Gov’t trims debt cut ambitions to $500m

BY NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

THE Government has quietly moderated its fiscal consolidation ambitions through now predicting it will slash its direct debt by around $500m over the three-and-ahalf years to the 2028-2029 Budget period's close.

The half-a-billion dollar cut, while still significant, nevertheless represents a $366m downward revision to the $866m forecast made just under a year ago in its previous Medium-Term Debt Managment Strategy. The current version, tabled in Parliament yesterday by Prime Minister Philip Davis KC, suggests that while its fiscal consolidation plans remain on track, it has trimmed its expectationsf for the pace of debt reduction.

The new document, which covers the three fiscal years between 2026-2027 and 20282029, also reveals that the Government has adjusted its

Revises goal downwards by $366m in under year

expectations over the size of annual Budget surpluses it expects to achieve as well as slight tweaks to its debt management plans. The Davis administration is now forecasting it will achieve annual Budget surpluses, which measure by how much the Goverment’s revenue income exceeds its total spending in any fiscal year, that “average an estimated 1.7 percent of gross domestic product” over the medium-term debt strategy horizon”. This is less than the average 2.3 percent Budget surplus that it forecast just 11 months ago when the previous strategy report was published.

Targeting $131m this fiscal year via corporate tax

And, while the basic foundations of the Government’s debt management strategy have changed little over the past year, it is now targeting a slightly higher proportion of external foreign currency borrowing as part of its total financing mix. Moving foward, external borrowing as a percentage of its total debt financing strategy will increase from 20 percent to 22 percent, while Bahamian dollar borrowing while fall slightly from 80 percent to 78 percent.

The Government also reaffirmed that the 15 percent corporate income tax, imposed on Bahamas-based companies that are part of

42% of B-dollar debt maturing in less than one year

multinational groups generating annual turnover of 750m euros to ensure comply with the gloal G-20/Organisation for Economic Co-Operation and Development (OECD) initiative, is forecast to generate $131m in revenue this fiscal year. "Additional yields" from the cruise industry's private islands are also expected, and the Government added that it is seeking to "stabilise recurrent expenditure at approximately 20 percent of GDP over the three-year" period covered by the medium-term debt strategy initiative.

- See Page B4

BPL in new hedge on 2.5m oil barrels

BY NEIL HARTNELL

Tribune Business Editor nhartnell@tribunemedia.net

BAHAMAS Power & Light

(BPL) was yesterday revealed to have executed a new fuel hedge covering 2.5m barrels of oil in a bid to protect consumers from energy price shocks during the transition to renewable and liquefied natural gas (LNG) power.

Jobeth Coleby-Davis, minister of transport and energy, told the House of Assembly that the all-in per barrel cost of the hedge was in line with that incurred by BPL under the former Minnis administration as the lower “premium”

compensated for the higher “strike price”. However, both she and Prime Minister Philip Davis KC reawakened the previously-dormant BPL fuel hedging controversy by accusing the Opposition Free National Movement (FNM) of prematurely mplementing a failed strategy that failed to ready the state-owned utility’s generation assets, systems and other infrastructure to maximise the potential financial savings for Bahamian households and businesses. And, in what some described as an attempt “to rewrite history”, they attempted to turn the tables

Uber meets livery drivers in push to enter Bahamas

BY ANNELIA NIXON Tribune Business Reporter

anixon@tribunemedia.net

UBER representatives were yesterday revealed to have reached out to The Bahamas Livery Drivers Union (BLDU) in their attempt to bring the rideshare services to The Bahamas.

Taurian Austin, the union president, said preliminary talks were held with Uber executives this week. Although no commitments were made, he added that he is open to future meetings in a bid to gather more information to share with his members.

“We will sit to the table and hear,” Mr Austin said.

“We can't say at this time because we don't know all the details, but we are open to anything that helps us to improve our sector. This is 2026 and a digital platform of booking for transportation is the way moving forward. So whether it's Uber or any other digital platform, we are willing to sit and listen and hear what they have to offer. And it may be something that we might be interested in. Like I said, I can’t say at this time what we would do, but we will definitely listen.

“They have reached out to us. We had a meeting with a group of Uber representatives already earlier this week. And I guess it

Gov’t seeks approval on $150m LNG credit

BY NEIL HARTNELL

Tribune Business Editor nhartnell@tribunemedia.net

THE Government yesterday sought parliamentary approval to guarantee almost $150m in letters of credit and credit facilities that will underpin its share of the financing for liquefied natural gas (LNG) supply and the Clifton Pier regasification terminal.

Jobeth Coleby-Davis, minister of energy and transport, told the House of Assembly that 57 mega watts (MW) of former rental generation units

based at the Clifton Pier power station will be converted to use the cheaper, cleaner LNG fuel source this year. She added that the units involved are now covered by a power purchase agreement (PPA), meaning that BPL only has to pay for energy it actually uses and no longer has to cover fuel costs. She added that, once phase two of the regasifiaction terminal is completed, the extra storage tanks and vaporisers will increase LNG generation capacity

on the former Minnis administration by asserting that it - not the Davis administration - was responsible for BPL under-recovering its fuel costs, which forced the

utility to increase its fuel charge by 163 percent in just eight months by mid-summer 2023 and the Government to

Chinese law to govern $195m hospital loan

• Arbitration location Beijing if disputes arise

• Minister pledges ‘50:50’ role for Bahamians

• Contractors chief hails ‘step in right direction’

BY NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

CHINESE law will govern the bulk of the financing for New Providence’s $268m second hospital, it can be revealed, with any disputes between the lender and Bahamian government settled in Beijing if negotiations fail.

The concessional loan agreement, which stipulates the terms and conditions upon which the state-owned China Export-Import Bank will release $195m to fund the new hospital’s construction, stipulates: “This agreement, as well as the rights and obligations of the parties hereunder, shall be governed by and construed in accordance with the laws of China.”

The deal, which was signed by Prime Minister Philip Davis KC in his capacity as minister of finance on December 30, 2025, and tabled in the House of Assembly yesterday, appears unusual in its choice of governing law. Virtually all past commercial and financial agreements that involve the Government and Bahamas-based assets typically select Bahamian law, and this nation, for any disputes that arise.

And, should such differences erupt over the 50-acre, Perpall Tract-based hospital, and negotiations not be successful, it is Beijing - not The Bahamas - where the Government and bank, which also financed the Baha Mar project, will head to.

“Any dispute arising out of, or in connection with this agreement, shall be resolved through friendly consultation,” the loan deal states. “If no settlement can be reached through such consultation, each party shall have the right to submit such dispute to arbitration. Each party shall have the right to submit such dispute to China International Economic and Trade Arbitration Commission (CIETAC) for arbitration.

PHILIP DAVIS KC

JOBETH COLEBY-DAVIS

Union leaders still seek overtime as nurses back

BY ANNELIA NIXON Tribune Business Reporter anixon@tribunemedia.net

UNION leaders yesterday said they are still working to obtain overtime payments for their members from the Public Hospitals Authority (PHA) even as nurses returned to work following a sick-out last week.

Muriel Lightbourn, the Bahamas Nurses Union president, said that - while it was promised monies would be disbursed by Thursday - nurses were still receiving cheques and payment as of Tuesday this week. The PHA last week said it would expedite the process with payments issued through a direct payment system because they fall outside the regular payroll cycle.

“The nurses, they would have received their overtime pay,” Ms Lightbourn said. “They would have been paid in cheques. Praise the Lord that has been ongoing. And there were some persons who would not have received their cheque, but it's been confirmed that their cheques would be issued to them in short order.

“And so everybody is content, and everybody is

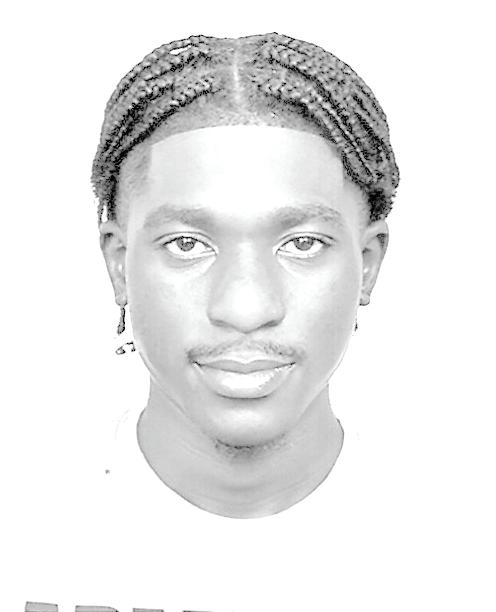

KIMSLEY FERGUSON

satisfied, and they're back to work. Actually, they were back to work from Monday. We went back to work on Monday in good faith that they would have been paid. And everything is going well. No complaints so far. Even though they would have said that we would have received the cheques as of Monday, the nurses did not receive the cheques until yesterday.”

Kimsley Ferguson, the Bahamas Public Service Union (BPSU) president, said his union has been in communication with

the PHA and, while talks about January's overtime are ongoing, he is satisfied with the results for December’s pay period. However, Mr Ferguson said he has advised his members not to work any more overtime until all outstanding payments have been settled.

“Yesterday I got quite a number of calls. Persons have collected cheques for that pay period, which was December, and the distribution is ongoing. I can't say it's going without incident or little hiccups, but that is to be expected. But we believe that if we both put our heads together, we'll be able to work it out and get it sorted,” he said.

“And, initially, the BPSU was the one who initiated this action concerning the overtime pay, and we have been in discussions with the PHA and we're satisfied to a great extent that persons are going to be paid for the December overtime period. And we are still in discussions about satisfying January's overtime. We have advised our members, members of our bargaining unit, to cease and desist from working overtime until such time as all the outstanding overtime is satisfied.”

When asked if she was concerned about further

issues with overtime payments, Ms Lightbourne said Dr Michael Darville, minister of health and wellness, said a plan was in place to ensure a situation like this does not happen again.

“The thing about it is, I believe the minister would have mentioned that they would have put things in place,” she said. “In his report, he said that they would have put things in place to avoid something like this from happening. And so, again, we just hopeful that this kind of thing does not happen.”

Dr Darville, in a voice note circulating online over the weekend, said: “I assure all impacted that new financial and IT measures are in place not only for rapid response but to prevent something from this happening again.”

However, Ms Lightbourn said she hopes to meet with Dr Darville to discuss overtime payments for nurses in the Department of Public Health (DPH), which date back to January 2025.

“My only thing is with PHA, we're going to be speaking with the minister,” she said. “I'm hopeful I will be able to meet with the minister to rectify the situation for the nurses in the Department of Public Health. Those nurses have

had outstanding overtime. Some way back as January of last year. And so we're hoping that those things could be rectified with the minister in short order, so they don't have to be compromised as well.

“They're not receiving their overtime, and so we're going to be speaking with the minister in regards to that, and hoping that they could resolve that and make overtime for the nurses in DPH as smooth as the overtime payments for the nurses in Public Hospitals Authority.

“I will be reaching out to him so I can get a meeting with him to see if I can get the same procedure or protocol that he said that he would put in place for PHA for the Department of Public Health nurses, because as we speak, there are nurses in the Department of Public Health who are still waiting on overtime payment from as far back as January 2025, and so we need to come to a resolution with that. Because the nurses in DPH, they are nurses as well. They have their families, and their situation is basically the same as with PHA. So we need to get I'm that resolved.”

Representing the porters, groundsmen, engineering staff, auxiliary

nurses, patient care attendants, lab staff, those in the morgue, radiology, records office and administrative persons, Mr Ferguson said he has presented to PHA outstanding overtime that dates back to Hurricane Dorian.

“We also presented to the PHA some overtime that was outstanding since Hurricane Dorian. And so we are waiting for a response on that. We would have been advised that the PHA is in talks with the Ministry of Finance to ascertain funding to address those outstanding concerns. And so our dialogue is continuing.”

On Tuesday, the PHA advised the public that outpatient clinic services including the eye clinic and speciality clinics - the medical clinic, surgical clinic and ENT clinic - would resume normal operations as of yesterday.

It said elective surgeries have also resumed and patients who were impacted by cancellations are being contacted about appointments. The announcement followed temporary service adjustments at the Princess Margaret Hospital and the cancellation of elective surgeries as it attempted to manage staffing levels due to the sickout.

Gov’t and Opposition battle over BPL rental generation

BY FAY SIMMONS

THE Prime Minister and Opposition leader yesterday sparred over the amount of rental generation currently employed by Bahamas Power & Light (BPL).

Philip Davis KC said that instead of spending on temporary measures, with the cost passed on to taxpayers and consumers, the Government is moving to provide permanent solutions to the country’s energy woes.

“Rental generation, intended as a temporary emergency measure, had become a routine feature of the system, diverting tens of millions of dollars each

year toward short-term fixes instead of permanent solutions. These costs were ultimately borne by consumers and by the public purse.

Tens of millions to rent generators,” said Mr Davis.

However, Michael Pintard, the FNM leader and Marco City MP, claimed that the cost and reliance on rental generation have actually increased under the current administration.

“My recollection is that the Prime Minister is seeking to mislead the public in that, while under our administration, what rental generators employed in the total mix to provide power to the Bahamian people, those figures have gone up under his administration in terms of what they are paying for

rental generation,” said Mr Pintard.

Jobeth Coleby-Davis, minister of energy and transportation, fired back by asserting that the Davis administration has actually reduced rental generation by ending three rental contracts that were put in place previously.

She stressed that the real problem it inherited was the absence of a serious energy reform plan, poor maintenance, and no attention to “N-minus-two” backup planning - meaning there was no proper system to ensure other generators could carry the load if one failed.

Due to these issues being ignored, Mrs Coleby-Davis said the Government had no choice but to rely

on rental generations in the short-term to keep electricity flowing to the Bahamian people while simultaneously working to fix the deeper structural problems in the BPL system.

Mr Pintard argued that the Davis administration has actually spent more on rental generation from a particular supplier, and noted that paying for rental generation was done in the same way for several years under the previous administration.

“The figures suggest that you paid more money for more rental generation from a particular supplier, and again, you are misleading the public. if you don't clarify that you have done the same thing for several years. That's no different than the

former administration,” said Mr Pintard. Mrs Coleby-Davis, however, argued that when the economy grows electricity demand naturally rises, but as there was little economic growth under the former administration it never prepared for increased demand and the Davis administration has to both meet the higher demand from growth and fix the problems left behind.

Minister and Opposition chief battle on fuel hedge

By FAY SIMMONS Tribune Business Reporter jsimmons@tribunemedia.net

A CABINET minister and the Opposition’s leader yesterday battled over which administration was responsible for the Bahamas Power & Light (BPL) fuel hedging fiasco that caused electricity bills to spike in 2023.

Jobeth Coleby Davis, minister of energy and transport, yesterday asserted that the Davis administration met BPL owing a $110m debt to fuel suppliers due to the former Minnis administration executing a failed fuel hedging strategy.

Speaking in Parliament, she alleged that under the former Minnis administration the cost of the hedge was not passed on to customers via the fuel charge, while electricity rates were kept artificially below cost, creating a significant shortfall.

“Because the hedged fuel volumes could not be fully utilised as intended, the hedge costs were ultimately absorbed into the fuel charge to customers.

During this period, electricity rates were artificially held below cost-recovery levels, resulting in significant under-recovery. This under-recovery accumulated over time and led to BPL owing approximately $110m to fuel suppliers,” said Mrs Coleby Davis.

“Remember that $100m bill we encountered as soon as we took office? This was a direct result of their decision to maintain a fuel hedge rate, even after it was evident that their hedge strategy had failed due to the poor condition of the plant.

“Yet they claim to be responsible, banging on the table and demanding that we renew a failed hedge at the cost of $30m while we also had to come up with $100m to cover a bill they created by setting an artificial rate that misled people into thinking power bills were lower than they actually were.”

Michael Pintard, the Opposition leader, however denied that the former Minnis administration had any outstanding arrears with fuel suppliers and implied it was the Davis administration that accumulated the debt.

“When the PLP came to office in September 2021, BPL did not, contrary to what was said on their feet, did not owe $100m. BPL did not owe $100 million in fuel charges. BPL was current with the fuel bill. The minister should put on the table proof that BPL had a $100m fuel bill in September of 2021; we'd like to see the bill,” said Mr Pintard.

“We do know that they had to lend BPL $110m, so that tells you something. But that's after they came to government. So I believe it's the minister and her colleagues who ran up a $110m fuel bill.”

Mr Pintard explained that under the he previous administration, money was supposed to be set aside in an “over/under” account as part of a fuel hedging strategy to protect against fluctuations in global fuel prices, which would have allowed electricity rates to stay at 10.5 cents per kilowatt hour (KWh).

He said the Davis administration ignored advice

from its own BPL Board to execute the necessary trade and, by cancelling the hedge, fuel costs rose. BPL could not cover the cost, and this led to the $110m debt to fuel suppliers.

“What the minister said was a complete falsehood. The arrears that accumulated on the fuel were accumulated under the Progressive Liberal Party because they cancelled the hedge. That's what they did,” said Mr Pintard. “The only people who repressed prices is this administration. They repressed the prices.”

Mrs Coleby Davis argued that BPL’s fuel usage forecasts were very different from reality, which caused the hedge to fail financially.

She explained that BPL’s Clifton Pier plant was using far less heavy fuel oil (HFO), and far more dieseld fuel, than expected. Since the hedge was based on the forecast fuel mix, the mismatch between projected and actual usage created a cost burden - even though the hedge itself was executed -because the calculations were tied to the wrong assumptions about fuel consumption.

“I also inquired with BPL to provide me in numbers what actually occurred and what actually they had forecasted. And so their modelled forecasting was 957,726 barrels of HFO,” Mrs Coleby Davis said. “Their actual was 336,656, and the model was supposed to be 51 percent usage of HFO and the actual was 18 percent HFO.

“Let me explain that again. So the model HFO usage was 957,726. The model prediction for ADO

(automotive diesel oil) was 427,725. The actual ADO was 1,044,571. The model was 23 percent ADO;the actual was 54 percent,” said Mrs Coleby-Davis.

“When I spoke about the state, the state of the plant ties back to the failure. And so the member spoke about the financial hedge, right? You have to hedge with something, your costing, your breakdown, your projections, are still attached to what you model your usage as, and so that's where the skew happened.

“That's where the cost burden came. Because even though you holding the huge hedge fuel rate, which you think is still working, it was not. You were suppressing the actual, and you were just going based on the model, the prediction. The actual showed the true numbers, and that's where we had a difference.”

Mr Pintard, however, maintained that $30m was saved under the hedge programme and this was projected to grow to $55m if the hedge continued.

“First of all, your demand increases, and you are supposed to be a responsible government. When you are an irresponsible caretaker, the responsible government has to improve and increase the demand for a growing economy, while also fixing the irresponsibility of the former caretaker.

“And so there was irresponsibility and there was negligence, and they ignored it but it was because there was no growth under them. So because there was no growth under that administration, they didn't know they had to prepare for demand growth.”

“I just wanted to clarify that when you have an increase in demand, when you have a growing economy, when you have done so much in the country to improve investments, to improve households, so much construction going on to improve businesses, so much businesses open. Your demand increases,” said Mrs Coleby-Davis.

“Lay the document. I've asked the minister to lay the proof that there was $100m arrears when they came to office, and we expect that she or the Prime Minister would be able to bring those figures back, or by the end of that should be a simple figure that somebody should be able to send to them,” said Mr Pintard.

“[The letter was sent] showing $30m earned under that programme, and then $55m that was projected to be earned if they had continued the hedge.”

Village Premium Office Space for Lease

850 sq.ft. 3 offices, reception, conference room, kitchen $2,125.00 pm. plus CAM and VAT

1,072 sq. ft. 4 offices, conference room, reception, kitchen $3,126.66 pm. plus CAM and VAT

Contact Mr. Sean McCarroll 359-2957

Email: sean@mccarrollrealestate.com

Refinancing risk is main Gov’t debt ‘vulnerability’

FISCAL - from page B1

“Collectively, these measures are projected to strengthen the overall fiscal surplus from 0.5 percent to an average 1.7 percent of GDP over the medium-term, with primary balances averaging 4.8 percent of GDP,” the Ministry of Finance added.

Meanwhile, the moderated debt reduction forecast is directly tied to the Government’s reduced annual Budget surplus predictions, which have been lowered from the $448.2m to $467.9m range stated in last year’s medium-term debt strategy report. These have been revised downwards to $75.5m for the current fiscal year, before rising to a narrow range between $291.4m and $309.8m for the Budget periods between 2026-2027 to 2028-2029.

The four debt management strategies examined by the Government are predicted to cut its direct debt, which stood at $11.769bn at end-June 2025, by between $476m and $519m over the four-year period that will

close at end-June 2029. Ironically, the Ministry of Finance’s chosen preferred strategy, that of “reducing refinancing risks by increasing portfolio maturities” through accessing “multilateral and bilateral” funding, is forecast to produce the smallest $476m reduction.

All four strategies were estimated to cut the Government’s Bahamian dollar debt by between $876m to $1.185bn, with only the preferred model achieving the latter figure. In contrast, foreign currency borrowing is forecast to increase by between $374m and $708m, with the difference between the two sparking the overall Bahamas national debt reduction.

“A negative figure represents an overall debt repayment, which means that for this representative instrument there were more repayments than disbursements,” the Government’s medium-term debt management strategy affirmed.

“Over the three-year medium-term debt management strategy timeframe, the economic outlook envisages moderate growth

Taxi chief: ‘Selling’ to public service drivers a problem

DRIVE - from page B1

was just an open dialogue of conversation. No commitments, nothing internal. But they are on the ground, and we had a meeting with them. It’s something that we’ll have to take to the body in one of our meetings and hear their feedback and what they may be interested in.

“I don’t want to speak for the entire group at this time. It was only preliminary talks. Nothing to go back with yet. That would be something I’ll have to go back to my drivers, the

livery union members, with and see if that’s something that may interest them. And, in all fairness to them as well, they would want to know the details. It sounds good, but they will have to know the details on how it works, how it benefits them, all the ‘t’s’, the ‘i’s’ etc, how it all works out. And we don’t have that information yet.”

Tyrone Butler, the Bahamas Taxicab Union leader, who last week said the offer proposed by Uber was “soundly rejected” by his membership, told Tribune Business yesterday that he does not have a position

momentum, with real GDP poised to average an estimated 1.8 percent, which is consistent with the projected long-run potential.”

The Ministry of Finance has thus revised The Bahamas’ economic growth prospects upwards from the 1.6 percent detailed in last year’s report.

As for the fiscal outlook, the current report released yesterday added: “Enhanced tax administration, targeted tax policy measures and judicious cost containment controls are forecast to reduce the overall deficit-to-GDP ratio to the medium-term statutory target of 0.5 percent [deficit] in 2024-2025, and secure surpluses averaging an estimated 1.7 percent of GDP over the medium-term debt management strategy.”

Rollover, or refinancing, risks were cited as the greatest debt “vulnerability” facing the Government with $3.098bn worth of liabilities coming due over the nine months between October 2025 and endJune 2026. This represents debt that either has to be repaid to lenders/investors, or refinanced through the issuance of new securities to replace those maturing. Given that the Government lacks the free cash flow to repay such substantial

on whether the rideshare service becomes part of the transport industry in The Bahamas. Mr Butler’s response came after businessman Mac Macklin said he was in talks with Uber’s corporate headquarters in the US to launch it in The Bahamas despite the taxi union’s objection.

Mr Macklin said he will move his plans forward by appealing to taxi drivers who are not part of the union. Mr Butler said Mr Macklin’s “problem” will be selling “the programme to the public service drivers”. He added: “The problem for him is he has to now go out and sell the programme to the public service drivers, particularly the taxi drivers, who are the only persons that they could use.

debt, all will have to be rolled over - something it has successfully managed to do thus far. Of the more than $3bn coming due over this period, the bulk - some $2.243bn - represents Bahamian dollar securities, most of which are likely to be short-term Treasury bills rather than longer-term Bahamas registered stock bonds.

The remaining debt coming due before June 2026 consists of $476.5m in foreign currency loans and $378.4m in Bahamian dollar borrowings. “Refinancing risk is the main source of vulnerability in the Bahamas’ debt portfolio, given the share of short-term domestic financing instruments - 15.9 percent of the portfolio,” the debt management strategy said.

“Refinancing risk remained moderate in the Government’s debt portfolio with the average time to maturity improving to 6.61 years at end-June 2025.” The Government’s $1.067bn external bond issue last year increased the average maturity of the Government’s foreign currency debt by 1.7 years to 6.9 years by taking out liabilities due to mature in the short-term and pushing the repayment date for the new securities further out.

“So if [there are] taxi drivers who want to engage his proposal, they’re free to do that. We don’t control them in the sense that we don’t tell taxi drivers what they can and cannot do because they’re independent operators that belong to the union. We give voice to their concerns, and we speak on behalf of them, whether they’re union or not, because we’re the official voice for taxi recognised by the Government.

“It sounds dramatic but nothing changes actually for us... I mean, in some case, the only persons that can offer that service is taxi drivers anyway. So it is not a service that’s going to be where some locals who want to make extra monies can go and sign up and become an Uber driver. Their company don’t have the luxury of engaging private citizens or private drivers; they have

This reduced the proportion of the Government’s foreign currency debt, which was due to come due within one year, from 31.58 percent to 9.38 percent. However, 42.28 percent or nearly half of its Bahamian dollar debt, was due to mature within one year. But, aided by exchange controls that help to create a captive investor market, and the absence of alternative investments, ensured demand for Bahamian dollar securities remains strong. During the 2024-2025 fiscal year, some $5.489bn in new Government debt securities were issued in the Bahamian market with some $5.063bn in redemptions taking place - an amount equal to 92.2 percent of issuances. “This outcome reflected an 8 percent contraction in gross issuance volume, attributable primarily to the replacement of the oneyear Bahamas Registered Stock with a 364-day Treasury Bill effective March 2025,” the report said.

“Investor participation patterns further demonstrated sustained market confidence. The Bahamas Registered Stock segment recorded an average absorption rate of 85 percent, reflecting selective

to use taxi drivers, or people with public service badge or maybe a livery driver, or somebody like that,” Mr Butler said.

“I mean me personally, I don’t have a position in terms of whether it should be or should not be. There are a lot of benefits based on what was explained to us that seem to be, on the face of it, seem to be very lucrative for taxi drivers on some things that were proposed. But, again, it’s the choice of the drivers, and the drivers tell us that that is something they don’t want us to pursue, and they want us to reject it. And we are obligated to speak their concerns to the people that are doing it. And that’s what we did.”

While the union’s members oppose a partnership with Uber, Mr Butler said some taxi operators - both seasoned and new to the

investor positioning towards medium and longer-term tenors. Conversely, Treasury Bill subscriptions exceeded offering sizes by approximately 30 percent, reflecting strong investor demand volumes for government paper.”

Some 101 trades involving government debt, involving a total 36,974 securities worth a collective $3.7m, took place on the secondary market in 2024-2025. The Ministry of Finance, meanwhile, said international capital market conditions for The Bahamas’ foreign currency debt issues are continuing to “normalise” aided by last year’s $1.067bn placement. “The Bahamas’ yield curve performance has strengthened with the 2032 Eurobond yield declining by 1,070 basis points (1.07 percentage points) to 6.67 percent and the synthetic 10-year US dollar yield dropping by 670 basis points since August 2022 to 7.35 percent,” the report added. “Nevertheless, alternative external funding sources remain comparatively more attractive than the Eurobond market until further easing in US dollar yields occurs”.

industry - have expressed interest in working with Uber. “It’s changing in the industry,” he added. “We’ve seen a lot of new drivers come into the industry, and they bring a different mindset. We still have a lot of veteran drivers that have been around and their mind is set, and they’re set in their ways. And so we just don’t know which way the pendulum is going to swing.

“Based on our conversation with some, we’ve had one or two individuals, veterans, who say they don’t have a problem with it. They’ll be prepared. And we have some young people who said the same thing. And it’s the same thing. Some young people say they’re not into it. But you just don’t know. I mean, as I said, the industry right now is changing.”

to 161 MW. The addition of a permanent jetty at Clifton Pier, to facilitate bringing LNG from ship to shore, where it will be converted back from liquid to gas form, will further increase generation capacity to 172 MW before the ultimate 190 MW goal is hit in the final phase.

While Mrs Coleby-Davis provided no timelines for the LNG roll-out, she said the termnal site is currently being prepared for development. The Government is partnering with Shell North America on its construction, development and operation, and one of the $30m “performance letters of credit” securing the Government’s obligations for the terminal and LNG supply is destined for the global energy giant.

The other is for New Providence Gas Ltd, a special purpose vehicle (SPV)

owned by the Government, and which will acquire the LNG supplied by Shell. A $99m credit facility will provide the Government and terminal project with working capital to mitigate “liquidity and emergency borrowing risk” for the Government. Elsewhere, Mrs Coleby-Davis touted findings from the International Monetary Fund (IMF) that BPL is “on track” to pay off its $500m debt within six years and “eliminate the historic $476m imbalance between the Government of The Bahamas and BPL”. She added that BPL’s annual rental generation costs have already been cut by $1.5m through the end of three such contracts, and both the Government and state-owned utility are targeting up to $24m in yearly savings through phasing out a further 13 arrangements and eliminating rental generation.

Mrs Coleby-Davis also asserted that, under BPL’s new tariff structure, “on average” 44 percent of residential customers had enjoyed electricity bills that were 15 percent lower than they would have been under previous pricing arrangements. She added that this applied to around 42,000 customers and added: “If we use a 5 percent savings gauge, on average 82 percent or 78,252 customers were positively impacted.”

The minister also said 30 percent of BPL residential customers received bills lower than $125 in the summer, with this percentage increasing to 80 percent in winter.

The Prime Minister, meanwhile, said the Government is working to develop solar and hybrid microgrids, which will make power more reliable and reduce reliance on diesel. He said rental generators are being phased out, with full elimination planned by 2028, which will save millions of dollars annually.

“Across New Providence and the Family Islands, solar and hybrid microgrids are

being developed with Bahamian partners to improve reliability, reduce diesel dependenceand enhance resilience in communities that have historically borne the brunt of outages,” Mr Davis said.

“At the same time, rental generation is being phased out, with full elimination targeted by fiscal year 2028.

In two years, we will say goodbye to the rentals and replace them with permanent solutions, saving tens of millions of dollars each year.”

Mr Davis said that, by late 2027, integrating LNG and 23 solar and microgrid projects across the Family Islands will add nearly 200 MW of reliable, low-carbon power, including 97 MW of solar with battery storage.

“As LNG is integrated into our fuel mix, we are projecting approximately 190 MW of natural gas generation capacity by late 2027. At the same time, 23

microgrid and solar projects are being developed across the Family Islands, delivering close to 200 MW of new generation capacity by 2027, including 97 MW of solar power paired with battery storage,” he added.

Mr Davis said upgrades to the New Providence grid have already been effective, with outage frequency cut by 45 percent and outage duration by 35 percent.

“In New Providence, foundational grid upgrades delivered a 45 percent reduction in outage frequency and a 35 percent reduction in outage duration in 2025 compared to historic averages, with smart grid devices preventing tens of thousands of customer interruptions,” said Mr Davis.

“These are not projections. They are recorded outcomes that demonstrate what disciplined investment and system reform can achieve.”

provide it with a $110m loan to keep it afloat financially.

Mrs Coleby-Davis, asserting that BPL’s generation plant had to first be fixed before the Davis administration could execute the latest fuel hedge, told Parliament:

“Only then did we proceed to hedge. We executed a hedge covering 2.5m barrels of oil at a $65 strike price with the premium at $3.68 per barrel.”

The all-in price of $69, she argued, compared favourably with the first fuel hedge implemented in 2020, which was for a “strike price” of $50 per barrel and $8.99 premium. The final hedge, which was proposed but never executed in September/October 2021 after the Davis administration took office, was for the same $50 per barrel price but the “premium” had increased to $19 per barrel.

“This hedge provides real usable protection against unexpected fuel price risk, preserving transparency and tariff integrity,” Mrs Coleby-Davis said. “This approach shields consumers from global fuel price shocks, avoids unnecessary pass through, inflated tariff pricing, eliminates artificially suppressed rates and aligns financial instruments with system capability.

“There’s no illusion or deferred liability. Rates reflect reality. Risks are disclosed and managed, and fuel cost protection is assured in operational systems. This is disciplined governance. Fix the plant first. Hedge second, and negotiate from strength not” weakness.

Her stance was echoed by the Prime Minister, who said the latest hedge - executed in December 2025 - was designed to give Bahamian businesses and households a degree of protection against potential volatility in their

energy bills and the fuel charge component, due to global oil price spikes, amid the transition to lower-cost LNG fuel and renewables.

“A fuel hedging strategy executed in December 2025 now provides 365 days of protection against fuel price volatility, covering approximately 2.5m barrels of fuel oil as the transition to LNG and new generation assets proceeds,” Mr Davis said. “This is what it looks like when you execute a hedge correctly and fix the foundational issues before you implement it. Fiveyear forecasts put BPL on track to eliminate its debt within six years and close the long-standing current account imbalance between the Government and the utility.”

However, both he and Mrs Coleby-Davis chose to revisit the past and turn the tables on the Opposition who have consistently argued that electricity prices soared between October 2022 and February 2024 because the Davis administration failed to execute the next in a series of rolling trades needed to secure more cut-price oil to support the hedge and relatively low BPL fuel charge. They argued that the Minnis administration effectively ‘put the cart before the horse’ by implementing fuel hedging before BPL’s infrastructure was ready to extract the benefits. Mrs Coleby-Davis said the original 2020 hedge was based on the utility using cheaper heavy fue oil (HFO) as its primary generation fuel.

However, she argued that problems with BPL’s “boiler integrity” meant that the HFO could not be heated consistently to the required state, or “viscosity”, for its Clifton Pier engines to use it sufficiently. And challenges with other “ancillary systems”, including cooling, worsened these problems

and forced BPL to burn the more expensive automated diesel oil (ADO).

These extra costs, she argued, meant that the financial savings and benefits from the fuel hedge were never fully realised by BPL’s consumers. And Mrs Coleby-Davis said these problems were compounded because it was the former administration, not this one, that had held BPL’s fuel charge at an “artificially low” rate where the utility was unable to recover the greater-than-anticipated fuel costs.

This, she argued, led to the “under-recovery” that sparked the 2022-2024 “glide path” strategy and $110m loan to BPL from the Government to help it cover and pay-off the unpaid fuel bill owed to Shell.

This was earlier echoed by Mr Davis yesterday, who said: “Under the previous administration, a fuel hedging strategy was executed based on the use of heavy fuel oil. In principle, hedging can be a responsible financial tool when it is aligned with operational capacity and infrastructure readiness.

We have no issue with hedging when done correctly. It is essentially a way to lock in fuel prices to manage volatility, not to gamble on the market. Prices rise and fall, but hedging helps smooth those swings and provide more predictable costs over time. It is a viable solution when done correctly.

“But the FNM did not do it correctly. At the time, some of the Wartsila engines that were supposed to utilise heavy fuel oil were offline,” he added. “Those were the engines that were going to use the heavy fuel oil. If you can’t use the fuel, then the savings you would have gotten from using that fuel, you don’t get any more.

“Furthermore, these engines were not tri-fuel as promised, further limiting their capacity. As a result, even when market conditions moved favourably, Bahamians saw limited benefit because the system

was incapable of converting those favourable prices into lower costs.

“The hedge existed on paper, but the engines required to realise its value were not in service,” Mr Davis continued. “That experience underscored a critical lesson for this administration.

“Financial instruments cannot compensate for broken or unavailable infrastructure. Savings projected in spreadsheets do not necessarily translate into relief for households unless the system itself is capable of performing.

“Any credible reform has to begin with restoring operational capacity before layering on sophisticated financial strategies. If you don’t do it this way, you end up like the FNM: bragging about savings that only exist in promises and plans, but never materialize in electricity bills. This country needed more than just a hedge.”

Tribune Business records show that Mr Davis and Mrs Coleby-Davis are partially correct in that the unexpectedly heavy ADO use reduced the savings and benefits of the Minnis administration’s hedge. But the spike in BPL prices and the fuel charge occurred under their administration’s watch after they failed to execute the necessary trades to support the hedge, and it was also the Davis administratin that kept the latter “artificially low”.

Shevonn Cambridge, BPL’s former chief executive, in a July 30, 2023, report to Mr Davis and Alfred Sears KC, then-minister of works and utilities, revealed the hedge was “in the money” even though fuel woes “substantially ate into the benefits”. He signalled the former Minnis administration’s fuel hedging strategy had generated savings for consumers that were sufficient to offset the utility’s greater-than-predicted use of higher cost fuel.

The report, which reviewed issues impacting operational performance

at Clifton Pier’s ‘Station

A’, said BPL’s hedged fuel price depended on the seven Wartsila engines that it housed “providing substantially more energy than they did” as well as using a fuel mix that was 60 percent weighted in favour of HFO.

That is cheaper than ADO which, according to Mr Cambridge was supposed to only meet 40 percent of the Wartsila engines’ needs under BPL’s fuel hedging strategy. However, that 60/40 mix intended to support the utility’s 10.5 cents per kilowatt hour (KWh) hedged price, which was locked in from summer 2020 to October 2022, was never achieved in any of those years.

“The units operated on 25 percent HFO and 75 percent ADO in calendar year 2020; 32 percent HFO and 68 percent ADO in calendar year 2021; and approximately 50 percent HFO and 50 percent ADO in calendar year 2022,” Mr Cambridge wrote to Mr Davis and Mr Sears.

However, according to BPL’s then-chief executive, who was not in the post when the fuel hedging strategy was executed, while the more expensive costs associated with this undesired fuel mix squeezed and slashed the anticipated savings for consumers it did not eliminate them entirely.

“Luckily, the fuel hedge placed at that time was in the money,” Mr Cambridge wrote. “However, the adverse generation fuel mix substantially ate into the benefits realised from the hedge.”

The Davis administration previously described the BPL fuel hedge initiated by its predecessor as not being worth the paper it was written on. It had also argued that it had to prioritise repayment of a $246m BPL loan that was falling due in early 2022, with no funds allocated for this purpose, and thus there was nothing available to finance further hedged fuel purchases.

With fuel hedging, utilities such as BPL typically do not

lock-in a price that secures 100 percent of their needs. This is done to minimise risk, cost and exposure in case they find themselves on the wrong side of an unexpected oil price move. As an example, they may hedge 80 percent of their fuel needs for the first year, 50 percent in the second and 30 percent in the third.

The Davis administration elected not to execute the trades that would have secured the extra cut-price oil volumes necessary to fill in these missing percentages to cover 100 percent of BPL’s fuel needs. However, they also held BPL’s fuel charge at the original 10.5 cents per kWh for a further 12 months until October 2022 even though - without the extra hedged volumes - the actual fuel costs were considerably more.

This compounded the fall-out from the earlier decision not to support the original hedge. The Government effectively subsidised BPL to ensure the 10.5 cents price could be maintained, which is something that the regulations accompanying the Electricity Act prevent it from doing, as fuel costs are supposed to be 100 percent passed through to the consumer.

The Government’s need to recoup its $110m loan, and reclaim the under-recovered fuel costs, caused the electricity monopoly’s fuel charges and overall bills to spike well in excess of market costs from October 2022 to February 2024. This ultimately represents a major wealth transfer from Bahamian businesses and households to the oil companies.

Tribune Business records also show that BPL attempted in February 2022 to raise its fuel charge by 3.2 cents to 13.7cents per kWh. However, this move was vetoed by the Davis Cabinet which elected to hold the fuel charge at 10.5 cents for a further eight months until October 2022, further compounding the under-recovery.

“The arbitration shall be conducted in accordance with the CIETAC’s arbitration rules in effect at the time of applying for arbitration. The place of arbitration shall be in Beijing. The arbitral award shall be finding and binding upon both parties.”

Dr Michael Darville, minister of health and wellness, in messaged replies to Tribune Business over the choice of governing law and arbitration forum, suggested that the fact this was “a government-to-government” loan may have influenced the selection but he would have to check with the Government’s legal advisers.

“This is a concessional loan facility with government to government, and not a commercial loan. I will speak with the legal team,” the minister added. The China Export-Import Bank loan is for a 20-year period with an attached interest rate of 2 percent, and a fiveyear upfront “grace period” on repayments.

The main contractor for New Providence’s second hospital is China Railway Construction Corporation, which “has a large footprint in the Caribbean and is currently building hospitals in Trinidad and Guyana”. Internet research by this newspaper shows it is described as a state-owned enterprise majority owned and controlled by the Beijing government, with its shares listed on the Shanghai and Hong Kong stock exchange.

However, the hospital contractor was among a group of Chinese entities that attracted Donald Trump’s attention during his first US presidential administration because of its historical origins and ties to the Chinese military. He issued an executive order banning Americans from

owning shares in these firms because of such links.

And the company has also been branded by Ukraine as an “international sponsor of war” because it has allegedly continued doing business in Russia following the February 2022 invasion, including building a tunnel connecting the annexed Crimea region.

However, the Bahamian Contractors Association’s (BCA) president yesterday hailed Dr Darville’s pledge that the ratio of Bahamian to foreign construction workers on the second hospital project will be “50:50”, or one local for each overseas employee.

Leonard Sands added that, while the industry would like to achieve a 60:40 ratio, where Bahamians are in the majority, the present division was a significant upgrade on previous Chinese projects.

Dr Darville also said the agreement with China Railway Construction Corporation calls for “skills transfer” to Bahamian workers, which Mr Sands described as “the real silver lining in the story” - provided it happens and can be enforced.

Arguing that this has not occurred on past foreign direct investment (FDI) projects, he suggested that one way to make it happen was for participating Bahamian contractors and workers to sign-up and be part of the National Apprenticeship Programme. The BCA chief said this would ensure that the skills transfer is monitored, and he also called for the Association to partner with the departments of labour and Immigration to enforce the worker ratio.

“In the contractors report, it confirmed that 50 percent of the workforce will be Bahamian and 50 percent of the workforce at this point will be foreign workers,” Dr Darville told

the House of Assembly. “I

must admit discussions are still ongoing for a better ratio of Bahamian construction workers.

“During the construction period an assessment team will operate on-site in collaboration with the Department of Labour and Immigration. This process will allow for continued monitoring of compliance, and skilled Bahamians will be qualified, assessed and, where necessary, referred directly to the contractor for employment. Let me make it very clear: Any violation of this agreement will result in fines to the contractor.”

Dr Darville also pledged that “on-site training programmes will also be implemented to ensure, on a project of this complexity, we have adequate transfer of knowledge.” The contract documents with China Railway Construction Company state: “The contractor shall endeavour to maximise the use of 50 percent of local labour, and maximise local resources as far as is practical, and shall ensure a measurable transfer of technology and/or skills to the local market.”

The minister, meanwhile, added that “concrete batching” will occur at the second New Providence hospital’s location, as well as off-site, “to ensure local construction companies get a piece of the pie”. And he explained that the aggregate generated on-site will be used for developing the parking lot and landscape as a means to reduce traffic congestion on nearby roads, minimise disruption and improve safety.

Dr Darville said the hospital’s construction will take an esrimated 36 months to complete following

ground-breaking, with con-

tractors set to arrive at the 50-acre site next week to begin its preparation.

China Railway Construction Corporation will have a post-construction “threeyear maintenance contract to satisfy all warranties” and, once it departs, a trained Bahamian workforce will be ready to take over.

Mr Sands yesterday branded the 50:50 Bahamian to Chinese worker ratio as “a step in the right direction”. He added: “We are also very encouraged by the ongoing negotiations to see that number improve.

We beliefve it’s because of the advocacy and relationship that seems to be growing between the BCA and the Government to seriously look at improving the number of local contractors and construction workers on FDI projects that we’ve come to such a place where agreements can be reached.

“Previous documents I’ve been able to find stated a 70:30 ratio [in favour of Chinese workers] so if we’ve got to a place of 50/50 the Government of The Bahamas should be congratulated. Because it’s a specialty hospital, and

not knowing enough about what is part of it, we’d be comfortable with 50/50. Ideally, it should be 60/40 because of the impact construction has on GDP, and with more people involved, but we’re satisfied with 50:50 ratio.”

The $73m hospital financing balance will come from domestic or international sources, or a combination of the two, and be arranged by the Ministry of Finance to secure medical equipment including laboratory gear, diagnostics and scanners.

JOIN OUR TEAM We are looking for

Job Description: Program Coordinator

Program: Local Sustainable Development in the Blue Economy (BHL1058)

Location: New Providence, The Bahamas (with field visits to Andros and Abaco)

Contract Duration: Full-time (minimum 8 hours/day), initial 24-month contract

About the Program

The Ministry of Economic Affairs is implementing a $30 million IDBfinanced initiative to promote sustainable growth in the Blue Economy, focusing on Andros and Abaco. The program aims to reduce businesses’ operational costs, develop blue economy clusters, strengthen human capital, and enhance marine protected areas. A dedicated Project Executing Unit (PEU) will be established by the Ministry of Economic Affairs to execute this Blue Economy loan.

Role Summary

The Program Coordinator leads the Program Execution Unit (PEU) responsible for implementing the loan program.

Key Responsibilities

• Lead and coordinate all program workstreams, including procurement, financial management, monitoring and evaluation, technical, and sectoral activities.

• Prepare annual operating plans, budgets, and schedules, setting targets and actions for each component.

• Ensure timely fulfillment of activities in alignment with approved multiannual operating plans and program objectives.

• Manage and oversee the PEU team, including the financial specialist and the procurement specialist.

• Coordinate with stakeholders, including government ministries, private sector, NGOs, and local communities.

• Report progress, provide expert recommendations, and serve as Executive Secretary to the Program Advisory Committee.

• Support beneficiaries and conduct due diligence for program participation.

• Liaise with organizations supporting MSMEs in the Blue Economy.

• Other duties as assigned.

Qualifications

• Bachelor’s degree in management, economics, legal, engineering, or similar fields.

• MBA or relevant postgraduate degree is desirable.

• Minimum 10 years’ experience in public or private sector, with at least 5 years in program preparation, management, evaluation, and administration.

• Experience with government, multilateral and/or donor organizations is an asset.

• At least 5 years’ experience managing MSME, private sector development, and sustainability activities.

• Demonstrated knowledge of business and private sector development in The Bahamas.

Skills

• Excellent customer relations and interpersonal skills.

• Strong analytical and problem-solving abilities.

• Outstanding oral and written communication skills.

• Proficiency in Microsoft Suite.

• Good judgment, sound reasoning, and effective time management.

Reporting & Supervision

• Monthly progress reports to the Ministry of Economic Affairs (MoEA)

• Timely submission of annual, semi-annual, and quarterly monitoring reports to the IDB

• Direct reporting to the Permanent Secretary, MoEA

Application Submission

· Email address: blueeconomypeu@bahamas.gov.bs

· Deadline to submit Cover Letter and CV/Resumé: February 15, 2026

Job Description: Procurement Specialist

Location: New Providence, The Bahamas (with field visits to Family Islands, especially Andros and Abaco)

Program: Local Sustainable Development in the Blue Economy (BHL1058)

Duration: 24 months, Full-time (minimum 8 hours/day)

About the Program

The Ministry of Economic Affairs is implementing a $30 million IDBfinanced initiative to promote sustainable growth in the Blue Economy, focusing on Andros and Abaco. The program aims to reduce businesses’ operational costs, develop blue economy clusters, strengthen human capital, and enhance marine protected areas. A dedicated Project Executing Unit (PEU) will be established by the Ministry of Economic Affairs to execute this Blue Economy loan.

Role Overview

The Procurement Specialist will be part of the PEU and manage and oversee all procurement processes for program implementation (planning, market analysis, tendering, supplier selection, negotiation, contract management), ensuring compliance with IDB and GOBH procurement policies and procedures and supporting the timely acquisition of goods,

services, and works with integrity, fairness, and the highest professional standards.

Reporting

The Procurement Specialist will report to the Program Coordinator and submit monthly reports to the MoEA.

Qualifications

Academic:

• Bachelor’s degree in Logistics, Procurement, Supply Chain Management, Engineering, Business Administration, Law, Public Administration, or related fields.

• Master’s degree or postgraduate certification in Logistics, Procurement, or Supply Chain Management is highly desirable.

• Professional certifications such as CIPS (Level 4 or above), Project Management Professional, or World Bank/IDB certification in procurement are an advantage.

Experience:

• Minimum 5 years of progressive procurement experience, including at least 3 years in public procurement or procurement under IDB or other MDB-financed projects.

• Experience in procurement planning, bidding, contract award, contract management, and supplier relationship management.

• Familiarity with development banks, government agencies, and procurement guidelines for IDB-financed programs or international best practices is an asset.

Skills:

• Excellent writing and communication skills.

• Strong analytical, problem-solving, and people skills.

• Proficiency in Microsoft Suite.

• Good judgment, reasoning, planning, organization, and time management.

• Strong customer relations.

Application Submission

• Email address: blueeconomypeu@bahamas.gov.bs

• Deadline to submit Cover Letter and CV/Resumé: February 15, 2026

Job Description: Financial Specialist

Program: Local Sustainable Development in the Blue Economy (BH L1058)

Location: Nassau, The Bahamas (with field visits to Andros and Abaco) Contract Type & Hours: Full-time, 8 hours daily; initial 24 month contract

About the Program

The Ministry of Economic Affairs is implementing a $30 million IDBfinanced initiative to promote sustainable growth in the Blue Economy, focusing on Andros and Abaco. The program aims to reduce businesses’ operational costs, develop blue economy clusters, strengthen human capital, and enhance marine protected areas. A dedicated Project Executing Unit (PEU) will be established by the Ministry of Economic Affairs to execute this Blue Economy loan.

Role Summary

The Financial Specialist will be part of the PEU and lead financial management for BH L1058, overseeing budgeting, payments, financial reporting, and expenditure monitoring. He/she is responsible for driving transparency, efficiency, fiduciary integrity, and ensuring full compliance with IDB Financial Management Guidelines, the Loan Agreement, the GOBH financial framework, and the Program Operating Manual (POM), including coordinating external audits.

Reporting

Submits monthly financial reports to the MoEA and the Program Coordinator.

Function oversight is provided by the MoEA and the Program Coordinator.

Qualifications

• Bachelor’s in Finance, Accounting, Business Administration, or related field (required). Master’s in Finance, Accounting, Business Administration, or related field (highly desirable).

• Professional accounting qualification (CPA, ACCA, CGA) is an asset.

• Minimum 5 years of experience in financial management, budgeting, reporting; proficiency with accounting software and reporting tools.

• Experience with government agencies and/or IDB financed program financial guidelines preferred.

Skills & Competencies

• Excellent writing and communication; strong analytical and problem solving skills; interpersonal effectiveness.

• Proficiency with Microsoft Suite; QuickBooks preferred.

• Sound judgment; time management; customer relations.

Application Submission

Email address: blueeconomypeu@bahamas.gov.bs

Deadline to submit Cover Letter and CV/Resumé: February 15, 2026

US wants to create a critical minerals trading bloc with its allies to counter China

By DIDI TANG, JOSH FUNK and MATTHEW LEE Associated Press

THE Trump administration announced Wednesday that it wants to create a critical minerals trading bloc with its allies and partners, using tariffs to maintain minimum prices and defend against China's stranglehold on the key elements needed for everything from fighter jets to smartphones.

Vice President JD Vance said the U.S.-China trade war over the past year exposed how dependent most countries are on the critical minerals that Beijing largely dominates, so collective action is needed now to give the West self-reliance.

"We want members to form a trading bloc among allies and partners, one that guarantees American access to American industrial might while also expanding production across the entire

zone," Vance said at the opening of a meeting that Secretary of State Marco Rubio hosted with officials from several dozen European, Asian and African nations.

The Republican administration is making bold moves to shore up supplies of critical minerals needed for electric vehicles, missiles and other high-tech products after China choked off their flow in response to President Donald Trump's sweeping tariffs last year. While the two global powers reached a truce to pull back on the high import taxes and stepped-up rare earth restrictions, China's limits remain tighter than they were before Trump took office.

The critical minerals meeting comes at a time of significant tensions between Washington and major allies over President Donald Trump's territorial ambitions, including Greenland,

and his moves to exert control over Venezuela and other nations. His bellicose and insulting rhetoric directed at U.S. partners has led to frustration and anger.

The conference, however, is an indication that the United States is seeking to build relationships when it comes to issues it deems key national security priorities.

While major allies like France and the United Kingdom attended the meeting in Washington, Greenland and Denmark, the NATO ally with oversight of the mineral-rich Arctic island, did not.

A new approach to countering China on critical minerals

Vance said some countries have signed on to the trading bloc, which is designed to ensure stable prices and will provide members access to financing and the critical minerals.

Administration officials said the plan will help the West move beyond complaining about the problem of access to critical minerals to actually solving it.

"Everyone here has a role to play, and that's why we're so grateful for you coming and being a part of this gathering that I hope will lead to not just more gatherings, but action," Rubio said.

Vance said that for too long, China has used the tactic of unloading materials at cheap prices to undermine potential competitors, then ratcheting up prices later after keeping new mines from being built in other countries.

Prices within the preferential trade zone will remain consistent over time, the vice president said.

"Our goal within that zone is to create diverse centers of production, stable investment conditions and supply chains that are immune to the kind of external disruptions that we've already talked about," he said.

To make the new trading group work, it will be important to have ways to keep countries from buying cheap Chinese materials on the side and to encourage companies from getting the critical minerals they need from China, said Ian Lange, an economics professor who focuses on rare earths at the Colorado School of Mines.

"Let's just say it's standard economics or standard behavior. If I can cheat and get away with it, I will," he said.

At least for defense contractors, Lange said the Pentagon can enforce where those companies get their critical minerals, but it may be harder with electric vehicle makers and other manufacturers.

US turns to a strategic stockpile and investments

Trump this week also announced Project Vault, a plan for a strategic U.S. stockpile of rare earth elements to be funded with a $10 billion loan from the U.S. Export-Import Bank and nearly $1.67 billion in private capital.

In addition, the government recently made its fourth direct investment in an American critical minerals producer, extending $1.6 billion to USA Rare Earth in exchange for stock and a repayment deal. The Pentagon has shelled out nearly $5 billion over the past year to spur mining.

The administration has prioritized the moves because China controls 70% of the world's rare earths mining and 90% of the processing. Trump and Chinese President Xi Jinping spoke by phone Wednesday, including about trade. A social media post from Trump did not specifically mention critical minerals.

Heidi Crebo-Rediker, a senior fellow in the Center for Geoeconomic Studies at the Council on Foreign Relations, said the meeting was "the most ambitious multilateral gathering of the Trump administration."

"The rocks are where the rocks are, so when it comes to securing supply chains for both defense and commercial industries, we need trusted partners," she said. Japan's minister of state for foreign affairs, Iwao Horii, said Tokyo was fully on board with the U.S. initiative and would work with as many countries as possible to ensure its success.

"Critical minerals and (their) stable supply is indispensable to the sustainable development of the global economy," he said. Agreements and legislation move forward

The European Union and Japan together as well as Mexico announced agreements to work with the United States to develop coordinated trade policies and price floors to support the development of a critical minerals supply chain outside of China.The countries said they would develop an agreement about what steps they will take and explore ways to expand the effort to include additional likeminded nations.

IN THE SUPREME COURT 2025/PRO/npr/00383

PROBATE DIVISION

NOTICE IN THE ESTATE OF BRETWOD STERRANO ADDERLEY late of Seabreeze Lane in the Eastern District on the Island of New Providence one of the Islands of the Commonwealth of The Bahamas, deceased.

NOTICE is hereby given that all persons having any claim or demand against the above Estate are required to send the same duly certified in writing to the undersigned on or before the 16th day of February, A.D., 2026, after which date the Administratrix will proceed to distribute the assets having regard only to the claims of which they shall then have had notice.

AND NOTICE is hereby also given that all persons indebted to the said Estate are requested to make full settlement on or before the date hereinbefore mentioned.

Raisa C. L. Eve, Chambers Attorneys for the Administratrix of the Estate Suite No. 4, Malcolm Building Bay Street & Victoria Avenue Tel.: 1 242 821 1812 Nassau, The Bahamas

SECRETARY of State Marco Rubio, right, welcomes Vice President JD Vance to the stage during the Critical Minerals Ministerial meeting at the State Department, Wednesday, Feb. 4, 2026 in Washington.

Photo:Kevin Wolf/AP

More drops for technology stocks weigh on Wall Street

By STAN CHOE AP Business Writer

MORE drops for technology stocks weighed on Wall Street Wednesday.

The S&P 500 fell 0.5% for its fifth modest loss in the last six days. The Dow Jones Industrial Average rose 260 points, or 0.5%, and the Nasdaq composite sank 1.5%.

More than twice as many stocks rose within the S&P 500 than fell, but sinking technology stocks weighed on the index for a second straight day.

Advanced Micro Devices dropped 17.3% even though the chip company reported a stronger profit for the latest quarter than analysts expected. It also gave a forecast for revenue for the start of 2026 that topped analysts' expectations, but that may not have been enough for investors after its stock had doubled over the last 12 months.

Tech stocks are broadly feeling pressure, even when they deliver stronger-than-expected profits.

Big Tech stocks are facing criticism that their prices shot too high following their yearslong dominance of the market. Companies like software makers, meanwhile, are struggling with questions about whether they'll lose in the future to competitors powered by artificial-intelligence technology.

Uber Technologies also dragged on the market after falling 5.1%. The

ride-hailing company reported results for the latest quarter that fell short of analysts' expectations. It also gave a forecast for profit in the current quarter that was below analysts' expectations, while naming a new chief financial officer. Some tech stocks nevertheless climbed, including a 13.8% rise for Super Micro Computer. The company, which sells AI servers and other equipment, delivered a stronger profit for the latest quarter than analysts expected.

Eli Lilly rallied 10.3% after topping analysts' expectations for profit in the latest quarter. It's been riding big growth created by its Mounjaro and Zepbound products for diabetes and weight loss.

Match Group climbed 5.9% after reporting better results than analysts expected and increasing its dividend. The company credited early signs of success from efforts to improve outcomes for users. It said a new facial verification feature for its Tinder service, for example, led to a sharp drop in interactions with "bad actors" where it's been rolled out.

Walmart edged up by 0.2%, a day after its total market value topped $1 trillion for the first time. The retailer has broken into a small club dominated by Big Tech companies like Nvidia and Apple, which are each worth more than $4 trillion.

Google’s quarterly results paint a picture of an internet powerhouse getting stronger in AI age

By MICHAEL LIEDTKE AP Technology Writer

GOOGLE'S latest quarterly report provided further evidence that its internet empire is withstanding an artificial intelligence shakeup that's turning into another potential boon for the company.

The numbers released Wednesday marked Google's third consecutive quarter of digital ad growth of more than 10% from the previous year, while also posting more than 30% sales growth in its division that powers data centers for AI services.

Those increases during the October-December period propelled Google's corporate parent Alphabet Inc. well past the earnings forecasts of stock market analysts.

Alphabet's fourth-quarter profit rose 30% from the prior year to $34.5 billion, or $2.82 per share, while revenue climbed 18% to $113.8 billion.

The collective momentum of Google's main business in search and advertising and the still-nascent AI field indicates a company born during the late 1990s internet boom is becoming even stronger during another technology phenomenon nearly 30 years later.

"Search saw more usage than ever before, with AI continuing to drive an expansionary moment," Alphabet CEO Sundar Pichai said.

Google's successful evolution has helped drive up Alphabet's stock price nearly 60% in the past five months, giving it a $4 trillion market value. Even so, some investors are still skeptical whether Google will be able to sustain enough growth to justify the more than $300 billion that Alphabet will have spent from 2024 through the end of this year on expanding the computing capacity needed for AI features. Those worries

All told, the S&P 500 fell 35.09 points to 6,882.72. The Dow Jones Industrial Average rose 260.31 to 49,501.30, and the Nasdaq composite fell 350.61 to 22,904.58.

Gold and silver prices rose after paring bigger, early gains. Gold added 0.3% to settle at $4,950.80 per ounce after earlier climbing back above the $5,000 mark. It's been swinging sharply after roughly doubling in price over 12 months. It neared $5,600 last week and then fell below $4,500 on Monday.

Silver's price, which has been on an even wilder ride, rose 1.3%.

Their prices had surged as investors looked for safer places to keep their money amid worries about everything from tariffs to a weaker U.S. dollar to heavy debt loads for governments worldwide. But critics said

their prices rose too far, too fast and were due for a pullback.

In the bond market, Treasury yields held relatively steady following a couple mixed reports on the U.S. economy. One from ADP Research suggested that U.S. employers outside of the government hired fewer workers last month than economists expected. A second from the Institute for Supply Management

said that growth for health care, construction and other U.S. services businesses continued in January at the same pace that economists expected.

That second report, though, also indicated that prices paid by U.S. services businesses rose at a faster rate in January, which could be a discouraging signal for inflation.

The yield on the 10-year Treasury edged down to

4.27% from 4.28% late Tuesday. In stock markets abroad, indexes were mixed across Europe and Asia. Japan's Nikkei 225 fell 0.8% from its all-time high. Nintendo sank 11%, even as the video game company reported strong profits. Investors and analysts are concerned about whether sales momentum can be maintained for the Switch 2 game console that was rolled out last year.

caused Alphabet's shares to see-saw between slight gains and declines during extended trading after Wednesday's report came out.

Apple, also currently worth $4 trillion, thinks so highly of Google's AI that the iPhone maker recently struck a deal to use Google's Gemini technology in a long-delayed upgrade to its virtual assistant, Siri.

Google is also embedding more of its Gemini AI into its long-dominant search engine, Gmail and Chrome browser as it tries to avoid complacency and being outmaneuvered by up-and-coming companies such as OpenAI, Anthropic and Perplexity. To meet the challenge, Alphabet has been on a spending spree to expand its AI capacity. After pouring $91 billion into capital expenditures devoted mostly to AI, the Mountain View, California, company disclosed Wednesday that it expects to double down by spending another $175 billion to $185 billion this year. Its capital expenditure budget has ballooned from about $30 billion annually since 2022 when OpenAI released its ChatGPT chatbot to much acclaim, prompting Google to pull out all the stops to catch up.

Alphabet's projected budget for capital expenditures represents nearly half of its 2025 revenue of $403 billion — a "jarring" commitment, said Ethan Feller, a stock strategist for Zacks Investment Research. But the past quarter "supports the view that Google is spending into strength and differentiation, not spending to stay relevant," said Investing.com Thomas Monteiro.

Google's thriving digital ad business is helping to finance the spending spree. Its digital ad sales totaled $82.3 billion in the fourth quarter, up 14% from the previous year.

TRADERS SEAN SPAIN, left, and Chris Lagana work on the floor of the New York Stock Exchange, Tuesday, Feb. 3, 2026.

Photo:Richard Drew/AP

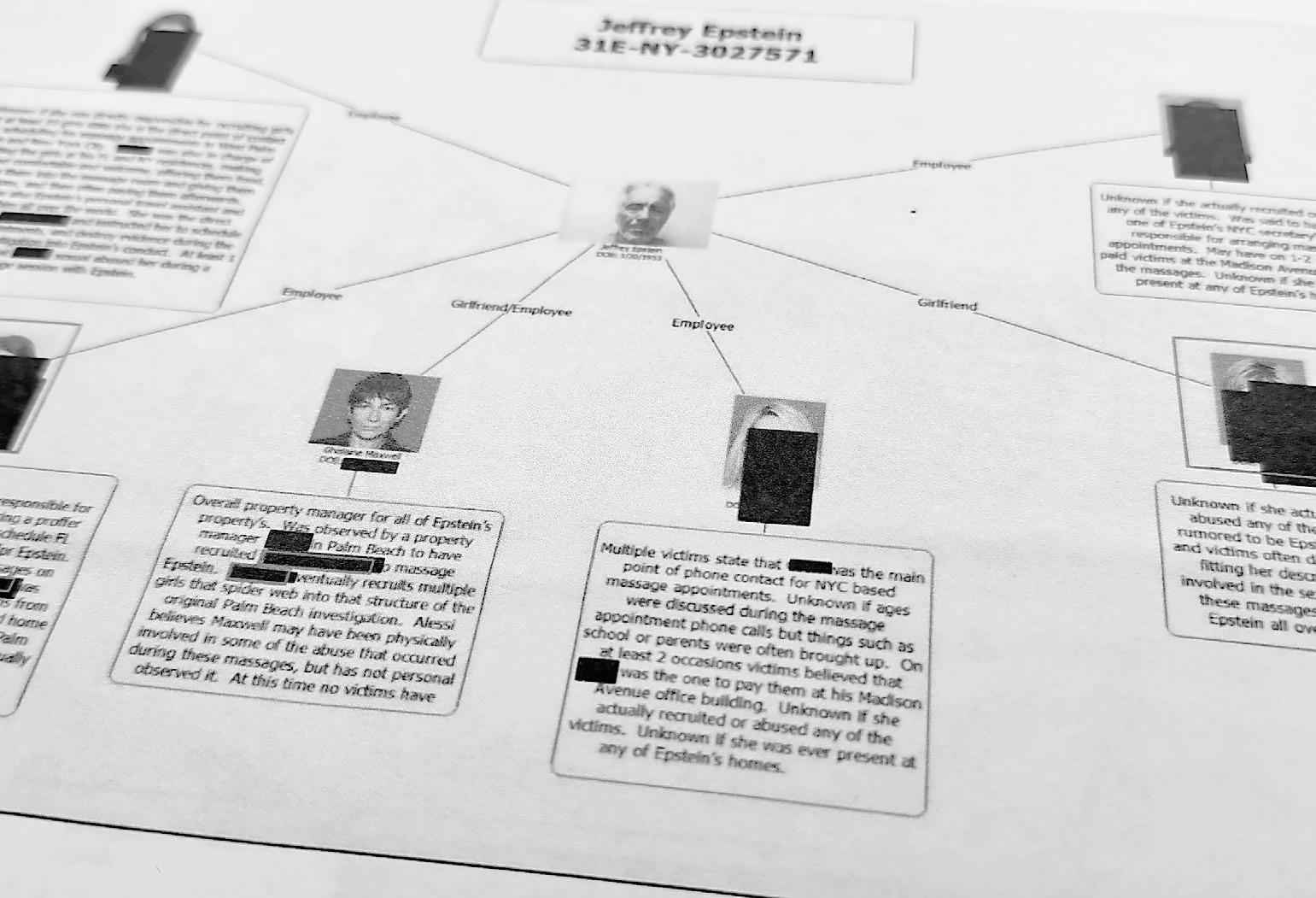

Epstein files rife with uncensored nudes and victims’ names, despite redaction efforts

By PHILIP MARCELO Associated Press

NUDE