completeness of any of the data provided herein. Crook County explicitly disclaims any

the implied warranties of merchantability and fitness for a particular purpose. Crook County shall assume no

or inaccuracies in the information provided regardless of how caused. Crook County assumes no liability for any decisions made or actions taken or not taken by the user of this information or data furnished hereunder.

Please send only a check or money order with your payment stub. DO NOT mail cash. Your cancelled check is proof of payment.

Property tax payments MUST be credited to the earliest year that taxes are due.

Tax statements for less than $40 must be paid in full.

Discounts/payment schedule (choose one)

To receive a discount, payments MUST be delivered, U.S. postmarked, or transmitted by private express carrier on or before November 15. Returned checks may cause a loss of the discount.

To receive any applicable discount you MUST make:

•Full payment— Receive a three percent (3%) discount on the amount of current year tax, as shown on your tax statement, if full payment is delivered, U.S. postmarked, or transmitted by private express carrier by November 15.

• Two-thirds payment—Receive a two percent (2%) discount on the amount of current year tax paid, as shown on your tax statement, if two-thirds payment is delivered, U.S. postmarked, or transmitted by private express carrier by November 15. Pay the final one-third (with no discount) by May 15 to avoid interest charges.

•One-third payment— No discount allowed. Pay one-third by November 15, followed by another one-third payment by February 15. Pay the final one-third balance by May 15.

Interest is charged at a rate of 1.333% monthly, 16% annually. Interest is accrued on past due installment payments accordingly:

•First one-third installment payment, interest begins accruing on December 16.

•Second one-third installment payment, interest begins accruing February 16.

•Remaining one-third payment, interest begins accruing on May 16.

If the 15th falls on a weekend or legal holiday, the due date will be extended to the next business day.

All personal property tax is delinquent when any installment is not paid on time. The responsible taxpayer can be served with a warrant 30 days after delinquency. Personal property can be seized and other financial assets can be garnished.

Real property tax is delinquent if not paid by May 15. Foreclosure proceedings on real property begin when taxes have been delinquent for three years.

Real property tax accounts with an unpaid balance for any tax year marked with an (*) on the front of this statement are subject to foreclosure if not paid on or before May 15. Payments MUST be applied to the oldest tax first.

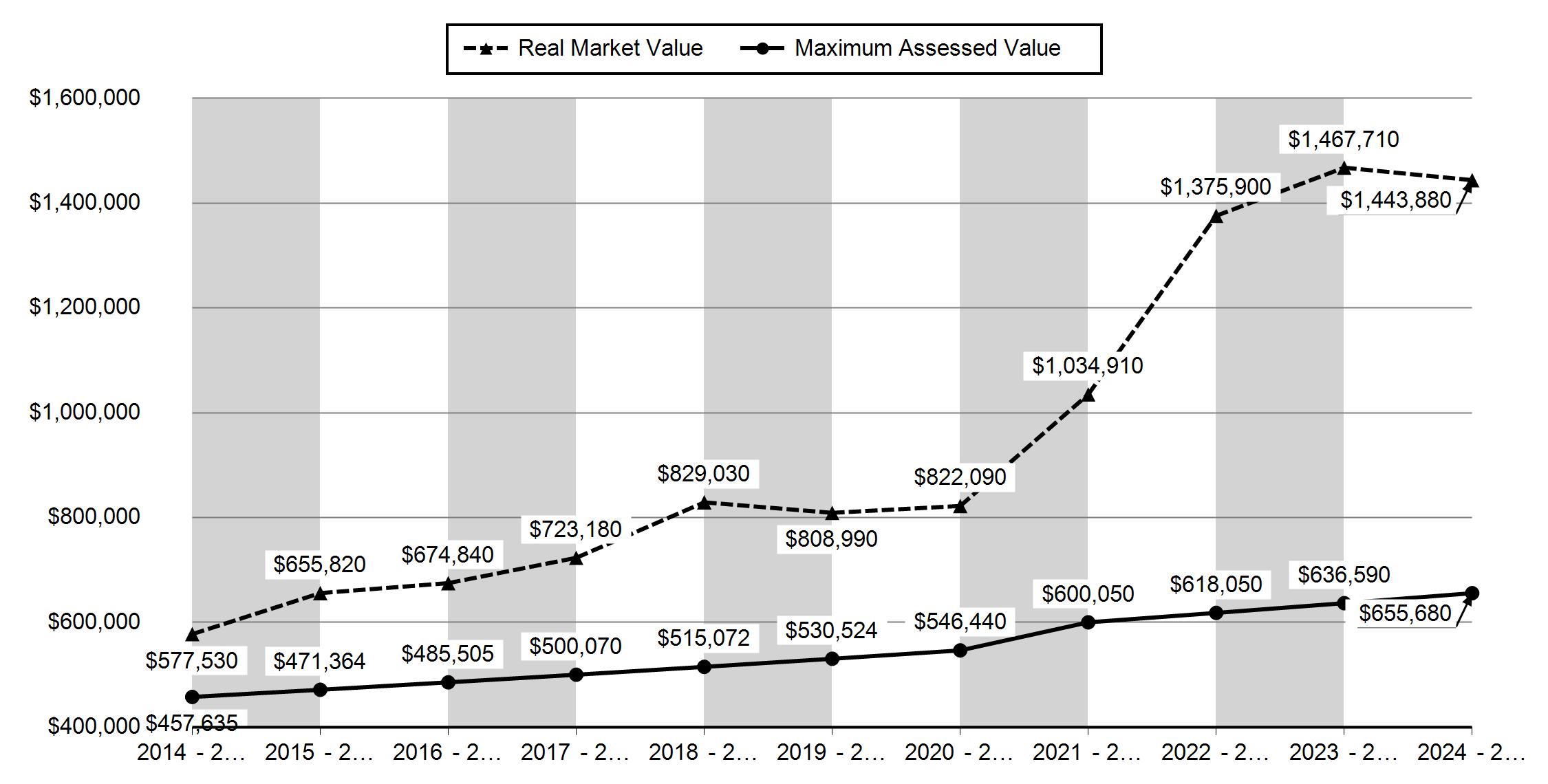

If you think your property value is incorrect or if there has been a change to the value that you did not expect or understand, review it with the county assessor’s office. Many assessors provide value information online. Visit your county assessor’s website or call them for more details.

If you think the VALUE of your property as shown on this statement is too high, you can appeal. Your appeal is to the county board of property tax appeals (BOPTA), except for state appraised industrial property. To appeal industrial property appraised by the Department of Revenue, you must file a complaint in the Magistrate Division of the Oregon Tax Court.

If you disagree with a PENALTY assessed for late filing of a real, personal, or combined property return, you may ask the county BOPTA to waive all or a portion of the penalty. See www.oregon.gov/dor/ programs/property/pages/property-appeals.aspx.

File your petition by December 31 with the county clerk in the county where the property is located. You can get petition forms and information from your county clerk, or at www.oregon.gov/ dor/forms.

Follow the payment schedule to avoid interest charges and to receive applicable discounts. If your tax is reduced after appeal, any overpayment of property tax will be refunded.

Tax statement information is available in alternate formats, in compliance with the Americans with Disabilities Act (ADA). Contact your county tax collector.

Mailing address change request

(Mailing address changes only. An address change requires the owner’s signature. Additional documentation may be required for name changes.)

Date:

Email:

Signature: X

���� ��� ���������� ��� ������� # 15640

The Crook CountyAssessor's Office is responsible for the appraisal and assessment of all taxable property within the County. Contact this department if you need additional information or if you have questions.

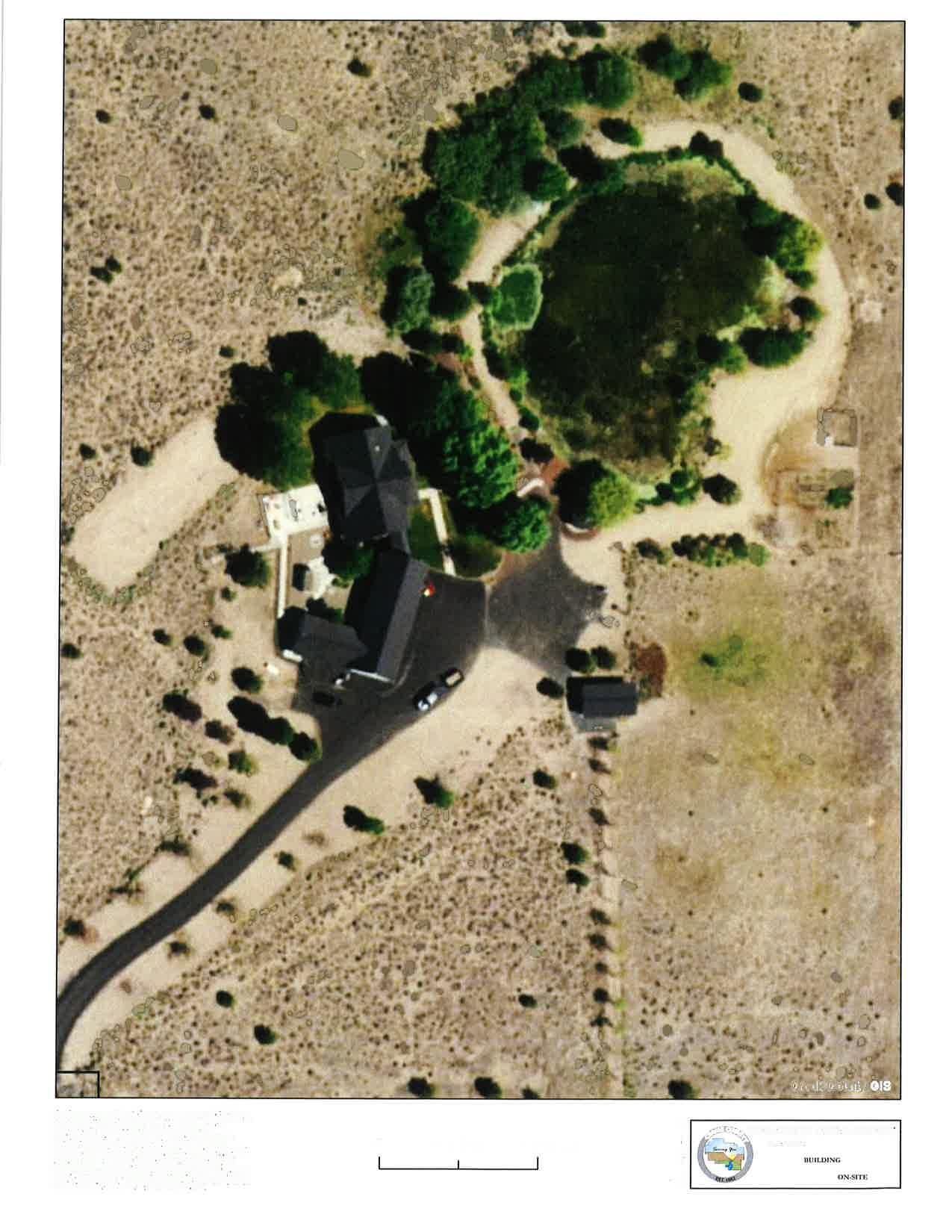

Mailing Name: SIEGMANNADRIAN & CAROLINE TRUSTEES

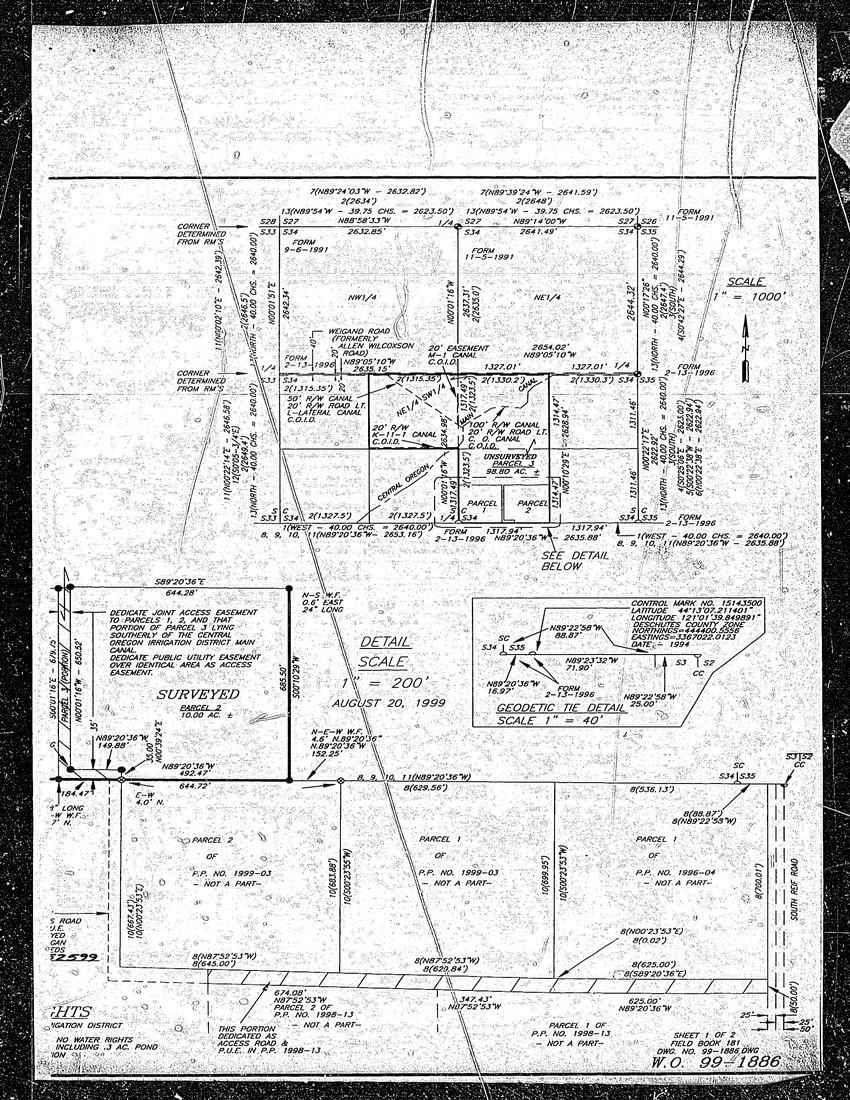

Map and Taxlot: 15143400-00604-15640

Account: 15640

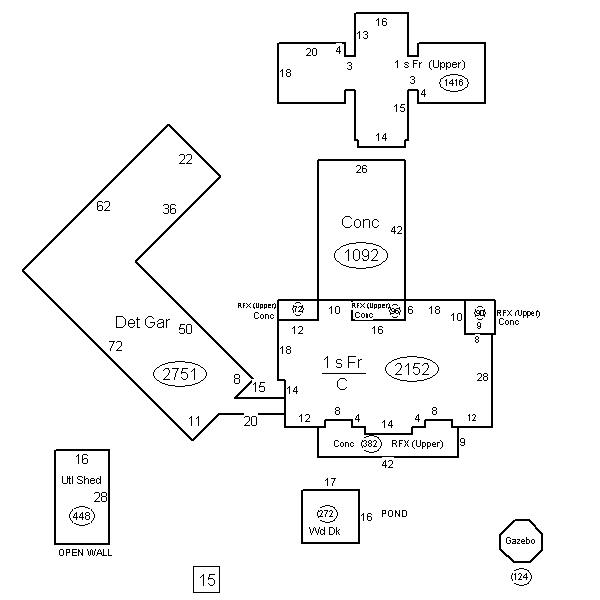

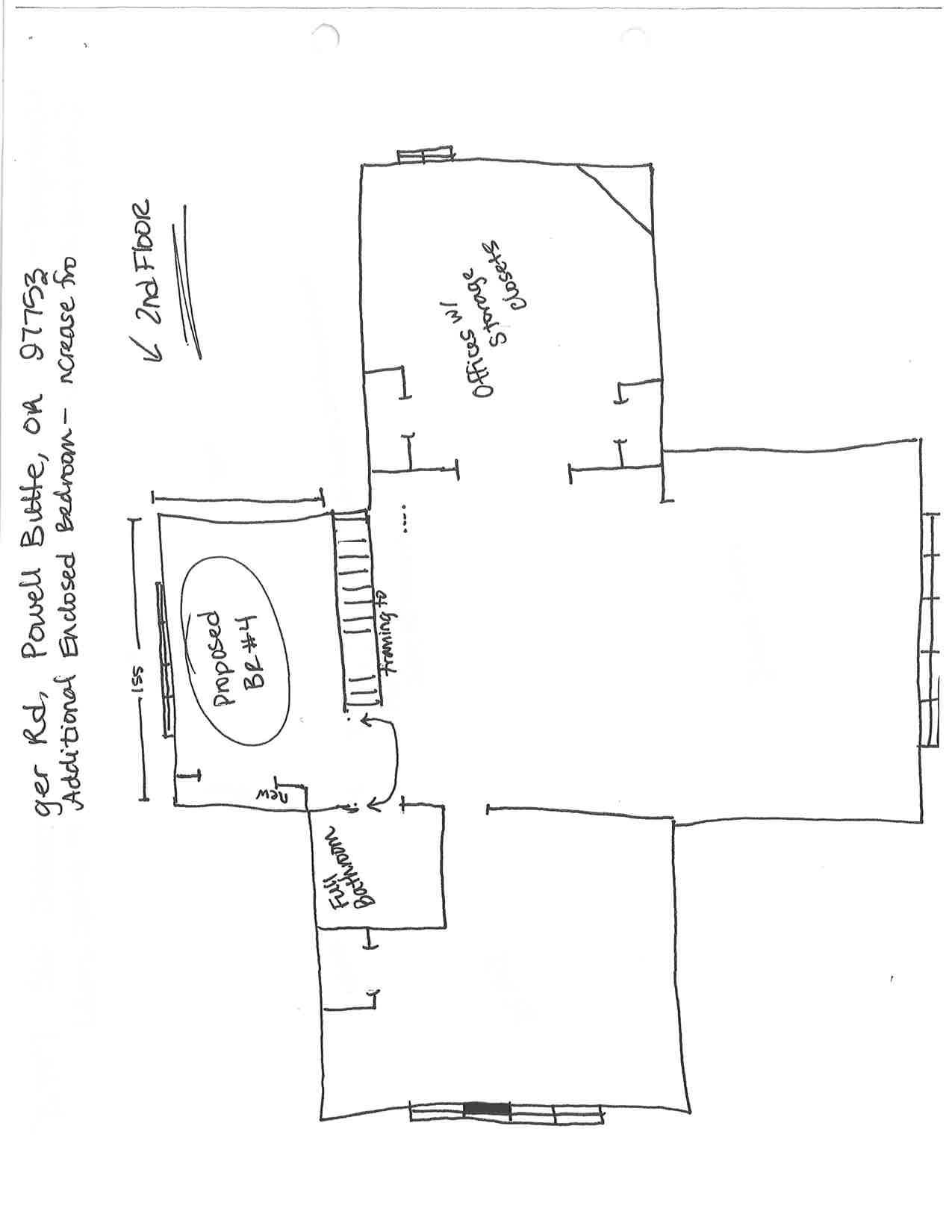

RESTwo story Sketch

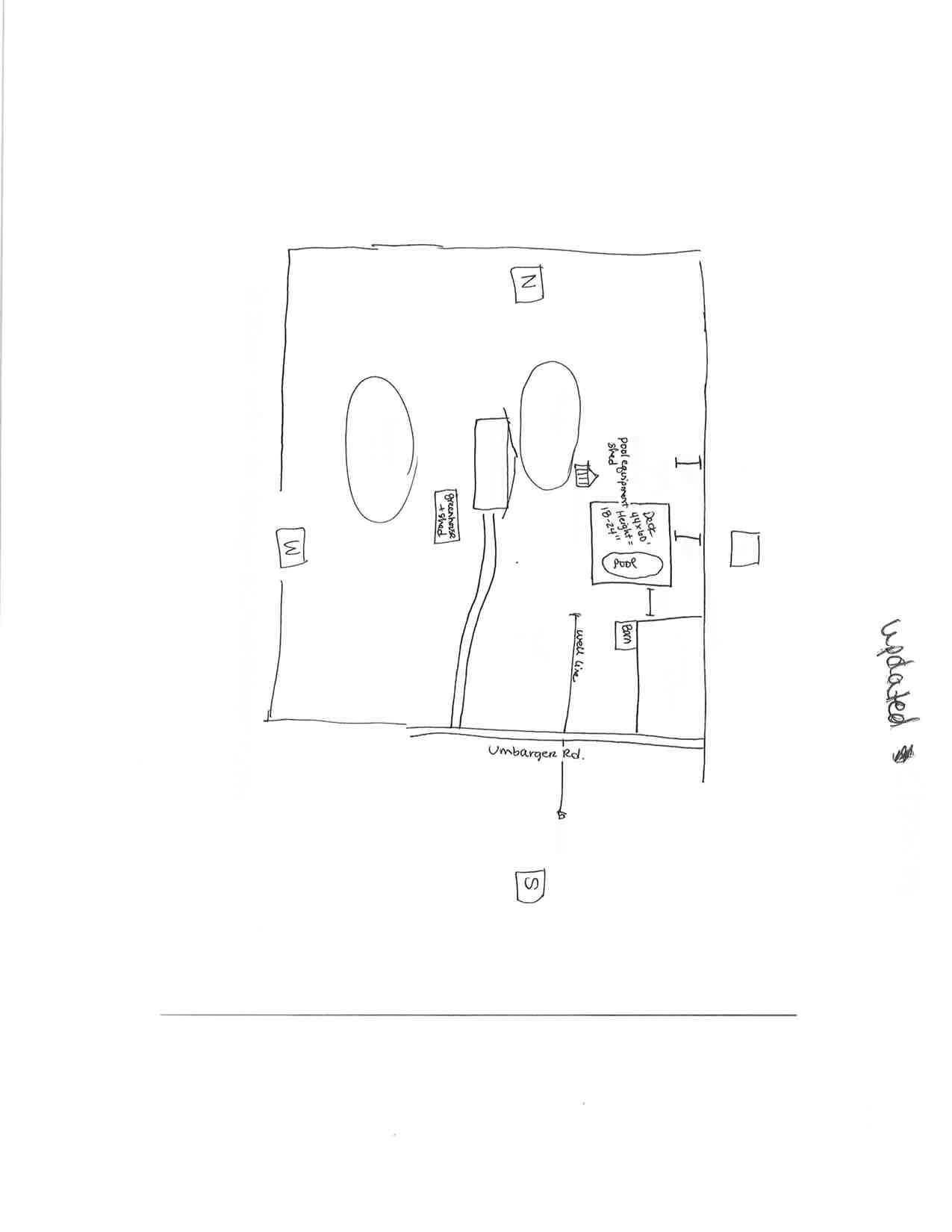

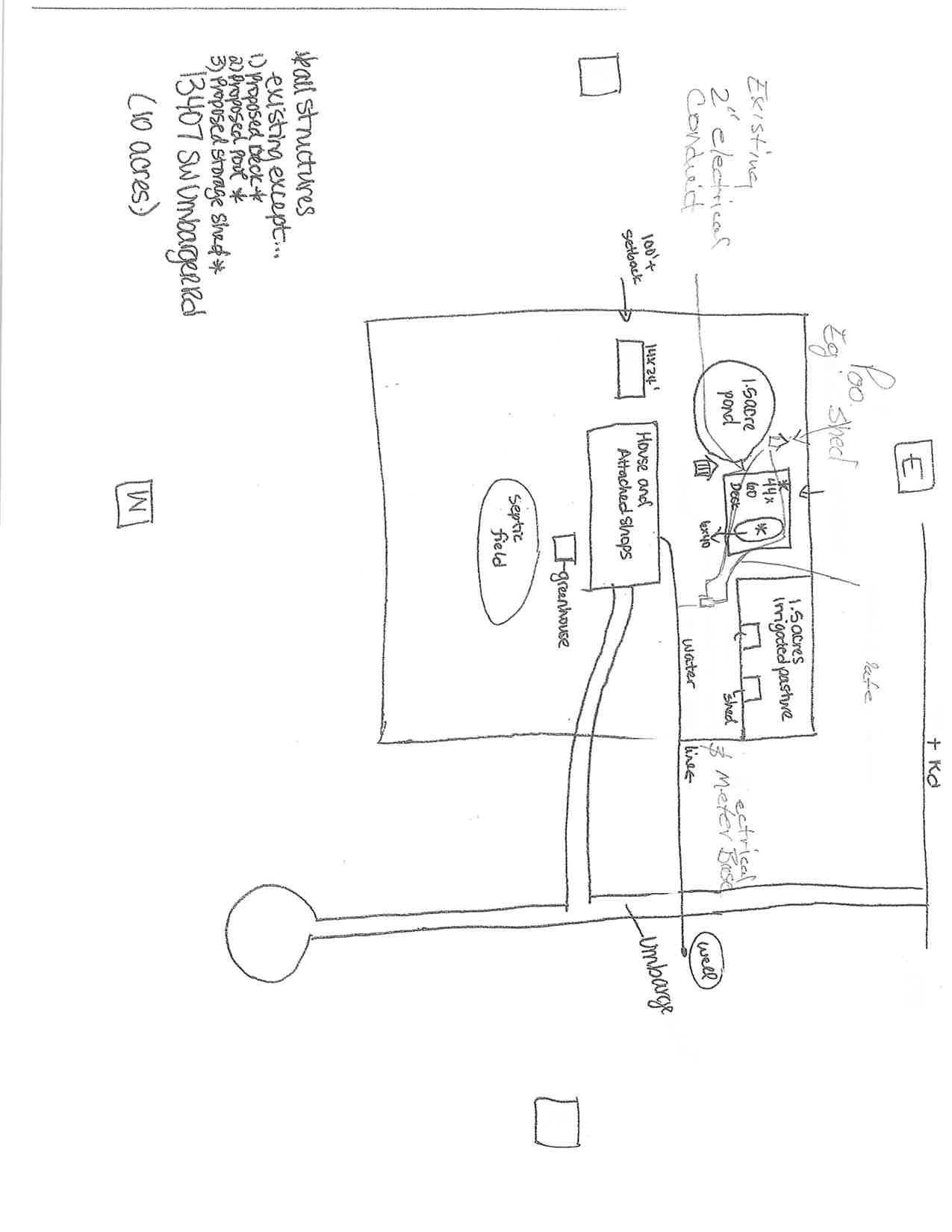

SitusAddress: 13407 SW UMBARGER RD, POWELLBUTTE OR 97753

Tax Status:Taxable

Structures Located

Description Stat Class

MPSHED FARM BLDG

MPSHED FARM BLDG

MPSHED FARM BLDG

MPSHED FARM BLDG

RESTwo story RESIDENCE

Land Characteristi

Land Description Acres

USER UNDERSTANDSANDAGREESTHE INFORMA HAS BEEN MADE TOASSURETHEACCURACY SEQUENCE,ACCURACY,TIMELINESS OR COMPLETENESS OF INCLUDING, WITHOUT LIMITATION,THE IMPLIED W ERRORS, OMISSIONS, OR INACCURACIES IN TAKEN OR NOTTAKEN BYTHE USER OF

© 2025 - CROOK COUNTY

Feb 27, 2025 | 10:39:28

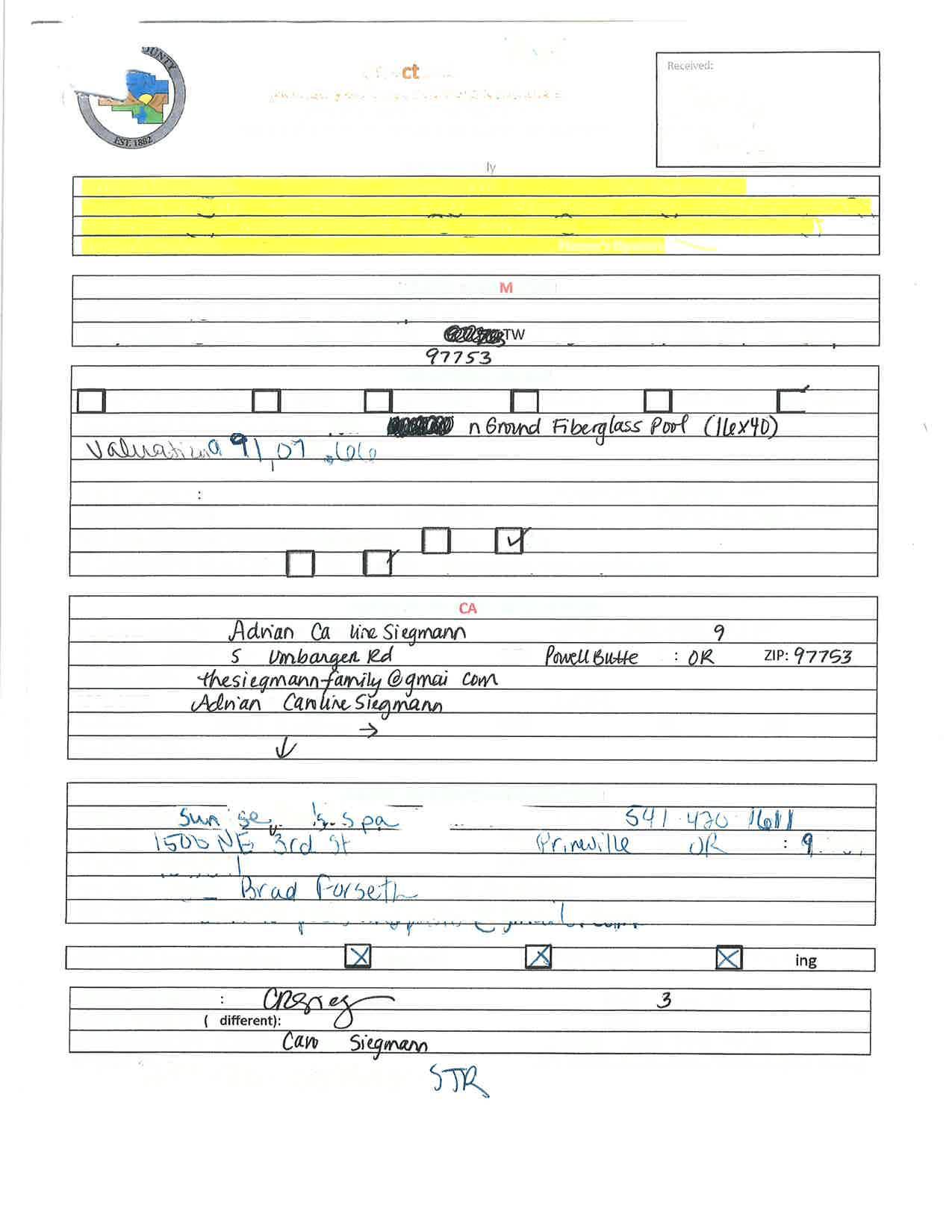

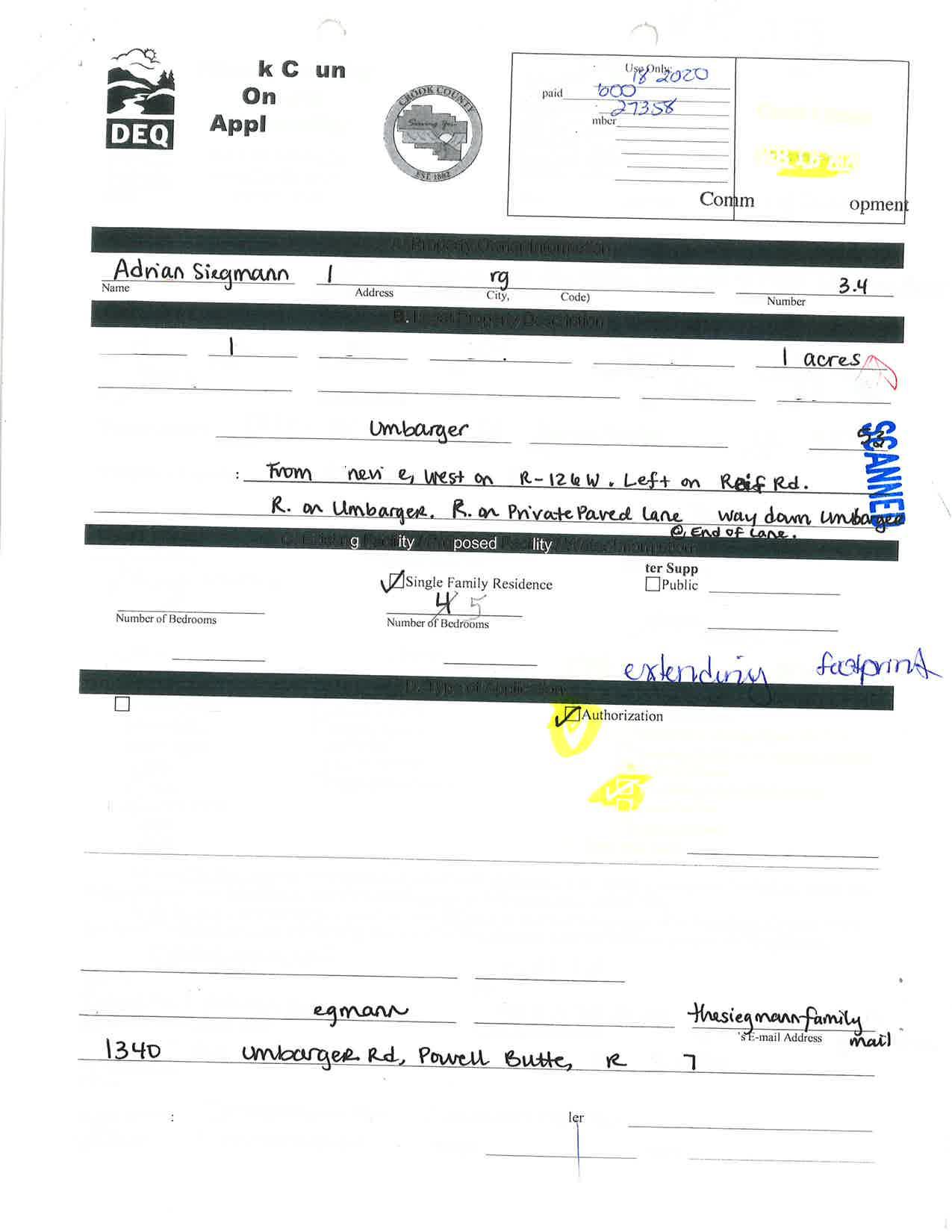

Date Issued: 3/6/20 Date Expiring: 3/6/21 Work Description:

Applicant: SIEGMANN ADRIAN J AND CAROLINE RUTH

Address:

13407 SW UMBARGER RD POWELL BUTTE OR 97753-1655

Phone: 5034709125

Crook County

300 NE 3rd St, Rm #12

Prineville, OR 97754

541-447-3211

Fax: 541-216-2139

onsite@co.crook.or.us

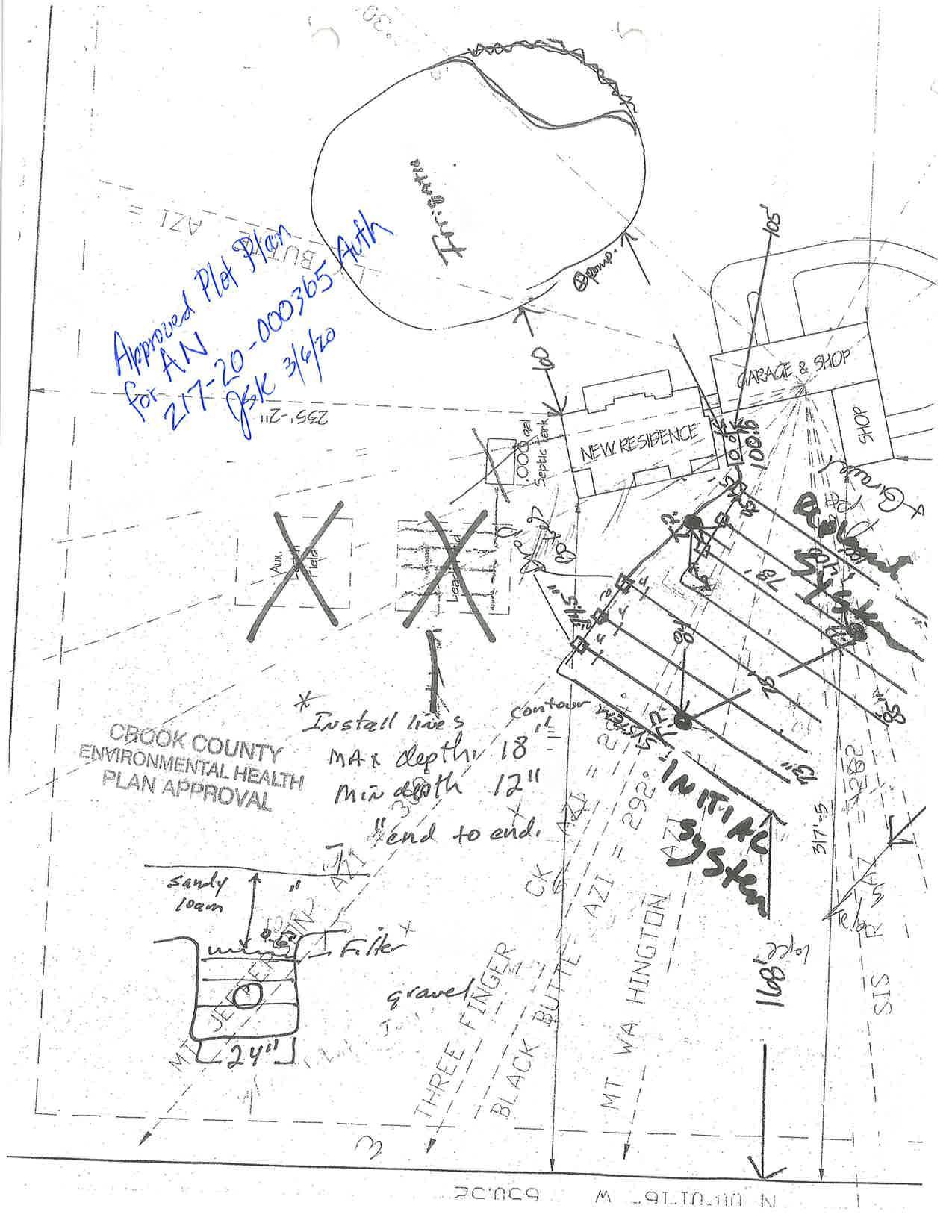

Website: co.crook.or.us 217-20-000365-AUTH

Email: THESIEGMANNFAMILY@GMAIL.C OM 13407 SW Umbarger Rd, Powell Butte, OR 97753

Owner: SIEGMANN ADRIAN J AND CAROLINE RUTH

Address: 13407 SW UMBARGER RD POWELL BUTTE OR 97753-1655

Authorization Notice for: Addition of One or More Bedrooms System is Failing?

Septic Tank Last Pumped: No 09/01/2019

Comments: Based on the file review, applicant's info and a site visit, the system appears adequate for the proposal of adding 2 bedrooms for a total of 5. My decision is based on DEQ rule 340-71-0205 (5). The replacement area is intact.

ADDING 1 BEDROOM. During the site visit today 3/6/20 the owner requested to have the system evaluated for 5 bedrooms rather than just a 4th one.

Number of Bedrooms: 3 5 System Specifications:

Other Special Requirement: A septic tank effluent filter is recommended in the outlet T of the septic tank.

Conditions of Approval:

Date Issued: 3/6/20 Date Expiring: 3/6/21

Work Description:

Note: This Notice does not guarantee satisfactory or continuous operation of the sewage system. Should the system fail, a repair permit from DEQ is required.

If you disagree with this report, you have the right to apply for an authorization notice denial review. The application for review must be submitted in writing within 45 days of the report issuance and be accompanied by the review fee in OAR 340-071-0140(3), Table 9C and any additional information DEQ needs to complete the review.

You may apply for a variance to the onsite wastewater treatment system rules. The variance application must include a copy of the site evaluation report, plans and specifications for the proposed system, specify the rule(s) to which a variance is being requested, demonstrate the variance is warranted, and include the variance fee in OAR 340-071-140 Table 9C. A variance may only be granted if the variance officer determines that strict compliance with a rule is inappropriate or special physical conditions render strict compliance unreasonable, burdensome or impractical. A senior DEQ variance officer will be assigned the variance application.

3/6/20:10:05:01AM Page 2 of 2

Home Building Licensing Planning PublicWorks

Apply Search ScheduleInspections

Record217-20-001270-PRMT:

OnsitePermit

RecordStatus:Finaled

ExpirationDate:08/04/2021

RecordInfo/Schedule Inspections Payments CustomComponent

WorkLocation

13407SWUMBARGERRD* POWELLBUTTEOR97753

RecordDetails

Applicant:

BobsSepticInstallation&Repair

3238NEClarkDr Madras,OR,97741

HomePhone:5414750570 museptic@yahoo.com

ProjectDescription: SIEGMAN SIEGMAN-MAJORSEPTICSYSTEMREPAIR

MoreDetails RelatedContacts ApplicationInformation

PrimaryContactinformation

13407SWUMBARGERRD POWELLBUTTE,OR,97753-1655

CONSTRUCTIONPERMIT

Repair

Oregon.ePermitting@d

LicensedProfessional:

BobsSepticInstallation&Repair 3238NEClarkDr Madras,OR,97741 InstallerLicense38616

Owner: SIEGMANNADRIANJANDCAROLINERUTH* 13407SWUMBARGERRD POWELLBUTTEOR97753-1655

Addtocollection

CategoryofConstruction: Single Family Dwelling

ProposedUseofStructure: MAJOR SEPTIC SYSTEM

REPAIR

ParcelInformation

ParcelNumber:1514340000604*

Block:99

Lot:28

ContractorResources

BuildingCodesDivision

ConstructionContractorsBoard

DEQOnsite/SepticContactList

ElevatorPermits

Subdivision:--

WaterSupply: Well

NumberofBedrooms(Existing): 5

OregonePermittingAppHelpHub

FormsLibrary

MinorLabels

Training:UsingOregonePermitting

JurisdictionResources

Android-OregonInspectorApp

iOS-OregonInspectorApp

ePermittingJurisdictionHub

Oregon.ePer 7:30a.m.to4 Closedmajor

County

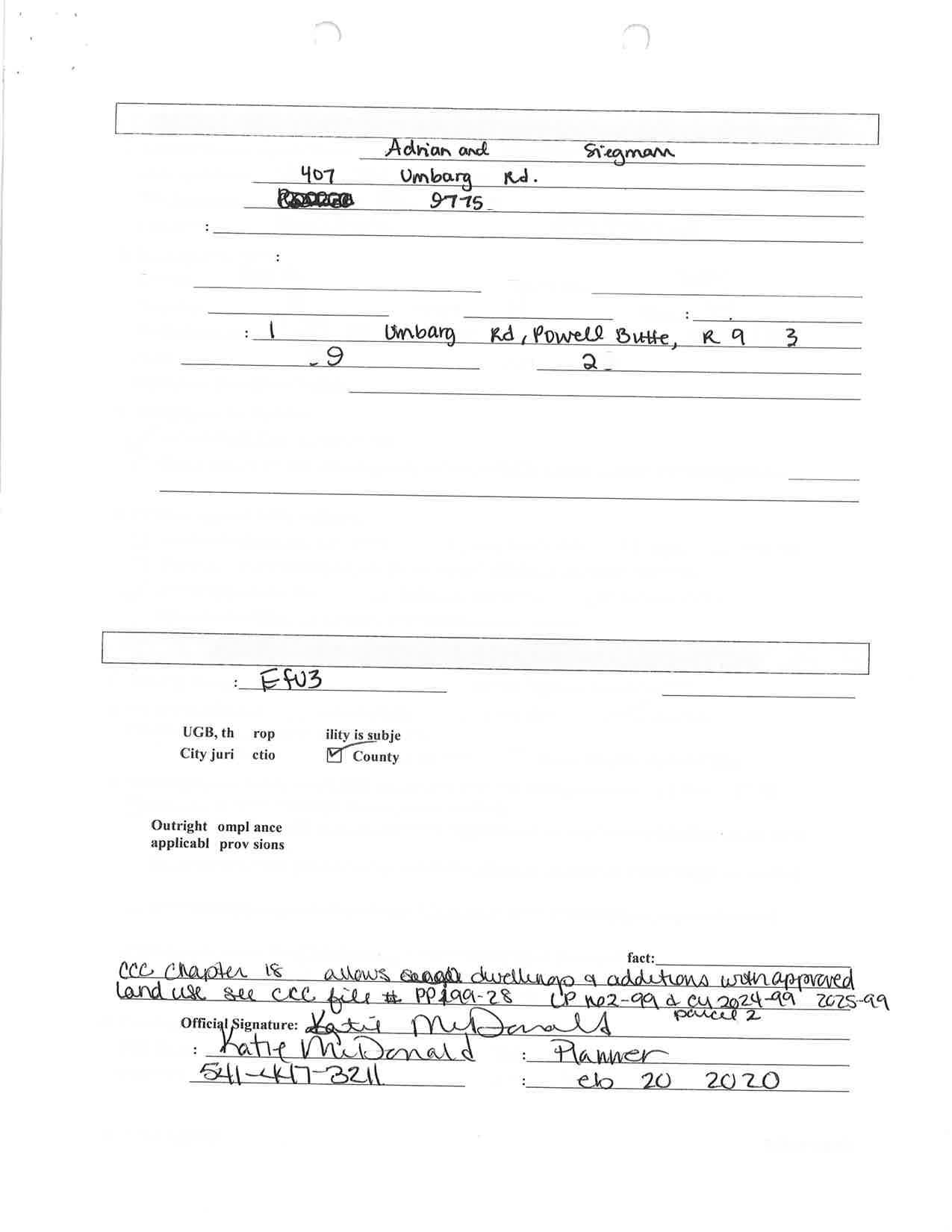

Community Development 300 NE 3rd St, Rm #12 Prineville, OR 97754 541-447-3211 Fax: 541-216-2139 onsite@co.crook.or.us

Number: 27358

Date: 2/18/20

Worksite address: 13407 SW UMBARGER RD, POWELL BUTTE, OR 97753 Parcel: 1514340000604

co.crook.or.us

Onsite Authorization Permit #: 217-20-000365-AUTH

Applicant: SIEGMANN ADRIAN J AND CAROLINE RUTH

CROOK COUNTY

300 NE 3rd St, Rm #12

Prineville,OR 97754

Phone: 541-447-3211

Fax: 541-416-2139

bld@crookcountyor.gov

IVR # 217022156113

Owner: SIEGMANN ADRIAN J AND CAROLINE RUTH, 13407 SW UMBARGER RD, POWELL BUTTE, OR, 97753-1655

Address:

Parcel:

13407 SW UMBARGER RD POWELL BUTTE OR 97753

1514340000604

Inspection Type:

Inspection Date:

Inspector:

Inspection Result:

Comments: Inspection in a Floodplain: No

Schedule Inspections online at: www.buildingpermits.oregon.gov or by calling: 1-888-299-2821 Use IVR # 217022156113

Schedule using the Oregon ePermitting Inspection App, search “epermitting” in the app store

7020 Pre-cover (4659711, Required)

13407 SW UMBARGER RD

POWELLBUTTE OR 97753

Status Approved 10/14/2020 12:00AM

Last updated Paige ReinhartAnez 10/14/2020 2:34 PM

Showing 1-2 of 2

Approved 10/14/2020 12:00AM

Pending TBD

Showing 1-1 of 1

Paige ReinhartAnez (10/14/2020 2:34 PM) Approved to cover drainfield.

Related Inspections

Showing 0-0 of 0

ID Inspection Name

No records found.

Print Record

217-20-001270-PRMT Onsite Permit

Status Status Date/Time Inspector Update Time Updated By Result Comments

Paige Reinhart Anez 10/14/2020 2:34 PM

Paige Reinhart Anez 10/14/2020 2:33 PM

Paige Reinhart Anez Approved to cover drainfield.

Paige Reinhart Anez

At Crooked River Elementary, we desire to know every student by face and name. Building relationships with families is of high importance to us as we work to provide excellent customer service. Time is embedded within our master schedule to begin and end each day intentionally, in an effort to help students be focused and secure. Our staff is approachable and available to students, families and each other.

The Oregon Department of Education is collaborating with school districts and communities across the state to achieve a 90% ontime graduation rate by 2027. Grounded in the pillars of Academic Excellence, Belonging and Wellness, and Reimagined Accountability, ODE prioritizes evidence-based practices to boost early literacy, attendance, and student engagement. We are committed to closing opportunity and achievement gaps for marginalized students and securing long-term success for all of Oregon’s learners by investing in culturally responsive practices, fostering inclusive environments and always driving for continuous improvement.

School Goals

The staff members at Crooked River Elementary School pride themselves on serving the whole child. We strive to create a culture where students want to be, full of rich educational experiences. We focus diligently on attendance, knowing that this is the greatest predictor of student success. Our highly trained educators see each student as a valued member of our school community. We focus on growth and celebrate individual success.

Starting in 2023-24, Senate Bill 923 updated the requirements for reporting a student's school information. More students are now included in school level rates.

School

Counselors/ Psychologists/ Social Workers

· Wellness Room · Calm Corners (in each classroom) · Kelso's Choices · Zones of Regulation

· Positive Behavioral Interventions and Supports (PBIS Team)

Students deserve to feel safe and secure at school. Bullying and harassment complaints are investigated and remedies to solve issues and repair relationships are of key importance. Systems designed to teach and encourage problem solving, as well as to empower students, include:

5th Grade Leadership

Music Programs

Field trips · After school clubs · Title One Reading Night · Holiday Festivities

We believe in providing multiple opportunities for students to allow them to develop and foster their individual strengths. Examples include: · Hands-on learning experiences

Parent partnerships are critical to highly successful schools. We encourage open communication through newsletters, Facebook, classroom communications, ParentSquare, e-mails and/or meetings (in person or over Zoom). We love to have parents share in their child's school experience in whatever ways work for them. Opportunities to volunteer within our school include: · PTC · Classroom helpers · Field Trips · Instructional Support/Enrichment Groups · Special Projects

Along with parent partnerships, we also pride ourselves in our multiple community connections. We are all working together to create the best future citizens possible. Some local agencies we work closely with are: · Facebook · OSU Cascades · COCC · Local mental health agencies · Juvenile Department · Prineville Police Department/Fire Department · Health Department · SMART Readers

Crook County Middle School strives to cultivate an environment of inclusion, safety, and acceptance where all students can discover their unique niche within the school. Whether greeting students at the door for class, maintaining an intentional servant mindset within our approach, or embedding the needs of the whole child in our professional practice, it is our desire for students to feel valued and enjoy their educational opportunities at CCMS.

The Oregon Department of Education is collaborating with school districts and communities across the state to achieve a 90% ontime graduation rate by 2027. Grounded in the pillars of Academic Excellence, Belonging and Wellness, and Reimagined Accountability, ODE prioritizes evidence-based practices to boost early literacy, attendance, and student engagement. We are committed to closing opportunity and achievement gaps for marginalized students and securing long-term success for all of Oregon’s learners by investing in culturally responsive practices, fostering inclusive environments and always driving for continuous improvement.

The goals of Crook County Middle School support our commitment towards each individual student being valued, feeling safe and connected to school, while believing that they can be successful in school and life. They include delivering a comprehensive academic support program, providing highly effective instruction, creating a 21st Century learning environment, offering multiple opportunities to engage students, and operating on the foundation of positive relationships. This is all part of our commitment to every child, every day.

Starting in 2023-24, Senate Bill 923 updated the requirements for reporting a student's school information. More students are now included in school level rates.

Crook County Middle School implements the following systems, protocols, and procedures in regards to the overall safety and wellbeing of students: CCMS Building Management Plan, Standard Response Protocol, Safe Schools Alliance, Peer Conflict Mediation Program, Bullying Tip Hotline, Individual & Group Counseling Services, School Resource Officer, Student Threat Assessment System, Positive Behavior Intervention System, & CharacterStrong Advisory curriculum.

In attempt to enrich student development and establish connections to school, Crook County Middle School offers the following extra-curricular activities: Art Club, Drama Club, STEM Club, Math Club, Choir, Band, National Honor Society, Leadership, Football, Cross Country, Volleyball, Basketball, Soccer, Wrestling, and Track & Field.

Growing and developing young teens demands a positive and effective partnership between families and schools. At Crook County Middle School we strive to include parent volunteers when applicable, encourage attendance at extra-curricular activities, collect and value parent input, and maintain regular communication and updates regarding student performance and progress.

Building partnerships and relationships within the community is important to the success of students at Crook County Middle School. Our school collaborates with the following community partners to support and deliver services: City of Prineville, Crook County Health Department, Prineville Police Department, Department of Human Services, Crook County Juvenile Department, Crook County Coalition, and Crook County Sheriff Department, and multiple private business partners.

Students

Students enrolling in a two or four year college within 12 months of completing high school in 202122 . Data from the National Student Clearinghouse.

Crook County High School is a place where all students are welcome. It is our priority that all students feel seen, heard, and supported. Our staff uses Positive Behavioral Interventions and Support to support our school wide values and norms. We have created student to staff and staff to staff culture teams to collect input around school climate and culture. We strive to continually improve how we can support students in our schools. Our welcome center supports non english speaking families with a bilingual staff. All communication sent home is translated for parent access and interpreters are available for parent meetings.

Students earning a high school diploma or GED within five years. Cohort Includes students who were firsttime ninth graders in 2018-19 finishing in 2022-23

No change from previous year

who were first-time ninth graders in 2019-20 graduating in 2022-23

The Oregon Department of Education is collaborating with school districts and communities across the state to achieve a 90% ontime graduation rate by 2027. Grounded in the pillars of Academic Excellence, Belonging and Wellness, and Reimagined Accountability, ODE prioritizes evidence-based practices to boost early literacy, attendance, and student engagement. We are committed to closing opportunity and achievement gaps for marginalized students and securing long-term success for all of Oregon’s learners by investing in culturally responsive practices, fostering inclusive environments and always driving for continuous improvement.

Crook County High School prioritizes college and career readiness for students. We have increased our offerings in career and technical education. These classes prioritize job skills and give students opportunities to learn things applicable in the workforce.

Crook County High School is an AVID showcase school. Collaborative structures focusing on rigor, engagement, and college readiness are implemented in all classes. We place a high importance on connecting students with sports, clubs, or extra curricular activities. We focus on student well-being and understand each student has a unique story that needs to be heard and honored.

School Website: https://cchs.crookcountyschools.org/ Starting in 2023-24, Senate Bill 923 updated the requirements for reporting a student's school information. More students are now included in school level rates.

please visit:

Health Sciences

Mangufacturing and Engineering

Construction Technology

Business Marketing

Agriculture Sciences

Career and Technical Education is a high priority for us and we place value on relevant, real world skills. We have eight programs of study that inlude:

We know when students feel connected with adults and peers in something other than class, they have a better attitude toward school. A better attitude increases their likelihood of happiness and academic success. Our CC Connect program empowers students to find something of interest. They are free to create their own club. We have over 30 clubs currently. With our CC Connect programs and all of the other offerings we have over 65% of our student body involved in something. Other extra curricular opportunities include: · 18 interscholastic athletic programs · 4 service clubs · Perfrorming Arts incuding Drama, Band, and Choir · Leadership · Link Crew

We want to continue to get creative finding ways to engage our parents and communities. We offer a variety of events encouraing parents and community to participate. These include: · Beyond High School Night · FAFSA Night · AVID showcase nights · Career Fair · Fall and Spring Conferences, rebranded to Conference+ · Freshmen Orientation Night · Cowboy Kick Off · Involvement in the senior part planning committee · Parent surveys · Invovlement in Booster Club