As we begin a new year of opportunity and transformation across the secured finance community, SFNet’s 2026 plans offer a clear view of the forces shaping our industry’s next chapter. From foundational education, to crucial information, to high-impact national, global, local and niche events, the months ahead promise meaningful dialogue, renewed connection, and practical insight at a time when adaptability and perspective are more important than ever.

February brings the Asset-Based Capital Conference in Las Vegas, one of the industry’s premier networking and deal-making forums. As lenders, advisors, investors, and service providers gather to make deals and exchange ideas, this conference sets the tone for how the market is thinking about growth, risk, and opportunity as we collectively prepare for new market cycles. It is a place where relationships are strengthened and transactions are sparked.

On March 3 (preceding the National Jewish Financial Services Dinner), the Supply Chain Finance Convergence ’26 in New York will spotlight the increasingly interconnected landscape of ABL, factoring, and supply chain finance, an evolution influencing every corner of our sector. As capital structures grow more complex and borrower needs more nuanced, this convergence is no longer theoretical; it is shaping how deals are structured and monitored every day. This program will also feature the presentation of findings from SFNet’s Fraud Task Force, offering a timely perspective on risk, transparency, and the governance frameworks that support resilient financing solutions. In an environment where speed and innovation often collide with controls, these insights are especially critical.

In April, SFNet will be in Atlanta for two key events: The Emerging Leaders Conference will convene rising professionals for targeted education and peer connection, while SFNet’s Independent Finance Roundtable (IFR) brings together nonbank factoring and ABL leaders to exchange insights on market trends and best practices.

June marks another important moment for our community. On June 11 in New York City, we will celebrate the 2026 class of the SFNet 40 Under 40 Awards, recognizing emerging leaders who are already making a meaningful impact across secured finance. Nominations remain open through February 12, and I encourage you to take a moment to nominate

your rising stars. These individuals represent not only the future of our industry, but also its continued commitment to excellence, innovation, and leadership. SFNet’s Women in Secured Finance Conference begins the evening before, convening industry leaders for candid conversations, skillbuilding, and connections across the industry.

That spirit of leadership and evolution is reflected throughout this issue. In The New Wave of Leaders: Rewriting the Playbook for ABL and Factoring , TSL’s editor-inchief speaks with ten professionals who have stepped into new roles across bank ABL platforms, independent factoring firms, and specialty lenders. Their perspectives highlight how the next generation is honoring the discipline and structure that have long defined the industry while bringing fresh approaches to growth, culture, and client solutions.

RICHARD D. GUMBRECHT SFNet Chief Executive Officer

2025 Asset-Based Loan Activity Highlights Wins and Losses as Over US$136bn Clears Market places recent performance in the context of volatility, policy uncertainty, and record-setting leveraged loan volume. Several articles in the issue explore risk from different angles, including the use of independent directors as an alternative to bankruptcy, the lessons hidden beneath record-breaking 2025 holiday sales, and the complex interactions between receivables purchase facilities and ABL structures through the lens of the First Brands case.

Finally, we look beyond U.S. borders with an overview of CRD VI and its implications for U.S. lenders operating in the EU, and we debut a new column, Industry Pulse . In this inaugural installment, we asked members a simple, but revealing, question: What is impeding deals from closing? Their candid responses offer a snapshot of today’s market realities.

As always, thank you for being an integral part of the SFNet community. I look forward to connecting with you in the months ahead and continuing the conversations that move our industry forward.

TABLE OF CONTENTS. JAN/FEB 2026 VOL. 82 ISSUE 1

THE NEW WAVE OF LEADERS: REWRITING THE PLAYBOOK FOR ABL AND FACTORING P6

From bank ABL platforms to independent factoring and specialty lenders, a new cohort of leaders is stepping into pivotal roles, bringing fresh perspectives while honoring the discipline and structure that have long defined the industry. TSL’s editor-in-chief interviewed ten leaders who have taken on new roles. 6 BY

MICHELE OCEJO

Maria Dikeos of LSEG LPC provides readers with the highlights of 2025 and explores the trends, insights, and what’s ahead for the leveraged lending market in 2026. 12 BY MARIA C. DIKEOS

APPOINTING INDEPENDENT DIRECTORS TO DISTRESSED COMPANIES: AN ALTERNATIVE TO BANKRUPTCY P.16

The most traditional avenue for a distressed company seeking to reorganize existing debts or maximize company value is through a Chapter 11 bankruptcy. However, due to its complexity, a Chapter 11 bankruptcy can be a lengthy, expensive process that is not always palatable for the distressed company’s secured lenders. 16 BY JOHN F. VENTOLA, JONATHAN D. MARSHALL, DOUGLAS R. GOODING, ALEXANDRA THOMAS, AND JACOB LANG

In November, Valley National Bank announced the appointment of Terry M. Keating as head of Asset-Based Lending (ABL). In this role, Keating oversees the continued growth and strategic direction of Valley’s ABL platform. 20 BY

MICHELE OCEJO

Articles

TRENDS IN SECURED FINANCE Receivables Purchase and Asset-Based Lending: Insights from First Brands

When a borrower layers factoring, supply chain finance, securitization, and ABL into a single capital stack, the risks multiply fast. 25

BY DAVID W. MORSE ESQ.

RETAIL FINANCE TRENDS

The Trillion-Dollar Question: What Holiday 2025 Really Revealed

Holiday sales in 2025 generated more than a trillion dollars in U.S. retail sales for the first time in history. It also revealed warning signs that asset-based lenders cannot afford to ignore. 32

BY DOMINICK KEEFE AND ALEXANDER MCKEOWN

NON-BANK TRENDS

New EU Branch Rules for Non-EU Banks: What US Lenders Need to Know About CRD VI

The EU is changing the rules for non-EU banks—and U.S. lenders need to pay attention. Under CRD VI, cross-border lending into the EU without a local branch will soon be off the table. 36 BY FRANS VAN DER EERDEN AND LAURENS SPELTEN

M&A TRENDS Distressed M&A Through the Lens of Asset-Based Lending

For decades, asset-based lenders have been essential participants in distressed situations. 39

BY KENNETH R. YAGER

The Secured Lender’s Industry Pulse

In this new column, we ask industry executives about a hot topic. In this issue, we are asking: What is impeding deals from closing? 42

BY EILEEN WUBBE

CAPITAL TO WORK

When Adil Hafeez launched Sweet Source in 2019, he had a bold vision: to bring premium, value-driven beverage brands from Asia to American shelves. 44

BY TINA SZWEJKOWSKI

SFNET COMMITTEE SPOTLIGHT

SFNet’s Emerging Leaders Committee

Here we speak with Boudewijn Smit, partner at NautaDutilh and chair of SFNet’s Emerging Leaders Committee. 46 BY EILEEN WUBBE

SFNET MEMBER PROFILE

ABLSoft is ‘Supercharged’ in

Veteran ABL lending platform ABLSoft continues to broaden and deepen its solutions for asset-based lending and factoring, delivering a best-in-class user experience at scale. 50

BY EILEEN WUBBE

Departments

The Secured Finance Network is the trade group for the asset-based lending arms of domestic and foreign commercial banks, small and large independent finance companies, floor plan financing organizations, factoring organizations and financing subsidiaries of major industrial corporations.

The objectives of the Association are to provide, through discussion and publication, a forum for the consideration of inter- and intra-industry ideas and opportunities; to make available current information on legislation and court decisions relating to asset-based financial services; to improve legal and operational procedures employed by the industry; to furnish to the general public information on the function and significance of the industry in the credit structure of the country; to encourage the Association’s members, and their personnel, in the performance of their social and community responsibilities; and to promote, through education, the sound development of asset-based financial services.

The opinions and views expressed by The Secured Lender’s contributing editors and authors are their own and do not necessarily express the magazine’s viewpoint or position. Reprinting of any material is prohibited without the express written permission of The Secured Lender

The Secured Lender, magazine of the asset-based financial services industry (ISSN 0888-255X), is published 6 times per year (Jan/Feb, March, June, July/Aug, Sept and Nov) $65 per year non-member rate, and $105 for two years non-member rate. SFNet members are complimentary.

Secured Finance Network

370 Seventh Avenue, Suite 1801, New York, NY 10001. (212) 792 -9390 Email: tsl@sfnet.com www.SFNet.com

Periodicals postage paid at New York, NY, and at additional mailing offices. Postmaster, send address changes to The Secured Lender, c/o Secured Finance Network, 370 Seventh Avenue, Suite 1801, New York, NY 10001

Editorial Staff

Michele Ocejo

Editor-in-Chief and SFNet Communications Director mocejo@sfnet.com

Eileen Wubbe Senior Editor ewubbe@sfnet.com

Aydan Savaser

Art Director asavaser@sfnet.com

Advertising Contact: James Kravitz

Chief Business Development Director

T: 646-839-6080 jkravitz@sfnet.com

2026

BMO Adds Paul Thomsen to Lead new Utah Commercial Banking Office

BMO Commercial Bank appointed Paul Thomsen as managing director and Utah market executive. Thomsen will build the bank’s new Middle Market office in Utah, which will provide capital and tailored financial solutions to Utah’s strong business community.

Cambridge Savings Bank Appoints

Cal Navatto as Senior Vice President, Senior Asset-Based Lending Relationship Manager

In this role, W. Calvin “Cal” Navatto will focus on expanding CSB’s assetbased lending portfolio, deepening relationships with middle-market companies, and supporting the continued growth of the Bank’s ABL business. Navatto brings decades of experience in commercial finance, business development, and asset-based lending.

Errin Richardson Glasgow Named as New President of Nationwide Operations of Cascade Credit Services, LLC

The Cascade Credit Services Board of Advisors and CEO, Wade Owens, is pleased to announce the addition of Errin Richardson Glasgow as the company’s new president of nationwide operations. With over three decades of experience in the asset-based finance sector, Glasgow is widely respected for her leadership, collaborative approach, operational insight, and deep understanding of credit risk and borrower dynamics.

Choate Hires Longtime Morgan Lewis

Partner Marc Leduc to Join Seasoned Finance and Restructuring Team

Marc Leduc has joined Choate as a partner in the Firm’s nationally recognized Finance and Restructuring Group. He will advise commercial banks and private credit lenders on a broad range of domestic and international finance transactions and debt restructurings.

Swimmer Named Head of Commercial Banking at Citizens; McCree to Retire in March 2026

Citizens Financial Group, Inc. announced that Ted Swimmer , head of capital markets and advisory for Citizens Commercial Banking, has been named head of Commercial Banking, effective immediately. Swimmer succeeds Don McCree, who will remain at Citizens as chair of Commercial Banking until his retirement at the end of March 2026.

Culain Capital Funding LLC Welcomes Travis Pocock as Chief Revenue Officer

Travis Pocock has joined Culain Capital Funding, LLC as chief revenue officer (CRO), bringing more than 15 years of experience helping businesses access the working capital they need to grow. Pocock is a seasoned finance executive with deep expertise in factoring, assetbased lending, and strategic portfolio growth.

Culain Capital Funding Appoints Travis Smith as Senior Vice President –Regional Sales Executive

Travis Smith brings over 25 years of experience in financial services with a deep focus on accounts receivable financing, asset-based lending, and commercial banking. Smith is a seasoned business development professional with extensive expertise in asset-based lending and commercial banking.

Robin Moses Joins Eastern Bank as Senior Vice President, Team Leader for Commercial & Industrial Banking In Rhode Island

Eastern Bank is pleased to welcome Robin Moses as senior vice president, team leader for Commercial & Industrial Banking in Rhode Island. Moses brings more than two decades of experience in commercial lending, relationship management and community leadership.

eCapital Names Amanda Bowman as Head of Sales, Transportation Group

Reporting to Melissa Forman-Barenblit, president, head of Transportation Group, Amanda Bowman will lead the division’s sales organization with a continued focus on client success, advancing eCapital’s long-standing commitment to delivering solutions that strengthen and simplify how transportation businesses access working capital.

eCapital Appoints Industry Veteran

Nate Gilmore as Head of Strategic Partnerships & Integrations for its Transportation Group

Reporting to Melissa Forman-Barenblit, president, head of Transportation Group, Nate Gilmore will lead initiatives to expand distribution, strengthen eCapital’s partner network, and drive new revenue growth through platform integrations and strategic collaborations.

eCapital Adds Rachel Navarro to Lead Client Experience for its Transportation Group

Reporting to Melissa Forman-Barenblit, president, head of Transportation Group, Rachel Navarro will play a central role in shaping and advancing the division’s client strategy. Navarro draws on over 15 years of leadership and industry insight in building lasting client relationships across transportation and commercial finance.

First Bank Appoints Bridget Welborn as New Chief Risk Officer

First Bank is pleased to announce Bridget Welborn joined the bank this October as its new chief risk officer and head of Legal. Welborn brings more than 15 years of experience in legal, risk, privacy, and regulatory compliance, with a proven track record advising boards, CEOs, and executive management on critical initiatives.

First Citizens Names Mike Spencer Middle Market Banking Leader in Georgia

First Citizens Bank announced that Mike Spencer has joined the company as managing director of Middle Market Banking in Atlanta. In this role, Spencer will expand First Citizens’ middle market banking presence throughout Georgia and nearby markets. Navarro draws on over 15 years of leadership and industry insight in building lasting client relationships across transportation and commercial finance.

First Citizens Names Snow Holding Middle Market Banking Leader for Northeastern United States

First Citizens Bank announced that Snow Holding has been named director and market leader of Middle Market Banking for the Northeast, where he will lead relationship managers and business expansion efforts in both the Boston and New York offices, as well as the broader Northeast Corridor.

First Horizon Bank Names Todd Warrick as Triangle Market President in the Mid-Atlantic Region

First Horizon Bank announced that Todd Warrick, executive vice president and Corporate and Commercial market leader, has been promoted to Triangle Market president for the Mid-Atlantic region.

FGI Risk Expands Southeast Presence with Hiring of Janelle Foy

FGI Worldwide LLC announced the hiring of Janelle Foy as director, FGI Risk. Based in Atlanta, Foy will focus on developing relationships and new business opportunities in the southeastern United States for FGI’s credit insurance brokerage and risk advisory division.

Frost Brown Todd Continues Growth in Texas with Commercial Finance Partner Sarah Naseman

Frost Brown Todd (FBT) announced that Sarah M. Naseman has joined the firm’s Houston office as a partner in the

Commercial Finance practice group. Naseman brings a wealth of experience in debt and equity finance, with a particular focus on private credit and lower middle-market leveraged buyouts, further expanding the firm’s capabilities in support of financial institutions nationwide.

Frost Brown Todd and Gibbons Announce Combination to Form FBT Gibbons

Frost Brown Todd LLP (FBT) and Gibbons P.C. have agreed to combine, with a planned effective date of January 1, 2026. The new firm, to be named FBT Gibbons LLP, will create a mid-market legal powerhouse with approximately 800 attorneys across 25 offices nationwide.

Robert Sartin , chairman of FBT, will serve as chairman of FBT Gibbons. Peter Torcicollo , managing director of Gibbons, and Adam Hall , chief executive officer of FBT, will serve as co-managing partners of the combined firm.

Gordon Brothers Bolsters Market Presence & Welcomes Brian Wright as Managing Director, Lending Client Coverage & Origination

In this role, Brian Wright will propel the lending business and origination efforts across the entire Gordon Brothers’ platform delivering tailored, end-to-end solutions for clients. Based in Chicago, Wright has over 30 years of experience in commercial banking, origination and credit leadership working with customers of all sizes and complexities.

Chad Simon Joins Gordon Brothers as Senior Managing Director, Transactions

In this role, Chad Simon joins the team responsible for structuring transactions that leverage the firm’s full asset capabilities to provide solutions for clients and partners as well as building lending solutions that complement Gordon Brothers’ existing asset-based lending facilities in North America.

Hilco Global Appoints Robert Gorin and David Campbell to Lead its Getzler Henrich Turnaround and Restructuring Practice

Hilco Global announced the appointment of new leadership of Getzler Henrich & Associates (“GHA”), Hilco Global Professional Services division’s dedicated turnaround and restructuring practice. Robert Gorin and David Campbell assume the role of coexecutive directors – Restructuring for Getzler Henrich & Associates, where they will lead the middle market advisory practice for corporate turnaround and restructuring. Gorin and Campbell succeed co-chairmen Bill Henrich and Joel Getzler, who will remain engaged in senior advisory roles and provide strategic counsel to ensure a seamless transition and business continuity.

J D Factors Hires Domenic Garcia as Business Development Officer

J D Factors is proud to announce the hiring of Domenic Garcia as business development officer in Austin, TX. Garcia will be responsible for generating new business in Texas along with Oklahoma, Louisiana, Missouri and Arkansas.

Legacy Corporate Lending Bolsters Leadership Team with Addition of Jeffrey Seiden as Executive Vice President

Legacy Corporate Lending, LLC announced the appointment of Jeffrey Seiden as executive vice president, Portfolio & Underwriting. Seiden will work closely with Legacy’s originations team and will be responsible for conducting the underwriting process and structuring and closing new transactions.

Mayer Brown Expands Global Leveraged Finance & Private Capital Practice with Leading Lawyers

Frederick Cristman and James Adams

Mayer Brown announced that Frederick Cristman and James Adams have joined the Washington DC office as partners in the firm’s Global Leveraged Finance and Private Capital Group.

BY MICHELE OCEJO

From bank ABL platforms to independent factoring and specialty lenders, a new cohort of leaders is stepping into pivotal roles, bringing fresh perspectives while honoring the discipline and structure that have long defined the industry. TSL’s editor-in-chief interviewed ten leaders who have taken on new roles: Jon Biorkman, head of Asset-Based Lending & Equipment Finance, BMO; Kim Fisk, president, Triumph Factoring; John Freeman, head of Asset-Based Finance, U.S. Bank; Yvonne Kizner, senior vice president, head of Asset-Based Lending, Cambridge Savings Bank; Niamh Kristufek, president – Specialty Finance, First Business Bank; Gen Merritt-Parikh, co-CEO, Haversine Funding; Steve Pomerantz, ABL group head, Fifth Third Bank; Jay Schweiger, president, Huntington Business Credit; Andrew Ray, global head of Asset-Based Lending, J.P. Morgan; and Neil Wolfe, CEO, Iron Horse Credit.

Adynamic handoff is underway across secured finance. From bank ABL platforms to independent factoring and specialty lenders, a new cohort of leaders is taking the helm. They are inheriting the sturdy foundations that built this industry, discipline, structure, and focus on collateral, while ushering in data-rich, technology-enabled ways of working.

The new leadership ethos isn’t about disruption for its own sake. It’s about sharpening the classic virtues of secured finance—clarity of purpose, disciplined risk-taking, and transparent communication—while empowering teams closest to the work to act decisively. ABL and factoring remain peopleoriented businesses: relationships, expertise, and judgment are integral to putting capital to work. Today’s leaders emphasize enabling their teams and removing friction so decisions can be made with speed and confidence.

John Freeman was named head of asset-based finance at U.S. Bank in 2024. He reflected on how three decades of diverse roles in asset-based lending shaped his problem-solving mindset and prepared him for this role: “My career in asset-based lending began 30 years ago with Congress Financial, where I held roles within ABL operations, field examination and portfolio management. From there, I embraced new opportunities with JPMorgan, including underwriting debtor-in-possession and exit financings, and opening an ABL office in Vancouver, Canada. Each of these experiences deepened my understanding of how to solve complex problems for clients. Joining U.S. Bank in 2020 also marked a pivotal chapter; by 2024, I was honored to lead our ABF business, driven by a passion for growth and teamwork.”

“Leadership today means shaping a growth trajectory that redefines what’s possible. For the next generation of ABL professionals, that requires cultivating collaboration across diverse viewpoints, eliminating friction in processes, and harnessing technology to elevate client outcomes. Effective leadership combines strategic vision with adaptability and an unwavering commitment to continuous improvement,” said Jon Biorkman who became head of Asset-Based Lending & Equipment Finance, BMO, in the fall of 2025, after Michael Scolaro’s retirement.

“At BMO, we’re fortunate to build on a foundation of excellence established by leaders like Mike Scolaro. Our mandate is to preserve that strength while advancing purposeful innovation. Modernization isn’t disruption for its own sake—it’s grounded in listening to clients, anticipating change, and empowering exceptional talent. We emphasize disciplined risk–reward decisions, a growth mindset, and delivering the full breadth of BMO’s capabilities to help clients thrive through all different market cycles,” he added.

Biorkman explained that a leader’s responsibilities include setting the direction, empowering team members, and communicating clearly and consistently. Biorkman believes that regardless of past outcomes, each day offers a new opportunity to make a significant impact, both now and in the future.

Steve Pomerantz, who became ABL group head at Fifth Third last year, said, “Leadership in today’s secured finance environment is about clarity, discipline, and adaptability… our core responsibilities haven’t changed: protect credit, manage risk, and deliver reliable liquidity through the cycle for our clients. What has changed is the pace. For the next generation, leadership means developing real credit judgment early, empowering teams to make decisions within clear guardrails, and reinforcing that accountability matters even more as the business moves faster.”

Across bank and independent platforms alike, empowerment recurs as a theme. Leaders are instituting clear decision-making rights and encouraging curiosity. They want team members to propose recommendations, then debate them to reach the best answer for clients and the institution.

Jay Schweiger, who was named president of Huntington Business Credit in the fall, said: “I strongly believe in empowering the entire team to make decisions. On my very first day with my new team, I emphasized that we could not be successful if they did not feel empowered to make timely decisions. We have established a framework for decision-making and are continually refining that and will continue to do so into 2026 and beyond.”

Kim Fisk, who was named president of Triumph Factoring in March 2025, said: “I believe the next generation of ABL and factoring professionals needs more than technical skills. They need confidence, creativity, and a collaborative mindset. Investing in people is imperative. My focus is on building a culture where ideas are valued, continuous learning is encouraged, and diversity of thought drives better outcomes.”

In early 2025, Iron Horse Credit announced the appointment of Neil Wolfe as CEO. Wolfe believes culture starts at the top. “Leadership is about fostering culture, which in turn helps to drive an organization’s vision, and, equally important, is being adaptable. Leaders must prioritize empowering their teams and encouraging cross-functional collaboration, even challenging executive decisions as may be necessary from time-to-time.” He added, “There is no secret sauce in my approach. One ‘legacy’ practice I cannot abandon is personal attention and touch. You can have the best data and technology, but if you can’t connect with people, I find organizations will struggle.”

Niamh Kristufek, who was named First Business Bank’s president-specialty finance last year, spoke of the bank’s core culture: “Thankfully, the culture at First Business Bank does not need

changing—it’s core to who we are and a competitive strength in the marketplace. Our latest results show 97% client satisfaction, 87% manager effectiveness, and employee engagement hit 86%.”

In early 2025, Yvonne Kizner was named head of Asset-Based Lending at Cambridge Savings Bank. She commented: “Engaging in culture is a core tenet of CSB, which I have seen in action with my involvement in our Professional Women’s Network. We try to foster engagement and development for women in their careers through various activities including networking, volunteering, and participating in wellness.”

Leaders are rewriting how talent enters the industry, furthers their professional development, and advances in their careers. The aim is to expose emerging professionals early to the realities of structuring, monitoring, and managing risk—while layering in analytics, automation, consulting skills, and rotational exposure.

Freeman of U.S. Bank said, “As our teams continue to evolve, attracting and developing emerging talent has become a key focus. Historically, the secured finance industry hasn’t seen a large influx of young professionals, but at U.S. Bank, we’ve made significant strides in developing talent both internally and externally, often promoting from within. This approach sets us apart in the marketplace, as we’re committed to supporting and retaining team members within the right roles, regardless of their initial function.”

Freeman explained it’s important to tailor your approach to each individual: “What matters most is finding the right fit for each person, so I strive to engage my team several layers deep, ensuring they feel heard and supported. I make it a priority to initiate career conversations early and regularly, making sure team members understand the opportunities available, and I encourage my team leaders to do the same.”

He went on to emphasize the importance of mentoring: “Mentoring is another cornerstone of our development strategy. We encourage participation in external classes – primarily through SFNet – and regularly give early talent learning opportunities, such as presenting potential transactions to senior leaders, clients and prospects. These experiences foster their growth and confidence over time.”

Ray of J.P. Morgan discussed the bank’s internship and analyst training programs: “The strength of our team is built on a solid foundation of hands-on training in diligence, structuring, and risk management. By exposing young professionals to real-world scenarios and mentorship early in their careers, we are able to prepare our next generation of leaders to thrive in a rapidly changing industry.”

Several of the leaders mentioned internships as being key to attracting new talent. “One of the teams that we established early after I arrived was an ABL summer internship program team, a fantastic 11–12 week rotational program through our ABL group. Our interns will rotate through all aspects of the team from field exam, underwriting, portfolio and relationship management, and finally business development,” said Schweiger.

Kizner said, “CSB also has a robust internship program in the summers, mainly focused on the credit analyst function. Whenever

possible, I try to expose the interns to ABL credits, in the hopes that they consider our entry-level position, which is usually the collateral analyst function.”

Gen Merritt-Parikh, who was named co-CEO of Haversine Funding last year, believes taking chances is key to growth. “Growth doesn’t happen by staying safe. We encourage team members to take on new goals each year, try things they haven’t done before, and build a broad set of skills. I believe we should give people the space to grow, especially when they’re willing to step out of their comfort zone.”

Concerning the next generation of leaders, Kristufek said: “I find younger professionals to be mission-driven. When we talk about secured finance as a way to help companies survive during hard times and grow during times of opportunity, that resonates. We encourage our younger professionals to keep an open mind and learn about all our groups and to remember that the one thing that connects all our teams is passion for our clients.”

Leaders also spoke at length about how to tell the story of secured finance to a generation that may not know the field exists. SFNet’s Guest Lecture Program and The Secured Lender’s Great Places to Work issues have been raising the profile of the industry across the country, but more work must be done to reach the next generation.

Kizner said, “Connecting individuals from the SFNet network with undergraduate and graduate finance students is a great way to attract new talent and makes students aware of the career opportunities our sector offers.”

Pomerantz said, “Most young professionals simply haven’t been exposed to secured finance, which puts the responsibility on us to tell the story correctly. ABL is problem-solving finance. We focus on early exposure to real transactions so people learn how risk actually behaves, not just how it looks in a model.”

Huntington has established and will utilize its summer program to seed a career development and rotational program, according to Schweiger.

“Internally, we foster the idea of developing career paths. Through pairing with experienced staff and affording opportunities to participate in training, we strive to fulfill colleagues’ desire to learn and grow without the conventional shackles,” said Wolfe.

Every leader interviewed respects the legacy practices because they work. What’s changing is how those practices are executed— augmented by data, automation, and analytics to reach better decisions faster while keeping human judgment front and center. Modernization is a means to strengthen discipline, not replace it.

Ray of J.P. Morgan, explained that the bank “has a deep-rooted culture of risk management and thoughtful structuring, which remains foundational to our approach. My goal is to enhance these practices by integrating advanced data analysis and digital tools into our prospecting and diligence processes. It isn’t about changing what has worked; it’s about making our legacy practices more efficient and insightful through technology.”

“To make modernization meaningful, we connect the why to

the how and the what happens if we don’t. That clarity lets the team innovate without losing sight of risk. Practically, we review our processes several times a year and ask: Are these steps still adding value? Reducing risk? Saving time? Getting us closer to the outcome we actually want? If the answer is no, we rethink it,” said Merritt-Parikh.

Fisk agreed that a balance must be struck. “Balancing legacy practices with modernization starts with understanding why those practices exist. They’ve built security, trust, stability, and reliability in our industry and amongst our people… modernization isn’t optional; it’s essential for staying relevant and competitive.” She added: “We’re automating certain processes that can think faster and more accurately than a human, which frees our people to focus on handling exceptions and complex scenarios. This allows our teams to evolve into true problem solvers and critical thinkers.”

Kizner agreed: “As we continue to grow, it is imperative we embrace technology, both to enable us to scale and to ensure our team is focusing on the more complex areas that require more management and possibly partnership with our clients. We’ve upgraded our collateral monitoring system over the past 12 months and have tried to cut out as many manual practices as possible, although the work continues with several initiatives in 2026 we are pursuing.”

Pomerantz said, “We need to question long-held assumptions the same way we test new ideas, using data, experience, and judgment rather than habit. Leveraging data and automation to improve decisions within clear guardrails allows us to create value rather than destroy it.”

First Business Bank is currently assessing end-to-end processes throughout the teams to identify where manual, low-expertise work is being completed, according to Kristufek. “By automating this type of work, it frees up our experienced back-office staff to redirect their talents into the more intuitive risk management, deal structuring, and customer service work where we excel,” Kristufek explained.

Schweiger described his team’s innovative work: “Our team is doing exciting and cutting-edge work with various technology tools including PowerBI and various API applications to mine data from our systems and use it to educate not only ourselves, but also our prospects and customers on various asset-based and financial best practices. One

9 THE SECURED LENDER JAN/FEB. 2026

of my favorite teams that we recently launched is the What-if-Council. We might brainstorm 1,000 ’what-ifs’ and only act on 10 of them, but I guarantee, those 10 will be game changers that elevate our performance enormously,” said Schweiger.

“If new systems are slower, too complex, or don’t add insight, we don’t implement them. But if they truly align the ‘how’ with the ‘why’ and make us better or more scalable, then we’re all in,” Merritt-Parikh said.

Reflecting on the role mentors played throughout his career, Freeman said: “Throughout my career, I’ve always taken the view that change is the only thing that stays the same, so I try to instill this mindset with my team. I also worked under great industry leaders who significantly impacted my approach to leadership: Dan Lane, with Chase, demonstrated balance and a relentless focus on putting the client first. Joe Virzi, now with First Merchants, exemplified the importance of culture as a foundation for success. Dan Son, U.S. Bank, taught me the value of visionary leadership and strategic foresight.

“These exceptional mentors have firmly shaped my conviction that adaptability, a strong organizational culture, and a client-first mindset are essential to lasting success. Sharing these values and investing in the growth of emerging talent isn’t just rewarding – it’s a responsibility I take seriously. As we navigate an ever-changing industry landscape, I remain committed to fostering the next generation of secured finance leaders and upholding the highest standards of excellence for our clients and our profession.”

Schweiger also emphasized the importance of mentors: “I’ve had the privilege of learning from some of the best in the industry-- Mike Scolaro, Kris Coghlan, and Steve Friedlander. They have advised me to listen, be patient, but act decisively, and always remember that you never know what someone else may be dealing with on any given day or in any situation.”

Ray describes his leadership philosophy as being anchored in four principles: attitude, effort, accountability, and curiosity. “I believe in making decisions collectively, but decisively, and executing with precision,” he said. “Leadership in today’s secured finance landscape is fundamentally about talent development and thoughtful client selection. By investing in our people and leveraging technology, we can build a culture that is both high-performing and resilient… Leadership is not just about setting direction, but about empowering teams to grow, adapt, and deliver excellence.”

“My leadership philosophy is grounded in integrity, commitment to both my colleagues and clients, and partnership. I believe in fair dealing when it comes to opportunity, and instilling calmness during uncertainty… My job is to make them successful. And if they are successful, I too will be,” explained Wolfe.

Kizner commented on the power of escaping your comfort zone: “I learned early on to say yes to opportunities that get you outside of your comfort zone, and to take on challenges that make your direct manager’s life easier. There is so much value in just showing up consistently in the office—being able to participate in hallway postmortems on calls and meetings will really push you along faster.” She

added: “To me, leadership is providing a framework for others to thrive, making sure we have the systems and structure in place to ensure efficiency, fostering teamwork, and ensuring there are opportunities to learn and grow.”

In many ways, the future will be much like the past: focused on relationships. The fundamentals of trust, but verify; structure and monitoring; cash conversion and collateral quality, remain nonnegotiable. However, the overlay is different: data-rich workflows, automated monitoring, transparent decision-making frameworks, and cultures that foster curiosity and accountability. Three trajectories stand out: responsibly data-driven underwriting and monitoring; human-centered automation that elevates exception handling and client dialogue; and onboarding models that blend rotations, external education, and strength-based coaching.

The result? An industry that can move faster without losing its balance. An industry that is resilient through cycles, more attractive to new talent, and more valuable to the companies that depend on secured finance for liquidity and growth. Technology matters, but people decide. The future belongs to organizations that limit friction so their experts can do what only humans do: ask better questions, make better calls, and build better relationships. Secured finance has always been durable and resilient, but many leaders believe its best years are still ahead.

“While technology is reducing friction in our processes and making it easier to serve customers day to day, the human element of banking remains unchanged. We are a relationship bank that does the work to really understand our clients’ needs today and their short-term and long-term goals so we can provide expert advice and guidance,” said Kristufek.

Fisk commented on the needs of the new generation and their role in the future: “Stepping into the role of president of factoring during such a transformative time means it’s imperative we meet the needs of a new generation. For me, leadership starts with the people you surround yourself with, the focus on development of who’s next, and embracing innovation and technology while putting the client’s needs top of mind.”

If there is a single mandate emerging from these voices, it is this: lead with sound judgment and build systems that make sound judgment easier every day. That means sticking to fundamentals while investing in tools, training, and culture that help teams see around corners. It means designing processes that surface problems quickly and empower experts to act. And above all, it means remembering that secured finance is a relationship industry. Success will come not by how fast leaders can decide, but by how well they listen, how clearly they communicate, and how reliably they show up for clients. In the end, technology will continue to evolve—but the industry’s compass remains the same: disciplined credit, resilient teams, and enduring partnerships.

Michele Ocejo is SFNet director of communications and editor-in-chief of The Secured Lender.

BY MARIA C. DIKEOS

Maria Dikeos of LSEG LPC provides readers with the highlights of 2025 and explores the trends, insights, and what’s ahead for the leveraged lending market in 2026.

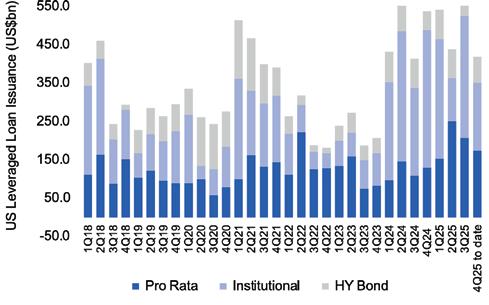

Against the backdrop of bouts of market uncertainty and the whiplash of tariff announcements (followed by episodic recants), US lenders placed US$1.7trn of leveraged loan volume via the broadly syndicated loan market by mid-December 2025. The results not only represent a 3% increase over year-ago totals, but are on track to set an annual record (Fig. 1).

Despite burgeoning M&A optimism and lender hopes for increased deal flow at the end of 2024, 2025 got off to a slow start in the wake of Liberation Day pronouncements. On the heels of a promising start in January, the leveraged loan calendar came to a near standstill by late March and into April as volatility spiked and the bond and equity markets tumbled.

The VIX, which represents market expectations of 30-day forward-looking volatility, shot up from a low of 21.51 at the end of March to a high of 52.33 in early April before coming down to about 16.6 by the end of June.

For much of the second quarter, both lenders and borrowers pulled back from deal making and/or slow walked existing pipeline deals in the near term, as they grappled with concerns around credit risk.

The market angst was proved to be short lived, however. Although actual headlines and circumstances did not meaningfully change or go away, the capital markets pivoted away from Liberation Day volatility as strong technicals supported a return to doing deals. In 3Q25 steady market liquidity shored up lender demand for assets, fueling a calendar of deals which, if not broadly aggressive, were certainly opportunistic in the form of repricings, refinancings, dividend recapitalizations and a smattering of M&A opportunities. Most of this activity came into focus during the normally tepid summer months – especially after Labor Day. At over US$525bn, 3Q25 leveraged loan volume, was not only up 56% compared to the same time last year, but also set a new quarterly record.

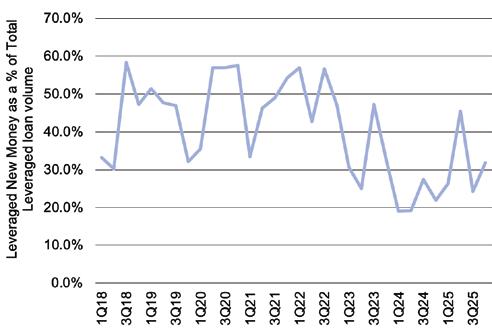

There were qualifiers to the strong results, however. At just over US$127bn, new loan assets represented only 24% of total leveraged loan volume for the quarter (Fig. 2).

In September, a record US$20bn financing backing the US$55bn buyout of video gamer, Electronic Arts – the largest leveraged buyout ever - was announced, a testament to the market’s appetite for deals. Notwithstanding the size and optimism around the deal, sustained momentum around new loan generation remained tenuous.

In early October, on the heels of the First Brands and Tricolor bankruptcies, hopeful signs of a credit rally were displaced by renewed focus on risk, monitoring and exposure levels to certain industries – including the automotive sector.

By December, predictions that the Federal Reserve was entering a rate-cutting cycle were tempered by inflation indicators. Despite lowering rates for the third time in 2025,

the Fed signaled that 2026 may only allow for one cut.

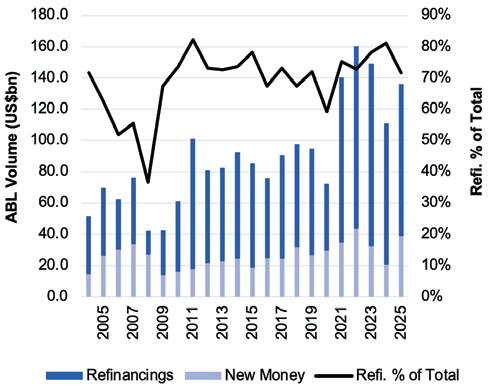

ABL Volume Near Record Highs, but Lending Felt Thin Against this backdrop, the US asset-based lending (ABL) market pushed over US$136bn of issuance through retail syndication by early December, increasing its share of total leveraged loan volume to 8% from the record low of 6% garnered last year.

The results represented the fourth highest annual total on record (although it is expected to edge up by the end of the year) and the highest total since the surge of issuance

fueled by Libor cessation. Similar to trends observed in the broader leveraged cash flow market, the mix of deals skewed heavily toward opportunistic refinancings, supplemented by a nascent but limited new money pipeline. There was spotty but real frustration with the lack of adequate deal flow to meet lender demand for assets and the reality of growth ambitions tainted by the largest write off in ABL history: Rite Aid.

Nearly 72% of total 2025 ABL loan volume or US$97.5bn came in the form of refinanced credits (Fig. 4), down modestly year over year on a pro rata basis, but up 16% in terms of dollars raised. Just shy of US$39bn, new money assets were up 42% year over year to mark the second highest annual total on record (2022 logged nearly US$44bn of new money issuance).

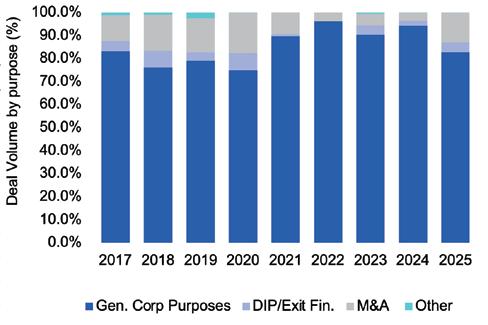

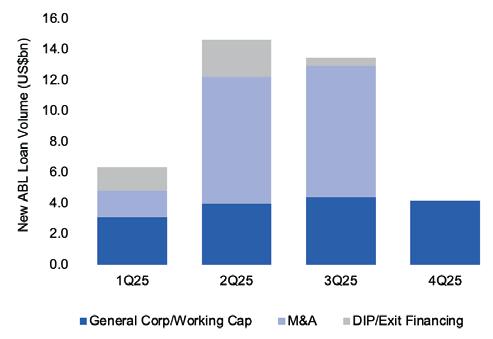

M&A financings totaled less than US$19bn for the year or roughly 13% of total annual issuance. This was up from full year 2024 results (US$3.5bn) which came in at just over 3% of ABL volume (Fig. 5). In July, Walgreens Boots Alliance tapped the market for over US$5bn in ABL loans which came in tandem with additional financing backing the sale of The Boots Group to Sycamore Partners. This was followed in September with the completion of a US$2.25bn ABL credit for C&S Wholesale Grocers Inc., which backed the company’s acquisition of SpartanNash. A US$1.4bn ABL facility backing Dollar Tree’s sale of Family Dollar (via 1959 Holdings Inc) rounded out the largest grouping of M&A deals for the year.

“It was not a great origination year,” pointed out one ABL lender. “There was not a ton of M&A or fallen angels.” Most of the new money origination came in the second and third quarters – followed by a significant drop in 4Q25 (Fig. 6). But if the calendar was not filled with new issuers in the ABL market, opportunities to top up on existing credits did present themselves. Nearly US$16bn of additional ABL loan volume or over 40% of new money came via the upsizing of existing credits as deals were renewed. In the context of the ABL construct, this is largely a function of inflation over the last

Outstanding ABL holdings over US$364bn, up nearly US$20bn year

five years cumulatively raising the working capital capacity of borrowers and presenting many with the opportunity to increase the size of their facilities.

The Rite Aid Impact and 2026 Prospects

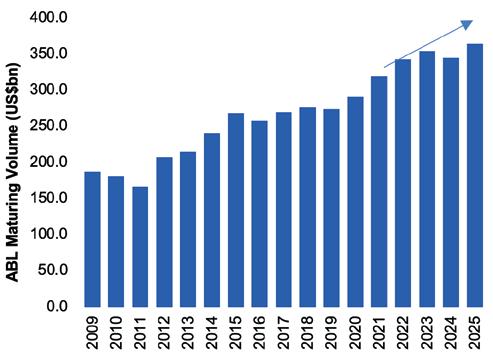

Despite the unevenness across the leveraged loan market as a whole, and the supply/demand imbalance relative to assetbased lending specifically, by the end of 2025, outstanding ABL holdings topped US$364bn, an increase of nearly US$20bn compared to last year and a new record (Fig. 7).

Lenders note that there is renewed momentum for M&A across several industry verticals heading into 2026 and that sponsors are transacting more. Additionally, until the matter of tariffs is resolved, a few companies may struggle with liquidity, potentially giving rise to a flurry of cash flow to ABL credits (in turn, there may be challenges for existing ABL borrowers who face liquidity challenges).

The December 5 announcement by the Office of the Comptroller of the Currency (OCC) and the FDIC that they are rescinding the Interagency Guidance on Leveraged Lending –the Federal Reserve is yet to opine – may allow for a lessprescriptive approach to leveraged lending, while providing bank lenders – on the margin – with more opportunities to do deals.

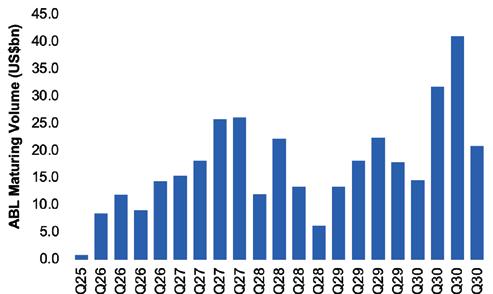

Yet all of this positive momentum is joined up with a dose of pragmatism. The maturity wall for the asset-based loan market has been pushed out significantly to 2029 and 2030. Roughly US$130bn or 36% of current ABL commitments are set to mature in the next two years with about US$45bn maturing in 2026 alone so there will be a steady – albeit not necessarily incremental - pipeline of refinancings to come in the new year (Fig. 8).

Additionally, to the extent that the Rite Aid and First Brands bankruptcies may be perceived as aberrations, they nonetheless represent real market losses. Coupled with smaller bank losses, lenders say there has been a real impact not only in the context of renewed focus on rigorous credit

Fig. 8: ABL Refi Cliff Hist Comp

US$130bn or 36% of current ABL outstanding commitments mature between 2026 and 2027

analysis, but also on growth ambitions. “It is a split screen for banks right now,” explains one lender. “Everyone will be more cautious to the extent [Rite Aid and First Brands] happened, but on the other hand there is demand for assets, and if you pair that with the cessation of Leveraged Lending Guidance, banks may get bolder.”

Maria C. Dikeos is a director of Analytics and head of Global Loans Contributions at LSEG LPC in New York. Dikeos runs a team of analysts in the US, Europe and Asia who cover analysis of the regional syndicated loan markets. She has a B.A. from Wellesley College and masters in international affairs from Columbia University.

BY JOHN F. VENTOLA, JONATHAN D. MARSHALL, DOUGLAS R. GOODING, ALEXANDRA THOMAS, AND JACOB LANG

The most traditional avenue for a distressed company seeking to reorganize existing debts or maximize company value is through a Chapter 11 bankruptcy. However, due to its complexity, a Chapter 11 bankruptcy can be a lengthy, expensive process that is not always palatable for the distressed company’s secured lenders.

In some situations, appointing an independent director or board of directors to replace the existing directors (consensually or non-consensually) is a quicker, more cost-effective turnaround approach. Independent directors can be beneficial for distressed companies because they (i) offer expertise as to maximizing value in a struggling business and (ii) insulate the company from liability related to any real or perceived conflicts of interest at the director level. For secured lenders, particularly when existing management is acting unreasonably, independent directors can offer fresh and unbiased perspective for the company, allowing for a unified path towards maximizing value. This article explores the mechanisms a secured lender can utilize when seeking to appoint independent directors, and key issues that secured lenders and independent directors alike should consider.

Independent directors can be appointed to take over a distressed company consensually or non-consensually.

Consensual path : A distressed company will often seek to alleviate economic stressors by negotiating an amendment to its existing credit facility or entering into a forbearance agreement with its secured lenders. Secured lenders can utilize this opportunity to add a condition precedent to the effectiveness of the applicable agreement that requires appointment of independent directors (who are agreeable both to the secured lenders and to the company) by a certain date. This is the most desirable approach, as it promotes a unified path forward and is generally less risky and less costly.

Non-consensual path: A typical secured financing will include an equity pledge and/or proxy right that allows secured lenders to exercise voting rights on the company’s behalf upon the occurrence of an uncured event of default. When a distressed company has triggered an event of default under the existing loan facility and is not cooperating with its secured lenders, the secured lenders can choose to exercise their proxy rights to replace the existing directors with new independent directors who are better suited to act in the best interest of the company’s stakeholders. This is generally considered the riskier approach, as it may result in litigation or disgruntled sponsors and company management that can undermine the new directors’ efforts.

The role of independent directors in a distressed company will vary based on the facts and circumstances of each company. Once independent directors have been appointed, however, they must comply with several fiduciary duties, including: Duty to maximize value: Directors of any company are obligated to maximize value for shareholders. However,

in the case of distressed companies that may be insolvent, directors are obligated to maximize value for all stakeholders — including both the existing equity holders and the company’s secured and unsecured creditors. Independent directors must therefore pursue the

transactions that would maximize value for the company as a whole, irrespective of the impact on any particular subset of stakeholders.

Duty of independence: One of the main benefits of appointing independent directors is that the new directors are free of any connection to the company’s existing management team or equity holders. This permits unbiased decisions with respect to the company’s goals and allows independent directors to engage in arms-length transactions with the company’s insiders if necessary. Independent directors have a duty to ensure that there is no conflict or appearance of conflict with the company’s insiders and largest creditors in any value-maximizing transaction.

Appointing new directors, particularly when done nonconsensually, is atypical and is often viewed as an extreme remedy. It is important that secured lenders and independent directors alike consider a few key issues when deciding on their course of action.

Industry:

that grants the assets to the buyer free and clear of all liens, claims, and encumbrances (which is not available outside of the bankruptcy process).

Litigious sponsor or equity holders: Consider the secured lenders’ relationship with the company’s equity holders and sponsor (if applicable) prior to appointing any new directors. Depending on the situation, the sponsor may or may not be cooperative. It is likely that a sponsor has one or two board seats and losing control of the company could result in material and costly litigation if the sponsor chooses to challenge the independent directors’ authority over the company. Affirmative steps may be necessary to thwart or mitigate litigation.

Understand the nature of the distressed company before deciding whether appointing independent directors would be valuemaximizing. If the company is in a specialized industry, appointment of independent directors may not be beneficial unless the new directors have expertise in that industry. Consider whether offering roles to existing management who have intimate knowledge of the business may be necessary to effectuate a value-maximizing transaction.

Appointing new directors, particularly when done non-consensually, is atypical and is often viewed as an extreme remedy. It is important that secured lenders and independent directors alike consider a few key issues when deciding on their course of action.

Insurance: Review the company’s existing insurance policies to confirm that coverage is sufficient to cover potential exposures occurring after the change of control — in particular, secured lenders should know whether a change of control will result in significant impact to, or termination of, any D&O policies. If coverage is insufficient, non-existent, or subject to termination, a new policy should be procured to protect the new directors prior to exercising the secured lenders’ rights.

Salary/Indemnity: Understand the independent directors’ desired salary and related indemnity rights. Consider whether the company’s current cash flow can support the new directors’ salary requirements. Independent directors may also request that the company indemnify the directors against any losses stemming from their appointment. Be prepared to negotiate indemnity provisions and tailor the provisions to the needs of the company and the particular directors.

Optimal path: Understand the optimal path for the company to recoup value. If the company is in a dire financial position, asset foreclosure may be the only viable option such that independent directors may not be a worthwhile appointment. If the company is seeking to sell all or substantially all of its assets, consider whether potential buyers may prefer a sale by and through a bankruptcy filing

Credit agreement and intercreditor provisions: To avoid scrutiny when exercising a pledge or proxy right, secured lenders must exercise caution and confirm that (i) an indisputable event of default has occurred under the applicable credit documents and (ii) they are exercising their rights in strict accordance with the terms of the applicable credit documents, including all relevant voting

and notice provisions. Before acting on an equity pledge, the agent of any secured facility should determine whether a required lender vote is necessary to effectuate the transaction and acquire the necessary votes, if applicable.

Other secured lenders: Consider the reaction of the company’s other secured lenders. Efforts should be made to gain the other secured lenders’ consent to the new directors’ appointment if possible. Otherwise, ensure that the appointment complies with existing intercreditor agreements, as they may impose additional requirements. The independent directors, once appointed, should confirm for the other secured lenders that all actions are being pursued for the benefit of all creditors, not just the most senior secured lender.

Other key constituencies: Review the company’s material contracts to determine if the board flip would trigger any change-of-control provisions and, if so, the impact on the company’s business. Additionally, the new directors should have a plan for go-forward communications with employees, key customers, suppliers and/or regulators.

Organizational structure: To maximize the authority of the independent directors, thoroughly analyze the company’s organizational structure and operational documents. There is likely to be an optimal entry point in the organizational structure that will bind all operational entities to the decisions of the new directors. It is unlikely, however, that any equity pledge would cover the equity owned by a sponsor in the ultimate parent company. As a result, the ultimate parent may not be bound by the organizational decisions of the independent directors. Consider whether the sponsor is likely to be uncooperative. It is also worth considering whether any existing directors or managers of the company’s subsidiaries must be replaced in accordance with the organizational documents in order to ensure that the independent directors have decisional authority over the subsidiaries.

Compliance with fiduciary duties: Independent directors should understand their fiduciary duties once appointed. It is important to maintain independence such that all transactions executed by the company, particularly those involving insiders or the secured lenders, will not be later analyzed by a bankruptcy court or creditors’ committee under a heightened standard of scrutiny. Be forewarned that the new directors may be challenged as lacking independence if they have been appointed as directors in past transactions involving the same secured lenders. New directors must distance themselves from the secured lenders and safeguard against perceptions that decisions are being made for their sole benefit. For Delaware LLCs, it is becoming common practice for a director’s fiduciary duties to be waived in the company operating agreement. In such scenarios, strict compliance measures are not the dominant concern.

John Ventola, department chair of Choate’s Finance & Restructuring Group, has more than 25 years of experience representing banks, private credit lenders, and distressed investors and helping guide them through a wide range of complex lending and corporate restructuring issues, including Chapter 11 cases and out-of-court workouts. John is a Fellow of the prestigious American College of Bankruptcy.

Jonathan Marshall is a partner at Choate with over a decade of experience advising financial institutions and companies on a range of complex financial transactions, with a concentration on corporate restructurings and loan workouts. He specializes in advising first- and second-lien lenders, troubled companies, and other strategic parties in both in- and out-of-court restructurings. Jonathan also has substantial experience representing insurance providers throughout the bankruptcy process.

Douglas Gooding, a partner at Choate, has more than 25 years of experience advising on financing and restructuring transactions, particularly on debtor-inpossession lending and the representation of holders of senior, second lien, and mezzanine debt in complex restructurings. He also specializes in advising troubled companies in various industries including healthcare and retail. Doug also has extensive experience in mass tort bankruptcy cases representing insurance providers.

Alexandra Thomas is an associate at Choate representing debtors, lenders, and creditors in chapter 11 cases across a variety of industries. She also has experience representing banks, non-bank lenders, and other financial institutions in a range of complex financial transactions.

Jacob Lang is an associate at Choate working with financial institutions and companies in a range of complex financial transactions, with a concentration on corporate restructurings and bankruptcies. He has experience advising financial institutions as debtor-in-possession lenders, as well as litigating on their behalf as the need arises. Jacob also advises insurance providers and other creditor-side companies throughout the bankruptcy process.

BY MICHELE OCEJO

In November, Valley National Bank announced the appointment of Terry M. Keating as head of AssetBased Lending (ABL). In this role, Keating oversees the continued growth and strategic direction of Valley’s ABL platform.

Keating brings more than three decades of leadership experience in commercial finance, specialty lending, growth, organizational development and transformation, including 25 years in commercial banking. Most recently, he was CEO of Access Capital leading the specialty asset-based lender through a period of transition and growth.

Based in New York City, Keating leads the ABL team delivering tailored financing structures to support workingcapital growth, acquisitions, and recapitalizations for middle-market businesses across a wide range of industries nationwide.

He is an active member of the Secured Finance Network, and has served on its Data Committee, DEI Committee, and also participates in leading its Mentoring Program. He also serves on the boards of the New York Chapter of SFNet and the New York Institute of Credit.

Keating succeeds John DePledge, who retired at the end of 2025 after a long and distinguished career in asset-based lending.

Tell us about your career trajectory. It has been an interesting journey thus far and not a short story. To paraphrase a favorite Beatles song, “It’s been a long and winding road.” After starting college at Valparaiso University in northwest Indiana as a history major, I graduated with a degree in economics and no specific career path in mind, just ambition and willingness to work hard.

A summer job at a local bank before my last semester of college turned into full-time when I graduated. This was a $50-million community bank, which I thought was all the money in the world. I had a wide variety of duties, from manning a teller window on Friday evenings (cashing a lot of payroll checks), to managing its student loan and auto finance portfolios, making and managing commercial loans to local businesses and farmers.

After three years I wanted to get to Chicago, answered an ad and more or less talked my way into a job as a middle-market lender that, at least on paper, I wasn’t qualified for. The bank was UnibancTrust Company, based in the Sears Tower. I went from a city of 20,000 people to a building with 15,000 people. That turned out to be one of many big transitions for me. At Unibanc, I was exposed to the Chicago middle market and completed my MBA at night.

Following three years at Unibanc, I moved to LaSalle Bank in a similar role, but with larger and more sophisticated companies. A couple of years in, I was trying to figure out how to differentiate myself. I had the idea of starting an industry specialty and was given the opportunity to do so. I’d had some experience dabbling in a couple of industry specialties: diamond/jewelry, short line railroad, and a few non-bank lenders. I chose lender finance and for the next 15 years I built a division lending to consumer, commercial, leasing, mortgage

banking, premium finance, BDCs, etc. Pretty much any lender that didn’t have a banking license across the country. This was LaSalle’s first national specialty business and when I left the bank, and banking, in 2005, it was $1 billion in commitments, $500 million in outstanding loans and $1 billion in deposits, primarily from mortgage servicing companies.

I then spent five years consulting on my own, before joining Amherst Partners, a Detroit-based investment bank and turnaround advisory firm. My role was sourcing and delivering services to financial companies, as well as building their market presence in Chicago.

Five years into my stint with them I was calling on Accord Financial, a Toronto Canada-based public company with a factoring business in the US. I was pitching some acquisition ideas to the CEO, who instead of hiring Amherst to do buyside work, hired me to run the US business, based in Greenville, SC. After a very short two-week interview process, I move to Greenville with a mandate to grow and “modernize” the business, including greatly expanding its nascent ABL product.

Over eight years, we more than doubled AUM, transformed every aspect of the business. I played a significant role in two acquisitions by the parent company, worked on other corporate projects, from brand refresh, digital marketing, better integrating and working more closely with the other business units, and increasing our bank facility.

I left in mid-2021 and returned to advisory work. Notably I arranged senior debt placement for an equipment lender and served as an independent director for a highly distressed commercial finance platform on behalf of its lender group. In addition, I joined forces with a former client, Crosslake Group, an independent sponsor who was building an aerospace parts platform. I served as an advisor to Crosslake and became a board member as we acquired several businesses.

Then in May of 2022 I was recruited by Access Capital, to become CEO following the death of its founder and longtime CEO. Access specializes in asset-based lending for temporary staffing and related industries. My mandate was to chart a course for the future of the business, modernize many aspects of its operations, and grow the platform. All of which we were able to do, including as I had told the family ownership, I would build/curate a team that didn’t need me, and I left in May of 2025 at the end of my three-year employment contract.

In the months following departing Access, I spent considerable time with Crosslake as we sold the four businesses we had acquired to a funded sponsor, while also

considering several leadership and board roles. Then in September I saw that Valley Bank was looking for a successor to John DePlege, who was retiring. I know John fairly well from industry associations in New York, we’ve spoken on panels together etc. In addition, I knew/know Valley Bank well, as they became Access’s lead bank during my tenure there.

Following a short, but fairly intense, interview process, I joined the bank on October 27.

As the new head of ABL for Valley Bank, what is your strategic vision for expanding the ABL platform, and how do you see it differentiating in today’s competitive market?

ABL has existed at Valley for a good number years, but it has been under-emphasized as a growth vehicle. Over the past few years, the bank has moved to significantly expand its commercial banking operations on top of its community bank and real estate roots. In 2022 Valley acquired Bank Leumi US, including its ABL business that John DePledge was leading.

A key component of our commercial growth going forward is to build on the asset-based lending foundation and significantly expand the business nationally. While there are ultimately many aspects to this, in the nearer term there are several primary levers to pull.

First is closely working with the commercial banking teams in our geographic markets. This includes New York, New Jersey, western Pennsylvania, Florida/Southeast, Chicago/Midwest, and Southern California. These teams are good sources of deals as they are out in their local markets every day.

Second, leveraging my network within various segments. With different things I’ve done over the course of my career, I have decent networks across the country within SFNet, TMA, ACG, NYIC PE/Independent Sponsors, and several industry groups. Since joining Valley, I have already been receiving calls and leads from my network.

Third, following two departures in 2025, we are reconstituting the originations team. As we do this we’ll be working developing a proprietary direct pipeline through a variety of techniques. With information and technology that is available today this is more achievable, but still a challenge to be effective. We have coverage today in New York, and Florida, and we are actively looking to add, in Chicago, in early 2026, Southern California.

The second part of your question, differentiation, that’s the simple but hard part.

Yes, the market is competitive, but as I’ve observed in the past, when hasn’t it been? Fundamentally, we sell a commodity product and the only real differentiation available is how you deliver service, through the entire customer journey. How a prospect is treated, how a referral source is treated and, most importantly, how a client is treated. I could talk about innovative structure and pricing and, not to diminish the importance, but there is honestly not a lot of room on structure or pricing that doesn’t imperil a lender over time, so it comes

down to asking a lot of questions, listening to the company, working to understand the business and industry and within reasonable parameters accommodate their business model. I have always found that personal touch and taking the time to educate and teach is generally successful.

Bottom line, personalized long-term relationship-based service is how we go to market.

You’ve spent over three decades in commercial finance, including leadership roles at Access Capital and Accord Financial. How has asset-based lending evolved during your career, and what trends do you believe will shape the next five years?

Now that’s a big question. For sure the competitive landscape and accepted deal structures have evolved over the years. Asset-based lending has become a much more commonly accepted form of finance. If you go back far enough, assetbased lending was considered a secondary form of finance and a sign that a company was having financial issues. Today it is very mainstream and often a preferred choice for companies looking for more leverage and covenant freedom versus normal commercial banking facilities.

Additionally, advance rates, covenants and other structural elements have gotten more liberal over time. Some of that is attributed to lenders seeking to defend or gain market share. But there is also a case to be made that with better information and use of technology, we are better able to evaluate and monitor collateral today than in the past. This means, to a certain extent, we can structure with a bit less margin for error and have a similar loss given default outcome. That’s the theory at least and to be fair, it’s not really been tested in a truly stressed credit environment. Since the Great Recession, we’ve not had a real credit event. The COVID years were the closest to that, and with the extensive government stimulus programs, everyone, including the lenders were bailed out.

Another thing that has changed is the geographic dimensions of the market. Real national competition was once the domain of larger companies, with lots of regional and local lenders. Today it is rare to see even a relatively small lender that does not do business nationally; even if they don’t have originators and portfolio managers across the country. Again, thank technology for that.

In terms of the next five years, look to technology to continue to influence how business is conducted; how we gather and process information. This has been a journey of 30-plus years. When I first came into banking fax machines, electric typewriters and FedEx were new on the scene, and changing how we did business. Now only FedEx remains active, but who has seen a fax machine or typewriter in the last five years? Laptop computers, tablets, email and messaging apps have vastly changed how and where we can operate.

Over the past few years, AI has “come on to the scene,” as if it is something entirely new. But it simply represents the most

advanced and accessible technology in a long evolution. In the past few months I have been hearing the term “machine learning,” again. I say again because this is something that goes back decades and was very prevalent in consumer finance products in the 1990s.

What all of this means is that we have even more powerful tools that accelerate the collection, organization and evaluation of data and information. It enables us to look at and evaluate companies in increasingly powerful and precise ways. But even though some scientists and others say it is replacing humans, I would argue that like most technologies since the dawn of time, it serves to make humans more productive and free us from tasks that require more labor than thinking.

Overall, the industry will look much the same as it does today, except we’ll do more, faster and with fewer errors (hopefully) than today.

As you step into this leadership role at Valley Bank, what qualities do you believe are essential for guiding teams through periods of economic uncertainty and rapid industry change?

Make sure the ship is prepared for rough water. Keep a steady hand on the tiller, a positive outlook and a determination to work through the challenges that confront us. The fear of the future is far worse than the reality in nearly every situation.

Lastly, remind the team that they are just that, a team. As we go along, you may get tired, weary, not know exactly what to do, but the team is there to support and assist – as a group we’ll chart a course and navigate what we need to navigate.

We’ve also been discussing a mid-career mentoring idea. Helping individuals who are moving up the leadership ladder, with support as they move from individual contributors to management and leadership.

First, as a leader, lean into change. Change is coming whether you like it or not. Change is a constant of the human condition. We can either embrace it and profit from it, or we can ignore it and get left behind. That doesn’t mean it is always easy and comfortable. In fact, in most cases, it is neither of those things. But people and organizations who learn to embrace being uncomfortable will advance and be more likely to prosper over the medium and long run.

As a leader it starts with me. Be a lifelong learner yourself. Set the example for your teams. Be honest that you don’t know everything and that you are willing to learn and evolve. This helps set up an environment where this is not only safe, but it is expected. I like to tell teams, “I don’t know all the answers, but I do know a lot of the questions. One thing I do know, is that we figure out the answers together.” I remind teams constantly that change has been a constant since the beginning of time, so whatever we are going through now is nothing new.

You’re active in the Secured Finance Network’s Mentoring Program. Tell us a bit about that experience and what you think the industry can do to attract and retain more young professionals. Thank you for asking about the Mentoring Program. Without detracting from the other important and tremendous work done throughout SFNet, I think the Mentoring Program is the single most important program we run. It is literally creating the future of the industry. But it is one part of a multiprong effort by our industry to develop its future. The young professionals community features social and education opportunities, an annual twoday Emerging Leaders Summit, a glossary of terms and is integrated into the local chapters.

The Mentorship Program was started to address one aspect of our industry’s workforce needs, retention and development. We had observed that young people were coming into the industry, but not staying, and to answer that challenge, the Mentorship Program was launched, initially led by Candice Hubert. It has been successful, grown to a spring and a fall class and it keeps evolving with new related initiatives.

Several years ago I had the privilege of moderating a panel of young professionals at the Annual Convention. One of the panelists, Boudewijn Smit, shared with us the idea of reverse mentoring. This is where a young professional mentors a seasoned executive – helping them see and understand the world views and concerns of the younger generation in a meaningful and in-depth manner. While we don’t have it off the ground yet, we’ve been discussing how to structure and

launch this initiative to further deepen the connection and communication between generations of leaders in our industry.