ELEMENTS OF STYLE

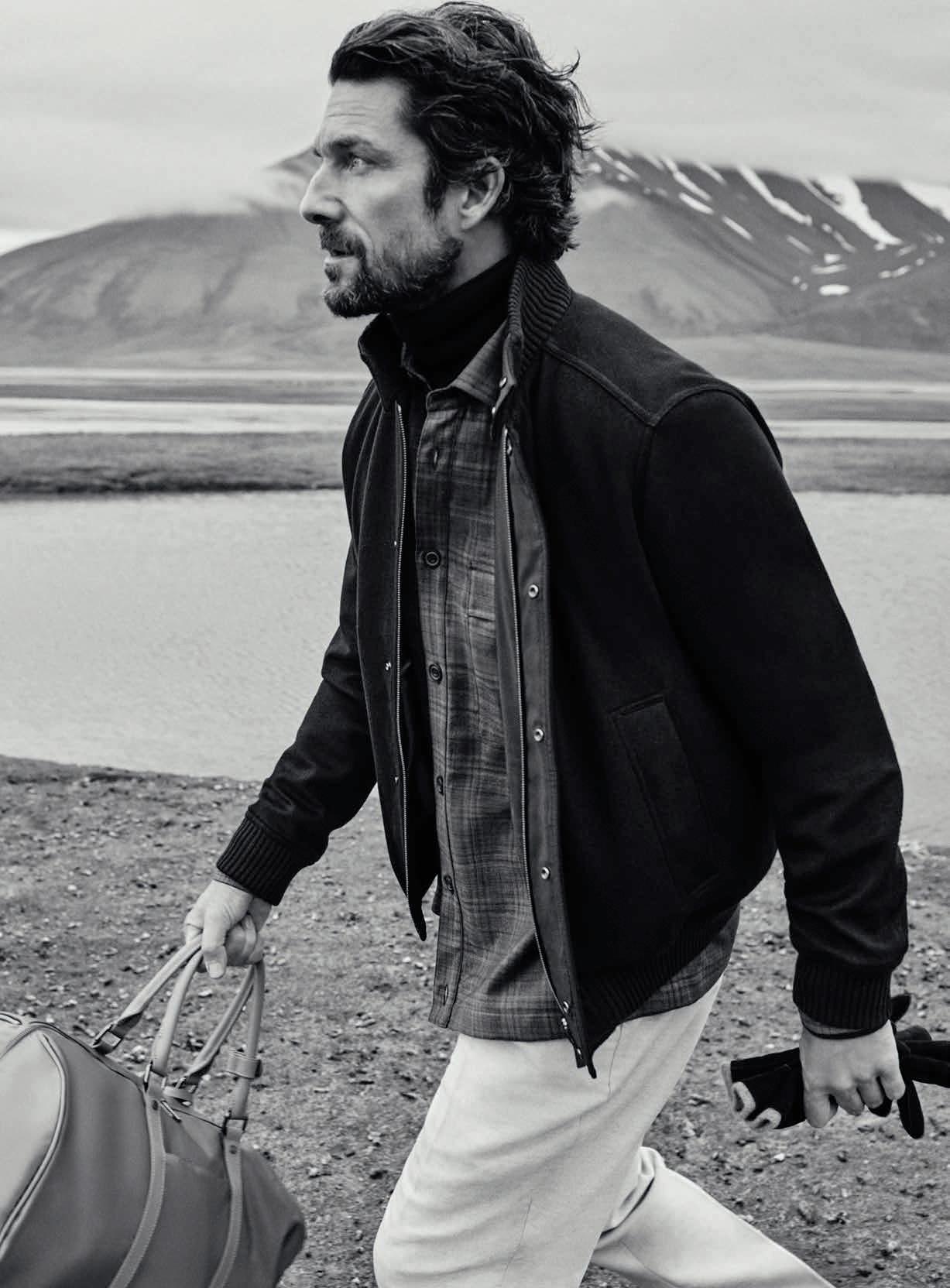

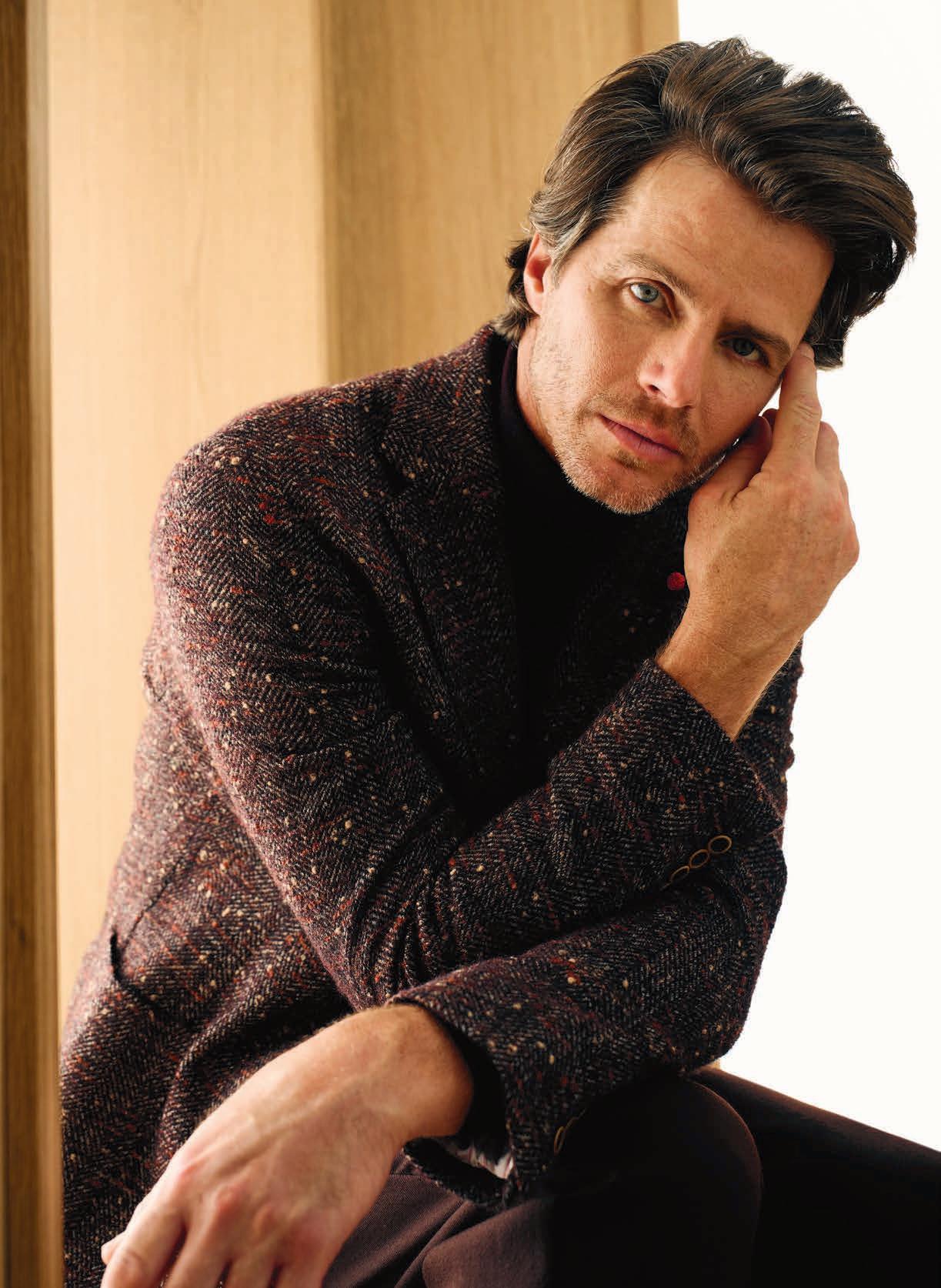

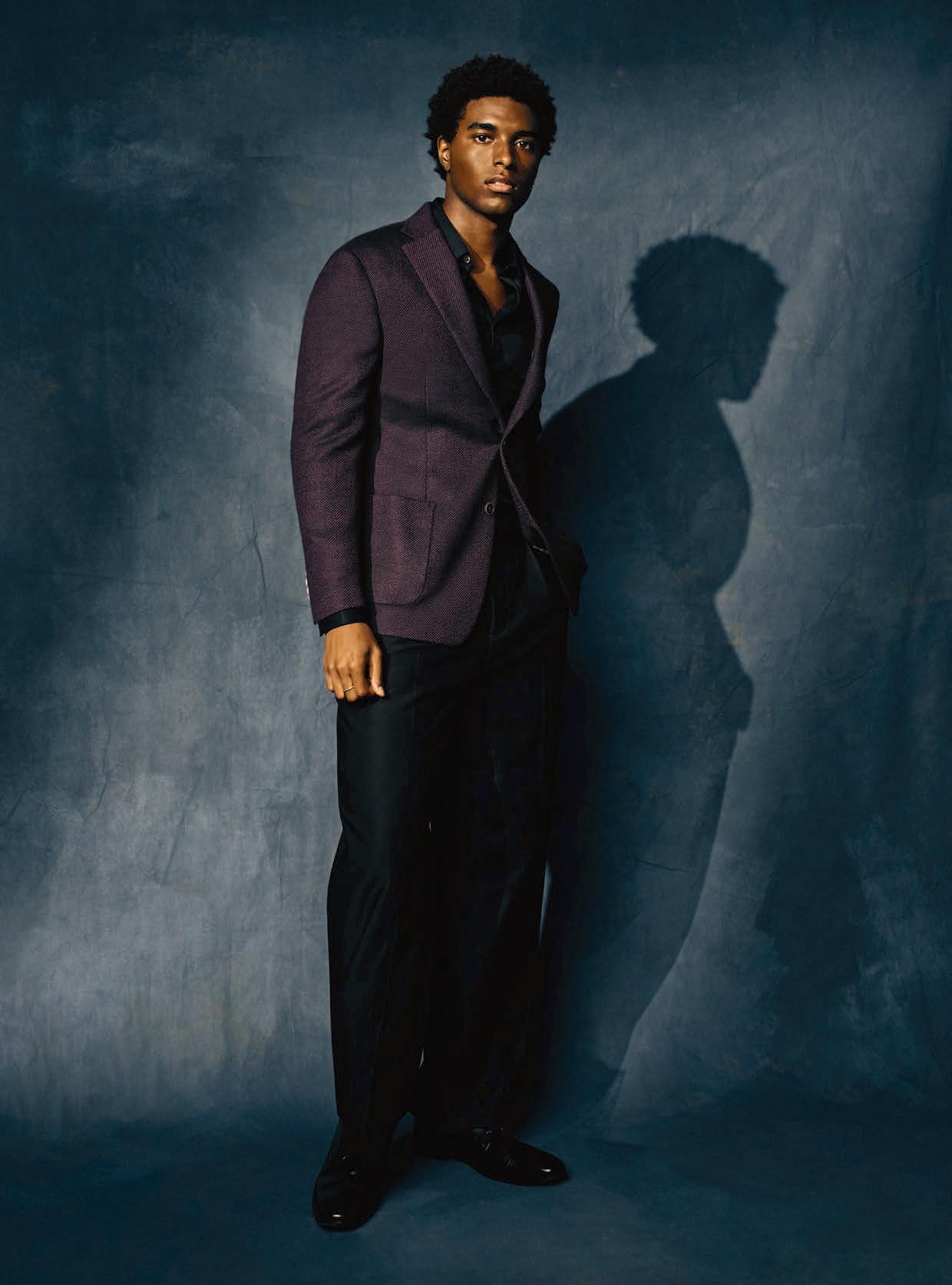

MR’S TAILORED CLOTHING HANDBOOK

THE PRICE OF LUXURY STRONG FOR HOW LONG?

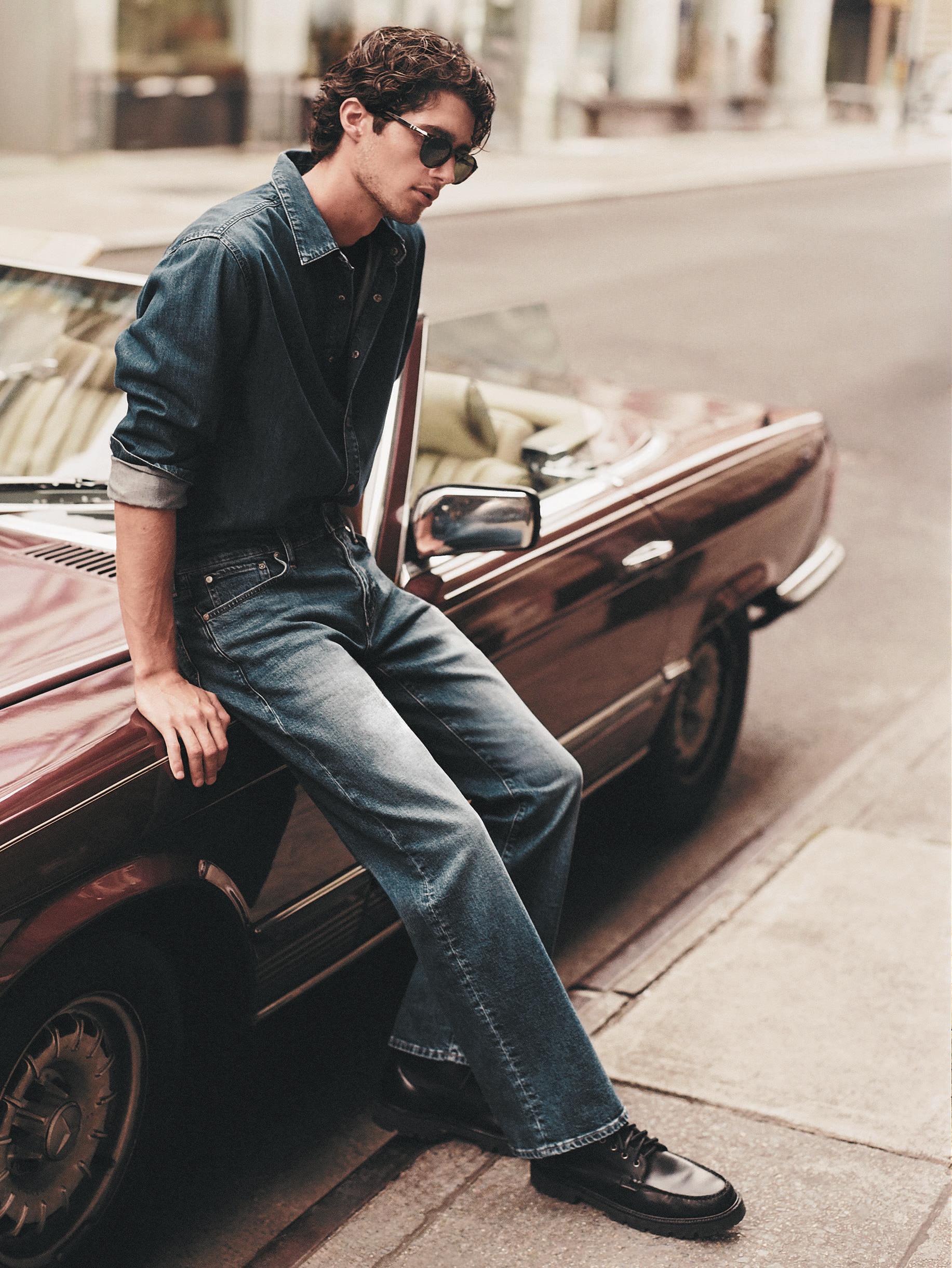

FOREVER DENIM FIT IS FUNDAMENTAL

LONE STAR STYLE

DALLAS PREVIEW

MR’S TAILORED CLOTHING HANDBOOK

THE PRICE OF LUXURY STRONG FOR HOW LONG?

FOREVER DENIM FIT IS FUNDAMENTAL

LONE STAR STYLE

DALLAS PREVIEW

LAS VEGAS

February 17-19

August 10-12

NEW YORK

February 24-26

September 9-11

NASHVILLE

April 28-29

NEW YORK

February 24-26

September 9-11

LAS VEGAS

February 17-19

August 10-12

LAS VEGAS

February 17-19

August 10-12

LAS VEGAS

February 17-19

August 10-12

Editor-in-chief KAREN ALBERG GROSSMAN

Managing Editor JOHN RUSSEL JONES

Web & Content Editor BRETT EDWARD STOUT

Art Director MIKE STEVEN FRANÇOIS

Contributing Editors

CRAIG CRAWFORD | DOUG HAND | MICHAEL FISHER

Contributing Creative Directors

TREVETT MCCANDLISS / NANCY CAMPBELL

Group Publisher LIZETTE CHIN

Publisher CHARLES GARONE

Production Managers

LAURIE GUPTILL / FERN MESHULAM / KATHY WENZLER

Marketing & Production Specialist

CATHERINE ROSARIO

Office Manager

MARIA MARTUCCI

Accounting

KASIE CARLETON / URZULA JANECZKO / BRUCE LIBERMAN

Chairman CARROLL V. DOWDEN

President & Ceo MARK DOWDEN

Senior Vice Presidents LIZETTE CHIN / RITA GUARNA

Chief Financial Officer/Vice President STEVEN RESNICK

Vice Presidents

NIGEL EDELSHAIN / THOMAS FLANNERY NOELLE HEFFERNAN / MARIA REGAN

January 24-26, 2026

Preview Day | January 23

July 25-27, 2026

Preview Day | July 24

(We’re finding a few good reasons…)

By Karen Alberg Grossman

Remembering the financial crash of 2008, I have nightmares. Could it happen again? Of course it could. We’ve ridden this wave before…

Midwest retailer

Yes, prices in tailored clothing are rising but few independent merchants are panicking. While we’re not advocating panic, we’re finding a few good reasons to pay attention.

• We’re seeing some scary high price tags on luxury tailored clothing, which is fine when the price tags reflect the intrinsic value. Unfortunately, this is not always the case.

• We’re seeing too many clothing retailers reluctant to try new ideas. As one merchant put it: “I’ve got a great selling team, but they want more of what they sold last year. I prefer to push the envelope. I admit our sell-through on DBs is only 50 percent and we’re not selling tons of pleated trousers, but we need to show what’s new.”

• Retailers admit pressure from some of the major luxury conglomerates who demand that merchants (those deemed worthy enough to carry their brand) spend an additional fixed percentage on their seasonal buy. This leaves many without the open-to-buy to explore the market and try out new trends.

• Several merchants fear they’re losing their aspirational customers, those who simply want a well-made, well-priced suit to wear to a wedding or graduation (and who might ultimately trade up to buying luxury in upscale stores if they can find a few affordable options to meet their current needs.)

”

Of course, not all beautiful clothing costs thousands of bucks. Says Peerless president Dan Orwig, “Core business has been strong, but we’re pushing fashion going forward. For example, our new Vince collection has a less formal West Coast vibe, incorporating cashmere knits and drawstring cargo pants. Ticket prices are $995 for suits, $695 for sportscoats.”

More discussion on price in our tailored clothing feature, page 34. Also in this issue, MR is proud to present our Tailored Clothing Handbook, page 17. In it: everything your sellers need to know about modern fabrics, fits, construction, selling tips, and fashion trends. Let us know if you need additional copies for your associates. Also in this issue: an important feature on shoppable video and why you might want to consider it, not as an alternative to the fabulous in-store experience you’ve already created, but as a way to add the power of instant online sales to your exceptional in-store experience. Read more on page 6!

As we at MR enter our 36th year of sharing insights and inspiration from the most knowledgeable experts in menswear, we want to thank you for your support over the past three and a half decades. Surely, we wouldn’t be here without you!

With love and light, Lizette, Charles, John, Brett and Karen

By Craig Crawford

Have you been too busy running your successful brick-and-mortar store to worry about the eCommerce/Digital craze? You’re not alone. For years, your personal touch, great service, and a physical location have been enough.

But today’s customer—the man who buys your suits, shirts, and accessories—is different. He’s glued to his phone, and he’s not just scrolling; he’s watching, and he’s ready to buy.

If you feel like you’ve fallen behind on social media and online shopping, don’t sweat it. Shoppable video is your chance to leapfrog the competition and blend your best asset— the in-store experience—with the power of instant online sales.

Your customers, like most Americans, are deeply engaged with video content, watching 84 minutes per day. In fact, video is 83% of global internet traffic, and 68% of viewers prefer watching videos to learn about new products or services. Almost one third (31%) of consumers watch videos posted by brands, and 86% want more videos from brands.

Here are more numbers that should make you put down that tape measure and pick up your phone!

Nearly half of US consumers are social shoppers: 47% have already bought something they saw on social media, and over half (58%) are interested in doing so. This trend is not going away.

Video dominates discovery: 75% of US consumers have shopped on Facebook and 50% on Instagram. 82% would rather watch live video than read social media posts, and they share what they watch—social video generates 1200% more shares than text and image content combined!

Live shopping converts: 96% have watched an explainer video, and 87% buy that product after watching the explainer. Almost half (46%) of Americans have made a purchase through a livestream event and would do so again. This is the new, digital version of your store’s best salesperson.

Video grows revenue 49% faster: Interactive videos increase conversion rates 70% and have an audience reach of 92% globally.

The influence of peer recommendations: A video posted by a real customer demonstrating the fit of a jacket is 184% more effective at converting clicks into sales than a video created by your brand. The customer who clicks

on a User Generated Content (UGC) link is already inclined to buy because they trust the endorsement from a peer, which significantly shortens their path to purchase and can boost spending by 45%.

The digital storefront is not replacing your physical store; it’s becoming the discovery channel for it. And the preferred format for discovery is video.

Think of a shoppable video as your best sales associate, available 24/7, with an integrated checkout. An interactive form of content, a shoppable video lets viewers purchase or learn more about featured products by clicking or tapping on clickable elements (known as hotspots or product tags) on the items themselves, all without leaving the video player or searching the internet separately. Instead of seeing a jacket they like in a video and then having to remember the brand, search your website, and hunt for the product page, customers can just tap the screen and buy the item right then, without disrupting the viewing experience.

The primary goal is to remove friction from the buying journey. When a viewer clicks a tagged product, they can typically:

• See price, size, and product details in an overlay

• Add the item directly to an in-video shopping cart

• Be redirected instantly to the product page with the item pre-selected.

Shoppable videos can be either pre-recorded or live-streamed, with the host showcasing products, answering questions, and viewers able to buy instantly.

A video posted by your store titled How to Style a Tweed Blazer for the Weekend. As the model puts on the blazer, a small, clickable icon (the hotspot) appears on it. The customer clicks the icon, and a pop-up shows the blazer’s price, available sizes, and a “Shop Now” button. The customer adds the blazer to the cart and continues watching the video to see the featured shirt and trousers, which are also clickable.

Shoppable videos leverage impulse purchases. You secure the sale at the peak moment of interest. This real-time process captures the customer’s attention exactly when they feel inspired. The video serves as a seamless bridge that narrows the gap between product discovery, excitement, and purchase.

Shoppable videos build trust and authenticity. People retain 95% of a message when they watch it in a video, compared to just 10% when reading. Video allows you to show off the texture of a wool suit, the fit of a denim jacket, or the details of a leather shoe in a way that static photos can’t.

If you’ve kept your focus on your physical store, you actually have a unique opportunity to create the most engaging shoppable content. Many large online-only brands struggle to create content that feels authentic. But you have:

1. Real Expertise: Your in-store staff are the best stylists and fit experts.

2. Real Inventory: You can show what’s actually in stock right now.

3. Real People: You can feature your own employees—the faces your community already knows and trusts—instead of costly, generic models.

You don’t need a huge budget or a massive social following. Start small and use your store as your studio. Start with free shoppable video platforms such as Instagram Shopping, Facebook Live, YouTube Shopping, or TikTok shopping. Integrate product tags directly into the video on your website or social channels.

Shoppable videos that run under a minute have the highest engagement rate—66% of consumers will watch the entire video if it’s less than 60 seconds long; most watch at least 16 seconds (27%) of a one-minute video. A 60-minute video has an average watch time of 16 minutes.

Instagram: 30 seconds

X (previously Twitter): 45 seconds

Facebook: 1 minute

YouTube: 2 minutes

TikTok: 21 to 34 seconds

Friction kills online sales. Shoppable video removes the friction between inspiration and ownership.

Click 1: The viewer taps the product in the video to see the price and sizes.

Click 2: They click “Add to Cart” or “Buy Now.”

Instead of just showing a product, show the value of the product:

• The 30-Second Style Tip: Your manager quickly shows Three Ways to Tie a Tie or The Right Length for Casual Trousers. Tag the ties or trousers so viewers can buy instantly.

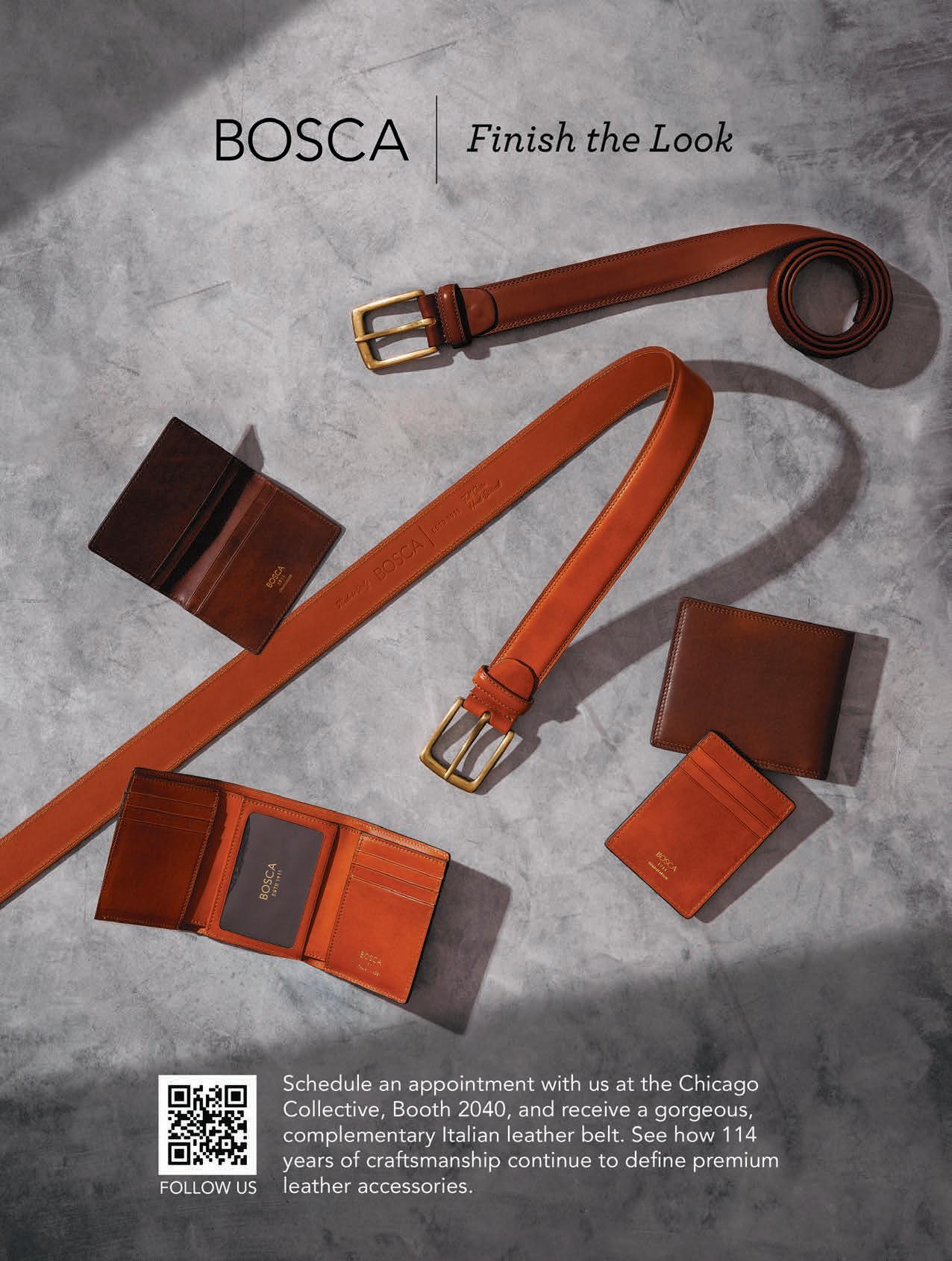

• The Unboxing/Quality Check: An employee discusses a new shipment of leather goods, feels the material, and explains why it’s worth the price. Shoppable tags appear on the featured wallets and belts.

• The Virtual Fitting Room: An employee models a suit in three different sizes, explaining the feel and fit of each. Viewers can tap the screen to select their size and add it to their cart.

Live commerce is the closest thing to your physical store experience:

• Host an event: Announce a Friday night cocktail attire live showcase. Your top sales representative from the store hosts the event and answers questions in real time. This can produce significant results. One luxury menswear brand experienced a 37% increase in sales through video consultations and virtual store tours.

• Create urgency by offering a special deal, like free monogramming for the next hour, to boost immediate sales while the video is live.

Your competitive advantage has always been your knowledge, your curated inventory, and your service. Shoppable video is simply the tool that allows you to bottle that amazing in-store experience and distribute it to a massive, readyto-buy audience.

Don’t wait for your competitors to figure it out. Start experimenting with a single, authentic shoppable video this week.

Sources for the statistics in this article include (in alphabetical order): ComScore OTT Intelligence, Dash, Demand Sage, HubSpot Blog Research: Marketing Trends Report, Insider Intelligence, eMarketer, Livestream, Oberlo, SocialInsider, Social Pilot, Sprout Social, Thrive Internet Marketing Agency, Wix, and Wyzowl.

-Step Shoppable Video Action Plan

Start with Social (Free): Use Instagram/Facebook Live for a 15-minute “New Arrivals Showcase” this week. Tag your products in the live stream. This gives you instant data on customer interest.

Repurpose Content: Take the best 30-second clips from your live session and turn them into Reels or TikToks, ensuring the product is tagged for instant purchase.

Invest in a Website App: Once you confirm video is driving sales, invest in a low-cost Shopify app like Vizup or ReelUp to embed your top-performing videos directly onto the corresponding product pages for higher conversion rates.

Craig Crawford is a two-time Tabbie award-winning author and founderprenuer of Crawford IT (https://crawfordit. com), a London-based consulting firm specializing in the digital transformation of brands. He’s on Instagram and X, @ getamobilelife; or call +44 07834584785.

By Douglas Hand

On a Wednesday evening in late November, a dedicated group of law students sat eating kosher sushi in a large lecture hall on the second floor of the Benjamin N. Cardozo School of Law. Despite the stress of looming final exams, there was an air of excitement in the room as the students prepared to hear from an all-star group of panelists that I moderated for an event titled Trademarks and M&A.

The eminently qualified panel featured Karen Artz Ash (Global Co-Chair of the Trademark, Copyright and Privacy Practice Group at Katten Muchin Rosenman LLP) and Claudine Meredith-Goujon (Global Co-Head of the Intellectual Property & Technology Transactions Practice Group at Paul, Weiss, Rifkind, Wharton & Garrison). Jordan CohenKaplan (an associate at Wachtell, Lipton, Rosen & Katz) brought the perspective of an antitrust attorney, and William Susman (a Managing Director at Cascadia Capital), who’s had experience completing transactions for numerous brands, including Nike and Nordstrom, rounded out a discussion from an investment banking point of view.

Each panelist emphasized the importance of the brand itself in valuing fashion and beauty companies. A major fashion company’s physical assets and inventory might be quite limited, with a huge portion of the value lying with the brand’s goodwill. Depending on how the strength of that brand is perceived by consumers, the value of the company can heavily wax and wane. Trademark is the legal validation of that goodwill and brand equity. Comprehensive trademark use, registration, and maintenance provide the backbone for the brand to grow. If that brand equity is strong

enough, the profit margins can be significant.

While historically, eponymous brands such as Calvin Klein and Tom Ford dominated, there’s been a perceptible shift toward celebrity-associated brands like Skims and Fenty. The risk of eponymous brands (a topic I’ve written about extensively) lies with the individuals and egos involved. If much of that brand’s value is built on an individual, what happens if that person “goes off the rails”? What happens if an outside party wants to come in and change the direction of that company? On top of those concerns, M&A transactions can become complicated when a founder is caught up in certain equity plans within a corporation.

Fashion and beauty companies are often engaged in extensive licensing and assignment arrangements. Brands can be built on licenses from others. Trademark diligence often focuses on these third-party agreements, in addition to the more standard practice of examining trademark registrations and applications. Understanding the ins and outs of these complex third-party trademark agreements can make or break a deal.

Meredith-Goujon addressed a transaction she worked on in 2022 – The Estée Lauder Companies Inc.’s agreement to acquire the Tom Ford brand and all its intellectual property. While many people associate Tom Ford with the men’s fashion line, the key asset that Estée sought in the deal was actually Tom Ford Beauty. The beauty brand became the owned and maintained property of Estée, while Zegna and Marcolin retained their long-term relationship with Tom Ford as licensees for Tom Ford Fashion and Eyewear, respectively.

Not every deal makes it to closing. When Tapestry sought to combine three close

competitors—Tapestry’s Coach and Kate Spade brands and Capri’s Michael Kors brand—in April 2024, the FTC challenged the deal before it closed. Ultimately, the U.S. District Court for the Southern District of New York agreed with the FTC that this merger of well-known handbag brands constituted an unacceptable combination of “accessible luxury brands.” Along with me, the panelists were surprised by the court’s decision, finding Mr. CohenKaplan’s arguments in favor of Tapestry more convincing. A main part of Tapestry’s argument was that the competitive analysis should focus more on Michael Kors losing brand equity despite its current revenue. It was also argued that the FTC did not properly estimate the size of the market or the consumer perception and choices within it. Whether this case indicates further limitations in fashion and beauty consolidation is not yet clear, but will assuredly be impacted by evolving consumer purchasing trends, as well as by changes within the FTC leadership and policy directives that change by administration.

The night was full of unique anecdotes, behind-the-scenes stories, and insights sparked by the gathering of these professionals. Thank you to the Cardozo Law Intellectual Property Law Society for hosting the event and its Chairman, Aaron Kaplan, for his assistance on this article.

By Karen Alberg Grossman

It’s been a good if not great year for denim sales, according to retailers and brands.

While most of the fashion innovation has been on the women’s side (looser fits, wider legs, higher rises, soft sustainable fabrics, and creative detailing), there’s enough going on in men’s to move the needle for retailers who emphasize key selling points and great storytelling. As Fred Derring from DLS puts it, “Retailers should be broadening their assortments beyond five-pockets, which guys already own plenty of. At the very least, they need slim fit, relaxed fit, boot cut, and flare to cover all bases…”

“The classic denim brands continue to drive our business,” says Aly Turchioe at Darien Sport Shop in Connecticut, alluding to AG and Citizens of Humanity. “However, we’ve seen an uptick in sales where we’ve expanded our assortment. We also re-introduced Frame to the store and it’s quickly become one of our top denim brands. We’ve developed a

nice replenishment program with them: we win when we can react and re-order quickly!

“Trunk shows are hit or miss for us,” she confides. “We find it’s hard to tell customers when to shop. We’ve been working hard to think outside the box for our in-store events to make them even more special for our customer. We’re doing things like bringing in coffee/food trucks and hosting personalization events. We just had an amazing trunk show with 34 Heritage where we featured a large, expanded assortment and hosted a beer-tasting with Spacecat, a local brewery, which was a huge hit.”

What are the key selling points that will drive men’s denim sales in 2026? According to Ugur Caymaz at DL1961, innovation is the biggest driver. “Customers want comfort, performance, and authenticity — and they buy from brands that stay consistent in fit while evolving in fashion. Clear fit architecture, strong fabric stories, and sharp floor presentations are critical. When

associates understand why a product is different, denim sales follow. It’s not rocket science when you execute on these fundamentals, it becomes a no-brainer.”

Anna Greco at Camouflage is most excited about special details. “For Fall ’26, I’m genuinely excited about how the Camouflage collection has evolved. The new fabrics, updated fits, unexpected color treatments, and select details bring something really special to the season—pieces that feel modern, wearable, and instantly compelling.”

At 34 Heritage, much excitement is in a total wardrobe approach to the business. Says Volkan Ureten, “The knit tops, quarter zips, shirt jackets, blazers, outerwear, and other elevated casual pieces make shop-in-shops an increasingly viable option. Recent trunk shows at our retail partner stores have been record-breaking.”

According to the marketing team at AG, Fall/Winter 2026 is about “exploring a fresh

range of novelty washes and new fabrications that introduce what we’re calling ‘familiar newness.’ This includes unique finishes such as coated denim in both garment and fabric form, as well as destroy-and-repair techniques that create a lived-in authenticity. We’re also developing rich blue-black indigos that add a refined dimension to men’s wardrobes. It’s an exciting evolution of the line that feels true to who we are.”

The AG team goes on to talk about retail success stories. “Specialty retailers like Mitchells are delivering exceptional results due to their elevated customer experience and strong visual storytelling. Bloomingdale’s has also been highly effective in presenting the full collection in a way that drives customers to our denim tables and encourages deeper engagement. And Nordstrom, one of our largest men’s accounts, continues to win by offering a complete, easy-to-shop bottoms assortment for customers seeking a trusted jean without overthinking the process.”

ABy Karen Alberg Grossman

recent teaching stint at Parsons School of Design with students in a Fashion Journalism class gave me the opportunity to reverse roles and learn from them. Here, a few insights from NYC college students, mostly females and hardly a likeminded group.

Thanks to Professor Christopher Blomquist for facilitating this project.

Ownership of denim jeans ranged from a single pair to nine, worn “rarely” to “every day.” Most recent purchases included “Orange overalls with bronze buttons that look vintage and theatrical but cost $40 at Target” (Emery, who is now boycotting Target), “hand-me-down Levi’s” (Isabella), “over-sized black carpenter jeans that cost $80 plus tax at Vintage Twin in the East Village” (Sydney), “a thrift-store jacket costing $5 at Red White & Blue” (Camille), “Revice jeans at $100+” (Kylie), “black barrel-leg jeans for $30 at Uniqlo” (Danielle), “vintage D&G jeans for $400” (Sarah) and “baggy raw denim pants from ASOS” (Jireh, who shops this brand for its large selection for tall people).

Asked what they want to buy next, responses once again varied. Emery is in love with a tan and black denim jacket that they saw at Coterie but only if it’s under $70. Kylie wants “fun denim pants with funky details,” while Sydney covets “skinny or boot-cut jeans reflecting the Indie sleaze of the 2010s.” Jireh has been

eyeing some $500 straight-leg pants from Acne Studios, grateful for a discount from friends who work in the store.

Virtually all students complained about fit, specifically the impossible dream of finding perfection. “Jeans should fit at the waist without pushing into it,” notes Emery. “If it fits at the waist, it’s too loose at the hips,” says Isabella, who adds that she’d spend up to $200 for a perfect fit, which seems impossible.” Sydney would also spend more for a perfect fit, and dreams of classic 501 Levi’s that sit perfectly at her waist. Sarah has problems fitting her tall and skinny frame, plus small sizes are too often sold out. “Sizing is important,” sums up Kylie. “Jeans are statement pieces and speak to me spiritually.” Jireh notes that since so few retailers carry long lengths in store, he’s forced to purchase online, a challenge in that sizing is not standardized across brands.

Current popular models according to these students are medium to low rise, wide-leg, flare, and bootcut jeans. A few mentioned slim-fit for more elevated occasions, and some specified baggy for comfort. (Interesting that none of the female respondents mentioned high-rise models.)

What would inspire these kids to spend more on denim? In addition to that elusive perfect fit, Emery would love to see “more creativity in materials and details.” Sydney believes that brands should remake vintage, praising

Revice Denim and Jaded London. Almost all students value the importance of sustainability, but only at more affordable prices. Several students mentioned a need for more small waist sizes (26 and 27), expanded inseam options, and real pockets.

And how much would these fashionistas spend for perfect fitting, artistically detailed, interestingly designed dream jeans? $120, $200, $250, even $1000 and $1500! Says Jirah, “I’ve solidified my style, so I’m confident investing in pieces to last a long time. It’s said that men’s fashion doesn’t change, but I think it’s more about too few interesting options in the stores.”

Let the creativity begin!

I’d buy jeans more often if designers were more creative with materials and details. Emery, Parsons student “”

Here’s just a sampling of what to expect at this season’s Dallas Men’s Show

By John Russel Jones

The Dallas Men’s Show kicks off with a preview on the afternoon of Friday, January 23rd, and runs through Monday, January 26th, part of the Dallas Market Center’s (DMC) Fashion Week, which includes women’s, children’s, Western, and English apparel and accessories. This season the show spotlights outdoor, accessories, gifts, grooming, and home décor. Temporary exhibitors continue to show in the natural light of the mid-century Market Hall, with permanent exhibitors available via shuttle service or a quick walk to the World Trade Center (it’s also a few steps across the parking lot from the Renaissance Hotel).

The DMC’s permanent exhibitor roster continues to grow: Young Robot Sales (WTC 7620) is a multiline showroom representing Smith eyewear, Brixton apparel and hats, and Blenders eyewear. Roostas & Bluecrest (WTC 7640) also debuts, featuring a collection of bold prints, collegiate-licensed apparel, and belts.

The outdoor lifestyle section of the Market Hall space includes a strong lineup of brands, including: Baja Llama, Ball and Buck, Burlebo, Decoy Apparel Co., Dubarry of Ireland, Duck Camp, Filson, Heybo, High Creek Outdoors, Local Boy Outfitters, Southern Point Co., Texas Standard, Tom Beckbe, and others.

With “Grads-and-Dads” season right around the corner, gifts and fashion accessories exhibitors include Edward Armah, Gentlemen 1677, JZ Richards, L.E.N Lifestyle, La Matera, Mistral, Next Belt, Raen Optics, Rey Pavon, Smathers & Branson, Unified, and many more.

Other notable brands include Billy Reid, Brax, Bugatchi, David Donahue, Faherty, Liverpool Los Angeles, Mavi, Mizzen + Main, Paige, Vineyard Vines, and others, giving retailers a strong mix of elevated essentials, modern sportswear, and fashion-forward collections.

Of course, this is Dallas, where they know how to party. After a long Saturday of writing orders, head to the Bourbon Bar in the Market Hall at 3:00 pm to slake your thirst, but don’t get carried away! The opening night cocktail hour begins at 5:30 pm, featuring perfectly crafted cocktails. On Sunday at 2:00 pm, take a break and head to the Market Tailgate party (also at the Market Hall’s central bar), and enjoy the big game. Taking advantage of the full fashion week? The Headwear Association will host its first ever non-New York City event on Thursday night at 5:45 (but space is limited, so give them—ahem—a “heads-up” at theheadwearassociation.org/2026-dallas-cocktail-party/)

Does your store venture beyond menswear? Dallas Fashion Week also includes:

• Women’s Apparel & Accessories Market: January 20–23

• KidsWorld: January 20–23

• WESA’s International Western/English Apparel & Equipment Market: January 21–24

• AETA International Trade Show: January 21–24 …all inside the World Trade Center.

Catching up with Cindy Morris, President and

CEO

of the Dallas Market Center

By John Russel Jones

How has aligning the January markets at the Dallas Market Center to create a Dallas Fashion Week changed the way retailers buy?

Bringing our January markets together to create Fashion Week has elevated how retailers see trends in real time across apparel, accessories, footwear, children’s, and men’s, while also making it easier to explore Western and English categories. It has encouraged a more holistic approach to expanding into new categories with confidence. Having everything under one roof helps buyers purchase more strategically and build a stronger, more competitive merchandise mix for the season ahead.

What new opportunities do you see that haven’t been fully explored yet?

Great independent retail is a tailored blend of categories, and there is an opportunity for us to present additional in-demand categories at the show to create a thoughtful, and helpful, buying experience. We’ve identified that men’s gift, accessories, grooming products, and even home accents are resonating strongly with retailers, and that’s why we have added more brands in these categories. Another key opportunity is the growth of outdoor lifestyle. Dallas is where these outdoor brands can reach the right buyers and build strong relationships with better retailers who want to offer their customers unique products.

How is the growing men’s gift category shaping the way retailers think about their merchandise mix?

Men’s gifts are in demand, and buyers are noticing, which is why we will have a special showcase of gift resources to help retailers find

the perfect product. Along with gift resources in Market Hall, buyers can explore dozens of brands throughout showrooms in the World Trade Center and Trade Mart that carry men’s gift lines, making it easy to source multiple styles and price points.

What are you hearing from retailers? What are the challenges and benefits in today’s market, and how is Dallas Market Center responding?

I have spent time on the road visiting retailers several times this year, and they tell me that their most precious commodity is time, so that’s why we focus on helping them make the most of their time at market. They want to discover unique, quality products, and they want a buying experience that’s efficient and intuitive. They also want an experience that’s welcoming and offers a true Texas spirit—which may or may not include barbecue and a margarita. Our Men’s Show allows us to deliver exactly that, with great hospitality, an open, easy-to-navigate floor plan plus key categories to help retailers stand out.

Anything specific you’d like retailers and brands to know heading into the upcoming show?

My message is simple: We will exceed your expectations. If you’re looking to write orders, build relationships, and explore a range of product categories, Dallas delivers it all in one efficient, welcoming marketplace. I’m incredibly proud of the momentum behind the Dallas Men’s Show, and I can’t wait for everyone to experience what’s ahead.

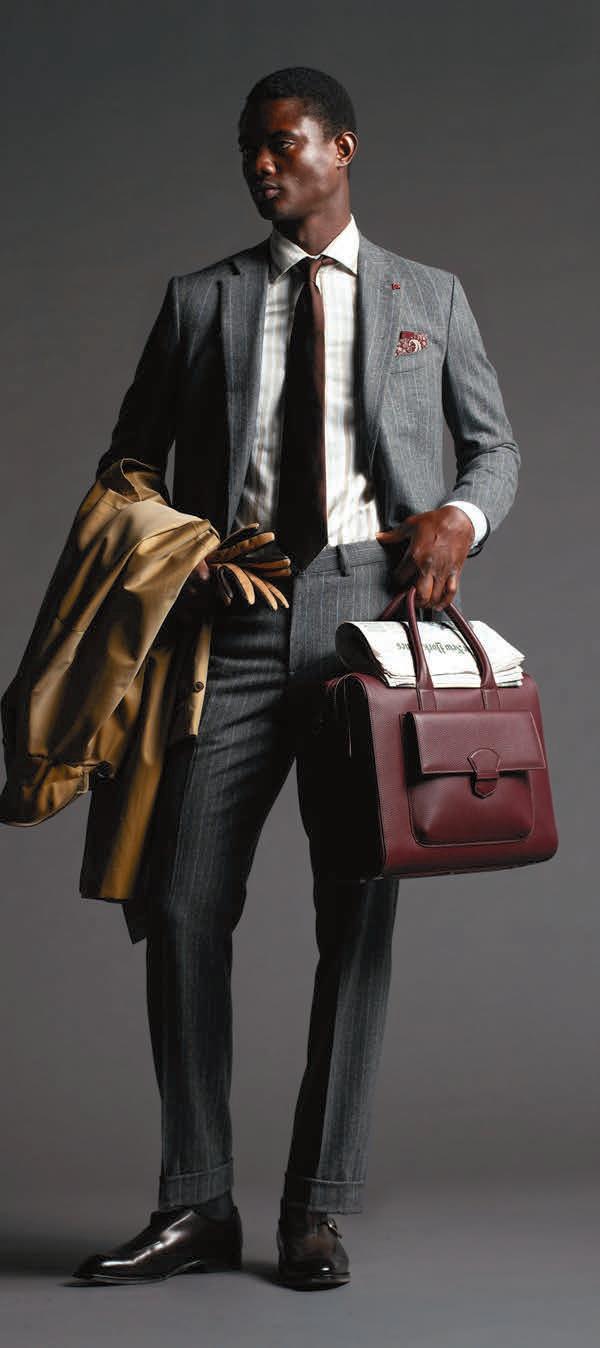

The tailored clothing universe is at an intriguing intersection of heritage and innovation. After a period where casualization dominated, men’s suiting and sport coats are experiencing a thoughtful revival—driven by younger buyers, hybrid work patterns, and a sharper emphasis on performance and personalization.

TAILORED CLOTHING: THE CHECK-IN

The Return of Getting Dressed

After years of dressing down, guys are rediscovering the power of looking put-together. Today’s suit or sport coat isn’t about rules—it’s about choice. And that sense of intention is bringing new energy to the floor.

Momentum Worth Watching

The U.S. suit market was projected to hit $2.09B in 2025 (Statista), while global tailored clothing and dress furnishings are expected to grow by $20.78B from 2024–2028, a 4.5% compound annual growth rate (Technavio). In other words: the category’s not just alive—it’s evolving.

Comfort is King

Stretch, breathability, lighter canvases, softer shoulders—performance is now part of the pitch. If it doesn’t move, men won’t either. Comfort is no longer a perk—it’s an expectation.

A Smarter, Savvier Customer

Today’s shopper—especially the younger one—walks in knowing his fit. He’s fluent in proportion, silhouette, and what feels modern. He’s looking for guidance, not a lecture.

There’s Opportunity for Sport Coats

For many retailers—particularly in moderate and better channels—sport coats have become the everyday tailored piece: easy, versatile, and wearable across hybrid work and social calendars. Luxury specialty stores report a firmer suiting business tied to custom programs, weddings, and events. Bottom line: the mix shifts depending on the door, but the appetite is there.

This revised and updated version of the MR Tailored Clothing Handbook [Our last version was from 2012, when slim-fit suits were just breaking through!] breaks down the fabrics, constructions, and trend stories shaping the industry in 2026 and beyond—so retailers and sales associates can meet today’s shopper with confidence. —Michael Fisher

From micron counts to smart finishes, here’s how tailoring’s textiles measure up—past, present, and future.

T ailored clothing has always started with cloth. Whether woven from pure wool, blended with silk or stretch, or finished with the latest performance tech, the story of a suit begins in the mill. Understanding the language of fabric—weight, weave, twist, and finish—makes all the difference between good and great.

The weight of fabric is measured in ounces per linear yard (36” x 60”). It defines how the cloth drapes, breathes, and performs through the seasons.

Fabric TypeWeight (oz.)Best For

Tropical 6.5–8.5 oz Warm-weather tailoring

Mid-weight 9–10 oz All-season suits

Regular-weight 11–13 oz Cool-weather structure

A continuous filament is a long, unbroken strand—usually synthetic—while natural fibers like wool are spun from staples (relatively short fibers, as they come from the animal or plant). Hanks measure yarn fineness (560 yards per hank); the more hanks per pound, the finer the yarn

Super Numbers express fiber diameter in microns (µ):

Super 100s = 18.5 µ

Super 120s = 17.5 µ

Super 160s = 15.5 µ (about the width of cashmere) And for synthetics, Denier flips the scale: smaller number = finer yarn.

Did You Know?

Savile Row tailors once judged fabric weight purely by touch. “Tropical Weight” was coined during British colonial expansion to describe lighter worsteds made for officers abroad. The softest wool ever measured was 11 microns—finer than a human hair (which averages 70 microns).

Twist gives yarns their resilience and character. High-twist yarns resist wrinkles and hold a crisp line, ideal for travel tailoring

Ply refers to how yarns are combined:

• Singles: one yarn—light and smooth.

• 2-ply: two yarns twisted together—adds strength and structure.

• 2x2 construction: plied yarns in both warp and weft for maximum balance.

Modern mills now use high-twist wools for mechanical stretch— no synthetics required.

Did You Know?

The original “crepe” wasn’t a fabric—it was a twist technique. Italy’s Biella region pioneered the first wrinkle-resistant wools for international business travelers. Denim’s signature diagonal twill is a cousin to suiting twill— we’re all part of the same loom family.

The warp runs vertically on the loom; each thread is an end. The weft runs horizontally; each thread is a pick. Together they form the structure of every tailored cloth.

Plain Over-under alternationLightweight, breathable

Basket Grouped yarnsSoft, textured surface

Twill Diagonal ridge Smooth drape, wrinkle-resistant

4-Harness / Venetian More warp shown on faceLuster, density, luxury finish

Today’s weaves incorporate open structures, stretch yarns, or hybrid blends to balance airflow with modern motion.

Did You Know?

The term warp comes from Old English weorpan, “to throw”— because the weft was “thrown” through the warp by shuttle. Hopsack sport coats are technically basket weaves—a casual cousin to classic suiting. Twill’s diagonal pattern helps mask creases, which is why it’s the standard for power suiting.

The newest chapter in suiting merges heritage with high tech. Mills now spin innovation into tradition—literally.

Stretch & Recovery Moves with the wearer

Cool Wool Regulates body temperature

Wrinkle Resistance Retains press through travel

Water & Stain Repellent Shields against the elements

Moisture Wicking Keeps you dry and cool

Thermo-Regulation NASA-level comfort control

Regenerative Fibers Sustainable luxury

Anti-Microbial Finishes Freshness between wears

Did You Know?

“Cool Wool” was coined by The Woolmark Company in the 1980s to rebrand wool for warm climates. Outlast®, developed for NASA, now lines tailored jackets to stabilize temperature. Some Italian mills embed QR codes in selvedges—scan it, and you can trace your suit back to the exact flock of sheep.

Finishing gives cloth its hand—that final feel, sheen, and structure

Finish

Fulling Compacts wool for density and strength

Napping Raises surface fibers for softness (flannel)

Decatizing Steam-sets structure and removes shine

Sponging Stabilizes fabric before tailoring

Shearing Smooths surface for even texture

Modern finishing goes beyond the aesthetic: wrinkle-resistance, moisture wicking, and nanotech coatings now merge performance with polish.

Did You Know?

“Decatizing” comes from décatir—“to take off the luster.” Some luxury mills sponge fabric for days to ensure perfect drape. Flannel’s fuzzy nap was first engineered to trap warmth for English mill workers.

The vocabulary of tailoring has expanded—from hanks and harnesses to hydrophobic coatings—but the goal remains timeless: a fabric that looks sharp, feels natural, and wears beautifully. Tradition isn’t lost—it’s just been rewoven.

Your cheat sheet for confident selling — short answers, modern takes, and timely talking points.

Q: What’s the difference between “black tie” and “black tie optional”?

A: “Black tie” means tuxedo, no exceptions. “Optional” gives customers some freedom — a dark suit and tie are acceptable, but it should still feel polished.

Q: How do I explain “creative black tie”?

A: Encourage subtle individuality — think velvet dinner jackets, tonal tux looks, or open collars for men with style confidence.

Pro Tip: Keep one or two fashion-forward tux looks on your floor for these occasions — customers often buy when they see how it could look.

Q: Are double-breasted suits back?

A: Yes, but redesigned — slimmer, shorter, and softer. A modern DB can be a great upsell for the customer who “has everything.”

Q: What’s the right button stance today?

A: Two buttons remain the classic. A “3-roll-2” offers subtle European flair and a cleaner line.

Q: What vent style should I recommend?

A: Side vents — they move naturally, look modern, and flatter most builds.

Pro Tip: When customers try on jackets, show how side vents keep the back clean when they move or sit. Small detail, big impression.

Q: What’s driving the comfort revolution in tailoring?

A: Athleisure’s influence. Look for stretch wools, knit constructions, and performance linings. Customers expect comfort — even in a suit.

Q: What does “soft tailoring” mean?

A: Less structure, more ease. Minimal padding, natural shoulders, and lightweight canvases that drape and move with the body.

Q: Are pleated pants really making a comeback?

A: Yes — single pleats, higher rises, and gently tapered legs are trending for the fashion customer. They read relaxed, not retro. For your everyday guy, a flat front will still suffice.

Pro Tip: Use “comfort” language customers understand — stretch, breathable, easy to wear — instead of tailoring jargon.

Q: What fabrics work best for warm weather?

A: Tropical wools, cotton-linen blends, and high-twist yarns that breathe and bounce back. Don’t overlook new performance blends — they’re wrinkle-resistant and travel-friendly.

Q: What pocket styles feel most current?

A: Patch pockets — especially on unstructured blazers or knit jackets. They instantly signal “relaxed sophistication.”

Pro Tip: Keep sample swatches handy. Feeling the difference between a tropical wool and a stretch knit often seals the sale.

Q: Can a customer skip the tie and still look dressed up?

A: Definitely. Recommend a structured spread-collar shirt or a fine-gauge knit polo for a confident, modern take.

Q: What colors and patterns are trending beyond navy and gray?

A: Taupe, stone, olive, chocolate, and soft blue. Tonal checks and fine stripes add visual interest without being loud.

Pro Tip: Encourage customers to “mix it up” — a neutral jacket and patterned pant combo can refresh their wardrobe without a full suit purchase.

Q: How has the customer’s view of suits changed?

A: The new suit mindset is about versatility pieces that can move from day to night, dress shoes to sneakers. Less about rules, more about personality.

Pro Tip: Frame tailoring as empowerment, not obligation “You don’t have to wear a suit; you get to wear one.”

In 2026, tailored clothing is in an interesting place. The category continues to rebound as more men return to suits, sport coats, and dress trousers for work, events, and self-expression. But unlike many other fashion categories, tailored clothing remains deeply personal: the fit is personal, the investment is personal, and the level of trust required between seller and shopper is higher than ever.

If there’s one idea from Jack Mitchell’s Hug Your Customer that holds especially true for suit selling, it’s this: relationships power revenue. When a customer feels seen, listened to, and guided—not pushed—he returns again and again. Tailored clothing is not a transactional business; it’s a long-game business. And the best associates today understand that they’re not simply selling garments; they’re building confidence, loyalty, and lifelong clients.

Here is a modern guide to suit-selling techniques that meet today’s customer where he is: time-pressed, information-overloaded, but eager for expertise he can trust.

1. Build Trust First; Build the Sale Second Tailored clothing is high-investment and high-emotion. For many men, buying a suit feels like choosing armor—something they’ll wear to weddings, funerals, job interviews, and life milestones.

Because of that, the associate must function as everything from a stylist and fit expert to a confidence coach. The more the customer trusts you, the less he hesitates.

2. Help Him Make a Smart Decision (Not the Most Expensive One)

Price leadership matters. Qualification helps you determine where to start: opening price, mid-tier, luxury, or custom. But the goal is always to lead him to the right choice—not simply the highest rung.

Smart guidance strategies:

• Start with the foundation piece (suit or sport coat).

• Present fits and fabrics that match his lifestyle.

• Show him why something works—shoulders, chest, drape, proportions.

• Let his body language lead your next move. And once the foundation is set, that’s when you thoughtfully expand the sale.

3. Master the Add-On Sale (Without Feeling Salesy)

In tailored clothing, add-ons aren’t upsells—they’re solutions. Every man wants to look complete.

Once the suit or sport coat is chosen, offer:

• Dress shirts that complement the palette

• Ties or pocket squares to refine the look

• Dress trousers or versatile five-pockets

• Modern, non-skinny denim for dressed-down sophistication

• Shoes, belts, and socks for a finished appearance

The key is purposeful curation. You’re not tossing product at him—you’re editing his wardrobe.

4. Fit Coaching: Get Hands-On (Respectfully)

Helping a man try items on—adjusting the collar, straightening the lapel, pinning the sleeve—reaffirms your status as an expert. Men appreciate being guided, especially when the steps are explained.

Examples:

• “Let’s pull this sleeve to show you the clean line at the cuff.”

• “See how this shoulder lays flat? That’s what we want.”

• “I’m pinning this here so the tailor can perfect your fit.”

Tailored clothing customers want reassurance. They want to know they’ve chosen well.

5. Look the Part (Because You Are Part of the Brand)

In tailored clothing, your outfit is your résumé.

Essential standards:

• Fit your own jacket and trousers impeccably

• Personalize your look—within reason

• Wear pieces you actually like and can speak about authentically

• Present yourself as someone who understands style today

Your personal appearance is silent trust-building.

The Takeaway: Sell With Heart, Skill, and Honesty

At the core of every successful suit sale is a relationship. If you know your inventory, listen well, guide with integrity, and follow up with genuine care, you’ll build a client book filled with men who trust you—not just with their purchase, but with their image.

Be yourself. Be passionate. Be the expert they didn’t know they needed.

And most of all—hug your customer. Not literally (unless it’s appropriate), but in how you serve, support, and show up for him.

That’s how suit sellers win today.

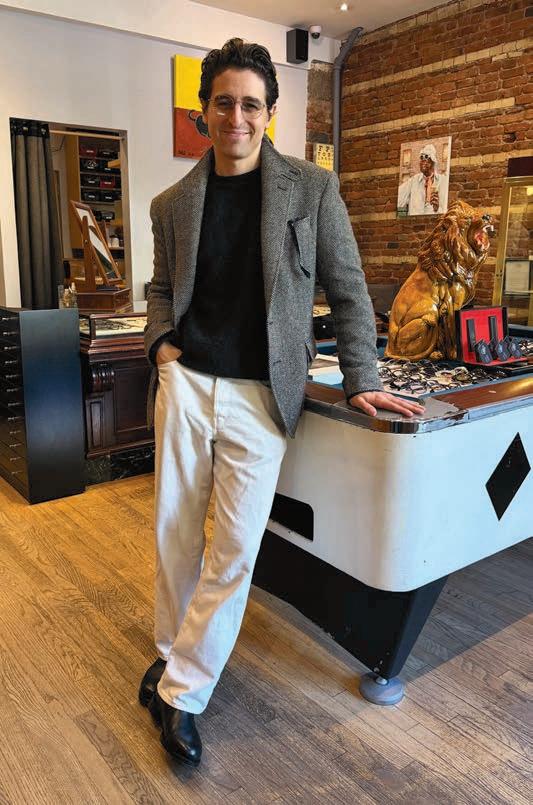

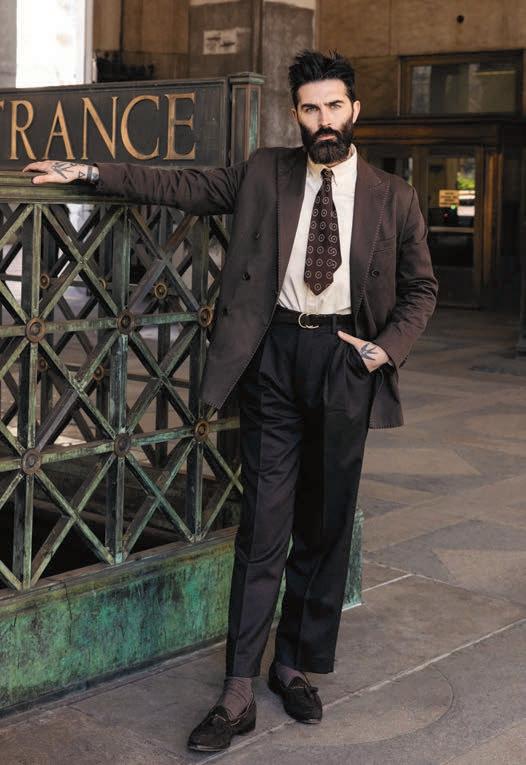

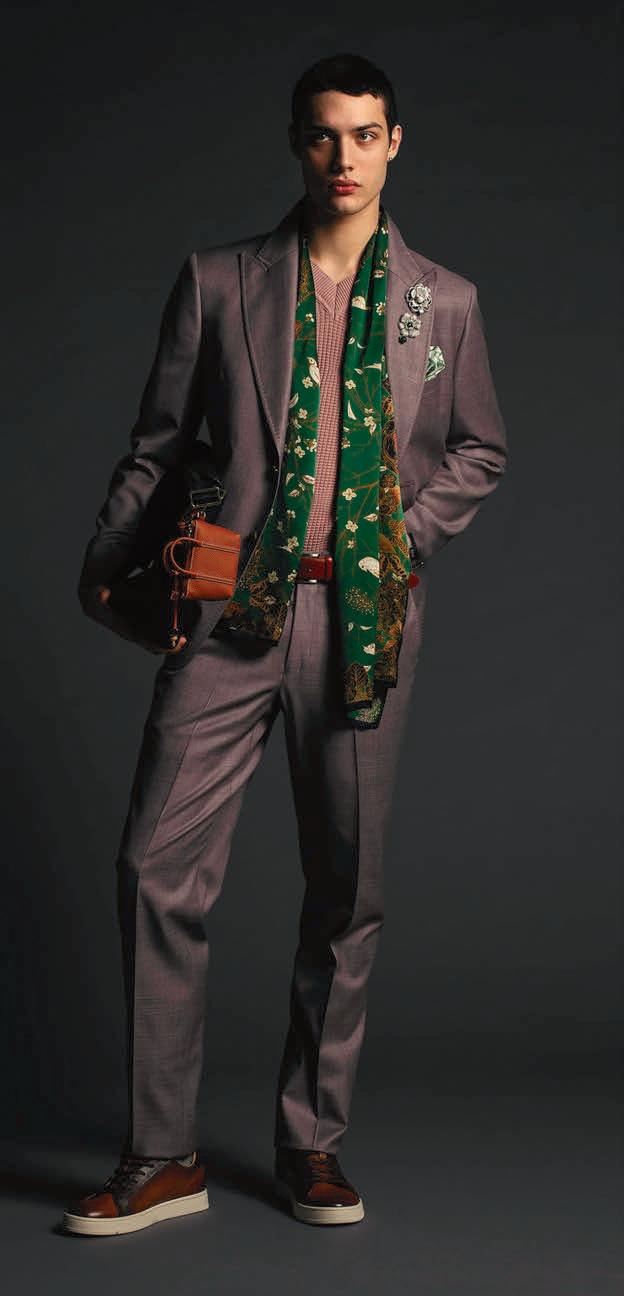

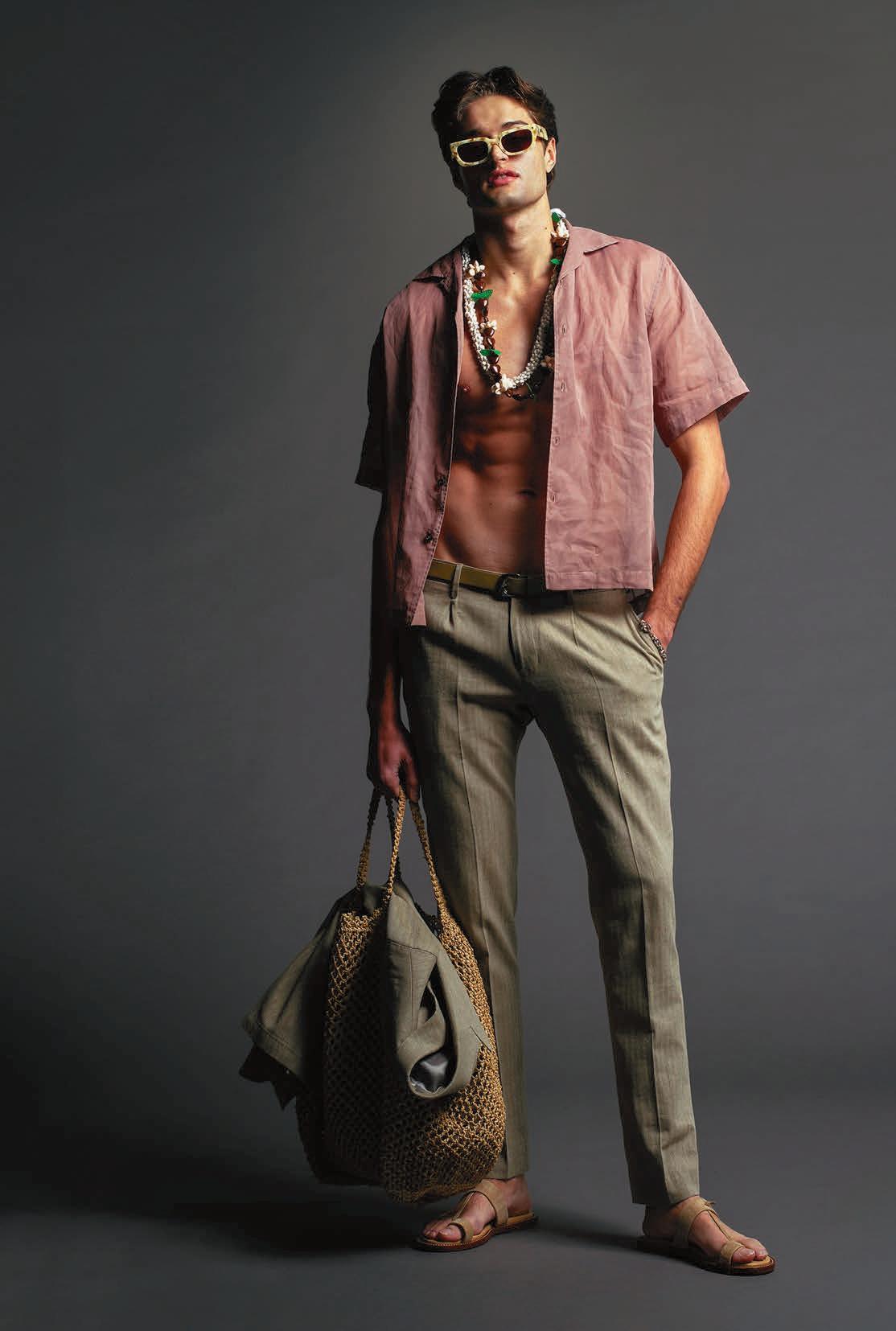

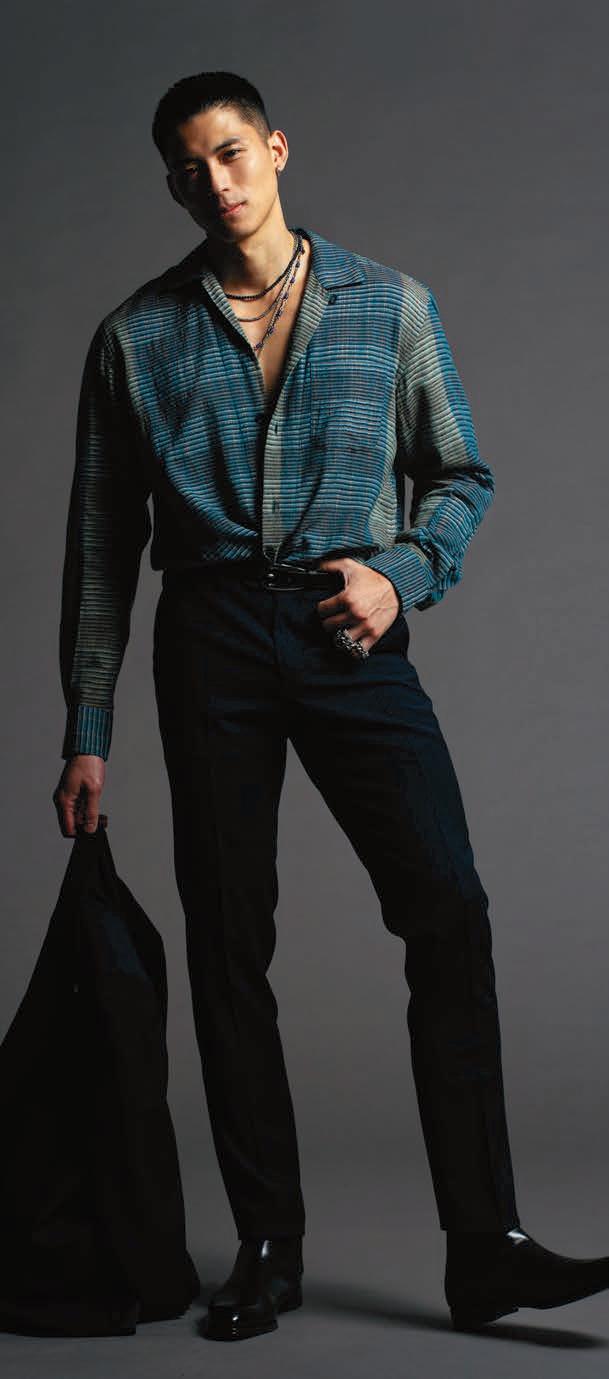

MR Catches up with four leading men’s fashion influencers to see how they wear tailored clothing.

There is a heightened level of confidence when I wear tailored clothing versus sportswear. I love the feeling of wearing something that was perfectly tailored for me. Tailored clothing shouldn’t feel restrictive, so that’s why I favor soft sport coats with little construction inside.

I’m a big sport coat and jeans guy. I grew up in the ’90s so I have nostalgia for those casual cool—but still puttogether—celebrity airport pics of the time.

“ ” “ ”

I like the idea of wearing historical pieces that connect me to a bygone era.

Kévis Manzi, Stylist @kevismanzi

I rarely stick with a consistent texture when I dress more formally, I feel a lot more comfortable when I’m mixing different materials in my own way. I don’t mind breaking a few rules.

Chris John Millington, Creative Consultant @chrisjohnmillington

As classic as suits are, there is still evolution in style.

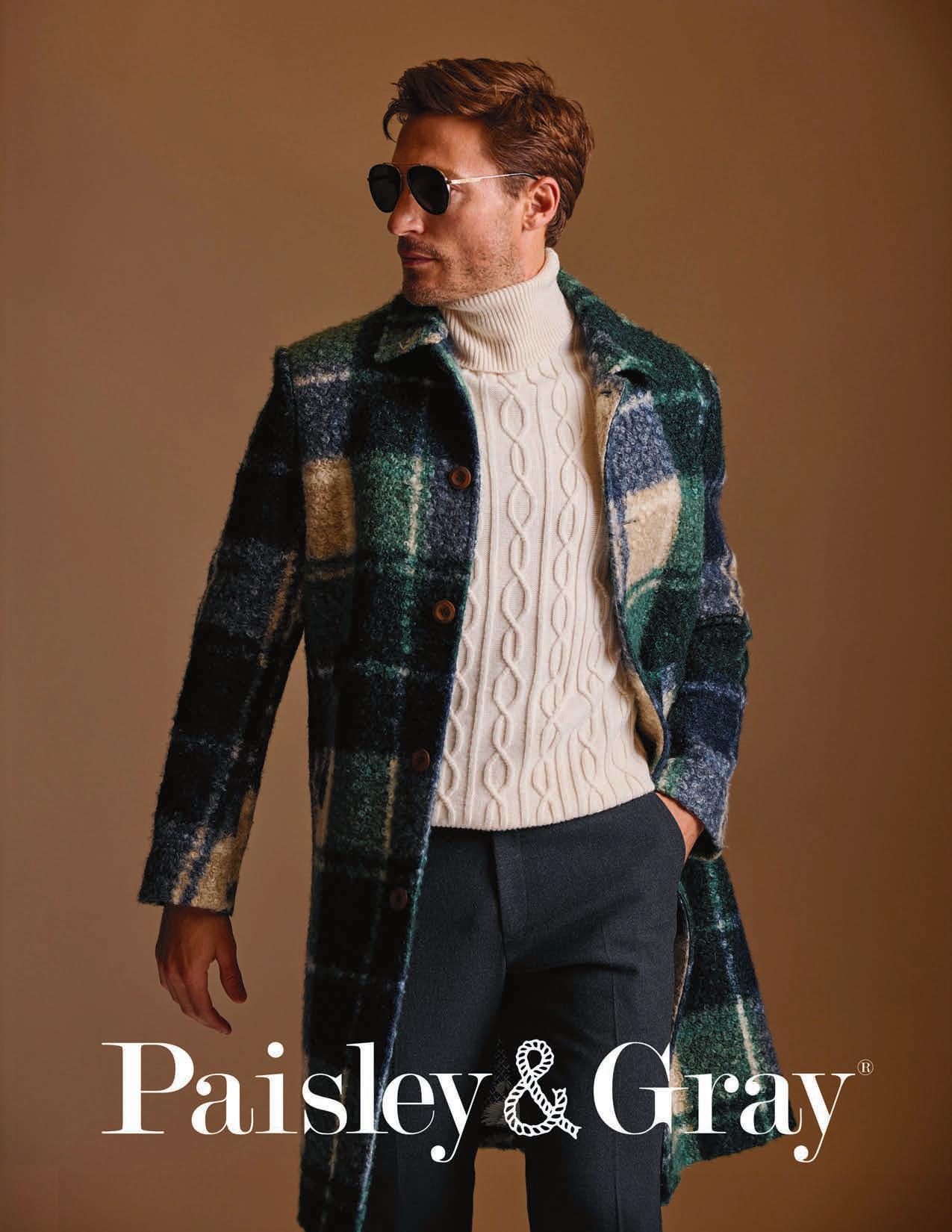

MR Magazine presents two tailored-clothing trend stories with real staying power—ideas that help your customer feel current without looking costume-y. These narratives give him just enough connection to fashion without pushing him into “fashion victim” territory. These are also great guides for season-less merchandising that helps tell compelling stories in-store.

A quiet rebellion dressed up as restraint, Radical Simplicity is a subversive nod to the corporate uniform at a time when the old office world feels like a relic. The traditional work wardrobe may have disappeared, but men’s desire for purposeful dressing is roaring back.

This story frames simplicity as a luxury: clean lines, roomier proportions, elevated materials, and small design shifts that make everyday staples feel intentional instead of obligatory. The look pulls from the ’90s—still minimal, but warmer and more human than the stark minimalism of the past.

Why now?

Because after years of athleisure fatigue, men want to feel put together again—but in a way that fits their hybrid lifestyles, not a cubicle schedule. Workplace basics suddenly feel fresh because they represent structure, calm, and competence in an unstable world. Tailoring becomes aspirational again precisely because it feels unfamiliar to our everyday routines.

Must-Haves:

• New Power Suit (relaxed, unfussy, confident)

• The Return of Pinstripes

• Fine-Gauge Knits as Underpinnings

• Banker-Stripe Shirt

• Double-Breasted Overcoat

Everyday Dandy embraces the renewed appetite for expressive, character-driven dressing. It’s a modern revival of the romanticism and flourish once central to menswear, now translated for men who want their wardrobes to feel personal, textured, and emotionally resonant. This man isn’t chasing attention—he’s chasing identity. The story celebrates craftsmanship, detail, and the small style moves that communicate individuality: pattern, color, embellishment, nostalgic fabrics, and tailoring with a wink.

Why now?

Because men are at a crossroads. They’re craving self-expression, but they still respect the code and heritage of tailoring. As eveningwear influences slip into daytime and men rediscover the pleasure of getting dressed, expressive tailoring offers a bridge between tradition and personality. It also ties into the broader cultural shift toward “romantic utility”—feeling something through what you wear.

Must-Haves:

• Pinstripe Suit (interpreted more playfully than in Radical Simplicity)

• Printed Corduroy & Velvet

• Heritage Tweed

• High-Waisted Trousers

• Lapel Embellishments

Today’s customer wants clothing that works for them—not the other way around. When a client struggles with fit, wants specific design details, or simply cares about expressing personal style, that’s your cue to introduce custom. What was once the domain of Savile Row insiders is now widely accessible, with MTM programs, workshop partnerships, and traveling tailors opening the door for every type of shopper.

Pro Tip: Listen for frustration. When a client says, “Nothing ever fits me right,” you’re already halfway to a custom sale.

THE CUSTOM SPECTRUM (Know This Cold) BESPOKE

The gold standard. A pattern drafted from scratch, handwork throughout, multiple fittings, and total control over silhouette and structure. Longer lead times, higher investment, unbeatable fit.

Best for: detail-driven clients or those with complex fit needs.

Pro Tip: Use the word “precision.” It resonates more than “luxury.”

MADE-TO-MEASURE (MTM)

The sweet spot. An existing pattern is adjusted to the client’s measurements. Faster timelines, strong fit improvement, and plenty of personalization.

Best for: the client ready to graduate from off-the-rack.

Pro Tip: Offer three fabrics max. Curating boosts confidence and conversion.

CMT (Cut, Make & Trim)

Custom Workshops

Flexible and collaborative. Retailers or brands design; workshops execute. Customization varies by vendor.

Best for: clients who enjoy co-creating their look.

Pro Tip: Set expectations early—CMT can vary widely depending on the maker.

THE HOUSE STYLES (A Quick Vocabulary)

Savile Row (British)

Structured shoulders, defined waist, clean lines. The classic power silhouette—now more accessible via global MTM programs.

Neapolitan (Italian)

Soft shoulder, high armhole, relaxed drape. Ideal for comfort-first clients or those transitioning from performance apparel.

American / Hybrid

Modern, minimal structure, fabric-friendly. Easy entry point for business-casual wardrobes.

Pro Tip: When in doubt, ask the client how structured they like their jackets—this instantly clarifies which “house style” suits them.

• Fit issues (sloping shoulders, posture, athletic builds).

• Requests for unique details OTR can’t deliver.

• Weddings, promotions, new roles.

• Fabric-obsessed clients.

• Anyone buying multiple suits—custom ensures consistency.

Pro Tip: Always mention timeline early, especially for event-driven clients.

• Keep fabric choices tight; don’t overwhelm.

• Know your vendor’s strengths and limitations.

• A quick fitting—even for MTM—improves satisfaction.

• Record every detail for perfect repeat orders.

• Be transparent about pricing tiers.

Pro Tip: The follow-up fitting is where loyalty is built—schedule it before the client leaves the store.

SAT/SUN/MON/TUE

JANUARY 31 - FEBRUARY 3, 2026

THE MART | FLOORS 4 & 7

The Chicago Collective is the premier menswear show in North America. On 2 floors at THE MART, Chicago Collective hosts the top brands and retailers from around the world. Shop the best brands, attend the iconic opening night party, enjoy exciting events and amenities.

OPENING NIGHT PARTY SPONSORED BY

SHOW HOURS:

SATURDAY PREVIEW DAY: 12:00 - 6:00 PM

SUNDAY: 8:00 AM - 6:00 PM

MONDAY: 8:00 AM - 6:00 PM

TUESDAY: 8:00 AM - 3:00 PM

chicagocollectivemens.com

WED/THU/FRI

FEBRUARY 11 -13, 2026

THE MART | FLOOR 7

The Women’s Edition features everything you love about Chicago Collective. Enjoy a great selection of brands, an easy to shop floor, a fun opening night party, special pop-up events and our popular buyer hotel reimbursement program.

OPENING NIGHT PARTY SPONSORED BY

SHOW HOURS:

WEDNESDAY: 9:00 AM - 6:00 PM

THURSDAY: 9:00 AM - 6:00 PM

FRIDAY: 9:00 AM - 1:00 PM

chicagocollectivewomens.com

By Karen Alberg Grossman

It’s interesting. Of all the factors impacting sales of tailored clothing this past year (declining consumer confidence, inflation, worldwide unrest, political dysfunction, fluctuating tariffs, sourcing issues, jobs replaced by AI…), who could have guessed that extreme weight loss would leave so many men needing to replace suits that no longer fit. According to a Sunlight.com survey of 1,500 U.S. adults prior to Black Friday, GLP-1 users planned to spend more than twice as much on clothing as non-users. Good news indeed for tailored clothing merchants (except perhaps for those who guarantee free lifetime alterations…)

Here, MR talks to a handful of smart retailers across the country to get their take on what lies ahead.

Says Wally Naymon from Kilgore Trout in Cleveland, whose tailored clothing is 43 percent of his total volume at suit retails from $1395-$8000, “Seven brands make up most of this volume. Selling especially well are Isaia sportcoats ($4500-$7500), Sartorio soft jackets ($2900-$3500), and Zegna suits ($4400-$5500).”

certain luxury Italian collections are now saying they’ve had enough. I want to ensure that with rising prices, we don’t abandon those price zones that have been productive for us. I don’t want to disappoint the aspirational customer because we’ve priced them out of the store.”

Tim Richey and Neil Guffey, from Guffey’s in Atlanta and Kirbys in Tampa, carry six key vendors in tailored clothing at retails from $1650-$12,000 for suits, $1295-$9,000 for sportcoats. “Sales are solid,” Richey tells MR. “Our better goods and luxury items continue to perform at a high level.”

Among his challenges, Richey cites how to grow traffic, develop a new client base, and find a proper balance between tailored cloth-

resonating with clients, outselling suits at a roughly 4-to-1 ratio. Jack Victor remains our top seller by unit volume, thanks to its range of price points and versatile offerings.

“On the revenue side, we continue to grow our Oxxford and Samuelsohn businesses, but our private-label made-to-measure and in-house bespoke programs continue to dominate. The combination of flexible pricing, an extensive fabric library, and a highly personalized experience has made these categories a standout for clients looking for elevated custom options.”

“At the end of the day, picking up the phone or texting your customers is still the best way to boost sales.”

Trey Gonzales, Smith’s Men’s Store, Lake Forest

As for the challenges, Naymon responds thoughtfully. “I worry about the stock market and how it emotionally affects our client. Many luxury stores have enjoyed solid results largely driven by clients who’ve realized great returns in the market. Since we can’t control the market, that element is a bit unnerving.

“As for growth opportunities, we continue to transfer our excitement about new product to our sales associates so they can passionately present to their clients and create momentum for the season. It’s all about the team.”

What’s needed to jumpstart sales? Naymon talks about “a sense of reality when it comes to prices. I’ve recently heard about luxury clients expressing strong resistance to unconscionable pricing. Clients who had been passionate about

ing and better sportswear. “We’re primarily a custom store,” he explains. “It represents the largest portion of our tailored business. Finding great items for our RTW collection remains a steady effort. Of course, customer relationships remain our highest priority. Offering exceptional product is only valid with exceptional service, which we strive to provide to every customer on a daily basis. There’s no better formula for success than that.”

At Smith’s Men’s Store in Lake Forest Illinois, Trey Gonzales estimates tailored clothing at 25% to total volume, planned at 26-28% next year. He carries 11 vendors, 7 of whom are core. Key suit pricepoints are $798$5998; sportcoats run $698-$5798.

“Sales this fall have been exceptionally strong, driven by the continued expansion of our assortment and our growing presence in the market. Blazers and sportcoats are clearly

Challenges, Gonzales says, involve raising awareness. “It’s about making sure people know who we are, what we offer, and the full scope of our capabilities. As we approach the oneyear anniversary of our Winnetka location, we still meet first-time visitors daily, many of whom are surprised they hadn’t discovered us sooner. Even in Lake Forest, where we’ve been established for six years, we regularly hear, ‘I had no idea you offered all this.’

“Raising visibility around our brand and services remains a top priority. As we continue to grow, ensuring that clients fully understand the breadth of our tailored clothing expertise, from ready-to-wear to made-to-measure and bespoke, will be essential to our long-term success.

“Unfortunately, there’s no silver bullet for jumpstarting sales. It comes down to consistently engaging our existing clients while cultivating new ones. Over the past year, we’ve learned how to make trunk shows more effective, not just for selling, but for connecting with customers and educating new clients about what we offer. Consistent, thoughtful engagement remains the key to growth. At the end of the day, picking up the phone or texting your customers is the best way to boost sales.

“Looking ahead, we’re keeping a close eye on fashion trends and exploring new partnerships that make sense for our clients. This season, we’re excited to bring in Eleventy, a brand that fills a niche by offering both sportswear and tailored clothing. It’s a natural fit for clients who want elevated casual pieces, and it gives us a way to introduce new clients to tailored clothing.”

Carla and Terry Felumb from Mister Guy in St Louis report healthy business driven by soft sportcoats (up 7 percent), particularly from Jack Victor and Canali. Tailored clothing (including made-to-measure) represents 44 percent of store volume, planned at 40 percent for 2026. Suit prices range from $1095 to $4495; sportcoats from $895-$3995.

Carla notes challenges that include narrowing vendor structure (Editor’s note: numerous retailers are aiming to be more important to fewer brands) and on-time deliveries. Her candid opinion on prices: “For all the talk

about price no longer mattering, we believe it still does.”

Lindsay Morton Gaiser from Andrisen Morton in Denver does 42 percent of her menswear volume in tailored clothing, planned

I don’t want to disappoint the aspirational customer because we’ve priced them out of the store.

Wally Naymon, Kilgore Trout Cleveland

at 45% for 2026. She carries eight clothing vendors at suit prices of $1395-15,000, sportcoats at $995-$13,500. “We’ve been selling basic suits very well, from Canali to Isaia. We’ve also observed renewed interest in patterned

sportcoats, with strong sell-thrus from Isaia, Zegna, and Canali. LBM and Tombolini have been tremendous additions to the assortment from a price perspective.”

Among her current challenges: too few style changes in market offerings. “We’re constantly striving to remain relevant with interesting style updates, always seeking what’s new, in and out of our vendor matrix.”

Another goal at Andrisen: to offer clients not just beautifully curated assortments but also experiences to remember. “We’ve seen growth in our MTM business, so we’re teaching our customers how to build clothing wardrobes made exclusively for them.”

Asked what she needs from the market, Lindsay doesn’t hesitate. “I never thought I’d say this, but I wish our vendors would reassess their pricing structure. Being a luxury business, we don’t see much price resistance, but this year has given me reason to shop the market with closer attention to prices.”

By Karen Alberg Grossman

Nice to meet you, Jeff! Let’s start with a little background on how you got into fashion retailing?

It was not my master plan; I was an engineering major in college but somehow found a job as a stockboy for Mercantile Stores, unloading boxes from a dock. I then spent some time at Kohls, followed by 11 years at JCPenney. I’m now SVP and Chief Merchant at Men’s Wearhouse.

How’s current clothing business at Men’s Wearhouse?

It’s been strong. We’ve up to more than 630 Men’s Wearhouse stores and growing, driven by rentals which now contribute 20-30 percent to total suit volume. A typical formalwear package runs $199-$249, including shoes.

What’s the average retail on a suit at Men’s Wearhouse?

It runs in the $500 range. While the number of weddings in the U.S. has been flat, Men’s Wearhouse has been gaining market share, due partly to store closures at Macys, Kohls, and other major competitors.

Back when men wore suits to the office, the target audience at Men’s Wearhouse was Baby Boomers. Is that still the case?

No. These days, a large prom and wedding business has brought down the average age range, which now starts at 15-18 year olds. But we don’t focus on age: our target audience is anyone who searches for wardrobe solutions. Our goal is to get the guys who buy our prom packages to come back for graduation and then

for their first interview suit. Then of course we want them for their wedding, and for office and weekend wear. We’re proud to be the solution to all of life’s special moments, even outside the tailored world.

To what do you attribute your growing business these past 12-18 months?

I believe it’s due to the growing number of back-to-the-office mandates. Customers don’t know what to wear to the office these days. We offer them numerous solutions, some mixing sportswear and tailored pieces. And strangely enough, our tie business has been phenomenal, especially considering the fact that we don’t see many guys wearing ties. Our average neckwear retails are at $59.99 to $79.99, similar to our prices on dress shirts.

How much of your business is store brands vs national brands?

Current clothing business at Men’s Wearhouse is dominated by store brands; the powerhouse labels are Awearness by Kenneth Cole and Joseph Abboud. (Calvin Klein, produced by Peerless, is another top seller but we don’t own the label…) It’s interesting: our two major store-owned brands are generally perceived as national brands, which lends status and credibility. This has allowed us to maintain healthy margins since the product is not available anywhere else.

Being able to leverage our sourcing and design talent has been another key to recent growth. We have amazing sourcing and design teams: their leadership, style and taste level have made a notable difference in our performance.

“”

One out of every two formalwear rentals in the U.S. is from Men’s Wearhouse.

JEFF

USEFORGE

SVP and Chief Merchant

Can you talk a bit about your made-tomeasure suit business: is this a growing part of overall sales?

Our custom business has gradually morphed from bankers and businessmen who had seasonal suits made for them two to three times a year, to the event customer who wants something special for a wedding or other occasion. Our customers can now buy, rent, or design their tuxedo; made-to-measure is also a good option for atypical body types. Our tailors are

trained not just to measure, cut and sew but also to listen and adjust. Some custom work is done in our Massachusetts facility but much is produced in our modern factories overseas.”

From a fashion perspective, it seems there’s much change happening in women’s clothing but less in men’s; is this a problem?

No. I believe the looser styling that’s evident in women’s apparel is translating in menswear. We’re clearly seeing some single pleat trousers and some looser-fitting men’s pants. We’re moving away from the very tight fits, and we’re mixing tailored clothing and sportswear. Jackets are softer, half-lined, less buttoned-up, often using fabrics with stretch. I’d estimate that tailored clothing is now 75% of our mix vs. 25% in sportswear. For sure, sportswear is now accounting for much of our growth.

How’s online business?

It’s one of the fastest growing parts of our business but tough in that in the online world, you’re competing with everyone! I look at our customer base as three groups: the ones who shop in-store only, the ones who shop online only, and the omni group that shops both. We’re finding that omni-shoppers are

Tailored Brands’ CEO John Tighe oversees all divisions of the company, and remains excited about each new store opening. “In 2025 we opened six new Men’s Wearhouse stores: in Colorado, Texas, and Florida. As we move into 2026, we have more openings planned, not just for Men’s Wearhouse but for Jos. A. Bank and K&G as well. These new stores are a way for us to bring our commitment to exceptional service and incredible breadth of product to these locations.”

Tighe also talks about localizing assortments and experiences. “One of our key strategies is to localize our

assortments and experiences so they are unique to the communities we serve. We do this for both new and existing stores, plus we’re committed to providing a robust eCommerce experience. Our goal is to continue delivering for our customers’ important moments.”

A serious point of pride for John and Jeff: their commitment to donate funds to U.S. veterans in need. The company’s Threads of Valor campaign in support of Veterans reached more than $16 million in donations since the campaign launched in 2022. This year alone, through customer contributions and $1 million in additional funding

the most productive and the most loyal. Our highest order-value customers are concentrated in this segment.

I notice from the few Men’s Wearhouse stores I’ve visited lately that your sellers are extremely knowledgeable without being overly aggressive. Are they on commission? No, they’re not. But we have great training programs and we pride ourselves on exceptional customer service: it’s our Superpower. In our training programs, sales associates learn not just how to measure but how to make customers feel comfortable being measured. They receive lots of information each season from a trend and style perspective. I believe our terrific sellers are a good part of the reason why we’re gaining share in tailored clothing.

Whatever happened to George Zimmer’s famous quote: “You’re going to like the way you look; I guarantee it!”

We still rely on George’s slogan: it was appropriate then and we believe it’s just as appropriate now. We want our customers to look their best for their most important moments and for every day. It’s what drives everything we do.

from Men’s Wearhouse, contributions were almost $5 million, with more than 950,000 unique customer donors. That’s a lot of important moments to celebrate. Thank you for your service, U.S. Veterans!

By Karen Alberg Grossman

Everyone knows Alessio Nanni, the handsome young Italian who’s building awareness for the ItalianTrade Agency (ITA) brands while charming his way across the country. Here, we catch up with him to talk about life, fashion, tariffs, and the compelling ITA presence at the Chicago Collective.

Rumor has it there will be a ski chalet gathering at the ITA hospitality booth at the Chicago Collective. True?

Ah, who told? Yes, every season we change up our Lounge area within the Italian Pavilion and this season, there was a natural tie-in to the Olympics excitement. Few Americans are as familiar with the snowy mountain vistas in northern Italy as they are with the southern seaside towns or larger cities–or even Tuscany. But ski culture is part of the Italian DNA–an incredible mix of luxury, fashion, and fun. The Milano Cortina Games will juxtapose one of the fashion capitals of the world against some of the most breathtaking mountains in the Dolomites. ITA is working to bring that experience to our hospitality lounge.

From a fashion perspective, what key trends can retailers expect from ITA exhibitors at the show?

This season, ITA will sponsor more than 64 ‘Made in Italy’ brands at Chicago Collective.

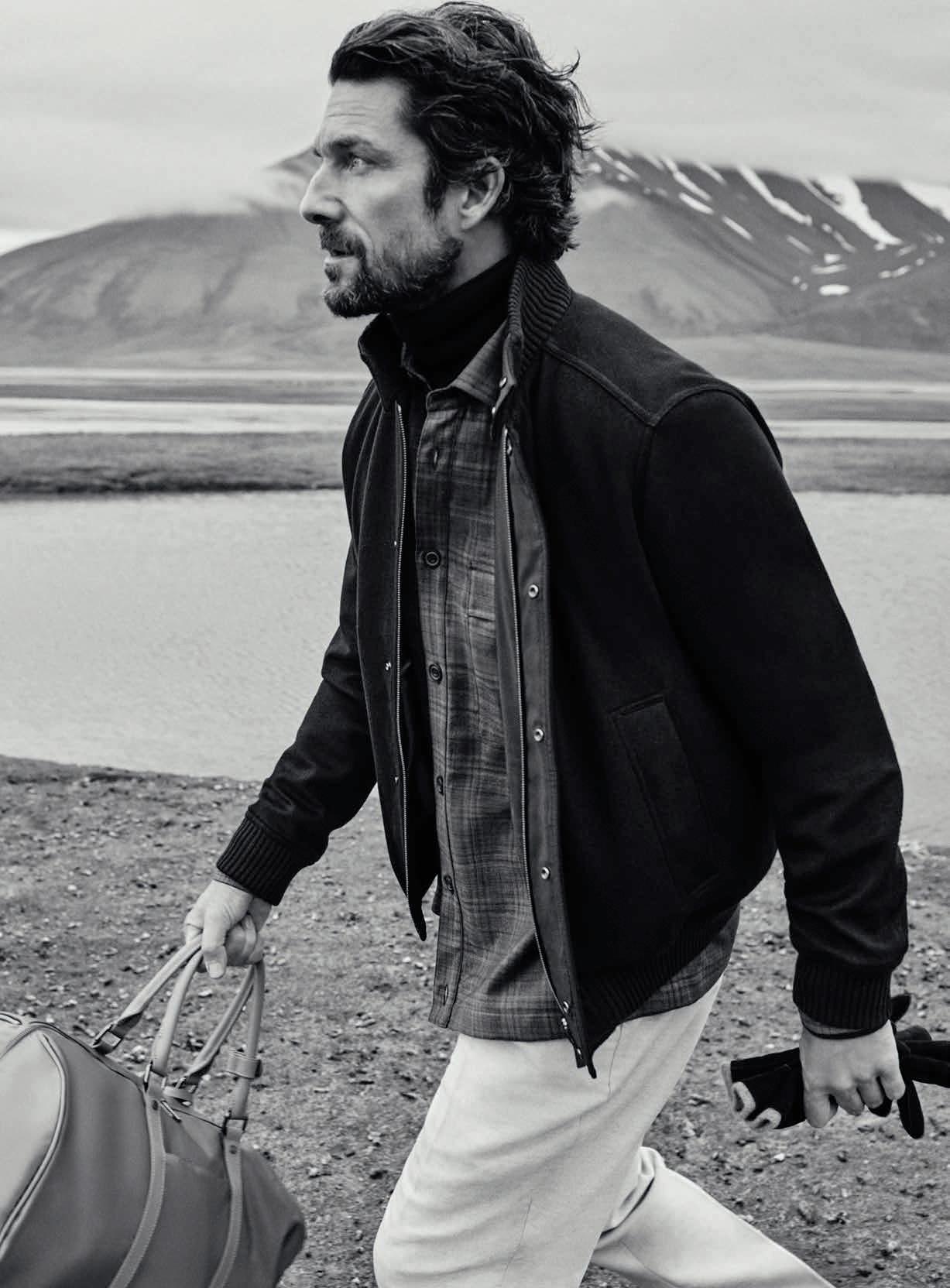

We expect a big emphasis on mixed textures and textiles–chunkier knits, velvet, cashmere, and double denim. It’s Fall/Winter, so obviously we’ll see lots of outerwear–including some interesting throwback styles inspired by vintage aviation and military jackets. I think the “prairie-toned” earthy neutrals like brown, sage, ivory, evergreen will play largely in the Fall ’26 collections. That leaves room for accessories that really pop–from silk ties and pocket squares to cashmere socks, our brands are not shying away from statement colors and patterns.

As a fashion aficionado, what was your most recent purchase, and what will you buy next?

I’m really into jackets and coats in leather or shearling, or mixed-material constructions with an edgier or more refined aesthetic than a standard puffer. I love chunky cable-knit sweaters, turtlenecks, layered cardigans–all types of knit layering pieces, even knit polos. They’re ideal for creating depth and comfort without losing style.

Will there be a special ITA event at the upcoming Chicago show?

Of course! We can’t release details just yet, but it’s widely known that the best party on Monday night is with the Italians! It’s always a fun experience to watch designers, retailers and press mingling away from the show floor–it’s

a crescendo that always ends in singing and dancing! It’s become a highlight of the show and within the industry. We’re very proud to foster these meaningful moments.

What other projects have you been working on lately?

Throughout this past year, I proudly led several major beauty and fragrance initiatives across New York, Los Angeles, and Miami, bringing Italian excellence to the U.S. audience. As for NYC, I sense a new energy that clearly indicates the city is coming back! I’ve made it a priority to get to a few Broadway shows, and I’m truly inspired by all the supper clubs popping up around the city.

How is the current tariff situation impacting prices on Italian goods?

The conversation around tariffs is constantly evolving. Italian brands that are best positioned to navigate uncertainty are the ones who’ve built personal relationships with their retailers. That’s why shows like Chicago Collective are so important: genuine relationships built over time grow the fruits of real partnerships. When both sides problem-solve, we are stronger together.