Socioeconomic Determinants of Banking Term Deposit Subscriptions: A Multivariate Analysis Approach

BY PRAKARSHA MITRA

Introduction Results

Customer deposits are vital for financial liquidity, and understanding consumer behavior allows banks to design better financial products. Telemarketing is a key tool in promoting term deposits. By analyzing socioeconomic factors influencing deposit decisions, banks can identify patterns, reduce telemarketing bias, and optimize targeted marketing strategies for broader industry application.

Methods

The study utilizes data from direct telemarketing campaigns conducted by a Portuguese banking institution, where customers were contacted via phone calls to promote term deposits. The dataset comprises a sample size of 4,521 observations, capturing various socioeconomic attributes and responses to the marketing efforts.

PCA (Principal Component Analysis)

Reduced dimensionality by consolidating similar variables into significant components

Logistic Regression

Modeled the probability of success based on identified patterns and predictors

Factor Analysis

Revealed hidden relationships by reducing highly correlated variables into root factors, uncovering patterns influencing customer decisions

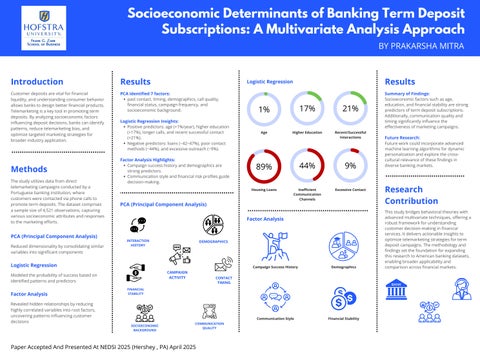

PCA identified 7 factors: past contact, timing, demographics, call quality, financial status, campaign frequency, and socioeconomic background.

Logistic Regression Insights:

Positive predictors: age (+1%/year), higher education (+17%), longer calls, and recent successful contact (+21%).

Negative predictors: loans (−42–47%), poor contact methods (−44%), and excessive outreach (−9%).

Factor Analysis Highlights:

Campaign success history and demographics are strong predictors.

Communication style and financial risk profiles guide decision-making.

PCA (Principal Component Analysis)

Logistic Regression

Results

Summary of Findings:

Socioeconomic factors such as age, education, and financial stability are strong predictors of term deposit subscriptions. Additionally, communication quality and timing significantly influence the effectiveness of marketing campaigns.

Future Research:

Future work could incorporate advanced machine learning algorithms for dynamic personalization and explore the crosscultural relevance of these findings in diverse banking markets.

Research Contribution

Factor Analysis

This study bridges behavioral theories with advanced multivariate techniques, offering a robust framework for understanding customer decision-making in financial services. It delivers actionable insights to optimize telemarketing strategies for term deposit campaigns. The methodology and findings set the foundation for expanding this research to American banking datasets, enabling broader applicability and comparison across financial markets.