Step by Step 2026–27

Step by Step 2026–27

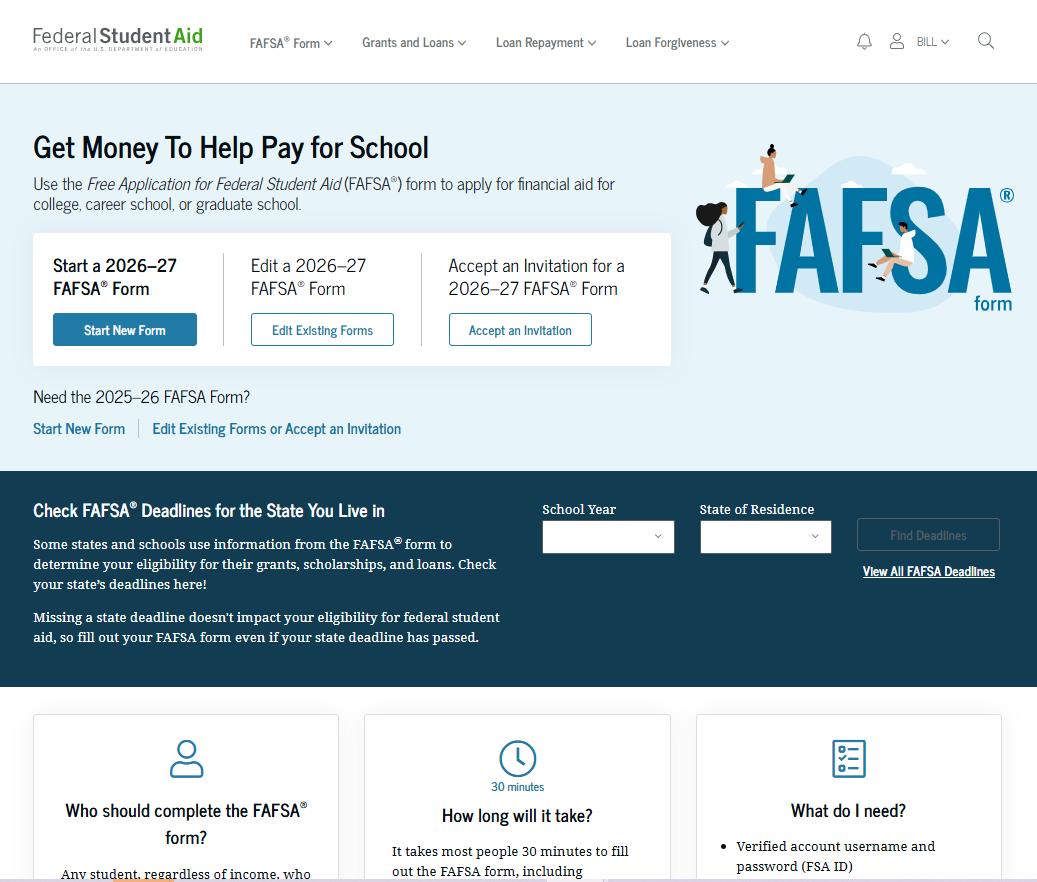

This is the main FAFSA® landing page. On this page, students are directed to "Start New Form," "Edit Existing Forms," or "Accept an Invitation." For this section we will choose “Start New Form”

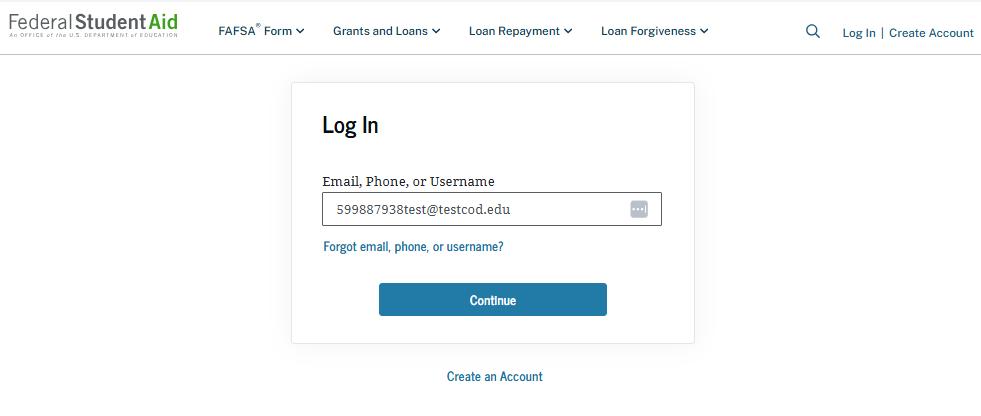

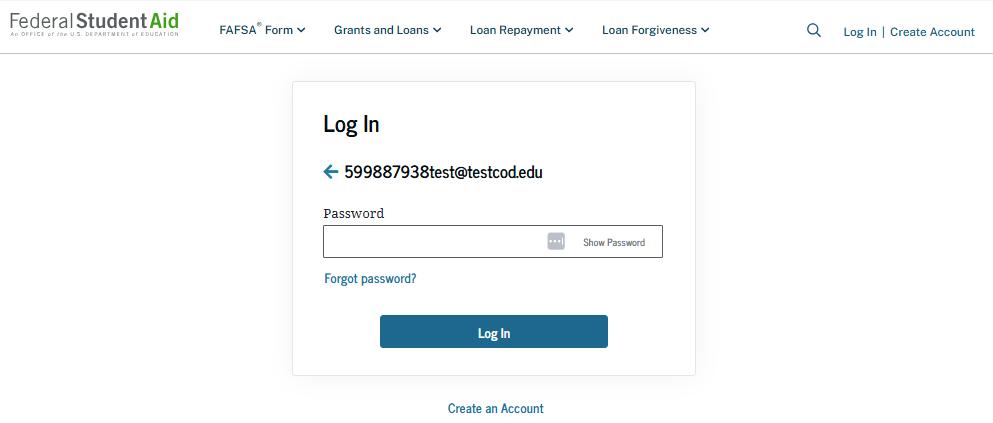

If you select "Start New Form" from the FAFSA® landing page and are not logged in to StudentAid.gov, you are taken to the "Log In" page to enter your credentials. To access the FAFSA form, all students are required to have a StudentAid.gov account username and password. If you don't have a username and password, you can select "Create an Account."

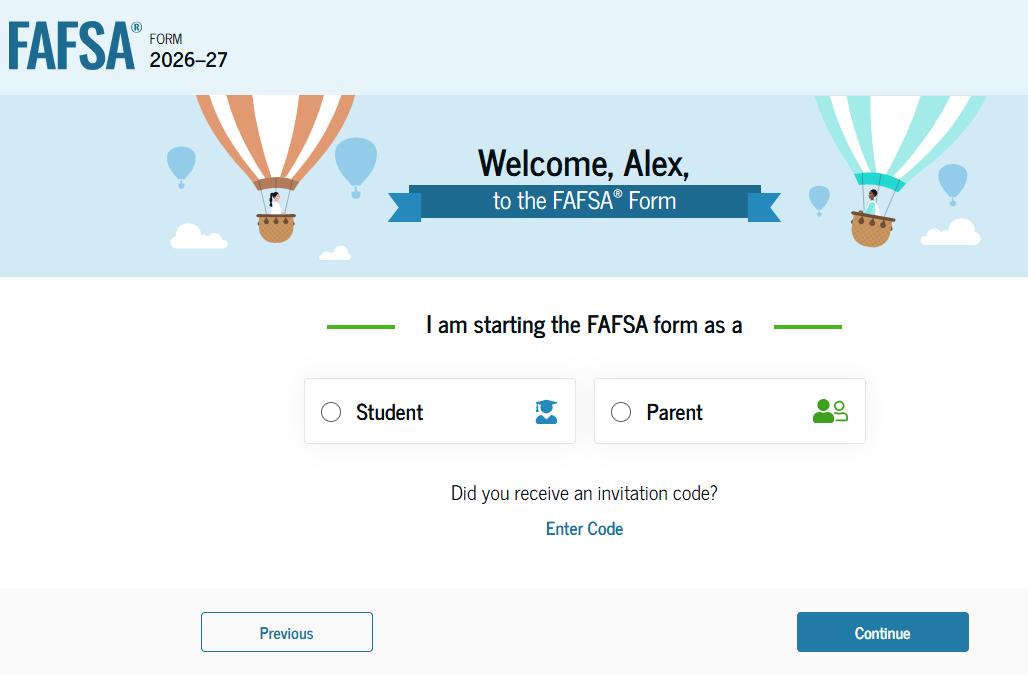

After logging in, you will select the applicable role to fill out the FAFSA® form: "Student" or "Parent." You also has the option to "Enter Code" if you received an invitation code. On this page, you would select "Student."

When you start the 2026–27 FAFSA® form for the first time, you are taken through the FAFSA onboarding process. The first onboarding page provides an introduction of the FAFSA form and an accompanying video. Documents that may be needed to fill out the form are also included on this page.

The second FAFSA® onboarding page provides information and a video about contributors who may be required to participate on your FAFSA form. This page also provides information on how you will invite contributors to the FAFSA form.

The third FAFSA® onboarding page provides information about what you can expect when completing the FAFSA form. This includes information about consent and approval, a time estimate for completing the form, and a note that you can save the form and return later if needed, along with an accompanying video.

The last FAFSA® onboarding page provides information and a video about what to expect once the FAFSA form is completed, submitted, and processed. On this page, you would select "Start FAFSA Form" to begin.

This is the first page within the student section. Herer you can verify that the personal information is correct. If any of the personal information is incorrect, you would need to update the personal information. In order to update personal information, you must access your account settings on StudentAid.gov.

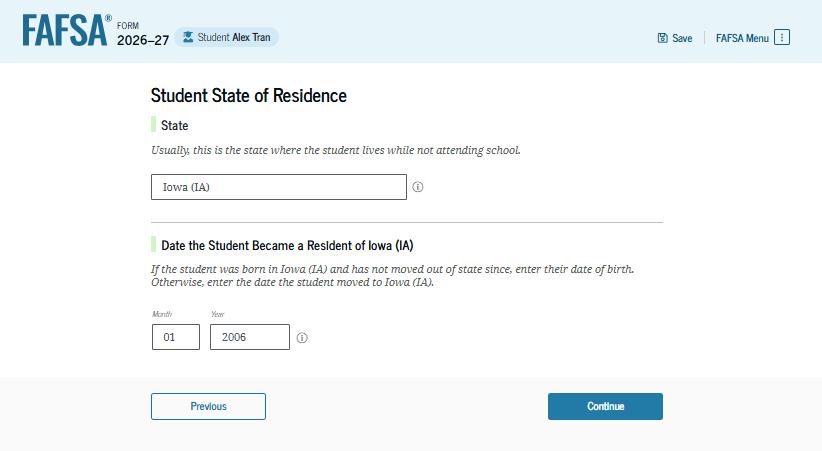

The student is asked about their state of residence. You select the state from a drop-down box and provides the month and year when you became a resident.

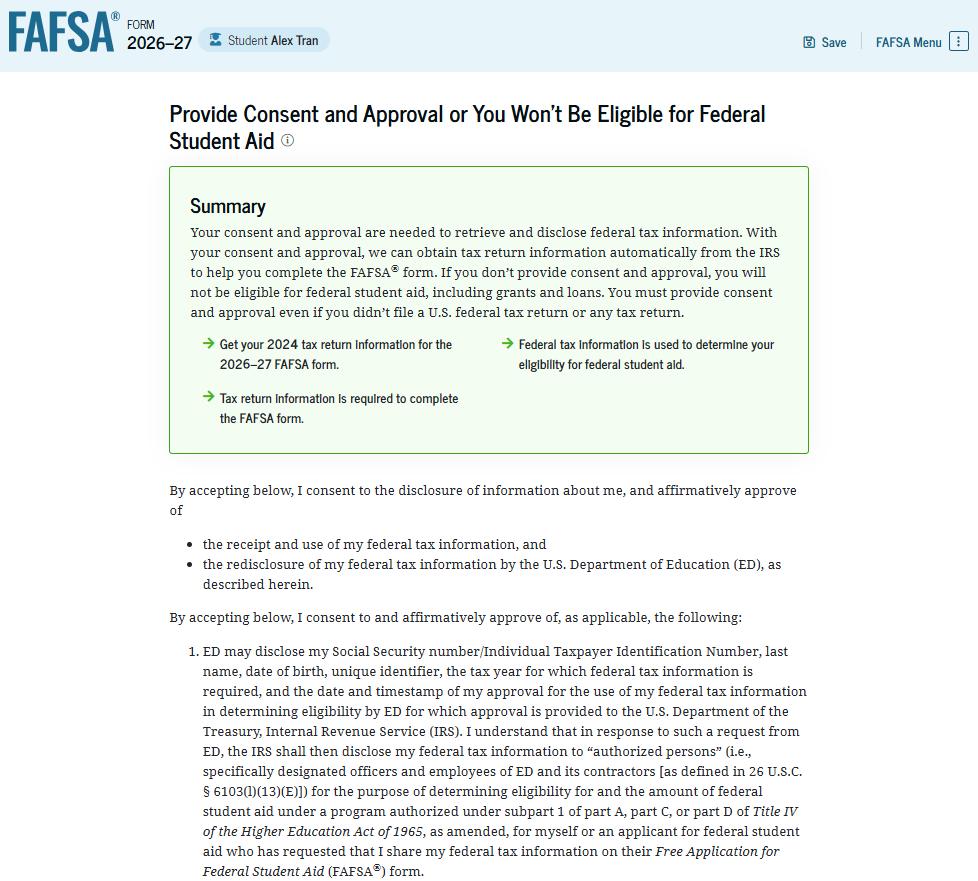

This page informs the student about consent, approval, and the use of federal tax information. Once you provide your consent and approval, your federal tax information is transferred directly from the IRS into the FAFSA® form to help complete the "Your Finances" section.

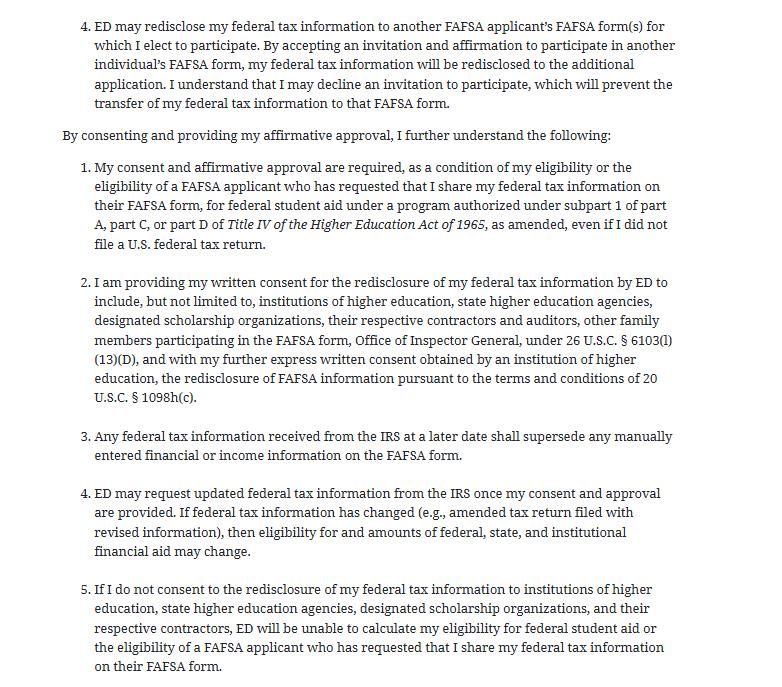

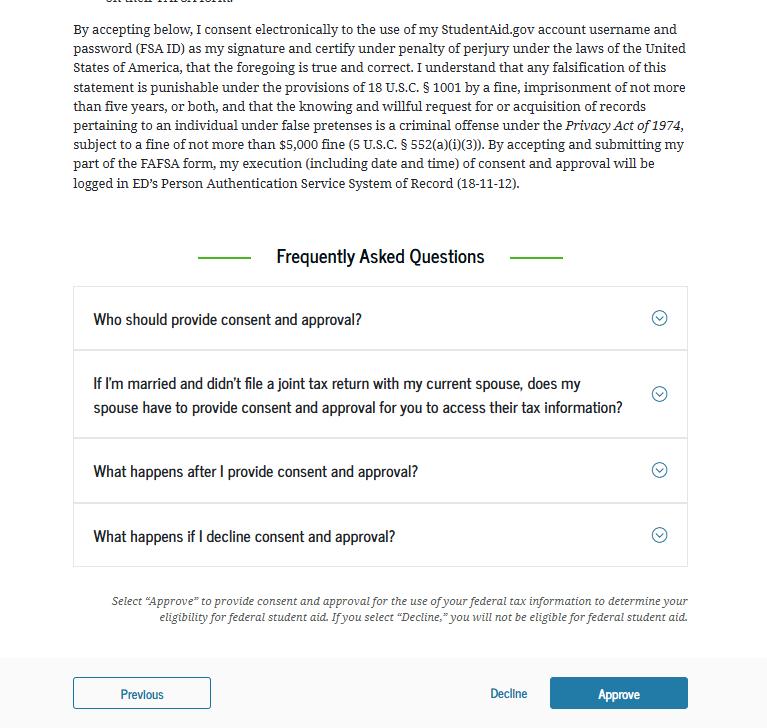

This is a continuation of the consent and approval page. You can expand and collapse FAQs about consent and approval.

Once you are ready, you select "Approve" to provide consent and approval and you are taken to the next page.

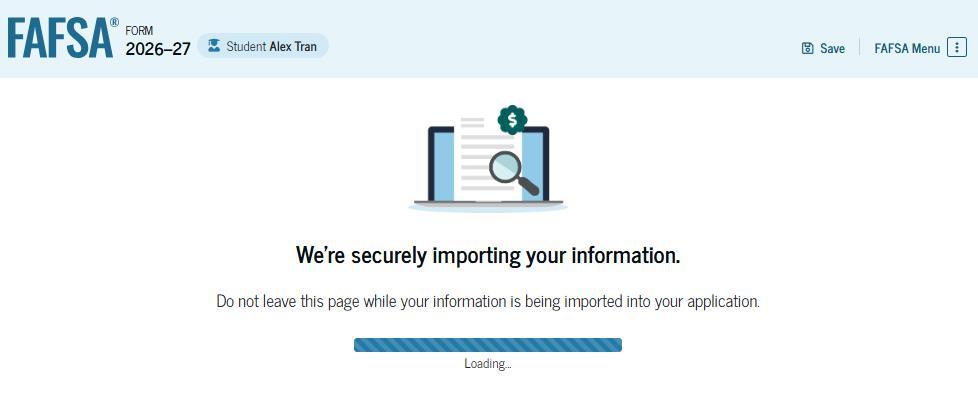

This page imports your federal tax information by directly transferring it from the IRS into the FAFSA® form to help complete the "Your Finances" section.

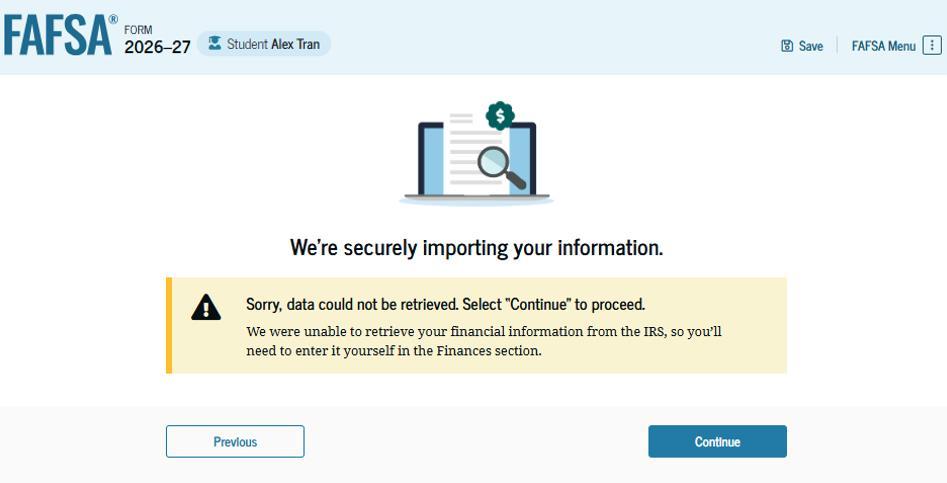

This page displays the results from the IRS import for the student. For this scenario, you are starting a new FAFSA® form and since you did not file a tax return in 2024, there is no federal tax information available from the IRS.

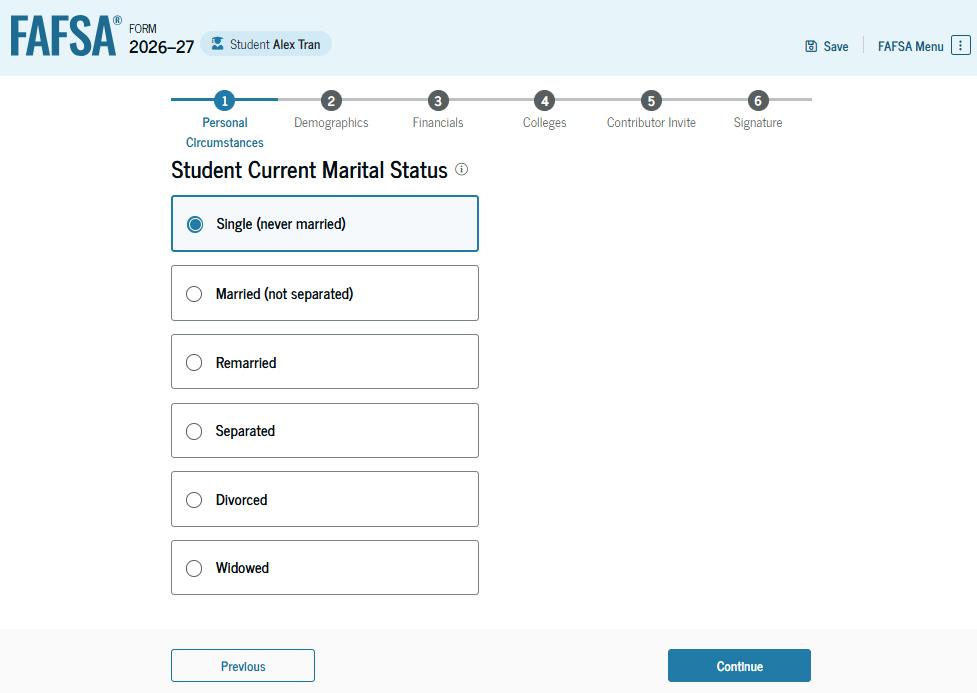

The student is asked about their marital status. For our purposes, we’ll select the "Single (never married)" option.

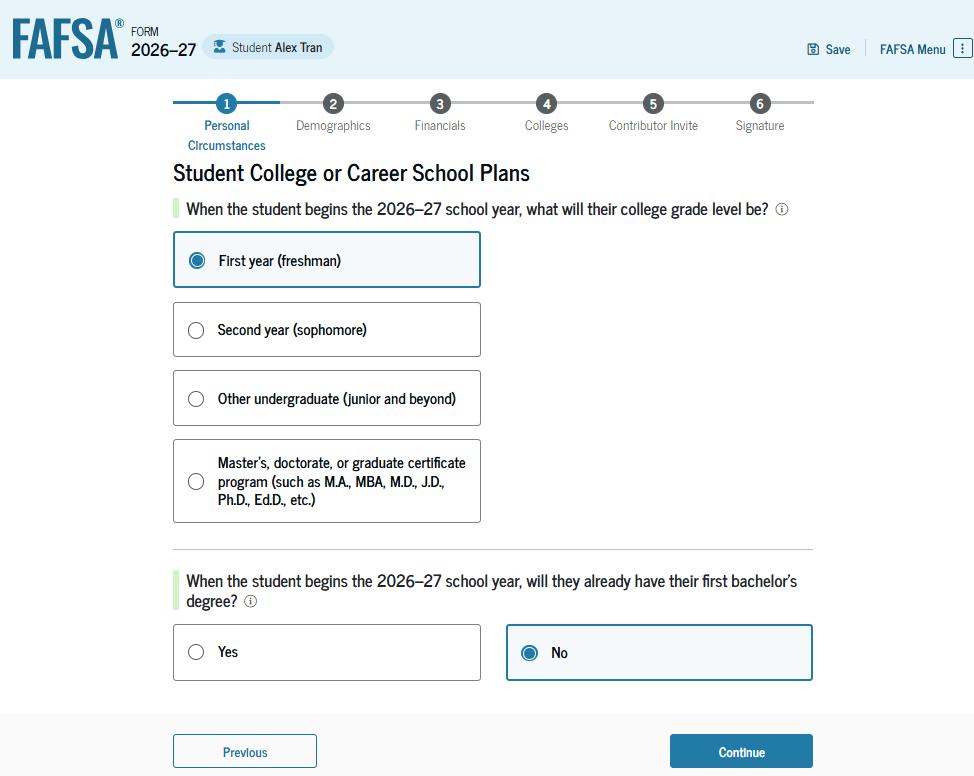

This page asks about your college grade level for the 2026–27 school year and if you will have your first bachelor’s degree prior to starting the new school year. In this case we select "First year (freshman)" and "No" to the question about your first bachelor’s degree.

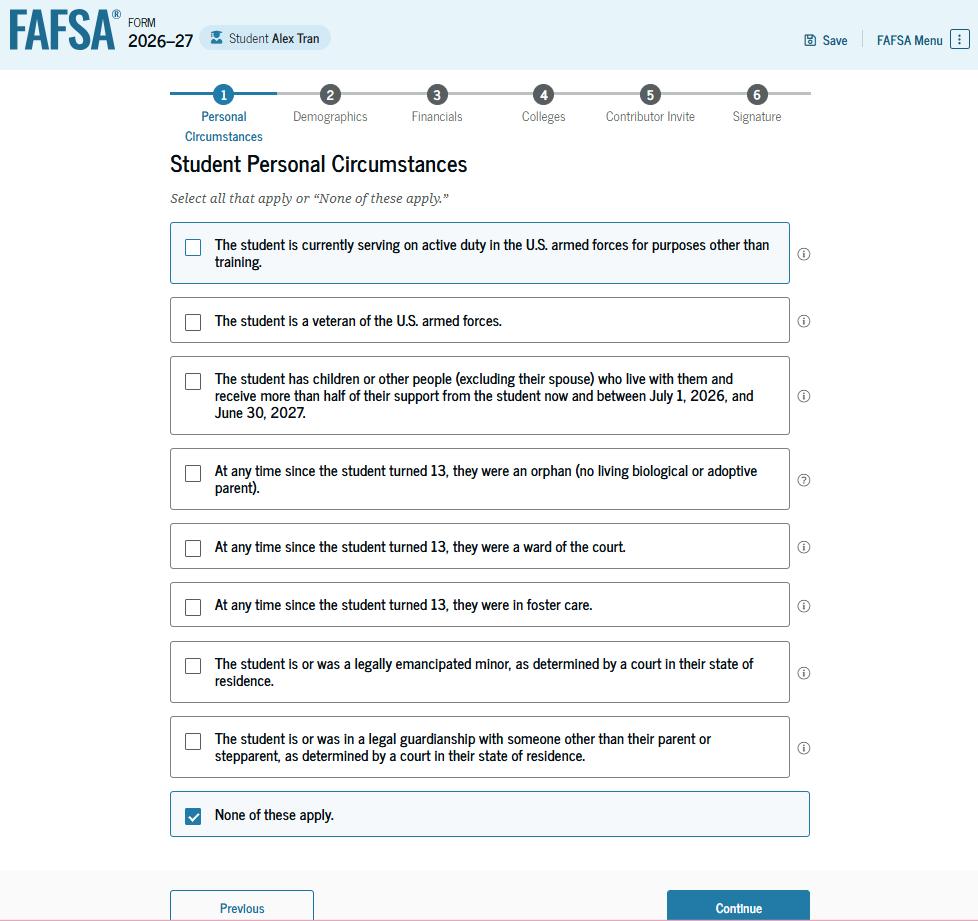

The student is asked if any of the listed personal circumstances apply. We select "None of these apply."

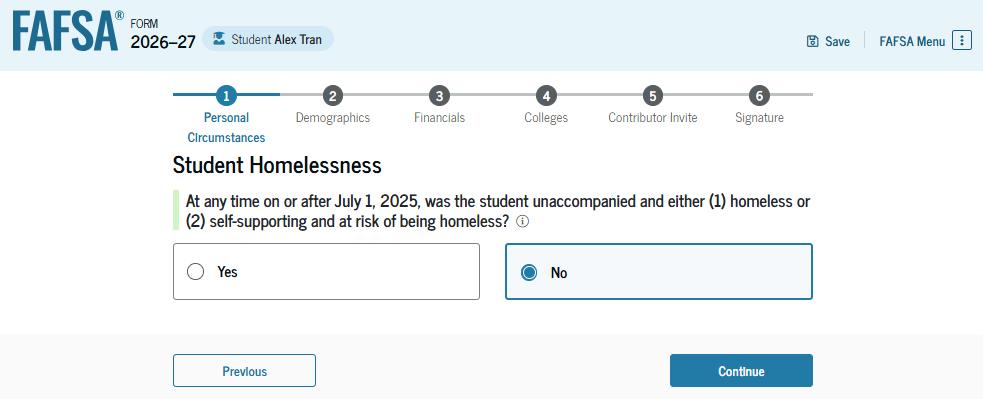

The student is asked if they were homeless or at risk of being homeless. We have selected "No."

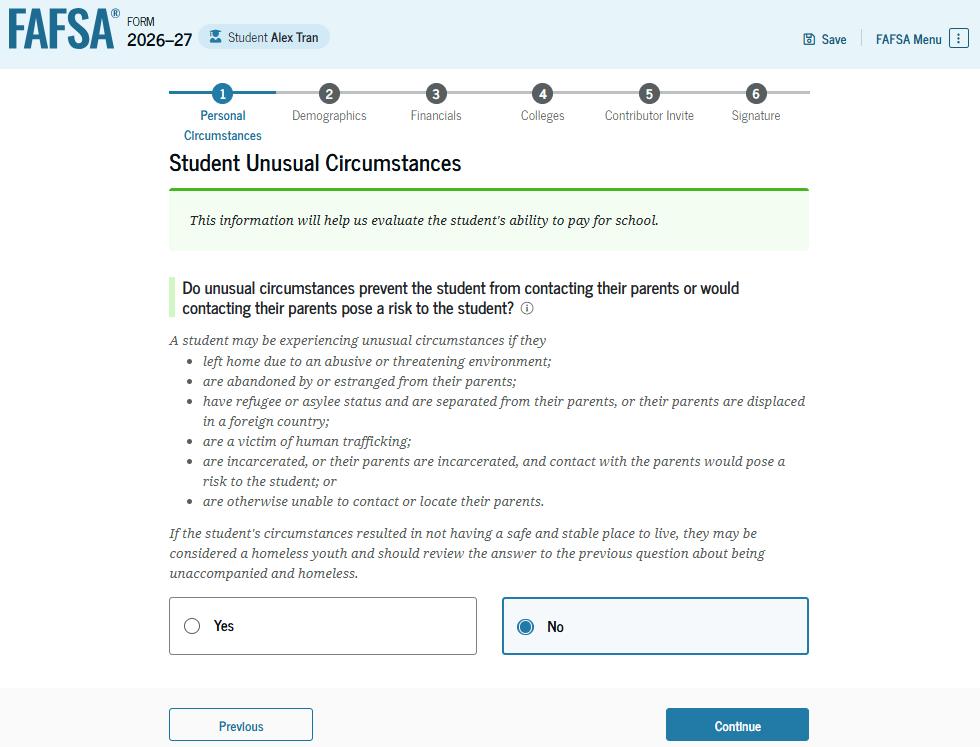

The student is asked if unusual circumstances prevent them from contacting the student’s parent(s).

We select "No."

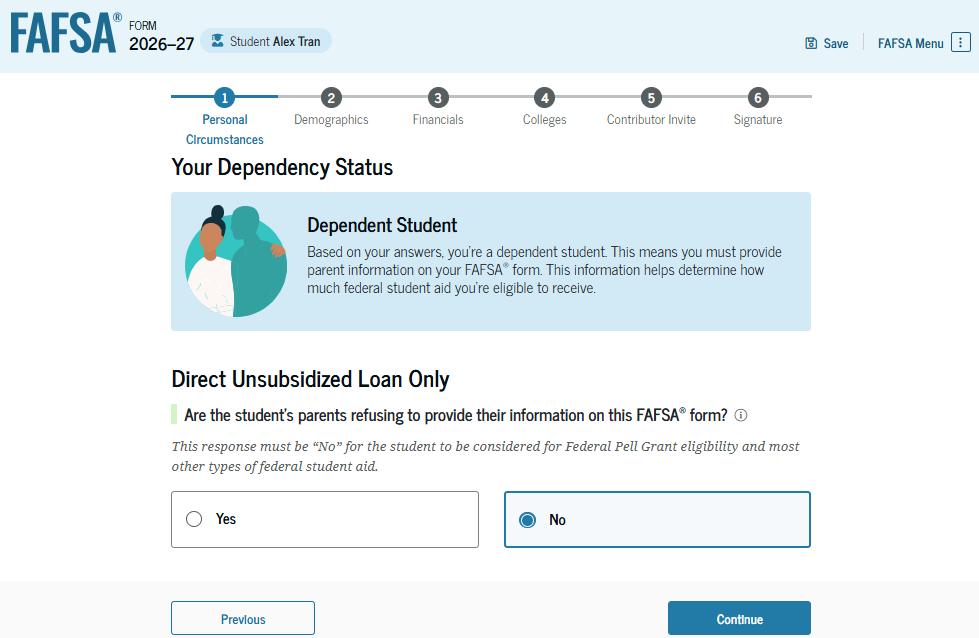

Based on the answers provided, you are considered a dependent student. You are asked if a financial aid administrator should determine your eligibility for a Direct Unsubsidized Loan only. This is an option if your parents are unwilling to provide information. In this case we selected "No." If you had selected "Yes," a modal would appear to warn about missing out on other potential federal student aid.

This is the first page within the "Student Demographics" section. It provides an overview of the section.

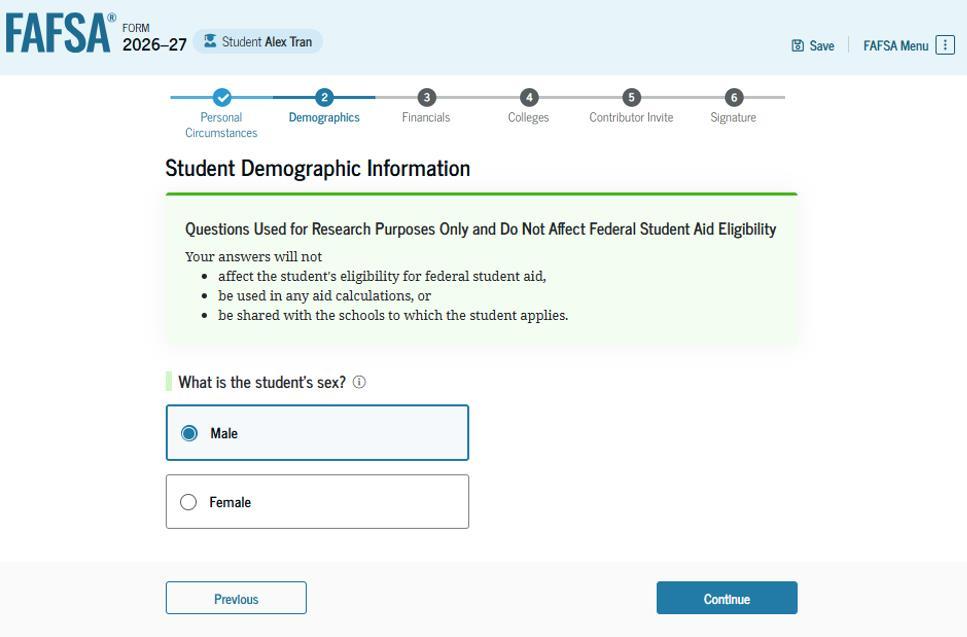

The student is asked to identify their sex. In this case we selected "Male."

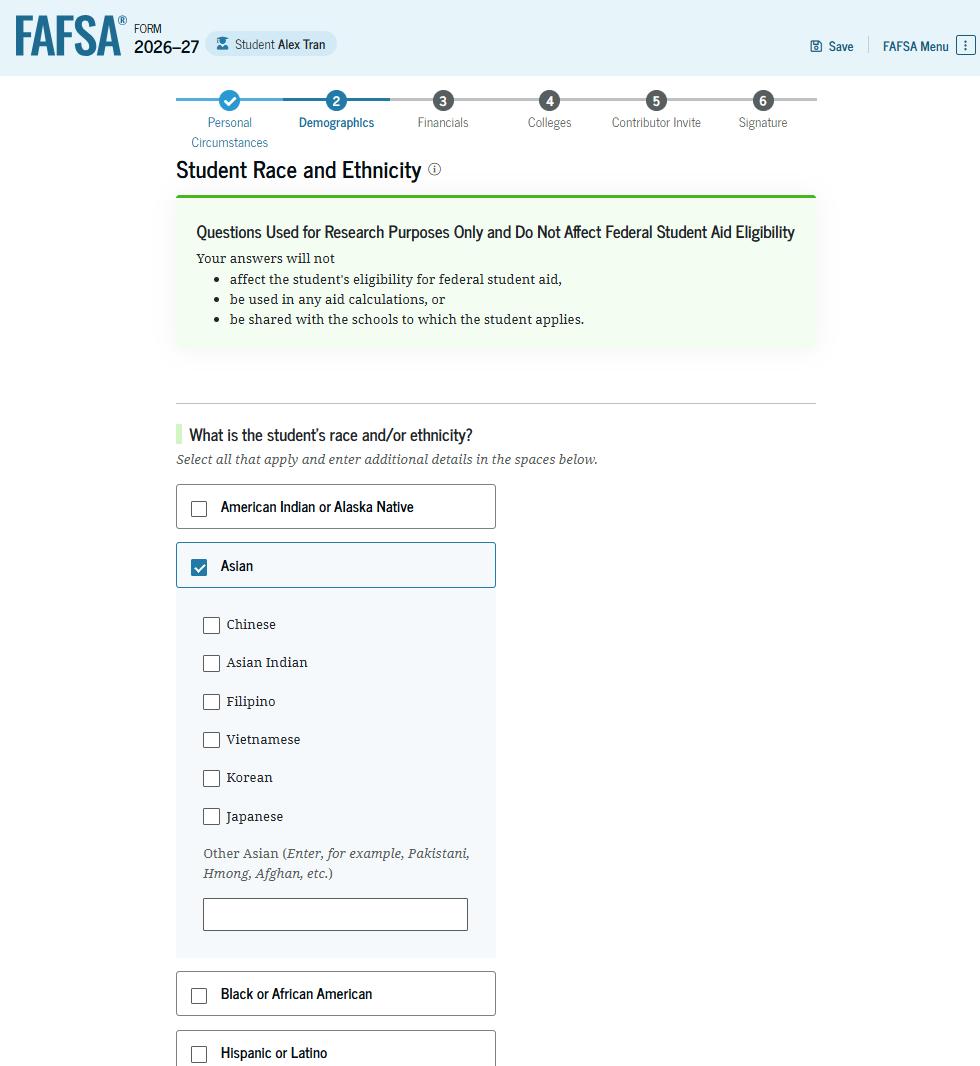

The student is asked to identify their race. You select the checkboxes that apply. After making a selection, a second drop-down box appears, and you select the checkboxes that apply to you.

The student is asked about their citizenship status. In this case we selected "U.S. citizen or national" option.

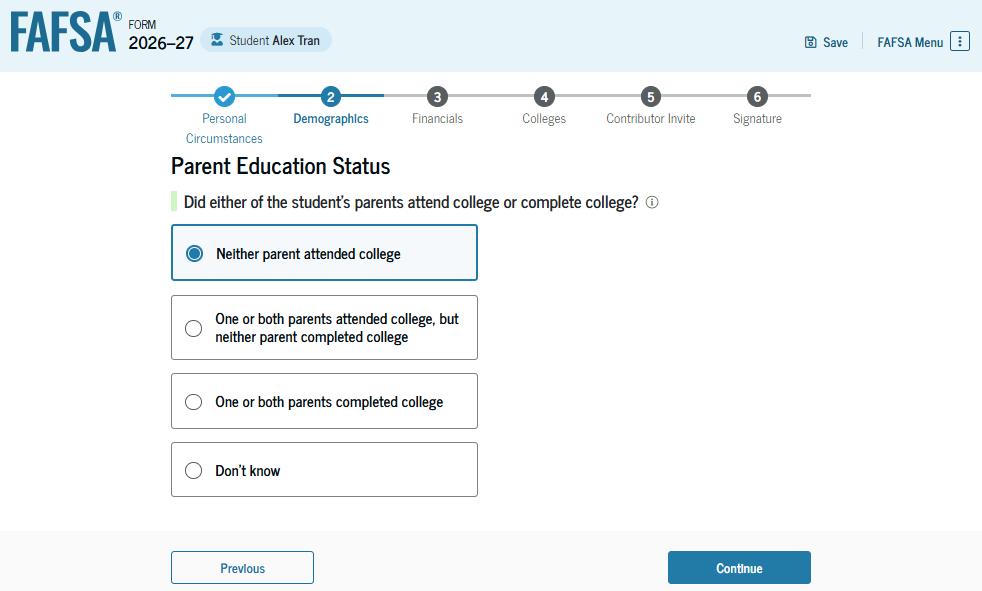

The student is asked about their parents’ education status. We chose to select the "Neither parent attended college" option.

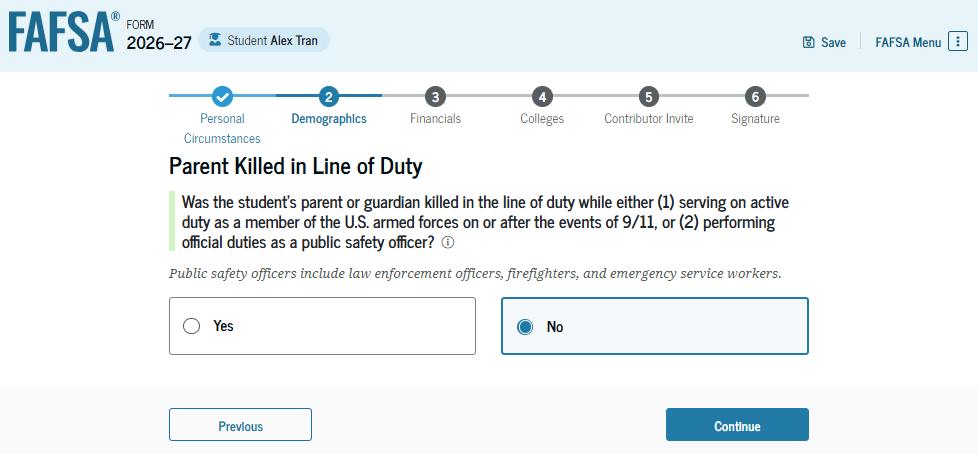

The student is asked if their parent was killed in the line of duty. We selected the "No" option.

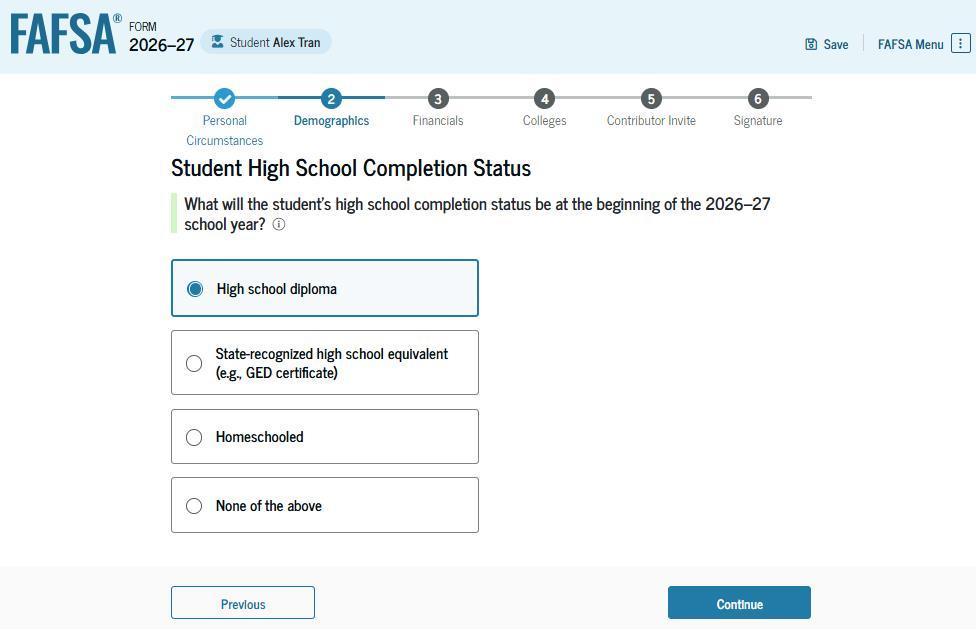

The student is asked about what their high school completion status will be when the student starts the 2026–27 school year. We selected the "High school diploma" option since that should be correct for most of you.

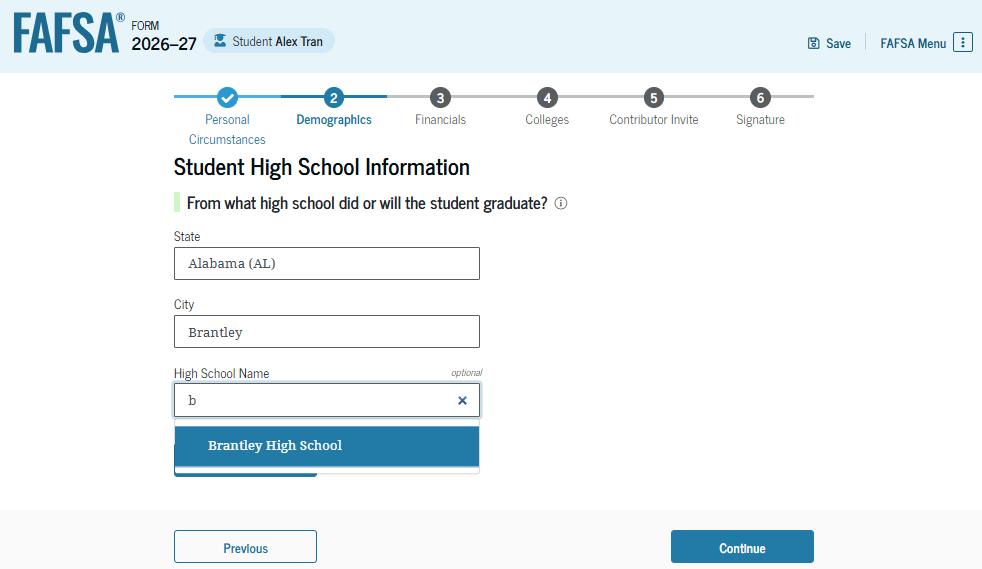

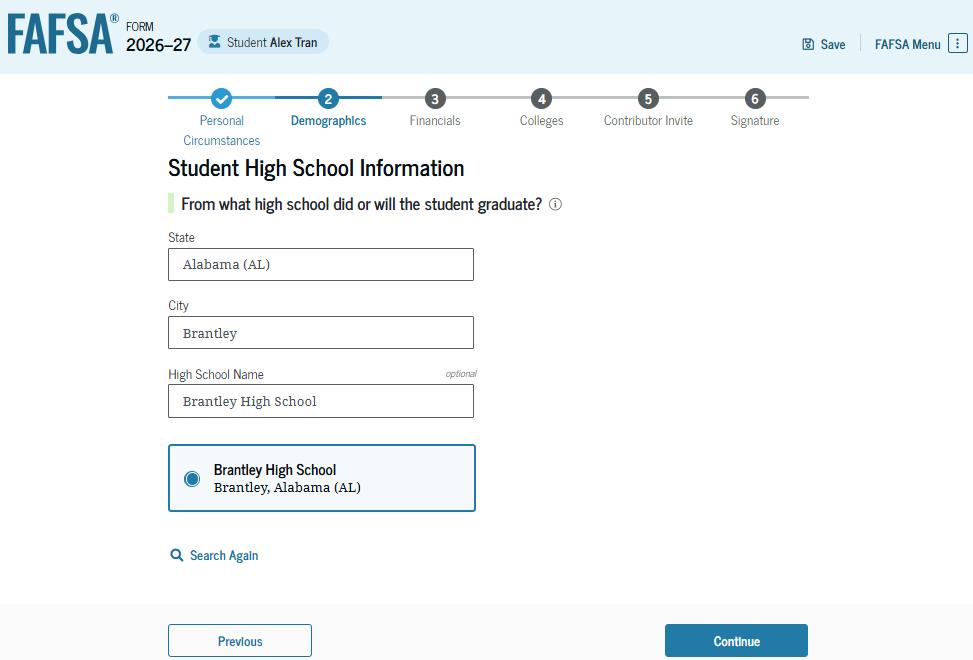

Because you selected high school diploma, you are asked to select which high school they did or will graduate from. You will enters the high school’s state and city. After selecting "Search," you will selects the correct high school from the search results.

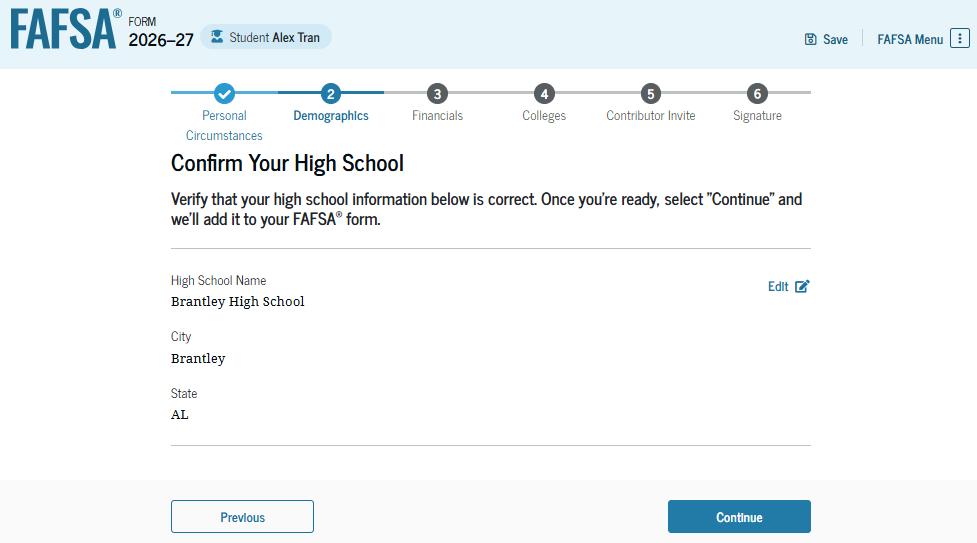

You will have the option to edit the high school information presented on this page by selecting "Edit," which will return you to the high school information page. You confirm the high school information and select "Continue" to proceed to the next section.

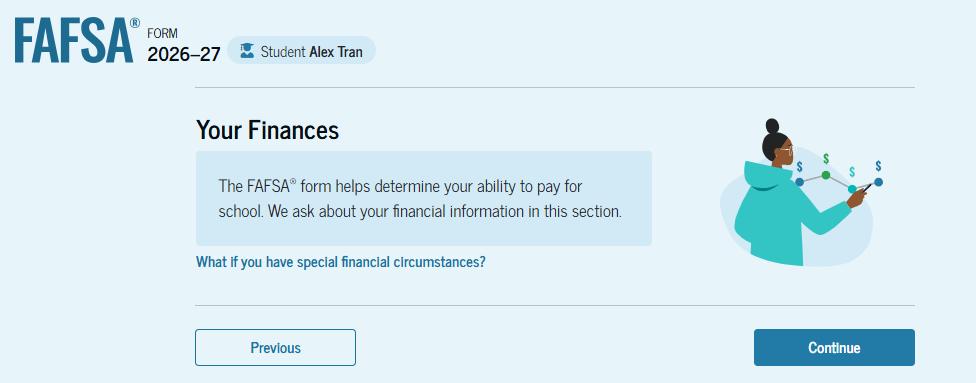

This is the first page within the "Your Finances" section. It provides an overview of the section. The student can select the hyperlink to learn about special financial circumstances.

The student is asked about their tax filing status. In this case we selected “No" to "Did or will the student file a 2024 IRS Form 1040 or 1040-NR?"

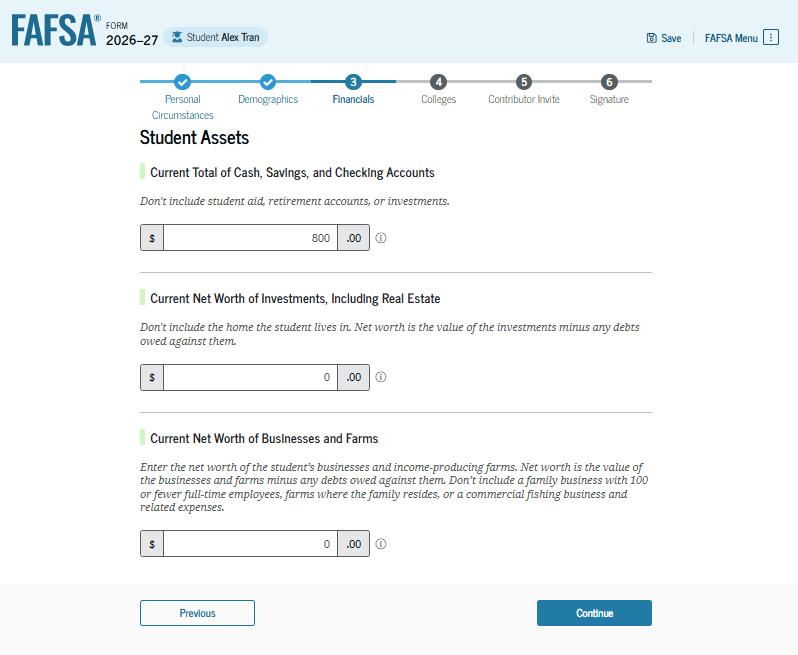

You are asked about their assets. You must enters a response in each entry field. If you have nothing to report, you would enter the numeral zero for each response.

This is the first page in the "Select Colleges and Career Schools" section. It provides an overview of the section.

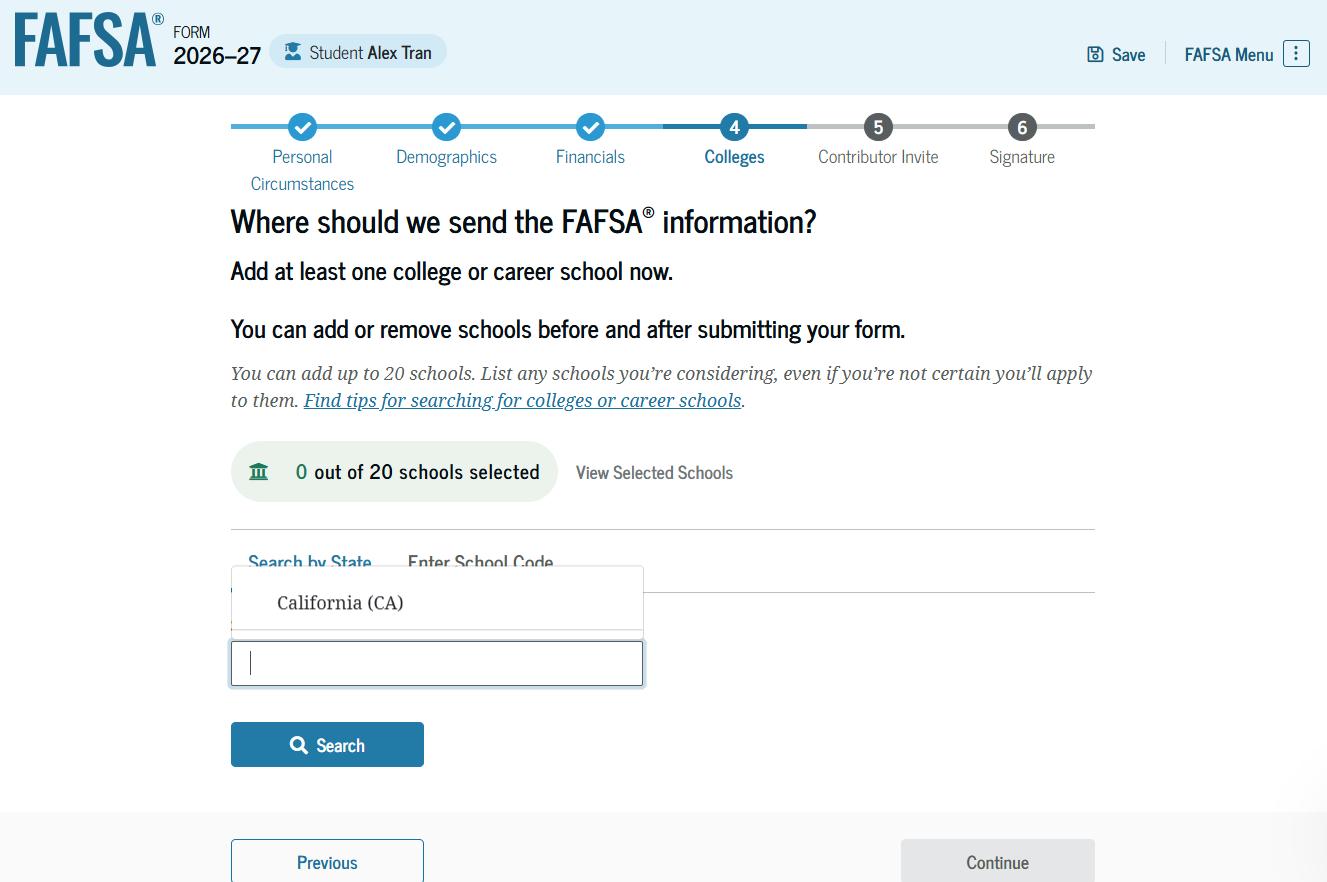

The student is asked to search for the colleges, career schools, or trade schools that will receive their FAFSA® information. You searchfor a school by selecting the state from the drop-down menu and selecting "Search." If you can’t find a school searching by state, you can search by school code.

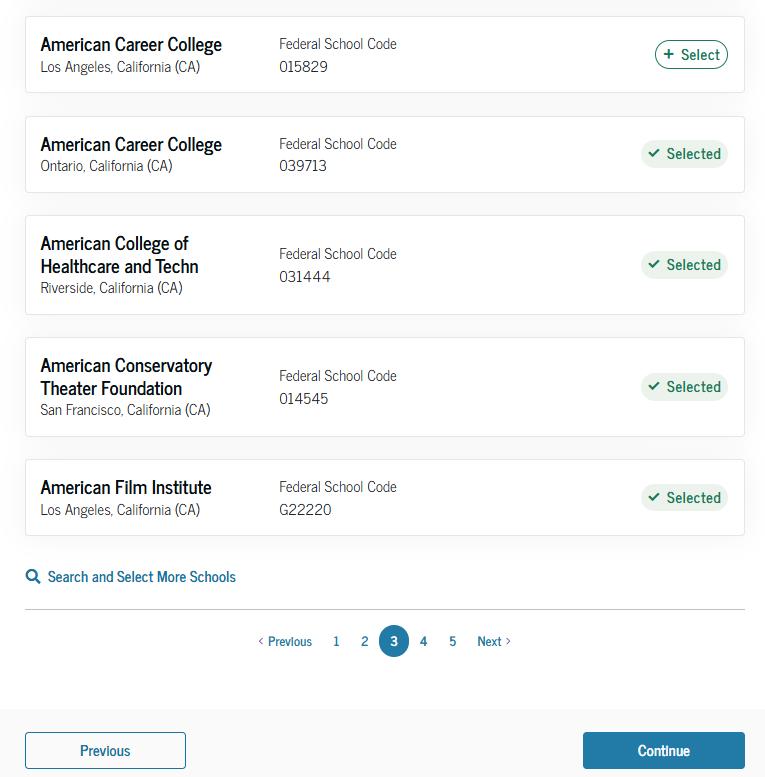

After entering a school’s state and selecting "Search," you would select the correct school(s) from the search results. You can send your FAFSA® information to a maximum of 20 schools. You must add at least one school to continue.

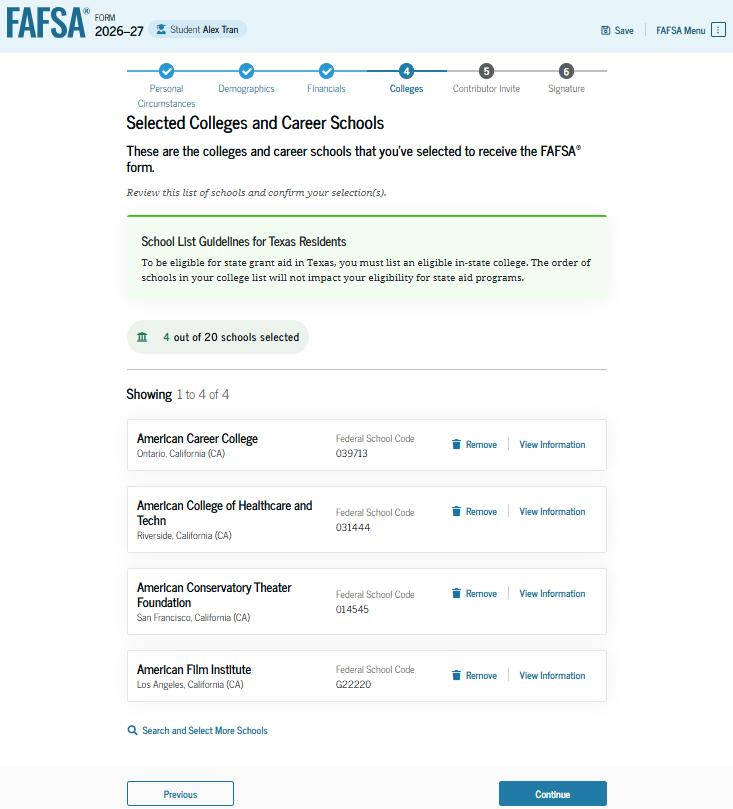

After you select the correct school(s) from the search results, you can review the school(s) chosen before continuing. If 20 schools have not been selected, you have the option to search and select more schools. You do not have to be accepted at a school to have them receive your FAFSA information. It is a good idea to select any and all schools you are considering attending, so there is no delay once you make a decision on where to attend.

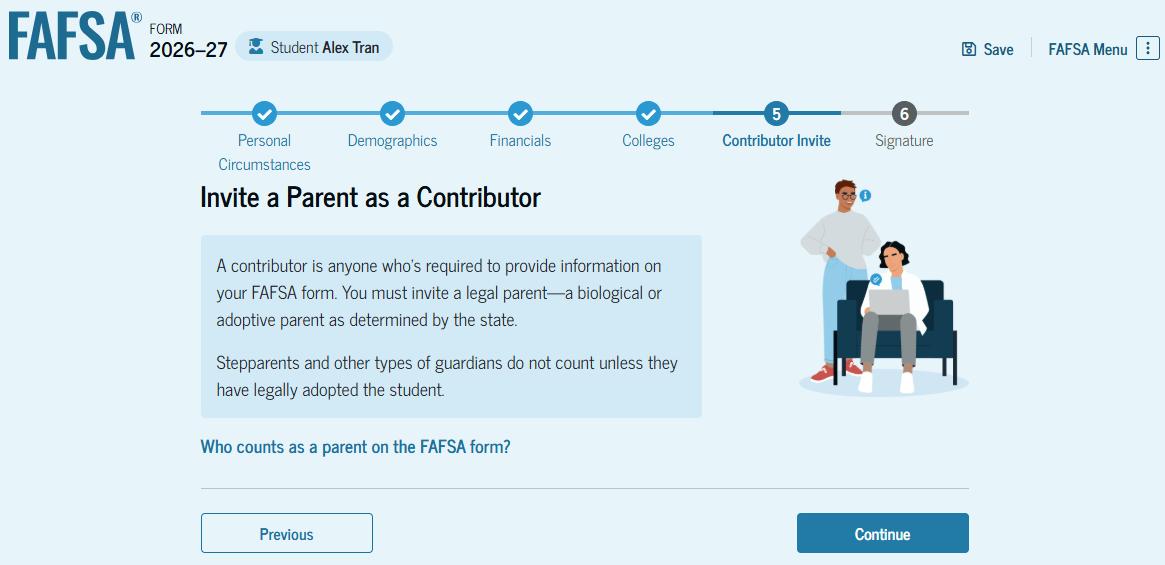

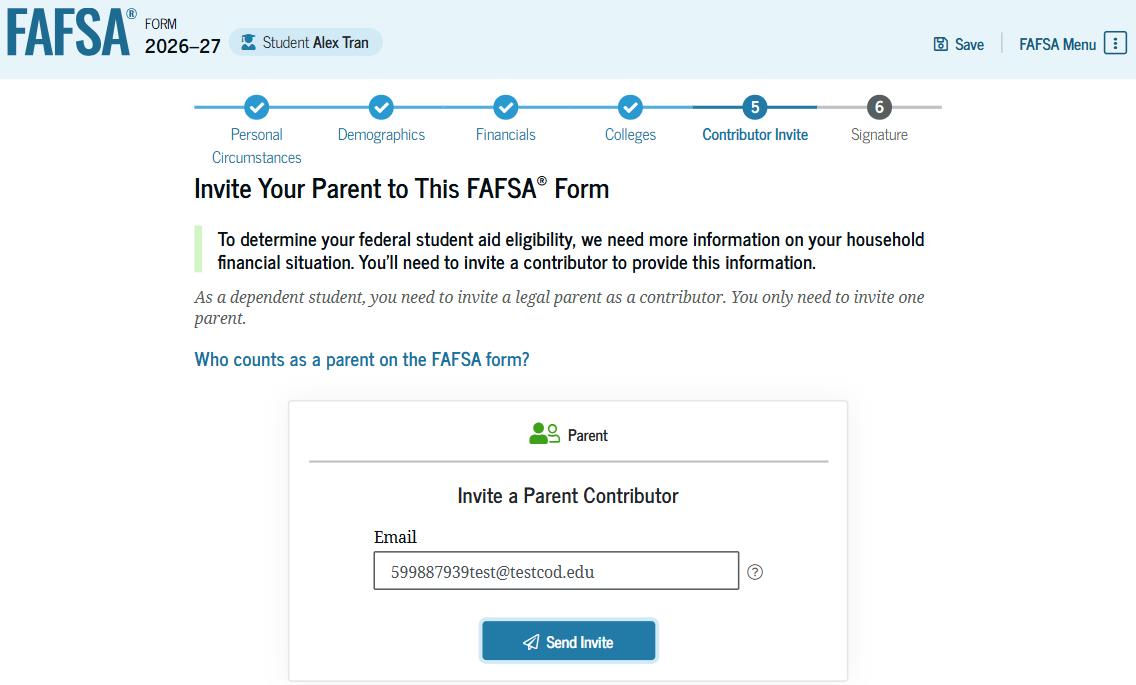

This is the first page in the "Invite a Parent as a Contributor" section, which is the last student section to require information. It provides an overview of the section. If you are unsure which parent should complete the FAFSA, click on the “Who counts as a parent on the FAFSA form” for help.

1 of 2)

This is the first page in the "Invite a Parent as a Contributor" section, which is the last student section to require information. It provides an overview of the section.

2 of 2)

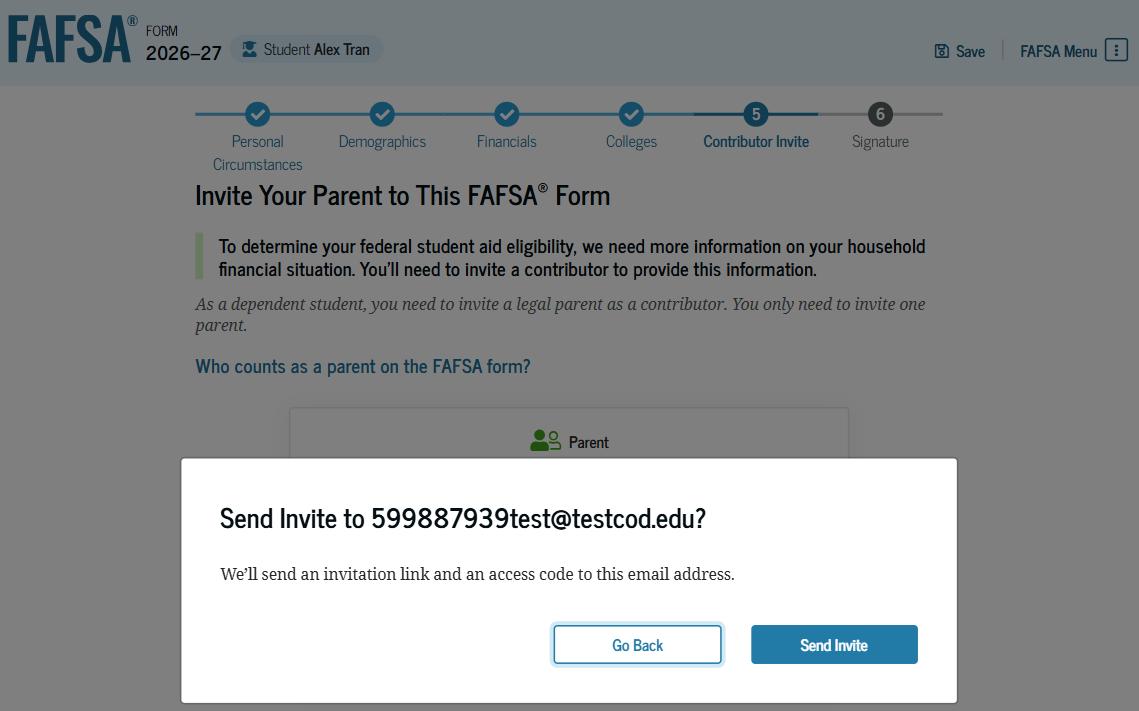

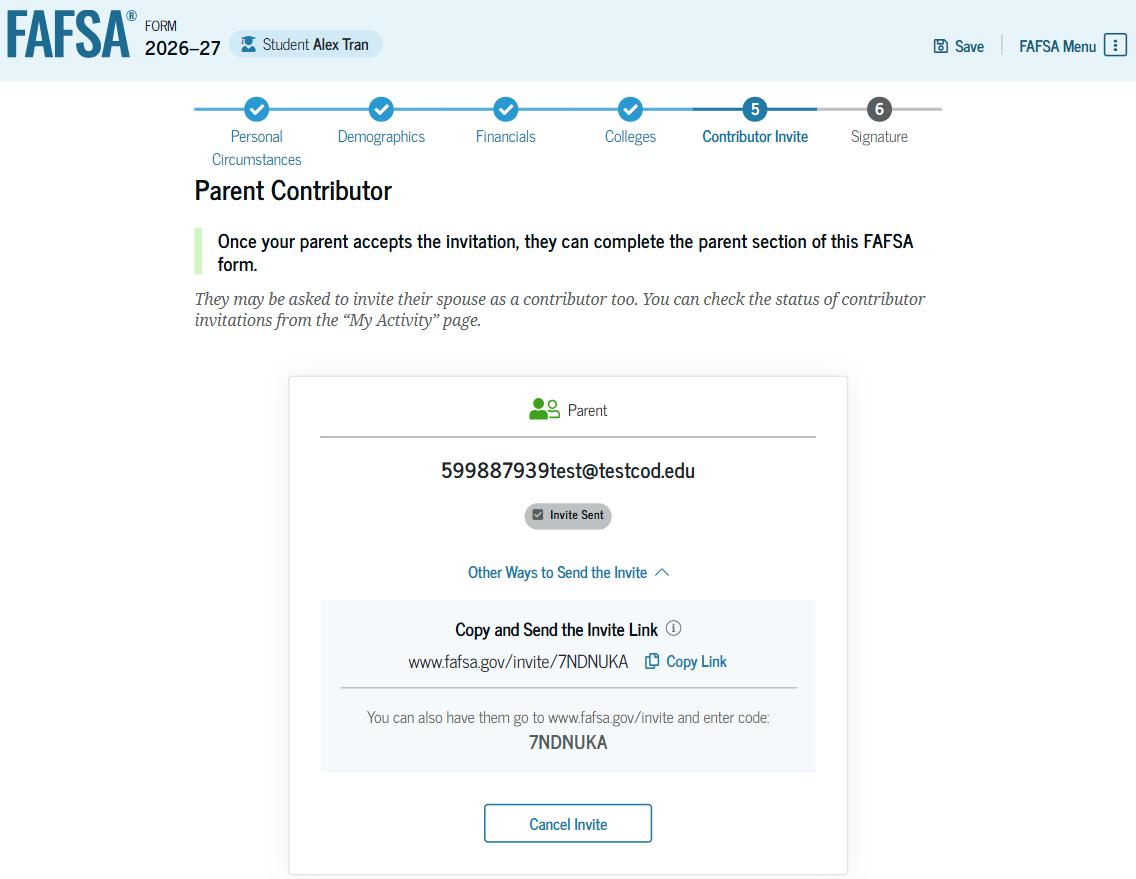

This page confirms your parent will receive an email inviting them to the student’s FAFSA® form. The parent can access the form by accepting the invitation in the email. On this page, you are also provided an invitation link and invitation code that can be shared directly with your parent.

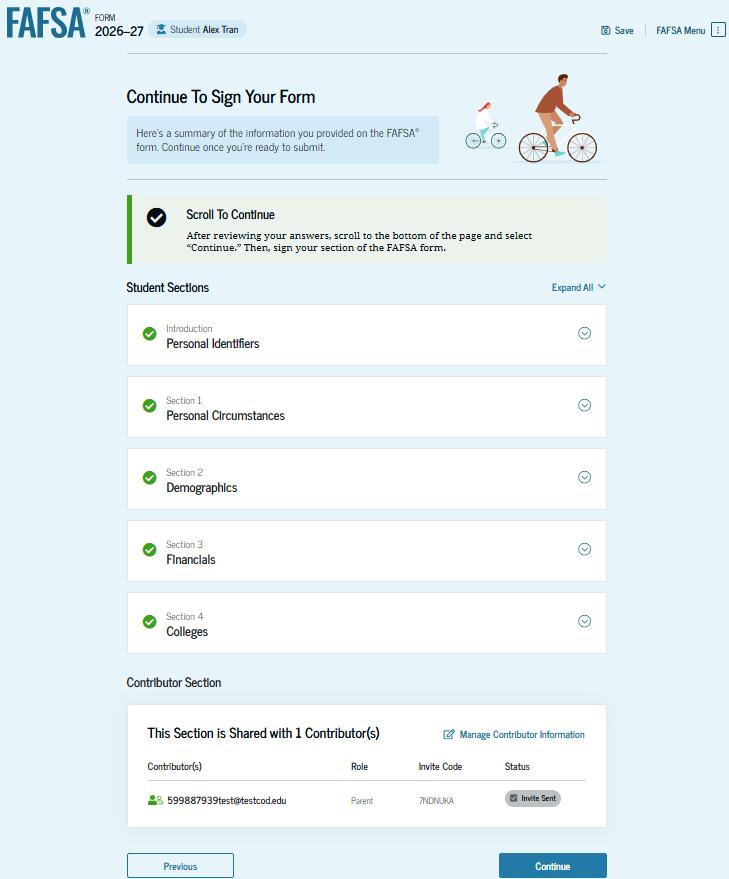

The review page displays the responses that you have provided in the FAFSA® form. You can view all responses by selecting "Expand All" or expand each section individually. To edit a response, you can select the question’s hyperlink to be taken to the corresponding page.

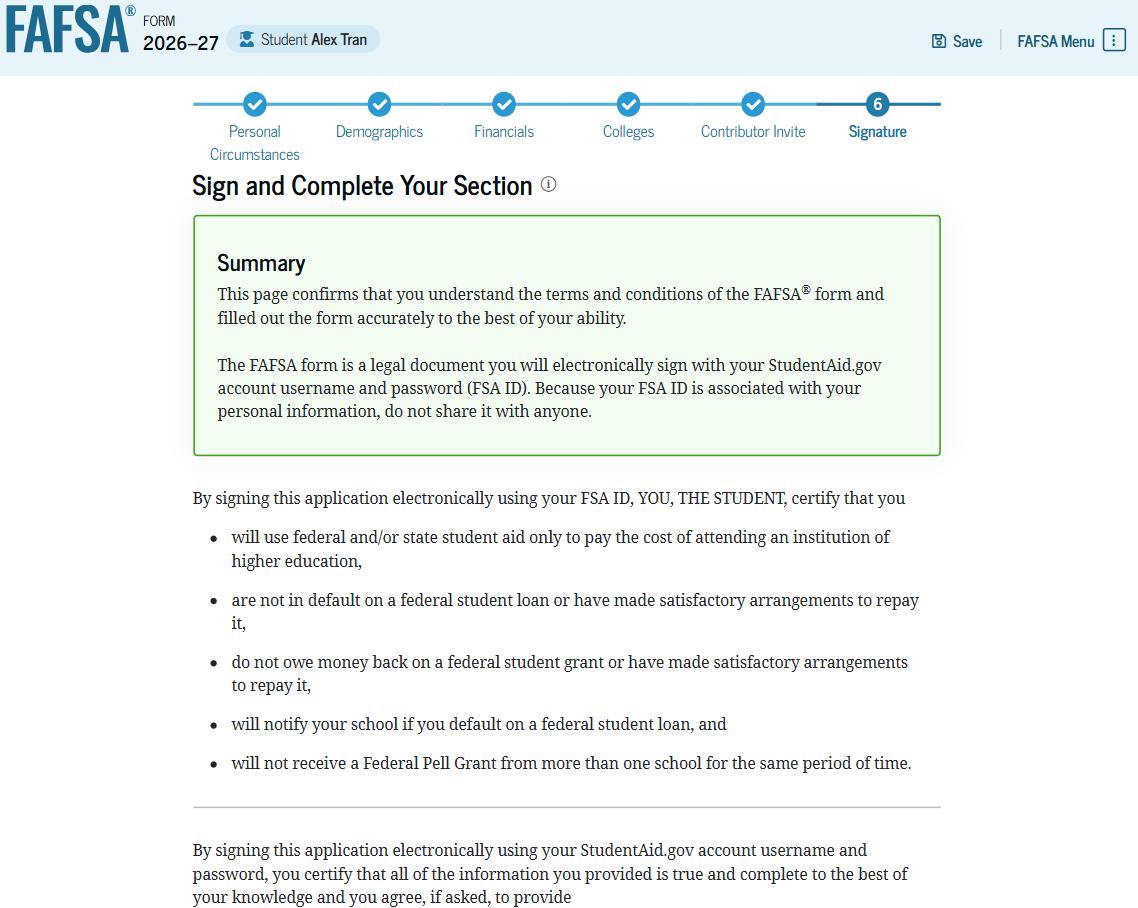

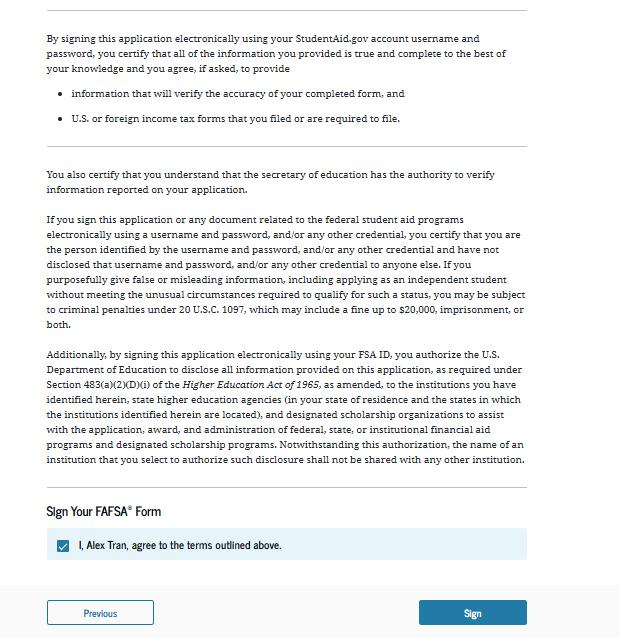

On this page, you review the terms and conditions of the FAFSA® form and what you’ll agree to when you sign the form.

This is a continuation of the student signature page. After agreeing to the terms and conditions of the FAFSA® form and digitally signing, you are able to submit your sections of the FAFSA form. Since parent information has not been provided, the FAFSA form is not considered complete and can’t be processed yet.

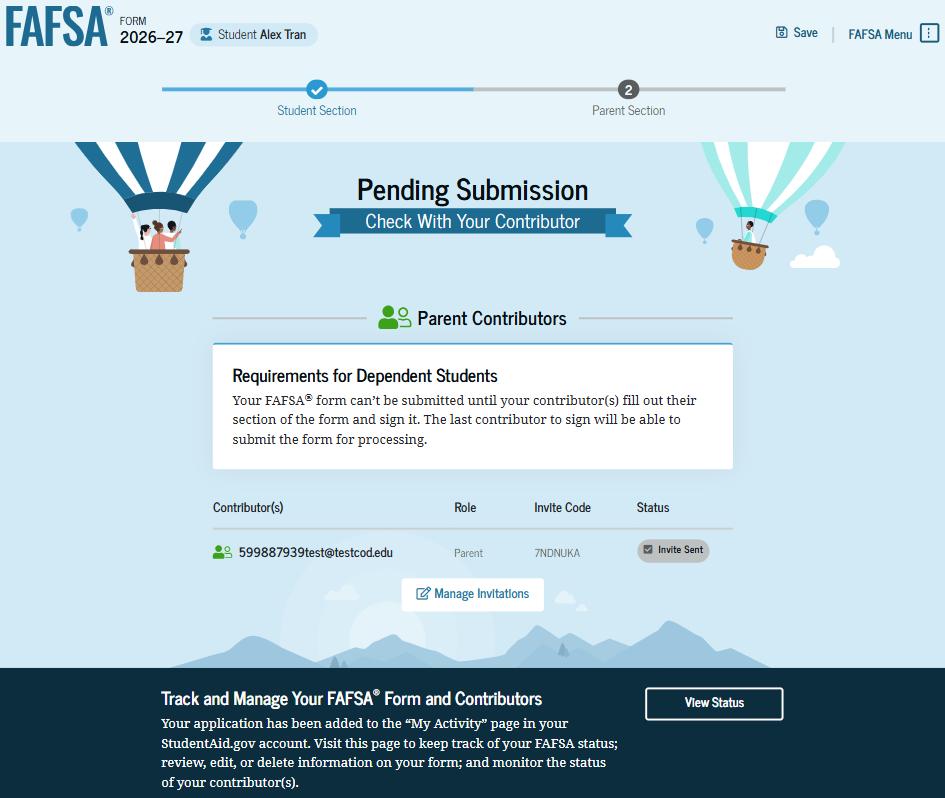

Upon digitally signing the student section, you are presented with the "Pending Submission" page. You are reminded that your FAFSA® form is not completed and can’t be submitted until the parent completes the contributor section of the form and signs it. This page also displays next steps the you can take, including tracking and managing your form.

This is a continuation of the student section complete page. This page displays information about next steps, including checking your email and a reminder that your FAFSA® form is not completed and can’t be submitted until the parent completes the contributor section of the form and signs it. Next, in this scenario, the invited parent will enter the FAFSA form and complete the parent section.

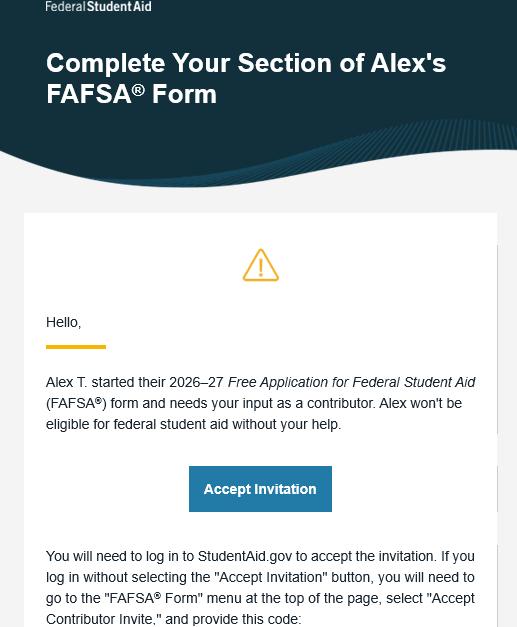

This is NOT a view within StudentAid.gov or the FAFSA® form. This view demonstrates a parent opening the FAFSA invitation from their email. The parent selects "Accept Invitation" and is taken to StudentAid.gov.

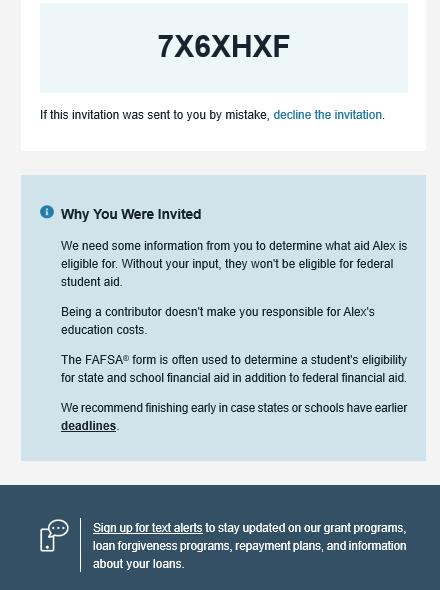

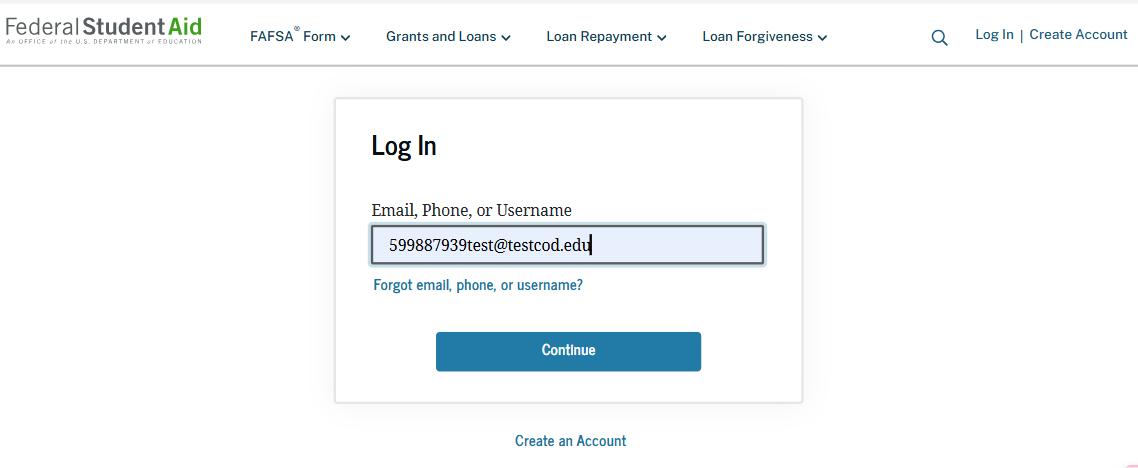

The parent is taken from their email to the "Log In" page to enter their credentials. To access the FAFSA® form, all users are required to have a StudentAid.gov account username and password. If the parent doesn't have a username and password, they can select "Create anAccount."

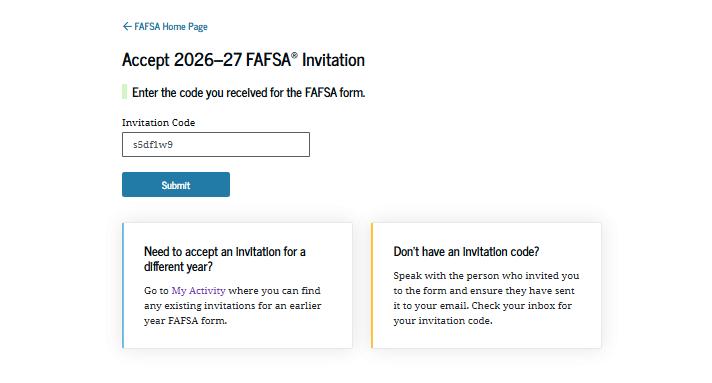

After logging in, the parent is taken to the "Accept 2026–27 FAFSA® Invitation" page. The invitation code from the parent’s email automatically fills in the text box if the parent used the link from the email.

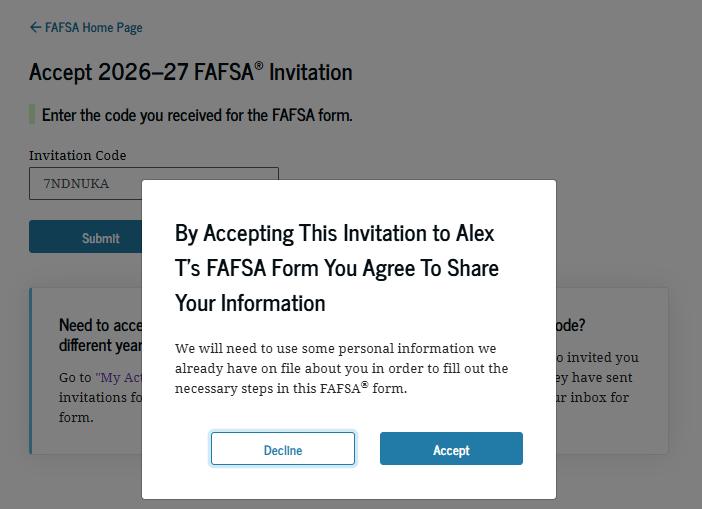

When the parent selects "Submit," a pop-up window appears, confirming the student’s name and reminding the parent that their personal information is needed to fill out the student’s FAFSA® form. The parent selects "Accept" to agree to sharing their information and enters the FAFSA form.

When the parent enters a 2026–27 FAFSA® form for the first time, they are taken through the FAFSA onboarding process. The first onboarding page provides an introduction of the FAFSA form and an accompanying video.

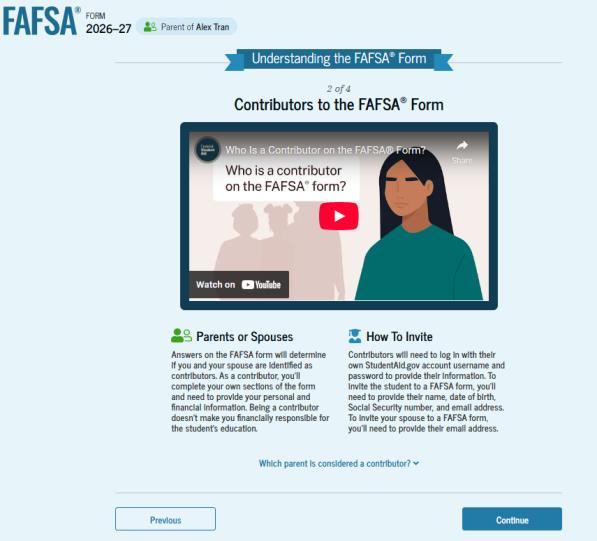

The second FAFSA® onboarding page provides information and a video about contributors that may be required to participate on the student’s FAFSA form. This page also provides information on how the parent will invite contributors to the FAFSA form.

The third FAFSA® onboarding page provides information about what the parent can expect when completing the student’s FAFSA form. This includes information about consent and approval, a time estimate to complete the form, and a note that the parent can save the form and return later if needed, along with an accompanying video.

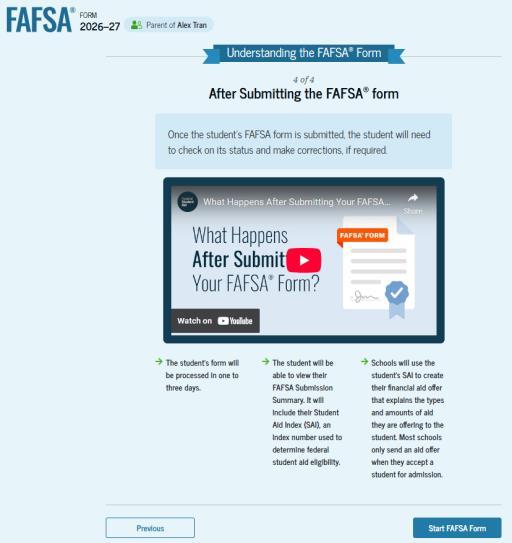

The last onboarding page provides information and a video about what to expect once the FAFSA® form is completed, submitted, and processed. On this page, the parent selects "Start FAFSA Form" to begin the parent section.

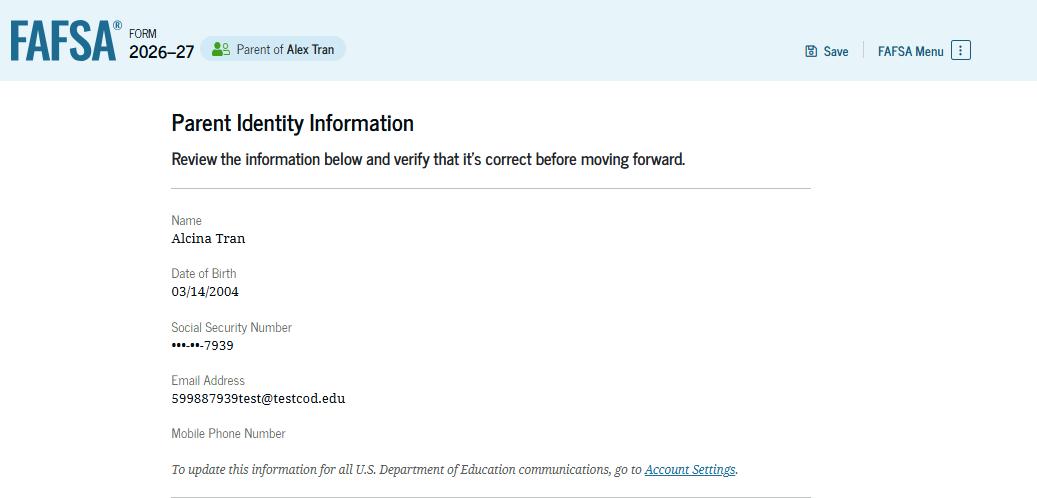

This is the first page within the parent section. The parent can verify that the personal information is correct. To update any of the personal information, the parent must access their account settings on StudentAid.gov.

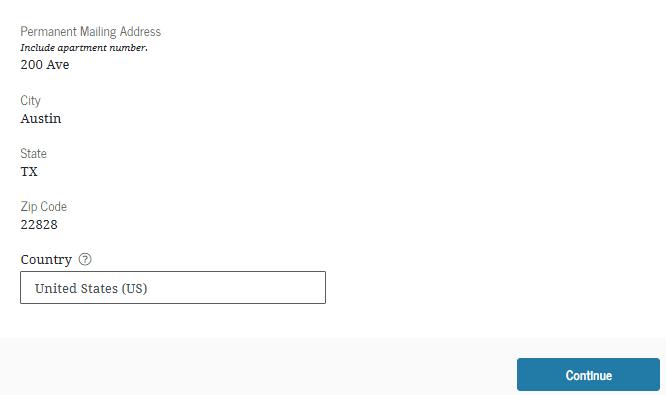

This is a continuation of the first page within the parent section. The parent can verify their mailing address on this part of the page. To update this information, the parent must access their account settings on StudentAid.gov.

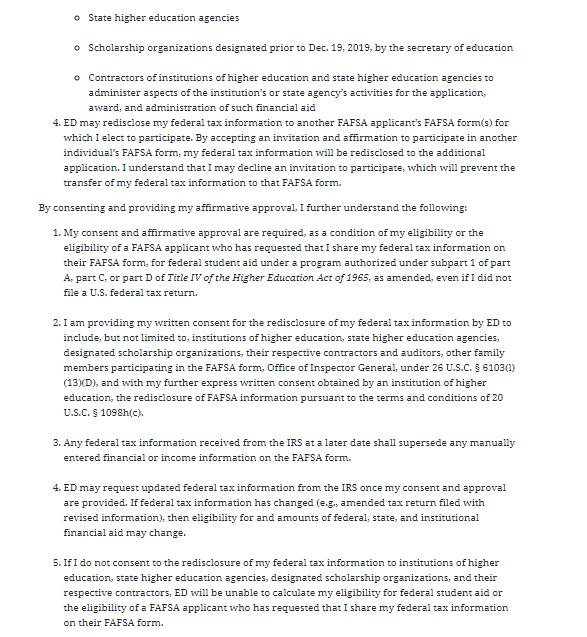

This page informs the parent about consent, approval, and the use of their federal tax information. Once the parent provides consent and approval, their federal tax information is transferred directly from the IRS into the FAFSA® form to help complete the "Parent Finances" section.

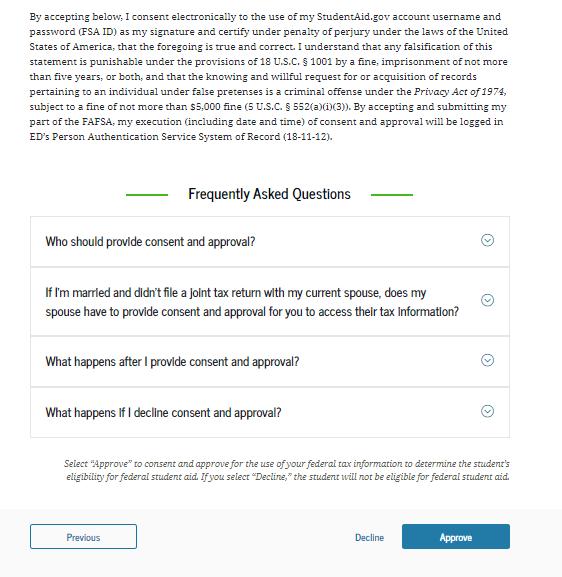

This is a continuation of the consent and approval page. The parent can expand and collapse FAQs about consent and approval. The parent selects "Approve" to provide consent and approval and is taken to the next page.

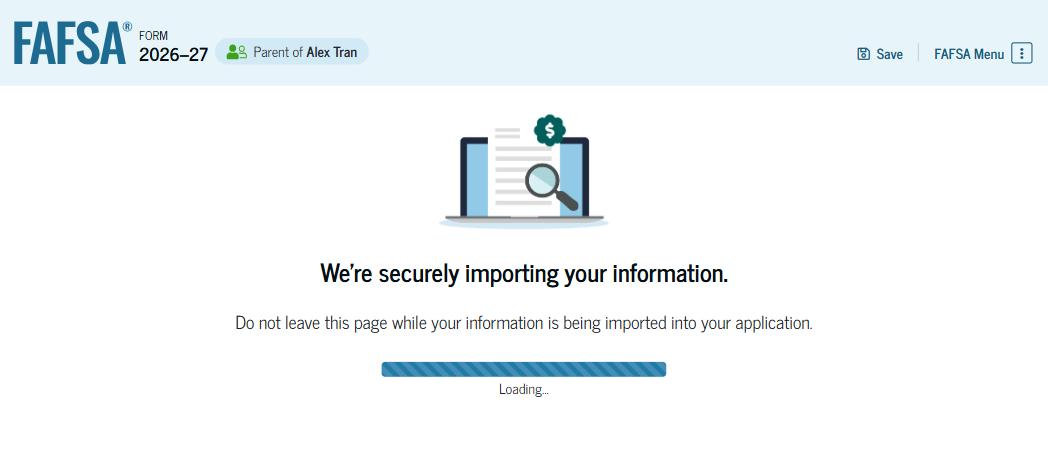

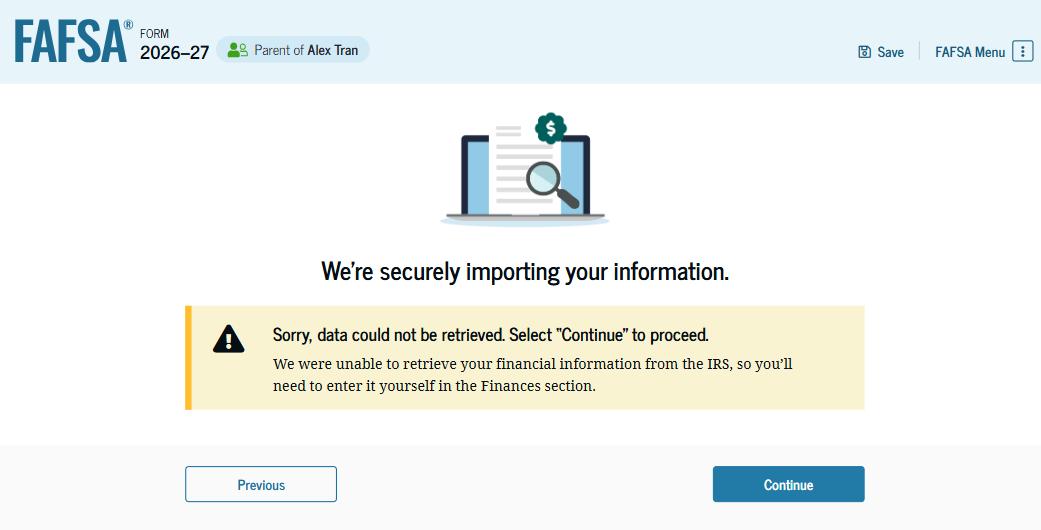

This page imports the parent’s federal tax information by directly transferring it from the IRS into the FAFSA® form to help complete the "Parent Finances" section.

This page displays the results from the IRS import for the parent. If the transfer was unsuccessful, the Parent will enter their financial information on subsequent pages.

This is the first page in the "Parent Demographics" section. It provides an overview of the section.

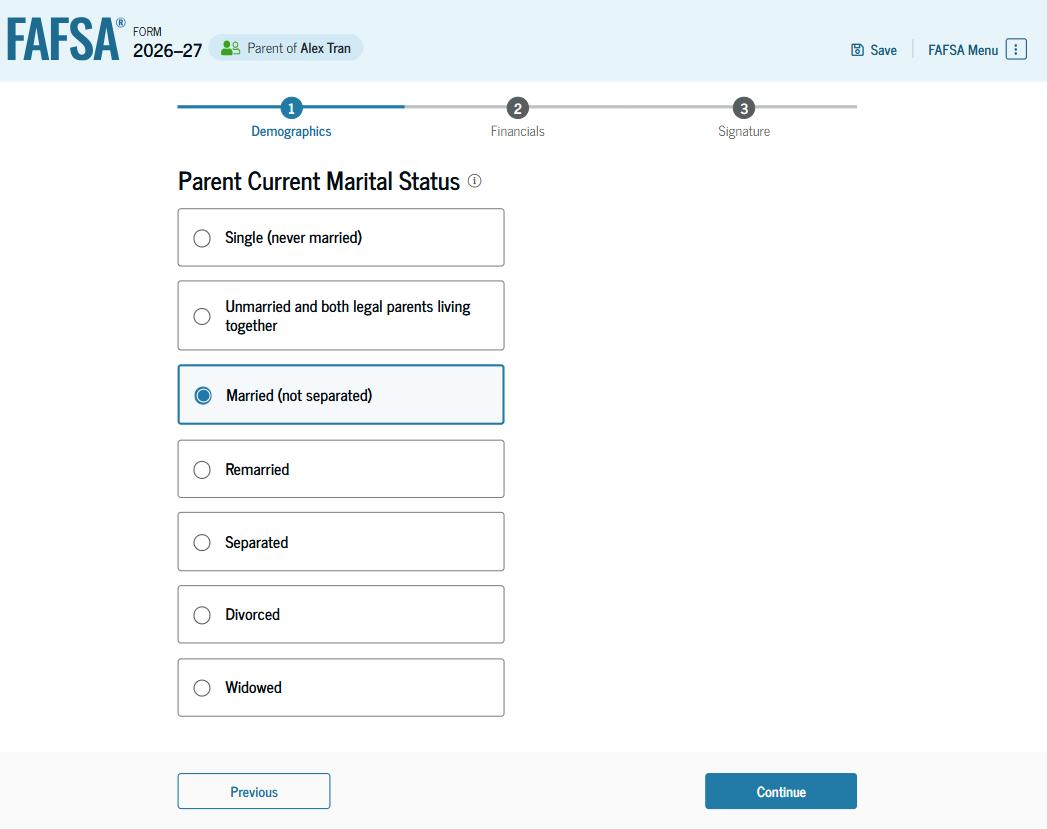

The parent is asked about their current marital status. The parent selects the "Married (not separated)" option.

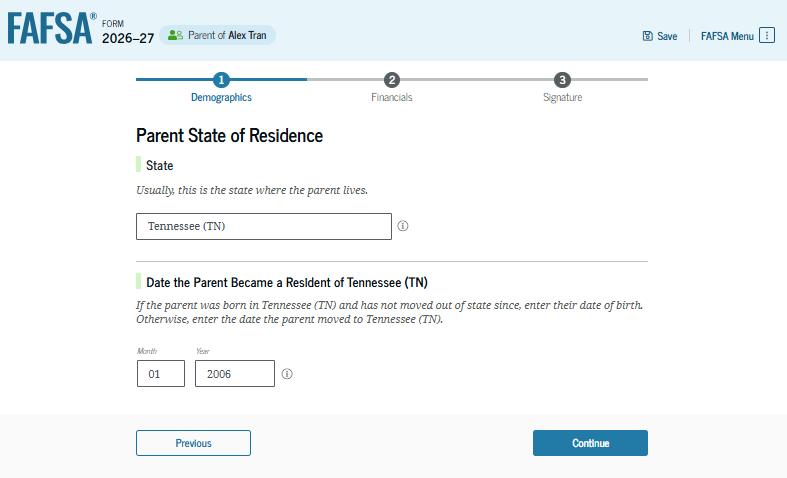

The parent is asked about their state of residence. The parent selects the state from a drop-down box and provides the month and year when the parent became a resident.

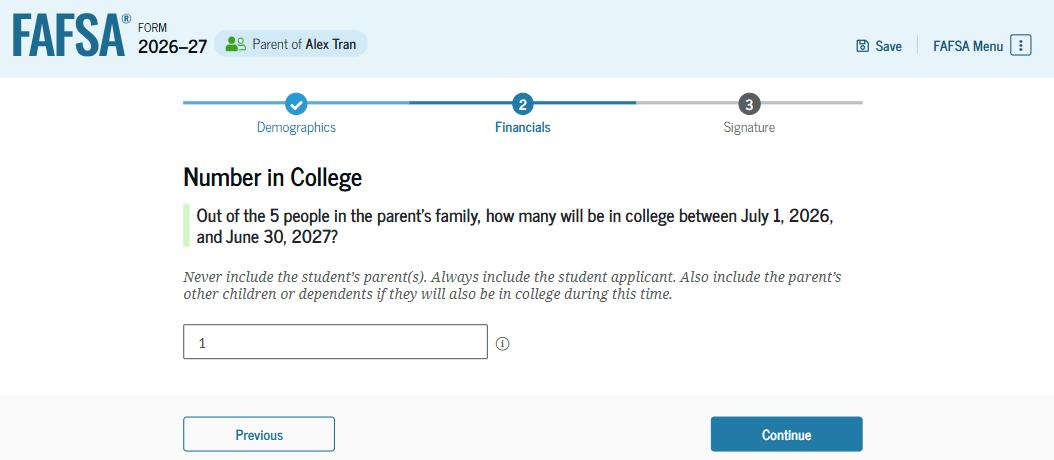

This page asks the parent how many people in the family will be in college between July 1, 2026, and June 30, 2027. The parent enters a response into the entry field.

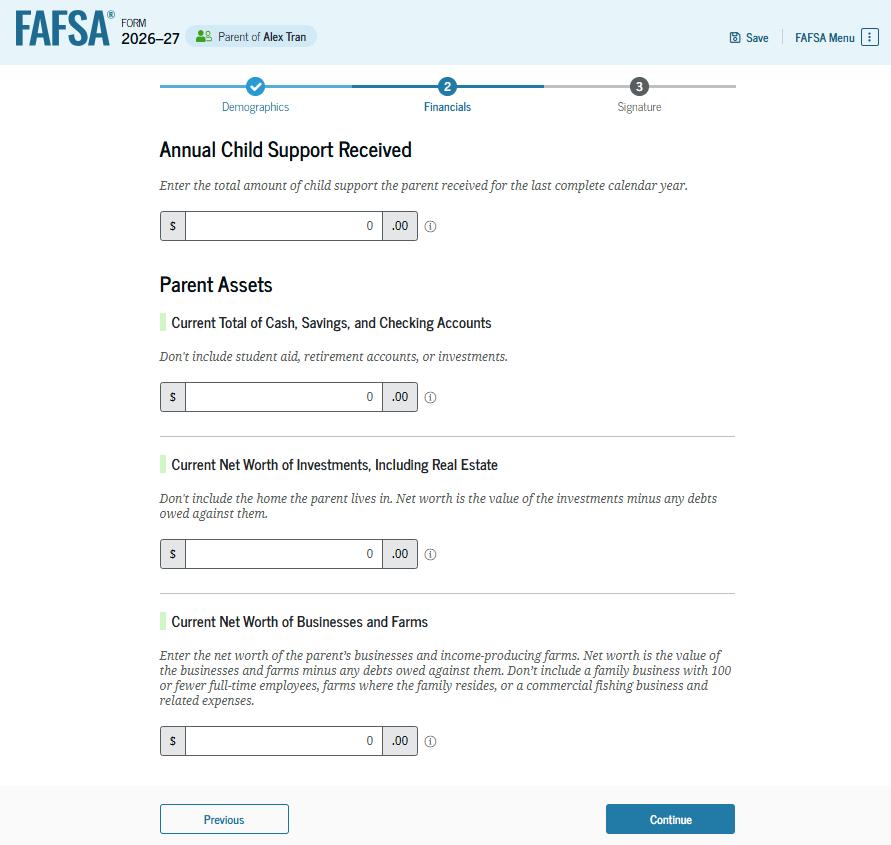

The parent is asked about their assets. The parent enters a response in each entry field. If the parent has nothing to report, the parent enters the numeral zero.

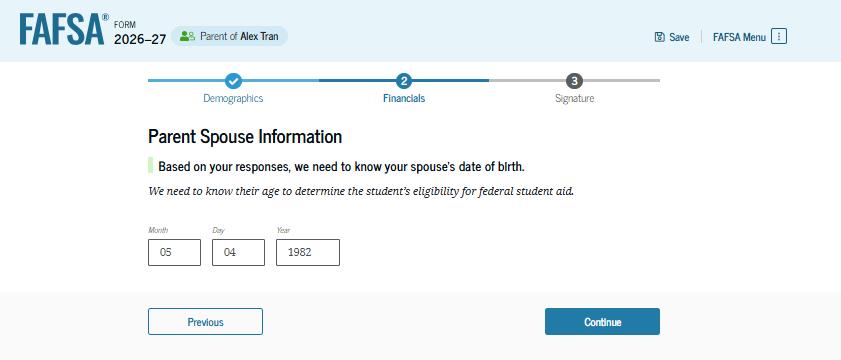

The parent is asked to provide information about their spouse or partner. In this example, the other parent does not need to contribute to the student’s FAFSA® form because the parents filed taxes jointly. After providing the other parent’s date of birth, all required parent information will be complete.

The review page displays the responses that the parent has provided in the FAFSA® form. The parent can view responses only within the parent section of the student’s FAFSA form. The parent can view all the responses by selecting "Expand All" or expand each section individually. To edit a response, the parent can select the question’s hyperlink to be taken to the corresponding page.

On this page, the parent acknowledges the terms and conditions of the FAFSA® form and digitally signs the parent section. Since all required sections are complete, the parent can both sign and submit the student’s FAFSA form.

Upon submitting the student’s FAFSA® form, the parent is presented an abbreviated confirmation page. This page displays information about tracking the student’s FAFSA form and next steps. The student will receive an email with the full, detailed confirmation. With the student and parent sections completed and signed, the FAFSA form is now considered complete and submitted for processing.

Significant change in your family…

▪ Unemployment of a parent

▪ Death in the family

▪ Change in parents’ marital status

▪ Medical expenses not covered by insurance

▪ Student cannot obtain parent information

Notify the financial aid office at your college of any special circumstances. Be prepared to provide documentation of any change, including the financial impact of the change

If parents refuse to complete FAFSA:

Student may be allowed to submit the FAFSAwithout parental information.

However, student will only be eligible for an UNSUBSIDIZED Loan.

Talk to financial aid office regarding any special circumstances.

In general, parent section is not optional if the student wants total aid eligibility!

Organizations that offer to locate more aid and then charge you a fee

Anyone who charges you a fee:

▪ for information about financial aid

▪ to complete the FAFSA

▪ to apply/receive a scholarship

Organizations that guarantee you will get a scholarship or aid.

Visit StudentAid.gov

Apply for federal financial aid at FAFSA.gov

Contact College Foundation of North Carolina at CFNC.org or toll free at 866-866-CFNC –Service of the State of North Carolina

Communicate with the college financial aid administrator

Ask your high school counselor