Crown Prince

bin Hamad Al

October - December 2025

Crown Prince

bin Hamad Al

October - December 2025

In the 2024 United States Presidential elections, the crypto industry engaged in intense lobbying efforts. They utilised campaign donations and reached out to individual lawmakers to ensure their demands were addressed. This strategy proved effective, as Donald Trump, who presented himself as the most pro-crypto presidential candidate ever, implemented significant reforms within the first few months of his second term. As a result, stablecoins became a safe and affordable option for borderless transactions, while also helping to maintain the dollar's global dominance.

Turning our attention to Africa, Ghana's economy is facing a new challenge. The country's banks are neglecting the farmers who feed the nation, the manufacturers who could build the future of the domestic industrial sector, and the productive sectors that create jobs and generate wealth. This lack of support is leaving critical areas underfunded and slowing overall economic growth.

Meanwhile, Saudi Arabia is making significant strides toward a diversified economy under its ambitious “Vision 2030” agenda, recently securing the hosting rights for the 2034 FIFA World Cup. The Kingdom has quickly positioned itself as a premier destination for major sporting events, enhancing its geopolitical and economic standing while attracting foreign investment and boosting tourism opportunities.

The cover story of the Global Business Outlook’s final edition for 2025 will focus on Crown Prince Salman bin Hamad Al Khalifa, the current Prime Minister of Bahrain, who is guiding the Gulf nation toward a diverse and sustainable economy. As the architect of “Economic Vision 2030,” the Crown Prince is working to strengthen Bahrain's financial and education sectors, promoting innovation in the process.

Thomas Kranjec Editor kimberly@gbomag.com

Editor's Note

Director & Publisher

Krushikesh Raju

Editor

Thomas Kranjec

Production & Design

Brian Williams

David Brenton

lan Hutchinson

Shankara Prasad

Editorial

Stanley Rogers

Rachel Taylor

Lucas Cooper

Tom Hardy

Business Analysts

Adam Fagoo

Arthur Salt

Jerry Thomas

Sumith Jain

Business Development Manager

Benjamin Clive

Head of Operations

David Pereira

Marketing

Danish Ali

Research Analysts

Richard Sam

Sophia Keller

Accounts Manager

Edyth Taylor

Press & Media Contact

Craig Penn

Registered Office

Global Business Outlook Magazine is the trading name of

Business Outlook Media Ltd

Congress House, 14 Lyon Road, Harrow HA1 2EN.

Phone: +44 203 642 0805

Fax: +44 (0) 203 725 9247

Email: media@gbomag.com

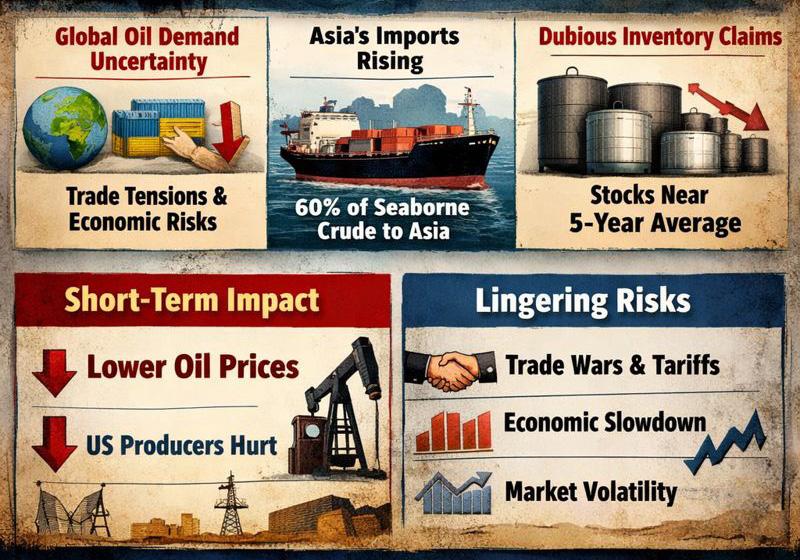

China Analysis

GBO Correspondent

The myth of China’s resilience, that its people are prepared to 'eat bitterness' while Westerners crumble under inconvenience, is outdated

Are there any non-secret weapons that China can use to outlive the United States in the trade war? It may appear such. Chinese officials urge young people that, in contrast to fat and slothful Americans, they should learn to bear adversity—or, as the Chinese say, "eat bitterness."

Because of its autocratic leadership, which tolerates no criticism, decisions should be made more easily and remain in place longer than in a divided America. Additionally, there are other ways for China to negatively impact American businesses, who can be counted on to pressure Washington to take a step back. However, these notions represent an outdated perspective on China and a basic misinterpretation of its political and economic structure.

Consume bitterness? Yes, back when China was much poorer. The Communist Party's legitimacy is mostly predicated on an implicit agreement that it will raise living conditions rather than lower them, and it currently has the same middle-class ennui as the United States.

What about the ability of a dictatorship to make decisions quickly? Not at all. Options are thoroughly examined and reexamined by Beijing's intricate bureaucracy before being sent up the chain for decision-making. Despite being the most powerful leader, Xi Jinping seeks agreement from the senior party leaders he appointed.

If anything, the United States is far more analogous to oneman rule than China when it comes to making decisions in the trade war. The fact that Donald Trump can impose, raise, cut, or stop tariffs at his discretion is one reason why he could enjoy them. On issues presented as preserving national security, the courts typically defer as well, and Congress has given the executive branch its constitutional tariff authority.

Of course, China has many options for trying to force the United States to give in, but each one has serious disadvantages.

Calling the "abnormally high numbers" a "joke in the history of the world economy," it can keep on matching Washington’s tariff hikes. Yes. They will crash orders and stop trade since they are so high right now, but don't expect Trump to see it that way.

Or Beijing might use antitrust investigations, restrictions on Hollywood movies, and the blacklisting of certain American exporters to put pressure on American businesses, which is what they are beginning to do. However, if you push too hard there, the foreign investment that China relies on for technology and jobs, which has decreased since the pandemic, will go.

Next is China's renowned dominance over the minerals and so-called rare earths that are used in electronics manufacturing. However, American businesses typically don't purchase the minerals straight from China. Instead, they come in components that are sold to customers in the United States. If Beijing exerts too much pressure, other countries will be encouraged to match Chinese mining and processing subsidies.

China depreciated its yuan to offset

And lastly, financial weapons. To lower the cost of its American exports, which were subject to tariffs ranging from 7.5% to 25%, China somewhat depreciated its yuan during the most recent trade war. However, even to partially offset three-digit taxes, the Chinese yuan would have to suffer a huge hit. This would make imports extremely costly in China and lead to a large capital flight as regular Chinese look for methods to exchange their yuan for dollars or euros.

On the other hand, the yuan would appreciate and

Source: Statista

Chinese exports would become even more costly if China attempted to sell off its hoard of over $760 billion in US Treasury notes, which would raise interest rates in the world’s largest economy. Once more, that is not what China desires.

Even though the ongoing trade war could harm Beijing more, China might attack the United States in any of the numerous methods mentioned. Alternatively, it may remain mostly motionless and wait for the US president to cause the economy to collapse.

The 125% tariffs on the United States' third-largest trading partner, which produces a wide range of products from iPhones to industrial components and Christmas lights, will significantly increase costs in the US. This may push the nation towards a recession. Furthermore, the poor will be more negatively impacted by tariffs than the wealthy, who can afford higher prices, as is always the case. Customers will be encouraged by Democrats, and possibly even retailers, to view the tariffs as a Trump sales tax.

Regardless of what China does, that alone will put pressure on the US to settle. There's yet another twist. Chinese producers have a strong incentive to avoid taxes by shipping their goods through a third country because the US currently charges at least 125% tariffs on anything from China and just 10% duties on items from everywhere else. That would drastically cut into the tariff revenue that Donald Trump and other Republicans rely on to support their agenda.

There are strong incentives for both countries to reach an agreement that would at least defuse the trade conflict. According to China's Commerce Ministry, "dialogue and consultation" are welcome. Donald Trump stated that he wants to talk to Xi Jinping about an agreement. He is using

his flattery playbook to get a favourable response, referring to his Chinese colleague as "a proud man" and using other praises.

When all the grandstanding is stripped away, what becomes painfully clear is that a prolonged trade war between the US and China is not only damaging for both nations, it’s strategically unwinnable for China, and arguably for America as well.

Despite the tough rhetoric and occasional sabre-rattling from Beijing, the structural weaknesses of China’s economic and political model make it ill-equipped for a sustained standoff.

The myth of China’s resilience, that its people are prepared to “eat bitterness” while Westerners crumble under inconvenience, is outdated. Modern China is not the ascetic, collectivist society it once was. It is home to a burgeoning middle class with rising expectations, consumer habits, and economic anxieties not so different from those in the United States. The Communist Party knows this. Its legitimacy now depends far more on delivering prosperity than ideology, and that leaves little room for policies that cause long-term pain without clear gain.

Even the idea of China's authoritarian efficiency is more illusion than fact.

Decision-making in Beijing is clogged with internal consultation, rigid hierarchy, and factional politics. Xi Jinping, while powerful, still operates within a system where every major move needs to be vetted and approved across multiple layers. Ironically, it’s Trump’s America, where a single person can change tariffs overnight, that acts more like a command economy in this context.

And though China has tools at its disposal, from currency manipulation to export restrictions and political targeting of American firms, none come without serious collateral damage. Weaponising

rare earth exports could inspire global competitors. Squeezing American businesses risks scaring off the very foreign capital that sustains China’s innovation and employment. Even depreciating the yuan too much could lead to inflation and capital flight, weakening domestic stability.

The US isn’t invincible either. Tariffs that go as high as 125% will eventually blow back on American consumers and businesses. The poorest will suffer most, inflation could spike, and key industries could face disruption. The political pressure will grow, especially in an election cycle.

Chinese exporters are already rerouting goods through third countries to avoid US tariffs, undermining both the effectiveness of the policy and the revenue that American politicians tout as justification. In this kind of economic chess match, both sides are bleeding, even if one believes they’re winning.

Ultimately, a trade war cannot have a winner when the weapons used cause mutual harm. China may be able to

withstand certain blows longer than anticipated, but it cannot emerge victorious without sacrificing the very progress it’s made over the past 40 years.

The United States, for its part, risks recession, division, and long-term damage to credibility. Both sides know this. That’s why beneath the noise, there’s still talk of deals, handshakes, and mutual praise. Because for all the chest-thumping, what both countries really want is not war, but a way out.

In the end, the trade war is a lose-lose situation. Both nations are exposed to real economic pain, and no single tactic can give either side a decisive advantage without creating major downsides. China cannot rely on its old strengths, and the United States cannot ignore the costs at home. What matters most is finding a negotiated solution that limits damage, restores trade flows, and prevents long-term harm to businesses and consumers in both countries.

Chinese producers have a strong incentive to avoid taxes by shipping their goods through a third country because the US currently charges at least 125% tariffs on anything from China and just 10% duties on items from everywhere else Analysis

Saudi Arabia is enhancing its transportation system to accommodate the large influx of fans and tourists that will come with hosting the FIFA World Cup

GBO Correspondent

Saudi Arabia aims to become a diversified, all-round economy within the next five to six years, as outlined in its ambitious “Vision 2030” agenda. According to analysts, the Kingdom's successful bid to host the FIFA World Cup in 2034 will add a major feather.

Over the past few years, Saudi Arabia has rapidly established itself as one of the world’s

premier venues for major sporting events, using these to elevate its geopolitical and economic statuses not only in the Gulf, but around the world.

The FIFA World Cup is set to be the largest and most symbolic event in this transformation, offering the Kingdom a platform to showcase its cultural depth, administrative capabilities, attractive tax regime, and growing foreign direct investment (FDI) opportunities.

A sector-specific investment plan for sports was developed in 2021, including a comprehensive study of 88 investment opportunities and a complete map of value-added chains in the sports sector

- Khalid Al-Falih

In fact, as per the Assistant Minister of Investment, Ibrahim Al-Mubarak, the market value of the Saudi sports sector has reached SR32 billion, compared to less than SR5 billion at the time of the launch of “Vision 2030” in 2016, brainchild of Crown Prince Mohammed bin Salman.

In April 2025, Saudi Minister of Investment Khalid Al-Falih, at the first "Sports Investment Forum" in Riyadh, stated that the target for the sector is to reach more than SR80 billion by 2030, while crediting factors like legislative structure, financial governance, and investment areas and models, that is not only turning sports into an integrated economic sector but also opening promising horizons for businesses.

Al-Mubarak said that the rate of sports practised in the Kingdom has increased from 13% to 48% currently since the launch of Vision 2030. Since 2016, more than 70

new sports federations have been established, overseeing activities covering various Olympic and non-Olympic sports, reflecting the diversity of the Saudi sports sector. Saudi Arabia has hosted more than 100 international championships, events, and activities.

The Ministry of Investment considers sports in the Kingdom to be an essential element in building a modern economy, shaping human capital, and building national identity. Sports is no longer a complementary sector, as it has become an avenue for reshaping the national economy, attracting investment, and building new value chains.

“The Ministry of Investment is working in an integrated partnership with the Ministry of Sports, the Public Investment Fund, sports federations, and all relevant entities to enable investors to enter the sports market with ease and transparency, based on modern legislation. This is achieved through initiatives, most notably developing a map of investment opportunities in the sports sector. This

includes infrastructure such as the construction of stadiums, training complexes, private clubs, and smart sports facilities; sports services such as marketing, media, sponsorship, and consulting services; and sports technologies like AI in sports performance, rehabilitation technologies, and interactive digital platforms. It also has sports tourism, specialising in the development of tourism programmes and packages that attract visitors to attend tournaments or practice sports in the Kingdom.” Al-Falih said.

Various incentives are being offered to investors, such as exemptions, logistical support, financing facilities, and partnerships with government agencies and programmes. The establishment of specialised business centres within and outside the ministry supports investors in the sports and other sectors, from the initial stage to operation and expansion, while providing information and studies.

Al-Falih also pointed out that a sector-specific investment plan for sports was developed in 2021, including a comprehensive study of 88 investment opportunities and a complete map of value-added chains in the sports sector. Twenty of these priority opportunities were identified, including sports clubs, academies, apparel, sports equipment, and sports facilities, with a total value of up to SR20 billion.

Within this framework, the Kingdom will host the AFC Asian Cup 2027 and the 2034 World Cup. The Gulf nation is certainly betting big on these two events to become a global hub through sustainable investments, world-class infrastructure, and an integrated and supportive legislative system.

While these two events will come with massive costs and benefits, the potential economic and social benefits could outweigh the investment if managed strategically. Let’s see what happened with Qatar and its tryst with the 2022 World Cup. The Gulf nation reportedly spent between $200 to $300 billion on infrastructure projects over a decade, while the short-term benefits (primarily visitor spending and broadcasting rights)

contributed approximately 1% of its GDP. In pure tourism revenue, Qatar gained between $2.3 billion and $4.1 billion, representing 0.7% to 1.0% of GDP in 2022 alone.

Saudi Arabia, with its larger economy and broader “Vision 2030” initiatives already underway, could expect even higher absolute figures. The indirect benefits, such as increased foreign direct investment, higher tourism inflows, and stronger nonoil sector growth, could have a much more profound effect.

Qatar’s experience shows that targeted infrastructure investments, beyond the immediate needs of the World Cup, can boost non-hydrocarbon income by as much as 40% over a decade. Saudi Arabia, with its ambitious reform programmes, may see even greater multipliers.

Moreover, hosting the tournament will solidify the Kingdom’s growing global influence, demonstrating its capabilities in project management, governance, and large-scale event hosting. On the infrastructure front, Saudi Arabia plans to build 15 new stadiums or refurbish existing ones across key cities such as Riyadh, Jeddah, Alkhobar, Abha, and NEOM. In Riyadh alone, six of the eight proposed stadiums will be entirely new, something which will put the city in direct competition with London, which boasts 22 stadiums across its entire urban area.

The new "NEOM Stadium," situated 350 metres above the ground, promises a futuristic experience, reinforcing the Kingdom’s commitment to innovation and modernity. Meanwhile, Jeddah will see the construction of three new stadiums and the refurbishment of an existing one. This scale of development is expected to contribute not just to World Cup success but to Saudi Arabia’s long-term strategy of boosting the non-hydrocarbon share of its GDP.

In hospitality, several new hotels will be constructed, including FIFA headquarters hotels in Riyadh’s New Murabba district, luxury accommodations for VIPs in Khobar’s Al-Olaya district, and exclusive venues

The new NEOM Stadium, situated 350 metres above the ground, promises a futuristic experience, reinforcing the Kingdom’s commitment to innovation and modernity

FIFA World Cup

The turning point for the league was the time when Al-Nassr signed football legend

Cristiano Ronaldo to a two-year contract worth $200 million

near Abha. King Salman International Airport in Riyadh will also expand, thereby aiming to accommodate up to 100 million passengers per year, representing a 170% increase compared to 2023 capacity.

Apart from sports and hospitality, another sector which will directly benefit from the 2034 World Cup bid is tourism, which is already experiencing impressive growth. In 2023, the Kingdom ranked among the fastest-growing countries for international tourist arrivals, according to the United Nations.

Hosting the event will further boost the Gulf major’s image as a desirable travel destination and cultural hub, thereby increasing the nation’s global visibility, encouraging cross-cultural interaction, and, most importantly, driving consumer spending. South Korea’s World Cup in 2002 brought in more than 2 million additional foreign visitors, while Russia in 2018 welcomed 570,000 tourists

during the event alone. Qatar also saw a remarkable post-tournament boom in tourism.

What Saudi Arabia needs here is targeted marketing strategies to promote post-World Cup tourism, which will ensure cultural, religious, and adventure tourism sectors continue to flourish, as major sporting events like the World Cup may end up temporarily diverting tourists from traditional hotspots, leading to short-term disruptions.

Job creation is another area that will reap the benefits from the excitement around the World Cup. Estimates suggest that World Cup preparations and the tournament itself could create more than 1.5 million new jobs in the Kingdom, representing nearly 10% of the current workforce. Again, going back to history, Russia anticipated around 220,000 jobs from the 2018 World Cup. Qatar claimed that 1.5 million new jobs were created in construction, real estate, and hospitality sectors during its preparation phase, with 850,000 additional residential sector

jobs added between 2010 and 2022.

A successful World Cup will underline Saudi Arabia’s commitment to reform, providing confidence to potential investors across sectors like finance, manufacturing, IT, and tourism. The requirement to follow FIFA’s infrastructure guidelines will boost standards across transport, hospitality, and urban planning—benefiting the economy long after the tournament’s conclusion. However, one immediate challenge here will be upkeeping and using the stadiums for long-term gains, as maintenance costs could be substantial.

Talking about the Kingdom's tryst with major sporting events, 2024 marked a pivotal year for the Gulf nation as it hosted many internationally recognised sporting events such as the Dakar Rally, the Formula 1 Saudi Arabian Grand Prix, the World Table Tennis Grand Smash, the Women’s Tennis Association Finals, and the Esports World Cup, in addition to growing the Saudi Pro League for professional football (soccer), thereby proving its organisational ability to showcase such showpiece tournaments, something which will keep the administration confident ahead of the World Cup 2034.

According to SURJ Sports Investments (Saudi Arabia's leading sports investor), the Saudi sports industry, currently valued at roughly $8 billion, will reach $22.4 billion in 2030. The Kingdom has initiated key developments, such as King Salman’s $23 billion project to build “The Global Sports Tower,” a state-of-the-art sports facility set to become the largest sports tower in the world.

Additionally, the Kingdom has started internal developments, like enhancing its transportation system, to accommodate the large influx of fans and tourists that will come with hosting the FIFA World Cup.

The Saudi Pro League has garnered significant global attention due to its high-profile signings of players from top football leagues, including LaLiga, the Premier League, Ligue1, and the Bundesliga. In 2024, the clubs spent roughly $1 billion to secure international

talent, including Neymar, who joined Al-Hilal from Paris Saint-Germain for roughly $98 million. The turning point for the league was the time when Al-Nassr signed football legend Cristiano Ronaldo to a two-year contract worth $200 million. Now the league boasts players like Karim Benzema, N’Golo Kante, Roberto Firmino, Sergej Milinkovic-Savic, Sadio Mane, Riyad Mahrez, and Jordan Henderson, which has elevated the league’s presence internationally.

Dr. Yaseen Ghulam, associate professor of economics and director of research at Riyadh's Al-Yamamah University, told Arab News that the last World Cup in Qatar was a major investment, with the Gulf country spending $200-$300 billion on infrastructure over a decade.

While short-term benefits from visitors’ spending and broadcasting rights were estimated at about 1% of GDP, tourism and tournament-related revenue were projected at $2.3-$4.1 billion, or 0.7%-1.0% of GDP in 2022.

Indirect benefits included higher FDI and tourism, while non-hydrocarbon income rose 40% during the decade of World Cup preparation through infrastructure investment and economic diversification.

For Dr. Ghulam, Saudi Arabia saw significant foreign tourism growth in 2023, per the UN. Large sporting events can boost a nation’s global reputation, promote tourism and cross-cultural interactions, and support economic development.

Hosting mega-events like the FIFA World Cup can increase GDP, jobs, tourism, and the national brand. By showcasing administrative skills and offering incentives, the Kingdom can attract FDI in finance, manufacturing, IT, and tourism. Following FIFA infrastructure guidelines boosts hospitality income and strengthens the Gulf nation’s global standing.

Top 10 Saudi Pro League clubs by average home attendance for the 2024-2025 season

Al-Ittihad Club 34,491

Al-Ahli SFC 22,887 Al-Hilal SFC 17,869

Al-Nassr FC 16,978 Al-Qadsiah FC 9,010 Al-Fateh SC 6,947 Al-Ettifaq FC 5,933 Al-Khaleej FC 5,565 Damac FC 5,245 Al-Taawoun FC 5,027

Cover Story

Bahrain

Crown Prince

Under Crown Prince Salman bin Hamad Al Khalifa's leadership, Bahrain has turned a corner from a complacent oil rentier to a more diversified, futureoriented economy

There is a question that was often secretly whispered but never posed in GCC (Gulf Cooperation Council) forums and press meets for decades. It pointed to an inevitability that unsettled the rulers and subjects of the region. The question is simple: “What would you do when you run out of oil?”

When the old guards of each of these nations handed the helm to newer generations, each Gulf economy had a bold new vision on how to thrive in a post-oil economy. There are ambitious growth milestones like Vision 2030, 2040, or 2071 adopted by major GCC players to diversify, including Saudi Arabia, the UAE, and Oman.

Bahrain's oil production dropped to just 35,000 barrels per day, barely enough to fill two Olympic swimming pools. Crown Prince Salman bin Hamad Al Khalifa took the seat of Prime Minister under such critical conditions, and there is no one more pivotal than him in Bahrain's economic renaissance.

As the heir to the throne and the serving Prime Minister since 2020, Crown Prince Salman bin Hamad Al Khalifa has used his decades of experience

in leadership roles across different sectors within the nation to push a radical reformation agenda for the Island Kingdom.

The world sees him as a young and dynamic leader who is spearheading an ambitious economic agenda that will broaden the economic base of Bahrain. He is the architect of “Economic Vision 2030” and is often credited for progressing the arduous task of diversifying Bahrain's traditional oil-intensive economy.

Under his reign, the island's financial sector has strengthened, and education, with innovation, is booming as well. Despite being in the middle of two of the region's most powerful rivals, Saudi Arabia and Iran, Bahrain is doing surprisingly well and remains a haven with no conflict.

Bahrain had always been a rentier economy (a system where national income is primarily derived from renting out indigenous resources to external clients). Before oil, it was pearls and trade duties. For four thousand years, pearling was integral to the island,

with even Assyrians and Roman writers like Pliny the Elder praising the quality of Bahraini pearls. The 19th and 20th centuries were the golden age of pearling for Bahrain, with at least 30% of its population involved in diving, selling, sailing, or polishing, and around 97% of Gulf pearls were traded through Bahrain.

For a small desert island, water-scarce and hostile to vegetation, pearling was a lifeline, a lifeline that was severed when a Japanese entrepreneur, Kokichi Mikimoto, produced the first commercially viable cultured pearl in 1893. It made dangerous sea diving and the seasonality of pearling obsolete.

The Japanese pearl farms had turned it from regal jewellery into something that became increasingly affordable. The disruption and the effects on Bahrain cannot be discounted, as prices of pearls fell by 85%, leaving many divers and merchants in ruin. The “Great Depression” of the 1920s destroyed any remaining demand for luxury goods.

But something miraculous happened when British geologist Major Frank Holmes convinced Bahrain's ruler, Sheikh Hamad bin Isa Al Khalifa, to drill oil wells on the island, leading to the discovery of the first oil well at Jebel Dukhan.

This led to the establishment of the Bahrain Petroleum Company (BAPCO), which was created by Standard Oil of California (which would later be named Chevron), and a new rentier economy with oil instead of pearls. From fishing villages, people shifted fast into roles tied to oil work, helped by jobs built from royalty income. Life in Muharraq, long centred on pearling, slowly gave way to Manama’s rise under new pressure. Money from crude flows fuelled roads, offices, and schools, turning quiet towns into bustling centres within years.

Fast forward a couple of years, and the oil pulled from wells powered a broad shift into today’s world. There were new roads, schools, hospitals, and housing mushrooming in Manama. By midcentury, Bahrain had developed a refinery and new towns like Awali for oil workers, laying the foundation for industrialisation. This is proof that Bahrain can withstand historical macro-economic shifts and even come out stronger.

However, Bahrain's oil reserves were modest in comparison to those of its neighbours, and they were quickly drying up. It had only one ageing oil field and no vast sovereign wealth to fall back on. Ever since then, successive rulers have been determined to diversify as much as possible. But the older generation, led by Prime Minister Sheikh Khalifa bin Salman Al Khalifa (the longest-serving Prime Minister in the world), was conservative and emphasised stability and caution, reflecting the challenges of their era.

Bahrain was yearning for reform, and Crown Prince Salman bin Hamad Al Khalifa was the man for the job. Even when he was younger, he was well respected by his father's generation and the

According to the World Bank’s "Doing Business" rankings released in 2019, Bahrain stood at 43rd place worldwide, noted among the fastestimproving economies

youth for his Western education at the Royal Military Academy Sandhurst and Cambridge University, and his progressive economic views.

His appointment as Crown Prince happened in the same year as the coronation of his father in 1999. In 2013, he was appointed Deputy Prime Minister, and over the decades, he built an image as the architect of Bahrain's economic reform.

He created a sort of shadow government via the Economic Development Board (EDB) to push change around an otherwise entrenched political establishment. In the 2000s and 2010s, Salman bin Hamad Al Khalifa quietly championed initiatives to modernise governance, attract investment, and invest in people.

Under his leadership, the EDB helped design and launch Bahrain's “Economic Vision 2030.” It was formulated in 2008 as a strategic plan to diversify the economy beyond oil. Vision 2030 sets out goals to build a knowledge-based economy and double household incomes by the

target year.

Boosting business activity and encouraging small business growth take centre stage in the strategy. Efficiency and openness within public institutions receive equal attention. Improving learning outcomes and worker abilities also stands among long-term goals. New sectors such as finance and transportation logistics slowly gain momentum, with support for modern tech systems, and renewable power joins this effort. Relying less on oil for funding has become a priority moving forward.

Around 2015, hints began appearing that Bahrain’s economic shift was gaining momentum. According to the World Bank’s Doing Business rankings released in 2019, Bahrain stood at 43rd place worldwide, noted among the fastest-improving economies, thanks to bold regulatory changes. Instead of long waits, starting businesses now faces far fewer hurdles due to streamlined procedures.

Digital systems replaced paper-based approvals for building projects, cutting delays. Even court proceedings moved faster, with reforms aimed at speeding up legal resolutions. Nowhere was growth louder than in fintech, where overseas funds began flowing fast. Logistics drew interest, too, along with factories needing capital. Tourism also drew attention, becoming one of the busier destinations for outside money.

Notably, Bahrain built on its early financial heritage. Unlike newly developed Gulf hubs, it has a long-standing banking sector and was the first in the region with a modern stock exchange and central bank. Under Salman's stewardship, Bahrain doubled down on finance and tech.

Cost analyses have repeatedly shown Bahrain as the lowest-cost GCC hub for fintech (about 48% cheaper than peers). Global firms took note: Citigroup opened a major tech hub in Manama, planning 1,000 Bahraini jobs, and JPMorgan Chase launched a Gulf tech centre.

Even through the uncertainty, the figures stayed put right up until 2022, showing a close to 4% jump, all while oil prices slipped. Right after the COVID-19 pandemic, Bahrain jumped into recovery mode. Thanks to solid public health moves plus steady change

Bahrain

Crown Prince

efforts, its budget gap almost vanished overnight.

By 2022, that gap had dropped close to 1.2% of economic output, down from about 6.4% just a few years before. Public borrowing also levelled off when measured against the national size. Higher crude prices helped, yet steady spending changes played a key role too.

In 2019, it brought in a 10% value-added tax to boost income, while 2022 saw a similar 10% tax on profits for bigger companies roll out. Many believed those strict changes would finally help cover public spending costs.

Bahrain's path is starkly different from its neighbours. It neither has Saudi Arabia's oil reserves nor Dubai's vast development budgets, but the Kingdom focuses on smallstate advantages like agility, cost-competitiveness, and specialised sectors.

Consider financial technology. The Kingdom has positioned itself as a regional fintech hub with striking success. Another strength that Bahrain has is its agile decision-making. It was the first in the region to adopt fintech-friendly licences and blockchain initiatives, moving quickly where others hesitated.

Back in 2018, Bahrain was one of the first in the world to pass a “data embassy” law, allowing foreign tech firms to host data on Bahraini soil under their home country's legal jurisdiction. It was an audacious move, and global tech titans who needed data sovereignty guarantees flocked to the archipelago.

An easier comparison to make is with Dubai's growth strategy. The UAE's crown jewel emphasises large-scale tourism, sprawling real estate developments, and highprofile spectacles like “Expo 2020” to draw millions of visitors and expatriates. Saudi Arabia, meanwhile, is embarking on massive, oil-funded megaprojects like NEOM to diversify its economy through sheer financial force.

Bahrain has instead exploited quieter strengths. Its workforce is well-educated, with 54% of Bahrainis holding college degrees. The Middle East is notorious for gender disparity, yet Bahrain's private sector ranks among the highest in the Arab world, with roughly 50% of the labour force being women, compared to about 33% in the UAE. These reflect decades of investment in human capital and social policy.

Another major point of differentiation is financial transparency. It has garnered an image over the years of a liberal banking centre with a strong regulatory framework and lower taxes. It's always been wary of

corporate taxation and has been content with oil revenue and government fees.

In fact, it was one of the last nations in the GCC to impose a corporate tax. They did in 2022 but have announced a 10% corporate tax in 2025, which is comparable to their neighbours, and their domestic fuel prices are now tied to global benchmarks.

These were painful, unpopular, but necessary reforms. Saudi Arabia and the UAE, with their sovereign wealth funds and vast oil resources, could procrastinate on such measures, but Bahrain was forced to make necessary changes due to a scarcity of resources. It was a test of political will that is paying off.

The Prime Minister's economic reform was not incremental but a reconstruction. The EDB pulled $1.5 billion from new project proposals in 2024 under his leadership. Even Citigroup and JPMorgan Chase built tech hubs in Manama.

Crown Prince Salman bin Hamad Al Khalifa didn't just tinker with subsidies; he dismantled them. Fuel and utility price reforms, introduced tentatively in 2016-18, became permanent fixtures by late 2025. Electricity and water tariffs climbed upward, though protections shielded the poor from the harshest impacts. Government salary growth flatlined.

These weren't popular decisions, as they sparked grumbling across coffee shops and majlises, but they worked. By 2023-24, credit rating agencies like S&P began acknowledging reality.

Bahrain's outlook was improving because the structural bones had been reset.

Infrastructure demands collided with budget constraints, producing an unexpected solution, which is publicprivate partnerships at scale. Roads materialised, housing developments sprouted, schools opened their doors, all financed through private capital, while the government conserved its dwindling resources.

A multi-billion-dollar housing expansion signed in 2024 exemplified this model, transferring fiscal strain from public coffers to private balance sheets. Perhaps most symbolically, Bahrain sold a minority stake in BAPCO itself to international investors.

The move accomplished two goals simultaneously. It injected capital and imported technical expertise. For a nation built on state-owned petroleum, privatising even a fraction of the national oil company marked a psychological threshold.

Also, international assessments began placing Bahraini students above regional averages in mathematics and science. The Crown Prince himself became a fixture at student delegations, preaching the gospel of STEM education to teenagers who would inherit this transformed economy. Today, Bahrain boasts one of the Arab world's highest proportions of female board members in publicly listed companies.

Crown Prince Salman bin Hamad Al Khalifa’s bold plans for artificial intelligence (AI) and digital upgrades across the nation began as early as 2018. The same year, filing for

In

IMD’s 2025 list across countries, Bahrain

ranked fourth, ahead of much larger places, for worker skills, a result some found hard to believe given that under 1.5 million people live there

business bankruptcy lost its criminal label, easing fear and shame tied to financial risk. In IMD’s 2025 list across countries, Bahrain ranked fourth, ahead of much larger places, for worker skills, a result some found hard to believe given that under 1.5 million people live there.

As of 2025, Bahrain stands at a crossroads. The economy is notably more diversified than it was a decade ago. Oil now contributes under 20% of GDP, whereas financial services, manufacturing, and tourism each account for significant shares.

The banking sector is robust, and Bahrain has become a small-scale centre for hospitality, with international hotels and some cruise traffic, and logistic re-exports. Petroleum refining and some petrochemicals still add value, but at this stage, it's service-led growth.

International ratings reflect cautious optimism. The IMF's 2023 Article IV report highlights that Bahrain's fiscal deficit shrank to about 1% of GDP and that authorities are “strongly committed” to further reforms. The Central Bank maintains ample foreign reserves. In surveys, investors now rank Bahrain's legal framework and transparency above many neighbours.

Under Crown Prince Salman bin Hamad Al Khalifa's leadership, Bahrain has turned a corner from a complacent oil rentier to a more diversified, future-oriented economy. His blend of consensusbuilding, technocratic management, and openness to innovation has been a departure from both Bahrain's own recent past and from some of its more conservative neighbours. As regional economies grapple with post-oil realities, Bahrain's experience, and the Crown Prince's role in it, will be watched closely as a test case of small-state adaptation.

GBO Correspondent

Contrary to the stereotype of the 'lazy youth' waiting for a handout, African graduates inhabit a zone of active waiting, engaged in a frantic, often invisible hustle to survive

For decades, the prevailing economic narrative for Africa has hinged on the "demographic dividend," the theoretical economic boom generated by a massive, youthful workforce entering the labour market. By 2050, the continent will house the largest workforce in the world, with youth populations in Nigeria and Tanzania projected to explode.

Yet, as 2025 draws to a close, this dividend is increasingly resembling a demographic disaster. The transition from higher education to gainful employment, once viewed as a reliable social contract, has fractured.

In September 2025, a landmark study released by the Human Sciences Research Council (HSRC) and the Mastercard Foundation, titled "The Imprint of Education," poses a haunting question: “Graduated, now what?” The answer, for millions of young Africans armed with degrees and certifications, is not a career, but a complex, indefinite suspension in a state of "waithood." This term, popularised by social anthropologist Alcinda Honwana, describes a systemic delay in achieving social adulthood, a status defined not just by age, but by financial independence, the ability to establish a separate household, and the capacity to support a family.

Today, structural unemployment has barred the gateway to these milestones. However, the HSRC study reveals that this period is far from passive. Contrary to the stereotype of the "lazy youth" waiting for a handout, African graduates inhabit a zone of "active waiting," engaged in a frantic, often invisible hustle to survive.

They are responding to labour market exclusion by constructing "portfolios of livelihood," where a single income stream is no longer sufficient. A graduate in Nairobi or Lagos might simultaneously hold a low-paying administrative job, run a side business selling goods on Instagram, and engage in subsistence

farming. While this diversification acts as a rational hedge against volatility, it often prevents the deepening of specialised skills, trapping many in a "jack of all trades, master of none" cycle.

The phenomenon of "education as shelter" sees thousands of youths pursuing postgraduate degrees not merely for intellectual advancement, but to remain within the institutional safety of the university system, masking their unemployment status while relying on scholarships as temporary income.

A comparative analysis of Nigeria, South Africa, Kenya, and Ghana in 2024-2025 reveals distinct structural pathologies that have led to "jobless growth." Nigeria, the continent's most populous nation, presents a case of statistical dissonance.

While earlier reports cited unemployment figures as high as 33%, the National Bureau of Statistics (NBS) reported a headline unemployment rate of just 4.3% in Q2 2024.

This precipitous drop is not an economic miracle but the result of a new methodology that classifies an individual as "employed" if they work for at least one hour a week. This technicality obscures the lived reality of "working poverty."

In Nigeria, 92.7% of the employed workforce operates in the informal sector, often in low-productivity roles that offer no social protection or path to advancement. The "misery index," the combination of unemployment and inflation, remains punishingly high, jumping to 38.3% in mid-2024. For the Nigerian graduate, the crisis is not just the absence of work, but the absence of decent work that pays a living wage.

In stark contrast, South Africa faces a crisis of mass exclusion. Official data places the Q3 2024 unemployment rate at 32.1%, with youth unemployment (ages 15-34) at a staggering 45.5%. Unlike Nigeria’s informal absorption, South Africa suffers from entrenched long-term unemployment.

The proportion of unemployed persons who have been jobless for a year or longer has risen to 76.7%. Once a young South African falls out of the education system without securing a job, the probability of re-entry diminishes exponen-

Source: Statista

tially, creating a "lost generation" cemented into permanent economic inactivity.

When it comes to East Africa, Kenya has aggressively positioned itself as the "Silicon Savannah," betting on the digital economy to absorb its youth bulge. While the Kenya National Bureau of Statistics reported a youth unemployment rate of roughly 12% in 2024, underemployment remains rife.

The gig economy offers flexibility, but often lacks social protection. Similarly, Ghana faces a youth unemployment rate of approximately 32% for those aged 15-24, despite government efforts to stimulate entrepreneurship.

The data confirms that across the continent, the formal sector is structurally incapable of absorbing the 10 to 12 million youth entering the labour market annually, leaving the majority to navigate the precarious informal economy.

A critical driver of this disconnect is the misalignment between educational output and market needs. The "paper qualification" trap has led to credential inflation, where employers demand degrees for roles that previously required only secondary education, yet find graduates woefully unprepared. Research from the African Development Bank highlights a "vertical mismatch," where 28.9% of employed African youth are under-skilled for their roles despite their degrees.

More pressing is the digital skills gap. While mobile penetration is high, advanced digital literacy, coding, data analysis, and cybersecurity remain low. The IFC estimates that closing this gap could create 650 million training opportunities by 2030, representing a $130 billion market potential. In response, governments and the private sector have launched

massive intervention programmes with varying degrees of success. Nigeria's “N-Power Scheme,” a state-led social safety net, successfully deployed over 500,000 beneficiaries but struggled with long-term sustainability and the transition of beneficiaries into permanent private-sector jobs.

Contrastingly, South Africa’s Youth Employment Service (YES) offers a market-led model. By incentivising companies with B-BBEE (Broad-Based Black Economic Empowerment) credits, YES has created over 200,000 work experiences since its inception, injecting billions into the economy through youth salaries. The programmes' absorption rate, where approximately 28% of participants find permanent work, demonstrates the value of integrating youth directly into corporate supply chains rather than relying on abstract training.

Kenya’s “Ajira Digital Programme” represents a strategic pivot toward the gig economy. By training youth in digital transcription, data entry, and digital marketing, the government aims to position Kenya as a global freelance hub. Reports indicate that over 33% of youth trained under the Ajira curriculum have successfully earned income online, validating the potential of the "iWorker" model. However, this also highlights the reliance on global demand and the vulnerability of gig workers to algorithm changes and a lack of benefits.

In Ghana, the focus has been on turning job seekers into job creators through the “YouStart” initiative, which provides grants and soft loans to youth-led MSMEs. Yet, the African Youth Survey (AYS) 2024 indicates that while 71% of youth desire to start businesses, capital access remains the primary barrier. Without robust access to credit, state-sponsored entrepreneurship risks creating a tier of subsistence enterprises rather than scalable SMEs.

The consequences of "waithood" extend far beyond economics. They are reshaping the geopolitical landscape of the continent. When "active waiting" yields no results, the final option for many is exit. The "2024 African Youth Survey" delivers a sobering verdict: nearly 60% of young Africans are considering emigrating in the next three years.

In countries like Nigeria and Ghana, almost half of those considering migration view it as a permanent move, signalling a potential "brain drain" that threatens to strip the continent of its most educated tier—the nurses, engineers, and teachers essential for development.

Frustrated with Western models of democracy and development that have failed to deliver economic dignity, African youth are increasingly looking East. The survey reveals that 76% of African youth now view

China as an influential power, with 82% viewing that influence positively. Russia’s influence is also perceived as rising, particularly in South Africa and Malawi, as youth attribute blame for global instability to Western leaders.

The "demographic dividend" requires the structural transformation of economies to absorb labour. The path forward demands moving beyond the fetishisation of the university degree toward vocational agility and digital competency. It requires the formalisation of the gig economy to protect the emerging "iWorker" class and a recognition that, without substantial job creation, the waiting room of African adulthood will eventually run out of space. As 2026 approaches, the question “Graduated, now what?” must be met with more than silence.

In Nigeria, 92.7% of the employed workforce operates in the informal sector, often in low-productivity roles that offer no social protection or path to advancement

The US is not yet in recession, but there are increasing signs of trouble ahead

GBO Correspondent

Things have been tough for the American economy of late. President Donald Trump, apart from announcing "reciprocal tariffs" against Washington's allies and adversaries alike, then backflipping from it, went after Federal Reserve Chair Jerome Powell for keeping interest rates "too high."

What do these actions suggest? Is Trump panicking? Is the world's largest economy going into the doldrums due to the Republicans' tariff game? However, one thing is clear: speculation of a potential recession, which was circulating for some time, has reached a fever pitch due to the chaos created by the new administration's inconsistent policy moves.

A recession is a period of declining economic activity, commonly defined by at least two consecutive quarters of economic contraction. Although difficult to experience, recessions are a normal part of the economic cycle.

According to the definition above, the United States isn’t currently in a recession. The Federal Reserve Bank of Atlanta estimates economic

growth at -2.8% for the first quarter of 2025. However, the Bureau of Economic Analysis estimated the American economy grew by 2.4% in the final quarter of 2024. If the world's largest economy experiences another period of negative economic growth, it will officially be in a recession by summer.

Apart from trade tariffs and the resultant tensions with crucial partners like Canada, Mexico, and Europe (along with economic standoff with China through supercharged tariffs), economists claim to see uncertainty in the crucial fronts called consumer confidence and business sentiment. It is worth noting that analysts often track these two parameters to decide whether an economy is showing signs of recession or not.

The "Economic Policy Uncertainty Index," which relies upon news articles, tax data, and insights from the Federal Reserve Bank of Philadelphia's "Survey of Professional Forecasters" to produce a metric that gauges uncertainty at the intersection of economics and politics, saw the parameter standing at its highest level since the COVID-19 pandemic.

Likewise, the University of Michigan's index of

By the

end of February 2025,

the Atlanta Federal Reserve Bank's GDPNow forecast for the first quarter of 2025 had dropped to -2.4%

consumer sentiment has also taken a hit due to tariffs and inflation. In February 2025, it fell nearly 16% compared to a year ago.

"What we're seeing right now is that consumers over the last two months... have been feeling less and less positive about the economy," said Joanne Hsu, director of the University of Michigan's "Surveys of Consumers."

In its latest survey of small business optimism, the "National Federation of Independent Business" recently noted that its index fell by 2.1 points in February to 100.7. That's down 4.4 points from its peak in December 2024, though still above its 51-year average of 98. The NFIB said its uncertainty index also rose four points to 104, the second-highest reading.

Emily Gee, an economist and senior vice president for Inclusive Growth at the left-leaning "Centre for American Progress," suggests that the Trump administration's erratic policy initiatives have created a level of uncertainty that is "more than just vibes."

The concern is real Economists defined a recession as a period of economic contraction marked by two consecutive quarters of negative growth. In the fourth quarter of 2024, the United States' real GDP grew at an annual rate of 2.3% However, by the end of February 2025, the Atlanta Federal Reserve Bank's GDPNow forecast for the first quarter of 2025 had dropped to -2.4%

Donald Trump has downplayed concerns that his seemingly indecisive policy pronouncements may contribute to uneasiness among consumers and businesses. When asked in a recent Fox Business interview about the Atlanta Fed's warning of an impending economic contraction, he sidestepped the question, saying, "I hate to predict things like that."

Kevin Hassett, the newly appointed director of the National Economic Council, also defended the White House's tariff policy by stating, "If we reduce inflation at the

aggregate level by cutting $2 trillion in annual deficit spending, that will have a much greater impact on grocery prices than a tariff here or there."

Hsu said, "Ultimately, the final judgment on the President's policy will be determined by everyday Americans voting with their cash — whether they continue purchasing cars, furniture, and electronics. Consumer spending makes up 70% of GDP. If consumers cut back on spending due to a significant drop in consumer sentiment, that would make it much harder to avoid a recession."

The harsh truth right now is that American households and businesses are practising restraint in response to the trade conflict instigated by Donald Trump and his successive policy reversals. This economic policy uncertainty has resulted in a decline in consumer confidence for three consecutive months, with a decrease of over 30% since November 2024, according to the University of Michigan Survey of Consumers. Consumer spending experienced a decrease for the first time in two years in January.

The National Federation of Independent Businesses reported that its uncertainty index fell in March, along with a decline in small business optimism. These entrepreneurs have lowered their expectations regarding their sales prospects in the coming days. Businesses find uncertainty unsettling since they are unsure of the operating environment. They can adapt once economic trends and policies are understood.

"GDP goes negative when businesses and consumers cut back on spending, which triggers a recession. The lack of clarity and difficulty in predicting where we're headed leads to precautionary reductions in spending," according to Laura Jackson Young, a professor of economics at Bentley University who has researched the economic effects of uncertainty.

As per her, people and businesses are becoming even more cautious as a result of the extreme uncertainty that Donald Trump's actions have created.

Economists, in general, are unsure of what to think due to the seemingly constant policy changes. At the Centre for Strategic and International Studies, a think tank in Washington, Philip Luck, director of the Economics Programme, says the tariff reversal "does very little to resolve the uncertainty."

According to him, the tariffs may have been "bananas," but nobody can truly say if they will be lifted in 90 days or even earlier.

Conversely, the global economic system is undergoing a significant reconfiguration as it attempts to address the new normal known as "reciprocal tariffs" and their impact on overall growth.

Washington's effective tariff rate eclipsed levels reached during the Great Depression, while counteractions from major trading partners markedly increased the global tariff rate. And this doesn't read well.

The US is not yet in recession, but there are increasing signs of trouble ahead. Reversing policy decisions, trade uncertainties, and loss of confidence are holding back economic outlays by both households and businesses. If uncertainties persist and economic growth remains weak, the chances of recession in the current year would remain high for policymakers and investors alike.

Gross Domestic Product of the United States at current prices from 2016 to 2025 (In Billion US Dollars)

30,507.22

Source: Statista

After three consecutive interest rate cuts, investors now confront an uncertain American monetary policy outlook for the year ahead, clouded by headwinds like persistent inflation, data gaps, and an impending leadership change at the central bank.

Economy

somewhat elevated."

The Fed's projection for a slower easing path contrasts with market expectations for two 0.25% cuts in 2026, which would bring the fed funds rate to about 3.0%. The policy rate currently stands between 3.50% and 3.75%.

While the monetary authority ended 2025 by cutting the rates by a quarter-percentage point, it signalled that it would likely pause further reductions in borrowing costs as officials look for clearer signals about the direction of the job market and inflation, which "remains

According to the UN Trade and Development (UNCTAD), global trade is expected to grow about 7% in 2025, adding $2.2 trillion and setting a new record, with East Asia, Africa, and South–South trade the strongest drivers of global gains.

"Manufacturing, especially electronics, remains the main engine of growth, while energy and automotive sectors lag," the

The direction of the Fed's monetary policy will further hinge on economic data that is still lagging from the impact of the government shutdown in October and November. Also looming is the midterm election factor, as the Donald Trump administration will be pressing for sharper rate cuts to placate voters and stimulate economic growth ahead of the polls.

global body stated, while noting that trade imbalances have remained high and geopolitical fragmentation is reshaping flows, with friend-shoring and nearshoring strengthening again.

Between July and September 2025, global trade grew 2.5% compared with the previous three months. Goods rose nearly 2%, and services 4%. Growth is expected to continue in the year’s final quarter, though at a slower pace: 0.5% for goods and 2% for services.

If UNCTAD's projections hold, goods would add about $1.5 trillion to this year’s total and services $750 billion, consistent with an overall 7% annual increase. The global trade is also on course to exceed $35 trillion in 2025 for the first time, stated the global body.

If UNCTAD's projections hold, goods would add about $1.5 trillion to this year’s total and services $750 billion, consistent with an overall 7% annual increase

Nigeria President Bola Ahmed Tinubu has linked the country's ambition to reach a $1 trillion economy to key factors such as boosting productivity, fostering innovation, and equipping citizens, especially the youth, with globally competitive digital skills.

Speaking at the Three Million Technical Talent (3MTT) Nigeria National Impact Summit held at the State House Conference Centre, Abuja, the President, represented by the Secretary to the Government of the Federation (SGF), Senator George Akume, said national prosperity does not come by chance but through deliberate investment in human capital.

He further noted that in an era defined by rapid

technological disruptions, countries that take the lead are those that strategically develop the capabilities of their young population.

The President further said human capital development remains at the heart of his administration's "Renewed Hope Agenda."

“Digital skills now power growth across agriculture, healthcare, finance, manufacturing, education, and public service. A strong digital workforce creates jobs, expands enterprise, and positions Nigeria to compete globally. More importantly, it shifts our role from passive consumers of technology to active creators and exporters of talent," Tinubu observed.

The Nigerian President called the 3MTT a proof of his economic vision.

The global digital economy is expected to grow by 9.5% in 2026, three times faster than the global economy, stated a Digital Economy Trends (DET) report.

The report was launched by the Digital Cooperation Organisation (DCO) at the Development Finance Conference “MOMENTUM” in Riyadh.

Drawing on DCO primary survey data from over 400 respondents among policymakers, economists, and technology leaders across 26 countries, DET 2026 identifies 18 digital economy trends and assesses their expected impact on industries, societies, and governments. According to the survey respondents, the global digital economy is projected to reach an estimated $28 trillion in 2026, representing 22% of global GDP.

DET 2026 also identifies trends like "Strengthening End-to-End Cybersecurity" and the "Dawn of Ambient Intelligence," poised to deliver the most significant positive socio-economic impact in the coming days.

Cyber-resilience will be the top priority for the 21st-century global economic order as sophisticated cyberattacks continue to rise, widening capability gaps, and creating new risks linked to generative AI and future quantum computing.

France Analysis

GBO Correspondent

Local employment growth in France is mostly driven by sectoral diversity, particularly in connected sectors

Regions experience regular economic shocks and fierce rivalry in a linked world economy. Knowing the causes of local job increases has become quite important for legislators and academics. Recent theoretical developments underline the significance of various relational distances affecting the advantages of spatial clustering of economic activities.

From 2004 to 2015, a study concentrating on France's labour market areas, “geographical areas within which most of the labour force lives and works," provides a fresh understanding of how industry diversification influences local employment.

Research shows that a diverse range of interconnected sectors can significantly boost employment growth. This finding has important implications for regional development plans.

The study provides an overview of various research efforts from across the continent and highlights some of the key challenges facing European nations.

Economic geography literature distinguishes between two forms of diversity, which are related variety and unrelated variety. Here, variety is industrial diversity, that is, the several types of industrial sectors or technologies, more especially, their variation. The consensus is that knowledge spillovers inside an area, which are known to increase employment, mostly affect connected businesses and, to a limited extent, unrelated businesses.

Related variety explains a condition whereby businesses share common elements, as do biotechnology and drugs. By means of their leveraging of knowledge bases, technology, and talents, such aspects enable synergy, cooperation, and invention.

On the other hand, unrelated variation characterises a situation in which sectors have little in common, as do agriculture and software development. Unrelated businesses

operate in quite diverse fields, which results in less direct synergy but may encourage innovation by difference.

Although unrelated variety protects against industryspecific downturns, it has less direct effect on job growth than related variety. Our study method distinguishes between these two variants at the local level, that is, within a labour market area, and at the neighbourhood level, that is, between neighbouring labour market regions.

Particularly in times of economic boom, a study by Nadine Levratto, Directrice de Recherche au CNRS, Université Paris Nanterre – Université Paris Lumières, and economist Mounir Amdaoud reveals that areas with high related variety had more job increases from 2004 to 2015. Industries such as manufacturing, chemicals, and IT, which clearly showed great benefits on local employment, showed this effect especially.

Industries provide circumstances for interactive learning and innovation when their knowledge bases, technology, or supply chains match. This approach promotes multidisciplinary information flows, therefore improving the capacity of areas to develop and adapt. It can help strike

a balance between regional diversity, which may suffer from too much cognitive distance, and regional specialisation, which runs the danger of stagnation due to industries' too close proximity, a condition economists call “lock-in.”

Unrelated variation revealed a more complicated link with occupation. Although local unrelated variation cushioned areas from economic shocks (because sectors are less subject to industry-specific downturns), it did not directly stimulate job development as related variation did. Furthermore, a detrimental effect of unrelated variation in adjacent areas on local employment dynamics was observed.

Knowledge flows from surrounding areas contributed to lessening the effect of the economic shock during the 2008 worldwide financial crisis. Related businesses served as a buffer, steadying local employment and shielding areas from further losses.

“Another crucial difference between rural and urban places is their respective character. Our study revealed that related variations in diversity had a more noticeable positive impact in urban regions, where rapid innovation and employment growth are facilitated by significant concentrations of industries. Less dense industrial ecosystems in rural areas probably contributed to their

France's unemployment rate from 2015 to 2024 (In Percentage)

lesser advantage from these information spills. This urban-rural gap emphasises the requirement of customised economic policies to assist various geographical demands,” stated Levratto and Amdaoud.

Promoting sectoral diversity, especially the related variation, should be a top concern for legislators. They could promote cooperation among adjacent industries in areas to improve resilience and expansion. Such action would involve helping the growth of innovation clusters, where companies in related fields are geographically concentrated, or platforms for cross-sectoral cooperation, whereby companies, colleges, research labs, and government agencies might exchange ideas and investigate joint ventures. Encouragement of interregional collaboration could also help to distribute the advantages of linked variety among surrounding areas, particularly in times of economic crisis.

challenges of economic development.

The role of industrial diversity in shaping local employment trajectories in France is both nuanced and critical.

The research by Nadine Levratto and her colleagues sheds light on how the structure and composition of regional economies directly influence their ability to generate jobs and withstand economic turbulence.

The findings clearly highlight that related variety, where industries share technological, knowledge-based, or skillrelated proximities, plays a central role in promoting sustained employment growth. By facilitating collaborative networks and enhancing innovation potential, related industries create fertile ground for adaptive and dynamic labour markets, particularly in urban centres.

Source: Statista

Policymakers should also take into account the part that unconnected diversity plays. Although unrelated industries might not immediately boost employment, by diversifying the area economy, they provide stability when economic uncertainty rules.

Encouragement of a balance between linked and unrelated industries could present the best of both worlds: economic stability and innovation-driven development.

Local employment growth in France is mostly driven by sectoral diversity, particularly in connected sectors. To ensure that areas flourish, however, politicians have to encourage crossregional cooperation in addition to helping local businesses expand. The lessons from France's labour marketplaces offer ideas for areas all around trying to negotiate the

The benefits of related variety are most pronounced during periods of economic expansion, but its importance also extends into times of crisis. As shown during the 2008 financial crisis, knowledge spillovers from related industries in neighbouring regions served as a buffer, mitigating job losses and offering a stabilising effect.

This speaks to the resilience-building capacity of related industrial ecosystems, especially when they are not confined to a single labour market area but are connected across regional boundaries.

At the same time, the role of unrelated variety cannot be dismissed. While it does not have the same direct positive impact on employment growth, its capacity to cushion regions from sector-specific downturns makes it a vital component of economic resilience.

A diverse industrial base, incorporating unrelated sectors, acts as a hedge against volatility, ensuring that regional economies are not overly dependent on the fortunes of a narrow set of industries.

The urban-rural divide in the benefits derived from industrial diversity also calls

for differentiated policy approaches. Urban areas, with their dense industrial networks and greater access to knowledge resources, are naturally positioned to take greater advantage of related variety.

Rural regions, on the other hand, may require more targeted support to build the foundational infrastructure needed to enable meaningful knowledge exchanges and innovation. This could include investment in transport and digital connectivity, support for local entrepreneurship, and the development of regional innovation hubs.

For policymakers, the takeaway is clear: promoting sectoral diversity, with a strategic emphasis on related industries, is a powerful lever for local employment growth and regional economic resilience. Strategies could include promoting industry clusters, facilitating crosssector partnerships, and encouraging interregional knowledge flows. Moreover, maintaining a balanced mix of related and unrelated industries ensures that regions are not only dynamic but also robust in the face of economic shocks.

France's experience offers valuable lessons for other countries and regions navigating the twin challenges of economic development and labour market volatility. By leveraging the insights from this study, regional planners and decision-makers can craft more informed, context-sensitive economic policies.

Ultimately, building resilient, innovative, and inclusive local economies will require not just a commitment to diversity, but a deep understanding of the types of diversity that matter most, and the mechanisms through which they translate into employment gains. The future of regional growth lies in ecosystems where industrial variety is not just present, but purposefully cultivated to drive both prosperity and stability.

Promoting sectoral diversity, with a strategic emphasis on related industries, is a powerful lever for local employment growth and regional economic resilience

Industry

Kelly Ortberg

Kelly Ortberg systematically applied engineering rigour to a manufacturing process that had degenerated into controlled chaos

GBO Correspondent

It wouldn't have been a stretch of the imagination to claim that Boeing was teetering on the edge of collapse just a year ago. It had been losing money for seven consecutive years, and there seemed to be no sign of a pause except in its demise. However, to everyone's surprise, the aviation giant has made a comeback under the leadership of President and CEO Kelly Ortberg.

In all likelihood, the company might be on the verge of its first annual profit in years. This miraculous turnaround happened within just 18 months of Ortberg's appointment on August 8th, 2024. And the CEO has reconstructed the operational scaffolding and rewired the cultural DNA of an aerospace titan whose financial hull was flooding from water in every direction.

When Ortberg walked through the door, Boeing was staring down a constellation of catastrophes that would've broken lesser companies. The FAA had slammed a production cap on the 737

after that door plug blew out mid-flight. It was a humiliating moment for the company. And for a while, it threatened public trust in aviation itself.

It wasn't just the company's tainted image. The machinists, almost 33,000 of them, were up in arms, the supply chains had been gutted like a fish, and the balance sheet was drowning under negative cash flow. Surely, Ortberg was handed down an organisation facing existential threats.

And how things have changed in late 2025. Boeing has negotiated a brutal 53-day strike, and it has reacquired a long-lost piece of itself through the acquisition of Spirit AeroSystems in what might be the most consequential deal in modern aerospace. Furthermore, it has stabilised its 737, including the much-debated MAX series, production at a respectable 42 planes per month, and, here's the kicker, beat Airbus in net orders for 2025.

Kelly Ortberg's playbook? Torch the old finance-obsessed, remote-control management style

Kelly Ortberg

Morale had hit rock bottom. Employee surveys conducted before Ortberg’s arrival delivered harsh verdicts, and the pride in working for Boeing, once sky-high, had plummeted.

Workers felt abandoned, even betrayed, by leadership that first decamped to Chicago in 2001 and then relocated again to Arlington, Virginia, in 2022

that's plagued Boeing since the McDonnell Douglas merger. Replace it with something radical, i.e., engineers running an engineering company.

He moved his office back to Seattle, put boots on factory floors, and told Wall Street that quarterly earnings could take a backseat to building planes that don't fall apart.

To grasp the magnitude of this turnaround, you need to understand just how catastrophically bad things were in summer 2024. Boeing wasn't just struggling. It was paralysed, locked in a regulatory chokehold with nowhere to go.

On January 5, 2024, a door plug ripped off an Alaska Airlines 737 MAX 9 at 16,000 feet. Four bolts were missing. The FAA's response was swift and merciless. Administrator Mike Whitaker capped 737 productions at 38 aircraft per month, a rate so anaemic that Boeing couldn't generate enough cash to service its mountain of debt, let alone fund development programmes.

The FAA further audited Boeing's production line and uncovered a litany of sins ranging from busted process controls and sloppy parts handling to product control failures. Whitaker demanded a "fundamental cultural shift," moving away from profit-chasing toward safety-first operations, and made it crystal clear that enhanced oversight was "here to stay." Overnight, Boeing’s autonomy vanished.

Morale had hit rock bottom. Employee surveys conducted before Ortberg’s arrival delivered harsh verdicts, and the pride in working for Boeing, once sky-high, had plummeted. Workers felt abandoned, even betrayed, by leadership that first decamped to Chicago in 2001 and then relocated again to Arlington, Virginia, in 2022.

This geographic exile bred an insular, toxic culture. Bad news crawled upstream at glacial speed. Decisions got made in spreadsheets, not on factory floors where metal meets mechanics.

Travelled work, the practice of shoving incomplete airframes down the assembly line to hit schedule targets, had metastasised into standard operating procedure. It created a cascading avalanche of defects that detonated in final assembly, where everything came due.

Financially? Haemorrhaging doesn't begin to cover it. Defence was shackled to fixedprice contracts on the KC-46 tanker and the new “Air Force One.” These programmes had metastasised into billion-dollar haemorrhages. Inflation? Supply chain chaos? Both were eviscerating margins with surgical precision.

Meanwhile, a different clock was ticking. The contract with “IAM District 751” hurtled toward its September 2024 expiration date. The union hadn't forgotten 2014, the year they lost their pension. That wound hadn't healed. It had festered.

Wages had flatlined through years of punishing inflation. The workers weren't just angry. They were ready to burn it down.

On July 31, 2024, the Board tapped Kelly Ortberg as CEO, effective August 8. The choice sent shockwaves, intentional ones. Ortberg wasn't some GE retread or spreadsheet jockey. He was a mechanical engineer who'd cut his teeth at Texas Instruments before building Rockwell Collins into a supplier legendary for discipline and customer trust.

He occupied a unique position. He was an outsider to Boeing's labyrinthine internal politics, but an insider to the aerospace engineering brotherhood. That duality gave him operational latitude a pure finance exec could never command.