e importance of small businesses to the economy cannot be overstated. ough national chains o en garner publicity, local businesses are equally, if not exceedingly, worthy of attention. What de nes a small business as “small” varies signi cantly, but these businesses are generally privately owned and generate far less revenue than big corporations. General consensus also de nes small businesses as companies with fewer than 500 paid employees, according to the U.S. Small Business Administration. Here’s a deep look at why small businesses are so vital, and why consumers should direct more of their purchasing power to smaller companies rather than the big box retailers & other national chains.

1. Autonomy & Diversity – e layout and o erings at national chains will be identical whether you live in the mountains or at the beach. Big box stores follow a consistent marketing strategy and look the same regardless of where they are located. at familiarity can come at the cost of variety. On the other hand, an independent business o ers the products and services that are re ective of the customers and the community they serve.

2. Local Hiring Strategy – Certain big box retailers will hire local residents, but hiring policies may push for promoting from within the organization. is could mean relocating an employee rather than bringing in someone from the community who may be more in tune with local sensibilities. Small businesses may be more inclined to hire residents they know and keep hiring centralized to the local area — something that keeps more resources and money in the community.

3. Adaptability & Change – Local businesses can move more quickly to respond to economic factors that require change. Since they are focused more on the needs of their customers rather than stockholders, changes can be implemented rapidly without having to go through red tape, meetings and updates to corporate policies. Changes also can be customized to the local community at large.

4. Investing in e Town – According to the nancial resource Financial Slot, shopping at locally owned businesses rather than big box retailers keeps more money in the community. Local property taxes and other taxes paid by the businesses go right back into the community. is helps raise overall value for homeowners and can even reduce their taxes. e funding helps keep police, re and school departments functioning properly.

5. Turnover is Greater – While no one wants to see a small business fail, that fate is sometimes unavoidable. However, that turnover helps teach communities what was done poorly & helps others learn from those mistakes. It also means fresh businesses will come in and replace the old, driving new growth, opportunity and competition that keeps prices competitive.

e bene ts of a thriving small business sector are numerous. Consumers can do their part by patronizing these rms more frequently.

Prices on the majority of goods and services have increased signi cantly over the last year-plus. Financial analysts report that in ation has reached heights that haven’t been seen in 41 years. According to the United States Department of Labor, the consumer price index, which measures changes in how much Americans pay for good and services, rose 0.4 percent in September. As prices soared, families’ budgets were being pushed. What can people do in the face of rising costs on items they need, including those who may be on xed incomes? ese suggestions may help.

• Frequently review your budget. Keep track of how much items cost right now. Document all spending by writing down a list of weekly expenses or utilizing any number of free budgeting apps available. Tracking what is going out may make it easier to cut costs on less essential items, such as streaming services or gym memberships.

• Contact service providers. You may be able to negotiate better deals with a service provider, such as a mobile phone company or a cable television provider, if they learn you are considering leaving. If they can’t work out a deal, go with the less expensive provider. You can always switch back at the end of the term if you desire.

• Stop automatic payments. Having subscriptions and other bills automatically deducted from your checking account is convenient, but those rising costs may be overlooked. By viewing your bill and paying it each

month, you can see where costs have increased and where you might need to rethink services.

• Carpool to work or school. Reduce expenditures on gasoline by sharing the costs with another person. Determine if public transportation is more cost-e ective than driving to work or school each day.

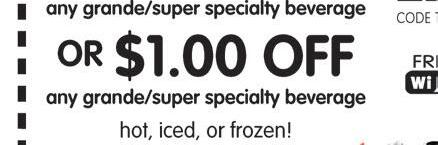

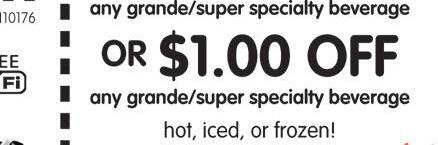

• Consider alternative retailers. Brand loyalty to one supermarket or a particular retailer is quickly becoming a thing of the past. Nowadays it is wise to comparison shop across various stores to gure out where you’re getting the best deal. Venture into stores you may not have considered previously. Divide your shopping list by store category, visiting several for di erent items if it leads to big savings.

• Unplug, literally and guratively. Cut down on energy costs by unplugging items when not in use. Reduce dependence on devices to further stem costs on electricity and gas-powered appliances.

Prices continue to rise and consumers can explore various ways to stick to their spending budgets.

Christmas carols can be heard far and wide from anksgiving weekend through Christmas Day. “ e 12 Days of Christmas” is one of the most recognizable carols, and for good reason, as the popular song can trace its history back several centuries. Researchers have traced the earliest printed version of the poem on which the song is based all the way back to 1780. at’s three years before the signing of the Treaty of Paris, which o cially ended the American Revolutionary War. e song has long been suspected to have been a way for Catholics in Britain to teach their children the catechism, as the 1700s was a controversial

period for Catholicism in the country. However, no documentary evidence exists in support of that theory, and many historians feel it is inaccurate. Others indicate that, while 1780 is likely the rst time the poem was printed, the poem is likely much older than that, with origins potentially in France or Scotland. What is known is that the version many people recognize today, namely in song form, can be traced to the early twentieth century, when English singer and composer Frederic Austin rst popularized the melody for the song. Austin performed that version of the song beginning in 1905, and it was rst published in 1909.

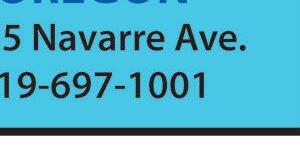

BOWLING GREEN

Published By Town Money Saver, Inc. Corporate Office • PO Box 356 • Lucas, OH 44843 © 2022 TMS Franchising, Inc. All rights reserved.

For advertising information, call 419-355-5477

NEXT ISSUE IN HOMES: January 6, 2023

ADVERTISING DEADLINE: December 14, 2022