By Peter Katz / pkatz@westfairinc.com

The deadline for submitting responses to the RFEI is Sept. 22 at 4:30 p.m., and North Castle says it may be ready to follow the RFEI by issuing a Request for Proposals sometime in October or November.

North Castle Town Supervisor Joseph Rende told the Business Journal that when he came into office he realized there were deficiencies in the town's current facilities including the police department and the town courtroom facility within the current town hall.

"We have people from various departments in different buildings and it's a very inefficient way of running the government," Rende said. "My understanding at the time was that the Boies Schiller building was underutilized. I spoke with one of the principals. We started to move forward with an eminent domain proceeding, which we still have available to us but there was a segment of the population in town that had concerns that

we look at other alternatives."

Eminent domain allows a government to acquire for public purposes a piece of property even if the owner is not willing to voluntarily sell. A proper price must be paid to the property owner.

According to the RFEI, the main site for redevelopment is approximately 9.4 acres in area. It is improved by the North Castle Town Hall, which houses the offices of the town's supervisor, board and administrator. It also houses the police department, and the North Castle Town Justice Court, as well as the town clerk, tax assessor, tax receiver. The building, planning, and conservation departments have offices in an annex located to the rear of Town Hall. The site also contains on-site parking and landscaped areas including a ball field.

The North Castle Town Highway Yard, covering approximately 4.5 acres, is currently located on the southeastern portion of the Town Hall site. The town intends to relocate that facility.

The REFI positions downtown Armonk as the primary center

“We want this to be an open and transparent process in the full light of day. We would not move forward with anything without the input of the public.”

— Joseph Rende, North Castle Town Supervisor

input and see what the developer community might have in mind.

"I looked at other municipalities, not only in Westchester, who have entered into public-private partnerships," Rende said. "They issue RFEIs. There is no commitment of any private enterprise that is responding. It would be an exercise in helping us get information and see if there are any possible ways to do this other than entering into eminent domain. The information or possibilities we get back may lead us to recognizing that 333 Main St., which is the Boies Schiller building is the best alternative."

Rende said that a mixed-use development could be an economical way for North Castle to wind up with the new municipal facilities it needs while the developer brings new residential and commercial uses to the area. He said that the budget for a project would depend on what the developer would propose.

"We have a lot of information on what the cost potentially could be on the Boies Schiller building, but we don't know what a complete new structure would cost us and that's what we're hoping to start getting some answers to in the responses to the RFEI," Rende said.

Rende said that once a plan has been created a referendum would be held, giving voters the chance to approve or reject moving ahead with a development plan.

"We want this to be an open and transparent process in the full light of day," Rende said. "We would not move forward with anything without the input of the public. There would definitely be a bond resolution with the referendum. The good news for us as a town is that financially we're in a very good, solid position. We have a Triple A bond rating, so our ability to borrow money through a bond offering is great and it would be the most economical way to pay for this at the end of the day."

Energy efficiency. Year-round comfort.

Rebates up to $25k.

A geothermal system has it all.

Install the future of home heating and cooling—now with a rebate up to $25k.

Special Permit and Site Plan approvals are being sought for a mixed-use project in White Plains that would have 154 units of affordable housing along with 5,000 square feet of retail space. The applicant Fisher Hill Owner LLC and Fisher Hill 90 Westmoreland LLC calls the proposed building The Sheffield, a nod to the Sheffield Dairy that in the past had a distribution facility at the site located at 90-114 Westmoreland Ave. The applicant is the contract vendee to buy the 1.024-acre site.

According to Attorney William Null of the White Plains-based law firm Cuddy & Feder, the site is immediately adjacent to the newly-renovated Kittrell Park and is on the easterly side of Westmoreland Avenue, surrounded by Home Street on the north and Intervale Street on the south.

By Peter Katz / pkatz@westfairinc.com

Null said that this is "an ideal location for an apartment building, particularly one focused on providing affordable housing in the City of White Plains. The Sheffield project is a collaborative venture amongst White Birch Development LLC, Marathon Development Group, and Lashins Development Corp."

Null said that since its inception in 2004, White Birch Development LLC/ Touchstone Builders Inc., and its affiliated development companies, have either constructed or redeveloped more than 2,200 affordable housing units in New York state, most of which are in Westchester County. He said they have an additional 400 affordable units in the pipeline.

At present, the site has on it oneand two-story warehouse buildings and at-grade parking. The

154 apartments in The Sheffield would consist of 26 studio units, 92 one-bedroom units, and 36 two-bedroom units. One apartment would be reserved for the building's superintendent. Rents would be set to be affordable to tenants earning 80% of the Westchester Area Medan Income (AMI) with approximately 80% of the units priced to be affordable to tenants earning 60% of the AMI.

"The Sheffield would help address the vision of the City of White Plains to increase access to affordable housing in the downtown area near the train station," Null said. "The Sheffield fully will provide needed housing near to the train station and will activate the pedestrian streetscape by adding residents and establishing neighborhood retail."

Null said that the applicant obtained a variance from the city's Zoning Board of Appeals to allow the building to rise to six-stories at 68 feet although zoning limits buildings in the area to four-stories and 50 feet. A variance also was obtained for

the building's coverage because it would exceed 80%. He said that a rezoning of the Westmoreland Avenue area was intended to encourage this type of residential development.

The plan calls for a total of 238 parking spaces to be provided in the cellar, first, and second floors of the building with vehicle access provided from both Home Street and Intervale Street.

An analysis of traffic impacts for this project by Kimley-Horn Engineering found that it would not have a significant adverse impact on area traffic operating conditions. The proposed development is projected to generate 56 trips during the morning peak hour and 60 trips during the afternoon peak hour.

Architectural plans were prepared by Warshauer Mellusi Warshauer Architects, P.C.

Members of the union 1199SEIU United Healthcare Workers East staged a oneday strike on August 12 against Rockland Pulmonary, part of the WMCHealth Network. The strikers gathered a short distance from the building at 2 Crossfield Ave. in West Nyack, one of the locations where Rockland Pulmonary has a facility.

The union said its workers at Rockland Pulmonary have been in negotiations with WMCHealth management for eight months in an effort to achieve their first contract and charged that they have faced intimidation and delay tactics from management. The workers were demanding what they view as fair pay, better benefits

By Peter Katz / pkatz@westfairinc.com

and an end to what they say is worker intimidation. In alleging that management violated federal labor law, union officer Angela Lane charged that it unilaterally changed job descriptions, threatened to close offices if employees elected union representation and told some employees to quit if they didn't like the rules.

WMCHealth told the Business Journal, "WMCHealth has bargained in good faith with 1199SEIU – offering a new contract that would increase salaries, preserve benefits for our frontline caregivers who are part of our incredible teams that provide patients at Rockland Pulmonary & Medical Associates the very best medical care. We have contingency plans in place to ensure this one-day strike will not

interrupt or interfere with our doctors, nurses, and other care team providers delivering the highest standard of care, and we hope the union leadership will meet with us to reach a fair, sustainable agreement.”

Last year, the National Labor Relations Board certified an election in which workers at Rockland Pulmonary voted to be represented by 1199SEIU. The election covered full-time and regular part-time workers, some per diem workers, and non-professional employees jointly employed by Rockland Pulmonary and Medical Associates and Bon Secours Charity Health System Medical Group P.C. at their health care centers in West Nyack, Suffern, Orangeburg, and Stony Point. Not covered by the union are professional employees, confidential employees, guards, managerial and supervisory employees.

By Peter Katz / pkatz@westfairinc.com

New York Attorney General Letitia James has led a group of attorneys general and governors filing a lawsuit against the Trump Administration in the U.S. District Court for the District of Oregon. The lawsuit names as defendants the U.S. Department of Energy (DOE) and Chris Wright in his official capacity as secretary of energy.

Joining James in filing this lawsuit were Attorney General William Tong of Connecticut along with the attorneys general of California, Colorado, Delaware, Hawaii, Illinois, Maine, Maryland, Michigan, Minnesota, Nevada, New Mexico, North Carolina, Oregon, Washington, Wisconsin, and District of Columbia, as well as Gov. John Shapiro of Pennsylvania

and Gov. Andy Beshear of Kentucky.

The suit seeks to block the DOE from imposing a new funding cap that would slash federal support for state-run energy programs. James says what the Trump Administration wants to do would raise costs for New York residents as well as others.

The new DOE policy would prevent states from using critical federal funds by limiting reimbursement for key administrative and staffing costs that have long been covered by federal energy programs. The lawsuit argues that by capping certain funding for these programs, DOE is jeopardizing states’ ability to keep them running, which threatens consumers’ access to critical benefits and savings. The lawsuit asks the court to vacate the

Attorney General

Letitia James is leading a multistate lawsuit against the U.S. Department of Energy’s new funding cap.

new federal spending cap and restore the reimbursement rates that it says are required by law.

“New Yorkers count on state energy programs to save money on their bills, prepare homes for extreme weather, and move toward clean, affordable energy,” said Attorney General James.

“The Department of Energy’s cuts threaten to pull the rug out from under those efforts. We’re taking them to court to protect the funding that keeps these programs running for families across New York.”

According to James, for decades federal law has required agencies like DOE to negotiate agreements with states that set fair reimbursement rates for federally funded, state-run programs. These have never been subject to a cap. On May 8 of this year DOE announced a new policy that ignores the longstanding practice, capping indirect and employee benefit costs at 10% of a project’s total budget regardless of previously negotiated rates or actual need.

James and the others take the position that every court to have ruled on the merits of such blanket limits has found them unlawful, unjustified, and disruptive to essential public programs.

No matter your goals, Ives Bank has a savings account to fit your financial journey. From everyday savings to high-yield options like our Money Market Choice, you’ll earn competitive interest and keep your money within easy reach. The more you save, the more you earn—with flexible, secure solutions built for real life.

By Gary Larkin / glarkin@westfairinc.com

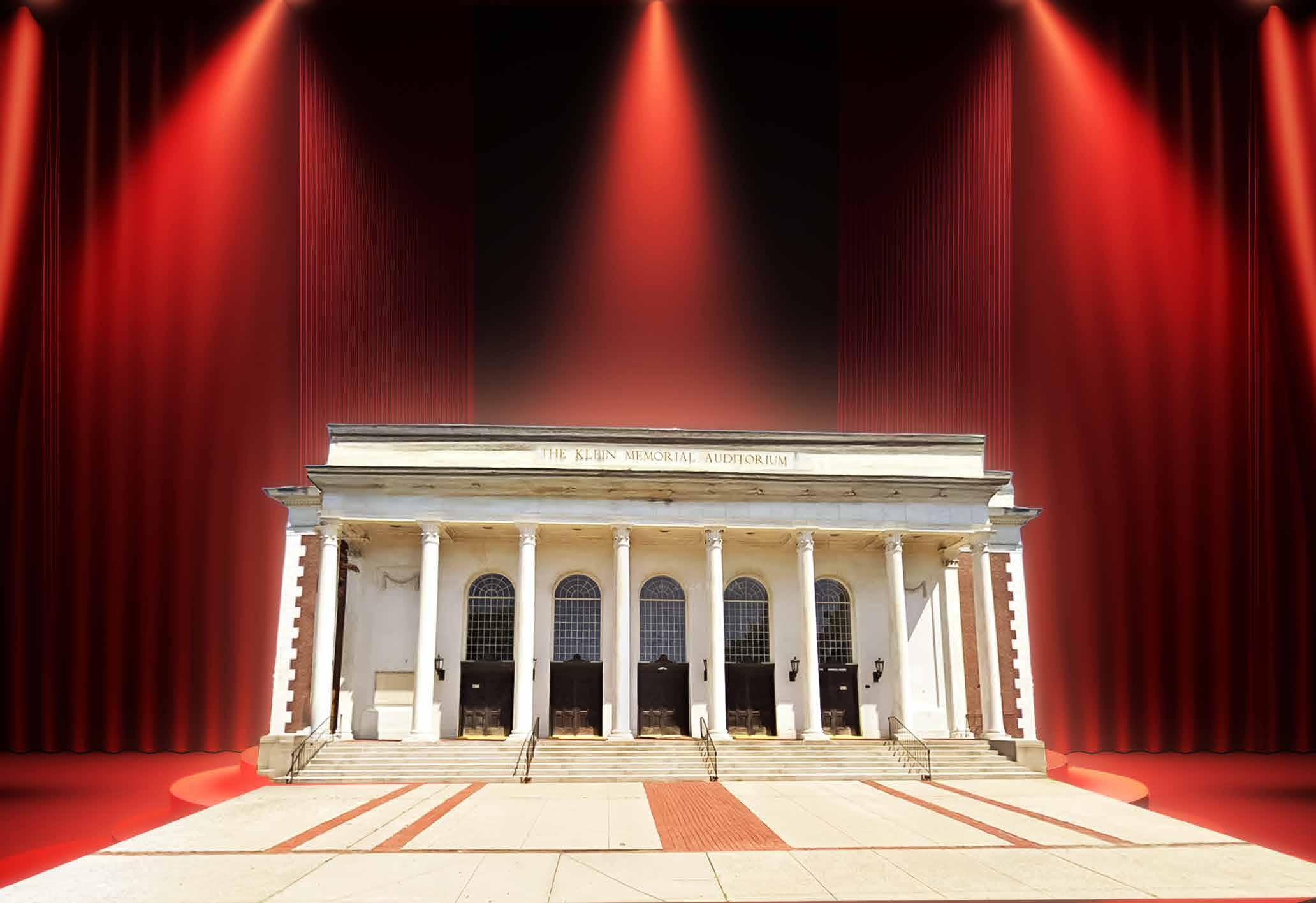

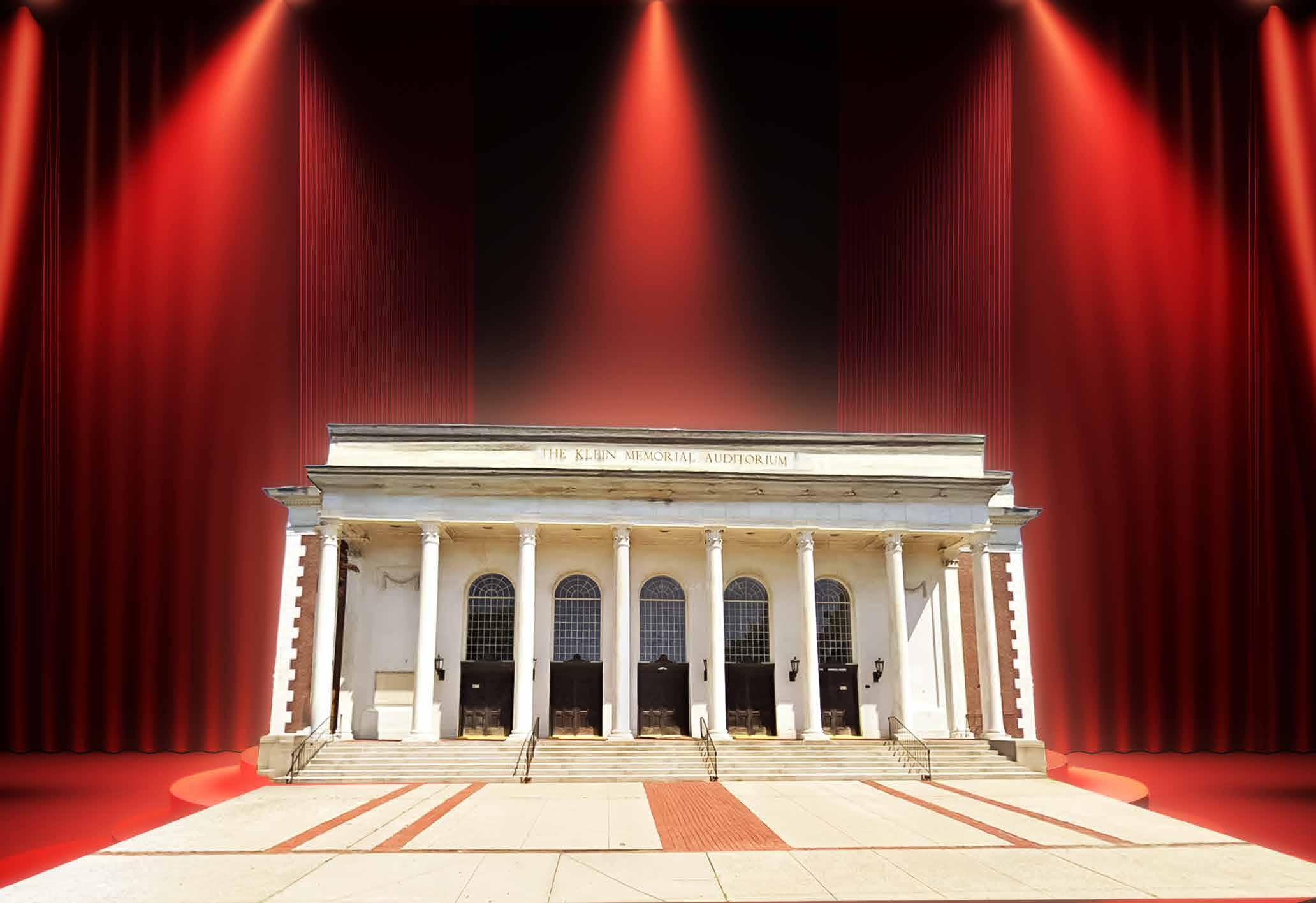

BRIDGEPORT – If any local arts and culture afficionado would be the happiest to see the fruition of the $3.8 million expansion and renovation of The Klein Auditorium, it would have to be Marilyn Moore and Tenisi Davis.

These aren’t just any big fans of the auditorium and its theater.

One is a state senator representing Bridgeport and the other is a professional actor who got his start on the very stage at The Klein when he was just 11 years old. State Sen. Moore, a Democrat who chairs the state Bonding Committee, was instrumental in lining up the bond funds used to fund the work at the 85-year-old institution. City funds were also used in the project.

Davis, 36, has been in such TV shows as “Black List,” “Blue Bloods,” “FBI,” and “Daredevil.” He has also performed at TheaterSquared in Fayetteville, Arkansas, and the National Black Theater in Harlem. He is now The Klein’s director of education and acting instructor.

The two, who have known each other since Davis started performing at The Klein, showed their affinity for the Bridgeport theater and their endearing relationship that has developed at Friday’s ribbon cutting with The Klein Executive Director Laurence Caso and Lt. Gov. Susan Bysiewicz.

“I remember what this building was like when I was a kid. It was closed,” Davis said. “The neighborhood was a little bit different. And now, to be here in this building and to see this expansion, to see the building is full and there is programming, it really brings extreme joy to my heart.”

For Davis, his lifepath has brought him back to Bridgeport after success as a professional actor.

“When I was on the stage at The Klein, I really didn’t know where my life was going to go, what I was going to do,” he said. “So, years later after being on TV and films and doing all this great stuff, I’m so happy to be back here and working with KTA (Klein Theater Arts).”

Moore, who couldn’t hold back tears

of joy during Friday’s ribbon cutting, remembered watching a young Davis grow up on stage into a successful actor. That was because she could remember being a young actor on that same stage when she was only a kid.

“I performed on that stage when I was 7 years old,” the state senator said. “Who would have thought that I when I was 7 I would be on an even larger stage as a state senator and help this organization build what it needs to build.”

And for Moore, it was more about just standing in the foyer of The Klein for the ribbon cutting press conference. She played a major role along with the rest of the state legislative delegation that included state Sen. Herron Gaston and state representatives Andre Baker (District 124), Fred Gee (District 126), Marcus Brown (District 127), Christopher Rosario (District 128), Steve Stafstrom (District 129), Antonio Felipe (District 130), and Cristin McCarthy Vahey (District 133).

“Today we get to turn the page in The Klein’s history book because we are unveiling the first new addition since its [opening] in 1940,” Bysiewicz said. “It was with the support of $3.8 million from our bond commission.

“There’s going to be space to accommodate over 70,000 patrons that attend events year after year. The governor and I are very proud to invest in Bridgeport and arts and cultural organizations.”

The new 4,950-square-foot wing includes the installation of an elevator to the mezzanine, a wheelchair-accessible restroom, a conference room, and three new offices. Earlier phases of the project included technical upgrades to the theater’s lighting, audio, and video projection systems, new carpeting, and an exterior digital billboard to promote upcoming events. The technical upgrades have mostly eliminated rental costs for audio and lighting equipment.

Caso explained the changes to the new wing at the theater.

“Today we get to turn the page in The Klein’s history book because we are unveiling the first new addition since its opening in 1940.”

— Lt. Gov. Susan Bysiewicz

“We’re just a few weeks away from being fully operable,” he said. “We started in 2016 with a bond commission grant that enabled us to make technical upgrades to the theater and upgrades to our video, audio and lights.”

Caso pointed to immediate dividends from having the technical upgrades as the theater hosted R&B star artist Maysa last week.

“We’re going to pay $1,500 for technical equipment for backlighting that would have cost us $8,500 if we didn’t have the [new lighting] system,” he said during the press conference.

And for the KTA, Friday night’s “Fame Jr.” production at The Klein included virtual sets that were made available because of the upgrades, Caso said.

[Friday night] “our kids in our after-school program are performing ‘Fame Jr.’ Instead of invest in sets, we could project background images as the sets,” he said. “All of these cost savings enable us to do more shows, create more jobs and create more economic activity.”

The Klein at 910 Fairfield Ave. has also hosted the prestigious Bridgeport Film Festival on its 30-foot screen since its inception in 2021 and will do so this year during the weekend of Sept. 12-14.

RIDGEFIELD – The Town of Ridgefield, in partnership with Davis Hill Development and the Connecticut Green Bank, has completed the commission of a 1,038 kW solar carport at Ridgefield High School.

Generating approximately 1.3 million kilowatt-hours of clean electricity annually, the system will reduce the school’s energy costs and carbon footprint while delivering an estimated $1.5 million in savings over the next 25 years. Designed to power the equivalent of nearly 100 homes per year, the solar installation also serves as a highly visible symbol of Ridgefield’s leadership in climate action and community stewardship.

“This project is a great example of what’s possible when forward-thinking communities and strong partners come together,” said Micah Brill, vice

By Gary Larkin / glarkin@westfairinc.com

president of asset management at Davis Hill Development. “Ridgefield had a clear vision. We were able to bring that vision to life–delivering real savings, clean energy, and long-term value to the town.”

The project was financed through an innovative structure that included support from the Connecticut Green Bank and a tax equity investment from Patriot Renewable Energy Capital. AEC Solar served as the engineering, procurement, and construction partner, completing the carport on an accelerated summer schedule to avoid disruptions to the school year. The project also benefited from federal investment tax credits enabled by the federal Inflation Reduction Act.

“At the Green Bank, we’re always looking to foster partnerships that make the benefits of clean energy projects a reality, including creating

By Bill heltzel / bheltzel@westfairinc.com

The general contractor that built the Alexan Harrison Apartments is demanding $1.1 million from a subcontractor for allegedly producing defective cabinetry and then abandoning the job.

March Associates Construction

Inc. sued The RAV Group 2, of Goshen, Orange County, Aug. 7 in U.S. District Court, White Plains.

"RAV breached the subcontract by failing to cure its defective and substandard work," the complaint states, "ultimately abandoning the project and outright failing to complete its contractual obligations."

RAV's owner, Vincent Angioli, did not reply to an email asking for his side of the story.

March Associates, of Wayne, New Jersey, agreed in March 2023 to

pay RAV $1.99 million to install kitchen cabinets and bathroom vanities in 450 apartments.

The two-building complex is on Westchester Park Drive in Harrison, near the Life Time Fitness gym and Wegman's market.

The dwellings are billed as luxury apartments, with prices starting at $2,505 for a studio, $3,065 for one bedroom, and $4,260 for two bedrooms.

"Incredibly, after walking off the project and forcing March to complete RAV's work," the complaint states, RAV filed a mechanic's lien on May 12 demanding $120,603.

According to the lien, March Associates still owes RAV $120,603 on the original $1.99 million contract.

March Associates' law firm deliv-

significant energy savings and supporting jobs in our communities,” said Mariana Cardenas Trief, director of investments at Connecticut Green Bank. “This is the latest of multiple solar projects that we have worked with DHD Renewables and the Town to complete, and we are proud to continue this support as they reduce their energy costs and move Connecticut closer to its clean energy goals.”

The solar power system is uniquely integrated into four separate town- and school-owned electric meters, allowing for optimal use of on-site solar production and full participation in programs like Connecticut’s Non-Residential Renewable Energy Solutions, Zero Emission Renewable Energy Credits, and Class I RECs.

This solar carport builds on Ridgefield’s broader sustainability initiative, which began nearly a decade ago and includes rooftop solar installations at eight other schools and municipal buildings.

ered a letter to RAV's attorney on July 29, listing nearly $1.1 million in back charges that March attributes to hiring replacement subcontractors to remedy defective and incomplete work.

The letter describes RAV's lien as exaggerated and "not grounded in reality," and demands that RAV withdraw the lien within 7 days.

When RAV allegedly ignored the demand to withdraw the lien, March Associates sued.

March Associates is asking the court to declare the mechanic's lien invalid and to award $1.1 million in monetary damages.

Lights, Camera, Yonkers! Behind every scene is a story. From the visionaries who dream it to the artists and technicians who bring it to life, Yonkers is powered by people. Welcome to Hollywood on Hudson—where it’s not just the stars who shine. It’s the crew behind the camera. The creatives behind the curtain. The community behind it all.

With ten active studios, Yonkers is now the largest film and TV production hub in the Northeast. At the center is Great Point Studios, where 60% of the team calls Yonkers home. This is more than a production hub. It’s a movement. A city rising with every frame, every take, every name in the credits.

Yonkers: Built by talent. Driven by pride. Ready for its close-up.

Hudson Piers marks a pivotal moment in Westchester real estate—Extell Development Company’s newest mixed use development is rede ning Yonkers’ downtown waterfront as a vibrant destination for luxury living, community life, and commercial opportunity.

Spanning 20 acres along Yonkers’ scenic Hudson River waterfront, Hudson Piers introduces six state-of-the-art residential buildings to a once-underutilized stretch of land. Its proximity to the Metro-North station places residents just a quick ride from Midtown Manhattan, while also o ering easy access to Hudson Valley destinations like Beacon, New Windsor, and Rhinebeck, as well as prime Westchester locations. The result is a community that feels tucked away from the bustle, yet remains e ortlessly connected.

Set apart by attention to detail, each studio, one, two, and three bedroom residence is meticulously crafted with luxurious interiors. Think open plan layouts, oor to ceiling windows that showcase sweeping views of the Hudson River and the Palisades, and upscale nishes—including quartz countertops, custom cabinetry, and top tier Miele appliances. Bedrooms are designed as serene retreats, with spa inspired bathrooms out tted with Kohler xtures, oversized mirrors, and custom millwork. Extra touches like walk in closets, private terraces or balconies in select apartments, and central in unit washers and dryers elevate the experience.

Manhattan’s Best Hudson Piers’ amenity roster is expansive— and exceptional. From 24 hour concierge service and on site security to state of the art tness facilities with yoga and spin studios, there’s a high level of convenience. Residents also enjoy a private screening room, business center with conference space, an indoor playroom and teen room, and bicycle and package storage.

Outdoor and social amenities are equally impressive: landscaped terraces with re pits, cabanas, a saltwater swimming pool, grilling stations, a bocce court, putting green, hammocks, billiards, waterfront lounge, and even a dog park. Upcoming phases will add an indoor swimming pool, basketball court, game room,

and outdoor park—creating a continuum of leisure both inside and out.

According to the New York Post, Hudson Piers is setting a new standard in Yonkers development. It’s the largest undeveloped parcel in downtown Yonkers, positioned to become a de ning project for the city’s future. The rst two buildings alone comprise 369 residential units and approximately 10,000 square feet of ground- oor commercial space.

Current leasing re ects both accessibility and value. Net e ective rents start at $2,089 for studios, $2,689 for one-bedrooms, $3,636 for two-bedrooms, and $4,564 for three-bedroom apartments—with two months free on an 18-month lease. That incentive not only reduces the overall monthly cost but underscores Hudson Piers’ appeal as a luxury waterfront community that remains competitive with markets across Westchester and the metro region. For many renters who once looked only to Manhattan or Brooklyn, the combination of elevated design, rst-class amenities, and meaningful value makes Yonkers an increasingly attractive choice.

Yonkers isn’t just hosting Hudson Piers—it’s transforming with it. City leadership is intent on modernizing downtown, unlocking waterfront access, and attracting new residents and businesses. Hudson Piers is central to that vision. As Moshe Botnick, Extell’s Senior VP of Development, puts it:

“Yonkers has been up and coming for a while… it’s now poised to be the next New York borough.”

He adds that residents will not only bene t from exceptional views—from the George Washington Bridge in the south to the Mario Cuomo Bridge to the north—but also from the dramatic, changing foliage of the Palisades across the river that de nes Hudson Valley’s distinctive skyline.

Hudson Piers extends beyond residential luxury. Its 10,000 square feet of commercial space at street level invites businesses seeking high foot tra $c and premium presentation along a revitalized promenade. This dynamic blend of living and commerce promises to catalyze new retail, dining, and service o erings in the heart of Yonkers.

Moreover, Hudson Piers contributes to a larger neighborhood renaissance. Yonkers is already seeing widespread development activity—including thousands of new residential units across projects like AMS Acquisitions’ proposed towers and adaptive reuse ventures. Hudson Piers stands out both by scale and amenity, acting as a north star for sustainable growth.

For Westfair readers—city o$cials, developers, commercial tenants, and institutional investors—Hudson Piers provides a compelling model for transforming post-industrial waterfronts into mixed-use, amenity-rich communities. It demonstrates how strategic investment, thoughtful design, and city support can converge to unlock the full potential of underused real-estate assets.

Hudson Piers is more than an amenity-rich luxury apartment development —it’s the beginning of a new era in Yonkers. As a meticulously crafted living community with high-end amenities, sweeping views, and access to urban vibrancy, it rede nes what residential life can look like outside the ve boroughs. Anchored by Extell’s vision and supported by a forward-looking city administration, Hudson Piers signals Yonkers’ arrival as a premier address for modern, elevated living. With net e ective rents beginning at $2,089— and two months free on an 18-month lease— Hudson Piers combines the quality and sophistication of Manhattan waterfront developments with a level of value that makes sense for today’s renters. It’s a rare convergence of design, lifestyle, and accessibility that positions Yonkers not as a secondary option, but as a destination in its own right.

For more than a century, Yonkers Raceway, today known as Empire City Casino by MGM Resorts, has been a cornerstone of the City of Yonkers. Generations have worked there, gathered there, and relied on the property as part of Yonkers’ identity and economy. Now, this site is on the cusp of its most transformative moment yet: the chance to secure a full commercial casino license.

This project will not simply add live-dealer table games or a sportsbook. It will result in billions in private investment, create thousands of good-paying union jobs, and give Yonkers and Westchester a sustainable revenue stream that strengthens schools, public safety, and infrastructure for decades to come. But there’s a critical truth that too many residents don’t realize: this project will only move forward if the state hears loud and clear support from the community. This is a once-in-a-generation opportunity.

Empire City already boasts the sixth-largest gaming oor in the nation and has been operating as a casino for nearly 20 years. With a full license, it can transform quickly into a world-class destination casino. The ripple e ects of that transition are profound.

Thousands of permanent union jobs will be created, creating new positions in hospitality, culinary arts, marketing, nance, IT, security, and gaming. These are careers with bene ts, training, and advancement opportunities inside a Fortune 500 company. Another 6,500 union construction jobs will be created. For local families, this means pathways to stability and mobility, without needing to leave Yonkers or Westchester for career opportunities.

Empire City’s partnerships with SUNY Westchester Community College and the Hotel Trades Council will establish a Dealer School, opening doors for young people and mid-career workers alike. MGM’s tuition support program means employees can also pursue nearly free

college degrees while working. This isn’t just a project, it’s a pipeline for long-term prosperity.

Across the region, businesses of all sizes stand to gain signi cantly. MGM already contracts with dozens of local suppliers, but a full casino license will multiply that demand: product manufacturers and suppliers, print shops, transportation providers, service providers, and countless other local enterprises will see new business.

And the tax bene ts? Substantial. A full license means hundreds of millions annually for education statewide, with direct revenue-sharing to Yonkers and Westchester County. That can mean stronger schools, improved infrastructure, and relief for local taxpayers. Instead of higher property tax bills to fund public services, Yonkers could have a reliable, recurring stream of private-sector dollars.

MGM’s plans include a state-of-the-art entertainment venue that could host nationally recognized performers year-round. Imagine world-class shows in Yonkers,

drawing visitors not just from Westchester but across the Tri-State area. Restaurants, shops, hotels, and attractions across the region would share in the bene t.

This would be a new cultural anchor, one that complements our local identity and makes Yonkers a true destination.

But there’s the catch: New York will award up to three downstate casino licenses. Competing projects are already lobbying hard, many tied to Manhattan-based developments with priorities that do not center on Yonkers or Westchester.

Empire City is unique. It is already operating, already unionized, already part of the community. It is ready to convert quickly, meaning the jobs and revenue will arrive years faster than other proposals. But readiness alone will not carry the day. State law requires that the Community Advisory Council (CAC) con rm broadbased public support. If that support is absent or muted, the license can and will go elsewhere.

On September 16th, the CAC will hold

public hearings, and written testimony will be accepted via email. This is where Yonkers’ future will be decided. It is not enough for a few stakeholders to speak up; the state must hear from ordinary residents, business owners, parents, and workers. Without visible, vocal support, this once-in-a-generation opportunity will slip away.

Empire City has been part of Yonkers for more than 126 years. A full casino license is the next logical chapter in that history. It means jobs, tax relief, entertainment, and investment, all in a project designed for and with this community. The choice is now in our hands. Do we want the revenue, the jobs, and the cultural spotlight to stay here in Yonkers, or watch them go elsewhere?

This September, let’s make sure Albany hears us. Attend a public hearing. Submit a written comment. Talk to your neighbors. Because the future of Yonkers won’t be decided by chance, it will be decided by whether we raise our voices to secure it.

MGM Resorts’ Empire City Casino is ready to unleash the full potential of a full-scale casino license — bringing thousands of new union jobs, generating thousands of construction jobs through a multi-billion-dollar private investment, and stimulating over 10,000 indirect and induced jobs across our communities. This is more than growth — it’s over $1 BILLION in new economic activity for the state we love.

We’re building a destination designed for New Yorkers — by New Yorkers — to create opportunity, entertainment, and lasting community impact.

STEP INSIDE THE FUTURE OF EMPIRE CITY

Scan to explore our all-new 360° virtual tour — from stunning new restaurants and a state-of-the-art sportsbook to reimagined casino spaces, world-class entertainment venues, and more. Experience the vision before it becomes reality.

As the retail sector adapts to evolving consumer behaviors, Cross County Center continues to lead as a cornerstone of economic activity in Yonkers. With the addition of new national retailers and the return of high-impact seasonal events, the center is reinforcing its position as both a major shopping destination and a vital contributor to the city’s economic growth.

This fall, Cross County Center expands its tenant mix with the openings of CAVA, Build-A-Bear Workshop, Levi’s, and a Spirit Halloween pop-up store. These new retailers support the center’s strateg y to deliver a well-rounded mix of experiential, lifestyle, and family-oriented o erings that serve local demand and draw regional visitors.

CAVA, the Mediterranean fast-casual restaurant, will open a 2,180 sq. ft. space with indoor and outdoor seating. Its customizable menu and community-focused brand are expected to attract strong customer interest and complement the center’s existing dining options.

Build-A-Bear Workshop brings an interactive 1,917 sq. ft. retail experience where guests create personalized stu ed animals—enhancing Cross County Center’s appeal as a family destination.

The new Levi’s® Store, at 3,343 sq. ft., o ers the latest denim styles in a digitally integrated, modern retail space that re ects the brand’s evolving customer experience strateg y.

The return of Spirit Halloween further positions the center as a timely, relevant shopping destination that meets seasonal needs.

These additions build on Cross County Center’s strong legacy in Yonkers. Its open-air format, diverse tenant lineup, and free parking—paired with its strategic location at the crossroads of I 87 and the Cross County Parkway—make it one of the most accessible and consistently high-performing retail destinations in Westchester County.

Beyond retail, Cross County Center continues to foster community engagement through large-scale events. This October, the popular Oktoberfest returns October 11–12 (rain date October 18–19), with live music, dancing, games, drinks, food, and fun for all ages. Enjoy local beers from Yonkers Brewing Co., grilled brats, pretzels with mustard, and more for purchase. Their annual Halloween Spooktacular follows on October 25, providing a festive and safe trick-or-treating experience throughout the center.

With more than 80 specialty stores and restaurants—including Target, Macy’s, Zara, H&M, Shake Shack, Victoria’s Secret, and Hyatt Place Hotel—Cross County Center attracts over 14 million visitors annually. Its ongoing investment in retail, infrastructure, and public programming reinforces its role as a driver of local employment, commerce, and civic pride.

To learn more about upcoming events and openings, visit www.crosscountycenter.com or follow Cross County Center on social media.

Real Estate Development

Sales and Acquisitions

Joint Ventures

Portfolio Transfers

Commercial and Retail Leasing Providing sophisticated legal services and counsel to all commercial real estate industry participants:

The Charter School of Educational Excellence (CSEE) in Yonkers is celebrating its 20th anniversary, marking two decades of dedication to developing critical thinkers, motivated leaders, and lifelong learners.

The school community has logged a period of remarkable growth and achievement, particularly in recent years, solidifying its place as a cornerstone of academic rigor.

A major milestone was the 2021 opening of a state-of-the-art, $27 million, 78,000-square-foot high school. This new facility has been instrumental in expanding opportunities for students. The high school’s rst senior class graduated in 2023, with students earning acceptances to prestigious universities such as Cornell, NYU, and Boston University. This success was a precursor to the 2025 graduating class of 88 seniors, who secured an impressive $20 million in scholarships and will attend institutions including the University of Virginia, NYU, University of Rochester, and Lehigh University.

The new high school is also a hub of opportunity. It provides students with 24 college credits and boasts an auto technolog y lab, a culinary arts training kitchen, advanced technolog y and science labs, an art studio, a g ym, and a band practice room. The school’s commitment to a holistic education includes an extended eight-hour school day, which allows for deeper focus on core subjects and time for PE, health, music, foreign language, and the arts.

The school’s athletic program garners

national attention. In the past year, the CSEE opened a new tness center and saw its girls’ volleyball team win a state championship. The school was also featured in a national high school sports safety video lmed by the NBA and the Hospital for Special Surgery, highlighting its commitment to student-athlete well-being. This was further a $ rmed in April when a national sports medicine coalition cited CSEE’s athletics program as a model for preventing youth athlete injuries.

“The momentum we’ve built is a testament to the hard work of our entire community and the unwavering support of our partners,” said co-founder Eduardo LaGuerre. “With the help of the business community, we and our foundation have elevated education for Yonkers’ most disadvantaged children, providing them with the resources and opportunities they need to succeed.”

CSEE’s mission is rooted in community partnership, and this was recently highlighted by the acquisition of two new mini-buses, thanks to $215,000 in funding secured by State Senate Majority Leader Andrea Stewart-Cousins. The buses will support the school’s robust extracurricular and athletic programming, further enriching the student experience.

As CSEE looks to the future, it does so with a proud history of achievement, a robust engagement with local businesses, and a clear vision for continuing its legacy of empowering students to reach their full potential.

For over 150 years, St. John’s Riverside Hospital has been a trusted pillar of the Yonkers and Rivertown communities, providing exceptional healthcare to generations of local families. But in recent years, the hospital has undergone a remarkable transformation, strategically positioning itself to be the premier community healthcare provider for the region.

At the heart of this growth is the hospital’s comprehensive Education Hub, which is addressing the looming healthcare provider shortage head-on. The hub includes The Cochran School of Nursing, LECOM Medical and Pharmaceutical students, and Internal Medicine and Emergency Medicine Residency Program. By educating and training the next generation of healthcare professionals, right within the community they will serve, St. John’s is ensuring a steady pipeline of skilled providers to meet the area’s evolving needs. In addition to serving local family, friends and neighbors, these healthcare providers allow for more medical expertise at the patients’ bedside.

The hospital’s commitment to the community doesn’t stop there. The St. John’s Medical Group has expanded to over 40 primary care and specialty providers, strategically selected to address the community’s most pressing health concerns. Whether you require an orthopedist, gastroenterologist, endocrinologist, nephrologist, podiatrist, pulmonologist, vascular surgeon, interventional pain management specialist, or a geriatric-focused primary care physician, St. John’s has you covered.

Recognizing the importance of seamless, coordinated care, St. John’s has also strengthened its partnership with Monte ore Health System. This collaboration provides the community access to world-renowned surgeons in elds like gastrointestinal, breast care, thoracic, hernia, and general – all conveniently located right at St. John’s Riverside Hospital facilities.

Adapting to the changing healthcare landscape, St. John’s Riverside Hospital has also invested heavily in infrastructure upgrades throughout its facilities. The hospital’s Maternity Department and lobbies have undergone renovations, and St. John’s $15 million state grant to renovate and expand the Emergency Department, doubling the current patient capacity is currently underway.

St. John’s Riverside Hospital remains steadfast in its commitment to be the go-to healthcare provider for the Yonkers and Rivertown region.

“We are here to grow and meet your healthcare needs by strategically building a better future for our community,” said St. John’s Riverside Hospital CEO, Ron Corti. “We are here for you, and we are Community Strong.”

The Yonkers Housing Authority has always been at the forefront of innovation. When HUD created the Rental Assistance Demonstration (RAD) Program, the YHA was an early adopter. Now, over a decade later, we are leading the way in building resilient, a ordable housing. LaMora, a senior building built to Passive House standards, opened last June. The four-story building at 23 Mulberry Street has 60 ener g y-e$cient, a ordable apartments for seniors. It was built to the highest level of sustainability, both because it’s better for the environment and also because it is the most resilient, comfortable, and overall cost-e ective method for the YHA and its tenants. It is the rst Passive House, a ordable, modular-built building in New York State.

When Palisade Towers, the YHA’s biggest property, su ered a signi cant

gas loss due to aging infrastructure, the YHA decided to go fully electric. Upgrading to electric will save the authority and taxpayers millions of dollars compared to returning to gas. Electric heat pumps are more e$cient than they have ever been. Tenants will be allowed to stay in place instead of having their lives disrupted by a temporary relocation, or worse, a site shutdown and evacuation.

The YHA is also partnering with Yonkers Mayor Mike Spano and the City of Yonkers to bring a ordable home ownership to quali ed families. Every day, our families work towards self-sufciency. We want them to succeed. As the Mayor often says, “A rising tide lifts all boats.” Helping families build equity in their communities has always been a goal of Mayor Spano, and we support his vision.

Lastly, the YHA and its a $ liated entities, The Mulford Corporation and Palisades Property Management, are expanding their property management services. Whether you need assistance in managing your A ordable Housing

Ordinance units, landlord/tenant issues or property management challenges, we are available to provide you with our exemplary services. We bring a holistic and innovative approach to everything we do, so let us do it for you.

MHACY, Mulford Corporation, and Palisades Property Management combine their expertise to provide a comprehensive suite of housing solutions. 1. MHACY

Known for quality affordable housing, from high-rises to townhouses. 2. Mulford Corporation

Specializes in resilient, affordable multi-family housing and homeownership.

3.

Delivers full-service property management, from legal services to ordinance compliance.

Together, we’re a tri-fecta of housing solutions.

Visit us online at mhacy.org to learn how we can be part of your next venture!

Rooted in Yonkers. Serving New York and Beyond. Smith Buss & Jacobs LLP celebrates Yonkers, its revitalization, an d its promise. With deep roots in Westchester and a strong presence across New York City a nd Long Island, we deliver real-world legal solut ions in real estate and litigation. Whether navigating property transactions, leasing disputes, boundary issues, or courtroom challenges, our experience supports businesses and communities in thriving.

By Peter Katz / pkatz@westfairinc.com

A commercial building at 126 N. Main St. in Port Chester that was constructed in 1890 has been sold for $1.9 million, according to Houlihan Lawrence Commercial. The buyer was Vandelay Main Street LLC and the seller was ECP Willett LLC.

The building had been home to the restaurant and bar Rye House, which operated at the location for about 10 years. It closed in May of last year.

The 13,620-square-foot mixed-use building consists of the restaurant and bar space on the first floor and office space on the second and third floors. Houlihan Lawrence Commercial's Mike Rackenberg, director of commercial and associate real estate broker, represented both the seller and the buyer.

“This sale underscores the sustained appeal and strength of the Port Chester commercial real estate market," Rackenberg said. "Active investment interest continues to flow into the area, and properties like this remain highly desirable due to Port Chester’s strategic location, vibrant downtown environment, and strong supportive infrastructure. Port Chester continues to stand out as a highly sought-after commercial hub, drawing attention from a diverse range of investors and businesses. This transaction is the latest example of the market’s dynamism and positive outlook,” he added.

Houlihan Lawrence Commercial specializes in investment opportunities, office, multifamily, industrial and retail sales and leasing, land acquisition, development, and municipal approval consultation.

“This sale underscores the sustained appeal and strength of the Port Chester commercial real estate market.”

— Mike Rackenberg

By Peter Katz / pkatz@westfairinc.com

Demonstrations were planned or held in a few U.S. cities including New York on August 18, following about 50 events that were held nationwide over the weekend including in Peekskill to show support for protecting Social Security.

A Monday afternoon gathering at the Manhattan location of the union 1199SEIU United Healthcare Workers East was to be a continuation of weekend rallies to mark the 90th anniversary of Social Security having been signed into law by President Franklin D. Roosevelt (FDR) on August 14, 1935, and rally for support of the Social Security program as it was originally established.

The Social Security Administration says that this year 72 million beneficiaries will receive more than $1.6

trillion in payments. At the same time, some people are concerned that the Trump Administration will try to make good on the long-time wish by some Republicans to privatize Social Security. Some see that beginning with the establishment of "Trump Accounts" in the recent tax and spending bill signed into law by President Trump that can be used for private investment of retirement funds.

According to the White House, "Trump Accounts for newborns will be seeded with a one-time government contribution of $1,000. The accounts will track a stock index and allow for additional private contributions of up to $5,000 per year. This will afford a generation of children the chance to experience the miracle of compounded growth and set them on a course for

prosperity from the very beginning."

U.S. Treasury Secretary Scott Bessent has described the new “Trump Accounts” as not only way to build wealth but also as a “backdoor for privatizing Social Security.” Senate Minority Leader Chuck Schumer of New York in a speech on the Senate floor said, "Bessent actually slipped and told the truth: Donald Trump and his government want to privatize Social Security.”

In Peekskill, a group gathered in Depew Park to defend Social Security as it has existed since it was created under the Roosevelt Administration. Social Security has been one of the most successful government programs of the last 100 years,” said New York State Sen. Pete Harckham. “It has provided countless hardworking Americans with a safety net after a long career contributing to our economy. The Trump Administration’s at-

By Peter Katz / pkatz@westfairinc.com

Senate Minority Leader Chuck Schumer, during an appearance at the Garnet Health Medical Center-Catskills in Harris in Sullivan County, warned that people in the Hudson Valley could be hard hit by the cuts to Medicaid and other health care in Donald Trump's "Big Beautiful Bill" that the president recently signed into law.

Schumer announced that he has proposed new legislation that would repeal the health care cuts and also extend tax credits due to expire at the end of December that have helped people pay premiums for their Obamacare (Affordable Care

Act) health insurance. The entire Democratic caucus has signed on to co-sponsor the legislation, according to Schumer.

Schumer noted that 37% of the population in Sullivan County is covered by Medicaid and that because of the spending cuts signed into law by Trump more than 150,000 New Yorkers in the Catskills and Hudson Valley are expected to lose health care.

"We are already seeing the impacts at our rural hospitals, including right here at Garnet Health Medical Center-Catskills, where they have already been forced to reduce vital medical services and lay off staff," Schumer

said. "This is a gut punch to Hudson Valley health care."

Schumer pointed out that Garnet has cut 42 workers in Sullivan and Orange. In Sullivan County, Garnet's Catskills campus just-ended outpatient diabetes care. In Orange, at Garnet's Health Medical Center-Middletown a potential trauma center downgrade would put pressure on county budgets. In Ulster, where rural clinics already run on tight margins, even modest Medicaid cuts could trigger service reductions, Schumer notes.

Schumer was joined by The Center for Discovery CEO Terry Hamlin. The center provides health care and education services for 1,200 children and adults with various medical conditions. It has 1,800 staff

tempts to undermine Social Security and deny future generations the hardearned benefits they deserve after a lifetime of working are emblematic of this administration’s decision to turn its back on regular people to give tax cuts to the ultra-wealthy.”

A 102-year-old woman from Peekskill identified only as Diane recalled hearing Roosevelt in a fireside chat on the radio talking about Social Security. "My cabinet and I have decided that you do not want your elderly to die in loneliness and with a lack of survival," she quoted FDR as saying. "We have started a program we are calling Social Security. Social because it covers every single person.”

Dylan Wheeler of the group Empire State Voices that was involved in organizing the Peekskill gathering noted that nearly four million New Yorkers and their families depend on Social Security.

members and is the largest employer in Sullivan County.

"The majority of the individuals we serve at The Center for Discovery rely on Medicaid, and 63% of our $155 million operating budget comes from it," Hamlin said. "These cuts aren't abstract numbers, they are a direct hit to the lifeline that keeps people alive, keeps families together, and keeps our rural county strong."

Garnet Health CEO and President Jonathan Schiller said,"These cuts will have devastating consequences for patients and hospitals across New York and especially in Sullivan County. We urge all lawmakers to recognize the real-world impact on access to care and work toward solutions that protect the health of our communities."

According to Sullivan County Manager Josh Potosek, "These cuts are not saving anyone money -- they simply shift more costs to states and counties. What this means is that taxpayers will pay significantly more to provide services which counties like Sullivan are mandated to offer. We're already wrestling with a potential property tax hike just to cover the increased expenses that will be coming our way in 2026, and we've yet to learn what New York state's reaction will be to the impacts of these federal-level changes."

By Georgette Gouvei a / ggouveia@westfairinc.com

Wall Street: The very name conjures images of wealth, power and control with all the distrust, ridicule, envy and ambition that these inspire.

But the 21st century didn’t invent Wall Street or such related issues as media mockery of the one-percenters (Jeff Bezos’ wedding, anyone, everyone?); and women and minorities looking to break "the Street’s" glass ceiling. Those seeds were planted in the 18th century to bloom in the “Gilded Age,” the period between the end of the Civil War (1865) and the beginning of World War I (1914), when enormous industrialization and economic growth coexisted with political corruption, wealth inequity and poverty. (The phrase was coined by author-friends – and Hartford residents – Mark Twain and Charles Dudley Warner to underscore this disparity as gilding is often used to suggest pure gold, disguising baser materials.)

Now a new exhibit turns its eye on Wall Street in the Gilded Age – and a not-so-distant lens on our own. “Bulls of Wall Street: High Finance, Power, and Social Change in Victorian America” – opening Thursday, Sept. 4 at The Lockwood-Mathews Mansion Museum in Norwalk – includes period artifacts, photographs, documents and costumes from public and private collections, set amid the Second Empire elegance of what was financier LeGrand Lockwood’s summer home.

“This exhibit will examine the business and social dynamics that led to the emergence of a capitalist society in America,, reflected in the Wall Street life and experiences of...Lockwood,” museum consultant and exhibit curator Stacey Danielson said in a statement. “It will also consider the similarities and differences between the Gilded Age era and today.”

The story of Wall Street begins 400 years ago when the Dutch West India Co. founded New Amsterdam on the southern tip of Manhattan island, creating a stockade (wall) from which the street gets its name that ran from what is now Broadway to the East River. While the mercantile Dutch would cede New Amsterdam in 1664 to the English, who renamed the colony for King Charles II’s brother, the Duke of York (later James II), they had set in motion New York’s financial destiny. It was cemented by the Compromise of 1790 in which Alexander Hamilton, President George Washington’s Treasury secretary, agreed to allow what is now Washington D.C. to become the

nation's capital -- something Southern Founding Fathers Thomas Jefferson and James Madison favored -- in exchange for being able to consolidate and fund the states’ Revolutionary War debt by floating federal bonds to pay it off.

This freed New York, the first capital of the country, to become its financial capital instead, although John E. Herzog, a lender to the exhibit who spearheaded the expansion of Herzog, Heine, Geduld Inc. into the third-largest NASDAQ market maker and founded the Museum of American Finance in Manhattan, said this was a more complex process, gradually spurred by the city’s location and commerce. But he lauds Hamilton as the key figure in creating a centralized economic system, complete with a national bank and support for American manufacturing, that has shaped the global economy and will, he added, continue to do so.

Hamilton’s actions also provided the framework for the establishment of the New York Stock Exchange (NYSE).

In response to the new nation's first financial panic, 24 stockbrokers came together outside 68 Wall St. on May 17, 1792 yo sign an agreement that established the regulations for trading securities. The Buttonwood Agreement – named for the buttonwood (sycamore) tree under which the brokers originally traded – “would become the foundational document of what officially became the New York Stock Exchange in 1863,” Danielson said. As the exchange grew – from informal gatherings in neighboring coffeehouses; to, in 1817, the New York Stock & Exchange Board, which rented a room at 40 Wall St. with chairs for brokers to trade 30 stocks and bonds, hence the phrase “a seat on the stock exchange,” Herzog said; to its permanent Georgian-style home in 1903, complete with a brass opening bell -- it spurred a new class of wealthy entrepreneurs considered titans of industries by some, “robber barons” by others. Lockwood, NYSE treasurer and a director of Cornelius “the Commodore” Vanderbilt’s New York Central and Hudson River Rail Road Co., Vanderbilt himself and Jay Gould, the railroad speculator who made Lyndhurst in Tarrytown his country home, were among the cutthroat, bold-faced names of the era, along with John D. Rockefeller, founder of Standard Oil. Co., and J. Pierpont Morgan, head of the banking firm that ultimately became JPMorgan Chase & Co. But

they weren’t the only ones.

The exhibit considers Jeremiah G. Hamilton, described as “the only Black millionaire in New York” in the decade before the Civil War. A ruthless entrepreneur who was also the victim of racism, Hamilton took on Wall Street’s elite, earning him the nickname “the Prince of Darkness” and a $2 million fortune (about $58.7 million today).

In a man’s world, three women stood out. Hetty Green’s honest, disciplined approach to investing and lending – she was a proponent of value investing, “buy low, sell high” and financial literacy for women – enabled her to build on her family’s whaling fortune and to help bail out New York City in the Panic of 1907, when the NYSE fell 50% from its peak of the previous year. Sisters Victoria Claflin Woodhull and Tennessee Claflin would overcome poverty and parental abuse to open the first woman-owned Wall Street firm, Woodhull, Claflin & Co., on Feb. 14, 1870, soon a hit with a heretofore untapped female market, everyone from Gilded Age matrons and matriarchs to businesswomen, actresses and even madams and high-priced prostitutes.

“These women were pioneers. They made their way on their own terms,” said historian-author Sheri Caplan, adviser to the exhibit on the history of women in finance – a sector in which women and minorities have made strides but have not achieved parity in representation, leadership roles and compensation. In an age of excess, Green was frugal to the point of miserliness, her well-worn black garb helping to earn her the nickname the “Witch of Wall Street.” Woodhull and Claflin – whose firm was backed by Vanderbilt, reportedly Claflin’s lover – later published a newspaper, Woodhull & Claflin’s Weekly, advocating for women’s rights and free love.

Their individualism “led to success, but it also made them objects of ridicule in private and public,” Caplan said.

A cartoon from the New York Evening Telegraph – dated Feb. 18, 1870, four days after Woodhull and Claflin opened their firm – depicts the sisters driving a team of bulls and bears with the faces of Vanderbilt and company as their carriage rolls over men and manfaced birds.

Another cartoon, circa 1886 and title “The Judge,” shows Jay Gould sitting on a throne inside a stock ticker machine, introduced in 1867, as traders run amok, with a caption that quotes the speculator saying: “I never speculate.”

“This exhibit will examine the business and social dynamics that led to the emergence of a capitalist society in America… and consider the similarities and differences between the Gilded Age era and today.”

— Stacey Danielson, Curator

In the age of the anonymous internet, our satires on the haves and have-mores are “much more scathing,” Danielson said.

A key difference between Wall Street then and now is that there are more vehicles for trading equities and more regulatory bodies, said Herzog, whose loans to the show range from photographs and newspaper illustrations to unissued bonds. Today, the NYSE is the largest stock exchange in the world, with a total market capitalization of $37.1 trillion as of May and some 2,800 companies representing everything from blue chips to high growth ventures. Right behind the NYSE is the NASDAQ (the National Association of Securities Dealers Automated Quotations), founded in 1971, with a total market capitalization of $29.9 billion. Approximately 3,890 companies trade on the electronic NASDAQ, with a heavy concentration of technology and growth businesses.

They’re overseen by such organizations as the Securities and Exchange Commission (SEC), which came out of President Franklin D. Roosevelt’s New Deal program in 1933, and the Financial Industry Regulatory Authority (FINRA), a self-regulatory organization (SRO) authorized by Congress and operating under the SEC.

They bring us full circle to that May day in 1792 when a group of concerned brokers sought to regulate their nascent industry to stave off a young nation’s financial panic, and the stock exchange was born.

“Having good rules ensures the nation’s progress," said Herzog, a Southport resident. And that in turn, he added, benefits its individuals.

August 2025

In a significant stride for real estate innovation, the Business Council of Westchester’s Westchester Innovation Network (WIN) recently facilitated a digital scan of a Simone Development Companies property by ReX2, a company at the forefront of digitaltwin technology.

The scanning of One Executive Boulevard in North Yonkers, a medical office building newly acquired and renovated by Simone Development, served as a crucial test and demonstration of ReX2's capabilities. A scan of the building, known as a digital twin, allowed ReX2 to create videos that allow prospective tenants to have a 3D experience walking through the building’s finished and unfinished spaces.

“The goal was originally to bring people into the space,” said Mattie Wilkes, ReX2’s founder. “Anybody on Simone’s leasing team can guide people, whether over the phone or on Zoom, through the whole building.”

The on-site scanning for One Executive Boulevard took approximately four days, followed by several weeks of collaborative work with Simone Development’s in-house leasing, construction, and property management teams for editing and information integration. Wilkes praised the experience of working with the Simone team, specifically commending director of leasing Jeremy Schwartz and vice-president of leasing Josh Gopan for their helpfulness and communication.

Mattie Wilkes, ReX2’s founder, at Simone’s One Executive Boulevard building in Yonkers

Wilkes, 26, of Mount Kisco, established ReX2 just over three years ago, focusing on creating tailor made digital twins of physical spaces, differentiating itself significantly from standard virtual tours.

Unlike typical virtual walkthroughs that feature standard imagery, ReX2 uses LIDAR (Light Detection and Ranging) and infrared scanning. LIDAR devices emit laser light pulses to measure distances to objects and walls to create 3D models of any environment. This versatile technology can map terrain, assess hazards, and guide autonomous vehicles.

The digital twinning of a property allows architects to export measurements directly into CAD software for proposals, printing, and even generate floor plans for buildings where none exist.

“We are very enthusiastic about supporting the WIN program by partnering with ReX2 to test their emerging real estate technology. The ReX2 team created an incredible 3D digital twin of our North Yonkers medical property at One Executive Blvd, which will be a phenomenal tool for our leasing team,” said Patricia Simone, Principal & President of Simone Management Group and a BCW board member. “This project truly embodies the mission of the BCW to connect businesses in our community so that they can support each other and grow the economy.”

The match between ReX2 and Simone Development reflects the BCW WIN's mission to pair emerging innovators with established local companies to foster the latest ideas, drive research and discovery, and cultivate job growth in Westchester County.

“We are thrilled that WIN facilitated such an impactful match between ReX2 and Simone Development Companies,” said BCW president and CEO Marsha Gordon. "Introducing cutting-edge technology to one of Westchester County's leading commercial real estate development companies exemplifies the WIN program’s primary mission: to empower business leaders to embrace innovative solutions, ensuring they continue to thrive and drive economic growth in our region.”

Chrystal P. Mauro Senior Counsel

IBM Consulting COFFEE CHAT FEATURED PANELISTS

MONDAY, SEPTEMBER 8, 2025

8:30 a.m. – 10:30 a.m.

$55 for Members

$80 for Future Members

Pace University

Join

James Brusseau PhD, Philosophy Professor Pace University

Amy B. Goldsmith Chair of Cybersecurity, Data Management & Privacy Practice Tarter Krinsky & Drogin

Hannah Hage Assistant Counsel Office of General Counsel, The State University of New York

Mairead Jones-Kennelly Senior Counsel

The State University of New York and the AI Legal Institute at SUNY (ALIS)

Keith Landa Director of the Teaching, Learning, and Technology Center

Purchase College SUNY

David Sachs Professor, Seidenberg School of CSIS Pace University

Elaine C. Zacharakis Health, Privacy & Technology Consultant/Attorney Zacharakis Loumbas Law LLC

By Jeremy Wayne / jwayne@westfairinc.com

A fully restored Citroën 2cv — bought third-hand from a French baker in Rhode Island—greets you as you enter Maison Brondeau, the striking new wine store now open in the City Square Arcade Shops development on Main Street in White Plains. It’s the first of many delightful surprises, most of them vinous, that await at this beautiful shop, owned and run by French-American Bronxville resident, Ben Brondeau.

Ben, thanks for speaking with the Westfair Business Journal.

You describe your gorgeous new wine store, Maison Brondeau, as “hospitality driven”: Can you explain?

“For us at Maison Brondeau, a hospitality-driven wine store means we go beyond a classic, transactional based retail shop. Through our store's design and staff's approach, we aim to foster a warm, welcoming environment. We place an emphasis on educating customers about wine and spirits, whether it’s through monthly ticketed educational sessions, weekly free tastings, or daily engagement with customers — from describing a bottle on the shelf to walking through varietal and regional differences with our automated pouring machines in-store.”

And why White Plains? Can you fill us in on what’s happening at the City Square Arcade Shops?

“I wanted to create a unique wine retail experience, so it was imperative I pick the right location…. The Ginsburg Development Cos. has done an incredible job transforming a part of White Plains that was previously primarily commercial space into a unique retail shopping experience (City Square Arcade Shops). Located steps from the Metro-North Railroad, and in the center of several new luxury high-rise apartment buildings, the space offers a great location within a growing part of Westchester and gave me the chance to build Maison Brondeau from the ground up.”

Maison Brondeau marquee. Photograph by Mark Jessamy.

Can you share any intel on how retail margins on wines work, and what do you expect to be the “bread and butter” of the business?

You’ve also referenced your “wine-loving culture” and family: Please tell us more.

“I was born in Paris, France. My dad was raised in Bordeaux, and my mom caught the ‘wine bug’ at an early age. France is, of course, known for its wines, but my family in particular fully embraced the wine-loving aspect of the French culture. Whether I was smelling my parents' glasses of wine as a kid trying to understand the nuances of different varietals or walking through vineyards in my grandparents’ backyard in the Roussillon region of France, wine was always a part of my life.”

And how did your career develop?

“I went to Villanova University where I studied finance and marketing, worked in management consulting at Deloitte and then corporate finance at NBCUniversal for eight years. I wanted to pursue my dream of working in wine and felt inspired to open a wine store that breaks the traditional mold of a stuffy, unapproachable shop and is instead a place where you come to learn and feel welcome.”

“At the core of the business it's a volume play, given we want to be conservative with our pricing in order to stay competitive and offer wines to our customers at an approachable price point. We love to bring the lesser known, smaller, high-quality producers to our shelves, along with some more recognizable, national brands. Our team often taste tests wines ‘price blind,’ meaning we don’t know what items cost when distributors sample products for us to purchase, to ensure prices don't skew our perception of the wine's quality.”

What wines / regions / countries are you personally excited about right now? What do you find yourself drinking most often?

“California is always a happy place for the team, especially since a trip to Napa served as inspiration for the store. We've also been very excited about the wines we've tasted from Portugal and have been encouraging customers to taste these wines they might not have picked up off the shelf themselves. Finally, a beautiful Rosé San Salvatore-Vetere from Southern Italy has been my go-to pick this summer.”

Lastly, 65% of businesses fail in their first 10 years. Do you have a “secret” for making yours work in White Plains?

“For us, there’s no secret, just a genuine belief in our store's concept, a love for what we do and the people we serve.”

By Jeremy Wayne / jwayne@westfairinc.com

A fully restored Citroën 2cv — bought third-hand from a French baker in Rhode Island—greets you as you enter Maison Brondeau, the striking new wine store now open in the City Square Arcade Shops development on Main Street in White Plains. It’s the first of many delightful surprises, most of them vinous, that await at this beautiful shop, owned and run by French-American Bronxville resident, Ben Brondeau.

Situated in the historic center of Litchfield, Connecticut — the landmarked town's first full-service high street hotel in more than a century – the restored, three-acre Belden estate has an 1888 Colonial Revival mansion with meticulously preserved period details at its core. With 31 guest rooms and suites –10 in the main house and 21 in the Mews — Belden House also offers gracious period public rooms, including the house’s original living room, dining room and library.

The Mews, a modernist three-wing structure, also houses a fully ADA (Americans with Disabilities Act) accessible room.

On a recent Friday night, I arrived

in time for a late supper, after which I was shown to my suite on the second floor of the main house by the night butler. Dominated by a magnificent carved four-poster bed, this elegant room comprised a sitting area, large desk, pantry with upscale edibles and one of those magical fireplaces that ignite at the touch of a button. A dressing room with a small terrace off it sealed its “luxury” credentials.

Touches like the radio set complete with antennas – remember those? – and fur rug-covered chairs in the dining room, along with its original tiled fireplace, give Belden House a retro feel, which, when paired with the Brooklyn-esque vibe, creates the unique atmosphere these experienced hoteliers are so good at framing.

The upholstery? Yes, it’s pukka, meaning “swell,” in spite of those “karate chops” as a dear friend of mine describes the mandatory V-shape knocked into the top of heavy pillows, now an interior design fashion statement which no self-respecting decorator dares to ignore.

Step outside the house and pathways lead to the Bathhouse, Belden’s wellness center, for massages and all

manner of treatments, and onwards to the 50-foot swimming pool and the lawn club for a game of croquet. The flower beds and borders are still a little sparse but a great deal of planting has already been done. Within a couple of seasons the backyard, if we can call it that, is going to be nicely mature, a riot of color in summer.

In the dining room, which is headed by executive chef Tyler Heckman, a Connecticut native, I waited so long for bread – admittedly ordered as an afterthought by yours truly once the appetizer had already been served – that I almost grew a beard in the interim. But boy oh boy was it worth the wait – two great hunks of soft, almost billowy sourdough focaccia underneath a thin sheet of crisp crust that shattered like glass on contact with the knife. Served with rich, cultured butter, this was an epochal, fantasmagorical piece of bread. Go to Belden House for that alone and the journey will have been worthwhile. But, of course, it didn’t stop with bread. Other dining room standouts – everything sourced with care from nearby farms and the New England coast – included an appetizer of fresh milk curd with peaches, fennel and pollen, which may sound like baby-food but was in fact a superb, very sophisticated and cohesive dish;

“At the end of the day, it’s not the history or location, nor the luxury touches… but the ambiance of Belden and the people who work there which make it special.”

and a silky Lobster custard, with heirloom corn and basil. This was an original treatment for lobster, which, a treat though lobster is for most of us, many Nutmeggers I suspect may be growing weary of this far into the summer season.

Service, by, the way, is excellent, although being asked three times by three separate staff members at breakfast whether I was enjoying my local Arethusa yogurt with flax-seed granola may just have been bordering on overkill.

But at the end of the day, it’s not the history or location, nor the luxury touches — like the BMW at your disposal should you want to explore the region; the Frette linens and slippers; the radiant heated bathroom floors or the natural British Wildsmith bathroom products — but the ambiance of Belden and the people who work there which make it special.

So, a shout-out to Ian, only a few days into his portering job, but kind and helpful, always carrying my bags; to Elizabeth at the front desk, the smiling “face” of Belden; to Mark – aforementioned butler; patient Katrina in the dining room; manager Greg, and many others besides who all help make Belden the utterly-luvverly, cultured-butterly place it is.

All In The Family

Cutting Edge

Female Innovator Promise For The Future

Urgent Care

Lifetime Achievement

Veterinarian

Power Couple

Outstanding Nurse

Doctor Without

Boundaries

Physician Assistant

Do

Compassionate

Concierge Doctor

Team

Dentist

Sponsorship

FAIRFIELD – As Acting First Selectman Christine Vitale is about to announce a special meeting to appoint a permanent first selectman on Aug. 25, state Sen. Tony Hwang had his own related announcement on Tuesday, Aug. 19.

The five-term Fairfield senator in the 28th District held a press conference Tuesday at Greenfield Hill Congregational Church to say he is going to petition for a special election as a Republican candidate to replace the late Bill Gerber, who died on July 15. He later told the Fairfield County Business Journal he would file the petition with the necessary 2,100 signatures – 5% of the town’s more than 42,000 registered voters by the Sept. 9 deadline.

The first step towards officially replacing Gerber begins with an Aug. 25 meeting of elected Democrats – a meeting that became necessary when sitting Republican Selectman Brenda Kupchick did not second a vote at a special Board of Selectman meeting earlier this month to elevate Vitale to permanent first selectman.

Acting First Selectman Christine Vitale, a Democrat, issued a statement to the Journal that read: “If I am selected on Monday, I will be honored to continue to serve the Town as First Select-

By Gary Larkin / glarkin@westfairinc.com

man. After that vote occurs, if residents want to support a petition for a special election, I will welcome the opportunity to once again earn their support.”

She went on to state the town charter and the names and titles of the Democrats who will vote Aug. 25.

“As defined by the Charter and state statute, the Democratic elected officials who will vote to fill the vacancy in the First Selectman position are: Christine Vitale (Selectman); Charlene Sabia-Lebo (Constable); Jay Wolk (Constable); Kevin Flynn (Constable); Ruth Smey (Constable); Jonathan Delgado (TPZ Alternate); Joseph Siebert (TPZ Alternate); Harold Zawadski (ZBA Alternate); Elise McKay (ZBA Alternate); and Matthew Waggner (Registrar of Voters).