends from a small buyer to a large multinational corporation. We also collaborate with reputable institutes to develop new technologies for fabrics.

IFJ: What are the advantages of the products that you offer vis-à-vis those offered by the competition?

Ranka: We do not use fillers, which help maintain the fabric’s quality, and we are still able to supply at competitive prices. The strength and quality of our 90 GSM fabric will be comparable to the 120 GSM fabric used by the competition, as we do not use fillers. The thickness of our fabric is also better when considering GSM, since we have done the fabric engineering ourselves. We have dedicated our various lines to the production of specific products, whether medical, hygiene or industrial. The Indian government is

developing standards that will be better for players like us, since we already manufacture to international standards. In the meltblown technology, the holes per inch in a die are very crucial and are standardized by the production line supplier. With nearly 20 years of experience, we have developed our own dies and optimized the holes-per-inch in a die.

Ranka: We foresee demand for more sustainable products, and that is where cotton fibres will come in, which is why we have installed a spunlace dedicated to producing fabrics from only cotton. We also recycle all side trims of fabrics where the raw material is polypropylene and constitutes 10% of the polypropylene that is used in our production.

IFJ: Does your nonwovens plant follow good manufacturing practices?

Ranka: We follow good manufacturing practices, and all our plants are GMP compliant. Our plants are sealed from the outside environment, as we have installed double doors, and the plants are hygienically maintained. Timely pest control is carried out to ensure there is no microbial contamination. Our bacterial loads meet world standards. We also have pressurized air handling units, while the floor is epoxy, which resists bacterial and fungal growth, crucial for sterile environments. We have also put up HEPA filters at certain locations in the plant. Proper sanitization is maintained at every level. Our products can pass the bioburden and cytotoxicity tests. Since we supply to multinational brands, it’s imperative that we follow best practices.

IFJ: What sustainable products or solutions do you offer to your customers?

IFJ: What hiccups did your company face in its 20-year-old journey?

Ranka: Our journey was never smooth, as we had a self-integrated plant, so it took us longer to achieve the highest efficiency and customer trust. For example, in our first SMS line, the beams came from China, the meltblown system came from Japan and we integrated it here. Buyers believe in the brand of the technology rather than the nonwoven fabric’s parameters and quality. But we proved we can provide the highest-quality nonwoven fabrics, even though our technology has not been sourced from well-known suppliers. Customers used to audit our facilities to ensure the quality of our products. We had to struggle to create a name for ourselves.

IFJ: Please share details of your presence in the Indian domestic and export markets.

Ranka: We supply about 80% in the Indian domestic and the rest is directly exported.

A major portion of the nonwoven fabrics sold in the Indian domestic market is converted and then exported by the converters. Hygiene and medical fabrics share almost equally in our sales. In medical fabrics, we sell to converters who then export the final product. However, we also directly export a few niche products.

IFJ: How have you seen the conversion industry evolving in the last few years?

Ranka: The conversion industry has grown phenomenally when concerning of hygiene and medical fabrics. Ever since the advent of COVID-19, awareness has grown among Indian hospital surgeons who now demand blood barrier disposable gowns as against the cloth gowns. COVID-19 has phenomenally expanded the medical fabrics market in India, while the hygiene market is growing consistently.

Hospitals have also started using disposable bedsheets and operating table sheets. As disposable income increases and awareness of hygiene increases, sales of hygiene fabrics will increase faster. The conversion industry is growing in Asian countries like China, Bangladesh, India and Vietnam since conversion is cheaper, and so directly exporting nonwoven fabrics to the EU or the U.S. is now becoming a challenge.

IFJ: Please share your plans for the future?

Ranka: We have continuously expanded in the last decade, and now it is time to consolidate. But we would surely like to expand our lamination and also spunlace capacity. We are also looking at spinning fibres from bio-degradable material, which, although a challenge, we will try to meet this challenge head-on. There has always been a tussle between cost and sustainability. PLA is an alternative, but it is biocompostable and not biodegradable. But we are of the firm opinion that the world will move to one-time-use products that contain biodegradable elements. By biodegradable products, we mean converting them into carbon dioxide, biomass and water and not into micro-plastics.

IFJ: Your expectations for the future growth and opportunities in the Indian as well as overseas markets?

Ranka: The nonwovens market has become highly adaptable, and we are in a consolidation phase. It has become very important to develop new varieties of nonwoven fabrics to survive. But we expect sales of medical fabrics to grow faster than those of hygiene fabrics in the near future. We expect that in the near future the Indian market will grow much faster compared to markets in other countries like the USA or countries of the EU, as the markets in those countries are already saturated.

Reasons include the large Indian consumer population, the rise in dual-income families leading to higher disposable incomes, and increasing awareness of hygiene products, healthcare, and medical disposables. The increase of Indian women from rural households in the workforce will also lead to growth. Baby diapers have also now started penetrating the construction industry workforce. India has a very big potential which needs to be exploited.

IFJ: Can you let us know the key trends in consumer demand and the growth trajectory of the nonwoven fabrics market?

Ranka: As the per capita income in India increases, we will see a multifold increase

in disposable products made from nonwovens. This should continue until per capita income increases from the current $2,700 to $10,000. We are saying this based on increased consumption observed in China following higher per capita income.

Secondly, as consumer awareness of sustainable products increases, we are seeing more customers enquire about biodegradable and reusable products. The nonwoven industry will undergo major technological changes as the push for biodegradable nonwoven products intensifies. Thus, our ability to keep learning and our readiness to invest will help us with changing market conditions.

Arun Rao started his career in the textile industry and has worked across the segments of spinning and weaving production. He forayed into the sales function, beginning with selling branded innerwear and graduated to selling clothing of wellknown brands. He then joined Fibre2fashion, a B2B textile website, as News Editor for seven years. Recently, he launched Taurus Communications, a PR & advertising agency focused on the textile industry value chain. With a love for journalism, he freelances for renowned textile magazines, along with managing the agency. He is the international correspondent, India, to the IFJ

By Philippe Wijns Principal at CleverSustainability, Filtration Expert and Sustainable Business Development Advisor

Murat Dogru, Deputy General Manager at EDANA. Philippe Wijns

EDANA held its Sustainability & Policy Forum in Brussels last week (December 9–10, 2025) at the Residence Palace, combining plenary sessions with an EU advocacy workshop and a visit to the European Commission. The agenda ranged from the strategic: sustainability priorities in the age of simplification and competitiveness, to the operational: sustainability disclosure and transparency, CSRD as a management tool, and product-level metrics such as product carbon footprint and life cycle assessment for durable applications. Circularity served as the other key theme. A panel emphasized that “Circularity in Europe will not be achieved in silos” and questioned how textiles and nonwovens can collaborate as regulations, technologies, and recycling infrastructure develop.

Philippe Wijns is Principal at CleverSustainability, and serves as a Filtration Expert and Sustainable Business Development Advisor. He is a Certified Expert in Sustainable Finance, Climate Finance, and Renewable Energy from the Frankfurt School of Finance and Management. He began with global leaders in the nonwovens industry before transitioning to the filtration sector, where he specialized in filtration technologies across a wide range of applications and markets—including industrial and automotive systems, HVAC, household appliances, medical and life sciences, as well as power storage solutions such as fuel cells, hydrogen systems, and battery separators.

Wijns recently founded CleverSustainability, a consultancy dedicated to sustainable business development to help companies develop and implement sustainability strategies, ensure compliance with the EU legal reporting requirements, and enhance their sustainable business growth, product portfolio and development, and market positioning.

Day one then focused on enabling routes, chemical recycling and mass balance, explicitly exploring whether policy supports or hinders progress. On the second day, the discussion focused on the formulation of EU policy within the EU Toolbox framework. An interactive advocacy workshop was introduced to examine how circularity objectives can be translated into practical regulations without compromising processes, safety, or performance. The closing exchange at the European Commission covered the Commission’s operations, the Waste Framework Directive, and “Environment Policy and Simplification.”

Throughout the Forum, EDANA stressed the importance of creating space for meaningful dialogue that goes beyond compliance and routine regulatory updates, fostering strategic collaboration across the nonwovens value chain. The sessions underscored the need for collective action, rather than isolated efforts, to tackle sustainability challenges, with stakeholders encouraged to anticipate future trends and coordinate solutions that balance regulatory demands with practical realities in safety and performance. This approach indicates a broader industry shift: from merely reporting sustainability data to actively managing it, ensuring that evolving EU policies yield credible, actionable outcomes for nonwovens manufacturers and their partners.

EDANA describes the Forum as a space where industry, policymakers, experts, and stakeholders can step back from daily regulatory pressures and engage in strategic, forward-looking discussions. Its purpose extends beyond sharing information: It is designed to foster dialogue across the value chain, identify emerging trends early, and support a more coordinated and credible industry response to sustainability and policy challenges.

In EDANA’s view, the format was effective: participation, diversity of viewpoints, and the quality of exchanges, particularly on regulation and circularity during the advocacy workshops, confirmed the

A central focus was the practical challenge of advancing circularity amid ongoing regulatory simplification. In particular, the advocacy workshop moved the discussion beyond debating whether circularity matters and toward the more consequential question of how product policy can operationalize circularity objectives in a way that is workable for nonwovens manufacturers.

Forum’s relevance. The real test, EDANA notes, is translating this into action: turning the exchanges into tangible follow-up work in the months ahead.

• Practical implementation within regulatory simplification

A central focus was the practical challenge of advancing circularity amid ongoing regulatory simplification. In particular, the advocacy workshop moved the discussion beyond debating whether circularity matters and toward the more consequential question of how product policy can operationalize circularity objectives in a way that is workable for nonwovens manufacturers. Participants consistently emphasized that performance requirements are nonnegotiable and must be embedded in any regulatory approach. This reinforces the case for proportionate, application-specific regulation that integrates essential performance criteria, especially for hygiene, medical and technical products, into the regulatory architecture, rather than treating them as secondary considerations to be addressed after the fact.

• Advancing from reporting to strategic sustainability management

Another key theme was the move from sustainability reporting to integrating sustainability management into core business practices. The Corporate Sustainability Reporting Directive (CSRD) could become a valuable strategic tool for organizations that invest in strong data systems and prepare to meet changing EU standards.

The increasing overlap and interaction between regulatory instruments were repeatedly cited as a source of complexity, strengthening the need for internal alignment across frameworks and functions. Operationally, this transition implies that sustainability teams must increasingly adopt approaches comparable to those of finance functions: rigorous data governance, strong internal controls, clear accountability, and outputs that are decision-useful, supporting prioritization, investment decisions, and performance management, rather than relying predominantly on narrative disclosures and claims. VSME—which stands for the Voluntary Sustainability Reporting Standard for non-listed SMEs—was briefly discussed.

• Driving systems-level circularity through collaboration

Systems-level circularity emerged as a further priority, with a strong call for deeper collaboration across the textiles and nonwovens value chains. Panel discussions highlighted the importance of reducing structural barriers, identifying shared opportunities, and converting ambition into practical actions that can be implemented at scale.

Conversations on chemical recycling and mass balance reinforced that, while innovative technical pathways are progressing, their uptake will be constrained without policy recognition and regulatory clarity. In this context, precise definitions, consistent interpretation, and legal validation were framed as prerequisites for investment confidence and wider market deployment.

• Emphasizing credibility and transparency

Throughout the sessions, credibility and trust served as unifying themes. Speakers consistently emphasized that credible communication requires transparency, traceable evidence, and data-driven commitments that withstand scrutiny from regulators, customers, and other stakeholders. The discussions aligned with the industry's pragmatic, science-based approach, emphasizing informed decision-making and reliable data as fundamental to progress.

Ultimately, the Forum reinforced that credibility is not just a communications exercise; it is a performance outcome driven by governance, evidence, and transparency, crucial for maintaining trust and advancing the industry’s sustainability journey.

• Circularity: The discussion centred on practical steps for cross-sector cooperation, chemical recycling technology, policy frameworks, and the legal recognition of circularity methods.

• Reporting: CSRD, ESRS and related disclosures were presented as strategic business tools, emphasizing data-driven commitments and solid data foundations.

• Program Sustainability & Policy: For durable nonwovens, sessions highlighted a push toward product-level evidence and customer-focused metrics, including PCF/LCA/EPD.

• Supply Security: Supply security was noted as a constraint in transformation, with companies needing to balance adaptation, innovation, competitiveness, and supply stability. Reporting also linked sustainability to operational and supply chain resilience.

• Greenwashing and Claims: While “greenwashing” wasn’t directly addressed, the emphasis was on credibility, transparency, and evidence-based claims.

• Single-Use Plastics Directive: Details on timing and dedicated coverage were not provided, but the Directive was referenced as a policy tool promoting reuse, collection, and recycling systems.

Two main trajectories emerge:

Near term (6–18 months): Reporting and policy have to be streamlined, with companies evaluated on their ability to provide credible, comparable sustainability data for reports, customers, and partners. Regulatory focus will shift from ambition to execution quality.

Medium term (2–5 years): Circularity will shift from messaging to infrastructure, fostering collaboration across sectors such as textiles and nonwovens. Progress in recycling and mass balance will depend on effective policies, sound methodologies (including chemical recycling), and reliable chain-of-custody systems.

The materials do not describe any formal communiqué or new commitment from the Forum. The primary outcome is EDANA's positioning of the event as a platform for constructive debate, with success measured by follow-up actions. Workshop questions remain how to make circularity goals into practical policy without sacrificing, how industry can influence Commission drafting, and how inter-departmental dynamics affect decisions.

For nonwovens, these issues impact compliance and innovation. EDANA notes the difficulty of keeping up with evolving regulations and ensuring innovation and supply security, particularly after DG ENV’s (Directorate-General for Environment of the European Commission) recent releases. It stresses that one-size-fitsall rules risk overlooking technical and societal differences across nonwoven applications, underscoring the need for segmentation for both advocacy and strategy.

Rawaa Ammar, Sustainability Director from EDANA, said: “This year’s Sustainability & Policy Forum brought together an exceptional mix of insights, exchanges and forward-looking discussions. The sessions were rich and thought-provoking, exactly the

kind of space we aim to create to network and co-develop ideas, stay up to date with the latest regulatory and market developments, and spark new reflections for the industry.

The true impact of the event will unfold in the months ahead, and I am keen to channel the valuable conversations we had into tangible projects that can strengthen the industry’s sustainability journey. As the new Sustainability Director, my focus is on building on this strong foundation and helping our sector accelerate credible, science-based action on climate, circularity and responsible value chains.”

From my perspective, the Forum reinforced a simple reality: Sustainability is becoming a contest of capabilities. In ESG strategy, CSRD/VSME and other reporting tools, sustainable finance, and value chain execution, I increasingly see that “good” performance is defined by transparency, repeatable methods, data flows, and decision processes within enterprises and across the industry.

For the nonwovens value chain, that implies three priorities.

• First, invest in data discipline (including PCF/LCA/EPD competence where it is commercially relevant) so that reporting becomes decision-useful and claims become defensible.

• Second, segment the sustainability strategy by application: consumer/hygiene, medical, filtration, and durable nonwovens will not share identical circularity routes or acceptable trade-offs.

• Third, get involved early and help shape policies using evidence specific to each application. Since workable sustainability rules aren't just beneficial, they're essential for making sustainability scalable in industry.

The next phase will reward the companies and associations that can connect policy intent, customer requirements, and technical realities into a single, credible story backed by evidence. If credibility is the new license to operate, are we treating data and cooperation as strategic investments or still as compliance costs?

The global economy of industries across most sectors are being stressed by sustainability, automation, technology, and more. Furthermore, spending is down with unpredictable consumer economies. For textiles, sourcing for circularity continues to trend in many ways, both as a source of frustration and also as inspiration. Innovators are thriving with ideas as sectors such as hemp are rising in feasability, while manufacturers are hard at work to pivot to meet EU and other regulatory mandates on every level. With all that said, the outlook seems promising. The pressure is yielding deals that would never have been considered just a few short years ago, which means change is slowly but surely making its way into the mainstream. We asked thought leaders to share their perspectives on issues and opportunities. Here is what they said.

—Caryn Smith, Publisher/Chief Content Officer, IFJ

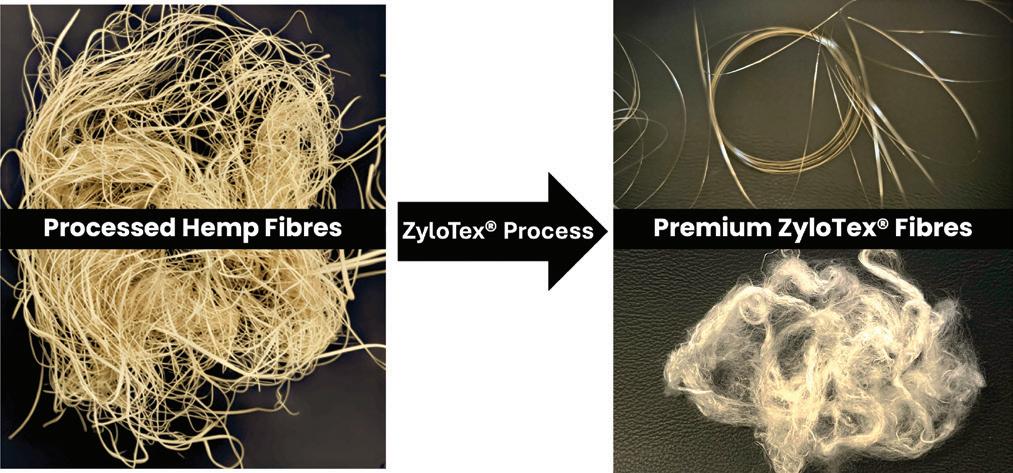

By Jason Finnis

Sustainable materials innovation is accelerating across the fibre and textile industries. New feedstocks, processing technologies, and fibre blends are being proposed at a rapid pace as brands respond to regulatory pressure, retailer sustainability targets, and growing demand for plastic-free and low-carbon products. The level of creativity and technical ambition is encouraging.

Yet many promising material innovations struggle to progress beyond pilot scale. The reason is rarely a lack of intent or even a lack of performance potential. More often, it is a disconnect between material innovation and the realities of industrial production. Sustainability benefits alone do not guarantee adoption. New fibres must be fit for purpose and capable of operating reliably within production systems that have been optimized over decades for incumbent materials such as synthetic or regenerated fibres.

This challenge is particularly visible in nonwovens and textiles, where manufacturing efficiency depends on consistency, predictability, and throughput. Fibre length distribution, diameter uniformity, elongation, cohesion, and cleanliness all influence how a material behaves on commercial equipment. When those parameters fall outside established tolerances, production lines slow, waste increases, and operating confidence declines.

An example from a textile development program illustrates this dynamic. A blended yarn was specified to include 70% cotton and 30% bast fibre. Laboratory testing showed that the bast fibre met the required physical properties, and early yarn samples met both visual and haptic expectations. However, once the fibre blend was introduced into a commercial spinning environment, all but 7% of the bast fibre was lost during processing. The system was not intentionally rejecting the new fibre. It was operating as designed to protect cotton performance, at the expense of bast fibre content. Only after targeted adjustments to fibre preparation and spinning conditions was it possible to retain bast fibre at meaningful levels in the finished yarn.

Similar issues arise in nonwoven production. Regardless of the nonwoven platform, the conversion equipment is designed around defined fibre behavior. Variability in fibre morphology or contamination levels can lead to web instability, uneven bonding, excessive linting, or frequent line stoppages. These outcomes increase cost and risk, even when the end product delivers attractive sustainability credentials.

Production systems reward materials that behave consistently. Operators expect predictable runnability, stable quality, and minimal disruption. When a new fibre introduces uncertainty, it places additional burden on maintenance teams, quality control, and supply chain planning. Over time, these frictions can outweigh perceived environmental benefits, especially in cost-sen-

sitive product categories such as wipes, hygiene, and commodity textiles.

Successful natural materials innovation requires alignment across the value chain. Reliable agronomic supply must be paired with clear and repeatable fibre specifications. Refining and preparation processes must be designed with downstream equipment in mind. Environmental claims such as reduced Scope 3 emissions, biogenic carbon retention, and plastic or tree-free positioning must be supported by data that holds up at scale. Just as importantly, the economics must remain competitive once pilot conditions are replaced by continuous production.

The next phase of growth for natural fibres will be shaped by innovation that respects these constraints. Designing materials to fit within existing manufacturing infrastructure does not limit progress. It enables it. When sustainability advantages are delivered alongside performance consistency and production practicality, adoption accelerates, and credibility grows.

The real test of innovation is not how compelling it appears in concept, but how well it survives the production line. That is where ideas become products, and where meaningful impact begins.

Jason Finnis is a fibre innovation executive and entrepreneur with more than three decades of experience taking natural materials from field to factory to market. He has built and scaled multiple companies in the sustainable fibre sector, commercializing new technologies across nonwovens, textiles, and consumer products. Today, he leads Material ReDesign, advising global partners on developing and deploying next-generation natural fibre and circular material solutions. Find him at https://www.linkedin.com/in/ jason-finnis-b2b172128/ or jasonfinnis01@gmail.com, +1.604.315.4789.

iStockphoto/Imagesines

By Manik Pavan K. Maheswaram

The global fiber industry stands at an inflection point. Sustainability has evolved beyond trend status to become a fundamental mandate. This shift is driven by intensifying regulations—such as the EU Green Deal—global initiatives aligned with the UN Sustainable Development Goals, and increasingly sophisticated consumer expectations.

Today, synthetic fibers represent over half of global fiber consumption. While calls to reduce synthetics persist, the more viable path forward is engineering them to be more sustainable. The question is no longer whether performance and sustainability can coexist—but how we enable it through innovation.

Masterbatch technologies, circular design principles, and PFAS-free chemistries are reshaping expectations across the textile supply chain. For brands and suppliers alike, this transformation is becoming essential as sustainability evolves from a value-add to a competitive baseline.

Sustainability drivers vary by region. Europe continues to lead with regulation and circularity mandates, while North America emphasizes transparency and extended producer responsibility. In Asia, export-oriented growth is prompting investment in greener manufacturing to meet global compliance requirements. Consumers, meanwhile, expect performance with proof. Sustainability is influencing purchasing behavior, supply chain audits, and material specifications. OEMs and converters increasingly demand lifecycle metrics, product carbon footprint (PCF) data, and recyclability documentation. These expectations are moving sustainability from an aspirational goal to an engineering requirement.

Color is central to consumer appeal, yet traditional dyeing methods consume significant water and energy. Solution dyeing—the practice of incorporating color directly into polymer melt—eliminates multiple wet-processing stages, dramatically reducing environmental impact.

This process can reduce water usage by up to 90% while improving energy efficiency, colorfastness, and overall consistency. For textile brands, it offers a rare opportunity: elevate sustainability while enhancing aesthetics and performance.

Per- and polyfluoroalkyl substances (PFAS) have long been used for water- and stain-repellency but are now under global regulatory scrutiny. With phase-out deadlines approaching, the need for alternative solutions is urgent.

One example of industry response is Americhem’s nDryve™— an in-melt additive delivering durable protection against alcohol, water, and oil-based fluids, plus stain resistance and hydrophobic performance.

Free of PFAS and fluorinated compounds, it supports both compliance and durability, especially in hygiene and medical applications. As manufacturers shift away from legacy chemistries, in-melt additive systems offer scalable paths to safer performance.

Demand for antimicrobial protection in textiles has grown post-pandemic, with heightened awareness around cleanliness and health. Traditionally, these functionalities relied on synthetic agents.

Americhem’s nShield® platform includes a plant-derived antimicrobial offering that aligns with rising interest in sustainable chemistry. These formulations aim to balance durability and eco-responsibility, supporting a range of applications from healthcare to filtration. As the industry pivots, nature-based solutions are increasingly seen as viable, scalable alternatives.

Historically, most masterbatch carriers were derived from fossil fuels. But as value chains seek to reduce Scope 3 emissions and improve recyclability, bio-based carriers are emerging as a focus.

Americhem’s development of renewable feedstock-based carriers represents a material shift toward lower-carbon fiber systems. When paired with monomaterial construction and recycled content, these carriers support a more circular and sustainable approach to synthetic fiber design.

Sustainability does not require sacrificing performance. In fact, it often enhances it.

Hydrophilic additives improve moisture management in medical and hygiene nonwovens, eliminating the need for

secondary treatments. UV stabilizers extend product life in outdoor environments, helping reduce waste. Americhem’s mBrace™ softening technologies enhance fabric haptics without contributing to volatile organic compound (VOC) emissions.

Each of these innovations demonstrates that additive design can enable both comfort and compliance, performance and planet-mindedness.

Product design is increasingly shaped by traceability. Certifications like GRS, OEKO-TEX®, and USDA BioPreferred® are now minimum thresholds. Meanwhile, initiatives such as the EU Digital Product Passport are demanding full transparency.

Designing fibers with compliance in mind is no longer optional. It simplifies validation and reinforces brand credibility. Americhem supports these efforts with tools like PCF reporting, helping customers quantify and communicate environmental impact with confidence.

Sustainability requires systems thinking. It involves collaboration across the fiber lifecycle—from polymer development to product design, regulatory strategy, and recycling.

•

• More Digital Options

•

Industry alliances, co-development programs, and transparent partnerships are accelerating innovation. Whether the focus is PFAS-free repellency, bio-based formulations, or circular masterbatch systems, progress depends on shared responsibility.

The future of sustainable fibers lies in integration: merging performance with environmental intent. Americhem’s work across solution dyeing, PFAS-free technologies, botanical antimicrobials, and bio-based carriers demonstrates that this convergence is possible. Sustainability is not a static destination but a dynamic opportunity. It will be defined by those who embrace material innovation, validate claims, and commit to collective progress. In the next era, collaboration isn’t optional—it’s the path forward.

With over a decade of experience in R&D, product development, and market strategy, Manik Pavan K. Maheswaram, Ph.D., MBA, Global Market Manager— Fibers at Americhem, specializes in sustainable polymer systems for synthetic fibers. His work focuses on PFAS-free additive innovation, bio-based materials, and circularity-driven design in performance textiles. He can be reached at MMaheswaram@americhem.com. For more information about Americhem, visit www.americhem.com.

Unwinds / Rewinds

Pocket filter machines • Slitters (Ultrasonic, Laser or Conventional) • Laminators (Ultrasonic,Thermal and Adhesive)

• Traverse and Spiral winders

• Membrane / Hollow fiber lines

• Festooners

• Accumulators

• Ultrasonic sewing machines

• Pleat welders

• Ring Welders

• Custom assembly machines

By Jenny Erwin

Despite technical advancement across the next-gen biomaterials sector, adoption remains limited. Many biomaterials companies that reach pilot scale, earn press attention, and secure brand partnerships are unable to cross into sustained market demand, particularly in the leather alternative space, where numerous pilot-scale materials have struggled to move beyond limited capsule collections. Unfortunately, biomaterials companies are building visibility around technically validated proof points before defining buyer value, resulting in products that do not align with market needs. They face a commercialization challenge, and it involves three interconnected concepts: visibility, viability, and value.

Visibility builds credibility through press coverage, brand partnerships, and sustainability narratives, attracting investors and enabling short-term viability by sustaining operations and development. However, the stakeholders who confer credibility are not acting on the same interests as consumers who would adopt the materials. Investors evaluate technical feasibility and market size, partners signal alignment with sustainability goals, and press amplifies novelty and environmental benefit. Thus, visibility and viability reinforce each other while buyer value remains unexamined, and companies optimize for credibility rather than demand. Product roadmaps are then built around the capabilities that generated interest from investors and scientists, not consumers.

expert interpretation, and iterative validation. Both the fashion and biomaterials industries must anticipate consumer desire for texture, status signaling, and values alignment before production. While borrowing from a fashion industry lens could be helpful, the biomaterials industry really needs to establish its own forecasting framework from the unique lens of biomaterials' needs and capabilities. It currently lacks an equivalent system, leaving companies to validate demand on their own. Trend forecasting could be the bridge between visibility, viability, and value.

For biomaterials, forecasting could be based on technical, functional, and sustainability factors that buyers and end-users truly value.