1.Welcome and Thanks

✓ AAACF, Song Foundation, Herrick Foundation

✓ Shannon Polk

✓ Khalilah Burt Gaston

✓ Wendy Brightman

✓ Howard Hanna Real Estate Services

✓ AAACF, Song Foundation, Herrick Foundation

✓ Shannon Polk

✓ Khalilah Burt Gaston

✓ Wendy Brightman

✓ Howard Hanna Real Estate Services

These slides are embargoed; they may not be used, distributed, copied, or otherwise utilized with notification present.

1. 150,000 households (92,000 home owners) (62%); 29,000 are 65+

2. 65,000 students – 45,000 off campus :: 22,500 student households off campus (1 HH=1 unit)

3. 70% (108,000) of all housing units in county is single family detached

4. 15,000 more households by 2045 were projected; now? ALL BETS ARE OFF

5. 5.8% of the county’s households live in Ypsilanti, but 12.6% of the subsidized units are there.

6. $225/SF is the cost for new construction, excl of land, predevelopment, contingency, profit

7. >85% of the housing engine is in the core of just five townships (Scio, A2, Superio, Pittsfield, Ypsilanti)

8. 55,210 employees at UM+ System – 11.4% increase since just 2020 ALL BETS ARE OFF

9. 4,500 single parent households are the net in real trouble

10.85-12-3. 85% of households are coping well, 12% are vulnerable; 3 % really hard hit

• 150,000 households

✓ 125,000+/- are doing well (if not perfectly)

✓ 20,000+/- are vulnerable (cost and quality burdened)

✓ 5,000 +/- are especially vulnerable

These slides are embargoed; they may not be used, distributed, copied, or otherwise utilized with notification present.

These slides are embargoed; they may not be used, distributed, copied, or otherwise utilized with notification present.

1. Pricey but, countywide, NOT an exorbitantly expensive housing market

2. Short** -11,000 (-10,895) affordable rental; and -4,000 (-4,010) affordable ownership units

3. Several interconnected transitions are now complete

4. 2025 housing market is very different in complexion than 20, 30, or 40 years ago

5. About 90% of households have found a very capable coping mechanism/workaround

6. Balance are truly on the outside looking in – single earner HHs w/o BA

7. For this 10% without BA as sole earner/HH it truly is a crisis

8. Unless the crisis faced by the 10% is tantamount to there being a crisis, there is no crisis

9. Important policy and program implications: land use and role of subsidy

10. A return to too much supply may be a real risk

**Not so much “short” as mismatched

1. Pricey but, countywide, NOT an exorbitantly expensive housing market

A. Ownership: 4.1 Value to Income Ratio (King County WA 6:1; Boulder County CO 6.9)

✓ 2024 SF$ $423,352 ($141,117 HHI needed)

1. @ Orange County/Chapel Hill ratios, Washtenaw would be $639,770 ($213,256)

2. @ Albemarle/Charlottesville, Washtenaw would be $463,857

3. @ Boulder, Boulder, Washtenaw would be $633,919

4. @ Alameda/Berkeley, Washtenaw would be $790,507

✓ Note – Price to Income Ratio in Washtenaw 19% higher @ 5.1

B. Rents: It takes $50,909 to rent in Washtenaw County

✓ 2024 Rents in Peer Markets

1. $50,436 to rent in Orange County/Chapel Hill

2. $59,028 to rent in Albemarle/Charlottesville

3. $68,836 to rent in Boulder, Boulder

4. $84,291 to rent in Alameda/Berkeley

✓ Still, median renter HH has not been able to afford median rent for 10+ years

C. Policy implications

✓ What problem are you really trying to solve?

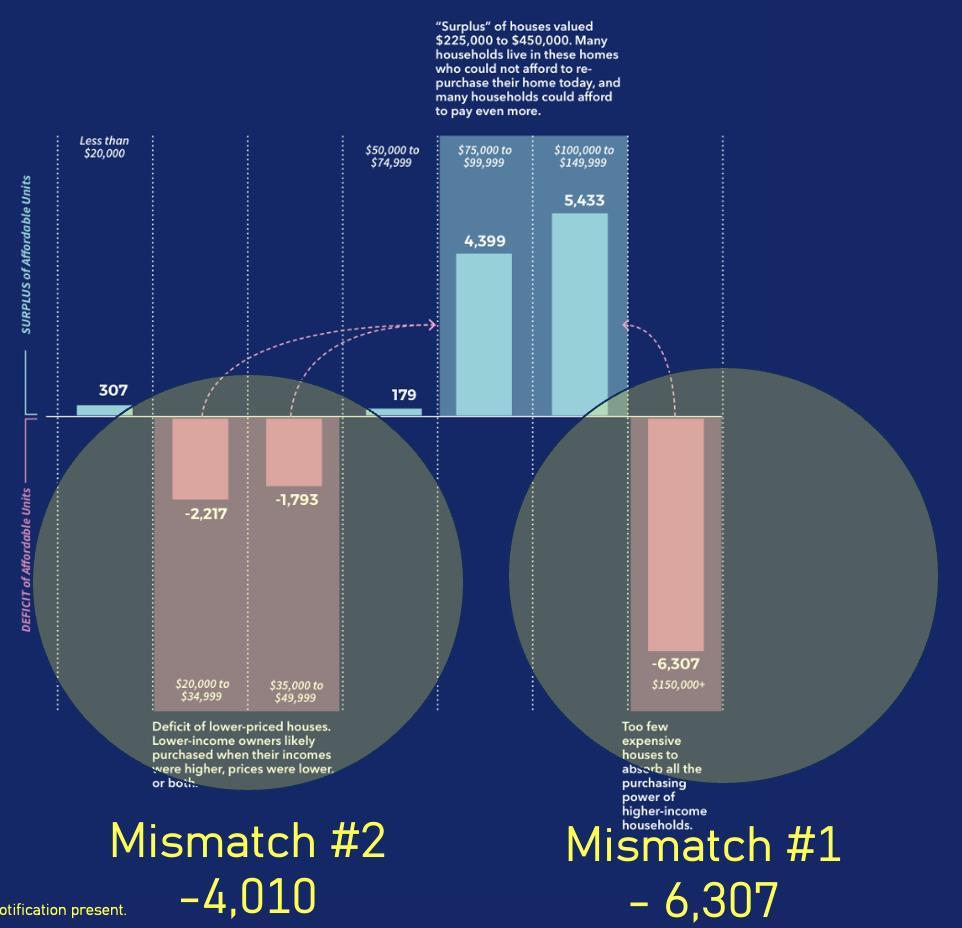

2. Short -11,000 (-10,895) affordable rental; and -4,000 (-4,010) affordable ownership units

A. When we look at owner household incomes and renter household incomes, and compare those to the value of homes that are owned and the rents charged for rental units, there’s a total shortage of almost -15,000 affordable units.

B. In actuality it’s not so much a shortage as a number of mismatches.

✓ Mismatch #1 is the county is short -6,307 ownership units that households making at least $150,000 can afford, so they buy down and impose pressure downladder

✓ Mismatch #2 is the county is short at the other end, having -4,010 too few homes affordable for purchase to HHs making less than $50,000; most rent instead

✓ Mismatch #3 is the county is short -8,739 rental units that households making at least $150,000 can afford, so they rent longer and paying less

✓ Mismatch #4 is the county is short -10,895 at the other end for those with less than $35,000 in annual income, so they overpay and usually for lesser quality

✓ Mismatch 1+2+3+4 = about 4,500-5,000 single parent HHs in (permanent?) trouble

C. Policy implications:

✓ Is home ownership a sensible goal for HHs w incomes <$50,000/yr? Even <$100,000?

✓ Who really is the target market for policy?

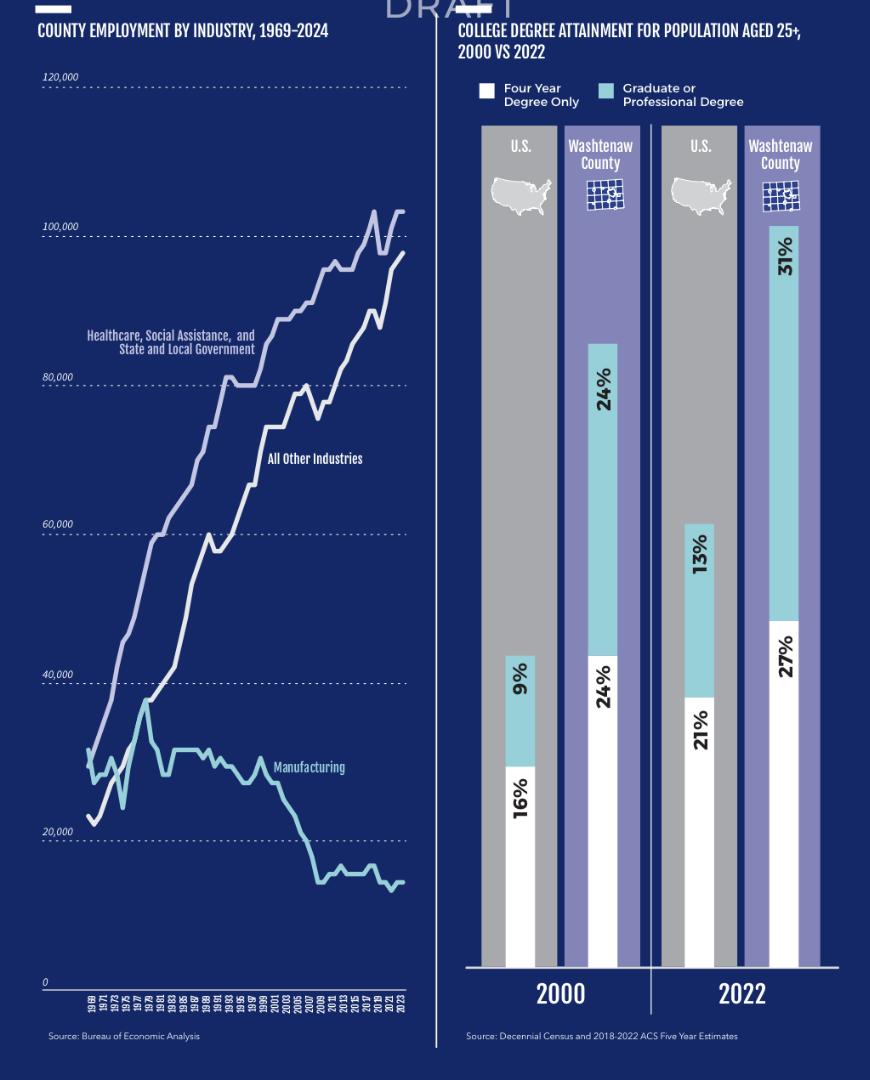

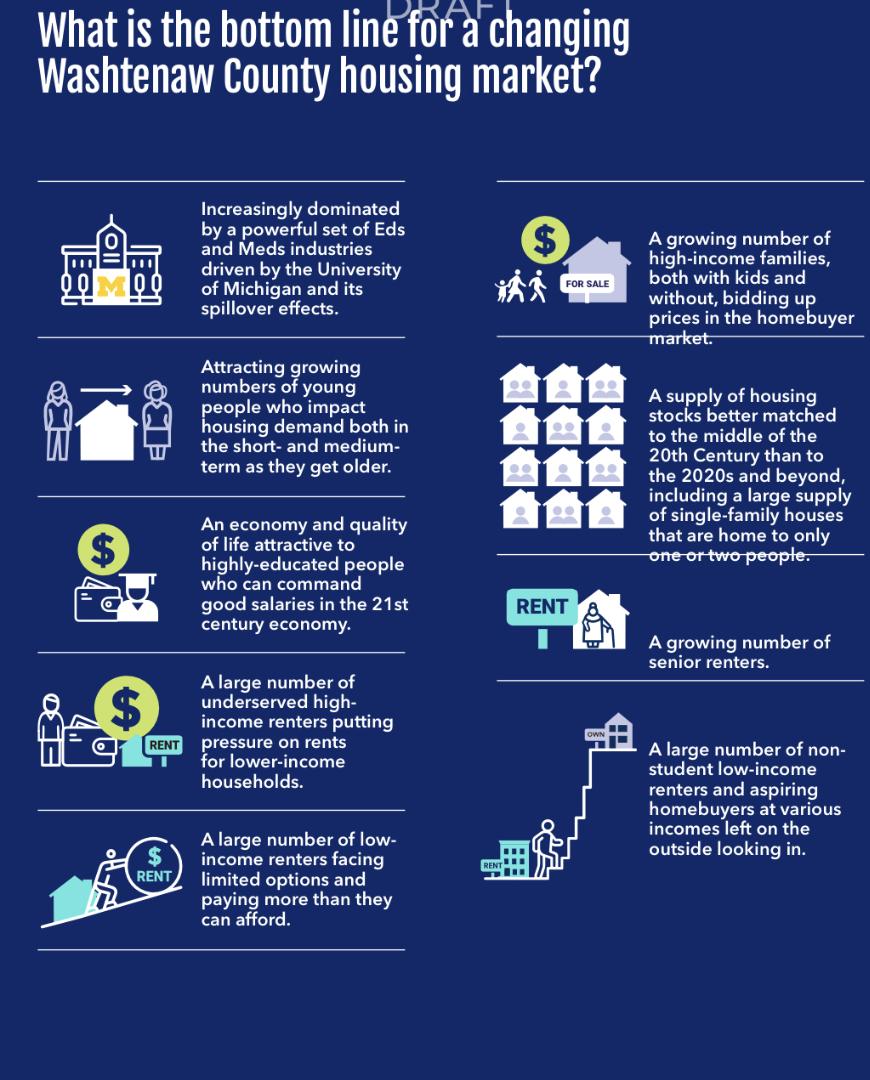

3. Several interconnected transitions are now complete…..lots of buts

A. From and To

✓ Manufacturing → eds/meds …..but (see Boston/Cambridge)

✓ Big UM → ginormous UM+ system …..but (see Boston/Cambridge)

✓ 1 earner/HH market → a 2+ earner/HH market (period, the end)

✓ Reasonable development cost market → a high development cost market …..but see tariffs

✓ Young renting and owning county → an aging and increasingly rental county

✓ Community where generations weren’t colliding → one where now they are …..but, wait

✓ Community where the step from renting → owning was small but no longer is …..but wait

✓ Good quality of life acceptable to who you used to be → a high Q/L required by who you have become …..but wait

Policy implications

✓ What is the trajectory for UM+ system?

✓ What kind of a county do you want to be in 2045?

4. 2025 housing market is very different in complexion than 20, 30, or 40 years ago

A. 1 earner/HH market → a 2+ earner/HH market – this is now priced in

B. Reasonable development cost market → a high development cost market

✓

✓

$200**/SF x 1,800 SF = $360,000 + predevelopment + financing + land (excl garage)

✓ $550,000 single family detached new (high 300s/low 400s double)

$250,000 TDC 850 SqFt 2 BR 2 BA apartment; 20-40 du/a

✓ $2,500 b/e

C. 1975-2005 the market was much more fluid; since 2005 it has really migrated towards the two well educated high-income earner household county it is now

D. Policy implications

✓ The < 2 earner non-student HH is who is cost-burdened; especially single parent

HHs in need of larger units that can only be delivered with extensive subsidy

✓ These are not the households easily welcomed into any community – which highlights the Ypsilanti problem

5. About 85% of households have found a very capable coping mechanism/workaround

A. Overwhelming majority of county households are coping with rents and the costs of buying/owning by pooling incomes, unless they bought years ago

✓ Students/roommates pool incomes to obtain otherwise unaffordable apartments or homes; couples pool incomes to rent and buy

B. IOW while housing is competitive, it’s a subset of renters that are stressed

C. Policy implication

✓ Do you have a problem? If so, what is it?

✓ 85% doing well + good quality LIHTC + your IZ efforts have also born fruit and are good

✓ The big coping mechanism – pooling income – is itself part of a feedback loop.

Pooled income raises buying power, which induces rent increases to which pooled incomes respond.

✓ About 20,000 student households living off campus are the tail wagging the rental dog;

✓ Meanwhile 30,000 married households with >$150,000 in income are pulling the ownership market further out of reach, ensuring a clogged upper end rental market

6. Balance are truly on the outside looking in – single earner HHs where earned lacks BA

A. > 58% of all county residents have at least a BA

✓ 64% in Boulder County (CU); 62% in Orange County (UNC-Chapel Hill); etc

✓ In such markets this leads to an important phenomenon

B. Policy implication

✓ If/as UM+ System expands, holds steady, or contracts, this will play a large role in determining demand for off campus rentals by students and employees of UM and related medical

7. Some households are truly in a crisis

A. Firewall in the housing market; steps are simply too steep

B. Geography-wise, working lowincome households are basically trapped

C. Policy implication

✓ Where will future LIHTCs go?

✓ How many jurisdictions will say YES to IZ/MF?

✓ How many jurisdictions can help financing IZ/MF (where >5% will likely require $)

7. Some households are truly in a crisis

A. Firewall in the housing market; steps are simply too steep

B. Geography-wise, working lowincome households are basically trapped

C. Policy implication

✓ Where will future LIHTCs go?

✓ How many jurisdictions will say YES to IZ/MF?

✓ How many jurisdictions can help financing IZ/MF (where >5% will likely require $)

Moderate Income HHs and Students 2 Income

High Earner HHs

Moderate Income HHs and Students

8. There is no county housing crisis at the systems level

A. With reasonable value and price – income ratios, the market is rather healthy

✓ It takes rising values to create home equity, and the market is providing this

✓ It takes demand to justify new development, and the market is providing this

✓ It takes subsidy to offset cost burdens and LIHTCs and other programs are doing this

B. BUT, there are real area where attention might be focused

✓ Senior housing development (market and below-market)

✓ Continued development of well conceived LIHTC in partnership w MSHDA

✓ Well conceived BY RIGHT IZ MF outside the core

✓ Well conceived traditional (8-12 du/a) and MISSING MIDDLE (12-24 du/a) products

✓ Grappling with UM’s footprint on the market

✓ Geographic exclusion

C. Policy implication

✓ Which partnership of jurisdictions can work together on one or more BY RIGHT mechanisms

9. Important policy and program implications: land use and role of subsidy

A. Subsidy

✓ If you are “short” -15,000 units (or mismatched), and each = -$75,000 in gap financing, you have $1.125B subsidy to raise; over 20 years that’s $56M/yr for 750 units as a county wide catch-up goal

✓ Woods and Poole projects +15,000* by 2045 so 750 net new

✓ Total 1,500/yr 2025-2045 (catch up and keep up)

✓ Question 1: can your systems scale to these volumes?

✓ Question 2: should you try, or work more surgically and wait for demographics shake out?

B. Land

✓ At average du/a 1 acre/unit = 47 square miles

✓ 10 units/acre = 4.7 square miles (3,000 acres)

✓ Question 1: what are your jurisdictions’ tolerances for moderate densities?

✓ Question 2: what is your capacity to collaborate on development rights?

C. Form and Codes

✓ Invariably, density and height will factor into determinations of feasibility

✓ Question 1: how ready are your plans and codes to cope with these challenges?

10. A return to too much supply may be a real risk

A. A year ago this might have seemed a distant concern

B. Current turmoil + demographics suggests overbuilding may be a risky bet

C. Policy implication

✓ How much, if any growth to incentivize?

Washtenaw County Housing Market in One Slide

Owners have home equity; renters can afford good quality; pooling incomes (roommates) makes budgets work for many These slides are embargoed; they may not be used, distributed, copied, or otherwise utilized with notification present.

LIHTC + Rental Vouchers Doing a Good Job (totally screwed without subsidy/help) (BUT the geography of help is problematic)

These slides are embargoed; they may not be used, distributed, copied, or otherwise utilized with notification present.

These slides are embargoed; they may not be used, distributed, copied, or otherwise utilized with notification present.

These slides are embargoed; they may not be used, distributed, copied, or otherwise utilized with notification present.

These slides are embargoed; they may not be used, distributed, copied, or otherwise utilized with notification present.

Mainly Through UM+ System Growth, Student Retention, InMigration

2 income HHs are driving the market on the ownership side and Roommates on the rental side

Doing a great job keeping young people; but a better job keeping old people – Q/L is HIGH

Student Demand (Pooled Roommates)

Driving Up Rents

Development Costs Are Up Across the Board

Not Selling Not Dying (Yet)

Wants

Apartments And Stuff (not much change) Wants

Homes w Yards (real change) Wants to Stay As Long As Possible (real change)

Healthy Vacancy % + 42,000 BRs

58% at least BA kinda/sorta all ya need to know

Ratios are NOT unreasonable Mismatch #1 - 6,307

Ratios are not unreasonable

If sales prices for SF homes in Washtenaw County were at the ratios they are in peer communities, they would be:

- $790,507 to match Cal-Berkeley

- $639,770 to match UNC Chapel Hill

- $633,919 to match CU Boulder

- $463,857 to match UVA Charlottesville

Instead of - $423,352 for UM Ann Arbor

Ratios are not unreasonable …but…

• Buying is becoming more and more expensive

• Older owners (more of them) are staying put

• No arbitrage opportunities

• Living longer

• Short supply of desirable options

• Interest rates are no longer low

• New construction is now prohibitive

• Again, financing is expensive (and going to get worse)

• Materials are expensive (and going to get worse)

• Labor is expensive

>$550,000 new SF**

Why is this important?

• $550K requires $180K

• To get this price lower means homes either get smaller or less well built if outside a few jurisdictions where land is objectively expensive

• It will mean there’s pressure on rural/farmlands you may have to cope with ~35,000 seniors

Why is this important?

• A lot of households

• Clogging the pipes

• Needing senior housing

• Will depart the county

Rents Rising Faster Renter HH Incomes

Mismatch #4 -10,895

Mismatch #3 -8,739

Always going to get about 3x units/$ by focusing on supply at upper end

Not politically popular, but it your dollars go further

Expecting Increase In Senior Renter HHs

Shifts in HHs w different levels of formal education

Shifts in HHs w formed in different ways +

1. <$50,000 income without another earner puts a HH in a real bind

2. This bind has become solidly geographical

3. As previously noted, choice locations are moving further away from good locations in terms of price, so William Fischel’s Homevoter Hypothesis is solidifying

1. A significant number of apartments have been developed, but more will be needed to match the sizable and growing cohort of welleducated $75,000+ renter households

2. As older owners begin to age out, pressure will ease in some respects, and grow in others.

3. Which jurisdictions are prepared to work together in what ways to facilitate by right MF IZ?

1. Most are estimated to be student households, but without accurate information from the universities and colleges, an exact count is not knowable.

2. czb estimates 4,500 are single parent households.

1. Net need for +4,800 rental units for older households (all else being equal) needed as current owners age/convert

2. They will exit their owned homes, so that inventory will expand

3. But they can’t exit until pickup units are in service or an undertaker intervenes (about 400/yr)

✓ Getting more more difficult in the core; each deal illustrates land assembly and cost issues, entitlement process complexities, and resulting escalation of costs.

✓ To cope with costs, products will become ever more pointed towards higher end consumers

✓ BUT, from a fiscal point of view, directing countywide demand into the core is sound in terms of infrastructure costs and taxes

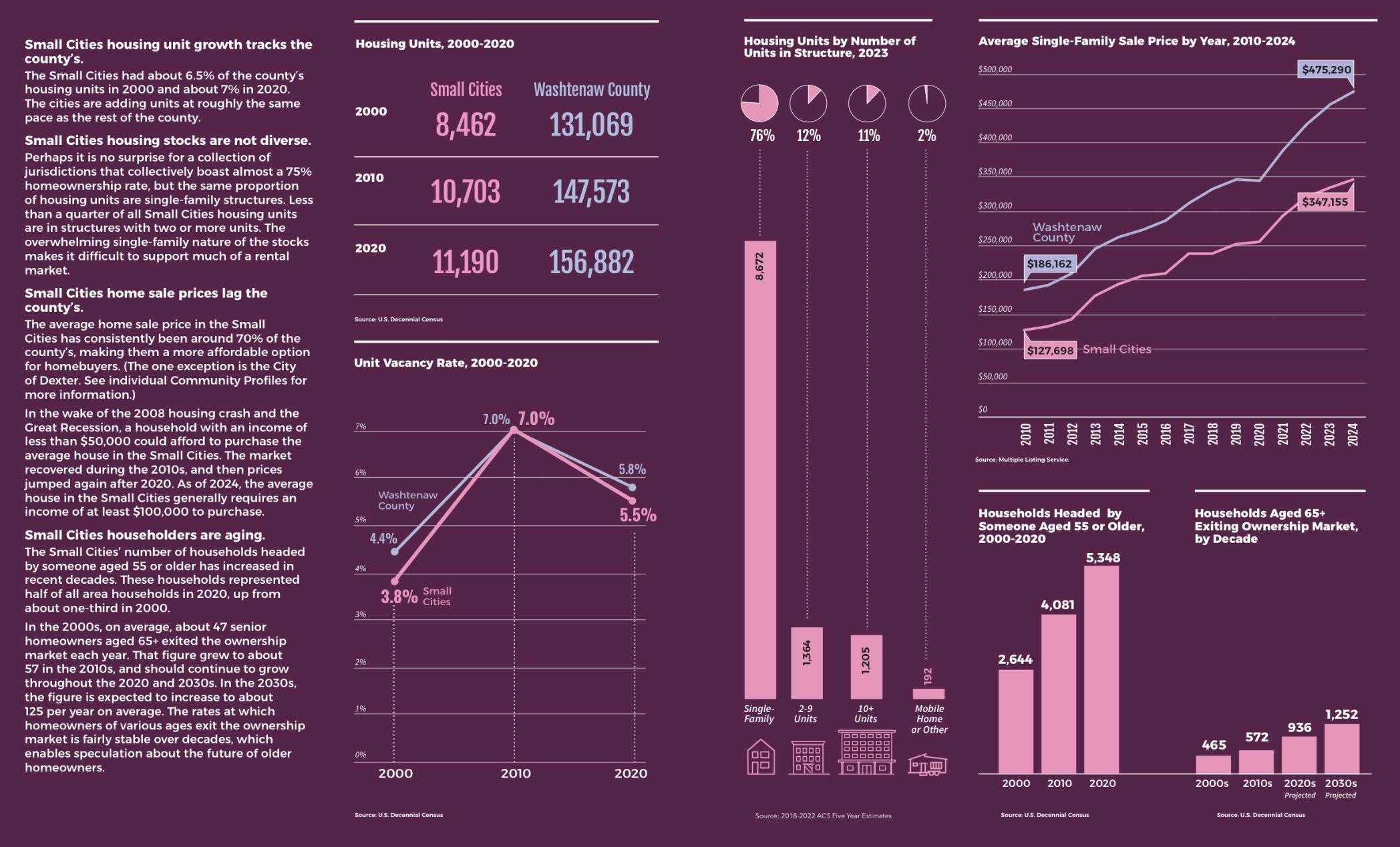

✓ Where the CORE is comparatively fat at the top and bottom, SMALL CITIES are fat in the middle

✓ 75% of homes are SFD; and HO% is high @ 74

✓ Affordable for buyers; exception is Dexter

✓ 2008 crash wake it took $50K to buy

✓ Today it takes about $110K

✓ Growing older, with implications for aging in place

✓ Very family HH dominant

✓ Very high HO% @ 91%

✓ This is where new homeowner growth has been in the county last decade

✓ 98% of all homes are SFD or mobile homes

✓ Higher % than county of HHs w $100,000+ income

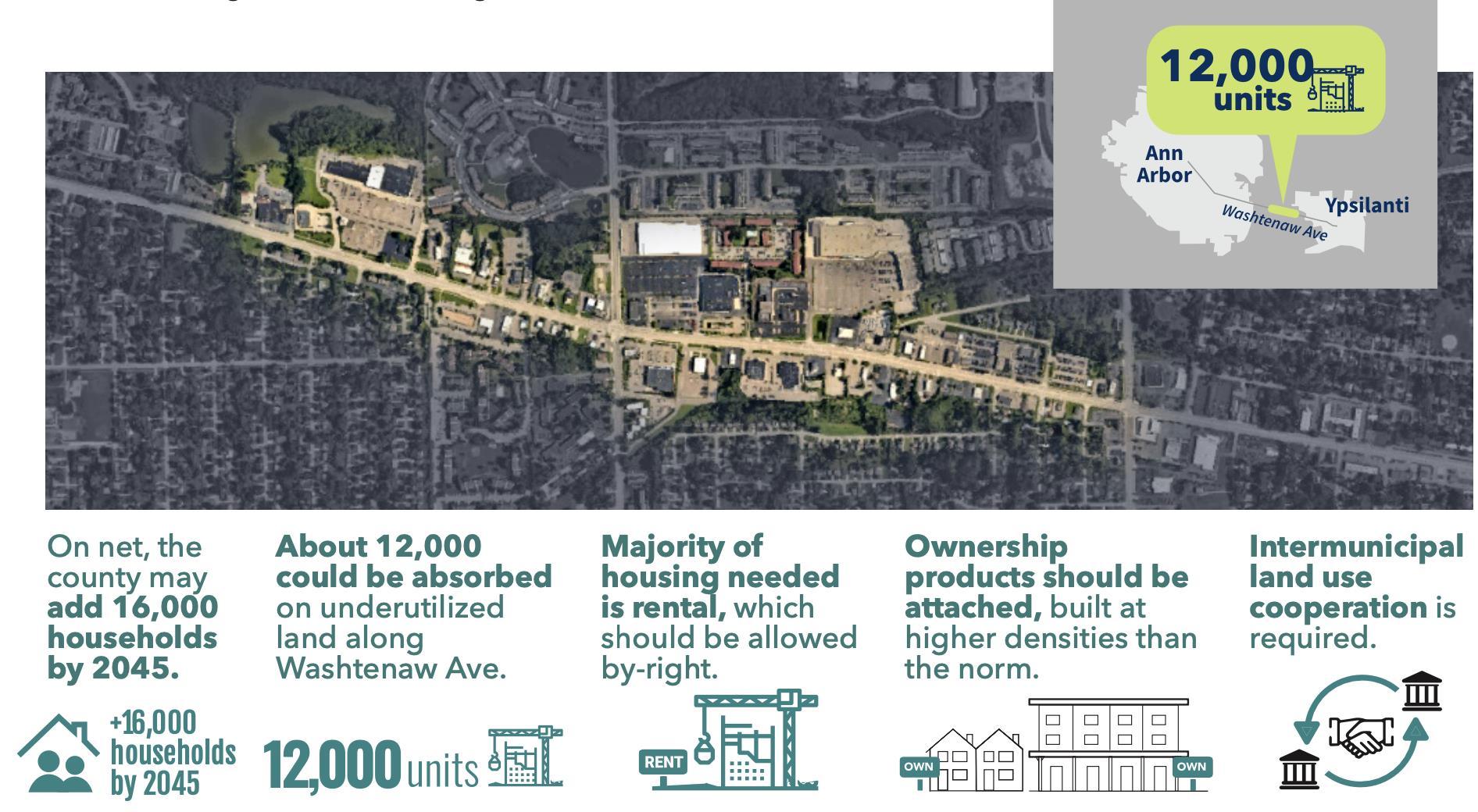

✓ 15,000 new households by 2045 expected

✓ 75% = 11,250

✓ 55% HO% x 11,250 = 6,188 new homes for buyers

✓ 45% R x 11,250 = 5,062 new apartments

✓ 6,188 homes at AVG du/a 8 = 773 acres needed

✓ 5062 apartments at AVG du/a 35 = 145 acres needed

✓ 917 acres needed across the CORE

✓ 15,000 new households by 2045 expected

✓ 7% = 1,050

✓ 74% HO% x 1,050 = 777 new homes for buyers

✓ 26% R x 1,050 = 273 new apartments

✓ 777 homes at AVG du/a 5.5 = 141 acres needed

✓ 273 apartments at AVG du/a 25 = 11 acres needed

✓ 152 acres needed across FIVE SMALL CITIES

✓ 15,000 new households by 2045 expected

✓ 18% = 2,700

✓ 91% HO% x 2,700 = 2,457 new homes for buyers

✓ 9% R x 1,050 = 243 new rental options

✓ 2,457 homes at AVG du/a .5 = 4,914 acres needed

✓ 243 rental options at AVG du/a 4 = 61 acres needed

✓ 4,974 acres needed across 15 SMALL TOWNSHIPS

✓ 917 acres needed across the CORE

✓ 152 acres needed across FIVE SMALL CITIES

✓ 4,974 acres needed across 15 SMALL TOWNSHIPS

1. Market (overall) is strong but structurally exclusive

2. Affordability stress is real but not universal by any means

3. Market has shifted from fluid to rigid

4. Coping mechanism mask stress

5. Structural exclusion is geographic

6. Shortfall is quantifiable

7. Subsidy is necessary

8. Land use reform is the lever

9. Overbuilding is a risk