Council measures its performance in its Annual Report in terms of progress made in implementing the Corporate Plan.

The Annual Report provides information about Townsville City Council and delivery of:

Townsville 2021–2026 Corporate Plan

Budget and Operational Plan 2024/25, including Water and Resource Recovery Performance Plans.

In accordance with section 45(b) of the Local Government Act 2009, Council has established commercial business units for its significant water and resource recovery business activities.

Council reports its performance by publishing:

Townsville Dashboards

Quarterly Performance Reports

Annual Report

Ordinary Council Reports.

Council’s strategies and plans include:

Townsville 2021–2026 Corporate Plan: Outlines the city’s shared vision for Townsville and the key issues and priorities for Council over the next five years and beyond

Budget and Operational Plan 2024/25: Council’s annual plan to allocate resources to deliver specific projects, activities and events in pursuit of the Corporate Plan goals

Townsville City Plan: Sets the direction for development and growth over the next 25 years

Strategic Asset Management Plan: Articulates the Asset Management System Model, Asset Management Framework and Asset Management Capability Delivery Model for Council

Townsville City Deal: A 15-year commitment between the Australian Government, Queensland Government and Townsville City Council to work together to plan and deliver transformative outcomes for Townsville and its residents.

This Annual Report is part of Council’s commitment to open, transparent and accountable governance. It identifies community service delivery and demonstrates how Council is meeting its strategic objectives.

Where to get a copy of this Annual Report 2024/25

Our reports are available to view in full, as a flipbook, at Council’s website. Go to https://www.townsville.qld.gov.au/about-council/corporate-information

Feedback on this report

We welcome our community’s feedback on this Annual Report for 2024/25. Please send feedback to enquiries@townsville.qld.gov.au

Thisyearhasbeenoneofmomentum,drivenby advocacyandcollaboration.

Ourcity'svibrancyhasbeenondisplay,withevents liketheNTI500Supercars,world-classexhibitionsat ourartgalleriesandthebiennial'OurTownsville' festival,whichalonedrewacrowdof38,000people. TheannouncementthatTownsvillewillhostfour RugbyWorldCupmatchesin2027aswellassailing andfootballaspartofthe2032Olympicsreinforces ourreputationastheEventsandSportsCapitalof theNorth.

Council’snewCorporatePlan,adoptedinFebruary 2025aftercommunityconsultation,willguidethe city’sgrowthandplanningduringthenextfiveyears.

Deliveringonourcommitmenttocoreservices,the Councilinvestedover$193millionintocapitalworks, includingroadinfrastructureandmaintenance, footpathrenewalsandimprovementstothewater andwastewaternetworks.

Welookedtothefuturewithreviewsofour TownsvilleCityPlandesignedtosupportbuilding andlandusedecisionsthatkeepourcommunitysafe andimprovefloodresilience.Thisworkalsoincluded areviewoftheLocalGovernmentInfrastructurePlan andtheimplementationoftheLocalHousingAction Plan.TheseplansensureTownsvillegrowsinaway thatprotectswhatweloveaboutourlifestyle,while supportingpopulationgrowthandcreatingnew opportunities.

Everysuccesshasbeentheresultofcollaboration betweenCouncil,communityandourstrategic partners,andIamproudofwhatwehaveachieved together.

Movingforward,ourfocuswillremainonlong-term financialsustainabilitywhiledeliveringthecore servicesthatmattermosttoourcommunity.

Cr Ann-Maree Greaney Acting Mayor

As CEO of Townsville City Council, I am proud to present the 2024/25 Annual Report.

Over the last twelve months our region saw accelerated development activity, with strong growth in approvals and construction driving economic confidence. Council implemented our Housing Incentives and City Activation Policy, which stimulated further investment and supported housing availability, while also rolling out our Local Housing Action Plan.

Townsville recorded its wettest year on record with rainfall and widespread flooding testing our city’s resilience. The development of the Event Specific Local Recovery Action Plan provides a clear path for recovery, ensuring affected communities are supported and essential services restored quickly.

We continued to focus on financial sustainability, operational efficiencies and maintaining over $10 billion worth of assets, including roads, water and wastewater infrastructure, while too recovering from a record-breaking weather event.

Looking ahead, innovation and strategic partnerships are set to drive greater efficiencies and create better value from every dollar spent in Council’s 2025/26 Budget and Operational Plan.

A major change is moving to a three-year rolling capital plan, which will allow for smarter scheduling and provide flexibility in responding to emerging and shifting community needs.

This has been a year of significant progress, and I would like to thank our Councillors and Council staff for their dedication to both serving our community and realising our goal to grow Townsville.

As we move through the next financial year, I am confident we are on the right path. Together, we will continue building a globally connected community driven by lifestyle and nature.

JoeMcCabe ChiefExecutiveOfficer

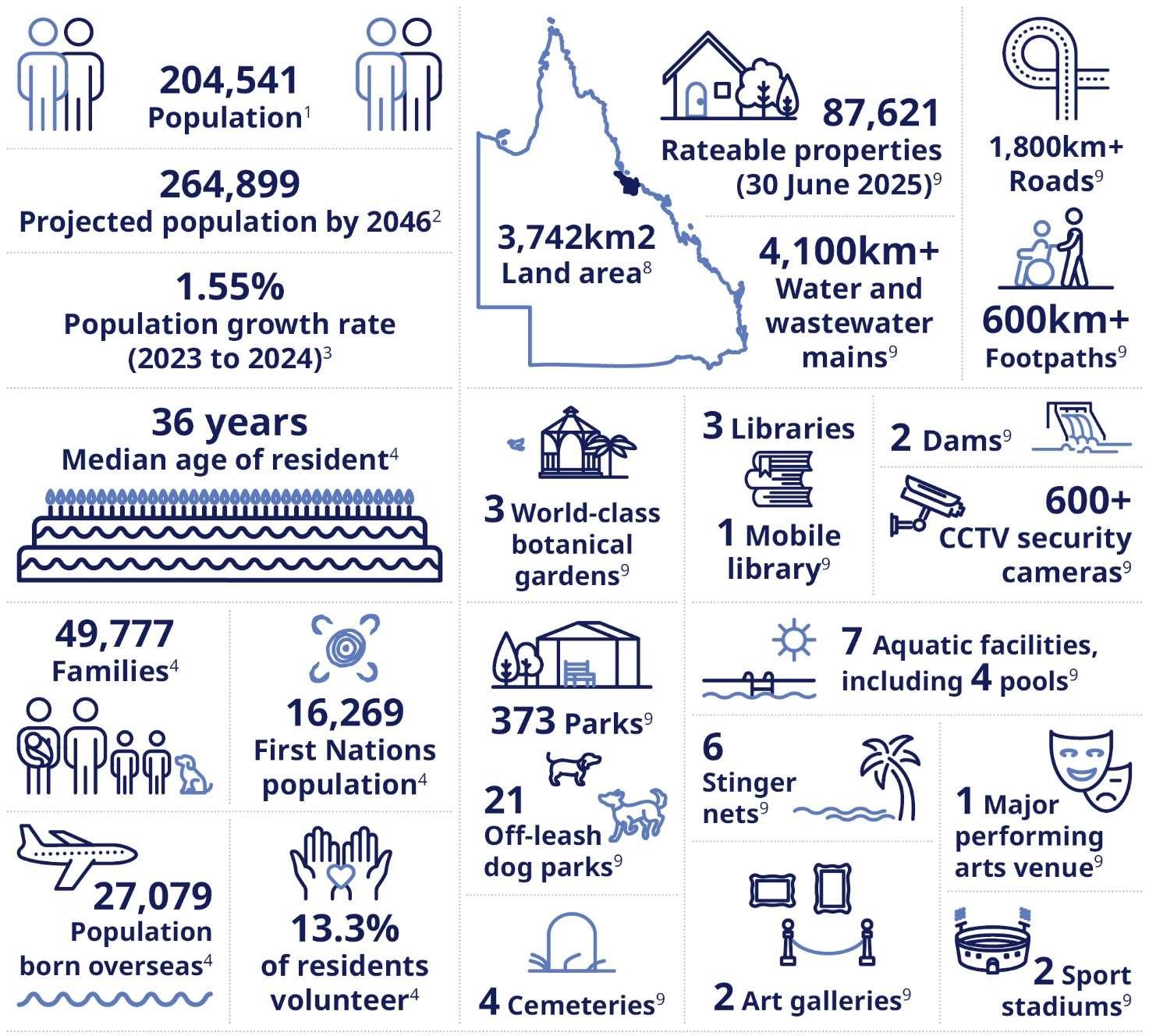

Population 1

Projected population by 20462 1.55% Population growth rate (2023 to 2024)3 36 years Median age of resident4 49,777 Families4 00

Population born overseas4

(2023-24}5

Libraries

Mobile library9

Rateable properties 1,800km+ Roads9 Land area8 3 World-class botanical gardens9 373 Parks9

t=f' Off-leash )})tr dog parks9

Dams9 _l~ 600+ CCTV security cameras9

Aquatic facilities, including 4 pools9

?~ Stinger V~ 1 Majo~ nets9 --.=~::~:::•,::~J l performing arts venue9

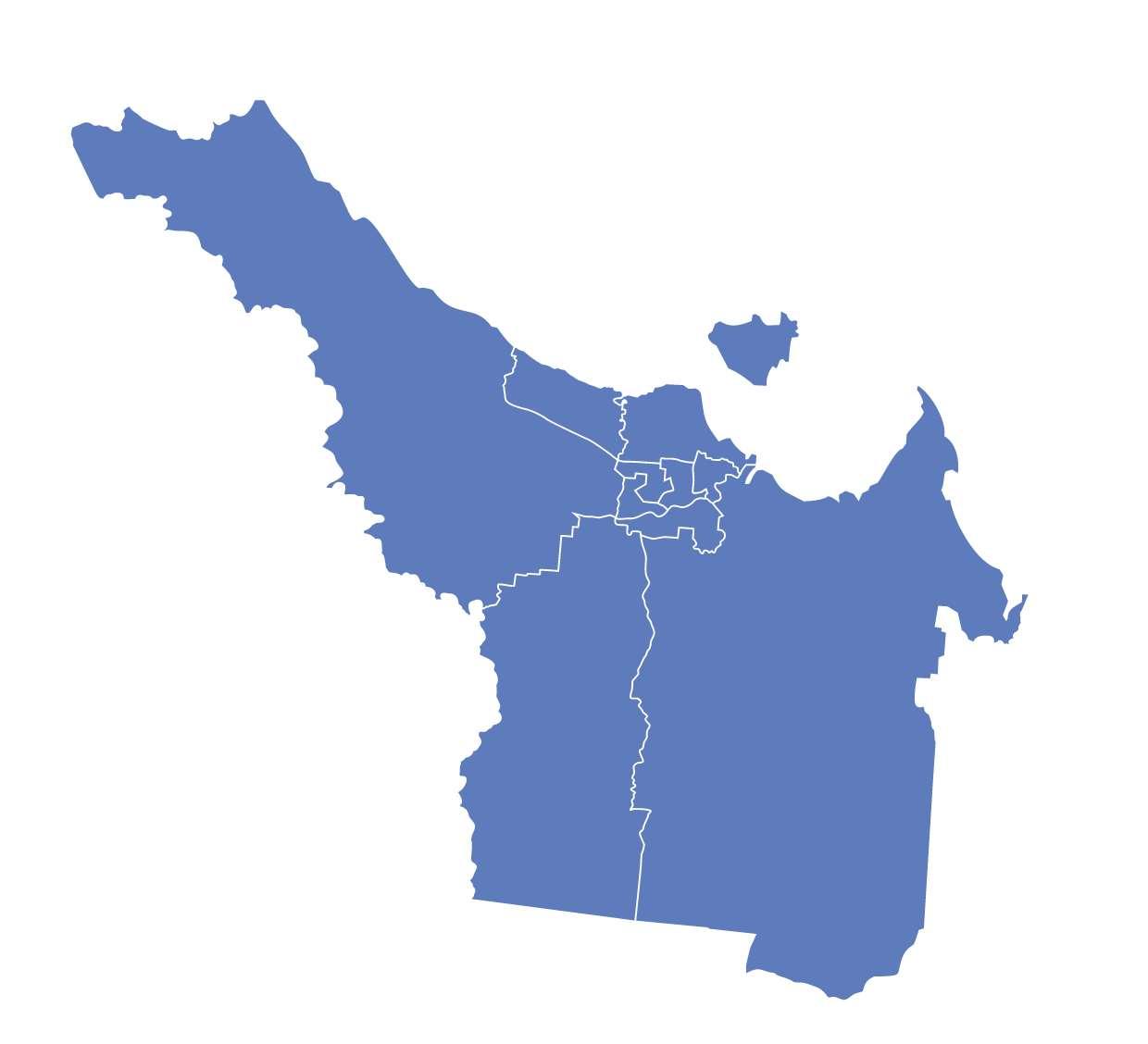

Total Land Area: 374,201 ha

Estimated Population (2024): 204,541

Population Density: 0.54 persons per hectare

DIVISION1

Population:22,792

DIVISION3

Population:19,966

DIVISION2

Population:22,465

DIVISION5

Population:19,341

DIVISION6

Population:21,349

DIVISION4

Population:20,018

DIVISION10

Population:20,732

Source:AustralianBureauofStatistics,EstimatedResidentPopulationat30June2024.

DIVISION9

Population:18,153

DIVISION7

Population:20,434

DIVISION8

Population:19,291

Council invests ratepayers’ rates and utilities back into our community. In 2024/25, every $100 was spent on the following infrastructure and service costs.

Council’s operating result for the 2024/25 financial year was a reduced deficit of $3 3 million. This compares to a forecast deficit of $4.2 million reported in June 2025 with the adoption of the 2025/26 budget. The improvement in Council’s financial position further supports the long-term forecast to return to a surplus by 2026/27.

Townsville City Council spent $550.8 million this year to provide services and facilities to more than 200,000 residents. We managed $7.5 billion of assets including roads, bridges, drains, land, recreation and leisure facilities, libraries and parks for the benefit of the local and visiting community.

We generated $615 million in income to fund services and facilities via rates and utilities on properties, government grants, interest on investments and fees and charges. This income is then spent on construction, maintenance, wages, borrowing costs and other operating costs to provide services to the community like libraries, parks, pools, art galleries and waste facilities.

This report provides an explanation of Council’s Financial Statements in an easy-to-understand format. It helps our community, customers, partners and employees understand how Council has performed financially this year.

The Statement of Comprehensive Income shows Council’s net result for the 2024/25 financial year, calculated using the formula: Total Income less Total Expenses equals Net Result.

Council reported a net result of $64.2 million. Primarily driven by grants received for the construction of infrastructure assets.

Council’s operating result is calculated using the formula: Total operating revenue less Total recurrent expenses.

Incomeisreceivedfromratesandutilitychargeson residential,businessandindustrialproperties,fees andchargesfromCounciloperations,Stateand Federalgrants,interest,developerandother contributions.

Ratesandutilitiescontinuetobethemajorsourceof incomeforthedeliveryofCouncilservicesand infrastructuretoourcommunity.Councilcontinues tofocusonlong-termplanningandongoingrenewal andmaintenanceofinfrastructuretokeepaverage ratesincreasestoaminimum.

Council’stotaloperatingincomeincreasedby13.7% fromtheprioryearlargelydueto:

increasesacrossratesandutilitycharges

removalofearlypaymentdiscountfornonprincipalplaceofresidencepropertiesand

increaseincommercialtonnagesatthe landfill.

Council’sexpensesareforemployeecosts,materials, utilities,services,depreciationandfinancingcoststo delivercommunityservices.Thefollowing informationcoversoperationalspendingascapital spendingisaddedtothevalueofassetswhen incurred.

Depreciationandamortisationrepresentan allocationoftheuseorwearandtearoverthe expectedlifeoftheasset.CouncilhasdetailedAsset ManagementPlanstoensurethebestvalueand longestlifeisachievedforeachasset.

Council’stotaloperatingexpenseshaveincreasedby 1.6%fromtheprioryearlargelyduetoadditional costsfordisasteroperationsandrecoveryworks relatedtoJanuaryrainevent,offsetbylessoccupied positionsduringtheyear.

Graph3-OperatingExpenses2024/25

The Statement of Financial Position shows what Council owns (assets), what Council owes (liabilities) and Council’s net worth. Table 1 – 2024/25 financial position

Graph4-Councilassets-5yeartrend

Council’sassetsincludeinfrastructure,cash,unpaid ratesandotheramountsowedtoCouncil.

Council’slargestassetcomponentisinfrastructure whichincludesroads,pipesandbuildingsthat benefittheTownsvillecommunity.

ThevalueofCouncil’stotalassetshasincreasedfrom theprioryearby$365.6million.Themovementwas largelyattributedtoinvestmentincapitalprojects combinedwithanincreaseinthefairvalueofpipe networkassets.

Council’sliabilitiesincludemoneyborrowedfrom QueenslandTreasuryCorporation,unpaidsupplier invoices,amountsowingtoemployeesforleave entitlementsandprovisionsforfuturelandfill capping.

Council’stotalliabilitieswere$672.5millionasof30 June2025,ofwhich$429.0millionrelatestoloans fromQueenslandTreasuryCorporation(Queensland Governmentownedlendingagency).

Totalliabilitiesincreasedby$97.9millionfromthe previousyear,whichisprimarilyrelatedtoan increaseinborrowingsandunspentgrantfunding.

TheStatementofChangesinEquitydetailsthechangesinCouncil’sretainedearningsoverthereportingperiod andprovidesamoredetailedpresentationofthecommunityequityshownintheStatementofFinancialPosition.

CommunityequityisrepresentedbyCouncil’snet worth:whatCouncilowns(totalassets)minus whatCouncilowes(totalliabilities).

Communityequityasof30June2025was$6.9 billion,whichis$267.7millionhigherthanthe previousyear.

Graph5showstheamountof Council’s communityequityoverthelastfiveyears.

Graph5–Communityequity: five-yeartrend

COUNCIL’S CASH COMES FROM AND WHERE IT GOES

TheStatementofCashFlows showsCouncil’scash inflowsandoutflows.

ThisstatementshowsCouncil’sabilitytopayitsbills tocontinuenormaloperations,payoffitsdebtsand havemoneyavailableforthe constructionofassets. Graph6showstheamountof Council’scash holdingsattheendofeachfinancialyear,overthe lastfiveyears.Cashbalancesareinfluencedby timingofgrantfundingreceived,thedeliveryof largeinfrastructureprojectsanddrawdownof borrowings.

Graph6–Councilcashholdings: five-yeartrend

Section 176 of the Local Government Regulation 2012 requires Council to report on specific financial sustainability ratios:

Operating surplus ratio

Operating cash ratio

Unrestricted cash expense cover ratio

Asset sustainability ratio

Asset consumption ratio

Asset renewal funding ratio

Council controlled revenue ratio

Population growth ratio

Leverage ratio

The results of these ratios calculated in accordance with the Financial Management (Sustainability) Guideline 2024 are shown in the Current Year and Long-Term Financial Sustainability Statements that follow the Financial Statements. The graphs below show historical ratio values for the current and last four financial years as well as the five-year average.

The operating surplus ratio measures the extent to which revenue raised covers operational expenditure.

A ratio of -0.6% in 2024/25 indicates Council’s operating expenses were marginally greater than its operating income received. Council has a plan to improve and strengthen its short and long-term financial position.

The operating cash ratio is a measure of Council’s ability to cover its core operational expenses and generate a cash surplus excluding depreciation, amortisation and finance costs.

A ratio of 30.2% in 2024/25 indicates Council is generating sufficient cash to fund operating activities.

Graph7-Operatingsurplusratio

2020/212021/222022/232023/242024/25

Graph8-Operatingcashratio

2020/212021/222022/232023/242024/25

The unrestricted cash expense cover ratio is an indicator of the uncommitted cash available to Council to meet ongoing and emergent financial demands.

Council achieved a ratio of 5.8 months in 2024/25. Council forecasts continued improvement as we strengthen our shortand long-term financial position.

The asset sustainability ratio approximates the extent to which the infrastructure assets managed by Council are being replaced as they reach the end of their useful lives.

The result of 35.4% reflects deferral of renewal projects to the 2025/26 financial year, driven by prioritisation of new and major projects as well as reallocation of resources to natural disaster recovery efforts.

The asset consumption ratio approximates the extent to which Council’s infrastructure assets have been consumed compared to what it would cost to build a new asset with the same benefit to the community.

The result of 65.8% indicates that Council’s assets are being consumed in line with their estimated useful lives.

The asset renewal funding ratio measures the ability of Council to fund its projected infrastructure asset renewal/replacements in the future.

A ratio of 93.9% in 2024/25 indicates Council is appropriately funding and delivering on the required capital program.

There are no targets specified for this ratio.

Graph9-Assetsustainabilityratio

2020/212021/222022/232023/242024/25

Council- controlled revenue is an indicator of Council’s financial flexibility, ability to influence its operating income, and capacity to respond to unexpected financial shocks.

The result of 89.4% indicates that Council is able to consistently generate operating revenue from rates, levies and charges.

There are no targets specified for this ratio.

Population growth is a key driver of Council’s operating income, service needs and infrastructure requirements into the future.

The result of 1.7% indicates that there is a net migration increase in the Townsville local government area.

There are no targets specified for this ratio.

The leverage ratio is an indicator of Council’s ability to repay its existing debt. It measures the relative size of Council’s debt to its operating performance.

A ratio of 2.6 times in 2024/25 indicates Council has generated sufficient cash to meet its debt obligations.

Council borrowings are assessed and approved through a separate process coordinated jointly by Queensland Treasury Corporation and the Department of Local Government, Water and Volunteers. Multiple factors and metrics are taken into consideration through the borrowings process.

Graph11-Council-controlledrevenue

2020/212021/222022/232023/242024/25

Graph12-Populationgrowth

2020/212021/222022/232023/242024/25

Graph13-Leverageratio

globally connected community driven by 'estyle and nature

row Townsville

A globally connected community driven by lifestyle and nature OUR Grow Townsville OUR ROLE

Council’s commitment to excellence in delivery of our everyday services, underpins our success.

Juncil's commitment to excellence delivery of our everyday services, nderpins our success

From new hires to experienced leaders, our employees are the essence and core of Townsville City Council. Our team culture and identity is based on our internal core values, SERVE.

om new hires to experienced aders, our employees are the :sence and core of Townsville City )uncil. Our team culture and entity is based on our internal core 1lues, SERVE.

Safety - Everyone goes home safe today and every day.

Excellence - We exceed expectations and get it right every time

Respect - We respect all people, their cultures and our environment - always.

for tomorrow.

Value - Today we create value for tomorrow.

Enjoyment - We work together to innovate, create and have fun.

Acitythatconnectsyoutowhatyouneedat thetimeyouchoose.

AsTownsvillegrows,theabilitytoparticipatein activitiesoraccessserviceshasprogressedpastthe traditional9amto5pmhours.Townsvillewill continueitsjourneytobeingaSmartCity,which focusesonenhancingtechnologythatmakeslife easier,providesaccesstoinformationeasierandis moreintuitivetopeople’sneeds.

1.1AphysicallyanddigitallyconnectedSmartCity

1.2Acitythatfacilitates24-houraccesstoservices

1.3Avibrantcitycentredaroundinclusiveconnected neighbourhoods

Achievements&Challenges

Replaced4,200watermeterswithsmartwater meters.

Launchedanewmobilelibraryvantoprovide accesstolibraryservicesacrossthecity.In additiontolendingbooks,themobilelibrary offersprogramsandactivitiessuchasbook clubs,Storytimesessionsanddigital technologyclasses.

LaunchedTownsvilleCityLibraries’newapp makingiteasiertoexplorethelibrary anywhereandanytime.Thisappallowslibrary memberstousetheirphonetotapand borrowbooks,reservebooks,managetheir family’saccount,accesstheirdigitallibrary cardandmore.

Replacedmorethan300metresofscenic footpathalongCapePallarendaRoadbetween PallarendaandRowesBay.

CouncilsecuredanAustralian-firstpartnership withARIO,introducing200futuristic,threewheeledelectricscootersacrossTownsville andMagneticIsland.

IntroductionoftwonewCoastSnapstandsat NellyBayandGeoffreyBaytogivevisitorsa chancetosnapaphotoofthecoastlineto monitorchangestothebeaches.Thiswill enableCouncilandlocalorganisationslike Envitetocollectdataonthewaysinwhichour coastlinesarechangingovertime.

Acirculareconomythatadvancesbusiness andmovestowardszerowaste.

Thecirculareconomymodelreusesandrecycles wastebackintoothervaluableproductsasopposed tolandfill.Alsoparamounttothetransitionofa circulareconomyissupportinglocalbusinesses throughCouncilprocurement.

2.1Zerolandfillby2030

2.2AcarbonneutralCouncilby2040

2.3Procurementthatencouragesbusinessinnovationand circulareconomyprinciples

Increasedourrenewableenergylightfleet vehiclesto31–anincreaseof10fromthe previousfinancialyear.

CouncilpartneredwithUPPAREL,an Australianleaderintextilerecoveryand recycling,toturnolduniformitemsintoa materialcalledUPtexwhichisusedforthings likehomewares,signageandacoustic panelling.

LaunchedanewtrialfortheContainersfor Changeprogram.With50designated collectionpointsatTheStrandandJezzine Barracks,thisinitiativeallowsforresidentsto collecteligiblebeveragecontainersandtake themtoContainersforChangefora10-cent refund.

Forthethirdyear,Councilinitiatedthe50per centrebate(uptoamaximumof$300)on eligiblepurchasesofreusablenappies, incontinenceandperiodproductstohelp reducewastetolandfill.

Townsvillewasrecognisedontheworldmap foritsforward-thinkingpracticesinlocal government,withCouncil’slow-cost environmentalsensorslandingaspotonthe GreenDestinations’Top100Stories2024.

The hub for modern industry.

Attracting industries of the future and world class research and education opportunities will drive population growth and retain our valuable residents. To be competitive, Townsville must have sites ready to de-risk investment, providing positive economic impact to local industries, both directly and indirectly.

3.1 Enabling development ready sites that attract industry, de-risks investment and value adds to supply chains

3.2 Supporting the establishment of renewable energy sources to facilitate green industry

3.3 Lead economic transition that supports future industries and business establishment in Townsville

Townsville’s Gross Regional Product (GRP) grew by 2% from 2023 to 2024 (calendar year).

The rejuvenation of the historic North Rail Yards site has commenced and is ongoing, which includes remediation of the site and stabilisation of the heritage buildings.

The Lansdown Eco-Industrial Precinct continues to gain momentum, with multiple proponents signing Options to Lease and progressing their projects through early feasibility stages toward Development Application lodgement. Council has also commenced construction of enabling road infrastructure, laying the groundwork for future industrial growth.

Significant increase in development in 2024/25 relative to 2023/24, with highlights being –

o Residential Lots Endorsed (POS): 2023/24 – 448 – 2024/25 – 832

o Residential Lots by Approved Development (RAL): 2023/24 – 392 – 2024/25 - 1328

o Detached Dwelling Approvals: 2023/24 – 575 – 2024/25 – 808

o Total Investment in Residential Development: 2023/24 - $321m – 2024/25 - $479m

o Commercial Building Investment: 2023/24 - $242m – 2024/25 - $288m

Development and launch of Council’s new Planning and Development website, a onestop shop for builders and developers to find everything they need to know about planning and development in Townsville.

Asustainabledestinationthatembracesand participatesinthearts,sports,eventsand recreationalactivities.

Townsvillehasworldleadingopenspaces,withover 180kmofcoastlineconnectedtotheGreatBarrier Reef,threebotanicalgardens,parksandparklands acrossthecityandnumerousheritageassets.Itis importantthatthecommunitycanaccessthese spaces,whilebalancingprotectionofthe environmentalandheritagefeatures.Toretain residentsofallages,wearefocusedondeveloping ourlocalvisualandperformingarts,growingour successfulsignatureeventsandconnectingpeople withsportingorganisations.

4.1Growingthecitythroughworldleadingplacemaking thatprovidesanationalandinternationalplatform

4.2Growingtheopportunitiestoparticipateinsportand supportsportingexcellence

4.3Developinghomegrownentertainmentandarts culturesupportedbyworld-classvisualand performingartsfacilities

4.4World-classliveabilitythroughexcellentopenspaces whichpromote,protect,andencourageutilisationof ournaturalenvironmentandheritage

Achievements&Challenges

Populationgrowthof1.55%.

RefurbishmentoftheStrandwaterpark includingafreshcoatofpaint,mechanical overhaulandrecertification.

ALIVEsitewasactivatedatRiverwayovertwo weekendsfortheParisOlympicsandaLIVE screenatStrandParkfortheParalympic Games.

CompletedtheJezzineBoardwalkplatform deckingupgradewhichprovidesavisual boostandsafeandcomfortablesurfacefor visitorstouse.

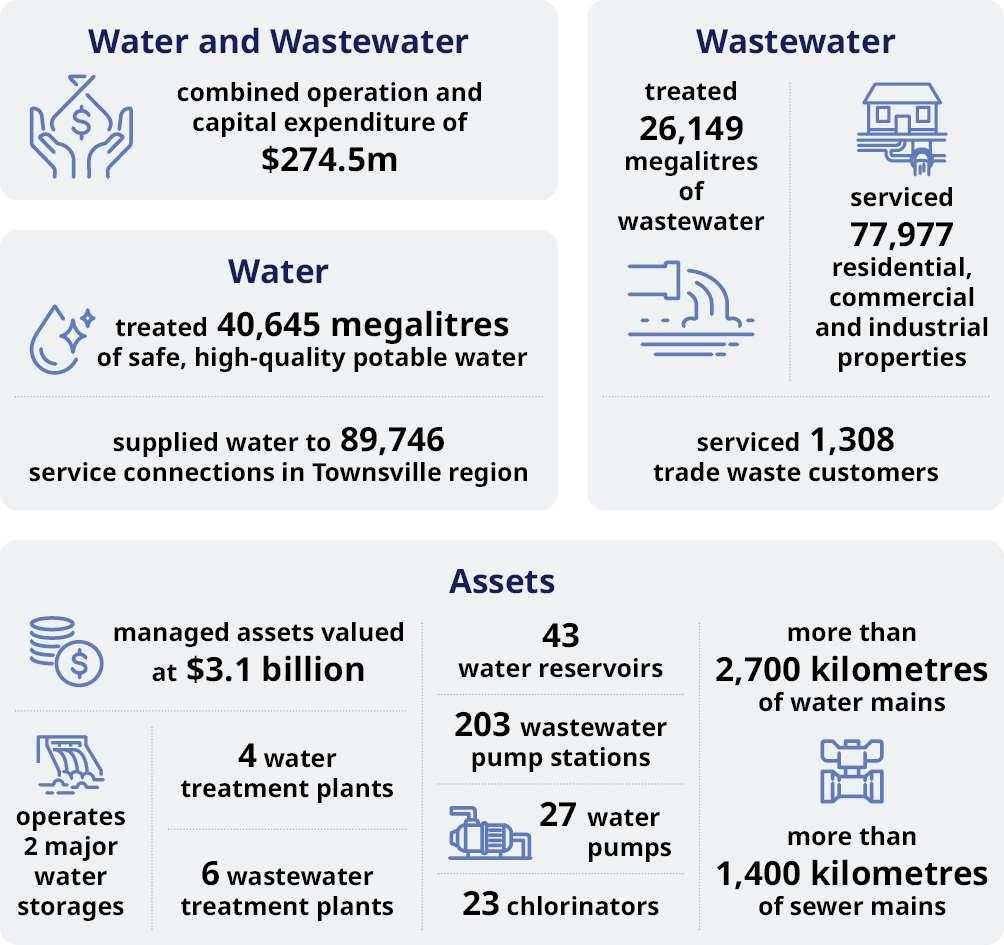

Completionofthenewpipelinespanning almost10-kilometresfromRossRiverDamto Council’sDouglasWaterTreatmentPlantto providelong-termwatersecurityforthecity.

Held14CitizenshipCeremoniesthroughout theyear.

EcoFiesta2024drewover10,000attendees andcelebratedsustainabilitythroughvibrant communityengagement,aligningwiththe3 forBeesprojectandabutterfly-themed activation.Byshowcasingeco-conscious businesses,localcreatives,andemerging filmmakers,theeventreinforcedTownsville’s visionofbecomingathriving,environmentally awaredestination.

RossRiverDamofficiallyopenedforlandbasedrecreationalfishing.Tosupportthis initiative,Councilconstructednew infrastructure,includingan85-metreconcrete footpathleadingfromthedamwalltothe water’sedgeandaccessstairswere constructed.

AnewpartnershipbetweenCounciland TownsvilleEnterpriseformedtofacilitatethe attractingandmanagingoffuturemajor eventstoTownsvilleEnterprise.

CouncilsubmittedtopprioritiestotheState Government’s100-dayreviewintoOlympic andParalympicGamesinfrastructure,which includedanewarenaandupgradestothree sportingprecincts.

Councilapprovedanewover-50slifestyle resortwithupto294sites,swimmingpool, tenniscourt,clubhouseandwellnesscentrein BohlePlains.

AdoptionofthenewCommunitySafetyand WellbeingPlan2025-2030.Thisplanoutlines thecoordinatedroadmaptotacklekeysafety issuesacrossthelocalgovernmentarea.

On19February2025,Counciladoptedanew five-yearCorporatePlan–Townsville20252029–thatsetsoutfourgoals:

oGoal1–ACityforEveryone

oGoal2–ASustainableandResilientCity

oGoal3–AFuture-readyCity

oGoal4–AWell-managedCity Townsville2025-2029isavailableonCouncil’s websiteandtookeffecton1July2025.

CouncilendorsedtheTownsvilleCity BiosecurityPlan2025-2030whichprovidesa coordinatedapproachtothemanagementof pests,plantsandanimalswithinTownsville.

PercTuckerRegionalGallerylaunchedthe worldpremiereoftheWedgwood:Artistsand Industryexhibition,directfromtheUK’s VictoriaandAlbertMuseum.Theexhibition connectedlocalartistsandbusinessestothe Wedgwoodexperience,offeringaonce-in-alifetimeeventfortouristsandlocalsalike.

EndorsedtheLocalHousingActionPlan20242027.ThisplanidentifiesactionsCouncilcan taketosupportdeliveryofhousing throughoutTownsville.

CarolsbyCandlelight2024welcomed15,000 attendeesforafestivenightoflocal performancesandfamilyfun,reinforcing Townsville’svibrantartsandeventsscene.

NewYear’sEve2024drewover29,000people acrossthreelocations–TheStrand,Riverway andNellyBay,celebratingwithfireworksand entertainmentthatshowcasedTownsville’s dynamicandinclusivecommunityspirit.

A leading centre of education, training and research commercialisation.

Townsville already stands as an education and research leader, with worldwide recognition for its marine science and management of the Great Barrier Reef, leading tertiary hospital in Northern Australia and ground-breaking research in tropical science with TropiQ. Research commercialisation will create jobs and demonstrate new pathways for school leavers, develop local industry and supply chains, and support Defence initiatives.

5.1 Formalising partnerships with industry, research institutes and all levels of government to support growth, innovation and resilience across the economy

5.2 A world-leading centre of research commercialisation that drives local manufacturing

5.3 A specialist leader in research and simulation

Achievements & Challenges

Townsville Citylibraries delivered nine Deadly Digital workshops for the First Nations community to preserve and share cultural knowledge for generations to come.

Successfully led local disaster coordinated response through the January-February significant rainfall event.

Facilitated the delivery of 20 disaster management modules as part of the Queensland Disaster Management Training Framework (QDMTF).

Delivered four disaster management exercises for the Townsville Local Disaster Management Group (TLDMG) and Local Disaster Coordination Centre (LDCC).

Hosted two international delegations from Papua New Guinea and Vanuatu to deliver disaster management training and information.

Delivered and participated in six disaster management workshops.

Activated the LDCC on three occasions for operational support to the TLDMG.

The Animal Care and Adoption Centre provided a training platform for fifth year veterinary students to undertake practical experience and placement. This has been an arrangement that has been occurring for over five years.

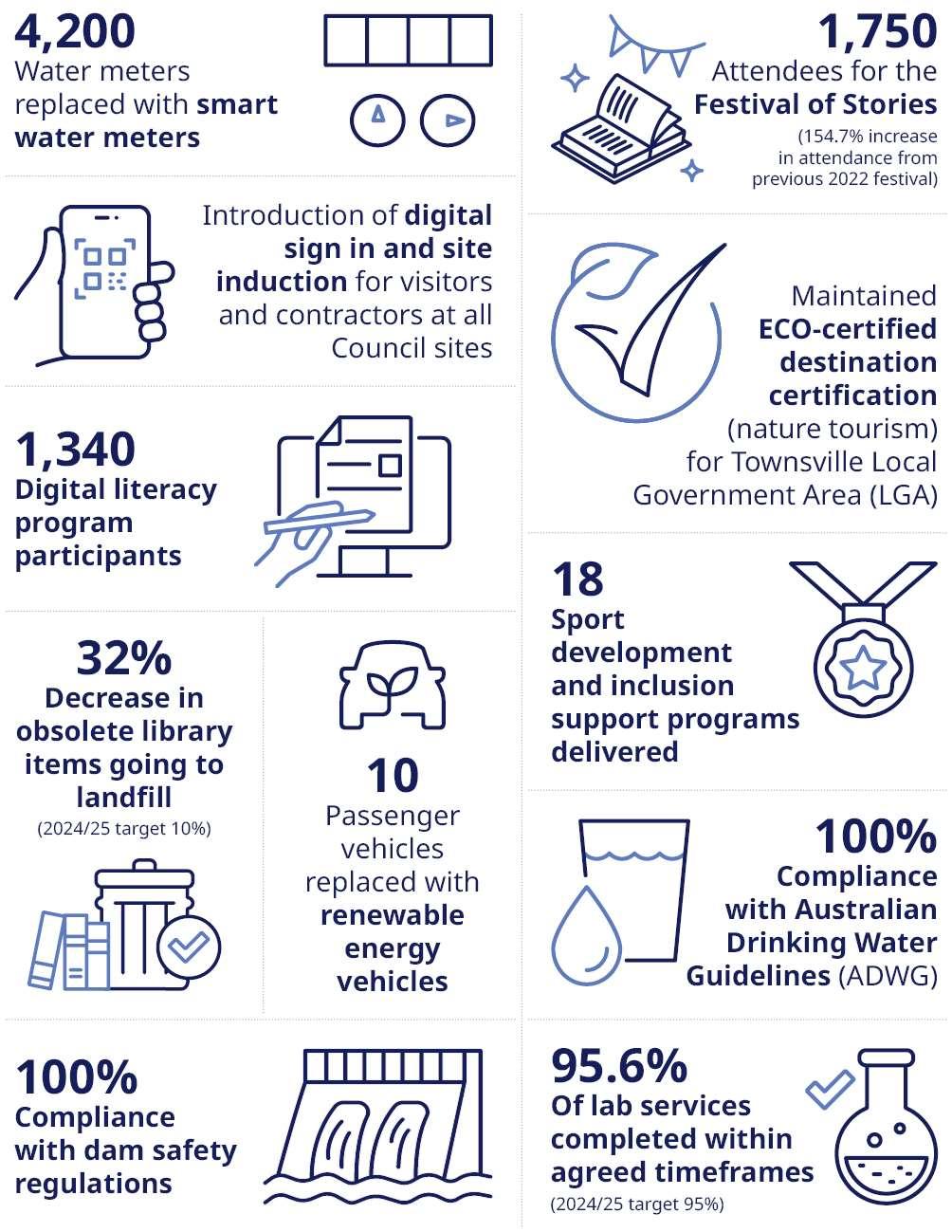

4,200 Water meters replaced with smart water meters

Introduction of digital sign in and site induction for visitors and contractors at all Council sites

1,340 Digital literacy program participants 32% Decrease in obsolete library items going to landfill (2024/25 target 10%)

100% Compliance with dam safety regulations

10 Passenger vehicles replaced with renewable energy vehicles

18

1,750

Attendees for the Festival of Stories (154 7% increase in attendance from previous 2022 festival) Maintained ECO-certified destination certification (nature tourism) for Townsville Local Government Area (LGA) Sport development and inclusion support programs delivered

100% Compliance with Australian Drinking Water Guidelines (ADWG)

95.6% Of lab services completed within agreed timeframes (2024/25 target 95%)

Cr Ann-Maree Greaney

Acting Mayor of Townsville*

Division 3

0448378111

Ann.Maree.Greaney @townsville.qld.gov.au

Termofoffice: 3

AsActingMayorofTownsville, CouncillorGreaneyplaysakey roleinadvancinginitiatives thatpromoteresilientand sustainabledevelopment alongwithstrategicfuturefocusedinvestmentthatbuilds ontheliveabilityofthecity.

Priortobecomingacouncillor, sheworkedforover10years withTownsvilleCityCouncilas SpecialEventsandProtocol Officer.

AsaMemberoftheAustralian InstituteofCompanyDirectors andaformerBoardMember oftheCowboysLeaguesClub, shebringsvaluableleadership andgovernanceskillstoher dualrole.

CrGreaneyandherhusband havetwoadultsonsandtheir beloveddog,Humphrey.

Qualifications: Memberof AustralianInstitute ofCompanyDirectors DiplomaofEducation

ExecutiveCertificateinEvent Management

*Refer to note on page 31

Cr Paul Jacob Division 1

0461347577

Paul.Jacob @townsville.qld.gov.au

Termofoffice:2 (non-consecutive)

ATownsvilleresidentformore than30years,CouncillorJacob isservingourcommunityin hissecondterm.

BorninSydney,CrJacob startedoutasanElectronics andCommunications Technician,workinginremote locationsacrossAustralia.This experienceequippedhimwith astrongunderstandingof infrastructureandessential services.

CrJacobhascontributedto ourcitythroughhisworkat TownsvilleHumanCapital, JamesCookUniversity,and TheTownsvilleUniversity Hospital.

CrJacobisdedicatedto supportingaback-to-basics approach,prioritisingessential infrastructurelikeroads, transport,sewerage,and transferstationstobuilda strongfoundationforour city’sfuture.

Cr Brodie Phillips Division 2

0461 442 642

Brodie.Phillips @townsville.qld.gov.au

Term of office: 1

Born and raised in Townsville, Councillor Phillips has a deep connection to the city’s rich heritage and vibrant community.

His passion for serving the community began with active involvement in local social media groups.

With a diverse background in justice, retail, finance and banking, he brings a breadth of experience to his role.

Since moving to Division 2 in 2018, Cr Phillips has embraced life in the area with his two sons and has become a passionate advocate for progressing key local interests.

Cr Phillips envisions Townsville as a city where residents can live, work, and play, no matter their interests, to foster a thriving, inclusive community for all.

Qualifications:

Diploma of Justice Studies

Cr Kristian Price Division 4

0461 481 414

Kristian.Price @townsville.qld.gov.au

Term of office: 1

Councillor Price has proudly called Townsville home since he was 10 years old, and his deep-rooted connection to the community continues to shape his values and vision for the city.

Starting his career in civil work and construction, he discovered a passion for hands-on work, later moving into mining, where he rose from entry-level “nipper” to a certified supervisor.

Embracing a new challenge, Cr Price turned his attention to hospitality, opening a successful pizza restaurant.

This experience deepened Cr Price’s appreciation for the tenacity and spirit of Townsville’s residents and equipped him with valuable insights into local business needs.

Cr Vera Dirou Division 5

0461 418 618

Vera.Dirou @townsville.qld.gov.au

Term of office: 1

Born and raised in Townsville, Councillor Dirou has always called this city home, even during years of travel with her husband’s military service.

Since returning in 2008, she developed a deep appreciation for local government’s role in shaping our community’s day to day life.

With a career spanning two decades in the Department of Defence, specialising in logistics, compliance, auditing, and administration, Cr Dirou brings a broad range of skills and experience to her role as Councillor.

She is a passionate advocate for transparent, accountable leadership in all levels of government.

With her dedication and vision, she strives to make Townsville an even better place to live, work, and thrive.

Qualifications:

Diploma of Quality Auditing

Cr Suzy Batkovic Division 6

0434 939 419

Suzy.Batkovic @townsville.qld.gov.au

Term of office: 2

Prior to being elected, Councillor Batkovic was a professional athlete, playing basketball for 23 years across the USA, Europe and Australia. During this time, she represented Australia at three Olympic Games (2004, 2008 and 2012), winning two silver medals and a bronze, and also competed at two FIBA World Cups.

In 2024, Councillor Batkovic was inducted into the Australian Basketball Hall of Fame.

Her experience in professional sport taught her the value of teamwork, leadership, compassion and the importance of listening. It also showed her how to stand up for what is right and most importantly, what it takes to work together to achieve positive outcomes.

Cr Batkovic, a proud mother of twin daughters, has lived in Division 6 for over 10 years.

Cr Kurt Rehbein Division 7

0439 847 860

Kurt.Rehbein @townsville.qld.gov.au

Term of office: 3

Now in his third term, Councillor Rehbein holds a genuine passion for serving community.

Born in Townsville and raised in Ayr, where his family owned a local convenience store, he learned early on about the value of community connection and the important role of small businesses.

Throughout a diverse career as a cabinetmaker, RAAF military dog handler, and firefighter, he gained valuable experiences and developed a strong sense of discipline and problem-solving skills.

When not spending time with his wife and four young children, he enjoys pursuing various hobbies, from casting a line to furniture restoration.

Qualifications: Trade Certificate in Cabinetmaking

Certificate III in Dog Handling and Military Operations

Diploma in Fire and Rescue Operations and Public Safety

Cr Andrew Robinson Division 8

0461 518 080

Andrew.Robinson @townsville.qld.gov.au

Term of office: 1

Councillor Robinson served 13 years as an officer in the Royal Australian Army Medical Corps, instilling a lifelong commitment to service. On being medically discharged, he earned his accounting qualifications at James Cook University before working in logistics and accounting roles.

Prior to becoming a councillor, he held a senior finance role in the Department of Transport and Main Roads. He has served on several boards, including a bank. Currently, he chairs one local investment company and is a graduate of the Australian Institute of Company Directors.

Cr Robinson enjoys chess, board games, military history, driving his Holden FJ Ute and spending time with his wife and three daughters.

Qualifications:

Bachelor of Commerce

(Accounting)

CPA

Graduate of the Australian Institute of Company Directors

Justice of the Peace (Qualified)

Cr Liam Mooney Division 9

0434925510

Liam.Mooney @townsville.qld.gov.au

Termofoffice: 2

AproudTownsvillelocal, CouncillorMooneyhaslivedin andaroundDivision9his entirelife.Watchinghisown childrengrowuphere–attendingschool,playing sports,andperforming,just as hedid–hasstrengthenedhis senseofprideand commitmentforthecity.

Drivenbyapassionfor performanceandsport,hehas representedTownsvilleand NorthQueenslandinmusic, theatre,soccer,and swimming.Alongsidehiswife, hesharesadeeppassionfor thearts, withextensive volunteerexperiencein communitytheatre, instrumentalmusic,andthe performingandvisualarts.

Withaprofessional backgroundinthePerforming ArtsandEventsindustry,Cr Mooneymaintainsstrong communitytiesthroughboth hispersonalandprofessional life.

Cr Brady Ellis Division 10

0499577788

Brady.Ellis @townsville.qld.gov.au

Termofoffice: 1

CouncillorEllisfirstfellinlove withTownsvillein2017, relocatinghereforhiscareer inbreakfastradio.

Afterasuccessfuldecadein theindustry,culminatingina prestigiousAustralian CommercialRadioAwardfor bestEntertainment/Music Announcer(2017),heretired fromradiotopursuenew ventureswithhiswife.

Bradyisanactivememberof theTownsvillebusiness community,owningand operatingtwosuccessfulKX Pilatesstudios.

Nowraisingafamilyin Division10,hehasdedicated himself toinvestinginwhathe proudlycalls“thebestcityin northernAustralia”.

Withavisionforathriving, active,andhealthyTownsville, heispassionateaboutplaying hispartinseeingTownsville transformintotheroaringhub ofthefuture.

Councilinvestigatesreportedorsuspectedinstancesoffraudandotherseriouscrime andmisconductand maintainsafocusonraising awarenessofCouncilvaluesandfosteringethicalbehaviour.Counciltreatsall allegationsoffraud,corruptionandseriousmisconductwiththeutmostimportanceandensurestheyare thoroughlyinvestigated.

TheOfficeoftheIndependentAssessor(OIA)investigatescomplaintsregardingtheconductandperformanceof Councillors.Duringthe2024/25financialyearthetotalnumberofcomplaintsreferredtotheOfficeofthe IndependentAssessor(OIA)undersection150P(2)(a) ofthe Local Government Act 2009 was5andthetotalnumber ofnoticesgivenundersection150R(2)oftheActwas68.

Councilcontinuesitscommitmenttoencourageandsupportpublicinterestdisclosuresofwrongdoing.Allpublic interestdisclosuresmadethisfinancialyearwereinvestigatedinaconfidentialmannerandinaccordancewith PublicInterestDisclosureStandardNo.2/2019.AlldisclosureswerereportedtotheQueenslandOmbudsman OfficeandtherelevantdocumentationrecordedinaccordancewithPublicInterestDisclosureStandardNo. 3/2019.

TheTownsvillecommunityreliesonCounciltodotherightthing,andCouncilvaluesitsreputationfordelivering servicesinanethicalandaccountablemanner.Councilsectionscontinuedtoworkcloselywithoneanotherto ensureacollaborativeandproactiveapproachtodrivingCouncil’sethicalstandards.TheannualCodeofConduct trainingwascompletedby100%ofstaff,andallnewstaffcompleteFraudAwareness andCodeofConduct trainingduringtheirinductionperiod.

Asanopenandtransparentlocalgovernment,Councilmakesinformationavailableforcommunitymembersina rangeofformatsusingTownsvilleDashboards.TownsvilleDashboardsisadigitalplatformtoaccesshighquality, currentdata,andinsightsaboutTownsville,informingandenablingtheTownsvillecommunityandthosewithan interestininvestingintheregion.

Tocomplywiththe Local Government Act 2009 andintheinterestofopennessandtransparency,allCouncillorsare requiredtodiscloseandprovideupdatesfortheirRegisterofInterestswhichcanbe viewedontheCouncil’s publicwebsite.

Councillorsareultimatelyresponsiblefordisclosingany prescribedconflictofinterestoranydeclarableconflictof interestonmatterstobediscussedataCouncilmeeting(otherthanordinarybusinessmatters).Prescribed ConflictofInterestandDeclarableConflictsofInterestdeclaredarerecordedintheminutesofthosemeetings. OrdinaryandspecialmeetingsofCouncilareopentothe publicunlessclosedinaccordancewithsection254Jof theLocalGovernmentRegulation2012.Oncethedeliberationsareconcludedinclosedsessions,themeetingis re-openedtothepublicfora decisionandthedecisionisplacedonthepublicrecord.

OrdinaryCouncilandSpecial Councilmeetingsarelivestreamed.Copiesoftherecordingsareavailableonthe Council’swebsite.

TheAuditandRiskCommitteeandtheInternalAuditUnit continuedtoprovideadvisoryandindependentforums whererepresentativesofCouncil,independentspecialistsandmanagementworkedtogethertofulfillspecific governanceresponsibilities.

Council meetings comprise of Ordinary Council meetings and Special Council meetings. Ordinary Council meetings have a membership comprising of the Mayor and all Councillors.

The attendance of Councillors at Ordinary Council meetings and Special Council meetings for the relevant periods are outlined in Table 2.

Table 2 – Councillor meeting attendance 2024/25

*Pursuant to subsection 253(1) of the Local Government Regulation 2012, Councillor Troy Thompson was suspended from office as the Mayor of the Townsville City Council for the period of one year starting on 22 November 2024. Subsection 253(1) gives effect to a recommendation made in writing by the Queensland Minister for Local Government, on 21 November 2024 under section 122(2)(b) of the Local Government Act 2009, that the Governor in Council suspend the Councillor for the period mentioned in the subsection.

On the suspension of Councillor Troy Thompson from office as the Mayor of the Townsville City Council, the Deputy Mayor commenced acting for the Mayor pursuant to subsection 165(1) of the Act. The Deputy Mayor at that time was Councillor Paul Jacob.

At a Special Meeting of Council on 17 December 2024, Council resolved that the office of Deputy Mayor be declared vacant. Council subsequently resolved that Councillor Ann-Maree Greaney be appointed to the office of Deputy Mayor. As a result of this appointment, Councillor Ann-Maree Greaney became Acting Mayor.

Councillors receive a remuneration package determined by the Local Government Remuneration Commission, which is reviewed on an annual basis.

The Commission increased the maximum remuneration levels for mayors, deputy mayors and councillors by 3.0% from 1 July 2024.

Table 3 outlines the remuneration received by Councillors in 2024/25, remuneration is inclusive of transport allowance.

Table 3 – Councillor remuneration 2024/25

Variances in superannuation due to options available for Councillors to make additional contributions throughout the year. *Refer to note on page 31 EXPENSES

Table 4 - Councillor expenses 2024/25

*Refer to note on page 31

Councillors were provided with the following facilities to enable them to perform their duties and undertake Council business:

personal protective equipment (PPE)

stationery supplies

full administrative support (Mayor and Deputy Mayor)

limited administrative support (Councillors)

telecommunications facilities

shared office facilities (Councillors)

home office facilities (Councillors)

At the Special Council Meeting of 26 June 2024 Council adopted the 2024/25 Budget and Operational Plan. No budget was allocated to the Mayor’s Community Assistance Grants for 2024/25.

In accordance with section 189 (2) of the Local Government Regulation 2012, the annual report must contain information about Councillor discretionary funds.

At the Special Council Meeting of 26 June 2024 Council adopted the 2024/25 Budget and Operational Plan. No budget was allocated to Councillor Discretionary Funds for 2024/25. Councillor discretionary funding for 2024/25 was as follows:

the prescribed amount for the financial year was $199,650

the total amount budgeted was $0

the total amount of discretionary funds budgeted for Councillors to allocate for capital works for a community purpose was $0, and other community purposes was $0

the amount of discretionary funds budgeted for use by each Councillor was $0

the total spent for the financial year was $0.

Under section 186(1)(d)-(k) of the Local Government Regulation 2012, Council’s Annual Report must contain details of any decisions, orders, recommendations, and complaints about Councillors during the financial year. Details for 2024/25 are outlined in Table 5.

Table 5 – Number of Councillor Conduct complaints, notices, referrals, orders and disciplinary actions

orders and recommendations made under section 150AR(1) of the Local Government Act

The name of each Councillor for whom a decision, order or recommendation was made under section 150I(2), section 150IA(2)(b), section 150AH or section 150AR(1) of the Local Government Act 2009,

a description of the unsuitable meeting conduct, conduct breach or misconduct engaged in by each Councillor, and a summary of the decision, order or recommendation made for each Councillor.

referred to the assessor under section 150P(2)(a) of the Local Government Act 2009 by local government entities for the local government.

mentioned in section 150P(3) of the Local Government Act 2009, notified to the Crime and Corruption Commission.

given under section 150S(2)(a) of the Local Government Act

Occasions the local government asked another entity to investigate, under chapter 5A, part 3, division 5 of the Local Government Act 2009 for the local government, the suspected conduct breach of a Councillor.

Applications heard by the conduct tribunal under Chapter 5A part 3 division 6 of the Local Government Act 2009 about whether a councillor engaged in misconduct or a conduct breach.

The total number of referral notices given to the local government under section 150AC(1) of the Local Government Act 2009 during the financial year and for those suspected breaches the subject of a referral notice mentioned;

the total number of suspected conduct breaches for which an investigation was not started or was discontinued under section 150AEA of the Local Government Act 2009.

The number of decisions made by the local government under section 150AG (1) of the Local Government Act 2009 during the financial year.

The number of matters not decided by the end of the financial year under section 150AG (1) of the Local Government Act 2009.

The average time taken by the local government in making a decision under section 150AG (1) of the Local Government Act 2009

Councilhasmadesignificant stridesinimprovingWorkHealthandSafety(WHS) performance,withastrong emphasisoncreatingasafer,healthier,andmoresupportiveworkplace.Thisprogressisreflectedinenhanced reportingpractices,proactiveriskmanagement,enhancedhealthmonitoringprogramandincreased engagementacrossteams. WHSisnotjustacompliance requirement—it’sacorevaluethatunderpinsCouncil’s commitmenttothewellbeingofitspeopleandthecommunitiesitserves.

Akeyfocushasbeenonpsychosocialsafety,recognising thatmentalhealthandwellbeingarejustascriticalas physicalsafety.Councilhasundertakenextensivereviewsandassessmentstoidentifypsychosocialrisk.These reviewshaveinvolvedcollaborationacrossteams,consultationwithworkers,andtheuseofevidence-based frameworkstoensureathoroughunderstandingofthechallengesandopportunitiesforimprovement.

ThedepthandbreadthofworkinthisspacehighlightCouncil’sdedicationtofosteringapsychologicallysafe workplace.Initiativessuchasleadershiptraining,wellbeingprogramsandtargetedinterventionsarebeing implementedtoaddressidentifiedrisksandbuildacultureofcareandinclusion.This ongoingcommitmentto psychosocialsafetynotonly supportsindividualwellbeingbutalsostrengthensteamcohesion,performanceand overallorganisationalhealth.

TheHealth,SafetyandWellbeingStrategy2025–2029identifiesfourstrategicprioritiesthatwillsupportthe continuousimprovementofallaspectsofhealthandsafetyandsupportthedeliveryof theOperationalPlan.

InalignmentwithCouncil’sstrategicimperativestobuildapositiveworkplaceculturethatalignswithourSERVE organisationalvalues,weactivelyrecogniseandvalueouremployeesthroughbothinformalandformalreward andrecognitioninitiatives.

Council’sformalrewardandrecognitioninitiativesincludetheannualLongServiceAwardsCeremony,wherestaff whohaveachieved10years ofserviceormoreinfive-yearincrementsarerecognised fortheircommitmentand servicetoCouncilandthecommunity.

AttendeesincludetheMayor,Councillors,CEO,Directorsandtheseniorleadershipteam,alongwithinvited colleaguesandspecialguests. Toshowourappreciationandrecognition,staffreceiveaframedservice certificate,acommemorativepinandgift.

For2024,Councilcongratulated130staffwithatotalof2,245combinedyearsofservice,rangingfrom10years rightthroughto45years.Theawardsareagreatopportunityforemployeestoberecognisedfortheir contributions,bigandsmall,overtheiryearsofservice.

TownsvilleCityCouncilcontinuestobearesponsible,open,andtransparentlocalgovernmentoperatingin accordancewiththeQueensland Local Government Act 2009,theLocalGovernmentRegulation2012andrelated legislation.Counciliscommittedtohighstandardsofcorporategovernanceandaccountabilityandseeks continuousimprovement.

Inlinewiththe Local Government Act 2009,theCouncilplaceshighimportanceonresponsiblegovernancedueto thefollowingreasons:

itunderpinstheconfidencethatthecommunityhasinCouncilandourservices

itaffectsthequalityofouroutputs

itisavalueaddingactivity

itensuresthattheCouncilmeetsitslegislativeresponsibilitiesand

itisastrongreminderthattheCouncilisultimatelyaccountabletothecommunity CouncilhasaCorporateGovernanceFrameworktoprovideguidelinesforcompliance withlegislationandbest practice.ForCounciltodemonstrategoodgovernance,thereneedstobeaclearunderstandingabout responsibilitiesandaccountabilities.Thisframeworksets outtherolesofelectedmembersandadministrationin representingtheinterestsof currentandfutureresidents ofTownsville.Townsville’selectedofficialsbringa diversewealthofexperience andpassion,andthroughouttheyearhavecontinuedtointeractwiththe communityandactonresidents’behalf.

Council’srisk managementapproachisbasedonvaluecreationandprotectioninalignmentwithinternational standardISO31000:2018RiskManagementGuidelines.Throughout2024/25Councilcontinuedtoassessriskfor anydecisionproposals,keepinganynewandemergingrisksunderconsideration.Managingrisksatan appropriatelevelremainsanintegralpartofourorganisation.Councilhasanestablishedriskmanagement framework,policy,proceduresandsystemswhichsupporttheidentification,assessmentandmitigationof strategicandoperationalrisksacrosstheorganisation.

AstheprimaryconnectiontotheTownsvillecommunity,Councilhascontinuedtoprioritiseriskmanagement, ensuringitreceivestheattentionnecessarytosafeguard ourcommunity’sinterestsandwell-being.Thesafetyof staff,thecommunityandcontractorsremainedthekeypriorityatCouncil.ItisimportantforCouncilthat “everyonegoeshomesafetodayandeveryday”.Riskmanagementcontinuestobearesponsibilityofall employeesandanintegralpartofthemanagementfunction.

SeniormanagementconductedanextensivereviewofCouncil’sstrategicriskprofileduringtheyearthrougha seriesofworkshops.Basedontheupdatedstrategicrisk profile,changesweremadetoCouncil’sRiskAppetite Statementandrelatedrisk tolerances.The2024/25RiskManagementPlanincludesarangeofmitigation strategiesdesignedtomanageorreducerisktoanacceptablelevel,whilemaximising identifiedopportunities. Minimisingpotentialadverse effectsonthefinancialperformanceoftheCouncilremainedapriority.Townsville CityCouncilcontinuedtomitigaterisksthatwouldpreventtheachievementofitsCorporatePlanandcontinued tofocusoncreatingagloballyconnectedcommunitydrivenbylifestyleandnature.

Topchallenges/risksfacedbyCouncil:

costpressuresofmaterialsandservicesversusrevenuestreamsandcustomerexpectations

assetdeteriorationandmaintenance

specialskillsdeficits

Topopportunities/strengthsrealisedbyCouncil:

continuedprovisionofservicesandcommunityeventsdespitehardeconomicconditions

continueddeliveryofprojectsthatserveourcityandgrowourcityfortomorrow

builtstrongpartnershipsandresilience

Councilconductsroutineoperationalriskassessmentsasaproactivemeasuretoidentifypotentialrisksthat coulddisruptitsoperations.Theseriskscouldoriginatefromvarioussources,includinginternalprocesses, people,systems, orexternalevents.

Allidentifiedrisksarecompiledintoaconsolidatedregisterofrisks,whichinformsthe internalauditplanning process.ThisprocessassiststheAuditandRiskCommitteeinmonitoringandtracking Council’sperformance againstareasofhighrisk,supportingeffectiveriskmanagementandmaintainingresilience.

CouncilhasanestablishedBusinessContinuityFrameworkandBusinessContinuityManagementPolicyin alignmentwithinternationalstandardISO22301:2019BusinessContinuityManagementSystems.These documentsaredesignedtoensuretheCouncil’sabilitytocontinueitsessentialservicesandoperationsduring anypotentialdisruptionsorcrises.Thisframeworkandpolicyprovideastructuredapproachtoidentifypotential threatstotheCouncilandtheimpactsthosethreatswouldhaveonbusinessoperations.

ThesedocumentsaresupportedbytheoverarchingTownsvilleCityCouncilBusiness ContinuityPlanandits22 subplans.TheseplansprovidestrategiesforsafeguardingandrecoveringCouncil’soperationalandservice deliverycapabilityduringsevereunexpectedevents.

Inthe2024/25period,Councilconductedacomprehensivereviewoftheframework,policyandsuiteofbusiness continuityplans.Thereview andupdateoftheseplansarepartoftheCouncil’sannualstrategicprocess, ensuringtheyremaincurrent,operationallyrelevantand effective.ThisreflectstheCouncil’scommitmentto resilience,continuousimprovement,andcommunityresponsibility.

Throughout2024/25,theCouncilremainedconsistentinitscommitmenttoidentifyingandmitigatingtheriskof non-compliancewithlegislativeobligations.Ourproactiveapproachencompassesthetimelyidentificationof legislativechanges,swiftresolutionofpotentialbreaches,andtheprovisionoftrainingandawarenessprograms forCouncilworkers.TheseinitiativesaimtoenhanceunderstandingofCouncil’sextensiverangeoflegislative responsibilities.Furthermore,Councilconductsthoroughassessmentsoftheeffectivenessofourinternal controlstomitigatetheriskofnon-compliance.ThisincludesatimelyandcomprehensivereviewoftheCouncil’s corporateguidancedocuments(e.g.policies,administrativedirectives,procedures)andregisters.

Council’sapproachtofraudandcorruptionmanagement iscomprehensive,involvingregularriskassessments, stafftraining,andcontinuousimprovementofourpoliciesandprocedures.Throughouttheyear,weconducted fraudriskassessmentsasakeypartofourFraudandCorruptionManagementPolicy andFramework.These assessmentshaveprovencrucialinseveralinstances,effectivelyidentifyingandmitigatingpotentialfraudulent activities,therebyprotecting theCouncil’sresources.

Wearepleasedtoreportthat99%ofourstaffandseniormanagementhavecompletedtheFraudandCorruption Awarenessrefreshertraining.Thishighcompletionrateisatestamenttoourteam’s commitmentto understandingandmitigatingfraudrisks.Thetraining,deliveredviaourlearningplatform,isdesignedtoequip ourteamwiththenecessaryknowledgetoidentifypotentialfraudrisksandrespondappropriately.

Council’sapproachtopolicymanagementisfocusedonensuringourcorporateguidancedocuments, predominantlyCouncilpolicies,areuptodate,fitforpurpose,andaddvalue.Wehaveestablishedarobust governanceprocessinrespecttopolicymanagement,whichincludes:

engagementwithkeystakeholders

adetailedassessmenttoevaluateitseffectiveness,compliancewithlegislativeobligationsandvalue additionand

astandardiseddevelopment andreviewprocessinalignmentwithCouncil’sestablishedriskappetiteand humanrightsconsiderations.

Throughouttheyear,Councilhasupdatedseveralkeypoliciesandintroducednewonesincollaborationwith Councillors.Councilvaluestheinputofourstakeholdersinourpolicymanagementprocess.Wehave mechanismsinplaceforinternalandexternalstakeholderstoprovidefeedbackonourpolicies,contributingto theirenhancementandfosteringacultureofcontinuouslearningandimprovement.

ThetotalvalueofcommunityassistanceprovidedbyTownsvilleCityCounciltothelocalcommunityin2024/25 was$22,043,605.

6 – Community assistance provided by Council

Waterandwastewater concessions

Not-for-profitconcessions ongeneralrates

Concessionofferedtoapprovedpensionersequivalentto 85%ofthe generalrate,uptoamaximumof$800perannum.

6,295,631

Concessionforutilitychargeswherelanduseisconsideredto contributetothesocial,cultural,economicorsportingwelfareof thecommunity. 3,532,439

Concessionforgeneralrateswherelanduseisconsideredto contributetothesocial,cultural,economicorsportingwelfareof thecommunity. 2,051,208

Concessionforwaterservice chargesincurredinrespectofkidney diseasepatientswhowereundergoinghomehaemodialysis treatment. 625

Totalannualestimatedvalue providedtocommunitygroups includingsportingclubs,theatregroups,scoutgroupsand swimmingpools. 5,239,373 EconomicActivation Partnerships

Partnershipsprovidingopportunityto:

delivereconomicuplifttotheregion

deliverincreasedtourismvisitationandbednights

deliverjobopportunitiesforTownsville

Thesemayfacilitateeventattraction,strategicpartnershipswith localorganisationsthatenhancetheregionanditsopportunitiesor othermulti-partneragreementswithregionwideimpact. 2,949,895 TownsvilleCityGrantsand PartnershipsProgram, includingFeeWaivers

Fundingapprovedthroughthe‘TownsvilleCityGrantsand PartnershipsProgram’(detailsprovidedinTable7). 1,697,663

Freeserviceprovidedtocommunityorganisationsthough CityLibrariesThuringowa. 21,956copiesfor21communitygroups. 2,196

Total $22,043,605

TownsvilleCityCouncil’sGrantsandPartnershipsprovidesfundingandin-kindsupporttohelplocalnot-for-profit communityorganisationsinTownsville.Councilrecognisesthetremendousworkand contributionthat communityandnot-for-profitorganisationsmakeinour community.TheGrantsandPartnershipsProgramhelps tocontinueandenhancethe impactcommunityorganisationsandactivitiesarealreadyhavinginthelocal Townsvillearea.ThetotalvalueoftheTownsvilleCityGrantsandPartnershipsProgramin2024/25was $1,697,663. Table 7 – Townsville City Grants and Partnerships Program

Inaccordancewithsection189AoftheLocalGovernment Regulation2012,theannualreportmustcontain informationaboutthetotalamountoffinancialcontributionsmadetothelocalgovernmentinthefinancialyear. TownsvilleCityCounciladvisesthatnofinancialcontributionsweremadeduringthe2024/25financialyearunder:

Acommunitybenefitagreementunderthe Planning Act;

Aconditionofdevelopmentapprovalimposedundersection65AA(3);

AconditionofadevelopmentapprovalimposedunderadirectionoftheChiefPlanning&Development Officerundersection106ZF(2);or

Anagreementmentionedinsection65AA(7) ofthe Planning Act. Asaresult,nocontributionwerespent,andthereareno associatedpurposestoreportforthisperiod.

TheCityActivationandHousingIncentivePolicywasendorsedforthe2024/25financialyeartopromote economicgrowthandcityactivationbygeneratinginvestment,increasinghousingdiversity,communityactivities andemploymentopportunities.

Fortransparency,recognisinginfrastructurechargeandfeewaivers(fullorpartial) areaformofforgone revenue,Councilwillpublishannuallyalistofinfrastructurechargesandfeewaiversprovidedunderthispolicyin theAnnualReport.

Summaryofincentivesforthe2024/25financialyear:

Revenueforgonefromwaiversto30June2025was$863,067

Grantsgivento30June2024was$50,000

Grantshavebeenfullyacquittedforthe2024/25financial year.

Waivershavebeenpartially acquittedforthe2024/25financialyear.

Undersection188oftheLocalGovernmentRegulation2012,Council’sAnnualReport mustcontaininformation aboutanyoverseastravelmadebyaCouncillororlocalgovernmentemployee.

TherehavebeennointernationaltravelexpensesincurredbytheCouncillorsoremployeesduringthefinancial year.

Theseniormanagementofalocalgovernmentconsistsof theChiefExecutiveOfficerandseniorexecutive employeesofthelocalgovernment.AseniorexecutiveemployeereportsdirectlytotheChiefExecutiveOfficer andwouldordinarilybeconsideredaseniorpositioninthecorporatestructure.

Totalremunerationforthese positionsfrom1July2024to30June2025was$2,319,159.22*.

*Inclusive of severance and termination entitlements.

Aspersection201ofthe Local Government Act 2009,Table8providestheremunerationrangesforthesenior executives.

Table 8 – Senior management remuneration

*During the financial year Council resolved to adopt a new Organisational Structure which reduced the number of senior executive management positions from five to four.

InaccordancewithDivision3,Section201ofthe Local Government Act 2009,Councilisrequiredtoincludeinits AnnualReportdetailsregardingthenumberofCouncillor Advisorsappointedandthetotalremunerationpayable tothemduringthefinancialyear.

Forthereportingperiodof1 July2024to30June2025,no CouncillorAdvisorswereappointed,andthereforeno remunerationwaspayableunderthisprovision.

ReportableresolutionsundertheLocalGovernmentRegulation2012fortheperiod:

Table 9 – Particular resolutions

InaccordancewithSection23ofthe Public Sector Ethics Act 1994,TownsvilleCityCouncilrequiretoprovidean implementationstatementoutliningtheactionstakenduringthereportingperiodtocomplywithSection15 (Preparationofcodesofconduct),Section21(Educationandtraining) andSection22(Proceduresandpracticesof publicsectorentities).

TownsvilleCityCounciliscommittedtoprovidingaworkingenvironmentwherepeoplearetreatedwithfairness, equityandrespect.Council’s commitmenttofacilitatingadiverseandequalworkforce isdemonstratedthrough commitmenttotheDiversity,EquityandInclusionintheWorkplacePolicy,alignmenttoQueensland’s AntiDiscrimination Act 1991 andobligationsunderrelevantfederalanti-discriminationlaws.

CouncilhasestablishedaCodeofConduct,whichdetails thestandardsofbehaviourandexpectationsforCouncil workerswhendealingwithcustomersandotherworkers.CouncilprovidesCodeofConducttrainingannuallyto allstaff,whichincorporatestheethicsprinciplesandobligationsunderthe Public Sector Ethics Act 1994 andthe fiveLocalGovernmentPrinciplesundersection4(2)of Local Government Act 2009.CodeofConducttrainingisan essentialcomponentofCouncil’sCorporateCompliance trainingprogram.

AtTownsvilleCityCouncil,LearningandDevelopmentisevolvingintoastrategicenablerofworkforcecapability, agilityandresilience.Weare reshapingourapproachtofosteralearningculturewithastrongemphasison digitaldexterity,data-drivendecision-makingandleadershipcapabilityatalllevels. Weaimtobuildaworkforce thatisfuture-ready,adaptable,andempoweredtoleadchange.Byaligninglearningwithstrategicworkforce planningandproactivelyidentifyingcriticalskillsgaps, wewillmitigatecapabilityrisks,enhanceemployee attraction,mobility,andretention,andsupportthedeliveryofCouncil’sstrategicobjectives;ensuringourpeople arecompetent,valued,andequippedtothriveinadiverseandrapidlychangingenvironment.

2025sawthebeginningofourInductionReviewProject, strengtheningtheinductionexperiencebydelivering criticalknowledgeandfoundationalskillsusingthemosteffectiveplatform.Byreducingdelaysinaccessto essentiallearning,minimisingexcessiveeLearningcontent,andfosteringaninclusive,engagingenvironment, thisprogramwillempowernewemployeestocontribute confidentlyandcompetently fromthestartoftheir employmentwithCouncil.

Withconsistentmessaging,improvedattendanceandalignmenttoCouncil’sSERVEvalues,thisupliftnotonly enhancesindividualperformancebutalsosupportsacultureofexcellenceandcontinuouslearningacrossthe organisation.

LearningandDevelopmentstrivetoensureourstaffareadequatelyskilledandhavetheopportunityfor upskillingintheirroleswhichguaranteesservicedeliveryacrossTownsvilleispossible.Weinvestinourworkforce toundertakeNationallyRecognisedQualificationsinavarietyoffields.Thequalificationsthatareundertakenby ourworkforceinclude:

CertificateIIIBusiness

CertificateIVBusiness

CertificateIIICivilConstruction

CertificateIVCivilConstruction

CertificateIIinDrainage

CertificateIIIinIrrigation

CertificateIIIinWaterIndustryOperations

CertificateIVLibraryandInformationServices

DiplomaGovernmentInvestigations

CertificateIIIElectrotechnology

CertificateIIIInstrumentationandControl

CertificateIIIinHeavyCommercialVehicle

CertificateIIIinEngineering (Fabrication)

CertificateIIIinEngineering (Mechanical–Fitting/Turning)

CertificateIIISportsTurfManagement

CertificateIIIParksandGardens

CertificateIIIOpenSpace(Arboriculture)

CertificateIIIMobilePlantTechnology (MobilePlantEquipment)

CertificateIIIinAutomotive Electrical Technology

CertificateIVinProjectManagement

Theabovequalificationsincludethosethatarebeingundertakenbythe14ApprenticesthatCouncilonboardedin the2025EntryLevelintake.TheseApprenticesareinvaryingsectionsandtradesacrossCouncil,allplaying importantrolesinbuildingourcityforthefuture.

Outsideofshortcourseand skillsettraining,inthe2024/25year,96employeeshave eithercompletedorare currentlyactivelyenrolledin anationallyrecognisedvocationaleducationqualificationsupportedbyTownsville CityCouncilsStudyAssistanceProgram.

ThesenumbersreflectCouncilsbeliefthatthetruevalue ofourorganisationisinthe capabilityofourpeopleand thatwecontinuallyupskilltoensureourstaffareequippedwiththemostup-to-dateknowledge.Withdedicated LearningandDevelopmentteammemberscommittedto developingandsourcingindustry-bestlearning,weare abletodemonstratetoCouncilstaffthatwecontinuously strivetoprovidethemwithappropriateopportunities forpersonalandprofessionaldevelopment.

Duringthefinancialyear,CouncilcontinueditspartnershipwithNorthQueenslandWaterRegionalAlliance Program(NQQWRAP)tosupportourWaterIndustryWorkerProgram,whichisprovidinggrowthandskills developmentopportunitiesforourexistingwaterandwastewaternetworkstaff.Thistrainingutilises collaborationwithotherregionalCouncils,forexample,MackayandCairns,tomaketheprogramasuccess. Participantsinthisprogram completeaCertificateIIIinWaterIndustryOperations.Thistraininghasbeen runningatCouncilsince2019andwasspecificallydesignedtosupportourwaterindustryworkerswhoarea criticalpartofourworkforce, providingadirectandessentialfrontlineserviceforourcustomers. LearningandDevelopmentstrivetoensureoutreachtoschoolsandlocalcommunities,withtheteamjoined collaborativelybyvaryingsectionsacrossCouncil,toattendvariousCareersExposacrosstheregion.Townsville CareerExpowasahighlight, asthelargestexpoheldinTownsvillebeingattendedbyanumberofschoolsacross theregion.Studentsparticipatedinengagingdiscussions withPeopleandCultureand variousteam representatives,aroundthecareersandentrylevelpathwaysintoCouncil.Eventslikethishelpinspirethenext generationbystrengthening Council’sfutureworkforcethrougheducationaroundalltherolesCouncilplaysin ourcommunity.

Council’sCorporateGovernanceandmanagementpracticeshaveproperregardtothe Public Sector Ethics Act 1994.Council’scorporateguidancedocumentsanddelegationsofauthorityaremonitoredandregularly reviewed.Corporateguidancedocumentsareexplainedtoemployeesatcommencementofemploymentand throughongoingtraining,as wellasbeingmadeavailableonCouncil’sintranet.

Counciliscommittedtofair,ethicalandtransparentmanagementofadministrativeactioncomplaints.This commitmentisdemonstratedbyourComplaintsManagementSystem(CMS) thataimstoprovideanaccessible, accountableandefficientmethodforaddressingcomplaintsinaccordancewiththeprinciplescontainedinthe Local Government Act 2009

Thepolicyisreinforcedbyaguidelinethatoutlinesdefinedadministrativeprocessforeffectivelyhandlingand resolvingcomplaintsraised bycommunitymembersonarangeofissuesincluding:

adecision,orafailuretomakeadecision,includingafailuretoprovideawrittenstatementofreasonsfor adecision

anact,orafailuretodoanact

themakingofarecommendation

ismadebyanaffectedperson(apersonwhoisaffectedbyanadministrativeactionofCouncil).

Councilisdedicatedtoconductingthoroughandtimelyinvestigationsforallcomplaints,withtheultimate objectiveofreachingaresolutionthatsatisfiesboththe Councilandthecomplainant.

Shouldcomplainantsbedissatisfiedwiththeoutcomeofthecomplaintinvestigation, ComplaintOfficersensure thatalladministrativeactioncomplaintdecisionnoticesincludeinformationonavailableappealoptionstothe QueenslandOmbudsman.

InaccordancewiththeLocalGovernmentRegulation2012,Councilisobligatedtodisclosetheadministrative actioncomplaintsreceivedandresolvedthroughthecomplaintsmanagementsystem.

*As at end of 30 June 2025.

TownsvilleCityCouncilcontinuestomakeiteasierforthepublictoaccesstheirinformation,maximisethe publiclyavailablecorporateinformationandidentifyinformationthatcanbeadministrativelyreleased.Council’s inductionprogramincludesarighttoinformationandinformationprivacycomponentstoeducateandraise awarenesstostaff.CouncilhasintroducedaRighttoInformationandInformationPrivacyeLearningmoduleto ensurestaffarekeptinformed.CouncilcontinuestopublishaDisclosureLogonthewebsite.

MoreinformationaboutCouncil’sRighttoInformationandInformationPrivacycanbefoundonCouncil’s website.

Table 11 – Right to information and information privacy

TownvilleCityCouncilhasseveralregistersopentopublicinspectionuponrequest.Thelistcanalsobefoundon Council’swebsite.

Register

BeneficialEnterprises

DogRegistry

RegisterofDogs

RestrictedDogRegister

RegulatedDogRegister

Registerofcost-recoveryfees

DelegationRegister

DevelopmentApplicationRegisterasAssessmentManager

DevelopmentApplicationRegisterasReferralAgency

EnvironmentallyRelevantActivitiesapplicationregister

Exemptioncertificatesregister

InformationAssetRegister

RegisterofInfrastructureChargesInformation

MajorContractsRegister

PetitionRegister

RegisterofPrivatelyCertifiedApprovals

RegisterofAnnualReturnsunderthe Environmental Protection Act 1994 (EPA) RegisterofAssetsandGifts

ADesignationRegisterofallDesignationsmadebyLocalGovernmentthatareineffect RegisterofCouncillorConduct

Registerofon-siteSewerageandGreywaterFacilities

RegisterofEnvironmentalAuthoritiesincludingSurrendered,SuspendedorCancelledAuthorities

RegisterofImpoundedAnimals

RegisterofInfrastructureAgreements

RegisterofInterimLandUsePlansunderthe Economic Development Act 2012 (EDA)

RegisterofLocalandSubordinateLocalLaws

RegisterofPDADevelopmentApplicationsundertheEDA

RegisterofPDADevelopmentApprovalsundertheEDA

RegisterofPermitsandInspectionCertificate(underthe Plumbing and Drainage Act 2018)

RegisterofProvisionalLandUsePlansundertheEDA

RegisterofRegulatoryFees

RegisterofShowCauseandEnforcementNotices(underthe Plumbing and Drainage Act 2018)

RegisterofSubmittedPlansofOperationundertheEPA

RegisteroftheTestableBackFlowDevices

RoadsMap

StatementofInterests

SupplementaryInformationElectoralDonations

Therearenodetailstoreportonforthefinancialyearunderthissection190(d) oftheLocalGovernment Regulation2012,onactiontakenfor,andexpenditureon,aservice,facility,oractivity:

i) suppliedbyanotherlocalgovernmentunderanagreementforconductingajointgovernment activity;and ii) forwhichthelocalgovernmentleviedspecialratesorchargesforthefinancialyear.

NellyBayHarbourDevelopmentspecialratelevyisappliedtomaintainingwaterqualityinthecanals,dredging thecanals,maintainingtherockwallsaroundthecanalareaandmaintainingthesedimentbasininGustavCreek. Aspecialrateofzerocentsinthedollarontherateablevalueofthelandappliestoidentifiedpropertiesforthe 2024/25year.

TheRuralFireBrigadeAnnualChargeisleviedonrateablelandsservicedbytheruralfirebrigadeslistedbelow. Thefundsraisedfromthischargeareprovidedtothevoluntaryruralfireservicessotheycanacquireand maintainfire-fightingequipment,providetrainingtovolunteersandtoenablethemtooperatethroughoutthe ruralareasoftheregion.

During2024/25Councilgrantedarangeofratesandchargesconcessions.Inaccordancewithsection190(1)(g) of theLocalGovernmentRegulation2012,asummaryofallconcessionsgrantedforratesandchargesisdetailed below.

Councilprovidedconcessionsonthegroundsthatpaymentoftheratesorchargeswillcausehardshiptocertain landowners.ConcessionsprovidedundertheHardshipConcessionPolicyincludedinterestfreepaymentplans andratedeferrals.FurtherdetailscanbefoundonCouncilswebsite–AppendixH:HardshipConcessionPolicy.

Aconcessionwasofferedto approvedpensionerswhoownandoccupytheirpropertyastheirprincipalplaceof residence.Thisappliedonlyifallratesandchargesleviedforthefinancialyearwerepaidinfullby31May2025. Themaximumpensionerratesconcessionavailablewas$800fortheyear.

Theamountofpensionerratesconcessionavailabletoeachapprovedpensionerwascalculatedbyreferenceto theproportionofafullpensionthattheratepayerreceived,andtheproportionateownershipshareoftheowneroccupiedproperty.

FurtherdetailsonthePensionerRatesConcessionPolicy areavailableonCouncil’swebsite–AppendixI: PensionerRatesConcessionPolicy.

Councilprovidedratesconcessionstoassisttheownersof propertiesidentifiedinthePre-2016PensionerArrears ConcessionPolicywithsignificantratearrears.Theconcessionincludedarebateofallinterestcharges.

FurtherdetailsareavailableonCouncil’swebsite–AppendixJ:Pre-2016PensionerArrearsConcessionPolicy.

Councilallowedaconcessionofgeneralratesandutilities chargestoeligiblepropertyownersinrecognitionof thecontributiontheiractivitiesmadetothecommunity,andallowedothertargetedconcessionswherethe grantingoftheconcessionencouraged:

economicdevelopmentofall orpartoftheTownsvillelocalgovernmentarea

thepreservation,restorationsandmaintenanceoflandthatisofcultural,environmental,historical, heritageorscientificsignificancetoTownsville.

FurtherdetailsontheCharitableandCommunityOrganisationsRatesandChargesConcessionsPolicyare availableonCouncil’swebsite–AppendixK:GeneralRatesandUtilityChargesConcessionsPolicy.

Incertaincircumstances,Councilprovidedreducedwaterconsumptionchargesforpropertyownerswhobecame responsibleforthosechargesasaresultofaconcealedleak.Whereanapplicationforareductioninwater consumptionchargeswasapproved,forbothStandardPlanandWaterWatchers,allexcesswaterwasbe chargedatarateequivalentto90%ofthewaterwatchers’rateapplicableintherelevantconsumptionyear.

FurtherinformationisavailableonCouncil’swebsite– AppendixL:ReductionofWaterConsumptionCharges Policy.

Councilprovidedaconcessionforwaterservicechargesincurredinrespectofkidney diseasepatientswhowere undergoinghomehaemodialysistreatment.Theconcessionwas$0.685perdaythroughouttheperiodofhome haemodialysis,administeredoneachhalfyearlyratenotice.

FurtherinformationisavailableonCouncil’swebsite– AppendixM:ConcessionofWaterChargesforHome HaemodialysisPatientsPolicy.

Councilwaivedfeesassociatedwithdisposalofwastefromcharitybinsforcharitableorganisationsthatoperated acharitybinservicetoraise fundsforacharitablepurpose. FurtherinformationisavailableonCouncil’swebsite– AppendixN:ConcessionofDisposalFeesforCharityBin WastePolicy.

InternalAuditisanindependent,objectiveassuranceandadvisoryactivityestablishedwithinCouncildesignedto addvalueandimproveoperationsandgovernance.TheunitoperatesundertheCouncil’sInternalAuditPolicy andinaccordancewiththeInternalAuditCharterwhichisendorsedbytheCouncil’sAuditandRiskCommittee. TheCharterauthorisesdirectaccesstotheAuditandRiskCommitteethroughtheChairandappropriateaccess toallactivities,records,propertyandpersonnelwithinCouncil.InternalAuditappliesarisk-basedapproachtoits activitiesandworksclosely withthecorporateRiskManagementfunctiontogainriskandassurancecoverage acrossCouncil. TheInternalAuditunitisguidedbyastrategicplanapprovedbytheAudit&RiskCommitteeand providesanannualreportto theCommitteeonoverallprogressoftheuniteachyear.

TheInternalAuditfunctionis conductedbyafull-timeInternalAuditorandsupplementedwithco-sourced resourcing.

Council’sInternalAuditorisrequiredtoundertaketrainingactivitiesinalignmentwithprofessionalmembership requirementsandaspartoftheannualInternalAuditPlan,whichisapprovedandmonitoredbytheCouncil’s AuditandRiskCommittee.TheInternalAuditorisaspecialistwiththefollowingprofessionalaffiliationsand qualifications:

TheInternalAuditunitappliesarisk-basedapproachtoitsplanningandauditactivitiestoproduceanassurance mapforthebusinesswhichsupportsnominationofprospectiveassuranceprojects.Annualandthree-year InternalAuditplansarepreparedbasedonCouncil’sEnterprise-WideRisk Managementassessmentsandarange ofotherrelevantsourcesofinformationincludingtheQueenslandAuditOffice,Statedepartments,Instituteof InternalAuditors,andotherlocalgovernments.TheCouncil’sAuditandRiskCommitteereviews,approvesand thenmonitorsperformanceagainstthisplanatmeetings.Fortheyearended30June 2025,InternalAuditand externalproviders,completedsixreviewsacrossCouncilinaccordancewiththeInternalAuditPlanincludingthe followingareas:

Landfillmanagement

Lowvalueassetcontrols

Dammanagement

OperationCentreprocesses

Workforcemanagement

Emergencyevacuationplanning

Additionally,InternalAuditconductsongoingmonitoring andmanagementofpreviouslyraisedauditfindings. TheInternalAuditunitworkscollaborativelywithmanagementtorecommendimprovementstosystems, processes,workpractices,complianceandbusinesseffectiveness,remainingindependentandobjectiveinthe fulfilmentofitsduties.

InternalAuditcomplieswithQueenslandGovernmentlegislativerequirementsforthe conductofinternal auditinginadditiontomeetingtheprofessionalstandardsoftheInstituteofInternalAuditors.TheInstitute’s standardsrequireanexternalqualityassessmentatleasteveryfiveyearswhichCouncillastcompletedinApril 2024.CouncilmonitorstheongoingqualityofitsInternalAuditfunctionthroughactivitieswhichincludequarterly progressreportsandcustomersurveysofkeystakeholders.InternalAudithasimplementedchangestoachieve compliancewiththestandardswhichbecameeffectiveon9January2025.

CouncilisauditedexternallyeachyearbytheQueenslandAuditOffice(ortheirappointedcontractors).During the2024/25financialyeartheannualexternalauditofCouncil’sfinancialstatementswasconductedbyCrowe AuditAustralia.

TheAuditandRiskCommitteeisanadvisorycommitteeof Council,whichprovidesanindependentforumwhere representativesofCouncil,independentspecialistsandmanagementworktogetherto fulfilspecificgovernance responsibilitiesassetoutinitsTermsofReference,whichincludesoversightofthe:

Integrityoffinancialdocuments

InternalAuditfunction

Progressofauditactionitems

Effectivenessandobjectivityofinternalauditors

Independenceandobjectivityofexternalauditors

Riskmanagementframeworkandprocessesrelatedtoidentificationofsignificantrisksandthreats During2024/25theAuditandRiskCommitteeconsideredreportsfromarangeofsourcesrelatingtoavarietyof topicsincluding:

Compliance

Financialmanagement

Governance&Fraud

Policy&keyguidancedocuments

Internalcontrols

Financialstatements

Emergencyresponseandbusinesscontinuityactivities

Enterpriseriskmanagement:riskappetitemanagement, strategic&operationalriskassessment

Internalaudit:compliancewithnewglobalinternalaudit standards,independenceandobjectivity, strategicdirection,planning,resourcing,monitoringofprogressandcommunicationoffindings