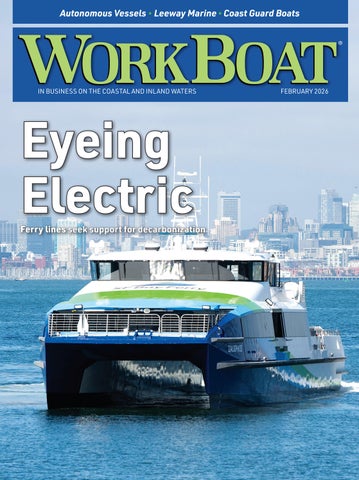

Ferry lines seek support for decarbonization

8 In Business: Leeway Marine

Technology, innovation, and ‘startup’ vibe drive growth.

18 Vessel Report: Force Multiplier

Navy pushes forward with plans for uncrewed eets.

22 Cover Story: Grant Support

Ferry eets modernize as emissions debate continues.

30 Focus: Cutter Pains

Coast Guard program plagued by costs and delays.

32 Final Word: Steve Nevey

Operational realities of running the nation’s largest ferry system.

12 On the Ways

Newburyport Whale Watch adds new, larger boat • Morrison dive eet adds new agship • SAFE Boats delivers 41' Interceptor to Florida • Coast Guard taps four builders to construct response boat demonstrators • First of four new towboats delivered to Canal Barge • Coast Guard orders up to six icebreakers from Finnish and U.S. yards • Gladding-Hearn delivers launch for Maryland pilots • Master Boat Builders launches nal vessel for Port Arthur tugboat joint venture.

26 Old Dog, New Tricks

WorkBoat puts restored Coast Guard lifeboat to the test.

4 Energy Level: The maritime industry’s active year-end.

4 On the Water: Breaking down communication breakdowns.

5 Credentialing Insight: NMC launches new application process.

5 Inland Insider: Study highlights advantages of waterway employment.

6 Nor’easter: The offshore wind merry-go-round.

6 Insurance Watch: Don’t sign blind.

7 Legal Talk: Open hatch: Who's liable?

7 Health, Safety, and Environment: Energy infrastructure support.

Eric Haun, Executive Editor ehaun@divcom.com

Those who read last month’s issue will have noticed that we have added a new section to the magazine. It’s called Final Word, and it’s intended to close each edition with insights straight from the minds of maritime industry leaders in a quick-toread question-and-answer format.

Last month, WorkBoat Senior Associate Editor Ben Hayden interviewed Roy Breaux Jr., president of Breaux’s Bay Craft, a family-run shipyard founded by Roy’s father. Since 1940, the Loreauville, La., builder has been delivering high-quality boats, including the San Jacinto and Juan Seguin, WorkBoat’s Signi cant Boat of the Year winners for 2025.

Roy described what sets a Breauxbuilt vessel apart, how the company maintains its reputation, and where he sees opportunity in a shifting market. If you haven’t read the interview, I encourage you to go back and do so. It’s a good one.

For this month’s Final Word, Ben interviewed Steve Nevey, executive director of Washington State Ferries (WSF). It’s a big job, and Nevey faces a complex web of challenges as he stewards the United States’ largest ferry system through a period of recovery and transition.

Nevey joined WSF in 2021, bringing decades of maritime industry experience from roles both at sea and ashore with Chevron and Holland America Line. At WSF, much of his work centers on restoring reliable service after pandemic-era reductions that left fewer vessels operating and long waits for commuters, requiring careful management of a eet containing many aging vessels with frequent and costly maintenance demands.

Nevey has also had to rebuild staf ng levels and crew quali cations, addressing chronic personnel shortages that previously caused frequent cancellations and disrupted schedules, while implementing apprenticeship and advancement programs to sustain future workforce needs. His efforts should be studied by other organizations experiencing similar crewing challenges.

At the same time, Nevey must work with Washington’s governor to balance modernization and decarbonization goals with operational realities: decisions like delaying hybrid-electric conversions to prioritize service levels, navigating the procurement of new ferries, and managing public expectations around these transitions.

Turn to page 32 to read his words about the progress being made.

EXECUTIVE EDITOR: Eric Haun / ehaun@divcom.com

SENIOR ASSOCIATE EDITORS: Ben Hayden / bhayden@divcom.com Kirk Moore / kmoore@divcom.com

CONTRIBUTING WRITERS: Tim Akpinar • Jonathan Barnes • Capt. Alan Bernstein • Stephen Blakely • Dan Bookham • G. Allen Brooks • Bruce Buls • Capt. Eric Colby • Casey Conley • Michael Crowley • Jerry Fraser • Nate Gilman • Pamela Glass • Capt. Arnie Hammerman • Ken Hocke • Craig Hooper • Joel Milton • Peter Ong • Richard Paine Jr. • Chris Richmond

DIGITAL & PRINT PROJECT MANAGER: Doug Stewart / dstewart@divcom.com

ADVERTISING ACCOUNT EXECUTIVES: Mike Cohen / mcohen@divcom.com Kristin Luke / kluke@divcom.com Krista Randall / krandall@divcom.com Danielle Walters / dwalters@divcom.com

ADVERTISING COORDINATOR: Wendy Jalbert / wjalbert@divcom.com

Producers of the International WorkBoat Show and Pacific Marine Expo

Vice President: Wes Doane / wdoane@divcom.com

Publishing offices: 2 Portland Sq., Suite 200, P.O. Box 7438, Portland, ME 04112-7438 207-842-5608 | Fax 207-842-5609

Subscriptions: cs@e-circ.net / 978-671-0444 Mon–Fri, 10 a.m.–4 p.m. ET ©

At Honda, we understand that commercial and government outboard applications demand professional-grade performance. For more than 60 years, Honda Marine outboards have delivered reliable, hardworking, fuel-e cient power for boats and crews that depend on our products day after day, job after job, year after year.

Backed by Honda’s legendary quality, commercial and government warranties, element-defying Honda corrosion protection, and a nationwide network of servicing dealers, Honda outboards keep your business going strong. Any time, any task, anywhere.

Learn more at marine.honda.com.

maritime industry’s active year-end

BY G. ALLEN BROOKS

G. Allen Brooks is an energy analyst. In his over 50-year career in energy and investment, he has served as an energy security analyst, oil service company manager, and a member of the board of directors for several oilfield service companies.

is usually a slow news time. Not in 2025! The end of December and early January have been active, highlighted by the United States arresting Venezuelan President Nicolás Maduro and his wife. The Special Forces and FBI raid was an exercise in precision. It showed, however, that U.S. Navy forces are spread thin globally, thereby challenging their mission to protect our allies and guarantee freedom of the seas.

While we were focused on Venezuela, widespread protests erupted in Iran and the Iranian military’s crackdown has killed many demonstrators. President Trump warned Iran’s leaders against the killing, but we have no major naval assets in the Middle East, having moved them to Venezuela. U.S. aircraft carrier groups in the Pacific-Asia region will take time to reposition. Any U.S. action against Iran’s leadership will rely on our Middle East allies, with our intelligence and long-distance support.

Another emerging hot spot is the Arctic and Greenland. The area’s strategic location along the emerging Asia-to-

BY JOEL MILTON

Joel Milton works on towing vessels. He can be reached at joelmilton@yahoo.com.

Because communication breakdowns or failures of one kind or another are one of the most common routes to negative outcomes, both great and small, it’s useful to examine what they look like in practice.

The short, simplified version goes like this: (1) a message sent is not necessarily a message received; (2) a message received is not necessarily a message understood; and (3) a message understood is not necessarily a message acted upon. Of course, it’s far more complex than this, and all three inevitably bleed across the porous boundaries between them. Still, it’s a very good starting point for identifying the weaknesses inherent in any communications chain — verbal or written, and whatever the purpose.

In this example, you could be sailing or landing a barge at

Europe trade route for Chinese and Russian ships makes it a critical defensive asset. Those nations are also sending naval vessels on reconnaissance missions, highlighting our inability to confront them due to a lack of icebreakers. The U.S. announced at year-end the award of two contracts to build Coast Guard icebreakers. The plan is to build the ships in Finland and the U.S. quickly, with the former’s knowledge and technical expertise transferred to a Gulf Coast shipyard.

The Trump administration recently proposed a 50% increase in defense spending for the next fiscal year, to begin rebuilding our military capabilities and weapons supply.

A new plan for the Navy has emerged that focuses less on growing the number of ships and more on creating a fleet with greater flexibility to wage a broader range of warfare. Redesigning the way the Navy purchases new warships is also underway to speed up delivery times and reduce costs.

The most recent maritime development is Venezuela’s agreement to provide 30-50 million barrels of oil to the U.S. The sale of the oil will accrue to the benefit of Venezuela’s citizens. However, the lack of available U.S.-flag tankers means foreign, non-sanctioned tankers will transport the oil. More oil is reportedly to follow this first tranche. The U.S. could offer this new cargo to foreign ships to entice them to reflag in the U.S., helping to grow our fleet.

After a slow start in 2025 to the effort to revitalize our maritime industry, the pace accelerated at year’s end. Can it continue? Yes. It must continue, given the significant challenges that revitalizing our shipping and shipbuilding industry must overcome, and the importance of our national defense and economic strength.

a terminal or anchoring a barge.

With respect to item No. 1, if a captain or mate assumes that barking commands or questions into a radio mic at the deck crew — or anyone else — constitutes fulfillment of that requirement, they would be wrong. You simply don’t know. Perhaps one or more parties are on the wrong channel, have the volume turned down, or (surprise!) didn’t bring a radio with them. Or their radio is full of water from the torrential downpour that just happens to coincide with your evolution. Or you have a bad mic. Who knows?

For item No. 2, even if you are certain that your message was audibly received in its entirety — clearly and at sufficient volume — whether the recipient fully understands it remains unknown, although as events progress, you will surely find out. Remember that comprehension always starts with you and your choice of words.

For item No. 3, assuming you have fully achieved the first two in stellar fashion, that still does not ensure effective or timely execution. Why might that be? The list is long: indifference, ineptitude, difference of opinion (a.k.a. defiance), distraction, or a subsequent equipment failure.

Any of these can cause the final breakdown, leading to simple frustration or possibly something far worse.

BY NATE GILMAN

Software, uses his hawsepiping experience to support mariners and workforce development. Connect on LinkedIn.

The National Maritime Center (NMC) has announced a long-awaited modernization effort: a new online application paperwork submission process, the Application Submission and Awaiting Information Portal, or ASAP, launched in January. This process provides a new way for mariners to submit their Merchant Mariner Credential and Medical Certificate application paperwork.

While hailed as a major enhancement, the day-to-day experience for the individual mariner will remain largely the same. Mariners and third parties will still be responsible for

BY PAMELA GLASS

Pamela Glass is the Washington, D.C., correspondent for WorkBoat. She reports on the congressional committees and federal agencies that affect the maritime industry, including the Coast Guard, Marad, and Army Corps of Engineers.

Working in the commercial barge industry has many advantages over trucking and railroad jobs, including reliable schedules, quick advancement, competitive pay, and job security, according to a new study commissioned by the National Waterways Foundation.

Conducted by the Texas Transportation Institute at Texas A&M University, the study takes a deep dive into employment conditions in the inland industry. It paints a picture of a workplace that outshines competitors by many measures, and that makes a substantial contribution to the economy through employment, taxes, and as a key player in the nation’s transportation supply chain.

“Compared to employment in the trucking and rail sectors, waterways positions require no prior experience, and offer advancement based on merit, the opportunity to acquire additional certification, and reliable scheduling of work periods,” said the study, Evaluating Employment by Inland Waterways Operators.

By contrast, the trucking sector is experiencing a critical driver shortage, high turnover rates, irregular work

creating and uploading the same PDF documents but will now do so through a website instead of attaching them to an email.

This move does raise a critical question for the industry: will the new submission process provide an automated submission receipt? Currently, a mariner’s “sent” email is their only proof of submission in a system known for human error and lost applications.

A verifiable, automated confirmation email that includes all of the documents submitted to the Coast Guard is the single most important feature this new portal must have. Without it, the new system would actually be a step backward for mariners and industry, removing the only piece of evidence that a mariner has submitted their application to the NMC.

This modernization also represents a fundamental shift in workload from the government to the applicant. By having mariners and third parties directly upload documents, they are now performing a data entry task that was previously handled by NMC staff. It is hoped that this increased efficiency and reduced workload for the government will include right-sizing the NMC’s staffing and budget to reflect this new, more modern reality.

schedules, and health problems due to the sedentary nature of the work. Railroad jobs have similar issues, the study notes, and have experienced big reductions in the workforce recently.

Inland jobs offer good pay, work-life balance, job security, and significantly safer environments than rails and trucks. Median compensation ($73,530 in May 2024) exceeds trucking wages and is close to rail wages.

Job security is another plus, the report finds, because vessel jobs can’t be replaced by autonomous vessels or artificial intelligence, “as too many variables and factors come into play that only an experienced crew member could address.”

Job growth on the waterways is projected at 3% from 2023 to 2033, and companies are actively recruiting to fill openings due to retirements.

Researchers analyzed Bureau of Labor Statistics data that included employment numbers and wages. They found that inland waterways jobs have a total economic output, including direct, indirect, and induced impacts of $36.1 billion yearly, contribute $10.2 billion in wages, and employ 127,500 people across the country. These jobs also contribute $4.2 billion in tax revenues annually.

“Our industry generates substantial national economic benefits while providing entry-level positions that can develop into skilled careers without requiring a college degree,” Cherrie Felder, chair of the foundation, said in a statement accompanying the report’s release.

A video and brochure that describe advantages of working on the water were also produced and will be provided to middle and high school guidance counselors and parents to introduce students to this promising career opportunity.

offshore wind merry-goround

BY KIRK MOORE

Senior

Editor

Kirk Moore, with over 30 years of experience, joined WorkBoat in 2015. He has won multiple awards for his marine, environmental, and military reporting. He can be reached at kmoore@divcom.com

Wind power developers pulled off a hat trick Jan. 16 in their fight against the Trump administration, with a third federal court injunction allowing the Coastal Virginia Offshore Wind project to resume construction work.

Dominion Energy won that temporary delay of the Dec. 22 stop-work order the Department of the Interior aimed at five ongoing East Coast wind turbine arrays. Its 2.3-GW, 176-generator project would be the nation’s largest — if it ever gets finished.

Dueling Interior Department orders and federal court decisions have kept the U.S. offshore wind industry in ongoing suspense since President Trump one year ago acted on his campaign promise to end projects “on day one” of his second presidency.

An early move against Equinor’s Empire Wind project off New York was abruptly rescinded in May, after reports

BY CHRIS RICHMOND

Chris Richmond is a licensed mariner and marine insurance agent with Allen Insurance and Financial. He can be reached at crichmond@allenif.com or 800-439-4311.

Our clients frequently ask us to review the insurance clause in a contract before they sign. Unfortunately, in many cases, the contract has already been signed before we have the opportunity to review it. Contracts are often prepared by legal teams or pulled from the internet. While ensuring legal accuracy is important, making sure the insurance provisions are correct is equally critical.

A properly drafted and signed contract is legally enforceable. However, just because you have signed the document does not mean that your insurance policy will react to it. Your insurance policy is itself a legal contract, and the insurer will only honor the limits and conditions stated in that policy. You should always make sure the limits and

that the Interior Department was horse-trading with New York state for a natural gas pipeline.

Opponents of wind projects were whipsawed by those changing legal and political fortunes and insisted the Trump administration must hew to total opposition. When the Dec. 22 stop-work order was announced by Interior Secretary Doug Burgum on Fox News, some exulted that “it’s over!”

But it was just starting over again. Ørsted’s Revolution Wind off southern New England and Empire Wind both won temporary injunctions. Developers of Vineyard Wind, nearly complete off southern Massachusetts, filed a lawsuit Jan. 15, and Sunrise Wind was expected to deliver its own impending court action.

With 44 turbines built, Vineyard Wind’s lawsuit attempts to keep alive a project that has recovered from near-disaster before. A turbine blade there fractured in July 2024, spilling 57 tons of foam and fiberglass debris into the ocean to wash up on Nantucket’s shores.

The blade failure led to a lengthy shutdown of the 804-MW-rated project. In July 2025, turbine manufacturer GE Vernova agreed to a $10.5 million settlement with Nantucket town officials to cover cleanup and other costs related to the accident.

One Nantucket critic in 2024 dubbed it “offshore wind’s version of Three Mile Island.” Now, Vineyard Wind is still alive, and again in an existential struggle.

conditions of your insurance meet the requirements of the contract you are signing.

Besides limits, there are often other stipulations that need to be verified with your agent before signing. Contracts often include clauses such as waiver of subrogation and hold harmless provisions. While these can be very beneficial to the party requesting them, they need to be approved by your insurance company beforehand. Contracts often include the words “any and all” when referring to risks covered. Your insurance policy most likely will not react to “any and all” claims made against it, which is why it is so important to have these clauses reviewed beforehand.

If your contract only involves a vessel, then any General Liability and Workers Compensation limits that are required will most likely not apply. Your hull and protection and indemnity policies will react to claims made against the boat. Convincing the other party to accept this reality is challenging and often futile. This is when you should get your insurance agent involved to help sort out the wording and coverage issues.

Contracts are required for a variety of different occasions. A standard boilerplate contract rarely fits your unique situation. Contracts are also negotiable. It is wise to involve your insurance agent in this process before signing the document.

BY TIM AKPINAR

Tim Akpinar, based in Little Neck, N.Y., is a maritime attorney and former marine engineer. He can be reached at t.akpinar@verizon.net or 718-224-9824.

Openhatches can pose safety hazards aboard all vessels, large or small. Falling 4' into a hold brimming with wheat could result in laughs from shipmates. Falling four decks into the cavernous hold of a Great Lakes ore carrier could be the last misstep of one’s life.

During cargo operations, this contrast underscores a critical question: who bears responsibility for the dangers posed by open hatches: the shipowner, the cargo terminal, or crewing contractors? A recent federal case addressed that question.

The case involved a longshoreman who fell through an open hatch on a large containership in Oakland, Calif. His duties included plugging in refrigerated containers to the ship’s power supply as they came aboard. The vessel was “turned over” to the stevedore company (the longshoreman’s employer). According to the captain, this meant that the ship’s crew were to stay clear of areas where longshoremen

BY RICHARD PAINE JR.

Richard Paine Jr. is a licensed mariner and certified maritime safety auditor with more than 25 years of maritime industry experience. He can be reached at rjpainejr@gmail.com.

Theclean energy marketplace continues to grow and thrive.

Owners and operators, both private and publicly funded, have an expanding menu of options to choose from. However, one critical area still needs greater attention to ensure these options can deliver immediate impact: infrastructure.

Over the last few years, those of us in the maritime industry have seen a wave of cleaner alternative energy options enter the market to power our fleets. We’ve seen advances in fully electric and diesel-electric technologies, along with clean fuel sources such as hydrogen and ammonia. Reusable fuels and biodiesels continue to emerge as viable alternatives as well. This growing list includes both existing solutions and whatever becomes “the next big thing” in reducing fleet emissions and carbon footprints.

When we look at how hybrid and fully electric vehicles have disrupted the automotive industry over the last decade, we can easily see the everyday changes that support their use.

were working.

After the accident, the longshoreman sued for his injuries under the Longshore & Harbor Workers’ Compensation Act. The ship’s owners argued that the longshoreman failed to show evidence of fault on the ship’s part. The court referred to Scindia Steam Nav. Co. v. De Los Santos, 451 U.S. 156, which outlined three general duties owed to longshoremen.

The first is the “turnover duty.” This requires the ship be turned over in such condition that experienced stevedores could conduct normal cargo operations with reasonable safety by exercising ordinary care.

The second duty is that the shipowner must exercise reasonable care to prevent injuries to longshoremen in areas that remain under the “active control of the vessel.” The third duty was the “duty to intervene,” involving the vessel’s obligations for areas under the main control of the independent stevedore.

The court ruled for the vessel on several points but ruled against it on the “turnover duty” of safe condition and the active involvement duty. The court saw that the yellow warning paint around the hatch was faded. Fresh paint could have been more visible, doing more to prevent accidents.

The decision shows that figuring out who is at fault when people from four or five different companies are crawling all over a vessel can sometimes be a difficult call.

Electric charging stations now appear in places where they once didn’t exist, from neighborhood supermarkets and shopping centers to schools, commercial buildings, and homes. Today, there are dedicated spots for drivers who need a timely charge. In the maritime industry, this level of infrastructure is not yet commonplace. While some marinas, yards, and docking facilities are equipped with shore power, many do not offer the fast-charging capabilities required by hybrid and fully electric vessels. Operations using these energy sources need expanded charging infrastructure to fully leverage their benefits, and that requires significantly more power than is currently available at many locations.

Clean fuel sources face challenges as well. They require more robust delivery systems to reach vessel fleets, along with increased storage capacity and a broader vendor network. Transportation costs, storage costs, and limited suppliers all present hurdles that must be addressed to normalize these options. In many ways, this echoes the old “Field of Dreams” mantra: “If you build it, they will come.” The technology to introduce these cleaner systems into today’s marine environment already exists. The ongoing challenge is how to maximize their potential when infrastructure and support systems are still not fully prepared for the shift.

For those committed to making these alternatives a routine part of daily maritime operations, the hope is that more ambassadors of change — both private and public — will step forward. Financial commitment to the infrastructure projects needed to support clean energy will be essential to turning these solutions into the new normal.

By Casey Conley, Correspondent

For most of his career, Jamie Sangster served as a marine systems of cer in the Canadian navy. The job involves solving problems and keeping the nation’s technically challenging but critically important warships operating smoothly at sea.

The skills he acquired during 20 years in the navy have served him well with Leeway Marine, which is based in Halifax, Nova Scotia. Sangster founded the marine surveying and logistics company nearly a decade ago with other retired navy of cers. Each brings a unique set of skills and expertise that includes naval architecture, engineering, navigation, and robotics.

nology you use in business,” he continued.

Marine surveying is a primary focus for Leeway Marine, which owns ve vessels and manages two more. Its survey eet consists of ve ships ranging from the 121' Leeway Odyssey to its newest acquisition, the 38' autonomous surface vessel (ASV) Viper, one of the rst uncrewed survey vessels operating in Canada.

Leeway has also branched into vessel management. In 2024, it won a contract to manage the 211' exploration vessel Nautilus for the Ocean Exploration Trust, which was founded by the legendary oceanographer Robert Ballard.

In a few short years, the company has earned a reputation for its willingness to embrace new tools and methods for getting things done.

“There is a broad spectrum of this sector that is ripe for growth and innovation and technology. You don’t have to be a rocket scientist to pick that up,” Sangster, Leeway’s CEO, said in an interview.

“It is not super complicated. But it can be dif cult for people who have been in the industry for 20 or 30 years to appreciate and latch onto the idea that you are going to make a signi cant change to the way you do business, or the tech-

Current and past projects have taken the company’s 60 or so mariners to the Canadian Arctic, the South Paci c, and South America. Its crews also have worked south of the Canadian border in U.S. waters. In 2020 and 2021, Leeway provided survey support for the Vineyard Wind project. Subsequent jobs followed at potential offshore wind sites off New Jersey and Maryland.

Meanwhile, Sangster and his partners have maintained close ties to the Canadian navy. Those connections have given the rm a chance to explore

technologies still in their infancy. The company is also connected with a growing ocean technology startup scene in Halifax, giving it a front-row seat to new tools and approaches before they hit the broader market.

“Innovation is such a ubiquitous term these days,” Sangster said. “There are so many new products out there and potentially new ways of doing business. But through our work with the navy, it gives us exposure to new and interesting ways to attack a similar problem in ways we hope introduces efficiencies to the client.”

As one might expect for a nation surrounded on three sides by water, Canada has a vast commercial maritime industry. Foreign and domestic shipping, natural resources, and fisheries are a big part of that industry. Canadian mariners frequently operate in harsh, unforgiving conditions in the Arctic or Atlantic Maritime provinces.

And much like in the U.S., Canada’s maritime space is crowded, competitive, and often traditional in its methods. It can be challenging for newcomers to break in. Leeway’s team found success by leaning on their navy backgrounds and embracing new approaches, according to Greg Veinott, Leeway’s chief commercial officer.

He likened the culture to a “startup mentality” that has allowed the company to consider alternative approaches and lean into emerging opportunities.

“We are not a bunch of people who have been in this industry for many years with set ways of doing things,” he said. “That has allowed us to come at problems and solutions from a bit of a different angle, and that has allowed us to be a little more nimble than some of our competitors.”

One clear example is the way Leeway Marine has built its fleet, which has the versatility of a Swiss Army knife. Leeway Odyssey is a former Canadian coast guard ship outfitted for ocean research and survey voyages lasting up to 21 days. Leeway Striker, a 180' near-to-midshore research vessel, cruises at 30 knots and has a top speed of 55 knots, with a 500-nautical-mile range.

The ultra-stable research vessel Novus is designed and equipped to gather accurate survey data even in challenging weather and sea states. It is one of the few small-waterplane-area-twin-hull (SWATH) vessels operating in North America and is equipped with a suite of Furuno and Kongsberg instruments.

ASV Viper is Leeway’s second smallest ship and possibly its most versatile. The uncrewed vessel was built to ZeroUSV’s Oceanus 12 platform and equipped with MarineAI’s GuardianAI infrastructure, allowing for fully autonomous voyaging. Leeway expects to use it for hydrographic and geophysical surveys, offshore wind and cable surveys, and Arctic ice observations, among other tasks.

The company received its Transport Canada certification last fall to conduct fully autonomous operations in Canadian waters with Viper. Leeway has already secured multiple contracts to put the vessel to work.

“ASV Viper is the pinnacle of where we have been headed for the last few years,” Veinott said. “We have watched the autonomous space for some time and looked at a lot of different products in different sizes and capabilities that have come across our desks.

“The Oceanus 12 is really something that ticked all the boxes for us in terms of reliability and endurance, and it does exactly what our clients need,” he went on.

Sangster sees Viper as a complement to the company’s crewed survey assets. Each has its strengths, and having both types of ships gives the company the unique ability to complete challenging projects with greater efficiency.

“The market share for [uncrewed surface vessels] will steadily increase in certain sectors. We wanted to be in the front end of it,” he said.

Matthew Ratsey, the managing director of ZeroUSV, first met Sangster more than two years ago at an industry trade show. ZeroUSV, based in Plymouth, England, is a sister company to MarineAI and its parent company, Msubs, which supported the Mayflower Autonomous Vessel project earlier this decade.

Ratsey said he and Sangster hit it off over discussions around autonomous vessel technology.

“We’re both from small companies where the whole philosophy is, if someone asks us a question, the answer is yes, and then we figure out how in the hell we are going to do it,” Ratsey said.

“In this day and age, that is relatively unusual. A lot of companies are so wrapped up in process that it takes ages to get things done,” he continued. “That is why we need these small companies that are innovative and on the bleeding edge.”

IIC Technologies is another one of Leeway Marine’s longtime industry partners. Derrick Peyton is CEO of the India-based company, which is focused on collecting, processing, and interpreting global geographic data. Its first project with Leeway happened

in the late 2010s, not long before the Covid-19 pandemic.

“We presented them with a challenge to map the Canadian Arctic using autonomous technology. It’s one thing to even accept the challenge to work with an autonomous vessel. It’s another kettle of fish to take on the challenge in the Arctic,” Peyton said. “Leeway had no issues with the challenge.”

“Those guys don’t stop,” Peyton added. “They think out of the box. Their team is innovative, productive, and effective.”

Veinott, who focuses on Leeway’s business development and partnerships, sees many more opportunities on the horizon. These include contin-

ued work in the Arctic, where Leeway has spent time building a network of partners to support sustained operations in harsh, remote locations. Offshore wind development also is showing promise in Canada, as is vessel management.

All options are on the table to grow out the company’s existing business lines. That includes buying or chartering additional ships if necessary.

“We are very focused on building the business to the opportunity,” Veinott said. “We are very good at listening to what our clients’ needs are and fitting to that need. We are not in the business of buying a ship and hoping work comes to us.”

The SAFE 41 Full Cabin is engineered for extended offshore operations, combining all-weather protection with long-haul comfort to keep crews effective for hours at sea. Built on SAFE Boats’ proven aluminum hull, it delivers exceptional maneuverability, responsive handling, and the speed required to cover distance efficiently.

In 2005, the Charos family was on its way to the International WorkBoat Show in New Orleans when one of the sons saw an ad for a shipyard called Midship Marine, Harvey, La. The fishermen from Newburyport, Mass.,

its offerings to include those outings and other tourism cruises.

“The boat fit the role nicely,” said Chris. “It was a fast boat and did the service speed comfortably.”

In the years leading up to the pandem-

were looking for a new offshore vessel, so they stopped in at the facility.

“It’s a family-run business, and we felt comfortable with them,” said Capt. Chris Charos, who owns Newburyport Whale Watch with his father George and brother Ryan. They ordered a new boat, the Captain’s Lady III. “We’ve stayed friendly with them through the last 20 years,” said Chris.

Captain’s Lady III was a 106'x24' Subchapter T boat rated for 149 passengers. In 2013, the Charos family had the opportunity to take over a local whale-watch business, and it expanded

ic, the whale-watching and cruise business picked up, so the family decided to build a new, bigger boat to focus on those opportunities.

“We started the design process two years prior to Covid,” said Chris. “We picked it back up in 2022.”

Because Midship Marine is a smallto-midsized operation, the yard’s design team could easily collaborate with the Charos’ on the design.

“Their first boat was a traditional head boat,” said Midship Marine treasurer Randy Hinojosa, whose family founded and runs the yard. “This boat’s designed

around all their parameters for evening cruises, whale watching, weddings. The design was a collaboration between them and us. It’s a group effort. They know their market.”

“In New England, our season is short and it’s hard to build a boat for one purpose,” said Chris. “The boat has to be able to do multiple things to keep the operation running.”

The company’s new 130'x29' boat, Captain’s Lady IV, will have a tripledeck configuration and draw 8' with a deadweight under 100 tons. Construction is all aluminum with a 1" thick keel, ¾” bottom plating, and ¼" on the hullsides. At 300 people, passenger capacity will be double that of her predecessor, and its multiple decks are designed to host a variety of gatherings. The flagship of the company fleet is one of four vessels the Charos family operates. Captain’s Lady III has already been sold, so the team is looking forward to having the new boat for the 2026 season. Because of its additional size, the new vessel could be put into ferry service as well.

Captain’s Lady IV’s main deck cabin is being built with a galley with two concession stands and seven heads, offering a protected area for dinner cruisers, weddings, and corporate outings. Part of the second deck is enclosed, and the bow has a tiered, stadium-style platform so whale-watchers can see over the bow.

The boat’s design has passenger comfort in mind. “There are certain parts of the boat that are set up for whale watching and certain parts of the boat set up for a cruise atmosphere,” said Chris.

One of the most important upgrades is a climate-controlled interior space that keeps customers comfortable during hot summer cruises and lets whale watchers stay warm during early and late-season trips. Seven Dometic reverse-cycle air conditioning units will keep the interior temperatures consistent.

“Every program has a different role in the cycle of people,” said Chris. “It’s important to have a flow of people for each program to go through the boat.”

During the peak of the season, the

company runs two whale watch trips per day, plus an evening cruise.

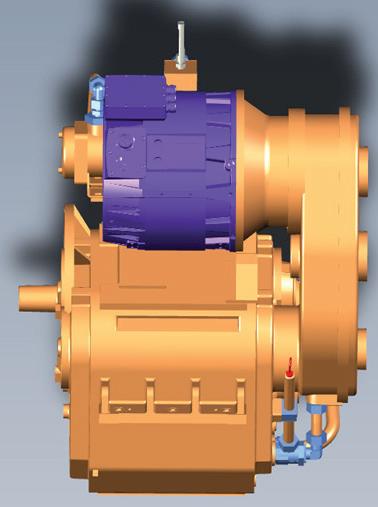

Quad 800-hp Caterpillar C32 diesels are expected to push Captain’s Lady IV to a top speed of 25 knots. Transmissions are Twin Disc with a 2.5:1 gear ratio, and they will spin Michigan Wheel 44"x44" 5-blade Nibral propellers on 3½" diameter shafts. Engine controls are Twin Disc EC 600 and steering is an electro-hydraulic system. Additional dockside maneuverability will be provided by a Sleipner bowthruster.

“Where we operate, a propeller-driven boat is comfortable,” said Chris. Electronics are a full suite from the Garmin Phantom line with radar, chartplotters, depth finders, and night vision all tied into flatscreen displays.

Ship’s service power is two CAT 4.4 118-kW generators with a 25-kW backup unit. Five to six crew members will tend to passengers, and the boats are maintained in-house. — Eric Colby

Morrison, Houma, La., has been a key player in the offshore diving and pipeline sector in the Gulf of Mexico for 40 years. For the last 20, the company has focused on establishing itself as a leader in diving, especially deepwater dives.

Recently, the company acquired a 260' Jones-Act-compliant vessel with dynamic positioning (DP) capabilities. Named after the company’s founder, the Chester Morrison will be the flagship of the Morrison dive-support fleet and the first equipped to hold position without needing a mooring system. Morrison’s other vessels use four- and eight-point moorings with anchors and winches to hold station offshore.

“There is currently only one other dynamic-position dive asset that is Jones Act compliant in the market,” said Nick Gregory, director of business development for Morrison, which is based in the U.S. with locations in Guyana, the

West Indies, and Mexico. He explained that the acquisition resulted from client requests to take on projects requiring a vessel with DP. “The investment demonstrates our dedication to the industry and clients and was well worth the leap,” said Gregory.

He said that once Morrison management decided to purchase a boat with DP capabilities, the team determined the size and configuration, including the number of bunks and deck spaces, needed. They reviewed the offshore supply vessel market and chose a ship that was work-ready and Jones Act compliant, avoiding the need to change flag states. The Chester Morrison meets the Association of Diving Contractors International and International Marine Contractors Association (IMCA) standards. It also has a self-propelled hyperbaric lifeboat (SPHL).

The steel-hulled vessel was refitted at two sites: Bollinger Shipyards’ facility in Amelia, La., and Morrison’s headquarters in Houma, where third-party contractors were brought in to perform some of the upgrades. In late November, the structural work had been completed, and the team was finishing the integration of a 35-ton telescopic boom crane. The bulk tanks were removed, and a 16-person saturation diving system was added, as was the moon pool for the diving bell deployment. Following sea trials scheduled for December and a topside inspection, Morrison hoped to have the vessel operational early in the

new year.

While boats now in the Morrison fleet are limited to working at about 1,000' below the surface, the Chester Morrison will give the team the ability to work at greater depths.

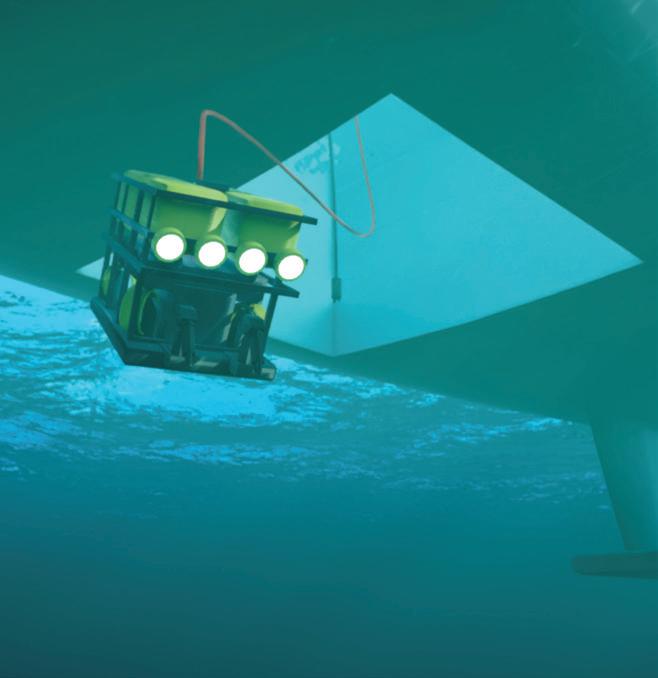

Gregory explained that oil majors such as Shell, Chevron, and ExxonMobil require contractors to meet top-tier IMCA standards. This includes the presence of the SPHL on board for redundant support in case something goes wrong with the dive bell. Because decompression from a 700' dive takes eight days, the SPHL lets divers remain pressurized at depth in containment. The Chester Morrison also has a remotely operated underwater vehicle (ROV) because some customers prefer pipeline work to be performed by a machine rather than by a diver. ROVs can work at 3,000' to 4,000' depths, and Gregory said the company uses work-class ROVs that can perform complex tasks and inspection-class units that primarily provide visual aids.

Cubic capacity of the Chester Morrison is 2,520 gt. The vessel has a 60' beam and 4,932 sq. ft. of deck space. Power is provided by two Caterpillar 3608 diesels producing a total of 6,780 hp. Inboard transmissions with 4.3:1 gears turn a pair of 4-bladed propellers. Three Caterpillar 3406 (960-kW) serve as primary generators. The DP system consists of Beier IVCS 4000 DP-2 equipment linked to Wartsila Cyscan AS laser-based, Kongsberg

radar-based, and Kongsberg hiPAP 452 acoustic referencing. Two 2,400-hp Brunvoll bowthrusters and a pair of 1,200-hp units in the stern hold the ship in place in DP mode.

Diving-speci c equipment includes a DNV-certi ed saturation diving system that can support up to 16 divers. The three-person diving bell complies with IMCA guidelines, and there is a threeman hyperbaric rescue chamber. The SPHL can carry 18 divers. — E. Colby

SAFE Boats International, Bremerton, Wash., has delivered a new 41' full cabin (FC) Interceptor to the Florida Fish & Wildlife Conservation Commission (FWC), marking the third vessel completed in the 41' FC series

and the second bound for the Florida agency.

The aluminum patrol craft is based on SAFE Boats’ 41' Interceptor hull and was displayed at the 2025 International WorkBoat Show before delivery.

Thw 41' Interceptor lineup is designed for offshore patrol missions and is available in center console, walkaround, and full-cabin con gurations. According to the builder, the enclosed model delivers improved crew comfort, expanded mission exibility, and enhanced ergonomics for extended operations. The latest FWC build differentiates from the rst by its “minor cabin re nements,” and the inclusion of a Seakeeper 6 gyrostabilizer, SAFE Boats said.

The vessel’s power comes from quad 450-hp Yamaha XTO Offshore outboards, supported by a 650-gal. fuel capacity.

Onboard electronics include a full Garmin suite.

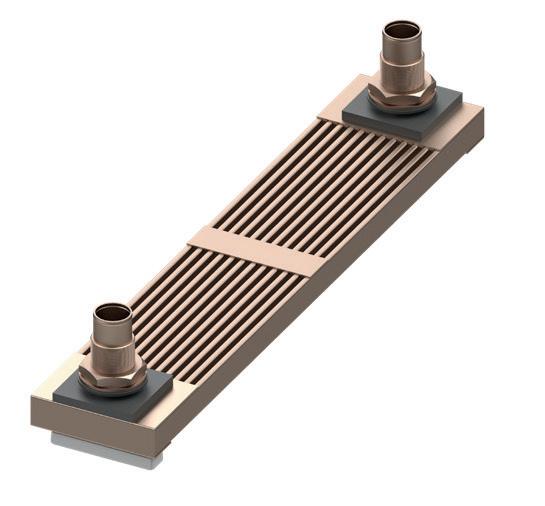

FERNSTRUM GRIDCOOLER® WHEN CUTTING CORNERS WON’T CUT IT

Keel Cooler

It’s easy to take cost out of a Keel Cooler. Just cut a few corners. While some people are more than willing to make compromises, we only build excellence. Call today or visit our website for a quote.

SAFE Boats director of business development Scott Clanton said the broader shift toward the 41' platform re ects evolving operational needs and cost-control strategies among state agencies. Clanton recalled early discussions with FWC leaders, who had previously relied on a much larger offshore patrol boat for multiday deployments.

“They were running… like an 83-foot offshore patrol boat,” Clanton said. “It cost so much to get out to that area of operation that it only made sense to stay out there for three to ve days… to justify the cost of the vessel.”

That approach changed when FWC evaluated the 41' Interceptor’s range and speed.

“We can run from Florida a hundred miles out to their target area, and they could do their job and they could come back the same day,” Clanton said. A subsequent fuel-use comparison, he added, showed “such a cost saver… for

the state of Florida.”

Beyond economics, the shift also improved quality of life for crews. “They’re giving them an asset that gets them out there faster, cheaper,” Clanton said. “If they get a call, they can respond quicker and get out there, get home,

have dinner with the family, you know, and they’re happy.”

For extended patrols, on board is a small kitchenette, two bunks and a head, including a gun safe.

In addition, featured throughout are Shoxs seats that are capable of dropping

down to provide increased space for the operator.

Shoxs vice president Tony Van Meter told WorkBoat that the 4600 model seats are a great addition for “crews when they want to get out the side doors, or they want to stand and operate. You can drop both down, and ingress and egress is really, really good.”

“What we provide that’s different from our competitors is we approach it from the user’s perspective,” Van Meter continued. “We understand you’re going to need shock mitigation, but what’s your job on the boat when you’re out there. How can we design a seat to function in a way that that supports what you’re doing on the boat?”

SAFE Boats has also delivered a 41' full-cabin patrol vessel to the Massachusetts Environmental Police, and additional models in the series remain in production at the company’s Bremerton, Wash., facility. — Ben Hayden

Whether

or

for your next project: www.LouisianaCat.com/Marine

The Coast Guard awarded four contracts totaling about $3.6 million to Birdon America Inc., Denver; Metal Shark, Jeanerette, La.; Inventech Marine Solutions, Bremerton, Wash.; and SAFE Boats International, Bremerton. Each company will deliver one Response Boat-Small (RB-S) demonstrator boat within three months. The boats, which will range in length from approximately 29’ to 37’ and be powered by twin outboard engines producing up to 600 hp, are intended to help the Coast Guard develop and validate performance requirements, assess industry capabilities, and gather information about the current marketplace. Data collected from operating the boats will be used to guide future acquisition decisions.

C&C Marine and Repair, Belle Chasse, La., has delivered the Al Sloss to Canal Barge Co., New Orleans, completing the first vessel in a four-boat newbuild series under construction for the operator. The 2,600-hp towboat, measuring 87’x34’ and designed in-house by C&C, is powered by two Mitsubishi S12R main engines supplied by Laborde Products and is equipped with two Laborde Products generators at 99kW each. The propulsion system includes Reintjes WAF 665 reduction gears provided by Karl Senner LLC. Steering, alarm, and monitoring systems were supplied by Eagle Control Systems Inc. Navigation and communications equipment was supplied by GMENI Marine Electronics and Supply, including Furuno radars, AIS, a satellite compass, a bridge alarm system, a loudhailer, and Standard Horizon VHF radios, along with associated bridge instrumentation and sensors. Additional equipment includes two Carlisle & Finch 1,000-watt searchlights, two Wintech 40-ton winches, and a Wintech 5-ton vertical capstan.

The Coast Guard awarded two contracts to build up to six Arctic Security Cutter (ASC) icebreakers. The initial ships will be the first newbuilds for the U.S. Arctic fleet since the medium icebreaker Healy was delivered in 1990. A contract with Rauma Marine Constructions Oy, Rauma, Finland, calls for up to two ASCs to be built in Finland, with a first vessel in 2028. A contract with Bollinger Shipyards, Lockport, La., includes up to four ASCs to be built in the United States, with first delivery in 2029. Bollinger will construct its ASCs based on the 328’x67’x21’ Multi-Purpose Icebreaker design by Seaspan Shipyards, Vancouver, British Columbia, jointly developed with Aker Arctic Technology Inc., Helsinki. The ships will run on diesel-electric propulsion using variable-speed genera-

tion with a DC-bus system that supplies 10,100 kW of installed power and 7,200 kW of propulsion power. The ships are designed for operations in first-year Arctic ice at speeds up to 4 knots in 3.28’ of ice.

The Association of Maryland Pilots, Baltimore, has taken delivery of a new high-speed aluminum pilot boat built by Gladding-Hearn Shipbuilding, Duclos Corp., Somerset, Mass. It is a sistership to the association’s first Baltimore Class launch, delivered four years ago. The Federal Hill measures 48.5’x15.6’ with a 4’ draft. It features a Ray Hunt Design deep-V hull and is powered by twin Volvo Penta D13 EPA Tier 3 diesels, each rated at 600 hp at 1,900 rpm, supplied by Power Products. The engines drive five-blade Bruntons NiBrAl propellers through ZF400A gearboxes. The vessel is equipped with a Humphree interceptor trim control system with automatic trim optimization at the transom and a 12-kW Northern Lights M673L3G generator. A suite of Furuno electronics was supplied by Cay Marine Electronics, including displays, radar and openarray radar scanner, VHF radios, GPS/WAAS sensors, depth sounder, satellite compass, and loud hailer.

Master Boat Builders Inc., Coden, Ala., has launched the final vessel in a series of six tugboats built for Gulf LNG Tugs of Port Arthur LLC, a joint venture of Bay-Houston Management LLC, Houston; Bay Towing LLC, Houston; Moran Towing Corp., New Canaan, Conn.; and Suderman & Young Towing Co., Houston. The Jill is a Rapport 2800 tug designed by Robert Allan Ltd., Vancouver, British Columbia, and is one of two identical boats built specifically for Gulf LNG operations and scheduled for delivery in the first quarter of 2026. Each tugboat measures 92’ in length with a 40’ beam and has a bollard pull capacity in excess of 85 metric tons. The tugs feature EPA Tier 4 Caterpillar 3516 E main propulsion engines connected to Kongsberg US-255 FP-Z drives. Each of the tugboats is outfitted with a Markey DESF-48-100 electric class III hawser winch with a render-recover feature for full bollard pull capacity. The vessels are equipped with firefighting systems meeting ABS Fire Fighting Vessel 1 classification standards to support terminal operations.

By Peter Ong, Contributor

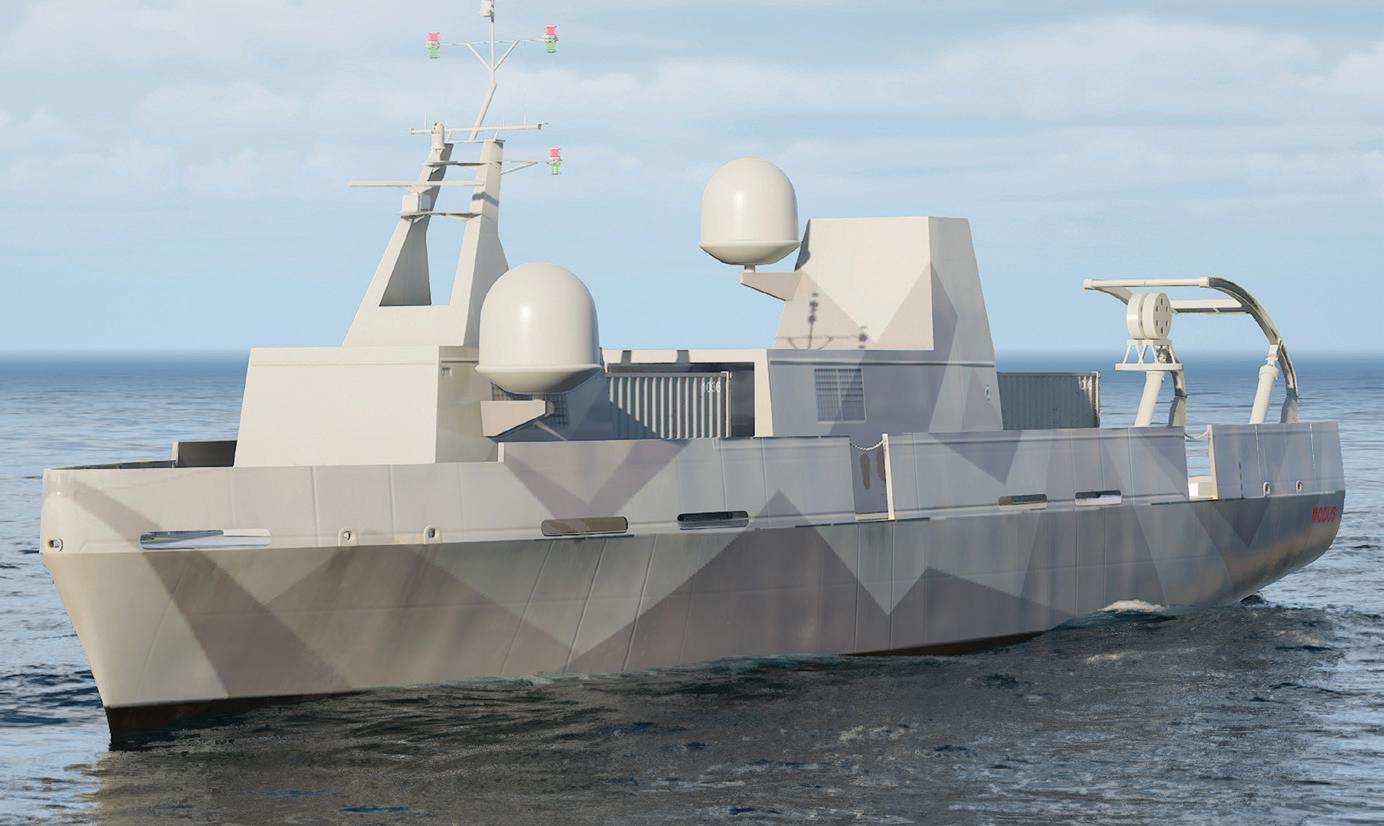

Convinced by lessons from the war in Ukraine — where small kamikaze uncrewed surface vessels (USVs) crippled or sank much larger Russian warships — and by the development of indigenous USVs by powerful rival nations such as China, the U.S. Navy is rapidly advancing plans to build out its own USV eets. These plans span a range of platforms, including small, medium, and large vessels, as well as fully autonomous systems.

When contacted for comment, the Navy’s Chief of Information Of ce declined to answer WorkBoat ’s questions on the service’s USV programs, instead directing WorkBoat to separate testimonies made by Navy Secretary John C. Phelan and Chief of Naval Operations (CNO) Adm. Daryl L. Caudle to the Senate Armed Services Committee.

“If the last few years of con ict have taught us anything, it is that we will not win the wars of the future with the platforms of the past,” Phelan said during the June 10 hearing. “Success in modern warfare will require the rapid, scalable production and integration of air, surface, and subsurface unmanned systems (UxS). Recent war ghting in Ukraine and the Middle East demonstrates that while UxS have not replaced manned systems, they effectively serve

as force multipliers, amplifying intelligence and lethal capabilities at signi cantly lower cost and reduced risk.”

“Unmanned systems are a force multiplier and provide options to manage risk to force and risk to mission across the spectrum of con ict,” said Caudle during his July 24 nomination hearing for CNO. “When paired with manned platforms, unmanned systems expand capacity and provide increased exibility that is central to the success of Distributed Maritime Operations. The Navy is building a mix of high-end war ghting systems and affordable, attritable, and attainable systems that provide mass and scale to challenge our adversaries.”

Brent Sadler, a senior research fellow for naval warfare at the Washington, D.C.–based think tank The Heritage Foundation, described to WorkBoat the 2021 launch of a Standard SM-6 surface-to-air missile — successfully intercepting an aerial target — from the Navy USV Ranger as a signal of the technology’s maturity.

The Navy will need USVs that are able to operate in the Philippine Sea and are armed with long-range strike weapons such as Tomahawk missiles and air/missile defense weapons such as Standard SM-6s, Sadler said.

Sadler said the Navy will also need smaller USVs for swarming tactics within the so-called rst island chain of

“If the last few years of con ict have taught us anything, it is that we will not win the wars of the future with the platforms of the past.”

— John C. Phelan, Navy secretary

archipelagos off Asia in the western Paci c, which includes Taiwan. “These [USV] platforms provide the only viable option to get repower to sea within the next 12 to 18 months in any meaningful scale in the Paci c. This is not [an] either/or proposition as these new platforms, along with recommitted shipbuilding of destroyers, submarines, [and] aircraft carriers, are urgently needed,” Sadler said. “Reliability of systems, supply

chain needs to sustain these platforms, and the tactics they will be used to execute” are the three key points that need to be understood about USVs for the Navy, he added.

The maritime industrial base has taken notice and is answering the call.

USV technology traces its origins to the late 19th century, beginning with Nikola Tesla’s demonstration of a radio-controlled boat at the 1898 Electrical Exhibition in New York’s Madison Square. Since then, uncrewed

2025_GH-Ferry2-WB.pdf 23 2/28/25 10:49 AM

vessels have progressed substantially, especially in recent decades, with the arrival of semiautonomous and fully autonomous capabilities.

“Today’s USV technologies are maturing fast, but from BMT’s perspective, there is still work to do before they are fully adequate for the scale, complexity, and tempo that navies and operators are aiming for,” said William Champagne, business development manager at BMT Group Ltd., London.

In September, BMT unveiled a exible, scalable family of USV designs called MODUS, for modular uncrewed surface vessels. These include pre-concept designs for a 131.2' medium USV (MUSV) and a 246' large USV (LUSV). The MODUS concept targets rapid production, cost effectiveness, and high availability.

“NATO navies — including the U.K. Royal Navy and the U.S. Navy — are all driving towards more modular, more autonomous, and more adaptable USVs that can be rapidly re-rolled across mine warfare, ASW, surveillance, logistics, and force protection missions,” Champagne said.

Blue Water Autonomy Inc., Boston, is another company focused on building ship-sized USVs for the Navy. Its cofounder and chief strategy of cer, Austin Gray, told WorkBoat that the company is the only “pureplay on autonomous ships,” noting it can produce more than 30 autonomous

MUSVs annually through its partnership with Conrad Shipyard, Morgan City, La. However, Gray said he couldn’t comment on Navy contracts, costs, or USV quantities.

Cory Emmons, general manager of maritime surface programs at Anduril Industries Inc., Costa Mesa, Ca-

lif., told WorkBoat that the company is developing a new dual-use class of surface vessels that are fully autonomous and modular in hardware and software for the U.S. Navy’s Modular Attack Surface Craft (MASC) program. “It provides a mission-focused solution for the Navy that, from its rst concept drawing, is focused on mass production, maintenance in austere locations, and continuous modernization,” Emmons said. “By pairing advanced autonomy software with proven shipbuilding expertise, we’re giving the Navy affordable, exible platforms built for contested maritime environments.”

“What sets Anduril apart is our proven ability to connect mission, design, and build into a cohesive system of engineering and production,” said Emmons. “Anduril has clearly demonstrated this, particularly with the Royal Australian Navy on Ghost Shark, showing how rapid iteration and close industry-government partnership can deliver capability fast. We’re now bringing that approach to the surface domain and pairing it with HD Hyundai Heavy Industries, one of the world’s leading shipbuilders, to not only deliver USVs but also bolster and sustain the dual-use shipbuilding supplier base.”

The Navy needs autonomous, modular vessels that can be built quickly, produced in quantity, and continuously modernized, Emmons

emphasized. “Traditional acquisition timelines won’t keep pace with global shipbuilding competition,” he said. “Prioritizing software-driven platforms that can be produced at scale and modular in architecture will be key for the Navy’s acquisition of ces. Trustworthy software at sea and partners that provide modular mission capabilities are important for the operators and essential to restoring maritime advantage.”

BlackSea Technologies, Baltimore, is an active supplier and partner in the Navy’s small USV (SUSV) program, the company’s president, Bob Pudney, told WorkBoat. “Our Global Autonomous Reconnaissance Craft (GARC) was built at the Navy’s request for a fast, rugged, and operationally relevant SUSV that could move beyond experimentation and into active eet use. BlackSea rapidly scaled to high-rate production and has delivered many hundreds of GARCs to the eet on time and on budget.”

Powered by a 200-hp diesel engine, the 15'8"x5'8" GARC reaches speeds up to 40 knots with a range exceeding 680 nautical miles, according to BlackSea. Its aluminum hull supports a 1,000-lb. payload and an open architecture that has successfully integrated seven different autonomy software stacks. “With more than 15,000 operational hours on the water with the Navy, GARC stands apart as a exible and combat-relevant platform that demonstrates how a company can mobilize to scale autonomous platforms for the Navy,” Pudney said.

“We designed GARC to be a true workhorse, a platform shaped by Navy operators with clear mission focus, said Pudney, noting that GARC is being integrated into day-to-day maritime operations in several Navy operational eets.

Saronic Technologies, Austin, Texas, offers six different types of USVs, ranging from small to large. A Saronic spokesperson said a $392 million Navy production contract has allowed the company “to move our 24-foot Corsair from prototype to

elded capability in high-rate production in under a year.”

Last year, Saronic acquired the Gulf Craft shipyard in Franklin, La., to immediately expand its shipbuilding capabilities. “We are currently constructing two 150-foot Marauder vessels, having progressed from initial design to full vessel development in just six months, and recently an-

nounced a $300 million investment into expanding the shipyard while adding 1,500 new jobs at the site,” the spokesperson said.

“We are also planning to build Port Alpha, the most advanced shipyard in the U.S., designed to produce large autonomous ships at speed and scale and create thousands of jobs in the process.”

Ferry eets modernize as decarbonization debate continues.

By Ben Hayden, Senior Associate Editor

Passenger ferry operators across the United States are accelerating the shift toward hybrid-electric and fully electric propulsion, buoyed by millions of dollars in federal funding aimed at modernizing aging eets, reducing emissions, and improving long-term nancial sustainability.

Executives currently operating hybrid and electric vessels, as well as those in the process of integrating them into their eets, say the transition represents a signi cant opportunity — provided the U.S. commits to it. While cleaner propulsion can lower lifecycle costs, build new domestic manufacturing capacity, and improve operational resilience, industry leaders continue to point to a lack of a cohesive, long-term national strategy: a hesitation that stands in contrast to European markets that have already decided on the shift and are now focused on execution.

That momentum took a tangible step forward in 2024, when the Federal Transit Administration’s (FTA) Passenger Ferry Grant Program awarded funding to operators in Alaska,

California, Delaware, Florida, Illinois, and Washington to begin moving away from traditional diesel propulsion. The funding supports a range of projects from diesel-electric ferries serving East Coast routes to fully electric vessels designed for high-frequency commuter service on the West Coast.

Among the awards, the Delaware River and Bay Authority (DRBA) received $20 million toward a new hybrid dieselelectric ferry for its Cape May, N.J. – Lewes, Del., service. On San Francisco Bay, the Water Emergency Transportation Authority (WETA) secured funding to build two fully electric ferries as part of its multi-phase zero-emissions transition plan.

While propulsion strategies vary by route length and operational pro le, the underlying drivers are consistent across regions. U.S. ferry eets built in the 1970s and ’80s are reaching the end of their service lives, the cost of maintaining legacy machinery continues to rise, and federal funding is increasingly aligned with emissions reduction goals. At the same time, operators are weighing how quickly, and how

years of mounting pressure from an aging eet and the increasing dif culty of maintaining vessels that were built decades ago. “We haven’t built a new ferry since 1981, so let’s try to futureproof this thing,” he said, noting that the authority’s goal is not simply to replace steel, but to create a platform that can adapt as technology and infrastructure change.

$20-million range, driven by generator replacement, new steering systems, and structural work. The experience reinforced a broader conclusion that midlife overhauls no longer deliver the value they once did.

decisively, to move beyond diesel as technology, infrastructure, and policy evolve.

DRBA’s new Cape May ferry is to be built at Senesco Marine, North Kingstown, R.I. Supported in part by the $20 million federal grant, the diesel-electric ferry will replace the more than 40-year-old Cape Henlopen and introduce hybrid propulsion to the system.

DRBA’s ferry operations director Heath Gehrke said the project re ects

Much of the “future-proofed” urgency stems from the condition of DRBA’s three-vessel eet, which dates to 1975 and 1981. Gehrke said two ferries have been repowered with EMD engines, but the third is still “operating Fairbanks-Morse opposing piston engines, which are circa 1929 technology” and Tier 0 emissions standards. As parts become scarce, maintenance has grown increasingly complex.

“In the last two years, we’ve been buying parts off of eBay,” Gehrke said, referring to a potentiometer that is presumably the last on earth for a particular steering system. The agency also has parts fabricated for its vessels.

A recent drydocking at Caddell Dry Dock in Staten Island, N.Y., brought those challenges into focus. Repairs initially estimated at $11 million to $12 million ultimately came back in the low

With overhaul costs approaching newbuild pricing without delivering decades of additional vessel life, DRBA shifted its mindset toward replacement. Even at a $78.6 million contract price, the diesel-electric hybrid newbuild offered a clearer long-term path.

The agency hired Elliott Bay Design Group to conduct a comprehensive operational planning study. The effort examined traf c demand, seasonal peaks, vessel speeds, crew requirements, and terminal constraints.

Early concepts explored smaller, 55-vehicle Subchapter K ferries that promised lower operating costs and reduced crew requirements from nine crewmembers to ve, but those designs reduced exibility during peak summer demand and complicated eet deployment. DRBA settled on a mediumsized 275’ design carrying about 75 vehicles.

The new hull ts existing terminals, improves fuel ef ciency compared with the current 100-vehicle boats, and is

designed to perform better in Delaware Bay’s challenging conditions. Gehrke said scale-model testing supported expectations for improved seakeeping, and the ferry will serve as a prototype for future fleet renewal. He said DRBA plans to operate the vessel for at least one full season before committing to additional vessels, with long-term plans calling for three or four ferries of similar design.

From the outset, DRBA viewed hybrid propulsion as a practical bridge between today’s diesel operations and a future that may include full electrification. Its new ferry will initially operate as a diesel-electric hybrid using EPA Tier 4 engines paired with an ABBsupplied hybrid system expected to incorporate Corvus Energy batteries.

The battery system will support zero-emissions maneuvering and allow the vessel to operate on battery power while docked. Just as important, the hybrid configuration allows DRBA to move forward without waiting for full shoreside charging capability, as diesel operation will charge the batteries while underway.

Gehrke said designers were instructed early to plan for expansion as battery technology advances. “From the very beginning, [we were] using the words ‘future-proof.’ Let’s make this thing so that long after I’m gone, somebody can say, ‘Hey, let’s get more batteries in there,’” he said.

Shore power remains the primary constraint. Lewes lacks sufficient grid capacity for rapid charging, while Cape May has greater availability. Gehrke said DRBA expects early electrification efforts to focus on Cape May, potentially supported by battery-energy storage systems that charge during offpeak hours.

The authority has also secured grant funding from the Environmental Protection Agency (EPA) to support engineering analysis and develop a phased emissions-reduction roadmap.

As part of its decision-making, DRBA looked to early adopters,

including Washington State Ferries as well as the fully electric Maid of the Mist sightseeing vessels in Niagara Falls, N.Y., while also involving its staff throughout the process. “Everybody had a say,” Gehrke said. “[Our staff] have some ownership. They’re excited about it.”

If the prototype performs as expected, DRBA plans to replace its remaining vessels rather than retrofit aging hulls. “We’re already on borrowed time a little bit,” Gehrke said.

In California, the San Francisco Bay Area Water Emergency Transportation Authority continues its multiphase plan to electrify San Francisco Bay Ferry service. Executive Director Seamus Murphy told WorkBoat the program is about more than emissions reductions, highlighting that it is increasingly tied to long-term financial sustainability, U.S. manufacturing growth, and expanding domestic shipyard capacity: trends he believes will shape the future of the ferry industry nationwide.

“I think a lot of… it’s just funding related,” he said. “You know the inflationary pressures are real in this industry. The cost of doing this work in the United States is… by itself more expensive than anywhere else. And so… our team’s been really creative

in navigating some of that and figuring out how to maximize the service potential with the resources that we have.”

New ideas have revealed themselves along the way, Murphy said. “I think more than… just overcoming challenges, I think we’ve probably identified a lot more opportunities that our program will be helpful in addressing,” he said.

Those opportunities are framed within WETA’s four-phase Rapid Electric Emission Free (REEF) ferry decarbonization roadmap, which is backed by federal, state, and local funds.

A WETA fact sheet lists more than $250 million secured for the program, including $131. 9 million in federal funding (EPA Clean Ports, FTA Passenger Ferry Grant Program, FTA 5307/5339 formula funds, Department of Transportation Carbon Reduction Program), $76.9 million in state funding (Transit Intercity Rail Capital Program, State Transit Assistance, Low Carbon Transit Operations Program, California Energy Commission Clean Transportation Program, Volkswagen Mitigation Funding), $42.8 million in regional funding (Regional Measure 1, 2, & 3 Bridge Tolls, AB 664), and $500,000 in local funding (Alameda County’s Measure BB program).

Phase one of the REEF program

centers on a trio of 150-passenger electric catamarans being built under contract with All American Marine, Bellingham, Wash., designed primarily for short-run, high-frequency service, while a pair of larger, 400-passenger battery-electric vessels will be built by Nichols Brothers Boat Builders, Freeland, Wash. In addition, a project to convert the agency’s Hydrus-class vessels is expected to be completed by Dec. 14, 2028.

“We’re gonna move it forward as quickly as we can,” Murphy said, referring to the Hydrus-class repower project, “but we want to make sure that the rest of the program is on cruise control.”

Phase two will complete the transition to zero-emission service on all WETA routes under 10 nautical miles. Phase three will extend electrification to routes in the 13- to 15-nautical-mile range, where technology exists but program funding still needs to be secured.

“We can do the 13-to-15 [mile trips] with existing technology,” Murphy said. “We just don’t have that funded yet for phase three.”

Phase four is set to address longerrun, higher-speed commuter services approaching 23 nautical miles. Murphy said those routes remain outside the range of current battery-electric propulsion technology at the speeds required for mass-transit service. He said

hydrogen propulsion remains a possibility, though the agency is waiting for someone to demonstrate its potential.

“We just need somebody to demonstrate… a hydrogen vessel can operate at 36 knots for… that amount of distance,” he said. “We don’t want to be the first ones to try it.”

Additionally, WETA is evaluating electric-foiling ferries capable of significantly reducing energy consumption.

As vessel delivery moves forward, charging infrastructure plans are advancing in tandem, with JT Marine, Vancouver, Wash., selected to build the charging floats that will support the new electric fleet. “We’re about to start that work,” Murphy said. “What we want to avoid is any significant amount of time where a vessel is delivered and we don’t have any way to operate it.”

Murphy said that the opportunities brought about by ferry electrification extend well beyond emissions reductions, particularly around domestic manufacturing and shipyard capacity. He pointed to the potential for “creating new U.S. manufacturing opportunities and jobs” as battery suppliers and technology firms respond to growing demand.

“This technology isn’t going anywhere,” Murphy said, given its operational and financial advantages. If executed deliberately, he said, the U.S. could “create a new industry…

building technologies that are going to be used all over the world,” rather than exporting those jobs overseas.

That long-term view mirrors comments from Washington State Ferries executive director Steve Nevey, who told WorkBoat that one of the most overlooked challenges in the U.S. transition is not technology but indecision.

Throughout his tenure, Nevey said, conversations with European ferry executives have often centered on how quickly those operators moved past debate and committed to decarbonization.

“The challenge that we face here is that in Washington state and the United States, decarbonization isn’t a decided upon path forward yet,” Nevey said, before noting that U.S. operators continue to revisit fundamental questions that other countries have already settled.

“We’re still having debates on should we use Tier 4 diesel engines and not decarbonize,” Nevey said. “It’s challenging when you’re out dealing with the rest of the world, and they’ve already made that decision to move on.

“Those things aren’t fully decided yet, and every legislative session we’re still called to answer questions about the path forward,” he said.

“I think it would be nice to just be the same as those European ferry operators that I talked to, where they’re confident that, ‘We’ve made this decision, we’re decarbonizing, this is our strategy, this is the best path forward.’ Whereas we’re still debating that.”

For DRBA, WETA, WSF, and ferry operators nationwide, federal funding is accelerating decisions already driven by aging fleets and rising maintenance costs. What is emerging is a generational replacement cycle that will shape ferry operations for decades. Hybrid and zero-emission propulsion are central to that transition, but equally important are clarity, consistency, and commitment factors that industry leaders say will determine how effectively the U.S. ferry sector capitalizes on the opportunity now taking shape.

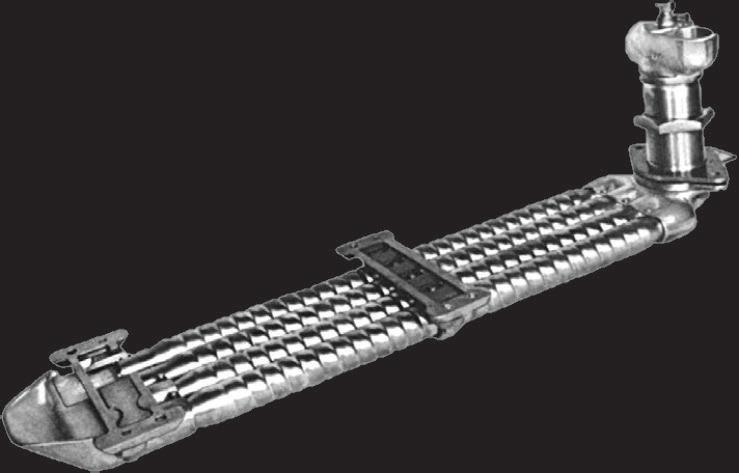

Coast Guard 47 Motor

are shown in various stages of refurbishment at Birdon America’s Bellingham, Wash., facility, where vessels undergo upgrades designed to extend operational life and improve performance.

WorkBoat gets behind the wheel of restored Coast Guard lifeboats.

By Capt. Arnie Hammerman

Government ef ciency has been a hot topic lately. While some would say those terms are mutually exclusive, certain Coast Guard boat programs are demonstrating otherwise.

By evaluating all classes of working vessels through its In-Service Vessel Sustainment (ISVS) program, the Coast Guard determines what maintenance and upgrades are necessary to keep its eet functioning. Equipment upgrades and improved maintenance processes allow vessels to operate more cost-effectively, sometimes even beyond their expected service life. Understanding these options also helps determine when it is necessary for vessels to be replaced.

There are two categories of missioneffectiveness improvement projects in the Coast Guard’s recapitalization and sustainment strategy: Major Maintenance Availability replaces old unsupportable systems so that vessels can work effectively during their design service life. Service Life Extension Programs (SLEP) are a cost-effective way to keep vessels in service beyond their intended service life.

The 47 Motor Lifeboat (47 MLB) SLEP is a prime example of the bene ts of extending the service life of a surface asset. I was able to see rsthand how this project works by observing the re t work in action, and test running 47 MLBs both before and after their re ts.

The workhorses of surf operations, 47 MLBs are an essential tool for surfmen performing search, rescue, towing, and recovery operations even in extreme

conditions. The boats’ proven performance, including self-righting, whether knocked down or rolled 360°, their ability to work in 50-knot winds, 30' seas, and 20' surf, and their all-aluminum construction make them good candidates for SLEP. The problem is not the vessels’ inherent capabilities; it is that after 20-25 years of rigorous service, their systems are aging, and maintenance costs and downtime are rising. Through careful assessment of the 117-boat 47 MLB eet, the Coast Guard

determined that a major overhaul of the eet is the most cost-effective way to maintain mission readiness. The 47 MLB SLEP is intended to extend the vessels’ service life an additional 20 years with projected operation through 2047, eliminating the need for designing and building a replacement vessel now.

In 2019, the Coast Guard awarded a $191 million xed-price contract to Birdon America Inc., Denver, for detailed design and service life extension work to refurbish 107 boats over a 10year delivery period. The work is being completed in two facilities, one on each coast. Birdon’s West Coast operations in Bellingham, Wash., where I visited, can have ve boats in production simultaneously. A new $5.5 million, 32-acre facility that opened in 2024 on the East Coast in Portland, Conn., can handle seven boats at once and includes a marina.

At the Birdon facility in Bellingham, a 47 MLB-Bravo (an original before SLEP) sat on the dock. The boat had just come up from Morro Bay, Calif., on its own bottom, and both original Detroit Diesel 6V92TA DDEC-IV, 435-hp engines were functioning, but not optimally.

Birdon test driver Uriah Beverage warned, “She runs, but seems to have some oil pressure issues, so I am not sure how well she will perform.”

I walked around inspecting the boat as we prepared for departure. The side stripes were faded, with the red looking pink in the morning light. The deck appeared sound, but the nonskid is tattered with missing patches. Exterior seats where we would run our test were torn. Knobs and buttons on control surfaces, including the throttles, were well worn. Paint has peeled off the steering wheel, and uneven caulk sealed its base. The vessel’s interior had a similar feeling. Floor covers, soft surfaces, and anything that was regularly touched or handled was visibly worn, but the aluminum hull, decking, and stringers did not appear corroded or damaged. The engine room was a bit dreary with the pale green Detroits slightly oily but seemingly well cared for.