Bahamas debunks claims Gov’t

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

The Securities Commis sion last night debunked accusations the Govern ment “directed unauthorised access” to FTX’s systems, and aided the withdrawal of digital assets, in violation of Bahamian and US court orders.

Tribune Business has seen an emergency Supreme Court Order, dated November 12, 2022, that gave the regulator lawful permission to trans fer assets potentially worth millions of dollars from FTX Digital Markets, the failed crypto exchange’s Bahamian subsidiary, to “a safer space” amid fears they were about to be stolen by hackers.

The Order, by Justice Loren Klein, completely rebuts allegations made by John J. Ray, appointed as FTX’s chief executive in the wake of its Chapter 11 bank ruptcy protection filing, that he possesses “credible evi dence that the Bahamian

government is responsible for directing unauthorised access to the debtors’ [FTX’s] systems for the purpose of obtaining digital assets” held by the exchange on behalf of clients.

However, the potential damage to The Bahamas’ integrity and allegations from such unproven claims may now be hard to reverse. Inter national news outlets, such as CNBC and Coindesk, were already yesterday report ing Mr Ray’s allegations and suggesting that FTX’s now-infamous founder, Sam

Bankman-Fried, sought to hide assets from the Chapter 11 proceedings in Delaware by transferring them to Baha mian government control.

The Davis administration, which has been seeking to place as much distance as pos sible between itself and the flagship digital assets inves tor it once warmly embraced, declined to respond to the FTX-related claims despite the high risk of damaging fall-out for the Government, fledgling digital assets indus try and wider financial services sector. Clint Watson,

the Prime Minister’s press secretary, said: “We have no comment at this time.”

The Government, instead, once again left the response to the Securities Commission as it moves to disassociate itself from FTX. However, the Prime Minister’s asser tion that The Bahamas will emerge from the crypto exchange’s spectacular implosion with an improved reputation as a sound digital assets jurisdiction now looks set for the severest of stress tests due to the erroneous accusations.

Well-placed sources, famil iar with how events unfolded but speaking on condition of anonymity because they were unauthorised to talk publicly, said the Securities Commission was last week end “really in a race against time” to secure and protect FTX Digital Markets assets for the benefit of clients and creditors.

They explained that the regulator had no choice but to

FTX’s Bahamas creditors unlikely to see full recovery

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

FTX’s newly-appointed chief executive yesterday asserted that corporate gov ernance was non-existent at its Bahamian subsidiary, adding: “Never have I seen such a complete failure of controls in my 40-plus years.”

John J. Ray, who almost two decades ago oversaw the bank ruptcy of Enron, the energy trader whose failure sparked global accounting and corpo rate governance reforms, also took a thinly-veiled swipe at this nation by referring to “faulty regulatory oversight abroad” of the collapsed crypto currency exchange.

And, in legal filings with the Delaware Bankruptcy Court,

he also alleged that FTX used corporate funds to acquire Bahamian real estate for its senior executives but placed these assets in their name - not the company’s. No details were provided.

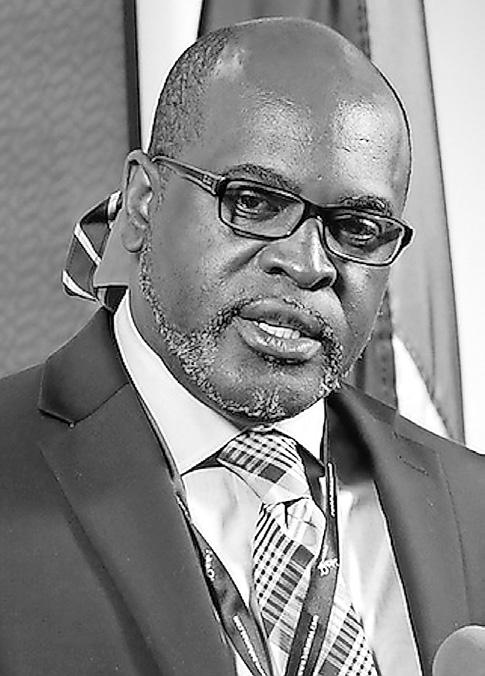

Meanwhile, Brian Simms KC, the senior Lennox Paton partner who has been appointed joint provisional liquidator of FTX Digital

$250m cruise port: ‘We’ll help Long Island flourish’

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

THE proposed $250m Long Island cruise port will handle up to 12,000 persons daily at full build-out, one of its principals revealed yesterday, adding: “Our goal is to help Long Island flourish.”

Sherif Assal told the Long Island Business Out look conference that the $250m Calypso Cove pro ject is “not a cruise line project” or typical private island destination, and pledged: “Our objective is not to suppress the locals; it’s to help the locals.”

Reaffirming that Long Island residents will have first eights to all job and

entrepreneurial oppor tunities, he added that a “ball park” date for the development’s initial opening was some two-anda-half to three years away in November 2025. Much depends on how rapidly planning, construction and environmental approvals are obtained, with much to be worked out from a logistics and infrastruc ture standpoint since it is a “greenfield” site.

Asserting that plans to raise the necessary financ ing are “coming along very well”, although provid ing no details, Mr Assal explained how himself and his business partner, Carlos Torres de Navarra, a former

Long Island’s to airport is branded ‘a disgrace’

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

LONG Island’s chief councillor yesterday branded the Deadman’s Cay airport “a disgrace and leaves much to be desired” as the lack of airlift and connectivity continues to undermine the island’s eco nomic prospects.

Ian Knowles, addressing the Long Island Business Outlook conference, voiced hope that the impending $250m Calypso Cove cruise port and other potential investment projects will give the Government little choice but to finally move on transforming the airport

into a facility capable of receiving commercial jet flights and direct interna tional airlift connectivity.

“The international air port at Deadman’s Cay has been the talk of the town for the last five years, and even after being presented with plans several years ago we still remain hopeful,” Mr Knowles said. Besides being unable to presently receive commercial jet flights, he added that Long Island has to share Bahamasair routes with other islands and there are “no direct flights from any international market”.

Gov’t investment chief: ‘We must regain people’s trust’

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

THE GOVERNMENT’S investments chief yesterday admitted it has “a lot of work to do in regaining the trust of the Bahamian people” while revealing that some $660m worth of projects are on the drawing board for Long Island.

Phylicia Hanna-Woods, the Bahamas Investment Authority’s (BIA) director, told the Long Island Business Outlook conference that the agency had to prove it is “not Nassau centric” and attract “meaningful investment” that translates into real projects with eco nomic benefits that extend beyond the mere creation of jobs.

She added that the BIA is also focusing on what she termed a “joint venture” promotion strategy, and is seeking to partner with each individual Bahamian island to “showcase” their respective needs, qualities and culture to potential investors.

Mrs Hanna-Woods said that, apart from the $250m Calypso Cove cruise port project for which a Heads of Agreement with the Gov ernment was signed recently, the BIA is also negotiating with investors seeking to rede velop the former Diamond Crystal property via a $410m, three-phase spend.

Pointing to the Long Island-related investments processed after the Davis admin istration took office, she said: “To-date, since September 2021, and I took on the position of director in October 2021, we’ve processed $660m worth of investments, one of which you’ve heard a lot about, Calypso Cove.

business@tribunemedia.net FRIDAY, NOVEMBER 18, 2022

SEE PAGE B4

SEE PAGE B8

SEE PAGE B6

‘unauthorised’

gave

FTX access

SEE

PAGE B7 SEE PAGE B5

• Hack forced relocation of local subsidiary’s assets • Commission obtained Supreme Court’s approval • Chapter 11 filings allege Gov’t violated Orders • Bahamas needs ‘meaningful investment beyond jobs’ • $660m in Long Island projects ‘processed’ post-election • BIA targets ‘joint venture’ promotions for each island $5.95 $5.97 $6.07 $5.87

BRIAN SIMMS

LIGHTHOUSE RESTORATION BOOSTED BY GRANT FUNDS

By YOURI KEMP Tribune Business Reporter ykemp@tribunemedia.net

EFFORTS to restore the Hope Town Lighthouse have been boosted by $472,000 in grant funding from the US government.

Heather Forde-Prosa, development director of the Elbow Reef Lighthouse Society, told Tribune Busi ness yesterday that work is well underway. She said: “We applied for the Ambas sador’s Fund for Cultural Preservation Grant through the US embassy in 2020. And when we applied, they told us don’t be upset if you don’t make it to the second round; just the fact that

you applied is a huge step forward.

“So we applied and we made it to the second round, and then we were given the grant. That whole process took about a year of work where we had to basically explain what happened with Hurricane Dorian. Hurricane Dorian in 2019 devastated Abaco to the point that even the team members were home less overnight. It was quite a shocking event, but we all came together and realised we have to write a report about what’s happened to the light station.”

The Hope Town Light house is still an actively functioning beacon while also serving as a tourist

attraction. It still guides ships at night, making its restoration more important than the traditional tourism landmark. Ms Forde-Prosa said: “For tourism, yes, it’s an attraction. It helps this island to maintain its iden tity and it’s an authentic and experiential tourism product.

“However, it’s not like the forts in Nassau that are tourist attractions. It’s not. It’s an active aid to naviga tion, which only the keepers allow people to come up. The keepers allow people to go and visit, but it’s not a paid attraction. So most people that visit leave a donation.”

There are no plans to turn the Hope Town Lighthouse

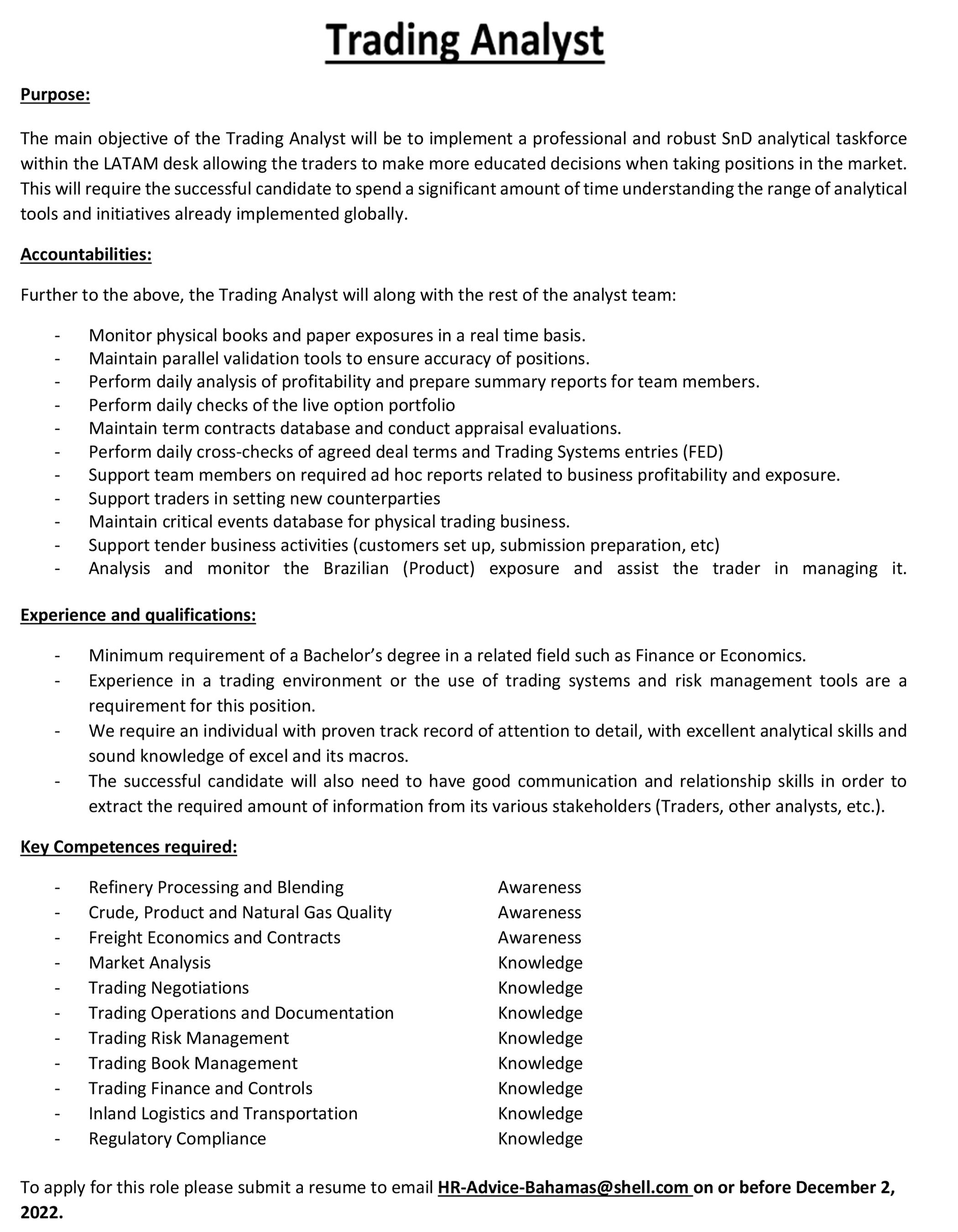

A WORKSHOP has been held to educate the private sector on the bid opportunities that will be forthcoming from a collective $89m financing designed to drive renewable

into a paid tourist attrac tion. A gift shop, though, is being renovated at its base to ensure some money is made from tourist traffic. The lighthouse is currently being painted, and there are four phases of works that will be undertaken, inclu sive of lantern and metal works restoration; stripping the tower and repairing the masonry, including paint ing; putting in new slate floors; and then operational systems restoration.

Repairs will be performed to the kerosene storage tanks and distribution system, as well as cleaning the lighthouse glass prisms. Ms Forde-Prosa said: “We put a report together that we sent to the Bahamas

energy’s roll-out across The Bahamas.

The Ministry of Finance’s project execution unit (PEU) for the ‘Reconstruc tion with resilience in the energy sector’ initiative, in conjunction with the InterAmerican Development Bank (IDB), staged the workshop at the National Training Agency.

The event was one of three organised to create public awareness of the

government to alert them of the damage and the extent of the damage, which came in over or around $1m estimated.

“Once we started trying to put budgets together to see what we were looking at having to fund raise, we realised that the lighthouse itself was about $500,000 worth of damage. The keepers’ quarters were partially destroyed. Our gift shop was just mostly destroyed, and we had all roof damage. We had to put new roofs on all of the sta tion outbuildings.

“The dock disappeared, so imagine trying to do res toration without a dock, because everything has to be transported over there.

project. Marco Rolle, pro gramme co-ordinator, explained that it was being financed by an $80m IDB loan together with a $9m grant provided by the Euro pean Union (EU). The loan aims to fund restora tion of Bahamas Power & Light’s (BPL) Dorianravaged transmission and distribution infrastructure in Abaco, as well as that in east Grand Bahama.

So we had help from NGOs that helped us get the dock back, but everything that we’ve done - even if we got grants or we got monies come in - we still have to fund raise through the whole project.”

The society is trying to raise more money to finish the keeper’s quarters. Once the restoration project is completed, there are main tenance costs that must be paid. More than $100,000 has already been spent on the lighthouse for it to be stripped and painted to a brighter shade of red, along with the white stripes that gives it its distinctive look.

The project is also aiming to strengthen iso lated and interconnected grid networks with resil ient renewable energy sources, teaming them with conventional power sys tems designed to withstand the increasing frequency and severity of hurricanes. Besides the IDB, Deloitte & Touche (Bahamas) also helped to facilitate the workshop.

PAGE 2, Friday, November 18, 2022 THE TRIBUNE

Workshop focuses on $89m renewable energy financing

ROBERTO AIELLO, principal energy specialist at the IDB, gave remarks during the workshop.

MARCO ROLLE, programme co-ordinator for the initiative, gives an overview of the project.

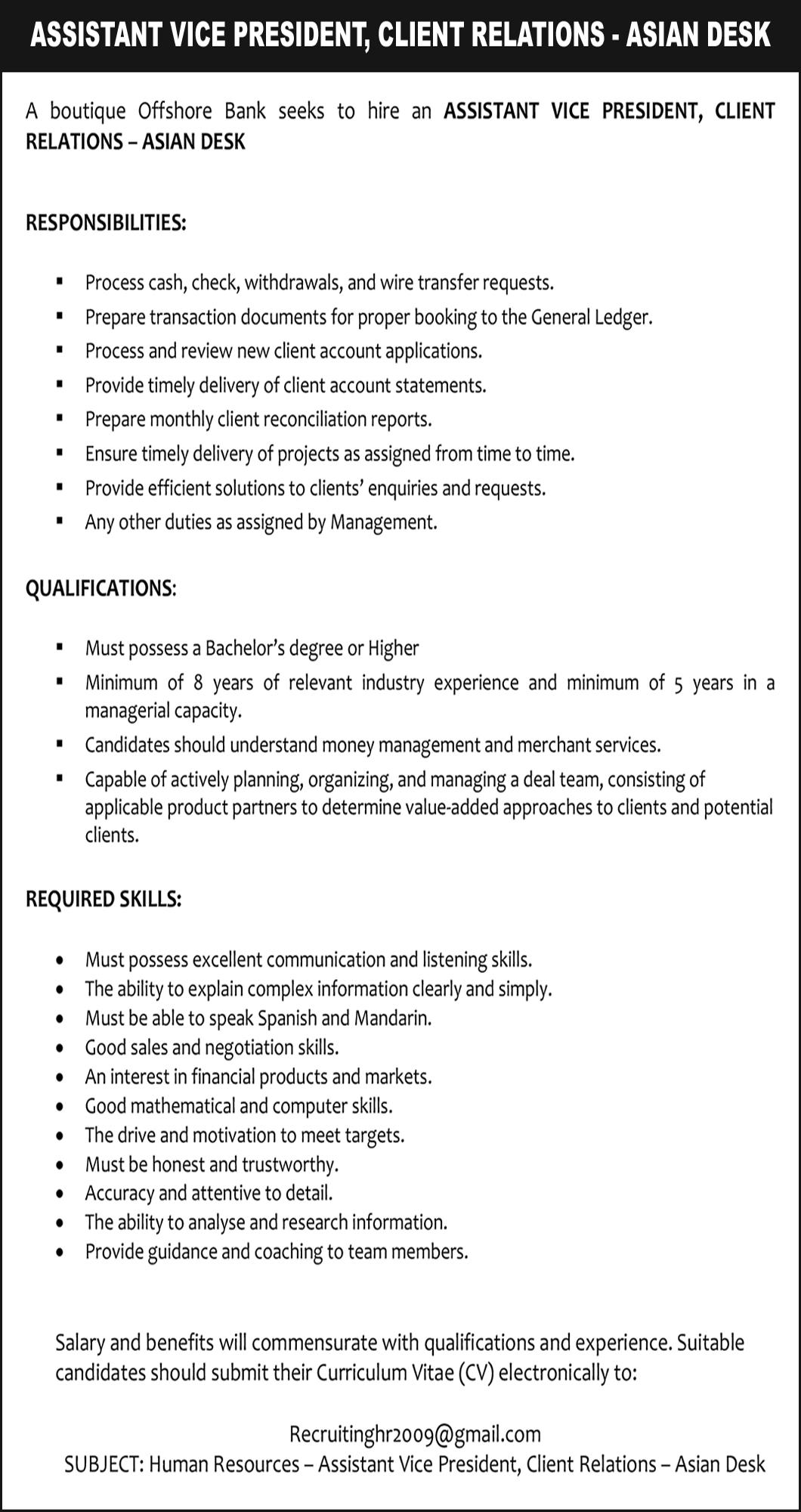

• Bachelors degree in accounting or finance • CPA Designation • Previous work as a senior accountant or a senior auditor • In depth knowledge of IFRS Accounting Standards is a must (specifically IFRS 9, IFRS 15 and IFRS 16) • Experience preparing financial statements • Experience overseeing year end audit engagements • Advanced knowledge of Microsoft Excel • Good Communication skills – written and verbal Please submit all resumes to humanresources@airportsbahamas.com on or before November 8th 2022. JOB OPPORTUNITY SENIOR ACCOUNTANT (6 MONTH CONTRACT) QUALIFICATIONS AND REQUIREMENTS

Photo:Mark Ford/BIS

GOV’T PAYING CIVIL SERVANTS $3M MINIMUM WAGE ARREARS

By YOURI KEMP Tribune Business Reporter ykemp@tribunemedia.net

A SENIOR Ministry of Finance official yesterday said the Government’s must pay civil servants a collec tive $3m in arrears due to a minimum wage hike that is retroactive to July 1, 2022, for the public sector only.

Simon Wilson, the finan cial secretary, told the Office

of the Prime Minister’s media briefing that all public officials will be “brought up to or above” the new minimum wage threshold of $260 per week.

“So this month, hope fully, we will bring all public officers up to the minimum wage, which is $13,520 (per year),” he said. “So all public officers by November payday will be at or above minimum wage. All the rest of the public officers will be

AIRLIFT WOES UNDERMINING LONG ISLAND REAL ESTATE

By YOURI KEMP Tribune Business Reporter ykemp@tribunemedia.net

LONG Island’s Cham ber of Commerce president yesterday said the island’s competitiveness, includ ing that of its real estate market, is being undermined by the lack of direct airlift and the state of its airport.

Cheryl de Goicoechea told the Long Island Busi ness Outlook: “I would like to speak on the main chal lenge that we as Long Island real estate agents have to deal with. We really have our work cut out for us trying to compete with the other Family Islands that have direct air transportation from the US.

“I feel that without this service to our island, there’s minimal growth and invest ment. Buyers come to Long Island, and because they are unable to get to the island in one day they may say it’s just too difficult and inconven ient.” This compares to the likes of Abaco and Exuma, international visitors can fly in directly without having to lay over in New Providence.

“I can tell you, and I’m sure the other agents can tell you the same thing, that I’ve lost many sales to these islands because of this reason. So this needs to be addressed in order for us to move forward and get up to par with the other islands,” Ms de Goicoechea added.

“Right now we have two flights daily to the island. However, their schedules are not set up to accommodate visitors arriving from the US or other international loca tions. When the international flights arrive, and passengers have cleared Customs etc, it

is too late to connect to flights going to Long Island.

“It would be a great advan tage to residents and visitors if one of these two airlines would schedule a late after noon flight to the island to accommodate visitors and residents travelling back and forth; to and from the island.”

Ms de Goicoechea also called for the Deadman’s Cay airport to be made into an international port of entry, in addition to Stella Maris. “This, I feel, is needed because it would attract those buyers with private aircraft to now come in to the south ern portion of the island,” she explained.

“It would be more con venient for them to land their private aircraft right at Dead man’s Cay and clear Customs there, instead of having to land at Stella Maris, clear and then fly over to Dead man’s Cay.”

The Government previ ously acquired 400 acres on which it planned to build a new international airport for Long Island at a cost of $19m. The scope of work for the airport went out to tender in December 2020 under the former Free National Movement (FNM) adminis tration, and construction was expected to begin from Janu ary 2021 with the runway expanded to 6,500 feet from the current 4,000 feet.

Chester Cooper, deputy prime minister and minister for tourism, investments and aviation, said at a press con ference last month that the airport expansion for Long Island is a “key requirement” for investments on the island. He added that later this year the Government expects the Request for Proposal (RFP) tender for the new airport will be ready.

paid. So we built that into our Budget.”

The Government last month affirmed a 24 percent increase in the minimum wage, equivalent to a $50 per week rise, to $260 from $210. The increase takes effect from January 1, 2023, for private sector workers.

Mr Wilson said: “The Prime Minister announced an increase with effect for all public officers from July 1. So that’s five months in arrears we estimate will be

around $3m that we will pay, in addition to the end of this month for those employee. [It] is roughly about 3,000 employees whose salary was below the new minimum wage. So we brought all of those persons up, we paid all of those arrears and that will be done by the end of this month.”

Turning to the Bahamas Power & Light (BPL) fuel charge hike, Mr Wilson voiced hope that the mini mum wage increase will

help to offset at least some of the impact for lower income earners. “In terms of what’s happening with the BPL increase, which is a staggered increase of 18 months, one of the things that I think that was said, and I will repeat it, is that the reason you stagger the increases, and allow persons a chance to adjust behav iour, the lower the costs,” he said.

“You may have seen the Ministry of Finance,

with BPL, is going through a street lighting project, changing the streetlights to LED and so forth. That’s going to lower electricity costs. We have issued an RFP (request for proposal) for roof-top solar, which is a big part of our plans. Again, all those things have been done to really bal ance things out, and making these small investments to reduce costs, operating costs going forward.”

Gov’t gaining $7m monthly in real property tax arrears

By YOURI KEMP Tribune Business Reporter ykemp@tribunemedia.net

A TOP Ministry of Finance official yesterday said the Government is collecting a “very signifi cant” $7m per month in real property tax arrears as it continues its crackdown on tax cheats.

Simon Wilson, the finan cial secretary, said the more than-$116m or 85 percent year-over-year shrinkage in the Government’s first quarter deficit was “very encouraging” as it increased revenues while simultane ously reducing subsidies.

Detailing the “key improvements” in rev enue for the three months to end-September, he said: “VAT increased by $35.4m and departure tax by $26.9m, excise duties by $23.6m, stamp tax or finan cial transactions, $1.8m.”

This occurred while total spending decreased by 7.9 percent or $58m compared to prior year.

Mr Wilson added: “This represents 20 percent of the budget target, so expenses are in line with the budget target. What drove the expenditure decrease was a $13.2m decrease in the acquisition of goods and services, and subsi dies which decreased by $16.7m. Social assistance for COVID-19 continued to decline. That decreased by $41.9m against the previous year’s quarter, which was very elevated.”

Interest payments increased because of a higher debt burden, rising by $10.5m, while pen sion gratuity payments rose by $4.4m along with civil servant compensation due to the Government signing several industrial agreements.

Mr Wilson said: “Capi tal expenditure, which is not unusual, was subdued in the first quarter of the fiscal year in comparison to previous first quarters. It reduced by $10.2m. Overall, the fiscal deficit declined in the first quarter in compari son to the previous fiscal period by $115.8m. We had a deficit for the first quarter of $20.6m, which was the lowest deficit for any quali fied extended period of time. So, the overall fiscal position was very, very encouraging.”

Mr Wilson added that the yield curve for the Gov ernment’s listed foreign currency bonds has now “flattened” after trading at default status for several

months. “If you take a look at our yield curve, I got a note from Rothschild [the Government’s advis ers] yesterday morning, indicating a congratulatory note that our performance, our bonds, have improved tremendously.

“We had an inverted yield curve. That curve has now flattened and it is now normal. So we are perform ing, in their words, better than the market, the emerg ing market, given the things that we do on the good news. These fiscal results here, we don’t want to rest on them, but these fiscal results here are very good.”

Mr Wilson said Bahamasbased investors had taken advantage of the Central Bank’s decision to elimi nate, for a short period of time, the 5 percent pre mium normally paid to convert currency for exter nal investments by using $180m for such purposes. He added that “close to $40m was actually” used to purchase bonds so the impact was “more symbolic than real, but it’s still a good sign”.

THE TRIBUNE Friday, November 18, 2022, PAGE 3

SIMON WILSON

ADVERTISE TODAY! CALL THE TRIBUNE TODAY @ 502-2394

Gov’t investment chief: ‘We must regain people’s trust’

“The other proposal we’re working on is a $410 three-phase project at the old Diamond Crystal prop erty.” Mrs Hanna-Woods said “a lot of activity” at that location, the site of the Salinas project, will take place in the coming years.

“As it relates to the Dia mond Crystal project, we’re in discussions with the investor for that project,” she added. “The investor has some wonderful plans for Long Island. We hope to announce what those plans are, what the timelines are and how that translates into economic benefits.”

The Salinas project’s Facebook page names the former Diamond Crystal salt property owner as Peter Young, while the “project lead” is Nina Pesavento.

Postings now almost three years-old, dating from just before the COVID-19 pan demic struck in early 2019, described Diamond Crystal Properties as being part of an entity called The Ham ilton Group, with plans to create an “eco-destination” at the site.

The Bahamas National Trust, in a June 23, 2022, statement responding to Chester Cooper, deputy prime minister, said it supported the Salinas pro ject’s plans to develop a nature reserve. “For the past several years we have been engaged with the landowner and his repre sentatives for the Salinas project, which covers the area formerly known as the Diamond Crystal salt works,” the BNT said.

“The 10,000-acre prop erty includes wetlands,

NOTICE

NOTICE is hereby given that GINO JOSEPH of P. O. Box N-8181, Meeting Street, New Providence, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/ naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/ naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 18th day of November, 2022 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

coppice and sandy shore habitats, and is home to a variety of wildlife, includ ing flamingos, ospreys and numerous species of scalefish. The landowner recognised the value of the site both culturally and ecologically, and deter mined more than 8,000 acres would be set aside as a nature reserve.

“The BNT’s involvement with this project is primar ily for the reserve. We are pleased that this project appears to be low-impact and will build on a relatively small percentage of the pro posed property. While we will await the submission of the Environmental Impact Assessment (EIA) for this development before offer ing our official review, we feel that in principle the developer appears commit ted to staying within a scale

that is compatible with the ecology and culture of Long Island.”

Mrs Hanna-Woods, meanwhile, acknowledged that the Government has to rebuild Bahamian con fidence given the multiple failed and stalled foreign direct investment (FDI) projects scattered across this nation, as well as numerous investors not delivering on their obliga tions and promises to local communities.

“When we sat at the Heads of Agreement for Calypso Cove, I believe last month, I remember a number of residents from Long Island being pre sent,” she disclosed. “At that signing, one thing that resonated with me was a gentleman who was excited about the development coming to Long Island, but

NOTICE

NOTICE is hereby given that INGRID ETIENNE of College Gardens, New Providence, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 18th day of November, 2022 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

NOTICE

NOTICE is hereby given that HERNCY SANEUS of P. O. Box N-356, Shrimp Road off Carmichael Road, New Providence, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/ naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 18th day of November, 2022 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

NOTICE is hereby given that GEDELIN ZAPORTE of #45 Podoleo Street, New Providence, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/ naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/ naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 18th day of November, 2022 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

he would like to see boots on the ground. Seeing is believing for him.

“That said to me, as director of investments, that I have a lot of work to do across our archipelago in regaining the trust of the Bahamian people. When I say regaining the trust of the Bahamian people, as a resident of Grand Bahama I see a lot of synergies between the islands, and there’s a perception that when it comes to promo tional strategy everything is Nassau-centric.

“For me, on a per sonal level, I have to do more work to show the Bahamas Investment Authority (BIA) is not a Nassau-centric agency but encompassing all islands and making opportunities available to all islands,” Mrs Hanna-Woods contin ued. “Another thing that resonated with me, it made me think about what mean ingful investment means to our country....

“Gone are the days when we could sell foreign direct investment projects to our people based on jobs. It has to be more than that. It’s a plea to you. Tell me, as Long Islanders, how do we make sure we attract mean ingful investment beyond jobs, creating entrepre neurial opportunities and expanding beyond existing business opportunities.”

Hinting that Nassau has in the past been too

eager to impose its own development vision on the Family Islands, rather than responding to the desires and needs of local commu nities, Mrs Hanna-Woods said: “This administration has made the decision it will take the approach of specific promotion strate gies that are geared towards showcasing the needs and culture of each island.

“What we plan for 2023 is bringing a number of investors to our shores, and have Long Island and all the Family Islands partici pate in that project which we anticipate will take a number of months to plan.... In my role, the biggest thing is making sure I’m account able to the people, and that I deliver meaningful invest ment to all islands of our country with individual pro motional strategies geared to the culture of each island and shape inward flows of investment so they are shared equally across the islands.”

The Government’s investments chief said the promotional strategy will not be so tourism and resort-focused, and urged Long Island residents to think of which industries can be revived or devel oped on the island. “Really and truly, I think this will be the first time that the BIA has really gone island by island,” Mrs Hanna-Woods said.

0.6460.32814.63.49%

NOTICE

PAGE 4, Friday, November 18, 2022 THE TRIBUNE

FROM PAGE B1 CALL 502-2394 TO ADVERTISE TODAY!

NOTICE is hereby given that DAMETRAID ROLLE of McKinney Drive off Fire Trail Road, New Providence, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 18th day of November, 2022 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

NOTICE

NOTICE is hereby given that JEAN GUILLAUME JEAN-PIERRE of #3 East Beach Drive, Freeport, Grand Bahama, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/ naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 18th day of November, 2022 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

NOTICE

NOTICE

is hereby given that ODILES POLINICE of Carmichael Road, New Providence, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 18th day of November, 2022 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

NOTICE THURSDAY, 17 NOVEMBER 2022 CLOSECHANGE%CHANGEYTDYTD% BISX ALL SHARE INDEX: 2623.82-0.090.00395.5817.75 BISX LISTED & TRADED SECURITIES 52WK HI52WK LOWSECURITY SYMBOLLAST CLOSECLOSECHANGE VOLUMEEPS$DIV$P/E YIELD 7.005.30 AML Foods Limited AML 6.95 6.950.00

53.0040.00 APD Limited APD 39.95 39.950.00

2.761.60Benchmark BBL 2.76

2.462.26Bahamas First Holdings Limited BFH 2.46

2.852.25Bank of Bahamas BOB 2.57

6.205.75Bahamas Property Fund BPF 6.20

Waste BWL

Bahamas CAB

10.657.50Commonwealth Brewery CBB

Bank CBL

Holdings CHL

17.5010.25CIBC FirstCaribbean Bank CIB 16.00

3.251.99Consolidated Water BDRs CWCB 3.19

11.2810.06Doctor's Hospital DHS 10.50

11.679.16Emera Incorporated EMAB 9.47 9.40 (0.07)

11.5010.00Famguard FAM 10.85

18.3014.05Fidelity Bank (Bahamas) Limited FBB 18.10

4.003.50Focol FCL 3.98 3.980.00

11.509.85Finco FIN 11.38 11.380.00

16.2515.50J. S. Johnson JSJ 15.55 15.550.00

PREFERENCE SHARES 1.001.00Bahamas First Holdings PreferenceBFHP 1.00 1.000.00

1000.001000.00 Cable Bahamas Series 6 CAB6 1000.001000.000.00 0.0000.0000.0000.00% 1000.001000.00 Cable Bahamas Series 9 CAB9 1000.001000.000.00 0.0000.0000.0000.00% 1.001.00Colina Holdings Class A CHLA 1.00 1.000.00 0.0000.0000.0006.25% 10.0010.00Fidelity Bank Bahamas Class A FBBA 10.0010.000.00 0.0000.0000.0007.00% 1.001.00Focol Class B FCLB 1.00 1.000.00 0.0000.0000.0006.50% CORPORATE DEBT - (percentage pricing) 52WK HI52WK LOWSECURITY SYMBOLLAST SALECLOSECHANGEVOLUME 100.00100.00Fidelity Bank (Note 22 Series B+)FBB22 100.00100.000.00 100.00100.00Bahamas First Holdings LimitedBFHB 100.00100.000.00 BAHAMAS GOVERNMENT STOCK - (percentage pricing) 115.92104.79Bahamas Note 6.95 (2029) BAH29 107.31107.310.00 100.00100.00BGS: 2014-12-7Y BG0107 100.00100.000.00 100.00100.00BGS: 2015-1-7Y BG0207 100.00100.000.00 100.00100.00BGS: 2014-12-30Y BG0130 100.00100.000.00 100.00100.00BGS: 2015-1-30Y BG0230 100.00100.000.00 100.00100.00BGS: 2015-6-7Y BG0307 100.00100.000.00 100.00100.00BGS: 2015-6-30Y BG0330 100.00100.000.00 100.00100.00BGS: 2015-10-7Y BG0407 100.00100.000.00 103.65103.65BGRS FX BGR105025 BSBGR1050255102.28102.280.00 92.5391.69BGRS FX BGR124238 BSBGR124238191.6991.690.00 100.71100.44BGRS FL BGRS77026 BSBGRS770264100.71100.710.00 100.66100.43BGRS FL BGRS80027 BSBGRS800277100.82100.820.00 100.57100.11BGRS FL BGRS95032 BSBGRS950320100.45100.450.00 100.5299.96BGRS FL BGRS97033 BSBGRS970336100.19100.190.00 100.0089.62BGRS FX BGR129249 BSBGR129249389.6289.620.00 100.0089.00BGRS FX BGR131249 BSBGR1312499100.00100.000.00 100.9890.24BGRS FX BGR132249 BSBGR1322498100.00100.000.00 100.0090.73BGRS FX BGR136150 BSBGR1361504100.00100.000.00 MUTUAL FUNDS 52WK HI52WK LOW NAV YTD%12 MTH% 2.552.11 2.552.24%4.01% 4.833.30 4.833.42%7.26% 2.241.68 2.241.70%2.82% 207.86164.74 197.44-2.97%-2.35% 212.41116.70 202.39-4.72%6.04% 1.751.70 1.751.96%2.84% 1.911.76 1.914.83%7.23% 1.871.77 1.873.48%4.44% 1.050.96

9.376.41

11.837.62

7.545.66

16.648.65

12.8410.54

10.779.57

10.009.88

MARKET TERMS BISX ALL SHARE INDEX - 19 Dec 02 = 1,000.00 YIELD - last 12 month dividends divided by closing price - Highest closing price in last 52 weeks Bid $ - Buying price of Colina and Fidelity 52wk-Low - Lowest closing price in last 52 weeks Ask $ - Selling price of Colina and fidelity Previous Close - Previous day's weighted price for daily volume Last Price - Last traded over-the-counter price Today's Close - Current day's weighted price for daily volume Weekly Vol. - Trading volume of the prior week Change - Change in closing price from day to day EPS $ - A company's reported earnings per share for the last 12 mths Daily Vol. - Number of total shares traded today NAV - Net Asset Value DIV $ - Dividends per share paid in the last 12 months N/M - Not Meaningful P/E - Closing price divided by the last 12 month earnings TO TRADE CALL: CFAL 242-502-7010 | ROYALFIDELITY 242-356-7764 | CORALISLE 242-502-7525 | LENO 242-396-3225 | BENCHMARK 242-326-7333 5.06% 4.56% 4.31% 5.55% 13-Jul-2038 4-May-2026 17-Apr-2033 15-Apr-2049 4.56% 4.31% 9-May-2027 25-Sep-2032 6.25% 30-Sep-2025 31-Mar-2022 FUND CFAL Bond Fund CFAL Balanced Fund CFAL Money Market Fund CFAL Global Bond Fund 6.25% 4.50% 6.25% 4.25% NAV Date 5.65% 5.69% 4.40% 15-Dec-2021 30-Jul-2022 15-Dec-2044 30-Jul-2045 26-Jun-2022 26-Jun-2045 15-Oct-2022 29-Jul-2022 21-Apr-2050 25-Jul-2025 15-Oct-2049 31-Mar-2021 31-Jan-2022 31-Jan-2022 31-Aug-2022 31-Jan-2022 31-Jan-2022 31-Jan-2022 31-Jan-2022 31-Aug-2022 31-Aug-2022 INTEREST Prime + 1.75% MARKET REPORT 31-Mar-2021 31-Mar-2021 MATURITY 19-Oct-2022 20-Nov-2029 31-Jul-2022 31-Jul-2022 6.95% 4.50% 31-Mar-2022 31-Aug-2022 4.50% 6.25% 5.60% 15-Jul-2049 Colonial Bahamas Fund Class D Colonial Bahamas Fund Class E Colonial Bahamas Fund Class F CFAL Global Equity Fund Leno Financial Conservative Fund Leno Financial Aggressive Fund Leno Financial Balanced Fund Leno Financial Global Bond Fund RF Bahamas Opportunities Fund - Secured Balanced Fund RF Bahamas Opportunities Fund - Targeted Equity Fund RF Bahamas Opportunities Fund - Prime Income Fund RF Bahamas International Investment Fund Limited - Equities Sub Fund RF Bahamas International Investment Fund Limited - High Yield Income Fund RF Bahamas International Investment Fund Limited - Alternative Strategies Fund

NOTICE is hereby given that GEORGE THYKKUTTATHIL ISAC of #20 Seafan Drive, Sea Breeze Estates P.O Box N-193, Nassau, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/ naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 11th day of November, 2022 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

0.2390.17029.12.45%

0.9321.26042.93.15%

2.760.00 0.0000.020N/M0.72%

2.460.00 0.1400.08017.63.25%

2.570.00 3600.0700.000N/M0.00%

6.200.00 1.7600.000N/M0.00% 10.058.78Bahamas

8.78 8.780.00 0.3690.26023.82.96% 4.342.82Cable

3.95 3.950.00 250-0.4380.000-9.0 0.00%

10.25 10.250.00 0.1400.00073.20.00% 3.652.27Commonwealth

3.49 3.490.00 0.1840.12019.03.44% 8.527.00Colina

8.52 8.520.00 0.4490.22019.02.58%

16.000.00 0.7220.72022.24.50%

3.16 (0.03) 0.1020.43431.013.73%

10.500.00 0.4670.06022.50.57%

10.850.00 0.7280.24014.92.21%

18.100.00 0.8160.54022.22.98%

0.2030.12019.63.02%

3000.9390.20012.11.76%

0.6310.61024.63.92%

0.0000.0000.0000.00%

0.96-6.57%-8.29%

9.37-0.02%10.36%

11.79-0.33%18.23%

7.540.22%3.05%

15.94-3.89%14.76%

12.47-1.04%-2.57%

10.740.81%4.20%

N/AN/AN/A 10.438.45 10.433.00%25.60% 14.8911.20 14.897.90%48.70%

(242)323-2330 (242) 323-2320 www.bisxbahamas.com

NOTICE

Bahamas debunks claims Gov’t gave ‘unauthorised’ FTX access

exercise its powers under the Digital Assets and Reg istered Exchanges (DARE) Act, and seek an emergency Supreme Court Order on Saturday past, for fear that the ongoing hack could result in valuable digital assets being stolen and/or lost. This, in turn, threatened to deprive clients and credi tors - the latter of whom includes FTX’s Bahamian vendors and employees - of a valuable recovery source.

The Supreme Court, which gave the regulator legal authority to do what it did, “ordered that the Securities Commission, as a regulator, do take the action of directing FTX Digital Markets Ltd, whether by its provisional liquidator or otherwise, to transfer forth with to an account holder and/or digital wallets estab lished and maintained by the Securities Commission all of the digital assets on the FTX.com platform within the possession, custody and/ or under the control of FTX Digital Markets Ltd, its offic ers, directors, employees and/or agents, including any digital assets held upon trust by FTX Digital Markets, on the grounds that such action is necessary to protect the interests of clients and credi tors of FTX Digital Markets and otherwise in the public interest to do so”.

One contact said FTX Digital Markets, as a Baha mas-domiciled entity, is not subject to the Chapter 11 proceedings in the Delaware court. However, they added that the Securities Com mission - and the Supreme Court Order it obtainedtook into account that the FTX companies subject to bankruptcy protection may claim an interest in some of the assets held by the Baha mian subsidiary.

This was taken care of by the reference to “digital assets held on trust”. The source added: “There was no attempt in any way to deprive the US court of its control.” They explained that the Securities Com mission rather than Brian Simms KC, the alreadyappointed joint provisional

liquidator, made the appli cation to the Supreme Court because the latter had to determine if he was impacted by the Chapter 11 ‘freeze’ given the worldwide reach of US law.

Tribune Business was told the Securities Commission felt time was of the essence, and that it had to move urgently, because the hack ing attempt threatened to cost it and the provisional liquidators control of FTX Digital Markets’ assets. “It was really a race against time for the Securities Com mission to move those assets out of the control of FTX Digital Markets and into a safer space,” one source said. “The assets are now secure.

“Under the DARE Act there is authority for the Securities Commission to make an application to the court to take steps to protect the interests of clients and customers of a registrant.

FTX Digital Markets was definitely a registrant... The Securities Commission took the view that they had the regulatory power under the Bahamian legislation to act. On that basis it did so.

“It couldn’t wait. The Securities Commission took the view that if it did nothing the reputation of the indus try, the investors and those assets went some place else. That would be a very bad story for The Bahamas and regulation of this new indus try. It decided to act. This is high stakes.”

These events were sub sequently confirmed by the Bahamian regulator in a less detailed statement, which said: “On November 12, 2022, the Securities Com mission, in the exercise of its powers as regulator acting under the authority of an order made by the Supreme Court of The Bahamas, took the action of directing the transfer of all digital assets of FTX Digital Markets to a digital wallet controlled by the Commission for safekeeping.

“Urgent interim regula tory action was necessary to protect the interests of clients and creditors of FTX Digital Markets. Under the

Digital Assets and Regis tered Exchanges (DARE) Act 2020, the Commission has the authority to apply for a judicial order to pro tect the interests of clients or customers of a registrant of the Commission under the DARE Act.”

This explanation, though, cut no ice with Mr Ray and his legal team. In documents filed with the Delaware bankruptcy court yesterday, they alleged that Mr Bank man-Fried was seeking to move assets belonging to FTX entities covered by the Chapter 11 proceed ings to accounts “under the control of the Bahamian government”.

“Mr Bankman-Fried, the co-founder and controlling owner of all of the debtors and of FTX Digital Markets, appears to be supporting efforts by the [Bahamian] joint provisional liquidators to expand the scope of the FTX Digital Markets pro ceedings in The Bahamas to undermine these Chapter 11 cases, and to move assets from the debtors to accounts in The Bahamas under the control of the Bahamian government,” Mr Ray and his attorneys charged.

“In verified messages posted through Twitter, Mr Bankman-Fried just yes terday expressed profane disdain for regulators, his regrets at these Chapter 11 cases having been filed, and disclosed his goal that ‘we win a jurisdictional battle versus Delaware’ to have any proceedings occur in The Bahamas.

“In addition, in connec tion with investigating a hack on Sunday, Novem ber 13, Mr Bankman-Fried and Mr Wang [FTX’s cofounder] stated in recorded and verified texts that ‘Baha mas regulators’ instructed that certain post-petition

transfers of debtor assets be made by Mr Wang and Mr Bankman-Fried (who the debtors understand were both effectively in the custody of Bahamas authorities) and that such assets were ‘custodied on FireBlocks under control of Bahamian gov’t’.

“The debtors thus have credible evidence that the Bahamian government is responsible for directing unauthorised access to the debtors’ systems for the purpose of obtaining digital assets of the debtors - that took place after the com mencement of these cases. The appointment of the joint provisional liquidators, and recognition of the Chapter 15 case, are thus in serious question.”

The Securities Com mission’s explanation, and November 12 court Order, call this “credible evidence” into question. And the fil ings by Mr Ray and his legal team expose what is likely to be the real agenda - to per suade the Delaware court that they should take the global lead on FTX’s insol vency, not the Bahamian provisional liquidators, and that the proper forum for resolving all issues should be the US state rather than The Bahamas.

The new FTX chief execu tive has filed legal papers requesting that the Chapter 15 action filed in the south ern district of New York bankruptcy court by Mr Simms and his fellow Baha mian provisional liquidators, PricewaterhouseCoopers (PwC) accountants Kevin Cambridge and Peter Greaves, be transferred to Delaware.

The FTX Digital Mar kets liquidators are seeking recognition as “the main foreign proceeding” from the US courts. This will

enable them to secure bank accounts and other assets; trace money flows; issue any subpoenas that are neces sary; and obtain all relevant documents that will aid with the Bahamian subsidiary’s likely full liquidation and winding-up.

The Bahamas, via the provisional liquidators and Supreme Court, will thus seek to exercise its author ity and lead the insolvency proceedings given that FTX’s controlling mind and management was exercised from this jurisdiction. This potentially sets the stage for a battle for control with the Delaware court’s Chapter 11 process that yesterday esca lated further.

By trashing The Bahamas’ reputation, Mr Ray and his team are likely seeking to influence and persuade the Delaware court to rule in their favour. “This is a tussle for control, that’s all it is,” one source said.

Mr Ray asserted it was “distressing” that the Baha mian provisional liquidators had chosen to file for Chap ter 15 as the two sides, via a November 15 Zoom call, had discussed “potential avenues of co-operation”. He added that no mention was made of the Chapter 15 plan, so the best forumNew York or Delaware - was never discussed.

“There is no doubt that there will need to be close co-ordination between the Chapter 11 cases and The Bahamas proceeding relating to FTX Digital Mar kets,” Mr Ray and his team asserted. “Whether that pro ceeding justifies the granting of relief under Chapter 15 must first be determined.

“Basic principles of effi cient judicial administration and effective co-ordination argue strongly in favour of all US proceedings relating to the FTX group occur ring in a single US court - this Court. Having two bankruptcy courts consider related issues simply makes no sense. It would result in potentially inconsist ent opinions, duplication of efforts and unnecessary expense.

“The filing of the Chap ter 15 case without advance notice and in the New York court is a blatant attempt to avoid the supervision of this court and to keep FTX Digital Markets isolated from the administration of the rest of the debtors, which constitute the vast major ity of the remainder of the FTX group. Under normal circumstances, that would be inappropriate and grounds for transfer to this court. But these are not normal circumstances.”

THE TRIBUNE Friday, November 18, 2022, PAGE 5

FROM PAGE B1 CWR Form No 22 Advertisement (Application for Supervision Order) (O 15, r 5) THE COMPANIES LAW ROCINANTE FUND (In voluntary liquidation) Grand Court Cause No FSD

of 2022

that: 1 The

was

2 A

3

4

JOB OPPORTUNITY HANDYMAN Must be over 30 years of age. Five years experience. Tel - 324-1511

243

TAKE NOTICE

above named Company

put into voluntary liquidation on 27 September 2022

petition has been presented to the Grand Court of the Cayman Islands by the Voluntary Liquidator for an order that the liquidation continue under the supervision of the Court

The hearing of the petition will take place at the Law Courts, George Town, Grand Cayman on 19 January 2023 at 10 00 am

Any member or creditor of the Company is entitled to appear at the hearing of the petition for the purpose of being heard upon the question of who should be appointed as official liquidator of the Company Any member or creditor wis hing to be heard must serve a notice of appearance upon the Voluntary Liquidator not less than three (3) days prior to the hearing date Dated this 2 day of November 2022 James Parkinson Joint Voluntary Liquidator

head of port and desti nation development for Carnival Cruise Lines, and also an ex-chief executive of Holistica, the joint venture

between Royal Caribbean and ITM Group, selected a location in close proximity to the settlements of Gor don’s and Mortimer’s.

A provider of security services to the global cruise industry for 22 years, Mr Assal said the duo first acquired some land on north Elizabeth Island in

the Exumas but quickly realised “it wasn’t big enough for what we wanted to do”. Eager to capital ise on the cruise industry’s forecast growth, with 75 new vessels projected to launch from shipyards over the next ten years, and to provide alternative desti nation to Nassau and other established ports, they resumed their search.

“We said: ‘Let’s look at at an independent cruise port and develop one of the Family Islands,” he added. “We were guided by our attorney, Thomas Dean; he’s of Long Island. We said: ‘Let’s come down’. On January 26 we flew down to Long Island, close to Gordon’s settlement, and walked the beach. It was calm. The beach was serene. There was no com parison to other beaches, with all due respect to people from Nassau.

“It was a peaceful, quiet beach. We walked all the way to the point. We had an architect with us. They did some drawings on a napkin. We looked at it again, and realised this could work provided it passed the environmen tal” approvals. Bahamian environmental engineer, Keith Bishop, of Islands by Design, has been hired to complete an Environmental Impact Assessment (EIA) study, while Bahamian engineer and Long Island native, Lambert Knowles, has also been engaged.

“The goal is to accom modate two Oasis-size vessels,” Mr Assal said. “We know we’ll get 70 percent of guests coming off [the ship], 30 percent won’t.” Of 5,000 total passengers, that means an average 3,500 cruise visitors will disembark when they arrive. Calypso Cove will be built-out in multiple phases, with the

Share your news

principals ultimately look ing to attract partners to develop facilities such as a resort and health and well ness amenities.

“What we’re expecting is that we can accommodate up to 12,000 people at this location,” Mr Assal added.

“Once it’s fully operational and up and running, we anticipate up to 200-250 full-time employees. To start with we thought we would only get ships from Miami, Port Everglades, Port Canaveral, Baltimore and New York. People said: ‘No. You’ll get cruise lines from Galveston, Tampa and New Orleans. It fits with a lot of their itineraries.

“We’re working with the locals, understanding what they are looking for and what they would like to see from this project. This is not a cruise line project; this is a Long Island project more with a development team looking to help the island and for a development plan.

At the beginning we antici pate most guests will come from the cruise ships.

“Our role is not to make it like some other desti nation. We’re going to give locals an opportunity to be entrepreneurs and come on-site and do their own crafts and businesses.

Unlike the private islands, where they do their own excursions, no, we’re going to partner with a Bahamian company and get it going.

Some 1,066 acres of the 1,566 acre project consists of private land that the Calypso Cove develop ers will close on once all necessary approvals and financing are in place. And, while the developers have requested a Crown Land grant for 500 acres critical to Calypso Cove’s buildout, along with a 50-acre seabed lease, the spokes person revealed the former deal will not be activated until “specific performance thresholds” have been met

by investing $100m in the project.

Mr Assal yesterday said the developers are acquir ing another 216-acre site north of the project for employee housing, and are also exploring the pos sibilities for introducing renewable energy at the site as well as environmentallyfriendly ways to generate and recycle water and wastewater.

He added that the devel opers are financing the EIA work and other stud ies themselves, and hinted that discussions between the cruise lines and project principals have focused on how the former can help finance Calypso Cove’s development.

“Our goal is not to sup press the locals; it’s to help the locals,” Mr Assal added.

“The locals tell me they’ve seen a lot of things from a lot of people, but they’ve never seen someone get this far. Our goal is to work with the locals, local Long Islanders, and support them in every which way.”

Tribune Business previ ously reported that besides committing to a workforce that is at least 80 percent Bahamian, the project’s principals have also agreed to put Long Island residents first when it comes to jobs and hiring. Using a sliding preference scale, existing residents will be called first, with Long Island descend ants getting the second go before the project casts its net wider to all Bahamians. The Bahamas Investment Authority (BIA), in con firming that the National Economic Council (NEC) had given its blessing to the project via a July 7, 2022, letter to the developers, affirmed that work per mits would be granted to key management person nel and specialised workers provided they adhered to “the Government’s 80:20 ratio (Bahamian to foreign) labour policy”.

Notice is hereby given in accordance with Section 138 (4) of the International Business Companies Act, 2000, the Dissolution of FEAJCM LTD. commenced on November 16, 2022. The Liquidator is Felipe De Araujo Costa Ubach Monteiro, whose address is R Dr Luis A Q Aranha 00173 Apt 111VL Madalena, Sao Paulo SP, Brazil.

Felipe

Notice is hereby given in accordance with Section 138 (4) of the International Business Companies Act, 2000, the Dissolution of MARAJO LTD. commenced on November 16, 2022. The Liquidator is Frederico Jose Correa Lobato, whose address is ua dos Caripunas 1399 ap 201, CEP 66033-230, Belem, PA - Brazil.

Frederico

PAGE 6, Friday, November 18, 2022 THE TRIBUNE

$250m cruise port: ‘We’ll

flourish’ FROM PAGE B1

help Long Island

AERIAL FORDS CHANNEL

The Tribune wants to hear from people who are making news in their neighbourhoods. Perhaps you are raising funds for a good cause, campaigning for improvements in the area or have won an award. If so, call us on 3221986 and share your story.

Jose Correa Lobato LIQUIDATOR NOTICE INTERNATIONAL BUSINESS COMPANIES ACT, 2000 MARAJO LTD. Registration number 202121 B

De Araujo Costa Ubach Monteiro LIQUIDATOR NOTICE INTERNATIONAL BUSINESS COMPANIES ACT, 2000 FEAJCM LTD. Registration number 205441 B

Markets, the exchange’s Bahamian subsidiary, warned in separate legal documents that its assets were “at serious risk” of being list, stolen or seized unless frozen by the US courts.

He and fellow pro visional liquidators, PricewaterhouseCoopers (PwC) accounting duo, Kevin Cambridge and Peter Greaves, urged the US federal bankruptcy court in southern New York to grant them “emergency” recognition. And Mr Simms also delivered bad, but not surprising, news for FTX Digital Markets’ creditors - including its Bahamian staff and goods and services suppliers - by warning they are unlikely to recover 100 percent of what is owed to them.

With the competition for control of FTX’s assets, and its winding-up, between Mr Ray and the Bahamian pro visional liquidation heating up, the former revealed that the Bahamian subsidiary’s balance sheet contained some $149.336m in assets as at end-September 2022.

While warning that FTX’s financial accounts and fig ures cannot be relied upon, Mr Ray disclosed that 55 percent or $82.564m of the

assets shown on FTX Digi tal Markets’ balance sheet relate to “cash and cash equivalents”. A further $45.944m, or 30.7 percent, was said to be owed to the Bahamian subsidiary by other entities in the FTX empire, and was listed as “related party receivables”.

However, Mr Ray’s fil ings in the Delaware courts alleged that FTX Digital Markets owed a net $30m debt to its group affili ates. “Non-debtor FTX Digital Markets has a net inter-company accounts payable of $30m due to entities controlled by debtor, FTX Trading Ltd,” he asserted.

Providing a bleak assess ment of what caused FTX’s implosion, which took its co-founder, Sam BankmanFried, from crypto genius and hero to zero in the space of a week, Mr Ray blasted: “Never in my career have I seen such a complete failure of corporate controls, and such a complete absence of trustworthy financial infor mation as occurred here.

“From compromised sys tems integrity and faulty regulatory oversight abroad, to the concentration of con trol in the hands of a very small group of inexperi enced, unsophisticated and potentially compromised

individuals, this situation is unprecedented.”

“Many of the companies in the FTX Group, espe cially those organised in Antigua and The Bahamas, did not have appropriate corporate governance. I understand that many enti ties, for example, never had board meetings.”

Focusing on FTX’s near-complete absence of payment and cash controls, Mr Ray added: “The debt ors did not have the type of disbursement controls that I believe are appropriate for a business enterprise. For example, employees of the FTX group submitted payment requests through an on-line ‘chat’ platform where a disparate group of supervisors approved dis bursements by responding with personalized emojis.

“In The Bahamas, I understand that corporate funds of the FTX group were used to purchase homes and other personal items for employees and advisors. I understand that there does not appear to be documentation for cer tain of these transactions as loans, and that certain real estate was recorded in the personal name of these employees and advi sors on the records of The Bahamas.”

Mr Simms, meanwhile, said it was vital that the US courts approve the FTX Digital Markets’ provi sional liquidators’ bid for an urgent asset freeze and recognition if they were to accurately determine the company’s true position and trace, secure and recover monies for clients and creditors.

“We are in the early stages of what will likely be a lengthy wind down or restructuring process for FTX Digital,” the Lennox Paton partner revealed. “As discussed, at this juncture, the full scope and location of FTX Digital’s assets, claims and liabilities are unknown. Accordingly, it is critical that the court enter an order preventing credi tors from executing on FTX Digital’s assets for at least two reasons.

“First, as discussed, at this time the full extent of FTX Digital’s assets is unknown, and therefore it is possible that unscrupulous creditors may attempt to take advan tage of this by executing on FTX Digital’s assets before they become known to the joint provisional liquidators.

“Second, it is believed that FTX Digital is cash flow insolvent, and credi tors may therefore receive something less than a 100 percent recovery on

their claims against FTX Digital. Accordingly, an order preventing creditors from executing on assets now in an attempt to real ise more than they would receive in the Bahamian liti gation is paramount.

“It is my belief and opin ion that an order of the court preventing execution against the debtor’s assets will ameliorate the threat of dissipation of the debtor’s assets before they can be properly administered by the joint provisional liqui dators. It is my belief that the longer the holders of the debtor’s assets have the ability to transfer or dis pose of them, the less likely it is the joint provisional liquidators will be able to recover said assets for dis tribution or restructuring in The Bahamas.”

Giving as equally a bleak picture as his Delaware counterpart, Mr Simms added: “At the most basic level, the joint provisional liquidators are presently unable to ascertain FTX Digital’s financial position, and its assets and liabilities more generally, nor do the joint provisional liquida tors have the totality of the information necessary to protect FTX Digital’s assets.

“The authority to seek discovery requested in the motion is critical to my

ability to discover the full extent of FTX Digital’s assets and financial situation so that I can work towards a full, efficient and equitable distribution of FTX Digi tal’s assets to creditors in the Bahamian liquidation.”

Asserting that the Bahamian provisional liquidators will need to determine whether FTX Digital Markets has claims against other group entities over “insider transactions”, Mr Simms added: “US records of FTX Digital and the FTX brand are likely to be of critical importance to the Bahamian liquidation for multiple reasons.

“For example, these documents could provide a clear picture of the reasons for the insolvency of FTX Digital, and allow the joint provisional liquidators to make an informed judgment as to the potential third party claims available to FTX Digital, and to deter mine if FTX Digital holds additional, undisclosed assets.

“The books and records will provide valuable insight into the financial machina tions that led to the alleged dissipation of FTX Digi tal assets at the expense of creditors. The discovery of these agreements and other financial documents will likely provide further insight into the financial engineering, which appears to have contributed to the insolvency of FTX Digital.”

Tuesday Wednesday Thursday

a.m.

9:00 a.m. 1.0 3:06 p.m. 2.5 9:31 p.m. 0.6 3:44 a.m. 2.6 9:56 a.m. 0.8 3:55 p.m. 2.6 10:15 p.m. 0.4

4:31 a.m. 2.8 10:49 a.m. 0.5 4:43 p.m. 2.6 10:57 p.m. 0.1 5:16 a.m. 3.0 11:38 a.m. 0.3 5:30 p.m. 2.6 11:40 p.m. ‑0.1

6:01 a.m. 3.3 12:27 p.m. 0.0 6:16 p.m. 2.7 ‑‑‑‑‑ ‑‑‑‑‑

6:47 a.m. 3.5 12:23 a.m. 0.3 7:03 p.m. 2.7 1:15 p.m. ‑0.1 7:34 a.m. 3.6 1:09 a.m. ‑0.5 7:51 p.m. 2.7 2:04 p.m. ‑0.2

THE TRIBUNE Friday, November 18, 2022, PAGE 7

FTX’S BAHAMAS CREDITORS UNLIKELY TO SEE FULL RECOVERY FROM PAGE B1 Shown is today’s weather. Temperatures are today’s highs and tonight’s lows. ORLANDO Low: 52° F/11° C High: 69° F/21° C TAMPA Low: 53° F/12° C High: 68° F/20° C WEST PALM BEACH Low: 69° F/21° C High: 79° F/26° C FT. LAUDERDALE Low: 70° F/21° C High: 78° F/26° C KEY WEST Low: 74° F/23° C High: 80° F/27° C Low: 75° F/24° C High: 83° F/28° C ABACO Low: 71° F/22° C High: 78° F/26° C ELEUTHERA Low: 74° F/23° C High: 82° F/28° C RAGGED ISLAND Low: 78° F/26° C High: 85° F/29° C GREAT EXUMA Low: 76° F/24° C High: 84° F/29° C CAT ISLAND Low: 74° F/23° C High: 81° F/27° C SAN SALVADOR Low: 74° F/23° C High: 83° F/28° C CROOKED ISLAND / ACKLINS Low: 77° F/25° C High: 85° F/29° C LONG ISLAND Low: 76° F/24° C High: 85° F/29° C MAYAGUANA Low: 77° F/25° C High: 85° F/29° C GREAT INAGUA Low: 77° F/25° C High: 86° F/30° C ANDROS Low: 76° F/24° C High: 82° F/28° C Low: 67° F/19° C High: 79° F/26° C FREEPORT NASSAU Low: 70° F/21° C High: 81° F/27° C MIAMI THE WEATHER REPORT 5-Day Forecast A few a.m. showers, then a t‑storm High: 83° AccuWeather RealFeel 87° F The exclusive AccuWeather RealFeel Temperature is an index that combines the effects of temperature, wind, humidity, sunshine intensity, cloudiness, precipitation, pressure and elevation on the human body—everything that affects how warm or cold a person feels. Temperatures reflect the high and the low for the day. A couple of late night showers Low: 75° AccuWeather RealFeel 75° F Mostly cloudy, a shower and t‑storm High: 83° AccuWeather RealFeel Low: 75° 88°-79° F A t‑storm around in the afternoon High: 84° AccuWeather RealFeel Low: 74° 90°-74° F Cloudy and humid with showers High: 85° AccuWeather RealFeel Low: 75° 86°-78° F Mostly cloudy and warm with showers High: 86° AccuWeather RealFeel 92°-78° F Low: 75° TODAY TONIGHT SATURDAY SUNDAY MONDAY TUESDAY almanac High 82° F/28° C Low 73° F/23° C Normal high 81° F/27° C Normal low 70° F/21° C Last year’s high 82° F/28° C Last year’s low 71° F/22° C As of 1 p.m. yesterday 0.00” Year to date 53.65” Normal year to date 37.36” Statistics are for Nassau through 1 p.m. yesterday Temperature Precipitation sun anD moon tiDes For nassau New Nov. 23 First Nov. 30 Full Dec. 7 Last Dec. 16 Sunrise 6:29

Sunset 5:21 p.m. Moonrise 1:13 a.m. Moonset 2:07 p.m.

High Ht.(ft.) Low Ht.(ft.)

a.m.

Today Saturday Sunday Monday

2:53

2.3

marine Forecast WINDS WAVES VISIBILITY WATER TEMPS. ABACO Today: N at 10 20 Knots 3 6 Feet 10 Miles 81° F Saturday: NNE at 6 12 Knots 3 5 Feet 10 Miles 81° F ANDROS Today: NE at 12 25 Knots 1 2 Feet 10 Miles 81° F Saturday: ENE at 12 25 Knots 1 2 Feet 10 Miles 79° F CAT ISLAND Today: ENE at 7 14 Knots 2 4 Feet 5 Miles 83° F Saturday: E at 10 20 Knots 3 5 Feet 10 Miles 83° F CROOKED ISLAND Today: E at 10 20 Knots 2 4 Feet 7 Miles 84° F Saturday: E at 12 25 Knots 3 5 Feet 10 Miles 84° F ELEUTHERA Today: NE at 8 16 Knots 2 4 Feet 6 Miles 82° F Saturday: ENE at 8 16 Knots 3 6 Feet 5 Miles 82° F FREEPORT Today: NNE at 10 20 Knots 2 4 Feet 10 Miles 80° F Saturday: NNE at 8 16 Knots 1 3 Feet 10 Miles 78° F GREAT EXUMA Today: NE at 8 16 Knots 1 2 Feet 10 Miles 82° F Saturday: E at 10 20 Knots 1 2 Feet 6 Miles 82° F GREAT INAGUA Today: E at 10 20 Knots 2 4 Feet 7 Miles 84° F Saturday: E at 12 25 Knots 2 4 Feet 10 Miles 84° F LONG ISLAND Today: E at 8 16 Knots 2 4 Feet 10 Miles 81° F Saturday: E at 10 20 Knots 2 4 Feet 10 Miles 81° F MAYAGUANA Today: E at 8 16 Knots 3 6 Feet 7 Miles 83° F Saturday: E at 10 20 Knots 4 7 Feet 10 Miles 83° F NASSAU Today: NE at 10 20 Knots 1 3 Feet 10 Miles 82° F Saturday: ENE at 10 20 Knots 1 3 Feet 10 Miles 82° F RAGGED ISLAND Today: E at 10 20 Knots 2 4 Feet 10 Miles 83° F Saturday: E at 12 25 Knots 3 5 Feet 10 Miles 83° F SAN SALVADOR Today: NE at 8 16 Knots 1 2 Feet 10 Miles 83° F Saturday: E at 10 20 Knots 1 3 Feet 5 Miles 83° F uV inDex toDay The higher the AccuWeather UV Index number, the greater the need for eye and skin protection. Forecasts and graphics provided by AccuWeather, Inc. ©2022 tracking map Shown is today’s weather. Temperatures are today’s highs and tonight’s lows. N S W E 12 25 knots N S E W 10 20 knots N S W E 12 25 knots N S W E 8 16 knots N S W E 8 16 knots N S W E 10 20 knots N S W E 10 20 knots N S W E 12 25 knots | Go to AccuWeather.com

Macy’s, Kohl’s, Gap point to cloudy holiday retail picture

By ANNE D’INNOCENZIO AP Retail Writer

By ANNE D’INNOCENZIO AP Retail Writer

RESULTS from Macy’s, Kohl’s and Gap on Thurs day further underscored the cloudy picture for U.S. retailers heading into the start of the holiday season.

A day after Target reported a sharp drop in quarterly profits, it’s clear that inflation-hit shoppers in the last few weeks were waiting for deals and not willing to pay full price for purchases they could put off. The big question will be if U.S. consumers will spend more freely in the coming weeks.

“I think everybody believes that Christmas will come, but I don’t think any body out there knows for sure exactly what’s going to happen,” Kohl’s chairman Peter Boneparth said.

Macy’s on Thursday reported that its profit and sales slid in the third quar ter. Yet, the New York company topped Wall Street expectations and raised its earnings outlook,

in part due to better credit card revenue. Its stock rose more than 15% Thursday.

Shares of rival Kohl’s rose 5% even after it withdrew its annual earnings outlook amid volatile spending, an uncertain economic environment and a CEO transition. Like Macy’s, it reported a drop in sales and profit, but beat Wall Street expectations.

Shares of struggling Gap Inc. rose 14% in extended trading Thursday after it reported better-thanexpected sales results. The San Francisco-based chain, which operates stores under its namesake, Banana Republic, Old Navy and Athleta, swung to a profit from a loss a year ago, and sales rose 2%.

But it also delivered a tempered holiday outlook.

Target, Macy’s and Kohl’s all noted a slowdown in spending in the last few weeks as the kickoff to the holiday shopping season approaches, which could force retailers to cut prices even further.

One exception was Walmart, which has a more robust grocery aisle and is the nation’s largest retailer, reported betterthan-expected earnings and raised its earnings outlook.

“Visibility for the fourth quarter has been as dif ficult as any period I can remember,” Boneparth told

analysts on a call Thurs day. He noted the situation a year ago, when retailers were dealing with supplychain snarls.

“You had last year a situ ation where nobody had inventory,” he said. “All customers were inclined to buy early. Now, we flip

over, everybody has a lot of inventory.”

Macy’s posted net income of $108 million, or 39 cents per share for the threemonth period ended Oct. 29. That compares with $239 million, or 76 cents per share for the year-ago period. Adjusted results were 52 cents per share,

Long Island’s to airport is branded ‘a disgrace’

FROM PAGE B1

“Deadman’s Cay is a dis grace and leaves much to be desired,” Mr Knowles concluded, adding that the Calypso Cove investment might spur the Government to finally make progress on the airport and other much-needed infrastructure developments.

Plans to redevelop Deadman’s Cay via a pub lic-private partnership (PPP), employing private capital and a developer to transform the airport,

operate and manage it, were much discussed during the Minnis administration’s time in office but little tan gible on-ground progress was made.

Chester Cooper, deputy prime minister and minis ter for tourism, investments and aviation, said last month that the proposed airport expansion is a “key requirement” for invest ments on Long Island and suggested that works may be put out to tender via a Request for Proposal (RFP) later this year.

Phylicia Hanna-Woods, the Bahamas Investment Authority’s (BIA) direc tor, yesterday told the same conference that Dr Ken neth Romer, acting director of aviation, had told her he planned to “not only deliver an airport but a world-class airport for Deadman’s Cay.

Meanwhile, Mr Knowles added: “There still remain many challenges on Long Island, and with this devel opment [Calypso Cove] it is my hope we will see more improvements especially with our airport.” He also

voiced optimism that the $250m cruise port will help to reverse the depopulation and decline suffered by the island’s south ever since the Diamond Crystal salt works closed decades ago.

“Since the closure of Diamond Crystal several decades ago, that part of the island has been on a decline and has never recovered,” the chief coun cillor asserted. “We have seen the closure of five primary schools in three decades, dilapidated hous ing and the closure of many

businesses, all due to the collapse of that property.

“The population has dwindled. Many have lost hope. This, coupled with the worst hurricane of our lifetime, Hurricane Joaquin, caused a further setback for residents of that area and some are leaving the island.” However, the emergence of Calypso Cove has given Long Islanders renewed optimism, and Mr Knowles said “residents are elated to hear that finally something is happening in Long Island. We await the

far exceeding the per-share earnings of 18 cents that Wall Street had expected, according to a survey by FactSet.

Sales slipped 3.9% to $5.23 billion from $5.44 billion in the year-ago period, but that also beat expectations.

Comparable sales — those from established stores and from online — slipped 2.7% including licensed businesses com pared with the year ago quarter, but it was up 6% compared with the third quarter of 2019, before the pandemic.

Online sales fell 9% com pared with the third quarter of 2021, but they were up 35% compared with the third quarter of 2019.

ground breaking and com mencement of the project.”

The Long Island chief councillor added that the Water & Sewerage Cor poration’s extension of potable water supply to Lochabar had prompted Ellis Major to add six build ings, and 48 rooms, to his Harbour Breeze property. That expansion has taken it to around 100 rooms, making it one of the largest - if not the largest - sources of visitor accommodation on Long Island.

is for life. So is the need

nurturing. That’s why we created The Step - a dynamic community that fosters growth in a safe, secure and supportive environment. More than a home, this haven provides young Bahamians with the tools, resources and support they need to continue to thrive as they transition into independent living and learn to become productive members of society. With your help, we can put them on the right path for a successful and productive life.

PAGE 8, Friday, November 18, 2022 THE TRIBUNE

SHOPPERS walk to the Macy’s store in the Downtown Cross ing district, Wednesday, Nov. 17, 2021, in Boston. Macy’s reports quarterly financial results reports quarterly finan cial results Thursday, Nov. 17, 2022.

Photo:Charles Krupa/AP

We believe in building a better tomorrow by empowering today’s youth. Step up for those in need DONATE TODAY & HELP US BUILD Learning

love, support

Learn more. Support today. Scan for full details The Ranfurly Homes for Children | T: 242.393.3115 | E: mail@ranfurlyhome.org | www.ranfurlyhome.org The Step Pods, currently Phase 2 is under construction at The Ranfurly Homes for Children, Nassau, Bahamas You can help *The Ranfurly Homes for Children is 501(c)3 Approved

for

and

By ANNE D’INNOCENZIO AP Retail Writer

By ANNE D’INNOCENZIO AP Retail Writer