Serving The Willistons, Albertson, Herricks, Mineola, Roslyn Heights, and Searingtown

D EODQN VOD WH PHGLD

VSHFLDO VH OLWPRU SX EOLFDWLRQV

FWLRQ Ĺ˜ GH FHPEHU

$1

Friday, December 29, 2017

Vol. 66, No. 52

SENIOR LIVING

WINTHROP TO OFFER HEART TRANSPLANTS

SENTENCED FOR BOMB THREATS

PAGES 25-32

PAGE 2

PAGE 6

North Shore braces for GOP tax bill impact L.I. lawmakers, experts worry about law, offer ways to mitigate harm BY LU K E TOR R A N C E A sweeping tax bill passed by Congress last week will severely reduce the tax deductions available to Long Island residents, which has many locals spending the ďŹ nal days of 2017 trying to pre-pay their taxes. The bill was slammed by Long Island politicians across the political spectrum. “This legislation is a disgrace and a ‘punch-in-the-gut’ to middleclass families throughout Long Island and Queens,â€? Rep. Tom Suozzi (D-Glen Cove) said in a statement. While no Democrat in Congress supported the bill, only a handful of Republicans joined them in voting against it. The 191 Democrats were joined by 12 Republicans in opposing the bill in the House of Representatives including Lee Zeldin (R-Shirley) and Peter King (R-Seaford). Eleven of the 12 Republicans,

the only members of their party in either the House or Senate vote against the bill, represented either New York, New Jersey or California. They opposed the bill for a similar reason: the deduction of state and local tax deductions, which will hit those three states particularly hard. Deductions for state individual income, sales and property taxes will be capped at $10,000. Zeldin called it a “geographic redistribution of wealth� during an interview with CNBC. King said in a statement that the $10,000 cap was not enough and claimed that the bill would reduce home values by as much as 10 to 15 percent. “The bottom line is that while most of the rest of the country will be getting a tax cut, it will be paid for by Long Island residents who will be getting a tax increase,� King said. Continued on Page 44

PHOTO BY AMELIA CAMURATI

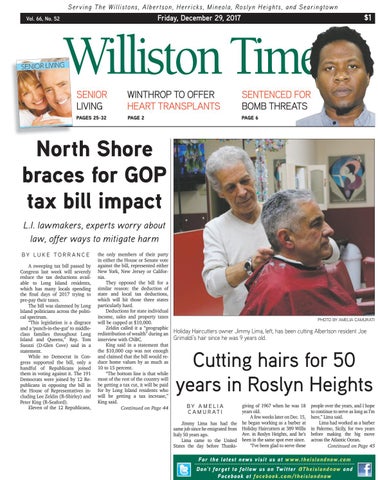

Holiday Haircutters owner Jimmy Lima, left, has been cutting Albertson resident Joe Grimaldi’s hair since he was 9 years old.

Cutting hairs for 50 years in Roslyn Heights giving of 1967 when he was 18 years old. A few weeks later on Dec. 15, Jimmy Lima has had the he began working as a barber at same job since he emigrated from Holiday Haircutters at 389 Willis Ave. in Roslyn Heights, and he’s Italy 50 years ago. Lima came to the United been in the same spot ever since. “I’ve been glad to serve these States the day before Thanks-

BY A M E L I A C A M U R AT I

people over the years, and I hope to continue to serve as long as I’m here,� Lima said. Lima had worked as a barber in Palermo, Sicily, for two years before making the big move across the Atlantic Ocean. Continued on Page 45

For the latest news visit us at www.theislandnow.com D on’t forget to follow us on Twitter @Theislandnow and Facebook at facebook.com/theislandnow