How’s the mining in Venezuela, Greenland? |

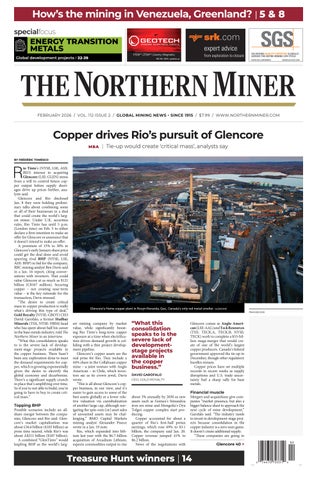

M&A | Tie-up would create ‘critical mass’, analysts say

BY FRÉDÉRIC TOMESCO

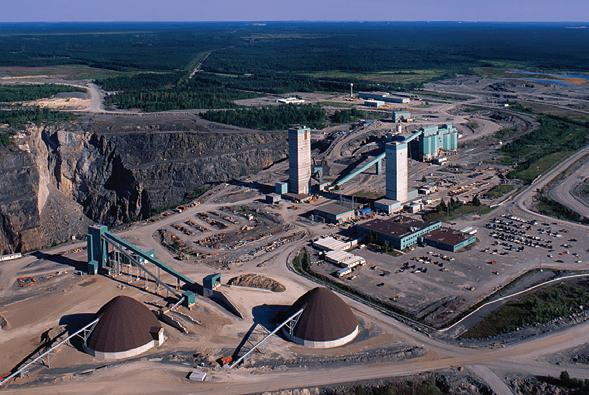

Rio Tinto’s (NYSE, LSE, ASX: RIO) interest in acquiring Glencore (LSE: GLEN) stems from a will to control future copper output before supply shortages drive up prices further, analysts said.

Glencore and Rio disclosed Jan. 8 they were holding preliminary talks about combining some or all of their businesses in a deal that could create the world’s largest miner. Under U.K. securities rules, Rio Tinto has until 5 p.m. (London time) on Feb. 5 to either declare a firm intention to make an offer for Glencore or announce that it doesn’t intend to make an offer.

A premium of 15% to 30% to Glencore’s early January share price could get the deal done and avoid spurring rival BHP (NYSE, LSE, ASX: BHP) to bid for the company, RBC mining analyst Ben Davis said in a Jan. 16 report, citing conversations with investors. That could value Glencore at as much as $121 billion (C$167 million). Securing copper – not creating near-term value – is the key rationale for the transaction, Davis stressed.

“The desire to create critical mass in copper production is really what’s driving this type of deal,” Gold Royalty (NYSE: GROY) CEO David Garofalo, a former Hudbay Minerals (TSX, NYSE: HBM) head who has spent about half his career in the base metals industry, told The Northern Miner in an interview.

“What this consolidation speaks to is the severe lack of development-stage projects available in the copper business. There hasn’t been any exploration done to meet the demand requirements for copper, which is growing exponentially given the desire to electrify the global economy and decarbonize. There’s a significant supply crunch in place that’s amplifying over time. So if you’re not able to build, you’re going to have to buy to create critical mass.”

Topping BHP

Possible scenarios include an allshare merger between the companies, Glencore and Rio said. Glencore’s market capitalization was about £56.6 billion ($105 billion) as press time neared, while Rio’s was about A$211 billion ($187 billion).

A combined “GlenTinto” would leapfrog BHP as the world’s larg-

est mining company by market value, while significantly boosting Rio Tinto’s long-term copper exposure at a time when electrification-driven demand growth is colliding with a thin project development pipeline.

Glencore’s copper assets are the real prize for Rio. They include a 44% share in the Collahuasi copper mine – a joint venture with Anglo American – in Chile, which investors see as its crown jewel, Davis wrote.

“This is all about Glencore’s copper business, in our view, and it’s easier to gain access to some of the best assets globally at a lower relative valuation via cannibalization of another large cap, although navigating the spin-outs [or] asset sales of unwanted assets may be challenging,” BMO Capital Markets mining analyst Alexander Pearce wrote in a Jan. 19 note.

Rio, which expanded into lithium last year with the $6.7-billion acquisition of Arcadium Lithium, expects commodities output to rise

“What this consolidation speaks to is the severe lack of developmentstage projects available in the copper business.”

DAVID GAROFALO CEO, GOLD ROYALTY

about 3% annually by 2030 as new assets such as Guinea’s Simandou iron ore mine and Mongolia’s Oyu Tolgoi copper complex start producing.

Copper accounted for about a quarter of Rio’s first-half pretax earnings, which rose 69% to $3.1 billion, the company said Jan. 20. Copper revenue jumped 41% to $6.2 billion.

News of the negotiations with

Glencore comes as Anglo American (LSE: AAL) and Teck Resources (TSX: TECK.A, TECK.B; NYSE: TECK) work to complete a $53-billion mega-merger that would create of one of the world’s largest copper producers. Canada’s federal government approved the tie-up in December, though other regulatory hurdles remain.

Copper prices have set multiple records in recent weeks as supply disruptions and U.S. trade uncertainty fuel a sharp rally for base metals.

Financial muscle

Mergers and acquisitions give companies “market presence, but also a bigger balance sheet to approach the next cycle of mine development,” Garofalo said. “The industry needs to invest in development-stage projects because consolidation in the copper industry is a zero-sum game. It doesn’t create additional supply.

“These companies are going to

Glencore 40 >

Discover Sandvik DS422iE, the world’s first battery-electric cable bolter. Zero emissions tramming, drilling and grouting on battery power.

Go Electric. Go Sandvik.

A resolution to rescind a Biden-era mining ban on public lands in northern Minnesota is going to the U.S. Senate, whose approval would send it to President Donald Trump for his signature.

It is not clear when or if the Senate – where Republicans hold 53 of the chamber’s 100 seats – will take up the matter, Associated Press reported Jan. 21.

Chile’s Antofagasta has been trying to develop a massive copper-nickel mine on public land for decades.

The Twin Metals project on one of the world’s largest polymetallic deposits would be the first underground mine in Minnesota since 1967.

Saudi Arabia’s Maaden plans to invest $110 billion into metals and mining over the next decade, the latest move by the state-owned miner as it aggressively expands in the sector.

The investment is aimed at tripling Maaden’s phosphate and gold business and doubling its aluminum business, as the company pursues eight megaprojects, CEO Bob Wilt said in January, according to news site Semafor.

It currently produces about 500,000 oz. of gold and about 7 million tonnes annually of phosphate and aluminum.

The investment announcement adds to Maaden drilling adding almost 8 million oz. of gold resources across four sites.

The Democratic Republic of Congo wants to develop a $29-billion (C$40.1-billion) iron ore export plan linked at one time to U.S.-sanctioned Israeli billionaire Dan Gertler.

Called Mines de fer de la Grande Orientale (Minefor), the northern area that Kinshasa wants to develop has cumulative resources of 15-20 billion tonnes which grades at more than 60% iron, according to the government.

It said initial production could be 50 million tonnes annually, with the potential to scale to 300 million tonnes.

“While details are unclear, this may well relate to the Banalia deposit in the Tshopo province, formally associated with Gertler,” BMO Capital Markets analysts said last month.

China’s Zijin Gold is buying Africa-focused Allied Gold for $5.5 billion (US$4 billion) in cash after the Canadian miner began looking at options in 2024.

The price is a 27% premium to Allied’s 30-day stock average, the company said Jan. 26. The federal government must approve the takeover expected to close in April, but Ottawa and Beijing just thawed relations with a trade deal.

Allied’s Sadiola mine in Mali accounts for about half the company’s 400,000 oz. per year output. It also holds Côte d’Ivoire operations and the Kurmuk project in Ethiopia due to start producing this year.

GLOBAL MINING NEWS • SINCE 1915 www.northernminer.com

PRESIDENT THE NORTHERN MINER GROUP: Anthony Vaccaro, CFA, MBA avaccaro@northernminer.com

EDITOR-IN-CHIEF: Colin McClelland cmcclelland@northernminer.com

COPY EDITOR AND PRODUCTION EDITOR: Blair McBride bmcbride@northernminer.com

SENIOR STAFF WRITER: Frédéric Tomesco ftomesco@northernminer.com

WESTERN EDITOR: Henry Lazenby hlazenby@northernminer.com

PODCAST HOST: Adrian Pocobelli apocobelli@northernminer.com

ADVERTISING: Robert Hertzman (416) 898-6654 rhertzman@northernminer.com

Kathleen Plamondon (514) 917-5284 kplamondon@northernminer.com

Michael Winter (416) 510-6772 mwinter@northernminer.com

SUBSCRIPTION SALES/ APPOINTMENT NOTICES/ CAREER ADS

George Agelopoulos (416) 510-5104 (Toll free) 1-888-502-3456, ext. 43702 gagelopoulos@northernminer.com

PRODUCTION MANAGER: Jessica Jubb (416) 510-5213 jjubb@northernminer.com

CIRCULATION/CUSTOMER SERVICE: (416) 510-6789 | 1-888-502-3456 northernminer2@northernminer.com

REPUBLISHING: (416) 510-6768 jmonteiro@northernminergroup.com

ADDRESS: Toronto Head Office

69 Yonge St, Toronto, ON M5E 1K3 (416) 510-6789 tnm@northernminer.com

SUBSCRIPTION RATES: Canada:

C$130.00 one year; 5% G.S.T. to CDN orders.

7% P.S.T. to BC orders

13% H.S.T.

809744071RT001

BY COLIN McCLELLAND

The first few weeks of the new year have seemed crazier than most.

Precious metal prices hit levels that not long ago would have seemed preposterous (page 9). A mid-January Goldman Sachs forecast for $5,400 per oz. gold by next December looked aggressive at the time and seemed behind the curve just days later.

Two of the largest miners, Rio Tinto and Glencore, said they are again in talks about merging to create what would be the industry’s biggest company ever (page 1). It would eclipse the most recent mega-deal, Anglo American’s acquisition of Teck Resources, which is now attempting to clear its final regulatory hurdles.

Of course, it all truly got going when American forces snatched then-President Nicolás Maduro from Venezuela on Jan. 3. We examine the South American country’s mining and metals potential on page 5.

Then the Trump administration ratcheted up pressure on Federal Reserve Chairman Jerome Powell with threats of potential criminal prosecution related to a central bank building renovation. “Unprecedented” has become a weak and overused word over the past year, but here it fits again: openly threatening the Fed’s independence, a bedrock of Western economic policy.

Adding more gasoline to the institutional fire, Donald Trump went to the World Economic Forum in Davos, Switzerland, with renewed vigour and a fresh declaration that Greenland must come under direct U.S. control. We look on page 8 at why the icy island is not the metals and mining bonanza the administration claims.

At Davos, in the month’s central moment for Canada and, by extension, for our industry, Prime Minister Mark Carney argued for a new way forward.

In a speech lauded globally, if not in the White House, Carney argued that the old rules-based order is no longer functioning as advertised; that great powers are using tariffs, finance and supply chains as weapons; and that middle powers like Canada must build strategic autonomy in energy, food, defence and critical minerals through new trade relationships and alliances.

That isn’t anti-mining. In fact, it is explicitly pro-mining, pro-infrastructure and pro-permitting speed.

The prime minister outlined how Canada is responding by cutting taxes, removing internal trade barriers and fast-tracking roughly $1 trillion of investment in energy, AI, critical minerals and trade corridors. Countries should stop “living within the lie” and pretending the system still works as it did, he said.

This is a tricky moment for the industry. Carney’s speech aligns with mining’s strategic interests — critical minerals, fast-tracking projects, trade corridors, defence and energy security — even as it attacks the broader transactional world that Trumpism represents.

Trumpism has been good for parts of the mining business. Tariff chaos and geopolitical stress push up gold prices. Deregulation and faster approvals in the U.S. help projects move. Tax cuts benefit capital-intensive industries and wealthy owners. “America First” industrial policy increases demand for domestic minerals.

So mining executives are in an awkward position. They benefit financially from the instability Carney is criticizing. But they need long-life, stable, predictable investment regimes to build $5-billion-to-$20-billion mines.

The smart response for the mining industry is not to take sides in a culture war, but to align itself openly with the logic of strategic autonomy and critical minerals that Carney is laying out. The industry can say, credibly, that the world is fragmenting, that supply chains are being weaponized, and that Canada and its allies need secure, domestic and allied sources of copper, nickel, uranium, potash, gold and rare earths.

And it can say, just as credibly, that achieving that requires faster permitting, deeper capital pools and major investments in infrastructure.

At the same time, the industry can acknowledge a quieter truth: volatility may be good for trading, but it is bad for building. Gold miners may love price spikes and macro stress, but builders of copper, uranium and potash mines do not. Mines are built for 30 years, not for one election cycle.

A sensible industry line is that short-term volatility may help some prices, but multi-decade assets require policy stability, predictable rules and reliable trade relationships. That fits squarely with Carney’s argument against a world of permanent coercion and retaliation.

The industry’s strongest political case, in fact, is to frame mining as part of the solution rather than as a beneficiary of chaos. The argument is not that miners are trying to profit from disorder, but that they are trying to reduce strategic vulnerability in energy, defence, food and industry.

That means building mines in Canada and allied countries even if it costs more than sourcing from the cheapest or most convenient jurisdiction. Once again, that maps almost perfectly to Carney’s concept of strategic autonomy.

And finally, even if some executives privately welcome the gold-price impact of geopolitical stress, it is not in the industry’s long-term interest to be seen as cheering instability. The permitting, financing and social-licence environment for mining is far better in a world of rules — even imperfect ones — than in a world of pure power politics. TNM

BY JAMES COOPER

The United States has danced this tune many times in the past, and each time it led to misery, bloodshed or civil war for its southern neighbours.

The track record of U.S. intervention isn’t good, and that’s perhaps sobering news for the Venezuelans. Take the period throughout the 1970s.

This was a dark period in U.S. geopolitical history; the Vietnam War was the key event. But it was also a prolific era of military interventions across South and Central America. And, like today, much of the geopolitical chest-beating was based on securing America’s supply of critical commodities.

‘Chilenization of copper’

If you’re not familiar, Chile is the world’s largest producer of copper, accounting for around 30% of total global supplies. It’s what makes copper a serious business in this South American nation, and it’s been that way for over 60 years.

In fact, half of the country’s total exports come from just this commodity. In a way, copper to Chile is similar to what iron ore or coal is to Australia, in terms of its essential role in the economy.

However, copper has also played a leading role in staging a dark and brutal chapter in Chile’s not-so-distant past.

It all started back in the early 1970s, when the left-wing Chilean government, led by Salvador Allende, set about the outright nationalization of the country’s copper mines. It was a period known as the ‘Chilenization of copper.’

Frustrated by multinationals siphoning the country’s mineral wealth mostly to the U.S., Allende gained widespread public appeal by bringing the country’s copper assets under state control. In 1971, Allende’s government amended the country’s constitution, which gave the nation full ownership of all major copper mines.

With tails between their legs, the multinational mining companies were swiftly extradited from the country.

No compensation

Multi-million-dollar assets were wiped from the companies’ balance sheets, effectively overnight.

In the early 1970s, copper accounted for 80% of Chile’s total exports. It’s why the commodity was popularized as “Chile’s salary!”

Unsurprisingly, the people adored Allende and his Marxistgovernment. But his bold actions were creating ripples to the north.

The U.S. government, suffering from years of chronic communist paranoia, was determined

to undermine Allende and eradicate the idea of nationalism for other would-be South and Central American nations looking to repeat Chile’s playbook. Which is precisely what the U.S. government did.

Chile was condemned by the West and given a strong dose of international sanctions. However, for then-U.S. President Richard Nixon, he wasn’t satisfied with these soft tactics.

Despite the Chilean public’s overwhelming support for the democratically elected Allende government, U.S. officials systematically dismantled his control.

On Sept. 11, 1973, a group of military officers led by General Augusto Pinochet seized power in a coup, ending civilian rule. Chile called the event its very own ‘September 11.’

The military established a junta (dictatorship) that suspended all political activity in Chile and repressed left-wing movements, especially communist and socialist parties. Allende was killed, most likely executed by the military, while his presidential palace was attacked.

The Nixon administration, which had worked to create the conditions for the coup, promptly recognized the junta government and supported it in consolidating power. It marked the end of Chilean democracy, which had been in place since 1932.

It also initiated one of the most violent periods in Chile’s history. The U.S.-supported government used political suppression, torture and murder to destroy all remnants of the left ideology. This persisted for years.

As the country’s most important export, copper played a critical role in sparking the darkest chapter in Chile’s history.

Dictatorship encore? Is history repeating itself 53 years later in Venezuela?

The U.S. has a poor history of military interventions in South America, sowing the seeds of chaos and often fanning civil war. There is no doubt that the U.S. is playing a dangerous game, and in some of the most important regions for future oil supply. The stakes are enormous, after all, oil is the global economy’s most critical resource.

So, what could possibly go wrong? It all boils down to this: Keep commodities at the forefront of your portfolio right now; we could be embarking on a major new chapter in this market. TNM

James Cooper is a geologist based in Australia who runs the commodities investment service Diggers and Drillers. You can also follow him on X @JCooperGeo.

BY FRÉDÉRIC TOMESCO AND COLIN MCCLELLAND

Venezuela has significant mineral resources – including gold reserves rivalling Peru and Brazil and large dormant projects the government seized more than a decade ago.

As companies and investors size up opportunities after the U.S. toppled President Nicolás Maduro, will that untapped potential be enough to attract the required capital?

Mining projects face severe headwinds in a country with dilapidated infrastructure, pervasive state control and patchy exploration records while world-leading oil reserves are bound to attract more immediate capital from U.S. companies, analysts said.

“Venezuela has considerable reserves of gold, iron ore oxide and coal,” veteran metallurgist Phillip Mackey told The Northern Miner last month. He was an expert witness in Anglo American’s (LSE: AAL) World Bank arbitration hearing over the Loma nickel mine that the Hugo Chávez regime stopped in 2015.

“Before Loma de Níquel was seized, Anglo American reported nickel ore reserves of 33.1 million tonnes at 1.47% nickel,” Mackey said by phone. “Cobalt is also present at lower levels.”

Most of Venezuela’s mining production, exploration and investment collapsed after Chávez nationalized the industry by expropriating foreign miners, such as Crystallex International and Gold Reserve (CVE: GRZ), and refusing to renew Anglo American’s concessions.

Mining had accounted for as much as 6% of the country’s total exports in the 1990s, J.P. Morgan says. At that time, Venezuela was a large regional producer of aluminum, gold, cement, bauxite, iron ore and steel.

Offers coming Gold Reserve’s shares have more than doubled since Jan. 1. As press time neared, the stock was trading at $5.60 apiece in Toronto. The developer, which owns the Brisas and Siembra Minera gold and copper deposits, is seeking more than $2 billion in compensation through World Bank tribunal arbitration.

“Gold Reserve has the means and the fortitude to return to Venezuela and we stand ready to do our part to work with all legitimate parties to assist with post-Maduro transition and recovery efforts to foster peace and prosperity,” the company said in a Jan. 5 statement.

Siembra alone holds 1.18 million measured and indicated tonnes grading 0.7 gram gold per tonne and 0.1% copper for 26.8 million oz. gold and 2.69 million lb. copper, according to a 2018 preliminary economic assessment.

The project, a joint venture between the Venezuelan government and Bermuda-based Gold Reserve, accounts for about 30% of the country’s identified gold reserves, Gracelin Baskaran, head of the critical minerals security program at the Washington, D.C.-based Center for International & Strategic Studies, said in a note last month.

“Asset-level data” of 24 identified goldbearing mines shows that Venezuela now holds an estimated 75 million oz. of gold, equivalent to roughly 2,343 tons in the ground, Baskaran said. Still, “assessing Venezuela’s mineral endowment is difficult because reliable data are scarce and often conflated,” she added.

U.S. Geological Survey data from last year show Peru has 2,500 tons in reserves and Brazil has 2,400 tons.

Artisanal gold

Only two of Venezuela’s 24 gold mines that have reserve data are active – while 19 are inactive and three have been suspended, Baskaran said.

“Assessing

Venezuela’s gold potential is vastly undeveloped. Artisanal operations, many of which are associated with regime-linked groups, dominate current production. Annual gold output ranges between 50 and 70 tonnes, Alicia Garcia-Herrero, chief economist for Asia-Pacific at the French investment bank Natixis, wrote in a LinkedIn post last month.

State ownership plays an outsized role in Venezuelan mining: 11 of the country’s 20 largest mines are held by the state-owned holding company Corporación Venezolana de Guayana.

“These dynamics underscore the extent to which Venezuela’s mining sector is constrained by state dominance and limited participation by credible private investors,” Baskaran wrote.

Crystallex, which owns the huge Las Cristinas gold project expropriated in 2011, won its arbitration claim against the government in 2016. John Ing, the CEO of Toronto-based investment firm Maison Placements who was active in Venezuela in the 1980s, suggested Crystallex could be “the first in line” to benefit from changes in the country’s economy.

“[Las Cristinas] is a big potential project,” he told The Northern Miner. “The question is, how much is left after all these years when the army and all these other people have raped and pillaged the deposit?”

Anglo nickel

Anglo American sought $600 million for alleged breaches of the U.K.-Venezuela bilateral investment treaty on the Loma de Níquel lateritic nickel mine. It operated it for decades as the country’s only nickel producer.

The World Bank tribunal ruled against the company in 2019. It said the nickel assets reverted to Venezuela by law at the conces-

Venezuela’s mineral endowment is difficult because reliable data are scarce and often conflated.”

— GRACELIN BASKARAN, CENTER FOR INTERNATIONAL AND STRATEGIC STUDIES

sion’s end and weren’t an unlawful expropriation. Today, it lies dormant like many mining operations the government took over.

Rusoro Mining (CVE: RML), which had the Choco 10 gold mine and part of the Isidora mine before the Chávez government expropriated the assets without compensation, agreed with Venezuela in 2018 on a $1.28-billion settlement. Some $100 million has been paid.

Most of the country’s minerals, which also include zinc and rare earth elements, are concentrated in the Orinoco Mining Arc, an area covering southern states such as Bolivar and Amazonas that has become a hub for illegal mining. The arc is part of the Guiana Shield, which covers neighbouring Guyana, Suriname and most of northeast South America.

The region surrounding Los Pijiguaos, the country’s sole operating bauxite mine, is estimated to contain up to 6 billion tons of probable bauxite resources, Baskaran said.

“Given the opaque nature of Venezuela’s official and black-market economy, we cannot say for sure what the real prospects are for critical mineral development,” Michael Cembalest, chairman of market and investment strategy for J.P. Morgan Asset & Wealth Management, said in a note last month. “But it’s notable that China, which controls the

By Frédéric Tomesco

Venezuela’s mining sector isn’t the only one to be hobbled by decaying infrastructure. Its energy industry too needs a lot of love.

Although it holds the world’s largest proven oil reserves, an estimated 303 billion barrels that account for about 17% of the worldwide total, Venezuela contributes less than 1% of global production. State-controlled oil producer PDVSA, which owns and operates the country’s five refineries, is the largest source of revenue for the Venezuelan government.

Venezuela owes its underperformance to deteriorating infrastructure – itself the result of a lack of investment and maintenance caused by international sanctions, restrictive government policies and a prolonged economic crisis, according to the US Energy Information Administration (EIA). Many of the country’s 25 operational pipelines estimated to be more than 50 years old, the EIA says.

ExxonMobil CEO Darren Woods put it more bluntly.

“If we look at the legal and commercial constructs–frameworks– in place today in Venezuela, today it’s uninvestable,” Woods said Jan. 9 in Washington during a meeting of oil industry executives hosted by U.S. President Donald Trump. “Significant changes have to be made to those commercial frameworks, the legal system, there has to be durable investment protections, and there has to be a change to the hydrocarbon laws in the country.”

Since 2005, the U.S. has slapped sanctions on Venezuelan individuals and entities for criminal, antidemocratic or corrupt behaviour. The U.S. government began to grant exemptions from sanctions starting in 2022, allowing more Venezuelan crude oil to enter the global market. Even so, Venezuela’s total energy production plunged by about 70% between 2013 and 2023. Petroleum and other liquids accounted for most of the drop.

Returning to earlier production levels could require between $60 billion and $70 billion over seven to nine years, economists at French bank Natixis estimated last month.

Key risks include uncertainty about contract sanctity under future governments; the fate of barrels that were pledged as collateral to China; and the equity positions of Russian energy producers in several Venezuelan oil ventures.

By Blair McBride

Rare earths – essential components in electronics, defence applications and electric vehicle batteries – are hot geopolitical items as Western countries seek to secure supplies outside of Chinese control. Exploration companies across many Canadian provinces and U.S. states are intently searching for the 17 elements, while MP Materials’ Mountain Pass mine in California is the only producing rare earths mine in North America. A handful of other companies whose projects have merited varying degrees of advanced economic studies are candidates for the second possible mine, though such studies don’t guarantee a mine will open. The Northern Miner takes a look at 10 projects with studies released between 2012 and 2025 that might become the next rare earths mine.

BY NORTHERN MINER STAFF

Spanish Mountain Gold (TSXV: SPA; US-OTC: SPAUF) says new drilling along the Orca Fault has returned broad, near-surface gold intercepts above the current resource grade at its Cariboo project in British Columbia, advancing it towards feasibility and a potential construction decision.

Recent drilling has extended the Orca Fault target to roughly 530 metres of strike, returning broad intercepts above the current resource grade, including 102 metres grading 0.92 gram gold per tonne, within areas previously modelled as waste inside the proposed open pit.

President and CEO Peter Mah says tighter drill spacing and improved core recovery are revealing continuous highergrade corridors that could improve mill feed grades and reduce strip ratios. “One of the major headwinds for this project has been the misconception that it’s just a low-grade deposit,” Mah said. “We’ve hit significantly higher grades than previously modelled, and in some areas that material was classified as waste.”

Cariboo, in the burgeoning namesake B.C. gold district that boasts the $890-million capex Osisko Development (TSXV, NYSE: ODV) project, might initially produce 203,000 oz. of the yellow metal a year, according to a 2025 preliminary economic assessment (PEA). Spanish Mountain is due to start a feasibility study within weeks as it heads towards a construction decision by late 2027.

Mine plan

Mah says current drilling is focused on strengthening years six to 10 of the mine plan, where grades are forecast to decline and project value is most sensitive. Improving grades in that period could help smooth cash flow and reduce risk across the first decade of operations, he said.

Drilling under the current exploration program is more than 90% complete, with about 9,300 metres drilled towards a planned 10,000 metres. The company has also implemented split tube core barrels to boost core recovery.

“We’re expecting the two-prong strategy of adding high grade within the deposit and ore sorting to improve and enhance mill feed grades respectively and hopefully scale production,” Mah said.

Located near Likely, roughly 550 km north of Vancouver in the central part of the province, Cariboo benefits from year-round access. The project is part of a resurgent gold district. The region is also home to Artemis Gold’s (TSXV: ARTG) Blackwater mine, which recently achieved commercial production.

Mah said the gentle terrain of the region is more amenable to mining. “It’s a mature mining district, the communities and the governments have been approving projects and advancing them,” he said. “This is really the next Golden Triangle.”

In parallel to its drill program, the company is advancing ore-sorting test work on representative samples from the Main deposit and the nearby Phoenix zone, with results expected to underpin a potential update to the project’s PEA. Mah said the approach mirrors Osisko’s use of a similar process at its Carboo project. “We have very similar mineralogy,” he said.

Mah describes the current PEA as a “vanilla base case” that intentionally excluded upside from higher grades, ore sorting and a higher long-term gold price environment.

The PEA was completed using a gold price of $2,450 per oz., Mah noted, and didn’t account for the higher long-term price assumptions now being used across the sector. He said any future update would

“We’re

going to be the third major gold project within a 200-km area in a district that’s been sleeping since the Cariboo gold rush in the late 1850s. This is a new Cariboo Gold Rush and Spanish

Mountain Gold is thrilled to be a part of it.”

— PETER MAH , PRESIDENT AND CEO, SPANISH MOUNTAIN GOLD

reflect both the evolving grade profile and the current gold price environment, which has been shaped by heightened geopolitical uncertainty.

“In Q1 of 2025, we hit the highest-grade sample ever in the history of this property,” Mah said.

One hole in the K Zone intersected 0.75 metre grading 719.26 grams gold, part of a wider 139-metre mineralized package averaging 4.18 grams gold within 200 metres of surface. “So it’s not just in the Main zone, there are multiple zones where we see high grade,” he said. “We’re really touching the tip of the iceberg of what’s possible.”

Spanish Mountain’s PEA also marked a significant shift in tailings management, replacing the conventional valley-fill concept outlined in the 2021 pre-feasibility with filtered dry-stack tailings.

The revised design relocates tailings out of the valley and away from fishbearing waters, a change the company says materially reduces environmental risk factors and improves the project’s permitting profile. Compared with the earlier

mine plan as a higher-grade feed source, potentially supporting an updated economic case.

Drilling at Phoenix will continue to test depth extensions and better define the geometry of the mineralization in all directions while moving forward at the Main deposit.

“Will we have a double up of a pit? Will they connect? The growth potential here just in that area is massive,” Mah said. Beyond Phoenix, Mah points to broader discovery potential along the project’s 12-km mineralized trend, much of which has seen limited drilling. To date, most work has focused within about 300 metres of surface, leaving open the possibility of additional mineralization at depth and along strike as the project advances.

Besides prepping for 18 months of feasibility work, Spanish Mountain is also advancing its power studies. The project is now in stage two of BC Hydro’s system impact process for a proposed 230-kilovolt, roughly 60-megawatt grid connection. Mah said that phase is expected to wrap up by the end of March, clearing the way to move into stage three – a key step towards securing power certainty and supporting future project financing.

“We’re on track there and already working with BC Hydro on next steps,” Mah said. “They’ve begun their First Nations and community engagement processes as part of stage two so that’s going well.”

plan, the updated mine layout cuts the water catchment area by about 50%, reducing the volume of water requiring treatment and discharge.

Mah says the dry-stack approach is fully incorporated into the project’s capital and operating cost estimates and provides greater flexibility as the mine plan evolves. Unlike conventional facilities, dry-stack tailings can be reconfigured as new deposits are defined, allowing the company to adapt infrastructure placement as exploration advances.

“We have all the characteristics to do something really special here in terms of sustainable mining,” Mah said.

The flexibility of dry-stack tailings is particularly relevant to the Phoenix deposit, located near the Main deposit, which hosts an inferred resource of about 357,000 oz. gold but is not included in the current PEA.

Spanish Mountain is testing Phoenix material as part of its ore-sorting program, with representative samples undergoing analysis in Saskatchewan. Mah says the assay results will help determine whether Phoenix could be brought forward in the

Spanish Mountain has also presented the project’s PEA to local communities and First Nations, building on feedback gathered over the past several years. Mah says the consultation has been constructive, and the company is now working towards a protocol agreement with the Williams Lake First Nation as it advances permitting and project planning.

The company is assessing non-dilutive financing options to fully fund the company through feasibility.

With multiple Cariboo projects now moving through construction and into production, Mah views the district as entering a new stage of consolidation and investment interest.

“We’re going to be the third major gold project within a 200-km area in a district that’s been sleeping since the Cariboo gold rush in the late 1850s,” Mah said. “This is a new Cariboo Gold Rush, and Spanish Mountain Gold is thrilled to be a part of it.”

The preceding Joint Venture Article is PROMOTED CONTENT sponsored by Spanish Mountain Gold and produced in co-operation with The Northern Miner. Visit: www.spanishmountaingold.com for more information.

BY FRÉDÉRIC TOMESCO

United States officials are misguided if they think gaining control of Greenland will give them access to a wealth of resources capable of shrinking overnight the country’s critical minerals reliance on China, analysts say.

President Donald Trump has repeatedly said he has to “have” Greenland, telling reporters that controlling the semi-autonomous Danish territory was a matter of national security. After threatening last month to slap tariffs on eight European nations that opposed a sale of Greenland to the U.S., he said at the World Economic Forum he had reached a “framework for a future deal” with Nato Secretary General Mark Rutte – without disclosing details.

Key Trump aide Stephen Miller had earlier said the island should “obviously” be part of the U.S. and that “nobody is going to fight the United States militarily over the future of Greenland.”

Strident statements such as those have sparked outrage in Europe and elsewhere, with many European leaders warning of catastrophic consequences. Danish Prime Minister Mette Frederiksen said that an American takeover of Greenland would probably spell the end of the Nato military alliance.

“We’re highly skeptical of Greenland as a cure-all for the U.S. minerals problem – especially in the near term,” Timothy Puko, director of commodities at the Eurasia Group, a New York-based political risk research and consulting firm, said via email.

While there are good reasons for the U.S. to consider setting up longterm partnerships to tap some of the island’s potential, “the logistics of retrieving any of the resources there are difficult, probably far more so than with other likely partners such as Australia, Canada, Brazil and Latin America at large,” Puko added. “It’s cold, it’s icy, it’s remote, and much of it is unproven. Prospects like that take sometimes decades to develop, and most development there is in its earliest stages.”

Miners gain

Investor interest in Greenland has been a boon for miners that operate in the Danish territory.

Critical Metals (Nasdaq: CRML) shares surged in January after the company unveiled plans to buy a fully integrated, mobile assay laboratory to supplement its Tanbreez project – which hosts one of the world’s largest deposits of rare earth minerals. Critical Metals was trading at $18.46 on the Nasdaq market as press time neared, taking its climb since Jan. 1 to 127%.

Amaroq Minerals (AIM, TSXV: AMRQ) also jumped after the Greenland miner disclosed talks with the U.S. government about investing in its mining projects on the Arctic island. Amaroq was trading at C$2.44 as press time neared for a year-to date gain of 21%.

CEO Eldur Olafsson told CNBC last month that discussions have been held with U.S. government bodies about potential investment opportunities, which may include “offtake agreements, infrastructure support and credit lines.”

Unforced error

Trying to seize Greenland, “by force or coercion, would be an unforced error for the Trump administration,” Otto Svendsen, an associate fellow at the Washington-based Center for International & Strategic Studies, wrote in a commentary last year.

“It is unnecessary on national security grounds, as Washington can already achieve its objectives through working with Greenland and Denmark. Moreover, Trump’s rhetoric could backfire and revive Chinese overtures toward the territory, activate European Union trade defense instruments, and accelerate the ongoing militarization of the Arctic.”

At any rate, it’s far from certain that the tough talk from Washington will result in U.S. boots on the ground. Trump is expected to pursue economic coercion to annex Greenland, Eurasia Group said in a recent report. Military action is unlikely “given its significant downside risks,” the firm added.

Untapped potential

Greenland hosts a wide variety of mineral resources such as coal, copper, gold, graphite, ilmenite, molybdenum, iron ore, lead, nickel, precious stones, rare-earth elements, silver, titanium, uranium and zinc.

Many of those fall in the category of so-called critical minerals, whose demand is driven by clean energy and technology transitions because they are deemed essential for everything from electric vehicles and renewable energy to semiconductors and defence technologies.

“Clearly the fact that most of Greenland is covered by areas with assumed potential for additional critical mineral resources highlights a possibly large untapped mineral potential that needs to be further explored,” according to a

44 million tonnes, followed by Brazil, with 21 million tonnes, India, with 6.9 million tonnes, and Australia, with 5.7 million tonnes, the data show. Canada’s reserves amount to 830,000 tonnes.

Over the years, the USGS has worked with Greenland’s government to map mineral resources, providing expertise such as hyperspectral imaging.

Several large deposits have been mapped and partially delineated in Greenland, particularly in the south, while vast areas remain poorly explored. The ice-covered interior – about 80% of the island’s surface – and difficult terrain have meant that many promising geological settings are under-sampled or lack modern resource estimates.

The southern Gardar province is believed to contain some of the territory’s most significant known resources. They include the Ilimaussaq complex, whose biggest orebodies are rich in rare earths and allied metals such as lithium, tantalum, niobium, hafnium and zirconium.

South Greenland is also home to Critical Metals’ Tanbreez property. It contains at least 45 million tonnes in resources within a massive kakortokite unit that has largely been underexplored to date, according to the company.

4 billion years

2023 report on the island’s mineral potential.

Geological complexity and low grades often make deposits harder to develop than those in established mining jurisdictions, though Greenland’s geology resembles that of well-mined countries such as Canada and Australia.

The island’s harsh climate, limited infrastructure and high operating costs compound costs and risk – as do strict environmental regulations. Greenland has banned the exploration and mining of uranium ore with an average concentration of more than 100 parts per million, as well as the extraction of oil and natural gas.

Its ice-free zone, covering about 400,000 sq. km., hosts complex geological terranes that represent almost 4 billion years of geological history, according to the 2023 report from the Geological Survey of Denmark and Greenland.

That same report judged Greenland’s potential to be “high” for 11 critical minerals, including graphite, molybdenum, niobium and platinum group metals. It also found “moderate” potential for 16 other elements, including antimony, chromium, lithium and nickel.

Greenland hosts an estimated 1.5 million tonnes of rare earths reserves, according to 2025 data from the United States Geological Service. That represents less than 2% of global reserves, trailing even the U.S. endowment of 1.9 million tonnes, USGS data show.

China has the most reserves of rare earth elements globally, with

East Greenland, which has traditionally been unexplored, is considered ripe for new discoveries of several commodities. It hosts the giant Malmbjerg molybdenum deposit and the Skaergaard intrusion, a well-known source of platinum group elements, titanium, vanadium and gold whose most recent aeromagnetic and gravity surveys date back to 1971. The region also holds the Karstryggen evaporitic strontium deposit. Still, support for mining among Greenlanders remains limited. And while authorities have taken early steps to support some development, “all political signs suggest locals don’t want to be rushed into any of this,” Eurasia Group’s Puko says. “In many cases they are likely to decide environmental protections and conservation are much more important than

for

BY BLAIR MCBRIDE

Facebook parent Meta signed deals in early January with three U.S. utilities to buy electricity for its data centres (enough to power 6 million homes) while the largest physical holder of uranium increased its reserves – more tailwinds for nuclear energy and the heavy metal.

Meta’s agreements with Vistra, TerraPower and Oklo announced on Jan. 9 cover up to 6.6 gigawatts of power by 2035. They will support the tech company’s operations as well as its Prometheus supercluster, a huge set of artificial intelligence servers located in New Albany, Ohio.

Canadian investor Sprott disclosed new purchases in January of physical uranium, or yellowcake, to hold the most in three years and raise the value of its Sprott Physical Uranium Trust (TSX: U.U for USD; U.UN for CAD) to $6.57 billion near press time.

The power deals and uranium buying reflect the industry’s resurgence 15 years after the Fukushima disaster in Japan as nations around the world embrace nuclear energy to slow climate change. U.S. President Donald Trump wants to increase Western control of fuel and promote plant construction, even restart the notorious Three Mile Island.

But the industry faces long-standing hurdles of cost, regulation and toxic waste.

The power deals would allow Meta to draw from Vistra’s plants in Ohio and Pennsylvania and future supply from TerraPower and Oklo’s planned facilities in Wyoming and Ohio. Meta didn’t provide financial details of the agreements.

“Our agreements with Vistra, TerraPower, Oklo, and Constellation make Meta one of the most significant corporate purchasers of nuclear energy in American history,” Joel Kaplan, Meta’s chief global affairs officer, said in a release. “State-of-the-art data centres and AI infrastructure are essential to securing America’s position as a global leader in AI.”

The projects will create “thousands” of skilled jobs in Ohio and Pennsylvania, add new energy to the grid, extend the life of three existing nuclear plants and accelerate new reactor technologies, Meta says.

“Our agreements... make Meta one of the most significant corporate purchasers of nuclear energy in American history.”

JOEL KAPLAN, CHIEF GLOBAL AFFAIRS OFFICER, META

The power agreements come just over eight months after Meta signed a 20-year deal with Constellation Energy (Nasdaq: CEG) to buy about 1.12 GW from its Clinton nuclear plant in central Illinois. That amount can power about 1 million homes.

Uranium purchases

Uranium, the key ingredient in nuclear power, continues to be a hot commodity, with Sprott’s dedicated fund buying 300,000 lb. of uranium oxide in the first week of January. After buying 100,000 lb. of physical uranium on Jan. 2, the trust bought another 200,000 lb. on Jan. 8 to bring its total holdings to about 75.4 million lb. near press time.

The purchases bring to 450,000 lb. Sprott’s uranium buys so far this year, its highest first-quarter level since 2023, BMO Capital Markets analyst Helen Amos said in a Jan. 9 note.

The spot uranium price sat at $88.40 per lb. in Toronto in late January, its highest level since May 2024. The price logged a 12% rise over 2025, ending the year at $81.55 per pound.

Power agreements such as Meta’s are occurring against a wider political backdrop favouring nuclear energy. Trump wants new nuclear reactors to be a cornerstone achievement of his second term.

The U.S. Energy Department has already awarded $800 million for new reactor technologies and offered $1 billion in loan guarantees in November to restart Constellation’s Three Mile Island power plant in Pennsylvania.

But the industry’s recent track record exposes the challenges and costs of those ambitions. NuScale, once seen as the early leader to deliver the first small modular reactor (SMR) in the U.S., was forced to

cancel its Idaho project in November 2023 after utilities walked away from power-purchase agreements because costs rose too high.

Costs

“Historically, new nuclear plants have been completed behind schedule and over budget,” the Pembina Institute, a Calgary-based non-partisan think tank supporting the clean energy transition, said in a November report.

“Recent nuclear projects around the world reflect this trend, with new facilities typically coming online six years late and at double the initial estimated cost.”

But the industry is today being buoyed by something it lacked in the early 2000s, when delays and soaring budgets dashed hopes of a nuclear revival: deep-pocketed tech companies, whose investments in AI are returning capital and urgency to the sector.

After being roughly flat for years, demand for power by data centres is projected to surge 175% by 2030 from 2023 levels, Goldman Sachs Research said in December.

Ontario invests Ontario, the province using the most nuclear power in Canada, is planning four 300-MW SMRs east of Toronto at Darlington, four large 1,200-MW units at the existing Bruce Power nuclear site on Lake Huron and eight large 1,000-MW units at Wesleyville on the site of an unfinished oil-fired power plant.

Together, these projects would add 14,000 MW of new generation capacity to Ontario’s grid, more than the province’s currently installed nuclear capacity.

“Ontario has demonstrated its expertise in delivering refurbishments of nuclear units on time, which extends their lifespans,” Pembina lead author David Pickup wrote.

“However, building new nuclear plants is fundamentally different to refurbishing existing ones, involving greater complexity, new regulatory frameworks, and engineering challenges that far exceed those encountered in refurbishment projects.”

The Darlington SMRs will also be the first grid-scale build in a G7 country, he said.

“This only increases the likelihood of a delay and cost overruns, with ratepayers ultimately taking on this risk.” TNM

Greenland, Fed control spook investors

By Frédéric Tomesco and Blair McBride

Precious metals set multiple all-time highs last month as heightened tensions caused by U.S. government threats to seize control of Greenland and criminally prosecute Federal Reserve chair Jerome Powell sparked safe-haven fears.

Gold surpassed $5,100 per oz. even after Trump had toned down his Greenland tariff threats as press time neared, taking its gain since Jan. 1 to about 17%. Silver traded at $109.75 per oz. for a 53% year-todate surge.

Investors tend to quickly react by moving toward safe-haven assets when institutional and policy risks rise – with gold once again coming out as the top choice, Linh Tran, a senior market analyst with Cyprusbased broker XS.com, said in a note.

“Gold is no longer merely reacting to tariff headlines or Fed-related developments but is entering a phase of strategic revaluation within global portfolios,” Tran said. “As risks stemming from unpredictable policy actions intensify and confidence in fiat currencies is increasingly tested, gold is gradually transitioning from a defensive hedge into a core asset within risk management strategies.”

Investor concerns escalated in early January after the United States Department of Justice threatened to criminally prosecute Federal Reserve chair Jerome Powell over a building project, sparking concern that the U.S. central bank might struggle to operate free of political control.

On Jan. 9, the Department of Justice served the Fed with grand jury subpoenas as it threatened a criminal indictment related to Powell’s June 2025 testimony before the U.S. Senate Banking Committee. That testimony included comments about a multi-year project to renovate historical Fed office buildings, whose cost has jumped to about $2.5 billion (C$3.5 billion).

Golden goose

“Going after the Fed’s independence is killing the goose that lays the golden egg because the Fed has monetized the deficit spending of the government for more than a century,” Jeffrey Christian, managing director of the U.S.-based research firm CPM Group, told The Northern Miner podcast host Adrian Pocobelli. “It has kept the dollar strong, and it has kept the dollar vital to the global economy. Going after the Fed’s independence puts the dollar at risk.”

The criminal investigation marked a sudden escalation in U.S. President Donald Trump’s spat with Powell, whom he has repeatedly criticized over the past year for ignoring calls to cut rates or acting too slowly. The Fed’s 25 basis-point reduction in September was its first since 2020.

The new developments bring “the independence of the Fed again into sharp focus,” BMO Capital markets commodities analysts Helen Amos and George Heppel wrote Jan. 12 in a note. Investors are seeking “hedges to concerns over U.S. dollar devaluation amid prospects for further monetary easing.”

Safe-haven demand

When combined with repeated U.S. threats to take over or acquire Greenland violent protests in Iran and the recent capture of Venezuela President Nicolas Maduro, the prospect of a Powell indictment is “keeping safe-haven demand for metals elevated,” Amos and Heppel wrote.

Beijing last month restricted the export of physical silver to the global market, piling additional pressure on inventories in London and Zurich, according to BMI, a unit of Fitch Solutions.

Mexico, the world’s largest silver producer, is also unlikely to increase volume this year due to declining ore grades and output at some mines, the analysts said in a note.

Many investors are moving out of cash and U.S. dollars to buy metals such as gold, silver, platinum or copper, Christian said.

“They’re getting out of the U.S. dollar and they’re putting their money not in the U.S. stock market…but in tangible assets that probably are going to become more expensive because of the economic and financial issues that just got worse,” he said.

The justice department’s “unprecedented” action “should be seen in the broader context of the administration’s threats and ongoing pressure,” Powell said Jan. 11 in a video posted to the Fed’s website.

“The threat of criminal charges is a consequence of the Federal Reserve setting interest rates based on our best assessment of what will serve the public, rather than following the preferences of the president. This is about whether the Fed will be able to continue to set interest rates based on evidence and economic conditions – or whether instead monetary policy will be directed by political pressure or intimidation.”

Central banks

Investment bank Goldman Sachs last month lifted its year-end forecast for gold to $5,400 per oz. to reflect the yellow metal’s growing appeal among private-sector investors.

In a note published Jan. 21, the bank’s analysts reiterated the confluence of factors – including strong purchases from central banks – that drove gold prices up 64% last year. TNM

HONOURS | Firms support young minds to boost industry

BY COLIN MCCLELLAND

Andrea Ferriss is studying for a B.Sc. (Hons) Geology at the University of Alberta to champion sustainable resource development as a priority for the industry.

“I’ve chosen a career in mining because I want to contribute to the energy transition through mineral resources,” Ferriss says. “I believe that critical metals are vital to fuel the innovation of decarbonization and renewable energy technology.”

Ferriss won the Sprott $10,000 Sustainability in Mining Scholarship. She is just one of 65 students awarded between $500 and $10,000 as part of the 2025 Young Mining Professionals Scholarship Fund’s $250,000 for mining-related programs at post-secondary institutions across Canada. Some 30 mining companies and other sponsors are backing the effort, including new supporter Franco-Nevada (TSX, NYSE: FNV).

“Our renewable scholarship program is about investing in people and the future of the mining industry,” says Paul Brink, president and CEO of Franco-Nevada. “By leveraging YMP’s extensive distribution network, we can broaden the reach of our support and join other industry leaders in helping ensure high-potential students from a broad range of backgrounds have the resources they need to thrive.”

Commitment

More than 3,000 students applied to the YMP fund. Applicants were considered based on academic achievement, extracurricular activities, and a commitment to a career in the mining industry.

The awards include several scholarships specifically targeting women, residents of Northern communities and Indigenous students, such as Maxwell Brown. He’s studying in his second year towards a B.Sc. in Mechanical Engineering at the University of Calgary. Brown earned American Eagle Gold’s (TSXV: AE; US-OTC: AMEGF) Lake Babine Nation mining scholarship.

“The mining industry has many benefits including a variety of engineering job positions to make a real-world impact,” Brown says.

“Encouraging young talent and expanding access to opportunity strengthens our industry.”

— JOHN MCCLUSKEY, CEO, ALAMOS GOLD

“This scholarship has and will support me on my path to be an engineer, and I will be forever grateful.”

Anthony Moreau, director of the fund and CEO of American Eagle Gold, recently hired two scholarship recipients to work at the company’s main copper-gold exploration project, NAK, in British Columbia this year. He says the industry’s rewards for him and his family motivated him to give back by personally supporting the initiative.

“The industry will continue to thrive, but we must focus on attracting and retaining talent,” Moreau says. “The YMP Scholarship embodies this effort. By offering scholarships and partnering with companies to support exceptional students, we not only keep these future leaders in the industry but also empower them to become ambassadors, spreading the word and fostering growth.”

Canada’s largest

The fund, Canada’s largest set of scholarships for students in mining-related programs, was established in 2018 by the Ore Group and Iamgold (TSX: IMG; NYSE: IAG) with a mere $12,000 awarded to students. The number of sponsors and the value of scholarships awarded has steadily increased since then.

“Alamos is proud to support the YMP Scholarship program, which plays an important role in opening doors for the next generation of mining leaders,” Alamos Gold (TSX, NYSE: AGI) CEO John McCluskey says. “Encouraging young talent and expanding access to opportunity strengthens our industry and helps to ensure a bright future for mining in Canada.”

Every dollar contributed by the sponsors goes to the scholarship winners as the program is administered entirely by volunteers. They see nurturing talent and fostering a pipeline of skilled professionals to drive innovation and sustainability in mining as critical for the industry, which in recent years has seen post-secondary enrolment in mining fields fall to half-century lows.

“Supporting the next generation of mining professionals is essential to the long term success and sustainability of our industry,”

B2Gold (TSX: BTO AMEX: BTG) CEO Clive Johnson says. “We are proud to contribute to this initiative and to help create pathways for female and indigenous talent and future leaders.”

The scholarship fund is a registered Canadian charity offering tax receipts to participating donors.

Benefactors

Returning supporters to this year’s scholarships are Agnico Eagle Mines (TSX, NYSE: AEM), Alamos Gold, American Eagle Gold, Auriginal Metals (TSXV: AUME) Awalé Resources (TSX-V: ARIC), B2Gold, Barrick Mining (TSX: ABX; NYSE: B); Eldorado Gold (TSX: ELD, NYSE: EGO), Equinox Gold (TSX, NYSE: EQX), Geiger Energy (TSXV: BEEP); Gold Royalty (NYSE: GROY), Iamgold, Kinross Gold (TSX: K; NYSE: KGC), Metal Energy (TSXV: MERG); Ore Group, OreCap Invest (TSXV: OCI; US-OTC: ORFDF), Pan American Silver (TSX, NYSE: PAAS), ResourceTalks.com, Stardust Metals (CSE: ZIGY), Joan Margaret Stewart, Sprott, TD Securities, The Northern Miner, Triple Flag Precious Metals (TSX, NYSE: TFPM), XXIX Metals (TSXV: XXIX) and YMP Toronto.

New sponsoring companies are Franco-Nevada, Mithril Silver and Gold (TSXV: MSG), Revival Gold (TSXV: RVG), Valkea Resources (TSXV: OZ) and Snowline Gold (TSX: SGD).

A list of winners can be viewed at YMPScholarships.com/2025-winners. To inquire about participating in the 2026 YMP Scholarship fund, please email amoreau@oregroup.ca. TNM

THOMAS AWARD | Winner aids BHP M&A

BY BLAIR MCBRIDE

Vicky Liu started at UBC with the “naïve science student aim” of potentially going into medicine, but geology pulled her in.

“It became really clear to me about a year or two into my sciences degree that I really loved the adventure nature of geology, the fact that you’re constantly solving a mystery,” she said.

Now on BHP’s (ASX, LSE, NYSE: BHP) Corporate Development team, Vicky works in portfolio strategy, long-term growth initiatives and M&A transactions across the major’s global assets. She is the 2026 recipient of the Eira Thomas Award for talented women leaders under age 40 from industry group Young Mining Professionals.

Geologist

Liu started her career as an exploration geologist at Silvercorp Metals’ (TSX, NYSE: SVM) former Silvertip project in a remote part of northern British Columbia. At the time, Silvercorp was trying to diversify away from its main assets in China.

The mapping, drill core logging and geophysics she did at the camp were all part of the first economic report Silvercorp filed for the project. Silvercorp sold Silvertip in 2013 to JDS Silver, which was later acquired by Coeur Mining (NYSE: CDE).

“We were really putting together an exploration program, a camp and a strategy for the asset from zero,” she said.

While her experiences as an exploration geologist were invaluable, she felt she needed to learn more about the financial markets side of mining.

Financial analyst

Vicky charted a different path working for an investment banking firm in Vancouver and then went onto Deloitte, where she was an analyst in the company’s corporate finance advisory side.

“That was really my first career change – still in mining – but very much learning more about the financial services side of the business,” she said.

Her success in the field built on more success, and she was hired

MUNK AWARD | Hard knocks prepped entrepreneur

for a similar role in London, U.K. before going on to work for French bank Société Générale and RBC, where she advised mining clients on financing and M&A.

In 2021 she moved on to BHP and now works as a practice lead on “future facing commodities” such as copper and potash.

“I do a lot of thinking and sourcing new opportunities for investment or for acquisitions and thinking about new areas where BHP could move into,” she said.

Global M&A

The role is taking her around the world, whether that’s to BHP’s iron operations in Australia or to Brazil, where she worked on the Carajas copper mines sale. BHP reached a deal in August to sell the sites to CoreX Holding BV for $465 million.

Amid the rising trajectory of her career, Vicky sees the progress made in raising women’s involvement in mining. While the industry remains male-dominated, she sees the huge opportunities that greater diversity can bring.

In her previous roles at RBC, she helped diversify teams when she worked in staffing and recruitment. She saw the value in widening the scope across gender, education, non-traditional backgrounds and geographic origins.

BHP is an industry leader with its target of reaching 50-50 male-female parity in its workforce, which Vicky says is a huge ambition for an employee base of 90,000 people.

“Where it’s still a bit lagging is when you think about who senior leaders are,” she said. “You still see a lot of imbalance there. It’s really important for our generation of mining professionals to stick with it and move into those leadership roles.”

TNM

BY COLIN MCCLELLAND

It was after the market hollowed out two of his mining startups that Fred Bell landed on royalty financing as the idea for a firm now valued at $1.76 billion and listed on Nasdaq. First the 2011 Fukushima disaster levelled an Australia-focused uranium company, then the 20-teens commodity slump sidelined a West African gold explorer.

“The only business model I can see where you can get cash flow early and protect yourself against the cyclic penalty of the space is in the royalty model,” Bell said from the London office of Elemental Royalty (Nasdaq, TSXV: ELE), where he’s founder, president and chief operating officer.

“That’s how it started: a private company, really lean, getting diversified cash flow to protect the downside from day one, and with

the basis that if you can do that, then you can scale the company up over time.”

Now all that growth in eight years has earned him the 2026 Peter Munk Award from Young Mining Professionals, a group backed by the mining industry’s major players such as Agnico Eagle Mines (TSX, NYSE: AEM), B2Gold (TSX: BTO; NYSE-A: BTG) and Kinross Gold (TSX: K; NYSE: KGC) among many others. Along with the Eira

Thomas Award this year for Vicky Liu, the YMP honours go to industry leaders under age 40.

Saloon

“I am 39 so I guess it’s last-chance saloon, you know,” London, U.K. native Bell said. “I was not expecting that. And in terms of some of the previous winners, I mean some really high-profile people, so, yeah,

BY BLAIR MCBRIDE

The mining career of FrancoNevada (TSX, NYSE: FNV) co-founder and board chair

David Harquail has taken him almost everywhere, even to discuss gold with a communist dictator.

Harquail recalled a trip to Havana with Franco-Nevada co-founder and fellow Hall of Fame member Pierre Lassonde in the 1990s. The pair met with Fidel Castro to talk about a gold project and decided to gift Castro a company gold pen, unaware the CIA had tried to kill him with a poison pen in the 1960s.

“And out jumped the security officers for Castro,” Harquail recounted. “They whisked him out of the room, they manhandled us, took the pen, tore it apart, the spring [jumped] out. And the big lesson here is do your homework before a meeting!”

As CEO of Franco-Nevada from 2007 until 2020, Harquail steered the royalties company into its initial public offering and raised $1.2 billion, still the largest mining IPO in Canadian history. FrancoNevada would eventually grow its market capitalization to more than $50 billion.

The achievement is one of the reasons he was celebrated on Jan. 8 for his induction into The Canadian Mining Hall of Fame. Vision, discipline, strategy and guts were all qualities honoured at the ceremony in the Toronto Convention Centre where ESG leader Don Lindsay, entrepreneur-trailblazer Catherine McLeod-Seltzer and people-focused explorer Gordon Morrison were also celebrated.

Industry safety

Harquail’s passion started early, and he was visiting mining camps in northern Ontario and Nunavut as a kid. Once he turned a family vacation to Machu Picchu in Peru into a side-trip to a copper mine. His contributions to Canadian mining have outlived the Cold War, and today the industry is regarded as positive and nation-building, he said.

“It’s the best of times to be a Canadian miner, and I’m very proud to be part of it.”

Mining veteran Don Lindsay remembers his first industry job with the Iron Ore Company of Canada and the short orientation he was given the night before he started.

“I was a foreman in the pit with 25 steelworker union guys reporting to me, at 21 years old,” he said in a video shown to the audience.

“I don’t know which way’s up! On night shift, I would try and operate every single [piece of] equipment: grader, a dozer, a drill, a shovel. You could never do that today, incredibly unsafe, but I wanted to know and understand what they were doing.”

That rugged introduction would set the tone for his later career when he prioritized safety, a focus that served him well in his tenure as president and CEO of Teck Resources (TSX: TECK.A, TECK.B; NYSE: TECK) from 2005 until 2022.

On his watch, Teck’s market capi-

talization grew from $8 billion when he started to $22 billion when he stepped down. Its copper reserves expanded from 2.5 million tonnes to 19 million and almost $9 billion was returned to shareholders.

ESG forerunner

Big numbers and achievements aside, Lindsay knows that business success should enhance the world and people rather than come at its expense.

His leadership helped kickstart Teck’s partnership with Unicef to address zinc deficiency in children, a problem that can cause death from diarrhea. The Zinc Alliance for Child Health program has reached more than 140 million people around the world. Lindsay saw the program up close in Kenya at a nursing station.

“There were 10 mothers and their children whose lives had been saved,” he said in a video. “I get choked up thinking about it. No one else was there to see. But it was so moving. It was so powerful knowing Teck made a difference.”

Whether it’s industry success or outreach to the world, Lindsay stressed that it comes down to having the tenacity to pursue dreams.

“I told geologists…they should come to my office and jump up and down on my desk, leave footprints and insist that we fund them,” he told the audience. “Some called it the ‘footprints on the desk speech.’ While we didn’t find many elephants, we did find one QB2.”

Teck’s Quebrada Blanca stage two expansion mine in Chile is one of the world’s largest copper producers with output of more than 300,000 tonnes a year.

“Dreams do come true, but only if you have the guts to pursue them.”

Pathfinder for women

Catherine McLeod-Seltzer’s industry ambition seems to be always buzzing, no matter the circumstances.

The founder of several exploration and mining firms, McLeod-Seltzer has raised more than $750 million in exploration capital and been behind more than $4 billion made in the building and selling of companies.

Her induction into the hall of fame marks the first time in its history that a father and daughter have both received the accolade. Her mining pioneer father Don was inducted in 2017.

She’s also a role model for women in an industry that’s still largely male-dominated. Her accolades include being named one of Canada’s Most Powerful Women by the Women’s Executive Network, Mining Person of the Year by The Northern Miner in 1999 and one of the 100 Global Inspirational Women in Mining.

When she was three months pregnant, she teamed up with geologist David Lowell to try and secure a copper asset in Peru. The day after McLeod-Seltzer gave birth, Lowell called her when she was in the hospital to tell her they had acquired it.

“I remember thinking, ‘Well, a new baby and a copper project. It’s going to be quite a year!’” she told the audience.

That project became Toromocho, one of the largest copper mines in the world, and McLeod-Seltzer and Lowell eventually sold it to Minera Chinalco Peru for $840 million. The duo also discovered the huge Pierina gold deposit in Peru and sold the company to Barrick Mining (TSX: ABX; NYSE: B) in 1996 for $1.1 billion.

“We built a dream on a shoestring budget,” she said. “I’ll never forget thinking when the deal was done that this is what happens when you work with the right people.”

McLeod-Seltzer has made her mark with responsible mining as well, particularly with a program in Peru focused on improving wool yields and hygiene among alpaca herders who work high up in the Andes mountains.

The inclusion of veterinarians, nutrition initiatives and medicines helped encourage more handwashing among children, who help their mothers with herding. Respiratory illnesses, which is the main fatality for infants in the highlands, were sharply reduced.

Gordon Morrison’s acceptance speech embodied much of the reason why he was honoured because he thanked others for their positive contributions to his career more than he told stories about himself.

“In any challenging endeavour, help can come from many sources but the people around you are key to that successful outcome,” he said. “That was the wisdom

imparted to me by my father, who saw the strength in good people.”

An exploration geologist whose innovative use of technology led to numerous discoveries in Ontario’s Sudbury basin, Morrison’s leadership led to 17 major metal finds, many with Inco and FNX Mining. Nine of those discoveries advanced into full production and three into partial development, representing billions of pounds of nickel and copper, and millions of ounces of platinum, palladium and gold.

The total value of those finds would be worth more than $70 billion at today’s prices.

“Respect and trust is really important,” he said. “Always try to respect other people’s point of view, and if you do that, they will trust you.”

It’s an approach that’s much needed when working with people from different cultures and it proved essential in Morrison’s work with TMAC Resources at the Hope Bay gold project in Nunavut. It was later acquired by Agnico Eagle Mines (TSX, NYSE: AEM).

He helped negotiate a 20-year agreement with Inuit landowners, crafting out the contours of Indigenous partnerships and consultations.

“The years at Hope Bay in the Arctic were very special, and I owe a debt of gratitude and a big thank you to the Inuit people for their friendship and their wisdom,” he said.

In his closing remarks to the audience, Morrison said he had a simple message for the mining industry. “Next time a new discovery is made and people are slapping themselves on the back saying, ‘Wow, we sure picked the right horse!’ Just remember that you guys, you are that horse, and without you, there is no horsepower.”

| How they knew they were close

BY NORTHERN MINER STAFF

Two Ontario sisters flew to Newfoundland on a hunch, followed the Argentia-region clues from The Northern Miner’s Great Canadian Treasure Hunt and dug up the latest $37,000 gold bonus prize.

Stefanie St. Denis and Jennifer Crichton are longtime Northern Miner subscribers and escaperoom regulars. They told The Miner’s anchor Devan Murugan their solve came from a mix of puzzle work, patience and a willingness to book the flight before they could talk themselves out of it.

Devan Murugan: Steph, what did it feel like to find the gold?

Stefanie St. Denis: It was surreal. It was a trek, but we were pretty confident. It’s exciting and it gives us confidence going forward in the hunt.

DM: Jennifer, you’re both big into escape rooms. How did that translate into treasure hunting?

Jennifer Crichton: We’ve done hundreds together. We’ve travelled around and done some of the best, especially in Montreal [which is considered one birthplace of the genre]. We’re naturally good at puzzles, so a treasure-hunt solve was right up our alley. We dove in from the start for the fun of it.

DM: You went from solving to

travelling fast. You hadn’t booked anything, right? What happened?

SSD: Spontaneity is the name of the game. We woke up and didn’t know we were going to Newfoundland that day. We had the idea for the solve around Christmas and sat with it for a while. Then we ran out of reasons not to go, booked a flight and by the end of the day we were in Newfoundland.

DM: It sounds spontaneous, but something pushed you over the line. What was it?

JC: We followed the clues and a lot of it was instinct. We felt we were onto something.

DM: Without giving away locations or trade secrets, what was it about Argentia that clicked?

SSD: It’s hard to say. When you watch earlier winners talk about their solves, you’re hanging on to every detail. We considered laying it all out, but the thrill is in the solve. Giving it away would take that fun away. We followed the signals we got from the article, the

clues and the video, and it led us to a place we felt strongly about.

DM: For people watching and thinking this looks tough – is it? What skill set do you need?

JC: It depends how you look at it. If you like puzzles, like hunting for clues and can trust your gut a bit, it’s doable for anybody. But we put in a lot of time before we felt confident enough to travel from Ontario to Newfoundland.

DM: Beyond the gold, what

stood out on the ground? Any memorable moments?

JC: For us it’s bonding. We have so much fun together. We’re sisters, best friends. We love doing things together – escape rooms, treasure hunts, all of it. A lot of it is the memories from the crazy stuff that happens along the way. It’s a story we’ll tell for a lifetime.

DM: This hunt pulls people into Canadian history and mining, too. Did you know much about mining going in?

SSD: Not nearly as much as we do now. We went into it with a lot less information about Canadian history and mining. Once you start digging in, you realize how big it is.

DM: What would you tell hunters still chasing the $1-million national prize?

SSD: Go with your gut. You have to trust yourself and your thought process. It’s not laid out crystal clear. You have to trust the path you’re on and act on it.

JC: TNM says it well: if you feel like you’re getting close, you probably are. If you think you’re onto something, take it right to the end. Take the risk. Try it.

DM: Well, best of luck chasing the big one.

SSD: Thank you so much. TNM

COIN SEARCH | ‘Silver Valley’ teased seekers for decades

BY NORTHERN MINER STAFF

On the rugged shores of Placentia Bay in southeastern Newfoundland lies a place shaped by sea spray, fog, and dreams bigger than its size. Long before roads or deepwater ports, this was the tiny fishing settlement of Petit Plaisance – “Pleasant Little Place” – named by French mariners who came here in the 1600s to haul cod from the richest banks in the North Atlantic.

But by the late 19th century, something stirred beneath the surface — something that would change how the world knew this isolated corner of what is known as “The Rock.”

A Priest, a Prospect, and a Name Reborn

It was Father John St. John, the energetic parish priest of Holy Rosary Parish, from 1895-1911, who first gave voice to a new identity for this humble community. In the shadows of towering cliffs near Broad Cove Point, local prospectors had stumbled on glittering veins of galena – rich lead ore that carried silver deep in the rock.