March 1, 2016

Edited: April 18, 2016

Prepared for: The City of Fayetteville, Georgia

EXECUTIVE SUMMARY

In August 2015, the City of Fayetteville, Georgia, retained Fayetteville-based Garner Economics, LLC to create an economic development strategy specific to the City that will take into account the current state of the City and provide a roadmap for Fayetteville to create economic opportunities for its citizens.

The focus of the engagement was to help Fayetteville’s leadership understand the product improvement, marketing, and potential organizational changes it must make to ensure that the City strengthens its competitive position and is able to attract and retain the types of businesses that will create jobs and opportunities for its citizens.

Specifically, the scope of services for the overall project included:

(1) A comprehensive and holistic assessment of key forces driving the economy and its shifting dynamics;

(2) An Assets and Challenges Assessment (A&C) of Fayetteville from the perspective of a site-location consultant that facilitates investment decisions;

(3) Recommendations for business targets suitable for the City based on our research and analysis; and finally,

(4) A set of implementable recommendations that the leadership in the City can utilize to enhance the economic well-being of the area and make Fayetteville a desirable business location and enhance its quality of place.

In assessing Fayetteville as a competitive place to locate and grow a business, the consulting team found that the City falls behind its peers, the State of Georgia, and national averages in many criteria considered important to a community’s competitive economic position. While Fayetteville has enjoyed several positive gains in the recent year for example, the creation of Pinewood Atlanta Studios and the building of the City’s film industry there are many areas the City needs to improve if it is to be successful in attracting and retaining the types of companies that will provide better opportunities for its residents.

To begin mitigating these challenges and strengthening the City’s overall position, this strategy creates a customized, comprehensive plan for Fayetteville’s economic development for the next several years. Its end goal is to give the City the tools it needs to grow along a positive trajectory and provide the community and the people that live and work there with a steadily growing economic future.

Analysis and Assessments

As summarized in the CompetitiveRealitiesReport shared with the City in December 2015, our approach to creating this strategy began with Garner Economics conducting an A&C of the City and gathering input and perceptions of Fayetteville’s business climate from the community. The former was done through a windshield tour of the City and against a predetermined list of 51 criteria used to evaluate Fayetteville from a siteselection perspective. Garner Economics assessed the City based on the qualities, elements, and infrastructure that a business will look for when considering Fayetteville as a place for its operations.

The community engagement phase took the form of three focus groups with key community stakeholders and an online survey to solicit a variety of perceptions of the area’s business climate and areas for improvement. This input was used to validate and augment conclusions reached in the A&C .

Finally, because Fayetteville must compete with other geographies both nationally and within the Atlanta metropolitan area, it is important to understand where the City stands compared to key competitors. Garner Economics evaluated key demographic and economic indicators for the City and compared them to statewide and national-level data, as well against the two benchmark cities: Woodstock, Georgia, and Opelika, Alabama. These benchmark geographies were selected by the strategy steering committee with the City of Fayetteville.

In addition to these assessments, the team also looked at Fayetteville’s retail sector and identified areas of leakage and conducted a Local Specialization, Competitiveness & Growth Assessment for the City.

These “building blocks” and the key findings of the Competitive Realities Reportare summarized in Chapter 1. This dataset and body of knowledge are the basis upon which the recommendations have been built.

Target Industries

The above analysis revealed that there are areas that need attention if Fayetteville is to reach its potential as a competitive place for business. To confront these challenges, the City must find a balance between proactively working to recruit investment to the community, while protecting the friendly, small-town fabric that makes Fayetteville what it is today. To do so, the City must find consensus around the type of community it wants to be and work to recruit and retain the types of companies and talent that will enable this vision to come to fruition.

Chapter 2 provides insights in to what types of targets are “best fits” for Fayetteville, given the City’s existing assets and goals for the future. The description of, and rationale for, the targets will help the City and other economic development groups in the area prioritize marketing resources and will identify areas where policymakers can act to increase Fayetteville’s competitive position in attracting and retaining these business sectors.

The identified target industry sectors for Fayetteville are:

Small Business, Retail, and Film Production Support Services

Professional and Corporate Office Users

Computers and Technology Health Services

Economic Development Strategy for Fayetteville

Recommendations

Based on the assets and challenges identified within Fayetteville and the needs of the target business sectors, the recommendations provided within this strategy, and presented in detail in Chapter 3, reflect items the team believes the City should undertake to mitigate negative perceptions by sitelocation advisors or companies looking to invest in Fayetteville. Additionally, the recommendations highlight areas where the City should work with others in the region to better leverage Fayetteville’s location in the Atlanta metropolitan area. The recommendations also provide tactics the City can use to effectively market Fayetteville to the recommended business sector targets.

The recommendations go beyond traditional recruitment, expansion, and retention activities and look at Fayetteville and its economic future holistically. The recommendations are meant to be a comprehensive economic development strategy and are built to support one another. To be successful in attaining its goals, City leaders will need to take on a more structured approach to economic development that is proactive in guiding the area’s growth and assertive in building a funding stream to catalyze the change. This will mean executing economic development efforts differently and being a champion for long-term investments that will add to the City’s “product” and quality of place.

The recommendations are broken into three categories: policy changes and investments that should be made to strengthen the City’s product, tactics to market the City and better tell its economic development story, and organizational changes that will allow Fayetteville to significantly increase and improve its economic development service delivery. The recommendations further provide the optimal sequencing for taking on the tasks.

FIGURE 1: STRATEGIC RECOMMENDATIONS

Organizational Change

1. Reorganize the City’s Community Development Department

a. Rename the community development department

b. Hire an Economic Development Director

c. Separate the Planning and Zoning functions from economic development

2. Expand the existing Fayetteville Downtown Development Authority to encompass radius business district boundaries

3. Promote the existing Tax Allocation District

4. Make the case for a sustainable funding source for economic development projects

Product Improvement

1. Recruit a vocational tech two-year college

2. Develop a city-sponsored or city-owned Center for Visual and Performing Arts

3. Implement the key recommendations of the 2010 LCI Urban Study

4. Create a plan to improve gateways into the City

5. Provide the public free, high-speed Internet access in the Core Business District and in disadvantaged neighborhoods

6. Conduct a downtown parking study

Product Marketing

1. Create a separate economic development portal to enhance the City’s website

2. Partner with local and regional economic development allies to market the City

3. Engage Atlanta area commercial developers to promote the City’s value proposition

4. Re-brand (or create) a unified Fayetteville brand

As described in the following chapters, Fayetteville has great potential but must confront current challenges to improve its ability to be a home for the types of businesses and talent it desires. Given the competition of its peer communities and the changing demands and needs of the City’s talented workforce, Fayetteville must be strategic in leveraging its assets and building its value proposition. Fortunately, the City has the leadership, aspirations, and resources to catalyze change in the community. By taking steps to change its trajectory, Fayetteville can shape its economic future and optimize economic opportunities for its residents.

The following chapters provide the rationale and create a plan for undertaking the strategy. Achieving these goals will require bold and strategic steps to transform Fayetteville into a place that attracts quality talent and companies, while maintaining the City’s unique character and commitment to quality and fully leveraging its position in the Atlanta metropolitan region.

CHAPTER 1: WHERE FAYETTEVILLE STANDS AS A PLACE FOR BUSINESS

ASummaryoftheCompetitiveRealitiesReport

This chapter summarizes the Garner Economics team’s findings in Phase I, the “discovery” phase of the assignment. The assessment was an objective and subjective evaluation, and it included data collection, on-site visits, and soliciting opinions and perspectives of the City’s stakeholders. By knowing where Fayetteville stands, the City knows what challenges or gaps exist and can take steps to ameliorate negative situations, strengthen its overall “product,” and be a more attractive business location. Likewise, by knowing the area’s strengths, the City can better market them in its efforts to attract external businesses and retain those businesses already located in Fayetteville.

What Stakeholders Think

To provide a context around the data accumulated in the A&Cand economic and labor analysis, Garner Economics held three focus groups with stakeholders in Fayetteville and Fayette County to solicit their perceptions and opinions of the City’s business climate. Fifty-two people participated in the focus groups. Additionally, an electronic survey based on the focus group responses was distributed by the City. There were 182 survey respondents. The respondents represented a broad group of area residents, including both corporate and economic development perspectives as well as feedback from the general citizenry. An additional opinion survey to a random selection of high school students was also provided.

Among the two groups, there were several areas of agreement. Survey respondents tended to focus on broader quality of place assets and issues, while focus group respondents had deeper comments and concerns over particular economic assets or challenges such as local regulations and procedures and workforce needs. Both groups rated the City as “average” in terms of its business climate (i.e., policies and laws enacted by the local government that impact local businesses). The overarching key themes that emerged include:

A desire for more streamlined interaction with the City

Continuing tensions between encouraging growth in Fayetteville and maintaining the status quo

The need to improve access to and through the City

A lack of amenities for younger professionals and visitors

The opportunity to leverage the energy of Pinewood Atlanta Studios

A desire for regionalism on the county level

Recruiting companies to Fayetteville, so residents have opportunities closer to home and the City’s tax base is increased

The graphs on the following pages highlight the feedback in terms of the overall competitive position of the City. A detailed summary of the community engagement input was provided in the Competitive Realities Report .

When asked to indicate the top items they would like to see the City leadership take on to strengthen Fayetteville’s ability to attract and retain quality companies and talent to the City—without worrying about money or politics—the two groups responded as follows:

Most frequently noted by focus groups:

Improve access to highways and strengthen the road system within Fayetteville

Create a cultural arts district and performing arts center

Develop an area within the City that is a destination for residents and attracts visitors

Ensure that the school system is ready to address the diversity that the County is experiencing

Communicate the many assets Fayetteville has to offer

Most frequently noted by survey respondents:

Develop downtown and adjacent properties

Attract/retain millennials; serve needs of aging population

Attract and grow jobs/lessen need to out-commute

Fix the internal road system

Create a shopping district that is unique and draws visitors

Ensure that our school system is ready to address diversity

Improve K-12 schools within Fayetteville

Better market Fayetteville to potential tourists/companies

Promote regionalism in Fayette County

Open a new park or nature area within the City

Create a cultural arts district

Host more festivals/events to build community

Encourage developments that are lifestyle centers

Improve inter-city transit

Better leverage and use the Tax Allocation Districts

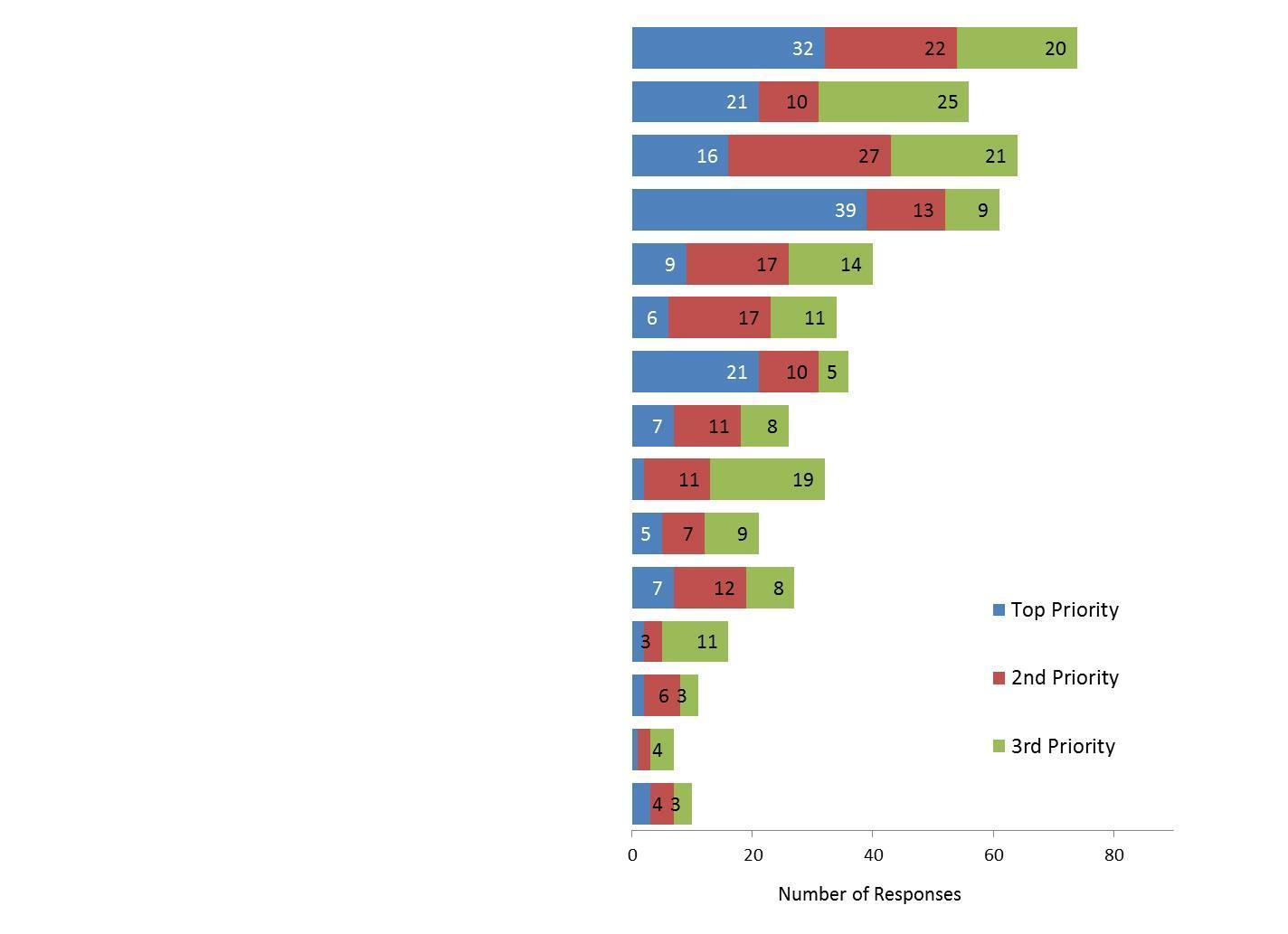

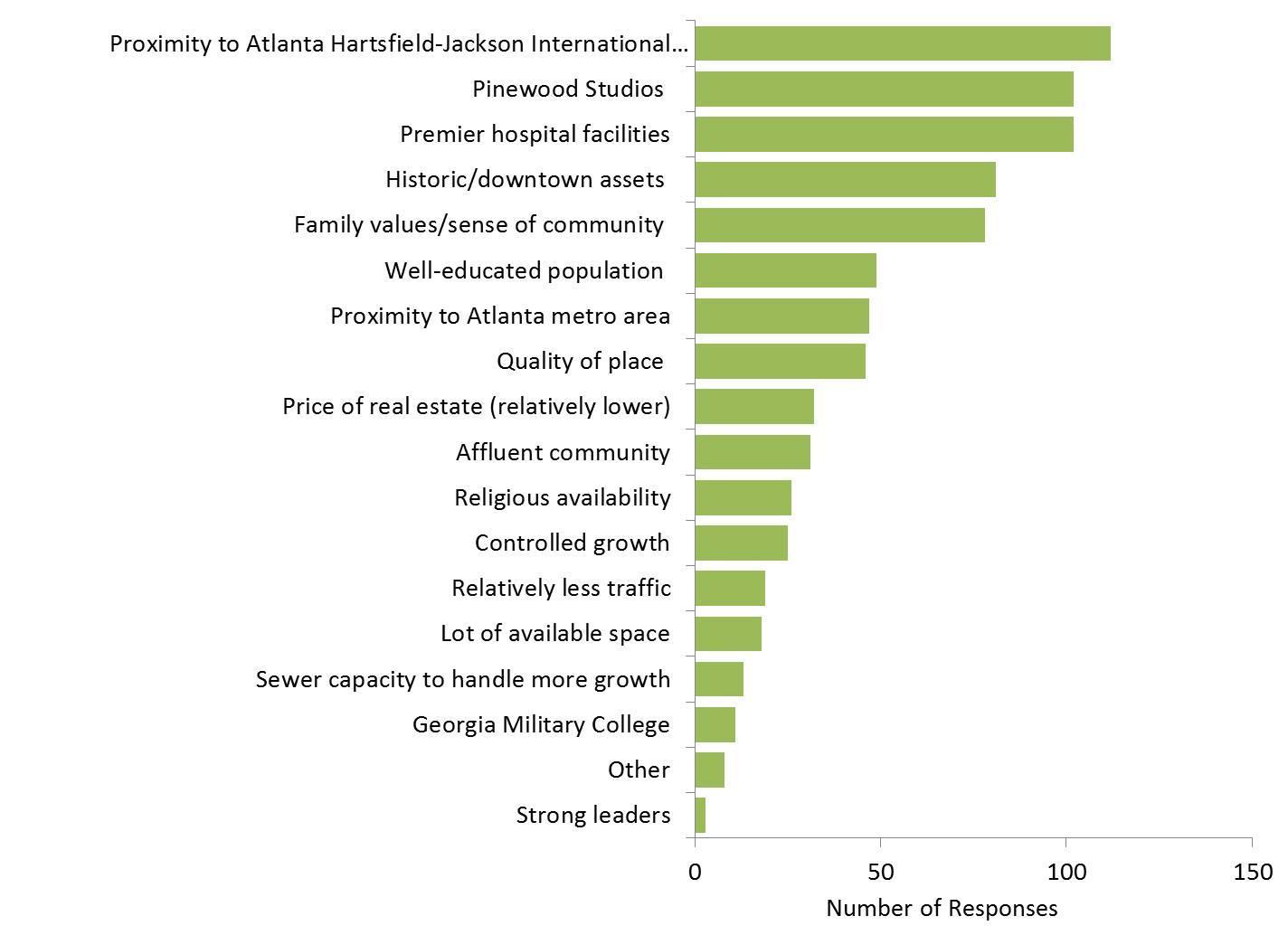

FIGURE 3: PERCEIVED STRENGTHS

When asked to indicate Fayetteville’s strengths, the two groups responded as follows:*

*Survey respondents were asked to choose up to five of the possible options.

When asked to indicate issues that inhibit Fayetteville from recruiting businesses, the two groups responded as follows:*

*Survey respondents were asked to choose up to five of the possible options

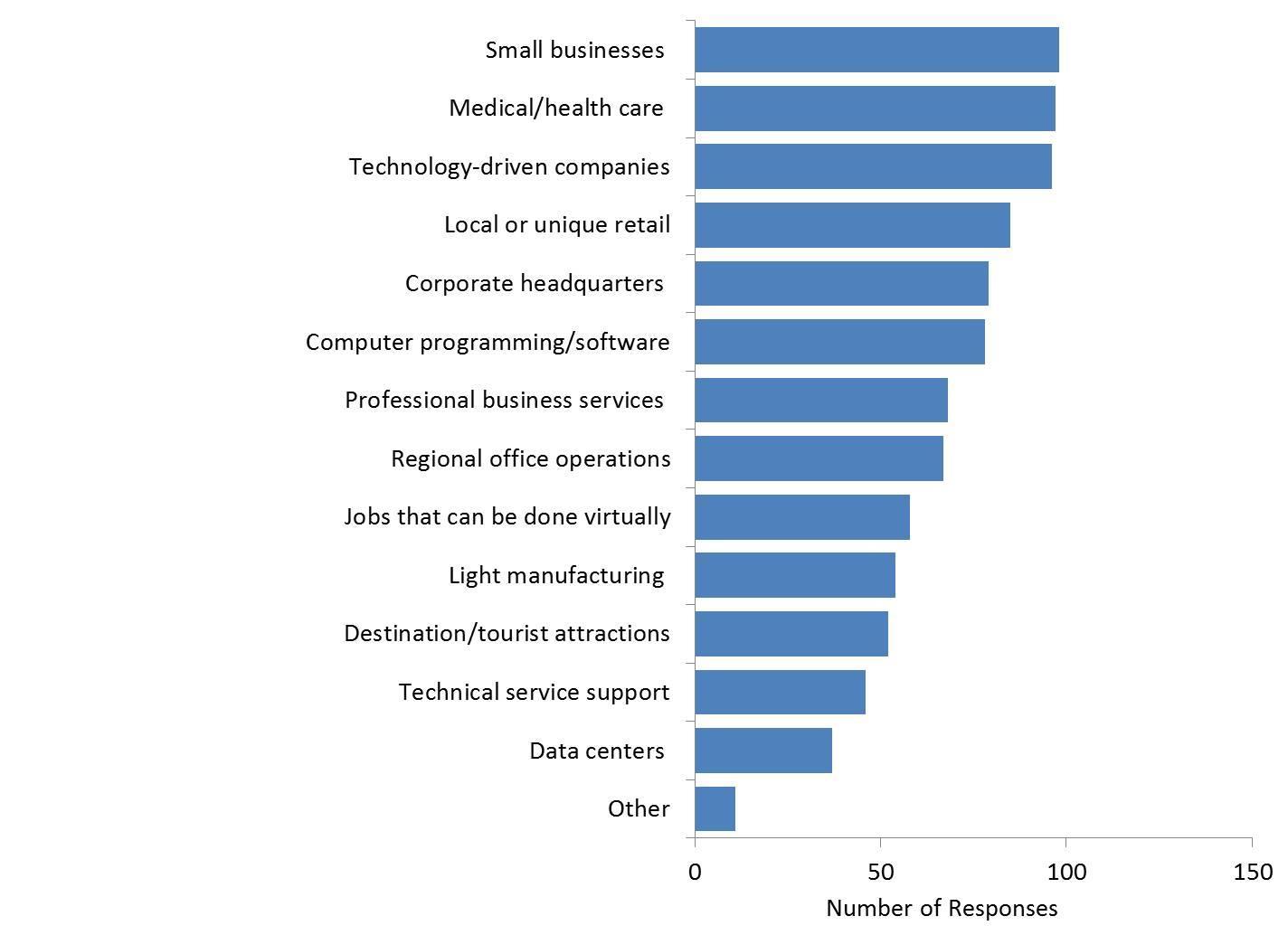

When asked what types of companies would be a good fit for the area, the two groups responded as follows:

FIGURE 6: LACKING INFRASTRUCTURE

When asked what hard or soft infrastructure* is weak or missing in Fayetteville, the survey respondents ranked the items as follows. Focus group participants most frequently noted the need for a more efficient road network and parking.

*Hard infrastructure was defined as the physical networks such as roadways, sewer, broadband Internet, airports, and/or ports

Soft infrastructure was defined as institutions or places that support the economic, health, and cultural climate of a place, such as the education system, the health care system, system of government, and/or parks.

Note: Survey respondents were asked to choose up to five of the possible options

Assets and Challenges Assessment

Grounded by decades of economic development, site-location analysis, and industry cluster targeting experience, Garner Economics began the project to assess Fayetteville by using a rigorous set of techniques based on fully sourced and reliable datasets to completely understand the City’s current economic state. The main component of this phase was the Assets and Challenges Assessment (A&C), which is a compilation of local facts and data points with quantitative analysis and some subjective opinions. These are typically the same variables that are used when we conduct a locational assessment on behalf of a corporate client. The team assessed Fayetteville against 51 criteria.

The A&Chelps local leaders understand the area’s potential so they can best develop realistic goals, identifies key strengths to emphasize in economic development marketing efforts, and identifies key weaknesses that may limit investment in the area. By knowing what challenges or gaps exist, Fayetteville can take the steps necessary to ameliorate the situation and be a more attractive business location. Likewise, by knowing its strengths, the City can better leverage them in its efforts to attract businesses.

Of the 51 variables analyzed, 17 are considered an Asset and 20 a Challenge (14 rated as Neutral). With 20 challenge rankings, Fayetteville has too many in the negative column based on the ratio of an economically healthy, dynamic city. The goal in the future will be for those policymakers engaged in local economic development to move the bar with the neutral rankings from neutral to an asset, and the challenge ranking to neutral (or better).

To enable a summary overview of the A&C’smainfindings for readers, a set of dashboard icons was presented. Each finding has an accompanying icon to assist with interpretation. The tables on the following pages summarize the assessment of Fayetteville.

REPORT DASHBOARD

Indicates the City is better (more positive) compared to a majority of the benchmark geographies or points to a positive trend or asset within the area.

Indicates the City is neutral or normal, neither positive nor negative. Indicator may represent an observation or be in the middle of the benchmark geographies.

Indicates the City is worse compared to a majority of the benchmark geographies or points to a negative trend or challenge within the area.

FIGURE 7: FAYETTEVILLE’S ASSETS AND CHALLENGES

Neutral ratings are not summarized in this report. Detailed data can be found in the COMPETITIVE REALITIES REPORT.

Assets

Centrally located for major regional market

Access to Markets

Centrally located for national market

Well positioned to serve international markets

Within 1 hour of commercial air passenger service

Broadband availability and speeds

Availability of managerial personnel

Within ½ hour of university/college

Challenges

Lack of interstate highway(s)

Lack of rail service

Lack of port facilities (inland and/or water)

Labor

No relative assets

City Economic Development Program

Access to Space

Availability of fully served and attractive office sites and space

Availability of fully served and attractive retail space

Access to Capital No relative assets

Lack of skilled industrial workers

Lack of skilled clerical workers

Lack of technicians and scientists

Lack of post-secondary vocational training

Lack of engineering program (local)

Lack of adequate level of professional staff

Lack of local economic development strategic plan(s)

Low level of leadership support of economic development program

Low level of funding for the City’s economic development program

Lack of availability of fully served and attractive industrial sites and space

Lack of availability of venture capital from local sources for business startups or early stage funding

FAYETTEVILLE’S ASSETS AND CHALLENGES, CONTINUED

Government

Impact on Business

Quality of Place

Assets

Availability/capacity of wastewater treatment

Availability of labor training incentives

Local property taxes (City of Fayetteville)

Availability of executive-level housing

Cost-of-Living Index

Level of cultural activity

Availability of shopping facilities

Availability of adequate medical facilities

Labor and Economic Trends

In addition to assessing Fayetteville against criteria and measures employed by site selectors, work during the assessments and analysis phase examined the area’s economic position against the State of Georgia, the United States, and two benchmark cities: Woodstock, Georgia, and Opelika, Alabama. These benchmark geographies were selected by the City.

Garner Economics used data that can be verified and, for which, comparisons with other cities or areas can be made at the level of detail

Challenges

Availability/capacity of water

SAT scores of Fayette County High Scholl related to the benchmarked jurisdictions

Availability of apartments

Availability of recreational opportunities

Availability of first-class hotels, motels, and resorts

Quality and variety of local restaurants

preferred by most site-selection professionals. The most detailed demographics data, industry statistics, and comparative rankings were used because businesses considering Fayetteville will do the same.

As the scorecards presented in the Competitive Realities Report (and replicated on pages 16-19) indicate, Fayetteville has mixed results in terms of demographics, labor, and economics.

Demographic & Labor Dynamics

Over the last decade, the total population of Fayetteville has increased 16.1% or 2,698 residents; the rate is above the nation, the state, Fayette County, and Opelika, but below the benchmark city of Woodstock.

Over the last five years, the annual rate of population growth in Fayetteville has been 1.5%, while over 10 years, the rate averaged 2.2%.

Fayetteville’s 5- and 10-year annual pace of population growth is above Opelika, Fayette County, the state, and the nation.

Over the 2009 to 2013 period, Fayetteville attracted 36.5% of its new residents from a Different County in Same State, a higher proportion than was experienced in both benchmark communities, the state, and the nation. Fayetteville attracted the lowest relative proportion of new residents from a Different State. The City also attracted the second highest percentage from Abroad.

Among all of the study areas, Fayetteville has the second most racially diverse population.

At 41.2 years, the median age in Fayetteville is higher than both benchmark cities, the state, and the nation, but slightly lower than the County median.

Fayetteville’s highest proportion of residents is in two age groups: 35–44 and 45–54. Fayetteville has a lower share of residents in age groups 25–34 than both benchmark cities.

Fayetteville’s violent and property crime rates were below Opelika, the state, and the nation, but above Woodstock and the County.

Educational attainment among the majority of Fayetteville’s population ages 25+ holds at least a high school diploma, with 42% holding a Bachelor’s Degree or Graduate or Professional Degree. With the exception of Woodstock, Fayetteville has the lowest proportion of residents whose highest level of educational attainment is Less than 9th Grade.

At 1379, Fayetteville’s 2015 composite SAT total score for Fayette County High School is below all of the study areas.

Fayette County High School and the entire district rank above all other benchmarks, except Opelika, in high school graduation rates.

Demographic & Labor Dynamics (continued)

Among Fayetteville’s new residents ages 25 and over, 42.3% hold a Bachelor’s Degree or higher. This is greater than Opelika, the state, and the nation and only slightly lower than Woodstock and the entire County.

Among Fayetteville residents ages 25 and over, median earnings areon par with the state and nation for all categories of educational attainment, however, lower than Fayette County. Earnings were lower than Woodstock as well, with the exception of the Graduate or Professional Degree category.

58.8% of those working in Fayetteville live outside the area (in-commute).

6,519 workers that live in Fayetteville travel outside the area for employment (out-commute).

Over the last 10 years, the number of workers Living in Fayetteville but Employed Outside (out-commuters) has increased 40.8% or 1,890 more workers.

The 2015 estimated average weekly wage in Fayetteville is $719. The average wage applies to employees that work in Fayetteville regardless of residence. This average wage is the third lowest among the study areas, with the lowest in Opelika.

Over the five-year period of 2010 to 2015, the estimated average weekly wage in Fayetteville increased by $26 or 3.7%. This increase is well above the benchmark city of Opelika, but behind Woodstock, the County, the state, and the nation.

For 2013, the per capita income in Fayetteville was $30,036, which was higher than Opelika, the state, and the nation but lower than Woodstock and Fayette County.

Over 11.2% of workers in Fayetteville classify themselves as Self-Employed—which is second only to Fayette County, which had 11.4% SelfEmployed.

Economic Dynamics

Economic Dynamics (continued)

At $18,049, median earnings among those Fayetteville workers classified as Self-Employed in Own Not Incorporated Business were the lowest among the study areas.

Among residents ages 16 and over in Fayetteville, 58.1% are employed, which falls between the two benchmark cities and is below the County, but above both the state and nation.

Fayetteville’s proportion of families with two income earners (Married, Husband and Wife in Labor Force) is 43.3%, which is higher than Opelika, the state, and the nation, but lower than Woodstock and the County.

Compared to the nation and the state, Fayetteville has the highest total share of households with incomes in the $15,000 to $24,999 category.

Fayetteville’s proportion of those above $100,000 is 26.4%, which is below the overall county average of 38.5% and Woodstock’s average of 28.5%.

Of 20 major industry categories, Fayetteville has the highest relative percentage in one industry: Health Care & Social Assistance.

The 2015 composite Cost-of-Living Index for Fayette County-Fayetteville is estimated to be 93.4. This is lower than Auburn-Opelika and the national average.

Households in Fayetteville have the greatest access to DSL and cable broadband compared to the benchmark cities, the County, state, and nation.

Fayetteville’s average percentage of retail leakage is 59.4, indicating that shoppers from Fayetteville spend less than half of their disposable income in the City.

The largest retail gap (indicating local consumers travel outside Fayetteville to satisfy their retail demands) is in Motor Vehicle & Parts Dealers at $212.9 million, followed by General Merchandise Stores with an $86.2 million gap.

Local Specialization, Competitiveness & Growth

Below are general observations from an in-depth analysis of industry sectors and occupational groups in Fayetteville. This information is not benchmarked to the nation, the state, or benchmark cities:

Since 2010, the largest absolute industry jobs gains in Fayetteville came from Health Care & Social Assistance, up 1,028 jobs or 27 percent, followed closely by Accommodation & Food Services, up 1,019 jobs or 61 percent.

There were significant job losses in Government (-454 jobs or 9 percent); Professional, Scientific & Technical Services (-75 jobs or 7 percent); Real Estate & Rental & Leasing (-57 jobs or 20 percent); and Crop & Animal Production (-33 jobs or 56 percent).

Industrial average earnings in Fayetteville are above the national same-industry average in two major sectors: Manufacturing (10.3 percent higher) and Transportation & Warehousing (8.8 percent higher).

Over the last five years, the single largest absolute occupational gains in Fayetteville came from Food Preparation & Serving Related, up 909 jobs or 48 percent.

Fayetteville’s median hourly earnings are above the nation for Military and Farming, Fishing & Forestry, but below the nation for the other 22 occupational sectors.

Five industry sectors in Fayetteville have a level of local specialization above 1.0 (which indicates a larger percentage than the national average) and have grown within the last five years: Health Care & Social Assistance, Accommodation & Food Services, Retail Trade, Construction, and Other Services.

The single industry At-Risk is Government, which has a strong local specialization at 1.2 but experienced a loss of 454 jobs over the past five years.

Motion Picture and Video Production, a subsector of the Information category, may be classified as an Emerging industry due to new studios in Fayetteville. Using the Atlanta MSA and the State of Georgia as comparisons, both show this subsector as Emerging.

Four main industry sectors with strong local Competitive effects were Accommodation & Food Services, Health Care & Social Assistance, Construction, and Transportation & Warehousing.

Over the last five years, the occupational groups of Food Preparation & Serving Related, Healthcare Practitioners & Technical, Sales & Related, Healthcare Support, Construction & Extraction, Personal Care & Service, and Community & Social Service each experienced job growth while exhibiting local specialization.

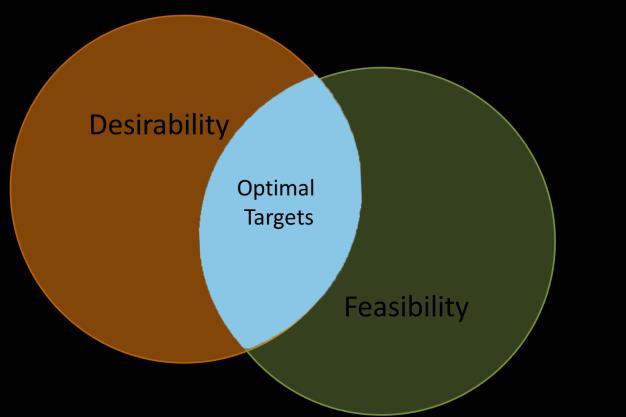

CHAPTER 2: OPTIMAL BUSINESS TARGETS FOR FAYETTEVILLE

The optimal business sectors target selection is based on the site-specific characteristics of the local economy in Fayetteville. The recommended targets are for those engaged in recruiting new business to Fayetteville to prioritize resources with these industry sectors that offer the most promise for the City. These optimal targets hold a competitive advantage to the community and, thus, help policymakers prioritize the City’s economic development strategy.

In selecting optimal targets, Garner Economics uses a desirability and feasibility screening matrix to determine the recommended targets. Desirability includes the types of business sectors the community would like to see in Fayetteville (Figure 8). Feasibility includes what the area can actually achieve in the short- to mid-term, based on current or planned locational assets and in conducting an analytical review of the local and regional economy.

Using results from the previously completed CompetitiveRealitiesReport , the AssetsandChallengesAssessment , focus groups, and field visits, four business and industry groups were chosen that best match the unique competitive advantages in the area to the needs of particular industry sectors. Special attention is given to sectors in the midst of significant change or innovative transformation, with the strong likelihood that there will be increased interest in adding, growing, or moving operational sites. Each sector selected has some sort of competitive advantage in the marketplace. Some sectors are already well established in the area and are positioned for additional growth. For others that are not as well established, there are opportunities to leverage Fayetteville’s assets in order to either attract existing businesses or to encourage entrepreneurs to start new ventures. For all targeted businesses, Fayetteville’s competitive advantages are presented, along with recent and projected performance of the targets at the national

level. In some cases, target sectors are actually losing jobs nationally, but Fayetteville’s particular set of economic development assets still put it in position to capture demand. For each target, a list of related occupations is presented, along with a count of the current number of employed workers in Fayette County for each occupation.

Because economies are dynamic and impossible to precisely predict, these four optimal targets offer opportunities across several non-competing sectors, affording a means to diversify economic development strategies and avoid risky overconcentration.

The target information is presented in a practical and workable format, avoiding complex analysis and extensive projections of future outcomes. Instead, the justifications for the targets should be clearly apparent and make sense to the average practitioner. Under each major target sector, a list of individual subsectors is provided with accompanying NAICS classifications. A full description for each subsector target can be found in Table 9. Detailed subsector targets help to bridge the gap from broad economic concepts to a workable means for identifying specific prospective industries and firms.

For each target, a bulleted list of rationales is presented and identified as appealing to the needs of prospects (P) or the community (C). This material can be used in marketing and community support efforts or to help economic development personnel prioritize targeting efforts.

OPTIMAL BUSINESS TARGETS FOR FAYETTEVILLE

Small Business, Retail, and Film Production Support Services Professional and Corporate Office Users Computers and Technology Health Services

MAJOR SUBSECTORS

Local or Unique/Boutique Retail

Destination/Tourist Attractions

Virtual Jobs and Co-Working Facilities

Restaurants and Other Dining Establishments

Film Production Support Services:

► Pinewood Forrest Development

► Catering

► Ground Transportation

► Staffing Agencies

► Agents and Talent Scouts

Regional and Corporate Headquarters for Private and Notfor-Profit Institutions

Legal Services

Accounting, Tax Preparation, Bookkeeping, and Payroll Services

Office Administrative Services

Business Support Services

Management, Scientific, and Technical Consulting Services

Scientific Research and Development Services

Software Publishers

Computer Systems Design and Related Services

Data Processing, Hosting, and Related Services

Facilities Support Services

High-Tech Light Manufacturing

Offices of Physicians, Dentists, and Other Health Practitioners

Health Services Educational Institutions

Outpatient Care Centers

Medical and Diagnostic Laboratories

Home Health Care Services

Nursing and Residential Care Facilities

SMALL BUSINESS, RETAIL, AND FILM PRODUCTION SUPPORT SERVICES

This target group seeks to leverage three of Fayetteville’s strongest assets: 1) its historic downtown, 2) its resident base of educated professionals, and 3) the presence of Pinewood Atlanta Studios. Collectively, these assets provide a platform for building a diverse base of small businesses that provide a range of goods and services related to retail, dining, entertainment, transportation, the arts, and professional businesses.

Downtown Fayetteville is a compact, but significant, historic district that presently contains a limited number of retail, dining, and shopping services. The downtown area boasts a large base of daytime employees, as well as a hotel, but business development has been limited by issues related to accessibility and parking; investments in these items could have a significant effect on increasing investment.

Rationales

Fayetteville’s combination of proximity to Atlanta, affordability, and quality of life has made it a popular place for many professionals to reside. However, since most of the jobs in the local economy are in lower wage industries, just 10 percent of the resident workforce works within the City. For the 6,500 commuters who leave the City every day to go to work, many may be entrepreneurs-in-waiting and others may be able and interested in working out of shared office space or “co-working” facilities in Fayetteville.

Pinewood Studios represents an enormous opportunity for promoting entrepreneurial business growth in Fayetteville. In addition to the studio itself, the planned Georgia Film Academy soundstage and future Pinewood Forrest mixed-use development will greatly expand the presence of the film industry in the area. This will create a variety of opportunities for support services, including catering, transportation, talent scouts, placement agencies, and even local acting talent.

Established Main Street development program (P) (C)

Presence of Pinewood Studios and related activity (P)

Availability of management personnel (P)

Within ½ hour of college/university (P)

High level of educational attainment among resident population (P)

Availability of fully served and attractive retail space (P)

Low local property taxes (P)

Availability of executive and moderate-cost housing (P)

Low cost of living (P)

Availability of major shopping facilities (P)

High rate of population growth (P)

Highly rated K-12 public schools in the County (P)

Opportunity to provide local opportunities for current out-commuters (C)

Opportunity to create entrepreneurship opportunities (C)

Opportunity to improve quality of retail and dining offerings (C) (P)

Opportunity to capture retail spending that is currently leaking out (C)

Excellent broadband access and speed (P)

Recent rapid growth in Accommodation & Food Services sector (P)

Average target subsector 2015 national earnings of $25,511 (P)

Average target subsector 10-year past employment growth of 22.1% (C)

Average target subsector projected 10-year job growth of 15.2% (C)

An existing local pool of high-demand occupations (Table 2) (P)

Quality of place assets: proximity to Atlanta (ATL) Airport, cultural activity, historic buildings and areas, medical facilities, low crime rate (P)

Table 2: Small Business, Retail, and Film Production Support Services: Fayette County Existing Labor Pool

PROFESSIONAL AND CORPORATE OFFICE USERS

Fayetteville’s unique assets make it a competitive location for a range of companies. The City has many assets for office-based businesses: residential appeal, proximity to ATL Airport, accessibility to the I-75 and I-85 corridors, affordable and available office space and sites, excellent broadband service, and many quality-of-life advantages.

Fayetteville is already home to a large base of professional workers but, as mentioned under the preceding target, nearly all of these workers commute to jobs in other locations. This resident workforce is important for two reasons: 1) it can be a springboard for entrepreneurs, and 2) it is attractive for prospective employers.

Businesses in each of the sectors in this cluster will be largely oriented towards serving larger businesses located across the Southeast. There are several models for successful businesses, including firms that provide services to local residents, firms that support businesses in larger cities, branch offices of national or regional companies, or firms that move to the area to take advantage of its assets.

Fayetteville’s appeal will differ somewhat for each specific sector. Law and accounting firms will be able to take advantage of population growth in the surrounding area. Administrative and business support services companies can perform outsourced functions for companies in Atlanta and other major regional markets. Regional or corporate headquarters can find affordable space in proximity to qualified workers that is still convenient to larger markets.

Rationales

Centrally located for regional, national, and international markets (P)

Availability of management personnel (P)

Within ½ hour of college/university (P)

Proximity to ATL Airport and surrounding business districts (P)

High rate of educational attainment (P)

High median household income level (P)

High relative share of residents with Bachelor’s Degrees (P)

Availability of executive and moderate-cost housing (P)

Excellent broadband access and speed (P)

Availability of fully served and attractive office sites and space (P)

High rate of population and labor force growth (P)

High percentage of Self-Employed workers in local labor force (P)

Competitive wages in Management of Companies & Enterprises and Professional, Scientific, and Technical Services sectors (P)

Ability to attract/retain the sizeable number of high-wage earners who presently out-commute (C)

High rate of growth in Office & Administrative Support and Management occupational groups (P)

Average target subsector 2015 national earnings of $85,501 (C)

Average target subsector 10-year past job growth of 19.2% (C)

Average major subsector projected 10-year job growth of 11.7% (C)

Strong existing local pool of high-demand occupations (Table 4) (P)

Quality of place assets: cultural activity, historic buildings and areas, medical facilities, low crime rate, shopping, medical, K-12 schools (P)

Source: EMSI, Garner Economics

Table 4: Professional and Corporate Office Users: Fayette County Existing Labor Pool of

COMPUTERS AND TECHNOLOGY

This target group includes a mix of technology-oriented industry sectors that aim to capitalize on Fayetteville’s skilled and educated workforce. This cluster places a particular focus on those who live in the local area but commute outside the local area to computing, IT, or tech jobs elsewhere in the Atlanta region.

The industry groups found in this cluster are all poised to benefit from the convergence of global economic and technological forces. These subsector targets are responding to corporate clients’ adaptation to rapid changes in customer expectations within an evolving technological landscape. Fayetteville’s proximity to Atlanta is an asset for this group of industries, as Atlanta is the leading location in the Southeast for businesses involved in technical consulting, computer systems design, data processing, and

Centrally located for regional and national markets (P)

Availability of technicians and scientists (P)

Within ½ hour of major college/university (P)

Availability of office and flex space (P)

Proximity to ATL Airport and surrounding business districts (P)

High rate of educational attainment (P)

Availability of executive and moderate-cost housing (P)

Excellent broadband access and speed (P)

High rate of population and labor force growth (P)

Strong wages in Manufacturing sector (C)

information technology. With digital transactions, virtual workplaces, and teleworking becoming the norm for many companies, lower cost areas close to major cities are poised to attract smaller businesses and/or startups from this cluster.

Fayetteville is also well positioned to attract niche manufacturing businesses, particularly those that use high-technology processes. This advantage is partly due to the number of qualified technical workers living locally and partly due to Fayetteville’s proximity to a large base of skilled manufacturing workers from existing businesses on Atlanta’s Southside. Given the limited amount of land and sites for industrial uses, this would need to focus on smaller and/or less labor intensive users, though.

Rationales

Competitive wages in Information and Professional, Scientific, and Technical Services sectors (P)

Emerging growth in local Manufacturing sector (P)

Ability to attract/retain the sizeable number of high-wage earners who presently out-commute (C)

Average target subsector 2015 national earnings of $103,214 (C)

Average target subsector 10-year past job growth of 30.0% (C)

Average major subsector projected 10-year job growth of 20.1% (C)

Strong existing local pool of high-demand occupations (Table 6) (P)

Quality of place assets: cultural activity, historic buildings and areas, medical facilities, low crime rate, shopping, medical, K-12 schools (P)

Source: EMSI, Garner Economics

Table 6: Computers and Technology: Fayette County Existing Labor Pool of High-Demand Occupations-2015

HEALTH SERVICES

The industries in the health services target already form the backbone of the Fayetteville economy. The Health Care & Social Assistance sector presently accounts for 20 percent of its jobs. Much of this industry centers around Piedmont Fayette Hospital, which is the largest private employer in the City, with about 1,450 jobs, and is considered the premier health care facility on Atlanta’s Southside. The hospital’s status is being enhanced further by its recent affiliation with the MD Anderson Cancer Network.

In addition to being Fayetteville’s largest industry group, health care has also been one of its fastest growing. From 2010-2015, the sector added more than 1,000 jobs in the City. More importantly, local wages in this sector are comparable to national averages, while most other local sectors pay far below national averages.

In spite of the major presence and growth prospects of this cluster, the local health care industry is limited by its orientation to providing retail health care services to the local resident market, as opposed to regional destination services. As such, the growth prospects of Piedmont Fayette Hospital and of related health care industries will be dictated by demand growth from Fayette County and surrounding areas. With continued population growth and an aging population in the area, this target should see sustained growth.

Another component of this target is specific to the region’s aging population: the care and housing of the elderly. This target includes nursing care facilities, continuing care retirement communities, and assisted living facilities. With Fayette County’s median age 7.1 years above the state average, these facilities will clearly be needed in the local area in the future.

Rationales

Centrally located for local and regional markets (P)

Availability of skilled medical workers (P)

Availability of post-secondary vocational training (P)

Within ½ hour of college/university (P)

Availability of executive and moderate-cost housing (P)

Presence of Piedmont Fayette Hospital (C) (P)

Availability of fully served and attractive office sites and space (P)

High rate of population and labor force growth (P)

High median household income level (P)

High median age in local and regional population (P)

High concentration of employment in Health Care sector (P)

Strong wages in Health Care sector (C)

Strong local Competitive effect for Health Care sector (P)

Strong growth for Healthcare Practitioners and Technical and Healthcare Support occupations (P)

Average target subsector 2015 national earnings of $58,753 (C)

Average target subsector 10-year past job growth of 33.6% (C)

Average major subsector projected 10-year job growth of 23.7% (C)

Strong existing local pool of high-demand occupations (Table 8) (P)

Quality of place assets: cultural activity, historic buildings and areas, medical facilities, low crime rate, shopping, K-12 schools (P)

Table 7: Health Services Subsectors Target Subsectors

Source: EMSI, Garner Economics

NAICS

4452

Specialty Food Stores

Small Business, Retail, and Film Production Support Services

This industry group comprises establishments primarily engaged in retailing specialized lines of food.

NAICS

4481

Clothing Stores

This industry group comprises establishments primarily engaged in retailing new clothing.

NAICS

453220

Gift, Novelty, and Souvenir Stores

This industry comprises establishments primarily engaged in retailing new gifts, novelty merchandise, souvenirs, greeting cards, seasonal and holiday decorations, and curios.

NAICS

485320

Limousine Service

This industry comprises establishments primarily engaged in providing an array of specialty and luxury passenger transportation services via limousine or luxury sedans generally on a reserved basis. These establishments do not operate over regular routes and on regular schedules.

NAICS 485510

Charter Bus Industry

This industry comprises establishments primarily engaged in providing buses for charter. These establishments provide bus services to meet customers' road transportation needs and generally do not operate over fixed routes and on regular schedules.

NAICS 531120

Lessors of Nonresidential Buildings (Except Miniwarehouses)

This industry comprises establishments primarily engaged in acting as lessors of buildings (except miniwarehouses and self-storage units) that are not used as residences or dwellings. Included in this industry are: (1) owner-lessors of nonresidential buildings; (2) establishments renting real estate and then acting as lessors in subleasing it to others; and (3) establishments providing full service office space, whether on a lease or service contract basis.

NAICS

561311

Employment Placement Agencies

This US industry comprises establishments primarily engaged in listing employment vacancies and in referring or placing applicants for employment. The individuals referred or placed are not employees of the employment agencies.

NAICS 561320

Temporary Help Services

This industry comprises establishments primarily engaged in supplying workers to clients' businesses for limited periods of time to supplement the working force of the client. The individuals provided are employees of the temporary help service establishment. However, these establishments do not provide direct supervision of their employees at the clients' work sites.

NAICS 711410 Agents and Managers for Artists, Athletes, Entertainers, and Other Public Figures

This industry comprises establishments of agents and managers primarily engaged in representing and/or managing creative and performing artists, sports figures, entertainers, and other public figures. The representation and management includes activities such as representing clients in contract negotiations; managing or organizing clients' financial affairs; and generally promoting the careers of their clients.

Small Business, Retail, and Film Production Support Services (continued)

NAICS 711510 Independent Artists, Writers, and Performers

This industry comprises independent (i.e., freelance) individuals primarily engaged in performing in artistic productions, in creating artistic and cultural works or productions, or in providing technical expertise necessary for these productions. This industry also includes athletes and other celebrities exclusively engaged in endorsing products and making speeches or public appearances for which they receive a fee.

NAICS 722310 Food Service Contractors

This industry comprises establishments primarily engaged in providing food services at institutional, governmental, commercial, or industrial locations of others based on contractual arrangements with these types of organizations for a specified period of time. The establishments of this industry provide food services for the convenience of the contracting organization or the contracting organization's customers.

NAICS 722320 Caterers

This industry comprises establishments primarily engaged in providing single event-based food services. These establishments generally have equipment and vehicles to transport meals and snacks to events and/or prepare food at an off-premise site. Banquet halls with catering staff are included in this industry. Examples of events catered by establishments in this industry are graduation parties, wedding receptions, business or retirement luncheons, and trade shows.

NAICS 722330 Mobile Food Services

This industry comprises establishments primarily engaged in preparing and serving meals and snacks for immediate consumption from motorized vehicles or non-motorized carts. The establishment is the central location from which the caterer route is serviced, not each vehicle or cart. Included in this industry are establishments primarily engaged in providing food services from vehicles, such as hot dog carts and ice cream trucks.

NAICS 722410 Drinking Places (Alcoholic Beverages)

This industry comprises establishments known as bars, taverns, nightclubs, or drinking places primarily engaged in preparing and serving alcoholic beverages for immediate consumption. These establishments may also provide limited food services.

NAICS 72251 Restaurants and Other Eating Places

This industry comprises establishments primarily engaged in one of the following: (1) providing food services to patrons who order and are served while seated (i.e., waiter/waitress service) and pay after eating; (2) providing food services to patrons who generally order or select items (e.g., at a counter, in a buffet line) and pay before eating; or (3) preparing and/or serving a specialty snack (e.g., ice cream, frozen yogurt, cookies) and/or nonalcoholic beverages (e.g., coffee, juices, sodas) for consumption on or near the premises.

NAICS

5411

Legal Services

Professional and Corporate Office Users

This industry comprises offices of legal practitioners known as lawyers or attorneys (i.e., counselors-at-law) primarily engaged in the practice of law. Establishments in this industry may provide expertise in a range or in specific areas of law, such as criminal law, corporate law, family and estate law, patent law, real estate law, or tax law. It additionally includes the offices of notaries, title abstract and settlement offices, and all other legal services.

NAICS

541211

Offices of Certified Public Accountants

This US industry comprises establishments of accountants that are certified to audit the accounting records of public and private organizations and to attest to compliance with generally accepted accounting practices.

NAICS

541214

Payroll Services

This US industry comprises establishments (except offices of CPAs) engaged in the following without also providing accounting, bookkeeping, or billing services: (1) collecting information on hours worked, pay rates, deductions, and other payroll-related data from their clients; and (2) using that information to generate paychecks, payroll reports, and tax filings.

NAICS

541219

Other Accounting Services

This US industry comprises establishments (except offices of CPAs) engaged in providing accounting services (except tax return preparation services only or payroll services only). These establishments may also provide tax return preparation or payroll services.

NAICS

551114

Corporate, Subsidiary, and Regional Management Offices

This US industry comprises establishments (except government establishments) primarily engaged in administering, overseeing, and managing other establishments of the company or enterprise. These establishments normally undertake the strategic or organizational planning and decision making role of the company or enterprise.

NAICS

561110

Office Administrative Services

This industry comprises establishments primarily engaged in providing a range of day-to-day office administrative services such as financial planning, billing and recordkeeping, personnel, and physical distribution and logistics for others on a contract or fee basis. These establishments do not provide operating staff to carry out the complete operations of a business.

NAICS

5614

Business Support Services

This industry includes a range of sectors that provide services to other business types, including document preparation, telephone call centers, business service centers, collection agencies, credit bureaus, repossession, court reporting, and other related services.

Computers and Technology

NAICS 33441 Semiconductor and Other Electronic Component Manufacturing

This industry comprises establishments primarily engaged in manufacturing semiconductors and other components for electronic applications. Examples of products made by these establishments are capacitors, resistors, microprocessors, bare and loaded printed circuit boards, electron tubes, electronic connectors, and computer modems.

NAICS 33451 Navigational, Measuring, Electromedical, and Control Instruments Manufacturing

This industry comprises establishments primarily engaged in manufacturing navigational, measuring, electromedical, and control instruments. Examples of products made by these establishments are aeronautical instruments, appliance regulators and controls (except switches), laboratory analytical instruments, navigation and guidance systems, and physical properties testing equipment.

NAICS 511210 Software Publishers

This industry comprises establishments primarily engaged in computer software publishing or publishing and reproduction. Establishments in this industry carry out operations necessary for producing and distributing computer software, such as designing, providing documentation, assisting in installation, and providing support services to software purchasers. These establishments may design, develop, and publish, or publish only.

NAICS 518210 Data Processing, Hosting and Related Services

This industry comprises establishments primarily engaged in providing infrastructure for hosting or data processing services. These establishments may provide specialized hosting activities, such as web hosting, streaming services, or application hosting; provide application service provisioning; or may provide general time-share mainframe facilities to clients. Data processing establishments provide complete processing and specialized reports from data supplied by clients or provide automated data processing and data entry services. This industry includes data centers.

NAICS 5415 Computer Systems Design and Related Services

This industry comprises establishments primarily engaged in providing expertise in the field of information technologies through one or more of the following activities: (1) writing, modifying, testing, and supporting software to meet the needs of a particular customer; (2) planning and designing computer systems that integrate computer hardware, software, and communication technologies; (3) on-site management and operation of clients' computer systems and/or data processing facilities; and (4) other professional and technical computer-related advice and services.

NAICS 5416 Management, Scientific, and Technical Consulting Services

This industry comprises a range of establishments that provide consulting services related to one or more of the following fields: business, administrative management, human resources, marketing, logistics, or environmental.

NAICS 5417 Scientific Research and Development Services

This industry comprises establishments primarily engaged in conducting research and experimental development in the physical, engineering, and life sciences, such as agriculture, electronics, environmental, biology, botany, biotechnology, computers, chemistry, food, fisheries, forests, geology, health, mathematics, medicine, oceanography, pharmacy, physics, veterinary, and other allied subjects. It additionally includes establishments primarily engaged in conducting research and analyses in cognitive development, sociology, psychology, language, behavior, economic, and other social science and humanities research.

Health Services

NAICS 621111 Offices of Physicians (Except Mental Health Specialists)

This industry comprises establishments of health practitioners having the degree of M.D. (Doctor of Medicine) or D.O. (Doctor of Osteopathy) primarily engaged in the independent practice of general or specialized medicine (except psychiatry or psychoanalysis) or surgery. These practitioners operate private or group practices in their own offices (e.g., centers, clinics) or in the facilities of others, such as hospitals or HMO medical centers.

NAICS 621112 Offices of Physicians, Mental Health Specialists

This industry comprises establishments of health practitioners having the degree of M.D. (Doctor of Medicine) or D.O. (Doctor of Osteopathy) primarily engaged in the independent practice of psychiatry or psychoanalysis. These practitioners operate private or group practices in their own offices (e.g., centers, clinics) or in the facilities of others, such as hospitals or HMO medical centers.

NAICS 621210 Offices of Dentists

This industry comprises establishments of health practitioners having the degree of D.M.D. (Doctor of Dental Medicine), D.D.S. (Doctor of Dental Surgery), or D.D.Sc. (Doctor of Dental Science) primarily engaged in the independent practice of general or specialized dentistry or dental surgery. These practitioners operate private or group practices in their own offices (e.g., centers, clinics) or in the facilities of others, such as hospitals or HMO medical centers. They can provide either comprehensive preventive, cosmetic, or emergency care, or specialize in a single field of dentistry.

NAICS 6213 Offices of Other Health Practitioners

This industry comprises a range of health care professionals, including chiropractors, optometrists, mental health practitioners, physical, occupational and speech therapists, audiologists, podiatrists, and other areas of expertise.

NAICS 6214 Outpatient Care Centers

This industry includes establishments that provide specialized outpatient treatment such as family planning, mental health, substance abuse treatment, kidney dialysis, ambulatory surgery, and emergency care.

NAICS 621511 Medical Laboratories

This industry comprises establishments known as medical laboratories primarily engaged in providing analytic or diagnostic services, including body fluid analysis, generally to the medical profession or to the patient on referral from a health practitioner.

NAICS 621512 Diagnostic Imaging Centers

This industry comprises establishments known as diagnostic imaging centers primarily engaged in producing images of the patient generally on referral from a health practitioner.

NAICS 621610 Home Health

Care Services

This industry comprises establishments primarily engaged in providing skilled nursing services in the home, along with a range of the following: personal care services; homemaker and companion services; physical therapy; medical social services; medications; medical equipment and supplies; counseling; 24-hour home care; occupation and vocational therapy; dietary and nutritional services; speech therapy; audiology; and high-tech care, such as intravenous therapy.

Health Services (continued)

NAICS 623110 Nursing Care Facilities (Skilled Nursing Facilities)

This industry comprises establishments primarily engaged in providing inpatient nursing and rehabilitative services. The care is generally provided for an extended period of time to individuals requiring nursing care. These establishments have a permanent core staff of registered or licensed practical nurses who, along with other staff, provide nursing and continuous personal care services.

NAICS 623311 Continuing Care Retirement Communities

This industry comprises establishments primarily engaged in providing a range of residential and personal care services with on-site nursing care facilities for (1) the elderly and other persons who are unable to fully care for themselves and/or (2) the elderly and other persons who do not desire to live independently. Individuals live in a variety of residential settings with meals, housekeeping, social, leisure, and other services available to assist residents in daily living. Assisted living facilities with on-site nursing care facilities are included in this industry.

NAICS 623312 Assisted Living Facilities for the Elderly

This industry comprises establishments primarily engaged in providing residential and personal care services (i.e., without on-site nursing care facilities) for (1) the elderly or other persons who are unable to fully care for themselves and/or (2) the elderly or other persons who do not desire to live independently. The care typically includes room, board, supervision, and assistance in daily living, such as housekeeping services.

Source: US Census Bureau, Garner Economics

CHAPTER 3: OBSERVATIONS & RECOMMENDATIONS—WHERE DO WE GO

FROM HERE?

To ensure that Fayetteville can leverage its many assets and strengthen its business climate so as to retain the companies it currently has, as well as attract its targets and others, the City must be proactive in shaping Fayetteville’s economic future and setting it apart from other peer jurisdictions.

The following observations, conclusions, and recommendations are based on data and feedback collected during Phase I and noted in the previously cited CompetitiveRealitiesReport . They also build upon the assessments made to prioritize the business targets identified in Chapter 2.

The resulting body of work suggests that the City has an opportunity to improve its business climate and make changes to its local development program to better attract the talent and companies that will create more opportunity within the City’s boundaries. The recommendations look to build upon the many assets Fayetteville has and to fill any product gaps.

As noted in the introductory chapters, this assessment—and the observations therein—were developed from a site-selector perspective. The recommendations are built with an eye toward those areas that will differentiate Fayetteville. The first goal of this master plan/strategy is to provide the City with a framework for the City Council to consider its economic development service delivery and activities to support and augment the work of other city departments and organizations involved in economic development. Therefore, these recommendations are designed to go beyond traditional recruitment, expansion, and retention activities. The recommendations look at Fayetteville and its economic future holistically and explore ways to better connect and leverage the City’s talent and workforce, entrepreneurship, infrastructure, and business climate.

As with any strategy, there will be some elements that the City can take on independently. There will be other initiatives that will need to be taken on in collaboration with others or in support of others. The City administration will be a champion for the initiatives as a means to improve the City’s competitiveness as a place to do business and one that can attract the types of talent that will drive the economy for years to come. The recommendations were written so as to calibrate the City’s actions to its specific role.

Garner Economics developed the conclusions and recommendations with the following principles for the City in mind:

Undertake economic development activities in the context of work being done to strengthen not only the City, but also the entire region. For Fayetteville to capitalize on such potential, Garner Economics recommends that the city government take a more proactive approach to driving the City’s growth—changing parts of the City’s economic development service delivery, working to improve the City’s overall product, and better telling the story of the many assets Fayetteville has to offer as a home for business.

Be a leader. The success of the economic development strategy will depend not only on the changes the City makes regarding how it does business and services its clients, but also on its ability to be a leader within the City for making the case for such collaboration and change. Where there continues to be disagreement as to the future trajectory of Fayetteville’s growth, the City government should work to build consensus around paths that are realistic given the City’s assets and potential, as well as around those that provide a strong enough value proposition so as to differentiate Fayetteville from its competitors and peers.

Recommendations for action are categorized under three areas of opportunity: Execute Effectively (Effective Service Delivery), Enhance the Product (Product Improvement), and Tell the Story (Marketing).

Execute Effectively

Enhance the City’s role as a leader in economic development by aligning Fayetteville’s mission and focus on those areas that will directly impact economic growth.

Enhance the Product

Strengthen the infrastructure, talent pool, and business climate of the City so that Fayetteville can attract investment and talent.

Tell the Story

Be a better spokesperson for the economic dynamism of the community by effectively communicating and engaging sitelocation advisors, entrepreneurs, and companies within the targeted business sectors.

EXECUTE EFFECTIVELY (EFFECTIVE SERVICE DELIVERY)

If the City of Fayetteville is to enhance its role as a leader in economic development for the region, then City government must align their mission and focus on those areas that will directly impact economic growth.

1. Reorganize the City’s Community Development Department to effectively seize on current and future economic opportunities.

Observation: The City does not have a true economic development department by name or in the traditional sense. Rather, it has a community development department that serves as the de facto economic development entity for the City. This includes managing and administering Planning and Zoning, the City's Main Street Program, and operating The Southern Ground Amphitheater. They provide staff support to the City of Fayetteville Downtown Development Authority and the Fayetteville Main Street Tourism Association. With 2.5 FTEs, they perform admirably. However, the City wishes to enhance its economic development efforts, and, as such, it will need to grow its economic development initiative and staffing. The City’s community development budget (economic development) is $275,000, which is significantly below the average benchmark in the Southeast of $500,000 for a community the size of Fayetteville.

Recommendations:

a. Rename the community development department to the Economic and Community Improvement (or Development) Department. This name change is more than symbolic. It first conveys to the citizens of Fayetteville and general public what the community development functions have been doing for some time creating opportunity and working diligently as a catalyst and or facilitator to execute initiatives by using the name “economic.” However, in reality, economic and community have two separate and distinct roles. The economic component of the department will work in wealth-building opportunities for the City, which is the definition of economic development. It conveys growth and serves in a proactive manner to achieve success.

The community improvement component focuses on building the product (the City of Fayetteville is the product). The two operate in tandem, and you must have an effective community development function to allow those engaged in economic development something to effectively market and sell.

b. Hire an Economic Development Director. As part of the reorganization, the City should hire a professional economic development director, who will serve as the department head for the expanded department. This person will manage the department and serve in a capacity to work with existing Fayetteville businesses in their expansion efforts, recruit new businesses noted in the previous chapter as part of the Optimal Targets for Fayetteville, and provide overall leadership, support, and direction to the City Manager, City Council, Mayor, and staff for the overall management of the department.

Best practice example: Woodstock, Georgia http://www.woodstockga.gov/index.aspx?NID=425

c. The Planning and Zoning function should be a stand-alone department. Currently, Planning and Zoning is under the community development department. It is the wrong place for the role they are in, which is to administer the planning and zoning laws and regulations and administer building and code enforcement for the City. Planners are regulators, and though they need to demonstrate a culture of yes, they are ultimately responsible for administering the planning and zoning rules and regulations of the City (with the understanding that being adaptive and flexible where possible is paramount to achieving success). Economic and community developers are doers. Their focus is on insuring economic opportunity for the residents of the City.

Though this proposed organization structure is not meant to create silos, it does illustrate the difference of the organizational tasks and job. It would be analogous to putting police and public safety under the direction of the Main Street program. It just does not fit as part of the existing community development or soon-to-be-named economic and community development department (Figure 9). Planning and Zoning, along with Building and Code Enforcement, should be autonomous and be led by an engineer or planner.

Best practice example: Columbus, Georgia http://www.columbusga.org/Planning/

2. Expand the existing Fayetteville Downtown Development Authority (DDA) to a more citywide Development Authority, encompassing the City’s radius business district boundaries.

Observation: The City has a Downtown Development Authority as prescribed under Georgia law. Its mission is to allow the City to use the tools available to DDAs to provide the ability to enhance economic opportunity within the Central Business District (CBD) of the City. DDAs allow “the revitalization and redevelopment of the central business districts of the municipal corporations of this state develop and promote for the public good and general welfare trade, commerce, industry, and employment opportunities and promote the general welfare of this state by creating a climate favorable to the location of new industry, trade, and commerce and the development of existing industry, trade, and commerce within the municipal corporations of this state. Revitalization and redevelopment of central business districts by financing projects under this chapter will develop and promote for the public good and general welfare trade, commerce, industry, and employment opportunities and will promote the general welfare of this state. It is, therefore, in the public interest and is vital to the public welfare of the people of this state, and it is declared to be the public purpose of this chapter, so to revitalize and redevelop the central business districts of the municipal corporations of this state.” O.C.G.A. SEC. 36-42-2.

Recommendation: Fayetteville needs a broad Development Authority that will allow for the City to offer incentives, development, and finance options as the current DDA is able to provide within its territorial boundaries. Ideally, the expansion of the current DDA, that will follow the City’s tax allocation districts and incorporate development corridors along Highways 85 and 54 and the CBD, is more ideal than creating a separate Development Authority. In conversations with a Georgia attorney who specializes in development authorities, his initial reaction is that an expansion of the current DDA may be possible and should be explored. If a legal opinion is returned that an expansion of the current DDA is not advisable, then it is recommended that the City create a citywide Development Authority that allows the City to offer the same benefits to new and expanding businesses as the current DDA. A consolidated DDA should be renamed as the Fayetteville Development Authority.

Best practice example: Alpharetta Development Authority http://growalpharetta.com/businessassistance/development-authority/

3. Promote the existing Tax Allocation District in Fayetteville

Observation: In 1985, the Georgia General Assembly authorized the formation of Georgia’s form of tax increment financing called Tax Allocation Districts (TADs). This redevelopment funding mechanism, which is used in more than 40 states, earmarks some or all of the new local real property and/or sales tax revenues generated within a specific geographic area for reinvestment within that area. TAD revenues are typically applied to finance the capital costs related to infrastructure, land acquisition, relocation, demolition, utilities, and planning initiatives. A TAD offers local governments the opportunity to undertake redevelopment projects in areas that would otherwise not receive investment.

Fayetteville created its first and only TAD in 2013. However, the program is not known in the community by many developers and potential investors, and the City does not effectively market the TAD. The City has a one-page flyer that gives a poor description of the TAD (see Appendix A). The TAD is not mentioned on the City’s website, and there is no published formal application process for property owners or developers to request financial support from the TAD.

Recommendation: The City needs to create a Frequently Asked Questions (FAQs) section and application process on the community development page of its website regarding the TAD. Gwinnett County, Georgia, offers a best practice example of a FAQs page for its TADs and other items related to economic development in the County. Fayetteville should replicate what Gwinnett has done.

Best practice example: Gwinnett County, Georgia https://www.gwinnettcounty.com/portal/gwinnett/Departments/Plannin gandDevelopment/EconomicDevelopment/TaxAllocationDistricts; https://www.gwinnettcounty.com/static/departments/planning/Economi c%20Development/TADs/Gwinnett%20Tax%20Allocation%20District%20 Policy.pdf

4. Make the case for sustainable funding sources to improve the City’s economic development infrastructure and identify catalytic programs to use the monies effectively.

Observation: Focus group participants and survey respondents commented that the City has a need for significant infrastructure improvements including roads to help traffic patterns, bike trails, green space, a performing arts venue, and more to allow for quality economic growth and to strengthen the City’s quality of place. However, these needs take resources or money, which the community must provide. As the community works to enhance its infrastructure, such as the New Downtown Plan related to this economic development strategy, the City must take the lead to find a sustainable funding source to present those plans and strategies from sitting on the “shelf of shame.” In all likelihood, this type of transformational initiative will take a series of champions, including assistance in the state legislature. A sustainable funding source for Fayetteville would serve as a catalyst for those city economic development initiatives that would otherwise be problematic to implement but would significantly improve the City’s business climate.