what’s next FOR HME

Lazy, Hazy, Crazy Days …?

Whoever wrote about the lazy, hazy, crazy days of summer (yes, I Googled it and know Charles Tobias wrote the English lyrics) clearly didn’t work in the home medical equipment (HME) industry.

In this season of supposed relaxation filled with lazy rivers, picnic baskets, and beach umbrellas, here in the land of HME we instead have tariff uncertainties, upcoming cuts to Medicaid programs following the July 4 signing of the One Big, Beautiful Bill, and a home health proposed rule that has reanimated Medicare’s competitive bidding program while seeking to expand the product categories involved. We’re also looking at the possibility of accreditation renewals taking place every year instead of every third year, as they happen now. Summer so far has been about as relaxing and comfortable as sand in your swimsuit. Ants at your picnic. A jellyfish in your waves.

In this issue, we asked our subscribers about their biggest challenges. While anyone familiar with the HME industry would expect inadequate funding to be high up on the list — and it was — so was the human factor. So was burnout. So was the labor-intensive, time-consuming work of recruiting, training and retaining employees.

We can trace the groundswell of employee burnout to the COVID-19 pandemic, but just as we never returned to pre-COVID “normal,” employees continue to report being disengaged at work. A May 2023 report from Harvard Business Review referenced a Deloitte study that said 77% of professionals experienced job burnout. And of course, burnout in a workplace can feel contagious: As employees quit, team members left behind have to carry even heavier loads, which increases their stress.

So what can you take away from our survey story, starting on page 8? First, you can read the questions and see how your own answers compare to those of your peers (and if you were one of those who answered our survey, thank you!). See how your daily challenges and your investment plans stack up.

Second, I hope you’re able to carve out a little bit of summer — the good, Popsicles-in-the-park kind — for yourself. In being an HME professional, you haven’t chosen an easy path. You do your best to support people with medical conditions, many of them serious and permanent, if not progressive. And then you are forced too often to fight for funding that barely covers the costs of doing business … and sometimes falls short.

But never doubt that you are making a difference. That you are an integral part of the health-care continuum. That you, and your work, are seen and appreciated. Wishing you some high-quality hammock time. HMEB

Laurie Watanabe, Editor in Chief lwatanabe@wtwhmedia.com @CRTeditor

July-August 2025

hme-business.com

CO-FOUNDER & CHAIRMAN, WTWH MEDIA Scott McCafferty CEO Matt Logan

EDITORIAL VP, EDITORIAL DIRECTOR Tim Mullaney

EXECUTIVE EDITOR Bob Holly EDITOR IN CHIEF Laurie Watanabe lwatanabe@wtwhmedia.com

ART VP, CREATIVE DIRECTOR Matt Claney mclaney@wtwhmedia.com

SALES

SENIOR VICE PRESIDENT & HEAD OF CONTENT STUDIO Patrick Lynch VP OF SALES Sean Donohue

INTEGRATED MEDIA CONSULTANT Randy Easton

HME Business (ISSN 1940-6479) is published 4 times a year: January/ February, April/May, July/August, and October/November, by WTWH Media, LLC., 1111 Superior Avenue, Suite 1120, Cleveland, OH 44114.

© Copyright 2025 by WTWH Media, LLC. All rights reserved. Reproductions in whole or part prohibited except by written permission. Mail requests to “Permissions Editor,” c/o HME Business, 1111 Superior Avenue, Suite 1120, Cleveland, OH 44114.

The information in this magazine has not undergone any formal testing by WTWH Media, LLC, and is distributed without any warranty expressed or implied. Implementation or use of any information contained herein is the reader’s sole responsibility. While the information has been reviewed for accuracy, there is no guarantee that the same or similar results may be achieved in all environments. Technical inaccuracies may result from printing errors and/or new developments in the industry.

Corporate Headquarters: WTWH Media, LLC 1111 Superior Avenue, Suite 1120 Cleveland, OH 44114 https://marketing.wtwhmedia.com/

Media Kits: Direct requests to Patrick Lynch, plynch@wtwhmedia.com, or Randy Easton (reaston@wtwhmedia.com).

Reprints: For more information, please contact Laurie Watanabe, lwatanabe@wtwhmedia.com.

Steve

Having worked with several accreditation organizations, Steve was looking for an AO with a DMEPOS program that made sense and was easy to follow. One that would work within his business model, help improve processes, and ensure Spectrum Medical met all CMS requirements.

“ DMEPOS Accreditation from The Compliance Team is one of the best decisions we ever made. After their onsite visit, we always have something that’s been improved.”

— Stephen Ackerman, CEO Spectrum Medical, Inc. Silver Spring, MD 16 years TCT accredited.

You have a choice. Choose TCT.

The Council for Quality Respiratory Care (CQRC) has warned that patient access to supplemental oxygen could be in danger based on the Medicare plans included in the Calendar Year 2026 Home Health Prospective Payment System proposed rule.

On July 9, the CQRC said it reviewed the Centers for Medicare & Medicaid Services (CMS) proposed rule, published in the July 2 Federal Register, and “is expressing concern that the proposed program could have substantial negative consequences on patient access and quality of care, urgently underscoring the need for Congress to pass supplemental oxygen reform that permanently removes the supplemental oxygen benefit from future rounds of Medicare’s competitive bidding program.”

encourages the agency to carefully consider flaws in the previous CBP model that resulted in below-market rates, drastically lower reimbursement, and restricted patient access to modalities of care that help our most at-risk beneficiaries.”

Menchen said competitive bidding’s reappearance “underscores the critical importance of passing the SOAR Act this year to ensure supplemental oxygen equipment and supplies remain available.”

“While we continue to review the proposed rule to understand its full impact and scope, the CQRC is deeply concerned the methodology proposed by CMS could impede patient access to life-sustaining supplemental oxygen,” said Robin Menchen, president/CEO of Rotech Healthcare and the chair of the CQRC. “CQRC greatly appreciates CMS’s previous decision to pause the CBP [competitive bidding program] and

The Supplemental Oxygen Access Reform (SOAR) Act — S. 1406 and H.R. 2902 — seeks to exclude oxygen from competitive bidding and “to eliminate the barrier Medicare rates have created for patients seeking access to liquid oxygen,” the CQRC said. “In addition, the SOAR Act would strengthen fraud and abuse policies, implement patient protections, support access to respiratory therapy services, and strengthen access to supplemental oxygen care in rural and underserved communities.”

The SOAR Act, introduced in April, is supported by the CQRC, the American Association for Homecare, and VGM & Associates, as well as patient, advocacy, and clinical groups HMEB

The U.S. Department of Health & Human Services (HHS) has announced that an analysis of 2024 enrollment data revealed 2.8 million Americans enrolled in Medicaid or the Children’s Health Insurance Program (CHIP) in more than one state, or enrolled in Medicaid/CHIP while also being enrolled in a subsidized Affordable Care Act (ACA) exchange plan.

In a July 17 press release, HHS said the Centers for Medicare & Medicaid Services (CMS) “is taking action to ensure individuals are only enrolled in one program and to stop the federal government from paying multiple times for these individuals to receive health coverage.”

Federal regulations in place to require exchanges to periodically check for dual enrollments were paused during the COVID-19 public health emergency, the press release said.

HHS added that eliminating duplicate enrollments could save taxpayers “approximately $14 billion annually.” Data showed that in 2024, an average of 1.2 million Americans were enrolled in Medicaid or CHIP in multiple states, while an average of 1.6 million Americans monthly were enrolled simultaneously in Medicaid or CHIP and a subsidized exchange plan.

“HHS staff uncovered millions of Americans who were illegally or improperly enrolled in Medicaid and ACA plans,” said HHS Secretary Robert F. Kennedy Jr. “Under the Trump Ad-

ministration, we will no longer tolerate waste, fraud and abuse at the expense of our most vulnerable citizens.”

HHS said CMS will work with states on three initiatives:

— CMS will provide states with lists of patients enrolled in Medicaid or CHIP in two or more states and ask states to check eligibility. “CMS will work with states to prevent individuals from losing coverage inappropriately,” the press release said.

— Patients enrolled in Medicaid or CHIP while also enrolled in a subsidized federally facilitated exchange (FFE) plan have been notified by CMS and will be required to withdraw from Medicaid or CHIP if they’re no longer eligible; or end their subsidy, with the option to end their coverage; or notify the exchange and provide documentation to show that they are not improperly enrolled.

“After 30 days, the FFE will end the subsidy for individuals who still appear to be enrolled in both Medicaid or CHIP and an exchange plan with a subsidy,” HHS said.

— CMS will provide subsidized state-based exchange plans (SBEs) with lists of patients that the agency believes are enrolled in Medicaid/CHIP and an SBE simultaneously. If the SBEs determine that patients are improperly enrolled, the SBEs will be told “to implement a process, similar to the federal exchange, to recheck eligibility.” CMS will work with states to prevent individuals from losing coverage inappropriately. HMEB

The American Association for Homecare (AAHomecare) has announced the industry issues it will prioritize when commenting on the Calendar Year 2026 Home Health Prospective Payment System proposed rule, published in the Federal Register on July 2.

In a July 23 email update to its stakeholders, the association indicated that its regulatory council has identified a number of key issues and is “refining messages and guidance to inform industry comments.”

Competitive bidding back in the spotlight

Among AAHomecare’s greatest concerns are several related to the upcoming return of the Medicare competitive bidding program for home medical equipment:

— Single-payment amount in competitive bidding: AAHomecare said the Centers for Medicare & Medicaid Services (CMS) has proposed setting the single-payment amount (SPA) at the 75th percentile of winning bids when it restarts the Medicare competitive bidding program.

That SPA would result in “potentially driving rates below sustainable and market-reflective levels,” AAHomecare said.

— Expanding competitive bidding to include medical supplies not previously part of the program: CMS also wants to add medical supplies such as urological, ostomy and tracheostomy supplies to the competitive bidding program, though “it has been commonly understood” that such items “do not meet the definition of ‘medical equipment items’ and therefore are not eligible to be included in the competitive bidding program,” the association said.

— Subjecting continuous glucose monitors and insulin pumps to competitive bidding: The proposed rule would subject continuous glucose monitors (CGMs) and insulin pumps to competitive bidding, which “raises significant concerns given the limited number of manufacturers and the evolving nature of the technology,” the association said. “We believe further evaluation is needed to ensure patient access isn’t impacted by adding these products to the competitive bidding program.”

Supplier considerations in the new program

AAHomecare is also concerned about supplier representation in the upcoming iteration of competitive bidding and intends to comment on the following:

— No supplier experience consideration. While the proposed rule does include a process to evaluate supplier capacity in the program, “it does not appear to consider a supplier’s experience, either in the product category or within a specific bidding area,” AAHomecare said.

It is not clear that such a requirement [as annual re-accreditation] will have a meaningful reduction in fraud and abuse by fraudsters exploiting the Medicare program — AAHomecare

— Arbitrary limit on number of winning suppliers, with no provision to guarantee that small suppliers will be able to participate: AAHomecare said the proposed methodology for determining the number of winning bidders arbitrarily limits the total number of suppliers in the program and also fails to affirm that small suppliers will be able to participate.

“CMS is statutorily required to provide small suppliers a fair opportunity to be considered for participation in the DMEPOS competitive bidding program, and CMS has historically aimed to target at least 30% of contract awards to go to small suppliers,” AAHomecare said. That provision is missing from the proposed rule.

— Annual accreditation for providers billing Medicare: Providers of durable medical equipment, prosthetics, orthotics and supplies (DMEPOS) are currently required to be accredited by a CMS-approved accreditation organization, then be reaccredited every third year.

The proposed rule would change that by requiring providers who bill Medicare to be reaccredited every year, a process that would be “logistically unworkable for accrediting organizations and suppliers,” AAHomecare said. “It is not clear that such [a] requirement will have a meaningful reduction in fraud and abuse by fraudsters exploiting the Medicare program. While we support CMS’s commitment to program integrity, we believe there are alternative approaches that would strengthen oversight without imposing additional burdens.”

CMS indicated that it’s scrutinizing the accreditation organizations as well.

Public comments on the proposed rule are due by Aug. 29. AAHomecare shared a work-in-progress document and said it would share its final version “in the coming weeks.” HMEB

THE NEXT GENERATION OF TAILORED POWER POSITIONING SOLUTIONS

Our all-new Signature power positioning system has been completely re-imagined, delivering a new modern aesthetic, enhanced adjustability and all the durability and reliability Amylior is known for. Available on every Alltrack model, Signature boasts industry leading modularity and the capability to provide Tailored Solutions for even the most complex positioning needs.

• Tailored for the user

• Durability meets design

• Efficiency and reliability

• Adjustable and adaptable

• Custom Solutions

Providers Facing

Familiar As Well As New Industry Challenges

By Laurie Watanabe

Home medical equipment (HME) providers are facing both familiar industry challenges and new ones, according to results from a recent HME Business survey.

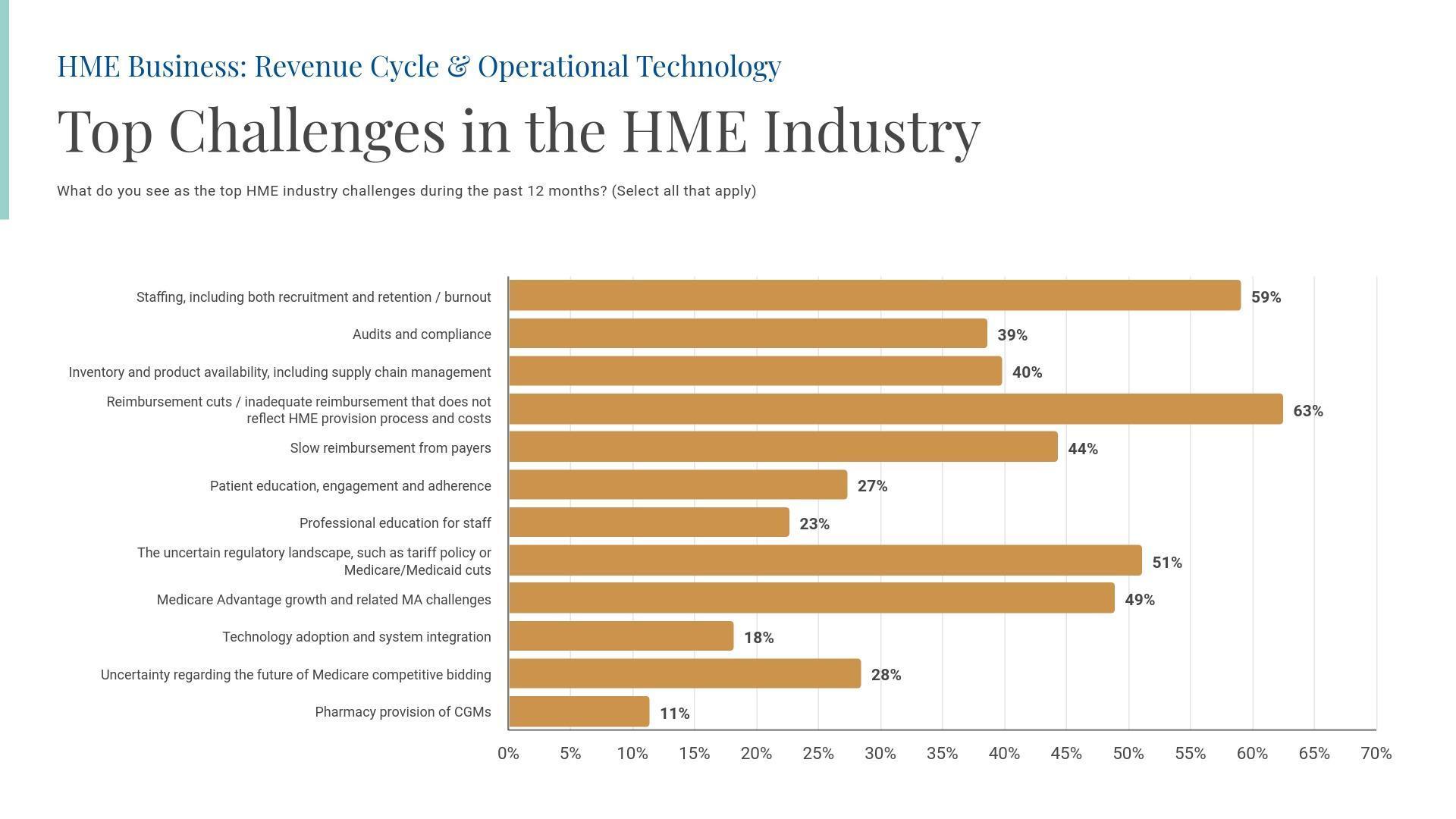

The business challenge most often mentioned by survey participants was inadequate reimbursement, including funding cuts and reimbursement rates that don’t reflect the true costs of the HME provision process. Reimbursement, of course, has become a perpetual challenge for HME providers.

But the second-most mentioned challenge was staffing, including recruitment of new employees and retaining current team members — made more difficult in some cases due to employee burnout.

The human factor of HME operations

Burnout became a significant, much-studied concern during the COVID-19 pandemic. Stress levels were especially acute among health-care professionals, who worked long hours with patients at higher risk for COVID and in higher-risk settings.

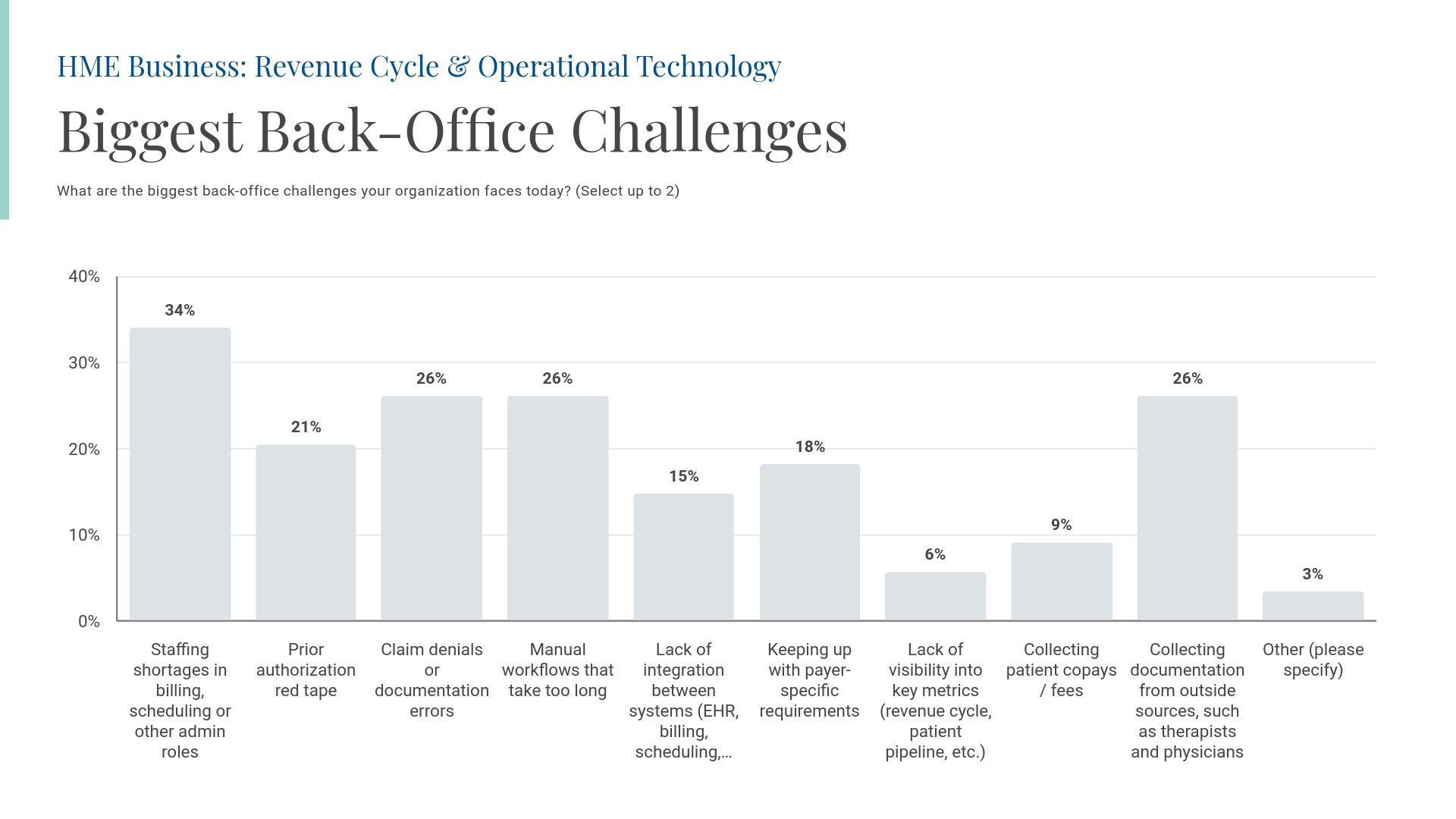

While the public health emergency officially ended in May 2023, its effects have seemingly became entrenched. In the survey, 59% of respondents said staff recruitment, retention and burnout were a top concern. Additionally, 34% of survey respondents said

staffing shortages in billing, scheduling or other administrative roles were their biggest back-office challenge — indicating that those staffing shortfalls are even more critical than traditional fundingbased concerns such as claims denials, collecting documentation, and dealing with time-consuming manual workflows (each of which was mentioned as a major concern by 26% of respondents).

The good news is that HME business executives are paying attention. Asked about their investment priorities over the next 12 months, more providers (36%) chose staffing, training and certification than any other option — an answer that beat out traditionally popular responses such as mergers and acquisitions (2%), organic growth (8%), expanding product and service offerings (18%), and optimizing delivery and logistics (23%).

After staff-related commitments, investing in revenue cycle management (RCM) or billing systems was the second-most common response, with 30% of survey participants choosing that answer. And 28% of respondents said they would invest in resupply improvements, including automating resupply systems, followed by 27% who said they would be re-evaluating their revenue mix — a strategy that could involve expanding the retail portions of their businesses.

Funding challenges continue

Not surprisingly, funding-related factors also ranked high on survey respondents’ list of challenges.

In addition to 63% of respondents saying that current funding isn’t keeping pace with the costs of operating an HME business, 49% said the growth of Medicare Advantage plans and related challenges were an issue. Slow reimbursement from an array of payers was mentioned by 44% of respondents.

And 51% of respondents expressed concern over the uncertainty of tariff policies and potential Medicare and Medicaid cuts. KFF (formerly the Kaiser Family Foundation) estimated in a July 23 report that the so-called One Big, Beautiful Bill signed into law on July 4 “would reduce federal Medicaid spending by $911 billion.”

More than a quarter of respondents (28%) expressed concern over the uncertainty of Medicare’s competitive bidding program, a longtime funding scourge. (The survey was completed before the Calendar Year 2026 Home Health Prospective Payment System proposed rule, which included competitive bidding updates, was published in the Federal Register on July 2.)

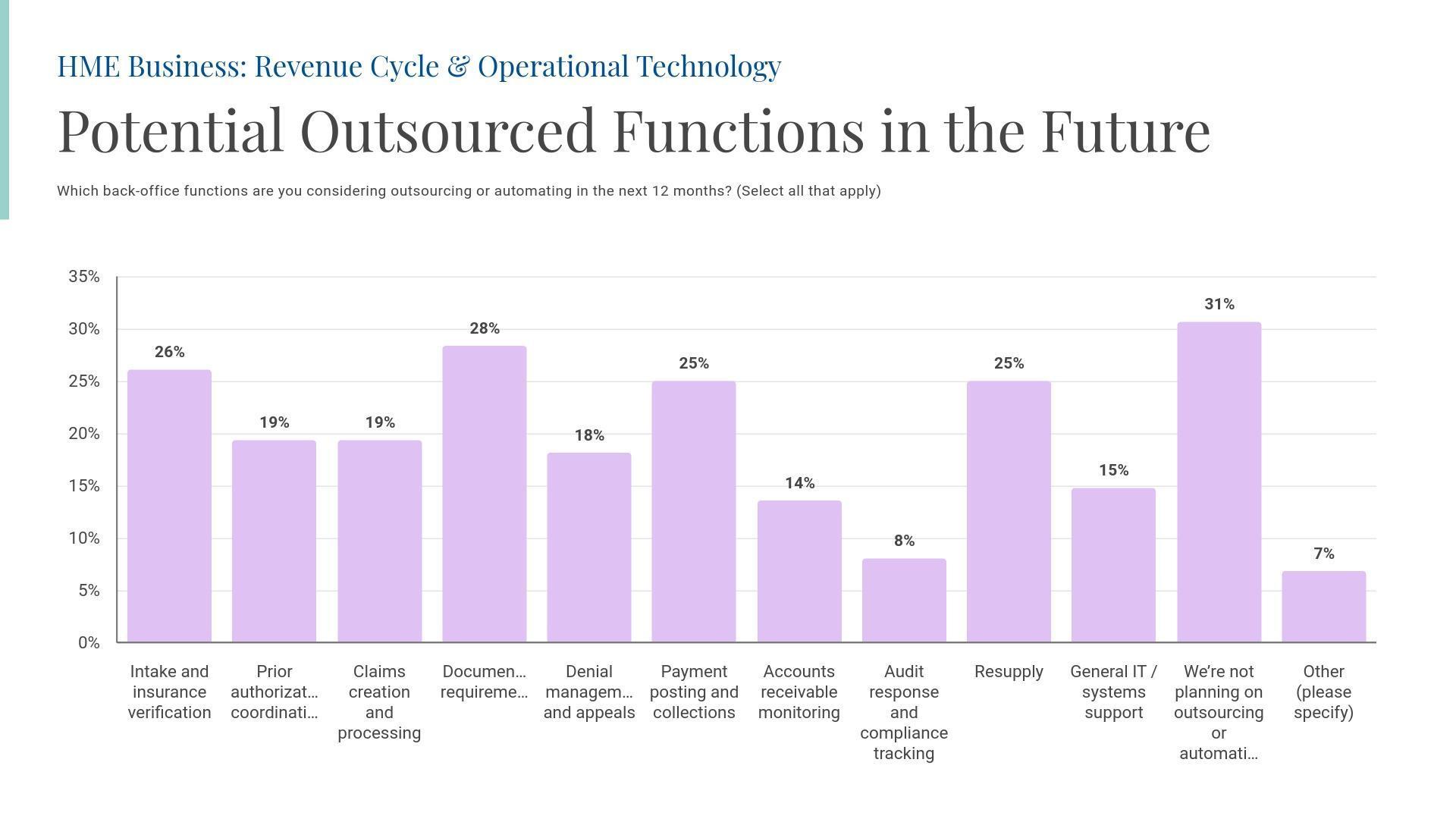

And finally, in response to a shifting HME landscape, respondents were asked which potential functions they would consider outsourcing

in the next 12 months. While 31%, the most common answer, said they weren’t considering any kind of outsourcing at the present time, 28% said they’d consider outsourcing documentation work, while 26% would consider assigning intake and insurance verifications to third parties to complete. One-quarter of respondents said they’d consider outsourcing payment posting and collections, and resupply tasks. The function least likely to be outsourced, among the options listed: Audit response and compliance tracking (8%).

HME Business conducted the survey in early summer 2025. Nearly half (49%) of the 89 respondents identified themselves as working at independent companies that sold HME; an additional 6% of respondents worked at national HME companies, and an additional 16% sold Complex Rehab Technology as their main product lines.

Asked their job titles, 30% said they were C-suite or executive leaders, while 17% identified themselves as holding vice president or director-level titles, and 34% were managers. Sales/marketing accounted for 13% of respondents, and 7% worked in administrative or back-office roles.

This story is based on a survey conducted by HME Business in May and June 2025. To request a copy of the research, please reach out to Robert Holly at rholly@wtwhmedia.com. HMEB

What do you see as the top HME industry challenges during the past 12 months? (Select all that apply)

What are your organization’s top investment priorities during the next 12 months? (Select up to 2)

What are the biggest back-office challenges your organization faces today? (Select up to 2)

Which back-office functions are you considering outsourcing or automating in the next 12 months? (Select all that apply)