A Framework for Vetting Foreign Entity Risk

HORIZON ADVISORY

Horizon Advisory, an independent strategic consultancy and data platform, helps businesses, investors, and government actors understand and respond to geopolitical, economic, and technological change.

ORIZON A DVISORY

Horizon Advisory

Horizon Advisory brings a new approach and unparalleled sources and methods to understanding geopolitics and supply chain risk. Horizon Advisory was formed with the mission of analyzing Chinese industrial strategy and implications for critical security and economic competitions. Decision-makers across sectors – national security leaders, stakeholders from the private sector, investors –face uncertainty associated with geopolitical, technological, and economic changes. Leveraging unprecedented primary sources, we apply updated strategic frameworks and novel analysis techniques to generate differentiated insights for businesses, investors, and governments grappling with uncertainties.

Disclaimer: The mention of any individual, company, organization, or other entity in this report does not imply the violation of any law or international agreement, and should not be construed as such.

Executive Summary

The Inflation Reduction Act (IRA), signed into law in 2022, sought to catalyze the domestic supply chain and domestic manufacturing for renewable energy, and solar energy in particular The law appeared intended to bolster both energy supply and reliable, domestic production to provide that supply But the IRA had a fatal flaw. It left the door open for Chinese companies to obtain US taxpayer support, including through section 45X and 48E credits. This vulnerability to Chinese subversion defeats the purpose of domestic production incentives – and, instead, risks enabling China’s non-market approach to capturing global energy markets and geopolitical influence. It undermines America’s pursuit of energy dominance.

But the One Big Beautiful Bill Act (OBBBA) of 2025 addresses this flaw. The law expands the definition of a FEOC, imposes new restrictions on foreign entity access to US taxpayer support –notably through 45X and 48E tax credits – and denies those credits to projects for which a “prohibited foreign entity” (PFE) provides material assistance. PFEs include FEOCs; Chinese military companies; companies controlled by covered nations (e.g., China), for instance through physical headquartering or ownership; and companies influenced by covered nation companies, for instance through investment or debt

The intent motivating these restrictions is to ensure that US government funding and tax incentive programs meant to support domestic industry actually do so, rather than enabling China and other adversarial and non-market nations. Many of these new limits go into place January 1, 2026: Projects that begin construction after December 21, 2025, will be subject to new PFE material assistance rules for 45X, 45Y, and 48E credits.

That detail, the intent behind it, and the trend toward increasing limits on FEOCs and PFEs are all evident and set to be implemented. However, significant uncertainty remains, including the specific definitions of these categories and enforcement of restrictions against them. The Department of the Treasury is expected to release new rulemaking on the subject. But the deadline for that rulemaking is not until the end of 2026, well after the new restrictions are scheduled to take effect.

This report serves two purposes. First, as the US domestic market waits for more detail coming from the US Treasury Department, this report presents a practical guide for identifying FEOC and PFE ties and highlights the risk that certain, representative manufacturers pose amid today’s uncertain regulatory environment. Second, this report offers a framework that US policymakers can use to define, review, and update foreign entity restrictions moving forward, to take into account the mechanisms through which Chinese companies are trying to manipulate US regulations and subvert US industry. America’s pursuit of energy dominance will require that both downstream industry and the policy ecosystems that support them align on guardrails and enforcement approaches that back real and enduring domestic production.

A Practical Guide for Industry

Prohibited foreign entity restrictions are complex and, at present, unclear. This creates a challenge for market actors as they vet prospective partners. The marketplace is awash with claims of regulatory compliance. For instance, Chinese and Chinese-tied manufacturers are taking advantage of the current regulatory opacity, as well as the difficulties of due diligence and screening, to position as vetted, compliant, and trusted sources of domestic products. Their potential partners are struggling to sort signal from noise and assess the actual regulatory risk of doing business Despite the obvious regulatory uncertainty, there are not enough cautions around the validity of compliance claims – or corresponding risks to investments ranging from project planning to transfer market trading.

In the absence of more detail coming from the Treasury Department, the US domestic energy market needs a practical guide for identifying FEOC and PFE manufacturers. This report provides such a guide.

The risks of inadequate vetting are severe. Without a proper framework for understanding FEOC and PFE exposure – and proper implementation of that framework – not only will Chinese entities subvert incentives intended for domestic industry, but so will those incentives fail to encourage the deployment of solar energy at the scale needed and demanded. Vetting failures will allow Chinese manufacturers operating in the United States to leverage non-market support from China to undercut domestic manufacturers, completing their cannibalization of the American industry, while and by receiving 45X credits backed by US taxpayers. Without appropriate vetting, project developers will not be able to determine whether the equipment that they use is eligible for 48E tax credits. Financiers of projects will face similar challenges – and therefore risk either not investing or investing poorly amid uncertainty as to 48E eligibility. And the OBBBA full transferable tax credits are now subject to 10-year recapture: Companies that purchase credits in the transfer market will face the risk that their tax credits become subject to disqualification.

These risks demand that companies across the energy sector update their compliance approaches and vetting methods – to account both for evolving foreign entity rules themselves and the manner in which companies, especially Chinese companies, seek to evade them. The report that follows outlines a framework for foreign entity risk vetting that captures six main risk categories:

• Ownership,

• Investment stakes,

• Technological dependence,

• Manufacturing dependence,

• Place of business, and

• Personnel.

A Template for Policy

The current uncertainty around foreign entity restrictions also provides an opportunity for US industry and relevant policy: Washington has the chance to stop Chinese subversion of US industry; to protect American energy security; and to ensure that trusted, domestic producers benefit from a new growth market. The US solar energy market is large and growing. Solar energy will be developed in America. The question is whether it will be produced based on US or Chinese technology, with US or Chinese manufacturing, and by US or Chinese companies.

Up until now, China has positioned to capture this market. Chinese companies have leveraged state support and non-market competition to become the world’s dominant solar producers. And Chinese companies have assumed that they can continue to do so, despite US regulatory restrictions, obfuscating covered nation ties and evading other policy limits. If Chinese companies succeed in doing so, they will undermine domestic manufacturers and industry, US energy security, and the US taxpayer.

But Washington can stop Chinese companies. A rigorous program for defining and restricting FEOC and PFE entities – and thorough enforcement of that program – will protect against Chinese solar subversion and allow trusted industry to succeed. US foreign entity definitions, and restrictions on them, should take into account all six risk categories outlined in this report, and all corresponding ways in which Chinese entities seek to access the US market.

Foreign Entity Risk Framework

The Department of Treasury and Internal Revenue Service have not yet published their final guidance on how foreign entity restrictions are to be interpreted, applied, and enforced. But that does not mean that thorough vetting is not possible now. The broad contours of the rules are clear – including the types of foreign adversary exposure, influence, and control that they target. Understanding those contours, as well as the motivating intent behind them, can allow decisionmakers to make more informed procurement and investment decisions and to mitigate foreign entity-related regulatory risk.

FEOC and PFE restrictions cover links to and dependence on foreign adversaries including investment, debt, tech licensing, supply, personnel, and corporate network ties that contribute to determinations of effective control and material assistance Effectively, the restrictions as they exist and are expected to evolve are intended to prevent companies with any form of dependence on or affiliation to covered nations from receiving government support.

That in turn means that updated, effective foreign entity vetting frameworks must take into account criteria including equity stakes, to cover minority and indirect stakes; technological, manufacturing, and supply chain dependencies; and personnel and corporate network connections to FEOCs and PFEs that suggest obfuscated relationships A thorough foreign entity risk assessment framework should cover the following six categories of exposure:

- Ownership

o Is the company owned by a PFE?

- Investment stakes

o Do PFE entities hold any investment stake in the company, including minority investments and, investments made through offshore and tax haven entities, intermediaries, or shell structures that obscure ultimate ownership?

- Technological dependence

o Does the company depend on PFE entities for technology, including via tech licensing deals?

- Supply chain dependence

o Does the company’s supply chain depend on PFE entities and/or their facilities in thirdparty countries? Does the company have manufacturing affiliates in covered countries?

- Place of business and corporate network ties

o Do the company, its subsidiaries, and/or its parent entities have any affiliates in covered countries? Do those serve as a principal place of business?

- Personnel and their affiliations

o Does the company’s leadership have affiliations to PFE-tied entities, including affiliations that could indicate obfuscated corporate relationships?

These are not notional avenues for foreign risk. Right now, Chinese companies are actively using every one of these strategies to access and influence the US energy sector – while in many cases positioning as FEOC- and PFE-free and advertising their products as “made in the USA.”

The following sections detail examples in all six categories. They highlight risks associated with major Chinese champions that have come to dominate segments of the solar supply chain, including JA Solar, LONGi, and JinkoSolar. The noted examples – covering both those large players and more emergent entities and partnerships – are far from exhaustive. Cases reviewed in this analysis are intended to provide representative examples of the types of PFE and FEOC exposure that exist and that can be documented – and to underscore the relevance of the criteria for thoroughly protecting against the risk of non-compliance in the future.

Ownership

Is the company owned by a PFE?

While China has an extensive, sophisticated arsenal for securing access to and influence over US industry, the first line of offense is simple: “Localization” in the United States through wholly- or majority-owned subsidiaries. Chinese energy champions including Runergy, Jinko Solar, JA Solar, Trina Solar, and C&D Clean Energy have all established wholly owned subsidiaries in the United States 1 Given the underlying intent motivating tariffs and US government incentives for domestic industry, all are at risk of being targeted by foreign entity restriction enforcement.

Examples of Chinese companies’ localization in the United States through subsidiaries include:

• China’s Jiangsu Runergy New Energy Technology (江 苏润阳新能源科技股份有限公司 ) in October 2024 announced that it had begun production at its solar module manufacturing facility in Huntsville, Alabama.2

• In 2018, Shanghai-based JinkoSolar (晶科能源股份有限公司 ) launched a module assembly facility in Jacksonville: It advertises that its modules are “assembled in the U.S.A [line break] from foreign components.”3

• Nanjing-based C&D Clean Energy, the clean energy subsidiary of China’s State-owned C&D Group (建发集团), operates C&D Clean Energy USA out of Chino Hills, CA.

1 JA and Trina have sold their subsidiaries but the companies’ products continue to be sold in the US market.

2 “Runergy Expands Global Presence with New U.S. Solar Module Manufacturing Facility Now in Production,” Runergy, October 4, 2024.

3 “Jinko,” Jinko Solar US, Accessed November 9, 2025. https://jinkosolar.us/jax/

• Hounen Solar America Inc., with a manufacturing facility in South Carolina, is the US subsidiary of Zhejiang-based Haoneng Optoelectronics (昊能光电股份有限公司).4

• Boviet Solar – which has a module facility and is building a cell plant in North Carolina and describes itself as “founded in 2013 in Vietnam”5 – is a subsidiary of China’s Ningbo Boway Alloy Material Co., Ltd. (宁波博威合金材料股份有限公司).6

• China’s Astronergy (正泰新能科技股份有限公司 ), a subsidiary of the CHINT Group, reports to be constructing a US manufacturing base.7

• Phono Solar (江 苏辉伦太阳能科技有限公司 ), which is reportedly building a solar panel factory in South Carolina, is a subsidiary of the State-owned SUME Group Corporation.8

• China’s Toenergy (杭州唐能能源科技有限公司 ) is reportedly building a 500-MW solar panel factory in Sacramento.9

• Singapore-headquartered Maxeon Solar Technologies is building a build a module assembly plant in New Mexico. That company is majority owned by China’s TCL Zhonghuan Renewable Energy Technology Co., Ltd. (TCL 中环新能源科技股份有限公司), part of the TCL Group (TCL 集团).10

• Imperial Star Solar (帝国星太阳能有限公司 ) – the website of which advertises “Americanmade solar modules built with precision, trust, and a commitment to powering US energy dependence – appears to be a subsidiary of Zhejiang Xingcheng Group (浙江星城集团), a Ningbo-based conglomerate specializing in research, development, manufacturing, and processing of solar cells and modules, among other things.11

• EliTe Solar (formerly ET Solar) describes has announced that it intends to develop a manufacturing presence in the United States and describes itself as headquartered in Singapore.12 But while Singapore-headquartered, EliTe is China-owned: Through Hong Kong-based Elite

4 "昊能光电将在美国建造 1 GW 太阳能组件工厂 [Huoen Solar to Build 1 GW Solar Module Factory in the US]," PV Magazine, March 21, 2023.

5 Ryan Kennedy, “Boviet Solar Completes Exterior Construction of 3 GW U.S. Solar Cell Factory,” PV Magazine USA, August 27, 2025.

6 “Boway Alloy,” Boviet Solar, Accessed November 9, 2025.

7 “Towards a Greener Solar Future, Astronergy Shares Its Industry Insights and Global Manufacturing Layout at the LSS USA 2024,” Astronergy, May 7, 2024.

8 “About Phono,” Phono Solar, Accessed November 7, 2025.

9 Kelly Pickerel, “U.S. Solar Panel Manufacturing Claims from Intersolar North America,” Solar Power World, January 22, 2024.

10 Jonathan Touriño Jacobo, "Maxeon to Focus on US Market, Sells Non-US Assets to Parent Company TCL Group," PV Tech, November 26, 2024.

11 浙江星城电子有限公司 [Zhejiang Xingcheng Electronics Co., Ltd.], Liepin, Accessed November 6, 2025.

12 “EliTe Solar,” LinkedIn, Accessed November 6, 2025.

Solar New Energy Co., Ltd., EliTe appears to be a subsidiary of Wuxi Boda New Energy Technology Co., Ltd. (无锡博达新能科技有限公司).13

Many of these companies advertise US-made products. But their ultimate ownership is Chinese. In some case, that ownership is not difficult to identify. In others, like EliTe Solar, the ownership tie is more obfuscated, transiting through a third-party country and multiple ownership vehicles. That means that surface-level claims about location of production, location of headquarters, and even first-order ownership have to be investigated and documented in detail to prepare for FEOC and PFE guidance, compliance, and enforcement over the temporal scope of an investment or development.

Investment Stakes

Do PFE entities hold any investment stake in the company?

Chinese entities can establish ownership and influence through investments that are neither direct nor amount to majority equity stakes. In many cases, Chinese entities forge footholds on US soil through minority stakes. And evolving FEOC and PFE restrictions are likely to target this, nonmajority ownership as a marker of influence.

LONGi and Illuminate USA offer a useful case. Illuminate USA was formed in 2023 – months after the Inflation Reduction Act, with its tax credits, was signed into law – as a joint venture between a US company Invenergy, an energy project developer, and China’s LONGi, a solar equipment maker.14 Invenergy holds a majority stake in the joint venture – with 51 percent to LONGi’s 49 percent. This means that Illuminate USA is “majority US-owned.”15

But while minority-owned by LONGi, Illuminate is still invested in by a Chinese entity. This puts it at risk of foreign entity restrictions. So does the fact that, as discussed in the following section, Illuminate’s Chinese ownership comes with dependence on Chinese technology.

Technological Dependence

Does the company depend on PFE entities for technology?

Evolving foreign entity restrictions – and therefore responsive vetting frameworks – also take into account technological dependence on FEOC and PFE entities. These can be difficult to identify

13 For instance, the founder and ultimate controller of Wuxi Boda New Energy, Liu Jingqi (柳敬麒), a Chinese national, is the director of Elite Solar New Energy Co., Limited.

14 "Leading American Solar Developer Brings Landmark Manufacturing Facility to Ohio," The Columbus Region, March 10, 2023.

15 "How American Tax Breaks Brought a Chinese Solar Energy Giant to Ohio," Bloomberg, October 29, 2024.

but often are reflected in tech licensing deals, imported personnel, and imported equipment. In many cases, PFE technological dependence and investment stakes go hand in hand.

Again, Illuminate USA bears this out. While LONGi is a minority owner, it is also the manufacturing partner in the joint venture. The joint venture appears to rely on LONGi’s, and therefore Chinese, technology. 16 LONGi has reportedly brought in more than 100 Chinese nationals to lead production operations leveraging Chinese equipment and technology.17

Manufacturing Dependence

Does the company’s supply chain depend on PFE entities?

Manufacturing and supply chain dependencies serve as additional avenues for foreign entity risk. Like technological dependence, these serve as avenues for PFE and FEOC influence and run contrary to the intent of regulatory incentives for domestic production: To revive US industry. But in many cases, companies incorporated in the United States, position as domestic manufacturers, and therefore appear on a surface level to be non-PFE – all while relying on PFE manufacturing. This risks triggering foreign entity restrictions stemming from material assistance

This manufacturing dependence can take the form of manufacturing subsidiaries in covered countries (e.g., China). It can also take the form of non-affiliated suppliers in covered countries Or it can manifest in imports from PFE companies’ subsidiaries in third-party countries (e.g., Chinese companies’ subsidiaries in Southeast Asia).

ES Foundry, for example, is headquartered in South Carolina. The company advertises having a “U.S.-based leadership and domestic ownership structure.”18 But it does not disclose any details about its ownership – beyond those featuring “private equity” funds.19

Regardless of ES Foundry’s investors or ownership, it appears to rely on China-based manufacturing – including on the part of both a subsidiary and unaffiliated suppliers. ES Foundry operates a Shanghai-based subsidiary, Yisifu (Shanghai) Technology Co., Ltd (易斯弗(上海)科 技有限公司 ), established in 2024. That company has, in China, posted hiring announcements stating that “ES Foundry is a solar manufacturing company that provides IRA-compliant product solutions to end customers in the United States,” while advertising for engineering jobs in Shanghai.20 In addition, every product that ES Foundry has imported into the United States since its inception, based on shipment manifest data, appears to have been from Chinese suppliers –

16 "How American Tax Breaks Brought a Chinese Solar Energy Giant to Ohio," Bloomberg, October 29, 2024.

17 Ibid.

18 “”ES Foundry,” ES Foundry, Accessed November 1, 2025.

19 “ES Foundry's CEO Alex Zhu on New Facility Plans in US: RE+ 2024 Exclusive,” Taiyang News on Youtube, September 26, 2024.

20 "助理设备工程师(光伏电池)[Assistant Equipment Engineer (Photovoltaic Cells)]," Liepin, Accessed November 5, 2025.

including Wuxi Dongfeng New Energy Technology, China Kide Engineering, Longi Malaysia, and Huai’an Xinyi New Energy Technology.

SEG Solar (世 际新能源科技 ) offers another case. The company was originally established as the US division of Chinese solar panel manufacturer Jiangsu Seraphim. In 2023, SEG announced that it was “no longer affiliated with Jiangsu Seraphim and is now operating independently.”21 But – formal independence or not – SEG Solar continues to depend on Chinese inputs and manufacturing, including those of its own China-based subsidiary.

SEG Solar appears to have a Jiangsu-based subsidiary, SEG Solar (Jiangsu) (世纪新能源科技(

江苏)有限公司) – and to rely on that subsidiary as a key supplier. This is not something that the company advertises. On the contrary: Its website reports that “SEG Solar has manufacturing facilities and offices in 4 countries and regions worldwide, including factories in USA and Indonesia” and lists locations in the US, Singapore, Thailand, Indonesia, and Spain.22 But Chinese corporate registry databases list a SEG Solar (Jiangsu), with the same website as SEG Solar, operating out of Nanjing, Jiangsu Province. And US shipping data shows that SEG Solar (Jiangsu) is an exporter into the United States, with 98.1 percent of its shipments, most of them composed of photovoltaic modules, going to the United States, primarily to SEG Manufacturing.23

SEG Solar also imports solar products from other Chinese entities, including State-owned Xiangyu New Energy, Jiangsu Meike Solar Technology Co., Ltd., and Nanjing C&D Clean Energy. In March 2024, SEG Solar and Xiangyu New Energy – a State-owned Chinese company – signed a strategic cooperation agreement for the latter to provide photolytic products such as cells and modules to SEG. The two parties signed that agreement at the Chinese government-hosted “ChinaUS Economic and Trade Cooperation Exchange Conference” in Xiamen, Fujian.24 In May 2023, SEG Solar signed an MOU with Jiangsu Meike Solar Technology Co., Ltd., according to which that entity committed to supply silicon ingots and wafers to SEG’s facility in the United States. SEG founder Jun Zhuge, described this MOU as a means of “ensuring the high quality of products from our module factory located in the United States.”25 And in December 2021, SEG Solar and Nanjing C&D Clean Energy Co., Ltd. signed the “600 MW US Market Strategic Cooperation Framework Agreement,” committing to “expand the US market together” through, among other things, C&D’s provision of photovoltaic raw materials.26

21 Kelly Pickerel, “SEG Solar Says It’s Opening a 2-GW Module Manufacturing Plant in Houston,” Solar Power World, September 21, 2022.

22 “Globalization,” SEG Solar, Accessed November 4, 2025.

23 “SEG Solar Jiangsu Co., Ltd.,” Panjiva, Accessed March 30, 2025.

24 "SEG Solar 携手象屿新能源,为低碳能源发展增加磅礴动能 [SEG Solar, in Partnership with Xiangyu New Energy, Is Adding Tremendous Momentum to the Development of Low-Carbon Energy]," SEG Solar, March 25, 2024.

25 "SEG Solar 与美科达成硅棒硅片原材料战略合作 [SEG Solar and MEC Solar Reach Strategic Cooperation on Silicon Rod and Wafer Raw Materials]," Polaris Solar PV Network, May 15, 2023.

26 "建发清洁能源与 SEG Solar 签订 600 兆瓦组件供应战略合作协议 [C&D Clean Energy and SEG Solar Signed a Strategic Cooperation Agreement for the Supply of 600 MW of Modules]," C&D Clean Energy, December 16, 2021.

Place of Business

Do the company or its affiliates have operations in a covered nation and could it serve as a principal place of business?

Evolving PFE and FEOC restrictions recognize that companies can evade ownership controls by incorporating in the United States or other, non-covered markets. As a result, new restrictions also account for companies’ principal place of business, considering entities to be PFEs if the main location where the company conducts business operations and where officials report to work is in a covered nation.

This is not always straightforward to ascertain. But subsidiaries in a covered nation with significant operations can be an indicator that that country is a principal place of business. So can assets, personnel, and even professional service providers in that country. And so can company statements with respect to regulatory authorities.

Canadian Solar is an example of a company that, while incorporated in a non-covered nation has indicators suggesting that its principal place of business is China. Canadian Solar is NASDAQlisted and headquartered in Canada. The company was founded in 2001 by Xiaohua Qu (瞿晓铧). Canadian Solar’s English-language website describes Qu as having founded the company in Guelph, Ontario. 27 But Chinese sources report that Qu “returned” to China in 2001 to launch Canadian Solar, bringing “advanced photovoltaic equipment” with him, as part of the National Thousand Talents Program. 28 The reality appears to be both. In 2001, Qu established two companies: Ontario-based Canadian Solar and Canadian Solar (Changshu) Co., Ltd., located in Jiangsu Province.29 Canadian Solar has maintained that structure in the decades since. Canadian Solar is technically headquartered in Canada. From that outpost, it has established a presence in the United States.

But the company’s assets, personnel, regulatory statements, and even professional service providers suggest that China could be its principal place of business. More than half of Canadian Solar’s long-lived assets – including property, plant and equipment, solar power and battery energy storage systems, intangible assets, and ROU assets – are based in China, as reflected in the table below. Employment figures tell a similar story. As of December 31, 2024, Canadian Solar had almost 12,000 employees in China and less than half of that in all of the rest of the world combined, including the US, Canada, Japan, Australia, Singapore, Korea, Hong Kong, Taiwan, India, Thailand, Vietnam, Brazil, the United Arab Emirates, South Africa, the United Kingdom, Latin America, and the European Union. The company’s China-tied reality is also evident in its professional services providers: Those, filed by an ostensibly Canadian entity to the US Nasdaq,

27 “Board of Directors,” Canadian Solar, Accessed October 71, 2025.

28 阿特新阳光店里集团获 2015 中国原创技术 [Art New Sunshine Store Group won the 2015 China Original Technology],” China Economic Weekly, December 28, 2015.

29 See: “Canadian Solar AMENDMENT NO. 3 TO FORM F-1 REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933,” Canadian Solar, Accessed October 17, 2025.

are audited by “Deloitte Touche Tohmatsu Certified Public Accountants LLP, an independent registered public accounting firm located in China.” 30

Canadian Solar Long Lived Assets by Country/Region31

Country December 31, 2023 (USD) December 31, 2024 (USD) China

The significance of the China-based portion of the Canadian Solar apparatus is also evident in ownership structures within the company. Canadian Solar’s main solar component subsidiaries in the United States, according to the company’s annual report, are owned by CSI Solar Co., Ltd., Canadian Solar’s majority-owned principal operating subsidiary incorporated and publicly listed in the PRC. In other words, Canadian Solar’s chief Chinese subsidiary owns the company’s US solar component facilities in the United States.

Canadian Solar’s 2024 annual report filed with the Securities and Exchange Commission – a USfacing statement – also contains language with respect to regulatory authorities that suggests China could be the company’s principal place of business. The annual report acknowledges that Canadian Solar is bound by Chinese laws and regulations 32 The annual report also acknowledges that the company cannot assert that its de facto management is not located in China: “However, it remains unclear as to whether our ‘de facto management body’ is located in China for PRC tax purposes.”33

Personnel

Does the company’s leadership have affiliations to PFE-tied entities, including affiliations that could indicate obfuscated corporate relationships?

Foreign entity restrictions also take personnel-level ties into account. For instance, companies can be determined to be PFEs based on PFE-tied individuals holding board seats. In addition, leadership ties to PFE entities can be an indicator of other, obfuscated risk factors – for example, that a company is a subsidiary of or invested in by a PFE. As such, significant ties between

30 “Canadian Solar Form 20F,” Canadian Solar, April 30, 2025.

31 “Canadian Solar Form 20F,” Canadian Solar, April 30, 2025.

32 For example, Canadian Solar’s 2024 annual report states that, because of its extensive presence in China, “we are subject to risks arising from the PRC legal system,” including the Data Security Law, the Personal Information Protection Law, and the Cybersecurity Review Measures. (“Canadian Solar Form 20F,” Canadian Solar, April 30, 2025.)

33 “Canadian Solar Form 20F,” Canadian Solar, April 30, 2025.

company leadership and PFE entities is at best a red flag that should prompt caution and enhanced vetting, at worst direct evidence for PFE classification.

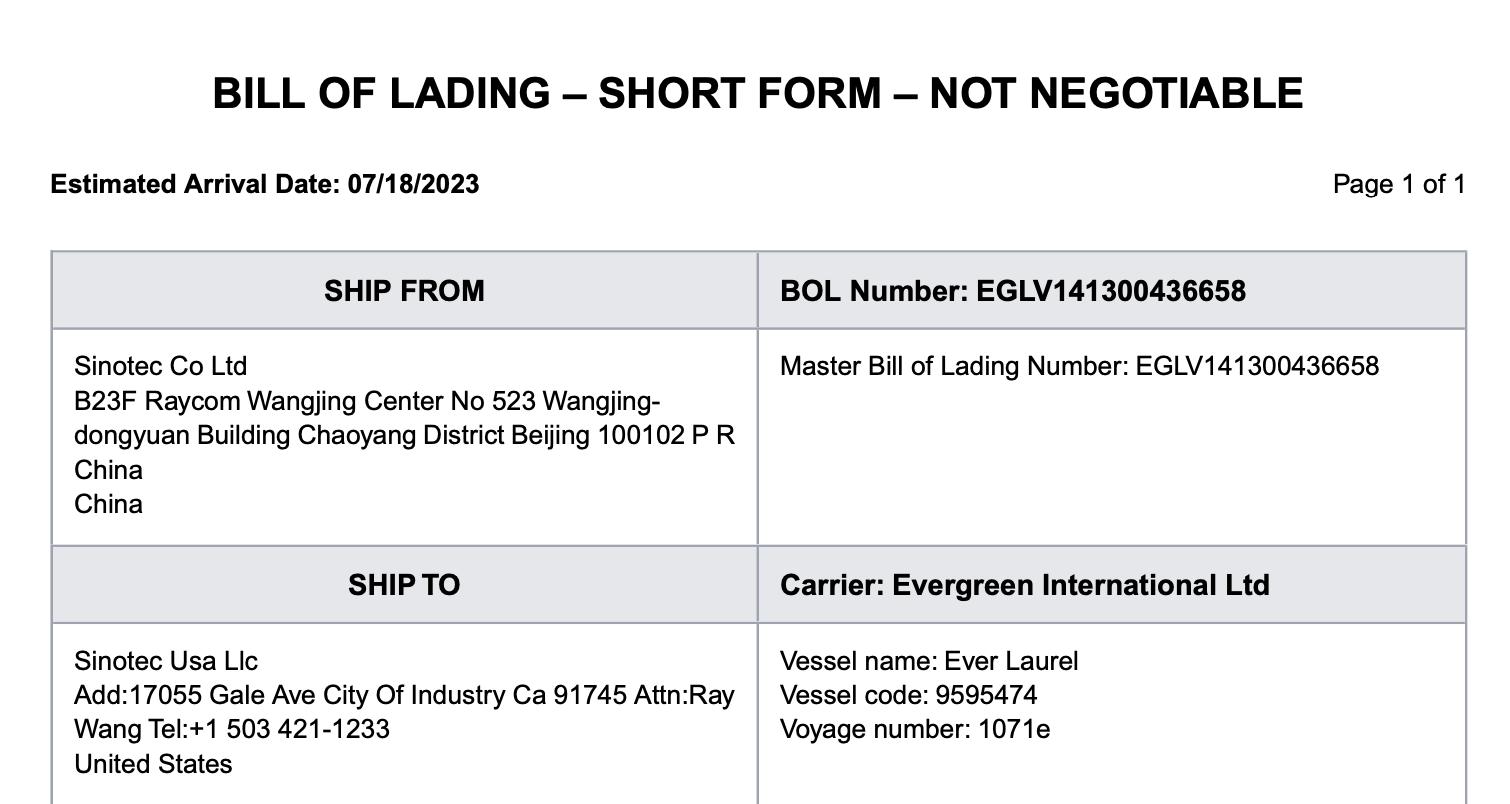

Sinotec Solar is a case of leadership ties to a PFE that raise clear red flags. A private company, Sinotec Solar is something of a black box in public sources. But its leadership appears to be affiliated with a Chinese company – suggesting that Sinotec itself may carry similar ties as well. According to California Secretary of State filings, Sinotec was established in 2015, led by CEO Guangming Jin – according to California Secretary of State filings. The company claims to be a “pioneer in Made-in-USA solar panels.”34 But it does not disclose its leadership or ownership. And Guangming Jin appears to be an executive at a Chinese conglomerate, China Power International Technology Co., Ltd. (中电国际技术股份有限公司), which goes by English name Sinotec Co., Ltd.

China Power International Technology Co., Ltd. is a Chinese EPC company focused on energy, water conservancy, industrial, and transportation sectors. The company is headquartered in Beijing – but its footprint spans Asia, Africa, and the Americas.35 Its subsidiaries include Nigeria-based China Power International Technology Co., Ltd.’s CCC International Engineering Nigeria Limited. And that company lists Jin Guangming as a member of its board of directors.36

34 “Home,” Sinotec Solar, Accessed November 6, 2025.

35 “Home,” Sinotec, Accessed November 6, 2025.

36 “Company History,” CCC International Engineering Nigeria Limited, Accessed November 6, 2025.

Conclusion

American industry – and the American energy industry in particular – are at a turning point. Policy, technological, and geopolitical trends all create the opportunity for a revival of domestic production, and concomitant economic and security boons. But this opportunity will only be realized if the US government defines and enforces appropriate safeguards against Chinese subversion, and if the American market internalizes and operationalizes those safeguards through their own approaches to procurement and investment. Foreign entity restrictions in industrial incentives, like those outlined in the OBBBA, are a first such line of defense. This report provides a framework for how those restrictions can be defined and applied to protect against Chinese evasion – and, ultimately, pursue American energy dominance on the strength of a truly domestic industrial base.

Company Profiles

Imperial Star Solar

Imperial Star Solar ( 帝国星太阳能有限公司 ) was established in 2020, 37 as a Cambodian contract manufacturer for Chinese Tier 1 solar panel companies. When Cambodian exports became a target for AD/CVD tariffs, the company added a silicon wafer factory in Laos. 38 In 2024, Imperial Star announced that it intended to launch a 1.5-GW solar panel assembly factory outside Houston, Texas.39

Imperial Star Solar’s company’s website advertises “American-made solar modules built with precision, trust, and a commitment to powering US energy dependence.” 40 Per its LinkedIn account, “Imperial Star Solar is a U.S. manufacturer trusted by developers and EPCs for IRAcompliant, American-made solar modules.”41

That framing belies the story in PRC sources that the company is in fact “Chinese-backed,” a subsidiary of a Zhejiang-based energy conglomerate. For instance, when Imperial Star Solar set up shop in Laos, a Chinese-language article published on Netease reported that:

Solar companies moving to Laos include Imperial Star Solar. This Chinese-backed company, which has most of its production capacity in Cambodia, opened a wafer fab in Laos in March of this year…The company stated at the time that the relocation helped it to circumvent US tariffs.42

Imperial Solar appears to be a subsidiary of Zhejiang Xingcheng Group ( 浙江星城集 团 ), a Ningbo-based conglomerate specializing in – among other things – research, development, manufacturing, and processing of solar cells and modules. Chinese commercial databases describe the relationship:

Founded in 2010 by a dynamic team of overseas returnees, Zhejiang Xingcheng Group is a diversified, modern glomerate…Its main subsidiaries include Imperial Star Solar

37 “About,” Imperial Star, Accessed November 6, 2025.

38 Kelly Pickerel, “Imperial Star Solar to Open 1.5-GW Solar Panel Factory in Houston This Year,” February 5, 2024.

39 Kelly Pickerel, “Imperial Star Solar to Open 1.5-GW Solar Panel Factory in Houston This Year,” February 5, 2024.

40 “About,” Imperial Star, Accessed November 6, 2025.

41 “Imperial Star Solar,” LinkedIn, Accessed November 6, 2025.

42 "美国万万没料到,中国出手这么快!大批中企转移,越南吞下“恶果”![The US Never Expected China to Act So Quickly! A Large Number of Chinese Companies Are Relocating, and Vietnam Is Reaping the Consequences!]," Netease, November 7, 2024.

(Cambodia), US-based Line Star New Energy Co., Ltd. (美国莱恩星新能源有限公司), Zhejiang Xingcheng Electronics Co., Ltd. (浙江星城电子有限公司), and Ningbo Fuxing Power Co., Ltd. (宁波市富星电力有限公司)…The group entered the solar photovoltaic industry in 2012…In 2019, the company began establishing overseas production bases.43

And the ties between the two corporations are also evident at the personnel level. Imperial Star Solar’s CEO , Isabella Xu (徐伊婷), is listed in Chinese corporate registry databases as among the “key personnel” of Zhejiang Xingcheng Electronics Co., Ltd. (浙江星城电子有限公司) – the China-based photovoltaic manufacturing subsidiary of Zhejiang Xingcheng Group.

43 浙江星城电子有限公司 [Zhejiang Xingcheng Electronics Co., Ltd.], Liepin, Accessed November 6, 2025.

EliTe Solar

EliTe Solar (formerly ET Solar) describes itself as “headquartered in Singapore, with manufacturing facilities in Vietnam, Indonesia, and Egypt.”44 The company has imported into the US from its Southeast Asia subsidiaries for years. More recently, EliTe Solar has invested in a production facility Egypt, because, as CEO Arndt Lutz has explained, “it’s not affected by Section 201 tariffs or the Antidumping or Countervailing Duties ”45 And the company has announced that it intends soon to develop a manufacturing presence in the United States.46 In a 2024 interview, EliTe’s general manager Alex Chen explained the company’s profile: “EliTe Solar is headquartered in Singapore. We are a fully integrated global PV manufacturer and supplier with our own production facilities, starting from ingots and wafers to cells and modules, all outside of China.”47

This framing nearly skips over the reality that, while Singapore-headquartered, EliTe is Chinaowned. Per Singapore’s corporate registry database, Singapore-based EliTE Solar Power Holding Pte. Ltd. is 100 percent owned by Hong Kong-based Elite Solar New Energy Co., Limited – which in turn appears to be the Hong Kong arm of Wuxi-registered Wuxi Boda New Energy Technology Co., Ltd. (无锡博达新能科技有限公司).48

According to Chinese corporate registry information, Wuxi Boda’s ultimate beneficial owner is Chinese national Liu Jingqi ( 柳敬麒 ) 49 – also director of Hong Kong-based Elite Solar New Energy Co., Limited. Wuxi Boda specializes in photovoltaic products (e.g., cells and modules) and equipment; it owns the company that owns a patent related to perovskite thin film passivation technology.50

44 “EliTe Solar,” LinkedIn, Accessed November 6, 2025.

45 "RE+ 2024: EliTe Solar on Its PV Manufacturing Plans In Egypt," Taiyang News, September 26, 2024.

46 "EliTe Solar: Realizing Our Mission and Standing by Our Core Values," EliTe Solar, November 22, 2024.

47 "RE+ 2024: EliTe Solar on Its PV Manufacturing Plans In Egypt," Taiyang News, September 26, 2024.

48 For instance, the founder and ultimate controller of Wuxi Boda New Energy, Liu Jingqi (柳敬麒), a Chinese national, is the director of Elite Solar New Energy Co., Limited.

49 Liu holds stakes directly and through holding company Wuxi Boda Heyi Technology Co., Ltd. (无锡博达合一科 技有限公司).

50 See: "江苏博达新能海内外城市 60 个岗位任您投![Jiangsu Boda New Energy Is Offering 60 Positions in Cities both Domestically and Internationally!]," Baijiahao, June 21, 2023.

51 "无锡博达新能科技有限公司 [Wuxi Boda New Energy Technology Co., Ltd.]," ENF, Accessed November 6, 2025.

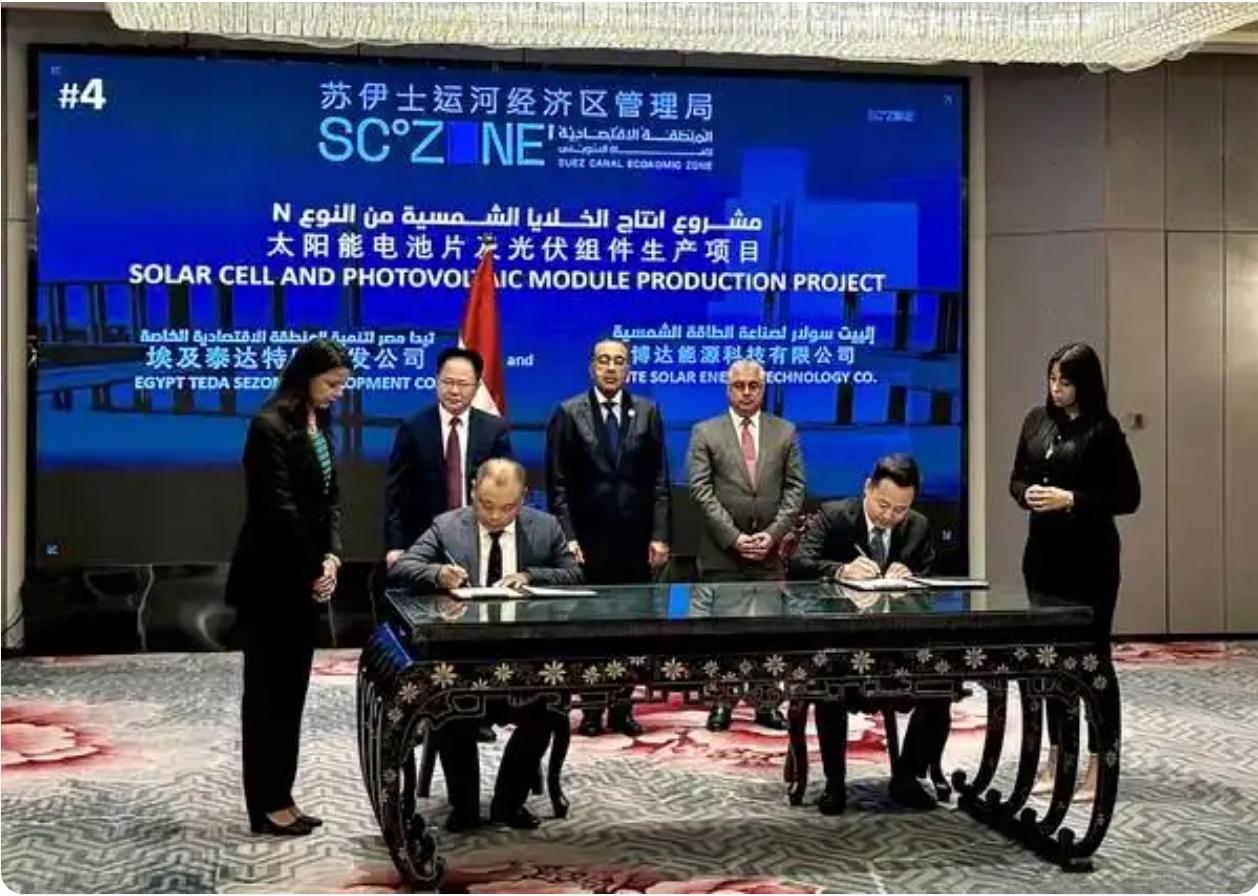

PRC sources describe EliTe Solar and Wuxi Boda as the same entity, referring to “Boda New Energy EliTe Solar.”52 The ties to the PRC are such that EliTe holds its important commercial negotiations in China, not Singapore. In September 2024, EliTe Solar’s chairman held talks with the Egyptian Prime Minister in Beijing, inking a deal for the first to make a more than 150 million USD investment in Egypt’s China-Egypt TEDA Suez Economic and Trade Cooperation Zone. The press release about the signing described the project as “a crucial component of Boda’s global strategic layout.”53

EliTe’s 2024 Egypt Deal Signing54

And EliTe appears to be seen by the Chinese government as a model for the “Go Global” campaign and for capturing foreign markets. In July 2025, leaders from the Wuxi Municipal Government’s

52 无锡博达新能科技有限公司 [Wuxi Boda New Energy Technology Co., Ltd.], Liepin, Accessed November 6, 2025.

53 "EliTe Solar 博达新能签约埃及项目:推动中东新能源产业崛起 [EliTe Solar Signs Egyptian Project: Driving the Rise of the Middle East's New Energy Industry]," PRNewswire, September 7, 2024.

54 "EliTe Solar 博达新能签约埃及项目:推动中东新能源产业崛起 [EliTe Solar Signs Egyptian Project: Driving the Rise of the Middle East's New Energy Industry]," PRNewswire, September 7, 2024.

Overseas Chinese Federation visited Wuxi Boda New Energy in order to gain insight into “promoting the development of the new energy industry and facilitating local industries in ‘Going Global.’” The visitors praised Boda New Energy for “setting an example for Wuxi’s overseas Chinese enterprises.”55

[Wuxi Municipal Government Overseas Chinese Federation Conducts Research on Boda New Energy]," Wuxi Overseas Chinese Federation, July 29, 2025.

ES Foundry

ES Foundry was incorporated in 2023, led by CEO Alex Zhu (aka Zhu Cheng)56 – formerly an executive at Chinese energy companies: From 2017 to 2021, Zhu served as president for North and South America Region for GCL System Integration Technology Co., Ltd. Before that, from 2014 to 2017, he was president of Shunfeng International Clean Energy Limited.57

ES Foundry aggressively advertises having a “U.S.-based leadership and domestic ownership structure ” 58 But it does not disclose any details about its ownership – beyond those featuring “private equity” funds.59 The only identified, known such fund is FH Capital, an Australia based fund whose Chief Investment Officer, Sanjeev Chaurasia, and Executive Director, Dennis Shi, are listed in SEC filings as ES Foundry directors.60 But FH Capital itself does not disclose its funding sources. And

Regardless of ES Foundry’s investors or ownership, it clearly relies on China-based manufacturing and has a corporate network in China The company operates a Shanghai-based subsidiary, Yisifu (Shanghai) Technology Co., Ltd ( 易斯弗 ( 上海 ) 科技有限公司 ), established in 2024 That company has, in China, posted hiring announcements stating that “ES Foundry is a solar manufacturing company that provides IRA-compliant product solutions to end customers in the United States,” while advertising for engineering jobs in Shanghai 61 ES Foundry also has a Hong Kong-based subsidiary, ES Foundry (HK) Limited, the controller of which, Gladys Chung, is affiliated with FH Capital.62 And from a supplier perspective, every product that ES Foundry has imported since its inception, based on shipment manifest data, has been from Chinese suppliers –including Wuxi Dongfeng New Energy Technology, China Kide Engineering, Longi Malaysia, and Huai’an Xinyi New Energy Technology.

56 ES Foundry Form D, 2024.

57 “Alex Zhu,” Rocket Reach, Accessed November 1, 2025.

58 “”ES Foundry,” ES Foundry, Accessed November 1, 2025.

59 “ES Foundry's CEO Alex Zhu on New Facility Plans in US: RE+ 2024 Exclusive,” Taiyang News on Youtube, September 26, 2024.

60 “Team,” FH Capital, Accessed November 1, 2025; ES Foundry Form D, 2024.

61 "助理设备工程师(光伏电池)[Assistant Equipment Engineer (Photovoltaic Cells)]," Liepin, Accessed November 5, 2025.

62 “Team,” FH Capital, Accessed November 1, 2025.

SEG Solar Inc.

SEG Solar (世 际新能源科技 ) was originally established as the US division of Chinese solar panel manufacturer Jiangsu Seraphim. In 2023, SEG announced that it was “no longer affiliated with Jiangsu Seraphim and is now operating independently.”63 But – formal independence or not – SEG Solar continues to depend on Chinese inputs and manufacturing, including those of its own China-based subsidiary; to be helmed and likely owned by former Seraphim executives; and to elide its historic ties to a Chinese company in its marketing materials. The result is that the company, a spin-out from a Chinese entity, is able not only to rely on imports from China but also its own manufacturing footprint in China – while advertising itself as “a pure US solar company” and “committed to promoting energy self sufficiency for America.”64

SEG Solar appears to have a Jiangsu-based subsidiary, SEG Solar (Jiangsu) (世纪新能源科技(

江苏)有限公司) – and to rely on that subsidiary as a key supplier. This is not something that the company advertises. On the contrary: Its website reports that “SEG Solar has manufacturing facilities and offices in 4 countries and regions worldwide, including factories in USA and Indonesia” and lists locations in the US, Singapore, Thailand, Indonesia, and Spain.65

But Chinese corporate registry databases list a SEG Solar (Jiangsu), with the same website as SEG Solar, operating out of Nanjing, Jiangsu Province. And US shipping data shows that SEG Solar

63 Kelly Pickerel, “SEG Solar Says It’s Opening a 2-GW Module Manufacturing Plant in Houston,” Solar Power World, September 21, 2022.

64 “About,” SEG Solar, Accessed November 4, 2025.

65 “Globalization,” SEG Solar, Accessed November 4, 2025.

(Jiangsu) is an exporter into the United States, with 98.1 percent of its shipments, most of them composed of photovoltaic modules, going to the United States, primarily to SEG Manufacturing.66

SEG Solar also imports solar products from other Chinese entities, including State-owned Xiangyu New Energy, Jiangsu Meike Solar Technology Co., Ltd., and Nanjing C&D Clean Energy. In March 2024, SEG Solar and Xiangyu New Energy – a State-owned Chinese company – signed a strategic cooperation agreement for the latter to provide photolytic products such as cells and modules to SEG. The two parties signed that agreement at the Chinese government-hosted “ChinaUS Economic and Trade Cooperation Exchange Conference” in Xiamen, Fujian.67 In May 2023, it signed an MOU with Jiangsu Meike Solar Technology Co., Ltd., according to which that entity committed to supply silicon ingots and wafers to SEG’s facility in the United States. SEG founder Jun Zhuge, described this MOU as a means of “ensuring the high quality of products from our module factory located in the United States.”68 And in December 2021, SEG Solar and Nanjing C&D Clean Energy Co., Ltd. signed the “600 MW US Market Strategic Cooperation Framework Agreement,” committing to “expand the US market together” through, among other things, C&D’s provision of photovoltaic raw materials.69

Finally, from a personnel perspective, while SEG claims no longer to be affiliated with Seraphim, the company’s leadership team are Seraphim veterans; the same people who ran the business while it was affiliated with the Chinese parent. SEG describes its primary founder as COO Jun Zhuge and its co-founder as Jim Wood, now CEO and president.70 Jun Zhuge was CEO of Seraphim Energy Group, the US entity of Jiangsu Seraphim Solar, and executive vice president of that Seraphim Solar 71 He remains listed as the registration agent for Seraphim Energy USA Inc. in the

66 “SEG Solar Jiangsu Co., Ltd.,” Panjiva, Accessed March 30, 2025.

67 "SEG Solar 携手象屿新能源,为低碳能源发展增加磅礴动能 [SEG Solar, in Partnership with Xiangyu New Energy, Is Adding Tremendous Momentum to the Development of Low-Carbon Energy]," SEG Solar, March 25, 2024.

68 "SEG Solar 与美科达成硅棒硅片原材料战略合作 [SEG Solar and MEC Solar Reach Strategic Cooperation on Silicon Rod and Wafer Raw Materials]," Polaris Solar PV Network, May 15, 2023.

69 "建发清洁能源与 SEG Solar 签订 600 兆瓦组件供应战略合作协议 [C&D Clean Energy and SEG Solar Signed a Strategic Cooperation Agreement for the Supply of 600 MW of Modules]," C&D Clean Energy, December 16, 2021

70 SEG Solar 与美科达成硅棒硅片原材料战略合作 [SEG Solar and MEC Reach Strategic Cooperation on Silicon Rod and Wafer Raw Materials], Polaris Solar PV, May 15, 2023.

71 “Seraphim Announces Long-term Partnership with Refacsol,” ENF, April 24, 2018; “PV Talk: Jun Zhuge, Executive Vice-President, Seraphim Solar,” Seraphim, June 27, 2019.

California Secretary of State database. Jim Wood served as Vice President of North America for Seraphim.72 SEG does not disclose its ownership.

72 “Seraphim Recognized as Top Performer in PVEL PV Module Reliability Scorecard for Third Time,” Seraphim, May 28, 2020.

Canadian Solar

Canadian Solar is NASDAQ-listed and headquartered in Canada. But its major operations have ties to China; it was founded by a Chinese returnee benefiting from the National Thousand Talents Program, who remains its largest shareholder; and the company receives Chinese government support. Canadian Solar’s 2024 annual report, filed with the Securities and Exchange Commission, acknowledges that this means that the company is bound by Chinese laws and regulations73 – also that, even in its US-facing statements, it cannot assert that its de facto management is not located in China: “However, it remains unclear as to whether our ‘de facto management body’ is located in China for PRC tax purposes.74

Canadian Solar was founded in 2001 by Xiaohua Qu (瞿晓铧) – who remains the company’s CEO, Chairman, and largest shareholder, with a 20.9 percent stake.75 Canadian Solar’s English-language website describes Qu as having founded the company in Guelph, Ontario.76 But Chinese sources report that Qu “returned” to China in 2001 to launch Canadian Solar, bringing “advanced photovoltaic equipment” with him, as part of the National Thousand Talents Program.77 The reality appears to be both. In 2001, Qu established two companies: Ontario-based Canadian Solar and Canadian Solar (Changshu) Co., Ltd., located in Jiangsu Province, his manufacturing arm.78

Canadian Solar has maintained that structure in the decades since, scaling it as the solar industry has grown and leveraging it to benefit both from Chinese State support, on the one hand, and the access to the US market provided by a Canadian domicile, on the other. Canadian Solar is technically headquartered in Canada. From that outpost, it has established a presence in the United States. But the company runs on, and its critical mass is made up of, manufacturing affiliates in the PRC. The company’s 2024 annual report acknowledges that “a significant portion of our manufacturing operations [are] in China.”79

A Critical Mass in China

This division, and the corresponding concentration of Canadian Solar’s physical presence in China, is reflected in the distribution of the company’s long-lived assets, including property, plant and equipment, solar power and battery energy storage systems, intangible assets, and ROU assets.

73 For example, Canadian Solar’s 2024 annual report states that, because of its extensive presence in China, “we are subject to risks arising from the PRC legal system,” including the Data Security Law, the Personal Information Protection Law, and the Cybersecurity Review Measures. (“Canadian Solar Form 20F,” Canadian Solar, April 30, 2025.)

74 “Canadian Solar Form 20F,” Canadian Solar, April 30, 2025.

75 “Canadian Solar Form 20F,” Canadian Solar, April 30, 2025.

76 “Board of Directors,” Canadian Solar, Accessed October 71, 2025.

77 阿特新阳光店里集团获 2015 中国原创技术 [Art New Sunshine Store Group won the 2015 China Original Technology],” China Economic Weekly, December 28, 2015.

78 See: “Canadian Solar AMENDMENT NO. 3 TO FORM F-1 REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933,” Canadian Solar, Accessed October 17, 2025.

79 “Canadian Solar Form 20F,” Canadian Solar, April 30, 2025.

More than half of those assets are based in China, as reflected in the table below. Employment figures tell a similar story. As of December 31, 2024, Canadian Solar had almost 12,000 employees in China and less than half of that in all of the rest of the world combined, including the US, Canada, Japan, Australia, Singapore, Korea, Hong Kong, Taiwan, India, Thailand, Vietnam, Brazil, the United Arab Emirates, South Africa, the United Kingdom, Latin America, and the European Union. The company’s China-tied reality is also evident in a quirk of its corporate filings: Those, filed by an ostensibly Canadian entity to the US Nasdaq, are audited by “Deloitte Touche Tohmatsu Certified Public Accountants LLP, an independent registered public accounting firm located in China.” 80

Canadian Solar Long Lived Assets by Country/Region81

Country December 31, 2023 (USD) December 31, 2024 (USD)

China

The significance of the China-based portion of the Canadian Solar apparatus is also evident in ownership structures within the company. Canadian Solar’s main solar component subsidiaries in the United States, according to the company’s annual report, are owned by CSI Solar Co., Ltd., Canadian Solar’s majority-owned principal operating subsidiary incorporated and publicly listed in the PRC. In other words, Canadian Solar’s chief Chinese subsidiary owns the company’s US solar component facilities in the United States.

Chinese Government Backing

Further underscoring Canadian Solar’s ties to the PRC, its affiliates in China receive government incentives and support. Multiple Canadian Solar subsidiaries – including Suzhou Sanysolar Materials Technology Co., Ltd, Changshu Tegu New Material Technology Co., Ltd, CSI New Energy Development (Suzhou) Co., Ltd, CSI Solar Technologies (JiaXing) Co., Ltd, Canadian Solar Photovoltaic Technology (Luoyang) Co., Ltd. and CSI Energy Storage Co., Ltd. -- have been designated by the Chinese government as “High and New Technology Enterprises.” 82 That designation, granted to preferred companies in key supply chain nodes, comes with, among other perks, preferential tax status. And in its 2024 annual report, CSI Solar Co., Ltd., Canadian

80 “Canadian Solar Form 20F,” Canadian Solar, April 30, 2025.

81 “Canadian Solar Form 20F,” Canadian Solar, April 30, 2025.

82 “Canadian Solar Form 20F,” Canadian Solar, April 30, 2025.

Solar’s main operating subsidiary in China, reported receiving more than one billion RMB in government subsidies.83

Canadian’s affiliates – in Canada, the US, China, and across the world exist in a complex web of subsidiaries and parents. Qu serves as a clear and unifying thread, as both a shareholder and manager.84 For example, he is chairman of both Canadian Solar, listed on the Nasdaq, and CSI Solar Co., Ltd., listed on Shanghai Stock Exchange's Sci-Tech Innovation Board. 85 And Qu’s personal biography further underscores the company’s ties to the country. Born in Beijing, he holds a bachelor’s degree from Tsinghua University, where he was made a visiting professor in 2011.86 He has won major PRC government awards including the Jiangsu Province May 1st Labor Honorary Medal and the Jiangsu Province “Young and Middle-Aged Experts with Outstanding Contributions” awards.87 Qu has served in PRC government roles too: He was a member of the Changshu Municipal Committee of the Chinese People’s Political Consultative Conference. And he has held leadership roles on government-overseen industry associations including the China Renewable Energy Society and Suzhou Photovoltaic Industry Association. 88

83 "阿特斯:2024 年年度报告 [Canadian Solar: 2024 Annual Report ]," Sina Finance, April 29, 2024.

84 “Canadian Solar Form 20F,” Canadian Solar, April 30, 2025.

85 "阿特斯:2024 年年度报告 [Canadian Solar: 2024 Annual Report ]," Sina Finance, April 29, 2024.

86 “瞿晓铧 [Qu Xiaohua],” Sina East Money, Accessed October 17, 2025.

87 "阿特斯(中国)投资有限公司董事长、总裁兼首席执行官 瞿晓铧[Qu Xiaohua, Chairman, President and CEO of Canadian Solar (China) Investment Co., Ltd]," Xinhua, July 4, 2017.

88 “瞿晓铧 [Qu Xiaohua],” SolarZoom, Accessed October 17, 2025.

Sinotec Solar

Sinotec Solar was established in 2015, led by CEO Guangming Jin – according to California Secretary of State filings. The company claims to be a “pioneer in Made-in-USA solar panels.”89 But it appears to be affiliated to a Chinese engineering, procurement, and construction (EPC) company, and to import extensively from Chinese suppliers.

Sinotec Solar does not disclose its leadership or ownership. Public information on Guangming Jin is limited. But he appears also to be an executive at – and Sinotec Solar appears to be affiliated with – Chinese company China Power International Technology Co., Ltd. (

限公司), which goes by English name Sinotec Co., Ltd.

China Power International Technology Co., Ltd. is a Chinese EPC company focused on energy, water conservancy, industrial, and transportation sectors. The company is headquartered in Beijing – but its footprint spans Asia, Africa, and the Americas. 90 It operates under the English name Sinotec Co., Ltd.

And the Chinese company’s apparent ties Sinotec Solar extend well beyond that naming and branding convention, to include both personnel and trade ties. On the first front, China Power International Technology Co., Ltd.’s CCC International Engineering Nigeria Limited subsidiary lists Jin Guangming as a member of its board of directors.91 And on the trade ties front, Sinotec Solar has, based on shipment manifest data, imported from Beijing-based Sinotec Co., Ltd. – based on out of the same address as China Power International Technology Co., Ltd.

89 “Home,” Sinotec Solar, Accessed November 6, 2025.

90 “Home,” Sinotec, Accessed November 6, 2025.

91 “Company History,” CCC International Engineering Nigeria Limited, Accessed November 6, 2025.