January - March 2026

January - March 2026

As 2026 begins, the "Global South" is experiencing a significant shift characterised by the rapid and structural reintegration of the Arabian Peninsula with the African continent. This new corridor is no longer defined solely by religious philanthropy, transactional crude oil trading, or labour migration. Instead, it is being built on critical infrastructure ownership, digital sovereignty, energy transition partnerships, and logistical dominance.

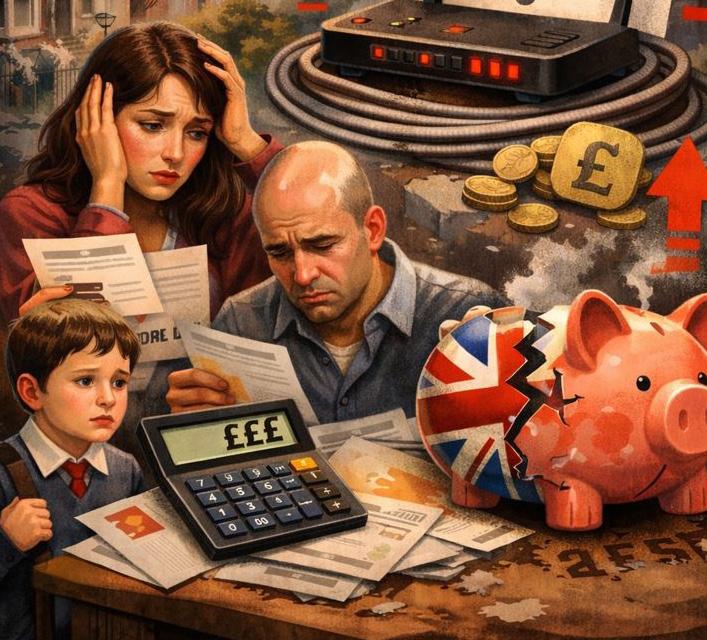

Meanwhile, it has been over a year since the deep rumble of the steelworks went silent in Port Talbot, a town in South Wales. The quiet fell upon the locality some time ago, when "Blast Furnace Four" was tapped for the last time. This decision, intended to pave the way for “Green Steel” and high-skilled jobs in the area, has instead resulted in a more profound economic crisis for the region.

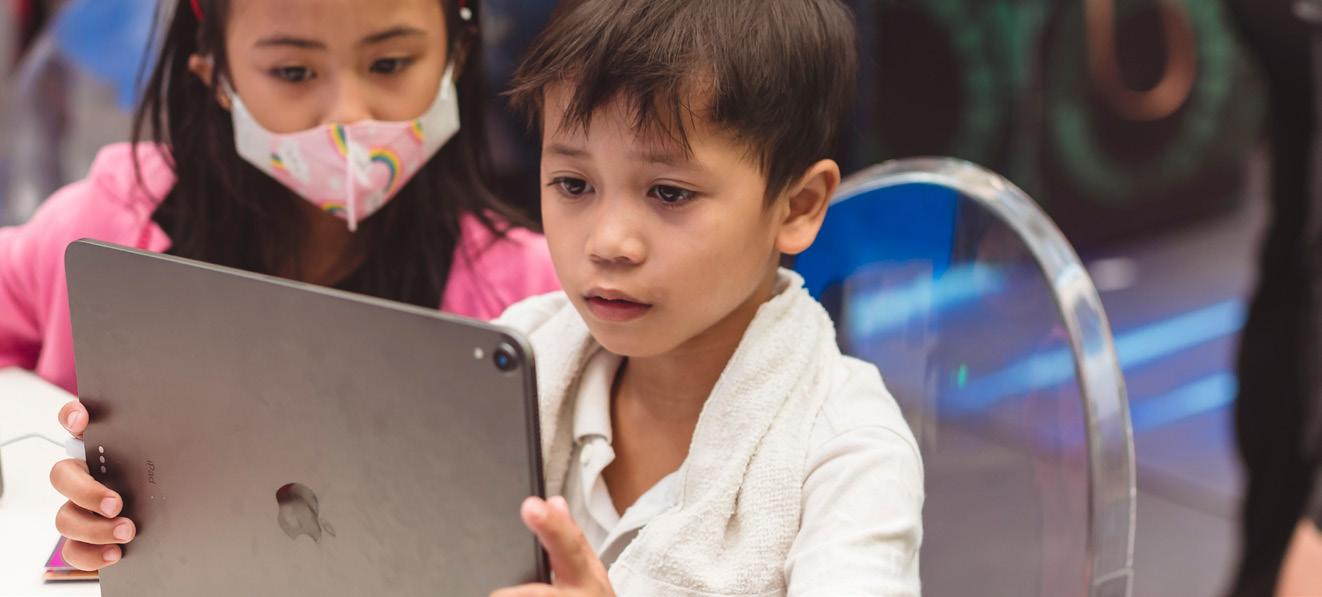

Amid the challenges, there is positive news. Apple has partnered with Michigan State University to establish the "Apple Manufacturing Academy" in Detroit, providing new training opportunities and skills development. The initiative aims to bring the high-tech innovations of Silicon Valley directly to the heart of America’s small and medium-sized manufacturers.

The cover story of Global Business Outlook's January-March edition will focus on Bupa Arabia, a healthcare insurance company based in Saudi Arabia. Since its inception in 1997, Bupa Arabia has expanded its international presence across various business operations, practices, and resources. Originally founded through a partnership between Bupa Global International and the Nazer Group, the company now offers high-quality health insurance services at competitive prices while ensuring a distinctive experience for its customers.

Thomas Kranjec Editor kimberly@gbomag.com

Retirees

Director & Publisher

Krushikesh Raju

Editor

Thomas Kranjec

Production & Design

Brian Williams

David Brenton

lan Hutchinson

Shankara Prasad

Editorial

Stanley Rogers

Rachel Taylor

Lucas Cooper

Tom Hardy

Business Analysts

Adam Fagoo

Arthur Salt

Jerry Thomas

Sumith Jain

Editor's Note

Email: media@gbomag.com 06 | Iron ore

Business Development Manager

Benjamin Clive

Head of Operations

David Pereira

Marketing

Danish Ali

Research Analysts

Richard Sam

Sophia Keller

Accounts Manager

Edyth Taylor

Press & Media Contact

Craig Penn

Registered Office

Global Business Outlook Magazine is the trading name of

Business Outlook Media Ltd

Congress House, 14 Lyon Road, Harrow HA1 2EN.

Phone: +44 203 642 0805

Fax: +44 (0) 203 725 9247

GBO Correspondent

The transition to green steel relies on "Direct Reduced Iron" technology, which processes iron ore using hydrogen or natural gas

In October 2025, global commodities markets faced a significant disruption that signalled a fundamental shift in the economic relationship between Australia and China. Reports emerged that the "China Mineral Resources Group," or CMRG, had paused purchases of iron ore from BHP Group.

This centralised, state-backed entity was established to consolidate the buying power of the world's largest steel industry. The immediate result was a sharp sell-off in BHP shares as prices fell to AU$41.50. While diplomatic concerns arose in Canberra, the true significance of this event extends beyond daily share price fluctuations. It serves as a clear warning of a new era in resource politics.

The incident involved conflicting reports, ranging from claims of a total ban on new dollar-denominated cargoes to denials by Chinese industry analysts. It represented a calculated pressure test of the global supply chain. Trade did not stop completely, but the move demonstrated a targeted use of leverage.

This was clear when trade resumed just days later with a 170,000-metric-ton shipment of BHP ore to a Chinese trading house. The temporary halt specifically targeted BHP's Jimblebar blend fines and showed that CMRG has the operational capability to manipulate market flows and discipline suppliers.

This disruption is part of a broader strategic movement by Beijing. The CMRG is using its buying power to erode the pricing dominance of major miners like BHP and Rio Tinto. At the same time, the accelerated development of the Simandou project in Guinea is set to achieve first production in late 2025.

This project promises to inject a massive stream of high-grade and Chinese-controlled supply into the market. The decades-long arrangement where Australian miners enjoyed unchecked pricing power is ending. The industry is transitioning into a period of managed competition where price discovery is influenced by statedirected stockpiling and centralised negotiation.

The creation of the "China Mineral Resources Group" in July 2022 ended the era of fragmented buying that defined the iron ore market for over a decade. Major miners previously benefited from negotiating with hundreds of individual Chinese steel mills, which allowed them to extract premium prices. The CMRG was designed to reverse this dynamic by creating a national buyers' group to counterbalance the supply oligopoly.

In just three years, CMRG has consolidated its position and now represents over half of China's steelmaking capacity in negotiations. This centralisation allows the entity to act as a strategic buffer for the national economy. By aggregating demand, CMRG has reduced the volatility of iron ore futures to record lows and dampened price spikes that historically transferred wealth from Chinese steelmakers to Australian shareholders. The group's operational footprint has expanded

aggressively. By mid-2025, CMRG was managing over 40 cargoes in transit at any given time, which gave it realtime visibility over spot market liquidity. This logistical capability enables CMRG to execute a strategic inventory policy where stockpiles are accumulated during price dips and released during spikes.

This mechanism was visible throughout 2025 as a divergence emerged between falling steel output and rising iron ore imports. This paradox is explained by CMRG's mandate to build strategic buffers rather than purchase solely for immediate consumption.

The October 2025 dispute with BHP demonstrated CMRG's tactical sophistication. Instead of a risky blanket ban, which could disrupt Chinese supply, CMRG reportedly targeted specific products like BHP's Jimblebar fines, which are a blend of significant but replaceable medium-grade ore. This approach allowed CMRG to signal displeasure over pricing and inflict commercial pain on BHP without

Australian ores like the "Pilbara Blend" have seen a gradual decline in iron content to around 60.8%, along with rising levels of impurities. In contrast, Simandou hosts reserves with an average grade of approximately 65%

jeopardising the critical flow of premium high-grade ores.

CMRG's formation has divided suppliers. While BHP and Rio Tinto transact with the centralised Chinese entity via spot deals, Brazil's Vale maintains direct contracts with individual mills, bypassing the collective buyer power.

This lack of a unified supplier front benefits Beijing. A key long-term CMRG goal is promoting the Renminbi's use in commodity trade, challenging the US dollar's global dominance through pressure to accept local currency for portside trade.

The Simandou project in Guinea represents a massive supply-side shift. For decades, Simandou was known as a sleeping giant because it is a massive and high-grade deposit that was stranded by political instability and high infrastructure costs.

In 2025, that giant will awaken with its first production scheduled for November of that year. The project involves the construction of over 600 kilometres of heavy-haul railway and deep-water port facilities.

This infrastructure is being delivered through a co-development model involving the "Winning Consortium Simandou" and a joint venture led by Rio Tinto and Chinese state-owned enterprises. The scale of investment is huge, with Rio Tinto's share of capital expenditure estimated at $6.2 billion. The project is designed to export up to 120 million tonnes per annum once fully operational. This volume is sufficient to displace a significant portion of high-cost supply from the seaborne market.

The strategic implication for China is vertical integration. Unlike Australian mines where China is a passive buyer, Simandou's ownership structure ensures

that Chinese steelmakers have guaranteed offtake rights and equity ownership. This effectively treats the mine as a captive domestic asset located overseas and eliminates the costs currently paid to Western miners.

The true threat of Simandou to Australian miners lies in chemistry. Australian ores like the "Pilbara Blend" have seen a gradual decline in iron content to around 60.8%, along with rising levels of impurities. In contrast, Simandou hosts reserves with an average grade of approximately 65% iron. This quality difference is becoming critical due to the decarbonisation of the global steel industry. The transition to green steel relies on "Direct Reduced Iron Technology," which processes iron ore using hydrogen or natural gas. This technology is chemically sensitive and requires feedstock with iron grades above 67% and very low impurities.

Most Australian ores cannot meet these specifications without expensive processing. Simandou's high-grade hematite is ready for this transition and positions it as the premium feedstock for the future low-carbon steel economy. As carbon pricing mechanisms come into force, the premium for Simandou ore is likely to widen. This could relegate Australian output to a discount tier suitable only for older blast furnaces. This supply expansion comes as the demand landscape in China shifts. In August 2025, China imported over 105 million tons of iron ore despite domestic steel output falling by 2.8% year-to-date. Port inventories swelled to nearly 150 million tons by late 2025. This accumulation is a deliberate policy of counter-cyclical stockpiling by CMRG. This inventory overhang allows CMRG to threaten to draw down stocks rather than buy seaborne cargoes during negotiations. Underneath this manoeuvring lies the

reality of peak steel. China's urbanisation phase is maturing, and the property sector remains in a structural slump. Steel demand is forecast to decline by 1.5% in 2025. The growth of the scrap steel industry also threatens iron ore miners. As China's infrastructure ages, the amount of scrap steel available for recycling grows. The government has set targets for "Electric Arc Furnace" production, which uses scrap instead of iron ore, to reach 15%20% of total output by 2030.

Rock bottom or just the pre-game?

The events of October 2025 were not an isolated anomaly but a structural turning point. They marked the public unveiling of the China Mineral Resources Group's capability to discipline the market. The global iron ore trade is transitioning from a seller's market dominated by the

Australian oligopoly to a buyer's market managed by a Chinese monopoly.

Major mining houses are adopting distinct strategies to survive this squeeze. BHP is aggressively pivoting its portfolio toward future-facing commodities like potash and copper. It aims to defend its iron ore margins through cost discipline rather than volume expansion.

Rio Tinto has executed a sophisticated hedge by becoming the lead developer of Simandou. This allows it to capture value from the new high-grade market segment even as it competes with its own Australian assets. Fortescue Metals Group faces the most significant challenge due to its lowergrade products and is betting heavily on green hydrogen to create a new value chain.

Production volume of usable iron ore worldwide from 2015 to 2024 (In Million Metric Tons)

Source: Statista

GBO Correspondent

The advent of fully electric, self-flying air taxis and cargo drones reflects a bold new horizon in aviation. As global air travel rebounds to record levels, the pressure is on to find new ways to increase capacity and efficiency.

According to the International Air Transport Association (IATA), the airline industry is poised to exceed $1 trillion in annual revenues by 2025. It will be the first time it breaks that barrier, and this growth is fuelled by around 5.2 billion passengers (up 6.7% year-on-year) and 72.5 million tonnes of air cargo (up 5.8%).

This soaring demand is prompting aerospace giants and innovative startups alike to explore autonomy as a way to scale operations and cut costs. Boeing, Airbus, Lockheed Martin, Northrop Grumman, and others are investing in autonomous flight systems, and a new crop of eVTOL startups such as Wisk, Joby, EHang, and Elroy Air are racing to turn autonomous air travel into a reality. Countries with deep pockets for R&D, notably the US, China, and

some European Union (EU) nations, are leading the push with government-backed programmes and defence-driven technology transfer.

Despite the hype, analysts caution that pilotless passenger aeroplanes remain years away from routine service. As aerospace historian Dan Bubb observes, “fully autonomous aeroplanes could still take several years to be available to the open market,” and many expect that true pilot-free jets will not dominate civil aviation until the 2040s.

In the meantime, incremental steps— from enhanced autopilots to hybrid crew/ autonomy models—are expected to roll out. Dr. Walter Stockwell of ANELLO Photonics notes that in the near term, we’ll see autonomy in niche roles (military drones, surveillance, speciality missions, cargo), with commercial passenger applications emerging in roughly 10-15 years, and “hybrid models combining autonomy with human oversight” in service by the early 2030s.

Likewise, Sylvester Kaczmarek of OrbiSky Systems predicts that automated cargo and logistics aircraft could be ready for large-scale operations within five to ten years, potentially easing current supplychain bottlenecks. In short, a stepwise

Urban Air Mobility concepts, think fleets of small air taxis shuttling commuters across cities, promise to revolutionise short-range travel

Air Mobility

Share of people in the following cities/regions who say they would be rather/very likely to try out an air taxi

approach, starting with drones and cargo and gradually expanding to passenger service, seems most likely.

The drive toward autonomy is shaped by market forces as much as by technology. In the cargo sector, soaring e-commerce and geopolitically driven supply-chain delays have created demand for faster, more flexible air logistics. Fully unmanned cargo planes and delivery drones could slash labour costs and operate around the clock, easing capacity crunches.

Bill Irby, CEO of AgEagle Aerial Systems, emphasises the potential. If airlines and militaries can even out pilot shortages and surpluses with automation, the payoff would be “huge.” Indeed, autonomous aircraft can significantly improve operational efficiency by optimising flight routes and fuel use, reducing maintenance downtime, and tackling dangerous missions without risking crew.

For passenger travel, the picture is more speculative but no less ambitious. “Urban Air Mobility” concepts, think fleets of small air taxis shuttling commuters across cities, promise to revolutionise short-range travel. Industry experts envision new ride-sharing models in the sky, and instead of airline hubs and runways, travellers might board on-demand eVTOL shuttles at “vertiports” on city rooftops or parking garages.

These vehicles could carry a handful of passengers (typically four to six) over distances of a few dozen miles, bypassing traffic, and potentially charging a premium for convenience.

management) and regulatory frameworks before they can scale. Other niche services will also emerge. Drones for infrastructure inspection, agriculture monitoring, or emergency response can deliver immediate value at lower risk, since they often involve cargo or unmanned flights over sparsely populated areas. In fact, several experts expect that the first widespread impact of autonomy will be felt in these support roles.

Michael Healander of Airspace Link argues that as “digital infrastructure matures,” we will see integration between traditional aviation and autonomous operations, eventually extending to passenger air taxis for people and cargo alike, and even opening new revenue streams for airports and municipalities. In essence, autonomy will replace existing business models and create entirely new ones. From “high-frequency” drone delivery networks to distributed urban air transit systems, and from remote-piloted cargo hubs to on-demand aerial services.

However, these new opportunities come with tough economics. Developing a safe autonomous aircraft is extremely costly. A recent McKinsey report estimates that each company developing such an aircraft might spend $1-$2 billion on engineering, prototyping, and certification alone. While some Advanced Air Mobility (AAM) firms are already injecting tens or hundreds of millions into research (often backed by venture capital or corporate partners), experts caution that this is only the start.

Source: Statista

According to a recent survey by Honeywell, nearly all frequent fliers (98%) said they would be willing to try an air taxi, and 80% indicated they would travel more often if a convenient air taxi to the airport were available. This suggests strong latent demand, at least among business-oriented travellers. That said, actual air-taxi networks will require new infrastructure (vertiports, charging/refuelling hubs, UAS traffic

Irby said, "Government tech investments need to increase to match what militaries have done in conflict zones."

Likewise, Healander notes that even in the United States, a potential leader in AAM, major aerospace and logistics companies must boost their R&D spending and work with regulators to create new equipment and airworthiness standards.

Aviation is one of the most heavily regulated

industries, and the move to autonomy adds layers of complexity. Regulators worldwide are scrambling to update rules, certify new vehicle types, and ensure safety in mixed airspace. In the United States, the FAA (Federal Aviation Administration) has already taken concrete steps. For example, by late 2024, it issued final regulations for “powered-lift” aircraft (the category including eVTOLs), setting pilot training and operational standards. In mid-2023, it expanded the definition of “air carrier” to explicitly include powered-lift commercial operators. The FAA has also released an “Innovate 28” roadmap to guide AAM integration by 2028 and even published vertiport design standards to lay the groundwork for physical infrastructure.

Additionally, the FAA is collaborating with international partners, including the United Kingdom, EU, Japan, Korea, and others, to harmonise certification and airspace rules, so that AAM systems can eventually operate across borders.

In Europe, regulators have been equally proactive. The European Union Aviation

Safety Agency (EASA) has created a unified set of EU-wide drone and eVTOL regulations, aimed at the “highest safety standards.” EASA highlights that it now covers over 1.6 million drone operators under a single rulebook, and it claims to have “the most advanced rules and standards for safe and secure drone operations” in the world. This includes risk-based categories (open, specific, certified) and a framework (SORA) for authorising complex operations.

EASA is also building an “Innovative Air Mobility” hub to coordinate stakeholders (cities, manufacturers, operators) and address issues like noise, sustainability, and airspace management. In practice, Europe is allowing some AAM trials (for example, in France, Germany, and the Nordics) but remains cautious on fully pilotless passenger flights until safety case data is mature.

China, too, has begun paving its regulatory path. In March 2025, it made headlines by granting the first-ever commercial operating certificates (AOCs) to autonomous passenger drone services. Companies EHang and Hefei

EASA highlights that it now covers over 1.6 million drone operators under a single rulebook, and it claims to have “the most advanced rules and standards for safe and secure drone operations” in the world

Who is at fault if an AI pilot errs?

How to prevent unauthorised drones from entering controlled airspace? How to ensure passenger privacy in a world of ubiquitous sensors?

Hey Airlines received CAAC approval to fly UAV “air taxis” for tourism and sightseeing.

Notably, these approvals came after the companies already obtained technical certification (type, production, and airworthiness), meaning regulators first ensured the aircraft met safety specs before allowing them to carry people. China is also rolling out “low-altitude economy” policies across cities to promote drone deliveries and eVTOL services, effectively treating them as part of the national industrial strategy.

Despite all the progress, major regulatory challenges remain. Authorities must define how autonomous flights will share airspace with conventional aircraft. Concepts like UAS Traffic Management (UTM) or Unmanned Aerial Systems (NAS) need to scale up to thousands of daily flights in cities. Existing air traffic control (ATC) systems were not designed for autonomous corridors, and managing mixed operations is “difficult,” to use Stockwell’s word.

Questions of liability, privacy, and security also loom large. For example, who is at fault if an AI pilot errs? How to prevent unauthorised drones from entering controlled airspace? How to ensure passenger

privacy in a world of ubiquitous sensors?

Regulators will need to address these with new laws and standards. As Irby and Bubb warn, easing the public’s deep concern over safety will require not only solid rules but years of proven reliability, especially given high-profile failures in related technologies like self-driving cars.

Autonomous flight pushes the boundaries of sensors, computation, connectivity, and navigation. Every potential collision must be avoided, and this requires “detect-andavoid” systems that work even in crowded, complex environments (downtown Manhattan or busy urban canyons).

Building those systems is non-trivial. Current machine-learning autonomy demands tremendous onboard computing power, which in turn adds weight and energy consumption—a major trade-off for aircraft.

Advanced inertial navigation and sensor fusion (radar, lidar, computer vision) will be needed to maintain precision even when GPS signals fade or communications lag. In short, true machine-learning and autonomy are very complex areas that are fundamen-

tally constrained by aircraft size, weight, and power considerations.

Urban air taxis will fly low and fast, often below tall buildings, so reliable networks are vital. Luckily, work is already underway, and NASA recently tested 5G cellular links between a research aircraft and ground stations, finding that 5G can “manage a lot of data at once” and handle low-latency demands for air taxi operations.

In fact, NASA engineers suggest that existing 5G networks might meet roughly 80% of aviation comms needs, with only modest upgrades needed. This kind of leveraging of commercial telecom infrastructure could save billions versus building a bespoke network. Nevertheless, operators will need redundancy to avoid single points of failure.

Autonomous aircraft will rely on digital command links and onboard computers for essential functions. Like any connected system, they could be vulnerable to hacking, spoofing, or software bugs.

A high-impact event could be catastrophic in a crowded sky. The recent Microsoft/ CrowdStrike blackout is a reminder that even the biggest tech systems can briefly fail. A robust aviation-grade cyber defence strategy, covering navigation data, command-and-control channels, and cloud services, will be mandatory.

Testing and validation pose a final barrier. Unlike self-driving cars that can pull over safely after a glitch, an aeroplane cannot just land on the shoulder. Any flight test of an autonomous aircraft carries real risk. As Stockwell notes, gaining access to controlled airspace for test flights and winning acceptance for occasional test failures is critical to progress.

Governments may need to sanction special test corridors or simulation environments where new systems can be trialled extensively. Synthetic testing will also play a major role, but ultimately, real flight hours will be required to certify safety.

Public perception and trust

Recent crashes (of drones, experimental

aircraft, or even incidents involving partial autonomy like Tesla’s autopilot) feed into a deep-seated fear that machines might “take off and not return” reliably. As aviation historian Bubb points out, the bar for safety will be extraordinarily high. Given “the deep concern the public has about aviation safety,” even minor setbacks could slow adoption. Convincing lay passengers to board a pilotless jet could take a generation of proven flight hours and transparency about safety cases.

On the other hand, Honeywell’s 2024 poll found that a remarkable 98% of frequent flyers would be willing to take an air taxi, and 80% said they would fly more if a convenient eVTOL service were available to the airport. Younger demographics and frequent business travellers expressed even higher interest. These numbers suggest that, if carriers can ensure safety and reliability, the market appetite may be strong, especially if air taxis can deliver on speed and convenience. Public acceptance will likely emerge in phases. Success stories in cargo and commuter drones might build trust before passenger service is phased in. Outreach campaigns, transparent safety reporting, and perhaps gradual steps will all help assuage public fear.

Enabling autonomous air mobility will require significant infrastructure, digital, and safety-related upgrades, which won’t be fulfilled without a massive, long-range investment. Aerospace companies are used to decade-long development cycles and multibillion-dollar budgets, but autonomy raises the stakes even higher.

Early adopter countries, those willing to invest now in vertiports, test corridors, and regulatory frameworks, stand to reap future economic benefits by hosting this new industry. Countries lagging in infrastructure risk watching domestic companies struggle overseas. In that sense, the flight path to autonomy is not just a technical one but a strategic national project as well. In the race to autonomous flight, foresight will matter as much as flight control.

Urban

air taxis will fly low and fast, often below tall buildings, so reliable networks are vital. Luckily, work is already underway, and NASA recently tested 5G cellular links between a research aircraft and ground stations, finding

that 5G can “manage a lot of data at once”

Bupa Arabia

GBO Correspondent

Bupa Arabia has positioned itself not just as a health insurer, but as a strategic enabler of SME success

Established in October 1997, Saudi Arabiabased Bupa Arabia, a healthcare insurance company (an associate business of Bupa Group), has created its own international reach that extends across multiple business operations, practices, and resources. The company, which was initially established through a partnership between Bupa Global International and Nazer Group, emerged with the key focus to provide high-quality health insurance services with competitive prices, while ensuring a distinctive experience for customers.

As a subsidiary of the global Bupa Group, the business draws upon international expertise while maintaining a profound understanding of local healthcare requirements and regulations This approach helps Bupa Arabia to offer comprehensive healthcare insurance solutions tailored to the unique needs of the Kingdom's market.

Bupa Arabia’s SME Sales team, part of the Growth Department, was recently awarded the title of “Best Medical Insurance Sales Team – Saudi Arabia 2025” by Global Business Outlook (GBO), and is transforming the Kingdom's SME healthcare landscape through strategic innovation, digital transformation, and a strong focus on people-centric excellence.

Building new operating model Small and medium enterprises (SMEs) are the backbone of the

Bupa Arabia

Saudi economy, contributing significantly to innovation, job creation, and the national transformation under the socioeconomic diversification agenda named “Vision 2030.” These businesses represent the entrepreneurial spirit, which in turn is helping the Kingdom diversify away from its heavy reliance on the energy trade-based revenue generation model, apart from employing millions of Saudi citizens and creating opportunities across diverse sectors, from technology, manufacturing, retail, to professional services.

As the needs of SMEs evolve in an increasingly complex business environment, so does the demand for healthcare solutions that go beyond traditional insurance solutions that provide trust, transparency, and comprehensive support through every stage of an employee's wellbeing journey.

Modern SMEs require partners who understand their unique challenges: managing costs while attracting talent, ensuring business continuity while caring for employees, and navigating regulatory requirements while maintaining competitive advantage.

Understanding the reality, Bupa Arabia, the Kingdom's leading health insurer with decades of experience serving businesses of all sizes, has been reshaping its SME proposition through a comprehensive multi-year transformation journey. This journey is about representing a fundamental reimagining of how healthcare insurance can empower businesses to succeed.

Bupa Arabia has taken an integrated four-pillar model: placing SME needs at the heart of every decision and process, streamlining processes to deliver efficiency and reliability, giving priority to technology-driven solutions that simplify and accelerate routine operational activities, and investing aggressively in human resources by building teams with the skills to excel in a transformed digital-dominated professional environment.

This roadmap has consolidated Bupa Arabia's reputation as a trusted partner for thousands of SMEs across the Kingdom, delivering not just health coverage, but a robust, holistic ecosystem designed to enable entrepreneurs and their teams to thrive in an era of rapid change and unprecedented opportunity. The company has created a structured, multi-phase programme, tailored to create a high-performing, scalable, and sustainable SME operating model that can adapt to market dynamics while maintaining consistency and quality across all touchpoints.

The SME sales department implements a unified operating model with a clearly defined structure covering SME Direct

Every touchpoint was examined through the customer lens, with pain points identified and resolved. The result is a customer experience that feels effortless, with reduced waiting times, clearer communication, and more predictable outcomes

Sales (Central, Eastern, and Western), SME Broker Sales, SME Subregional Sales, SME Recovery Sales at a Kingdom-wide level, and SME Management & Support encompassing Development, Operations, Customer Centricity, and Strategy & Projects. This enhanced structure ensures absolute role clarity, promotes cross-functional collaboration, and guarantees consistent delivery across all customer-facing channels, whether direct or through broker partnerships.

In an exclusive interaction with GBO, Managing Director of SME Sales, Feras AlTamimi said, “With strengthened governance mechanisms embedded throughout the organisation, we introduced rigorous monthly performance reviews, enhanced funnel

and portfolio dashboards providing real-time visibility, standardised reporting frameworks that ensure consistency, and clear escalation mechanisms for rapid issue resolution. This governance structure ensures organisational agility, complete transparency across all levels, and disciplined execution aligned with strategic objectives. Decision-making is now informed by comprehensive data analytics, enabling proactive rather than reactive management.”

Echoing similar views, Director of SME Direct Sales, Central Region, Raed Al-Zahrani stated that the complete SME lifecycle from initial prospecting and quotation through onboarding, ongoing servicing, and renewal was fundamentally redesigned to eliminate friction points, simplify handovers between teams, and deliver a seamless, intuitive customer journey.

“Every touchpoint was examined through the customer lens, with pain points identified and resolved. The result

is a customer experience that feels effortless, with reduced waiting times, clearer communication, and more predictable outcomes. This journey redesign represents hundreds of hours of process mapping, customer feedback integration, and iterative refinement," he noted.

To understand SME owners and their needs better, Bupa Arabia conducted more than 1000 interviews with decision makers from different enterprises in the Kingdom, which helped the venture to design a health insurance that suits SME needs. Known as “Bupa Munsha’at Health Insurance,” the programme comes in three categories: Essential, Classic, and Premium.

Essential provides health insurance at a competitive price that fits SMEs' operational budgets. In the case of “Classic,” the network options increase further, as per the beneficiaries’ needs, and “Premium” comes with exceptional benefits to fit the customers' expectations.

While all these programmes have common benefits like maximum coverage level (varies as per the plans) for insured persons for the term of the policy (including the sub-limit) at an approved network of hospitals and clinics, coverage of hospitalisation costs, same-day cases (including level of accommodation within the network and companion charges when medically necessary), out-patient department costs, doctor consultations, laboratory tests, scans, medications, and other treatments like follow-up visits and referrals, Classic also covers selective (non-emergency) treatment out of its Saudi-based network, as per accepted prices, that have been approved for the same level of network coverage mandated within the Kingdom.

While Premium also possesses the same feature, it has an additional benefit: emergency medical evacuation in cooperation with “International SOS Assistance” when the illness occurs outside Saudi Arabia only.

Digital automation transforming SME sales

To accelerate transformation and dramatically reduce manual complexity that historically slowed down sales cycles and introduced errors, Bupa Arabia has developed SADiR, a pioneering digital platform that automates the entire SME New Business (NB) and Renewal (RNW) journeys from end to end.

SADiR represents a quantum leap in how Bupa Arabia serves SME customers, replacing manual, paper-based processes with intelligent, automated workflows that enhance speed, accuracy, and customer satisfaction simultaneously.

Acting Director of SME Management and Support, Tariq Jumah said, “SADiR was launched through a carefully structured pilot developed in close collaboration with SME and Digital Sales teams. This pilot-first approach enabled iterative learning, rapid feedback integration, and confidencebuilding before full-scale deployment, ensuring the platform truly meets user needs.”

SADiR works on five basic principles: System Eligibility Assessment (defining clear use cases and system boundaries for optimal performance), User Adoption Programmes (comprehensive training ensuring frontline teams are confident and capable), Funnel Accuracy Enhancement (data quality initiatives to improve forecasting and pipeline management),

SADiR was launched through a carefully structured pilot developed in close collaboration with SME and Digital Sales teams

Turnaround Time Optimisation (process refinement to accelerate every stage of the customer journey), and Stakeholder Satisfaction (measuring and improving experience for customers, brokers, and internal teams).

SADiR's transformative impact on the Saudi SME sector has been a profound one. On the policy quotation and issuance front, the platform has reduced turnaround times from days to hours, enabling SME sales teams to respond to market opportunities with unprecedented speed.

Automated checks and validations are eliminating human error and ensuring compliance with regulatory requirements at every step. SADiR is also providing entrepreneurs with real-time insights into pipeline health (condition and effectiveness of an SME's sales pipeline), conversion rates, and bottlenecks, while creating a single source of truth for customer data and interaction history.

Building capability

Behind every sophisticated system and streamlined process lies a strong human foundation. Technology and process improvements can only deliver their full potential when supported by skilled, motivated, and aligned people.

Recognising this fundamental truth, Bupa Arabia has invested heavily in strengthening its SME workforce through structured capability-building programmes, leadership alignment initiatives, and fostering a culture centred on collaboration, accountability, and ownership.

The newly structured “SME Management & Support” function now serves as the strategic anchor for the entire SME business, providing critical enablement across four interconnected domains: development, operations, customer centricity, strategy, and projects. This integrated enablement model ensures that sales professionals have everything they need, be it tools, insights, processes, or support, to excel in serving customers and achieving business objectives.

Acting Director of SME Management and Support, Tariq Jumah, said, “Through continuous training, awareness sessions, and engagement initiatives, we are cultivating a culture where every SME employee deeply understands the strategy, aligns with the operating model, and actively contributes to customer excellence. This culture

Through continuous training, awareness sessions, and engagement initiatives, we are cultivating a culture where every SME employee deeply understands the strategy, aligns with the operating model, and actively contributes to customer excellence transformation is not a programme with an end date; it's an ongoing commitment to growing our people as we grow our business.”

The “SME Management & Support” is driving performance management, governance frameworks, forecasting accuracy, budget discipline, and continuous capability enhancement through targeted training programmes. On the operational front, the solution delivers comprehensive sales operations support, apart from maintaining rigorous funnel hygiene, managing portfolio health, and ensuring operational efficiency across all sales channels.

When it comes to customer centricity, “SME Management & Support” champions quality standards, integrating voice of customer insights and embedding service excellence principles throughout the organisation.

Also, the solution is helping SMEs to lead long-term strategic planning, manage transformation initiatives, and provide execution governance to ensure strategic objectives translate into operational reality.

Bupa Arabia's comprehensive SME transformation has generated significant, measurable business impact across multiple dimensions, from portfolio growth and customer satisfaction to operational efficiency and team capability. These achievements reflect the maturity of a disciplined, customerfocused operating model that consistently delivers value.

SMEs are now witnessing substantial onboarding expansion in their customer base and premium volume, driven by improved value proposition and market presence. Enhanced customer loyalty and renewal rates also reflect superior service quality and relationship strength.

Insurance

Bupa Arabia

Crucial financial activities like pipeline visibility and revenue predictability are registering dramatic improvement through better data and governance, and digital automation and process optimisation have made quotation and policy issuance significantly hassle-free and faster for the Kingdom's SME sector.

Director of SME Direct Sales, Eastern Region, Hani Al-Harbi said, “Beyond quantitative metrics, the transformation has created powerful qualitative improvements that position us for sustained success. There is now strong alignment between sales, development, operations, and customer-centricity teams, with all functions working in concert rather than in isolation. Cross-functional collaboration has become the norm rather than the exception, breaking down historical silos and creating a unified team focused on customer outcomes.”

Broker partners are now reporting higher satisfaction with streamlined processes, faster response times, clearer communication, and more sophisticated digital tools, solutions that have revitalised the broker channel as a whole. Bupa Arabia's partners are viewing the company as their preferred carrier for SME business.

“SME customers experience a dramatically improved journey from first inquiry through renewal, with less paperwork, faster decisions, more transparent communication, and easier access to support. Customer satisfaction scores have risen consistently, and complaint volumes have decreased, reflecting the tangible impact of journey redesign and digital enablement on everyday customer experiences. These results collectively demonstrate a mature, disciplined, and genuinely customerfocused SME operating model that delivers value for all stakeholders, customers, brokers, employees, and shareholders alike. The foundation has been built for sustainable growth and continued market leadership,” Director of SME Broker Sales, Razan Ajzaji noted.

The road to 2026 and beyond Bupa Arabia's SME transformation journey is far from complete, as the venture recognises that maintaining market leadership requires continuous evolution, innovation, and improvement. The next phase of Bupa Arabia's SME innovation will focus

on scaling what works, apart from optimising performance and deepening impact across the entire ecosystem, as the Kingdom accelerates its socio-economic diversification efforts under “Vision 2030.”

Director of SME Direct Sales, Central Region, Raed Al-Zahrani, said, “Building on the successful SADiR pilot, the digital roadmap includes scaling the platform across additional customer segments and use cases, enhancing automation capabilities with more sophisticated validations and workflow intelligence, integrating more deeply with CRM systems and analytics platforms for unified data views, and significantly improving digital touchpoints for sales teams, customers, and broker partners. The vision is establishing a fully digital-first SME experience that maintains the human touch where it matters most while leveraging technology for speed, accuracy, and convenience.” Through the company's help, SMEs are able to continuously refine Bluebook standard operating procedures to reflect evolving best industrial practices, apart from strengthening risk management and quality assurance frameworks with proactive monitoring and controls. All these elements are helping the Kingdom-based businesses to fully align with evolving regulatory standards put forward by SAMA (Saudi Arabian Monetary Authority) and other government bodies, apart from embedding quality metrics

The journey continues with clear strategic priorities, committed leadership, capable teams, and an unwavering focus on customer success. We are keeping pace with market evolution and actively leading the transformation of SME healthcare, setting new standards

throughout the value chain. Quality is not an endpoint but a continuous journey of improvement, and governance frameworks will evolve to support both growth and control simultaneously.

Managing Director of SME Sales, Feras AlTamimi, said, “The progress achieved through our transformation journey is only the beginning of what we will accomplish together. With strong values that guide our decisions, a unified operating model that aligns our efforts, disciplined governance that ensures consistency, bold digital transformation that accelerates our capabilities, and empowered teams who bring their best every day, we are actively shaping the future of SME health insurance in the Kingdom. Our focus remains unwavering: delivering excellence in everything we do, strengthening partnerships with brokers and customers alike, and enabling SMEs across Saudi Arabia to thrive by providing the healthcare security and support their employees deserve. We are not just an insurance provider, but also a strategic partner committed to the success and well-being of the businesses building Saudi Arabia's future.”

As Saudi Arabia advances toward “Vision 2030,” SMEs will continue to play an increasingly

vital role in economic diversification, innovation, and job creation. These businesses need partners who understand their aspirations, challenges, and the critical importance of protecting their greatest asset, their people.

Bupa Arabia has positioned itself not just as a health insurer, but as a strategic enabler of SME success. Through years of disciplined transformation across customer experience, operations, digital capabilities, and people development, the company has built a robust platform for sustainable growth and market leadership.

“The journey continues with clear strategic priorities, committed leadership, capable teams, and an unwavering focus on customer success. We are keeping pace with market evolution and actively leading the transformation of SME healthcare, setting new standards for what insurance partnerships can and should deliver. For thousands of SMEs across the Kingdom, we are more than a health insurer. We are the trusted partner enabling businesses to protect their people, attract talent, ensure continuity, and build the future with confidence. Together, we are leading the future of SME health insurance in Saudi Arabia,” Chief Growth Officer Atef M Mufti concluded.

Industry

Port Talbot Analysis

GBO Correspondent

The new electric arc furnace at Port Talbot will not be ready until late 2027

On September 30, 2024, a heavy silence fell over Port Talbot. For more than a century, the deep rumble of the steelworks had been the heartbeat of this South Wales town. Steam vented from the towers, and the sky often glowed with the work of the blast furnaces. That afternoon, “Blast Furnace Four” was tapped for the last time. The iron stopped flowing. The heat faded.

One year later, the skyline looks different. The towers still stand, but they are cold and await demolition. The silence is not just industrial. It feels like a pause in the town’s history. The transition to “Green Steel” was supposed to be a new beginning Politicians promised it would bring clean technology and highskilled jobs. They said it was vital for the climate. But for the people living here, the last twelve months have not felt like a new beginning. They have felt like an ending.

Hard numbers drove the closure. Tata Steel reported daily losses of around one million pounds. They blamed soaring energy costs and fierce competition from cheaper Chinese imports. The plant was also the single largest carbon emitter in the United Kingdom. It was responsible for 1.5% of the country’s total emissions.

Faced with a choice between shutting down completely or changing, the government stepped in. They committed £500 million to help switch to cleaner electric arc furnaces. This technology promises to cut emissions by 90%. That is a massive win for the environment. Yet the cost of this victory is being paid by the local working class.

The 2024 statistics reveal a community in crisis. Tata Steel announced the elimination of 2,800 jobs. This represents roughly 10% of the total employment in Port Talbot, a town of just 35,000 people. The plant once employed 4,000 people directly. Today, only half that workforce remains.

Analysis \ United Kingdom

The ripple effects extend far beyond the factory gates. Estimates suggest as many as 9,500 additional jobs could be affected throughout the supply chain. These are the scaffolders, cleaners, and engineers who kept the giant site running. For a community that has built its identity around steelmaking for over a century, this is not just an economic blow. It is an existential crisis.

The government and Tata Steel tried to soften the landing. A "Transition Board" was set up to help. They funded 3,667 training courses and qualifications for displaced workers. Grants were provided to 37 supply chain businesses, which protected nearly 200 jobs. Employability services directly supported 332 people into new positions. Around 600 employees who faced compulsory redundancy were offered other roles within the business.

Despite these efforts, the reality on the ground is tough. Many former steelworkers have had to pivot to entirely different careers. Some have used their redundancy money

Estimates suggest as many as 9,500 additional jobs could be affected throughout the supply chain. These are the scaffolders, cleaners, and engineers who kept the giant site running 9,500

to establish pizza businesses. Others have retrained to become prison officers. These jobs often pay significantly less than their previous skilled roles in the heavy industry. The uncertainty of the service sector has replaced the pride of making steel.

The handling of Port Talbot stands in stark contrast to

Port Talbot

other industrial closures. In September 2024, the Ratcliffe-on-Soar power station also closed. It was the last coal-fired power station in Great Britain. However, that transition is viewed as a success. Unions were involved five years in advance. Workers were given flexible release dates and fully funded training before their jobs ended. There were no compulsory redundancies. In Port Talbot, the process felt chaotic and rushed. Workers felt excluded from the decisions that sealed their fate. This failure to manage a “Just Transition” has left deep scars.

The anger in Port Talbot has spilt over into national politics. The closure has become a weapon for those who oppose the “Net Zero” agenda. The Reform Party and its leader, Nigel Farage, have seized on the discontent. Farage visited the town and promised to reopen the blast furnaces. Industry experts say this is technically impossible, but the message resonated.

In the 2024 General Election, Reform UK surged to second place in the local Aberafan Maesteg constituency. They secured 20.9% of the vote, pushing the Conservatives into third. This is a historic shift in a traditional Labour stronghold. Reform argues that “Net Zero” is an expensive illusion that kills jobs and raises bills. They have vowed to abolish netzero policies in local councils under their control.

This rhetoric is working. Trade unions report that their members are increasingly turning toward Reform. Workers feel abandoned by the mainstream parties. They see a political class in London that prioritises carbon targets over industrial communities.

The closure also exposes a major strategic weakness for the United Kingdom. It is now the only major economy in

the G20 that cannot make “virgin” steel from scratch. Electric arc furnaces rely on recycled scrap metal. This is fine for construction beams, but it is hard to use for high-quality products like car bodies or military equipment. These require the purity of virgin steel made from iron ore. By closing the blast furnaces, the European country has become dependent on imports. The United Kingdom now faces the compulsion of buying raw steel slabs from other countries to keep its rolling mills running. This reliance on foreign supply chains is risky in an unstable world. It also raises the issue of “carbon leakage.”

The Conversation UK, Editor, Jo Adetunji, said, “We have stopped the smoke rising over Port Talbot. But if we import steel from countries like India or China, we have not helped the planet. We have just moved the pollution elsewhere. In a bitter irony, Tata Steel is commissioning new blast furnaces in India at the same time it is closing them in Wales.”

“The UK steel industry faces unique hurdles. Our industrial electricity prices are the highest in Europe. This makes it very hard to compete. Producing steel here costs more than in France or Germany. Research shows that we need lower energy costs and a Carbon Border Adjustment Mechanism (CBAM) to level the playing field. This mechanism would tax dirty steel imports, protecting our domestic producers. The government plans to introduce this by 2027, but that may be too late for the workers who have already lost their jobs,” she noted.

There is also a dangerous gap in the timeline. The new electric arc furnace at Port Talbot will not be ready until late 2027. This creates a three-year “valley of death” where no steel is made on site. The skilled workforce may disperse during this time. When the new plant finally opens, the people who need to run it might be gone. Industry

Analysis \ United Kingdom

The Keir Starmer government has recognised the urgency of the situation. It has announced plans to invest £2.5 billion into the steel industry. A new “Steel Strategy” is scheduled to be published in the spring of 2025. Additionally, the “National Wealth Fund” will provide £5.8 billion for green projects, including green steel and hydrogen. These are positive steps. But for the thousands of families in Port Talbot, the help feels slow to arrive.

The transition to “Net Zero” cannot just be a technical exercise. It cannot be solved only with capital grants and carbon spreadsheets. It must be a social contract. When communities feel they are being sacrificed for an abstract environmental goal, trust evaporates.

The public supports climate action in principle. They lose faith when they see the costs burdening workers. The difference between the orderly closure at Ratcliffe-on-

Soar and the crisis at Port Talbot proves that management matters. Workers need genuine pathways to quality jobs, not just a redundancy cheque.

The hope is that the site will rise again as a leader in green technology. But the silence of the old furnaces serves as a warning. If the path to “Net Zero” destroys the communities it is meant to save, the political consensus for climate action will crumble. The Keir Starmer administration must ensure that the "green revolution" does not leave United Kingdom's industrial towns behind.

Industry CEO

The CEO's entire career has been built on the collaborative, inclusive 'we'

The CEOs who frame their apologies using the singular pronoun, for example, "I apologise," experience significantly smaller stock price drops. In some cases, this acceptance of personal responsibility can even be correlated with modest stock gains in the immediate aftermath. Conversely, CEOs who employ the collective pronoun, GBO Correspondent

In the landscape of modern corporate governance, a crisis is not a matter of "if" but "when." A product recall, an ethical lapse, or a data breach can erase billions in market value within hours. While the event itself is often uncontrollable, the leadership response is not. New research demonstrates that the financial outcome of a crisis, measured in stock performance, is critically dependent on the linguistic choices made in the public apology.

The thesis, supported by research from

academics including Prachi Gala, is that a single word choice by the Chief Executive Officer (CEO) functions as a powerful, quantifiable financial signal to investors.

for example, "we apologise," are associated with the very stock sell-offs they are attempting to prevent.

This finding reframes the act of a corporate apology. It is not a "soft" function of public relations or a matter of rhetorical style. Instead, it is a hard, financially material action. The linguistic framing of the apology is a direct signal to the market, and investors, who are the primary audience for this type of financial research, have learnt to decode it.

The market's positive reception to "I" is based

on its perception as a direct signal of personal accountability. When a CEO uses the singular pronoun, they are communicating strong, decisive leadership.

They are, in effect, telling the market that the problem has been identified, that a single, high-ranking individual is taking ownership, and that the chain of command is intact. This perception of control and accountability is precisely what investors seek in a moment of high uncertainty.

Conversely, the use of "we" is perceived by

Industry CEO

the same investors as evasive. This collective pronoun is interpreted as a deliberate attempt to spread, or diffuse, responsibility so thinly that no single individual can be held accountable.

This linguistic choice triggers a cascade of negative assumptions. Assumptions that the leadership is weak, that the CEO is unaware of where the fault truly lies, or, perhaps most damagingly, that the CEO is aware and is actively concealing the single point of failure.

This leads to what can be termed an "evasion penalty." The negative stock performance following a "we" apology is not merely a failure to create a positive outcome; it is an active financial punishment for the perceived evasion. Investors penalise the "we" apology because it suggests a lack of control and a high risk of future, unmanaged failures.

To assert that a single pronoun can impact a firm's stock price requires a rigorous, quantitative methodology. This claim rests on the

Source: Nation Thailand

"event study method," a standard and widely accepted tool in financial economics used to measure the impact of a specific event on the value of a firm.

This method allows analysts to isolate the financial impact of a specific announcement, such as a crisis apology, from the market's general fluctuations. The process, in simple terms, involves three steps.

An "estimation window" (for example, 200 days before the event) is used to observe the stock's normal performance relative to the market, establishing an expected return. Analysts define a short "event window" (for example, the day of the apology and the few days surrounding it) to measure the stock's actual performance.

The core output is the Cumulative Abnormal Return (CAR), which is the difference between the stock's expected performance (from the baseline) and its actual performance during the event window.

This methodology is specifically designed to demonstrate the short-term impact of crises, such as product-harm incidents, on a firm's financial value. It is the tool that allows analysts to move from correlation to a strong inference of causation, isolating the market's reaction to the event itself.

Under "diffusion of responsibility," individuals in a group feel less personal accountability for taking action (or for a failure) because the presence of others dilutes their sense of responsibility. It is the "someone else will handle it" effect.

Research highlights that diffusion of responsibility is most common in "hierarchical organisations" and "group decision-making processes," which perfectly describes the modern corporation.

The very mechanisms of corporate efficiency, such as "division of labour" and "collective action", create this diffusion. They allow individuals to shift their attention from the "morality of what they are doing to the operational details" of their specific job,

creating a psychological schism between causal influence and moral accountability.

When a CEO, the highest-status individual at the apex of this hierarchical organisation, issues an apology beginning with "we," they are doing far more than making a grammatical choice. They are linguistically triggering the market's deepest fears about corporate structures.

The "we" apology is a verbal confirmation of the diffusion of responsibility. It tells stakeholders that the organisational structure itself (the "we") is to blame, and that this same structure is now being used to obscure accountability. It creates profound ambiguity and leads to a situation often referred to by researchers as responsibility gap. A harm has occurred, but there is no identifiable, culpable agent.

Investors, who abhor ambiguity and unmanaged risk, interpret this "we" not as collective remorse but as a definitive statement that no one is in control and no one will be held personally accountable. This signals a systemic, unmanaged, and potentially recurring risk, which is a clear signal to sell.

The 'I/We' contradiction

Prominent business thinkers, like Reid Hoffman, explicitly train leaders that "'I' vs 'We'

is a false choice. It's both," promoting a collaborative team-building concept of "I We." This "people-centric” approach is excellent for internal management, for sharing credit, and for building a cohesive team.

Furthermore, in a scandal, employees themselves may begin to create an "I vs We" separation to distance their personal identity from the corporate misconduct. This creates an internal environment where a "we" apology from the top feels hollow.

This creates a "trained (wrong) reflex." The CEO's entire career has been built on the collaborative, inclusive "we." Then, in the moment of crisis, this instinct is powerfully reinforced by the two departments they trust most, the legal and human resources departments.

Therefore, when a "preventable crisis” hits, the CEO's entire support system (legal, HR, and their own well-honed leadership instincts) will be screaming, "Say 'we'!" What Prachi Gala’s report provides is the financial and psychological evidence that this instinct, while logical and well-intentioned, is strategically catastrophic and financially damaging in this specific, external-facing context.

When a CEO, the higheststatus individual at the apex of this hierarchical organisation, issues an apology beginning with "we," they are doing far more than making a grammatical choice. They are linguistically triggering the market's deepest fears about corporate structures

Wataniya Insurance

Wataniya Insurance has remained steadfast in its commitment to delivering exceptional insurance solutions through a customer-first approach

Wataniya Insurance: Awardwinning service, rooted in trust

Wataniya Insurance was established in 2010 under the legacy of the Saudi National Insurance Company (SNIC), with roots dating back to 1975, to promote conventional insurance in the Kingdom as one of the leading organisations empowering humans in various walks of life.

Since then, the company has become a major player in the Kingdom's insurance sector, providing customised products and services to individual customers, corporates, industries, and SMEs (small and medium enterprises). Every milestone Wataniya Insurance achieves carries a story of dedication, purpose, and the people who make it possible—the company's customers and employees.

As a leading insurance provider in Saudi Arabia, Wataniya Insurance has remained steadfast in its commitment to delivering exceptional insurance solutions through a customer-first approach. Apart from rewriting the industry rulebook through its comprehensive insurance offerings and exceptional customer service, Wataniya is also redefining the standard for transparency (including zero hidden charges in its products) and innovation in the industry.

Due to these efforts, the venture has been honoured with the "Most Customer-Centric Insurance Company — Saudi Arabia — 2025" award by the Global Business Outlook (GBO). Winning this award for the second consecutive year is more than recognition; it reflects the journey the company has taken with its community.

"It reaffirms our promise to place our customers at the heart of every decision, every innovation, and every interaction. This achievement is not a coincidence; it is the result of the values that guide us, the trust that binds us, and the relentless commitment of every member of the Wataniya family toward serving our customers with care, understanding, and integrity. This recognition is not merely an external acknowledgement; it mirrors our internal culture and the philosophy that has shaped Wataniya for over five decades. Since our establishment, our mission has always been grounded in one core belief: that insurance is not about transactions, but about human connections," Wataniya Insurance told GBO.

Every policy Wataniya issues, every claim it handles, and every service it provides begins with one simple question: What does this mean for the customers?

This mindset has allowed Wataniya to grow and evolve with the people and communities it serves, ensuring that the company's offerings are not just products but personalised experiences that protect, empower, and support its customers' lives.

"Winning this award again validates that our approach is rooted in empathy, innovation, and trust, as it reflects the success of our continuous efforts to enhance customer satisfaction, whether through simplified processes, smarter digital tools, or more transparent communication," Wataniya continued.

Behind every award lies a story of teamwork, and the credit behind Wataniya's GBO Award win belongs to every employee at Wataniya. From the frontline representatives who greet the venture's customers every day, to the claims experts ensuring that support is delivered swiftly and fairly, to the technology teams building seamless digital solutions, each person has played a vital role

in shaping this success.

"Their daily dedication, professionalism, and empathy are what make Wataniya truly customer-centric. They are the reasons why customers not only trust us with their protection but also feel understood and valued at every step. Our employees are more than just part of the process; they are ambassadors of our promise. They turn our values into actions, ensuring that every touchpoint reflects our care and respect for those we serve. This award is therefore not just a win for the company; it is a win for every individual who carries the Wataniya spirit within them," Wataniya remarked.

Winning the GBO Award for the second time also perfectly aligns with the message behind the venture's recent campaign, "From You and Among You مكنم

."

This campaign captures the

essence of Wataniya's identity as a reflection of how deeply it is rooted in Saudi communities.

Talking more about the campaign, the company told the GBO, "We are not just an insurance company operating in the Kingdom; we are part of the fabric of society. We grow alongside our customers, share in their challenges, and celebrate their milestones. From supporting families during times of uncertainty to protecting businesses as they expand, we see ourselves as partners in every success story. This campaign and the award together highlight the same truth: Wataniya is not separate from the people—it is made of the people. Every achievement we celebrate is shared with them; every innovation we introduce begins with their needs in mind."

In today’s rapidly evolving world, being customer-centric also means staying ahead of change, be it socio-economic or in the industrial vertical in which a business operates. Wataniya too understands that the 21st-century customers’ expectations are all about a continuous search for simplicity, speed, and trust.

"To meet and exceed these expectations, we have invested heavily in digital transformation, ensuring that our services are accessible anytime and anywhere. From our intuitive online platforms to the integration of smart payment options like Amazon Pay, we continue to simplify the customer journey and make interactions more seamless. But innovation for us goes beyond technology; it’s

about reimagining experiences. It means creating products that adapt to customers’ evolving lifestyles, providing faster and more empathetic claims handling, and ensuring transparency in every step. It means empowering our customers with knowledge so they can make informed choices about their protection and future," Wataniya continued.

What truly makes Wataniya stand out is the insurance company's dedication to listening to customers and other stakeholders. Every piece of feedback it receives, whether positive or constructive, becomes a source of learning as the business believes that being customer-centric is not a destination, but an ongoing conversation.

"It’s about continuously evolving based on what our customers tell us they need. This dialogue shapes our services, strengthens our relationships, and helps us stay aligned with our promise to always be: From You and Among You," Wataniya noted.

The GBO Award is a significant recognition for Wataniya's operational excellence, but it is not the end of the journey. Instead, it serves as motivation for the company to continue pushing the boundaries to futureproof its products and services.

"It reminds us that excellence is not achieved once; it is earned every day through consistency, compassion, and creativity. We see this recognition as a call to action to keep asking

ourselves: how can we make our customers’ experiences even better tomorrow? It inspires us to explore new technologies, enhance our service delivery, and invest in training programmes that empower our employees to serve customers more effectively," Wataniya said, while informing that its journey ahead will focus on deepening personalisation, integrating data-driven insights, and, most importantly, continued effort to innovate across all touchpoints. The goal is simple yet profound, namely, to make every interaction with Wataniya feel reassuring, effortless, and human for customers.

"For us at Wataniya, customer centricity is not a slogan; it is a way of life. It defines how we think, act, and serve. It’s what guides us to go the extra mile,

to listen before we respond, and to build relationships that last. As we celebrate this award, we do so with pride, but also with humility. Because we know that the trust of our customers is something we must continue to earn every day, with every policy, and every interaction. At Wataniya, we remain committed to ensuring that our customers are not just at the centre of our services, but truly at the centre of our story. This recognition is a chapter we are proud of, but the story continues, written with the same care, integrity, and dedication that have always defined who we are," the company concluded.

The Egyptian cabinet has approved a request by the North African country's Ministry of Transport to contract between the Egyptian National Railways Authority (NAT) and Italian firm Arsenale for the provision, management, and operation of a high-end tourist sleeper train that will be supplied, operated and fully funded by the Italian venture.

The project is expected to attract international visitors while also boosting domestic tourism among Egyptians, without imposing any additional financial burden on the North African state.

Additionally, the Egyptian cabinet approved a request from the Ministry of Tourism and Antiquities to extend the free emergency entry visa for travellers arriving by air at Luxor and Aswan airports during the summer seasons of 2026 and 2027.

The extension will apply from May 2026 through the end of October under the same

regulations currently in place, following positive results reflected in tourist arrival indicators from several markets that favour cultural tourism, particularly in the two governorates. The North African country's cabinet also approved the extension of the free 96-hour transit visa for an additional year, ending in April 2027, under the same controls currently governing its application to Egyptian airlines.

The United Kingdom's house prices surprisingly fell by 0.4% in December to finish 2025 just 0.6% higher than 2024's figures. It was also the weakest annual growth since April 2024, stated monthly figures from mortgage lender Nationwide Building Society. The fall

was surprising because economists polled by Reuters had forecast a 0.1% monthly rise to leave prices 1.2% higher than in December 2024, slowing from a 1.8% annual price rise in November 2025.

While talking about the slowdown

The project is expected to attract international visitors while also boosting domestic tourism among Egyptians

in the year-on-year growth rate, Nationwide Chief Economist Robert Gardner stated that the trend partly reflected strong price gains in December 2024 as well as the December 2025 price fall, and that the number of mortgages approved remained similar to pre-COVID levels.

"With price growth well below the rate of earnings growth and a steady decline in mortgage rates, affordability constraints eased somewhat, helping to underpin buyer demand. Nationwide expected annual house price growth of 2-4% in 2026," he added.

The average price in Q4 2024 was £273,077 ($367,561), but ranged widely from £168,317 in northern England to £529,372 in London.

According to Oman Electricity Transmission Company (OETC), renewable energy accounted for 9.46% of electricity transmitted by Oman’s national grid in 2025, marking a significant milestone in the Sultanate’s energy transition, apart from placing the Gulf country on a trajectory that will require renewable capacity to more than triple to meet the 30% target by 2030.

Grid-connected renewable sources generated around 4.26 terawatt-hours (TWh) of electricity during 2025. Reaffirming its role in enabling the national energy transition, OETC is now strengthening the integration of clean and renewable energy into the Sultanate's grid to support growth

ambitions, innovation and long-term sustainability, while reinforcing national objectives to expand renewable power flows across the nation’s extensive transmission network.

Renewable electricity currently supplied to the grid comes from four projects: Dhofar Wind I (50 MW), Ibri II Solar (500 MW), Manah I Solar (500 MW) and Manah II Solar (500 MW). Oman also has a substantial pipeline of solar and wind projects under development.

This pipeline will lift total renewable capacity to approximately 8.8 GW by around 2030, aligning with the target of renewables accounting for around 30% of total power generation capacity by then.

In 2025, Norway ranked first among European countries for electric vehicle adoption. Tesla drove the surge in sales as the Nordic nation strengthens its position in phasing out petrol and diesel-powered vehicles.

The development contrasts with the rest of Europe, where weak demand for EVs prompted the European Union in December 2025 to reverse its planned 2035 ban on internal combustion engine cars.

Driven by tax incentives, 95.9% of all new cars registered in Norway in 2025 were electric vehicles, and that number reached almost 98% in December. The annual figure was up from 88.9% in 2024, Norwegian Road Federation (OFV) data revealed. A record 179,549 new cars were registered in Norway during the year, a 40% increase from 2024.

Talking about Tesla, the Elon Muskled automaker was Norway's top-selling car brand for a fifth consecutive year, with a 19.1% market share, followed by Volkswagen at 13.3% of registrations and Volvo Cars at 7.8%. Tesla sold 27,621 cars in Norway in 2025, more than any other automaker has sold in the European country in a single year.

Retirees Analysis

GBO Correspondent

The failure of Australian super funds to support retirees is not a failure of investment performance but a failure of purpose

The Australian superannuation system stands as a global titan of asset accumulation and a testament to the legislative foresight of the early 1990s. With assets now exceeding $4.3 trillion and representing approximately 160% of the nation's GDP, the system has successfully enforced a culture of savings that has created a deep pool of national capital.

However, as the system enters its fourth decade, it faces a critical maturation crisis that threatens to undermine its fundamental social purpose. The accumulation phase has been executed with ruthless efficiency, yet the decumulation phase, the complex process of converting those assets into a reliable income stream, remains structurally immature and culturally neglected.

The release of the “2025 Retirement Income Covenant Pulse Check” by APRA and ASIC serves as a watershed moment for the industry. It provides a damning empirical validation of a long-held suspicion, confirming that Australian superannuation funds are excellent at taking money in but deeply ambivalent about paying it out.

The regulators’ assessment that the industry’s progress has been slow and merely incremental reveals a systemic inertia. This leaves millions of retirees navigating the most complex financial transition of their lives with inadequate support.

We are witnessing an industry suffering from a deep-seated accumulation bias, where the metrics of success are antithetical to the objective of the decumulation phase. The fear of running out is driving a paradox of thrift among the elderly, converting the superannuation system from a consumption-smoothing vehicle into a tax-advantaged inheritance scheme.

The introduction of the “Retirement Income Covenant” in 2022 was intended to be the legislative mechanism that forced

the superannuation industry to pivot its focus from accumulation to decumulation. The Covenant imposed a positive obligation on trustees to formulate strategies to assist members in maximising retirement income while managing the risks of longevity and inflation.

Three years into this regime, the 2025 review reveals a stark disparity between legislative intent and industrial reality. The findings were unequivocal in showing that the industry has failed to embrace the spirit of the reform. While compliance documents have been filed, the operational transformation required to deliver on these strategies has stalled.