Live Local Act Legislative Update

2025 - Live Local Act Legislative Update

Affordable Housing

• APA 2025 Policy Priority

• Federal support for zoning reform is key to increasing housing supply

• Zoning Reforms for Housing Abundance

• New research reports that the nation's housing deficit is nearly 4 million homes — and smaller regions and mid-sized communities are being hit the hardest. These communities need support at every level of government to enact the planning-led reforms needed to increase housing supply.

Source: https://planning.org/policy/priorities/

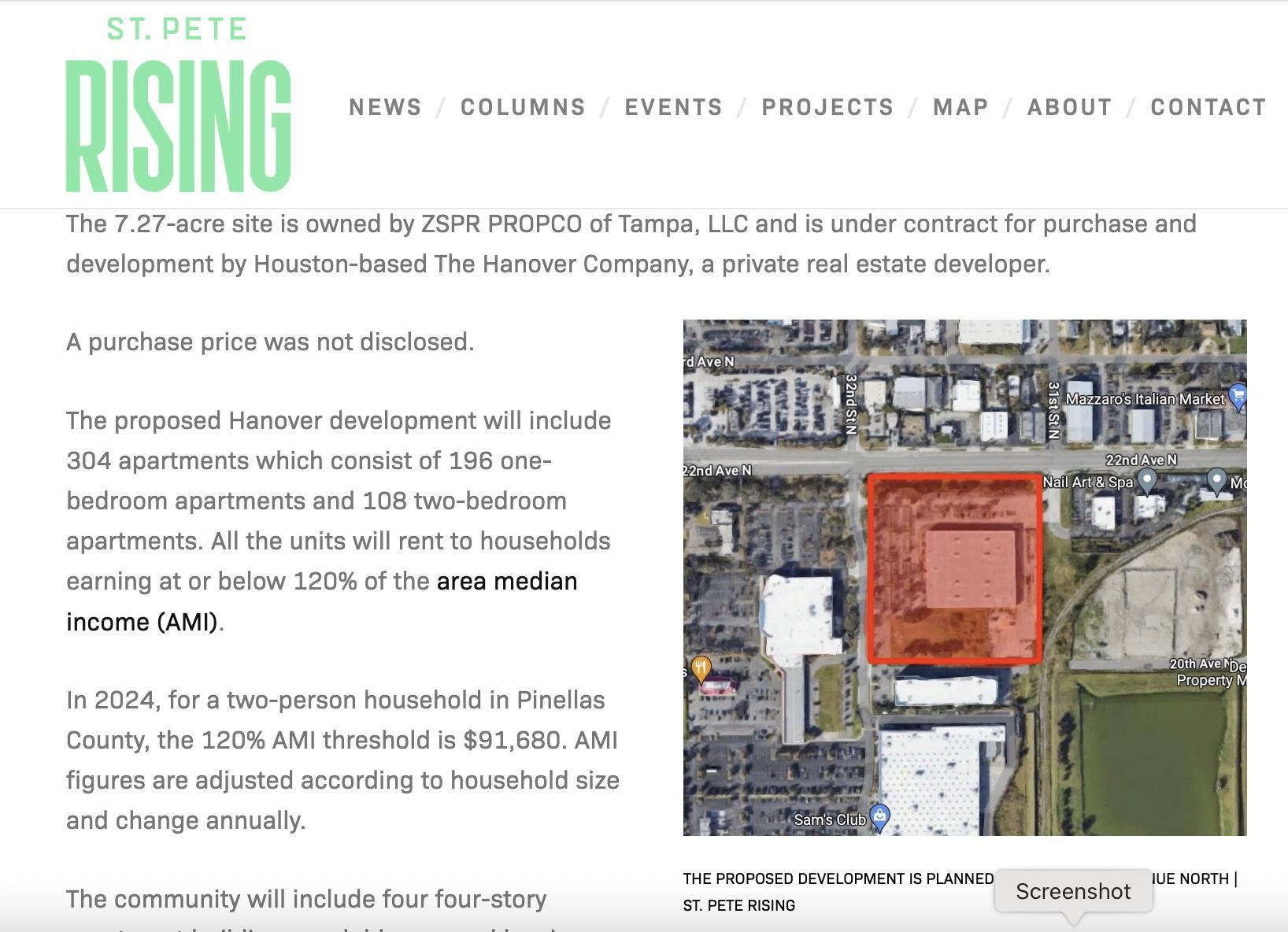

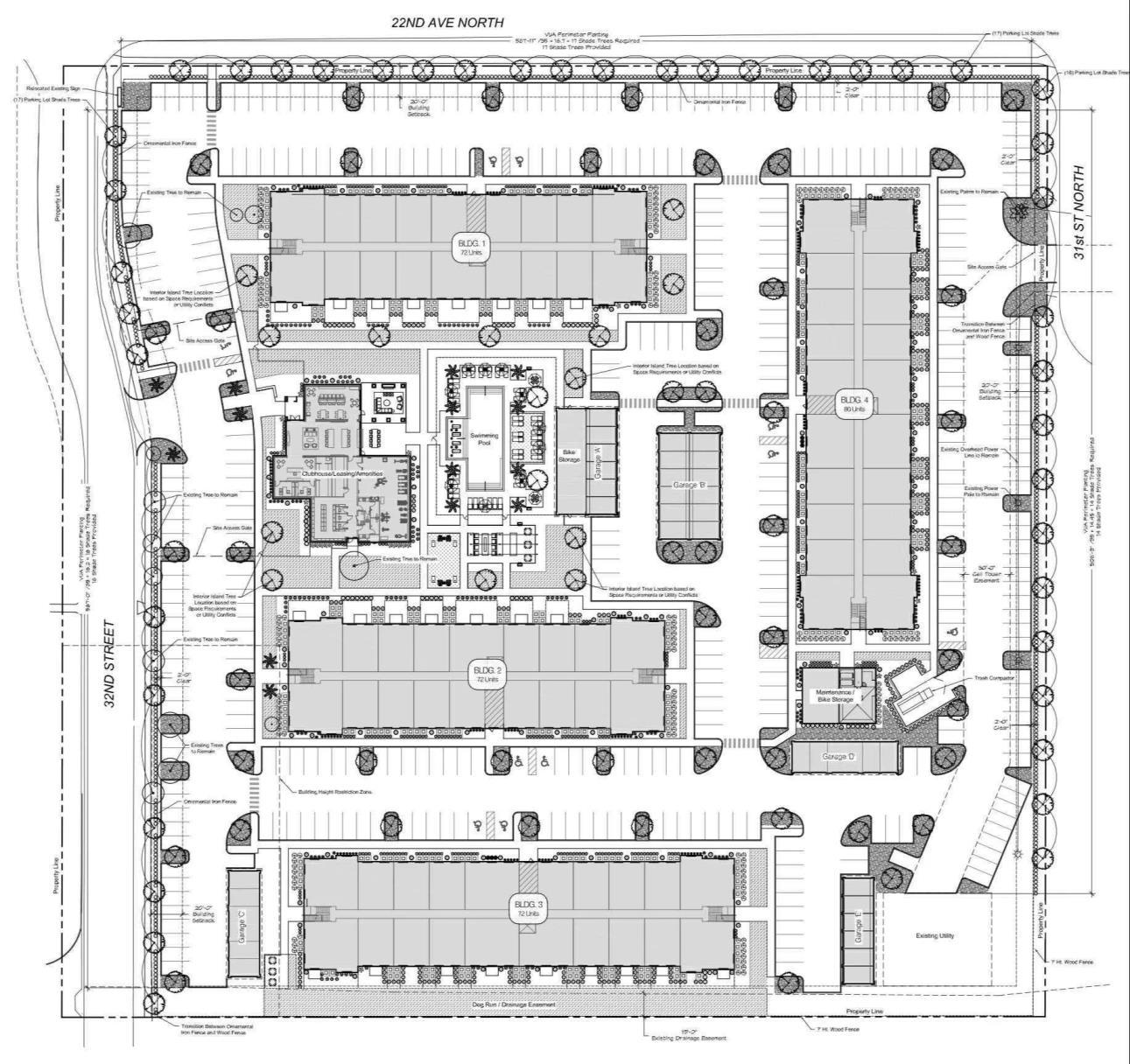

https://stpeterising.com/home/304-unit-apartment-development-filed-under-floridas-live-local-act-

• 304 Units

• Redevelopment of former Big Box

• Large Empty Parking Lot

• No longer a high demand for large areas dedicated for parking

• No risk of displacing high employment generator

• Close to existing bus routes

• Close to future BRT - 34th Street

• Services for Daily Needs in walking distance

• Proximity US Hwy 19 & I-275

The Live Local Act: Two Years Later

Purpose

✓ Quickly increase affordable housing stock

✓ Started with Senate Bill 102 (2023)

✓ Amended in 2024 (Senate Bill 328) and 2025 (Senate Bill 1730)

✓ Sunsets October 1, 2033

Land Use & Zoning Preemption

Land Use & Zoning Preemption

✓ Affordability Requirement: 40% of units must be affordable rental units for 30 years

✓ Eligibility: zoned for commercial, industrial or mixed use

✓ Commercial: retail sales; wholesale sales; rentals of equipment, goods, or products; offices; restaurants; public lodging establishments as described in s. 509.242(1)(a); food service vendors; sports arenas; theaters; tourist attractions; and other for-profit business activities.

✓ Industrial: such uses or activities as automobile manufacturing or repair, boat manufacturing or repair, junk yards, meat packing facilities, citrus processing and packing facilities, produce processing and packing facilities, electrical generating plants, water treatment plants, sewage treatment plants, and solid waste disposal sites.

✓ Mixed Use: any use that combines multiple types of approved land uses from at least two of the residential use, commercial use, and industrial use categories.

Land Use & Zoning Preemption

➢ Density: highest density allowed in the jurisdiction (but not density approved via bonus, special exception, etc.)

➢ Practice tip: look at density in highest multifamily FLU and zoning district

➢ Intensity: 150% of the maximum FAR allowed in the jurisdiction (but not FAR approved via bonus, special exception, etc.)

➢ Development Standards: land development regulations for multifamily development

Land Use & Zoning Preemption

➢ Height: highest currently allowed height for a commercial or residential building within 1 mile or 3 stories, whichever is higher

➢ Note: if adjacent on 2 sides to single family with at least 25+ homes, limited to 150% of the tallest adjacent building. Adjacent means properties sharing more than one point of a property line, but does not include property across a public road or body of water

➢ Note: if development is on a parcel with a contributing structure/building within a historic district & is listed on the National Register of Historic Places before 1/1/2000, or is on a parcel individually listed in the National Register of Historic Places, may restrict height to the highest currently allowed height for a commercial or residential building within 3/4 of a mile or 3 stories, whichever is higher.

Land Use & Zoning Preemption

➢ Mixed Use Required: (1) in a TOD area; (2) a city that designates less than 20% of its jurisdiction or commercial or industrial use; and (3) a county which is within the boundaries of a multicounty independent special district that was created to provide municipal services and is not authorized to levy ad valorem taxes, and less than 20 percent of the land area within such district is designated for commercial or industrial use

➢ Mixed Use projects: cannot require more than 10% non-residential

➢ Parking:

➢ Must reduce parking by 15% (upon request of the applicant) if the property is:

➢ Within ¼ mile of a transit stop;

➢ Within ½ mile of a major transportation hub; or

➢ Within 600 feet of available parking (on-street parking, parking lots, or parking garages available for use by the residents.

➢ Parking within a mixed-use project in a TOD area: NONE

Land Use & Zoning Preemption

➢ Prohibited Areas

➢ Wekiva Study Area

➢ Everglades Protection Area

➢ Airport noise zone, flight path (1/4 mile laterally on each side of a runway, extended out 10,000 feet) or higher than allowed in local airport zoning regulations.

➢ ¼ mile of a military installation

➢ Property designated as a recreational or commercial working waterfront that is zoned industrial

Land Use & Zoning Preemption

➢ Meet these requirements?

➢ No public hearings!!!!!

➢ No comprehensive plan amendment, rezoning, special exception, conditional use, variance, transfer of density, amendment to a DRI, or charter.

➢ LURAs or Declarations

➢ Method for securing the 30-year commitment

➢ Recorded on title so that the affordability covenant runs with the land

➢ Timing Issues

Land Use & Zoning Preemption

➢ Moratoriums: do not apply to LLA if longer than 90 days in any 3-year period

➢ Exception: moratoria addressing stormwater or flood water management, supply of potable water, or due to necessary repair to sanitary sewer systems (if applied to all types of multifamily or mixed-use development)

➢ Litigation

➢ Court must prioritize these cases over pending cases and render a preliminary or final decision as expeditiously as possible

➢ If case is filed and local government is found to violate LLA, court must assess reasonable attorneys fees and costs to the prevailing party, not to exceed $250,000

Land Use & Zoning Preemption

➢ Annual Reporting:

➢ Beginning 11/1/2026, local governments must provide an annual report to the state land planning agency, which includes:

➢ Summary of LLA litigation in previous fiscal year;

➢ List of proposed or approved projects during the previous fiscal year

➢ Report will be submitted to Governor, President of the Senate and Speaker of the House

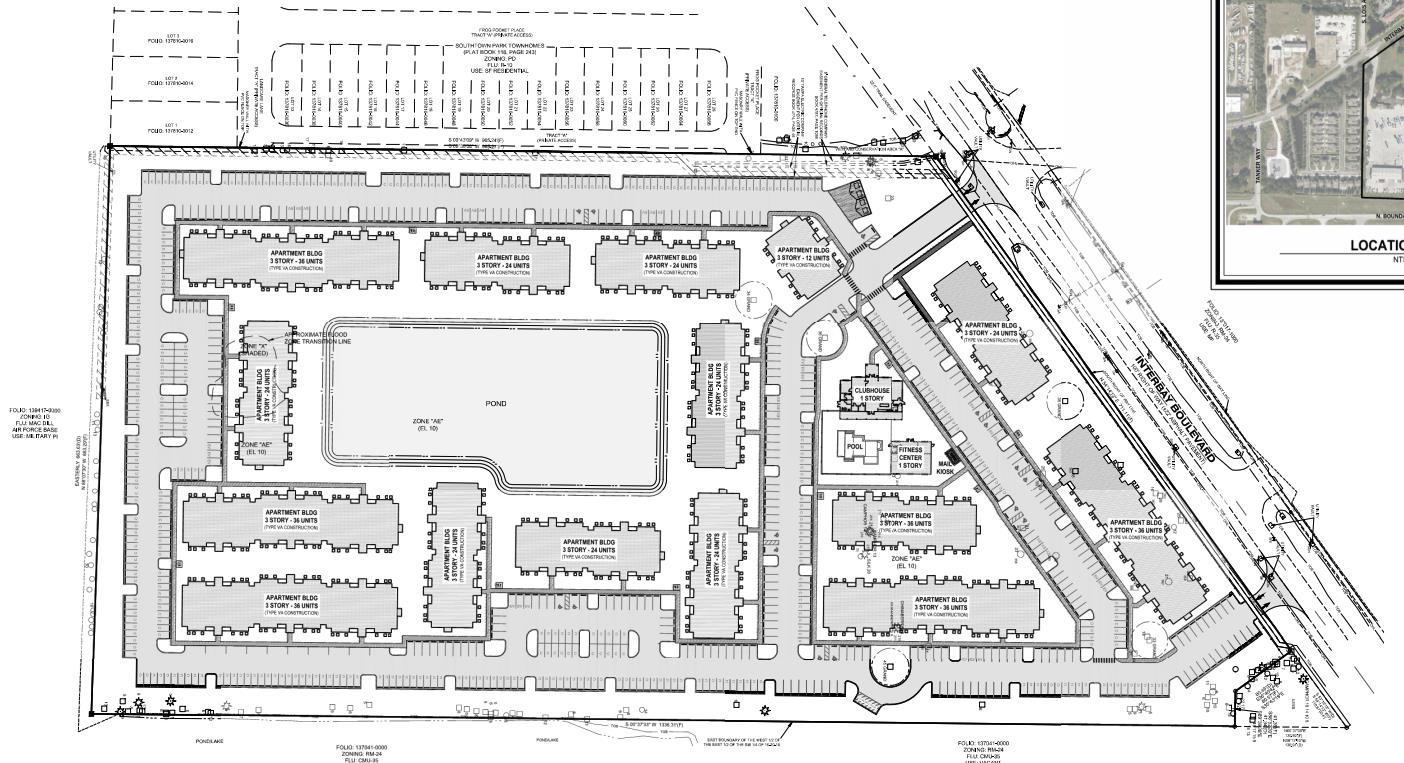

Interbay – City of Tampa

✓ Zoning: Industrial

✓ 408 units (minimum 192 affordable)

✓ Within the City of Tampa

✓ Originally approved in 2023 and set to break ground end of 2025/early 2026

Tracker

➢ Florida Housing Coalition dashboard: https://flhousing.org/resource-library/live-localdashboards/

➢ “Yes in God’s Backyard”

➢ Statutory change in 2025 to the Live Local Act predecessor (HB 1339)

➢ Allows, but does not require, local governments to allow affordable housing on property owned by a religious institution which contains a house of public worship if 10% of the units are affordable

Ad Valorem Tax – Missing Middle

➢ Unit Requirement: Minimum 71 units at 120% AMI and below

➢ In the Florida Keys? Minimum 11 units

➢ New construction: constructed in the last 5 years before first submittal

➢ Rent restriction: lesser of 120% AMI or 90% of market as determined by third party appraiser

➢ Reduction:

➢ 80% AMI and below = 100% ad valorem exemption per unit

➢ 120% AMI and below = 75% ad valorem exemption per unit

➢ Commitment: 3 year commitment that renews annually

➢ 2025 change: runs with the land, not the property owner!

➢ End date: December 31, 2059

LIVE LOCAL ACT: PASCO PERSPECTIVE

David Goldstein, Esq. Chief Assistant County Attorney

2023LiveLocalAct—TaxExemption

➢Section 196.1978(3), Florida Statutes

➢Provides ad valorem tax exemption if 71 or more units are dedicated to “affordable” housing

➢75% tax exemption for units at or below 120% of Area Median Income (AMI), or 90% of fair market value rent, whichever is less

➢100% tax exemption for units at or below 80% of AMI

➢Applies to multifamily projects “newly constructed” within 5 years prior to application (can predate Live Local Act)

➢Florida Housing Finance Corporation does initial certification notice

➢Final decision on exemption made by Property Appraiser

➢Tax exemption applies from 2024 to 2059 (up to 35 years)

2023LiveLocalAct--Affordability

➢Both the zoning/land use preemption and tax exemption rely on the same definition of “affordable” in Section 420.0004, Florida Statutes

➢This definition includes “moderate income” households making up to 120% of AMI, which is often referred to as the “missing middle”

➢The zoning/land use preemption and tax exemption apply even if the jurisdiction has a surplus of rental housing in this income range

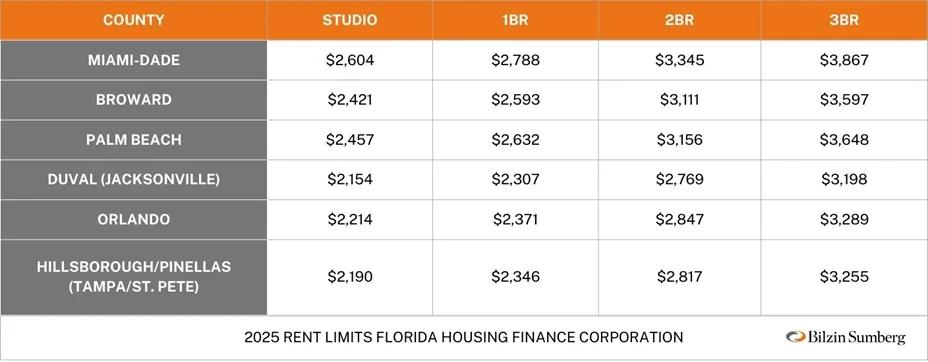

➢The rents at 120% of AMI are over $2,000 to $3,000 per month, which in many cases are market or above-market rate rents

HB7073—TaxExemptionOpt-Out

➢During 2024 legislative session, Pasco became very vocal with concerns about Live Local

➢First two existing “luxury” apartment complexes seeking tax exemption would have resulted in estimated $38 million dollar impact to County budget (average of approximately $500,000 per year per complex)

➢Apartments were charging market rate rents (no rent reduction); owned by California and Connecticut corporations

➢Pasco threatened litigation against apartments

➢At very end of session, Legislature added new tax exemption opt-out in Section 196.1978(3)(o), Florida Statutes

HB7073—TaxExemptionOpt-Out

➢Opt out only affects 120% AMI tax exemption

➢Does not allow opt out of land use/zoning preemption

➢Does not include 2024 tax roll

➢Each taxing authority in jurisdiction must affirmatively opt-out by resolution or ordinance

➢Requires notice and 2/3 vote

➢Projects granted tax exemption before opt out can continue to qualify for exemption after opt out

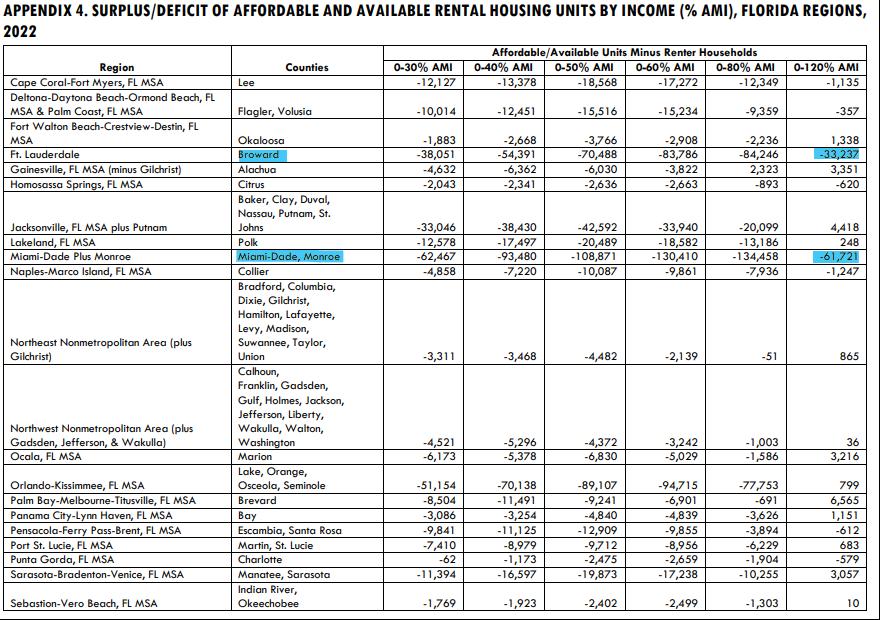

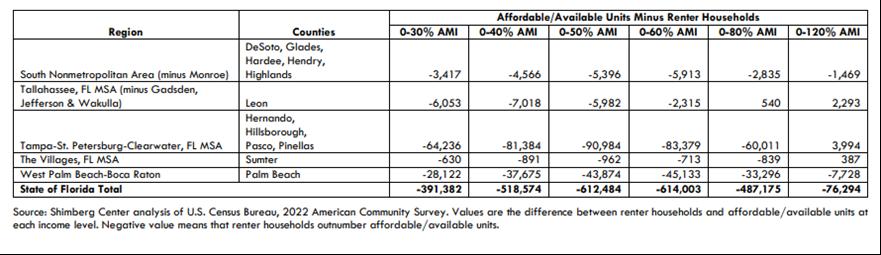

➢Must have surplus of rental housing in the 0-120% AMI column in latest Shimberg Report to opt out

SummaryofLiveLocalLandUseandTaxExemptionApplicationsasofJune2025

➢Based on survey of counties over 100,000 population

➢Approximately 44 Live Local projects have been administratively approved under the land use/zoning preemption

• Largest numbers are Miami-Dade (10), Pinellas (6), Volusia (6) and Hillsborough (5)

➢Approximately 83 Live Local tax exemptions granted in 2024 and 160 granted or applied for in 2025

• Largest numbers are Miami-Dade (43), Orange (39), and Duval (22)

➢Notwithstanding opt-out, tax exemption applications almost 6 times the number of Live Local administrative approvals

SummaryofMajorRemainingLegalandPolicyConcernswith LiveLocal

➢Economic development/job creation (land use preemption)

➢Due Process (land use preemption)

➢Impairment of Contract (land use preemption and tax exemption)

➢Not Charitable Purpose (tax exemption)

➢Expenditure of Public Funds for Private Purpose (land use preemption and tax exemption)

➢Arbitrary and Capricious (land use preemption and tax exemption)

➢Over-reliance on Shimberg Report data for opt-out

Economic Development/JobsKiller

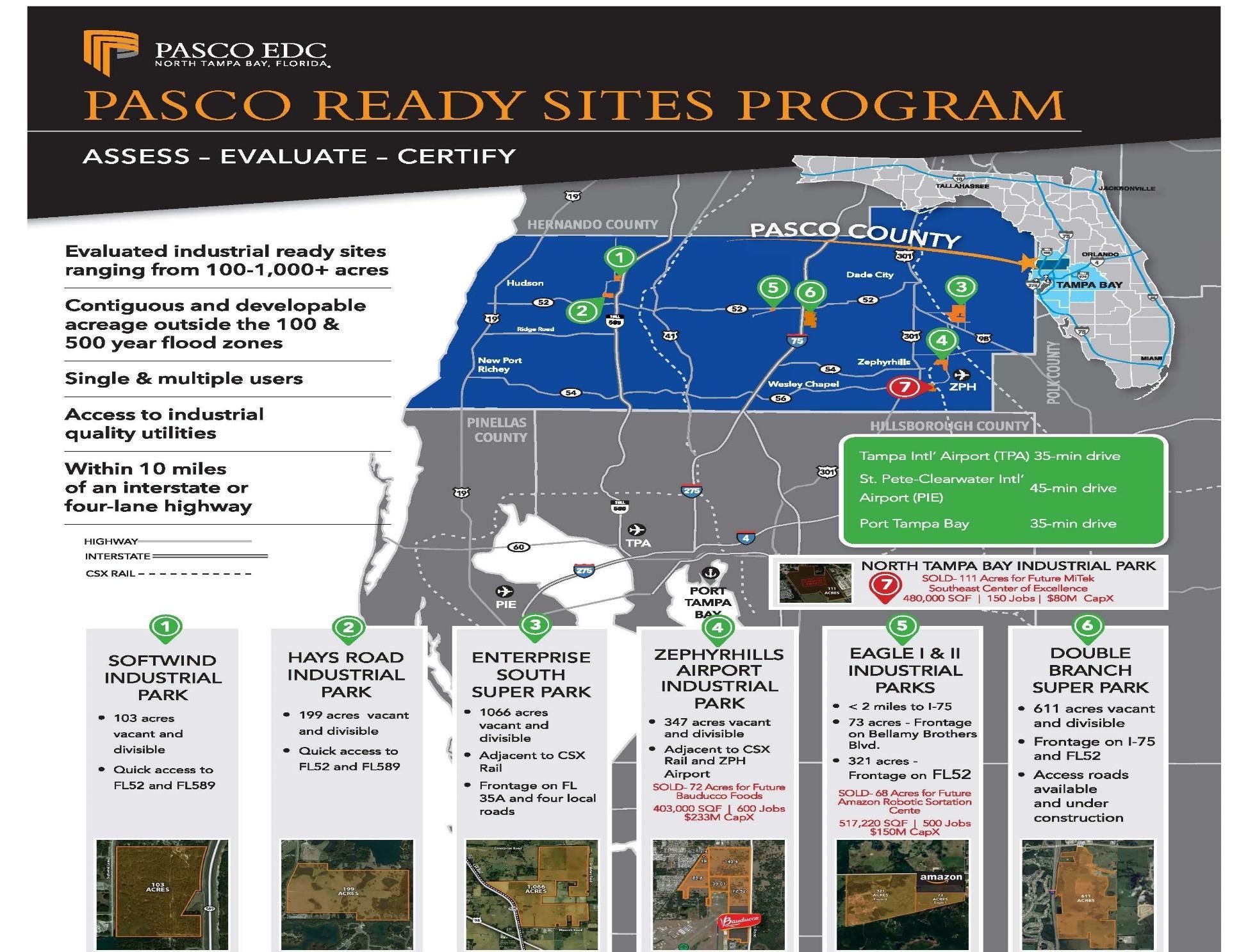

➢The land use/zoning preemption allows commercial and industrial sites that local governments have reserved for job creation to be administratively converted entirely to residential uses, which exacerbates jobs to housing deficits for counties like Pasco

➢Existing and prospective light industrial businesses have expressed apprehension being located proximate to multi-family residential development

➢In some cases, the state or local government have expended significant funds on infrastructure to support these job creation sites assuming that they would remain commercial or industrial sites

Economic Development/JobsKiller

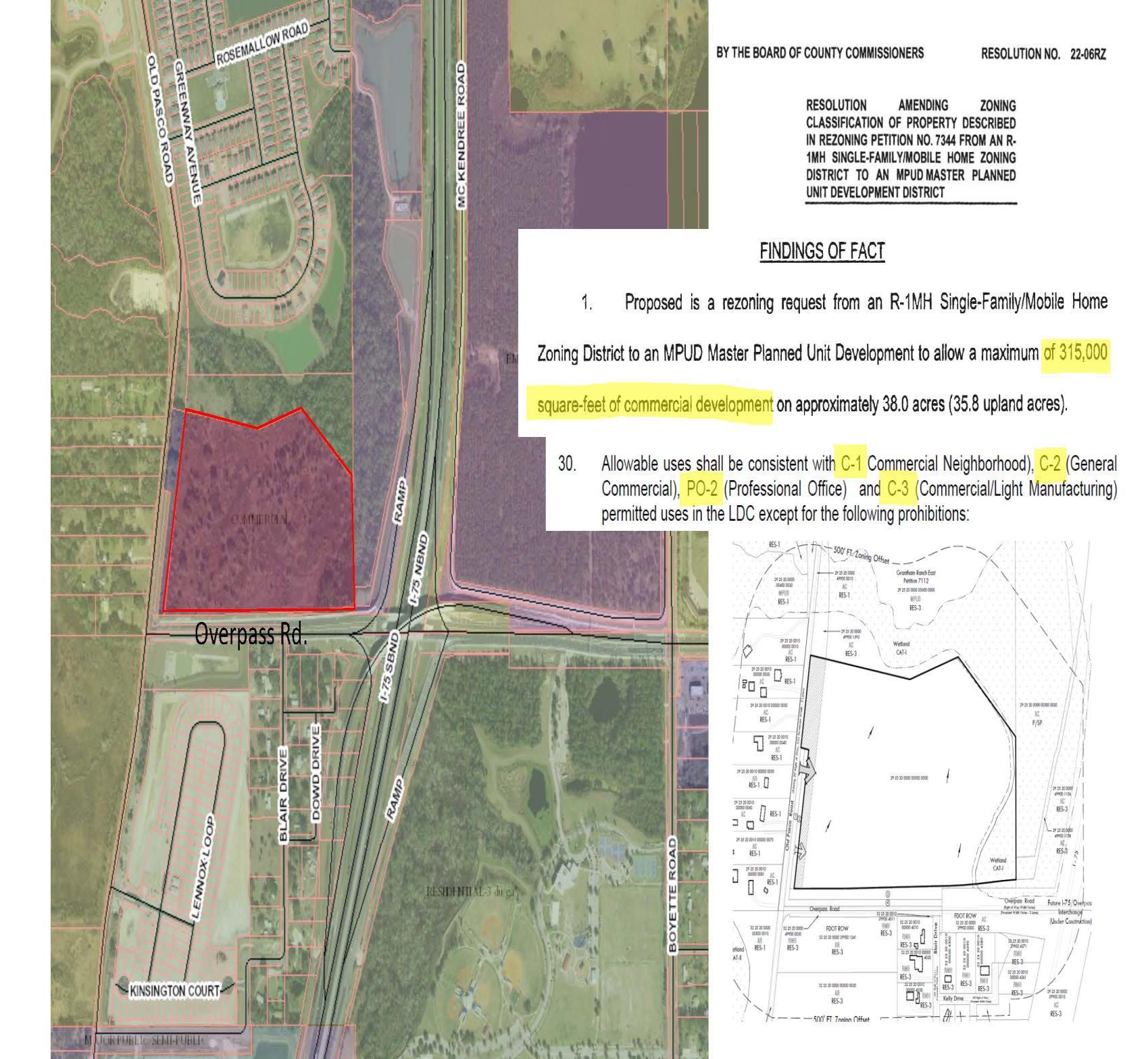

➢The State and Pasco County have spent over $64 million on a new interchange at Overpass Road and I-75, which has been open for less than a year

➢In addition, Pasco County is about to spend approximately $25 million on the widening of Old Pasco Road adjacent to this site

➢In recognition of this infrastructure investment, in 2022, Pasco County changed the future land use classification and zoning of the property at the northwest quadrant of the new interchange to allow exclusively commercial, office, and light manufacturing uses. The Comprehensive Plan and zoning for this site specifically prohibited residential uses.

Economic Development/JobsKiller

➢After the Live Local Act was adopted, the property owner contacted the County to state that they intend to invoke the Live Local Act to convert the site to predominantly multi-family housing

➢As a result, Pasco County will lose not only the jobs that would have been created on the site, but also a significant portion of the ad valorem tax revenue that the County was anticipating from the site to help reimburse the County for its significant infrastructure investment

➢Pasco will also now be forced to provide residential services (schools, parks, libraries, public safety etc.) to a site where it was not anticipating a need for residential services

➢Existing Pasco residents are deprived of a chance to “Work Local”, forcing longer commute times

DUEPROCESS?

➢The Live Local Act land use/zoning preemption effectively changes the land use and zoning of commercial, industrial and mixed use property to multifamily

➢This change was made without any required notice and opportunity to be heard to those adjacent property owners who may have purchased their property in reliance upon the existing land use and zoning

➢Double standard—local governments are required by state law to provide notice and an opportunity to be heard before making these types of land use and zoning changes

➢SB 1730 exacerbates issue—even if notice provided, no quasi-judicial body that the administrative approval can be appealed to for an “opportunity to be heard”

ImpairmentofContract

➢Live Local tax exemption does not exclude bonded millage—appears to be unconstitutional impairment of general obligation bonds

➢PUDs in many jurisdictions are considered a “contract” or “agreement” between the developer and county; inclusion of PUDs in SB 1730 appears to impair that agreement

➢Many PUDs have multiple developers and caps on total trips or entitlements; one developer in PUD invoking Live Local could effectively take away existing trips or entitlements from another developer and impair their contracts

➢Early version of SB 1730 would have also preempted local government restrictive covenants and development agreements; likely removed over impairment of contract concerns

CharitablePurpose?

➢Archer v. Marshall, 355 So. 2d 781 (Fla. 1978)—requires all exemptions from property taxes to have a constitutional basis; reason most property tax exemptions require voter approval of constitutional amendment

➢Live Local tax exemption was declared to be “charitable purpose” under Article VII, section 3(a)

➢Pasco has argued that granting a tax exemption to a for-profit corporation charging market rate rent is not a “charitable purpose,” particularly when (a) Pasco has no deficit of rental housing at the rents being charged, and (b) there is no requirement that the apartment complex actually reduce its rents to qualify for the tax exemption

ExpenditureofPublicFundsforaPrivatePurpose

➢Article VII, section 10 of the Florida Constitution prohibits the expenditure of ad valorem taxes for a predominantly private purpose

➢Live Local tax exemption effectively requires counties to use their taxing power to aid a for-profit apartment complex charging market rate rents— predominantly a private purpose

➢Live Local land use/zoning preemption effectively requires counties to spend public funds to monitor the “affordability” of for-profit market rate apartments for 30 years—predominantly a private purpose

Arbitrary andCapricious/LackofUniformity

➢Live Local tax exemption does not include (a) apartments not built in last 5 years, (b) most apartments with 70 or less units, and (c) owner-occupied housing, even if such housing is restricted to at or below 80% AMI (and helping address affordable housing deficit)

➢Does not ensure that all ad valorem taxation is at a uniform rate, which could violate Article VII, section 2; Article VII, section 4; and Article 1, section 9 of the Florida Constitution

➢Live Local land use/zoning preemption does not include multi-family zoning districts, and does not allow owner-occupied affordable housing to obtain the benefit of the preemption—arbitrary and capricious exclusions that do not further the stated purpose of the Live Local Act

OverRelianceonShimbergReportforOpt-Out

➢Shimberg Report was designed to provide a general report on the status of affordable housing in the state, not to create a “pass/fail” test for jurisdictions to be able to opt-out of a tax exemption

➢Shimberg Report has a margin of error; some jurisdictions have such a small deficit that it could fall in this margin of error (e.g., Lee, Citrus, Marion, Flagler, Charlotte, Indian River)

➢Shimberg Report utilizes Census and American Community Survey data that can be up to 2 years old; does not consider recent construction

➢Shimberg Report reports by MSA; does not report surpluses/deficits for individual counties in the MSA (Pasco’s supply of rental housing at 120% and 80% AMI is much higher than Tampa Bay MSA based on recent Pasco-only study)

PotentialFutureLegislativeSolutions

➢Allow for similar opt-out from land use/zoning preemption if county has no need at 120% of AMI

➢Limit the land use/zoning preemption to commercial and industrial redevelopment sites

➢Allow the local government to remove key commercial and industrial sites, on an acre for acre basis, for multi-family zoned land that the local government subjects to the preemption

➢Allow for at least a 5% deviation for the opt out to account for (a) recent construction not reflected in the data, (b) individual county variations, and (c) statistical margins of error

Questions?

➢Can email additional questions to dgoldstein@pascocountyfl.net

➢Or call 727-847-8120