$1,390,000 1.45% CAP

$1,495,000 1.35% CAP $1,615,000 1.25% CAP

NOI LEASE TYPES YEAR BUILT LOT SIZE

1972

$20,152 GROSS 1.16 Acres

- Infill Dallas Location in Strong Submarket

- MT Flex/Industrial Sought after Asset

- Easy Access to I635

- Deferred Maintenance

- MTM Tenants

- Uncertain Business Environment

STRENGTHS CHALLENGES BUYER POOL QUALIFICATIONS RECOMMENDATIONS & TIMING

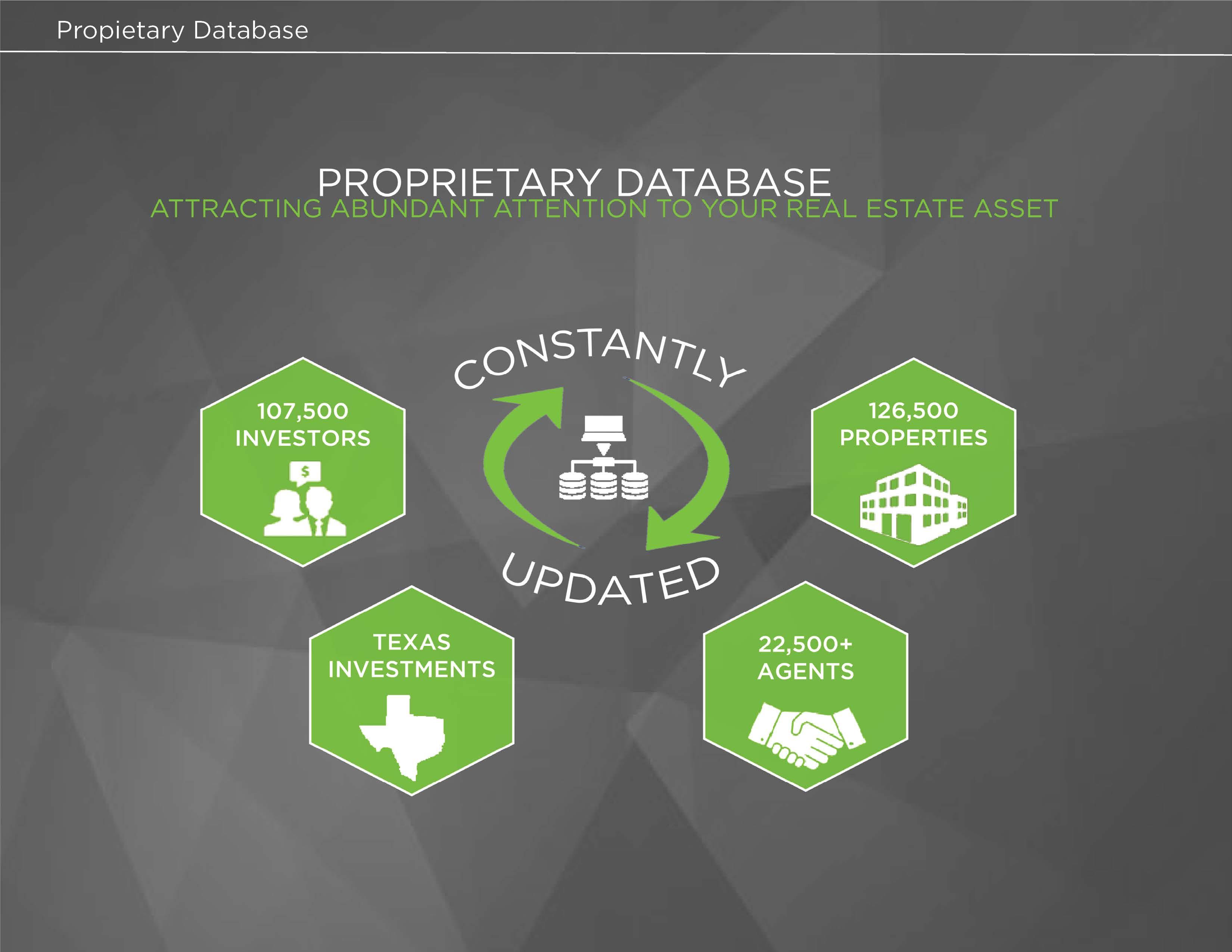

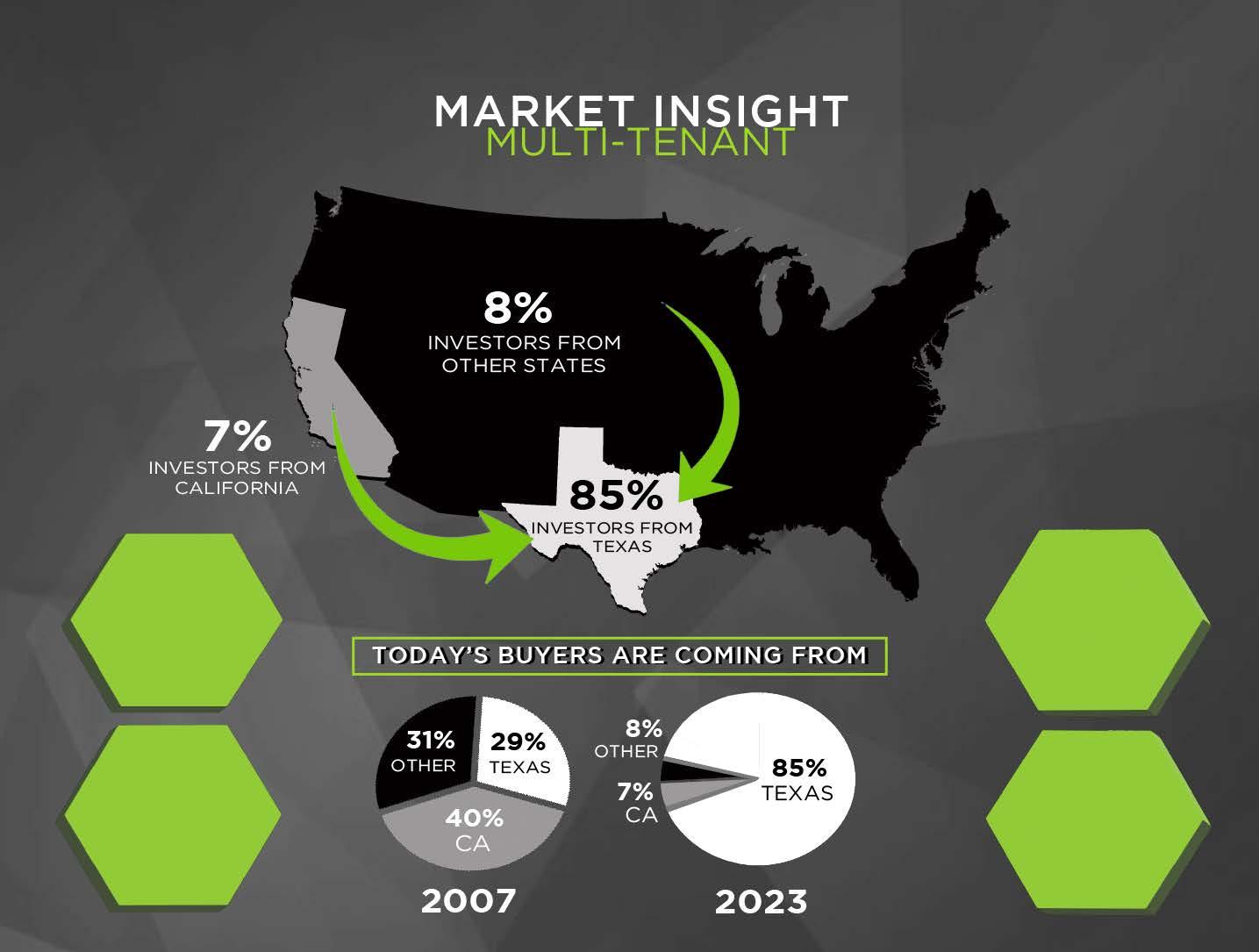

- Local, Regional, National, & International Private Capital Buyers, Many of Whom are in 1031 Exchanges

- Institutional Capital Targeting Quality, Stabilized Real Estate

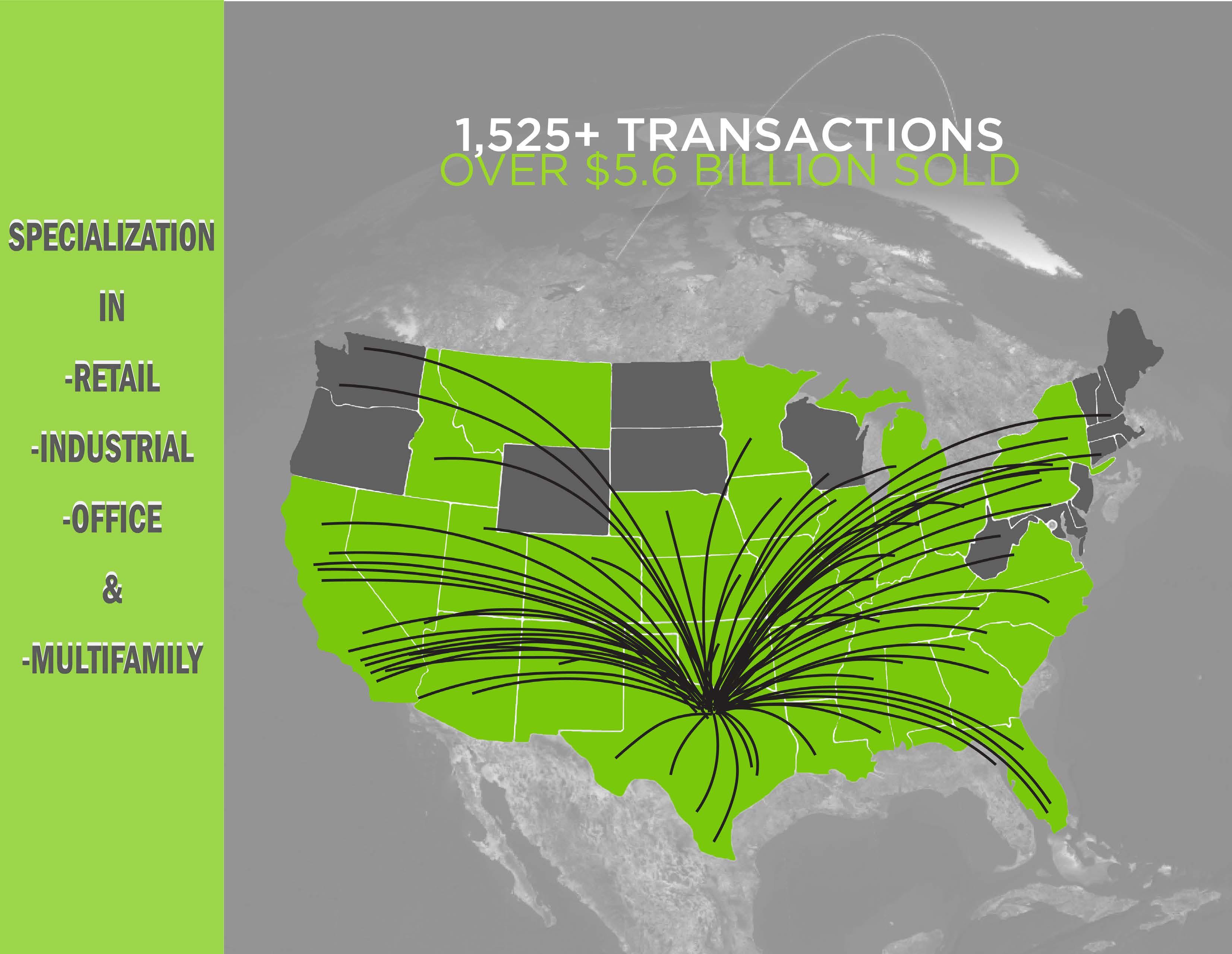

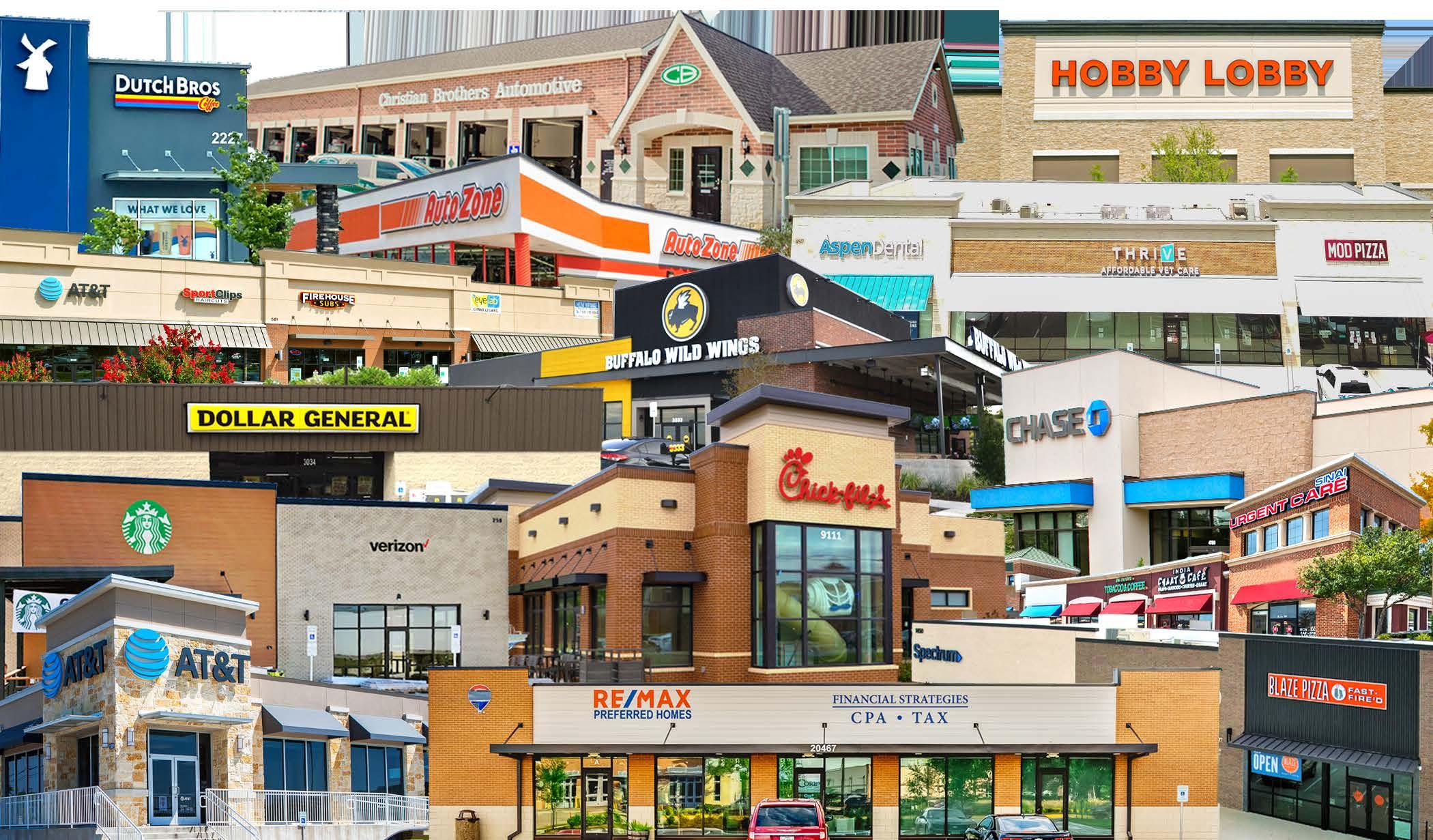

- STRIVE: Most Active Retail Team in Texas & Surrounding States

- Track Record: We Close Transactions - Sold More Than 1,200 Retail Transactions

- STRIVE Team Controls the Entire Process - Underwriting & Financial Analysts, Full Marketing Dept, Transaction Coordinators, and Team of Agents to Ensure High Probability of Closing

- 100% Cooperation – More Buyers - More Offers = Higher Price

- Ability to Source Qualified Debt Thru High Street Capital

- Sell Now to Take Advantage of the Current Market Before Interest Rates Increase Further and Capitalize on 1031 Buyers

- If Awarded the Assignment, We Can Be on the Market Within One Week and Closed Within Our Average List-to-Close Time Frame of 5-6 Months

PROPERTIES SOLD SINCE 2022

TOTAL VALUE SOLD SINCE 2022 SOLD & COUNTING

MULTI-TENANT PROPERTIES SOLD SINCE 2022 172 $5.6 BILLION 380 $1.5+ BILLION