PROVINCE OF ALBERTA

For the Year Ended December 31, 2024

Town of Rocky Mountain House 5116 - 50 Avenue PO Box 1509

Rocky Mountain House, AB T4T 1B2

403-845-2866 www.rockymtnhouse.com

2024 Financial Report & Community Update, for the year ended December 31, 2024

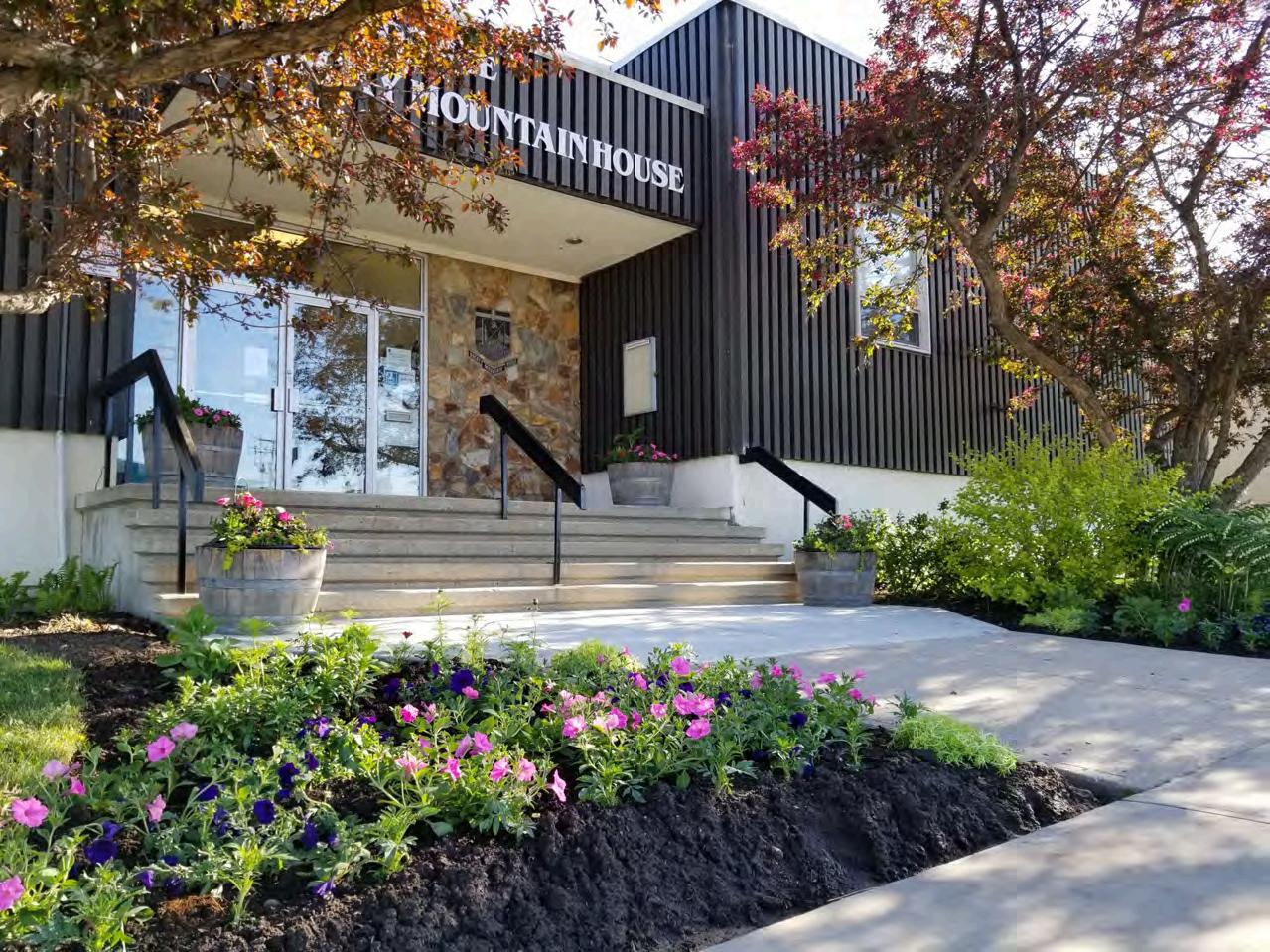

This report has been prepared by the Corporate Services Department, with support from Communications and all other Town Departments. Edmonton Calgary Rocky Mountain House TREATY 6

The Town of Rocky Mountain House acknowledges that the land on which we gather is Treaty 6 territory and a traditional meeting ground and home for many Indigenous Peoples, including the Blackfoot, Cree, Saulteaux, Stoney and Métis.

Land Acknowledgement

Message from Town Council

Message from the Chief Administrative Officer

Organizational Chart

Council Boards & Committees

Town Vision and Mission Statements

Strategic Plan 2023-2026

Strategic Plan 2024-2026

Legislative Authority

Departmental Services

Corporate Services

Engineering & Operations

Legislative Services

Protective Services

Planning & Community Development

Recreation & Community Services

Message from the Director of Corporate Services Award for Financial Reporting

Financial Management

Financial Statement Analysis

Audited Financial Statements

Management’s Responsibility for Financial Reporting

Independent Auditor’s Report

Consolidated Statement of Financial Position

Consolidated Statement of Operations

Consolidated Statement of Change in Net Financial Assets

Consolidated Statement of Cash Flows

Schedules of Consolidated Financial Statements

Notes to Consolidated Financial Statements

The Town of Rocky Mountain House Council is proud to share this annual financial and community report for the year ending December 31, 2024.

Our Mission Statement is to support economic growth and strengthen municipal infrastructure in a fiscally and environmentally responsible manner. The five guiding pillars of sustainable communities help us chart our path forward. They are: Economic Social Environmental Cultural Governance

These pillars are the foundation of our decisionmaking process, that support our vision: To cultivate a robust, diverse community where people and businesses flourish!

Through 2024, Council developed a suite of economic development incentives to encourage economic growth and development.

We now have incentives for non-residential building and land development, a storefront improvement program that can be applied to all commercial properties, no longer just the Downtown core, and we are a designated Rural Renewal Stream community.

Building permits and values were up by $2.8 million dollars over 2023.

Commercial/Industrial and Residential construction values both more than doubled. With more than $9.5 million dollars of commercial/industrial construction, that’s the most in over a decade.

Development permits were up by fifteen per cent, and we issued 599 business licences in 2024, and 73 of these were new businesses operating in the Town of Rocky Mountain House for the first time.

Some other 2024 highlights were celebrating 40 years of friendship with our Twin Town of Kamikawa. We were honoured to welcome the Alberta/Japan Twin Municipalities Association and visitors from Kamikawa to mark that special occasion.

A new Community Events Committee launched to bring positive family fun to our community in an accessible way.

And in all things, we remain compliant with the Municipal Government Act of Alberta.

The Town’s inaugural report in 2019 earned the Government Finance Officers Association Canadian Award for Financial Reporting, an honour we received again in each subsequent year.

The publication of this 2024 report is a commitment to citizens that we are being responsible, practical, fair and consistent with the Town’s legislative and fiscal functions.

Council is committed to serving all residents according to the five pillars of sustainable communities. As always, Council will meet any new challenge that comes to light as we chart the best path forward for our community.

Sincerely,

Acting Mayor Phillips on behalf of Town of Rocky Mountain House Council

I am pleased to again introduce this comprehensive annual community financial report on behalf of Administration for the Town of Rocky Mountain House.

This report outlines Town operations for the 2024 calendar year. It builds on the 2023 report and showcases, again, streamlined governance and accounting that meets or exceeds all our legislative obligations and strategic plan goals.

I give my utmost gratitude to the staff who work diligently to maintain our finances and operations at this high level. Across all departments, we are constantly reviewing service level expectations with Council, finding efficiencies, and reducing costs. This is an ongoing process to ensure the needed and wanted services in our community are provided in the best way.

I am proud to be a part of the Town of Rocky Mountain House team going into 2025 and I look forward to reflecting on even more progress and achievements in the years to come.

Dean Krause CLGM CPT Chief Administrative Officer (CAO), Town of Rocky Mountain House

Town Council is elected at large by residents to serve a four-year term and governs in accordance with powers granted under the Municipal Government Act. Town Council provides strategic direction to Administration through a variety of plans, bylaws, policies and other governance processes.

The Chief Administrative Officer leads the Senior Management Team, consisting of six members, who work to make Town Council’s strategic direction a reality.

Council committees play an important role in good governance by offering recommendations to Council on a wide range of civic matters. Established through legislation, these groups examine issues and help ensure a well-rounded approach to addressing community needs and priorities. By involving both elected officials and appointed public members, advisory committees encourage public engagement and support the prosperity and sustainability of the Town of Rocky Mountain House.

You are encouraged to get involved and help shape the future of our community. For information on how to join, visit www.rockymtnhouse.com/p/boards-committees

To support economic growth and strengthen municipal infrastructure in a fiscally and environmentally responsible manner.

To cultivate a robust, diverse community where people and businesses flourish.

A strategic plan is the guiding document that outlines Council’s priorities and the actions it will take to achieve them. Strategic Plan 2023-2026 served as a roadmap for Council and Administration to move toward a shared vision for the future, that would see our local economy grow, our infrastructure maintained and our community safe and healthy.

Through 2024, Council developed a suite a economic development incentives to encourage economic growth and development.

Tax incentives for non-residential building and land development.

Storefront Improvement Program can be applied to all commercial properties, no longer just the Downtown core.

We are a designated Rural Renewal Stream community.

Rocky Mountain House Rural Renewal Stream Program provides the endorsement of the Town of Rocky Mountain House to candidates applying to the Alberta Advantage Immigration Program, a start on the road to fast-tracked Canadian Permanent Residency. This valuable endorsement helps Employers recruit foreign nationals for jobs in Rocky Mountain House that they otherwise cannot fill with a Canadian citizen or permanent resident. At the same time, the Program connects the newcomers to community services and supports, so they not only stay in Rocky Mountain House, but thrive here.

Building permits and values were up by $2.8 million dollars over 2023.

Commercial/Industrial and Residential construction values both more than doubled. With more than $9.5 million dollars of commercial/industrial construction, that’s the most in over a decade.

Development permits increased by fifteen percent.

The Town of Rocky Mountain House issued 599 business licences in 2024; 73 of these were new businesses operating in the Town of Rocky Mountain House for the first time.

Six approved tax incentives for non-residential developments, each with a minimum assessed value of $100,000.

The Town of Rocky Mountain House is committed to strengthening and expanding the local tourism sector to support economic growth, create employment opportunities and enhance the community’s profile as a destination of choice. By partnering and leveraging natural assets, cultural attractions, events and hospitality services the Town is well-positioned to attract visitors yearround.

Strategic Partnerships

Tourism Alberta

Parks Canada Rocky Mountain House National

Historic Site

Community Events Committee

Discover Rocky

Rocky Mountain House and District Chamber of Commerce

David Thompson Country Tourism Region

Central Alberta Tourism Association

Alberta/Japan Twin Municipalities Association

75 participants at the David Thompson Tourism Forum (co-hosted by the Town of Rocky Mountain House).

Marketplace on Main returned for the 13 year. This open-air pedestrian market is held every Thursday night in summer, and yielded an average of 75 vendors each week through July and August. th

40 anniversary of our Twin Town agreement with Kamikawa, Japan.

Infrastructure is the cornerstone of a municipality. Safe, reliable roads, water and sewer systems, facilities and parks directly support quality of life and economic development.

Through a vigorous preventative maintenance program, the Town is able to extend the lifespan of these essential assets and improve service reliability. The 10-year capital plan prioritizes the funding for upcoming projects based on their expected life-cycle, reducing emergent and urgent spending.

A robust infrastructure maintenance and investment plan ensures the Town of Rocky Mountain House is building not just for today, but for future generations.

Utility Master Plan Update: Water, Wastewater and Stormwater systems are well-sized for near-term use.

New $30 Million mechanical Wastewater Treatment Plant under construction.

$3.6 Million investment in capital Transportation projects in 2024.

Lifecycle Building Assessment shows over 70% of Town-owned buildings are in Fair or Good condition.

Successfully lobbied Alberta Government to complete a Functional Study of the provincial Hwy. 11 corridor through Rocky Mountain House.

This goal reflects Council’s responsibility to protect the well-being of residents, enhance quality of life and foster a sense of security and belonging across the entire community. The following related policies were updated or adopted by Council in 2024:

Property Tax Relief Policy

To provide a framework for Council, in the exercise of its discretion under section 347(1) of the Municipal Government Act, when considering requests from residential property owners that experienced a structural fire for property Tax Relief.

Town of Rocky Citizen of the Year Award Policy

To recognise individuals, businesses, groups or teams who have made a significant contribution and recognition to Rocky Mountain House.

Support Funding Policy

To provide a framework for Council, in the exercise of its discretion to fund Supplementary Service organizations through the annual operating budget.

Public Participation Policy

To support quality public participation as a critical component of good governance. Adequate resources will be allocated and the appropriate level of public participation undertaken.

Recreation Facility Access Policy

To allow for residents of the Town of Rocky Mountain House or Clearwater County that are facing financial barriers to participate in leisure opportunities and facilities offered and operated by the Town of Rocky Mountain House.

The Town of Rocky Mountain House also signed updated Joint Use Planning Agreements with Wild Rose School Division and Red Deer Regional Catholic Schools.

In September, we joined the Rocky Rebels Minor Football Association to flip the switch on new lighting at Curtis Field. This investment extends the playable time on this multi-sport facility.

Looking ahead to 2025, Council has allotted funds to update the Recreation Master Plan.

In 2024, the Town held dedicated public engagement activities on the following topics:

Development incentives

Rural Renewal Stream

A new Civic Building

McNutt subdivision assessment sub-class.

Community Landmark

Mail delivery service to Industrial Area

The Town continued to action the Waste Reduction Strategy, with a targeted organics diversion education campaign in 2024.

Recreation facilities and programs welcomed 95 users under the Recreation Facility Access Policy.

The Town considers the five pillars of community sustainability in all our planning and operations:

In the fall of 2024, Council participated in several strategic planning sessions that reviewed the goals and outcomes of the 20232026 Strategic Plan and the community’s 2010 Sustainability Plan.

Having completed the majority of its 2023-2026 Strategic Plan goals, Council established a new strategic plan to guide it through 2024 and beyond.

We have a robust and resilient commercial sector with a growing tourism industry. The costs of building and maintaining the community will not become an undue burden on future generations.

Downtown is Flourishing and Expanding

Our Commercial and Industrial Sectors are Growing

Rocky is Recognized as a Destination

We have a diverse community with access to housing, education, health care and public amenities.

We have a strong central social organization

Safe and Secure Life for All

Building a strong, community through social activities and events

We use our natural resources responsibly. We encourage development that minimizes air, water and soil pollution and protects natural systems.

We Promote Growth through the lens of Environmental Stewardship

Our Water Resource is used responsibly

The Town is a Leader in Environmental Stewardship

We respect and enhance the cultural capital of our community in terms of its heritage, sense of place, arts, diversity and history.

Promote our Cultural Diversity

Promote our Performing and Visual Arts Community

Promote and Preserve our History

We approach decision-making in a democratic, transparent, accountable and inclusive manner to foster informed dialogue and an engaged citizenry.

The Town is Positioned for Opportunities

The Town has Strong Relationships with all Levels of Government

The Town Maintains the Viability of Core Services

The Town Promotes Open Governance and Communication

As per the Municipal Government Act (MGA), a municipality's purpose is to provide good governance through essential services, facilities and programs that benefit the community, while fostering environmental well-being to maintain safe and viable communities. Additionally, municipalities must collaborate with neighbouring municipalities to plan, deliver and fund intermunicipal services.

Services are provided in several key areas to meet MGA mandates:

General Government: Mayor, Council and administration which includes CAO administration, legislative services, communications, finance, information technology, human resources and risk management.

Protective Services: Policing, fire services, community/bylaw enforcement, occupational health and safety and disaster services.

Operations: Road maintenance, snow removal, fleet maintenance, airport and storm sewer operations.

Environmental Services: Water supply and distribution, wastewater collection, treatment and distribution, solid waste and environmental stewardship.

Social Services: Clearwater Regional Family and Community Support Services, social housing programs and cemetery services.

Planning & Development: Community planning and development, subdivision and land use bylaw development and management, building inspections and economic development.

Recreation and Cultural Services: Recreational programs, arena, pool, parks, sports fields, community center and library operations.

Council has identified which services are core, supplementary and discretionary under the Core Services Policy 009/2023. This provides clarity to the public on responsibility and guides in the budgeting process. Core services are required in the budget and discretionary services are a higher priority than supplementary services.

Services and the related assets that are legislated and/or required for the health and safety of the residents.

Services and the related assets that enhance the quality of life for the residents but are not legislatively required or imperative for health and safety.

Services that are the responsibility of another level of government or organization that improve the quality of life of residents.

2024 recipients of the Dedicated Senior Leadership Team Award from Alberta Municipalities and the Society of Local Government Managers.

The administrative engine that helps power every part of your local government.

Corporate Services manages the entire organization’s financial transactions and fiscal responsibilities in accordance with the Municipal Government Act and other provincial and federal laws and regulations. It is also responsible for information technology, human resources, assessment, taxation, budgeting and all financial policies.

CORE

Assessment

Financial

Utilities

Human

Information

Corporate

Records

Risk

DISCRETIONARY SERVICES

Animal

Business

Serving your community from the ground up.

Engineering & Operations is responsible for 58 kilometres of paved roads, a network of alleys and underground water distribution and wastewater pipelines. It manages the Class III Water Treatment Plant, wastewater treatment facility, parks, green spaces, playgrounds and the Town’s fleet of vehicles and equipment.

The support structure that keeps your local government transparent, fair and accessible.

Legislative Services ensures the direction of Council is carried out in accordance with the Municipal Government Act and other provincial and federal legislation. It is charged with administering municipal elections and by-elections, maintaining official records, managing the appointments and operations of Council boards and committees and coordinating Access to Information requests.

Keeping your community safe and well.

Protective Services works to safeguard the health, safety and well-being of the community. It is responsible for emergency response and bylaw enforcement, coordinating with regional and provincial agencies to ensure effective and timely response.

Land Use Bylaw GIS & Mapping Subdivision Application Design Guidelines Statutory Plans Development Agreements OH&S

Supporting the growth and resilience of your community through collaboration and policy.

Planning and Community Development oversees land use planning, zoning and development approvals to ensure sustainable growth aligned with the municipality’s strategic vision. It leads economic development initiatives to attract investment, support local businesses and create employment opportunities. It also promotes tourism by enhancing community assets, marketing local attractions and fostering partnerships that boost visitor engagement and regional visibility.

Enhancing the vibrancy and promoting the health and well-being of your community.

Recreation and Community Services provides accessible programs and facilities for the community. It manages the booking, staffing and maintenance of the Town facilities accessed by residents and visitors of Rocky Mountain House and Clearwater County every day. It includes the regional Family and Community Support Services, which offers services and partnerships that address the diverse needs of residents.

Facility Bookings Facility Management and Operations Recreation Programming

Events

Sponsorships and Grants

FCSS Administration

FCSS Programming

Betty Quinlan B.Comm CPA CMA Director, Corporate Services Town of Rocky Mountain House

I am pleased to present the sixth Annual Financial Report for the Town of Rocky Mountain House. This 2024 report aims to deliver a clear and concise update on the Town's activities and financial status. By expanding upon the audited financial statements, readers will gain a comprehensive understanding of the Town's initiatives and how they relate to the financial statements.

The annual report includes much more than just the audited financial statements. It offers a detailed analysis, five-year comparative financial information and additional economic data, providing a comprehensive overview of the Town's financial health and economic environment.

In compliance with Section 276 of the Municipal Government Act (MGA) of Alberta, all municipalities must undergo an audit and prepare audited statements in line with the principles and standards set by the Public Sector Accounting Board (PSAB) of the Chartered Professional Accountants of Canada. This ensures consistent reporting and reliability of the information presented.

Management is responsible for preparing financial statements that accurately reflect the Town's activities, including financial information and disclosures. This information provides valuable insights for both internal and external users on how the town delivers services and meets its objectives.

Guided by the Council's strategic plan, the Town strives to provide high-quality, fiscally responsible, and environmentally sustainable services, aiming to foster a vibrant, diverse community where people and businesses can thrive.

I would like to extend my gratitude to everyone involved in this process. Your dedication and hard work have been crucial to our success.

Thank you for your ongoing support and commitment to our Town’s financial integrity.

April 30, 2025

Government Finance Officers Association of the United States and Canada (GFOA) awarded a Canadian Award for Financial Reporting to the Town of Rocky Mountain House for its annual financial report for the fiscal year ended December 31, 2023. The Canadian Award for Financial Reporting program was established to encourage municipal governments throughout Canada to publish high quality financial reports and to provide peer recognition and technical guidance for officials preparing these reports.

In order to be awarded a Canadian Award for Financial Reporting, a government unit must publish an easily readable and efficiently organized annual financial report, whose contents conform to program standards. Such reports should go beyond the minimum requirements of generally accepted accounting principles and demonstrate an effort to clearly communicate the municipal government’s financial picture, enhance an understanding of financial reporting by municipal governments, and address user needs.

A Canadian Award for Financial Reporting is valid for a period of one year only. We believe our current report continues to conform to the Canadian Award for Financial Reporting program requirements, and we are (will be) submitting it to GFOA to determine its eligibility for another award.

The Town has a comprehensive financial management system that aligns the financial process with Council's goals and objectives, translating the budget into a functional operational plan. Council's strategic plan, reviewed annually, is tied to a service level document and is used to assess and adjust service levels to meet community needs.

The Town’s robust system of financial policies and internal controls monitors financial activity, safeguards municipal assets and ensures compliance with Public Sector Accounting Board standards. Internal controls cover segregation of duties, quarterly reporting, year-end auditing, review and approval processes, major area reconciliations, physical inventory counts and standard approval levels throughout the organization. Policies include:

Budget and Taxation

Procurement and Purchasing

Asset Management

Surplus Disposal

Signing Authority

Liability for Contaminated Sites

Tangible Capital Assets

Corporate Credit Cards

Council Remuneration

Year-End Surplus Allocation

Reserve

Related Party Disclosure

The budget document includes a current operating budget, a four-year forecast, a current capital budget and a ten-year capital plan. A key component of the budget is balancing financing for operating and capital plans over five years, ensuring viability and sustainability of Town operations and infrastructure. This involves considering available grants, projected taxation, potential increases and debt servicing to meet objectives. This approach prioritizes capital development while ensuring reasonable community property taxes and future financing requirements.

The entire process becomes a blend of balancing requests for services with the ability to finance them and the reasonability of tax rates. The goal of Council is to provide a community with a blend of services that cover the range of safety, functionality, recreational and future planning.

Performance against the financial management system is monitored and reported to Council throughout the year, including quarterly financial statements and variance analysis. A year-end analysis is presented once the audited financial statements are complete.

The Municipal Government Act requires Council to appoint an external auditor to perform the annual audit of the Town’s financial activity and present an opinion on the Town’s financial position, independent of management. Baker Tilly WCR LLP was awarded the contract for audit services and prepared the statements in accordance with Canadian Public Sector Accounting Standards.

The Audit Committee, composed of all of Council, is responsible for appointing the auditor, approving the terms of the audit engagement, reviewing the audit findings, approving the audited financial statements and ensuring management fulfills its financial oversight duties.

The Town of Rocky Mountain House operates independently but collaborates with regional entities to enhance services. Key partnerships include Clearwater County and Parkland Regional Library Board. Numerous other service groups also share resources or information to improve service delivery.

Despite the Town of Rocky Mountain House’s commitment to financial reporting – as evidenced by this 6 edition of a Financial and Community Report, there are still some significant activities that don’t show up clearly in financial data. This is either because they don’t involve major spending or because their value is qualitative rather than monetary. th

Community Engagement and Relationship Building

Hosting town halls, surveys and or stakeholder meetings in accordance with the Public Participation Policy.

Building trust with residents and businessowners.

Fostering partnerships with Indigenous communities, nonprofits, or service clubs

Policy Development and Strategic Planning

In 2024, Council updated, adopted or passed 14 separate policies and 19 different bylaws. Having completed the majority of its 20232026 Strategic Plan goals, Council established a new strategic plan to guide it through 2024 and beyond.

Intergovernmental and Regional Collaboration

Working with other municipalities and provincial ministries on shared initiatives, such as the Recreation Agreement with Clearwater County; the Hwy. 11 and Hwy. 11A functional study with Alberta Transportation and Economic Coridors. Participating in regional boards or advocacy groups, such as the Central Alberta Economic Partnership, Parkland Regional Library Board, Community Futures, Clearwater Regional FCSS, the Health Professions Engagement Team and AB Munis.

Capacity Building and Staff Development

Leadership development, training programs, and workplace culture initiatives.

The Town of Rocky Mountain House earned the Dedicated Senior Team Award from Alberta Municipalities and the Society of Local Government Managers.

Organization-wide participation in developing the Core Values statement for all employees:

Communications and Public Awareness

Organics waste diversion, emergency preparedness, construction notices and prompt communication of unexpected service disruptions.

In 2024, wildfire smoke from other parts of Canada affected tourism in the Rocky Mountain House region.

The Town of Rocky Mountain House remains committed to providing sound financial stewardship for the public it serves. A fully funded 10-year capital plan has been developed and approved, ensuring continued maintenance of infrastructure and services while preserving the necessary financial reserves for future needs.

Through strategic planning, service level reviews and a rigorous budgeting process, Council ensures Town operations are running as efficiently as possible. With the Town’s financial house in order and the supporting legislative and policy framework established, Council’s revised Strategic Plan focuses in part on setting the Town up for future opportunities. The 2025 budget allots funds for the design of a new civic building, a recreation centre expansion, infill and outline plans so we can be ready for grant opportunities as they become available. This proactive approach will allow the Town to quickly and effectively respond to new opportunities as they arise.

The audited statements provide a comprehensive overview through consolidated statements of:

• Financial position

• Operations

• Changes in net financial assets

• Cash flows

Additionally, several supporting schedules detail major activity categories, accompanied by notes that explain the balance sheet items and other operational activities throughout the year. These statements reflect the Town’s operational activities for the 2024 fiscal year.

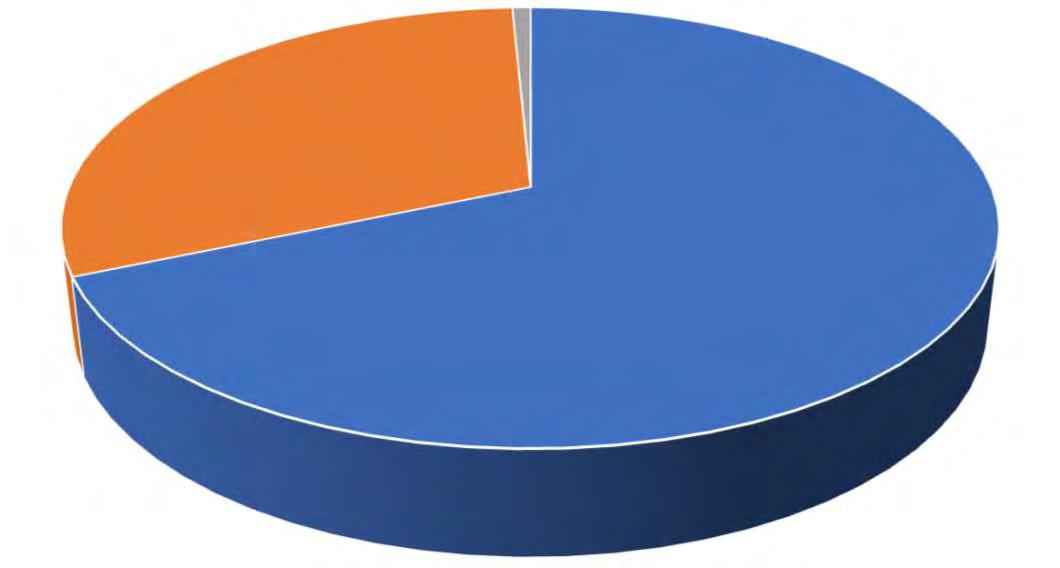

This statement presents the assets and liabilities at a specific point in time, highlighting the Town's financial position by showcasing net financial assets and accumulated surplus.

Financial assets include cash, investments, accounts receivable, and land held for resale inventory. Liabilities comprise accounts payable, deferred revenue, long-term debt, and asset retirement obligations.

The difference between assets and liabilities represents the net financial position, indicating the amount of cash the organization would have if all assets and liabilities were liquidated.

The Town demonstrates a strong financial position with growing reserve balances and net financial assets (remaining assets after liabilities are paid) amounting to $23 million. Non-financial assets have increased by $13 million from 2023 due to the completion of capital projects being added to tangible capital assets. This figure is expected to rise significantly over the next two years with the completion of the $30 million wastewater treatment plant.

Assets in 2024 were lower than in 2023 by $1.7 million as the funds received for the wastewater treatment plant are being spent during the construction.

Liabilities decreased by $4 million due to the consumption of deferred revenue for various capital projects, the majority of which was for the wastewater treatment plant. Consolidated Financial Position

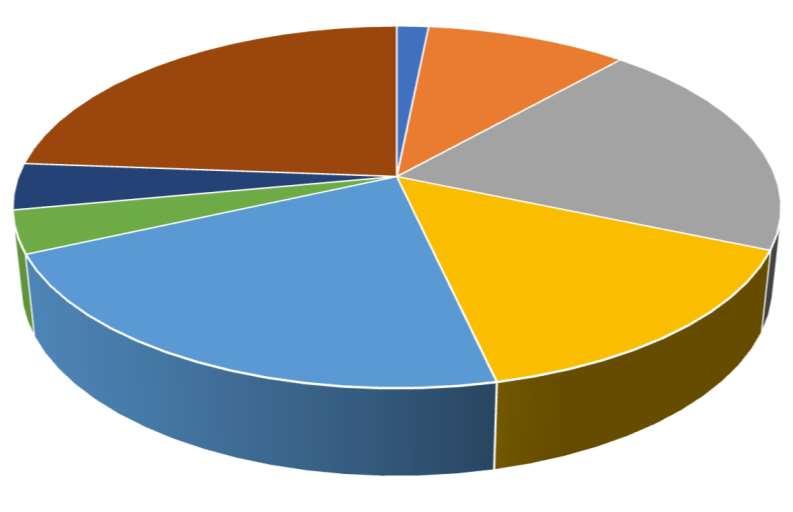

This statement reflects the operating activities for the year, including any capital funding received for tangible capital asset projects. Municipalities prepare an annual operating budget, and activities are measured against this budget. This statement is a key document for the Council as it demonstrates how well the organization met the goals and activities outlined in the budget.

The surplus or deficit for the year, shown as the excess of revenue over expenses, serves as a critical performance and accountability measure.

Overall, financial activities for 2024 closely aligned with the budget, with very small variances throughout. Operating activities concluded with a surplus of $2.4 million. Revenue exceeded the budget due to other income that was recognized being $1 million received as a contribution to the wastewater treatment plan and a decrease in the provision for the landfill liability of $184,000.

Expenses were $1 million under budget. The consists of amortization being under budget by $302,000; however this is a non cash transaction. Protective services was under budget by $267,000 due to higher revenues being received by the Regional Fire and there were vacancies in the RCMP staffing complement that resulted in this area being under budget.

Operations was under budget by $221,000 but the majority of this was due to lower amortization, which was mentioned above.

Utilities were collectively under budget by $493,000 due to the commissioning of the WWTP being postponed, remediation costs for the landfill being $150,000 under budget and there being fewer repairs and maintenance in the water area.

Other variances are highlighted in the variance analysis that is attached. Other activities include a small gain on the sale of tangible capital assets and government transfers (grants) for capital projects. Government grants were notably high in 2023 due to the construction of a $30 million wastewater treatment plant, which received $20 million in federal and provincial grants.

The accumulated surplus increased by $15.6 million, reflecting both the annual operational surplus and the addition of tangible capital assets.

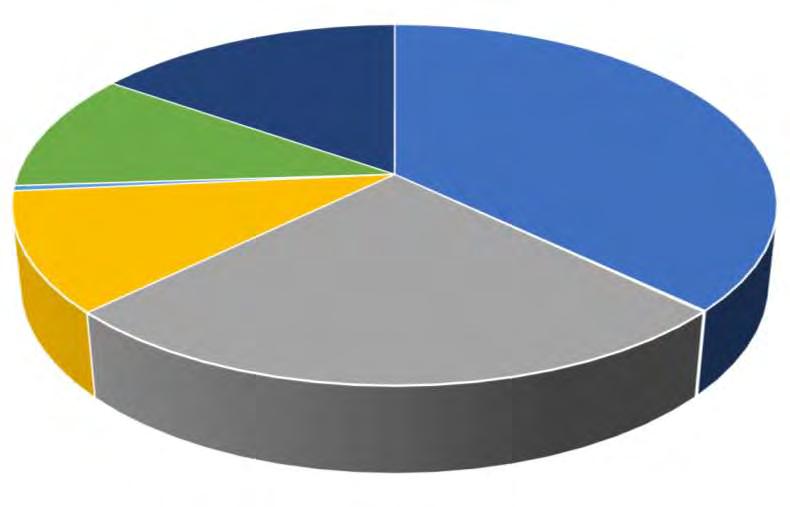

Consolidated Operating Results

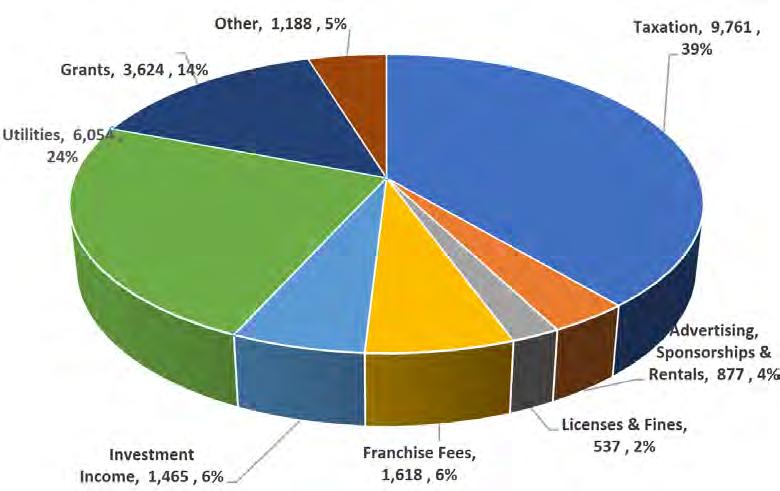

Revenues in 2024 were $2.3 million higher than in 2023. Overall, operating revenues were quite comparable to last year with two one time revenues generating one half of the increase. Taxes and user fees generated the remaining half of the increase.

The major factors contributing to this increase are:

• Property Tax Increase: A 4% increase generated an additional $395,000 and new assessment generated $36,000

• Sales & User Fees, Permits & Licenses, and Franchise Fees: New utility rates and higher user fees in recreation generated an additional $538,000 in revenue.

• Other Revenue in 2024: One time receipt of funds in 2024 of $1 million contribution to the wastewater treatment plant and a decrease in the post closure liability of $184,000 caused other revenue to be higher than in 2023.

Expenses in 2024 were $814,000 higher than in 2023. The primary areas of change include:

• Salaries and Benefits: Increased in 2024 due to the addition of a new position in 2024 and cost of living increases.

• Grants to Regional Fire Services: there was a large grant paid totaling $673,000 was paid to the regional fire service for the Town’s portion of new fire equipment. This is recorded as a grant payment since the regional fire service sets up the asset. The purchase of a new ladder truck replacing a 20 year old model. This is an usual purchase that occurs infrequently.

• In addition, the cost of the regional fire service increased by $121,000 from $443,000 to $564,000 in 2024. The town pays a percentage of the fire operations that is associated with coverage for the Town.

The operating results for the year show that revenues were higher than budgeted. This is mostly due to the one time revenues received under Other. They were the $1 million donation for the WWTP and the decrease in the post closure liability for the landfill of $184,000.

by Type

Overall Expenses: The total expenses for the year were very close to the budgeted amounts, and were under budget by $1 million, including amortization.

Regular Operating Expenses: Regular operating expense was $787,000 under budget. The main areas consisting of utilities being under by $495,000 because the opening of the wastewater treatment plant was delayed until 2025. The remainder is spread throughout protective services and operations.

Amortization: Amortization costs came in under budget due to changes in the way it was budgeted compared to the actual amortization. As a non-cash transaction, this overage does not impact the cash flow directly but affects the overall accounting of asset depreciation.

Summarized Operating Statement

Expenses by Division

Below is a summary of the key expense categories:

• Overall Expenses (including amortization): $1 million under budget

• Regular Operating Expenses: $787,000 under budget

• Amortization: $303,000 under budget (non-cash expense)

• Operations & Infrastructure: Amortization under budget by $140,000; remainder of areas all slightly under budget to account for the remainder.

• Protective Services: RCMP contract is under budget by $128,000 due to position vacancies; fire billing from Regional Fire is under budget by $105,000 due to higher fee revenue than was budgeted by the Regional Fire for highway MVA's. Supplies also under budget in Bylaw and OH&S.

• Landfill Remediation Costs: Funded from the solid waste reserve and in 2024 were included as revenue due to the decrease in the liability.

The Statement of Changes in Net Financial Assets provides a reconciliation of the change in net financial assets between the current period and the prior year. This statement connects the annual operating surplus or deficit, as reported in the Statement of Operations, to the change in net assets indicated in the Statement of Financial Position.

The main variances are due to lower revenue and a lower increase in capital assets because the wastewater treatment plant was budgeted for completion in 2024, however completion was delayed until 2025.

This statement explains the change in cash and cash equivalents from the prior year and provides information about how cash is generated to meet the needs for the year. The layout shows how the entity financed its activities.

FINANCIAL STATEMENTS

DECEMBER 31, 2024

Management of the Town of Rocky Mountain House (Town) is responsible for the preparation, accuracy, objectivity and integrity of the accompanying consolidated financial statements and all other information contained within this Financial Report. Management believes that the consolidated financial statements present fairly the Town's financial position as at December 31, 2024 and the results of its operations for the year then ended.

The consolidated financial statements have been prepared in accordance with Canadian public sector accounting standards (PSAS).

The consolidated financial statements include certain amounts based on estimates and judgments. Such amounts have been determined on a reasonable basis in order to ensure that the consolidated financial statements are presented fairlyin allmaterial respects.

In fulfilling its responsibilities and recognizing the limits inherent in all systems, management has designed and maintains a system of internal controls to produce reliable information and to meet reporting requirements on a timely basis. The system is designed to provide management with reasonable assurance that transactions are properly authorized and assets are properly accounted for and safeguarded.

These systems are monitored and evaluated bymanagement and reliable financial information is available for the preparation of the consolidated financial statements.

The Town Council carries out its responsibilities for review of the consolidated financial statements principally through its Audit Committee. This committee meets regularly with management and external auditors to discuss the results of audit examinations and financial reporting matters.

The external auditors have full access to the Audit Committee with and without the presence of management. The TownCouncil has approved the consolidated financial statements.

The consolidated financial statements have been audited by Baker Tilly WCR LLP, Chartered Professional Accountants, independent external auditors appointed by the Town. The accompanying Independent Auditor's Report outlines their responsibilities, the scope of their examination and their opinion on the Town's consolidated financial statements.

Dean Krause

on behalf of

April 28, 2025

Date

Chief Administrative Officer BettyQuinlan

Director of Corporate Services

April 28, 2025

Date

Suite #201, 5133 - 49 Street

P.O. Box 100

Rocky Mountain House, AB Canada, T4T 1A1

O: 1 (403) 845-3226 F: 1 (403) 845-5666

To the Mayor and Councilof the Town of RockyMountain House Opinion

We have audited the accompanying consolidated financial statements of the Town of Rocky Mountain House (the "Town"), which comprise the consolidated statement of financial position as at December 31, 2024, and the consolidated statements of operations, changes in net financial assets and cash flows for the year then ended, and notes to the consolidated financial statements, including a summary of significant accounting policies and other explanatoryinformation.

In our opinion, the accompanying consolidated financial statements present fairly, in all material respects the consolidated financial position of the Town as at December 31, 2024, and the results of its consolidated operations, change in net financial assets and cash flows for the year then ended in accordance with Canadian public sector accounting standards.

Basis for Opinion

We conducted our audit in accordance with Canadian generally accepted auditing standards. Our responsibilities under those standards are further described in the Auditors' Responsibilities for the Audit of the Consolidated Financial Statements section of our report.

We are independent of the Town in accordance with the ethical requirements that are relevant to our audit of the consolidated financial statements in Canada, and we have fulfilled our other ethical responsibilities in accordance with these requirements. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our opinion.

Other Information

Management is responsible for the other information. The other information comprises the information included in the Annual Report, but does not include the consolidated financial statements and our auditors' report thereon. The Annual Report is expected to be made available to us after the date of this auditors' report.

Our opinion on the consolidated financial statements does not cover the other information and we will not express anyform of assurance conclusion thereon.

In connection with our audit of the consolidated financial statements, our responsibility is to read the other information and, in doing so, consider whether the other information is materially inconsistent with the consolidated financial statement or our knowledge obtained in the audit, or otherwise appears to be materially misstated. When we read the annual report, if we conclude that there is a material misstatement of this other information, we are required to report that fact to the Mayor and Council.

Management is responsible for the preparation and fair presentation of the consolidated financial statements in accordance with Canadian public sector accounting standards, and for such internal control as management determines is necessary to enable preparation of consolidated financial statements that are free from material misstatement, whether due to fraud or error.

In preparing the consolidated financial statements, management is responsible for assessing the Town's ability to continue as a going concern, disclosing, as applicable, matters related to going concern and using the going concern basis of accounting unless management either intends to liquidate or to cease operations, or has no realistic alternative but to do so.

Councilis responsible for overseeing the Town's financial reporting process.

Auditors' responsibilities for the Audit of the Consolidated

Our objectives are to obtain reasonable assurance about whether the consolidated financial statements as a whole are free from material misstatement, whether due to fraud or error, and to issue an auditor's report that includes our opinion. Reasonable assurance is a high level of assurance, but is not a guarantee that an audit conducted in accordance with Canadian generally accepted auditing standards will always detect a material misstatement when it exists. Misstatements can arise from fraud or error and are considered material if, individually or in the aggregate, they could reasonably be expected to influence the economic decisions of users taken on the basis of these consolidated financial statements.

As part of an audit in accordance with Canadian generally accepted auditing standards, we exercise professional judgment and maintain professional skepticism throughout the audit. We also:

Identify and assess the risks of material misstatement of the consolidated financial statements, whether due to fraud or error, design and perform audit procedures responsive to those risks, and obtain audit evidence that is sufficient and appropriate to provide a basis for our opinion. The risk of not detecting a material misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control.

Obtain an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Town's internal control.

Evaluate the appropriateness of accounting policies used and the reasonableness of accounting estimates and related disclosures made bymanagement.

Conclude on the appropriateness of management's use of the going concern basis of accounting and, based on the audit evidence obtained, whether a material uncertaintyexists related to events or conditions that may cast significant doubt on the Town's ability to continue as a going concern. If we conclude that a material uncertainty exists, we are required to draw attention in our auditors' report to the related disclosures in the consolidated financial statements or, if such disclosures are inadequate, to modify our opinion. Our conclusions are based on the audit evidence obtained up to the date of our auditors' report. However, future events or conditions may cause the Town to cease to continue as a going concern.

Evaluate the overall presentation, structure and content of the consolidated financial statements, including the disclosures, and whether the consolidated financial statements represent the underlying transactions and events in a manner that achieves fair presentation.

We communicate with Council regarding, among other matters, the planned scope and timing of the audit and significant audit findings, including anysignificant deficiencies in internal control that we identifyduring our audit.

RockyMountain House, Alberta

Chartered Professional Accountants April28, 2025

FINANCIAL ASSETS

CONSOLIDATED STATEMENT OF FINANCIAL POSITION DECEMBER 31, 2024

- FINANCIAL ASSETS

(Note 2)

ACCUMULATED SURPLUS (Schedule 1, Note 15) $140,326,619 $124,712,590 Contractual Rights, Contractual Obligations and Contingencies - See Note 17

Approved byTo

See accompanying schedules and notes to the financial statements.

REVENUE

STATEMENT OF

YEAR ENDED DECEMBER 31, 2024

See accompanying schedules and notes to the financial

CONSOLIDATED STATEMENT OF CHANGE IN NET FINANCIAL ASSETS YEAR ENDED DECEMBER 31, 2024

$20,583,704

See accompanying schedules and notes to the financial statements.

CONSOLIDATED STATEMENT OF CASH FLOWS FOR THE YEAR ENDED DECEMBER 31, 2024

NET INFLOW (OUTFLOW) OF CASH RELATED TO THE FOLLOWING ACTIVITIES:

TOWN OF ROCKY MOUNTAIN HOUSE

SCHEDULE OF CHANGES IN ACCUMULATED

FOR THE YEAR ENDED DECEMBER 31, 2024 SCHEDULE 1

TOWN OF ROCKY MOUNTAIN

SCHEDULE OF TANGIBLE

FOR THE YEAR ENDED DECEMBER 31, 2024 SCHEDULE 2

During the year, the Town recognized the acquisition of land with a value of $374,000

SCHEDULE OF PROPERTY AND OTHER TAXES FOR THE YEAR ENDED DECEMBER 31, 2024 SCHEDULE 3 Budget (Unaudited) 2024 2023

TOTAL NET MUNICIPAL TAXES (AFTER REQUISITIONS) $9,754,516 $9,749,116 $9,318,017

SCHEDULE OF GOVERNMENT TRANSFERS FOR THE YEAR ENDED DECEMBER 31, 2024 SCHEDULE 4 Budget (Unaudited) 2024

GOVERNMENT TRANSFERS $25,801,391 $16,420,926 $10,433,044

SCHEDULE OF CONSOLIDATED EXPENSES BY OBJECT FOR THE YEAR ENDED DECEMBER 31, 2024 SCHEDULE 5

CONSOLIDATED EXPENSES BY OBJECT

(1,139,309) (3,484,519)

$10,857,651 $(3,483,305) $(2,355,085) $(500,748) $41,209 $(2,193,731) $13,248,038 $15,614,029

932,164 4,959,629 6,996,044 Amortization expense (166,726) (59,912) (1,368,867) (31,498) (3,496) (985,112) (1,175,787) (3,791,398)

REVENUE $10,852,349 $(2,497,497) $(2,333,646) $(250,547) $478,585 $(2,465,053) $4,318,999 $8,103,190

The Townof RockyMountain House (the Town) is a municipalityin the Province of Alberta, Canada and operates under the provisions of the Municipal Government Act, R.S.A., 2000, c. M-26, as amended (MGA).

The consolidated financial statements (the financial statements) of the Town are the representations of management prepared in accordance with generally accepted accounting principles for local governments established by the Public Sector Accounting Board and as published by the Chartered Professional Accountants of Canada. Significant aspects of the accounting policies adopted bythe Town are as follows:

The financial statements reflect the assets, liabilities, revenues and expenses, changes in fund balances and change in financial position of the reporting entity. This entity is comprised of municipal operations plus all the organizations that are owned or controlled bythe Townand are, therefore, accountable to the town council for the administration of their financial affairs and resources.

Included in these financial statements are fifty percent of the Rocky Mountain House Municipal Airport assets, liabilities, revenues and expenses.

The schedule of taxes levied also includes operating requisitions for education, health, social and other external organizations that are not part of the municipal reporting entity.

The statements exclude trust assets that are administered for the benefit of external parties. Interdepartmental and organizational transactions and balances are eliminated.

The financial statements are prepared using the accrual basis of accounting. The accrual basis of accounting records revenue as it is earned and measurable. Expenses are recognized as they are incurred and measurable based upon receipt of goods or services and/or the legal obligation to pay.

Funds from external parties and earnings thereon restricted by agreement or legislation are accounted for as deferred revenue untilused for the purpose specified.

Government transfers, contributions and other amounts are received from third parties pursuant to legislation, regulation or agreement and may only be used for certain programs, in the completion of specific work, or for the purchase of tangible capital assets. In addition, certain user charges and fees are collected for which the related services have yet to be provided.

Revenue is recognized in the period when the related expenses are incurred, services performed or the tangible capital assets are acquired.

The preparation of the financial statements in conformity with Canadian public sector accounting standards requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenditures during the reporting period. Where estimation uncertainty exists, the financial statements have been prepared within reasonable limits of materiality. Actual results could differ from estimates. The amounts recorded for valuation of tangible capital assets, non-vesting employee benefit liabilities, asset retirement obligation, contingent liabilities and commitments and accruals are areas where management makes significant estimates and assumptions in determining the amounts to be recorded in the financial statements.

The town's financial assets and liabilities are measured as follows:

Financial statement component

Cash and cash equivalents

Trade and other receivables

Measurement

cost and amortized cost

lower of cost or net recoverable value

Long term receivable lower of cost or net recoverable value

Investments amortized cost

Accounts payable and accrued liabilitiescost

Securitydeposits cost

Demand loan amortized cost

Long term debt amortized cost

(e) Cash and Cash

Cash includes items that are readily convertible to known amounts of cash, are subject to an insignificant risk of change in value, and have a maturityof three months or less at acquisition.

(f)

Investments consist of amounts held in term deposit accounts with a maturity date exceeding 90 days and less than one year from the balance sheet date.

Debt charges recoverable consist of amounts that are recoverable from municipal agencies or other local governments with respect to outstanding debentures or other long-term debt pursuant to annexation orders or joint capital undertakings. These recoveries are recorded at a value that equals the offsetting portion of the un-matured long-term debt, less actuarial requirements for retirement of any sinking fund debentures.

Long-term receivables are initially measured at cost with valuation allowances subsequently used to reflect loans receivable at the lower of cost and net recoverable value. Changes in valuation allowances are recognized as expenses in the statement of operations. Interest revenue is recognized when earned, to the extent the collectibilityof the loan and interest is reasonablyassured.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS DECEMBER 31, 2024

Long term debt is initially recognized net of any premiums, discounts, fees and transactions costs, with interest expense recognized used the effective interest method. Long-term debt is subsequently, measured at amortized cost.

Over-levies and under-levies arise from the difference between the actual property tax levy made to cover each requisition and the actual amount requisitioned.

If the actual levy exceeds the requisition, the over-levy is accrued as a liability and property tax revenue is reduced. Where the actual levy is less than the requisition amount, the under-levy is accrued as a receivable and as propertytax revenue.

Requisition tax rates in the subsequent year are adjusted for any over-levies or under-levies of the prior year.

Land held for resale is recorded at the lower of cost or net realizable value. Cost includes costs for land acquisition and improvements required to prepare the land for servicing such as clearing, stripping and leveling charges. Related development costs incurred to provide infrastructure such as water and wastewater services, roads, sidewalks and street lighting are recorded as physical assets under the respective function.

Tax revenues are recognized when the tax has been authorized by bylaw and the taxable event has occurred. Requisitions operate as a flowthrough and are excluded from municipal revenue.

A liability for an asset retirement obligation is recognized at the best estimate of the amount required to retire a tangible capital asset at the financial statement date when there is a legal obligation for the town to incur retirement costs, the past transaction or event giving rise to the liability has occurred, it is expected that future economic benefits will be given up, and a reasonable estimate of the amount can be made. The best estimate of the liability includes all costs directly attributable to asset retirement activities, based on information available at year-end. The best estimate of an asset retirement obligation incorporates a present value technique, when the cash flows required to settle or otherwise extinguish an asset retirement obligation are expected to occur over extended future periods.

When a liabilityfor an asset retirement obligation is initially recognized, a corresponding asset retirement cost is capitalized to the carrying amount of the related tangible capital asset. The asset retirement cost is amortized over the useful life of the related asset. Asset retirement obligations which are incurred incrementally with use of the asset are recognized in the period incurred with a corresponding asset retirement cost expensed in the period.

At each financial reporting date, the Town reviews the carrying amount of the liability. The Town recognizes period-to-period changes to the liability due to the passage of time as accretion expense. Changes to the liability arising from revisions to either the timing, the amount of the original estimate of undiscounted cash flows or the discount rate are recognized as an increase or decrease to the carrying amount of the related tangible capital asset. The Town continues to recognize the liability until it is settled or otherwise extinguished. Disbursements made to settle the liability are deducted from the reported liabilitywhen theyare made.

Revenue from transactions with no performance obligation is recognized at realizable value when the town has the authorityto claim or retain an inflowof economic resources and identifies a past transaction or event giving rise to an asset.

Revenue from transactions with performance obligations is recognized as the performance obligations are satisfied byproviding the promised goods or services to the payer. User fees are recognized over the period of use, sales of goods are recognized when goods are delivered. Licenses and permits with a single performance obligation at a point in time are recognized as revenue on issuance, those which result in a continued performance obligation over time are recognized over the period of the license or permit as the performance obligation is satisfied.

Requisitions operate as a flowthrough and are excluded from municipal revenue.

Construction and borrowing costs associated with local improvement projects are recovered through annual special property assessments during the period of the related borrowings. These levies are collectible from propertyowners for work performed bythe municipality.

Where a taxpayer has elected to prepay the outstanding local improvement charges, such amounts are recorded as deferred revenue. Deferred revenue is amortized to revenue on a straight-line basis over the remaining term of the related borrowings.

In the event that the prepaid amounts are applied against the related borrowings, the deferred revenue is amortized to revenue byan amount equal to the debt repayment.

The Townrecognizes liabilities for post-employment benefits and compensated absences that vest or accumulate during the period in which the employment services are rendered, assuming payment of benefits is probable and the amounts can be reasonablyestimated. Accumulating, vesting benefits liabilities are measured at cost. Accumulating, non-vesting benefits liabilities are recognized at cost to the extent theyare expected to be used byemployees.

Deferred revenues represent government transfers, donations, and other amounts which have been collected, but for which the related services have yet to be performed or agreement stipulations have not been met. These amounts willbe recognized as revenues when revenue recognition criteria have been met. Interest earned on deferred revenues, reserves, and offsite levies are calculated using an average investment earnings monthly.

The Townparticipates in a multiemployer defined benefit pension plan. Contributions for current and past service pension benefits are recorded as expenses in the year in which theybecome due. See Note 19 for details of the pension plan.

Government transfers are the transfer of assets from senior levels of government that are not the result of an exchange transaction, are not expected to be repaid in the future, or the result of a direct financial return.

Government transfers are recognized in the financial statements as revenue in the period in which events giving rise to the transfer occur, providing the transfers are authorized, any eligibility criteria have been met, and reasonable estimates of the amounts can be determined.

Non-financial assets are not available to discharge existing liabilities and are held for use in the provision of services. They have useful lives extending beyond the current year and are not intended for sale in the normal course of operations. The change in non-financial assets during the year, together with the excess of revenues over expenses, provides the consolidated change in net financial assets for the year.

Tangible capital assets are recorded at cost which includes all amounts that are directly attributable to acquisition, construction, development or betterment of the asset. The cost, less residual value of the tangible capital assets is amortized on a straight-line basis over the estimated useful life as follows:

No amortization is charged in the year of acquisition and a fullyear of amortization is taken in the year of disposal. Assets under construction are not amortized until the asset is available for productive use.

Tangible capital assets received as contributions are recorded at fair value at the date of receipt and also are recorded as revenue.

Leases are classified as capital or operating leases. Leases which transfer substantially all of the benefits and risks incidental to ownership of property are accounted for as capital leases. All other leases are accounted for as operating leases and the related lease payments are charged to expenses as incurred.

Inventories held for consumption are recorded at the lower of cost determined on a specific identification basis and net realizable value.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS DECEMBER 31, 2024

Contaminated sites are a result of contamination being introduced into air, soil, water or sediment of a chemical, organic or radioactive material or live organism that exceeds an environmental standard. The liabilityis recorded net of anyexpected recoveries. A liabilityfor remediation of a contaminated site is recognized when the town is either directlyresponsible or accepts responsibilityand is management's estimate of the cost of post-remediation including operation, maintenance and monitoring.

The Townfollows the indirect method in reporting its cash flows from operating activities.

$30,361,979 $ 38,973,202

Cash includes amounts held in a chequing bank account earning interest at graduated rates ranging from the bank's prime rate less 1.55% - 1.90% (2023 - 1.45% to 1.90%) per annum. The effective rate at year end is 3.75% - 5.26% (2023 - 4.30% - 5.75%) per annum. Cash also includes amounts held in a savings account earning interest at 3.10% (2023 - 3.10%) per annum.

3.TAXES RECEIVABLE

These allocations are receivable as the Town has submitted eligible capital projects that were sufficient for the release of the capital funding.

5.INVESTMENTS

Investments are non-redeemable guaranteed investment certificates (GIC's) on deposit with the Alberta TreasuryBranch.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS DECEMBER 31, 2024

Long term receivables consist of amounts owed to the Town for the developer's portion of costs relating to a long-term construction project. The amount is receivable with interest. Effective interest at December 31, 2024 is 7.35% (2023 - 8.20%). The amount is due September 27, 2025.

To fund the 54 street construction project, The Town has a revolving demand loan available to a maximum of $2,390,000, bearing interest at prime plus 1.00% per annum, secured by a general security agreement covering all assets of the Town. The effective interest rate at year end is 6.45% (2023 - 8.20%). At December 31, 2024 $2,164,245 (2023 - $1,986,861) was borrowed against this loan. Annual interest payments are required to be made twelve months after the first advance, with periodic principal payments to be made from receipt of grant funds earmarked for this project.

This loan is associated with the long term receivable described in note 6.

The total cash payments for interest on the bank demand loan paid in 2024 was $165,570 (2023$157,974).

At December 31, 2024 the Town has a revolving demand loan available in the amount of $3,200,000 this is usable in order to fund the Clean EnergyImprovement Tax Program. This is due on demand with interest at the bank's prime lending rate plus 1.00%. The effective interest rate at year end is 6.45% (2023 - 8.20%). As of December 31, 2024 the Town has a $59,790 credit balance (2023 - $59,790).

Vacation and incentive time

The vacation and bank time liability is comprised of the vacation and overtime that employees are deferring to future years. Employees have either earned the benefits (and are vested) or are entitled to these benefits within the next budgetaryyear.

The personal time liabilityis management's estimate of the cost of sick time that has accrued to employees and willbe taken in future years as paid time off. Employees can accrue and carryover up to 320 hours (2023 - 320 hours) of sick time but are not entitled to pay-in-lieu of unused sick time upon termination of their employment. Based on historical information management expects that 37% (202334%) of the accrued sick hours willbe used.

Security deposits consist of financial deposits for private development, rental deposits and deposits on utilityaccounts.

Private development deposits are held by the Town to ensure that the development has been completed to the required specifications. Deposits are for items such as landscaping, fencing, paving and service connections.

Rental deposits are held by the Town to ensure that rental spaces and properties are left clean and in good repair after the rental period.

Utility account deposits are for rental properties where utility bills are in the tenant’s name. Utility deposits are for unpaid utilities.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS DECEMBER 31, 2024

Inflows and outflows of restricted resources during the year were as follows:

Prepaid local improvement charges are being amortized to revenue over the useful life of the corresponding debentures with a term of 5 years.

Deferred projects are funds received in advance for specific projects and will be recognized as operating revenue or capital revenue in the year the expenditure occurs.

Deferred operating revenue relates to monies received for goods or services which have not yet been delivered, and willbe recognized as revenues when provision of the goods or services is completed.

Deferred capital grants relate to government and other funding received for specific capital projects that are not yet completed, and will be recognized as revenues when the projects are completed in the case of government grants, or on the same basis as the capital asset is amortized in the case of other contributions. Deferred capital grants is comprised of:

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS DECEMBER 31, 2024

The current portion of the long-term debt amounts are $579,902 (2023 - $806,843).

Principal and interest repayments are due as follows:

Debenture debt is repayable to Alberta Capital Finance Authorityand bears interest at rates ranging from 2.03% to 4.91% per annum and mature in periods 2024 through 2047. The average annual interest rate is 3.47% (2023 - 3.78%).

Debenture debt is issued on the credit and securityof the Townof RockyMountain House at large.

The total cash payments for interest on debenture debts paid in 2024 were $342,280 (2023 - $376,034).

An advance for the Green Municipal Fund Loan of $Nil was received during the year (2023 - $194,100). Payments are $8,823 (2023 - $3,882) semi-annually including interest at 0.00% per annum. The first payment is due September 22, 2025.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS DECEMBER 31, 2024

Landfill

Pursuant to an agreement the Town has accepted partial responsibility for a post closure liability. The Townhas agreed to fund 34.5% of future closure and post closure costs of a landfill.

Closure and post-closure activities include the final clay cover, landscaping, as well as surface and ground water monitoring, leachate control, and visual inspection. A liability for the total obligation, which was incurred pursuant to the agreement, has been accrued.

Undiscounted future cash flows expected are a closure cost in year 2037 of $19,194 with annual post closure activities stating in the year 2037 of $289,886 per year, increasing at an annual inflation rate of 2.31% for 25 years to year 2061. The estimated total liability is based on the sum of discounted future cash flows for closure and post-closure activities for 25 years after closure using a discount rate of 4.91% (2023 - 5.28%) and assuming annual inflation of 2.31% (2023 - 3.50%). The Town has not designated assets for settling closure and post-closure liabilities.

The accrued liability portion is based on the cumulative capacity used at year end compared the estimated total landfill capacity. The total capacity of the site is estimated at 2.305 million cubic metres. The estimated used capacity of the landfill site is 2.305 million cubic metres. There is no estimated remaining life in years.

Post closure care is estimated to be required until 2061.

The town owns a building which contains asbestos and, therefore, the town is legallyrequired to perform abatement activities upon renovation or demolition of this building.

Abatement activities include handling and disposing of the asbestos in a prescribed manner when it is disturbed.

Undiscounted future cash flows expected are an abatement cost in year 2030 of $250,000. The estimated total liability of $250,000 is based on the sum of discounted future cash flows for abatement activities using a discount rate of 4.90% and assuming annual inflation of 2.00%. The town has not designated assets for settling the abatement activities.

Total asset retirement obligations 2024 2023

Section 276(2) of the Municipal Government Act requires that debt and debt limits as defined by Alberta Regulation 255/00 for the Townof RockyMountain House be disclosed as follows:

The debt limit is calculated at 1.5 times revenue of the municipality excluding transfers from the government of Alberta and Canada for the purposes of capital property(as defined in Alberta Regulation 255/2000) and the debt service limit is calculated at 0.25 times such revenue. Incurring debt beyond these limitations requires approval by the Minister of Municipal Affairs. These thresholds are guidelines used by Alberta Municipal Affairs to identify municipalities that could be at financial risk if further debt is acquired. The calculation taken alone does not represent the financial stability of the municipality. Rather, the financial statements must be interpreted as a whole.

Total debt includes long-term debt less debt charges recoverable. Debt servicing includes principal and interest payment due on long-term debt in the 12 months subsequent to year-end less amounts that are recoverable.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS DECEMBER 31, 2024

Accumulated operating surplus consists of internally restricted and unrestricted amounts and equity in tangible capital assets as follows:

The Townof RockyMountain House administers the following trust: 2024 2023 CemeteryPerpetual Care

In 2014 the Town entered into a financial contribution agreement with the Rocky Curling Club (the "Club") wherebythe Club agreed to contribute a total of $1,500,000 toward renovations to the curling rink building. In 2018 the Town also advanced the Club $37,100 for exterior renovations. The balance receivable is measured at cost. Annual payments are due in November of each year. There are no terms regarding interest, forgiveness nor security. In 2020, the annual receipt from the curling club was deferred. In 2022 this agreement was extended to a 15 year period. The future receipts under this agreement are detailed in the table below. Pursuant to a cost sharing agreement, Clearwater Countywill pay50% of anyamounts defaulted bythe Club.

On January 1, 2021 a new agreement between the Town and Clearwater County was signed for the period January 1, 2021 to December 31, 2025. The County committed to make annual payments to the Town calculated as (Town Service Property Tax - County Service Property Tax) x County percentage. In 2024 the payment is $405,230 (2023 - $426,300).

In 2010, the Town and Countyas joint landlords entered into a triple net lease agreement for the lease of a municipally owned building. The monthly payment of $9,243 is shared 50% between the Town and County. The Town's share of the monthly lease payment is $4,621. Estimated maximum future receipts under this agreement are:

(Continued)

Contractual Obligations

RCMP Contract

On April 1, 2012 the Town entered into an agreement with the Government of Canada for the employment of the Royal Canadian Mounted Police to provide policing services during the term of the agreement which ends March 31, 2032. The policing services expenses for 2024 are $2,656,970. (In 2023 the Town recognized $2,528,484). The Town received Provincial grants to assist with the cost sharing in the amount of $354,120. (In 2023 the Townrecognized $353,080).

Lawsuits

From time to time, the Town is a defendant in various lawsuits. When the outcome of a claim against the Town is considered likely to result in a loss and the amount of the loss can be reasonablyestimated, accrued liabilities have been recorded. When the resulting potential losses, if any, cannot be determined or the occurrence of future contingent events is unknown, accrued liabilities have not been recorded.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS DECEMBER 31, 2024

Disclosure of salaries and benefits for municipal officials, the chief administrative officer and designated officers as required byAlberta Regulation 313/2000 is as follows:

1. Salary includes regular base pay, bonuses, overtime, lump sum payments, gross honoraria, compensated absences and anyother direct cash remuneration.

2. Benefits for Council include a communication benefit for cell phones, Internet and CPP deductions. Benefits for the CAO includes employer's share of all employee benefits and contributions or payments made on behalf of employees including pension, health care, dental coverage, vision coverage, group life insurance, accidental disability and dismemberment insurance, short-term disabilityplans, professional memberships and tuition.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

DECEMBER 31, 2024

Employees of the Town of Rocky Mountain House participate in the Local Authorities Pension Plan (LAPP), which is covered by the Alberta Public Sector Plans Act. The Plan serves about 304,451 people and about 444 employers. It is financed by the employer and employee contributions and investment earnings of the LAPP Fund.

Contributions for current service are recorded as expenditures in the year in which theybecome due.

The Town is required to make current and past service contributions to the LAPP of 8.45% (20238.45%) of pensionable earnings up to the year's maximum pensionable earnings under the Canada Pension Plan and 11.65% (2023 - 12.23%) on pensionable earnings above this amount. Employees of the town are required to make current service contributions of 7.45% (2023 - 7.45%) of pensionable salary up to the year's maximum pensionable salary and 10.65% (2023 - 11.23%) on pensionable salary above this amount.

Total current and past service contributions by the Town to the Local Authorities Pension Plan in 2024 were $492,544 (2023 - $476,560). Total current and past service contributions by the employees of the Townto the Local Authorities Pension Plan in 2024 were $438,476 (2023 - $424,689).

The LAPP discloses an actuarial surplus at year end. The 2024 numbers were not available at the time of preparing these financial statements. (2023 - $15.057 billion surplus).

For further information of the amount of LAPP deficiency/surplus information see: www.lapp.ca/page/annual-reports.

20.CONTAMINATED SITES LIABILITY

The town did not identifyanyfinancial liabilities (2023 - nil) as a result of contaminated sites. 21.SEGMENTED DISCLOSURE

The Town of Rocky Mountain House provides a range of services to its ratepayers. For each reported segment, revenues and expenses represent both amounts that are directly attributable to the segment and amounts that are allocated on a reasonable basis. The accounting policies used in these segments are consistent with those followed in the preparation of the financial statements as disclosed in note 1.

Refer to the Schedule of Segmented Disclosure (schedule 6).

General government includes council and other legislative, and general administration. Protective services includes bylaw enforcement, police and fire. Transportation includes roads, streets, walks and lighting. Planning and development includes land use planning, zoning and subdivision land and development. Public health and welfare includes familyand communitysupport. Recreation and culture includes parks and recreation, libraries, museums and halls. Environmental use and protection includes water supplyand distribution, wastewater treatment and disposal, and waste management.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS DECEMBER 31, 2024

22.BUDGET RECONCILIATION