WEDNESDAY,

Attorney overturns $70,000 ‘jail avoidance’ repayment

By NEIL HARTNELL Tribune Business Editor

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

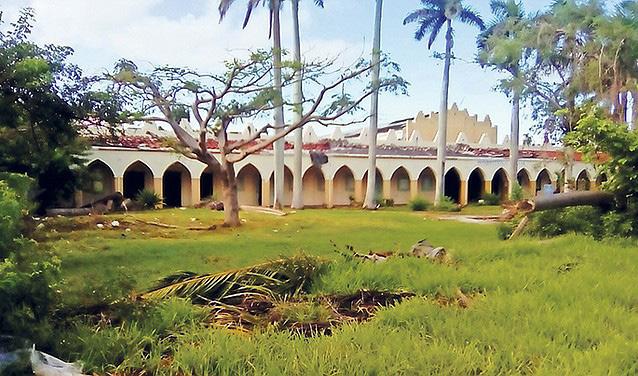

THE Supreme Court has paved the way for the Grand Bahama Port Authority (GBPA) to “repossess” the Royal Oasis casino and nearby parking lot over $1.2m in unpaid service charge debts.

Justice Petra HannaAdderley, in an August 22, 2025, verdict ruled that Freeport’s quasi-governmental authority and its Freeport Commercial and Industrial affiliate are “entitled to re-enter” and seize control of both sites unless the rundown resort’s owner, Harcourt Development, pays off the service charge arrears in full. And she affirmed that the Irish-headquartered property developer’s failure to pay, which dates back to 2008 - the year after it acquired the Royal Oasis property - means

both the GBPA and Freeport Commercial and Industrial are “entitled to a declaration” that all of Harcourt’s “rights, title and interest” in the two land parcels have been “extinguished” as if its purchase never happened.

Justice Hanna-Adderley’s ruling has emerged at a critical and sensitive time for many of the parties involved, as well as the Government’s ambitions for Freeport. With Harcourt thought to be seeking an exit route from its Grand Bahama investments, the judgment effectively means it will now need to pay an extra $1.2m to maintain ownership of the whole Royal Oasis property and clear the way for its sale.

One potential buyer appears to be the Government. The 2025-2026 Budget again sets aside $1m in the Ministry of Grand Bahama’s capital budget for the “acquisition of Royal

A BAHAMIAN attorney yesterday successfully overturned a verdict ordering she repay $70,000 provided by her late former parents’ in-law to prevent her being jailed for stealing client funds.

The Court of Appeal, in a unanimous September 9, 2025, decision agreed with the arguments advanced by Sonia Timothy-Serrette and her attorney, ex-MP Keod Smith, and set aside “In its entirety” the previous Supreme Court ruling that found the payment was a “soft loan” she was obligated to repay to her former in-laws within two years.

The events behind yesterday’s verdict, which saw the Court of Appeal blast the dispute’s handling by the Supreme Court and Justice Cheryl Grant-Thompson as “a colossal waste of judicial time” (see other article on Page 1B), dated from 2009 when Ms Timothy-Serrette was charged with stealing $96,968 from retired teacher Fiordelisa Bain, who attended the same church.

The Tribune’s records from the time record how Ms Timothy-Serrette was given one month by then-deputy chief magistrate Carolita Bethell to repay the monies to her client otherwise she would be sentenced to a two-year prison term. To raise the funds, which she did not have, she “coerced” her former in-laws to sell property they owned at Yamacraw to Sir Franklyn Wilson’s Arawak Homes.

By NEIL HARTNELL

MORE than 3,000 North Eleuthera “common land owners” are concerned the Government has “put the car before the horse” on the compulsory acquisition of 628 acres for expansion of the area’s airport.

Dorlan Curtis, executive secretary for the Harbour Island Commonage Committee, told Tribune Business the several thousand owners it represents

also want to ensure the timely payment of compensation for the loss of their land-holdings “doesn’t get pushed under the rug” as the Davis administration proceeds with North Eleuthera airport’s $55m development. He explained that, while the Committee and those it represents are not opposed to the airport’s expansion or the Government’s acquisition of their land for this purpose, they are instead concerned that construction work appears to have started and be progressing

‘Colossal waste of judicial resources’

without any official consultation or talks with themselves.

Noting the similarities between the present situation and tensions that surfaced when the North Eleuthera airport expansion plans surfaced under the former Minnis administration, Mr Curtis told this newspaper that prior talks with the Government about the commoners enjoying a share of the per passenger departure, landing and other fees “never came to fruition”.

Stating that it is now “fast forward” to 2025, he added: “As a

By NEIL HARTNELL

Business Editor

COURT of Appeal judges yesterday slammed the Supreme Court’s handling of a dispute related to an attorney accused of stealing client funds as “a colossal waste of judicial resources”.

Both justice Milton Evans, the Court of Appeal president, and fellow justice Stella Crane-Scott, asserted that based on the record of proceedings before them Justice Cheryl

commonage we don’t necessarily object to the airport. We do object to the way proceedings are being handled. We’re not

Grant-Thompson had failed to “take control of the proceedings” in a case involving allegations that Sonia Timothy-Serrette had failed to repay a $70,000 loan obtained from her former parents-in-law to refund monies taken from her clients.

Justice Crane-Scott, in writing a unanimous verdict in favour of Ms Timothy-Serrette, and which overturned the Supreme Court verdict (see other article on Page 1B), said it would not have taken almost eight-and-a-half

Stephen Serrette senior and Bessie Serrette, both of whom have now passed and were represented before the Court of Appeal by their respective estates, asserted in their original claim filed in 2015 that they sold the Yamacraw Beach Estates property at a 33 percent discount to its appraised value due to the urgency with which their then-daughter-in-law needed funds - costing them $35,000.

“The defendant had two matters before the courts as it related to monies owed to her clients,” the couple alleged, one of which involved “allegedly misappropriating” monies from a bishop whose name was blanked out by the Court of Appeal.

years from the time the claim was filed in April 2014 to produce an initial ruling if the matter had been properly managed by the judge. The Supreme Court decision was eventually rendered in September 2022, but the Court of Appeal hinted strongly that it may have been disposed of much sooner if Justice Grant-Thompson had heard Ms Timothy-Serrette’s application to strike her parents-in-law’s claim out. This was never heard, and the judge ultimately

proceeded to a full trial on the claim’s merits.

“It need hardly be said that a Judge’s duty to ‘actively manage cases’ involves much more than merely giving directions and fixing timelines to ready a matter for substantive trial,” justice Crane-Scott wrote.

“As we have demonstrated, if the learned judge had taken the necessary steps to ensure that the appellant’s strike-out application was either struck-out for want of prosecution, or

‘Scores’ fall victim to phishing scammers

By ANNELIA NIXON

Business

FINANCIAL crime investigators yesterday warned that so-called ‘phishing’ scams are increasing with “a number of suspects” being arrested by the Royal Bahamas Police Force.

Anthony McCartney, head of the Royal Bahamas Police Force’s financial investigation branch, said

that the scam - which sees perpetrators sending e-mails, text messages or some other form of electronic communication to potential victims, pretending to be their bank or other financial institution in a bid to fool them into handing over their bank account number - has used the name of many local providers.

“We want persons who have a relationship with any financial institution to take, and to heed, advice that we

are giving here today. So this applies to all persons, as I indicated, who who have a banking relationship with any financial institution here in The Bahamas,” Mr McCartney said. He added that while certain population groups are not being targeted, it was clear there is an uptick in phishing scams compared to last year. He added that both Bahamians and nonBahamians have been charged, and the Financial Crimes Investigation

Branch has “been successful in apprehending a number of suspects in relation to these matters”.

“So we use basic crime scene solving techniques with the use of technology, of course,” Mr McCartney said. “I would also like to point out that we are also utilising our partners in other jurisdictions to assist us with our investigations. We know that this is not isolated here to just Nassau,

AVIATION SAFETY CULTURE IS NATIONAL IMPERATIVE

In civil aviation, safety is not merely a requirement - it is a culture. It is the cornerstone upon which all other aspects of air transportation must be built. In The Bahamas, where air travel is the lifeline connecting our islands, cultivating and maintaining a robust culture of safety is not optional. It is a national imperative.

As the Civil Aviation Authority of The Bahamas (CAA-B) continues to fulfill its mandate to regulate and oversee the aviation sector, we are intensifying our efforts to embed safety into every aspect of our operations - from licensing and certification to inspection, enforcement and education.

What is a Culture of Safety?

A culture of safety is an organisational mindset, and operational discipline, that prioritises safety at every level. This has to exist within government oversight bodies, airlines, airports, maintenance companies, and among individual airmen and aviation personnel. It is the conscious and collective commitment to “do the right thing”, even when no one is watching.

It is characterised by:

* Transparency and accountability

* Continuous improvement

* Proactive risk management

* Open reporting and non-punitive safety reporting environments

* Leadership commitment and staff involvement

Elevating safety in The Bahamas: CAA-B’s strategic focus

As part of our national strategy to enhance aviation safety, the CAA-B safety oversight division - working in close co-ordination with the State Safety Programme (SSP) - has adopted, and is actively implementing, a series of transformational initiatives.

The SSP serves as the national framework for managing safety in civil aviation, in line with the International Civil Aviation Organisation’s (ICAO) Annex 19 requirements.

It integrates policy, risk management, safety assurance and promotion across all sectors of aviation in The Bahamas, ensuring that safety performance is continuously monitored, analysed and improved at the state level.

The programme brings together regulatory authorities, service providers and industry stakeholders to achieve common safety objectives, and align The Bahamas with the ICAO global aviation safety plan (GASP).

Key initiatives include:

1. Modernising regulatory frameworks

We are aligning our Civil Aviation Regulations with ICAO standards and recommended practices (SARPs), ensuring that operators, airmen and service providers in The Bahamas are meeting globally-accepted safety and operational requirements.

2. Safety management systems (SMS) integration

The CAA-B now mandates SMS implementation for all air operators, airports and certified service providers. A mature SMS fosters hazard identification, risk assessment and mitigation before accidents occur.

3. National Aviation Safety Plan (NASP)

Our NASP outlines safety performance targets, priorities and key risk areas such as runway incursions, loss of control in-flight, and unauthorised air operations. This plan ensures

that national safety initiatives are aligned with global strategies under the ICAO global aviation safety plan (GASP).

4. Surveillance and audit intensification

We have enhanced the frequency, scope and depth of oversight audits for AOC (air operator certificate) holders, aviation maintenance organisations (AMOs), aviation training organisations (ATOs) and aerodromes. Surveillance findings are followed by corrective action plan (CAP) implementation, tracking and closure to ensure real improvements are made.

5. Human factors and training development

CAA-B has developed and supported competency-based training and assessments (CBTA) for inspectors and industry personnel. We are also strengthening programmes in human performance, fatigue management and just culture - areas that directly impact operational safety.

6. Public awareness and industry engagement

Through blogs, seminars, CAA-B Talks, flyers and public campaigns, we are building public awareness on topics such as the dangers of using unauthorised air operators, flight planning, personal safety responsibilities and identifying certified operators, among others.

Police: Don’t let fraudsters use your banking accounts

FRAUD - from page B1

Bahamas. This is happening in other parts of the world.

“And so we’re working with other law enforcement counterparts as well, sharing information, because we see that these suspects as well, they are without borders. And so apart from that, we use our basic tracing and identifying techniques to locate and identify who the perpetrators are, along with the use of technology.

“We’ve been successful in apprehending a number of suspects in relation to these matters. For instance, we find that funds that are sent to a particular account, that information is provided to the police so we know to go directly to that account,” he added.

“The funds have to be withdrawn and so our investigation starts there, from the point of the funds being withdrawn. Who would have withdrawn those funds and then, etc, and so

Empowering the industry: The role of every stakeholder

While CAA-B regulates and monitors the aviation industry in The Bahamas, safety is a shared responsibility. We call on: * Air operators to ensure their operations are conducted in strict compliance with their Air Operator Certificate (AOC) and the applicable regulations.

* Pilots to stay current in both flight proficiency and regulatory knowledge, reporting all safety hazards encountered.

* Aircraft maintenance providers to follow manufacturer guidelines and regulatory standards to the letter.

* Aerodrome operators to maintain infrastructure in accordance with safety specifications and report non-compliance.

* Training organisations to deliver ICAO-compliant, scenario-based, and outcome-focused training for all licence types.

* The public to make informed decisions when booking flights and avoid engaging with unauthorised operators.

From compliance to culture It is important to understand that compliance is a starting point, but culture is the destination. Our ultimate goal is not merely to meet ICAO and national requirements, but to foster an aviation system in which safety is instinctive, not enforced.

on. That vein, we’ve been quite successful in placing a number of persons before the court being charged for receiving funds that were fraudulently sent to other person’s accounts.”

Mr McCartney said scammers will contact victims via SMS text message or a link, or may even call persons. Once given a response, persons are directed to a website and asked to enter their personal banking information. This leads to customers being locked out of their accounts, and funds being transferred and sent elsewhere.

“What you have is the SMS text coming to the individual, apprising them that they were locked out of their account, or their account has been placed on hold,” Superintendent Yvette Rolle-Davis said.

“They would then send the link asking them if they want to access the account to press that particular link.

“As they go into pressing the link, they’re now forwarded to where they have to enter their user name and their password. At that time, because you are actually into the fraudulent website, the scammers are there for taking over your bank account information. Most banking institutions would send you a verification code so the fraudsters would then reach out to you and ask you for your verification code.

“As you were speaking with them, and most persons we see in the amount of crimes that were being reported, they believe that the fraudsters were

genuine and would then send their banking information code to the fraudsters. Afterwards, they would then be locked out of their accounts. That is a one-step scheme,” she added.

“On the other step of the same scheme, what we have is individuals who are recruited for the accounts to be used, and these are where the fraudsters are sending the money to. So you may have family or a friend who’s giving you some excuse as to whatever reasons that they need to use your bank account information to transfer funds.

“And so those fraudulent funds that were taken from an individual are then transferred to these individuals who allow their accounts to be used, I guess, by a family friend or a friend or for whatever reason. We see that most of them, they’re receiving funds for their use. That itself is a no, no. And, as we know with your account, the individuals who are allowing their accounts to be used, they are, in fact, responsible for their own accounts.

“So we are advising them to not fall for those schemes. Like McCartney also stated, the bank will never ask you for your personal information. They will never ask you for your verification code. If you are unsure, you are to go into the bank and clear up whatever it is that you need to.”

Ms Rolle-Davis added that perpetrators normally send messages and links to random numbers, and that is how they rope in their victims. She said if the stolen funds are still available, the impacted person would get their money back.

Mr McCartney added:

“Again, we just want to

We encourage all aviation professionals in The Bahamas to reflect on the following:

* Are we proactively identifying and mitigating risks?

* Are we encouraging open communication without fear of retribution?

* Are we investing in continuous education and training?

* Are we setting the right example for the next generation of aviation leaders?

Looking ahead

The Bahamas is undergoing significant transformation in its civil aviation sector. With the planned implementation of new drone regulations, urban air mobility (UAM) initiatives, remote air traffic services and regional oversight satellite offices, the stakes - and opportunities - have never been higher.

The CAA-B remains steadfast in its commitment to supporting this transformation through a transparent, consistent and accountable oversight framework rooted in a proactive culture of safety. We invite the entire aviation community to walk this path with us. Together, we can elevate aviation standards in The Bahamas; not just by regulation, but by conviction.

senior deputy director general of Civil Aviation Authority Bahamas

sensitise members of the public, as we have been doing in the past. Please, if you’re not familiar with the persons you are speaking with, as we always say, a financial institution will not contact you under any circumstances to require you to change your personal banking information.

“These are all signs of a person who is not authorised to conduct those transactions. We also want to send an appeal to persons who facilitate or assist these scammers in perpetrating these offenses. We find that often-times persons who come in contact with the police, they indicate that their banking information was stolen or lost, and they’ve been asked by a friend to assist them with withdrawing funds from their account.

“Again, if you want to prevent being subject to the harsh penalties of the law, we would advise you to desist from conducting such activities. Persons who own and operate accounts at the various financial institutions, again, if you are unsure as to what’s happening with your account please go into the institution or call. Never respond to a link or a text from persons that are unknown to you,” he added.

“Again, we want to emphasise that. We’ve had scores of persons affected by this, and the numbers are increasing every day. Again, this is very alarming to us as law enforcement as our resources are directed solely into dealing with persons who, just by taking a little bit due diligence, can minimise or prevent themselves from being the victim of crimes.”

Push for Bahamasair tie-up with Air Canada

BY ANNELIA NIXON Tribune Business Reporter

anixon@tribunemedia.net

FAMILY Island tour-

ism is pushing an interline agreement between Bahamasair and Air Canada to improve same-day connectivity from Nassau and exploit the increase in Canadian winter airlift.

Kerry Fountain, the Bahama Out Island Promotion Board’s executive director, told Tribune Business he sees an “opportunity” with increased airlift from Canada to Nassau through pushing for an interline agreement. This, he believes, will allow more tourists to visit the Family Islands without having to stay overnight in Nassau waiting for their connecting flight.

“Now that Air Canada will be increasing its frequency from both Montreal and Toronto, and adding new flights from Halifax and Ottawa, the push, or the initiative now, is to get Bahamasair and Air Canada to have an interline agreement,” Mr Fountain said. “And once that interline agreement is in place... it allows passengers now to connect almost seamlessly, via Nassau, via LPIA (Lynden Pindling International Airport).

“As an example, let’s say the flight from Ottawa

arrives in Nassau at 11am in the morning. That would now allow for a sameday connection to islands like Abaco, Marsh Harbour, islands like Exuma at Georgetown airport. In essence, any flight that Bahamasair has going out to one of our Family Islands after about 1pm.

“Again, let’s say if the Ottawa flight arrives at 11am and flights outbound to the Family Islands are leaving after 1pm, it allows for a connection. Which means now visitors that are travelling to the Family Islands, they do not have to overnight on Nassau, Paradise Island, and they’re able to fly to and from the Family Islands via Nassau once Bahamasair has those flights in place.

Having an interline agreement would mean travellers only have to buy one ticket, Mr Fountain

added. “Again, as an example, if you’re flying from Ottawa and you want to go to Georgetown, Exuma, you purchase one ticket. Ottawa, Georgetown, Ottawa, that’s your roundtrip ticket.

“Once you get to the airport, you check in your bags and your bags are tagged for Georgetown and not Nassau. Now it still requires you, once you get in Nassau, to go through Bahamas Immigration, you know, on that fast line that Bahamas residents go through. Remember, that’s a Family Island transit line.

“So that speeds up the process, the formalities, and you still have to go downstairs and collect your bags from Customs, because that’s your first port of entry. But once you walk over to domestic and check in on Bahamasair here, your bags are already tagged. So all you’re doing, in essence, is dropping your bags off and then walking upstairs to domestic. That is the power... of an interline agreement.”

With muted airlift to Family Islands such as Long Island, an interline agreement will still be effective especially once that island’s new airport is completed. Mr Fountain stressed the importance of airport development on the Family Islands adding that Bahamasair is the only domestic

global distribution system (GDS) accessible airline flying to these destinations.

“The only GDS accessible airline we have in the country is Bahamasair, and I’m talking about domestic carriers,” Mr Fountain said. “I don’t care how many airlines we are flying out of Nassau to the Family Islands. If you go into kayak.com and you’re searching for a flight, as far as domestic airlines are concerned, Bahamasair is the only one.

“I know Western Air is working on GDS access but that has not been finalised as yet. But Bahamasair is the only GDS accessible airline in The Bahamas, and that is why the interline agreement, we are pursuing that first with Bahamasair and Air Canada. Once Western Air has GDS access, of course, we will be looking to work much more closely with them to ensure that they forge the right interline agreement partnerships.

“For us, the lowest hanging fruit we feel is Air Canada. Once we see that interline agreement is in place, of course, we would want to encourage and push for interline agreements between Bahamasair and WestJet, or Bahamasair and Porter [Airlines]. But, for right now, we want to start off getting Air Canada in the gate.”

CENTRAL BANK MOVING ON BASIC BANK ACCOUNT

By FAY SIMMONS Tribune Business Reporter jsimmons@tribunemedia.net

THE Central Bank yesterday reiterated its ambition to ensure Bahamian commercial banks provide a ‘basic bank account’ that would cap or eliminate fees for lowerincome individuals.

John Rolle, its Governor, said the regulator is working to complete the regulatory framework for such an account as a targeted measure to address the cost of banking services for persons of lower economic means. Speaking at the Central Bank Digital Currency conference, he added that the initiative is a key element of ongoing efforts to make

the financial system more accessible and affordable. “Most important result for us in the near term is going to be to complete the work on having a basic bank account,” Mr Rolle added.

“The basic bank account is a facility that would have protections around what sort of charges are passed on to the users of

ACCOUNT - See Page B5

COMFORT SUITES FULLY OPEN FOLLOWING BLAZE

By FAY SIMMONS Tribune Business Reporter

jsimmons@tribunemedia.net

COMFORT Suites yesterday said it remains open and fully operational following a a fire that struck part of its premises late on Monday afternoon.

In a statement, the Paradise Island resort confirmed a minor electrical blaze erupted at its premises due to a lightning strike during a severe afternoon thunderstorm. It said the incident was contained swiftly, with

no injuries reported and no damage to guest areas.

“On Monday, September 8, 2025, Paradise Island experienced severe afternoon thunderstorms, during which our transformer was affected by a lightning strike. This occurrence, not human error, led to a small fire erupting in our basement,” said the resort. Comfort Suites said the fire was contained to the hotel’s electrical room, which houses its transformer, and did not spread to other parts of the property. The hotel added that its guest areas, including

NOTICE

NOTICE is hereby given that LOUIS LOUVENS of Shamerock Close, off Carmichael Road, Nassau, The Bahamas, is applying to the Minister responsible for Nationality and Citizenship, for Registration/ Naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 10th day of September 2025 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, New Providence, The Bahamas.

rooms, the lobby and public spaces, remained unaffected.

“We are pleased to advise that damage is limited to our electrical room which houses our transformer, and elated to share that no one was injured. Our hotel is laid out in two wings; luckily, no damage was sustained to our guests’ areas, including sleeping rooms, public spaces and our lobby. We are open and remain viable to welcoming you to enjoy,” Comfort Suites said.

The hotel also praised the swift action of an employee, who acted immediately to

suppress the fire before emergency crews arrived, and acknowledged the rapid response of emergency personnel in helping bring the situation under control.

“One of our employees, Ken Rolle, was in the area and sprung into immediate action to extinguish the blaze. Ken is our very own hero and a true champion. His quick thinking aided the mitigation of a larger catastrophe,” the resort added.

“The Royal Bahamas Police Force fire services and The Royal Bahamas Police Force arrived promptly when contacted and acted quickly. We are sincerely grateful for their swift vigilance.”

NOTICE

NOTICE is hereby given that YOUSELINE BELLEVUE of East Street South, Nassau, Bahamas, is applying to the Minister responsible for Nationality and Citizenship, for Registration/ Naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 10th day of September 2025 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, New Providence, The Bahamas.

NOTICE

NOTICE is hereby given that JUSLENE DANIEL of #18 Carib Road, off Mackey Street, Nassau, Bahamas, is applying to the Minister responsible for Nationality and Citizenship, for registration/ naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 3rd day of September, 2025 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

Governor: ‘Work to do in bringing the Gov’t along’

By FAY SIMMONS Tribune Business Reporter jsimmons@tribunemedia.net

THE Central Bank is seeking to put the onus on developers to produce consumer and merchantfriendly digital payments systems that encourage a shift to electronic transactions, its governor said yesterday.

John Rolle said a key part of the vision to modernise The Bahamas’ payments systems includes a seamless, interoperable arrangement where consumers can simply scan, send or tap to pay.

Speaking at the Central Bank Digital Currency Conference, he added that making payments must be made easier through an integrated system capable of processing multiple payment methods seamlessly.

“One thing that we know is very important is that the way we make payments in the future has to be simpler at the cash register,” Mr Rolle said.

“Whether you are using cash or digital cash, or you’re transferring the monies from one bank account to the next, all that we expect of the average individual is that they should be able to scan and pay, or to enter the name or the alias of the recipient of the funds and send the funds, and allow the technology to work behind the scenes to decide whether you’re paying in Sand Dollars or you’re just making a transfer from your checking account to somebody else’s checking account.”

Mr Rolle said that by shifting the complexity of designing platforms able to handle multiple payment methods to developers — and integrating those platforms behind the scenes — businesses are freed from the burden of managing multiple systems and consumers can transact more easily.

“It’s really integrating a lot more of the platforms that receive payment, and the more we do that, we also simplify the decisionmaking for businesses. They don’t really have to think about whether they have multiple terminals, for example, to receive payments, or that they have to put multiple plug-ins and

add-ons in order to receive payment from different sources. You shift more of that burden to the developers of payment solutions to communicate in a uniform way to the payment terminals,” said Mr Rolle.

He added that the Central Bank is working to future-proof the country’s financial infrastructure and expand flexibility across cash, digital wallets and traditional banking.

“That’s the sort of vision that we were defining for where The Bahamas goes. And that really means that people then have even greater flexibility in terms of what they’re using for payments; whether it’s the credit cards, an electronic transfer from their banks or an electronic transfer from a digital wallet,” said Mr Rolle.

In the short-term, Mr Rolle said the Central Bank is continuing its drive to introduce more residents to the Sand Dollar through public education initiatives aimed at helping them understand how to complete digital transactions and safeguard themselves in the new environment.

He added that the Central Bank is still working to have the Government, the largest recipient and issuer of payments in the Bahamas, fully integrated into the Sand Dollar system.

“The area where we have continued work to do is bringing the Government along. It is very important for the Government to be fully inserted into the system in terms of being able to make payment to individuals in Sand Dollar or to receive payments from the public in Sand Dollar,” said Mr Rolle.

“The Government is the single largest recipient of payments, and the single largest issuer of payments in The Bahamas. For us, it’s important, and we have ongoing conversations with the Government in terms of how we get their systems developed to do this. Of course, being the size of the Government also means that you have greater complexity in what those systems look like.”

PUBLIC NOTICE

INTENT TO CHANGE NAME BY DEED POLL

The Public is hereby advised that I, JOEL DIEUFORT of Baillou Hill Road, Nassau, Bahamas intend to change my name to JOEL OLIBRICE. If there are any objections to this change of name by Deed Poll, you may write such objections to the Chief Passport Offcer, P.O.Box N-742, Nassau, Bahamas no later than thirty (30) days after the date of publication of this notice.

NOTICE

NOTICE is hereby given that ANNE PRUD’HOMME of Feather Lane, Yamacraw Hill Road, Nassau, Bahamas, applying to the Minister responsible for Nationality and Citizenship, for Registration/ Naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 10th day of September 2025 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, New Providence, The Bahamas.

NOTICE

JEAN

that

of

P.O.

N-8240, Nassau Bahamas, is applying to the Minister responsible for Nationality and Citizenship, for registration/ naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 3rd day of September, 2025 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

Royal Oasis owner never took 20% discount offer

Oasis”, although not a single cent of the same sum - allocated for this purpose in the prior 2024-2025 fiscal year - had been spent as of March 2025. A further $1m has also been provided for “West Sunrise Highway” in 2025-2026.

The Supreme Court verdict’s effect is that the Government may now have to deal with the GBPA, as well as Harcourt, if it wishes to acquire the Royal Oasis should the former “repossess” the derelict casino site and parking lot. This, ironically, comes as the GBPA and the Government today enter the third day of the two-week arbitration over the latter’s demand that Freeport’s governing authority pay it $357m.

Any Royal Oasis deal is likely linked to the Davis administration’s bid to acquire the nearby International Bazaar site for its much-touted Afro-Caribbean Marketplace. It was confirmed earlier this year that the GBPA had agreed to write-off 50 percent of the service charge debts owed by the Bazaar’s owners - the same charges that it is seeking to collect in full from Harcourt.

Justice Hanna-Adderley, detailing the GBPA and Freeport Commercial and Industrial case in an action which was filed with the Supreme Court eight years ago in 2017, said it related to Lot 11M and Lot 2B of ‘Block M’ in Freeport’s central area. The former is the site of the Royal Oasis

casino, and Lot 2B the location of the parking lot behind it.

“The claimants [GBPA and Freeport Commercial and Industrial] contend that despite their lawful demand over the years the defendant [Harcourt Resorts Bahamas] has failed to pay long overdue arrears of service charges on land which was conveyed to it, and that they are now entitled in law to payment of the arrears or immediate possession of the land to which the service charges attach,” the judge wrote.

“According to the claimants, the Lot11 M (casino) service charges due and payable stand at $1.111m as at August 24, 2023, and the Lot 2B service charges due and payable stand at $52,415 as at August 24, 2023. The balance on both accounts is continuing to grow.”

The Royal Oasis complex has now been shuttered for more than two decades, having been closed in September 2004 following damage inflicted by Hurricane Frances some 21 years ago. It has never re-opened under Harcourt’s ownership, the Irish developer having acquired the resort in 2007 from Lehman Brothers Holdings, only for the 20082009 recession to sink its redevelopment plans.

However, Harcourt Resorts Bahamas challenged the GBPA and Freeport Commercial and Industrial claim on multiple grounds while asserting it was “invalid”. The Royal Oasis owner argued it had never been informed that the right to

collect service charges, and enforce remedies for nonpayment, had been assigned to the GBPA thereby “disentitling” it from “bringing proceedings in its name”.

And, even if the right to collect arrears had been correctly assigned, this did not include the right for the GBPA and its affiliates to reenter and repossess the land. Harcourt Resorts Bahamas also alleged it “would be wholly inequitable to grant the full arrears” claimed because many of the services the charges were supposed to finance had not been provided to it. It also alleged the claim was statute-barred.

Several senior GBPA executives, including Karla McIntosh, its vice-president of legal affairs; Gwenique Musgrove, the financial controller; and Dwight Malcolm, collections manager for its Port Group Ltd affiliate, gave evidence during the trial. The casino lot covers 2.493 acres, while the parking lot is spread over 1.234 acres.

“Under cross-examination, Miss McIntosh’s evidence is that the first claimant, as regulator, is responsible for the maintenance of the city of Freeport as a whole within the 235 square miles,” Justice Hanna-Adderley wrote. “It paves roads. It cuts verges. It deals with street lights. It picks up trash. So generally, it maintains Freeport, the Port area...

“That there have been complaints received from property owners within the Port area about the lack of maintenance and upkeep.

Appeal court president warns on case workload

MANAGE - from page B1

alternatively, was heard and disposed of as a preliminary issue, the [parents-in-law] action would in all likelihood have been struck-out years ago.

“As things turned out, the pending strike-out summons was repeatedly adjourned by the judge between 2016 and 2018 and was never heard.

Instead, the action was then scheduled for substantive trial before the judge in 2018 and - after numerous adjournments - only finally concluded in September 2022 when the learned judge handed down

her written decision,” she added.

“Simply put, rules of court exist for a reason. Regrettably, what transpired in the court below can only be described as a colossal waste of judicial time.” She was backed by justice Evans in his capacity of Court of Appeal president, who wrote: “It is unfortunate that an action which was commenced on April 7, 2014, would not be the subject of a written judgment until September 30, 2022.”

He added that the thenSupreme Court Rules’ case management Order was “put in place to avoid the

Legal Notice

Vie en Vert Limited

INTERNATIONAL BUSINESS COMPANIES ACT (No.45 of 2000)

In Voluntary Liquidation

Notice is hereby given that in accordance with Section 138 (4) of the International Business Companies Act, (No.45 of 2000), that Vie en Vert Limited (Registration no. 209421 B is in dissolution. Te date of commencement of the dissolution is the September 4th, 2025. Te Liquidator of the Fund is Crowe Bahamas and can be contacted at Harbour Bay Plaza, Shirley Street, Suite 587, P. O. Box AP-59223, Nassau, Bahamas. Email andrew.davies@crowe.bs. All persons having claims against the above-named company are required to mail and email their names, addresses and particulars of their debts or claims to the Liquidator October 4th, 2025.

Crowe Bahamas Liquidator

N O T I C E

NIGERIAN JV SERVICES COMPANY LIMITED

Pursuant to the provisions of Section 138 (8) of the International Business Companies Act 2000, notice is hereby given that the above-named Company has been dissolved and struck off the Register pursuant to a Certifcate of Dissolution issued by The Registrar General on the 21st day of August, 2025.

Dated the 10th day of September A.D., 2025.

Jamie L. Penny Liquidator of NIGERIAN JV SERVICES COMPANY LIMITED

That the first claimant

[GBPA] maintains the city

based on the amount of funds that are available to do it. That in a perfect world everything would be done, but the claimant can only do as much as it can with the resources that it has.”

The GBPA executives said the service charges are indexed to inflation, meaning they rise in line with cost of living increases. The Royal Oasis casino’s billing was linked to the Bahamian retail price index, while others were tied to the US cost of living index. The casino parcel’s service charge had risen from $36,000 in 1983 to $92,745, inclusive of VAT, some 40 years later.

Mr Malcolm also detailed “his interaction” with Donald Archer, former chief executive and president of Harcourt Resorts Bahamas, “who on September 18, 2012, indicated that the defendant intended to address the issue of the outstanding service charges when the resort was either re-opened or sold.

“He chronicled the requests for ‘write-offs’ and reduction of service charges by the defendant, and the offers of substantial discounts, none of which was taken advantage of by the defendant,” Justice HannaAdderley noted.

Mr Archer, who was Harcourt’s main trial witness, said the developer had challenged the “exorbitant service charge” on the casino land parcel only to be told that it was high to compensate for the fact there were no hotel or casino taxes in Freeport at that time.

He recalled the “significant damage” and Hurricane Frances-enforced closure of 2004, and Justice HannaAdderley wrote: “The casino and hotel remain closed to-date despite numerous attempts at repairing

robust criminal calendar and was seeking to fit the hearing dates for this civil trial into that schedule.

very same results which have occurred in this particular case. The learned judge in her judgment sought to rely on the fact that counsel appearing for both parties before her were attorneys who carried out a very active criminal practice.

“However, the code of professional conduct for attorneys is clear that attorneys ought not to commit themselves to a workload which affects their ability to give proper attention to assisting their clients,” justice Evans wrote. “It is also noted that in the present case the learned judge herself was in charge of a

“This is clearly not an ideal situation and ought to be avoided. The judge may have thought that she was being helpful but the results should be a cautionary lesson. Whereas it may be feasible to fit a short civil application into a criminal schedule, the attempt to conduct a full civil trial is not in my view a prudent course of action.”

Justice Evans concluded:

“We in this court have had to rely on the judge’s hand written notes as opposed to full and proper transcripts and, in the final stages, some written notes were not available. It is these types of situations which could give rise to successful challenges to judgments where delays have been excessive.

Legal Notice

DOIST LIMITED

INTERNATIONAL BUSINESS COMPANIES ACT

(No.45 of 2000)

In Voluntary Liquidation

Notice is hereby given that in accordance with Section 138 (4) of the International Business Companies Act, (No.45 of 2000), that DOIST LIMITED (IBC no. 174202B) is in dissolution. Te date of commencement of the dissolution is September 4th, 2025. Te Liquidator of the Company is Crowe Bahamas and can be contacted at Harbour Bay Plaza, Shirley Street, Suite 587, P. O. Box AP-59223, Nassau, Bahamas Email andrew. davies@crowe.bs. All persons having claims against the above-named company are required to email their names, addresses and particulars of their debts or claims to the Liquidator by October 4th, 2025.

Crowe Bahamas Liquidator

N O T I C E

TAMA HOPE SHIPPING COMPANY LTD.

Pursuant to the provisions of Section 138 (8) of the International Business Companies Act 2000, notice is hereby given that the above-named Company has been dissolved and struck off the Register pursuant to a Certifcate of Dissolution issued by The Registrar General on the 25th day of August, A.D., 2025.

Dated the 10th day of September, A.D., 2025.

Kirvy Ferguson LIQUIDATOR

Unit 8 Caves Village Professional Center West Bay Street Nassau, The Bahamas

all damage. Attempts at re-opening the hotel or finding a suitable buyer for the same have also been unsuccessful as the economy in Freeport has yet to improve significantly.” Mr Archer said Harcourt “does not deny” service charges are owed, but added that it disputes the sum claimed. He asserted that the developer “has been put at a significant disadvantage of not having the income to pay for the exorbitant service charge unfairly levied” by the GBPA because the casino has been closed for more than 20 years. He added that the service charge gas never been decreased to reflect “the economic impact of the hurricanes” and, instead, has undergone a series of increases leading Harcourt to “dispute the amounts levied and question the validity of the service charge levied”.

Mr Archer, though, said the $107,000 service charge arrears accumulated by Lehman Brothers Holdings and the resort’s operator, Driftwood Hospitality, were paid in full when Harcourt acquired the Royal Oasis in 2007. The former Harcourt Resorts Bahamas chief disagreed with Robert Adams KC, the Delaney Partners attorney, who said the payment showed it knew service charges were due and owing.

And he confirmed that Harcourt had failed to take advantage of the GBPA’s offer of a 20 percent service charge discount, having written to Ian Rolle, the GBPA’s president, on January 13, 2010, requesting that the be totally waived until the Royal Oasis hotel and casino components became operational. At that stage, the sum owed was $118,450.

However, Mr Archer also argued that the GBPA’s

claim was statute-barred due to the six-year “limitation period”, as it was aware of Harcourt’s “inability to pay” from 2008 and only took legal action in 2017. And he reiterated that the service charges imposed on the two lots were “unequal to market value and/or unequal to service charges billed on similar lots within the subdivision”.

Justice Hanna-Adderley, in her verdict, agreed with the GBPA that the service charges are “rent charges” that are bound to and “run with the land”. And she ruled that the right to collect, and enforce, the service charges had been assigned to both the GBPA and Freeport Commercial and Industrial by previous conveyances that transferred ownership of the two Royal Oasis lots.

The constant back-andforth between the GBPA and Harcourt, discussing discounts and waivers, as well as demands for payment showed that Harcourt Resorts Bahamas knew it was obligated to make the payments, the judge added.

And, while there was “some evidence” that the GBPA and Freeport Commercial and Industrial did not provide the promised services, Justice HannaAdderley ruled that full payment of the charges was not contingent or conditioned on this happening.

She also found that the claims were not statutebarred, ruling that the limitation period for such an action “based on instruments under seal” is 12 years and the clock started running on this from 2008 when Harcourt’s failure to pay began. Thus the 2017 filing was well within the time limits, leading Justice Hanna-Adderley to reject Harcourt’s defence.

“I make these observations not to interfere with the administrative operation of the Supreme Court nor to criticise the learned judge, but rather to highlight concerns which result when we have to resolve cases on appeal where the case has not been properly managed below.

“The goal of the judiciary is to do justice between the parties. When attorneys do not comply with rules of the court and the court does not hold them accountable, it is usually the litigant who suffers.”

Share your news

The Tribune wants to hear from people who are making news in their neighbourhoods. Perhaps you are raising funds for a good cause, campaigning for improvements in the area or have won an award. If so, call us on 322-1986 and share your story.

Legal Notice

Doist Technology Holdings Ltd.

INTERNATIONAL BUSINESS COMPANIES ACT (No.45 of 2000) In Voluntary Liquidation

Notice is hereby given that in accordance with Section 138 (4) of the International Business Companies Act, (No.45 of 2000), that Doist Technology Holdings Ltd. (IBC no. 175082B) is in dissolution. Te date of commencement of the dissolution is September 4th, 2025. Te Liquidator of the Company is Crowe Bahamas and can be contacted at Harbour Bay Plaza, Shirley Street, Suite 587, P. O. Box AP-59223, Nassau, Bahamas Email andrew.davies@crowe.bs All persons having claims against the abovenamed company are required to email their names, addresses and particulars of their debts or claims to the Liquidator by October 4th, 2025.

Crowe Bahamas Liquidator

N O T I C E

TAMA STAR SHIPPING COMPANY LTD.

Pursuant to the provisions of Section 138 (8) of the International Business Companies Act 2000, notice is hereby given that the above-named Company has been dissolved and struck off the Register pursuant to a Certifcate of Dissolution issued by The Registrar General on the 25th day of August, A.D., 2025

Dated the 10th day of September, A.D., 2025.

Kirvy Ferguson LIQUIDATOR

Unit 8 Caves Village Professional Center West Bay Street Nassau, The Bahamas

‘Just as Govt can acquire, we have right to inquire’

EXPANSION - from page B1

commonage we don’t necessarily object to the airport. We do object to the way proceedings are being handled. We’re not being consulted in any official capacity as representatives of the body, and the Government has already started to develop on the land without properly acquiring the property.”

Mr Davis said it appeared that a company had already been contracted, and is presently doing, land clearance, excavation and moving soil. With the Government having formally given notice that it plans to acquire 628 acres of commonage property to facilitate the airport’s expansion under the Acquisition of Land Act, he added that negotiations by previous committees appeared to have produced no results.

“We do acknowledge that the Government has a right to compulsory acquisition of the land. We’re not disagreeing with that,” Mr Davis told Tribune Business. “But, as legal land owners, there are protocols for that to happen under the Acquisition of Land Act, and that’s what we’re requesting - due diligence and respect for the land owners to be consulted.

“That’s not happened, and they’re putting the cart before the horse. This is just me personally, but personally I would like at a minimum to be at the table for discussions on the development. I think we are due that as legal land owners. Regardless, if the Government acquires the land, we want some say on what’s happening with the land we live and reside on.

“Outside of being owners, we’re still constituents of North Eleuthera and residents. If a major development is happening, we need to be part of what’s happening and for there to be actual transparency. That’s a minimum.”

Tribune Business has reported on numerous examples where it has years, and often decades, for the Government to pay private owners for land it has acquired in the public interest - for example, use as road corridors - using its compulsory powers under the Acquisition of Land Act.

One recent ruling from the Supreme Court involves Nassau Exotic Gardens, and the Government’s compulsory acquisition of two tracts of land in The Grove and Perpall Tract areas of western New Providence, via

Appeal Court reversal on no written loan agreement

REPAY - from page B1

“With respect to both matters, the defendant pleaded with the plaintiffs to financially assist her in acquiring a substantial sum of money as she maintained that the courts were willing to consider a Compensation Order dependent on the complainant’s acceptance,” the Serrettes alleged.

They added that their daughter-in-law knew they owned the Yamacraw Beach Estates property, and urged them to “sell the land and loan her the proceeds of the sale” with a promise “she would repay the loan within two calendar years”. Based on this, the Serrettes obtained an appraisal from Bishop Walter Hanchell, who valued it at $105,000.

“The defendant insisted that the said funds were imperative and, as such, pressed the plaintiffs to accept a lower offer of $70,000 made by Harmony Homes Ltd,” the couple alleged, referring to an Arawak Homes affiliate.

“As a result, the plaintiffs conveyed the said property

to Harmony Homes Ltd on or about the 30th day of June 2010 for the said amount. The plaintiffs were coerced into selling their said property at an undervalued price and, as a result, suffered an additional loss in the amount of $35,000.” The sales proceeds were paid direct to Ms Timothy-Serrette but the move did not produce family harmony.

The Serrettes alleged that their daughter-in-law failed to repay the money and subsequently divorced their son, Stephen Jnr, on March 25, 2013. This sparked their Supreme Court action, where they sought damages and costs, eventually obtaining a favourable verdict from Justice Grant Thompson on September 30, 2022 - almost eight-and-a-half years after the claim was filed on April 7, 2014.

Justice Grant-Thompson said she was “satisfied” that the $70,000 represented a ‘soft loan, adding that Stephen Serrette senior had “made it clear that he loved his son and daughter-in-law and would do what he could to avoid distress and shame to his family.

Sand Dollar to aid bank access

ACCOUNT - from page B3

the facilities, whether it is for withdrawals or making of payments, and the intent there is to target a product like that to persons who have less economic means than the average persons in the population.”

Mr Rolle said such an account would be structured to prevent persons from being excluded from formal banking activities due to high service charges.

“As we try to get to a better place in terms of the fee structure in the financial system, you do not want people to be forced to exclude themselves from taking advantage of making use of financial services because they can’t afford it, and it’s making the difference between whether they have sufficient groceries or not at the end of the month,” said Mr Rolle.

While the income threshold for qualifying has not yet been determined, he added that customers who meet the criteria will be given clear information about the account’s terms, costs and protections.

“A basic bank account would mean that the individuals who are not making a lot of money, and that’s a definition where there has to be a consensus as to what that threshold is, but those individuals would be able to get this facility at any financial institution, and then to have some assurances as to what it would cost from an

the Acquisition of Land Act that dates from last century - 1999 or some 26 years ago.

Mr Davis said obtaining timely and fair compensation from the Government is another top priority for the commoners, telling this newspaper: “I think that’s one of the major concerns. The schedule of compensation, that’s one of the biggest issues for the commoners - at least from what I’ve heard.

“We want to make sure this issue doesn’t get pushed under the rug, personally speaking, and that it’s at the fore in conversations over the development of the airport. Just as the Government has a right to acquire, the owners have a right to inquire. We’re just making sure our rights are upheld, both as Bahamians and commoners.”

Mr Davis added that, until the plans and design for the new North Eleuthera airport are released publicly, “it’s really theoretical to say everyone will benefit. You can say that because of the expected increase in airlift traffic theoretically because of the expanded footprint but is that a one:one benefit”?

Kenneth Romer, the Government’s director of

“I found his evidence to be credible both by his words and his demeanour. I accept that he liquidated his property in order to realise cash proceeds which he could make available to his daughter-in-law in order to satisfy the outstanding debt which she had to avoid her being incarcerated,” Justice Grant-Thompson added.

Ms Timothy-Serrette said there was no evidence of a binding loan agreement between the two parties, but the judge backed the undervalued sale and payment of the proceeds to her on the same day as the conveyance was executed as signalling “the existence of an agreement”. “The fact that the transaction closed on April 20, 2010, and the cheque was

aviation, did not respond to

Tribune Business inquiries before press time last night. Attorneys for the commoners, acting under a previous committee, in February 2021 sought $25.889m in compensation on behalf of their clients for the past use of their property by the Government and its agencies.

This was broken down into $9.3m and $3.5m for the 150-acre and 100-acre tracts that comprise the existing North Eleuthera Airport, the latter of which was taken in 1986. The wellfields and dump site were priced at $12.339m and $750,000, respectively, and it was said the commoners will also seek “damages for the permanent scarring and abuse of the land” by those two facilities.

The 450-acre and 30-acre sites taken for the Water & Sewerage Corporation’s wellfields/reverse osmosis plant and the district dump, respectively, were taken in the mid-1990s. The attorneys argued that in the circumstances the Government was “a willful trespasser”. This claim appears not to have moved forward.

However, Tribune Business previously reported that the issue’s roots date back to the pre-colonial era of the 1950s, when the decision was made to construct North Eleuthera’s airport on a portion of 6,000 acres that were subject to a Crown commonage grant on July 1, 1842.

issued on the same date supported the plaintiffs’ case that there was some urgency which required matters to move quickly,” Justice Grant-Thompson ruled.

“The court takes judicial note of the defendant’s well-publicised cases of misappropriation of clients’ funds and of her incarceration, which supports the plaintiffs’ pleaded case.”

Ms Timothy-Serrette, though, moved to overturn the Supreme Court verdict on the basis that there was ““no evidence of a loan” and that he former parentsin-law “did not prove” the existence of a contractual loan arrangement between them.

Mr Smith, acting as her legal representative, asserted that the case

Foster Clarke, the thenMP, wrote a 1956 letter to RE A Sweetnam, a crown lands officer, warning that “the preliminary question of granting title to the land should be settled before constructing the airstrip or the road” given “very strong opposition” by some Harbour Island/Dunmore Town residents who felt their property rights were being violated.

His warning went unheeded, and the North Eleuthera Airport’s construction proceeded in 1959 amid alleged government promises that the commoners would be compensated via a portion of the aircraft landing fees collected.

That, though, never happened even though the airport was expanded by an estimated 150 acres in the 1970s to take it to 250 acres. The Government then came back for more land in the mid-1990s via the 450-acre wellfield and, again, in the late 1990s and early 2000s for the 30-acre Harbour Island garbage dump.

Sources familiar with events, speaking on condition of anonymity, said the commoners received “not a cent” for the Government’s use of their land, which ultimately resulted in a 1996 legal action against the Government on the Harbour Island Commonage Committee’s behalf that was brought by former minister of state for legal affairs, Damian Gomez.

against his client was “an action for repayment of a debt based on a verbal arrangement between the parties”. He added that the Supreme Court’s findings that a loan agreement were “clearly erroneous” because there was no signed written agreement as required by the Statute of Frauds (Bahamas) Act. This stipulates that words, or a verbal agreement alone, are insufficient evidence in the Bahamian judicial system to prove a loan agreement exists. Travette Pyfrom, representing the Serrettes’ estate, argued that there was sufficient evidence to show the $70,000 was not a gift but a loan to enable Ms Timothy-Serrette to avoid jail - especially the fact that the funds were

The legal action petered out as the Committee’s membership changed, but talks between the then-Harbour Island Commonage Committee and the Government, headed by Algernon Cargill, former director of aviation, on establishing a partnership arrangement between the two sides began in early 2019. This was to develop and gazzette “rules” that would enable the commoners to licence the airport land to the Government.

The 1896 Commonage Act permits at least 20 persons to hold a right in non-partitioned land with others, and have these rights protected. Only registered commoners are allowed to work on or possess this land, meaning that all othersincluding the Government - who encroach on it can technically be treated as trespassers.

However, the Minnis administration reversed course in April/May 2020 when it revealed it would acquire 658 acres for the airport - the 250-acre existing site, plus an extra 408 acres - via the Acquisition of Land Act rather than the original partnership proposal.

Mr Cargill said the Government changed course because it felt owning the land would provide the airport with a more secure future rather than leasing it from the commonage. The acreage sought then is similar to what is being acquired now.

paid on the same day as the conveyance.

But the Court of Appeal, agreeing with Mr Smith, ruled: “We are satisfied that, in this particular case, the learned judge’s findings as to the existence of a loan are plainly erroneous as a matter of law... The claim against the appellant for breach of contract was clearly based on an oral agreement.” It added that the absence of a written agreement, confirming that the $70,000 was a loan and due to be repaid, was “fatal” to the claim under the Statute of Frauds (Bahamas) Act. As a result, the Court of Appeal found for Ms Timothy-Serrette and reversed the Supreme Court ruling.

affordability point of view,” said Mr Rolle.

“When we talk about a basic bank account, for those who qualify there will be some understanding as to what charges, or what maximum charges or what zero charges, apply in the case of certain types of transaction for those facilities.

“Whether it’s making a transfer between banks, or whether it’s about what that monthly maintenance fee is or what it should not be for those facilities. So it’s really just at a minimum to carve out some level of protection for those people at the lower end in terms of economic means.”

Mr Rolle also pointed to the Sand Dollar — the Central Bank’s digital currency — as an additional tool that could help lower financial costs, particularly for Family Island residents who face challenges accessing traditional banking infrastructure.

“The Sand Dollar gives us an opportunity to intervene a lot more directly to control costs. Say, for example, as we think a lot more about how we provide access to some of the cash dispensing services in the Family Islands, we know that making a lot more of that infrastructure interoperable with Sand Dollar could provide direct means to subsidise the cost for persons who might be accessing those services,” said Mr Rolle.

Wall Street rises to more records

By STAN CHOE AP Business Writer

U.S. stocks rose to more records on Tuesday after the latest update on the job market bolstered Wall Street's hopes for a slowdown that's deep enough to get the Federal Reserve to cut interest rates, but not so overwhelming that it causes a recession.

The S&P 500 rose 0.3% and squeaked past its alltime high set last week. The Dow Jones Industrial Average climbed 196 points, or 0.4%, while the Nasdaq composite gained 0.4%. They likewise set records.

Traders have become convinced that the Federal Reserve will cut its main interest rate for the first time this year at its next meeting in a week to prop up the slowing job market. A report on Tuesday offered the latest signal of weakness, when the U.S. government said its prior count of jobs across the country through March may have been too high by 911,000, or 0.6%.

That was before President Donald Trump shocked the economy and financial markets in April by rolling out tariffs on countries worldwide.

The bet on Wall Street is that such data will convince Fed officials that the job market is the bigger problem now for the economy than the threat of inflation worsening because of Trump's tariffs. That would push them to cut interest rates, a move that would give the economy a boost but could also send inflation higher.

A lot is riding on Wall Street's hope that the job market is slowing by just the right amount: Investors have already sent U.S. stock prices to records because of it. Inflation also needs to stay at a reasonable level, even though it looks tough to get below the Fed's target of 2%.

Traders are unanimously expecting a rate cut next week, but they pared their forecasts for a deeper-thanusual reduction following Tuesday's revision for U.S. job growth. That caused a slight recovery for Treasury yields following their sharp recent slide.

"The more likely course is for the Fed to deliver an October and December cut rather than trying to deliver a catchup cut in September," said Brian Jacobsen, chief economist at Annex Wealth Management.

Coming reports on inflation due on Wednesday and Thursday could alter expectations further. Hotter-than-expected readings could put the Fed in a worst-case scenario and make a series of cuts to rates less palatable.

On Wall Street, UnitedHealth Group climbed 8.6% after saying its executives plan to tell investors and analysts that it's sticking with its profit forecast for 2025. That helped it trim its loss for the year so

far, which came into the day at 36.7%, as insurers across the industry have contended with soaring medical costs.

Nebius Group, a Dutch company working in artificial-intelligence infrastructure, saw its stock that trades in the United States soar 49.4% after announcing a contract to deliver GPU services to Microsoft. The contract could be worth between $17.4 billion and $19.4 billion, and it runs through 2031.

Fox dropped 6.1% after Rupert Murdoch's family said they've reached a deal on control of the 94-yearold mogul's media empire after his death. The agreement ensures that there will be no change in direction at Fox News, the most popular network for President Donald Trump and conservatives.

The deal creates a trust establishing control of the Fox Corp. for Lachlan Murdoch, Rupert's chosen heir who has been running Fox

Hefter works on the floor of the New York Stock Exchange, Friday, Sept. 5, 2025.

in recent years, along with his younger sisters, Grace and Chloe. Apple slipped 1.5% after unveiling its next generation of iPhones. All told, the S&P 500 rose 17.46 points to 6,512.61. The Dow Jones Industrial Average added 196.39 to 45,711.34, and the Nasdaq composite climbed 80.79 to 21,879.49.

In stock markets abroad, France's CAC 40 rose 0.2% as the market remained relatively calm even though its government is facing a crisis of confidence after legislators voted to oust another prime minister. It and other governments around the world, including the United States, are facing increased scrutiny on how they plan to pay for their spending. Indexes were mixed across the rest of Europe and in Asia.

Japan's Nikkei 225 erased early gains to finish 0.4% lower as political uncertainty continued after Prime Minister Shigeru Ishiba said over the weekend that he planned to step down.

MARINE FORECAST

Apple’s iPhone 17 line-up includes a new ultrathin model and $100 price hike for Pro model

By MICHAEL LIEDTKE AP Technology Writer

APPLE on Tuesday rolled out its next generation iPhones, which include a new ultra-thin model and a slight price hike for one of its high-end models, while the company feels the squeeze of a global trade war.

The iPhone 17 line-up includes a new slimmeddown model that will adopt the "Air" name that Apple already uses for its sleekest iPads and Mac computers.

In what has become an annual rite for Apple, all four new iPhone 17 models will feature better cameras and longer-lasting batteries than last year's lineup. The iPhone 17 will all boast at least 256 gigabytes of storage, doubling the minimum amount from the last generation.

"We are raising the bar again," Apple CEO Tim Cook boasted in front of a crowd gathered in an auditorium named after the company's late co-founder, Steve Jobs, located on its campus in Cupertino, California.

Grappling with tariffs

The new iPhones are the first to be released since President Donald Trump returned to the White House and unleashed a barrage of tariffs, in what his administration says is an attempt to bring overseas manufacturing back to the U.S. — a crusade that has thrust Cook into the hot seat. All the iPhone 17 models are still expected to be made in Apple's manufacturing hubs in China and India, exposing them to some of Trump's tariffs.

Analysts believe the additional fees on iPhones coming into the U.S.

increase the pressure on Apple to raise prices to help protect its profit margins on its most marquee product. Without giving a specific reason, Apple will charge $1,100 for the iPhone 17 Pro, an increase of $100, or 10%, from previous versions of that model. The iPhone Air will start at $1,000 — the price of last year's iPhone 16 Pro. Apple is sticking with the same starting price for the basic iPhone 17 at $800 and the iPhone 17 Pro Max at $1,200.

All four models will be in stores Sept. 19. Apple's shares closed down 1.5% Tuesday amid gains in the broader stock market, an indication that investors might be worried the company didn't do enough to prop up its profits amid the trade war. A breath of fresh iPhone Air

The release of the iPhone 17 Air created the biggest buzz of the day as Apple found a way to pack in

NTSB describes the turbulence that threw passengers around the cabin on a Delta flight

By JOSH FUNK AP Transportation Writer

PASSENGERS who weren't buckled aboard a Delta Air Lines flight to Europe were violently thrown into the ceiling and back down to the floor in July when the plane encountered severe turbulence in a thunderstorm over Wyoming, according to a new report on the incident.

The National Transportation Safety Board said Tuesday that passengers endured 2.5 minutes of turbulence that caught the pilots by surprise on July 30 even though they had already altered their route to try to avoid the storms.

The seat belt sign was off so passengers, flight attendants and drink carts were thrown around the plane.

The flight took off from Salt Lake City and was bound for Amsterdam, but it diverted to Minneapolis, where 24 people were evaluated by paramedics and 18 were taken to hospitals. Two crew members sustained serious injuries and five sustained minor injuries.

The preliminary report described how passengers were thrown upwards with a force equal to three-quarters of their body weight that the NTSB estimated at 1.75 g. Then they were pulled downward by a force equal to half their body weight.

"That's a lot of force. That's like a muscle man grabbing you by the shoulders and with all of his strength trying to pull you up," said aviation safety consultant Jeff Guzzetti, who used to investigate crashes for the NTSB and FAA. "If you're standing and you experience those types of forces, you're going to be thrown upward into the ceiling and then back down again onto the floor with a lot of force."

Guzzetti said that enduring turbulence that lasted that long would seem like "an eternity" for the

passengers feeling those forces. The NTSB also said the plane's wing dipped down as much as 40 degrees at one point, and Guzzetti said that would have alarmed passengers.

That fits with what passengers described afterward.

"They hit the ceiling, and then they fell to the ground," Leann ClementNash told ABC News.

"And the carts also hit the ceiling and fell to the ground and people were injured. It happened several times, so it was really scary."

The report said that the pilot had turned off the seatbelt sign and flight attendants had begun drink service shortly before the plane encountered the turbulence.

The pilots likely believed they were in the clear after asking air traffic controllers to route them around the storms. But the NTSB charted the plane's flight path over a radar report from the National Weather Service that showed the plane flew directly into a bright red section of the map showing the worst of the storm.

Guzzetti said the NTSB will investigate whether the pilots and crew did enough to avoid the storms and whether the pilot made a good judgement in turning off the seatbelt sign.

Serious injuries from inflight turbulence are rare, but scientists say they may be becoming more common as climate change alters the jet stream. Several turbulence incidents have been reported this year, which only added to the concerns about aviation safety after the worst aviation disaster in years.

In January, a midair collision over Washington, D.C., killed 67 people. A plane also flipped over as it crashed in Toronto in March.

most of the punch of its Pro models while coming up with a fetching design that Forrester Research analyst Dipanjan Chatterjee will prod more trend-conscious consumers to splurge on the latest fashion in tech devices. The Air model is just 5.6 millimeters wide compared to 8 to 9

millimeters for the other iPhone 17 choices.

"There were plenty of crackles and one big pop," Chatterjee said of Tuesday's event.

One of the crackles came with the introduction of new features aimed at the selfie culture. The iPhone 17 models include a front camera with more

megapixels for crisper photos, along with an "Center Stage" option that will take advantage of a wider field of view and a new sensor that will enable users to take landscape photos without having to rotate the iPhone.

Although most of the upgrades to the iPhone 17 are similar to the incremental improvements of recent years, Apple appears to have done enough to "bring a sense of newness to the iPhone, which has remained the same for too long," said PP Foresight analyst Paolo Pescatore.

Apple also unveiled its latest smartwatches, including a health tool that is supposed to help detect potential hypertension, and its next generation wireless AirPod headphones.

Looking for a sales accelerator

Apple has been trying to accelerate its growth after several years of lackluster sales growth that has still

been enough to maintain its status as a moneymaking machine while raising questions about its ability to innovate. Those doubts, combined with the uncertainties swirling around tariffs, are, one of the reasons the company's market value has dropped by 6% so far this year while the techdriven Nasdaq composite index has gained 13%.

While the iPhone 16, released last year, fared reasonably well, the models didn't sell quite as well as analysts had anticipated because Apple failed to deliver all of the artificial intelligence features it had promised, including a smarter and more versatile Siri assistant. The Siri improvements have been pushed back until next year.

"To truly differentiate and outperform its competition, Apple will have to crack AI as a new contextual user-interface," predicted Thomas Hussan, another analyst for Forrester Research.