2 minute read

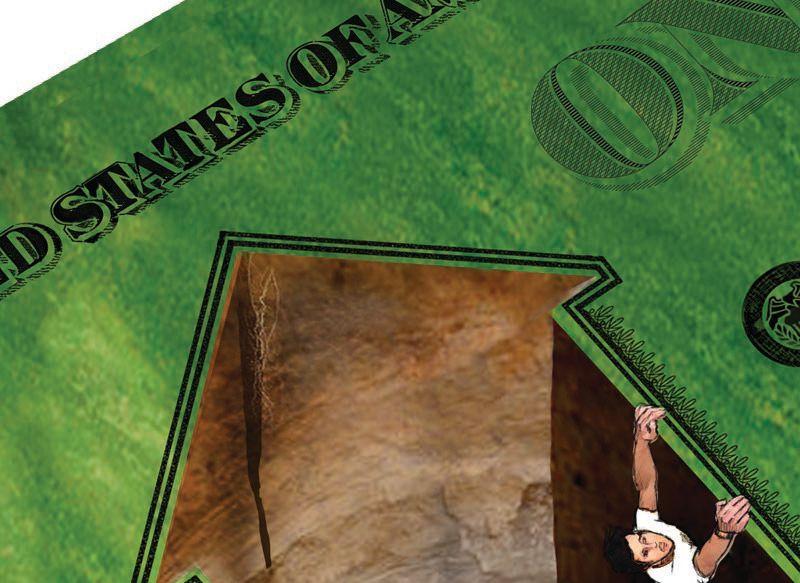

WHEN A SINKHOLE MAKES YOUR WORLD CRUMBLE AROUND YOU

WRITER: HEATH NAILOS // ILLUSTRATOR: ANTHONY CASTO

Disastrous sinkholes are relatively rare, but recent sinkholes that have opened up locally and around the state have many homeowners wondering: Does my insurance cover that?

In most states, the answer is no. However, in Florida, home insurance providers are required to offer coverage for “catastrophic ground cover collapse,” which covers the insured if his or her home or property is damaged due to a sinkhole. By law, insurers must also offer additional separate coverage for other sinkhole damage.

Under Florida law, “catastrophic ground cover collapse” is defined as geological activity that cover results in all of the following:

• The abrupt collapse of ground cover;

• A depression in the ground cover that is clearly visible to the naked eye;

• Structural damage to the building, including the foundation;

• The insured structure being condemned and ordered to be vacated by the government agency authorized by law to issue such an order for that structure.

In other words, if a sinkhole swallows your home or part of your home outright, you should be compensated through a typical home insurance policy. Beyond that, things can get confusing, and in some cases, nightmarish scenarios have played out for policyholders and providers alike.

Because of recent changes in Florida statutes, structural damage that’s not as severe as that outlined in the list above has been largely written out of insurance claims.

WHAT DOES YOUR POLICY COVER?

It’s wise to talk with your insurance agent to determine if you are covered against sinkhole damage, and if any optional coverage is available.

If you do have sinkhole coverage, don’t drop it without consulting your attorney.

WHEN DO I CALL FOR HELP?

While stair-step cracks and cracks in floors and foundations are often caused by routine settling of homes, damage from an actual sinkhole may be as minor as a cracked sidewalk or as large as a swallowed home, (such as the headline-grabbing sinkhole that opened up in Seffner, near Tampa, and resulted in loss of life). Actually, as many as 99 percent of “sinkholes” are not actually holes.

Repairing a sinkhole house typically costs more than $100,000 and if not handled correctly can affect the value of your home.

WHAT CAN I DO TO PROTECT MYSELF?

Property insurance issues can be highly complex. Homeowners worried about their coverage should first go over it with their insurer. It is also very helpful to have an attorney who knows the relevant laws and how claims are filed look at it. The time spent could save you a lot of money down the road.

If problems or concerns arise, you want to consult with an attorney who understands not only the legal aspects of these cases, but also the technical aspects of them. An attorney experienced in property law can go to your house, look at it with you and help you consider your options. Sometimes it’s better to make a claim — other times not.

The initial consultation should be free, so there’s no reason not to include an attorney on your team. Then, should you have a claim later on, your attorney will be at your side to ensure you are treated and compensated fairly.