2026: A Year of Breakthroughs

What I’m Seeing Heading Into 2026

AFTER RETURNING FROM AN ECRM TRADE SESSION AND THEN WALKING STORES ACROSS FOOD, DRUG, AND MASS RETAILERS—I FOUND MYSELF THINKING LESS ABOUT WHAT’S NEW AND MORE ABOUT WHAT’S QUIETLY CHANGING.

Trade shows still matter. Shelves are still competitive. Innovation is still coming. But the way brands show up and what retailers expect in return has shifted in ways many smaller suppliers still underestimate.

As we head into 2026, here are a few observations worth sharing.

GETTING ON THE SHELF IS STILL A WIN— BUT IT’S NO LONGER THE VICTORY

We all say it because it’s true: getting on the shelf is just the start. Yet many early-stage brands still treat distribution as the finish line. The product lands, photos are taken, posts go up—and momentum is assumed.

It won’t.

Retailers today are more data-driven, less patient, and far more skeptical. They expect brands—especially emerging one tto invest, communicate clearly, and have a defined plan for what happens after placement.

In 2026, shelf space isn’t a reward.

It’s an audition.

OTC: FROM MEDICINE CABINET TO DAILY ROUTINE

In the OTC aisle, consumers aren’t just buying relief they’re building habits.

Categories like nasal care, sleep, and immunity are increasingly about daily use and lifestyle fit, not just symptom treatment. Products that combine function with sensory experience are finding space alongside long-established brands,

reshaping how shoppers think about everyday wellness.

Trust, belief, and familiarity continue to matter sometimes as much as clinical claims. Efficacy still reigns supreme, but how a product fits into a consumer’s routine is becoming just as important.

Even in traditionally generic segments, brands that offer reassurance, clarity, and consistency are proving that differentiation is still possible.

For retailers, OTC is no longer just about coverage.

It’s about use occasions.

VITAMINS: LESS “MORE,” MORE “SPECIFIC”

The vitamin category is contracting and expanding at the same time.

Redundant SKUs and oversized multis are overwhelming shoppers, while condition-specific solutions stress, sleep, gut health, immunity, and especially women’s health continue to grow.

What stood out most wasn’t flashy formats, but brands that clearly communicate who they’re for and why

they exist. In 2026, vitamins don’t need more SKUs.

They need better storytelling.

Retailers are responding by curating more intentionally and rewarding brands that educate rather than overwhelm.

EVEN “GENERIC” HBA ISN’T GENERIC ANYMORE

Some of the most compelling brand stories are happening in categories that were once treated as pure commodities.

Products long viewed as interchangeable are being reimagined through wellness positioning, scent, and clearly defined benefits. The result is stronger engagement and, in many cases, real brand loyalty in places where it didn’t previously exist.

Private label still matters and much of today’s innovation is coming from private label manufacturers. But brands continue to win when they give shoppers a clear reason to choose.

TRADE SHOWS: ONE MOMENT IN A LONGER CYCLE

Too many companies attend trade shows with expectations instead of plans.

Meetings happen. Samples are shared. Then momentum fades. Weak preparation and poor follow-up create friction for retailers— and over time, skepticism.

In 2026, trade shows are just one moment in a longer discovery cycle. Retailers gravitate toward brands that show consistency and momentum before and after the booth.

FINAL THOUGHT

2026 won’t be defined by massive reinvention, but by smaller, more intentional shifts—on shelf, online, and in how brands engage retailers.

The brands that win won’t celebrate getting on the shelf.

They’ll recognize that’s when the real work begins.

Chris Stanton Publisher

chris@themosaicgroup.org

Beauty Moves Faster—and Retailers Are Setting the Pace

OTC: Where Trust Still Wins

OTC may not generate the same buzz as beauty, but in 2025 it quietly became one of the most revealing categories in mass retail—and that momentum is carrying into 2026.

30 A Conversation with Beth Allgaier

Beth Allgaier of CHPA shares thoughtful insights and what the future of OTC looks like. we look behind the scenes on the CHPA’s advocacy of OTC in the retail marketplace.

26 Health and Wellness 2026: The Pillars Reshaping Consumer Behaviors

As 2026 gets underway, one thing is for certain: U.S. consumers are doubling down on health and wellness — reframing what they buy, how they shop, and the claims they trust. Here are three pillar themes driving the next wave of growth across retail and consumer healthcare:

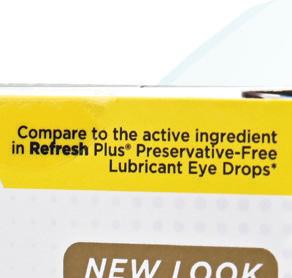

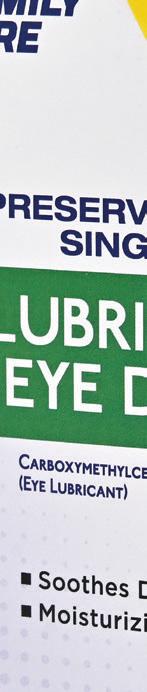

Eugene Choi discusses a new product launch from the Family Care brand.

JAN

1/11/2026-1/14/2026

Everyday and Holiday Cosmetics, Skin, Fragrance & Bath Session

Sheraton Dallas Hotel, Dallas, TX

1/12/2026-1/15/2026

Cough, Cold, Preventative & Allergy Session

Sheraton Dallas Hotel, Dallas, TX

1/18/2026-1/20/2026

NACDS Regional Chains

Bonita Springs, FL

1/21/2026-1/22/2026

On & Off Premise Adult Beverage, Winter Session

Held Virtually

1/21/2026-1/22/2026

THC & Hemp Beverage Session

Held Virtually

1/21/2026-1/24/2026

FMI Mid Winter

Chula Vista

FEB

2/1/2026-2/4/2026

European Colour Cosmetics and Fragrance Session

Hilton Prague, Prague, Czech Republic

2/1/2026-2/4/2026

European Skin, Bath, Hair & Sun Care Session

Hilton Prague, Prague, Czech Republic

2/2/2026-2/4/2026

Convenience Session

Hilton Sandestin Beach Golf Resort & Spa, Destin, FL

2/3/2026-2/5/2026

Hardware & Automotive Session

Hilton Sandestin Beach Golf Resort & Spa, Destin, FL

2/3/2026-2/5/2026

Impulse, Front-End & Checklane Session

Hilton Sandestin Beach Golf Resort & Spa, Destin, FL

2/3/2026-2/5/2026

Outdoor, Seasonal and Garden Session

Hilton Sandestin Beach Golf Resort & Spa, Destin, FL

2/9/2026-2/12/2026

Educational Supplies & Furniture Session

Hilton Sandestin Beach Golf Resort & Spa, Destin, FL

2/10/2026-2/12/2026

Total Wellness: GLP-1, Weight Management, Nutrition & Vitamin Session

Hyatt Regency Chicago O’Hare, Rosemont, IL

2/15/2026-2/17/2026

Beverage, Winter Session

Hyatt Regency DFW, Dallas-Fort Worth, TX

2/15/2026-2/18/2026

Candy Planning: Christmas & Halloween Session

Hyatt Regency DFW, Dallas-Fort Worth, TX

2/16/2026-2/17/2026

Coffee, Tea & Cocoa, Winter Session

Hyatt Regency DFW, Dallas-Fort Worth, TX

2/17/2026-2/18/2026

Baking, Spices & Breakfast Foods, Winter Session

Hyatt Regency DFW, Dallas-Fort Worth, TX

2/17/2026-2/18/2026

Canned, Dry & Boxed Foods, Winter Session

Hyatt Regency DFW, Dallas-Fort Worth, TX

2/17/2026-2/18/2026

Condiments, Sauces & Spreads, Winter Session

Hyatt Regency DFW, Dallas-Fort Worth, TX

2/17/2026-2/19/2026

Snack, Winter Session

Hyatt Regency DFW, Dallas-Fort Worth, TX

MAR

3/16/2026-3/18/2026

CHPA Self Care Leadership Summit Orland, FL

APR

4/18/2026-4/21/2026

NACDS Annual Meeting

Palm Beach, FL

4/20/2026-4/22/2026

Private Label Health & Beauty Care Session

Hyatt Regency Chicago O’Hare, Rosemont, IL

As 2026 begins, the retail landscape continues to evolve at a rapid pace. From membership-driven giants to regional grocery leaders and health-focused chains, retailers are finding new ways to blend convenience, digital capabilities, and private-label innovation.

Here, we take a closer look at

nine major players shaping the industry today

and what they have in store for the year ahead.

BY CHRIS STANTON, PUBLISHER AND EDITOR

COSTCO

Costco drives loyalty through its membership model, bulk merchandising, and the Kirkland Signature private brand. In 2026, the chain will likely expand its global footprint while enhancing membership perks, checkout efficiency, and in warehouse experiences.

CVS

CVS combines retail and pharmacy services with a growing focus on healthcare solutions. In 2026, the company will continue refining its footprint while expanding privatelabel health and beauty offerings and integrated care services.

WALGREENS

Walgreens is recalibrating its retail-healthcare model through store optimization and operational efficiency. In 2026, expect continued closures of underperforming stores alongside investments in highermargin pharmacy services and partnerships.

WALMART

Walmart remains a leader in scale and omnichannel fulfillment, leveraging Walmart+ and same day delivery. In 2026, expect Walmart to keep being Walmart; making investments in automation, marketplace expansion, and digital fulfillment to strengthen convenience and engagement.

TARGET

Target differentiates through curated assortments and strong private brands like Good & Gather. In 2026, the chain will improve operations, while emphasizing private-label growth, experiential shopping, and blended digital and in-store fulfillment.

KROGER

Kroger combines grocery scale with digital and loyalty programs to drive competitiveness. In 2026, it will continue expanding healthy choices, digital fulfillment, private brands, and value initiatives while exploring strategic alliances.

MEIJER

Meijer blends grocery and general merchandise with strong regional loyalty. For 2026, it will likely focus on store optimization, digital offers, and promotional timing to remain competitive and expand in the Midwest.

HY VEE

Hy Vee is a regional grocery leader with a focus on fresh foods, pharmacy, and private brands. For 2026, it will expand omnichannel grocery services, remodel stores, and strengthen nutrition-focused and specialty offerings.

H E B is a Texas favorite known for tailored assortments, community focus, and omnichannel services. In 2026, the chain will grow in fast-expanding (north) Texas markets, enhance existing stores, and invest in technology, logistics, and service innovations to sustain loyalty.

Beauty Moves Faster—and Retailers Are Setting the Pace

MASS RETAILERS ARE ENTERING 2026 WITH A MORE DELIBERATE AND INTEGRATED APPROACH TO HEALTHDRIVEN BEAUTY. WHAT WAS ONCE TREATED AS A SEASONAL INITIATIVE OR A STANDALONE CATEGORY IS NOW BEING WOVEN INTO EVERYDAY SHOPPING BEHAVIOR CONNECTING SKIN CARE, HAIR CARE, FRAGRANCE (YES FRAGRANCE HAS WELLNESS BENEFITS!), AND PERSONAL CARE TO BROADER WELLNESS GOALS ACROSS THE STORE.

At Target for example that shift is already visible. The retailer recently announced a 30% expansion of its wellness assortment, adding thousands of products priced under $10. The move reflects a broader mass-channel strategy: make wellness-oriented beau-

ty accessible, routine, and value-led, without sacrificing credibility or performance.

At the same time, beauty trends that gained momentum in 2025 are reshaping the competitive landscape in 2026 particularly in skin care and lip care. Lip care, once viewed primarily as a cosmetic add-on or a cold-weather seasonal item, has evolved into a yearround essential tied to skin health, hydration, and protection. Brands such as ChapStick, eos, and Carmex have long operated at this intersection, blending wellness benefits with mass accessibility and reinforcing lip care’s role as both a health and beauty staple. Increasingly, these products appear across departments, illustrating how beauty is crossing channels and becoming part of everyday care routines.

Innovation remains the defining currency in beauty, but thanks to social media sites like TikTok and YouTube, speed has become just as critical. Retailers are no longer waiting for traditional brand development to play out. Instead, many are accelerating in-house development, private label, and exclusive “control brand” strategies to keep pace with how consumers discover beauty digitally, socially, and often outside the aisle. This approach allows mass retailers to test trends faster, manage pricing, and stay discovery-relevant in an increasingly crowded marketplace.

Together, these shifts signal a more strategic era for mass beauty—one defined less by sheer shelf space and more by curation ...

A key enabler of this model is Maesa, a company focused on speed, alignment, and execution. By combining formulation, branding, and retailer collaboration, Maesa has helped redefine how innovation reaches mass shelves. Rather than waiting years for national rollouts, retailers can introduce differentiated beauty brands designed for limited distribution, exclusivity, and faster time to shelf.

Together, these shifts signal a more strategic era for mass beauty—one defined less by sheer shelf space and more by curation, credibility, and control of innovation timelines. For suppliers, the opportunity in 2026 will be less about simply being present and more about proving relevance within a wellness-forward ecosystem that values speed, clarity, and storytelling. In today’s beauty aisle, discovery belongs to those who move fast—and move with purpose.

SALES BASED ON 52 WEEKS ENDING DECEMBER 28, 2025 VS. SAME PERIOD THE PRIOR YEAR

TOP 3 FASTEST-GROWING

SEGMENTS

"MAKEUP COMBO PACKS (+41%)

MAKEUP COMBO PACKS ARE GAINING TRACTION AS SHOPPERS LOOK FOR VALUE AND CONVENIENCE. BUNDLED SETS THAT INCLUDE COMPLEMENTARY PRODUCTS — LIKE FOUNDATION AND CONCEALER OR LIP AND EYE ESSENTIALS — APPEAL TO CONSUMERS SEEKING A STREAMLINED BEAUTY ROUTINE WITHOUT SACRIFICING QUALITY.

WOMEN’S

GIFT PACKS (+29%)

THESE CURATED ASSORTMENTS, WHICH OFTEN COMBINE SKINCARE, FRAGRANCE, OR OTHER BEAUTY PRODUCTS, ARE EXPERIENCING ROBUST GROWTH FUELED BY STRONG SEASONAL DEMAND AND ONGOING SELF-CARE TRENDS. THE SEGMENT’S EXPANSION REFLECTS CONSUMERS’ PREFERENCE FOR THOUGHTFULLY PACKAGED, MULTI-PRODUCT SETS THAT OFFER BOTH CONVENIENCE AND VALUE FOR GIFTING OCCASIONS AND PERSONAL PAMPERING.

SHAMPOO & CONDITIONER COMBO PACKS (+20%)

COMBO PACKS ARE SURGING AS CONSUMERS SEEK VALUE AND CONVENIENCE IN HAIR CARE ROUTINES. GROWTH IS DRIVEN BY LARGE-FORMAT OFFERINGS AND BUNDLED SOLUTIONS THAT SIMPLIFY SHOPPING AND DELIVER COST SAVINGS. THIS TREND REFLECTS A SHIFT TOWARD STREAMLINED REGIMENS, WITH MULTI-PURPOSE PACKS APPEALING TO HOUSEHOLDS LOOKING FOR EFFICIENCY WITHOUT SACRIFICING QUALITY.

US MARKET SIZE ($ SALES, BILLIONS)

175.7 4%

TOP THREE SEGMENTS (BASED ON $ SALES, BILLIONS) % GROWTH/ DECLINE VS. PRIOR YEAR WEIGHT CONTROL/ NUTRITIONALS

$11.7

$8.9 $7.1

Oilogic Extends Beyond the Bath

Oilogic, the first brand to help soothe baby’s cold symptoms in the bath, introduces Stuffy Nose & Cough Vapor Rub. Made with the brand’s best-selling essential oil blend and a gentle, vegan-based balm, it easily rubs onto chest, neck, and feet to comfort baby after bath time and throughout the night.

SmileyWorld® by O’life Natural combines sustainability with positivity. Our Cylinder Facial Tissues are made from 100% bamboo — tree-free, FSC-certified, and plastic-free. Ultrasoft 3-ply sheets in iconic Smiley designs add color and good vibes to any desk, car, or home. Eco-minded, dust-free, and reusable packaging make smiling the most natural thing in the world.

Founded on the belief that pure, plant-based formulas can transform hair, PURA D’OR crafts small-batch collections guided by three core values: Purity in Every Bottle, Peace with Mother Earth, and Proven Results. The Advanced Therapy Shampoo & Conditioner strengthens and revitalizes hair using organic oils and natural extracts, available at Costco.com, CVS, Meijer, and Target.com, and more.

OOTD’s Vitamin C Body Wash and Body Lotion bring the brand’s clinical skincare expertise to body care. Clinically tested and dermatologist-tested for sensitive skin, this Vitamin C body care targets dark spots and uneven tone from neck to toe. Powered by Vitamin C, Niacinamide, and Glutathione, the duo delivers smoother, brighter skin with gentle, daily-use formulas for all skin types.

OTC: Where Trust Still Wins—and Innovation Shows Up in Unexpected Ways

OTC MAY NOT GENERATE THE SAME BUZZ AS BEAUTY, BUT IN 2025 IT QUIETLY BECAME ONE OF THE MOST REVEALING CATEGORIES IN MASS RETAIL— AND THAT MOMENTUM IS CARRYING INTO 2026.

From my perspective, what shifted wasn’t consumer need; it was how consumers decide. Shoppers are more informed, more selective, and far more intentional about what they choose, even when they’re looking for fast relief.

That shift has created room for brands willing to rethink familiar solutions. Consider BoomBoom. In a category long dominated by legacy players like Vicks, BoomBoom re-

Retailers are paying close attention. As discovery accelerates and digital influence reshapes health decisions, mass merchants are no longer willing to wait for slow innovation cycles.

moditized. Saline sprays are a prime example. While formulations are largely similar, brands like Ayr from B. F. Ascher consistently outperform generics because reassurance matters—especially when products are used frequently or on children. Clear labeling, clinical cues, and long-standing presence still influence decisions at shelf.

framed the nasal inhaler as a modern, lifestyle-oriented product—portable, scented, and positioned for focus and energy as much as congestion. It didn’t disrupt the category with new chemistry; it disrupted it with new context, expanding when and why consumers engage with the product.

At the other end of the spectrum is Boiron’s Oscillococcinum. Despite being homeopathic—and often debated—it continues to outsell many conventional flu remedies in mass retail. That performance speaks less to ideology and more to brand trust, shelf clarity, and familiarity. Consumers may not all agree on how it works, but they clearly believe in it—and belief matters in OTC.

The same dynamic plays out in categories often dismissed as com-

Even Epsom salt tells a similar story. Dr Teal’s took a basic ingredient and reframed it as part of a broader wellness ritual. By layering in scent, benefit-led messaging, and self-care positioning, the brand transformed a functional product into a lifestyle choice—without changing what’s inside the bag.

Retailers are paying close attention. As discovery accelerates and digital influence reshapes health decisions, mass merchants are no longer willing to wait for slow innovation cycles. They are increasingly selective, balancing trusted brands, emerging challengers, and private-label development to keep OTC relevant and responsive.

Heading into 2026, OTC success won’t hinge on novelty alone. It will favor brands that earn trust quickly, communicate clearly, and understand that even in the most functional categories, brands still matter especially when the product feels generic.

Signals from the Shelf

SALES BASED ON 52 WEEKS ENDING DECEMBER 28, 2025 VS. SAME PERIOD THE PRIOR YEAR

TOP 3 FASTEST-GROWING SEGMENTS

LIP BALMS & TREATMENTS (+13%)

THE TOP GROWTH SEGMENT WITHIN TRADITIONAL OTC, LIP BALMS AND TREATMENTS’ GROWTH IS FUELED BY A COMBINATION OF TREND-FORWARD INNOVATION AND WELLNESS-FOCUSED POSITIONING, WITH NEW ITEMS APPEALING TO YOUNGER AND MIDDLE-AGED CONSUMERS. THE SEGMENT’S MOMENTUM REFLECTS INCREASED DEMAND FOR EFFICACY-DRIVEN HYDRATION AND BEAUTY CROSSOVER PRODUCTS.

ACNE TREATMENTS (+5%) EXTERNAL ANALGESIC RUBS (+4%)

WITH GROWTH STEMMING FROM ACNE PATCHES, ACNE TREATMENTS IS THE SECOND FASTEST-GROWING SEGMENT IN TRADITIONAL OTC. THE PREFERRED FORMAT PROVIDES A QUICK, DISCREET, OR SOMETIMES STYLISH SOLUTION, FOR SPOT TREATMENTS. ACNE TREATMENTS IS AMONG THE SEGMENTS WHERE WELLNESS AND BEAUTY CONNECT.

GROWTH IN EXTERNAL ANALGESIC RUBS IS FUELED BY CONSUMERS SEEKING FAST, TARGETED RELIEF FOR MUSCLE AND JOINT DISCOMFORT. DEMAND IS SUPPORTED BY ACTIVE LIFESTYLES AND INCREASED INTEREST IN PAIN MANAGEMENT SOLUTIONS THAT OFFER CONVENIENCE AND NON-INVASIVE APPLICATION.

TOP THREE SEGMENTS (BASED ON $ SALES, BILLIONS)

US MARKET SIZE ($ SALES, BILLIONS)

36.5

% GROWTH/ DECLINE VS. PRIOR YEAR

$7.1

COUGH/COLD/FLU/ SINUS

$4.1 $4.0

OCuSOFT® Retaine® Allergy™ original prescription strength antihistamine drops only need to be used once daily and work in minutes to provide relief from pet dander, pollen, grass, ragweed, and other contaminants. Each multi-dose bottle contains a 30-day supply that works directly on the cells that make eyes itch for long-term support of allergy eye symptoms.

Playboy Condoms isn’t just a name— it’s an invitation to explore, express, and own your and your partner’s desires. Crafted with confidence and designed for those who play by their own rules, we’re here to make every moment unforgettable.

Live. Love. Louder. Stay Playful. Have Fun.

Fresh Scents is a proven growth driver in home fragrance, with scented sachets representing a meaningful and incremental portion of category sales. Manufactured in the USA, Fresh Scents sachets fill a category gap of scenting small and enclosed spaces like closets, dressers, and bathrooms. With strong merchandising support and seasonal, trend-forward designs, Fresh Scents keeps shelves relevant and shoppers returning.

“Increases in nasal symptoms related to colds and flu motivate consumers to seek affordable, first-line O-T-C treatments such as NeoSynephrine decongestant nasal sprays, helping drive the entire cough/cold category,” said Ben Knopke, Marketing Manager at B.F. Ascher. “Understanding the needs of our customers allows us to work in unison with retailers across the drug channel to ensure quality health care brands like Neo-Synephrine are made readily available to the market.”

A Conversation with Eugene Choi

BRAND: FAMILY CARE / NEW PRODUCT: SINGLE VIAL LUBRICANT EYE DROPS,

PRESERVATIVE-FREE / LAUNCH: Q1

FAMILY CARE IS LAUNCHING PRESERVATIVE-FREE, SINGLE-VIAL LUBRICANT EYE DROPS THIS QUARTER. WHAT OPPORTUNITY DID YOU SEE IN THE CATEGORY?

We saw a growing demand for preservative-free eye care that consumers can trust for everyday use. Many people rely on eye drops daily, and preservatives can be a concern over time. This product was developed to provide gentle, effective relief in a sterile, single-use format, while being responsibly manufactured in the United States.

WHY WAS THE SINGLE-VIAL FORMAT IMPORTANT FOR THIS PRODUCT?

Single-use vials help ensure sterility and freshness with every application. They remove the risk of contamination associated with multi-use bottles and offer convenience for consumers on the go. Each vial is designed for one use, making it simple, safe, and reliable.

HOW DOES U.S. MANUFACTURING FACTOR INTO THIS LAUNCH?

Manufacturing in the United States was very important to us. It allows for tighter quality control, greater supply-chain reliability, and faster response times. For retailers and consumers alike, “Made in the USA” adds a level of confidence in both product quality and consistency.

THE PRODUCT IS COMPARED TO REFRESH PLUS® PRESERVATIVE-FREE. HOW DOES FAMILY CARE POSITION ITSELF IN THIS SPACE?

We use the same active ingredient, carboxymethylcellulose sodium 0.5%, and focus on delivering a comparable experience in a sterile, single-use format. Our approach is to offer trusted performance while maintaining strong value for retailers and consumers.

HOW DO THE 5-COUNT AND 30-COUNT PACK SIZES SUPPORT RETAIL STRATEGY?

The 5-count pack is ideal for trial, travel, and convenience-driven shoppers, while the 30-count pack supports regular users and value-oriented households. Together, they allow

retailers to serve multiple consumer needs and encourage repeat purchase within the category.

WHAT EXCITES YOU MOST ABOUT LAUNCHING THIS PRODUCT IN Q1?

We are excited to introduce a product that combines comfort, safety, and trust. Being able to offer a preservative-free eye drop that is sterile, easy to use, and made in the USA is something we are proud of. It reflects our commitment to dependable, everyday health care solutions.

Signals from the Shelf

SALES BASED ON 52 WEEKS ENDING DECEMBER 28, 2025 VS. SAME PERIOD THE PRIOR YEAR

TOP 3 FASTEST-GROWING SEGMENTS

WEIGHT CONTROL/ NUTRITIONALS LIQ/PWD (+13%)

DEMAND FOR NUTRITIONAL PRODUCTS CONTINUES TO CLIMB, LIFTED BY A GROWING CONSUMER FOCUS ON THE BENEFITS OF PROTEIN FOR OVERALL WELLNESS. ADDITIONALLY, GLP-1 USERS ARE PLAYING A ROLE IN THIS TREND, SEEKING PROTEIN-RICH OPTIONS TO HELP PRESERVE MUSCLE MASS AND MAINTAIN HEALTH AS PART OF THEIR REGIMEN.

MINERAL SUPPLEMENTS

(+8%)

GROWTH STEMS FROM RISING EMPHASIS ON PERSONALIZED WELLNESS AND SELF-CARE. MAGNESIUM STANDS OUT AS A KEY CONTRIBUTOR, THANKS TO ITS BENEFITS FOR SLEEP QUALITY, MOOD BALANCE, AND BLOOD SUGAR REGULATION.

LIQUID VITAMINS & MINERALS

(+6%)

CONSUMERS ARE INCREASINGLY CHOOSING LIQUID FORMATS FOR THEIR CONVENIENCE AND PERCEIVED BENEFITS.

THESE PRODUCTS OFFER EASY INTAKE AND ARE OFTEN ASSOCIATED WITH IMPROVED ABSORPTION, MAKING THEM AN APPEALING OPTION FOR THOSE SEEKING BETTER-FOR-YOU INGREDIENTS.

TOP THREE SEGMENTS (BASED ON $ SALES, BILLIONS)

$11.7

WEIGHT CONTROL/ NUTRITIONALS LIQ/PWD

$8.9

US MARKET SIZE ($ SALES, BILLIONS)

28.3 8%

% GROWTH/ DECLINE VS. PRIOR YEAR

$3.0

Health and Wellness 2026: The Pillars Reshaping Consumer Behaviors

AS 2026 GETS UNDERWAY, ONE THING IS FOR CERTAIN: U.S. CONSUMERS ARE DOUBLING DOWN ON HEALTH AND WELLNESS — REFRAMING WHAT THEY BUY, HOW THEY SHOP, AND THE CLAIMS THEY TRUST. HERE ARE THREE PILLAR THEMES DRIVING THE NEXT WAVE OF GROWTH ACROSS RETAIL AND CONSUMER HEALTHCARE:

BY KRISTIN HORNBERGER, EVP, PRACTICE LEADER, WELLNESS, BEAUTY & HOMECARE AT CIRCANA

1. The GLP-1 Effect: Rapid adoption is changing eating habits, fueling demand for high protein, fiber, hydration, and microbiome support — while oral options for the medication are expanding accessibility, adherence, and retail activation opportunities

2. Women’s Health at Scale: A rapidly expanding market, the women’s health niche is bustling with new products tailored to life-stage needs, from fertility and maternal health to menopause and healthy aging

3. Holistic Self-Care: Consumers of all ages are prioritizing physical, mental, and social health, lifting categories such as nutritionals; beauty; sleep, mood, and brain support; and active aging solutions

For manufacturers, brands, and retailers, these pillars create fertile ground for innovation, cross-category collaboration, and portfolio diversification.

THE GLP1 EFFECT: ACCESSIBILITY, BEHAVIOR SHIFTS, AND RETAIL ACTIVATION

GLP-1 medications have moved firmly into the mainstream of the health and wellness industry. U.S. household usage reached 23% in September 2025 — up 4 points versus 2024. Weight management motivations now top the list of why consumers are using GLP-1 medications. Among recent users, their top three food- and beverage-related wellness goals are as

follows: losing weight (61%), managing a medical condition (37%), and feeling better (35%).

Dietary and other lifestyle changes of GLP-1 users are revealing themselves at retail. Consumers are shifting more of their spending towards products considered positive for GLP-1 including protein, fiber, and hydration. Importantly, these changes extend beyond food and beverage into beauty and personal care. GLP-1 users are investing more in enhancing their appearance through skincare, makeup, fragrance, and oral care products — signaling that feeling better physically is translating into confidence and self-expression. The industry must ensure it is meeting the needs of consumers wherever they are on their GLP-1 journey. Brands should build GLP-1-ready portfolios with claims tied to benefits like satiety, lean mass, hydration, and GI support. Retailers can curate assortments and focus on club and e-commerce channels where GLP-1 users over-index, as well as pharmacies and grocery stores – frequent retail touchpoints that will benefit from the rising accessibility of GLP-1s. Foodservice operators should offer GLP-1-friendly menus with protein, fiber, zero-sugar smoothies, teas, fruits, and portion-controlled items, as casual dining shows the strongest uptick among GLP-1 users.

GLP-1 developments in 2025 including regulatory actions, its addition to the World Health Organization’s essential medicines list, and the approval of oral formulations have paved the way for improving accessibility for GLP-1 medications, though cost and insurance coverage remain friction points. Assuming current affordability and access trends persist, GLP1 households are projected to account for approximately 35% of food and beverage and 37% of non-food units by 2030, reinforcing the need for durable, cross-category strategies that serve users during and after their GLP-1 journey.

WOMEN’S HEALTH: A MULTIGENERATIONAL GROWTH ENGINE

Women’s health accounts for nearly $8 billion in annual CPG sales, with 89% of women wanting to be more proactive in managing their health. This opportunity spans life stages: establishing healthy habits for Gen Z and Millennials; providing perimenopause and menopause support for Gen X; and supporting healthy aging for Boomers.

Looking at product archetypes that are gaining traction, momentum is strong for maternal health categories (prenatal and postnatal multivitamins with DHA/folate), microbiome solutions (women’s probiotics), hormone

balance, and stress support. Benefitled claims, clean formulations, and approachable formats such as gummies and soft chews convert across channels.

In addition, authentic claims resonate loudly with this audience. Transparency and clinical coherence are table stakes; successful brands connect specific benefits – energy, immunity, bone health, skin/hair/nails – to lifestage needs, while offering flexible forms for convenience. Collagen, hyaluronic acid, CoQ10, omega3s, and targeted mineral supplementation are central to women’s wellness routines.

To succeed in this expanding women’s health space, retailers and manufacturers must design for life transitions, not just demographics — ensure product assortments cover fer-

tility, pregnancy, postnatal, perimenopause, menopause, and healthy aging with clear guidance. Lean into format innovation (gummies, RTD, dualformat powder/RTD, stick packs) to meet onthego lifestyles and personal preferences. And finally, elevate trust with clean labels, evidencebased claims, and accessible education — particularly in social channels where discovery happens.

SELFCARE’S TRIFECTA: PHYSICAL, MENTAL, AND SOCIAL HEALTH

A universal priority, self-care has become more holistic as it touches on all physical, mental, and emotional aspects of our lives. Across generations, consumers rank healthy eating, exercise, and vitamins/supplements

at the top of planned wellness activities — alongside routine doctor visits and moodenhancing practices such as meditation, fragrance usage, and personal grooming. The net-net is that selfcare is broad, unceasing, and increasingly proactive.

Mental wellness is surging. Interest in stress, sleep, mood, and cognitive support is at an all-time high — with top searches and sales momentum in ashwagandha, magnesium, CBD, and brain health supplements. Even in satellite categories such as beverages, the hydration segments increasingly carry mental wellness claims of focus, mood, and calm as lines blur between functional beverages and vitamin/ mineral supplements (VMS).

As with many things, generational nuances matter: younger cohorts over-index on discovery-driven purchases and challenger brands, while Boomers lean into active aging solutions for cognitive vitality. For all groups, the intersection of health, beauty, and social well-being is clear — self-care is no longer siloed but integrated across lifestyle choices.

To support self-care goals and stand out in the crowd, retailers and manufacturers must build holistic bundles that stitch together physical, mental, and social benefits. Leverage retail media and social commerce to translate science into everyday rituals. And serve consumers with empathy

A universal priority, self-care has become more holistic as it touches on all physical, mental, and emotional aspects of our lives.

and design rigor, focusing on comfort, cognition, and independence — while keeping packaging, sizing, and guidance inclusive.

ACHIEVING WELLNESS: CONNECTING NEEDS AND UNIFYING SOLUTIONS

Health and wellness in 2026 is multi-dimensional and opportunity-rich, but winning in this space requires more than presence — it demands solution-based precision. GLP1 therapies are shifting behaviors and opening adjacencies; women’s health is scaling with lifestage precision; and holistic selfcare is mainstream across ages. Brands, manufacturers, and retailers that integrate these pillars — with credible science, approachability, flexible formats, and wellness-focused design — will earn trust and outgrow the market.

A Conversation with Beth Allgaier

SVP, BUSINESS DEVELOPMENT AND INDUSTRY RELATIONS, CHPA

BETH ALLGAIER SHARES THOUGHTFUL INSIGHTS AND WHAT THE FUTURE OF OTC LOOKS LIKE.

WE LOOK BEHIND THE SCENES ON THE CHPA’S ADVOCACY OF OTC IN THE RETAIL MARKETPLACE.

FOR READERS WHO MAY NOT BE FAMILIAR WITH CHPA. HOW WOULD YOU DESCRIBE WHAT YOUR ORGANIZATION ACTUALLY DOES, IN SIMPLE TERMS, AND WHY IT MATTERS TO THE COMPANIES YOU SERVE?

First: Advocacy. CHPA brings together and represents the companies that make and sell trusted over-thecounter (OTC) medicines, dietary supplements, and OTC medical devices that consumers use each day, such as pain relievers, allergy medicines, daily vitamins, oral health products, and more. CHPA advocates, on behalf of the self-care industry, with policymakers and regulators to support consumer access and trust in today’s evolving marketplace.

Second: Connection and Education. We also focus on helping our member companies succeed in a fast-changing marketplace by creating opportunities for manufacturers and retailers across the broader self-care ecosystem to connect, learn, and collaborate. That happens

through our industry-leading conferences, including our annual Self-Care Leadership Summit (SLS) and Regulatory, Science, and Quality Conference (RSQ), as well as our annual Marketing Forum, and on-demand education through CHPA Academy and our Retailer Resource Center.

Third: Information. Our team delivers practical insights and resources that help members navigate change, innovate responsibly, and respond to evolving consumer needs.

Fourth: Engagement. Just as importantly, we convene the industry, bringing people together through committees, events, and ongoing engagement to create spaces where relationships are built, ideas are shared, and business can move forward.

WHAT STANDS OUT MOST TO YOU ABOUT HOW CONSUMER HEALTHCARE IS EVOLVING HEADING INTO 2026? What stands out most heading into 2026 is the growing complexity of

the self-care marketplace. Consumers have more access to products, information, and purchasing channels than ever before, while also navigating more noise and misinformation. At the same time, growth opportunities are expanding across traditional retail, e commerce, and emerging digital platforms, which make peer learning, expert access, and timely education increasingly important. Our role is to help industry leaders stay informed, anticipate what’s ahead, and navigate change so they can focus on meeting the needs of today’s consumers.

YOU INTERACT WITH CHPA MEMBERS EVERY DAY. WHAT DO YOU THINK SUPPLIERS ARE GETTING RIGHT AT RETAIL? What stands out most is how closely suppliers are listening and how quickly they’re translating insights into action at retail. We’re seeing members respond by consistently meeting consumers where they are: adapting product portfolios, sharpening education, and working closely and transparently with retail partners

to improve accessibility, relevance, and the overall consumer experience.

We saw that agility during COVID, and we’re seeing it again today as companies innovate to fill emerging gaps and prepare for new channels and technologies shaping the retail landscape, including agentic commerce, where AI tools help guide online shopping by identifying products and streamlining the path to purchase.

IN TODAY’S ECONOMIC ENVIRONMENT,

HOW ARE YOU SEEING COMPANIES

CONTINUE TO INNOVATE TO MEET CONSUMERS’ EMERGING NEEDS?

Innovation today is being driven by how well companies stay informed, aligned, and connected, both internally and across the broader industry.

In today’s economic environment, companies are innovating by closely listening to the needs of the consumers they serve and by leveraging data, technology, and market insights to identify where gaps exist. We see this firsthand as companies explore emerging areas like digital health and the future of self-care, and as new brands and brand extensions come to market to meet evolving expectations.

Through engagement with CHPA, including events like SLS and RSQ and educational programs such as CH101, member companies are turning insights into action. CH101, for example, brings together profes-

The most common concern we hear is how to keep moving forward in an increasingly complex, uncertain, and fast-changing environment while maintaining consumer trust.

sionals across business, legal, regulatory, marketing, and R&D to build a shared understanding of the consumer healthcare marketplace, helping teams apply insights responsibly and with confidence.

That combination of consumer listening, data-driven decision-making, and cross-functional education helps companies translate insight into action, whether that’s advancing new products, refining consumer education, or responding to changing expectations, so innovation remains practical, responsible, and focused on empowering people to take their health into their own hands.

HOW IS CHPA EVOLVING TO MEET THE NEEDS OF A GROWING AND CHANGING MEMBERSHIP BASE?

CHPA is evolving by designing programs and resources that reflect how diverse and interconnected today’s consumer healthcare community has become. As our membership grows, including more startups and emerging brands, we recognize the increasing need for regulatory, quality, and compliance support, all areas where CHPA plays a critical role. We’re focused on creating opportunities for companies of all sizes – emerging brands and long-established manufacturers alike – to learn from one another, build relationships, and stay informed through practical, business-focused engagement.

Initiatives like our Retailer Resource Center help foster collaboration across the ecosystem, including with retailers who are increasingly engaging with CHPA as members themselves.

Our conferences, forums, and education programs, including CH101, the Marketing Forum, Women’s Leadership Forum, SLS, and RSQ, support companies at every stage of growth.

Ultimately, our goal is to strengthen the broader self-care community by equipping current and future leaders with the insights, connections, and confidence they need to succeed in a rapidly evolving marketplace.

WHAT ARE QUESTIONS/ CONCERNS ARE

YOU ARE HEARING MOST OFTEN FROM MEMBERS/INDUSTRY RIGHT NOW?

HOW ARE YOU HELPING ADDRESS THEM?

The most common concern we hear is how to keep moving forward in an increasingly complex, uncertain, and fast-changing environment while maintaining consumer trust.

Members are looking for clarity, shared insight, and practical guidance as they plan for innovation, manage uncertainty, and respond to evolving expectations. We’re listening closely and responding by convening stakeholders and creating forums and new committees to tackle emerging issues, helping companies access timely education and peer learning.

Through CHPA’s committees, conferences, education programs, and ongoing engagement, CHPA helps companies connect, share experiences, and build confidence as they make decisions.

IF YOU WERE ADVISING EMERGING OR FAST-GROWING BRANDS ENTERING MASS RETAIL FOR THE FIRST TIME, WHAT WOULD YOU TELL THEM?

Don’t go at it alone! Entering mass retail is complex and getting it right from the start is critical. Having access to industry expertise and peers who have navigated these transitions before can save time, reduce risk, and help brands avoid costly missteps.

A trade association can serve as an extra set of eyes, helping companies stay informed about what’s coming and make decisions with greater confidence.

By being part of an association, companies gain practical insights, build critical relationships, and enter the marketplace better prepared to succeed

MOVING FORWARD, HOW DO YOU ENVISION CHPA AND RETAILERS PART OF THIS ECOSYSTEM WORKING TOGETHER AND WHY IS THIS RELATIONSHIP SO IMPORTANT?

Moving forward, CHPA and retailers will continue to work together as partners in broadening consumer access to trusted, science-based information, especially as consumers are exposed to more information—and misinformation—from a wide range of sources.

Several retailers are associate members of CHPA, and look to us not just for policy insight, but for education and connection through resources like our Retailer Resource Center and the Health In Hand Foundation, which serve as credible tools to support consumer understanding.

By collaborating across the ecosystem, we help ensure consumers can make informed choices, whether that’s understanding product ben-

efits, coverage considerations like FSA/HSA eligibility, or navigating self-care options with confidence.

PLATFORMS LIKE RBD TRY TO SPOTLIGHT EMERGING TRENDS AND HELP RETAILERS AND SUPPLIERS STAY CONNECTED. FROM YOUR PERSPECTIVE, HOW IMPORTANT ARE THESE KINDS OF PLATFORMS FOR ELEVATING NEW PRODUCTS AND IDEAS ACROSS THE INDUSTRY.

These platforms play an important role in helping industry stay connected, informed, and forward-looking. There’s strong momentum across the industry as new ideas emerge and products come to market, and platforms like RBD create visibility and spark dialogue between retailers and suppliers. That kind of engagement complements CHPA’s role in bringing the industry together and helping give visibility to emerging trends and innovation across the self-care ecosystem. CHPA also supports this ecosystem by recognizing innovation through efforts like the Health In Hand Foundation Gala and U. S. Marketing Awards, which highlights impactful product launches and marketing campaigns that support informed self-care. Together, these touchpoints help ensure innovative, consumer-focused selfcare solutions are recognized early and can ultimately reach consumers who need them.

As retailers and suppliers head deeper into 2026, Retail Brand Discovery continues its focused

Ongoing coverage of Health & Beauty Care, OTC, and Vitamins, Diet & Nutrition.

INSIDE THE MARCH/APRIL 2026 ISSUE: PLUS,

An emphasis on new, emerging, and genuinely innovative brands. Insights informed by our Circana data report, highlighting where shoppers are moving and why.

Bonus distribution at the CHPA SLS Meeting and the NACDS Annual Meeting.

Stewardship — reflections on leadership, influence, and long-term thinking in today’s retail landscape. Retail Brand Discovery. Where innovation meets the shelf.