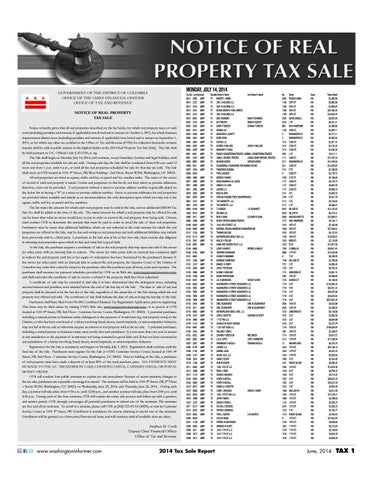

MONDAY, JULY 14, 2014

GOVERNMENT OF THE DISTRICT OF COLUMBIA OFFICE OF THE CHIEF FINANCIAL OFFICER OFFICE OF TAX AND REVENUE NOTICE OF REAL PROPERTY TAX SALE Notice is hereby given that all real properties described on the list below, for which real property taxes or vault rents (including penalties and interest, if applicable) were levied and in arrears on October 1, 2013, for which business improvement district taxes (including penalties and interest, if applicable) were levied and in arrears on September 1, 2013, or for which any other tax certified to the Office of Tax and Revenue (OTR) for collection hereunder remains unpaid, shall be sold at public auction to the highest bidder at the 2014 Real Property Tax Sale (Sale). The Sale shall be held pursuant to D.C. Official Code § 47-1330, et. seq. The Sale shall begin on Monday, July 14, 2014, and continue, except Saturdays, Sundays and legal holidays, until all the real properties available for sale are sold. During each day, the Sale shall be conducted from 8:30 a.m. until 12 noon and from 1 p.m. until 4 p.m., or until all the real properties scheduled for sale for that day are sold. The Sale shall occur at OTR located at 1101 4th Street, SW, West Building - 2nd Floor, Room W250, Washington, DC 20024. All real properties are listed in square, suffix and lot, or parcel and lot, number order. The name of the owner of record of each real property is stated. Certain real properties on this list do not have street or premise addresses; therefore, none can be provided. A real property without a street or premise address number is generally stated on the below list as having a “0” as a street or premise address number. Street or premise addresses for real properties are provided where available and strictly as an accommodation; the only description upon which you may rely is the square, suffix and lot, or parcel and lot, numbers. The list states the amount for which each real property may be sold at the Sale, and an additional $200.00 Tax Sale Fee shall be added at the time of the sale. The stated amount for which a real property may be offered for sale can be lower than what an owner would have to pay in order to prevent the real property from being sold. Owners must contact OTR to determine the amount that must be paid in order to avoid the sale of their real properties. Purchasers must be aware that additional liabilities, which are not reflected in the total amount for which the real properties are offered at the Sale, may be due and owing on real properties and such additional liabilities may include liens previously sold to a third party. A purchaser at the Sale acts at his or her own risk, must exercise due diligence in selecting real properties upon which to bid, and must bid in good faith. At the Sale, the purchaser acquires a certificate of sale to the real property that may ripen into title if the owner (or other party with an interest) fails to redeem. The owner (or other party with an interest) has a statutory right to redeem the real property until his or her equity of redemption has been foreclosed by the purchaser’s lawsuit. If the owner (or other party with an interest) fails to redeem the real property, the Superior Court of the District of Columbia may order that a deed be issued to the purchaser after the purchaser pays all taxes, costs and expenses. The purchaser shall monitor tax payment schedules provided by OTR on its Web site, www.taxpayerservicecenter.com, and shall surrender the certificate of sale to receive a refund if the property shall have been redeemed. A certificate of sale may be canceled if, inter alia, it is later determined that the delinquent taxes, including accrued interest and penalties, were satisfied before the end of the last day of the Sale. The date of sale of any real property shall be deemed to be the last day of the Sale, regardless of the actual day of the Sale during which the real property was offered and sold. The certificates of sale shall indicate the date of sale as being the last day of the Sale. Purchasers shall have filed Form FR-500, Combined Business Tax Registration Application, prior to registering. This form may be filed online by visiting OTR’s Web site, www.taxpayerservicecenter.com, or in person at OTR located at 1101 4th Street, SW, 2nd Floor - Customer Service Center, Washington, DC 20024. A potential purchaser, including a natural person or business entity, delinquent in the payment of in rem taxes (e.g. real property taxes) to the District, or who has been convicted of a felony involving fraud, deceit, moral turpitude, or anti-competitive behavior, may not bid at the tax sale or otherwise acquire an interest in real property sold at the tax sale. A potential purchaser, including a natural person or business entity, must certify that such purchaser: 1) is not more than one year in arrears in any jurisdiction in the payment of in rem taxes not being contested in good faith; and 2) has not been convicted in any jurisdiction of a felony involving fraud, deceit, moral turpitude, or anti-competitive behavior. Registration for the Sale is mandatory and begins on Monday, July 7, 2014. Registration shall continue until the final day of the Sale. Purchasers must register for the Sale at OTR’s Customer Service Center, located at 1101 4th Street, SW, 2nd Floor - Customer Service Center, Washington, DC 20024. Prior to bidding at the Sale, a purchaser of real property must have made a deposit of at least 20% of the total purchase price. ALL PAYMENTS MUST BE MADE TO THE D.C. TREASURER BY CASH, CERTIFIED CHECK, CASHIER’S CHECK, OR POSTAL MONEY ORDER. OTR will conduct four public seminars to explain tax sale procedures. Because of recent statutory changes to the tax sale, purchasers are especially encouraged to attend. The seminars will be held at 1101 4th Street, SW, 2nd Floor – Room W250, Washington, DC 20024, on Wednesday, June 25, 2014, and Thursday, June 26, 2014. During each day, a seminar will take place from 9:30 a.m. until 12:00 p.m., and another seminar will take place from 2:00 p.m. until 4:30 p.m. During each of the four seminars, OTR will explain the entire sale process and follow-up with a question and answer period. OTR strongly encourages all potential purchasers to attend one of the seminars. The seminars are free and all are welcome. To enroll in a seminar, please call OTR at (202) 727-4TAX (4829), or visit its Customer Service Center at 1101 4th Street, SW. Enrollment is mandatory for anyone planning to attend one of the seminars. Enrollment will be granted on a first-come/first-served basis, and will continue until all available slots are taken.

Stephen M. Cordi Deputy Chief Financial Officer Office of Tax and Revenue

Sq-Suf- Lot Improved 0014 2059 &IMP 0014 2232 &IMP 0014 2233 &IMP 0014 2242 &IMP 0014 2244 &IMP 0016 0076 &IMP 0025 2310 &IMP 0028 2285 &IMP 0037 2014 &IMP 0038 2039 &IMP 0038 2054 &IMP 0048 2004 &IMP 0048 2026 &IMP 0048 2039 &IMP 0051 2002 &IMP 0051 2333 &IMP 0053 0007 &IMP 0058 0011 &IMP 0067 2028 &IMP 0069 0829 0069 2005 &IMP 0071 2008 &IMP 0071 2009 &IMP 0071 2085 &IMP 0075 2084 &IMP 0081 0078 &IMP 0081 2227 &IMP 0081 2228 &IMP 0093 0106 &IMP 0093 0815 &IMP 0095 2011 &IMP 0098 2009 &IMP 0109 0028 &IMP 0109 0040 &IMP 0131 2126 &IMP 0133 0114 &IMP 0133 2061 &IMP 0139 0007 &IMP 0149 0005 0150 0156 &IMP 0151 0804 0151 2299 &IMP 0152 2247 &IMP 0153 2003 &IMP 0155 2099 &IMP 0155 2289 &IMP 0156 0337 &IMP 0166 0863 &IMP 0166 7002 &IMP 0166 7003 &IMP 0166 7006 &IMP 0166 7008 &IMP 0175 2010 &IMP 0175 2011 &IMP 0179 0065 &IMP 0179 2015 &IMP 0179 2095 &IMP 0179 2143 &IMP 0183 0091 &IMP 0190 2044 &IMP 0192 0832 &IMP 0202 0082 &IMP 0207 2037 &IMP 0208 0140 &IMP 0208 2140 &IMP 0208 2161 &IMP 0209 2024 &IMP 0210 2160 &IMP 0211 0863 &IMP 0212 2006 &IMP 0212 2116 &IMP 0236 0064 &IMP 0236 0065 &IMP 0237 0013 &IMP 0237 0805 &IMP 0242 0810 &IMP 0243 2099 &IMP 0247 2327 &IMP 0271 0213 &IMP 0274 0833 &IMP 0278 0032 &IMP 0280 0828 0281 2139 &IMP 0305 0048 &IMP 0309 2011 &IMP 0309 2013 &IMP 0309 2014 &IMP

Taxable Owner’s Name 2nd Owner’s Name TX ROBERT L HAMM TX 2501 A HOLDING LLC TX 2501 B HOLDING LLC TX GHANA GROWTH FUND LIMITED TX 2501 B HOLDING LLC TX SIKE SHARIGAN NANCY SHARIGAN TX M R YAGHEFI SIMIN B YAGHEFI TX DAVID P SNIEZEK EDWINA T SNIEZEK TX ANDREA LIU TX BRADFORD A JEWETT TX RAFID FADUL TX CAYADA LLC TX GEORGE P MALLIOS JENNY H MALLIOS TX MARGARET E RAND TX PASUR S SENGOTTAIYAN TRUSTEE NORMA L SENGOTTAIYAN TRUSTEE TX JOHN E. BRYSON, TRUSTEE LOUISE HENRY BRYSON, TRUSTEE TX BELINDA KEISER ARTHUR KEISER TX EDUCATIONAL FOUNDATION FOR GAMMA ETA INC TX FRANCISCO GUZMAN TX FRITS JACOBSE TX NOREEN V BANKS TX ABDULRAHMAN H AL-SAEED TX AHMED H AL SAID TX AJNERG LLC TX INDU M JOHN TX EPSILON HOUSING TRUST INCORPORATED TX THE MERRIETTA LLC TX THE MERIETTA LLC TX T G BOGGS J H SCHWARTZ TX MELINDA LIU TX REID A DUNN ELEANOR B DUNN TX GEARY STEPHEN SIMON TRUSTEE TX 1816 19TH STREET LLC TX NATIONAL ITALIAN AMERICAN FOUNDATION INC TX THOMAS GOLDEN TX METROPOLITAN CIRCLE ONE LLC TX MOLLIE H TAYLOR TX DAVID AND SANDRA FOLEY LLC TX LEROY N BARLEY PATRICE A BARLEY TX TADAHIKO NAKAMURA TX KENNETH FAIRBAIRN TX BARBARA THOMPSON TX MANUEL G SMITH TX JOHN F PETERSON TX GLORIA C BROLAND TX MCDM PARTNERSHIP TX LEE R GRANADOS KEVIN R KLYNN TX WASHINGTON H STREET ASSOCIATES LLC TX WASHINGTON H STREET ASSOCIATES LLC TX WASHINGTON H STREET ASSOCIATES LLC TX WASHINGTON H STREET ASSOCIATES LLC TX WASHINGTON H STREET ASSOCIATES LLC TX ERIC ZILBERKWEIT ERIC M ZILBERKWEIT TX ERIC ZILBERKWEIT ERIC M ZILBERKWIET TX METROPOLITAN CIRCLE ONE, LLC TX JOHN C SCOTT III SUSANNE M SCOTT TX 1 P ST NW LLC TX CHARLES M SHUEY SECOND TX 1128 16ST DCIB LLC TX WILLIAM F JONES TX EDWARD T GREEN SR IRIS GREEN TX LUZ D LOPEZ LOPEZ HUMBERTO TX PARMINDER S BEESLA POONAM BEESLA TX LOFORD LLC TX GABRIEL SILVA TX VALOR 1634, LLC TX DAVID V BLOYS TX PARI M GHODSI TX 1336 14TH ST LLC TX ROSS J HEIDE TX SUSAN E MALONEY TX HENRY B MCCALL TX HENRY B MCCALL TX DANIELLE A INSETTA TX LARRY J MCADOO KAREN E HARDY TX 1333 14TH ST NW LLC TX JOHN P MADEI TX SUSAN K POWELL TX HELENA J SEEGERS TX VIKTOR A SIDABRAS TX FRED L GUNTER C M GUNTER TX EVELYN SEIGEL TX PATRICE M DICKERSON TX ARMOND W SCOTT TX 1610 11TH ST LLC TX 1610 11TH ST LLC TX 1610 11TH ST LLC

No. 2555 1100 1100 1100 1100 2535 2425 908 1140 3 3 1414 1414 1414 2201 1111 2211 524 2141 0 1320 1177 1177 1177 2141 2156 2112 2112 2023 2029 2000 1272 1816 1860 1918 1739 1828 1823 1706 2006 0 1749 1731 1726 1712 1601 1725 1710 1710 1710 1710 1710 2026 2026 1616 1615 1615 1615 1128 1901 1714 2212 13 1634 1634 1634 1408 1441 1336 1420 1420 1357 1355 1325 1350 1333 1300 1133 2244 1225 1213 0 1245 1922 1610 1610 1610

Street PENNSYLVANIA 25TH ST 25TH ST 25TH ST 25TH ST QUEEN ANNES L L ST NEW HAMPSHIRE 23RD ST WASHINGTON CI WASHINGTON CI 22ND ST 22ND ST 22ND ST L ST 23RD ST WASHINGTON CI 22ND ST P ST 22ND ST 21ST ST 22ND ST 22ND ST 22ND ST I ST F ST F ST F ST HILLYER PL HILLYER PL MASSACHUSETTS NEW HAMPSHIRE 19TH ST 19TH ST 18TH ST 19TH ST RIGGS PL M ST FLORIDA AV 17TH ST T ST WILLARD ST S ST S ST CORCORAN ST 18TH ST CHURCH ST H ST H ST H ST H ST H ST 16TH ST 16TH ST CORCORAN ST Q ST Q ST Q ST 16TH ST 16TH ST 15TH ST 14TH ST BISHOPS GATE 14TH ST 14TH ST 14TH ST Q ST RHODE ISLAND 14TH ST N ST N ST U ST U ST T ST WALLACH PL 14TH ST 13TH ST 14TH ST 12TH ST T ST RHODE ISLAND 12TH ST 13TH ST 11TH ST 11TH ST 11TH ST 11TH ST

Quad NW NW NW NW NW NW NW NW NW NW NW NW NW NW NW NW NW NW NW NW NW NW NW NW NW NW NW NW NW NW NW NW NW NW NW NW NW NW NW NW NW NW NW NW NW NW NW NW NW NW NW NW NW NW NW NW NW NW NW NW NW NW NW NW NW NW NW NW NW NW NW NW NW NW NW NW NW NW NW NW NW NW NW NW NW NW NW

Taxes Owed $2,409.99 $3,096.50 $2,948.07 $22,435.28 $19,833.76 $8,975.03 $8,201.41 $2,309.58 $2,997.11 $2,717.21 $2,855.53 $2,971.16 $5,136.26 $2,840.35 $3,211.11 $12,797.24 $14,193.94 $14,079.63 $2,290.03 $4,135.74 $2,196.48 $6,134.74 $5,991.97 $6,080.15 $2,036.25 $5,841.70 $3,126.92 $5,506.51 $15,125.82 $6,724.41 $16,995.51 $5,104.11 $7,263.80 $27,586.51 $4,137.01 $10,540.01 $2,119.86 $14,851.58 $29,821.91 $16,245.80 $5,708.97 $2,780.69 $4,699.46 $5,783.32 $2,081.15 $7,809.88 $4,166.83 $144,954.42 $52,851.42 $40,287.89 $36,833.52 $577,901.20 $4,523.08 $4,469.57 $6,146.00 $2,002.60 $6,694.09 $2,272.79 $106,620.97 $2,269.67 $3,615.72 $17,269.04 $5,275.78 $54,105.15 $3,522.43 $5,929.85 $2,924.45 $5,405.43 $12,878.48 $5,786.37 $3,714.37 $86,024.28 $33,627.26 $4,063.48 $2,012.38 $14,728.21 $3,700.53 $3,358.27 $2,693.23 $7,253.77 $2,764.82 $21,042.07 $3,036.66 $6,215.93 $5,169.64 $3,083.35 $3,050.20

www.washingtoninformer.com

2014 Tax Sale Report

June, 2014

TAX 1