TOUSSANT BOYCE, PH.D. Head, Office of Integrity, Compliance and Accountability

Each year, the Office of Integrity, Compliance and Accountability (ICA) publishes an Annual Report with a summary of key activities relevant to its work and effectiveness over the past year (Report). This Report promotes transparency, in alignment with ICA’s Board-approved mandate to operationalise and manage the Strategic Framework for Integrity, Compliance and Accountability (Strategic Framework) of the Caribbean Development Bank (CDB). The Report is written to help ensure accessibility by diverse types of audiences ranging from the most seasoned development bankers to less sophisticated and curious stakeholders who interested in learning more about ICA and its work.

It highlights how ICA added value to CDB’s internal governance and external operations in 2024, in alignment with ICA’s strategy, principles, pillars, mission and mandate. It is organised thematically based on ICA’s four pillars. It begins with a brief background to ICA’s history and mandate. It then outlines activities under each pillar.

Pillar I covers Institutional Integrity, Ethics and Whistleblowing. Pillar II covers Compliance. Pillar III covers Project Accountability.

These three pillars collectively address all relevant, cross-cutting and multidisciplinary activities.

Pillar IV covers ICA’s collaboration with other partners to learn, share and develop international best practices to enhance the effectiveness of the Strategic Framework and ICA.

The final section provides general information and commentary about ICA’s activities, challenges, and outlook for the year ahead.

Background

On March 18, 2015, the Board of Directors (BOD) approved the establishment of the Office of Integrity, Compliance and Accountability (ICA), the Strategic Framework for Integrity, Compliance and Accountability (Strategic Framework), and a suite of supporting policies. ICA was established with the mandate and authority to function as an operationally independent office. On December 1, 2015, ICA was established formally. In January 2016, ICA commenced accelerated operationalisation of the Strategic Framework.

The Strategic Framework

The Strategic Framework converges five internal governance functions into ICA, a single office as illustrated by Figure 1 below.

ICA has a broad mandate to operationalise, manage and refine the Strategic Framework to help ensure good governance of CDB’s internal systems and external operations. This mandate includes the detection, prevention and investigation of wrongdoing and the suspension and enforcement of sanctions imposed against wrongdoers. It also includes promoting thought-leadership through collaboration, both internally and externally with other organisations. The Strategic Framework is being implemented in a phased but accelerated manner, using an operationalisation strategy that is risk-based and tailored to CDB’s needs, size, risks, resources and operating environment.

The Strategic Framework is based on four pillars, and four principles. The four pillars are: Whistleblowing, Integrity, and Ethics (Pillar I), Compliance (Pillar II), Accountability (Pillar III) and Collaboration (Pillar IV).

The four principles are: integrity, accountability, excellence, and transparency. ICA pursues excellence as a standard of quality for its work, which covers operationalising the Strategic Framework to promote integrity, ethics, compliance, transparency and accountability in the Bank’s systems and operations.

The Office of Integrity Compliance and Accountability ICA reports functionally to BOD through the Oversight and Assurance Committee and administratively to the President.

ICA’s work during 2024.

During 2024, ICA continued to apply its operationalisation strategy to prioritise the prevention of wrongdoing. ICA has also conducted independent administrative investigations and other collaborative activities within its mandate, whenever it was necessary to do so.

Training members of staff is a key activity undertaken by ICA in pursuit of its mandate to prevent corruption, fraud and other integrity and ethics violations. ICA designs and delivers training to all members of staff. However, the management of the Bank has the primary responsibility for ensuring that all members of staff and management are trained.

ICA delivers four types of training, namely:

(a) Annual Mandatory Training and Awareness for all members of staff through multiple sessions. Annually, each member of staff is required to attend at least one of four ICA mandatory training sessions;

(b) Orientation Training for new members of staff including young professionals and interns as requested by the Human Resources and Administration Department (HR&AD) which is typically done in an in-person group session. Senior members of staff receive special extended orientation training in an in-person session;

(c) Annual Training and Sharing Lessons Learned with Management; and

(d) Targeted Training which supplements annual mandatory training. Targeted training is focused on supporting the work of a specific division, department, or on a special topic. Special topics covered in recent years were cybercrime risks, conflicts of interest, gender-based violence, and sexual exploitation and abuse.

On February 27, March 7, March 13, and July 23, 2024, ICA delivered mandatory training and awareness sessions for all members of staff.

Over 230 members of staff registered and attended the ICA Annual Mandatory Training sessions. This training covered:

(a) Overview of CDB’s Strategic Framework and ICA: which discussed CDB’s fiduciary duty and the history, global developments and drivers that led to the creation of each of ICA’s five functions. This part of the session enabled members of staff to have insights into the origins, and scope of the Strategic Framework.

(b) ICA’s Five Functions (Institutional Integrity, Ethics, Compliance, Accountability and Whistleblowing): which provided key information under each function including relevant principles and their application. This part of the training focused on discussing key provisions in CDB’s Integrity and Ethics, Staff Code of Conduct, Projects Complaints Mechanism Policy, Whistleblower Policy and other policies and procedures.

(c) Case Studies on Integrity, Ethics, Compliance and Accountability: which discussed fictional and real scenarios taken from the case history of ICA and other IFIs. The case history session covered a wide range of relevant ethics, compliance and accountability challenges like fraud, conflicts of interest, harassment, gifts, sexual exploitation and abuse, and other issues covered by CDB’s policies and procedures. This part of the training focused on the ethical conduct of members of staff while working in the physical environment (office on campus), virtual environment and while travelling on mission.

(d) Lessons Learned • Sharing Lessons from Select ICA Cases/Investigations (2016-2023).

• Recent lessons from experiences of other financial institutions.

All members of staff who attended the Annual Mandatory Training were also provided with and completed an e-quiz.

ICA provided mandatory training for bank staff which covered several relevant areas of ethics, compliance and accountability.

During 2024, ICA managed a significantly increased volume of intake and intensity of investigative traffic for ethics and integrity investigations. ICA:

(a) opened 13 new cases pursuant to complaints received through whistleblower channels, of which there were two new Integrity cases, one Accountability and 10 new Ethics cases. This caseload was in addition to the one Integrity case, one Ethics case, and one Accountability case carried over from 2023. The new cases opened throughout 2024, exceeded the four new cases opened by ICA during 2023.

The allegations in these cases include breach of the Code of Conduct; abuse of CDB’s assets, systems and operations; abuse of privileges and immunities; conflicts of interest; falsification of documents and records; social harm (sexual exploitation and abuse) and fraud, as illustrated on the graphic at Figure 2 below.

(b) received numerous consultations and pre-cases during in-person and virtual office visits from members of staff;

(c) received four new requests for assistance from the Finance Department;

(d) received 17 new requests for assistance and conducted Enhanced Due Diligence (EDD) exercises on individuals and entities, in accordance with ICA’s Integrity Due Diligence (IDD) Toolkit. These 17 requests, exceed the 13 similar requests received in 2023;

(e) received for review 171 conflicts of interest submissions with disclosures for resolution. These 171 submissions were received through the Conflicts of Interest Disclosure Portal or by email and can be contrasted with the 72 submissions received in 2023. Annually, each member of staff is required to disclose whether there is any actual, apparent or potential conflict of interest between their private interests and their official duties to CDB and to attest to HR&AD that they have read and understood the Code of Conduct. Each submission is made digitally using a questionnaire through a Conflicts of Interest Portal which helps CDB to detect, assess and resolve conflicts of interest. Submissions that contain specific disclosures are resolved by ICA and HR&AD with the assistance of the member of staff who made the submission or against;

(f) conducted other investigative activities to assist the Operations Area, related mainly to suspicions of procurement-related integrity violations;

(g) assisted HR&AD with the resolution of an attempted cyber fraud. This exercise was undertaken in collaboration with the Information Technology Solutions Department and the Finance Department; and

(h) assisted an external independent investigator with the conduct of a special investigation.

Note that all reports do not necessarily lead to cases being opened and entered in the CMS. Some staff visit ICA to seek advice and share concerns about a possible report to ICA but are not yet ready to make a full report or never wish to do so. These are referred to as ‘consultations’ or ‘pre-cases.’ Some may expressly request ICA to not open or to delay opening a case or to open a case and then suspend it.

ICA conducted outreach in CDB’s Borrowing Member Countries (BMCs) and collaborated with the Operations Area to make outreach presentations at project launches in the following BMCs:

(a) Saint Lucia on February 9, 2024;

(b) Grenada on February 19, 2024;

(c) St. Vincent and the Grenadines on February 26, 2024; and

(d) The Bahamas on May 7, 2024.

ICA worked on its internal Self-Review that was circulated to OAC in September 2023 and re-circulated in March 2024. ICA also worked on the Review of ICA related Policies. The marked-up bundle of ICA policies was initially circulated to and discussed with OAC in September 2023. These ICA policies are the Integrity and Ethics Policy, Whistleblower Policy, Compliance Policy and the Projects Complaints Mechanism Policy which are being reviewed for update, harmonisation and alignment with ICA’s evolution and operationalisation. ICA also advised and assisted with revisions to general CDB policies and procedures like the Professional Work Environment Guidelines and Sexual Harassment Policy and Revised Code of Conduct.

ICA provided general advice and assistance to various offices in the Bank, on a wide range of matters, documents and agreements which were received by CDB for review and response to other IFIs, funders, and other external counterparties. For example, ICA advised several members of staff from various departments on integrity and accountability provisions in seven major funding agreements, and several due diligence checklists from funding counterparties that conducted due diligence on CDB.

Examples of these revisions include clarifying ICA’s mandate to investigate sexual harassment allegations and to add obstructive practices to the list of Prohibited Practices.

During April 8 - 11, 2024, two ICA staff attended the ACAMS Hollywood Annual Conference 2024 in Florida, United States of America. ACAMS is the premier global provider of anti-financial crime training. One ICA Officer successfully completed the ACAMS Foundation Course in 2023 and the Certified Anti-Money Laundering Specialist (CAMS) certification which is the global gold standard in Anti-Money Laundering certifications. Another ICA Officer completed the Foundation Course in 2024 and will aim to complete the CAMS certification in 2025. This will enable ICA to have three CAMS certified staff continue operationalization of the Compliance Function.

On December 5, 2024, the Head ICA represented CDB at the virtual ACAMS Caribbean Conference 2024. He moderated a Panel on Fraud Risks, Current Fraud Trends and Typologies in the Caribbean.

The Head, ICA hosted collaborative discussions with the Heads of the Ethics Office and the Institutional Integrity Office (OII) of the IDB pursuant to the Memorandum of Understanding between ICA and OII and between CDB and IDB. This collaboration was intended to facilitate in 2024 or 2025:

(a) A high-level visit by the IDB Heads to participate in two training sessions for CDB management and staff. This may include a joint ICA and OII session with OAC, if possible; and

(b) Staff exchange visits to conduct training, share insights, and best practices and collaboration techniques for investigative support including to deepen networking and prepare for the conduct of joint investigations.

On May 21, 2024, ICA conducted a special session for visiting students from the Turks and Caicos Islands Community College as part of an Educational Tour. The students are studying for degrees in accounting, finance, and human resource management. The theme of the tour was “Appreciating the Economic Development of the Caribbean.” The school indicated that their specific areas of interest were integrity, compliance and accountability and risk management in multilateral development banks (MDBs).

During a May 2024 educational tour of CDB, students from the Turks and Caicos Islands Community College (photo above) listened keenly during the knowledge-sharing session on integrity, compliance and accountability; and (photo at left) posed for a photo with the Bank’s Acting President, Dr. Isaac Solomon.

The Head, ICA attended the Ethics Network of Multilateral Organisations (ENMO) Meeting 2024 hosted by the World Health Organisation in Geneva, Switzerland from July 9-12, 2024. This was CDB’s first attendance at an ENMO meeting since CDB joined ENMO in 2019. ENMO convenes annual meetings and training for heads and senior professionals of Ethics functions in over 50 multilateral intergovernmental organisations.

The meeting covered progress group reports on staff conflicts of interest, outside activities, whistleblower protection, artificial intelligence and innovative technologies, leveraging interactive/innovative forms of training, culture changes through ethics progammes, lessons from past ethics crises. The meeting also enabled Heads to discuss and negotiate new Standards of Practice which are due to be implemented

The Head, ICA delivering a presentation on internal investigations in MDBs at the 2024 ENMO Meeting.

Two staff from ICA attended the inaugural 2024 MDB Data and AI Governance Symposium which was hosted by the International Finance Corporation of the World Bank Group, in Washington DC from October 29-30, 2024. The purpose of the symposium was to connect MDBs and foster a deeper understanding of data and AI governance challenges, risks, opportunities and strategies being used globally to manage data and AI governance. Through panel and individual presentations, it explored current trends, concerns and frameworks being used by MDBs.

CDB representatives attending the inaugural 2024 MDB Data and AI Governance Symposium (from left) Dr. Toussant Boyce, Head of ICA, Ms. Frances Okosi, Advisor to the General Counsel and Ms. Thandiwe Lyle, Senior ICA Officer.

Ms. Thandiwe Lyle, Senior ICA Officer, makes a point during a discussion at the inaugural MDB Data and AI Governance Symposium.

As regards Data Governance, the Symposium covered: effective data governance; challenges in managing procurement related data; challenges with internal data sharing; challenges with classification and confidentiality; data anonymisation techniques; and challenges with external data sharing. The Symposium covered the following AI issues: Governance frameworks; AI tools currently in use in MDBs; preparing for increased AI usage; lessons learned and tips for integrating AI governance; key risks of AI usage and hindrances to AI adoption.

ICA staff engaged and contributed to the CDB participation during the meeting.

Attendance at the 24th Conference of International Investigators and Heads of Integrity Meeting.

Two ICA staff attended the 2024 Conference of International Investigators hosted by the Asian Development Bank, from November 10-13, 2024.

During the conference the CDB staff engaged in and received training on a wide scope of topics including Investigating Retaliation; Conducting Ethics Investigations; Investigating Sexual Exploitation and Abuse and Harassment; Navigating Remote Investigations; AI for Investigations - Ethical Use and Implications for People and Processes; Proactive Investigations; Investigative Interviews; and Complaints Intake.

The conference also covered: Internal Investigations; External InvestigationsNavigating Corruption, cultural Norms and Human Rights Violations; Due Process in Investigations - Balancing Rights, Efficiency and Confidentiality; Investigations in Fragile States and Small Island Developing States; Business Integrity Programs; Integrity in Climate Finance Projects; Strategies for Adopting and Scaling AI Solutions.

The Head ICA:

(i) represented CDB at the Heads of Integrity MDB+ Meeting;

(ii) delivered a presentation on two Workshop panels titled ‘Ethics and Investigations: Navigating Open Source Intelligence (OSINT), AI and Digital Forensics;’ and

(iii) completed training on ‘Artificial Intelligence: Advanced Investigators Training’

The ICA Officer who attended the conference completed the training on Investigations of Complaints of Sexual Exploitation, Abuse and Harassment.

Caribbean Conference on Corruption, Compliance and Cybercrime (3Cs) 2024 - 2025

ICA commenced collaboration with other IFIs and agencies, like the World Bank and Federal Bureau of Investigations, to advance plans to deliver free 3Cs forums in 2024 and two special thought leadership events in 2025. The first thought-leadership event in 2024 was an expert-led event held on December 9, 2024, to coincide with International Anti-Corruption Day. It was titled “Expert Forum on (Anti) Corruption in the Age of Artificial Intelligence” within the theme of “Using AI to Combat Corruption for Good Governance.” The second and third expert forums are to be held in 2025 and will focus on AI and Cybercrime and AI and Anti-Money Laundering.

participation

The Head, ICA represented CDB at IFIs Integrity Investigations Technical Working Group (TWG) meetings of which ICA is a member. The TWG meets virtually each month to collaborate on best practices, share insights and discuss all issues related to the adoption and application of technology like artificial intelligence, to integrity and ethics investigations in IFIs.

AI is a synergy of technologies that enables machine to mimic and someday exceed human intelligence. ICA recognises that AI is a game-changer revolutionising and revitalising how we live, work, and deliver good governance for the benefit of our people, institutions and countries. AI, in particular generative AI, as a game changing exponential transformative general-purpose technology, offers both promise and peril. It has immense potential to be used wisely and wielded as a force for good to expose corruption and foster transparency. However, it is also vulnerable to misuse and abuse which requires safeguards.

AI is embedded in ICA’s suite of productivity tools. A good example of this is the Integrity Due Diligence Searchbot which uses AI. ICA intends to make greater use of AI in its work, particularly by integrating AI in its investigations. AI can be used to efficiently produce accurate interview transcriptions and translations. ICA also hopes to promote the safe and ethical use of AI by CDB, CDB’s borrowing member countries and regional youth to promote good governance and combat corruption and other wrongdoing.

Led by ICA, CDB joined the world in observing International Anti-Corruption Day 2024 under the theme: “Uniting with Youth Against Corruption: Shaping Tomorrow’s Integrity.” During November and December 2024, in furtherance of this observance, ICA successfully delivered a youth forum and an expert forum on corruption and artificial intelligence.

On November 19, 2024, ICA in collaboration with the Social Sector Division (SSD) of the CDB Projects Department, ICA hosted the inaugural Youth Forum titled “Caribbean Youth Combatting Corruption in the Age of Artificial Intelligence.” The Youth Forum received an opening presentation from Dr. Toussant Boyce, Head, ICA, a detailed presentation and interactive session with Mr. Marcelo Donolo, Manager, Prevention, Risk and Knowledge of the World Bank, and an exchange with regional anti-corruption expert Mr. Josh Drayton and closing remarks from Dr. Martin Baptiste.

Through the Youth Forum, ICA and SSD enabled CDB to engage and amplify the role and voices of regional youth and help to enable the engagement of Caribbean youth and to equip them as innovators of today to leverage technology like AI.

ICA recognised that corruption robs youth of opportunities, but it can also drive their determination to fight it, their willingness to engage with innovative technologies like AI, their vision, creativity and energy to help drive the change needed to counter corruption effectively. The forum empowered young people to share their insights on how AI can be both a tool and a challenge in the fight against corruption to shape the future.

The success of the Youth Forum reflects CDB’s belief that youth engagement is essential to achieving the Bank’s fiduciary duty and ensuring good governance across the Caribbean. The practical and intelligent contributions were captured in a Youth Statement, which was delivered during ICA’s Expert Forum on Combatting Corruption in the Age of Artificial Intelligence.

On December 9, 2024, ICA hosted an Expert Forum on Anti-Corruption in the Age of AI to mark International Anti-Corruption Day. The event was part of ICA’s outreach to the Bank’s Borrowing Member Countries under the ambit of its capacity building on Anti-Corruption, Compliance, and Cybercrime (3Cs). Attendees were from over 45 countries worldwide.

The Expert Forum addressed the urgent and evolving challenges identified by 3Cs and posed by AI in the fight against corruption in the Caribbean. The expert-led session brought together international thought leaders to explore the role of AI in combating corruption and its potential impact on governance, public trust, and institutional accountability.

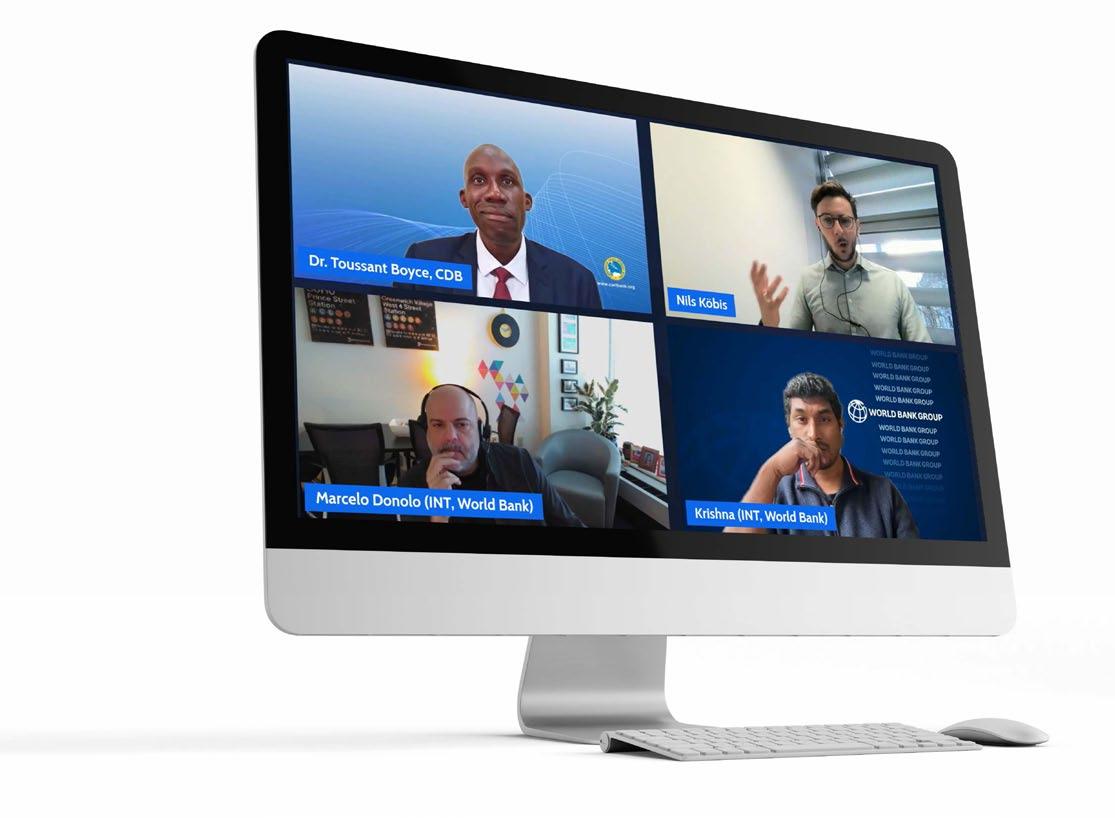

The Expert Forum received a kick-off presentation from Mr. Eugene Wu, Chief of the International Corruption Unit who shared insights on how the FBI counters corruption on a global scale. The Forum then received a keynote presentation from Professor Kobis, the Professor for Human Understanding of Algorithms and Machines at the University of Duisburg-Essen and the Mac Planck Institute who delivered a spotlight session on corruption and the risks and potential of AI to combat corruption, promote good governance, transparency and accountability.

The third presentation was by experts from the Integrity Vice Presidency of the World Bank led by Marcelo Donolo, Manager, Prevention and Knowledge Management and Krishna Kesari, Data Scientist, Data Lab Team Lead. It was focused on learning and understanding how to use AI algorithms and to leverage data and agentic systems and practical strategies to strengthen institutions and combat corruption.

The Expert Forum was closed by a session focused on Youth, Artificial Intelligence and Corruption moderated by Ms. Thandiwe Lyle, Senior ICA Officer with Dr. Darran Newman, Advisor to the Vice President Operations, Ms. Rianka Chance and Ms. Samiya Cumberbatch, as speakers.

This Expert Forum brought together international experts, thought leaders and youth to explore the role of AI in combating corruption and its potential impact on good governance, public trust, and institutional accountability. Participants were able to:

(a) Understand the opportunities provided and risks AI poses to anti-corruption efforts and good governance;

(b) Understand the potential and risks of AI to Anti-corruption;

(c) Gain expert insights on AI’s potential to counter corruption and enhance transparency;

(d) Discover strategies to build regional institutions’ capacity to fight corruption in the AI era; and

(e) Explore approaches to fostering good governance, strengthening institutions, and building trust amidst technological risks.

Participants in the Expert Forum on Anti-Corruption in the Age of AI, held in December 2024 to mark International Anti-Corruption Day, Dr. Toussant Boyce (top left) Head, of CDB’s ICA, Professor Nils Köbis (top right) Professor of Human Understanding of Algorithms and Machines, University of DuisburgEssen, Mr. Marcelo Donolo, (top right) Manager, Prevention, Risk and Knowledge Management, World Bank, and Mr. Krishna Kesari, Data Scientist and AI Specialist, World Bank.

2024 was a year of major success for ICA and also significant challenges for CDB which required expertise, experience, agility, innovation, and patience.

During the first half of the year, many of these challenges related to managing a spike in sensitive internal investigations, and other major related commitments with staff resource and time constraints. ICA has managed similar spikes in sensitive internal and external investigations before, however, 2024 had other unique complexities and organisational processes that placed extraordinary demands on ICA throughout the year.

During the second half of the year, ICA staff, like all CDB staff, had other major disruptions including the need to transition to a fully remote working environment. This transition was seamless but challenged ICA staff to maintain the same high standards of excellence in delivery of sensitive investigations from a difficult remote working environment.

ICA also managed challenges related to misinformation among staff and the public about CDB’s Whistleblower System and the conduct by ICA of internal investigations. Despite these challenges, ICA commenced corrective action to address information asymmetries and gaps through planning special targeted training in 2025 on the CDB Whistleblower System for BOD, training on internal investigations for staff and for the public during ICA outreach exercises.

Consistent with its strategy to priortise prevention, ICA staff also contributed significantly to the delivery of all CDB’s major private sector projects approved

by the BoD during 2024. Further, ICA’s policies, procedures and work to mitigate reputational, integrity, compliance, and accountability risks had provided strong support to CDB’s credit and operational risk profile. The effectiveness of ICA’s work has enabled CDB to experience a low to medium integrity and AML/CFT compliance risk profile. However, ICA expects many other challenges in the short, medium, and long terms as the Bank transitions from 2024 to 2025.

In the short term, the ICA team will need to continue working remotely until likely end of Q1-2025 and to do so without losing momentum. In the medium term, ICA expects that as the new President is onboarded, his vision is implemented and the Bank’s strategy evolves, new challenges will arise, the resolution of which will help CDB significantly. For example, there may be an increase in private sector interventions and IFI funding collaborations and funds being managed by CDB. Many private sector engagements tend to involve high-risk counterparties which require different approaches to that undertaken by ICA to help manage risk in CDB’s current public sector dominant portfolio. This increase in private sector intervention will consequently drive increased demand for ICA’s work in leading preventive due diligence and investigations. ICA will leverage its skills and new technologies like artificial intelligence to assist its staff with and drive efficiency in ICA’s investigative and EDD processes.

For the longer term, ICA expects that the Bank’s new Strategic Plan will enhance and broaden the Bank’s operating environment. This enhancement will drive new challenges to which ICA will adapt and to help CDB improve its internal governance, credit rating and to thrive as an organisation.

ICA maintains a positive outlook for 2025 and beyond. ICA is confident that it will be able to continue to deliver on its strategy to prioritise prevention and deliver effectively on its broad mandate despite the challenges mentioned above. ICA remains committed to ensuring that:

(a) at the front-end, CDB remains attractive to harness more capital from funders and deploy that capital as required by the fiduciary duty in its Charter to ensure that every dollar of development funding lent or granted is used for its intended purposes;

(b) in the middle, ICA can identify proactively, prevent and mitigate reputational damage and financial loss from fraud, corruption and other related risks and activities; and

(c) at the back-end, ICA can respond effectively to all reports and complaints alleging integrity violations, ethics violations and accountability-related (environmental and social) harm, and to independently resolve all issues by itself or in collaboration with other IFIs and stakeholders.

ICA will continue to help ensure that CDB is a credible steward of development resources, a reputationally stable, effective development agency and an attractive highly rated financial institution. ICA will leverage technology to ensure that its work is efficient and effective. ICA’s positive contributions will help in many ways to support CDB’s staff, work, internal governance and CDB’s drive for a productive, stable, and resilient Caribbean.