THE INCOMPARABLE FALCON 6X AT THE SINGAPORE AIRSHOW

THE INCOMPARABLE FALCON 6X AT THE SINGAPORE AIRSHOW

The People’s Liberation Army Air Force’s Bayi Aerobatic Team wows the Singapore Airshow crowd with its first-ever demonstration of the Chengdu J-10C fighter outside of China. The team’s last Singapore Airshow aerial display was in February 2020.

By Charlotte Bailey

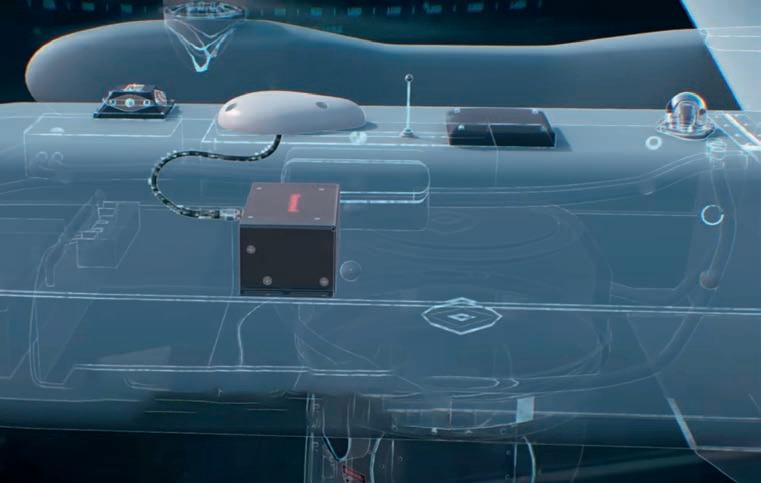

Singapore Technologies (ST) Engineering continues to expand its aerospace offerings with a renewed focus on artificial intelligence and autonomous technologies. Speaking to reporters on the eve of the Singapore Airshow, the company noted that such multidisciplinary capabilities remain essential across various domains and acknowledged that these technologies are growing increasingly relevant on the battlefield.

An example of ST Engineering’s autonomous innovation is the DrN-600 uncrewed aerial system (UAS), its largest cargo drone to date, which has been in development for two years. The lift-and-cruise-configured aircraft features propeller-enabled thrust vectoring and swappable lithium-polymer batteries that provide a range of up to 120 kilometers.

A 1.5-cubic-meter cargo space can accommodate up to 100 kilograms on standard pallets.

Flight testing of the DrN-600 will be conducted at an as-yet-unspecified location outside of Singapore, a company representative told AIN. Certification is targeted for 2028, building on operational experience accumulated since 2018 with smaller UAS variants. ST Engineering intends to gather additional insight and customer feedback from operational trials with the prototype prior to entry into service.

Other ST Engineering solutions making their debut at the Singapore Airshow this week include the AXIOS aerial exploitation and intelligence ordnance system, which is a drone-agnostic multi-payload delivery solution. ST Engineering has also developed the Gemini-X airborne tactical continues on page 22

ENGINES

Robotic Maintenance

Pratt & Whitney’s Singapore facility breaks service records with robotic systems | 04

ELECTRIC AVIATION

APAC eVTOL Debut

Vertical Aerospace’s Valo eVTOL mockup shows a possible way to fly in the future | 06

SPACE

Summit Soars

The inaugual Space Summit drew large crowds on the eve of the Singapore Airshow | 12

OEMS

Commercial Programs

Airbus and Boeing face a significant number of challenges and opportunities | 16 alerts

By David Donald

Korea Aerospace Industries (KAI) has been developing autonomous air vehicle capabilities and recently unveiled two collaborative combat aircraft (CCA) intended to act as “loyal wingmen,” or adjunct platforms, to crewed fighters. They were first shown at the ADEX show in Seoul in October and are making their international debut in Singapore.

Known as the Small Unmanned Collaborative Aircraft (SUCA) and Medium Unmanned Collaborative Combat Aircraft (MUCCA), they are, respectively, an air- or ground-launched expendable 330-pound vehicle and a runway-launched reusable 11,950-pound pilotless aircraft.

SUCA draws on technology from the company’s Adaptable Aerial Platform, which incorporates an AI agent for autonomous control. The catapult-launched, turbojet-powered version is undertaking flight tests to validate and refine the AI pilot for missions such as pinpoint attack and defense suppression. The vehicle can fly to Mach 0.65 and a range of 220 nm. It can carry a 55-pound modular payload. MUCCA is a much larger machine, similar in size to a light attack jet/advanced trainer. Powered by a single 4,100-pound-thrust turbofan, the aircraft has a range of 1,400 nm and a maximum speed of Mach 0.85, the latter permitting

Aviation Industry Corporation of China (AVIC) is heavily promoting the J-35 stealthy multirole fighter at the Singapore Airshow, with a large-scale mockup dominating its hall exhibition and J-35 branding to the fore on its chalet. The aircraft is being o ered as a low-cost alternative to the Lockheed Martin F-35.

Beginning life as the FC-31, the aircraft underwent a considerable redesign that led to the J-35, a carrier-capable aircraft with twin nosewheels. A naval prototype first flew in October 2021, and the type is now in production at Shenyang for the People’s Liberation Navy. Last September, a prototype became the first

AVIC’s J-35 is available in a naval version and, with non-folding wings, for air forces.

it to fly alongside crewed aircraft such as the Republic of Korea Air Force’s KAI KF-21, Boeing F-15, and Lockheed Martin F-35 during missions. Intended to be reusable, but with a low cost making it attritable, MUCCA can operate on autonomous missions or controlled by crewed platforms. In the latter application, it would typically fly ahead of the main force to target critical facilities and engage defenses in hostile airspace. The maximum payload is 2,650 pounds carried in internal bays and can include various effectors such as precision-guided munitions up to a single 2,000-pound weapon. The MUCCA can also air-launch SUCA vehicles. z

fifth-generation fighter to launch from a carrier using an electromagnetic launch system during trials aboard Fujian. Production is underway for the J-35A for the People’s Liberation Army Air Force (PLAAF), with a single nosewheel and smaller non-folding wings. The first PLAAF J-35As entered service last year, ahead of the navy’s J-35s, although operational capability for both the aircraft and the carrier Fujian is imminent.

The J-35A forms the basis for the principal export version now being marketed internationally. Its stealthy characteristics, distributed aperture system, and electro-optical targeting system are broadly similar to those installed in the F-35. Having used various other engines in earlier prototypes and trials aircraft, power for the J-35 now comes in its definitive form with a pair of Guizhou WS-19s, each rated at around 25,000 to 26,000 pounds thrust. D.D.

By Chad Trautvetter

Pratt & Whitney’s Eagle Services Asia facility in Singapore is the hub for the RTX company’s engine MRO services throughout the region, performing maintenance on the PW1100-JM Geared Turbofan (GTF) and the PW4000. It also serves as the innovation and technology incubator for the rest of the P&W engine services network, notably robotic systems that stack low- and high-pressure compressor sections, cutting process times by about 50% and man-hours by 70% or more.

The 370,000-sq-ft Singapore complex comprises two main buildings—Eagle 1 and Eagle 2, which handle engine inspection/assembly and disassembly, respectively. While Eagle Services Asia was established in 1978, the Eagle 1 building came online in 2018, and the 48,000-sq-ft Eagle 2 opened two years ago. Two engine test cells are also on the property. Thanks to the second building and increased use of automation for inspections and assembly, the Singapore location has increased its service volume by 40% annually since the start of 2024, according to Eagle Services Asia general manager Gilbert Sim. Overhauls of the GTF engine that powers the Airbus A320neo account for about 70% of the facility’s volume, while the remainder is for the PW4000, he told AIN. The latter engine is on the Boeing 747, 767, and 777, as well as the Airbus A300, A310, and A330.

About a third of the work at the Asia facility is now automated, improving consistency and accuracy, not to mention making Eagle Services Asia the highest-volume heavy engine services provider among the 17 Pratt & Whitney GTF MROs, Sim said. Much of the automation came from employee suggestions, he added.

Although the disassembly process is lowtech, the company now employs an automated robot at Eagle 2 that takes photos of inboarded engines before they are torn down. “This ensures we’re taking the exact same set

of photos for each engine,” Sim noted.

These images are digitally enhanced and help determine if any engine components are missing—some operators remove them in whole or in part before sending in engines for overhaul. In addition, the photos are used to generate an automated report, reducing manhours by 90% for this task.

Meanwhile, its Eagle 1 facility leverages far more robotic technology for both inspections and assembly, and that will only grow in the coming years, according to Sim. Inspection times are more than halved by collaborative robots fitted with a vision system and customized fixtures.

For example, a robotic system that inspects integrated bladed-rotor disks on high-pressure compressors improves reliability and repeatability while reducing inspection time from three

hours to about one hour. A human inspector is still required to review the images, though the company is exploring the use of artificial intelligence to further automate the process, Sim said.

Automation stacking systems for the lowand high-pressure compressors and core sections are where the technology really shines. Robotic arms handle heavy and oven-heated compressor and core stages with ease and precision, improving stack consistency, reliability, and safety. They also greatly reduce process times and man-hours.

Alfred, the automated robot that stacks high-pressure compressor sections, halves the processing time and reduces man-hours by 85%. It also increases worker safety, handling stages heated in an oven to 245 deg C without breaking a sweat. (The metal expansion aids in assembly.)

A low-pressure compressor assembly robot, dubbed Atlas, is now in testing and expected to come online by April. Future areas of automation include turbine section stacking, according to Sim. Eagle Services Asia is also exploring how AI could speed up inspection work at the facility. z

Pratt’s Eagle Services Asia facility here in Singapore (left) is pioneering automation to reduce process times for engine inspections and assembly. Atlas (below) uses a robotic arm to stack low-pressure compressor sections.

By Charles Alcock

Vertical Aerospace expects the Asia-Pacific to be the biggest market for early use cases of eVTOL aircraft such as the six-passenger Valo model it aims to bring to market in 2028. The UK manufacturer already has prospective operators in that region, including Japan Airlines, Air Asia, and leasing group Marubeni.

At the Singapore Airshow, Vertical is displaying a mockup of the Valo, which features several design changes from the VX4 prototype that it has been flight testing since 2022. The new design features what Vertical claims is a more aerodynamic airframe with an

under-floor battery system, a redesigned wing, and new propeller architecture.

The Valo is expected to have a range of up to 87 nm and top speed of just over 130 knots. Vertical said the initial premium version of the cabin will have four seats with room for two more to be added for some applications, and space next to the pilot for “an observer.” Each passenger will be able to bring one checked bag and a smaller bag on board.

According to Michael Cervenka, Vertical chief commercial and strategy officer, the airlines plan to deploy the eVTOLs on airport

The Republic of Singapore Air Force’s latest uncrewed air vehicle is making its public debut at the Singapore Airshow. Hermes 900s are being supplied by Israeli company Elbit Systems to replace the same company’s smaller Hermes 450s, which entered RSAF service in 2007. The long-serving IAI Heron 1s are also due for replacement. The Hermes 900 has an endurance of up to 36 hours and can be configured for various roles, including maritime surveillance. In this role, it could further the coverage provided by Singapore’s forthcoming Boeing P-8 Poseidons. Other Hermes 900 users in the region are the Philippines and Thailand.

shuttle services. However, the ability to carry six people opens possibilities for lower-cost services in markets such as India, as well as Malaysia and Indonesia for cross-border routes to Singapore. “The Asia-Pacific region will be a dominant market for eVTOLs because it has a lot of megacities where ground connectivity is challenging,” Cervenka told AIN.

Typically, the Valo will operate on routes of between 17 and 44 nm. Vertical is working on plans for a hybrid-electric version that could have a higher payload and fly up to 261 nm with passengers on board.

Sightseeing trips and connections to major sporting events are among the anticipated applications, and Vertical is also in talks over possible defense use cases, which could involve uncrewed versions of the hybrid aircraft, carrying more than a tonne of equipment for surveillance flights of up to 870 nm.

Vertical is close to completing full transition test flights with its full-scale, piloted prototypes. During 2026, the company says it will complete the critical design review for the Valo. It is preparing to start building the first of seven prototypes for the new design, with five of these to be used for flight tests and the other two for ground tests, all leading to type certification.

The hybrid-electric aircraft will have an as-yet-unspecified turbogenerator and a fuel tank that Vertical says can be accommodated in the standard Valo airframe. Four of the eight battery packs will be removed for the hybrid-electric version. z

Air India has started operating Boeing 787-9 airliners with new cabin interiors and Thales’ Avant Up in-flight entertainment system.

By Charles Alcock

The first of six Air India Boeing 787-9 widebodies equipped with Thales’ Avant Up in-flight entertainment (IFE) platform entered service on Sunday. India’s flag carrier displayed the updated aircraft at the Wings India show in Hyderabad last week.

Air India’s IFE upgrade is part of a cabin interior design and fleet renewal for the airline’s Dreamliners overseen by JPA Design. This has resulted in new interiors for the economy, premium economy, and business class cabins.

The new IFE system supports the latest iteration of Air India’s Vista IFE offering with more than 3,000 hours of content in multiple languages. The hardware and software package includes Optiq 4K QLED HDR displays with a new user interface for features such as interactive 3D maps and route programming. The installation includes Bluetooth connections for wireless headphones and other devices, plus Thales’ Pulse power supply for up to 60 watts of in-screen USB-A and USB-C high-speed charging.

According to JPA, its cabin design is the

first work it has done for Air India’s twinaisle fleet and reflects “contemporary Indian identity.” Signature colors include soft cream, pink, reds, warm golds, and rich purples.

In all cabins, improved stowage spaces for passengers have been included, plus new surfaces and finishes throughout the aircraft interior with what the design bureau described as soft curves and warm lighting cues.

“Our design goal was to create an interior that feels modern, elegant, and deeply considered, while staying true to the vibrancy and warmth that define Indian hospitality,” said Richard D’Cruze, managing director at JPA Design. “Every detail has been designed to bring Air India’s renewed ambition to life, delivering a world-class experience for passengers from the moment they step on board.”

Last Thursday, Air India confirmed orders for 30 more 737 Max narrowbody jets that took its order backlog with Boeing to 200. Announcing the deal at the Wings India show, the airline finalized previously agreed incremental purchases of twenty 737-8s and confirmed it is the customer for 10 more 737-10s that were already included in the airframer’s orders tally. z

Qantas has announced plans for a multi-million-dollar upgrade of its regional QantasLink fleet, with wholly-owned subsidiary Network Aviation to benefit from a variety of cabin refurbishments. An initial three of a potential order for 14 Embraer E190s are also set to start arriving by the end of the year, replacing Network Aviation’s aging fleet of Fokker 100s.

Cabin enhancements across Network Aviation’s 28 Airbus A319s and A320s will include installation of airborne connectivity. Passengers will also benefit from new seats equipped with charging ports and portable device holders. The first refurbished aircraft is expected to enter service later this year, with the full program to be completed in early 2027.

Meanwhile, Network Aviation has also secured what Qantas terms its first three “mid-life” Embraer E190s, which will also begin arriving in 2026. The gradual introduction of the E190s will complement Network Aviation’s acquisition of A320s from Jetstar Asia, which ceased operations in July 2025.

Network Aviation’s fleet of more than 35 aircraft typically operates 600 flights per week to 25 destinations across regional Western Australia.

The aircraft acquisitions form part of the Qantas Group’s broader fleet renewal program, with the first new types arriving in 2023. Deliveries of more than 200 new aircraft are set to continue into the next decade, including the Airbus A350-1000 from late 2026. This will operate direct flights from Sydney to London and New York under Qantas’ Project Sunrise initiative.

Qantas said its investments in both new aircraft and enhanced onboard o erings will “help improve reliability, reduce fuel burn per seat, and create a more consistent experience for millions of Australian travelers.” C.B.

Where ‘what ifs’

By Charles Alcock

Year-end airline passenger traffic data released by IATA last Thursday served up hearty ground for optimism, but came with the caveat of ongoing concerns over supply-chain constraints on the industry’s ability to satisfy rising demand. The figures for the Asia-Pacific region were especially encouraging for airframers exhibiting at this week’s Singapore Airshow, with this part of the world dominating global market share.

In 2025, Asia-Pacific airlines accounted for 34.5% of revenue passenger kilometers (RPK)— ranking ahead of Europe (26.6%), North America (21.8%), the Middle East (9.5%), Latin America and the Caribbean (5.4%), and Africa (2.2%). The region generated year-on-year load factor growth of 7.8% and a 6.5% boost in available seat kilometers (ASK), IATA’s measure of air transport capacity.

Globally, RPK increased by 5.3% over 2024,

while ASK grew by 5.2%. It was also a record year for the international load factor average, which reached 83.7%.

IATA concluded that supply-chain issues for aircraft manufacturers were the “biggest headache for airlines” last year. The industry group expressed hope that 2026 could mark a rebound after what it said marked a nadir for the supply chain crisis in 2025.

“People clearly wanted to travel more, but airlines were continually disappointed with unreliable delivery schedules for new aircraft and engines, maintenance capacity and constraints, and resultant cost increases that are estimated to exceed $11 billion,” complained IATA director general Willie Walsh. “Airlines scrambled to accommodate the demand by keeping aircraft in service longer and filling more seats on every flight.”

On the eve of this week’s Singapore Airshow, expectations for new airliner sales seemed muted, compared to previous shows

and those in other regions. “In the commercial [airline] market, where they have already ordered 10 years of backlog, I don’t expect many new orders,” Joshua Ng, a director with Singapore-based consultants Alton Aviation, told AIN

According to Alton, Asia-Pacific air transport started last year strong but became destabilized amid the anticipated fallout from U.S. President Donald Trump’s tariffs targeting multiple states in the region. In the company’s view, the consequences were not as impactful on airlines as might have been expected, which would explain the strong growth recorded by IATA.

“Even though there is strong traffic growth, airlines are not making as much money due to continued uncertainty over tariffs and the impact on yields and profits,” Ng said. “The only saving grace is that oil prices went down, and the airlines benefited and managed to keep profits flat, at least.”

Meanwhile, airliner fleets are aging and becoming progressively less cost-efficient due to increasing maintenance costs. “The average age [of airliners] compared with pre-Covid is around two years older, and so airlines are operating much older aircraft than they would have liked,” Ng explained. “We are not expecting new aircraft production rates to recover fully until 2027 or 2028, but the leasing market is doing well.”

Alton sees shifts in the Asia-Pacific aerospace manufacturing ecosystem, where the industrial base has historically been concentrated in Japan, China, and South Korea. “We are increasingly seeing companies in countries like India and Malaysia taking a bigger slice of the supply-chain pie for activity such as composites. With [airframing] work increasingly being dual or triple sourced, Southeast Asia is a big beneficiary.”

With geopolitical shifts around the U.S., its NATO allies, Russia, and China threatening defense insecurity worldwide, Alton also sees a pivot towards military markets in the Asia-Pacific region. “There are many new manufacturers trying to compete on the defense side in countries like Korea, Taiwan, Japan, and India, and the [Singapore] show is a good time for them to be promoting their technology.”

Since our first delivery in 1978, Embraer has expanded across APAC, contributing to the aerospace and defense industries, strengthening partnerships, and fueling local growth.

Today, that commitment supports an ecosystem that keeps Embraer fleets flying reliably across the region, connecting people and opportunities.

Guided by innovation and sustainability, our journey in Asia Pacific continues, with exciting possibilities ahead.

embraer.com

By Charlotte Bailey

In a first for its Singapore Airshow presence, Airbus is presenting a dedicated area focusing on its uncrewed aerial systems (UAS) offering, something the manufacturer says underscores its “growing position as a key player in the UAS market.”

UAS solutions on display include Airbus Helicopters’ Flexrotor VTOL tailsitter, the Aliaca family of UAS it acquired from Survey Copter in October, and the Sirtap high-performance tactical drone developed by Airbus Defence and Space. Assembly of its first Sirtap prototype was completed last June, ahead of a ground-testing campaign scheduled to run throughout 2026.

Increased market traction for its drones was reinforced during the company’s January earnings call, during which Airbus Helicopters CEO Bruno Even noted that integrating UAS systems into the company’s core operations was helping create a “comprehensive range of tactical drones.”

“By combining drones with our advanced and unique HTeaming capabilities, [Airbus can] provide a seamless, networked ecosystem for the modern battlespace,” Even added. According to Airbus, its HTeaming solution “offers additional mission capabilities by extending sensor range

The 10th edition of the Singapore Airshow opened this week with a new addition to its program: the Space Summit, a two-day conference and exhibition dedicated to the rapidly expanding global space economy. On the opening day, Singapore’s government announced plans to launch a national space agency on April 1.

Organized by Experia Events, which runs the Singapore Airshow, the Summit is taking place on February 2 and 3 at Sands Expo and Convention Centre at Marina Bay Sands.

Under the theme “New Frontiers: Shaping a Responsible and Inclusive Space Future,” the Space Summit agenda includes plenary sessions and panel discussions focused on infra-

structure, regulatory frameworks, sustainability, and commercialization pathways.

The inaugural Space Summit arrives at a pivotal moment for the global space sector and for the Asia-Pacific region, Leck Chet Lam, managing director of Experia Events, told AIN.

“The global space economy is really growing at a very fast pace,” he said, citing McKinsey research that projected the global space economy will be worth $1.8 trillion in 2035, nearly triple the $630 billion it estimated for 2023. With a projected average compound annual growth rate of 9%, the global space economy is growing about twice as fast as the global GDP.

Meanwhile, “Asia-Pacific is one of the fast-

far beyond the aircraft’s line of sight.”

In March 2025, Airbus signed an agreement with Australian aerospace start-up Drone Forge to collaborate on the development and operational integration of the Flexrotor UAS. At the time, Airbus explained: “Designed as a force multiplier for diverse missions...this partnership signals strong confidence in our Flexrotor capabilities and offers perfect crewed-uncrewed teaming possibilities for aircraft operators.” The Flexrotor system is designed for ISR missions ranging from 12 to 14 hours and can accommodate a variety of payloads. z

est growing economic regions in the world, and one of the things that these growing economies are looking for are space-related services,” Lam said. For example, the region has seen increasing demand for satellite-based services such as GPS navigation, communications, Earth observation, climate monitoring, and national security applications.

“There’s a very huge drive with a huge demand in this growing part of the world for space technologies and space applications, so that’s also another key driver for us in wanting to launch this show,” Lam said.

For Singapore Airshow attendees, the summit o ers an opportunity to engage with an adjacent sector that increasingly overlaps with aviation and defense, underscoring how space is becoming an integral part of the broader aerospace ecosystem. H.W.

Military helicopters must be equipped to perform the most demanding battlefield missions in the harshest environments.

The AW149 is a latest-generation medium multi-role military helicopter that delivers the highly effective and survivable capability required by today’s armed forces, combining advanced technologies, equipment and weapons with unparalleled safety and performance characteristics.

The AW149 is optimised for a multitude of battlefield missions such as troop transport and re-supply/external load lift; medical and casualty evacuation; Search and Rescue (SAR) and Personnel Recovery; special forces operations; close air support/armed escort; Command and Control (C2); and Intelligence, Surveillance and Reconnaissance (ISR).

The AW149 blends performance, lower life-cycle costs and day/night all-weather capability in a single platform. The large, rapidly reconfigurable cabin can accommodate a wide range of role equipment and weapon systems to enhance operational effectiveness and survivability on the battlefield. The advanced open architecture mission system enables the quick and effective integration of mission-specific and customer-specific equipment, avionics, weapons and defence systems. The helicopter is day/night capable with a single pilot Night Vision Goggle (NVG) compatible, low workload glass cockpit.

The AW149 ensures unparalleled crew safety. Contributing to its superior battle survivability are high levels of ballistic tolerance of the blades, airframe and components, crashworthy fuselage and seats, energy-absorbing landing gear and structure. The main gearbox has a 50-minute dry run capability, while the helicopter also features self-sealing fuel tanks, a fully integrated defensive aids suite along with additional armour protection.

The spacious, unobstructed cabin and large sliding doors on both sides enable the rapid transport of heavily laden troops and mission equipment in support of high-tempo operations. The large sliding doors support fast roping and hoist operations, enabling troop insertion and extraction on the hover while allowing simultaneous cover fire from windowmounted machine guns. A large equipment stowage area for stretchers and medical kit can be accessed optionally from the cabin.

Around 90 AW149s have been ordered by operators worldwide to date in Asia, Europe and Africa, and it’s being evaluated by several new potential users globally.

By Hanneke Weitering

Honeywell Aerospace Technologies sees the Singapore Airshow as an opportunity to highlight its expanding role as a behind-the-scenes technology provider for civil and military aviation programs across the Asia-Pacific region, with a particular focus on autonomous systems, counter-drone capabilities, and resilient connectivity solutions.

The U.S. company, whose products are ubiquitous across all aerospace sectors, generates more than $17 billion annually in revenue from its aerospace business, with roughly 60% tied to commercial programs and the remainder to defense and space. Its international defense business now exceeds $2 billion, and customers in the Asia-Pacific region account for nearly one-third of that total, according to Matt Milas, president of defense and space at Honeywell Aerospace Technologies.

Japan, South Korea, and Australia are driving much of the recent growth as regional defense budgets rise and indigenous industrial capabilities expand, Milas told AIN. “We’ve been seeing a lot of the international interest

picking up, especially in the APAC region,” he said. “New OEMs are emerging, and there’s more of a desire for indigenous capability both for production and sustainment of defense assets, so we are working closely with each of the countries and their industrial partners to help them develop new programs and platforms, insert our technology into them, or help create sustainment capabilities.”

At the Singapore Airshow this week, Honeywell is showcasing technologies it developed for various civil and defense applications, including major air warfare platforms such as the multinational Global Combat Air Program, South Korea’s KF-21 Boramae multirole fighter, and the Turkish TF Kaan stealth fighter.

Among the innovations Honeywell is promoting is its system-agnostic approach to counter-UAS operations, which aims to minimize collateral damage. Honeywell’s counter-UAS approach leverages electronic warfare tools such as electronic jamming and radiofrequency takeover, as well as drone-on-drone interception, “so that you don’t have the drones you’re trying to take out causing unexpected damage to buildings or people,” Milas explained.

In September, Honeywell announced that it had successfully completed U.S. military demonstrations of its Stationary and Mobile UAS Reveal and Intercept (Samurai) system, a modular counter-drone platform it developed for moving ground vehicles in contested environments. Honeywell conceived the Samurai system by integrating detectors, sensors, and other components from defense manufacturers, including Blue Halo, Leonardo DRS, Pierce Aerospace, Silent Sentinel, Walaris, Rocky Research, and Versatol.

Autonomy is another major theme of Honeywell’s presence at the show this year. Honeywell is adapting technologies originally developed for advanced air mobility and eVTOL aircraft—where size, weight, and power constraints are critical—for use in military drones. These include compact fly-bywire systems, electromechanical actuators, and high-capacity thermal management hardware designed to keep avionics and mission systems cool on smaller platforms such as collaborative combat aircraft and other drones.

Connectivity and navigation technologies also feature prominently at Honeywell’s chalet. The company is showcasing its VersaWave system, a satcom solution for uncrewed aircraft that’s intended to support beyondline-of-sight operations and higher data throughput, even in GPS-denied or actively jammed environments. Lessons learned from the war in Ukraine, where GPS jamming and spoofing are common, informed the company’s efforts to fortify navcom systems against electronic attacks, Milas said.

Also on display at Honeywell’s chalet is the company’s next-generation cabin connectivity service, JetWave X, configured to connect to the new ViaSat-3 broadband satellite network that is expected to become operational this year. Beyond individual products, Honeywell is pitching its broader value proposition to regional operators and manufacturers: commercial-derived technologies that can be adapted quickly for defense use, lowering development costs and accelerating timelines. As Southeast Asian nations invest in new platforms and sustainment capabilities, the company sees opportunities to support both emerging OEMs and existing fleets throughout the region.

AINalerts delivers the news and intelligence that directors of aviation, chief pilots, flight department leaders, OEMs, MROs, and industry executives need to stay ahead. Trusted reporting, exclusive analysis—delivered straight to your inbox Monday through Friday.

Slots for Airbus’ A350 product line are sold out, giving Boeing an opportunity to meet airlines’ needs.

At the start of each year, Leeham News and Analysis (LNA) gives its assessment of the challenges and opportunities facing leading aerospace companies. These in-depth features are available to subscribers, and here is a summary of the AIN Media Group platform’s key takeaways for the world’s leading airliner manufacturers, Airbus and Boeing.

Lars Wagner, who succeeded Christian Scherer as president and CEO of Airbus Commercial Aircraft on January 1, faces an array of supply chain issues and key decisions over the future of the A220 program and prospects for open-fan engine technology.

Airbus seeks to ramp production of the A320 family to 75 aircraft per month by 2027, meanwhile boosting A220 production to 12 per month this year—a rate it aims to match for the A350 in 2028, followed by five A330s per month in 2029. Like its airframing rivals, engine makers, and other key suppliers, supply-chain stress continues to pose obstacles to these ambitions.

Quality-control issues on A320 fuselage panels that became public on December 1 pose another headache for Wagner. Those problems, among others, prevented Airbus from meeting its 2025 delivery target of 823 aircraft.

Over the next few years, Airbus’ leadership

the A220-300 into an aircraft the size of the A320neo. It also faces a choice as to whether to select CFM International’s RISE open-fan engine for the anticipated A320 narrowbody replacement in the coming decade.

On the supply-chain front, the integration of several former parts of Spirit AeroSystems—most of which Boeing acquired in December—is high on the agenda. Airbus now owns the following assets:

• Kinston, North Carolina site that makes A350 fuselage sections

• A350 fuselage line in Saint-Nazaire, France

• Casablanca, Morocco factory that makes A321 and A220 components

• A220 wing and mid-fuselage production in Belfast, Northern Ireland

• Prestwick, Scotland site that produces wing components for the A320 and A350

Additionally, A220 pylon production, which has been handled by Spirit’s facility in Wichita, is now moving to the Airbus plant at Saint-Eloi, near Toulouse, France.

Spirit had been reporting losses on the A220 and A350 work for years. These losses are now absorbed into Airbus’ profit and loss (P&L) reporting. Airbus not only has the challenge of integrating all the former Spirit operations into its processes; it must figure

out how to eliminate the costs that led to Spirit’s P&L losses.

The A220 has continued to operate at a loss since Airbus acquired the former Bombardier CSeries program in 2017. Wagner and his team now have to address how to breathe new life into the lower end of its narrowbody offering, while stemming financial burdens and resolving issues with its Pratt & Whitney Geared Turbofan engines.

On the upside, the A320neo family continues to dominate the single-aisle airliner sector, which is why boosting production rates is imperative for the European airframer.

Airbus’ North American nemesis, Boeing Commercial Airplanes, is looking to build on the progress it made in 2025 in returning to profitability while restoring its tarnished reputation for reliability, quality, and safety. It also faces some key challenges and important decisions this year.

The path to Boeing’s technical and financial recovery flows through production. It ended 2025 with FAA authorization to proceed to a production rate of 42 737s a month—up from the 38 limit imposed by the agency after the January 2024 accident in which a door plug

blew off a new 737 Max 9 after takeoff from Portland International Airport in Oregon.

For the 787, the production rate ended the year at seven per month. The rates for the 777F and 777X ticked over at a combined rate of between two and a half and three units. Production for the 767-300ER freighter and KC-46A military aircraft also ticked over at around the same rate.

Boeing expects to boost the monthly 737 rate to 47 by mid-year and 52 by year-end. However, some observers believe this may be optimistic. A survey of 35 suppliers by RBC returned a consensus that rate 52 won’t happen until 2027. Production of the 787 is expected to head to 10 per month by year’s end.

Once Boeing gets authority to boost the 737 rate to 52, it plans to activate its new North 737 production line at the Everett, Washington factory, which has been exclusively a widebody plant. Activation is slated for later this year. All Max 10 assembly lines will be in Everett.

One of the first decisions made by Kelly Ortberg, who was named Boeing CEO in August 2024, was to announce the termination of the commercial 767 program in 2027. The military 767-based KC-46A would continue. According to Cirium, the last 767300ERF will be delivered this year.

In October, Boeing announced that certification of the 777X widebody will slip to 2026 and entry into service to 2027 as the FAA continues its in-depth review of the company’s flight testing and other processes.

Boeing has some 30 777-9 models that have been built in open-air storage. Once certified, the FAA will require changes to these aircraft to reflect new information, software changes, and perhaps some hardware changes, but the extent remains unclear.

Development of the 777-8F freighter is underway. Service entry for this model is slated to be two years after the 777-9. The 777-8 passenger model is expected to follow about a year after the freighter.

In 2025, Boeing broke ground on an expansion of its 787 assembly site. Once completed in 2028, Boeing should be able to produce 14 of the widebodies each month. After a long sales drought, orders for the 787 poured in last year, filling current assembly line slots up to the next decade.

With slots for the rival Airbus A350 sold out and the A330-900 filling a niche role, Boeing was able to capitalize on near-term availability. Now, Boeing must add production capacity to continue winning deals. Even if Boeing gets the FAA’s authority this year to boost overall monthly production to 52 aircraft, the ability of the 737 to compete with Airbus’ A320neo family remains hampered, for now.

The smallest 737, the Max 7, and the largest, the Max 10, remain in certification limbo. Boeing hoped for certification in 2024, then 2025, and now 2026 as engineers address engine deicing issues. Southwest Airlines, the principal customer for the Max 7, said it

expects certification of this model in August 2026 and entry into service in 2027.

No date has been suggested for certification of the Max 10. However, activation of the North Line will presumably be tied to the anticipated date. Still, according to some LNA sources, certification for both airplanes will slip yet again, to 2027.

Hand in hand with production increases, Boeing is working to improve its safety and quality control protocols. The FAA won’t approve increased production rates unless it is satisfied that Boeing meets several key performance indicators and maintains performance on these. z

Leeham News and Analysis is the premier source for in-depth aerospace and airline industry insights. Its team of highly experienced journalists and analysts provides coverage of topics including airframe and engine manufacturers, the aerospace supply chain, airline fleet planning, future technology, and maintenance, repair, and overhaul.

LNA is led by Scott Hamilton, founder and managing director of the Leeham company, and aeronautical and economics analyst Bjorn Fehrm. Subscribers, who include C-suite industry leaders, have exclusive access to its expert coverage. LNA and AIN news teams are increasingly collaborating on this content, making some of it available across AIN platforms, including the FutureFlight weekly newsletter, and show daily publications.

AIN acquired LNA in 2025, although the Leeham Co. LLC and Leeham Consulting businesses remain independently owned and operated.

By Charles Alcock

Growth in business aircraft activity in Southeast Asia was the motivation for ExecuJet MRO Services’ investment in a new maintenance, repair, and overhaul (MRO) facility in Kuala Lumpur, a move the Malaysian company expects will be fully vindicated by rising demand in 2026. The 149,000-sq-ft complex is on the opposite side of Sultan Abdul Aziz Shah Airport (WMSA) from its previous base, providing the space it needs to expand the scope of its services and accommodate up to 15 aircraft at a time.

The Malaysian capital’s second airport (formerly known as Subang) is one of 13 locations worldwide for the South Africa-based group, and it has operated there since 2009. The company’s portfolio of MRO capabilities expanded to include the Falcon family of business jets when it was acquired by Dassault Aviation in March 2019, and it continues to support other types, including those made by Gulfstream and Bombardier.

According to Ivan Lam, ExecuJet MRO Services’ regional vice president for Asia, over the past 12 months, the company has boosted its workforce by 18% to employ 104 people. As part of its efforts to ensure that its workforce

has the required skills, the company operates its own training and apprenticeship program.

The new Kuala Lumpur facility has an overhead crane that makes the engine removal process far more efficient than the mobile crane the ExecuJet MRO Services team previously used. The company is now negotiating with a possible aircraft painting partner, which Lam said would be “the last piece of the jigsaw puzzle” to complement the cabin interiors refurbishment service it already provides.

In December, the facility secured EASA clearance to provide line and base maintenance for the Falcon 7X model in the latest extension to its array of approvals from 17 international regulators. The new hangar has doors, which is a specific EASA requirement, and the site also includes workshops and offices.

In addition to the European agency, the FAA, and Malaysia’s aviation safety authority, the company has been approved in Asian states including the Philippines, Thailand, Taiwan, Japan, Indonesia, and China. The operation, which is also certified by popular private jet registers such as San Marino, Aruba, and Bermuda, sends technicians throughout the region to provide aircraft-on-ground support.

ExecuJet MRO Services Malaysia provides

Jet Aviation is celebrating 30 years of operations in Singapore, marking the anniversary of its maintenance, repair, and overhaul and FBO facilities there. Established in 1995 and o cially launched at the Singapore Airshow the following year, the site was the business aviation services group’s first location in Asia. It is now Jet Aviation’s largest hub in Asia-Pacific, offering maintenance, refurbishment and modification, FBO, and aircraft services.

In 2006, Jet Aviation Singapore extended FBO services to Changi Airport, opened a new 5,000-sq-m maintenance hangar in 2014, and added a third 3,850-sq-m hangar in 2017. In 2023, the FBO launched onsite sustainable aviation fuel in partnership with FlyORO and, in late 2024, achieved IS-BAH Stage 3 accreditation.

“When we first arrived in 1995, business aviation in the region was in its infancy,” said Jet Aviation president Jeremie Caillet. “As a key location for travel in Asia and beyond, as well as an important global hub, Singapore has continued to develop as a center for the industry in APAC. Over the decades, we have committed to growing and evolving our sites and services to support this development.”

In 2025, Jet Aviation Singapore became the third Jet Aviation site to join the Airbus Corporate Jets service center network, and it is the network’s only member in Asia-Pacific. The site also underwent a renovation, with upgrades in the reception and crew lounges, plus 15 new customer o ces and meeting rooms. A.W.

authorized service center or dealer support for customers of engine OEMs including Pratt & Whitney, General Electric, Honeywell, RollsRoyce, and Safran. z

News and analysis covering cutting edge aviation technology and business models, including zero carbon propulsion, eVTOL aircraft, automation and autonomy, and new infrastructure.

The Gulfstream G800’s 8,200-nm range and spacious, flexible cabin are a major draw for potential Asia-Pacific customers.

By Charles Alcock

Economic growth and the need for flexible, intercontinental travel have made the AsiaPacific region a prime market for the new generation of long-range, large-cabin business jets. Gulfstream’s latest G800 and Bombardier’s Global 8000 now face competition from a new addition to Dassault’s Falcon family, the 10X. The rivals are priced between around $71 million and $81 million, with many variables including cabin interior options.

Gulfstream delivered the first example of the G800 last August, providing customers with an 8,200-nm range at a long-range cruise speed of Mach 0.85, or a faster Mach 0.90 velocity on sectors of up to 7,000 nm. The new model has replaced the earlier G650

and joins a product line that already includes the 7,750-nm G700, as well as the G600, G500, G400, and the recently launched G300.

“We are seeing great interest in and demand for the G700 and G800 in Asia-Pacific,” Scott Neal, Gulfstream’s senior vice president for worldwide sales, told AIN. “Safety, speed, and range are among the top performance attributes for customers in Asia-Pacific, and Gulfstream has been leading the industry in this space for more than a decade.”

The U.S. airframer now has almost 330 jets based across the vast region, including China, Southeast Asia, Oceania, and India. According to the company, the combination of range, speed, and spacious cabins that can accommodate up to 19 passengers in various configurations has proven to be compelling to customers

Cabin height, width, length, volume (excluding baggage area and flight deck)

Avionics Gulfstream Symmetry flight deck (Honeywell Epic)

Next-generation NeXus flight deck (Honeywell Epic)

Bombardier Vision flight deck (Collins Aerospace Pro Line Fusion)

Engines Rolls-Royce Pearl 700Rolls-Royce Pearl 10XGE Passport

Takeo distance (SL, ISA, MTOW) 5,812 feet 6,000 feet 5,760 feet

who need nonstop global connections from business hubs like Singapore and Hong Kong.

According to Neal, the G650, announced in 2008, was instrumental in building the Asia-Pacific business aviation market. He said that safety and performance available from the next-generation Gulfstreams, combined with the manufacturer’s cabin experience options, give “operators in Asia the opportunity to select an aircraft, or a fleet, that is tailored precisely to their mission requirements.”

According to Carlos Brana, executive vice president for civil aircraft at Dassault, buyers in this part of the world place a high value on having the latest technology and high levels of comfort. The French manufacturer has seen strong demand for its Falcons driven by rising wealth across the region, drawing new customers in countries including rapidlyindustrializing India, where it delivered its first 6X jet last year, as well as the Philippines, Indonesia, Vietnam, and Thailand.

“The level of modernization in this market is impressive, with a high priority for export activity,” Brana said. From his perspective, the 7,500nm range promised for the 10X will be compelling for Asia-Pacific customers, who he said also need the flexibility that business aircraft offer in a region where scheduled airline networks do not adequately serve all destinations, such as the multiple islands of the Philippines and Indonesia.

In Bordeaux, the French manufacturer is now preparing 10X prototypes for a flight test

program set to start in the early part of this year. It is targeting type certification and service entry in 2027.

China, once viewed by business jet sales executives as a key growth opportunity because of its population size, has experienced relatively flat market conditions in recent years. Several factors, including recovery from the Covid pandemic and political pressure on high-net-worth individuals, have inhibited demand.

Nonetheless, at Dassault, Brana has not given up on the People’s Republic, where he sees dynamic automotive and electronics sectors driving up demand for business aircraft. In addition to the 10X, the company offers the 6X (with a 5,500-nm range) and the threeengined 8X (6,400 nm), which is not restricted by extended twin-engine operations requirements on flights over oceans.

“The 10X will be a game-changer, not only for its range, but in terms of cabin and technology, and not only in Asia-Pacific, but also in regions like Latin America,” Brana said. “Connectivity and time savings are key factors.”

On December 8, Bombardier delivered the first of its Global 8000 jets, which, as its name suggests, can fly up to 8,000 nm. The new model also claims the title of the fastest inservice civil aircraft with a top speed of Mach 0.95 (albeit with reduced range). According to the company, the top speed could shave around 7% off the flight time on popular intercontinental routes such as New York to London.

According to the Canadian airframer, the new Global’s advanced wing design with slats

Dassault is targeting type certification and entry into service of the 7,500-nm Falcon 10X in 2027.

has delivered “takeoff and landing performance comparable to that of a light jet.” This enables the aircraft to access smaller airports across the Asia-Pacific region and other parts of the world.

With passengers potentially flying for up to 17 hours on the new ultra-long-range business jets, cabin comfort is prominent among the options offered for the G800, Falcon 10X, and Global 8000. The interior design teams of all three manufacturers can deliver an assortment of layouts that can include sleeping berths for 10 or more passengers, a private bedroom, dining space, showers, and crew rest areas.

Product support is another key factor for manufacturers making the case for Asia-Pacific customers to invest in business jets made on the other side of the world. The robustness of supply chains and approved service centers

can make all the difference between aircraft being available when needed and owners left wondering whether they might be better off with the region’s airlines.

For Gulfstream, its General Dynamics sister company Jet Aviation is a critical part of the support equation, with well-equipped facilities in Singapore and Hong Kong supporting its customers, along with nine authorized warranty facilities in the region. “We also continue to invest; in the past year, we have more than doubled the inventory of spare parts in Asia-Pacific and continually assess customers’ needs there to identify new opportunities for growth,” Neal explained.

Dassault’s ExecuJet MRO Services subsidiary is at the forefront of its product support infrastructure. Last year, the company opened an expanded facility in the Malaysian capital Kuala Lumpur, and its Asia-Pacific network also extends to Australia.

datalink system to enhance real-time situational awareness across multiple platforms.

With more countries augmenting their defense spending, “This is not just about procuring but also a greater focus on sovereign supply-chain resilience to be able to produce capabilities in-country,” explained Chua Jin Kiat, ST Engineering executive v-p, international defense business. However, he acknowledged that capacity constraints are affecting many industrial sectors.

Physical products aside, ST Engineering is investing heavily in AI, something Chua

ST Engineering’s DrN-600 has a wingspan of 8 meters and a maximum takeoff weight of 600 kilograms. It can carry 100 kilograms of cargo for 70-120 kilometers.

believes is “central to [its] core strategy.” To date, the company has trained more than 10,000 employees to be “future ready” for AI technologies, including 2025’s launch of a five-year, $250 million AI research and training program.

ST Engineering is also preparing to commence flight trials of the AirFish wing-inground-effect maritime vehicle in the second quarter, according to Kevin Chow, ST Engineering executive v-p and head of aerostructures and systems, commercial aerospace. While key parts of the inaugural vessel are coming together, an as-yet-undisclosed Singaporean ferry operator is set to become the launch operator in the third quarter, subject to the craft’s certification. z

Elbit Systems has selected fellow Israeli company Lowental Hybrid to provide Native Parallel Hybrid propulsion systems for Elbit’s tactical uncrewed aerial vehicles (UAVs). The new engines offer extended flight duration and continuous in-flight battery charging, permitting vehicles to undertake silent flight during covert missions.

Combining conventional internal combustion and battery-electric systems,

the Native Parallel Hybrid is capable of seamless transitions between power sources. The concept can be scaled to meet the power demands of a wide range of UAVs.

Under the 10-year deal, Lowental will provide development, procurement, and services, with an initial phase to be valued at around $1.4 million. Subsequent multi-year revenue will come through additional systems and support. D.D.

JAMES HOLAHAN (1921-2015), FOUNDING EDITOR

WILSON S. LEACH, FOUNDER & CHAIR EMERITUS

EDITOR-IN-CHIEF – Matt Thurber

MANAGING EDITOR – Charles Alcock

PRESS ROOM EDITOR – Hanneke Weitering

THE EDITORIAL TEAM - Charlotte Bailey, David Donald, Jennifer Meszaros, Chad Trautvetter, Amy Wilder

PRODUCTION MANAGER – Martha Jercinovich

GRAPHIC DESIGNERS – Alena Korenkov, Grzegorz Rzekos

PHOTOGRAPHERS – David McIntosh

DIRECTOR OF VIDEO – Ian Whelan

EXECUTIVE CHAIR – Dave Leach

PRESIDENT – Ruben Kempeneer

HEAD OF PEOPLE & BRAND – Jennifer Leach English

SENIOR DIRECTOR EVENTS – Nancy O’Brien

ADVERTISING SALES

DIRECTOR OF SALES - Henry Specht

Victoria Tod – Northeastern U.S./Eastern Canada/United Kingdom, +1 (203) 733-4184

Michelle James – Western U.S./Western Canada, +1 (520) 343-0236

Joe Rosone – Midwestern U.S., Southeastern U.S./Caribbean/ Brazil, +1 (301) 693-4687

Diana Scogna – Europe/Middle East, +33 6 62 52 25 47

DIRECTOR MARKETING AND CLIENT SERVICES – Lisa Valladares

AUDIENCE DEVELOPMENT DIRECTOR – Eileen Silberfeld

SOCIAL MEDIA MARKETING – Zach O’Brien

SALES ADMINISTRATOR – Cindy Nesline

FINANCE & HR DIRECTOR – Tracy Britton

ACCOUNTS PAYABLE MANAGER – Mary Avella

ACCOUNTS RECEIVABLE MANAGER – Bobbie Bing

U.S. HEADQUARTERS:

214 Franklin Ave., Midland Park, NJ 07432, +1 (201) 444-5075

Advertising Inquiries: +1 (201) 345-0085, adsales@ainonline.com

Circulation Inquiries: +1 (201) 345-0085, subscriptions@ainonline.com

WASHINGTON, D.C. EDITORIAL OFFICE: Kerry Lynch (business aviation) – klynch@ainonline.com +1 (703) 969-9195

EUROPEAN EDITORIAL OFFICE: Charles Alcock – calcock@ainonline.com, Tel: +44 7799 907595

Singapore Airshow News is a publication of the AIN Media Group, Inc., 214 Franklin Ave., Midland Park, NJ 07432; Tel.: +1 (201) 4445075. Copyright ©2025 All rights reserved. Reproduction in whole or in part without permission of AIN Media Group, Inc. is strictly prohibited. AIN Media Group, Inc. publishes Aviation International News, AINonline.com, AINalerts, AircraftPost.com BJTonline.com, BJTwaypoints, Dubai Airshow News, EBACE Convention News, Farnborough Airshow News, FutureFlight newsletter, HAI Convention News, Leeham News and Analysis, MEBAA Convention News, NBAA Convention News, Paris Airshow News

Leeham’s Aircraft Performance & Cost Model (APCM) delivers the unbiased insights you need to make smarter decisions across every major expense — from aircraft purchase to fuel and maintenance