SAFETY: 2025 A BAD YEAR FOR BIZAV ACCIDENTS

EVENTS: CHANGING TIDES FOR BIZAV SHOWS

REGIONS: IMPROVING PROSPECTS IN SOUTHEAST ASIA

ROTORCRAFT: THE 4TH AXIS FOR HELICOPTER AUTOPILOTS

SAFETY: 2025 A BAD YEAR FOR BIZAV ACCIDENTS

EVENTS: CHANGING TIDES FOR BIZAV SHOWS

REGIONS: IMPROVING PROSPECTS IN SOUTHEAST ASIA

ROTORCRAFT: THE 4TH AXIS FOR HELICOPTER AUTOPILOTS

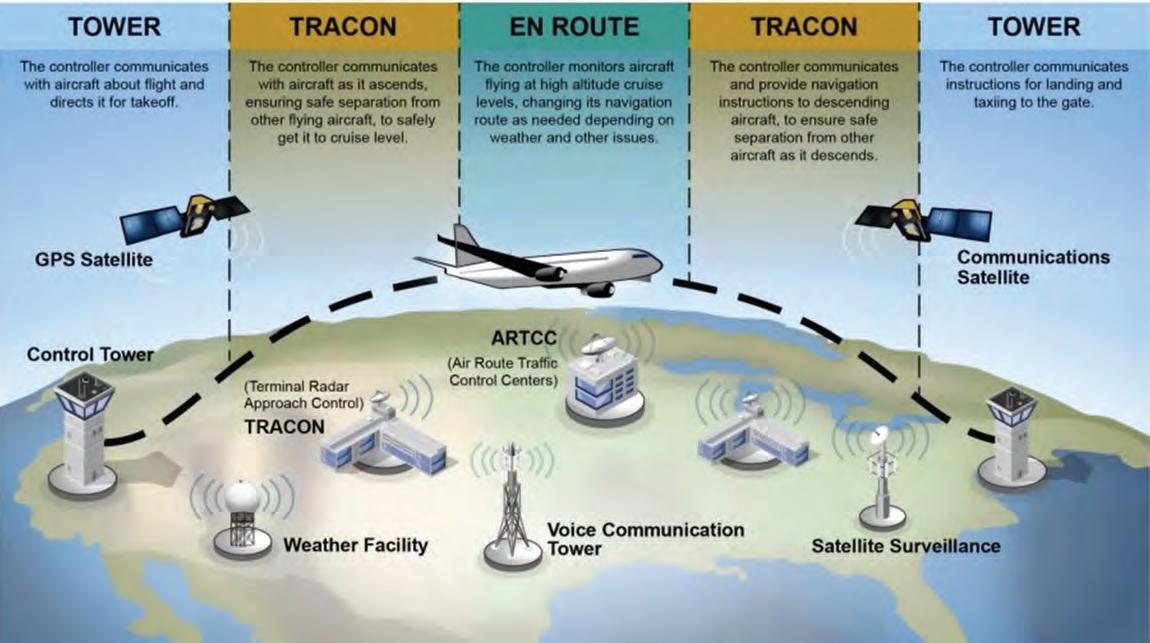

Billions more dollars for a new air traffic control system promise to fix problems that NextGen neglected

Private jets o er lifeline to kids through AeroAngel

38 Delivery forecasts see growth ahead of GAMA report

Thales/StandardAero StableLight four-axis autopilot targets AStar market

2 Textron Aviation brings three updated Citation models to market

4 Leonardo Next-gen civil tiltrotor makes first flight

6 Business aviation safety su ers worst year since 2011

8 Daher refreshes turboprop family with TBM 980

10 Special Report: Our once and future ATC System

17 Special Report: How LiveATC went live

20 Special Report: The next frontier for notams

The changing tides of bizav events

Legacy constraints, new opportunities in Southeast Asia aviation

BY KERRY LYNCH

Three of Textron Aviation’s latest Cessna Citation model updates have entered service, with the first Ascend delivered to an unnamed retail customer and a CJ3 Gen2 handed over to longtime Citation owners Dave Mecartney and Shannon Day. Also entering service was the M2 Gen2 with a Garmin Autothrottle system.

“The first Citation Ascend delivery underscores Textron Aviation’s commitment to redefining the midsize segment with an aircraft that blends innovation, efficiency, and unmatched comfort,” said senior v-p of sales and marketing Lannie O’Bannion.

While it did not disclose the first retail customer, Textron Aviation previously named NetJets as the Ascend launch customer under a potential $32 billion order placed in 2023 for up to 1,500 Citation Longitudes, Latitudes, and Ascends.

In an extensive update to Textron Aviation’s 560XL series, the Ascend brings a flat floor and 15% larger windows, along with Garmin G5000 avionics and improved performance. With three 14-inch, ultrahigh- resolution displays and dual flight management systems, the G5000 folds in

autothrottles, synthetic vision, advanced weather detection and avoidance, and a second Iridium data link, along with optional controller-pilot datalink communications.

The customizable cabin accommodates 12 passengers and features wireless controls for lighting, temperature, window shades, and entertainment. Gogo’s Avance L3 Max Wi-Fi is standard, but customers can upgrade to Avance L5 or Galileo HDX.

Two Pratt & Whitney Canada PW545Ds increase fuel efficiency and thrust, enabling a top speed of 441 ktas and a 1,940-nm range.

Meanwhile, in what Textron Aviation calls its “most comprehensive Gen2 investment,” the CJ3 Gen2 adds customer-driven upgrades including Garmin autothrottles, more pilot legroom, and a customizable cabin environment.

The CJ3 Gen2 features the latest Garmin G3000 avionics suite, including autothrottles and GDL 60 for aircraft connectivity. It can seat up to 10 occupants and has an externally serviceable lavatory.

Approved in October, the M2 Gen2 with Garmin Autothrottles provides greater control and precision to pilots. z

On December 20, a Beechcraft King Air B200, registered as N479BR, landed at Colorado’s Rocky Mountain Metropolitan Airport after the aircraft’s Garmin Autoland system activated, marking the system’s first in-service activation. The aircraft experienced rapid, uncommanded loss of pressurization, the pilots donned their oxygen masks, and Autoland automatically engaged when the cabin altitude exceeded prescribed safe levels. While the pilots remained conscious, they left Autoland engaged, citing “exercising conservative judgement under their emergency command authority (FAR 91.3).”

Gogo last month o cially activated its 5G air-to-ground connectivity network for customers in North America. This came after recently completing more than 30 hours of flight tests across nearly 20 routes to prove that its 5G tower network will deliver high-speed, low-latency connectivity. During testing, the network provided broadband speeds of more than 80 Mbps download and 20 Mbps upload, allowing streaming and internet browsing simultaneously.

Gulfstream’s G500 and G600 last month received EASA steep-approach certification, enabling the twinjets and their approved crews to access an extended range of airports. The approvals follow equivalent regulatory permissions already in place in the U.S.; the G500 received an FAA nod for steep approaches in October 2023, with the regulator awarding similar approval the G600 in May 2024. Gulfstream conducted G500 and G600 steep-approach landing demonstrations at London City Airport and Switzerland’s Lugano and Sion Airports.

BY CHARLOTTE BAILEY

Leonardo Helicopters has made the first flight of its Next Generation Civil Tiltrotor (NGCTR) demonstrator aircraft from its Costa di Samarate facility in Italy. Part of an EU-funded initiative, NGCTR was first launched in 2015 under the European Union’s Clean Aviation Clean Sky 2 program, which described the project’s aims to “design, install, and demonstrate, in flight, innovative civil tiltrotor technologies enabling future prototype development.” At the time, Clean Aviation envisaged a first flight in 2023.

Ground runs in June 2024 paved the way for the latest milestone, which “represents a fundamental step towards validating the five new technologies and performance improvements,” Leonardo said. To help achieve this, the

demonstrator includes “advanced wing architecture, innovative tail layout, non-tilting engine installation…[and] an advanced, modular, distributed and scalable flight control system.”

The Italian OEM intends for the NGCTR to “revolutionize civil vertical lift by combining helicopter versatility with fixed-wing aircraft performance.” Its prototype aircraft offers a cruise speed of 280 knots and a range of around 1,000 nm. According to Leonardo, this will open “new scenarios for mobility, freight transport, and search-and-rescue missions, enabling faster coverage of larger areas.”

More than 85 organizations from 15 countries are collaborating on the NGCTR project, which has received around € 116 million ($136 million) in EU funding. z

Bombardier in late December received FAA certification of the Global 8000, the company’s flagship ultra-long-range aircraft and the fastest business jet in production with an Mmo of Mach 0.95. The Global 8000 received Transport Canada approval on November 5. Meanwhile, the Global 8000’s GE Passport 20 engine obtained its nod from EASA around the same time, and European certification of the twinjet was imminent at press time.

The 2026 European Business Aviation Convention and Exhibition (EBACE) will be staged later than usual—June 2 to 4—with the venue remaining in Geneva. EBAA said it pushed back the event from the last week of May after “a detailed review of the broader events calendar” and is also promising more competitive pricing for exhibiting companies. Moving the dates from the earlier May 27 to 29 schedule means Europe’s largest business aviation show will resume its traditional pattern of running from Tuesday through Thursday.

Owners and operators of classic HondaJets and those upgraded to the Advanced Performance Modification Group (APMG) configuration can now add further enhancements with Honda Aircraft’s APMG S package. Already certified by the FAA, the APMG S upgrade adds software and hardware improvements to the HondaJet’s Garmin G3000 avionics; graphical weight and balance; the Advanced Steering Augmentation System; and a 300-pound mtow increase. Honda Aircraft’s 21 authorized service centers and its headquarters service center in Greensboro, North Carolina, are o ering the upgrade.

With 13,000+ member aircraft, CAA gives Part 91 operators unmatched access to top-rated FBOs and the best fuel prices in the industry.

• Exclusive member-only fuel rates

• Seamless consistent experiences at every stop

• 300+ trusted Preferred FBO partners

• 90 days FREE for new members

CAA membership pays for itself—fast. Join the CAA network today!

BY GORDON GILBERT

Last year was one of the worst on record for business aviation safety, as fatalities soared 53.8% year over year (YOY) to 143, only eclipsed by 156 fatalities in the sector in 2011, according to preliminary data tabulated by AIN. Fatalities from business jet accidents globally climbed 171.4% YOY, from 21 in

2024 to 57 last year, while turboprop fatalities rose 19.4%, from 72 to 86.

The 104 business aircraft accidents—32 involving business jets and 72 turboprops— last year represented a 15.6% increase over 2024. Worse, more accidents were fatal as these mishaps soared

Dassault appears to be getting closer to the start of flight testing for its ultra-long-range Falcon 10X, according to images of the first 10X prototype posted in mid-December by French aviation media group Actu Aero. The aircraft manufacturer declined to comment on reports that first flight could happen soon. Actu Aero’s photo shows what appears to be a 10X with power on during ground testing. Dassault is targeting service entry for its largest jet in 2027.

PlaneSense is collaborating with European charter broker CaptainJet to expand international private aviation options between the U.S., Europe, and other regions. Under the arrangement, the PlaneSense sourcing solution team will coordinate private aircraft charters across Europe and beyond, while PlaneSense will reciprocally support CaptainJet clients flying to the U.S. The collaboration builds on PlaneSense’s 2025 agreement with Jetfly, which allows PlaneSense fractional clients to use flight hours on Jetfly’s Pilatus PC-12 and PC-24 fleet in Europe and North Africa, with reciprocal access for Jetfly clients.

NBAA has rescheduled its 2026 White Plains Regional Forum due to pending runway construction at Westchester County Airport (KHPN). The annual Northeast business aviation showcase, originally slated to take place on June 3, has been moved to May 20. For the past several years, the regional show has been held in and around the 52,000-sq-ft hangar at the Million Air FBO at KHPN, but FAA o cials notified airport o cials of plans for upcoming runway construction work as part of an agency grant. The project will begin in the second quarter.

A proven predictive analytics system that forecasts the service you need—before you need it.

BY CHARLES ALCOCK

Daher has refreshed its family of single turboprops, launching the TBM 980 model during an event on January 15 at its headquarters in Tarbes, France. The main change for the latest version of the aircraft is in the cockpit, now based on Garmin’s third-generation G3000 Prime avionics suite, while the cabin features enhancements for passenger comfort.

EASA has issued airworthiness certification for the new version of the TBM, and the FAA has validated this approval. First deliveries of the 980 started in January.

The TBM 980 is priced at $5.82 million. Daher said it will continue to offer the 960 model for operators who prefer this version, which carries a lower price tag of $5.62 million.

In the six-seat cabin, Daher is now offering the ability to install a Starlink Mini terminal for satellite-based internet connectivity, along with 100-watt USB-C ports for charging mobile devices. Passenger displays for the TBM 980 have also been

upgraded to show en-route flight data.

According to Daher, the latest Prime version of the G3000 avionics suite improves cockpit ergonomics for pilots with a highly intuitive and refined interface. Earlier members of the TBM 900 family use the G1000 technology, while the TBM 960 has the first iteration of the G3000.

The TBM 980’s flight deck has three 14-inch, edge-to-edge touchscreen displays, providing what Garmin says is improved image quality. Customizable presets and a streamlined user interface have been introduced to reduce pilot workload.

With an app-based interface, the G3000 Prime provides shortcuts intended to enable pilots to quickly access essential functions, such as radios, transponders, flight plans, and operating procedures, without scrolling through multiple menus. The checklist button on earlier versions of the avionics suite has been replaced by a four-position joystick for up/down scrolling, checks, and quick access. During a media

Bombardier received a $400 million order from the Canadian government for six Global 6500s to support the Royal Canadian Air Force in a range of missions throughout the world. The order builds on a long-time relationship with the Royal Canadian Air Force, which has operated Bombardier Challengers since 1983. Plans call for delivery of the Globals to begin by mid-2027 for use in missions including aeromedical, disaster relief, humanitarian aid, and national security.

About 800 aircraft—including 52 turboprops, business jets, and turbine helicopters—registered with the FAA under trustee Southern Aircraft Consultancy Inc. (SACI) were grounded last month because they no longer have valid registrations. According to the FAA, all of SACI’s aircraft registration certificates are invalid because the UK-based company violated U.S. citizenship requirements when it submitted the registration applications. A ected aircraft owners must re-register their aircraft, either through the U.S. or another country’s registry, and will then receive temporary authority to operate in the U.S. until a certificate of aircraft registration is issued or the FAA denies the application.

International Flight Center (IFC)—one of four service providers at Miami Executive Airport (KTMB)—opened its new FBO terminal last month. The 10,500-sq-ft facility, which took two years to build, replaced a small terminal attached to an old, since-demolished 10,000sq-ft hangar. It o ers guest lounges, a refreshment bar, a pilot lounge with private bed- and bath-equipped snooze rooms, a catering kitchen, a conference room, a business center, a concierge, crew cars, and an in-house café. IFC also has an FAA Part 145 repair station.

visit in Tarbes, Daher test pilot Guillaume Remigi demonstrated how crew can quickly action alert messages because each of these presents clear commands, avoiding the need to search through flight manuals.

“The app-based approach to the flight management and information system is far more tactile,” Daher Aircraft CEO Nicolas Chabbert explained to reporters. “The system shows each mode of operation and the pilot simply confirms actions from a menu and can change the [content shown on each] display, enlarging or reducing different features.”

According to Chabbert, the increased sophistication of the TBM 980’s cockpit technology combined with its speed bolsters its potential to compete with light jets as well as other turboprops. Daher estimates hourly operating costs at $1,100.

Also featured in the TBM 980 model is Garmin’s HomeSafe emergency autoland

capability. The avionics manufacturer’s GWX 8000 digital radar incorporates its StormOptrix technology, which automatically adjusts radar settings for more accurate 3D profiling of storm cells.

Daher’s new aircraft retains the fadec-controlled Pratt & Whitney Canada PT6E-66XT turboprop engine and

five-blade Hartzell composite propeller system.

In 2025, Daher delivered 76 TBM and Kodiak turboprops, with total deliveries 7% down on the 82 aircraft shipped in 2024. Last year’s total included 51 TBM 960s made in Tarbes and 25 Kodiak 100s and 900s from its factory in Sandpoint, Idaho. z

BY DAVID HUGHES

The DOT and the FAA forged ahead with plans to push forward on the $12.5 billion “down payment” part of a “brand-new” ATC system by 2029, even as a 43-day government shutdown harried the current system and forced air traffic controllers to work without pay.

This effort follows the FAA’s twodecade-long NextGen project, which made some improvements but didn’t create the modern system desired to supplant the legacy one controlling crewed aircraft traffic.

The aviation industry is obviously thrilled to have the government suddenly spending $12.5 billion to help the aging legacy ATC system get its legs under it again— Congress in July furnished the sum in the One Big Beautiful Bill following a series of

communications and notam outages, along with intense scrutiny on controller shortages in the wake of the January 29 midair collision by Ronald Reagan Washington National Airport (KDCA).

The industry is concerned about the effects of the government shutdown on National Airspace System (NAS) operations and whether the hiccup will happen again. The 2025 43-day shutdown broke the record at eight days more than the 35-day one in Trump’s first term, causing widespread outages as the FAA grappled with rolling controller shortages.

In announcing those rolling outages, DOT Secretary Sean Duffy maintained that the government was still pushing ahead on the modernization plans but conceded

that it was hampering controller recruitment efforts. At the end of the shutdown in November, he responded: “Now we can refocus our efforts on surging controller hiring and building the brand-new, stateof-the-art air traffic control system the American people deserve.”

However, at press time, another potential shutdown could happen—a stopgap measure passed in November only funded the federal government through January 30.

Aviation advocacy groups in Washington, D.C., can disagree on some issues, but they all seem to be in favor of spending $12.5 billion immediately to improve the NAS. The Modern Skies coalition of 60 aviation and aerospace organizations, including business and general aviation

groups, is backing DOT’s ATC upgrade plans. But at the same time, industry groups are adamant about the need to head off potential harms of any future government shutdown.

Legislation has been introduced in the House and the Senate aimed at funding the FAA should another shutdown occur. This is a problem that would be solved for the rest of the current fiscal year if Congress passes the Transportation and Housing and Urban Development appropriations bill covering the DOT, FAA, and other agencies. Ed Bolen, president and CEO of NBAA, sees passage as the highest priority.

Meanwhile, the need for modernizing the aging ATC systems comes at a critical time. Not only did the system show signs of wear over the past year, but new-entrant drones are being managed in a few places in U.S. low-altitude airspace with private Unmanned Aircraft Systems Tra ffi c Management (UTM) systems using new concepts of operation. This is without any directions from air traffic controllers. The UTM system for new-entrant air vehicles was developed from a clean sheet design over a decade. How it will merge with the brand-new ATC system is not yet defined, but is looming large as a challenge.

The legacy ATC system update is starting with equipment such as new radars and telecommunications links that will roll out over the remaining three years of this administration. The DOT wants another $20 billion from Congress to build out the new ATC system, but there is no certainty as to when this money might be appropriated.

In his first appearance before Congress as FAA administrator, Bryan Bedford reiterated that the initial $12.5 billion will fix what is necessary but not overhaul the system. The $12.5 billion would make the airspace more efficient, “but it would still be antiquated,” Bedford told the House

Transportation and Infrastructure Committee in December. “We need to make sure that modernization gets done, gets done on time, and achieves the results that we’ve set before this committee—which is to deploy new technology within the next three years.”

Plans are for use of off-the-shelf technology, “not some new technology that may or may not be created over the next several years,” he added. The FAA—in concert with the DOT—has “adopted a mantra of think slow, move fast, understanding what the end state of modernization needs to look like, and then determining how best to plot a course to get there as opposed to just let’s go out and spend money,” Bedford continued.

With that in mind, o ffi cials have spent the last several months plotting what the end state of the National Airspace System should look like. “It’s an exciting vision,” he said.

The new ATC system and the shutdown were hot topics at Honeywell’s Aviation

Leadership Summit on November 19 at the company’s offices in Washington, D.C., in the shadow of the Capitol Dome.

Airlines for America (A4A) senior v-p for legislative and regulatory policy Sharon Pinkerton hit the nail on the head when she said, “It doesn’t matter if we have a newer ATC system if it’s going to be shut down for 40 days.” She was speaking on a panel on airspace integration and ATC modernization with Bob Buddecke, president of Electronics Solutions at Honeywell.

She did marvel at the speed with which the DOT and the FAA are working on this new ATC system. Contracts had already been inked for radar services and voice switches, and agency officials in December selected Peraton—a spinoff from the Harris Corporation’s government IT services group—as the prime integrator to oversee the project. That selection was named just a few months after the request for solutions was released. “This is a different FAA; it has been remarkable,” Pinkerton said.

In his appearance before Congress, Bedford had provided insight into the selection of Peraton to act as a prime integrator. He

said the organization will guide the FAA on modernization execution, particularly on challenging issues such as shifting from analog systems to digital systems. “These are not competencies the FAA has internally. We need assistance from people who’ve done this before. Peraton brings us that experience.”

At the Honeywell conference, Duffy also said the $12.5 billion received so far is for replacing equipment, including radars and voice switches, and replacing copper wires with fiber-optic cables as the FAA moves from analog to digital systems.

The FAA says it has already converted one-third of ATC’s copper wire to fiber, satellite, and wireless, deployed 148 radios to facilities, and provided surface awareness systems to 44 towers. And by the end of 2025, the agency had already committed half of the $12.5 billion, according to Bedford.

In January, the agency announced contracts with RTX and Indra to work with

Peraton on radar replacement. Plans call to replace up to 612 radars by June 2028 with “modern, commercially available” surveillance radars. The work is to begin this quarter with replacements prioritizing high-traffic areas, the agency said.

“While our air travel system is the safest in the world, most of our radars date back to the 1980s. It’s unacceptable,” Duffy said in announcing the contract awards.

“Many of the units have exceeded their intended service life, making them increasingly expensive to maintain and difficult to support,” added Bedford. “We are buying radar systems that will bring production back to the U.S. and provide a vital surveillance backbone to the National Airspace System.”

Indra has also won a contract valued at up to $244.3 million to manufacture, test, and qualify up to 46,000 new radios, as well as provide support for 10 years. Under the contract, Indra is replacing legacy analog radio systems with next-generation

digital radio equipment capable of both analog and Voice over Internet Protocol (VoIP) operations.

However, at the Honeywell conference, Duffy explained that the $12.5 billion does not cover a new common automation platform (CAP) or new software—both considered critical for the brand-new ATC system. The new platform will allow the FAA to design ATC apps as the agency moves to an architecture not unlike the iPhone, which has access to new apps when they are developed.

In November, the FAA released a request for information on a CAP. Responses were due by December 19. The agency is eyeing replacements for systems including En Route Automation Modernization (ERAM) and Standard Terminal Automation Replacement System (STARS) with a unified, modern platform, the agency said. “The FAA is open to new ideas, new

technologies, new procurement strategies, new implementation structures, and any other considerations that will enhance the common automation platform solution,” according to the agency.

Bedford said there will be four layers: one each for compute, the operating system, data, and applications. “This will unlock the pace of innovation that has been beyond the FAA’s grasp,” he said. The FAA wants to move siloed computing from 350 ATC facilities to the cloud to complete the move from an analog to a digital ATC system.

Once this platform is in, both en route and terminal facilities will be able to exchange digital data rather than being siloed, as is the case now with standalone automation systems. Only the local controllers can now see the data covering traffic in their area.

Honeywell’s Buddecke said that, in addition to ATC improvements, the company would like to see more avionics equipment in air transport aircraft to counter things like runway incursions. Honeywell is in favor of the Rotor Act, which he said would create an orderly transition to ADS-B In and leverage the aviation community’s investment in ADS-B Out. The Senate unanimously passed this bill, S.2503, on December 17, and it goes to the House now. The bill would require all aircraft in designated airspace to be equipped with ADS-B In over a period of years.

Bob Poole, who directs transportation policy at the Reason Foundation and edits an ATC newsletter, said he has not noticed any interest from Congress in coming up with the extra appropriation. Poole is an advocate of privatizing the ATC system and said in the interview he hasn’t seen any momentum on this lately, but recently, the Washington Post editorial board endorsed ATC privatization. AOPA and NBAA strongly opposed privatization the last time it came up. In an interview with AIN, NBAA’s Bolen

noted that Bedford has been unequivocal that the FAA is not going down the privatization path.

Bolen said a lot of people say the U.S. should not emulate the current Canadian ATC system. “Canada’s ICAO safety rating (now privatized under Nav Canada) has gone from the 90s in 2005 to 65 now, a significant drop,” he said. “There are significant delays at airports that are not that big or that complicated, and there isn’t a single airport in Canada in the top 15 in terms of the number of movements. They do not seem to have the ability to run it [the ATC system] without significant delays and enormous frustration for the airlines, pilots, and controllers.” Nav Canada was formed in 1995.

Rep Sharice Davids (D-Kansas), whose district includes Olathe (where Garmin is headquartered),said she and her colleagues are focused not only on how to bring the NAS up to date but to prepare it for the future and make sure it doesn’t fall further behind. Working group meetings with the aviation industry have been invaluable in coming up with solutions that will work, Davids said. “The meetings have been as pragmatic, substantive, and realistic as possible about the problems that are in front of us,” she said.

On a panel at the Honeywell gathering led by Bolen, House aviation subcommittee chairman Troy Nehls (R-Texas) from the Houston area questioned the request for additional funds, given the lack of significant progress in the past. “We do not have the answer on how to fix this problem and modernize the NAS,” Nehls said. “What the hell does that even mean?”

In the government/industry working group meetings, Nehls said he was floored on several occasions to learn that technology that has been around for decades, like fiber-optics, hasn’t been deployed. He asked industry members to explain why this happened, and they said it was because no one in the government was listening to them.

BY THE NUMBERS

5,170 — new high speed network connections on fiber, satellite, and wireless

27,625 — new radios

462 — new digital voice switches

612 — state of the art radars

44 — airports will have new replacement surface radars

200 — airports will have Surface Awareness Initiative surveillance technology

89 — airports will have new Terminal Flight Data Manager tools

435 — air tra c control towers will have new Enterprise Information Display Systems

113 — air tra c control towers will have new Tower Simulation Systems

1 — new consolidated Air Route Tra c Control Center (first new one since the 1960s)

110 — additional weather stations in Alaska

64 — more weather camera sites in Alaska

1 — new consolidated Terminal Radar Approach Control

Bolen asked Nehls if the $12.5 billion was a down payment on ATC modernization. Nehls answered, “$12.5 billion is a lot of money.” Now that the DOT has it, “it is incumbent on me and everyone in Congress to make sure that we know where it is going to go. I think the federal government’s response to most tragedies [like the one at National Airport] is to throw money at it as if that is going to solve the problem, but that doesn’t necessarily do it. I am just not going to throw another $20 billion in their [the FAA/DOT team’s] direction if we can’t hold them accountable for the $12.5 billion, but I think they will produce results.”

Nehls noted that an Inspector General report found that only about 16% of NextGen was deployed after expenditures in the billions. He said he and Davis will be working together to try to have Congress come up with the additional money. But he said the ambitious three-year timeline may be unrealistic, and success will require alignment between industry, Congress, and the FAA.

Bolen said in an interview that the first phase of work is a “comprehensive and aggressive plan to move the foundation from analog to digital. That is so fundamental.” This will provide the needed tools to move in the direction of a common automated platform.

William (Bill) Payne is the project manager for the Colorado Department of Transportation, who is working to get a remote (a.k.a. digital) tower implemented to serve multiple ski airports in the mountains from one location in the flatlands. He told AIN in an interview that the FAA NextGen office is suddenly quite keen to move ahead with digital tower initiatives. He firmly believes these systems should be an integral part of any future ATC system in the U.S. He added that the FAA’s Bedford has seen the RTX/Frequentis system being tested at the FAA Tech Center and has expressed support for the concept as part of the new

ATC system. In the meantime, remote/digital towers are making rapid advances in Europe and the rest of the world.

Colorado wants to employ the RTX/Frequentis system once it is approved, which may happen soon. Lack of FAA support canceled CDOT’s initial remote tower project with Canada-based Searidge Technologies in 2023 at Northern Colorado Regional Airport (KFNL). FAA also tested a Saab remote tower system at Leesburg Executive Airport (KJYO) from 2015 to 2023, which was also shut down. Frequentis has deployed 16 digital towers outside of the U.S., so its system has already been approved by other civil aviation safety agencies.

Payne leads a group of corporate pilots that meet regularly at Centennial Airport (KAPA) in Colorado. He hopes the FAA’s new ATC system doesn’t lead to negative side effects for business aviation, as air navigation improvements have at Denver International Airport. The FAA published RNAV STARS and RNP procedures used

primarily by airline aircraft. At times, controllers break business jets off STARS procedures and send them “way the hell out west” before bringing them back in, Payne said. This puts business jets over high terrain where mountain waves can create moderate to severe turbulence. An old pilot adage in business aviation is that passengers don’t like having white caps on the martinis. Payne thinks any ATC improvements will be good for business aviation, but he, for one, will be keeping an eye out for unwanted side effects.

He noted that business aviation also got unwanted attention during the government shutdown but business and general aviation access was restored after the FAA imposed more than a week of operational limits at 40 airports, including an unprecedented curtailment of Part 91 and Part 135 operations at 12 major hub airports.

On a panel on airspace integration and ATC modernization at the Honeywell

leadership summit, David Murphy of ANRA Technologies said there are two parallel ATC modernizations going on right now: one for crewed aircraft and one for uncrewed aircraft and drones.

Today, ANRA and other private providers of UTM systems and services are preclearing delivery drones in North Texas to then monitor and deconflict them in flight with digital data as they operate below 400 feet in the FAA’s UTM site. ANRA is one of the UTM providers working with Walmart. The retailer has ambitious plans to use drones to serve 1.5 million households in the DallasFort Worth metro area from 30 stores. Murphy said the drone community now must figure out how to integrate drone operations in the airspace without disrupting current crewed operations. “I see it all coming together very soon,” he said. ANRA is also working on many UTM projects worldwide.

Trajectory-based operations techniques (using time and constantly updated trajectories for planning) are used in UTM. It was the holy grail of the NextGen program, but it was not achieved. Alan Mulally, as a young engineer, experimented with the trajectory-based concept on a Boeing 737-200, so the idea has been around for a long time.

steps: concept and specification; procurement and development; integration, validation, and training; and operational deployment. This cycle routinely spans 10 to 15 years with an additional 3 to 5 years needed to refine software, correct integration issues, and achieve full operational maturity under high traffic loads. He said a four-year ATC modernization program timeline is unprecedented.

Deleau said regarding privatization in Europe that even when air navigation service providers are reorganized to be somewhat private, the government usually retains a controlling golden share. He added there was no documented signif-

Just because Congress can’t get its act together and members act like children at times, why should the American people su er as a result?

— Troy Nehls (R-Texas) House aviation subcommittee chairman

it caused a sharp divide in the controller workforce between those who left the ATC facilities and those who stayed, and he wonders what the effect of post-shutdown $10,000 government bonuses for controllers who stayed on the job will do to team morale now.

Nehls stressed to attendees at the Honeywell event that such a shutdown “can never happen again.” He has co-sponsored a bipartisan bill along with the chairman and ranking member of the Transportation and Infrastructure committee to ensure that controllers and others at the FAA managing airspace will be paid if there is another government shutdown.

This is the Aviation Funding and Solvency Act (H.R 6086). It would use funds in the Aviation Insurance Revolving Fund to cover critical services. The fund covers war risk insurance claims from airlines that were terminated in 2014 and now has $2.6 billion on account.

Things are different in some ways in Europe. A U.S.-style government shutdown cannot happen in Europe, according to Frédéric Deleau, executive v-p of Europe for the International Federation of Air Traffic Controllers’ Associations. However, air navigation services can and have been disrupted in Europe due to strikes and other events. Air navigation services are fragmented there, and controller salaries have been reduced during some funding disputes or low traffic periods during the pandemic.

Deleau said in a response to email questions that equipment is also diverse, and some systems are beyond typical desired life cycles of 15 to 20 years. A typical modernization project in Europe involves four

icant reduction in North Atlantic traffic during the U.S. government shutdown.

John Walker, who managed New York airspace at the FAA and is now a consultant who serves on U.S. and international standards committees, remembers the failed IBM Advanced Automation System (AAM) that was shuttered by the FAA in 1994 after a $100 million overrun.

He recalls that it also called for a layered system. IBM had little ATC experience, which is also true of Peraton, whose track record includes putting some Pentagon systems on the cloud.

Walker hopes the lessons have been learned from that AAM fiasco, so mistakes won’t be repeated this time. He was also at the FAA when PATCO controllers went out on sick leave the first time. He remembers

“Just because Congress can’t get its act together and members act like children at times, why should the American people suffer as a result?” Nehls asked. Later in November, Nehls said he will not run for reelection to Congress. His twin brother plans to run for the seat.

In a prepared statement for the Senate aviation subcommittee on November 19, Bolen wrote that the shutdown had a significant impact on all facets of the business aviation segment as it “delayed safety approvals, jeopardized investments, reduced safety margins, and restricted airspace capacity.”

Meanwhile, the Senate has a bill under consideration titled the Aviation Funding Stability Act of 2025 (S. 1045) introduced by Sen. Jerry Moran (R-Kansas) in March. It would tap the Airport and Airway Trust Fund to pay for FAA operations during a shutdown. z

Anyone who learned to fly in the last 10 or 15 years knows about it. Print, TV, and online journalists worldwide know it as a trusted aviation resource when there’s a mishap. Airplane geeks infatuated with listening to pilots and controllers jabbering at hundreds of airports around the globe can’t seem to turn it off

It’s LiveATC.net, a free link to air traffic control communications that’s available anywhere there’s a good Wi-Fi signal. I find LiveATC’s iPhone app a lifesaver when I neglect to bring my PJ2 portable com radio to the airport. Just as important as live audio, LiveATC includes an extensive archive of past transmissions from all the sites it monitors.

BY ROBERT P. MARK

“LiveATC captures air traffic control conversations at more than 1,500 different airports located on every continent except Antarctica,” said founder Dave Pascoe. “We’re live in 64 countries with over 3,400 channels and over 1,200 receiver sites. We have many customers interested in our audio capture service today, like the NTSB. One of the first things that, in talking with some of the investigators, they pull the ADS-B tracks. They pull the LiveATC audio because it’s expedient for them when they’re headed out the door to a crash site.”

An amateur radio operator (KM3T) since he was a teenager, Pascoe got the idea for LiveATC in 2002. “I was on a year-long sabbatical and had gotten my private pilot certificate about a year prior,” he said. After

earning his instrument rating, he became enamored with air traffic control communications. “I was also heavily involved with the virtual air traffic simulation network [Vatsim] and ATC simulator network/community and wanted to share real-world communications with my cohorts there.”

Pascoe decided the best solution was to put some receivers “on the air.” He said his background in communication systems and IT, as well as his heavy involvement in amateur radio, helped organize things. “My youngest brother lived near Boston and let me put some receivers at his house so we could monitor ATC there.” More than 15 years later, LiveATC became self-sufficient with the advent of smartphones, internet

advertising, B2B opportunities to run commercial ATC audio streaming systems, and the sale of audio data.

Shortly after the service was launched, Max Trescott, a well-known flight instructor, podcaster, and amateur radio operator (K3QM) based in California’s Silicon Valley, recognized the value of the LiveATC service. “When I worked with student pilots in particular, a lot of them had difficulty learning how to communicate with ATC at a busy airport like my base at Palo Alto, for example. Vehicle procedures here are very nonstandard, so it was helpful for students to listen to the Palo Alto tower via LiveATC. It helped them rapidly improve their radio communication skills. Instrument pilots who wanted to learn to handle IFR clearances and fly instrument approaches got pretty good at that, too, by listening to Norcal Approach.”

In addition to live air traffic control communications, LiveATC offers users easy access to an extensive archive of ATC audio from all locations monitored. “We started off retaining about 30 days of data, similar to what the FAA retains themselves,” Pascoe said. “As storage got cheaper and more widely available, we increased our storage capability to store one year. In January of this year, I upgraded our storage again to add an additional four years. So nominally, we can store pretty much everything that we take in for four to five years from all over the world.”

Using LiveATC is simple. Users visit the website and choose the ATC location they’re interested in hearing by typing the three or four-letter ICAO code for a Class B, C, D, or nontowered location. Alternatively, listeners can use the three-letter code for an FAA air route traffic control center (ARTCC) or type in the specific frequency they want to hear or the state in which the airport is located.

Never having searched by frequency before, I typed in 119.90, the frequency for our local tower at Chicago Executive Airport (KPWK). This is a VFR tower in Class D airspace just north of Chicago O’Hare International Airport (KORD). The frequency entry returned information for three dozen other ATC facilities in North America that share the same frequency. I didn’t find this method all that useful. Using the airport code returns information that’s much easier to deci pher, most of the time.

couple of paid employees. The soul of LiveATC—about 99% of it—is sta ff ed by dozens of volunteers who believe in the service they provide. “What we’re doing is such a niche that people find me rather than me looking for people,” Pascoe said. “I’ve got a guy whose full-time job is just building and shipping systems where they’re needed.”

From my travels, I knew the country code for England is E, so I added the airport code LHR for London Heathrow, but received this error message. “Sorry, ELHR is not currently covered by LiveATC.net.” Pascoe explained that there are countries such as the UK, Spain, and France that don’t allow third-party rebroadcasting of ATC frequencies, with controller privacy being one of the chief objections. The fact that ATC communications can be heard by anyone over an air band radio without any difficulty apparently never altered that objection.

The site offers listeners a variety of aviation resources in addition to the actual frequency feed, such as the Top 50 feeds in the LiveATC system at a given moment in time. “A lot of people seem to think that LiveATC.net is a service provided by the FAA,” Trescott explained, “but that’s the furthest thing from the truth.”

While LiveATC is 100% owned by Pascoe, the site’s backend is run by just a

The growing number of LiveATC feeds has evolved organically, according to Pascoe, hosted by “a large and increasing group of volunteers near airports around the world.”

New feeds are being added constantly. Feeds can also disappear for several reasons. “The volunteer who first established the connection may have moved, taking their radio equipment with them, or for some reason the volunteer is no longer able to provide service at that location.”

Pascoe said if a volunteer who’d like to establish a new feed can afford the equipment themselves, he’ll work with them. “We try very hard to recruit great volunteers who will take pride in maintaining high uptime and high-quality reception. LiveATC is truly a community where people pitch in and feed the network.”

He invited volunteers to get involved, especially “if you’re nearby an airport that’s not on the network.” He said that, unlike an ADS-B feed, setting up a new LiveATC feed is a little bit harder. “For good ADS-B signal reception, you just need to see the sky. VHF band ATC communications, however, are line of sight. It might not be something you’d put at your house, but maybe your flying club, or on top of a friend’s hangar, where they’d be willing to host the equipment. Again, we work with volunteers to find the best place for the receiver antenna so our listeners can hear both sides of the conversation. If the volunteer doesn’t have their own receiver or antenna and the airport’s high enough on our priority list, we’ll loan out the equipment more or less permanently, as long as someone’s there to host it.” Right now, Pascoe said LiveATC could really use a solid feed from George Bush Intercontinental Airport at Houston (KIAH).

There’s another link on the LiveATC website labeled “Interesting Recordings,” and these are interactions that are auto-populated from the site’s forums. I skimmed a few one afternoon and stumbled across one labeled, “Real Close Call at Logan.” Even though I had absolutely no idea of what led to the event, spending 30 seconds here told quite a story. A Delta heavy jet was sent around during an approach to Runway 4R at Boston, and on the go, the pilot working the radios remarked, “Man, that was close.” In another, I followed along with a Milwaukee departure controller’s assist in mid-September to a VFR Cirrus SR22 over Lake Michigan when the aircraft’s engine quit. Thanks to the close coordination between the pilot and the Milwaukee controller, the Coast Guard was on scene within minutes of the aircraft hitting the water. Everyone aboard was rescued safely. You’d never be able to hear this kind of drama anywhere else.

“We aren’t perfect, but we do strive for constant improvement,” Pascoe said. z

3-8 FEBRUARY 2026

3-8 FEBRUARY 2026

BY JULIE BOATMAN

The notices from the county planning commission went up first. I registered the white posters with bold lettering on my morning stroll just as my neighbor walked up to me to tell me what they meant.

“They wanted to put in a new cell tower,” she said as she gestured up the hill to the crest of a pasture that often held a passel of dairy cows. What she didn’t say: We hope everyone’s okay with all this new technology rising up in the midst of farm

fields held by Mennonite families for the past nine generations.

What she didn’t know was that I took one look at that tower site and thought, “Dang, that is right under the ILS approach course to 27. I wonder when the notam’s going to pop up?”

Pilots must access and understand the notams relevant to their planned flight per 14 CFR 91.103, covering

preflight action. That hasn’t changed in a long time.

But the system through which you obtain those notams is undergoing a serious overhaul—and for most pilots, it’s about time. We have collectively spent countless hours poring through textual piles of spurious entries to find the one needle in the haystack that could prick us sharply if we missed it. Runway and taxiway closures, lighting outages, and new towers spring up like mushrooms after the

rain—and change the instrument approach procedure or departure procedure we might file and follow, or the very airport to which we’ll fly.

The sheer volume of data is immense, and it continues to accelerate. Cracks in the existing distribution and dissemination architecture have shown in recent years, with the most top-of-mind one occurring on Jan. 10, 2023, when contract personnel unintentionally deleted files “while working to correct synchronization between the live primary database and a backup database,” according to an FAA statement nine days later. “The agency has so far found no evidence of a cyber-attack or malicious intent.” It appears to have been a simple error, relatively speaking.

For those who were working in ATC, in dispatch operations, and on the flight deck that day, the situation took just about everyone off guard. The underlying system had been deemed adequate but, in the wake of the coding problem, quickly became overwhelmed—like a 5-gallon bucket trying to capture Niagara Falls. Stakeholders such as FAA operations personnel had no trouble putting info into the system, but soon airlines, ARTCC facilities, and other ATC “customers” began calling in, reporting info going into the system but not coming out.

Anyone who flies or schedules aircraft using an ops spec understands immediately the problem: Aircraft by SOP are not allowed to fly if the crew doesn’t have current runway and other airport information delivered by the notam system. While there was a ground stop, those operators had, for the most part, already stopped dispatching flights in the absence of the notam information.

It was like “a rolling earthquake that would not end,” according to one operations person I spoke with off the record.

The notam system has been slated for upgrading for several years, and now we’re

beginning to see the fruit of that effort.

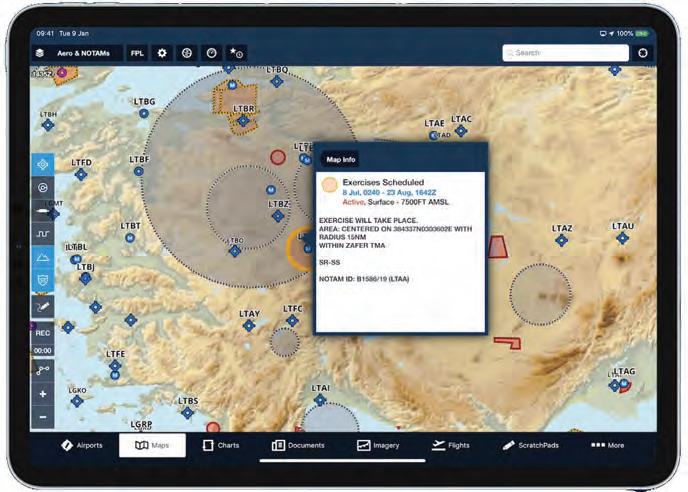

On Sept. 29, 2025, the new Notam Management Service went into an initial deployment, distributing notams to “early adopter stakeholders,” according to the FAA. “This initial deployment establishes the framework for the new service, enabling testing and validation with early user adopters. The full transition to the new single-source notam service is on track for late spring 2026.”

The new system hosts a modern, more streamlined interface, according to the agency, enabling near-real-time data exchange and active collaboration between stakeholders in the National Airspace System. It’s hosted in the cloud, and “has a scalable and resilient architecture designed for high availability.”

You can also quickly find the latest notams directly pertaining to your airport

or route using FAA.gov’s new NotamSearch functionality.

The FAA still has under development the Candidate Notam Contingency System, which is intended to kick in during a major outage of the notam system—such as that experienced in January 2023. It will work by allowing the “FAA and its stakeholders to maintain an accurate picture of the NAS while the primary notam system is returned to service by allowing authorized FAA and Flight Service personnel to issue ‘candidate’ notams—i.e., notams not yet entered into the o ffi cial notam system and thus missing notam numbers—and distribute them to the public using a standalone website,” according to the agency. When the system is operating normally, a message indicating this is displayed on Notambackup.faa.gov.

Understanding how a notam comes into being and how the system has changed can help you determine the best way to leverage those dynamics so that you minimize your search time and maximize time left for other preflight tasks—not to mention reducing the hazards instigated by not knowing a critical detail pertaining to your flight or operations.

The notam’s originator, who enters the notam data, “is respon sible for classifying, formatting, canceling, and informing the controlling facility and other facilities/offices affected by the aid, service, or hazard contained in the new notam.” The air route tra ffi c control centers (ARTCCs) are responsible for forwarding flight data center and special activity airspace (SAA) notam information to the affected ter minal facilities. In the case of our example cell-tower obsta cle, notam near KHGR in Hager stown, Maryland, the Washington ARTCC Flight Data Unit is the official coordinating entity.

Special rules also apply to TFRs that are presidential in nature, are special security instructions, invoke emergency air tra ffi c rules, or pertain to mil itary operations.

In general, “temporary changes anticipated to last less than three months are considered to be information of short duration, which is distributed by notam,” according to the FAA. In cases where notams cover a change expected to persist for longer than three months, that information should be submitted to the FAA to be published in chart or other format. When a notam is originated for a permanent change to published aeronautical information, “PERM” must be inserted in place of a 10-figure date-time group end of validity time.

To submit data for notam creation and distribution, or specifically for obstructions, you can go to the relevant page on FAA.gov. A good place to start—if your side hustle to piloting involves real estate development or tower construction—is the Obstruction Evaluation/Airport Airspace Analysis (OE3A) site, with its helpful introductory video: https://oeaaa.faa.gov/

nm of an airport (or otherwise of safety concern to the airport). And you must be brief: the text of a domestic U.S. notam cannot be longer than 20 lines.

As it turns out, prior notification to the FAA was required for the tower on our road, because it sits inside the airport’s airspace area and sticks up above the tree line, essentially, at all of 157 feet agl.

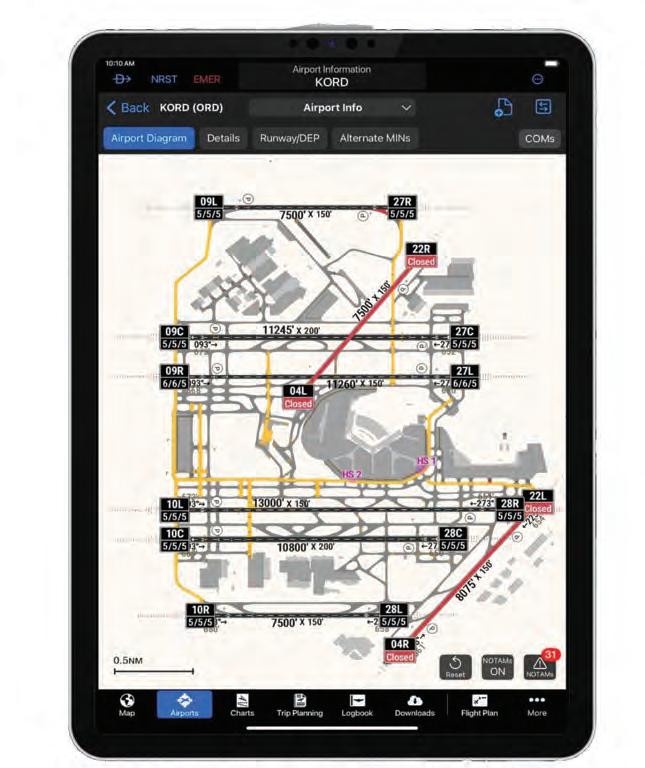

Garmin’s graphic notams overlay highlights airport problems in any easy to interpret format.

oeaaa/oe3a/main/#/home.

Plainly put, a developer generally needs to file 45 days before construction if the structure it plans to build is more than 200 feet agl, or penetrates the “trapezoid” of protected area approaching a runway—and it may need to be lit or marked even if not above the 200 feet benchmark, depending on the circumstances. Criteria also exist for lit versus unlit obstructions; those more than 400 feet agl, or those within 6

But it does not present undue hazard, so it was approved within the normal process, which goes like this: the airport receives notification during the planning process, though it does not approve projects, per se. Instead, it may make recommendations to the builder regarding mitigations and/or markings to incorporate into the design to reduce impact to the airport’s approach corridors and instrument procedures. The FAA can disapprove a project, but very rarely does. Instead, it would note any impact to the procedures and use of the full length of the runway—for example, if a developer wanted to build a 50-story hotel just outside the airport property. Any reduction in service puts the airport’s grant assurances in jeopardy and risks fines, normally leading to the changing of said developer’s plan. The obstruction must complete construction before the notam enters the system and the data goes to the various charting entities, such as Jeppesen, Garmin, and the FAA’s Aeronautical Information Services division.

Which makes sense, if you think about it. If all the projects submitted and under construction were entered into the system before completion, you could hardly see the ground on any given chart—it would resemble a garden of toothpicks carpeting the land. Not to mention the incredible

traffic jam of notam text delivered in a preflight briefing. So a delay of a few days between a tower’s apparent completion and the pop-up of the notam advising pilots of it in the system is typical—and considered a reasonable level of safety.

Obstructions take time to build—but the dynamic nature of airport runway and taxiway closures drives more immediate concern for pilots and other stakeholders in the system (as the January 2023 outage illuminated dramatically).

That’s why having new graphical tools available to flight crews and dispatchers makes a lot of our planning easier. And, this is especially important because while the FAA has improved the infrastructure of the notam system, it’s still up to the disseminators to organize how they are presented.

closures come in yellow and require the pilot to consult the notam for the details. A clock resident in the runway label will show the time period for any closure, if warranted.

ForeFlight’s graphical notams in the map view help pilots view potential issues more easily than reading text.

Garmin’s SmartCharts within the Pilot app has helped pilots put this data into context since mid-2025, with its placement of notams at the top of the airport page, and on the map page in the lower right corner of the plan view. Now, Garmin’s new graphic notams overlay option—launched in November and available with a Premium subscription—makes visualizing the data that much easier. When selected, it depicts active runway, taxiway, and ramp closures, with added FICON (field condition) codes appearing on the runway label.

Closed runways and taxiways are color-coded red, while closed runways will show a yellow “X” at each end, just as you’d expect in real life. Conditional

ForeFlight’s graphical notams functionality got a serious expansion in August 2025, when its en-route notam depictions became supported globally. Color-coded based on type, severity, and active times, the notam warnings can also be filtered by type in the map settings. The marriage between Jeppesen and ForeFlight reached a new apex early this fall with

the acquisition and melding of the two former Boeing business units into Jeppesen ForeFlight. The relationship has been going on for some time—witness the evolution of Jeppesen’s FlightDeck Pro. Originally, the electronic flight bag application targeted for airlines and large flight departments was aimed as a digital chart viewer, but with the Pro X version, it has featured a display-notam tab since 2019, and more recently, a notam overlay option on a selected map—clear collaborations between the Jepp and ForeFlight teams now officially making a go of it together. With the confluence of an extreme volume of data, AI powering a slew of consumer and B2B apps to crunch it, and a more streamlined FAA pipeline to sluice it through, perhaps the days of wading through an ocean of notams—making so much white noise that it’s impossible to pick out the critical signals among them—will soon be as antiquated an operation as straining to listening to a Morse code dot-dash to identify a VOR station. z

HELPFUL SITES

Primary FAA notam site: https://www.faa.gov/air_tra c/flight_info/aeronav/Notams/

Notamresponsibilities guidance: https://www.faa.gov/air_tra c/ publications/atpubs/Notam_html/chap3_section_1.html

Obstruction Evaluation/Airport Airspace Analysis (OE3A): https://oeaaa.faa.gov/oeaaa/oe3a/main/#/home

Notam search: https://Notams.aim.faa.gov/NotamSearch/ Contingency notam site: Notambackup.faa.gov

BY AMY WILDER

AeroAngel founder Mark Pestal still remembers the flight that changed everything.

A young woman with terminal kidney disease, who’d been ill since childhood, had exhausted local treatment options in Denver. Her mother found a doctor at Johns Hopkins in Baltimore willing to help—but they couldn’t fly commercially, couldn’t afford a medevac flight, and couldn’t wait. Pestal, a private pilot and former volunteer with Angel Flight, called a friend with a jet. “He agreed to do the flight the next day,” Pestal recalled. “She was in very bad shape. But we got her to the hospital—and she walked out a month and a half later.”

That was more than a decade ago. Since then, AeroAngel has quietly grown into a vital link for children and young adults who need urgent, distant, and otherwise unreachable medical care.

Based in Denver and operating since 2010, AeroAngel is a 501(c)(3) nonprofit that arranges free private jet transportation for seriously ill children. Its patients may be immune-compromised, unable to tolerate long car trips, or too medically fragile to fly commercially. Unlike other aviation charities, AeroAngel’s flights are dedicated—they aren’t tied to airline schedules, donor availability, or open seats. “We don’t wait for a match,” Pestal said. “If I get a call this afternoon, I’ll try to get the flight filled, if we can.”

AeroAngel doesn’t operate its own aircraft. Instead, it relies on a growing network of private jet owners, corporate flight departments, and charter operators who donate flights, crew time, or charter hours. When

When 10-year-old Ava su ered a leukemia relapse in early 2024, she needed to get from Tampa, Florida, to Philadelphia for an evaluation and immediate CAR T-cell therapy. AeroAngel was able to arrange the trip within 48 hours, and she is now home and cancer-free.

no donated option is available, the organization taps an emergency flight fund to purchase time-critical charters.

These trips often come together within 48 hours. One such flight in 2024 brought 10-year-old Ava from a hospital in Tampa, Florida, to Philadelphia’s Children’s Hospital for evaluation in a leukemia relapse. It was too dangerous for her compromised immune system to fly commercially, and she was ineligible for an air ambulance. Ava’s doctors approved release from her local medical care, on condition that she could be flown privately to and from the hospital the same day. AeroAngel arranged the flight. Ava received cutting-edge CAR T-cell therapy. Today, she is home and cancer-free.

The average retail value of AeroAngel’s annual flight activity exceeds $2.5 million. “If [each] family had to get a charter flight, I mean, it’d be well over that,” said Pestal.

“We spend a million dollars a year on charter alone.”

In total, AeroAngel has completed close to 500 missions. “We’re probably north of 90% fulfillment on requests,” said Pestal, “but our goal is 100%.”

The landscape of aviation charity is broad—but most programs rely on donated flights in piston or turboprop aircraft, and many are limited by geography, schedule, or diagnosis. “The typical Angel Flight is under 1,000 miles,” Pestal said. “We’re doing flights across the country.”

Corporate Angel Network, for example, provides space-available seats for cancer patients on business jet flights. But complementary organization AeroAngel targets a di ff erent need—all kinds of

whose condition demands the safety and speed of pressurized jet transport.

“We do all medical issues,” Pestal said. “Surgery, chemotherapy, discharges. These kids just can’t wait—and they can’t go commercial.” He added that many children use wheelchairs, need reclining space, or require private environments to reduce infection risk.

One of AeroAngel’s aviation partners is FlyExclusive, which has operated more than 100 missions for the nonprofit since 2021.

“The little girl in their logo was actually on our first flight,” said Matt Lesmeister, COO of FlyExclusive. That inaugural mission launched the partnership, which now includes jet card hour donations, flight time from members, and direct operations

of the value of time—and what we provide.” Lesmeister, who joined FlyExclusive shortly after the AeroAngel partnership began, sees it as core to the company’s culture. “Private aviation is often seen as a luxury,” he said. “But it needs to go beyond just the high-net-worth individual. This provides access to children who need it— and likely can’t get it otherwise.”

AeroAngel’s team is lean: a flight coordinator, part-time contractors, a bookkeeper, and Pestal himself, serving as the full-time, unpaid executive director. “I pray a lot,” he joked about making the budget work.

“Some of our pilots have said their best flight ever was one of these,” Lesmeister added. “It leaves a mark. It reminds them

Requests come in through hospital social workers, Google searches, or word of mouth—often from families who have flown with AeroAngel before. A recent upgrade to the organization’s website added links for those interested in becoming a donor, an ambassador, or a corporate sponsor.

Looking ahead, Pestal hopes to secure funding for an aircraft: a light jet, like a Phenom 300, based in Denver, could allow AeroAngel to guarantee flights even more quickly. “We’d love to have a plane ready,” he said, “and then find a donor to back it up if needed.”

For the children who fly with AeroAngel, the flights are more than just transportation. “We’re not just getting someone from point A to point B,” said Lesmeister. “We’re giving back time—and access. And sometimes that access saves a life.”

He recalled a boy named Leo, who had no immune system and needed a cell transplant at Duke Health. “Without a private flight, there was no way to get him there safely,” he said.

Pestal hopes more industry members will recognize the potential impact of a single trip. “One donated flight can save a child’s life—and has,” he said. “That’s the power of business aviation.” z

BY KERRY LYNCH

When NBAA wrapped up its 78th annual Business Aviation Convention and Exhibition (BACE) in October in Las Vegas, much looked familiar. It had a static display with about 50 aircraft, a convention hall filled with a diverse set of exhibitors pushing their wares, an opening general session that featured famed country singer and aviator Dierks Bentley and honored aviation and business visionary Steuart Walton, and the wide range of receptions and celebrations.

Yet, for an association that is a veteran in the events business, the 2025 convention was also a time of “test and learn.”

“We were extremely enthusiastic about NBAA-BACE 2025 for several different reasons,” said NBAA president and CEO Ed Bolen. “I think there was an energy there that was palpable. We tried several new things,

and they seemed to be very well received and created opportunities for us to build upon.”

Jo Damato, senior v-p of events and professional engagement for NBAA, explained the changes, ranging from a “reimagined” set-up of the static display called “Aircraft Connection” to the addition of a “Military Connect” transition program.

“They were [developed] to meet the imperative of BACE as a community—a place where we wanted everyone to be able to find what was created for them; simply put, to help people find their people,” Damato continued. “That’s important for our exhibitors, our sponsors, our attendees, our volunteers, and our speakers. So, the test-and-learns that we created were done knowing that the feedback was going to be how we determined the path forward. We have done a lot of listening.”

Like so many other events, BACE, which has been an anchor for NBAA and the gathering place for the business aviation community, is facing the shifting tides of conventiongoers and, importantly, exhibitors.

Events such as BACE and its global counterparts—EBACE in Europe, ABACE

in Asia, and LABACE in Latin America— have not only connected people but have served as a central location to show off aircraft, parts, and services to potential customers, and to interact with vendors and the greater community within their respective regions. However, in recent years, they have faced challenges.

Long-time attendees and industry leaders, such as industry analyst and data specialist Rolland Vincent and aircraft broker Jay Mesinger, pointed out that many of the changes came as Covid reshaped how people interact. And, it sped up those changes with the manufacturers.

“This is an issue that has been front-andcenter with the big trade associations and, of course, the OEMs for several years,” said Vincent, president of Rolland Vincent Associates. “As with many other industry and societal trends, Covid has been the underlying great accelerator.”

Mesinger pointed out that several things happened during Covid: the industry grew—unpredictably—while the high-net-worth-individual population swelled. Yet the corporations weren’t flying. With the onset of Covid, many events were cancelled. The OEMs kept selling and making airplanes, but they needed to find a way to reach out to the buyers, Mesinger said. “We’ve created some new methods of getting in touch with these people.” OEMs and other companies instead stepped up their activities surrounding private events. And there, they found substantial success.

Aviation businesses already felt the strain of the expense of exhibiting at the major business aviation gatherings, as well as the other events—the Paris Air Show, Dubai Airshow, and Farnborough Airshow, among them. Private events enabled a contained audience and controlled costs. This altered strategies at companies, particularly the OEMs, which instead focused on their own events but also tried out new or

PRESIDENT,

different events to reach untapped or different markets.

Aero Friedrichshafen, for instance, long thought of as a light general aviation show rather than a business aviation convention, increasingly became more attractive as it opened a door to the Central European market. Dubai provided a gateway to a potentially lucrative Middle East market, as well as the growing defense markets where business aviation is finding increasing success.

Shows such as ABACE disappeared altogether, leading some manufacturers to find their way to Singapore before experimenting with newcomers Aero Asia in Zhuhai, China, which held its second edition last

year, and the inaugural Business Aviation Asia Forum & Expo in Singapore. And of course, Paris and Farnborough have always attracted defense businesses. In Latin America, shows such as the Catarina Aviation Show in Brazil began to gain steam.

And then came the May 2023 security breach, where anywhere between 80 and 100 protesters cut through the fence at Geneva Airport in Switzerland and entered the static display at EBACE. Seven protestors handcuffed themselves to a Gulfstream—three attached to the nose gear and four on the jet’s cabin entry door handrails. Others secured themselves to other aircraft.

Vincent pointed out the magnitude of the moment. “I was actually on the ramp just moments after the protester attack at EBACE, a moment when you-know-what hit the turbofan. It was shocking to witness, and in some ways a signal of the end of an era,” he said.

EBACE organizers increased the protections the following year, but neither Gulfstream nor Bombardier exhibited despite

stepped-up security. However, neither cited security as their reason for opting out, instead highlighting their strategic decision to focus on other events.

Then NBAA sold its stake in EBACE, leaving the European Business Aviation Association (EBAA) as the sole show manager. The parties never fully explained the split, but it came at a time when EBAA was increasing its voice in Europe, and the move enabled it to highlight this activity.

But aside from the protestor breach, EBACE was already facing complaints about it being staged only in Geneva, which many found an expensive show. European operator Luxaviation in 2019 publicly withdrew from EBACE, citing the high costs involved with the show.

All of this has been colliding with larger macro events. “The value of the Big Box trade shows is no doubt linked to economic and business cycles. With new business aircraft order backlogs at twoplus year levels—and inflationary events and travel pricing attracting management attention on marketing expenditures—it is difficult to say that there is much nearterm ROI to be had right now,” Vincent pointed out. “Elevated security and personal health and safety concerns (remember Covid?) are coinciding with the very high costs and risks of having aircraft demonstrators onsite at an event in which there can be too many uncontrollables.”

But for Vincent, this is not a fait accompli. “This feels like the pendulum has firmly swung in one direction, but things change, and this too shall pass. Change brings opportunity and pressure to innovate. We are already witnessing examples of this happening at EBACE and NBAA-BACE in particular.”

Once EBAA and NBAA ended their decades-long partnership in August 2024, EBAA recommitted that there would be an EBACE in 2025. The event, held in May 2025, was significantly scaled down with

no static display, no press conferences, and large networking “lounges” and topical stages strategically placed throughout a downsized footprint where exhibitors once occupied the space.

STEFAN BENZ CEO, EBAA

For EBACE 2026, our goal is to build on that foundation and ensure the city’s strengths, its accessibility, professionalism, and global outlook are used to their full potential.

The networking lounges proved a success, drawing the European business aviation community and beyond together, and the range of topical sessions often brought standing-room-only attendance to the three stages. The buzz of the show became where would EBACE be held next; EBAA officials were holding discussions about potentially moving the show, or at least rotating it.

However, after EBACE, EBAA went through a leadership change with the departures of secretary-general Holger Krahmer and COO Robert Baltus, and the appointment of Stefan Benz—a former Luxaviation executive—to lead the organization.

In the weeks following, EBAA made an announcement that surprised some— EBACE would return to Geneva. Further, it was bringing back the static display. But it would adopt an every-other-year approach for alternating locations.

Benz told AIN, “We’ve been pleasantly surprised by the positive and supportive reaction to EBACE remaining in Geneva with a static display. Switzerland remains the center of business aviation in Europe, and Geneva combines outstanding connections, a strong financial ecosystem, and a clear appeal to the industry’s end users.”

Benz further maintained that, in the past, the true value of Geneva was not fully realized. “For EBACE 2026, our goal is to build on that foundation and ensure the city’s strengths, its accessibility, professionalism, and global outlook are used to their full potential.”

But he recognized the importance of EBAA focusing on evolving the show. The organization wants to take a holistic view of the event, he said. “There was a wish for change.” He pointed to the slide over the past couple of years in visitors and the movement toward more of a classic B2B environment and networking-focused event, rather than also serving as a B2C, client-based event.

This movement, along with the shift of EBAA as the sole host of EBACE, prompted a review of “what do we want to do,” Benz said. While NBAA is no longer a part of hosting the event, Benz stressed the ongoing cooperative relationship the organizations maintain as they both advocate for the business aviation community.

In charting a path forward, EBAA gathered feedback from exhibitors and other stakeholders and found a desire to return more to an event that draws clients, whether high-net-worth individuals, family offices, or others involved in business aviation, he said.

Logically, he continued, that was a driver for OEMs to exhibit and, as a result, for a return of the static display. However, Benz

EBACE26 marks a decisive step forward, bringing fresh energy and opportunity to the global Business Aviation community. The static display returns in a new dedicated location at Geneva Airport, designed to deliver the most secure, fexible and customer-focussed aircraft showcase in the event’s history.

Coupled with Geneva’s well-connected ecosystem, nowhere else in Europe brings together this calibre of key stakeholders, infuential customers and industry associations.

Be part of the new experience.

Find out more at ebace.aero

added, EBAA is considering only holding the static display when EBACE is held in Geneva every other year. This appears to be more in line with the preferences of OEMs, which are working to spread their activities among multiple shows in a given year, he maintained.

At the same time, Aero Friedrichshafen is leaning into the business aviation community. Aero Friedrichshafen had grown into Europe’s largest general aviation show, having attracted everything from experimental and novelty up to turbine aircraft. In 2025, however, the show opened a business aviation dome to extend the reach into the full scope of the sector and attracted interest from the largest business jet OEMs and their suppliers as they looked to tap into the Central European market. This helped fill a void left by the lack of a static display at the 2025 EBACE.

Speaking at the Irish Business and General Aviation Association’s fourth annual International Business Aviation Conference (another upstart event growing in popularity), Dennis Schulz—Aero Friedrichshafen’s project manager of international sales in EMEA, North America, and China—gave a glimpse of the plans for the 2026 show. He noted that organizers are paving the way to accommodate substantially more exhibitors and aircraft on static display next year.

He noted that in 2025, the organization had to turn away displays. “We simply just ran out of space…There were just so many inquiries.” The organization had set up a 2,000-sq-m (21,500-sq-ft) dome adjacent to the exhibition Hall A1 at Messe Friedrichshafen to host the business aviation activity. But organizers quickly discovered it was not big enough, so they are doubling the dome size for the 2026 event.

In addition, organizers are opening up Hall A1 to business aviation to provide even more space. “We realized that the dome alone will not accommodate the business aviation community,” Schulz added.

Business aviation exhibitors are already lining up for the space, with many returning from the 2025 show. They include most of the major business aircraft OEMs such as Bombardier, Textron Aviation, Gulfstream, Pilatus, Dassault Aviation, Daher, Piaggio, and Honda Aircraft. “As you can see, our show is growing,” Schulz concluded.

Aero Friedrichshafen organizers say the goal is not to replace EBACE, but rather to complement the pure-play business aviation convention. Whether this will have an effect on EBACE and its static display remains to be seen.

NBAA also mixed up its static display at Las Vegas Executive Airport in Henderson, Nevada, again hoping to make it more attractive for a steady stable of OEM exhibitors. As part of the test-and-learn mantra, it shortened the renamed Aircraft Connection availability to a day and a half, eliminating large chalets to provide views all around, and planning a “golden hour” celebration to draw attendees. Unfortunately, the golden hour was canceled for

high winds, but it was clearly embraced by attendees.